(Bloomberg) -- The best way to play the Federal Reserve's pivot toward monetary easing is to load up on shorter maturity debt that still provides a 4%-plus yield.

That's the overarching sentiment in the Treasury market as the Fed — with inflation falling — gears up to lower rates and support a soft landing. Meanwhile, a chunk of the nearly $6 trillion parked in money-market mutual funds has new reason to move into Treasury notes as investors fear rates on cash-like investments could soon plunge.

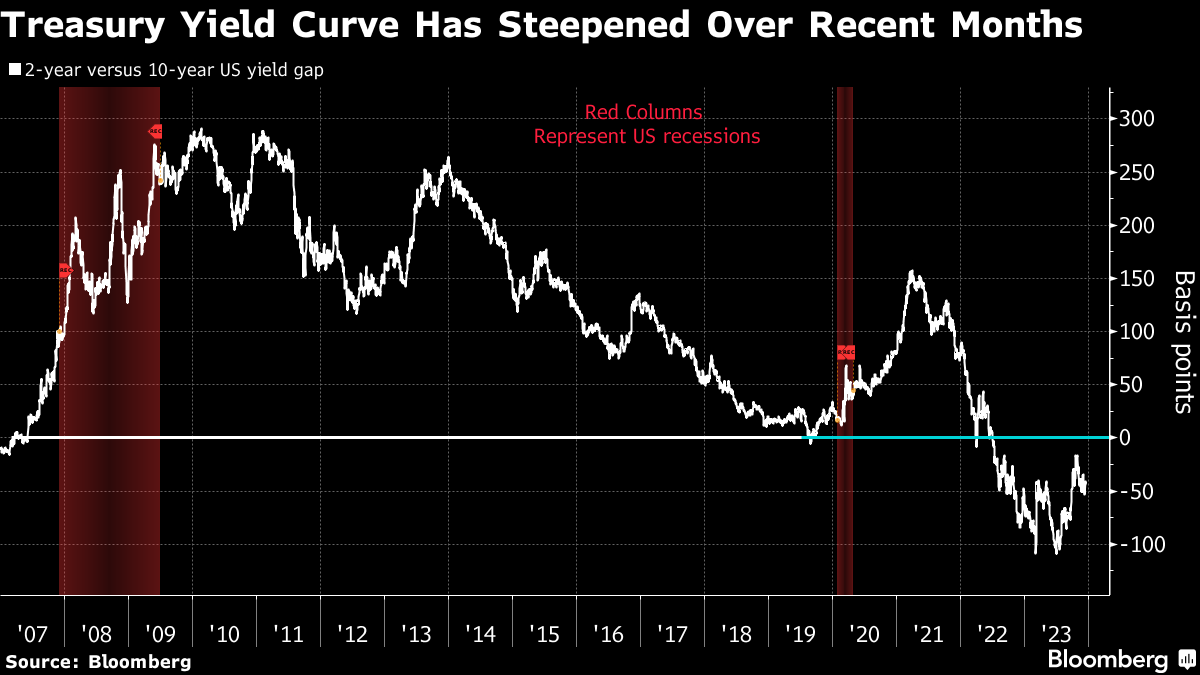

Add to that a strong conviction that the economy may avoid the recession that was once seen as virtually inevitable, and investors' lack of appetite for longer-term securities as they expect the yield curve to steepen back to its more typical upward slope. The consensus on Wall Street is clear: The two-year Treasury is the sweet spot on the yield curve, offering an attractive yield of around 4.4% that's higher than any other maturity.

“The Fed gave us their 2024, 2025 expectations for where rates go, and they go lower,” said Lindsay Rosner, a portfolio manager at Goldman Sachs Asset Management. Investors should aim for “a mixture of two and fives,” she said, as “out the curve is not where we see much value.”

Long-term debt is set to underperform, as traders want to be compensated for the added risk they see embedded in these securities. Among their concerns: a continued onslaught of issuance to finance the persistently high US government deficit as well as tail risks that inflation could reignite next year.

