Indian equities are expected to correct on Thursday as Tata Consultancy Services Ltd. marks the beginning of the earnings season, with support broadly at the 24,270 level for the Nifty 50.

Heavy call writing and a "decent" put unwinding ahead of the weekly expiry indicate the possibility of a correction, according to Rupak De, senior technical analyst at LKP Securities.

He said if the index falls below 24,270, then it might fall to the range of 24,100–24,000. De also expects another round of short covering above 24,400.

Echoing a similar opinion, Siddhartha Khemka, head of retail research at Motilal Oswal Financial Services Ltd., said the markets will consolidate in the higher zone and any dip is an opportunity to buy for long-term investors.

With the earnings season beginning tomorrow, the IT sector is expected to remain in focus. However, expectations continue to be muted due to moderate sales growth amid a slowdown in the world economy and consolidation in margins.

Analysts also expect the consumer goods and pharma sectors to scale to further highs on the back of stocks like Dabur India Ltd., Emami Ltd. and Hindustan Unilever Ltd.

For Bank Nifty, which settled the day on a negative note, 52,000 will act as a support level. If the index can maintain the level, then Hrishikesh Yedve, AVP-technical and derivatives research at Asit C Mehta Investment Intermediates Ltd., expects a relief rally. If the Bank Nifty falls below that level, then it could trigger further weakness.

The GIFT Nifty was trading 13.5 points, or 0.06%, higher at 24,394 as of 06:39 a.m.

F&O Action

The Nifty July futures are down 0.53% to 24,355.05 at a premium of 30.6 points, with open interest down 2.8%.

Nifty Bank July futures are down by 0.55% to 52,318.60 at a premium of 129.3 points, while its open interest is down by 8.96%.

The open interest distribution for the Nifty 50 July 11 expiry series indicated most activity at 24,500 call strikes, with 24,000 put strikes having maximum open interest.

For the Bank Nifty options July 16 expiry, the maximum call open interest was at 55,000 and the maximum put open interest was at 52,000.

FII/DII Activity

Overseas investors remained net buyers of Indian equities for the sixth consecutive session on Wednesday. Foreign portfolio investors mopped up stocks worth Rs 584 crore, according to provisional data from the National Stock Exchange.

Domestic institutional investors stayed net buyers for the second session and bought equities worth Rs 1,416.4 crore, the NSE data showed.

.jpg)

Market Recap

The Sensex and Nifty succumbed to intense selling pressure, plunging below their record highs on Wednesday. This downturn was led by significant losses in metal, auto, and IT stocks as investors engaged in widespread profit-booking following recent rallies.

The NSE Nifty 50 closed 0.45% lower at 24,324.45, while the S&P BSE Sensex ended 0.53% lower at 79,924.77.

In early trade, the Nifty rose 0.11% to an all-time high of 24,461.05, while the Sensex went 0.16% up to hit its highest level of 80,481.36. During the day, the Nifty and the Sensex dropped as much as 1.19% and 1.14% to 24,141.80 and 79,435.76, respectively.

The broader markets ended lower as the BSE Mid-cap and Small-cap indices settled 0.19% and 0.69% lower, respectively.

Sixteen out of the 20 sectors on the BSE declined, with auto falling the most, while S&P BSE Utilities rose the most.

Major Stocks In The News

Asian Paints: The company confirmed a price hike across its portfolio by approximately 1%, effective July 22.

Glenmark Pharma, Glenmark Life: Glenmark Pharma is to sell up to a 7.84% stake in Glenmark Life via an offer-for-sale. Glenmark Pharma and Glen Saldanha will sell up to a 7.85% stake via OFS at a floor price of Rs 810 per share. OFS will open for non-retail investors on July 11 and for retail investors on July 12.

Sula Vineyards: The company saw the highest-ever first quarter net revenue and own brand revenue. Net revenue grew 9.7% year-on-year to Rs 130 crore. Wine tourism revenue in the quarter was Rs 11.3 crore, down 2.5% year-on-year. Own brand revenue rose 2.7% to Rs 104.4 crore.

GE Power India: The company will sell its hydro business undertaking to GE Power Electronics and its gas power business undertaking to GE Renewable Energy Technologies.

IRB Infrastructure Developers: The company's gross toll collection rose 35% year-on-year to Rs 517 crore in June.

Global Cues

Asian stocks powered ahead in early trade on Thursday tracking cues from the relentless rally in the US markets ahead of the key inflation print.

Equities in Japan and Australia advanced the most while the scrips in South Korea also edged higher. The S&P ASX 200 was 72 points or 0.92% higher at 7,889 while the Kospi was 23.2 points or 0.81% up at 2,890 as of 06:23 a.m.

