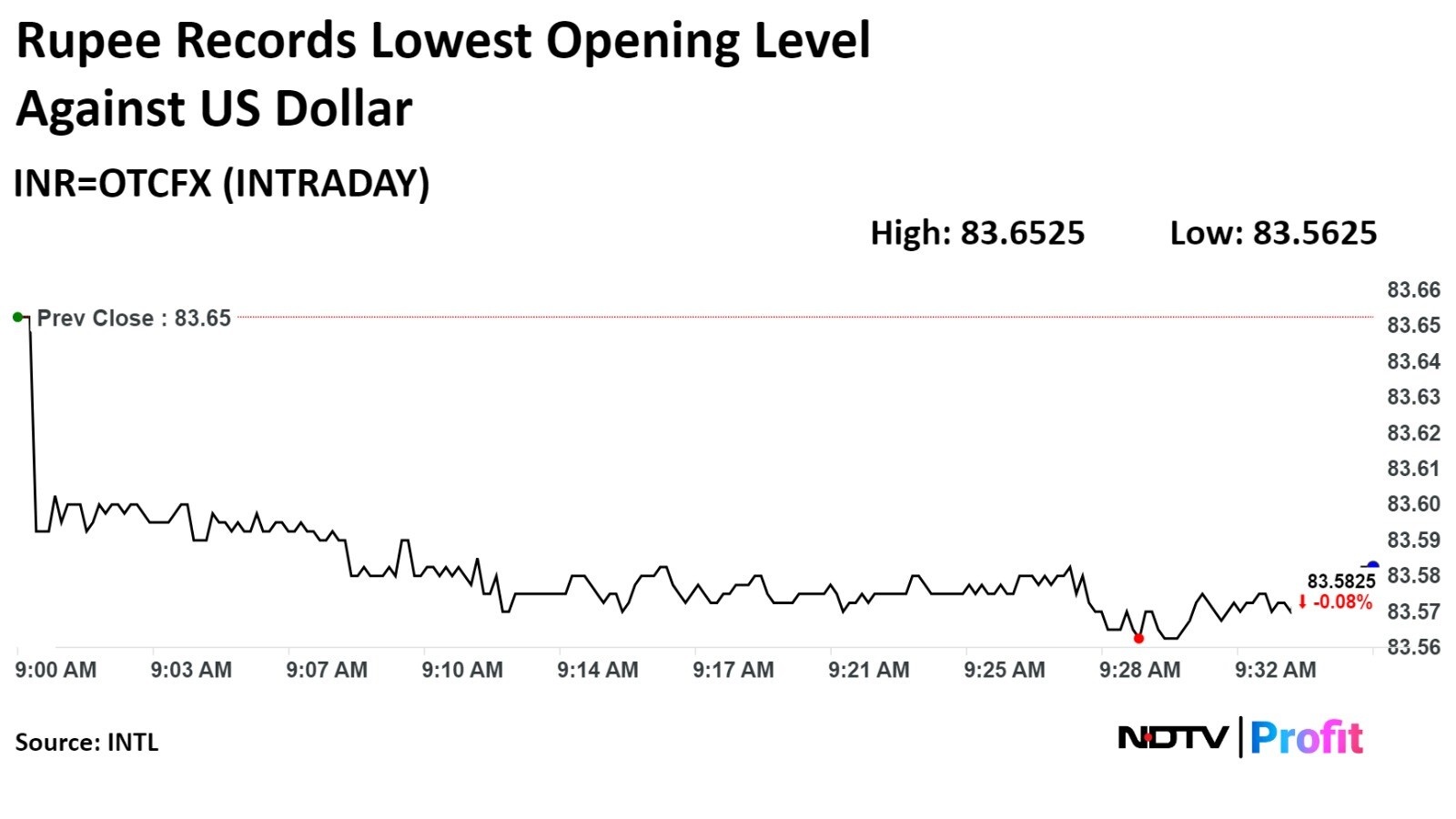

-The local currency strengthened by 11 paise to close at 83.54 against the US dollar.

-It closed at 83.65 on Thursday.

