Indian equities have another 2-3% upside, with the next resistance level for the Nifty at around 24,336 in the short-term, according to analysts, as the benchmark index ended June with 6.56% gains, the most since December.

The Nifty index has found resistance near the 24,200 levels, and failed to close above the trendline resistance. "If the index sustains above 24,200 levels, then the rally could extend towards 24,500-24,600 levels in the short-term," according to Hrishikesh Yedve, AVP Technical and Derivatives Research at Asit C. Mehta Investment Interrmediates Ltd.

The NSE Bank Nifty opened higher but closed lower at 52,342, forming a bearish candle near resistance. "We might see a push towards 54,000 for the Nifty Bank index, despite today's decline. The long-term trendline from 2010 indicates resistance at 54,000 to 56,000, suggesting some upside but warranting extreme caution," according to Jai Bala, founder and chief market technician at Cashthechaos.

With economic growth likely to be around 7% and the full-fledged budget expected by mid-July, the market may remain well-bid. But adverse influences from developments overseas may not be ruled out for the time being, according to Dr. Joseph Thomas, head of research, Emkay Wealth Management.

The GIFT Nifty was trading 16 points, or 0.07%, higher at 24,136 as of 06:31 a.m.

F&O Action

The Nifty July futures are up by 0.15% to 24,132 at a premium of 122 points, with open interest up by 1.65%.

The Nifty Bank July futures are down by 0.73% to 52,530 at a premium of 187 points, while its open interest is up by 0.8%.

The open interest distribution for the Nifty 50 July 4 expiry series indicated most activity at 25,000 put strikes, with 23,000 call strikes having maximum open interest.

For the Bank Nifty options July 3 expiry, the maximum call open interest was at 53,000 and the maximum put open interest was at 50,000.

FII/DII Activity

Overseas investors turned net sellers of Indian equities on Friday after a day of buying.

Foreign portfolio investors offloaded stocks worth Rs 23.1 crore, while the domestic institutional investors turned net buyers after a session of selling and mopped up equities worth Rs 6,658.3 crore, the NSE data showed.

Market Recap

India's benchmark stock indices closed higher on a weekly basis for the fourth consecutive week, marking their best month so far in 2024. The Nifty 50 ended June with 6.56% gains, the most since December 2023, when it had gained 7.9%.

On Friday, the Nifty closed 0.14%, or 33.90 points, lower at 24,010.60, and the Sensex fell 0.27%, or 210.45 points, to end at 79,032.73. During the day, the Nifty touched a fresh record of 24,174, and the Sensex hit a lifetime high of 79,671.58.

Broader markets outperformed benchmark indices, with the S&P BSE Midcap and Smallcap ending with 0.41% and 0.56% gains, respectively.

On BSE, eight sectors declined and 12 advanced. The S&P BSE Bank declined the most, and the S&P BSE Energy rose the most.

Meanwhile, the yield on the 10-year government bond closed flat at 7.01%, even as the JPMorgan Chase & Co. began adding domestic gilts to its benchmark emerging-market bond index.

Major Stocks In News

BEL: The company received a contract worth Rs 3,172 crore from Vehicles Nigam to supply sighting and fire control system for Indian Army Tanks and received additional orders worth Rs 481 crore for meteorological equipment.

Cochin Shipyard: The company's unit signed a pact with Norway's Wilson ASA for constructing four 6,300 TDW dry cargo vessels and agreement for four additional vessels to be formally contracted within Sept. 19. The overall project cost for eight vessels was about Rs 1,100 crore.

UltraTech Cement: The company commissioned additional 3.35 MTPA clinker and 1.8 MTPA grinding capacity at its Tadipatri unit in Andhra Pradesh. The company also increased the capacity of grinding unit in Jharsuguda, Odisha, by 0.4 MTPA.

Godrej Properties: The company acquired leasehold rights for 11-acre land parcel in Pune, offering developable potential of 2.2 million square feet with an estimated revenue potential of Rs 1,800 crore.

TVS Motor: The company acquired additional stake in TVS Credit Services for Rs 283 crore.

JSW Energy: The company subsidiary JSW Neo Energy got a letter of award for 300 MW wind-solar hybrid power projects from SJVN.

Jindal Stainless: The company acquired 100% stake of Sulawesi Nickel Processing Industries Holdings PTE, Singapore, for setting up a joint venture in Indonesia for investing, developing, constructing, and operating a stainless-steel melt shop in Indonesia.

Global Cues

Stocks in the Asia-Pacific region started the week on a mixed cue as investors awaited fresh catalyst from China's key economic report that would shed light on the nation's economic progress.

