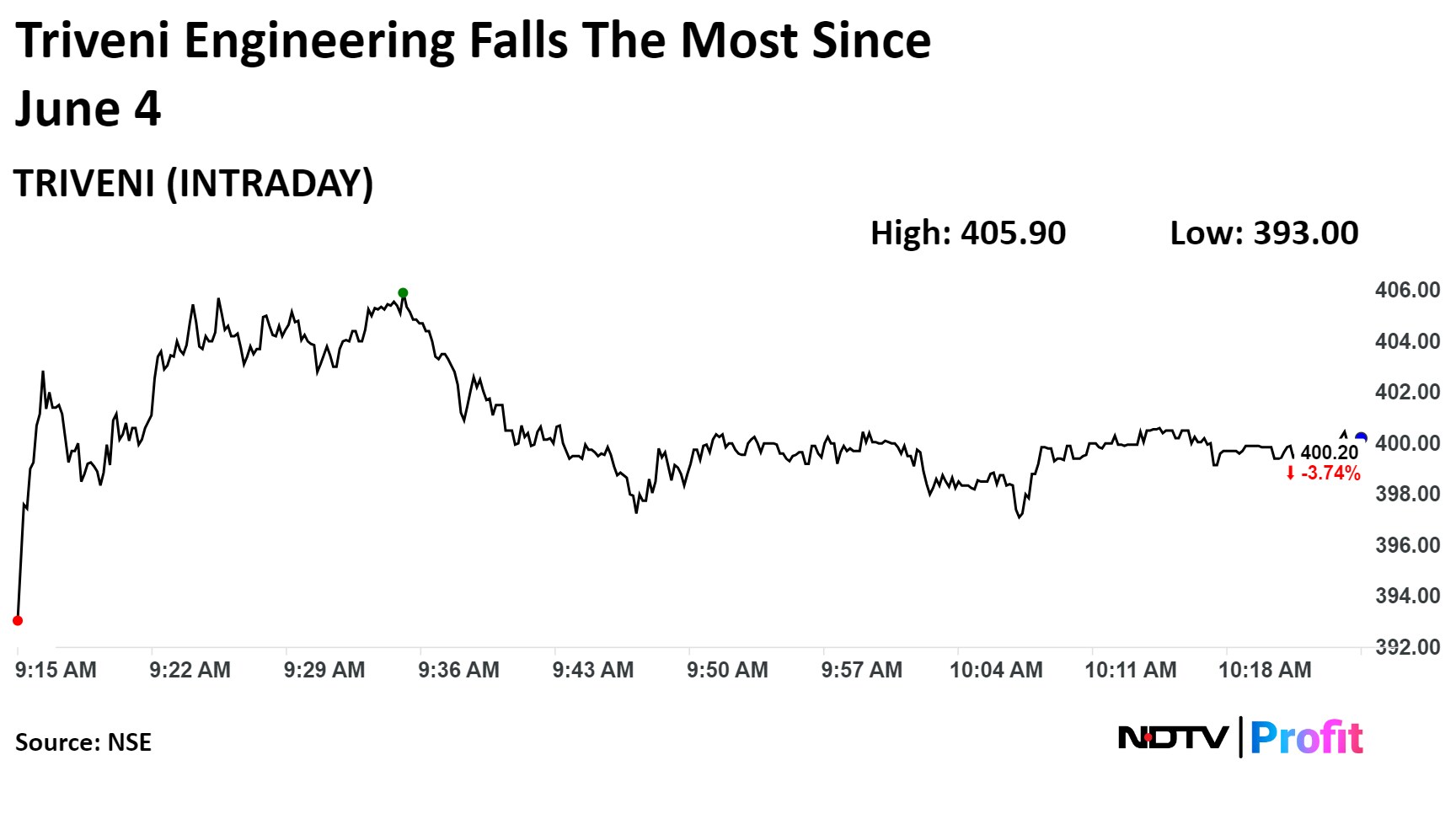

Shares of Triveni Engineering & Industries Ltd. fell the most since June 4 after its profit fell 54% in the June quarter, missing analysts' estimates.

The company reported a net profit of Rs 31 crore in the quarter ended June compared with Rs 68 crore a year ago, according to an exchange filing. That compares with the Bloomberg's estimate of Rs 72 crore.

Triveni Engineering Q1 FY25 (Consolidated, YoY)

Revenue up 7% at Rs 1,534 crore. (Bloomberg estimate: Rs 1360.95 crore).

Ebitda down 31% at Rs 86 crore. (Bloomberg estimate: Rs 127.45 crore).

Ebitda margin at 5.6% versus 8.7% (Bloomberg estimate: 9.4%).

Net profit down 54% at Rs 31 crore. (Bloomberg estimate: Rs 72 crore).

The company said that segment profitability was lower across businesses, with the exception of the water business, where cost savings led to higher profitability, according to an exchange filing.

"The profitability of the sugar business, despite a higher contribution to sugar sales, was lower due to lower production and a higher charge of off-season expenses owing to the early closure of the season," it said.

That of its alcohol business was adversely affected due to restrictions imposed by the government on the grain feedstocks, as a result of which surplus rice operations were substituted by maize, increasing the transfer price of molasses, and due to lower sales volume by 4.3% with lower dispatch of ethanol from higher-margin sugarcane-based feedstocks.

"Our focus is to restore normalcy in our sugar operation, and we are vigorously working in this direction—uprooting infected crops, substituting vulnerable varieties with more robust varieties, enhancing yields, and stepping up surveillance to get early warning of any challenges to our crop," the company said. It has also undertaken curative control measures to contain and control the spread of red-rot disease that affected operations in the previous season.

"We earnestly hope that the government will do away with feedstock restrictions and address ethanol pricing feedstock-wise based on viability so that a concerted effort is made to achieve the EBP targets," it said. "The industry also keenly awaits the revision to the minimum selling price, which is vital for the sustainability of the industry."

Shares of the company fell as much as 5.47% to Rs 393 apiece, the lowest level since July 24. It pared losses to trade 3.7% lower at Rs 400.45 apiece, as of 10:29 a.m. This compares to a 1.03% decline in the NSE Nifty 50 Index.

The stock has risen 16.19% on a year-to-date basis and 27.43% in the last 12 months. Total traded volume so far in the day stood at 0.64 times its 30-day average. The relative strength index was at 48.84.

Out of the six analysts tracking the company, five maintain a 'buy' rating, none recommend a 'hold,' and one suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 7.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.