Source: Bloomberg

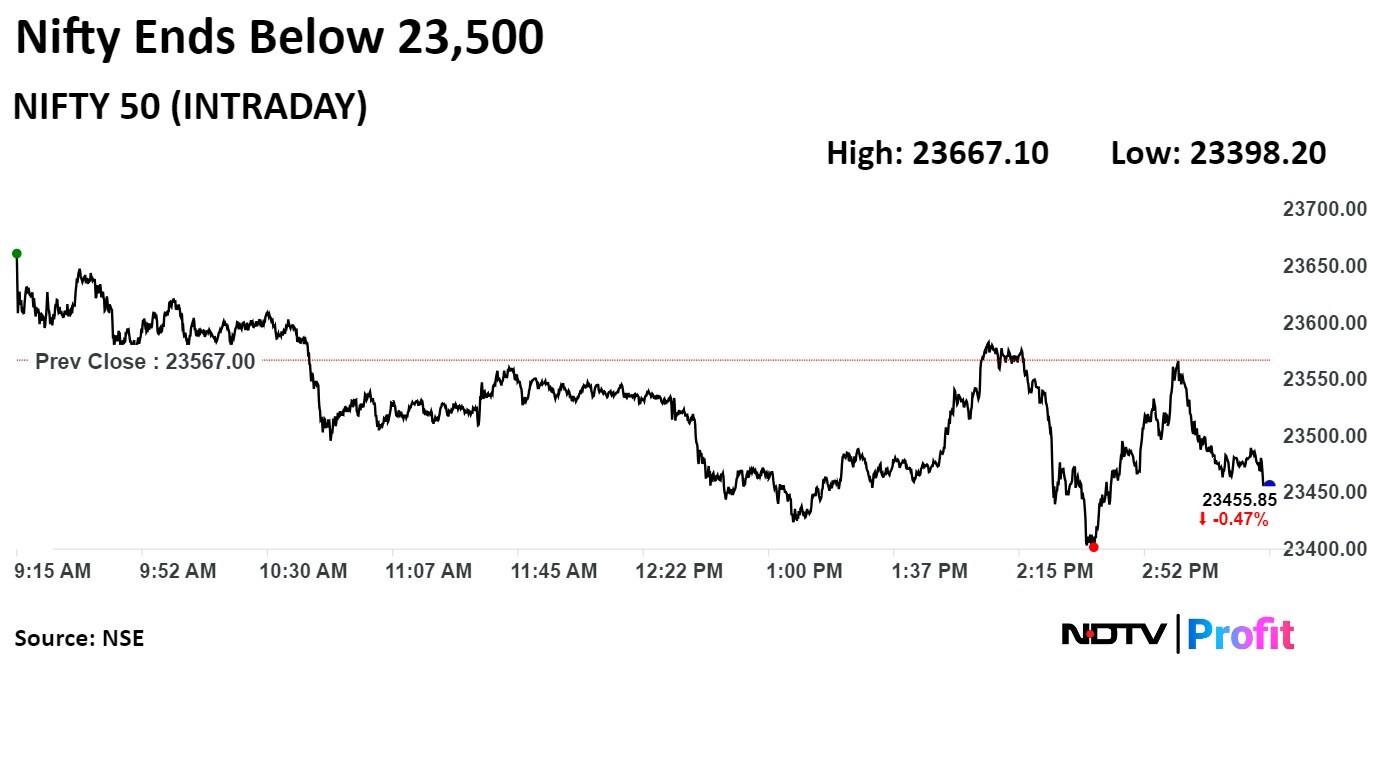

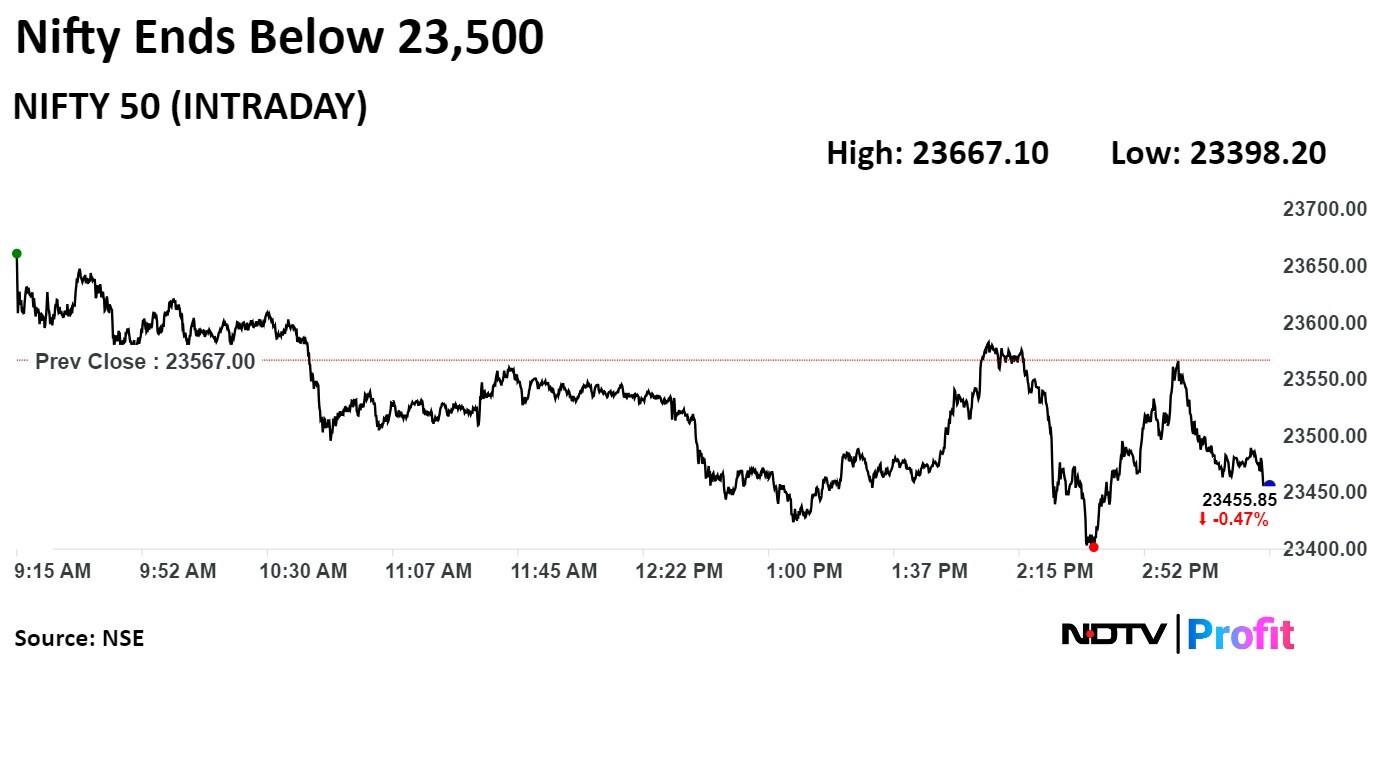

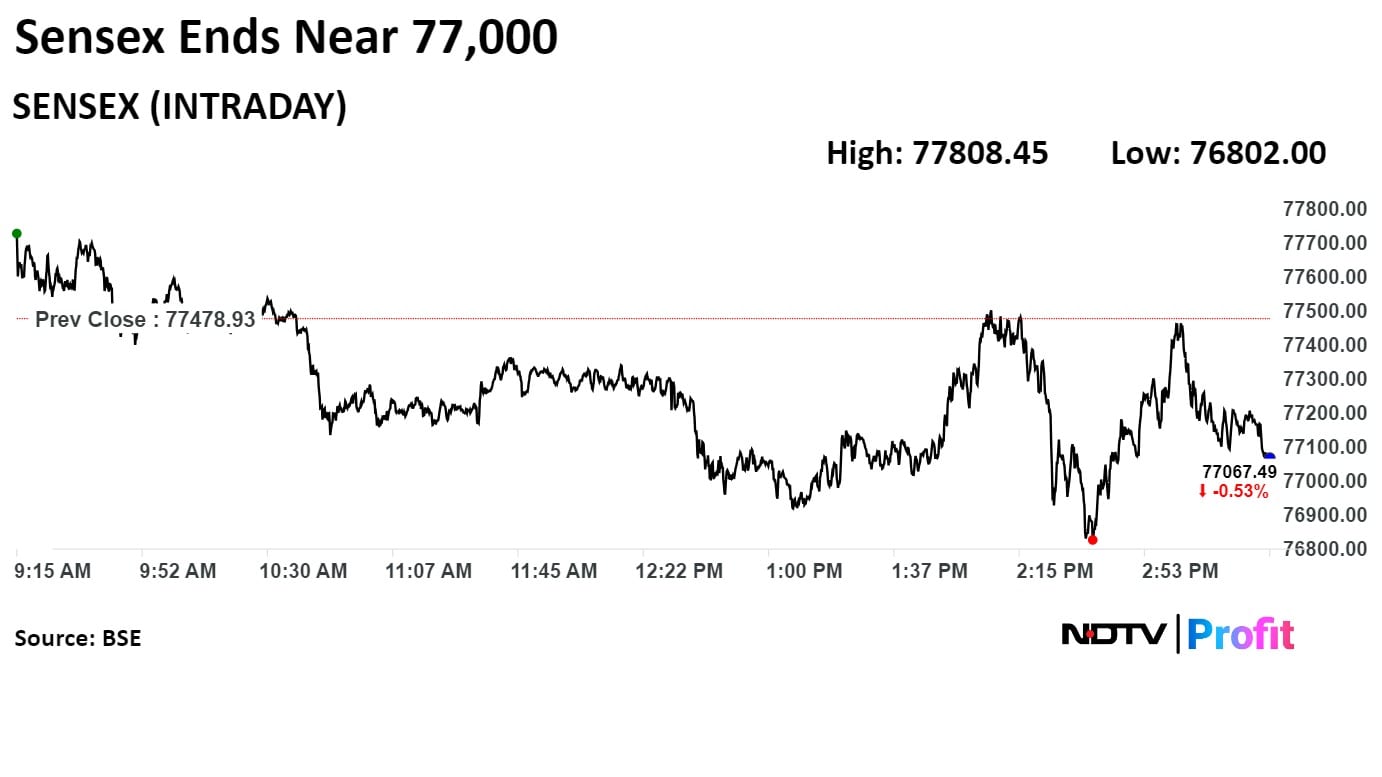

