Most Asia–Pacific share indices rose on Tuesday tracking overnight gains on Wall Street. The Nikkei 225 was trading 469.32 points or 1.18% higher at 40,075.12, and the S&P ASX 200 was trading 62.40 points or 0.76% higher at 8,315.20 as of 06:26 a.m.

The S&P 500 hit record high in Monday's session before settling 0.77% higher at 5,859.85. The Dow Jones Industrial Average and Nasdaq Composite ended 0.47% and 0.87% higher, respectively.

Oil prices declined over 3% in early trade Tuesday, which provided some respite to the Asia–Pacific markets. Brent crude was trading 2.28% lower at $75.40 a barrel as of 06:32 a.m.. Oil prices declined after the Washington Post reported Israel has no plan to attack Iran's oil or nuclear facility.

Gold rose 0.02% to $2,649.16 an ounce as of 06:35 a.m.

The GIFT Nifty was trading 0.07% or 15 points higher at 25,238.0 as of 06:37 a.m.

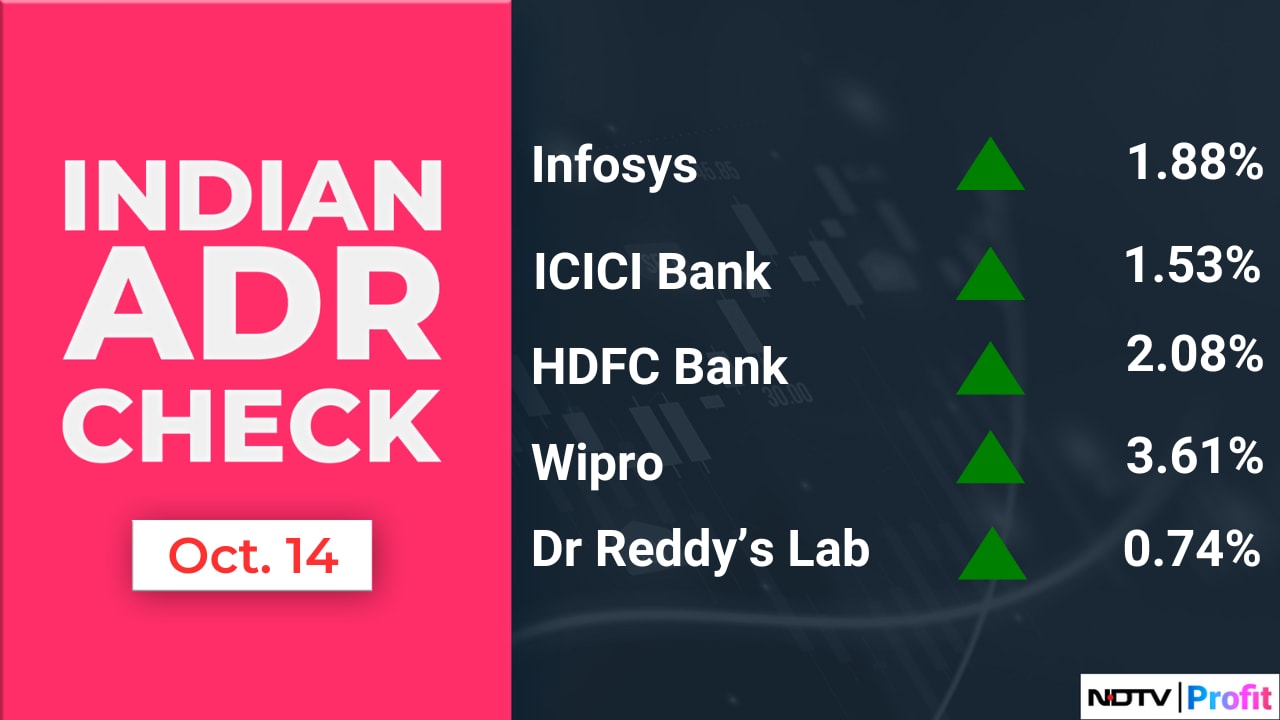

India's benchmark stock indices, Nifty and Sensex, ended at over one-week highs on Monday, tracking the sharp gains in Infosys Ltd. and HDFC Bank Ltd. Market participants await earnings from Reliance Industries Ltd. and HCL Technologies Ltd. for cues. To get live updates on RIL Q2 earnings, click here.

