As traders head into Wednesday's session, they are expected to navigate a narrow and indecisive trading range, as seen in the previous session where the Nifty managed to eke out a gain of just one point, closing at 25,279.85.

Despite a gap-up opening, the index struggled to sustain higher levels, reflecting potential fatigue and the ongoing tug-of-war between bulls and bears according to analysts.

Key levels to watch include 25,350 on the upside, which could trigger a rally towards 25,500, while 25,200 on the downside might lead to a correction towards 25,100 and below, according to Shrikant Chouhan, head of equity research at Kotak Securities.

"Consider booking profits and re-entering at dips. Traders should exercise caution, waiting for the index to test and halt at key support zones before re-entering the market," said Kush Bohra, founder of KushBohra.com.

While the broader market remains in a narrow range, Bank Nifty's recent performance can inject momentum if buying activity continues, according to Osho Krishan, senior analyst at Angel One Ltd. "Looking ahead, 25,200 is poised to act as a key support for the benchmark, while a solid support zone is expected within the 25,100–25,000 range."

"On the higher end of the spectrum, 25,350–25,400 is anticipated to act as intermediate resistance, followed by the sturdy hurdle of 25,500 in the comparable period," Krishan said.

Hrishikesh Yedve, assistant vice president of technical and derivatives research at Asit C Mehta Investment Intermediates Ltd., suggested using dips around the 25,070 level as buying opportunities, with an eye on potential targets between 25,500 and 25,600.

The GIFT Nifty, an early indicator of the Nifty 50's performance in India, was down 75.5 points or 0.30% at 25,170.5 as of 7:05 a.m.

F&O Action

Nifty September futures went up by 0.02% to 25,354.55 at a premium of 74.7 points, while open interest grew by 7.23%.

Nifty Bank September futures rose by 0.38% to 51,834.1 at a premium of 145 points, while open interest inched up marginally by 0.06%.

The open interest distribution for the Nifty 50 Sept. 5 expiry series indicated most activity at 26,000 call strikes, with 25,000 put strikes having maximum open interest.

For the Bank Nifty options expiry on Sept. 4, the maximum call open interest was at 53,000 and the maximum put open interest was at 51,000.

FII/ DII Activity

Overseas investors remained net buyers of Indian equities for the third consecutive session on Monday.

Foreign portfolio investors mopped up stocks worth Rs 1735.5 crore and domestic institutional investors turned net buyers after one day of selling and bought equities worth Rs 356.4 crore, the NSE data showed.

Market Recap

The benchmark indices closed mixed on Tuesday as the NSE Nifty 50 ended flat and at an all-time high, while the S&P BSE Sensex snapped its 10-session gaining streak.

The Nifty ended 1.15 points higher at 25,279.85, and the Sensex was 4.4 points or 0.01%, down at 82,555.44.

On the Nifty's hourly chart, there are divergences emerging but consolidation is still away, according to Kush Bohra, founder of investment advisory firm kushbohra.com.

Major Stocks In News

CUPID: The firm plans to significantly expand B2C reach, with a target of reaching 1 lakh touchpoints by the end of the calendar year 2024. The firm is planning partnerships with Blinkit and Zepto to expand its e-commerce presence. Additionally, an almond hair oil will be launched this month in four different stockkeeping units, among other new products.

General Insurance Corporation of India: Administrative authorities to sell up to 6.8% stake via offer for sale, to sell 3.4% stake via base offer, with an oversubscription offer for 3.4%, floor price set at Rs 395/share. Offer to take place over Sept 4 and Sept 5

Zydus Lifesciences: The company has provided clarification regarding the intimation dated August 30, 2024, about the Warning Letter received from the USFDA. The letter points out concerns with the injectable manufacturing facility in Jarod, Gujarat. The company is currently addressing these concerns and taking necessary corrective and preventive measures as requested by the USFDA.

Torrent Power: The company has entered into a fresh MoU with the Department of Water Resources, Government of Maharashtra for the establishment of pumped storage projects with a total capacity of 5,600 MW instead of 5,700 MW.

Yatra Online: To acquire Globe Travels for Rs 128 crore.

MOIL: In August 2024, MOIL achieved its highest-ever production of 1.24 lakh tonnes. For the first five months of the current financial year (April to August 2024), MOIL produced 7.24 lakh tonnes, a 7% increase compared to last year. The company sold 5.92 lakh tonnes during this period, which is similar to last year despite tough market conditions and fluctuating international prices. Revenue from operations grew by about 11% from April to August 2024. MOIL has also focused heavily on exploration, drilling 46,585 meters by August 2024, which is 1.6 times more than the previous year.

AU Small Finance Bank: The bank has submitted an application to the Reserve Bank of India to seek approval for voluntary transition from a small finance bank to a universal bank.

NHPC: Company signs MoU with the Maharashtra Department of Water Resources. The agreement includes setting up pumped storage projects (PSPs) and renewable energy projects with a total capacity of 7,350 megawatt locations, including Kengadi (1,550 MW), Savitri (2,250 MW), Kalu (1,150 MW), and Jalond (2,400 MW).

Ashiana Housing: The company announced that by Sept. 1, 2024, 168 out of 280 units in Phase 4 of the "Ashiana Amarah" project in Gurugram have been booked. These units, which cover 282,365 square feet, have a total sale value of Rs 403.49 crores. Phase 4 of the project includes a total saleable area of 495,000 square feet with 3 bedroom house kitchen units and is located in Sector 93, Gurugram, Haryana.

