(Bloomberg) -- Traders who just boosted bearish dollar bets might still be wishing it was 2023 after the greenback rang in the new year with its best start in more than a decade.

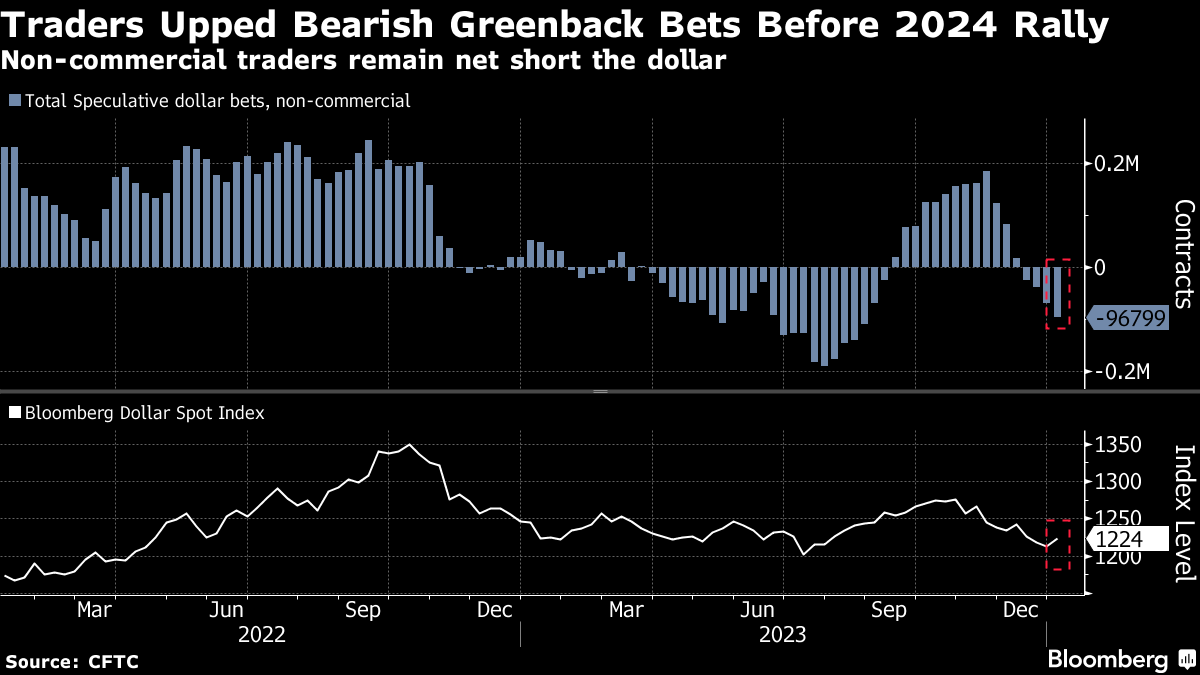

Non-commercial traders — a group that includes hedge funds, asset managers and other speculative market players — added to their short positions on the dollar in the week ended Tuesday, according to CFTC data compiled by Bloomberg. Roughly 96,800 contracts worth almost $10 billion are now tied to expectations that the US currency will fall, up more than 26,000 from the previous week and the most bearish since late August.

The snapshot of positioning was taken ahead of the Bloomberg Dollar Spot Index's best start to the year since 2011, according to data compiled by Bloomberg that looked at performance during the first trading weeks. The greenback has surged about 0.9% since markets opened the year on Tuesday, finding traction alongside Treasury yields as traders reel in bets, if only slightly, on future interest-rate cuts from the Federal Reserve.

The gauge ended the Friday session down less than 0.1%, buffeted by both stronger-than-expected headline US jobs growth in December as well as a weak ISM services reading.

“What we're seeing for 2024 so far is this pushback against rate cuts for the first half of the year, second half of the year as well, and the dollar is just a reflection of that,” Alan Ruskin, macro strategist at Deutsche Bank, said in a Bloomberg Television interview after the release of the payrolls data Friday.

One specific group of speculative traders, leveraged funds, remained long the dollar but also were caught out by the currency's sudden rise this week. Leveraged funds cut bullish bets on the greenback to about 76,100 contracts, down about 18,200 from the prior week and the lowest amount in 10 weeks, the CFTC data showed.

The CFTC report also showed leveraged funds added to a long-held and sizable net short position on the yen, while sharply reducing bearish bets on the euro.

- Leveraged funds adjusted net positions as follows:

- Increased net JPY short by 452 contracts to 61,995

- Decreased net EUR short by 12,522 contracts to 10,122

- Lowered net GBP long by 429 contracts to 25,697

- Decreased net AUD short by 5,770 contracts to 5,122

- Boosted net NZD long by 1,112 contracts to 1,696

- Lowered net CAD short by 494 contracts to 53,394

- Reduced net CHF long by 345 contracts to 1,657

- Lowered net MXN long by 457 contracts to 25,452

- Asset managers changed net positions as follows:

- Raised net JPY long by 6,489 contracts to 24,198

- Increased net EUR long by 2,960 contracts to 383,359

- Raised net GBP short by 3,598 contracts to 47,047

- Cut net AUD short by 11,452 contracts to 42,658

- Trimmed net NZD short by 1,760 contracts to 3,842

- CAD position switches to net long 12,589 from net short 1,155

- Reduced net CHF short by 1,163 contracts to 2,283

- Increased net MXN long by 3,475 contracts to 149,283

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.