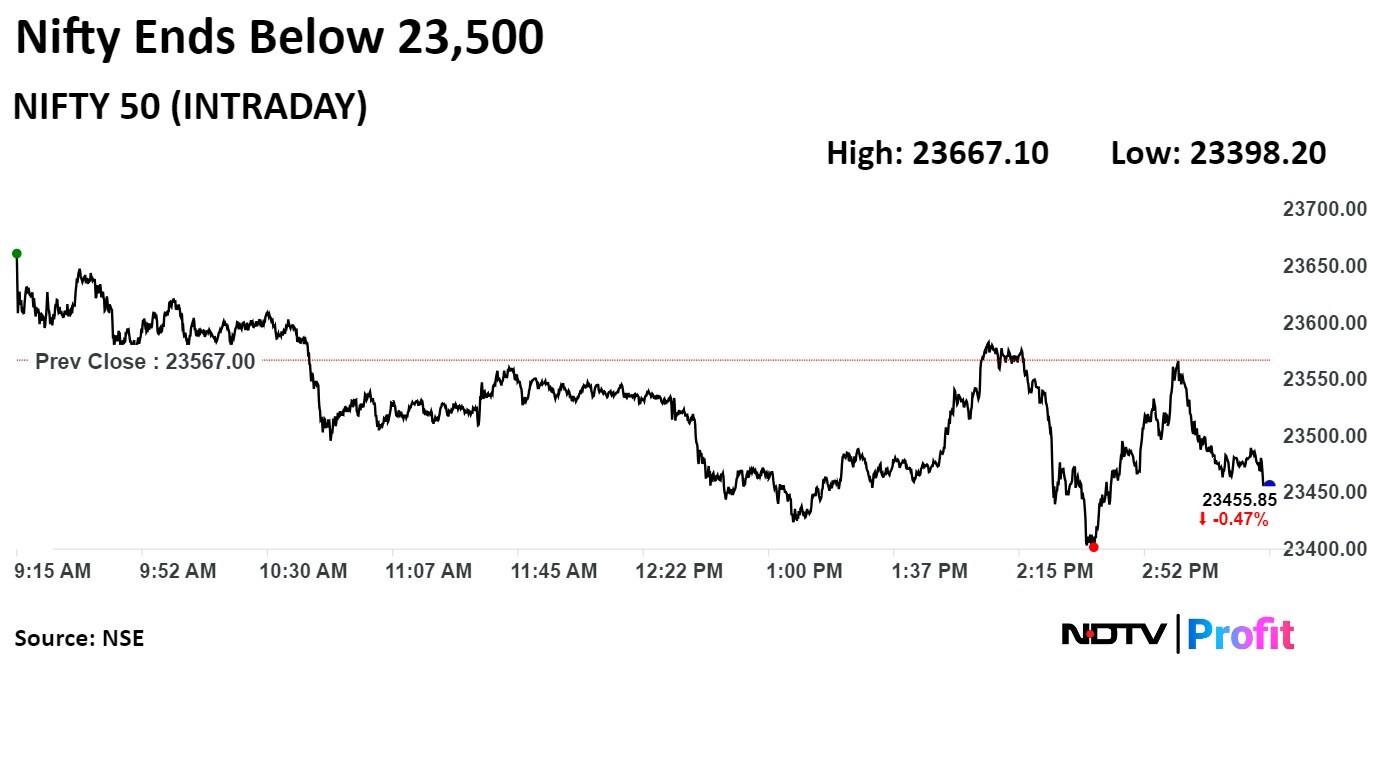

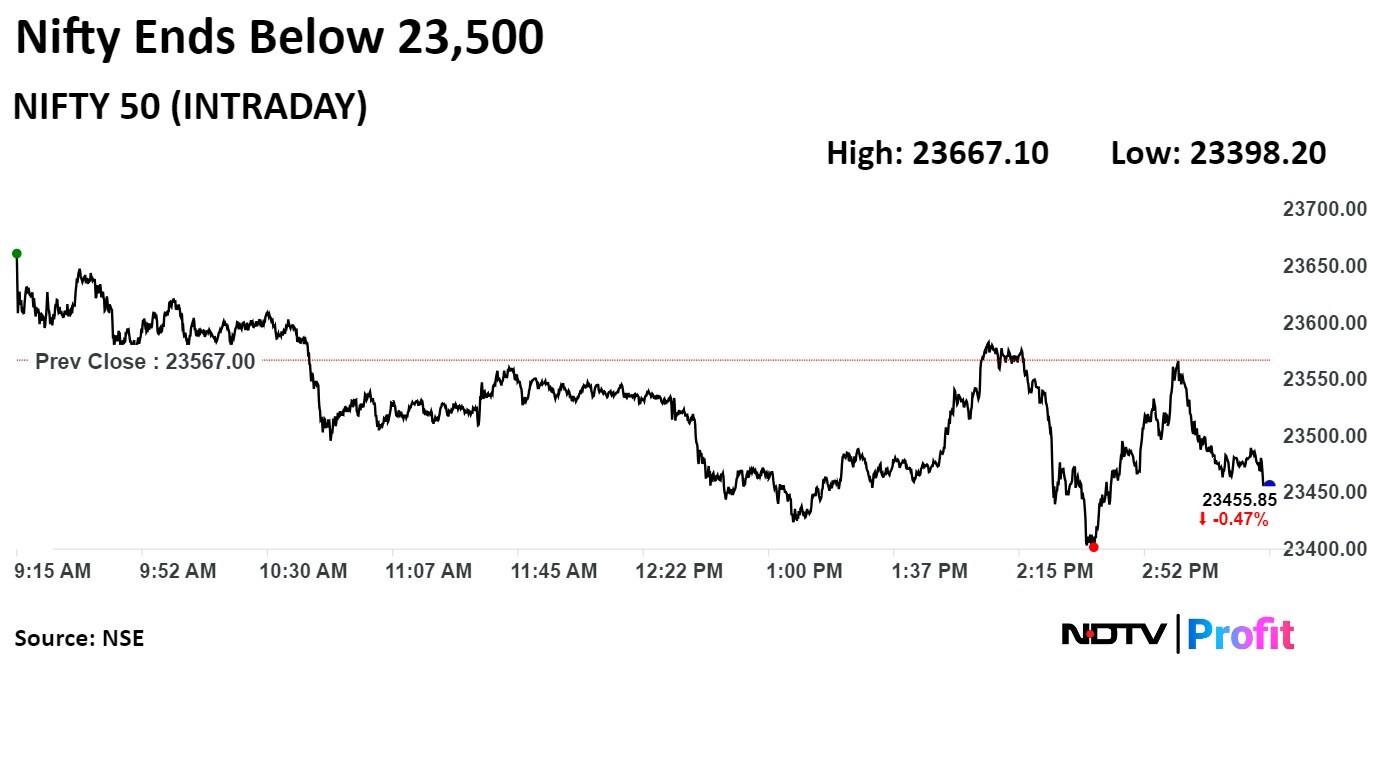

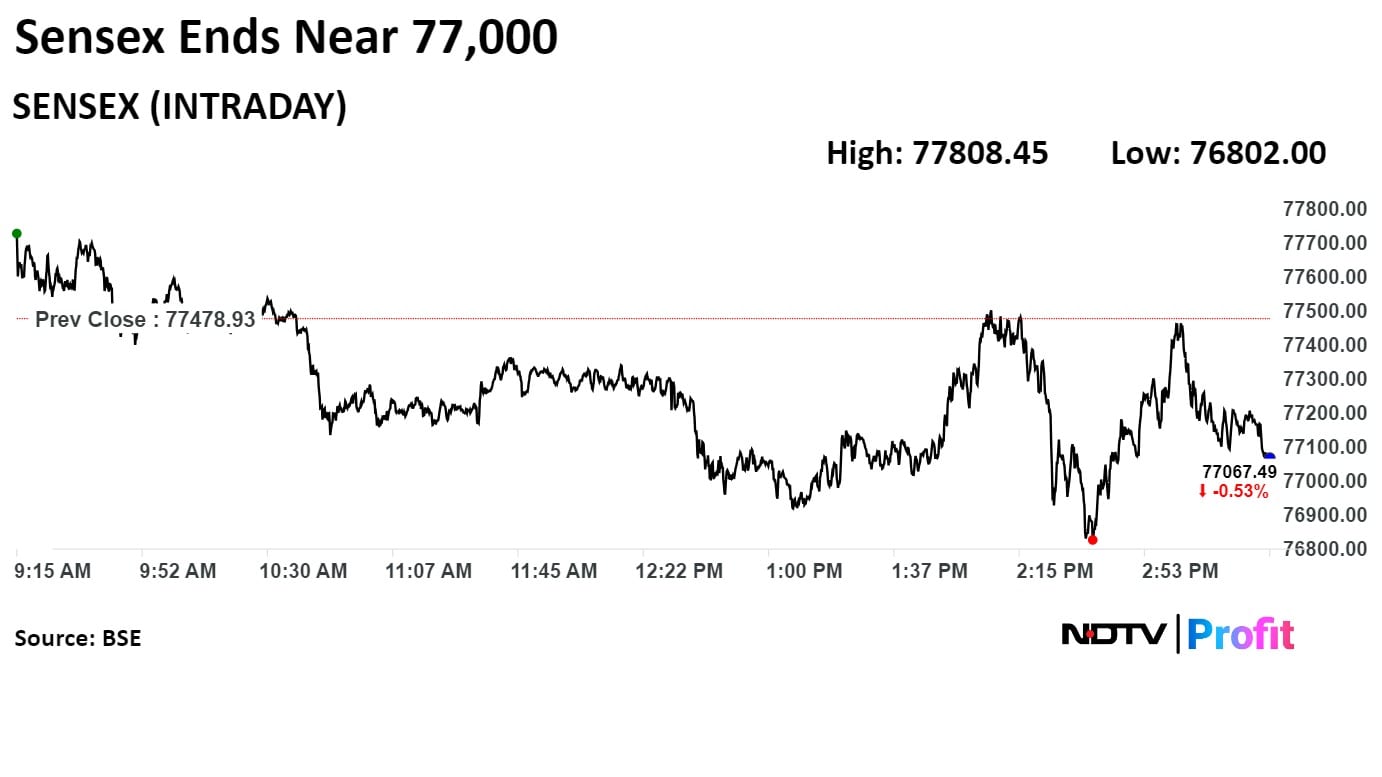