Japanese stocks were trading higher at the open, while those of Hong Kong and South Korea were lower. The Nikkei 225 was 300 points or 0.75% higher at 39,882 while the S&P ASX 200 was 45 points or 0.58% up at 7,722 as of 06:22 a.m.

Meanwhile, the euro strengthened after initial election results showed Le Pen's National Rally won with a smaller margin than some polls had indicated. The private Caixin China manufacturing PMI release is scheduled later on Monday.

The US stocks ended the week lower on Friday as traders remained cautious ahead of any news regarding the US presidential race. President Joe Biden's poor performance in the debate boosted sentiment around Donald Trump's chance of securing a second term.

The S&P 500 Index and Nasdaq Composite slipped 0.41% and 0.71%, respectively as of Thursday. Dow Jones Industrial Average also fell 0.12%.

Brent crude was trading 0.16% lower at $85.14 a barrel. Gold was 0.10% lower at $2,324.39 an ounce.

Key Levels

US Dollar Index at 105.64

US 10-year bond yield at 4.40%

Brent crude up 0.16% at $85.14 per barrel

Bitcoin was up 1.22% at $62,659.18

Money Market Update

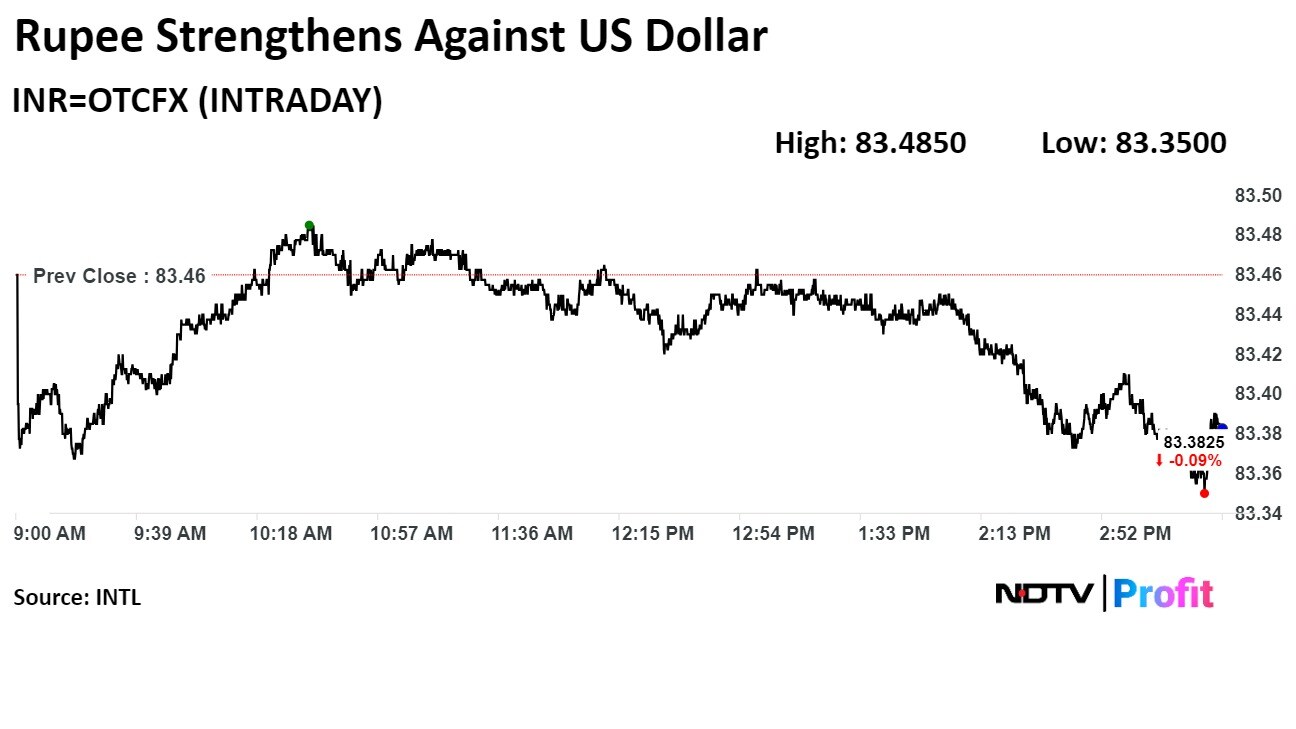

The rupee opened stronger on Friday as the inclusion of Indian government bonds in the JPMorgan emerging markets index began.

The local currency appreciated by 7 paise to close at Rs 83.39 against the greenback. It opened at Rs 83.40.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.