The NSE Nifty 50 is steadily approaching the critical resistance of the bearish gap situated around 24,850–24,950, which would be crucial to monitor amid the current momentum, according to analysts.

A gradual upshift in the support base is evident, with 24,650–24,600 likely to provide a cushion against any potential setbacks, while the sacrosanct support lies around the pivotal zone of 24,500, according to Osho Krishan, senior analyst at Angel One Ltd.

Krishan suggested investors keep a close tab on the Nifty Bank, as its participation would play a crucial role in setting up momentum in the market. "One must stay vigilant with global developments and act according to the levels mentioned."

If the benchmark indices are trading above 24,650/80,600, the bullish texture is likely to continue on the higher side, and the market can rally up to 24,850–24,900/81,300–81,600, according to Shrikant Chouhan, head of equity research at Kotak Securities. "On the flip side, dismissal of 24,650/80,600 may trigger one quick intraday correction till 20-day simple moving average or 24,525–24,500/80,100–79,800."

"For the index, the view remains the same, that is, heading towards 24,870 (range breakout target), while the support level shifted higher to 24,640," Aditya Gaggar, director of Progressive Share Brokers Pvt., said.

Global markets exhibited a mildly cautious tone ahead of the release of the Federal Open Market Committee's minutes later in the day, according to Vinod Nair, head of research at Geojit Financial Services. "Currently, the expectation of a rate cut remains high, given the fall in US inflation and moderation in overall growth."

The GIFT Nifty, an early indicator of the Nifty 50 Index's performance in India, was down 3 or 0.01% at 24,891 as of 6:44 a.m.

F&O Action

The Nifty August futures were up 0.34% to 24,798 at a premium of 28 points, with the open interest down 0.5%.

The Nifty Bank August futures were down 0.17% to 50,806 at a premium of 121 points, while its open interest was down 1.9%.

The open interest distribution for the Nifty 50 Aug. 22 expiry series indicated most activity at 25,000 call strikes, with 24,300 put strikes having maximum open interest.

For the Bank Nifty options expiry on Aug. 28, the maximum call open interest was at 58,000 and the maximum put open interest was at 52,800. The Nifty August futures were up 0.34% to 24,798 at a premium of 28 points, with open interest down 0.5%.

The Nifty Bank August futures were down by 0.17% to 50,806 at a premium of 121 points, while its open interest was down by 1.9%.

The open interest distribution for the Nifty 50 Aug. 22 expiry series indicated most activity at 25,000 call strikes, with 24,300 put strikes having maximum open interest.

For the Bank Nifty options expiry on Aug. 28, the maximum call open interest was at 58,000 and the maximum put open interest was at 52,800.

FII/DII Activity

Overseas investors stayed net sellers of Indian equities on Wednesday for third straight day.

Foreign portfolio investors offloaded stocks worth Rs 799.9 crore while domestic institutional investors stayed net buyers for the 13th session and bought equities worth Rs 3,097.5 crore, the NSE data showed.

Market Recap

The benchmark stock indices ended Wednesday's choppy session on a positive note, with the NSE Nifty 50 recording a five-session winning streak as ITC Ltd. and Bharti Airtel Ltd. gained.

The NSE Nifty 50 settled at 71.35 points, or 0.29% higher at 24,770.20, and the S&P BSE Sensex ended at 102.44 points or 0.13% higher at 80,905.30.

Major Stocks In News

Zomato: The company said that it will acquire the entertainment, sports, and events ticketing business—Insider and TicketNew—from Paytm operator One 97 Communications Ltd. for Rs 2,048 crore.

Kalyan Jewellers India: Highdell Investment to sell 2.36% stake to promoter Trikkur Sitarama Iyer for Rs 1,300 crore at Rs 535 per share.

India Grid Trust: Sponsor Esoteric II to sell up to 17.32% stake in the company via offer for sale. This includes a base offer of up to 9.66% with an oversubscription option of additional 7.66%.

Hudco: The company signed an MoU with Yamuna Expressway Industrial Development Authority to extend loan assistance towards projects on both sides of Yamuna Expressway.

Welspun Enterprises: The company's arm received an order worth Rs 160 crore from BMC for the rehabilitation of man-entry sewers using trenchless technology in Mumbai.

Ireda: The company to consider raising of funds up to Rs 4,500 crore through FPO, QIP or other means.

Punjab National Bank: The government has extended Kalyan Kumar's term as executive director for two years beyond Oct. 20.

L&T Technology Services: The company has extended its collaboration with Paris-based Thales for software monetisation solutions.

Zen Technologies: The company launches QIP and sets the floor price at Rs 1,685.18 per share.

RVNL: The company signed an MoU with Dhaya Maju Infrastructure for rail infra projects in the Asean market. The project will focus on establishing a manufacturing base in Malaysia for railway coaches.

BEML: The company partners with the Indian Navy to develop advanced marine applications for defence.

Global Cues

Stocks in the Asia-Pacific region inched higher on Thursday as lower-than-anticipated US payroll data and Federal Reserve meeting minutes hinted at September rate cuts.

The scrips in the region rose ahead of key central banks' comments on their respective country's rates. Jerome Powell's Jackson Hole meeting will begin on Thursday, and September rate cuts on his speech are expected on Friday. The Bank of Korea will announce its rate decision later in the day and is expected to remain status quo, according to Bloomberg.

