(Bloomberg) -- A warm reception for the first of this week's three Treasury note and bond auctions brightened the outlook for what's set to be the biggest-ever 10-year on Wednesday.

Tuesday's $54-billion auction of three-year notes drew a yield slightly lower than the one that had been predicted by trading at the bidding deadline, a sign of stronger-than-anticipated demand. While Treasury yields had seen a sharp two-day rise — potentially increasing the auction's appeal — a subsequent rally erased about 8 basis points from the three-year by the time of the auction.

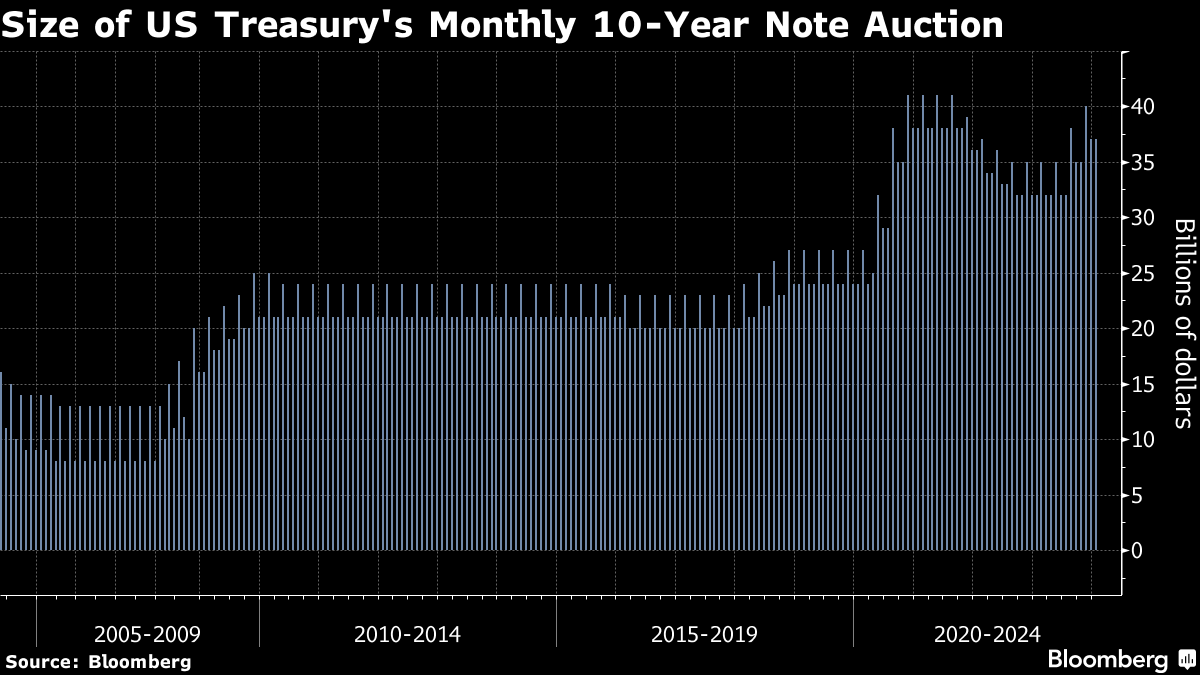

That investors didn't balk bodes well for Wednesday's 10-year new issue: At $42 billion, it will be the largest on record, eclipsing the $41-billion high-water mark reached in November 2020. With the latest changes to Treasury auction sizes announced last week, three of its seven notes and bonds, including the two- and five-year, are scheduled to hit record sizes in the February-to-April quarter.

“We have the largest 10-year note auction in history and rates are 90 basis points lower than they were back in October. And that auction will certainly get absorbed tomorrow around market levels, whether or not there's some concession going into it,” said Michael Cudzil, portfolio manager at Pimco. “Supply can tell a story that it matters in any given moment, but bigger picture, if you look at just what supply has meant for yields, it hasn't meant very much. You look at what happened in January between investment grade, high yield and bank loans, it was the largest issuance month ever.”

In pre-auction trading Tuesday, the new 10-year yield was around 4.08%. It dipped below 4% as recently as Friday, before the selloff sparked by strong employment data. Still, four of the past five have drawn higher yields.

“It'll be fascinating see if that is enough for the auctions,” said Jack McIntyre, portfolio manager at Brandywine Global Investment Management. The preferred range for buying 10-year yields, he said, is between 4.25% and 4.5%, he said, adding that Brandywine trimmed its exposure to Treasuries when the 10-year yield fell below 4% late last year.

Treasury investors are grappling with at least two sets of challenges. One is the uncertain outlook for monetary policy. The Federal Reserve has signaled it's likely to cut interest rates this year amid ebbing inflation, but the economy's strong performance is challenging market-implied expectations for when and for how much.

Another challenge is the growth in the size of bond markets, including for Treasuries. The market surpassed $26 trillion last year, but has benefited from demand factors including increased global private-sector savings and historically low interest-rate volatility.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.