The domestic markets will trade cautiously as tensions in the Middle Eastern countries escalated after Iran's attack on Israel. While the geopolitical impact is contained for now, an overhang remains. Markets are likely to see a range-bound move with a mild downward bias, though outflows may dip on Monday. Metals are witnessing institutional buying and chemical stocks starting to see breakouts.

In its election manifesto, Bharatiya Janata Party pledged to focus on infrastructure and keep popular subsidies in place. Traders must keep an eye out for the manifesto-related stocks.

Meanwhile, the inflation print for the country came on a positive note on Friday, while Tata Consultancy Services Ltd. kicked off the fourth-quarter earnings by beating estimated figures.

"We expect markets to remain volatile in the near term given the global concerns and the start of an election next week," Siddhartha Khemka, head - retail research, Motilal Oswal Financial Services Ltd. "With the onset of the earning season, the focus will shift more toward domestic cues along with macro data points. "Markets on Monday will react to India's inflation data and TCS Q4 numbers."

The NSE Nifty 50 has been trading in a broadening formation and facing hurdles around the upper band of the 22,700-22,800 zone, according to Ajit Mishra, senior vice president, technical research, Religare Broking Ltd. "Indications are in favour of a further dip and likely to retest the support zone of short-term moving average around 22,350 and next at 22,150."

Considering the scenario, traders should focus more on stock selection and prefer a hedged approach, Mishra cautioned.

The GIFT Nifty was trading 0.5 points up at 22,450.00 as of 06:31 a.m.

FII And DII Activity

Overseas investors turned net sellers of Indian equities on Friday.

Foreign portfolio investors offloaded stocks worth Rs 8,027 crore and domestic institutional investors remained net buyers and mopped up equities worth Rs 6,341.5 crore, according to provisional data from the National Stock Exchange.

Markets On Friday

India's benchmark stock indices ended lower on Friday as upbeat US economic data pushed back hope of an earlier rate hike triggering profit booking by market participants.

Both indices snapped a three-weekly winning streak to end this week flat, as heavyweights HDFC Bank Ltd. and Larsen & Toubro Ltd. dragged.

The NSE Nifty 50 closed 234.40 points, or 1.03%, lower at 22,519.40, and the S&P BSE Sensex declined 793.25 points, or 1.06%, to end at 74,244.90.

The Nifty fell 1.06% to hit an intraday low of 22,512.70, and the Sensex declined 1.10% to touch a low of 74,213.76 on Friday.

All 12 sectors ended in negative on NSE. The NSE Nifty Pharma fell the most among peer indices, tracking sharp loss in Sun Pharmaceutical Industries Ltd.

Major Stocks In News

Power Grid Corp>: The company will consider raising up to Rs 12,000 crore via non-convertible debentures on a private-placement basis in a board meeting on April 17.

Patanjali Foods Ltd.: The company said segmental volume in Q4 experienced mid-single-digit growth (YoY) and revenue from the edible oil segment showed modest single-digit growth compared to the previous quarter.

Reliance Power Ltd.: The company has transferred its 45 MW wind power project located in Maharashtra to JSW Renewable Energy for a consideration of Rs 132.4 crore.

Major Earnings Post Market Hours

TCS Consolidated (QoQ)

Revenue up 1.1% at Rs 61,237 crore vs Rs 60,583 crore (Bloomberg estimate Rs 61,451.3 crore).

EBIT up 5.03% at Rs 15,918 crore vs Rs 15,155 crore (Bloomberg estimate Rs 15,548.3 crore).

Margin expands 97 bps at 25.99% vs 25.01% (Bloomberg estimate 25.3%).

Net profit up 12.66% at Rs 12,502 crore vs Rs 11,097 crore. (Bloomberg estimate Rs 12,034.2 crore).

Declared dividend of Rs 28 per share.

Top Brokerage Calls

Citi On Delhivery

The brokerage opened an upside 90-day catalyst watch on Delhivery.

It expects over 330 bps year-on-year improvement in adjusted Ebitda margins to 3.6%.

Expects 11% YoY in volumes and partial truckload volumes to be strong.

Expects e-commerce/PTL yields to be decent albeit e-commerce yields to be seasonally lower.

Expects mid-mile tonnage carried on Delhivery's network to be flattish quarter-on-quarter.

Beyond Q4, expects Delhivery to report a stronger margin trajectory.

Delhivery well positioned to benefit from any uptick in industry e-commerce volumes in the second half of 2024.

Citi Research on March CPI

Continues to expect stance change in June and first rate cut in October.

Retains headline inflation forecast at 4.5% year-on-year for FY25 with food inflation key upside risk to watch.

RBI Monetary Policy Committee might want to wait for better clarity on monsoon before a rate action.

No signs of pickup in core CPI inflation.

Cut in fuel prices contributed 14 bps to the decline in CPI.

Vegetable CPI remains elevated due to supply pressure.

Food, except vegetable inflation, remains stable due to offsetting moves in underlying components.

Global Cues

Asian stocks were trading lower on Monday, tracking their Wall Street peers, while investor sentiments were deterred following the escalation of geopolitical tensions with Iran's attack on Israel during the weekend.

