As the markets approach Friday's session, Nifty is expected to find strong support in the 25,000–25,100 range, providing an opportunity for a "buy-on-dips" strategy, according to Hrishikesh Yedve, assistant vice president, technical and derivatives research at Asit C. Mehta Investment Intermediates Ltd.

He added that on the upside, the index could test the 25,500–25,600 levels in the near term.

The key support levels of 25,100–25,000 are likely to act as a cushion for intraday dips, said Osho Krishan, senior analyst, technical and derivatives at Angel One Ltd. However, should this range be breached, it may trigger further downsides. On the higher side, resistance is expected between 25,250 and 25,350, he added.

Although Nifty opened 51 points higher on Thursday, it failed to sustain its early gains, closing in the lower quartile of its trading range at 25,199, said Avdhut Bagkar, technical and derivatives analyst at StoxBox. Despite this, the market breadth remained positive, even though Nifty ended in the red.

The GIFT Nifty, an early indicator of the Nifty 50's performance in India, was up 46.5 points or 0.18% at 25,246 as of 6:24 a.m.

F&O Action

Nifty September futures fell by 0.05% to 25,236.75 at a premium of 91.65 points, while open interest fell by 2.33%.

Nifty Bank September futures rose by 0.2% to 51,727.6 at a premium of 254.55 points, while open interest fell by 1.6%.

The open interest distribution for the Nifty 50 Sept. 12 expiry series indicated most activity at 26,400 call strikes, with 23,900 put strikes having maximum open interest.

For the Bank Nifty options expiry on Sept. 11, the maximum call open interest was at 59,000 and the maximum put open interest was at 51,500.

FII/ DII Activity

Overseas investors remained net buyers of Indian equities for the fifth consecutive session on Thursday.

Foreign portfolio investors mopped up stocks worth Rs 975.5 crore and domestic institutional investors stayed net buyers for the third consecutive day and purchased equities worth Rs 97.4 crore, the NSE data showed.

Market Recap

India's benchmark indices ended lower on Thursday, dragged down by heavyweights Reliance Industries Ltd. and Bharti Airtel Ltd. The NSE Nifty 50 extended the fall for the second day to end 53.60 points, or 0.21%, lower at 25,145.10. The S&P BSE Sensex declined for the third straight session to settle 151.48 points, or 0.18%, down at 82,201.16.

During the day, the Nifty rose as much as 0.30% to 25,275.45 and the Sensex added as much as 0.32% to hit a high of 82,617.49.

Major Stocks In News

KEC International: The company received new orders worth Rs 1,423 crore for the supply and installation of 380 kV transmission lines in Saudi Arabia.

Rashtriya Chemicals and Fertilisers: The company approved the issue of secured/unsecured, non-convertible debentures aggregating up to Rs 1,400 crore in the period of the next twelve months through a private placement basis.

Aditya Birla Fashion And Retail: The company will raise funds up to Rs 500 crore through non-convertible debentures. The company also approved the allotment of 5.57 crore shares to shareholders of TCNS Holdings. The company will allot 11 ABFRL shares for every six held in TCNS Holding.

Ashoka Buildcon: The company announced that its wholly-owned subsidiary, Viva Highways Ltd, has successfully monetised its land in Hinjewadi, Pune, for a total value of Rs 453 crore.

L&T Finance: The company has issued 17,500 listed, secured, rated, redeemable non-convertible debentures worth Rs 175 crore to selected investors through a private placement on Sept. 5.

Wipro: The company has been enlisted by JFK International Air Terminal, the operator of JFK's Terminal 4, to help meet its net zero targets.

JSW Energy: The company has received a Rs 55 lakh tax penalty for the financial year 2019-20.

Adani Enterprises: The company approved the early closure of the NCD issue. The issue will now close on Sept. 6 instead of Sept. 17.

Jindal Stainless: The company has supplied high-strength tempered 301LN grade austenitic stainless steel for this prestigious government project. The coaches are manufactured by Integral Coach Factory and Bharat Earth Movers Ltd.

Pidilite Industries: CollTech Group, a company specialising in high-performance adhesives and thermal solutions, has signed an exclusive distribution agreement with Pidilite Industries. Under this partnership, Pidilite will be the sole distributor of CollTech's products in India, helping both companies strengthen their market presence, especially in the electronics industry.

Medplus Health: Optival Health Solutions Private Ltd., the subsidiary company, has received two suspension orders for drug licenses for stores situated in Bangalore, Karnataka.

Venus Pipes: The Revenue Intelligence Directorate conducted a search at the company's corporate office over alleged evasion of customs duty on goods imported. The company has deposited Rs 5 crore as duty.

Matrimony.com: The board approved Rs 72 crore buyback at Rs 1,025 per share.

Global Cues

Most Asian stocks were hit on Friday open as traders remain cautious just ahead of the release of US payroll data which could set the tone for the September rate cut.

