Traders Boost Global Rate-Cut Wagers After Fed’s Dovish Pivot

Traders ramped up bets on European Central Bank and Bank of England interest-rate cuts next year after the Federal Reserve’s pivot toward looser policy.

(Bloomberg) -- Traders ramped up bets on interest-rate cuts around the world ahead of European Central Bank and Bank of England policy decisions later Thursday, as global markets adjust to the Federal Reserve’s pivot toward looser policy.

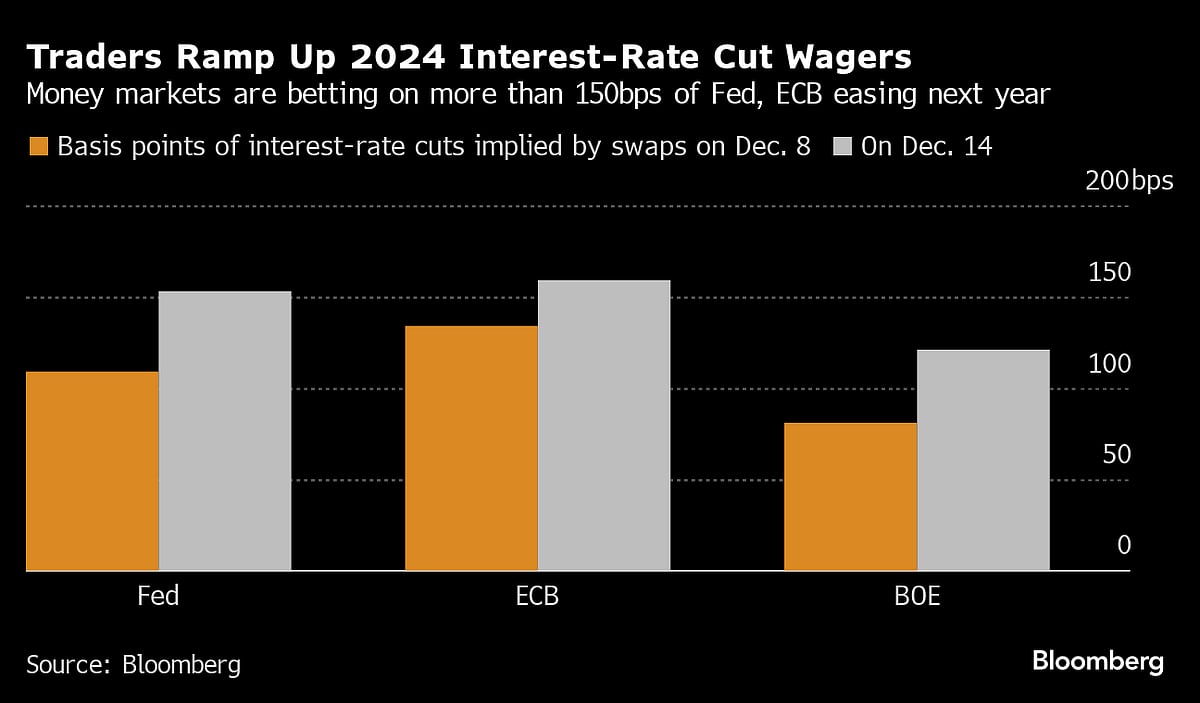

Investors are now pricing in at least six quarter-point cuts in 2024 by both the Fed and the ECB, and five for the BOE. The moves follow the US central bank’s signal that its historic policy-tightening campaign is over, with officials projecting aggressive monetary easing to come.

The repricing is part of a broader shift that’s touched all corners of financial markets, as global stocks surged, bond yields tumbled and currencies rallied versus the US dollar. Yet there are risks the wagers have gone too far — and ECB and BOE officials could push back against the rapid moves.

“I think the markets are playing a dangerous game here, extrapolating from Fed messaging to the ECB and BOE,” said James Rossiter, head of macro strategy at TD Bank. “There’s no reason we should think that just because the Fed pivoted messaging a bit that the others will too.”

Markets are betting on around 160 basis points of Fed rate cuts, with the first cut fully priced by March. While Chair Jerome Powell said Wednesday policymakers are prepared to resume rate increases should price pressures return, he and his colleagues issued forecasts showing that a series of cuts would be likely next year.

They also priced over 160 basis points of ECB easing next year, the most in the current cycle. That means six quarter-point cuts are fully baked in, with the first seen likely in March, and there’s some additional hedging for a seventh move.

ECB President Christine Lagarde is unlikely to validate those expectations at her press conference later Thursday, even after inflation sank to the lowest since mid-2021. Instead, she’ll probably explain that price pressures are set to tick up again, and that such discussions are premature.

For the UK, markets fully priced five quarter-point cuts next year, up from four before the Fed decision. The first cut is seen in May with significant hedging for such a move in March.

The BOE is forecast to leave interest rates at a 15-year high on Thursday, with investors focused on signs of when officials might gauge inflationary pressures have subsided enough to open the way for reductions.

“The bid in markets will have to face two big headwinds today: the ECB and BOE meetings,” said Evelyne Gomez-Liechti, a rates strategist at Mizuho. “We think the reaction and rally are overdone, but data will tell and momentum remains strong.”

--With assistance from James Hirai.

(Updates with details on timing of first rate cuts throughout.)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.