The catch-up rally for Tata Consultancy Services Ltd. shares is on the horizon as it reported its first-quarter earnings in line with estimates, brokerages believe. But the analysts remain wary as the management pointed out unchanged market conditions with the results announcement.

The IT bellwether's results confirm the bottoming out of the sector in terms of growth trends. However, commentary pushed back hopes of any sharp recovery in the near term. The results did not indicate any revenue upgrade cycle around the corner for the sector in general, Morgan Stanley said in a note on July 11.

The IT major is well-positioned to withstand the lukewarm macro environment, given its size and order book, the brokerage said in a report. "Owing to its steadfast market leadership position and best-in-class execution, the company has been able to maintain its industry-leading margin and demonstrate superior return ratios."

JPMorgan said a strong revenue beat should drive a catch-up rally and expects the stock to react positively. "We expect a consensus earnings upgrade of 1–2%, given the beat on revenues and earnings."

India's largest software services provider's earnings downgrade cycle is , Nuvama Institutional Equities said. "Deal wins shall gradually convert into revenue in coming quarters."

Goldman Sachs raised their estimates and target price. The brokerage retains a 'buy' rating and views TCS as a solid defensive play, given its diversified revenue base, robust deal momentum and strong growth/margin profile.

TCS reported an EBIT margin of 24.7% for the first quarter of the financial year, down from 26% in the previous quarter

Revenue rose 2.2% sequentially to Rs 62,613 crore in the three months ending June. Bloomberg analysts had projected Rs 62,128.4 crore. Revenue in dollar terms increased by 2.7% compared to the March quarter, reaching $7.5 billion.

TCS Q1 Results: Key Highlights (QoQ)

Net profit fell 3.2% to Rs 12,105 crore (Estimate: Rs 11,959 crore).

EBIT declined 3% to Rs 15,442 crore (Estimate: Rs 15,245.5 crore).

The IT major also announced its first interim dividend of Rs 10 per equity share for fiscal 2024–25.

Here's What Brokerages Say On Tata Consultancy Services

Goldman Sachs

The brokerage maintains a ‘buy' rating on the stock and increased the target price to Rs 4,470 apiece from Rs 4,450 apiece earlier, implying a potential upside of 14% from the previous close.

Believes that first quarter results are in line and on track for double-digit earnings growth in fiscal 2025.

Forecasts sector-leading 6.9% YoY revenue growth in fiscal 2025.

Will drive 110 bps Ebit margin expansion in fiscal 2025, translating into 12% YoY Ebit growth.

Sees neutral-to-positive read-across from TCS' results for both growth and margins across their coverage.

Valuations are in line with the company's five year history versus peers trading at a premium.

Morgan Stanley

Morgan Stanley maintained an ‘overweight' rating on the stock and increased the target price to Rs 4,480 apiece from Rs 4,350 earlier, implying a potential upside/downside of 14% from the previous close.

Maintains growth forecasts for fiscal 2025 and expect double-digit EBIT and earnings-per-share growth in fiscal 2025.

Revenue beat in Q1 was led by both India and the international business.

The company sounded cautious about extrapolating from the slight recovery seen in North America and in BFSI.

With a strong base in Q1, the company is set to deliver reasonably strong margins in fiscal 2025, helping to deliver double-digit EBIT.

Key concerns include soft deal wins in the quarter and fiscal 2025 growth supported by volatile regional markets.

JP Morgan

The brokerage remained 'overweight' on the company and has a target price of Rs 3,924 per share.

The tech major printed a clear beat on revenues with margins in line.

Given the stock's underperformance, strong revenue beat will drive a catch-up rally.

Expects consensus earnings upgrade of 1-2%, given the beat on revenues and earnings.

BoFA

The brokerage maintained a 'neutral' rating with a target price of Rs 4,125 per share, implying an upside of 5.5% from the previous close.

Beat on revenues and large segments show stability.

Stability in BFSI, but teleco still weak.

The company reported in-line margin performance.

The brokerage waits for management commentary on the strength of the deal pipeline.

CLSA

The brokerage maintained its 'hold' rating with a target price of Rs 4,007 per share from Rs 3,990 apiece earlier, implying an upside of 3%.

Growth largely led by ramp-up of BSNL deal.

Margin slightly ahead of estimates due to lower subcontracting costs.

Demand commentary remains unchanged.

Slightly increased revenue forecasts due to ramp up of BSNL deal.

Slightly lower margins due to pass through from BSNL contract.

Nuvama

Maintains a 'buy' rating on the stock and raised the target price to Rs 4,800 apiece from Rs 4,560 earlier, implying a potential upside of 23% from the previous close.

Deal flows soft at $8.3 billion.

Earnings downgrade cycle for the sector is behind.

