Wednesday's market action will largely depend on whether the NSE Nifty 50 can overcome the critical resistance zone of 25,080–25,100, a level that has repeatedly capped the index's upward momentum, according to analysts.

If the index sustains above this range, it could trigger a rally towards 25,300–25,500, they said. "The index found resistance near its previous record high of 25,078 and witnessed profit booking, resulting in the formation of a small red candle on the daily chart," Hrishikesh Yedve, AVP of technical and derivatives research at Asit C. Mehta Investment Intermediates Ltd., said.

The key indices' current position reflects a thin trading range, according to Hashim Yacoobali of South Gujarat Shares and Sharebrokers Ltd. While Nifty managed to hold above the psychological 25,000 mark, it struggled to sustain above the 25,052–25,099 resistance zone, he noted.

"The index has made a doji candlestick pattern near the record levels, indicating indecisiveness between the bulls and bears," said Aditya Gaggar, director of Progressive Share Brokers Pvt.

Tuesday's muted market movement was influenced by global factors such as the ongoing west Asia conflict and anticipation of Nvidia's earnings report, which kept the Nifty confined within a 99-point range, said Avdhut Bagkar, technical and derivatives analyst at StoxBox. This narrow range and the inability to close above key levels suggest that investors should brace for potential volatility in the coming sessions, he added.

The GIFT Nifty, an early indicator of the Nifty 50's performance in India, was down 11 points or 0.04% at 25,001.5 as of 6:43 a.m.

FII/ DII Activity

Overseas investors stayed net buyers of Indian equities on Tuesday for the fourth consecutive session.

Foreign portfolio investors bought stocks worth Rs 1,503.8 crore and domestic institutional investors turned net sellers after remaining buyers for 16 sessions and offloaded equities worth Rs 604.1 crore, the NSE data showed.

Market Recap

The benchmark stock indices ended a lacklustre session on Tuesday with little change as gains in Infosys Ltd. and Larsen & Toubro Ltd. supported the indices, while losses in Reliance Industries Ltd. and Hindustan Unilever Ltd. weighed on the indices.

The NSE Nifty 50 ended 7.15 points, or 0.03% higher at 25,017.75, and the S&P BSE Sensex closed 13.65 points, or 0.02% up at 81,711.76.

Intraday, Nifty rose 0.25% to 25,073.10 and Sensex was 0.27% higher at 81,919.11. Nifty moved in the range of 99.45 points and Sensex moved in a 318.6-point range.

Major Stocks In News

ICICI Prudential Life Insurance Co.: The company received a GST demand and penalty order worth Rs 429 crore from the Maharashtra tax authority.

Godrej Agrovet: The company completed the acquisition of an additional 49% stake in arm Godrej Tyson foods from Tyson India Holdings. Godrej Tyson Foods has become a wholly owned subsidiary of the company effective from Tuesday.

Gensol Engineering: The company launched US subsidiary Scorpion Trackers and targets a 2,000-megawatt annual supply by 2028.

PNC Infratech: The company was declared the lowest bidder for a highway project worth Rs 380 crore in Uttar Pradesh and Bihar.

Aditya Birla Capital: The company made an investment of Rs 300 crore via rights in Aditya Birla Housing Finance.

Indostar Capital Finance: The company sold a portion of its stressed book to Pridhvi Asset Reconstruction. The sale includes certain Stage 2-tagged accounts with outstanding dues of Rs 357 crore.

SBI, SBI Cards: Dinesh Khara retired as chairman and he resigned as director of SBI Card and Payment Services.

Awfis Space Solutions: The company signed the largest managed aggregation deal of three lakh sq. ft. with Nyati Group.

Skipper: The company approved raising up to Rs 600 crore via equity and debt.

Jio Financial Services: The company subscribed to an additional 6.8 crore shares of Jio Payments Bank for Rs 68 crore. The company's holding in payment bank units increased to 82.17% from 78.95%.

Bank of Baroda: The company announced that it has raised Rs 5,000 crore by issuing long-term infrastructure bonds. The lender said it is a 10-year bond issued at a coupon of 7.30%, as per an official statement.

Yes Bank: Amit Sureka, country head of financial markets, ceased to be part of senior management of the bank.

Medplus Health Services: Warburg Pincus affiliate exited the company by selling an entire 11.35% stake via an open market transaction.

IndiaMart InterMesh: The company incorporated a new unit, IIL Digital for digital marketplaces and software solutions.

UPL: The company arm acquired the remaining 20% stake in PT Excel for $6.9 million.

Infibeam Avenues: The company's artificial intelligence arm introduced a women's safety feature in 'AI Facility Manager' for CCTVs.

NBCC (India): The company is to consider a proposal for the issue of bonus shares on Aug. 31.

Carysil: The company's UK unit will acquire the remaining 30% stake of Yorkshire-based Carysil Brassware for £350,000.

Global Cues

Asian stocks fell in early trade on Wednesday following a cautious rise in the US stocks, ahead of Nvidia Corp.'s earnings, while traders weighed on the magnitude of September rate cuts.

Future contrast in the US pointed to a negative start while the benchmarks in Australia declined the most in Asia. The Nikkei 225 was 0.14% lower at 38,230, and the S&P ASX 200 was 0.42% higher at 8,035 as of 6:33 a.m.

