The NSE Nifty 50 needs to break through the resistance zone between 24,950 and 24,960 for fresh bullish momentum, according to analysts. Investors are waiting for US Federal Reserve Chair Jerome Powell's upcoming speech on Friday for insights into a potential interest rate cut by the Fed later this year.

From a technical perspective, the index briefly entered the gap zone between 24,852 and 24,956 but experienced profit-booking, leading to the formation of a red candle on the daily chart, according to Hrishikesh Yedve, assistant vice president of technical and derivatives research at Asit C Mehta Investment Intermediates Ltd.

For a fresh bullish trigger, the index needs to overcome the hurdle at 24,950–24,960. On the downside, strong support is expected from the 21-day exponential moving average, located near 24,480, Yedve said.

Hopes are high for a rate cut in the Fed's September meeting, followed by further cuts in subsequent sessions, according to Siddhartha Khemka, head of retail research at Motilal Oswal Financial Services Ltd. "The market is likely to consolidate in the near term, with sectoral rotation and stock-specific action driving momentum."

The Bank Nifty also closed at 50,986 on Thursday. Technically, the index has sustained above its 21-day EMA support, forming a green candle on the daily chart, signalling strength.

As long as the index remains above the 21-day EMA at 50,780, a buy-on-dips strategy is advisable. A resistance is near the 51,200 level and a breakout above this could pave the way for the index to reach 51,500–51,800, according to Yedve.

"In the interim, maintain a focus on a stock-centric approach, implement proper risk-management strategies, and consistently secure profits at opportune times," Osho Krishan, senior analyst at Angel One Ltd., said.

The GIFT Nifty, an early indicator of the Nifty 50 Index's performance in India, was up 3.5 or 0.01% at 24,820.5 as of 6:30 a.m.

F&O Activity

The Nifty August futures were up 0.17% to 24,840 at a premium of 29 points, with open interest down 1.5%.

The Nifty Bank August futures were up by 0.45% to 51,037 at a premium of 52 points, while its open interest was down by 2.85%.

The open interest distribution for the Nifty 50 Aug. 22 expiry series indicated most activity at 26,000 call strikes, with 24,000 put strikes having maximum open interest.

For the Bank Nifty options expiry on Aug. 28, the maximum call open interest was at 51,000 and the maximum put open interest was at 51,000.

FII/ DII Activity

Overseas investors turned net buyers of Indian equities on Thursday after three straight sessions of selling.

Foreign portfolio investors bought stocks worth Rs 1,371.8 crore, while domestic institutional investors stayed net buyers for the 14th session and bought equities worth Rs 2,971.8 crore, the NSE data showed.

Market Recap

The benchmark equity indices pared some of their morning gains but still managed to close higher on Thursday, with the NSE Nifty 50 recording its best streak since the six sessions that ended on May 23.

The Nifty closed 41.30 points or 0.17%, higher at 24,811.50, while the S&P BSE Sensex ended 0.18% or 147.89 points up at 81,053.19. Both indices recorded their highest closing since Aug. 1.

The broader markets outperformed the benchmark indices, as the BSE MidCap and the SmallCap ended 0.67% and 0.47% higher, respectively.

On the BSE, 15 sectoral indices advanced and five declined out of 20.

Major Stocks In News

Zomato: The company to shutdown Zomato Legends, as the company is unable to find product market fit.

Adani Power: NCLT has approved company's resolution plan to buy Lanco Amarkantak Power for Rs 4,101 crore.

Ambuja Cement: Adani Group plans to divest $500 million worth of shares or 2.84% stake in company. The value of the deal is Rs 4197.8 crore at the floor price of 600 per share according to the terms of deal viewed by NDTV Profit.

FSN E-Commerce Ventures: Harindarpal Singh Banga and Indra Banga offer to sell as much as 4.09 crore shares, or 1.4% stake in the company via block deal. The floor price is set at Rs 198 rupees.

Shriram Finance: The company approved the sale of entire stake in Shriram Housing Finance to mango rest investment, an affiliate of Warburg Pincus.

Wipro: The company extends its pact with John Lewis Partnership to complete their cloud transformation project.

Jain Irrigation Systems: The company signed MoU with Indian coffee board for commercial release of disease-resistant coffee plants to growers.

Bharat Forge: The company to invest additional Rs 105 crore in unit Kalyani Power Train via share subscription.

Power Mech Projects: The company to issue bonus shares in the ratio of 1:1. The company has set Sept. 28 as record date for determining eligible shareholders.

Global Cues

Asian stocks saw cautious open on Friday as traders feared that the US Federal Reserve Chair would turn against the expectations of aggressive rate cuts in the Jackson Hole Economic Symposium.