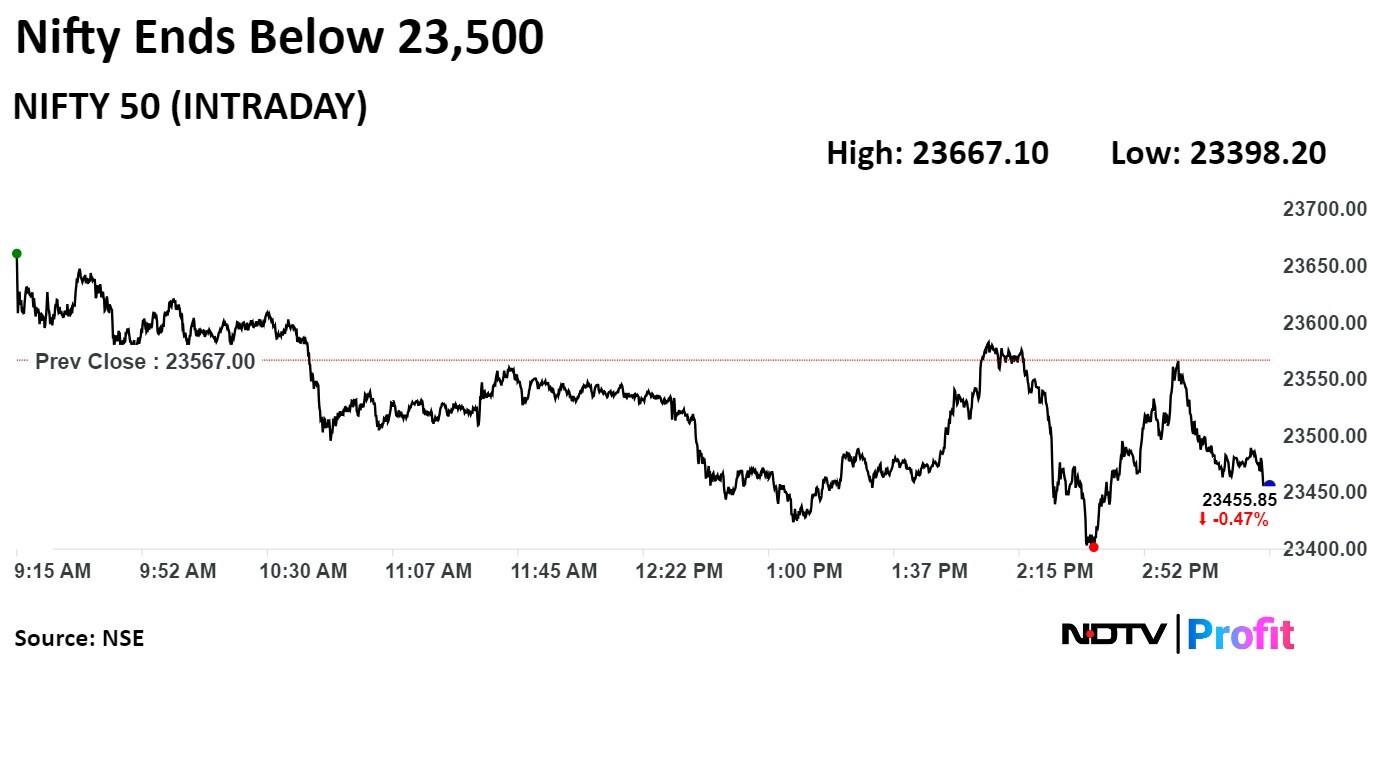

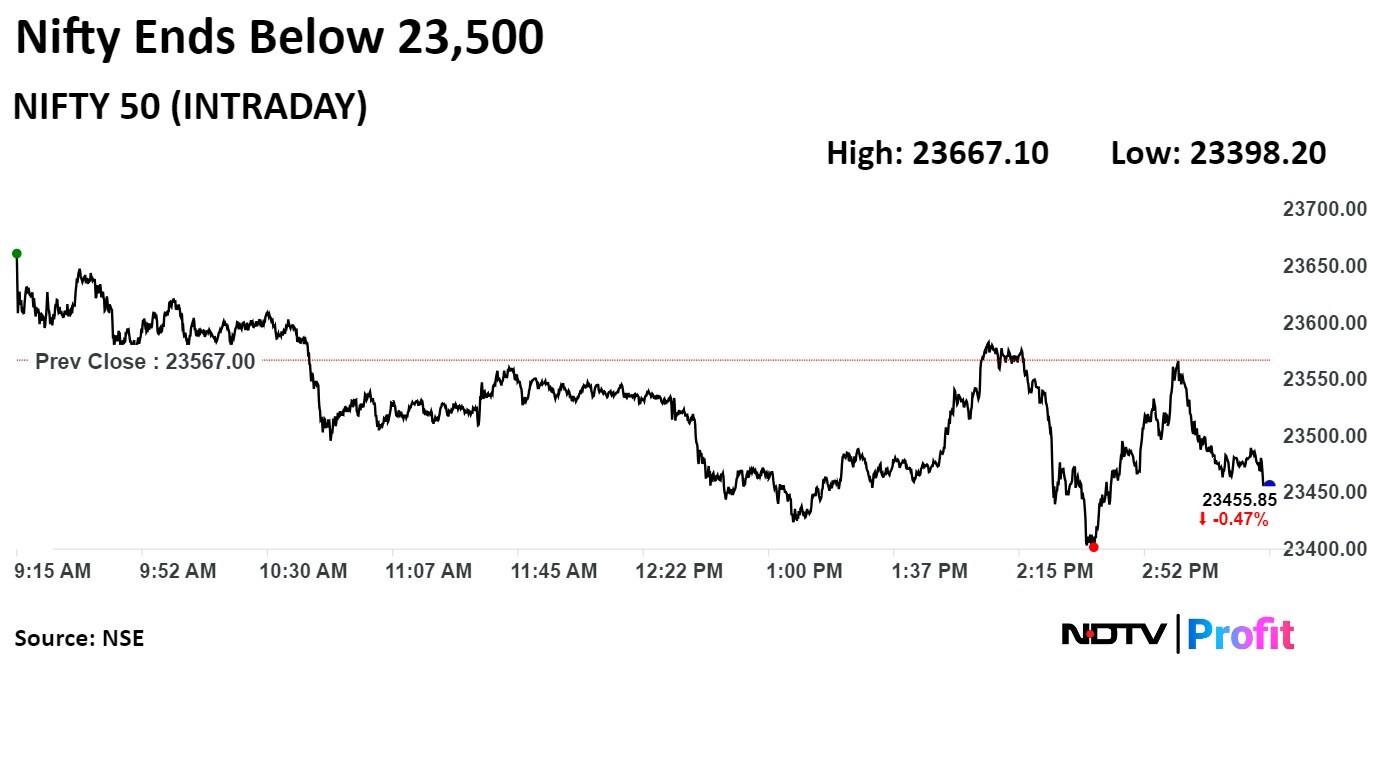

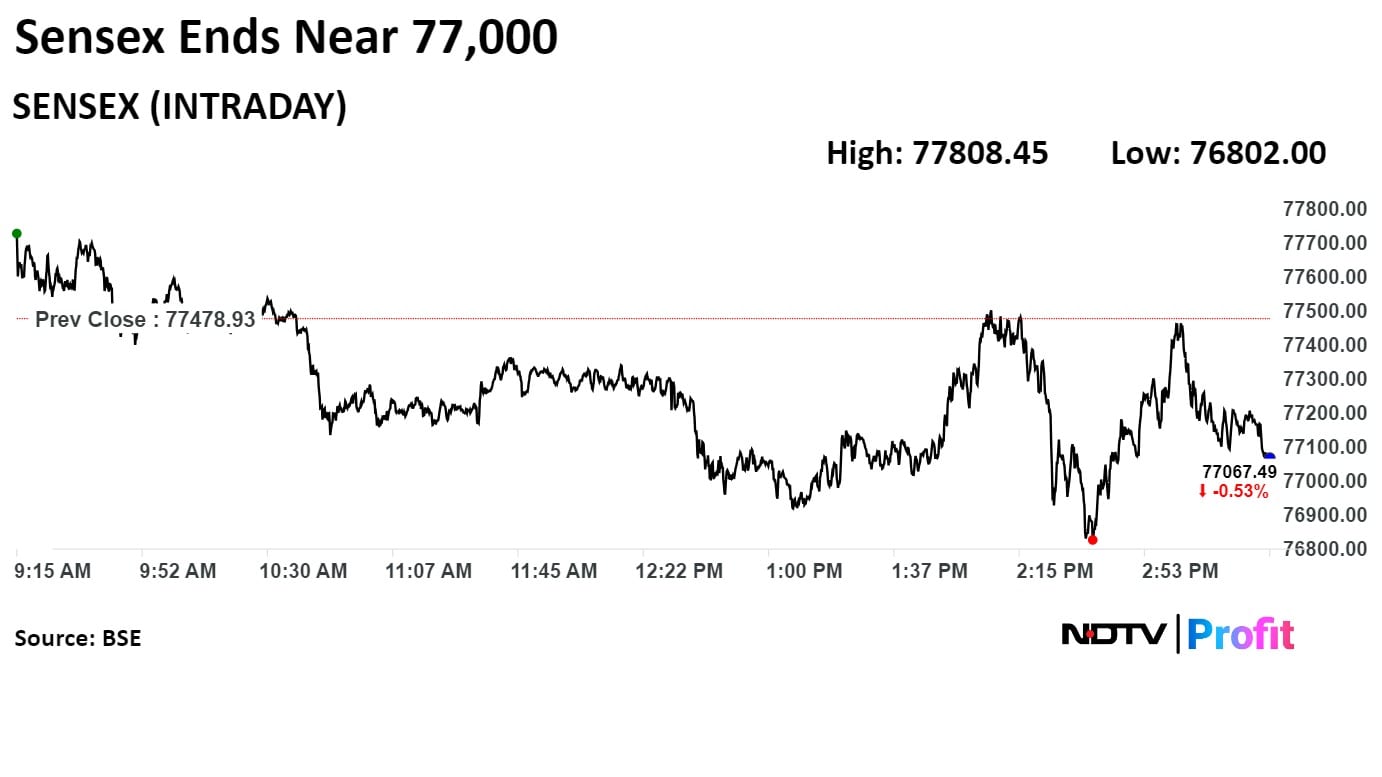