It's easy to see why the two-year note appeals from a look at the yield curve. It first inverted this cycle over a year-and-a half ago, resulting in long-term rates trading below those on debt with shorter tenors. A groundswell of investors is wagering it will flip back to a more usual pattern sometime next year. At present, the 10-year note yield is about 50 basis points below that on debt with two years to maturity. As recently as July, the gap stood at over 100 basis points.

Sixty-eight percent of respondents to Bloomberg's Instant Markets Live Pulse survey after the Fed meeting predicted the curve would turn positive sometime in the second half of 2024 or thereafter. Meanwhile, 8% said that would happen in the first quarter and 24% in the second.

Big investors, including Jeffrey Gundlach at DoubleLine Capital LP, Bill Gross — Pacific Investment Management Co.'s former bond king — and billionaire investor Bill Ackman predict that the curve will disinvert. Gundlach says US 10-year yields will fall toward the low 3%-range next year, while Gross and Ackman believe a positive slope could surface by the end of 2024.

Fed policymakers on Wednesday penciled in no further interest-rate hikes and left the target range at between 5.25% to 5.5%. Officials' quarterly projections also showed 75 basis points in cuts next year, with the federal funds rate dropping to 3.6% by the end of 2025. From there, it would decline to 2.9% a year later.

Brandywine Global Investment Management LLC is among the investors already positioning for that. “Cash is great and you should have been moving out the curve,” said portfolio manager Jack McIntyre. He prefers to “bypass 2 years and buy 5-years and further out,” because there is some risk around whether “the Fed is going to stick a soft landing.”

The sudden shift in the bond market has highlighted the sense that 5% Treasury yields — as seen in October — were too good to pass up, extending a rally for many fixed income funds that not so long ago were expecting another poor performance this year. A Bloomberg Treasury index is up 3.5% this year through Dec. 15, after losing an unprecedented 12.5% last year and 2.3% in 2021.

Bearishly positioned players however lost out, a trend highlighted on Friday after New York Fed President John Williams said talk of a potential rate cut by March is “premature.” After an upward spike in yields, buyers quickly stepped in and left rate cut expectations little changed. Swaps show a roughly 80% chance that the Fed cuts rates as early as March. In total, the market expects 1.64 percentage points of easing by the end of 2024.

In Europe, investors are also trying to figure out how to trade the pivot even as central banks there pushed back on market expectations. For the euro-area central bank, traders see six quarter-point cuts in 2024, while in the UK, bets are on 115 basis points of easing next year, which translates into four quarter-point cuts with a fifth hanging in the balance. That's 40 basis points more than a week ago.

So long as forthcoming data supports that narrative, overall sentiment in the bond market will likely remain bullish, with any back ups in yield being bought.

Still, there are potential pitfalls along the way, said Michael de Pass, global head of rates trading at Citadel Securities LLC. “Certainly all markets really seem to be pricing a soft landing to perfection at this stage and any deviation from that narrative leaves the risk of a repricing,” he said.

What to Watch

- Economic data:

- Dec. 18: NY Fed services business activity; NAHB housing market index

- Dec. 19: TIC flows; building permits; housing starts

- Dec. 20: MBA mortgage applications; current account balance; Existing home sales; Conference Board consumer confidence/expectations

- Dec. 21: GDP; Personal consumption; initial jobless claims; GDP price; Core PCE price; Philadelphia Fed business outlook; leading index; Kansas City Fed manufacturing

- Dec. 22: Personal income/spending; PCE deflator; durable goods; Bloomberg Dec. US economic survey; U. of Michigan sentiment; Kansas City Fed services activity

- Fed calendar:

- Dec. 19: Atlanta Fed President Raphael Bostic

- Auction calendar:

- Dec. 18: 13-, 26-week bills

- Dec. 19: 42-day cash management bills

- Dec. 20: 17-week bills; 20-year bond reopening

- Dec. 20: 4-, 8-week bills; 5-year TIPS reopening

--With assistance from Aline Oyamada.

(Updates Treasury index return. A previous version corrected direction of Fed move derived from swaps bets.)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.