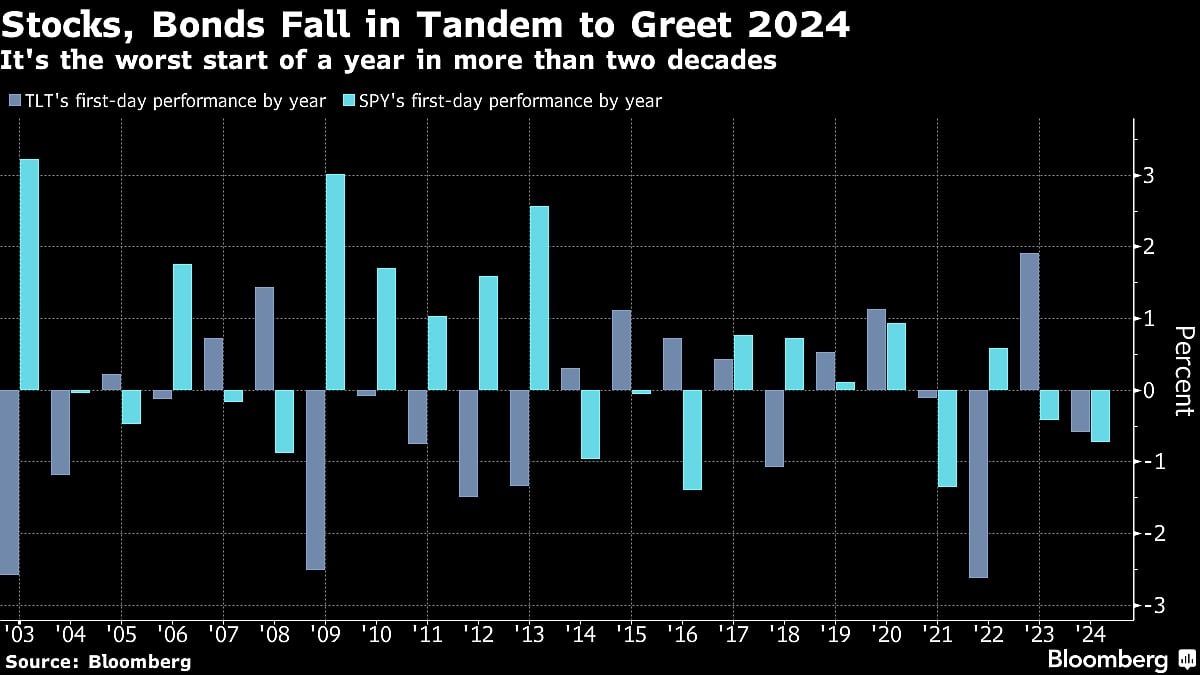

Stocks, Bonds Drop In Tandem For Worst Start To Year In Decades

A heavy corporate issuance slate weighed on spreads, while traders pared bets on deep interest-rate cuts from the Federal Reserve this year.

(Bloomberg) -- Traders hoping that a pan-markets year-end rally would pick up where it left off got the opposite on 2024’s first trading day, a session that featured one of the worst-ever concerted drops in stocks and bonds to start a year.

The SPDR S&P 500 ETF Trust (ticker SPY) and iShares 20+ Year Treasury Bond ETF (TLT) each fell 0.6% Tuesday, the first time they’ve both slumped so much to start the year since TLT began trading in 2002.

While the first-day performance says little about what markets will do for the rest of 2024, the synchronized retreat signaled at least some hesitation among investors to chase a fourth-quarter rally that lifted both US shares and long-dated Treasuries by more than 10%.

“The most common concern or belief we have heard from investors is that overbought conditions and euphoric sentiment will set up for a reversal to start 2024 in both bond yields” and stocks, said Dennis DeBusschere, founder of 22V Research. “The overbought conditions and sentiment readings are tough to argue with.”

Treasury yields ended higher across the curve Tuesday, led by the front-end. A heavy corporate issuance slate weighed on spreads, while traders pared bets on deep interest-rate cuts from the Federal Reserve this year.

Tech megacaps, among the top winners in 2023’s stock market, led Tuesday’s selloff as Apple Inc. slumped following an analyst downgrade. The Nasdaq 100 tumbled 1.7%, marking the third-worst first-day performance since the 2001 dot-com bust.

There are signs that money may be flowing out of recent darling stocks and into cheap-looking laggards. The Russell 1000 growth index fell 1.5% Tuesday, while its value counterpart was up 0.4%.

“Crowding risk in the leaders of 2023 has been cited by many (including ourselves) as a key risk in 2024,” Bank of America Corp.’s strategists led by Savita Subramanian wrote in a note. A “January rout in megacap tech is now consensus.”

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.