Tilaknagar Industries Ltd.'s share price surged nearly 12% to its highest in over a month on Tuesday as its profit jumped in the July–September quarter. The company's consolidated net profit surged 57% year-on-year to Rs 58.23 crore in the quarter ended September 2024, according to an exchange filing.

Market participants' views turned positive for the company after it turned net debt-free ahead of the expansion, Systematix said in a note Tuesday. The company is guided to turn net debt-free by the end of the financial year 2025.

Despite sluggish revenue growth, Tilaknagar Industries reported a substantial rise in its net profit due to its operating profit expanding better than expected. The company's topline rose 9.7% yoy to Rs 374.85 crore in the second quarter, from 354.39 crore.

The company reported that its consolidated Ebitda, or operating profit, rose 39% to Rs 65.98 crore in the second quarter from Rs 47.43 crore.

The Blue Lagoon Gin producer's margin expanded 420 basis points on an annualised basis to 17.6% in the September quarter because of cost optimisation initiatives and premium products' sales, Systematix said. Tilaknagar Industries received a Rs 10.35 crore subsidy from the Government of Maharashtra, which also contributed to the margin. Excluding the subsidy, its margin for the September quarter stands at 15.3%.

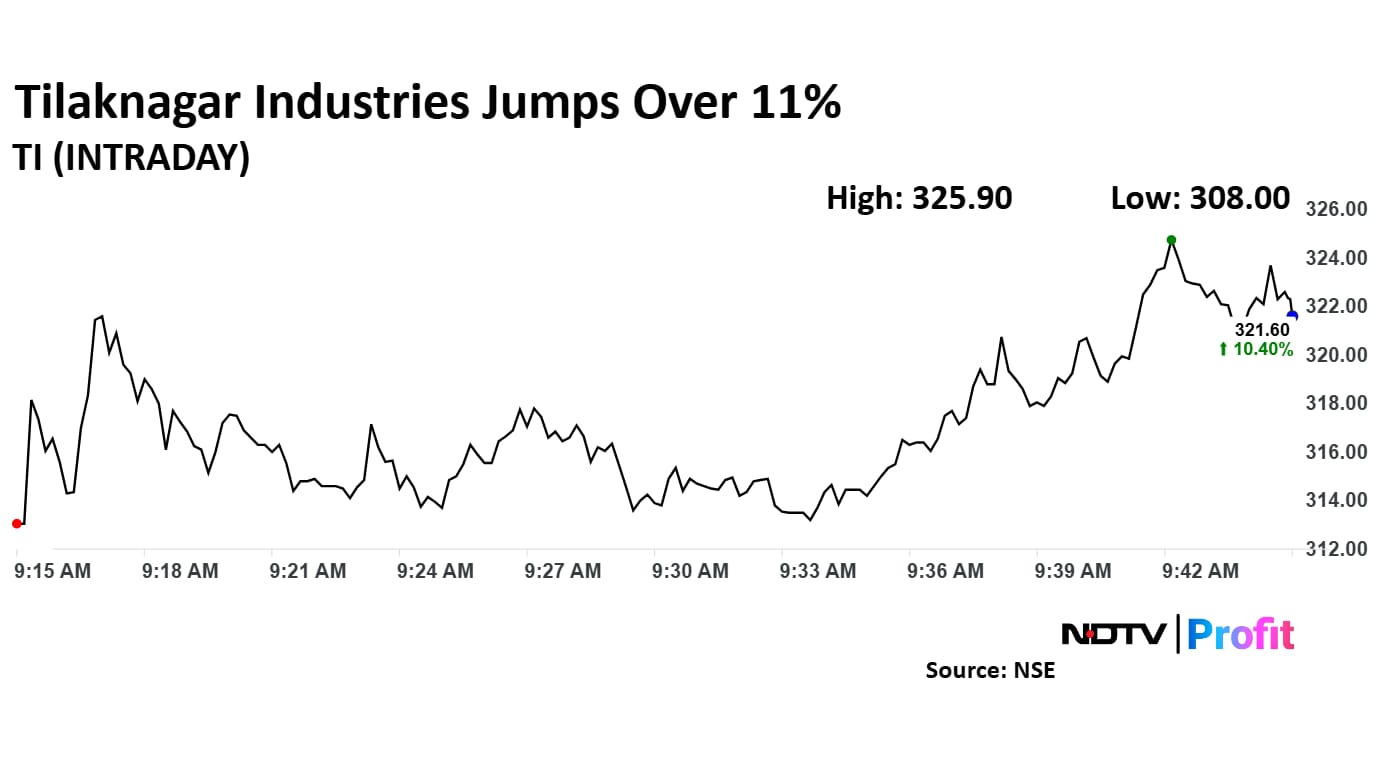

Tilaknagar Industries share price was trading 10.40% higher at Rs 321.60 apiece.

Shares of Tilaknagar Industries jumped 11.88% to Rs 325.90 apiece, the highest level since Sept. 19. It was trading 10.57% higher at Rs 321.85 apiece as of 9:43 a.m., compared to a 0.13% decline in the NSE Nifty 50 index.

The stock gained 25.75% in 12 months and 32.48% on a year-to-date basis. Total traded volume so far in the day stood at 30 times its 30-day average. The relative strength index was at 63.51.

One analyst tracking the company maintains a 'buy' rating, according to Bloomberg data.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.