Japanese stocks recorded the most gains, while Australian and South Korean scrips edged higher. The Nikkei 225 was 0.89% higher at 38,284, and the Kospi was 0.16% higher at 2,705 as of 6:30 a.m.

The Fed minutes released last night pointed out that a "vast majority" saw the September cut as likely appropriate while "several" officials saw the case for cutting at the July meeting. The officials noted an increased downside risk to employment and almost "all" Fed officials expected continued disinflation.

The US stocks closed higher after the downward revision of US payroll growth fueled renewed hopes for September rate cuts. The S&P 500 and Nasdaq Composite climbed 0.42% and 0.57%, respectively. The Dow Jones Industrial Average advanced 0.14%.

Brent crude was trading 0.05% lower at $76.01 a barrel as of 06:39 a.m. Gold fell 0.01% to $2,512.3 an ounce.

Key Levels

US Dollar Index at 101.15.

US 10-year bond yield at 3.80%.

Brent crude down 0.05% at $76.01 per barrel.

Bitcoin was down 0.31% at $61,059.

Gold was down 0.01% at $2,512.3.

Money Market

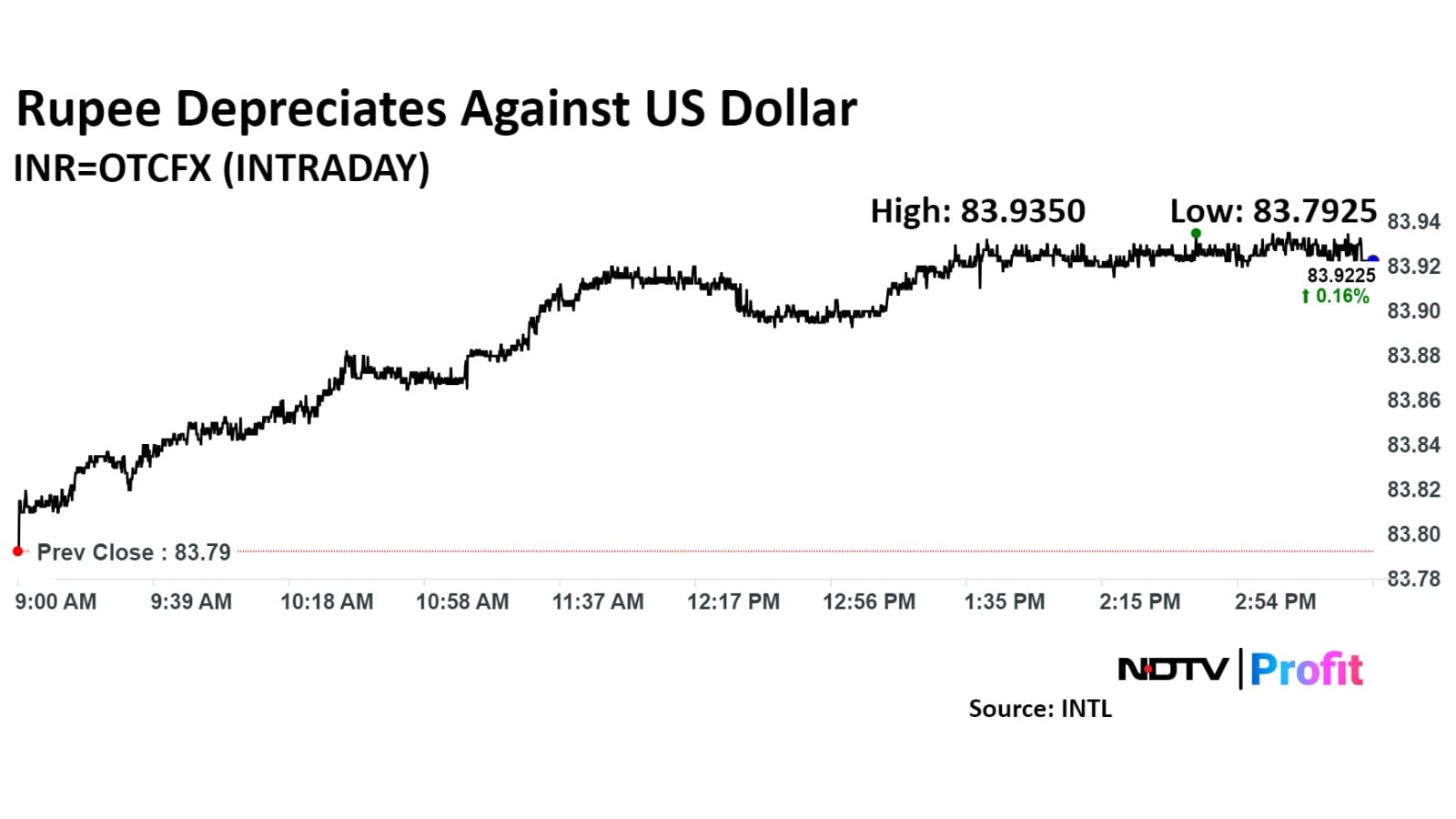

The Indian rupee closed weaker against the US dollar on Wednesday, ahead of Federal Reserve Chair Jerome Powell's speech.

The rupee depreciated 14 paise to close at 83.93 against the greenback, according to Bloomberg data. It had closed at 83.79 on Tuesday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.