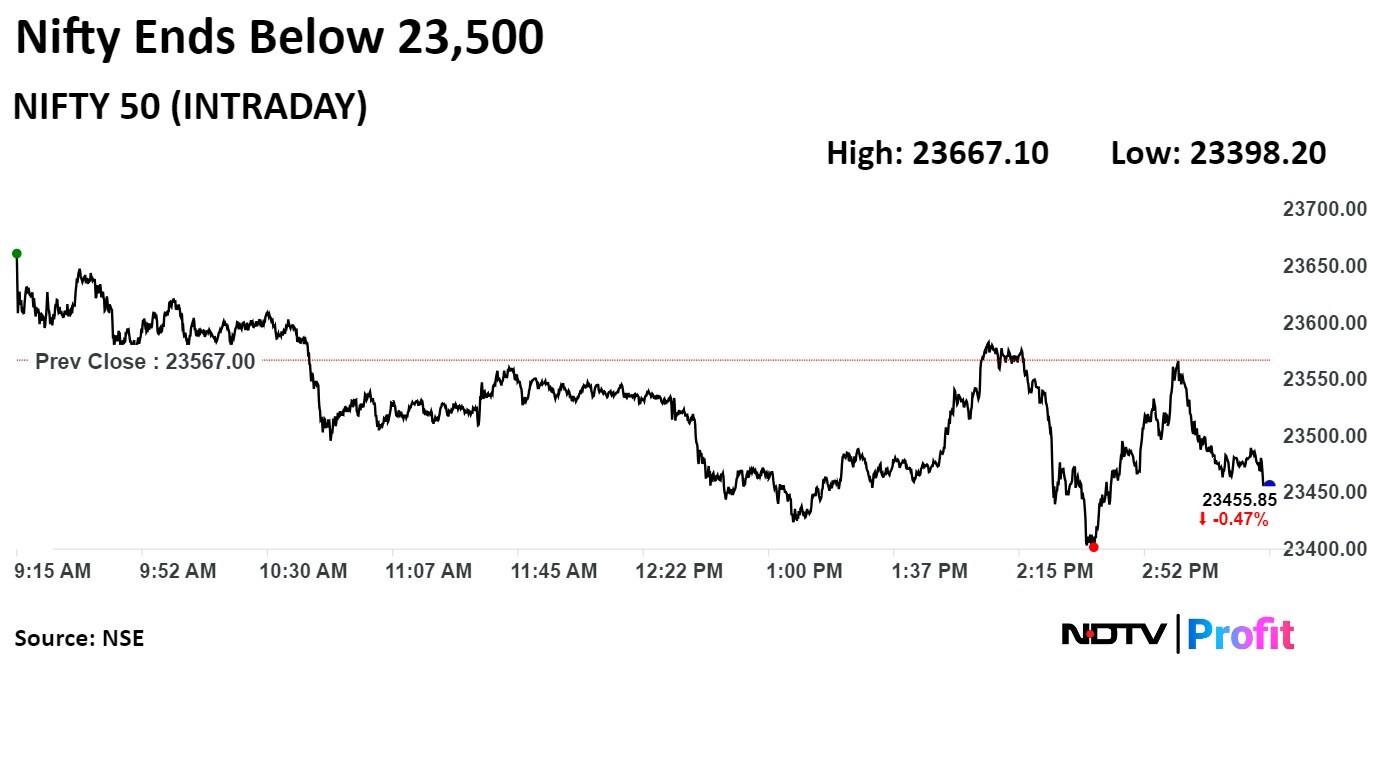

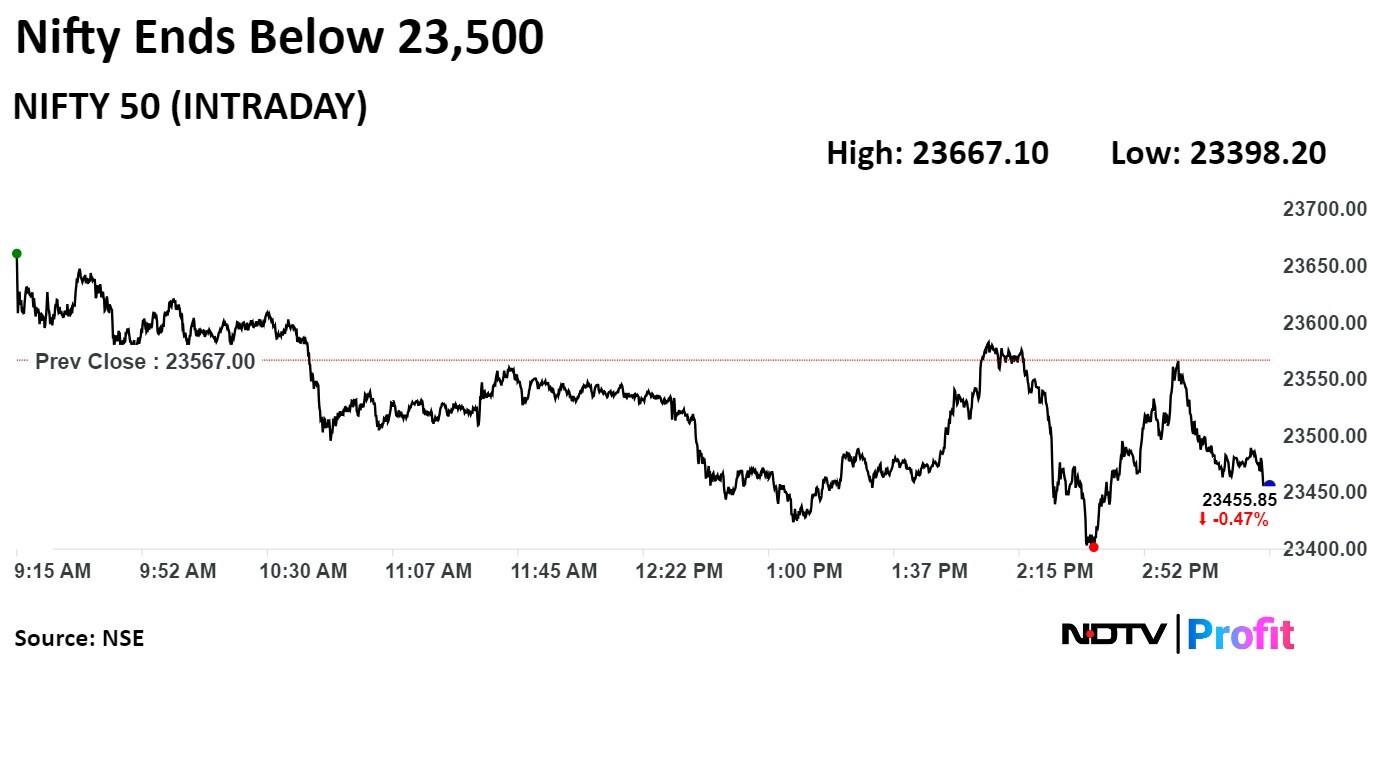

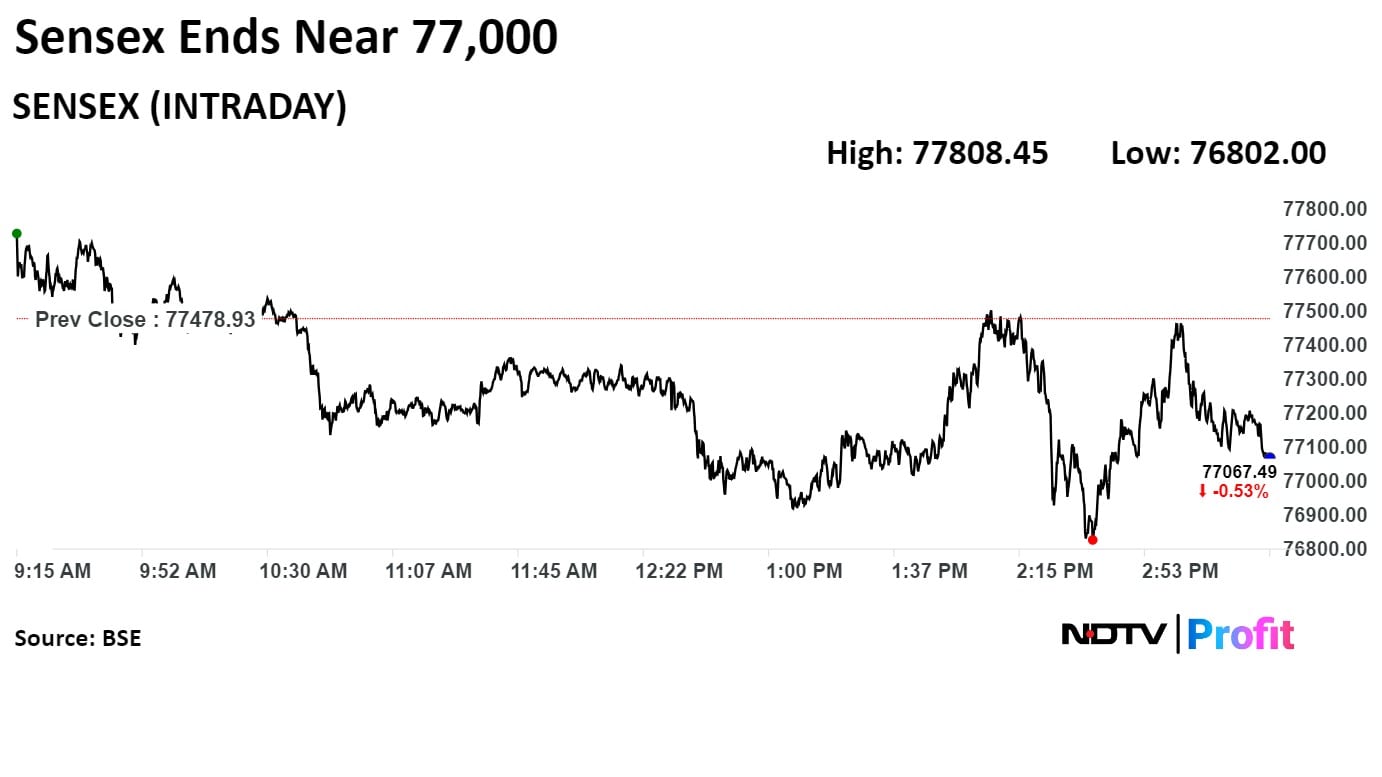

