Shares of Tata Motors Ltd. declined on Friday after its first-quarter results indicated an over-reliance on its luxury business for higher operational profitability.

The consolidated net profit of the Nexon maker rose 72.4% year-on-year to Rs 5,692 crore in the three months ended June, on the back of revenue that rose 5.7% to Rs 1,08,048 crore, according to an exchange filing on Thursday. Analysts polled by Bloomberg had estimated the top line at Rs 1,09,228.43 crore and the bottom line at Rs 5,309.96 crore.

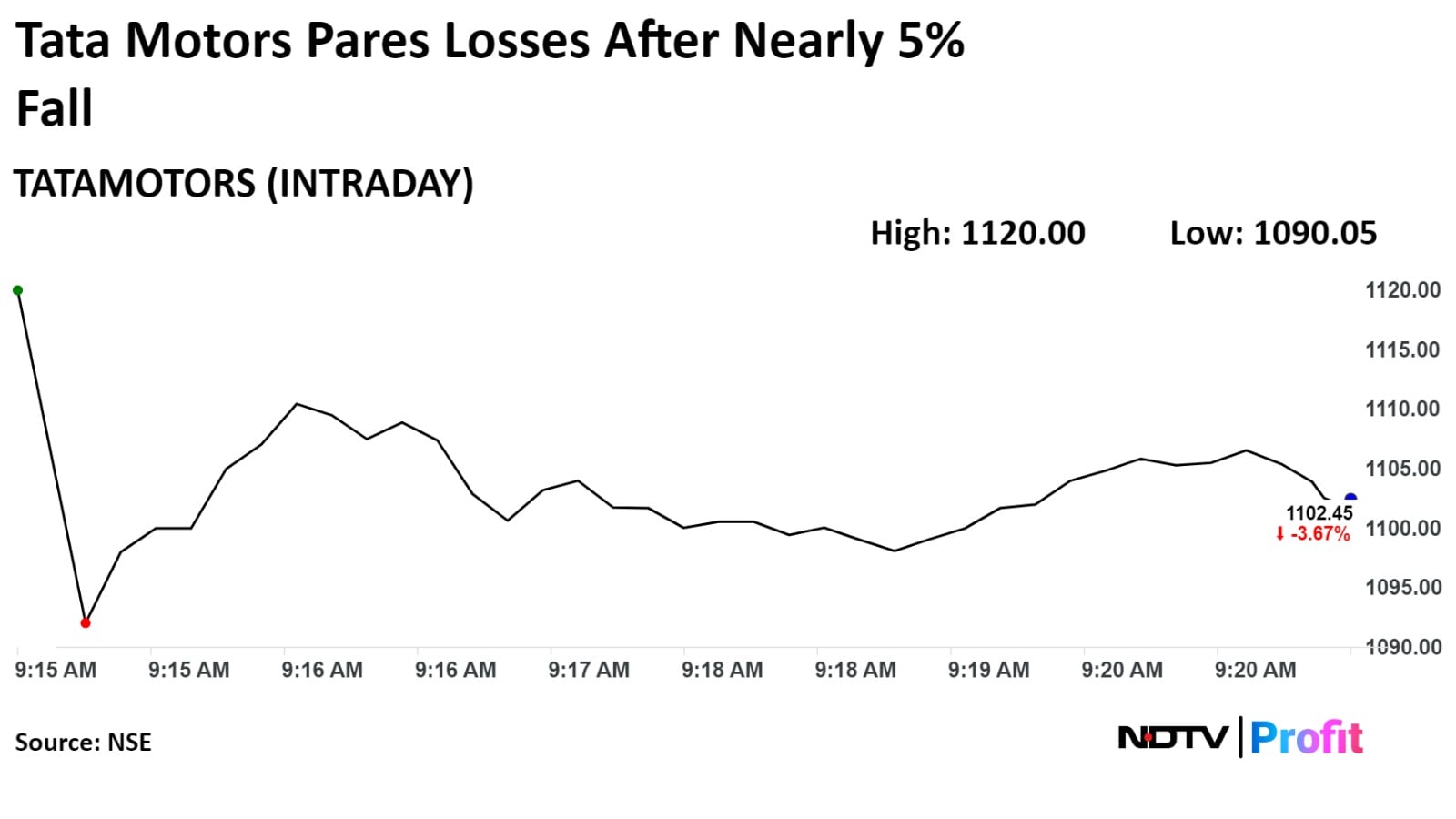

Tata Motors shares opened in the red on Friday after the auto major reported its first-quarter earnings for FY25.

Tata Motors Q1 Results: Key Highlights (Consolidated, YoY)

Revenue up 5.7% to Rs 1,08,048 crore (Bloomberg estimate: Rs 1,09,228.43 crore)

Ebitda up 14.4% to Rs 15,509 crore (Bloomberg estimate: Rs 15,266.08 crore)

Margin expands 109 basis points to 14.35% (Bloomberg estimate: 14%)

Net profit up 72.4% to Rs 5,692 crore (Bloomberg estimate: Rs 5,309.96 crore)

One basis point is one-hundredth of a percentage point.

Here's a look at what brokerages had to say on Tata Motors' first-quarter Results:

Nomura

JLR's transition to luxury will support ASP and margin

Estimate EBIT margins at 8.5%, 8.5% and 10% for fiscal 2025, 2026 and 2027

Net debt of Rs 18,600 crore in first quarter increased sequentially from Rs 16,000 crore

Company to turn to net cash of Rs 145 per share by fiscal 2027

Nuvama

JLR saw optical beat on EBIT on lower depreciation, Ebitda in-line

Tata Motors anticipates near-term production issues at JLR (Q2/Q3)

India PVs slated to outperform led by the new mid-size SUV launch

Jefferies

India commercial vehicle's Ebitida was better, JLR's in line, India passenger vehicle was lower

JLR expects Q2/Q3 to be impacted by aluminium supply issues

Demand for Tata Motors' trucks and cars has slowed down

CV profitability improving, new SUV launch to support volumes

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.