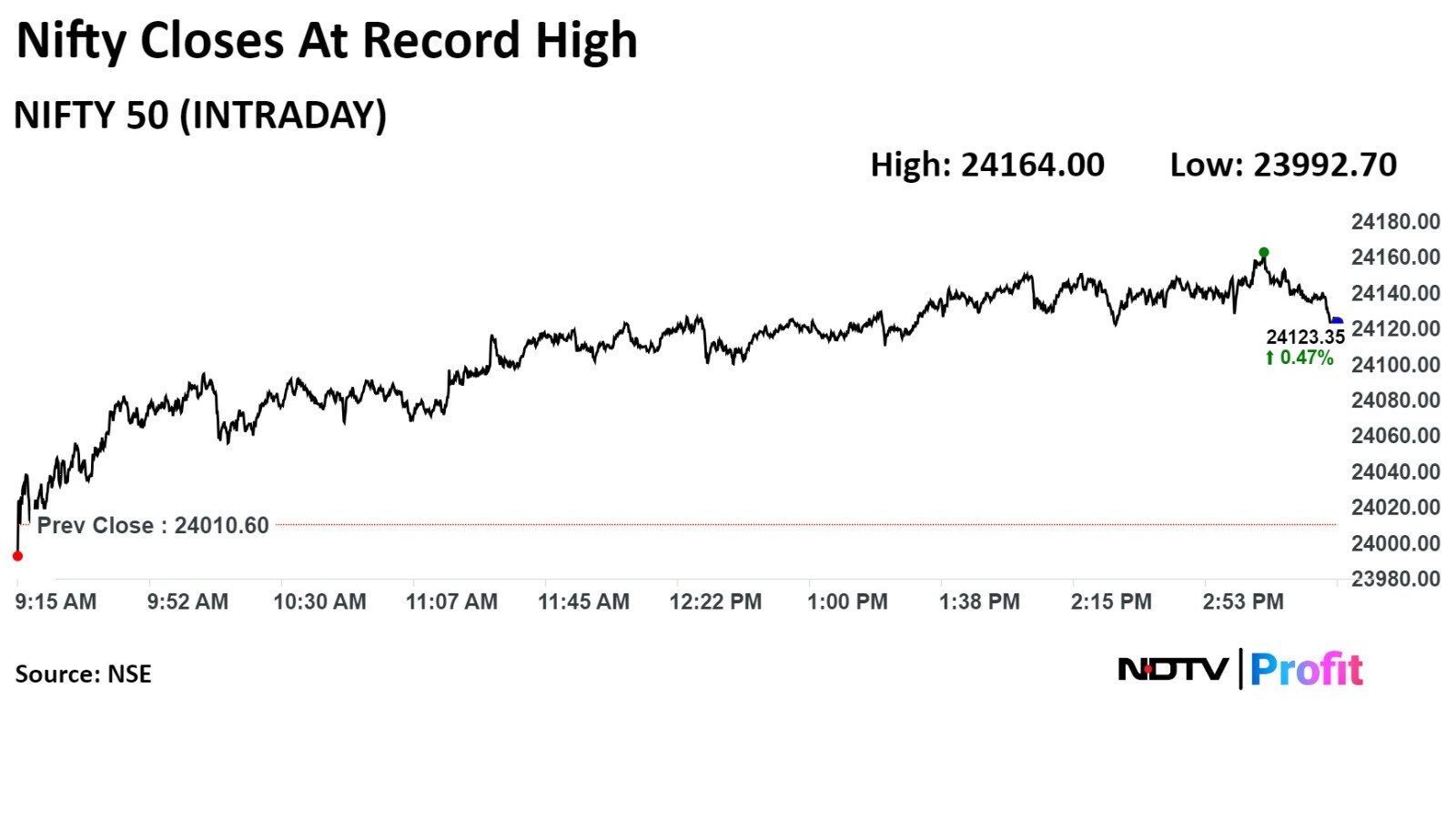

Indian equities can witness profit-booking at higher levels from Monday's close, due to temporary overbought conditions, according to Kotak Securities Ltd.