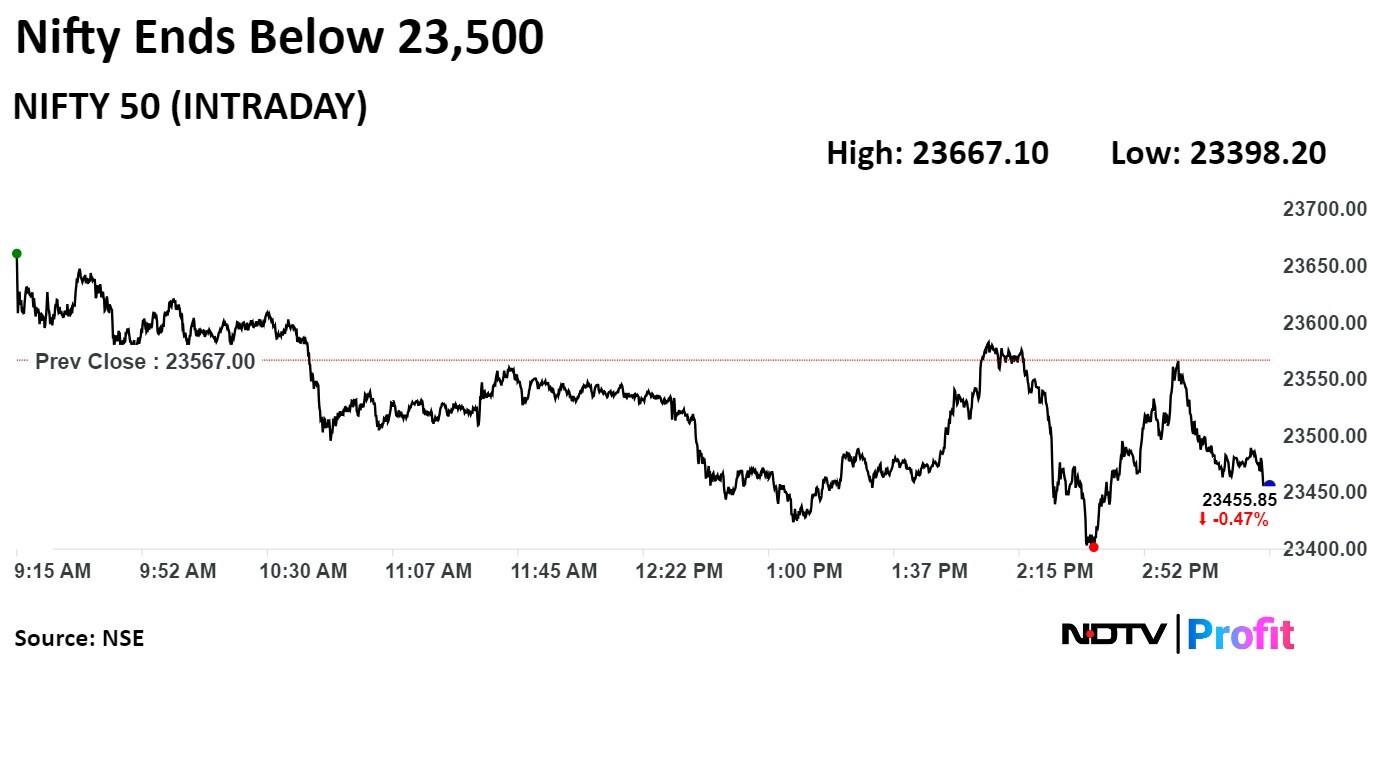

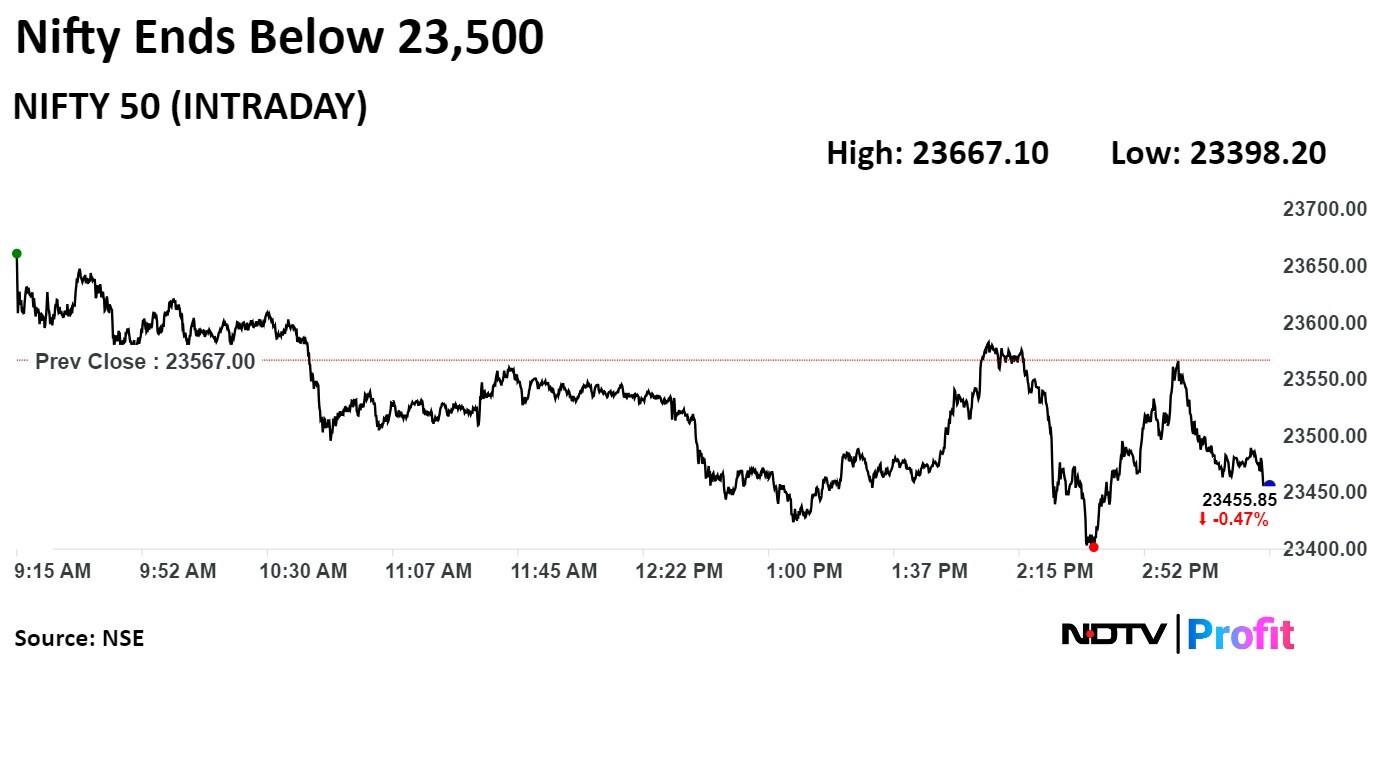

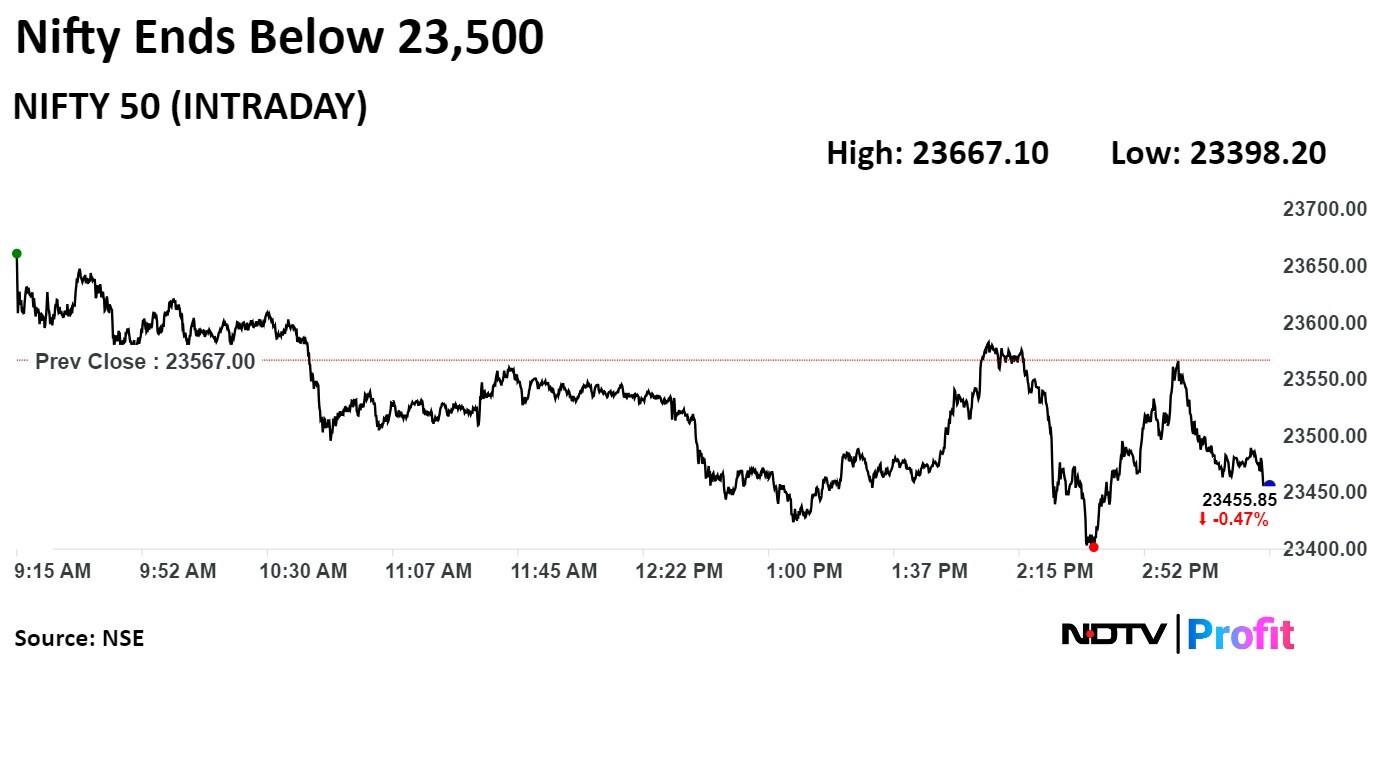

