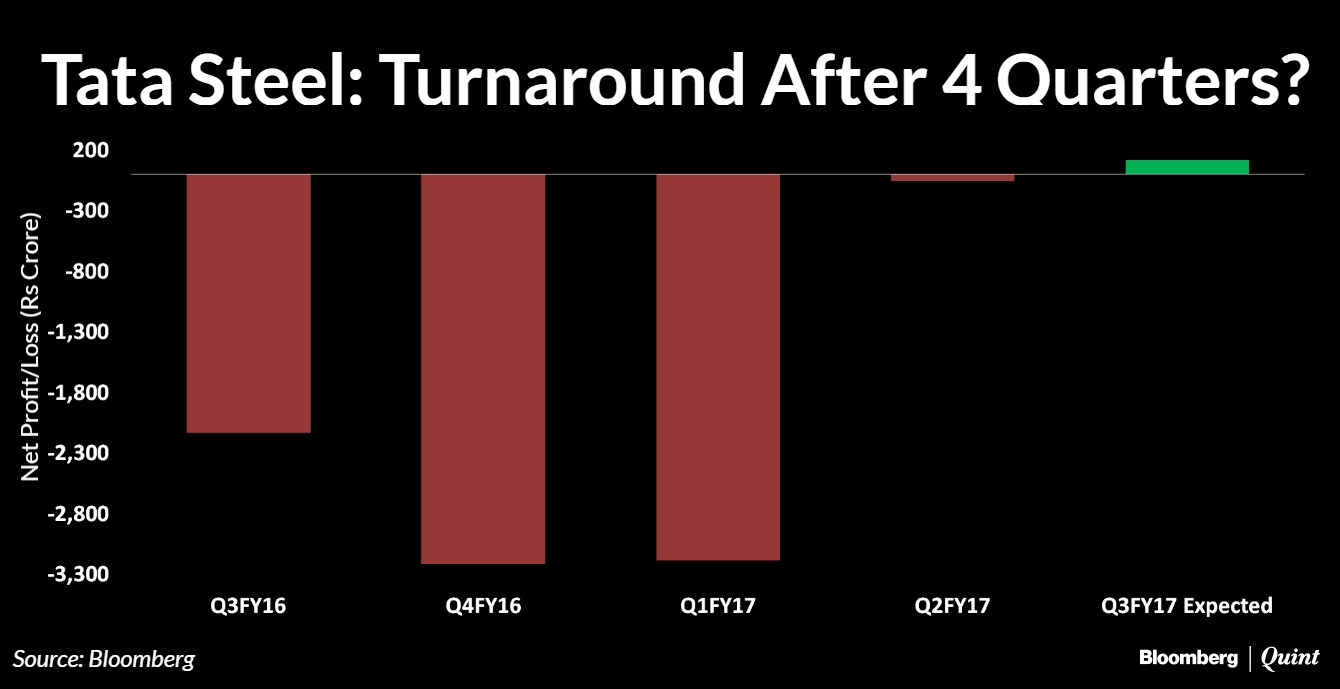

Tata Steel Ltd. is expected to report a net profit in the October-December quarter after posting losses for four consecutive quarters, helped by a rise in commodity prices. A Bloomberg consensus estimate of 14 analysts pegs the bottom line at Rs 113.7 crore for the third quarter of the financial year 2017-18.

The steel giant's revenue is expected to rise 3.4 percent, compared to previous year, to Rs 28,762 crore. Earnings before interest, tax, depreciation and amortisation (EBITDA) is expected to grow 4.6 times to Rs 3,615 crore over the previous year, driven by strong profitability in its Indian division.

Domestic volumes are expected to increase 12 percent in the third quarter, compared to last year, aided by the commencement of the Kalinganagar plant. Volumes are expected to decline sequentially by 2 percent due to demonetisation.

Sale of the long products division in the U.K. and muted production at its remaining U.K. plants are expected to weigh on volumes from its European operations.

High contract coking coal prices are likely to have a limited or no impact on third-quarter earnings as Tata Steel meets 35 percent of its demand from captive mines. The company had 1.2 million tonne of coking coal in stock, which would have satisfied the needs for third quarter. The major impact of rising coking coal prices will be realised mainly in the fourth quarter.

What To Watch

- Commentary on European business restructuring

- Pension liability

- Debt levels

- Clarity on government's stance on imports from China

- Global iron ore prices

Though Tata Steel has outperformed its benchmark, BSE Metal Index, over the last 12 months, giving a return of 102 percent, only 39 percent of the analysts tracked by Bloomberg have a ‘buy' rating on the stock.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.