The Nifty displayed resilience, closing the day on a flat to negative note at 24,347 levels, which indicates that the 24,400-level would be the immediate breakout zone, according to analysts.

Railway sector stocks like Rail Vikas Nigam Ltd., Indian Railway Finance Corp., and Railtel Corp. saw significant rallies in Monday's session, driven by the government's approval of eight new railway projects.

The volatility index, INDIA VIX, saw a jump of 3.47%, settling at 15.87, indicating heightened market volatility.

Technically, the Nifty index formed a green candle with shadows on both sides on the daily chart, signaling uncertainty, according to Hrishikesh Yedve, assistant vice-president of technical and derivatives research at Asit C. Mehta Investment Intermediates Ltd. "If the index sustains above 24,480, it could trigger a fresh rally towards the 24,600–24,700 levels."

He recommends a buy-on-dips strategy, noting that the 34-day Exponential Moving Average (DEMA) near 24,240 provides crucial support, making the 24,200–24,240 range a key support zone for Nifty in the short term.

Shrikant Chouhan, head of equity research at Kotak Securities Ltd., pointed out that for the bulls, the 24,400-level would be the immediate breakout zone. A sustained move above this could propel the market towards 24,500-24,550, while a drop below 24,300 could shift sentiment, leading to a retest of the 24,200–24,170 range.

Looking ahead, investors are closely watching the release of India's July CPI inflation data, which will be crucial for assessing inflation trends in light of the RBI's recent upward revision of the Q2 FY25 CPI forecast to 4.40%, up from the previous estimate of 3.80%, noted Vikram Kasat, head of advisory at PL Capital Ltd.

The Bank Nifty index ended the day positively at 50,578.

"The index attempted to surpass the 50,710-level but couldn't sustain above it, forming a green candle with large shadows. A sustained move above 50,710 could push the index towards the 51,000-51,200 levels<" Yedve said.

He also suggested a buy-on-dips strategy for Bank Nifty, with the 100-DEMA around 49,870 acting as a firm support level in the short term.

The GIFT Nifty, an early indicator of the Nifty 50 Index's performance in India, was up 11 points or 0.05% at 24,359 as of 06:37 a.m.

F&O Action

The Nifty August futures are up 0.29% to 24,357 at a premium of 10 points, with open interest down by 0.04%.

Nifty Bank August futures are up by 0.29% to 50,721 at a premium of 143 points, while its open interest is down by 3%.

The open interest distribution for the Nifty 50 Aug. 14 expiry series indicated most activity at 25,000 call strikes, with 23,500 put strikes having maximum open interest.

For the Bank Nifty options expiry on Aug. 14, the maximum call open interest was at 52,000 and the maximum put open interest was at 49,000.

FII/DII Activity

Overseas investors turned net sellers on Monday.

The FPIs offloaded equities worth Rs 4,680.5 crore, while the domestic investors remained net buyers for the seventh consecutive session and mopped up equities worth Rs 4,477.7 crore, the NSE data showed.

Market Recap

The Indian benchmark indices erased some losses to end Monday on a muted note as Infosys Ltd. and HDFC Bank Ltd. led the gains. The NSE Nifty 50 ended 20.50 points, or 0.08%, lower at 24,347, while the S&P BSE Sensex closed 56.99 points, or 0.07%, down at 79,648.92.

Of the 12 sectors on the NSE, six ended higher and the rest ended lower. The NSE Nifty Media declined the most, and the NSE Nifty Realty rose the most.

On the BSE, the broader indices were mixed as the BSE MidCap ended flat and the SmallCap closed 0.6% higher.

Five of the 20 sectoral indices on the BSE closed lower and 15 ended with gains. BSE Realty was the top gainer.

The market breadth was skewed in favour of the sellers as 2,148 stocks fell, 1,925 advanced, and 105 remained unchanged on the BSE.

Major Stocks In News

JSW Steel: The company is set to acquire up to a 66.7% economic interest in M Resources NSW through the purchase of Class B shares. The acquisition will be made at a cost of $120 million, with an additional investment obligation of $50 million. M Resources NSW holds a 30% stake in the mine operator of coking coal mines located in New South Wales, Australia.

Vodafone Idea: The company reported a net loss narrowed in the first quarter of the current financial year. The telecom firm posted a loss of Rs 6,432.1 crore in the June quarter in comparison to a loss of Rs 7,665.9 crore in the same quarter of the last fiscal, according to an exchange filing on Monday.

Kotak Mahindra Bank: The company's unit Sonata Finance and BSS Microfinance has approved the merger with each other.

Jindal Stainless: The company has been accredited by BrahMos Aerospace as a qualified vendor for steel sheets.

Crisil: The company's unit to form private entity for serving as industry association for SEBI-registered ESG ratings service providers.