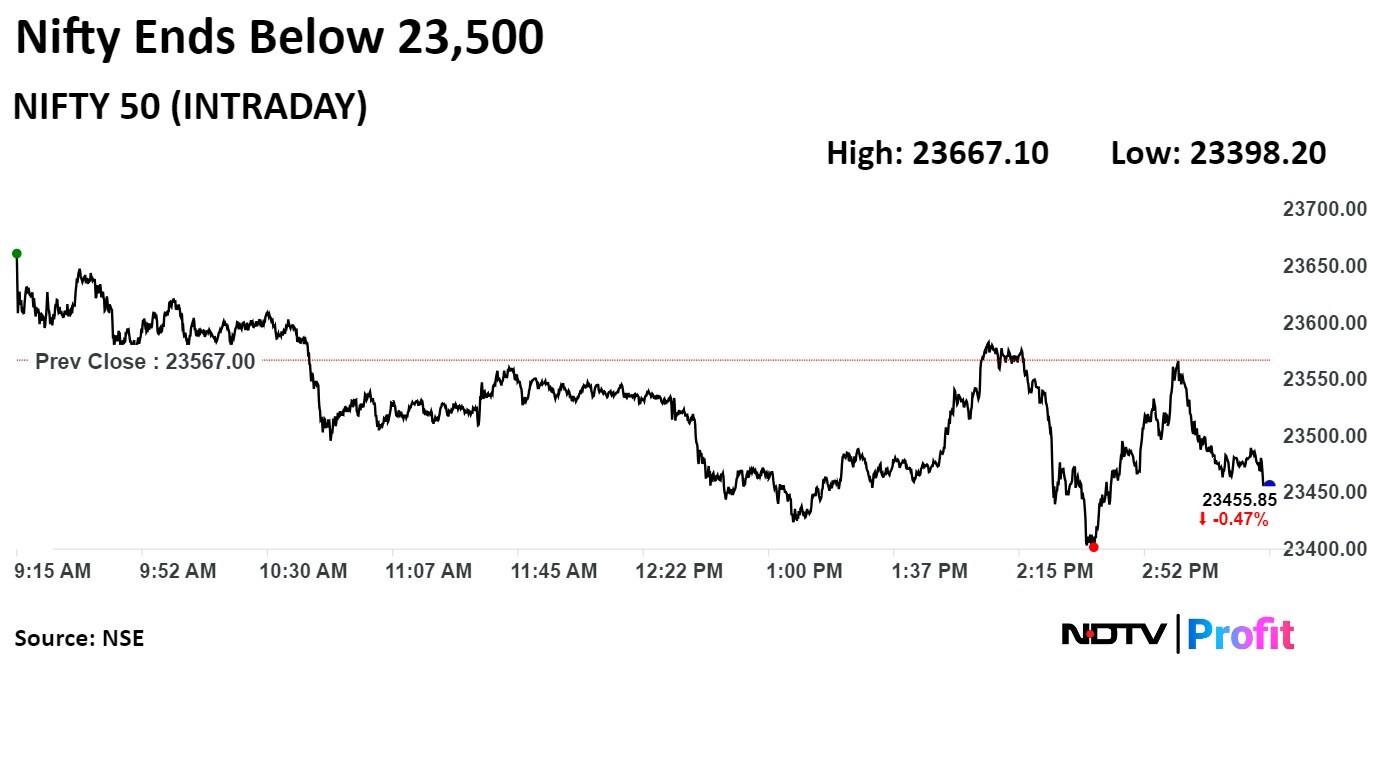

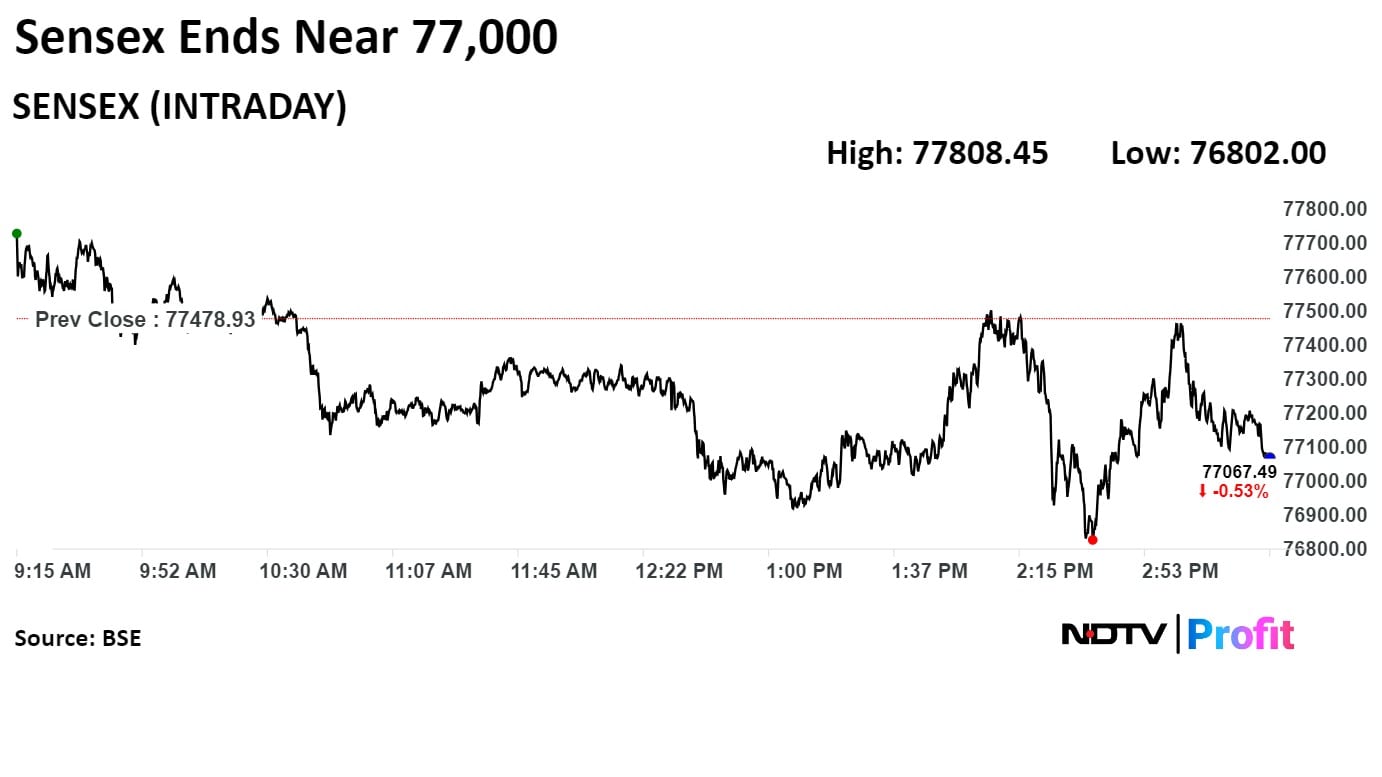

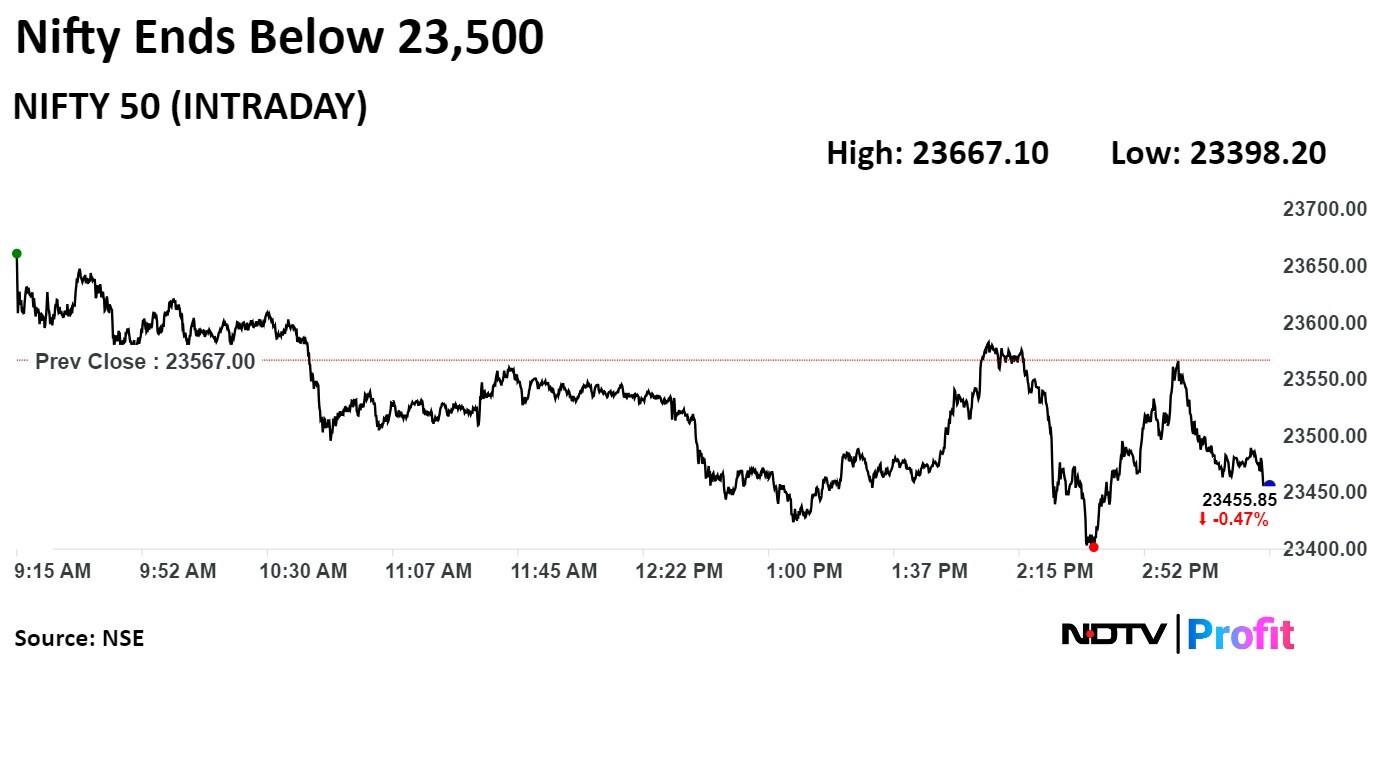