Benchmarks in Australia and South Korea declined in early trade, while that of Japan was marginally higher. The Nikkei 225 was 0.35% higher at 38,340, and the Kospi was 0.35% lower at 2,698 as of 6:18 a.m.

Singapore's core inflation print will be released later in the day while the Bank of Japan's Governor is set to face questioning in the country's parliament about the July rate hike. Jerome Powell's Jackson Hole meeting began on Thursday, and September rate cuts on his speech are expected on Friday.

Meanwhile, stocks in Wall Street lost steam near record highs as fears that Jerome Powell might reverse the expected aggressive rate cut stance. Bonds in the US rose ahead of the country's new home sales data and Powell's speech.

Dorp in the Asian stocks echoed the decline in US stocks led by technology stocks. The S&P 500 and Nasdaq Composite plunged 0.89% and 1.67%, respectively. The Dow Jones Industrial Average slipped 0.43%.

Brent crude was trading flat at $77.22 a barrel as of 06:29 a.m. Gold rose 0.25% to $2,490.88 an ounce.

Key Levels

US Dollar index at 101.45.

US 10-year bond yield at 3.84%.

Brent crude flat at $77.21 per barrel.

Bitcoin was down 0.01% at $60,680.

Gold was rose 0.25% at $2,490.88.

Money Market

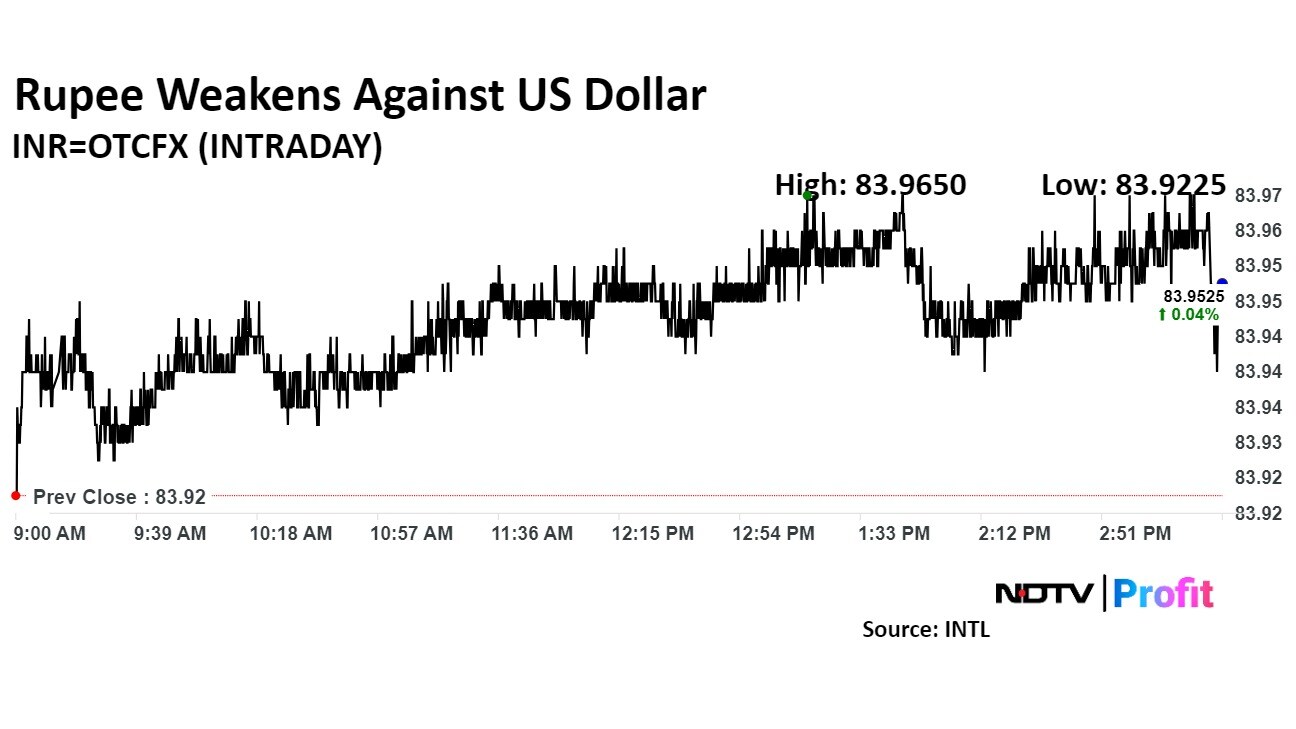

The Indian rupee weakened against the US dollar on Thursday on continued demand for the greenback from importers, even as US Fed meeting minutes increased bids for a rate cut in September.

The local currency depreciated 2 paise at Rs 83.95 after opening at Rs 83.94 a dollar. It had closed at Rs 83.93 on Wednesday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.