The Bank of Korea and Bank Negara Malaysia will announce their key policy rates on Thursday.

Meanwhile, the US stocks extended their record rally as the S&P 500 surpassed the 5,600 mark for the first time as tech stocks pushed the markets higher near the closure of the trading hours.

In his second day of testimony to the Senate Banking Committee, the US Federal Reserve chair said that he doesn't need inflation below 2% before cutting rates. "I do have some confidence that inflation is headed lower," he said.

The S&P 500 Index and Nasdaq Composite advanced 1.02% and 1.18%, respectively as of Tuesday. Dow Jones Industrial Average also rose 1.09%.

Brent crude was trading 0.47% higher at $85.48 a barrel. Gold was 0.11% up at $2,373.7 an ounce.

Key Levels

U.S. Dollar Index at 104.95

U.S. 10-year bond yield at 4.28%

Brent crude up 0.47% at $85.48 per barrel

Bitcoin was up 0.01% at $57,412.12

Gold spot was up 0.11% at $2,373.7

Money Market Update

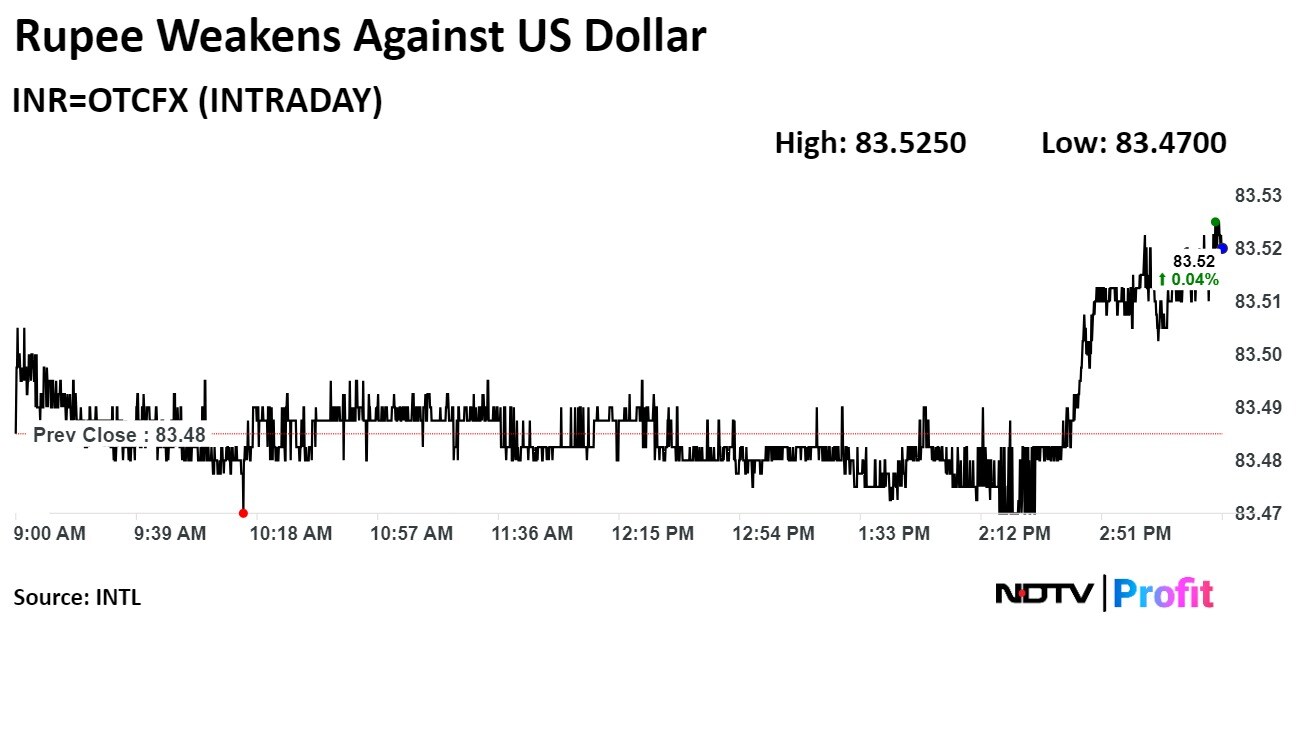

The Indian rupee weakened against the U.S. dollar on Wednesday after Federal Reserve Chair Jerome Powell refrained from committing to any policy rate cut during his testimony to the U.S. Congress.

The local currency depreciated 4 paise to close at Rs 83.53 against the greenback. It had closed at Rs 83.50 on Tuesday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.