Stocks staged a late-week rebound, with traders looking past noisy economic data and uncertainties about one of the most closely contested elections in US history to focus on Corporate America's strength.

The S&P 500 halted a two-day rout amid solid signals from industry bellwethers. Tech megacaps, which bore the brunt of the recent selling, led gains on Friday.

Amazon.com Inc. surged 6.2% after strong results. Intel Corp. rallied 7.8% on a bullish outlook. Exxon Mobil Corp. and Chevron Corp. beat profit, output and sales estimates. Boeing Co. rose 3.5% on optimism that a lengthy strike is nearing an end. Apple Inc. fell 1.2% after a tepid forecast.

Wall Street tried not to read too much into data showing US hiring advanced at the slowest pace since 2020 in October while the unemployment rate remained low. The numbers were distorted by severe hurricanes and a major strike. The jobs report is the last major data point before next week's Federal Reserve meeting and the Nov. 5 presidential election.

“We're in the midst of a hectic stretch with economic data, earnings, the Fed, and the US election,” said Bret Kenwell at eToro. “There's been some additional volatility around these events, but so far nothing has changed the big-picture view. Until that changes, the long-term drivers of the bull market remain intact.”

In fact, the S&P 500 rally of roughly 20% in 2024 through the end of October was the strongest in a presidential election year since 1936, according to Bespoke Investment Group strategists. Historically, gains of that magnitude in such a span have been followed by stronger-than-normal finishes to the year, they said.

The S&P 500 rose 0.4%, trimming this week's losses. The Nasdaq 100 added 0.7%. The Dow Jones Industrial Average climbed 0.7%. A gauge of the “Magnificent Seven” megacaps rallied 1.1%.

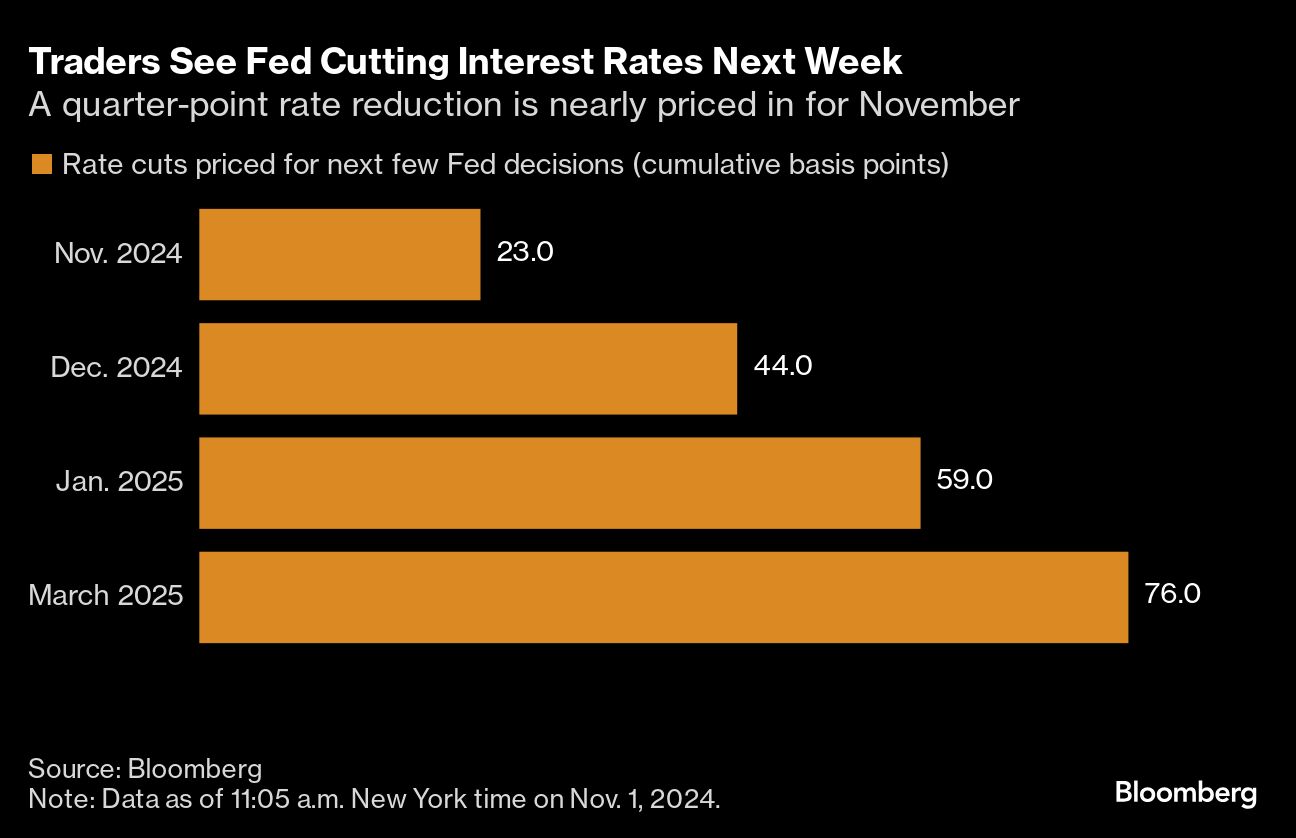

Treasury yields rose, reversing an earlier slide. Traders held tight to expectations that that policymakers will cut rates by a quarter-point on Nov. 7 and again on Dec. 18, pricing in 44 basis points by year's end. They see less than 60 basis points of cumulative easing by the end of January, implying the potential that officials pause early next year.