The Nikkei 225 was trading 654.04 points or 1.65% lower at 38,869.51, and the KOSPI was trading 28.47 points or 1.06% down at 2,653.35 as of 06:28 a.m.

Investors pull out their money from risk assets, and shift it to safe haven assets like dollar, US Treasuries, and gold.

The global financial world was roiled by a flare-up in geopolitical risks that sent US stocks sliding, while spurring a flight to the safest corners of the market from bonds to gold and the dollar. Oil rallied, Bloomberg said.

The S&P 500 index and Nasdaq Composite fell by 1.46% and 1.62%, respectively as on Friday. The Dow Jones Industrial Average declined 1.24%.

Brent crude was trading 0.05% higher at $90.50 a barrel. Gold gained 0.37% to trade at $2,353.13 an ounce.

The GIFT Nifty was trading 0.5 points up at 22,450.00 as of 06:31 a.m.

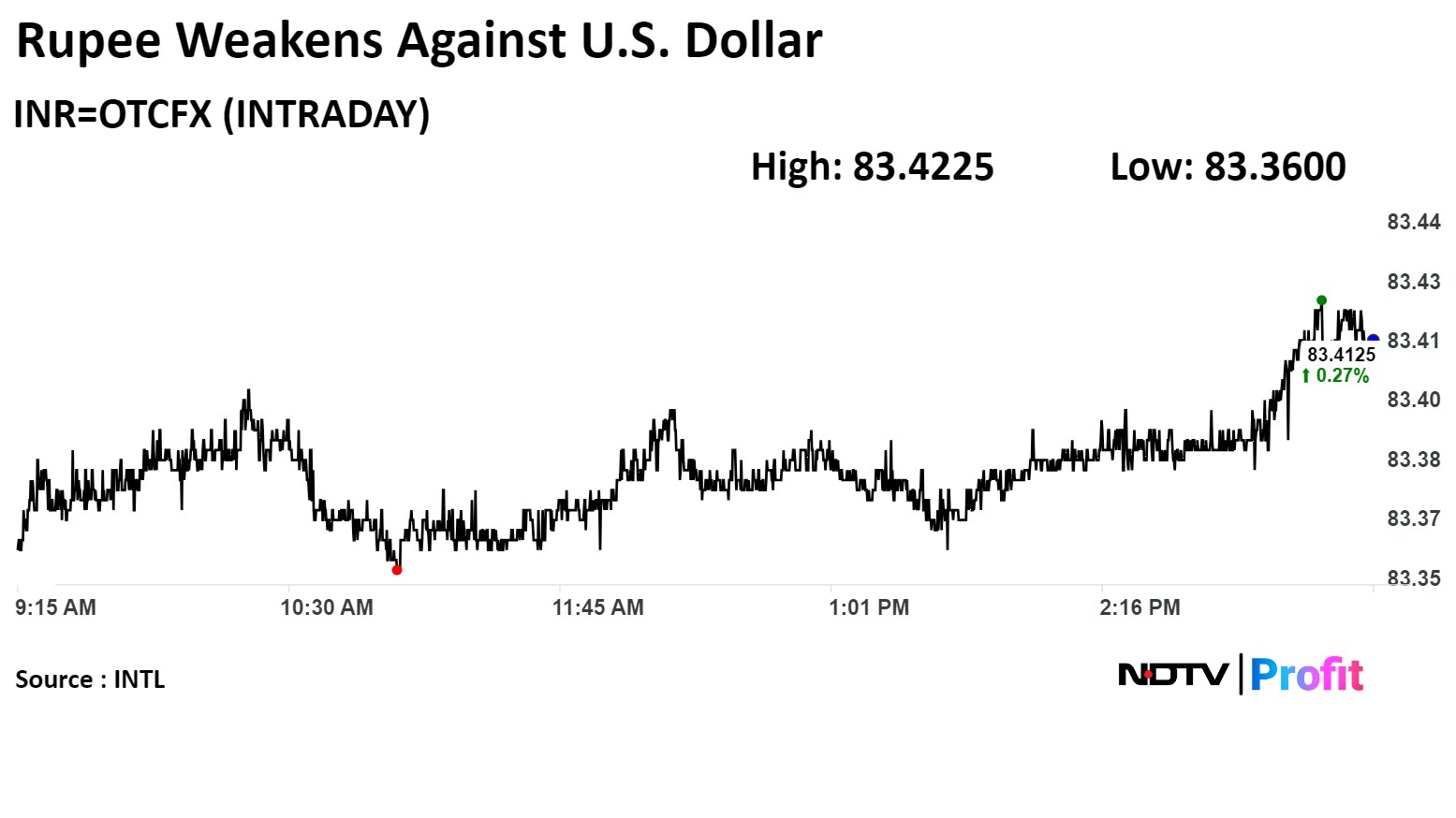

Rupee Update

The Indian rupee closed weaker on Friday, tracking the strengthening of the dollar index following the release of higher-than-expected US consumer inflation.

The local currency depreciated 23 paise to close at Rs 83.42 against the US dollar.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.