Indian equities will "cool off" by 100–150 points, with 24,000 acting as a major support level for the NSE Nifty 50, according to analysts, as the benchmark index ended a volatile session 0.07% lower at 24,123.85 on Tuesday after hitting record highs in early trade, weighed by banks.

“I don't see a runaway rally in the markets just yet,” said Aditya Agarwala, head of research and investments at Invest4edu. “Till the time 24,000 is broken, I'm not going long on the Nifty index,” Agarwala said.

Technically, the index has formed a red candle around resistance of 24,200 levels. "If the index sustains above 24,200, then the rally could extend towards 24,500–24,600 levels in the short term," according to Hrishikesh Yedve, assistant vice-president, technical and derivatives research at Asit C. Mehta Investment Intermediates Ltd.

Bank Nifty opened with a gap up, but after reaching an initial high, the index witnessed profit-booking and finally settled the day on a negative note at 52,168.

"In the short term, Bank Nifty will find support around 51,000–51,100 zone and resistance at 53,000–53,200 zone. Since the trend is up, a buy-on-dips strategy should be adopted," Yedve said.

The GIFT Nifty was trading 2 points, or 0.01%, lower at 24,350 as of 06:40 a.m.

F&O Action

The Nifty July futures are up by 0.02% to 24,203 at a premium of 80 points, with open interest up by 0.09%.

The Nifty Bank July futures are down by 0,62% to 52,368 at a premium of 200 points, while its open interest is down by 2.5%.

The open interest distribution for the Nifty 50 July 4 expiry series indicated most activity at 25,000 call strikes, with 24,000 put strikes having maximum open interest.

For the Bank Nifty options July 3 expiry, the maximum call open interest was at 53,000 and the maximum put open interest was at 50,000.

FII/DII Activity

Overseas investors stayed net sellers of Indian equities for the third consecutive session on Tuesday.

Foreign portfolio investors offloaded stocks worth Rs 2,000.1 crore, while domestic institutional investors stayed net buyers for the third session and bought equities worth Rs 648.3 crore, the NSE data showed.

Market Recap

The benchmark equity indices ended a volatile session flat on Tuesday after hitting record highs in the early trade as shares of banks weighed on them.

The NSE Nifty 50 ended 18.10 points, or 0.07%, lower at 24,123.85, while the S&P BSE Sensex closed 34.74 points, or 0.04%, down at 79,441.45.

During the day, the Nifty advanced as much as 0.39% to a record high of 24,236.35 and the Sensex rose 0.48% to an all-time high of 79,855.87.

The broader markets ended on a mixed note, as the BSE MidCap ended 0.57% lower and the SmallCap settled 0.07% higher.

Of the 20 sectors on the BSE, 13 sectors declined and seven advanced, with telecommunications declining the most and information technology rising the most.

Major Stocks In News

Yes Bank: The company reported that its loans and advances were up by 14.8% year-on-year at Rs 2.29 lakh crore, deposits up by 20.8% year-on-year at Rs 2.64 lakh crore for the end of Q1 FY25. CASA ratio at 30.7% vs 30.9% QoQ.

NTPC: The company reported power generation up by 9.5% year-on-year at 113.87 BU, and coal stations recorded plant load factor of 79.5% at the end of Q1 FY 25.

Avenue Supermarts: The company reported standalone revenue up by 18% YoY at Rs 13,712 crore. The total stores as of June 30 stood at 371.

Zomato: Zomato Financial Services will withdraw RBI application for getting registered as an NBFC. Company does not want to pursue lending/credit business anymore.

Puravankara: The company acquired 7-acre land parcel in Bengaluru with potential gross development value of Rs 900 crore.

KEC International: The company received new order worth Rs 1,017 crore in its T&D and renewables businesses.

MosChip Technologies: The company signed a pact with C-DAC and Socionext for making high performance computing processor AUM. The processor to be built on TSMC's 5 nm technology node.

Global Cues

Stocks in the Asia-Pacific region rose after a strong closing by its Wall Street peers and the possibility of rate cuts in the US after Jerome Powell's comments on the country being back on a disinflationary path.

Stocks in Japan rose the most while those in South Korea and Australia also inched higher. The NIKKEI 225 was 296 points or 0.75% higher at 40,373 while the S&P ASX 200 was 19 points or 0.25% up at 7,737 as of 06:31 a.m.