The NSE Nifty 50 ended 0.66% higher at 25,127.95, and the BSE Sensex closed 0.73% higher at 81,973.05. Both the indices closed at their highest levels since Oct. 3.

Overseas investors, commonly known as foreign portfolio investors, remained net sellers of Indian equities for the 11th consecutive session on Monday. The investors mopped up stocks worth Rs 3,731.6 crore, while domestic institutional investors bought stocks worth Rs 2,278.09 crore, according to provisional data from the National Stock Exchange.

The Indian currency closed flat at 84.06 against the US dollar.

Earnings Post Market Hours

Reliance Industries Q2 FY25 (Consolidated, QoQ)

Revenue down 0.32% to Rs 2,31,535 crore versus Rs 2,31,784 crore (Bloomberg estimates Rs 2,35,519 crore).

Ebitda up 0.75% to Rs 39,058 crore versus Rs 38,765 crore (Bloomberg estimates Rs 40,421 crore).

Ebitda margin up 14 bps to 16.86% versus 16.72% (Bloomberg estimates 17.2%).

Net profit up 10.76% to Rs 19,323 crore versus Rs 17,445 crore (Bloomberg estimates Rs 18,813 crore)

HCL Technologies Q2 FY25 (Consolidated, QoQ)

Revenue up 2.86% to Rs 28,862 crore versus Rs 28,057 crore (Bloomberg estimate Rs 28,637 crore).

EBIT up 11.82% to Rs 5,362 crore versus Rs 4,795 crore (Bloomberg estimate Rs 5,111 crore).

EBIT margin up 148 bps to 18.57% versus 17.09% (Bloomberg estimate 17.8%).

Net profit down 0.51% to Rs 4,237 crore versus Rs 4,259 crore (Bloomberg estimate Rs 4,061 crore).

The company declared dividend of 12 Rs per share.

Reliance Jio Q2 FY25 (Standalone, QoQ)

Revenue up 7.02% to Rs 28,338 crore versus Rs 26,478 crore.

Ebitda up 8.01% to Rs 15,036 crore versus Rs 13,920 crore.

Ebitda margin up 48 bps to 53.05% versus 52.57%.

Net profit up 14.43% to Rs 6,231 crore versus Rs 5,445 crore.

ARPU at Rs 195.1 versus Rs 181.7.

Reliance Retail Q2 FY25 (Consolidated, YoY)

Revenue down3.54% to Rs 66,502 crore versus Rs 68,937 crore.

Ebitda rose 0.3% to Rs 5,850 crore versus Rs 5,830 crore.

Ebitda margin up 30 bps at 8.8% versus 8.5%.

Net profit up 1.3% to Rs 2,836 crore versus Rs 2,800 crore.

Gopal Snacks Q2 FY 25 (YoY)

Revenue up 13% to Rs 403 crore versus Rs 358 crore.

Ebitda up 3% to Rs 46.8 crore versus Rs 45.5 crore.

Ebitda margin to 11.6% versus 12.7%.

Net profit up 6% to Rs 28.8 crore vs Rs 27.2 crore.

Angel One Q2 FY25 (Consolidated, YoY)

Revenue up 44.56% to Rs 1516 crore versus Rs 1049 crore (Bloomberg estimate Rs 1,208 crore).

Net profit up 39.14% to Rs 423 crore versus Rs 304 crore (Bloomberg estimate Rs 407 crore).

Earnings in Focus

HDFC Life Insurance, HDFC AMC, KEI Industries, Bank of Maharashtra, Newgen Software Technologies, and PVR Inox.

Stocks To Watch

Sunteck Realty: The company in the second quarter reported a 32.7% year-on-year jump in pre-sales at Rs 524 crore and collections stood at Rs 267 crore, up 25% year-on-year.

Adani Energy Solutions: The company's system availability stood at 99.7% for the quarter ended Sept. 30, while the project pipeline stood at Rs 27,300 crore and the total transmission network at 23,269 CKM.

Can Fin Homes: The company will consider raising Rs 4,000 crore by issuance of NCDs on a private placement basis.

J. Kumar Infraprojects: The company received a project worth Rs 298 crore from M/s. Pune Municipal Corporation for the development of the Mula River from Wakad bypass to Sangvi bridge.

IFGL Refractories: The company has signed a 51-49 JV with Seychelles-based Marvels International for Brick Manufacturing in India.