While 24,200-24,300 for Nifty 50 could be the immediate profit-booking zones for day traders, any dip below 24,000 could lead to exit from long positions, the brokerage said.

Nifty is finding resistance near the 24,150-24,200 levels and a breakout above 24,200 could extend the rally towards 24,500-24,600 levels in the short term, said Hrishikesh Yedve, AVP of technical and derivatives research at Asit C. Mehta Investment Interrmediates Ltd.

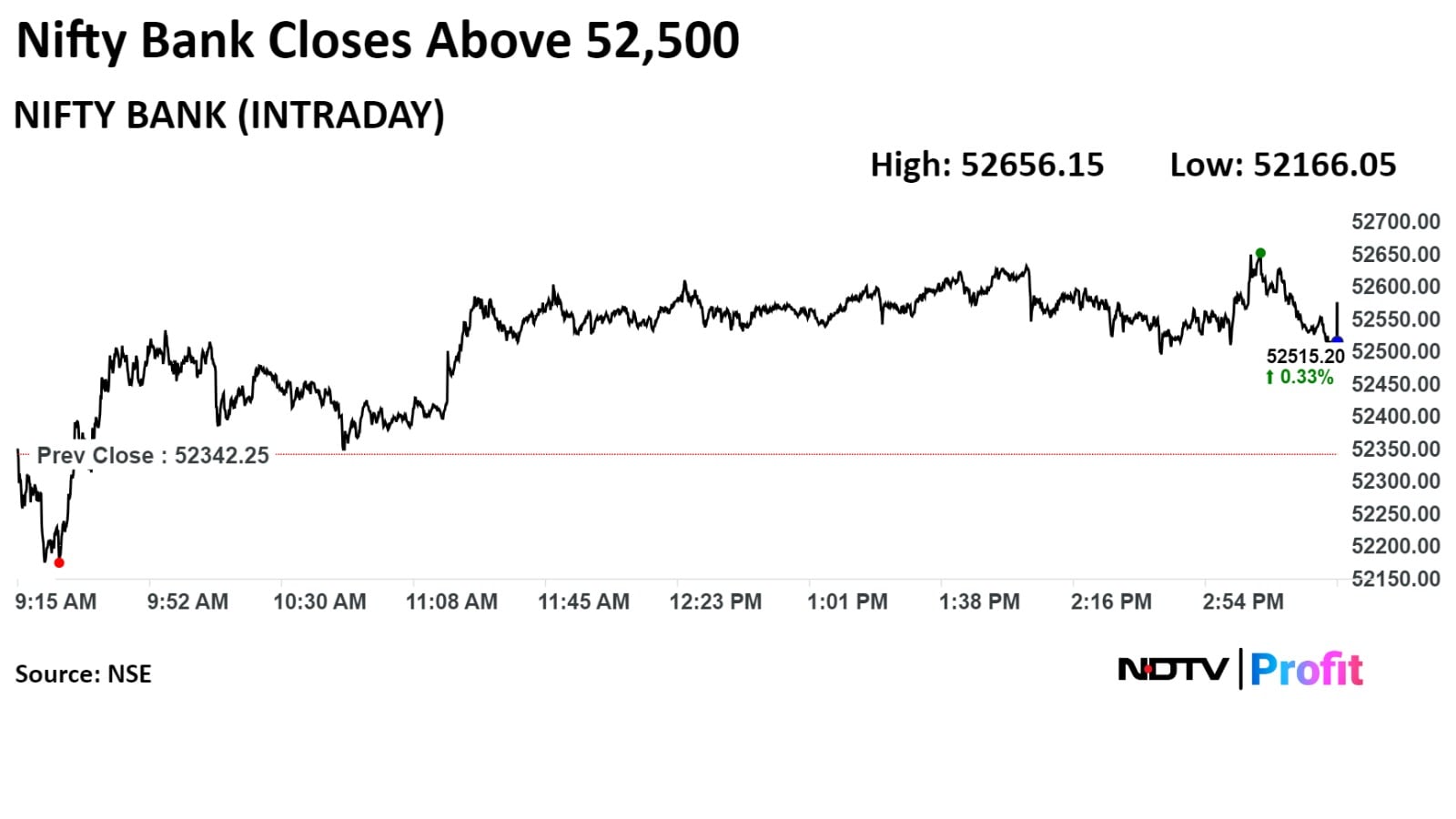

The Bank Nifty is trading below short-term trend line resistance and the 53,000-53,200 levels will act as a hurdle. If the index sustains above 53,200, the rally could extend towards 54,000, according to Yedve.

