The NSE Nifty 50, which had been on a five-day record run, fell on Friday due to weak global cues. Analysts anticipate that the index may experience consolidation for a few days or weeks as the market adjusts to the current global environment. It recently hit the 25,000 mark but encountered a setback on Friday, closing at 24,717.70.

"Currently, most stocks and indices are close to important resistance levels, and we may see consolidation for a few days or weeks. This occurs whenever indices move too far from short-term averages," said Amol Athawale, VP, technical research at Kotak Securities Ltd.

In the short term, 25,080 and 82,130 will act as stiff resistance for Nifty and Sensex, respectively, according to Hrishikesh Yedve, AVP technical and derivatives research at Asit C. Mehta Investment Intermediates Ltd.

On the downside, 24,600 and 24,500 will provide significant support for the Nifty, while 80,500–80,400 will support the Sensex, he said.

As the halfway point of first quarter earnings comes up, growth for Nifty companies has been sluggish, noted Krishna Appala, senior research analyst at Capitalmind Research. "This tepid earnings growth, if echoed by the remaining companies, could impact the broader market."

With global markets experiencing a risk-off sentiment, highlighted by sharp sell-offs in the Nasdaq and Nikkei this week, accelerating earnings growth is crucial. "If earnings growth doesn't pick up, the market may face a risk of near-term consolidation," Appala said.

Investors should be cautious next week, considering the Reserve Bank of India's monetary policy meet and potential impacts from recent declines in Asian and US markets, said Avdhut Bagkar, technical and derivatives analyst at StoxBox.

The Bank Nifty closed at 51,350. "It is advised to wait for a decisive breakout of the 51,000–52,300 range to determine the Bank Nifty's further direction," said Yedve.

As of 7:16 am, the GIFT Nifty is trading 1.09%, or 268 points, lower at 24,360.

F&O Action

Nifty August futures were down by 1.33% to 24,700, at a discount of 17 points with open interest down by 0.4%.

Nifty Bank August futures were down by 0.64% to 51,420, at a premium of 70 points, while its open interest was up 6.1%.

The open interest distribution for the Nifty 50 Aug. 8 expiry series indicated most activity at 26,000 call strikes, with 24,000 put strikes having maximum open interest.

For the Bank Nifty options expiry on Aug. 7, the maximum call open interest was at 52,000 and the maximum put open interest was at 50,000.

FII/DII Activity

Overseas investors turned net sellers of Indian equities on Friday. Foreign portfolio investors offloaded equities worth Rs 3,310 crore, according to provisional data from the National Stock Exchange.

Domestic institutional investors turned net buyers after one session of selling and mopped up equities worth Rs 2,965.9 crore, the NSE data showed.

Foreign institutions have been net buyers of Indian equities worth Rs 34,539 crore so far in 2024, according to data from the National Securities Depository Ltd., updated till the previous trading day.

Market Recap

India's benchmark equity indices reversed five consecutive sessions of gains to close lower on Friday, snapping a weekly gaining streak of eight weeks to end at their lowest closing since July 25.

The NSE Nifty 50 closed 293.20 points, or 1.17% down at 24,717.70 and the S&P BSE Sensex was 885.60 points, or 1.08% lower at 80,981.

The broader markets ended lower as the S&P BSE MidCap and the SmallCap indices ended 1.19% and 0.58% lower, respectively.

On the BSE, all sectors ended lower except BSE Healthcare. BSE Realty declined the most to become the worst performing sector.

Major Stocks In News

Power Grid: The company emerged as a successful bidder for an inter-state transmission line in Rajasthan.

HEG: The board to consider a stock split on Aug. 13.

Power Mech Projects: The company received an order worth of Rs 142 crore for the revival of Phase II of Meenakshi Energy in Nellore district, Andhra Pradesh.

Gland Pharma: The USFDA conducted an unannounced inspection at the company's facility for Good Manufacturing Practices between July 25 and Aug. 2 and concluded with three 483 observations.

Mahindra and Mahindra: The company's subsidiary Classic Legends executed a JV agreement with Tube Investments of India in the ratio of 50:50 to use the BSA Marks in India for motorcycles, its parts, and accessories to be manufactured and sold by subsidiary.

Mahindra and Mahindra Finance: The company reported overall disbursement at Rs 4,530 crore, up 3% YoY, Business assets at Rs 1.07 lakh crore, up 22% YoY and collection efficiency at 95% for the month of July.

SJVN: Cabinet Committee on Economic Affairs has approved the investment of Rs 5,792.36 crores for the 669 MW Lower Arun Hydro Electric Project at a levelized tariff of Rs 4.99 per unit.

Samvardhana Motherson: The company will acquire Sojitz Corp's 34% stake in JV Motherson Auto Solutions for Rs 237 crore.

Global Cues

Asian markets took heavy losses led by the Japanese index as lower economic growth in the US spurred bets for aggressive rate cuts aided with heightened geopolitical tension in West Asia.

