The NSE Nifty 50 ended Friday on a bullish note, closing at 24,541 levels, with analysts predicting potential tests of 24,700 and 24,850 in the upcoming sessions as immediate hurdles. All sectors finished in the green, led by IT and realty, both gaining over 2%.

The volatility index, India VIX, dropped by 6.68%, settling at 14.40, indicating reduced market volatility.

On the technical front, the Nifty surpassed the 21-day exponential moving average at 24,365, forming a strong green candle that signifies continued strength. "As long as the index stays above 24,350, the bullish momentum is likely to persist. Resistance levels are placed near 24,690 and 24,960," Hrishikesh Yedve, assistant vice-president, technical and derivatives research, at Asit C Mehta Investment Intermediates Ltd, said.

"We may see levels of 24,700 and 24,850 being tested as immediate hurdles. If global markets remain supportive, a retest of 25,000 levels and beyond is possible," Rajesh Bhosale, equity technical analyst at Angel One, said. He cautioned that the bullish gap around 24,200 from Friday is crucial. If breached, the market could slide back towards 24,000 and 23,900.

The Nifty 50 earnings grew 4% year-on-year, with expectations of steady earnings growth of approximately 15% over the next two years, according to Siddhartha Khemka, head of retail research at Motilal Oswal Financial Services Ltd.

The Bank Nifty also closed positively at 50,517. "Technically, it formed a green candle on the daily chart, signaling strength," Yedve said. "However, the index may face resistance near 50,805, where the 21-DEMA is located. A sustained move above 50,810 could propel the index towards the 51,200-51,500 range."

The GIFT Nifty, an early indicator of the Nifty 50 Index's performance in India, was up 82 or 0.33% at 24,711.5 as of 08:32 a.m.

F&O Action

The Nifty August futures were up 1.75% to 24,585 at a premium of 44 points, with open interest down 2%.

Nifty Bank August futures were up by 1.34% to 50,624 at a premium of 108 points, while its open interest was down by 13%.

The open interest distribution for the Nifty 50 Aug. 22 expiry series indicated most activity at 25,000 call strikes, with 23,000 put strikes having maximum open interest.

For the Bank Nifty options expiry on Aug. 21, the maximum call open interest was at 53,000 and the maximum put open interest was at 50,000.

FII/DII Activity

Overseas investors snapped a three-session selling streak as it turned net buyers on Friday.

Foreign portfolio investors mopped equities worth Rs 766.5 crore, while domestic investors remained net buyers for the 10th consecutive session and mopped up equities worth Rs 2,606.2 crore, the NSE data showed.

Market Recap

Benchmark equity indices ended with weekly gains after two consecutive weeks of losses. Both the Nifty and Sensex recorded their highest closing since Aug. 2 on Friday as shares of financials and technology companies led the gains.

Only three out of the Nifty 50 stocks ended with losses and 47 ended higher. Both the Nifty and Sensex closed at their highest levels since Aug. 2.

The Nifty ended 1.64% or 396.80 points higher at 24540.55 while the Sensex rose 1.68% or 1,330.96 points to end at 80436.84. Intraday, the Nifty rose 1.74% and the Sensex rose 1.79%.

Market breadth was skewed in favour of buyers. Around 2,475 stocks advanced, 1,454 stocks declined, and 107 stocks remained unchanged on BSE.

Broader markets rose in line with the benchmark indices. The BSE Midcap and Smallcap indices ended 1.81% and 1.69% higher, respectively.

On BSE, all 20 sectors ended higher on Friday, with the BSE IT index logging the most gain to become the best performing sector.

Major Stocks In News

Vedanta, Hindustan Zinc: Vedanta to exercise oversubscription option for additional 0.29% stake in ongoing offer for sale. Vedanta's total offer size now represents 1.51% of the company's total stake.

Techno Electric: The company partnered with IndiGrid for developing greenfield transmission projects.

Escorts Kubota: The company has submitted an investment intent to the Uttar Pradesh government to acquire land in the state for setting up a greenfield facility. The company intends to invest Rs 4,500 crore through direct and indirect investment in multiple phases. Annual production revenue estimated at over Rs 100 crore at full capacity.

Jubilant Pharmova: The company's unit Jubilant Biosys to add drug discovery & preclinical development capabilities. Capabilities to be added via a new company incorporated in France, which will in turn acquire Pierre Fabre's R&D Centre in the country. The company will invest up to 14.4 million Euro over seven years, including 4.4 million Euro for 80% stake in the new company.

KPI Green: The company raises Rs 1,000 crore via QIP, allotted 1.06 crore shares to QIBs at Rs 935 per share

URJA Global: The company announced the pre-launch of its new high-speed electric scooter, CHETNA.

Global Cues

Asia-Pacific stocks began the week cautiously ahead of the major central banks and the US Federal Reserve Powell's economic outlook at Jackson Hole.