The banking gauge has formed a bullish candle in the daily timeframe but moved below the regression line. The 20-day moving average is placed at the 51,000 level. Bank Nifty could consolidate or oscillate within the 52,200-53,200 range in the next session, according to Om Mehra, technical analyst at SAMCO Securities Pvt.

The GIFT Nifty was trading 24 points, or 0.1%, lower at 24,247.5 as of 06:41 a.m.

F&O Action

Nifty July futures are up by 0.34% at 24,212, at a premium of 70 points, with open interest up by 3%.

The Nifty Bank July futures are up by 0.32% to 52,700, at a premium of 125 points, while open interest is up by 3.3%.

The open interest distribution for the Nifty 50 July 4 expiry series indicated most activity at 25,000 call strikes, with 24,000 put strikes having maximum open interest.

For the Bank Nifty options July 3 expiry, the maximum call open interest was at 53,000 and the maximum put open interest was at 50,000.

FII/DII Activity

Overseas investors remained net sellers of Indian equities on Monday.

Foreign portfolio investors sold stocks worth Rs 426 crore, while domestic institutional investors remained net buyers and mopped up equities worth Rs 3,917.4 crore, according to provisional data from the National Stock Exchange.

Market Recap

Indian benchmark indices recouped loss from last session and closed at all-time highs on Monday, tracking gains in shares of HDFC Bank Ltd. and Infosys Ltd.

The NSE Nifty 50 ended at 131.35 points, or 0.55%, higher at 24,141.95, and the S&P BSE Sensex settled 443.46 points, or 0.56%, up at 79,476.19.

The broader indices outperformed as the BSE MidCap rose 1.11% and the SmallCap gained 1.58%.

On BSE, 17 out of 20 sectors advanced, with information technology rising the most.

Major Stocks In News

Tata Motors Ltd.: The company reported 2% year-on-year jump in domestic sales at 2.25 lakh units. Total commercial vehicle sales were up 65%, while passenger vehicle and EV sales declined 1% and 14%, respectively.

Maruti Suzuki India Ltd.: The company's June production volume declined 3% year-on-year to 1.33 lakh units.

Patanjali Foods: The board approved the proposal to buy Patanjali Ayurved's non-food business for Rs 1,100 crore. The payment will be done in five tranches of 20%, 20%, 45%, 10% and 5%.

DCX Systems Ltd.: The company bagged orders worth Rs 1,250 crore for electric modules from Larsen & Toubro Ltd.

Sakuma Exports: The company approved bonus issue of shares in the ratio of 4:1, raising up to Rs 500 crore via QIP and investment of Rs 600 crore in its subsidiaries.

Asset management companies: SEBI has asked stock exchanges and other market infrastructure institutions to charge all its members uniformly and not offer discounts based on the trading volume or activity.

Global Cues

Asia-Pacific stocks were lower in early trade after the US factory activity fell for a third straight month in June and China's company managers' expectations for future output declined to the lowest since late 2019.

Stocks in South Korea fell in the most while the Japanese and Australian stocks were marginally lower. The KOSPI was 20.3 points or 0.72% lower at 2,783.6 while the S&P ASX 200 was 3.9 points or 0.05% down at 7,746 as of 06:33 a.m.

China economic data prints released on Monday showed a mixed trend as their factory activity indicated the strongest figures since May 2021 but company managers' expectations for future output fell.