Nvidia will report its earnings on Wednesday and the world's most valuable chipmaker is expected to report revenue growth of more than 70%, according to Bloomberg. The shares are expected to see a movement of 10% on both sides depending on the earnings figures.

Meanwhile, the broad crypto market took a hit in the previous session, with Bitcoin falling nearly 5% to 59,087.44.

The US stocks saw a marginal rise with traders contemplating if the artificial intelligence rally has outrun the fundamentals ahead of the tech giant's earnings. The S&P 500 and Nasdaq Composite rose 0.16% and 0.16%, respectively. The Dow Jones Industrial Average climbed 0.02%.

Brent crude was trading 0.49% higher at $79.94 a barrel as of 06:41 a.m. Gold fell 0.13% to $2,521.39 an ounce.

Key Levels

US Dollar Index at 100.61.

US 10-year bond yield at 3.82%.

Brent crude up 0.49% at $79.94 per barrel.

Bitcoin was down 4.26% at $59,215.91.

Gold fell 0.13% at $2,521.39.

Money Market

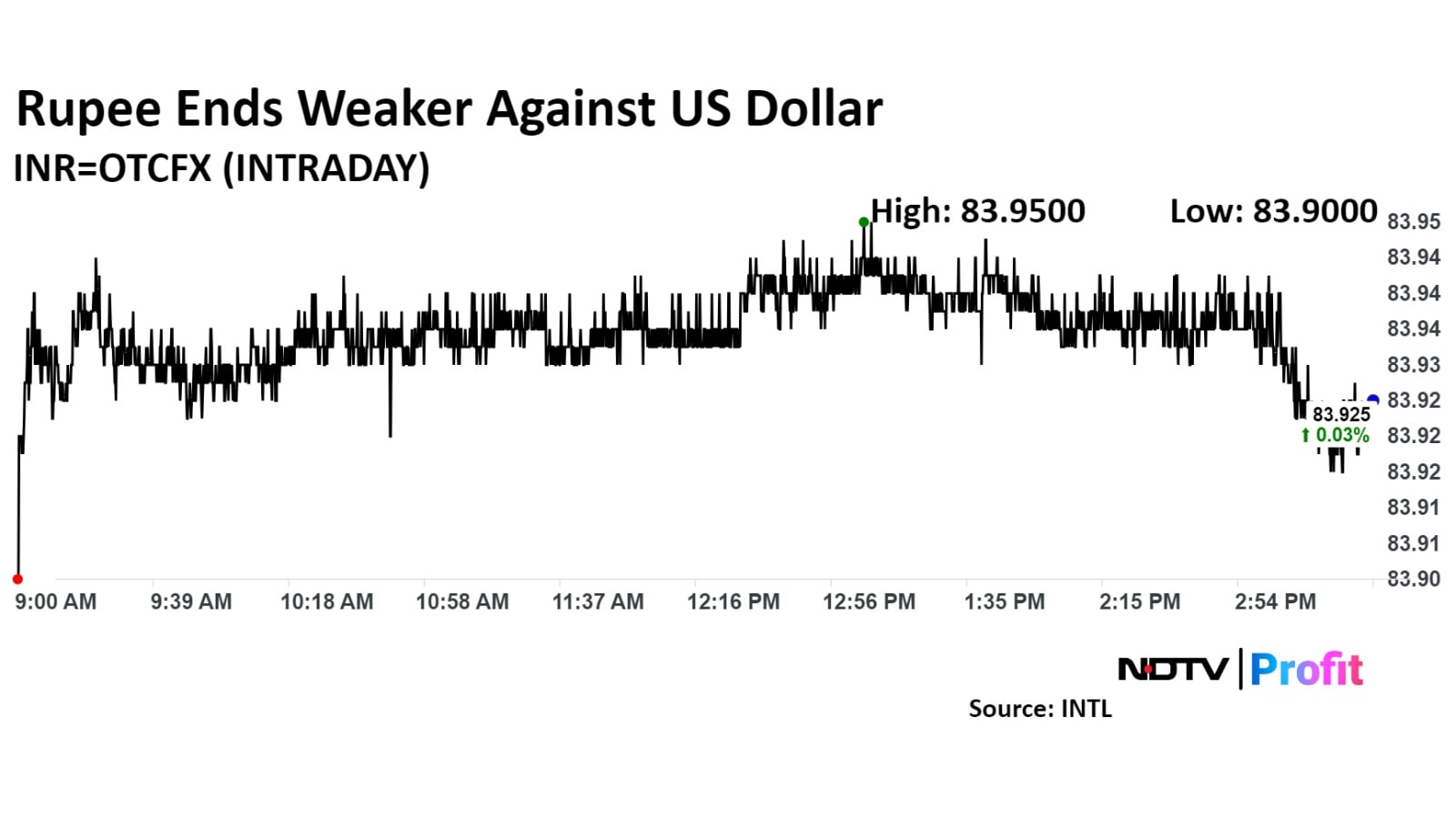

The Indian rupee closed weaker against the US dollar on Tuesday amid falling crude prices and an expected weightage increase in the MSCI Index.

The local currency depreciated by 2 paise to close at 83.92, according to Bloomberg data. It had closed at 83.90 on Friday.

The dollar index, which tracks its performance against a basket of 10 leading global currencies, opened flat and was trading 0.04% lower at 100.82 at 3:40 p.m. IST.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.