Adani Enterprises: Adani Global Pte. Ltd., Singapore, which is a step-down subsidiary of the company, has set up a new wholly-owned subsidiary called Adani Energy Resources (Shanghai) Co., Ltd. (AERCL) in Shanghai, China. AERCL is incorporated to carry out the business of providing supply chain solutions and project management services.

Asian Stocks Plummet On US Risk-Off Mood: Global Cues

Asian stocks plunged in early trade on Wednesday tracking the overnight rout in the US markets led by weak economic data and easing oil prices on weak global demand.

Japanese benchmark slipped over 3% while those in Australia and South Korea plunged with futures contracts pointing lower. The Nikkei 225 was 3.44% lower at 37,352, and the S&P ASX 200 was 1.93% down at 7,946 as of 6:28 a.m.

The risk-off mood came following a weak economic print in the US weighing on the expectation of a soft landing, triggering the worst fall since the Aug. 5 rout. The technology stocks led the selloff with Nvidia Inc. losing a record $279 billion in market cap.

The manufacturing index for the world's largest economy missed forecasts and rose to 47.2 in August against the estimate of 47.5, the lowest since May 2023.

Traders will also focus on the upcoming monthly economic report for August which will set the stage for the Federal Reserve to assess the magnitude of the rate cuts. Traders anticipate that the Fed will reduce rates by more than two full percentage points over the next 12 months, according to Bloomberg.

Meanwhile, oil prices plummeted on sluggish global demand for crude following a prospective deal to restore supplies from Libya. Crude oil prices were below the $75 mark at about 73.60 per barrel as of 6:58 a.m.

Even the futures contracts in the US pointed at a negative start for the market. The S&P 500 and Nasdaq Composite plunged 2.12% and 3.26%, respectively. The Dow Jones Industrial Average declined 1.51%.

Key Levels

US Dollar Index at 101.7

US 10-year bond yield at 3.83%

Brent crude down 0.66% at $73.26 per barrel

Bitcoin was down 0.56% at $57,885.91

Gold fell 0.02% at $2,492.48.

Money Market

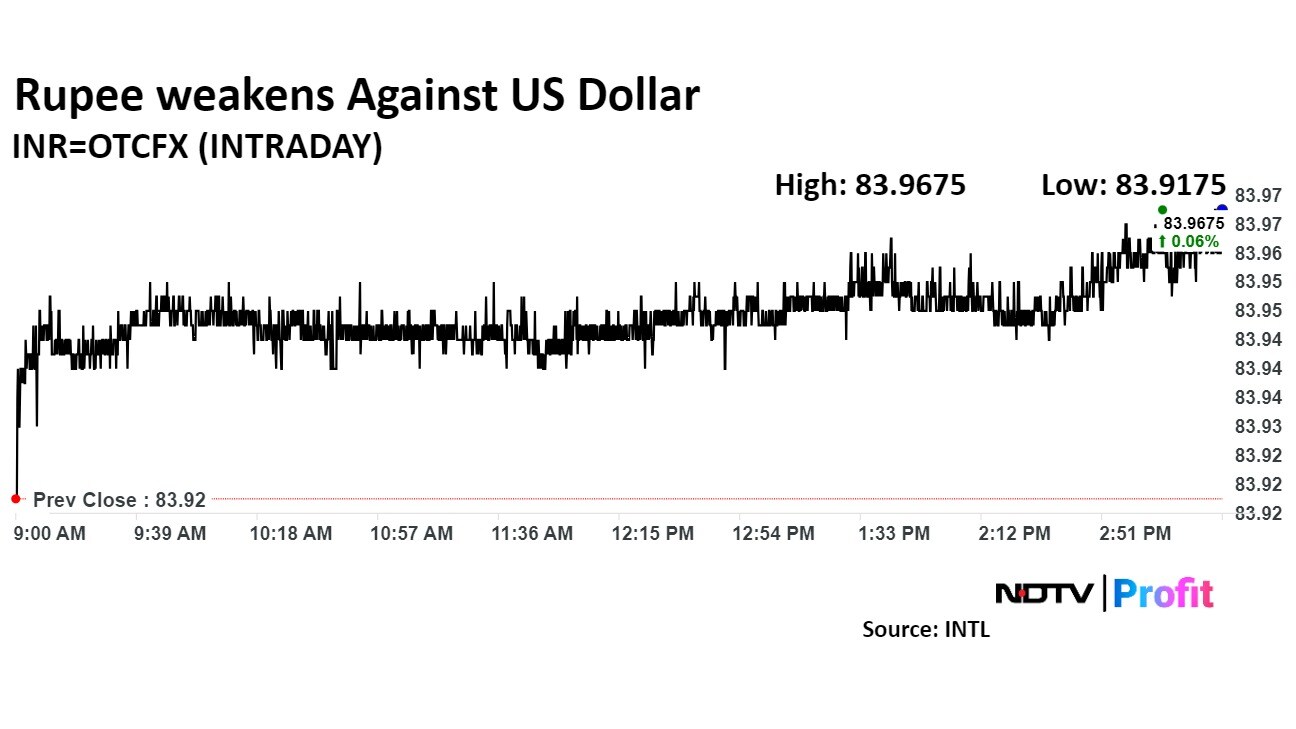

The Indian rupee closed weaker against the US dollar on Tuesday, tracking the strength of the dollar index. However, easing oil prices limited the demand for the greenback. The local currency has been oscillating in a tight range because of intervention by the Reserve Bank of India.

The rupee depreciated 5 paise to close at Rs 83.97 after opening at Rs 83.95 against the US dollar, according to Bloomberg data. It closed at Rs 83.92 against the greenback on Monday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.