While the US futures were pointing at a positive start, benchmarks in Japan Australia and South Korea were lower in early trade. The Nikkei 225 was 50 points or 0.13% lower at 38,011, and the Kospi was 7.8 points or 0.26% lower at 2,690 as of 06:18 a.m.

The rate decisions in Asian countries like Thailand, Indonesia, and South Korea will be in focus during the week. Meanwhile, Jerome Powell is expected to confirm if interest rate cuts are on the cards when he speaks in Jackson Hole meeting.

The weak start to the Asian trade comes after the US stocks saw the best week this year on resilient economic data confirming a September rate cut. The S&P 500 and Nasdaq Composite climbed 0.20% and 0.21%, respectively on Friday. The Dow Jones Industrial Average advanced 0.24%.

Meanwhile, Goldman economists lowered the risk of a US recession to 20% from 25%. Brent crude was trading 0.20% lower at $79.52 a barrel as of 06:27 a.m. Gold fell 0.22% to $2,502.49 an ounce.

Key Levels

US Dollar Index at 102.42

US 10-year bond yield at 3.91%

Brent crude down 0.20% at $79.52 per barrel

Bitcoin was down 2.33% at $58,428.9

Gold was down 0.22% at 2,502.49

Money Market

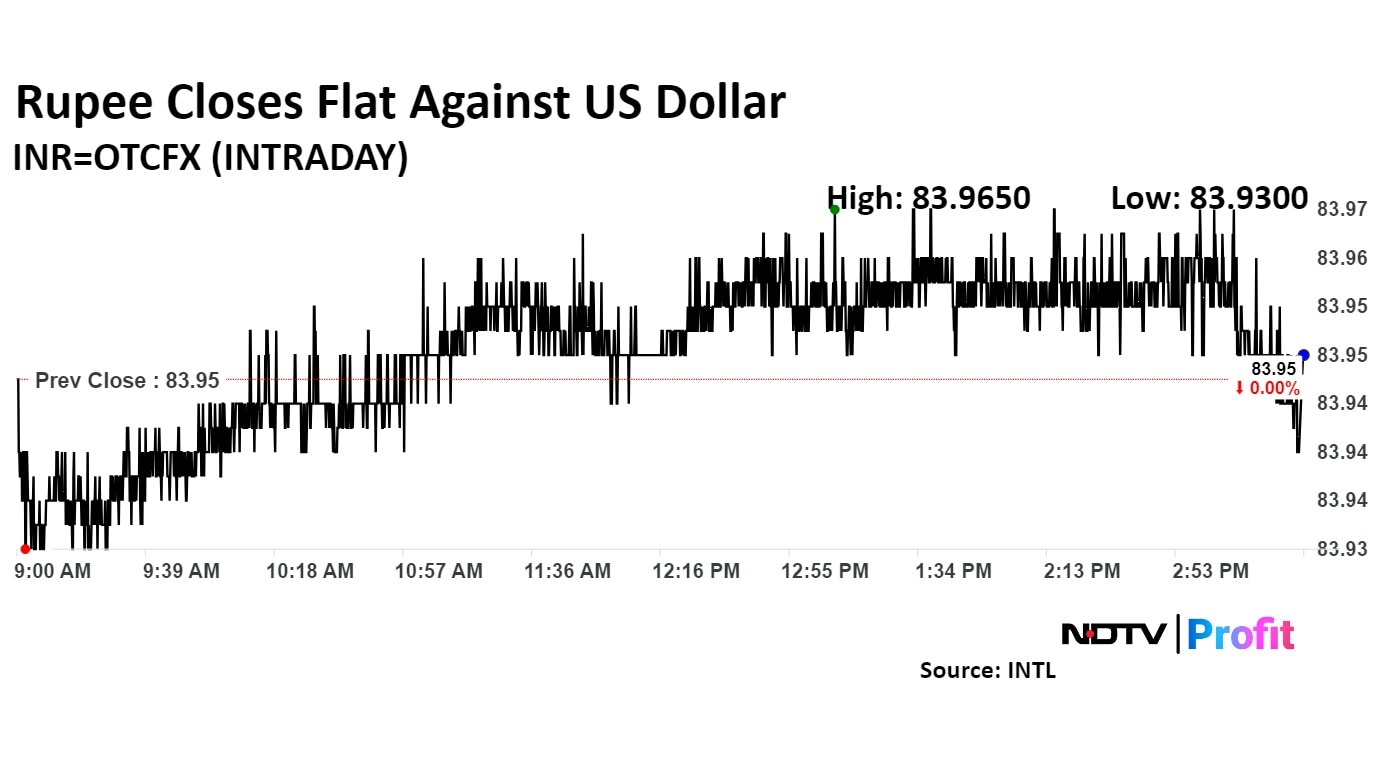

The Indian rupee closed little changed against the US dollar on Friday amid an easing oil price, even as a widening trade deficit weighed on the local currency. New economic data that alleviated recessionary fears in the US and led to a global market recovery may support the rupee.

The rupee closed at Rs 83.94 against the US dollar. It had closed at Rs 83.95 on Wednesday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.