Marico: The company's manufacturing operations in Bangladesh have resumed at normal scale from yesterday.

KPI Green Energy: The company opened its QIP, sets floor price at Rs 983 per share.

Global Cues

Stocks in the Asia-Pacific region pointed to a positive start with the equities in Japan leading the rally as a weaker yen aided the country's exports.

Benchmarks in Japan rose over 1% after a holiday Monday while South Korea and Australia were marginally higher. The Kospi was trading 2 points, or 0.08% higher at 2,610, while the S&P ASX 200 was 3 points or 0.07% up at 7,818 as of 6:27 a.m.

Australia will see its wage price data on Tuesday while the US inflation print will be released the next day.

After a week of volatility, stocks in the US struggled for direction while the crude oil prices surged over the latest geopolitical developments. Oil hit $80 and bond yields fell amid reports that an Iranian attack against Israel is increasingly likely.

The S&P 500 close flat while the Nasdaq Composite declined by 0.36%, as of Friday. The Dow Jones Industrial Average advanced 0.21%.

Brent crude was trading 0.60% lower at $81.81 a barrel. Gold was up 0.01% at $2,473.15 an ounce.

Key Levels

US Dollar Index at 103.13

US 10-year bond yield at 3.91%

Brent crude down 0.60% at $81.81 per barrel

Bitcoin was up 1.16% at $59,540.06

Gold spot was up 0.01% at $2,473.15 an ounce.

Money Market Update

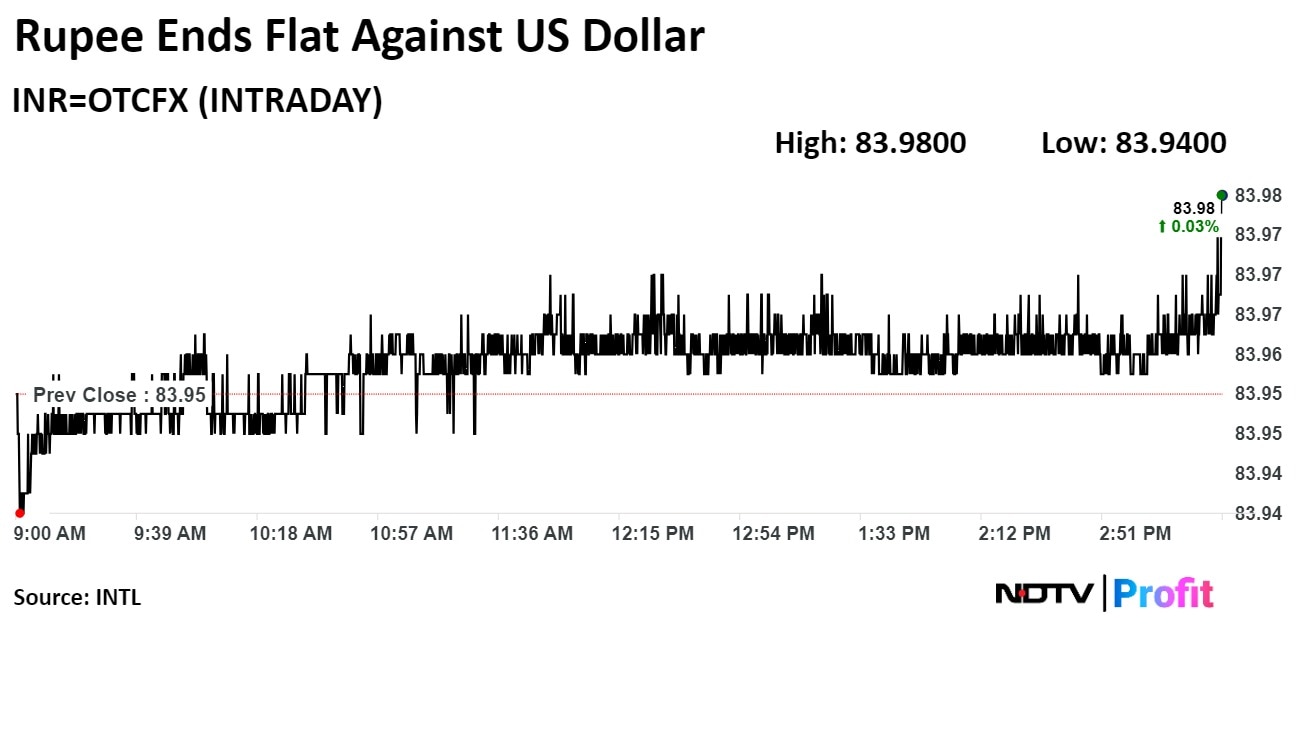

The Indian rupee closed at a record low closing against the US dollar on Monday.

The rupee closed flat at Rs 83.97 after opening little changed at Rs 83.95 against the US dollar. On Friday, it had closed at Rs 83.96.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.