The equity benchmark in South Korea fell the most followed by Japan while Australia's gauge declined in early trade. The region's equity futures contracts remained mixed. The Nikkei 225 was 0.08% lower at 36,628, and the Kospi was down 1.32% at 2,541 as of 6:10 a.m.

Trading in Hong Kong will be shut on Friday as the country is battered by Super Typhoon Yagi. The city raised its storm warning to the third-highest level.

All eyes will be on the upcoming monthly economic report for August due Friday, a key indicator of whether the Federal Reserve will initiate a half-point interest cut in September.

Wall Street was hit as traders sent most equity benchmarks down in the run-up to the US payroll figures. The S&P 500 and Dow Jones Industrial Average slipped 0.30% and 0.54%, respectively. The Nasdaq Composite rose 0.25%.

Brent crude was trading 0.15% higher at $72.80 a barrel as of 06:11 a.m. Gold was down 0.02% at $2,516.31 an ounce.

Key Levels

US Dollar Index at 101.04

US 10-year bond yield at 3.73%

Brent crude up 0.15% at $72.80 per barrel

Bitcoin was up 0.22% at $56,199.96

Gold was down 0.02% at $2,516.31 an ounce.

Money Market

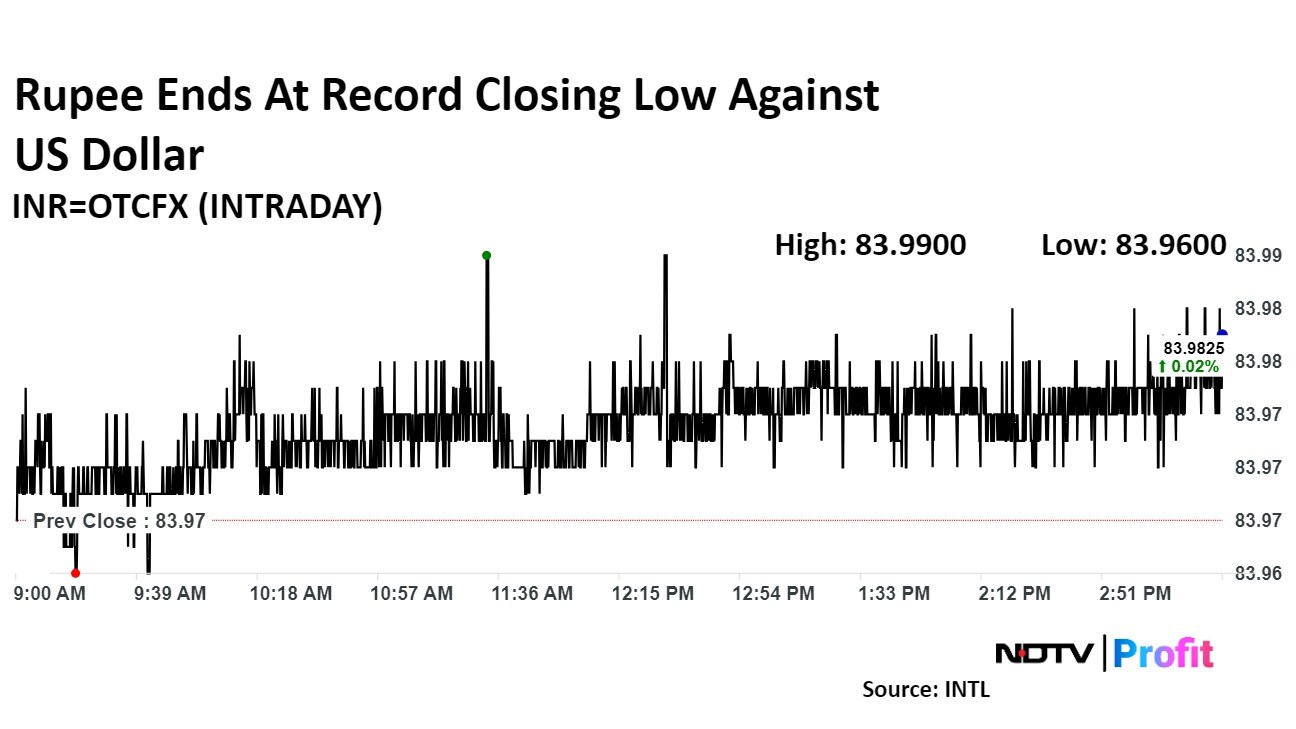

The Indian rupee nearly touched 84, closing at a record low against the US dollar on Thursday, as crude oil prices steadied along with a flat dollar index. The currency hit an all-time low of 83.99 during the day.

The rupee closed at a record low of 83.98 after opening at 83.98 against the US dollar, according to Bloomberg data. The domestic currency had closed at 83.97 against the greenback on Wednesday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.