Looking ahead to Thursday's session, the NSE Nifty 50 is expected to face resistance around 25,300–25,350, with a strong support seen at the 25,100–25,080 zone, followed by the crucial 25,000 level, according to analysts.

"The recent fall could be seen as a breather with no alterations to the ongoing trend," Osho Krishan, senior analyst of technical and derivatives at Angel One Ltd., said. "An authoritative breach of the 25,300–25,350 resistance zone could open the next leg of the rally towards 25,400–25,500."

Krishan cautioned that global developments could significantly impact the intermediate trend, urging investors to proceed thoughtfully and focus on selective stock choices for superior performance.

"As long as the index holds above the 25,000–25,100 levels, a buy-on-dips strategy should be employed," Hrishikesh Yedve, assistant vice president of technical and derivatives research at Asit C Mehta Investment Intermediates Ltd. "On the upside, the index may test the 25,500–25,600 levels in the near future."

"We expect the market to remain cautious until there is a clear view on the US economic data lined up for the week," Avdhut Bagkar, technical and derivatives analyst at StoxBox. He said that despite opening 189 points lower due to weak global cues, the Nifty managed to trend higher after early volatility settled.

The domestic benchmark indices opened on a negative note on Wednesday, in line with global cues. The Nifty began the day with a gap-down and remained under pressure, ultimately closing on a negative note at 25,199 levels after a late recovery, according to Yedve.

The GIFT Nifty, an early indicator of the Nifty 50's performance in India, was down 8 points or 0.03% at 25,348 as of 6:28 a.m.

F&O Action

Nifty September futures fell by 0.41% to 25,247.8 at a premium of 149.1 points, while open interest grew by 1.21%.

Nifty Bank September futures went down by 0.46% to 51,607.6 at a premium of 207.35 points, while open interest grew by 1.98%.

The open interest distribution for the Nifty 50 Sept. 5 expiry series indicated most activity at 25,300 call strikes, with 25,000 put strikes having maximum open interest.

For the Bank Nifty options expiry on Sept. 11, the maximum call open interest and the maximum put open interest for both was at 51,500.

FII/ DII Activity

Overseas investors remained net buyers of Indian equities for the fifth consecutive session on Wednesday.

Foreign portfolio investors mopped up stocks worth Rs 975.5 crore and domestic institutional investors stayed net buyers for the third consecutive day and purchased equities worth Rs 97.4 crore, the NSE data showed.

Market Recap

The Indian benchmark indices took a breather from a record rally to close lower on Wednesday as sentiment was hit after a rout in global stocks. The closing came after Asian stocks plunged, tracking the overnight losses in the US markets, led by weak economic data and easing oil prices on weak global demand.

The NSE Nifty 50 ended 0.32% or 81.15 points, down at 25,198.70, while the S&P BSE Sensex declined 0.25% or 202.80 points, to close at 82,352.64. Intraday, the Nifty fell as much as 0.78% to 25,083.80 and Sensex plunged 0.87% to hit a low of 81,833.69.

Major Stocks In News

Raymond, Raymond Lifestyle : Shares of Gautam Singhania's consumer lifestyle business, Raymond Lifestyle Ltd., to list on stock exchange on Thursday.

PNB Housing Finance: The board will consider raising up to Rs 2,500 crore through NCDs on Sept. 9.

Sona BLW Precision Forgings: The company has set the floor price at Rs 699.01 per share for qualified institutional placement to raise Rs 2,400 crore. The QIP price is at a 3% discount to the current market price. Company may, at its discretion, offer a discount of not more than 5% on the floor price calculated for the issue.

Canara Bank: The company will issue five-year $300 million medium-term notes through the IFSC Banking unit. The bonds are to be issued at a coupon rate of 4.896% to be paid semi-annually.

Suzlon Energy: Executes conveyance deed with OE Business Park for the sale of office space for Rs 440 crore. The company will lease One Earth Property back for five years.

General Insurance Corp.: The Government of India will exercise the oversubscription option in its current offer for sale which will include an additional 50.49 lakh equity shares. The overall offer size will, therefore, increase to 6.45 crore shares or 3.68% stake.

Exide Industries: Arun Mittal tenders resignation from the position of managing director and chief executive officer of its arm, EESL, effective Oct. 31. Mittal's resignation is for personal reasons.

Allied Blenders and Distillers: The board approves the acquisition of a majority stake in the target entity to be formed in collaboration with film star Ranveer Singh, represented by Oh Five Oh Talent Ltd. Liability Partnership. The company will undertake manufacturing, distribution, licensing, and marketing of various types of luxury and premium spirits comprising owned and third-party brands. The company appoints Anil Somani as chief financial officer and key managerial personnel effective Sept 5.

Kaynes Technology India: The company clarified that it has received no formal letter from the government to build a semiconductor unit.

Kalpataru Projects International: The board approved the conversion of the outstanding loan granted to Kalpataru Power Do Brasil Participações, a Brazil-based wholly-owned subsidiary of the company, into equity shares of KPBPSA.

Godrej Properties: The company approved the issuance of 6,460 unsecured, redeemable, rated, listed, non-convertible debentures of the face value of Rs 1 lakh, aggregating to Rs 64.60 crore.

Apollo Hospitals: Apollo Healthco Ltd., an unlisted material wholly owned subsidiary of the company, incorporated a wholly owned subsidiary named Apollo 2417 Insurance Services Ltd. on Sept. 3.