Deal wins will gradually convert into revenue in the coming quarters.

Management sounded positive as they see a recovery in US Banking and Financial Services and bottoming out of the retail vertical.

Marginally tweaks FY25E and FY26E earnings.

Sees TCS as a perfect large-cap proxy to play this upcycle.

Citi

Reiterates 'sell' rating on the stock but raised the target price to Rs 3,645 apiece from Rs 3,555 earlier, implying a potential downside of 7% from the previous close.

Q1 revenue was higher due to India and regional markets.

The EBIT margin in line, subcontractor costs down 60 basis points.

Management commentary suggests market conditions unchanged.

Margin resilience needs to be watched.

Earnings-per-share estimates unchanged but roll forward to 26 times the FY26 estimates.

Ongoing pair trade — overweight on Infosys Ltd. and underweight on Tata Consultancy Services Ltd.

IIFL Securities

Retains 'reduce' rating on the stock and a target price of Rs 3,950 apiece, implying a potential upside of 1.2% from the previous close.

Largely retains FY24–FY26 earnings estimates.

Marginally better-than-expected numbers.

Deal wins moderated due to timing of deal closures, but within guided range.

Management refrained from giving growth commentary.

Near-term demand volatility due to weakness in discretionary demand.

FY25 will be better than FY24.

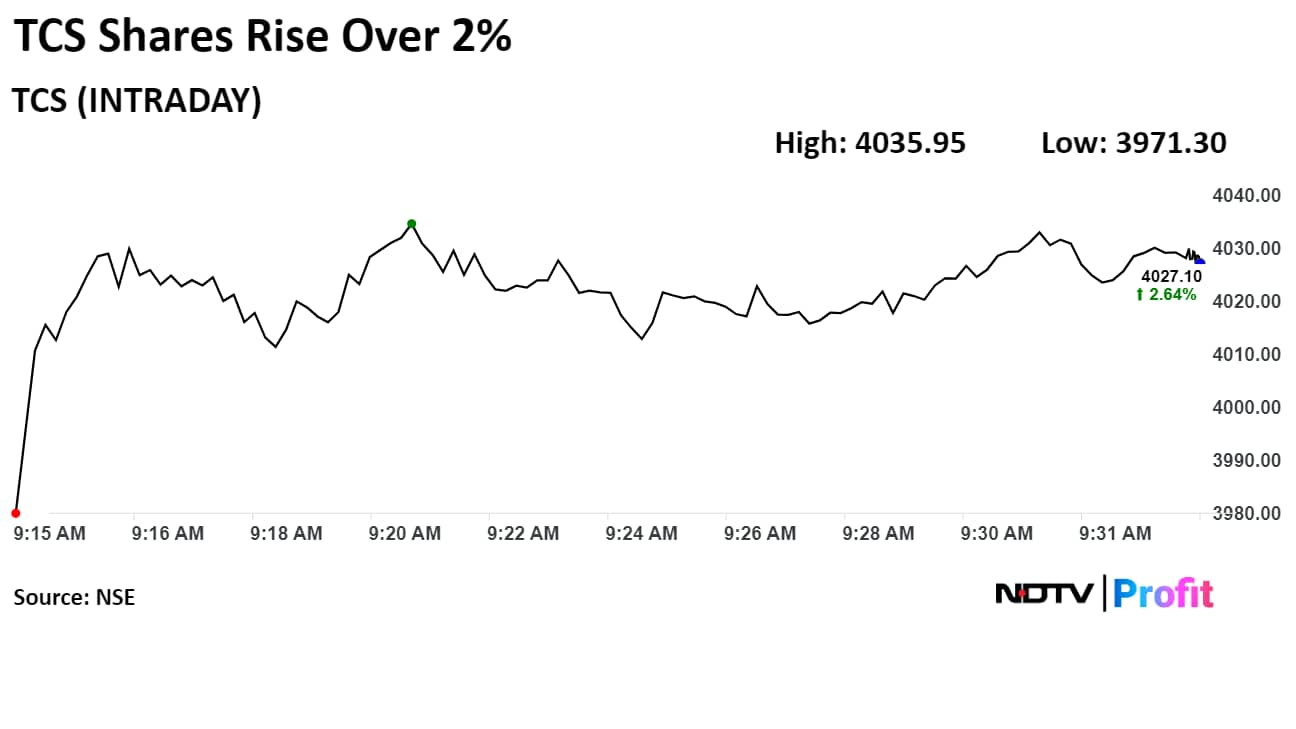

TCS' stock rose as much as 2.86% in early trade to Rs 4,035.95 apiece on the NSE. It was trading 2.51% higher at Rs 4,022 per share, compared to a 0.44% advance in the benchmark Nifty at 9:33 a.m.

Watch More Here:

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.