Trading in Japan's Topix saw a brief halt after it hit a lower circuit of 7.5% in early trade. Equities in Australia and South Korea were in a rout, with the Kospi trading 112 points or 4.2% lower at 2,563, while the S&P ASX 200 was 223 points or 2.8% down at 7,719 as of 06:52 a.m.

Traders braced for increased tensions with reports of a possible attack on Israel from Iran and regional militias in retaliation for the assassinations of top Hamas officials.

This comes after all major US stocks closed the week in the red as weak economic data pointed to an increased recession risk with traders weighing aggressive rate cuts by the Fed. Economists at Goldman Sachs raised the probability of recession in the next year to 25% from 15%.

Meanwhile, risk-off sentiments persisted with Warren Buffett's Berkshire Hathaway halving its stake in Apple Inc.

The S&P 500 and Nasdaq Composite declined 1.84% and 2.43%, respectively as of Friday. The Dow Jones Industrial Average fell 1.51%.

Brent crude was trading 0.30% higher at $77.04 a barrel. Gold was 0.35% down at $2,434.76 an ounce.

Key Levels

US Dollar Index at 103.07

US 10-year bond yield at 3.75%

Brent crude up 0.30% at $77.04 per barrel

Bitcoin was down 4.09% at $56,714.64

Gold spot was down 0.35% at $2,434.76 an ounce.

Money Market Update

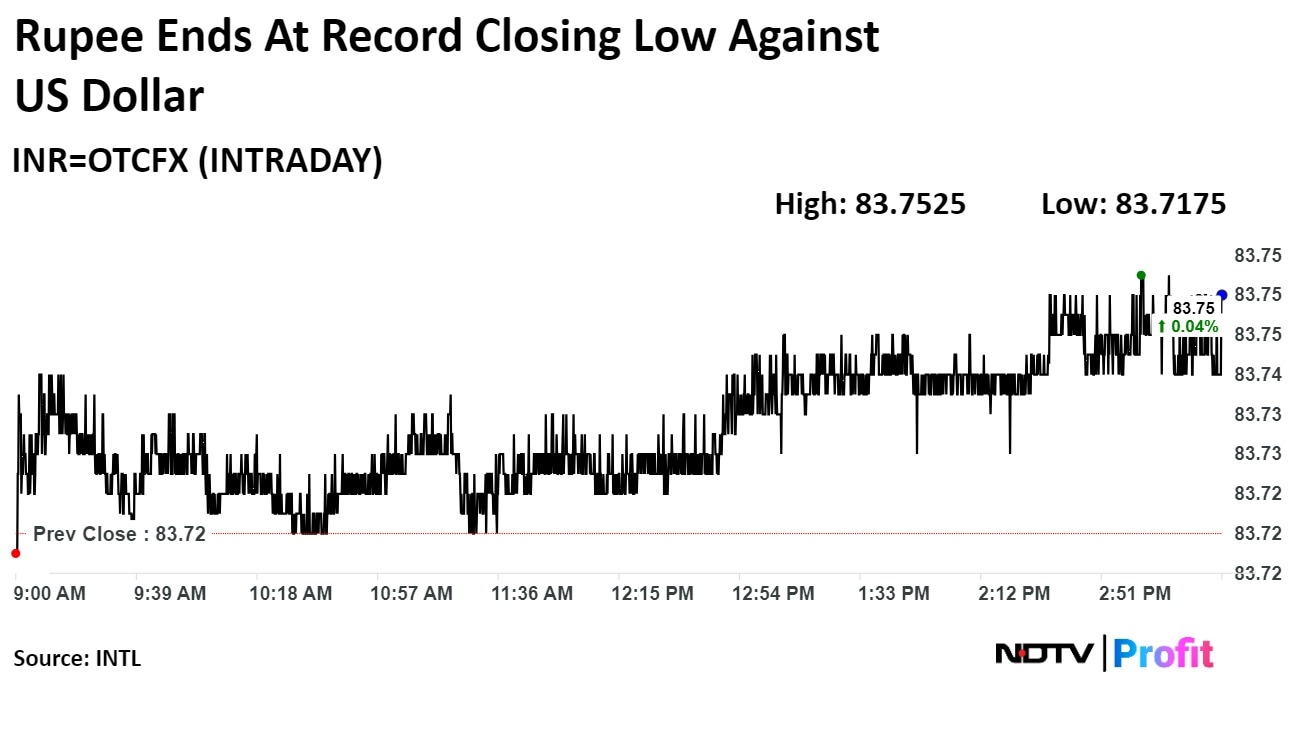

The Indian rupee closed at a record low against the US dollar on Friday after stock indices crashed over 1%, tracking their global peers amid rising geopolitical tension and weak economic data from the US.

The Indian currency depreciated 3 paise to end at a record closing low of Rs 83.75 after opening at Rs 83.73 against the greenback. It closed at Rs 83.72 on Thursday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.