Chalet Hotels: ICRA upgrades the company's long-term rating to A+ from A.

Indian Overseas Bank: The bank has hiked the overnight and one-month MCLR rate by 5 basis points, effective tomorrow.

Sterlite Tech: The company divested its stake in China-based Metallurgica Bresciana Maanshan Special Cable.

Zydus Lifesciences: The company signed an agreement with the Indian Council of Medical Research for phase two clinical trials of desidustat in patients with sickle cell disease.

Diamond Power Infra: The company to consider stock split and fundraising on Oct. 18.

Exxaro Tiles: The board has approved splitting each share into 10.

Indian Oil: The company to form JV with EverEnviro resource management for Sustainable Energy Solutions.

Quess Corp: The company arm, Quesscorp Holdings, incorporated a step-down unit, Quesscorp Solutions, in Singapore.

Lyka Laboratories: The company received product permission from the Central Drugs Standard Control Organisation to manufacture and market Pregabalin Gel 8% in India.

Honeywell Automation: The company received a contract to provide an airfield ground lighting system for Noida International Airport.

CESC: The company arm purvah green power to acquire 100% stake in Deshraj Solar Energy for expansion of renewable energy business.

Listing

Garuda Construction and Engineering: The company's shares will debut on the stock exchanges on Tuesday. The Rs 264.1-crore IPO has been subscribed 7.55 times on final day. The bids were led by retail investors (10.81 times), non-institutional investors (9.03 times), qualified institutional investors (1.24 times).

IPO Offering

Hyundai Motor India: The company will offer its shares for bidding on Tuesday. The price band is set from Rs 1,865 to Rs 1,960 per share. The Rs 27,870-crore IPO issue is entirely an offer for sale. The company raised 8,315 crores from anchor investors.

Block Deals

Trent: Dodona Holdings sold 10.42 lakh shares (0.29%) at Rs 8,115 apiece, and Siddhartha Yog bought 10.42 lakh shares (0.29%) at Rs 8,115 apiece.

Transformers and Rectifiers: Jitendra Mamtora sold 27 lakh shares (1.79%) at Rs 780 apiece, New York State Teachers Retirement System bought 13.6 lakh shares (0.9%), PRU World FD INC. Pgim Jennison Emerging Markets Equity Opportunities Fund bought 6,09 lakh shares (0.4%) at Rs 780.3 apiece.

Trading Tweaks

Moved in short term ASM: BF Utilities.

F&O Cues

Nifty October futures up by 0.75% to 25,237 at a premium 110 points.

Nifty October futures open interest down by 2.33%.

Nifty Bank October futures up by 1.36% to 52,042 at a premium of 226 points.

Nifty Bank October futures open interest down 7.17%.

Nifty Options Oct. 17 Expiry: Maximum call open interest at 26,000 and maximum put open interest at 25,000.

Bank Nifty Options Oct. 16 Expiry: Maximum call open Interest at 54,000 and maximum put open interest at 51,000.

Securities in ban period: Chambal Fertilizers, GNFC, Granules, Hindustan Copper, IDFC First Bank, IEX, Manappuram, National Aluminium, PNB, RBL Bank, Sail, Tata Chemical.

Money Market Update

The Indian rupee ended the day little changed on Monday amid likely dollar selling by the Reserve Bank of India that countered the impact of demand for the greenback from foreign portfolio investments.

The unit appreciated 1 paisa to Rs 84.06 against the US dollar after closing at Rs 84.07 on Friday. This comes after the currency touched an all-time low of Rs 84.09 in the previous session, according to Bloomberg data.

Research Reports

Time Technoplast Gets A 'Buy', As Systematix Initiates Coverage; Sees 56% Upside

Life Insurance Q2 Results Preview - Stable Quarter; New Business Margins To Improve QoQ: DRChoksey

Skipper - A High Voltage Story; ICICI Securities Initiates Coverage With A 'Buy' Rating

Federal Bank - Growth Outlook Steady; Getting Future-Ready Under New Leadership: Motilal Oswal

AMCs Q2 Results Preview - Strong Equity Flows May Drive Earnings Upgrade: PL Capital

Internet Q2 Results Preview - Mixed Bag; Gearing Up For Festive Season: ICICI Securities

Defence Sector Q2 Results Preview - Expect Stable Performance In A Weak Quarter: Nirmal Bang

Disclaimer: NDTV is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.