While US stocks ended the session higher on Monday, their bond market was hit after the recently concluded presidential debate for the November US election weighed investor sentiments. The Treasury 10-year yields rose 6 bps to 4.5%.

The S&P 500 Index and Nasdaq Composite advanced 0.27% and 0.83%, respectively as of Thursday. Dow Jones Industrial Average also rose 0.13%.

Brent crude was trading 0.12% higher at $86.70 a barrel. Gold was 0.04% up at $2,332.85 an ounce.

Key Levels

US Dollar Index at 105.84

US 10-year bond yield at 4.46%

Brent crude up 0.12% at $86.70 per barrel

Bitcoin was down 0.62% at $62,841.35

Money Market Update

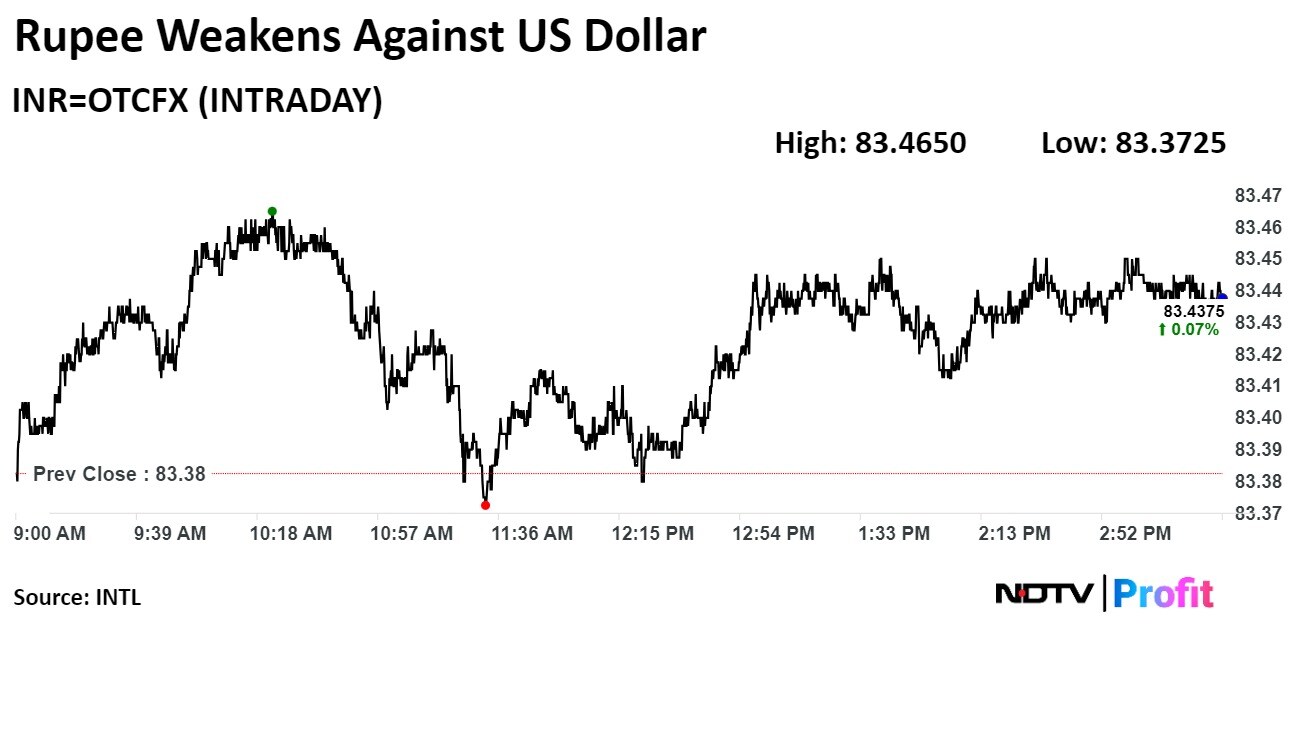

The Indian rupee closed weaker on Monday as crude prices surged, nearing a two-month high.

The local currency closed 5 paise weaker at Rs 83.44 and opened flat at Rs 83.4 against the greenback.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.