The US stocks continued their record-setting surge as the S&P 500 closed above 5,500 to extend the rally. The US treasury yield fell with traders weighing a potential rate cut by the Fed.

The S&P 500 Index and Nasdaq Composite advanced 0.62% and 0.84%, respectively as of Thursday. Dow Jones Industrial Average also rose 0.41%.

Brent crude was trading 0.24% higher at $86.45 a barrel. Gold was 0.07% up at $2,331.04 an ounce.

Key Levels

US Dollar Index at 105.63

US 10-year bond yield at 4.42%

Brent crude up 0.24% at $86.44 per barrel

Bitcoin was up 0.43% at $62,186.32

Gold spot was up 0.07% at $2,331.04

Money Market Update

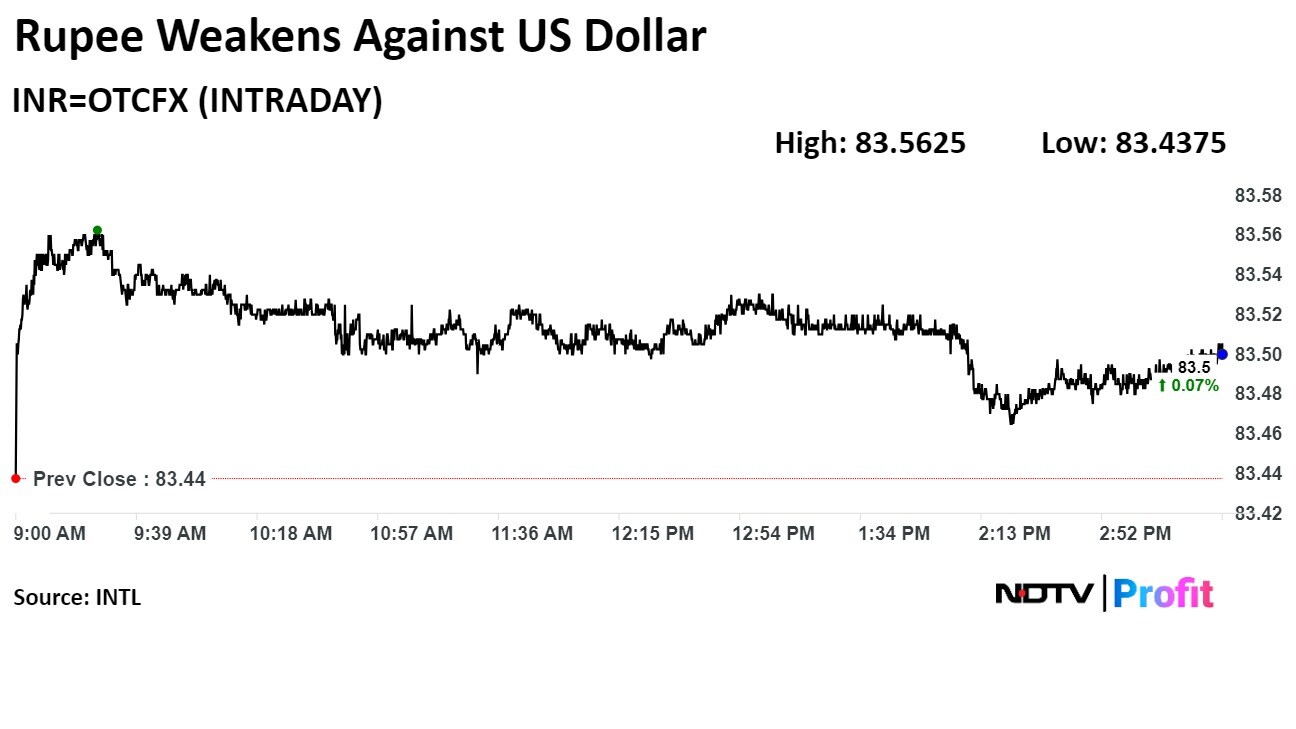

The Indian rupee closed weaker on Tuesday after the Brent crude oil price spiked to a two-month high on Monday.

The local currency weakened 6 paise to close at 83.50 against the US dollar. It closed at 83.44 on Monday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.