Borosil Renewables: The company will acquire a 49% stake in Clean Max Prithvi Pvt Ltd from Clean Max Enviro Energy Solutions Private Ltd. The acquisition is to be completed in two months.

Global Cues

Most Asian stocks bounced back from Wednesday's sell-off with global bond yields falling as a weak economic print in the US brought back wagers that the Federal Reserve will initiate a half-point interest cut in September.

The equity benchmark in Japan continued its plunge as Yen rose over 1% while the dollar weakened on signs of aggressive rate cuts. The Nikkei 225 was 0.7% lower at 36,799, and the Kospi was 1.25% up at 2,612 as of 6:09 a.m.

The July job openings for the US fell to 7.67 million against the estimated 8.1 million, the lowest since the start of 2021, proving that a soft landing is difficult to come by for the world's largest economy.

The US stocks mostly ended lower on Wall Street as traders shifted focus to send treasury yields lower on weak jobs data. The yield on the 10-year Treasury note fell eight basis points Wednesday. The S&P 500 and Nasdaq Composite slipped 0.16% and 0.30%, respectively. The Dow Jones Industrial Average rose 0.09%.

Brent crude was trading 0.21% higher at $72.85 a barrel as of 06:02 a.m. Gold remained flat at $2,526.1 an ounce.

Key Levels

US Dollar Index at 101.27.

US 10-year bond yield at 3.76%.

Brent crude up 0.21% at $72.85 per barrel.

Bitcoin was up 0.25% at $58,186.5.

Gold flat at $2,526.1.

Money Market

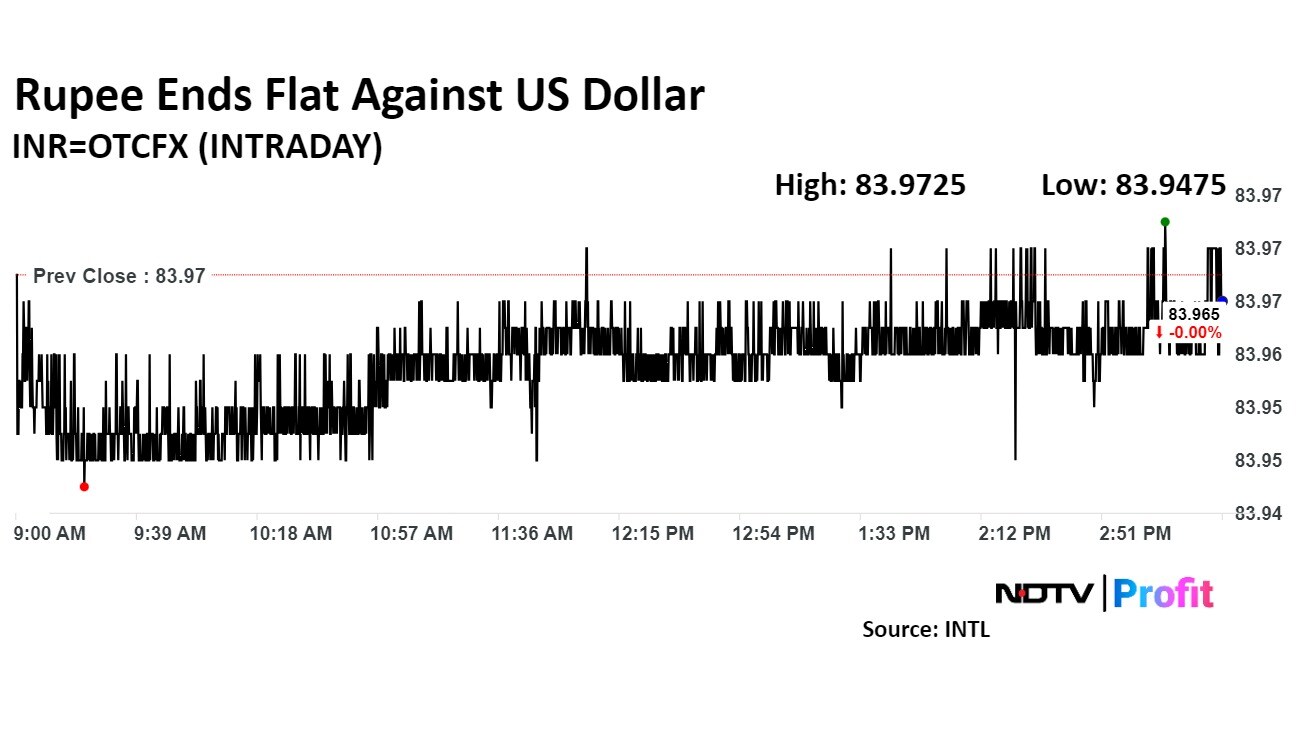

The Indian rupee closed flat against the US dollar on Wednesday as crude oil prices declined along with a weak dollar index.

The rupee closed at Rs 83.97 after opening stronger by two paise at Rs 83.95 against the US dollar, according to Bloomberg data. The domestic currency had closed at Rs 83.97 against the greenback on Tuesday.

Oil prices plunged almost 5% on Tuesday as weak global demand persisted on a possible easing of political unrest in Libya. Brent was hovering around $73 a barrel and West Texas Intermediate was below $70 for the first time since early January, according to Bloomberg.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.