Treasury 10-year yields advanced nine basis points to 4.37%. The dollar rose. Oil edged higher on a report that Iran may be preparing to attack Israel from Iraqi territory in the coming days, though crude still finished the week lower amid skepticism that the war will disrupt supplies.

The muddied jobs report provides more evidence that the labor market is still down-shifting from the overheated levels seen a few years ago, supporting the case for Fed officials to keep dialing back the restrictive rates they put into place to quash inflation.

“We still think the Fed will follow a gradual pace of policy rate cuts, including 25 basis points next week and likely, but not a done deal another 25 bps in December,” said Tiffany Wilding at Pacific Investment Management Co. “While the US economy has been very resilient overall, we think today's softer jobs report was a good reminder that markets are not priced for a potential downside scenario for the economy that requires the Fed to cut rates more aggressively.”

To Ian Lyngen at BMO Capital Markets, it was a disappointing employment update that was noisy enough to prevent a rethink of the state of the labor market.

“While the Fed will likely attribute some of the weakness in today's data to one-off factors, the softness in today's data argues for the Fed to continue its easing cycle at next week's meeting,” said Lindsay Rosner at Goldman Sachs Asset Management. “Stormy numbers, but sky clearing for November 25 basis-point cut.”

Seema Shah at Principal Asset Management says markets can “likely park” the data to the side due to the hurricane impact that clouded the picture of labor market strength.

“It reaffirms that the Fed must persist with its easing cycle, even in the face of surprisingly strong economic activity data in recent weeks,” Shah said.

“In the end, we think the Fed will cut rates 25 basis points next week, and probably also in December, but we are also ready to engage with the slew of further data and information over the coming days and weeks,” said Rick Rieder at BlackRock.

US mutual funds' cash holdings have fallen to the lowest level in Bank of America Corp.'s records going back to 2015, suggesting increasingly bullish equity sentiment that coincides with the start of the Fed's easing cycle, according to strategists led by Savita Subramanian.

The bank's “sell side indicator” — which tracks the average Wall Street strategist's allocation to equities in a balanced fund — has also ticked up this year. In a contrarian signal, “sentiment indicators are turning increasingly bullish, suggesting potentially limited upside at the index level,” the strategists wrote.

“Equity and bond fund inflows have been remarkably strong over the last year, with over $500 billion going into equities and $700 billion into bonds,” said Deutsche Bank strategists including Parag Thatte and Binky Chadha. “Amidst widespread concerns about the cycle, low confidence, and perceptions of stretched household budgets, a frequent question has been ‘where is all this money coming from'?”

They say part of the puzzle is explained by large upward revisions to household income and savings. Another part is explained by massive cash holdings built up around the pandemic. However, while the capacity to invest is clearly helpful, it is not by itself sufficient to drive inflows, they noted.

“For equities, booming inflows are tied to strong growth but also to rising risk appetite, which is now very elevated,” they said. “Given our view that the business cycle has plenty of legs, we see strong equity inflows continuing.”

Hedge funds and other speculative traders are positioned for a further a rally in the dollar as speculative traders anticipate the election's potential implications on demand for haven assets and the path for tariffs.

Hedge funds, asset managers and other speculators held some $17.8 billion in bullish dollar positions as of Oct. 29, according to Commodity Futures Trading Commission data compiled by Bloomberg. They added more than $8 billion in the period after abandoning a negative outlook in mid-October.

Corporate Highlights:

Dish Network Corp. creditors plan to reject the US satellite-television provider's revised bond-exchange offer, approval of which is needed for the company's proposed acquisition by rival DirecTV to occur.

B. Riley Financial Inc. agreed to sell a portion of its wealth-management business to Stifel Financial Corp. for as much as $35 million, the latest in a series of asset deals aimed at stabilizing the money-losing investment firm.

BYD Co. kicked off the final quarter of the year with record monthly sales, continuing its strong performance in what is typically a peak season for auto purchases in China.

Charter Communications Inc. shares surged after the cable and internet giant reported losing fewer broadband subscribers than analysts expected in the third quarter despite the end of a federal internet subsidy program.

Reckitt Benckiser Group Plc jumped following a US jury verdict that cleared it and Abbott Laboratories over claims they hid potential risks of their premature-infant formulas.

Some of the main moves in markets:

Stocks

The S&P 500 rose 0.4% as of 4 p.m. New York time

The Nasdaq 100 rose 0.7%

The Dow Jones Industrial Average rose 0.7%

The MSCI World Index rose 0.3%

Currencies

The Bloomberg Dollar Spot Index rose 0.4%

The euro fell 0.4% to $1.0836

The British pound rose 0.2% to $1.2921

The Japanese yen fell 0.6% to 152.98 per dollar

Cryptocurrencies

Bitcoin fell 1% to $69,253.43

Ether fell 0.2% to $2,513.58

Bonds

The yield on 10-year Treasuries advanced nine basis points to 4.37%

Germany's 10-year yield advanced two basis points to 2.41%

Britain's 10-year yield was little changed at 4.44%

Commodities

West Texas Intermediate crude rose 0.3% to $69.47 a barrel

Spot gold fell 0.3% to $2,734.44 an ounce

This story was produced with the assistance of Bloomberg Automation.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.