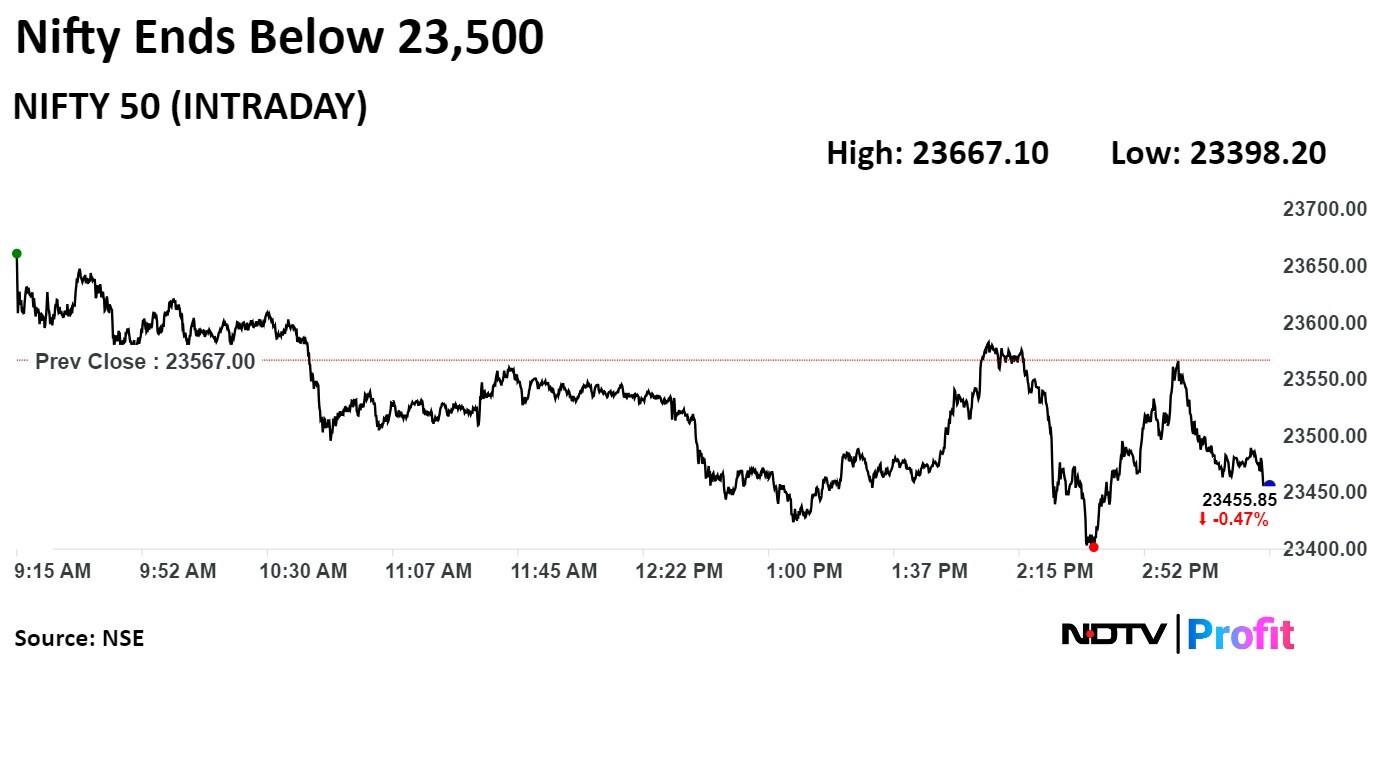

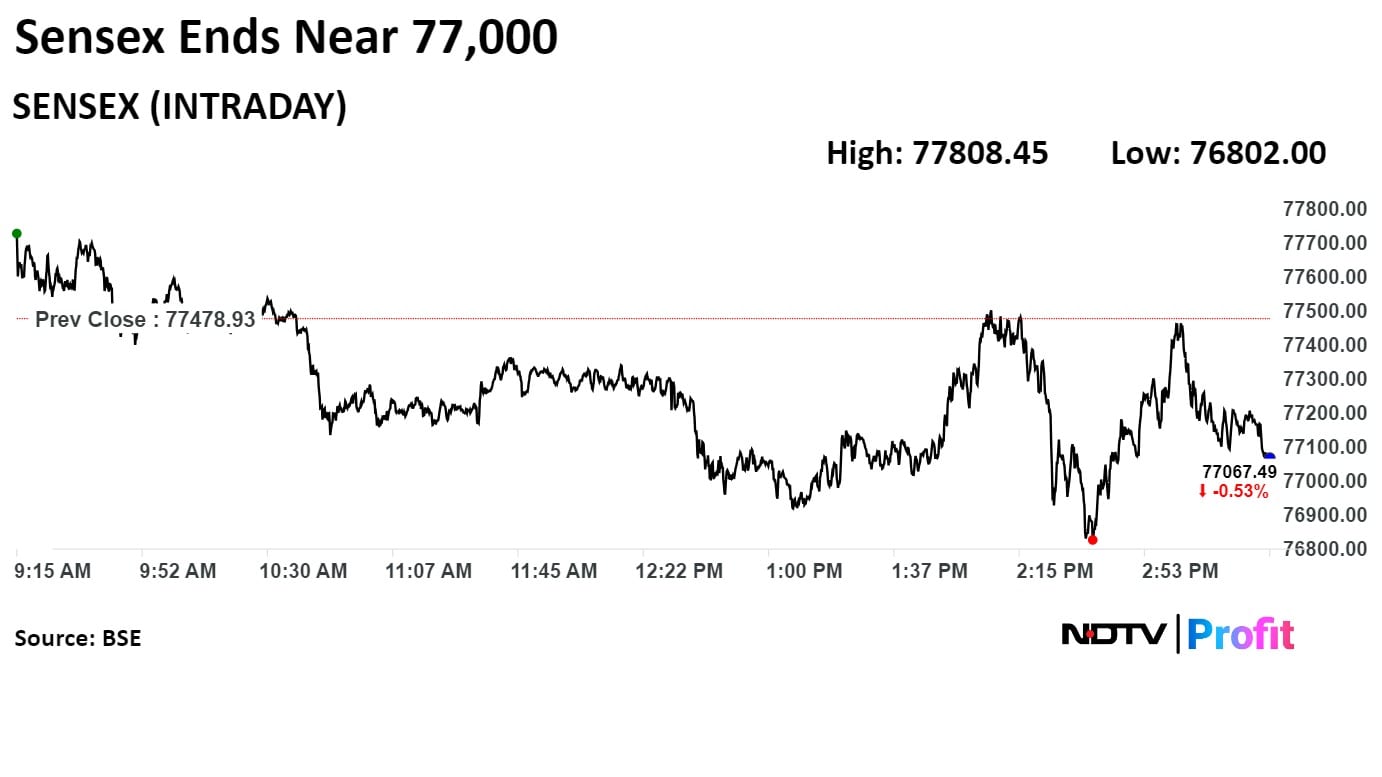

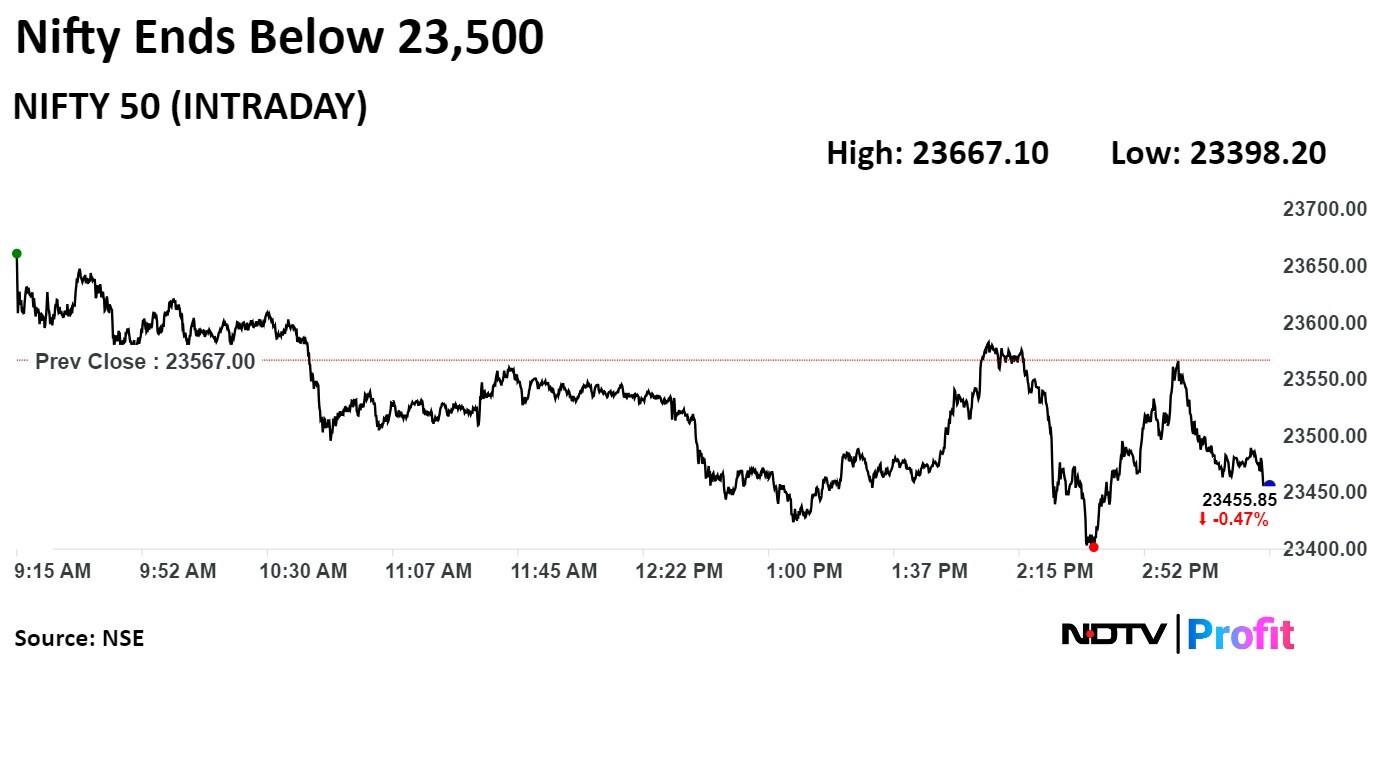

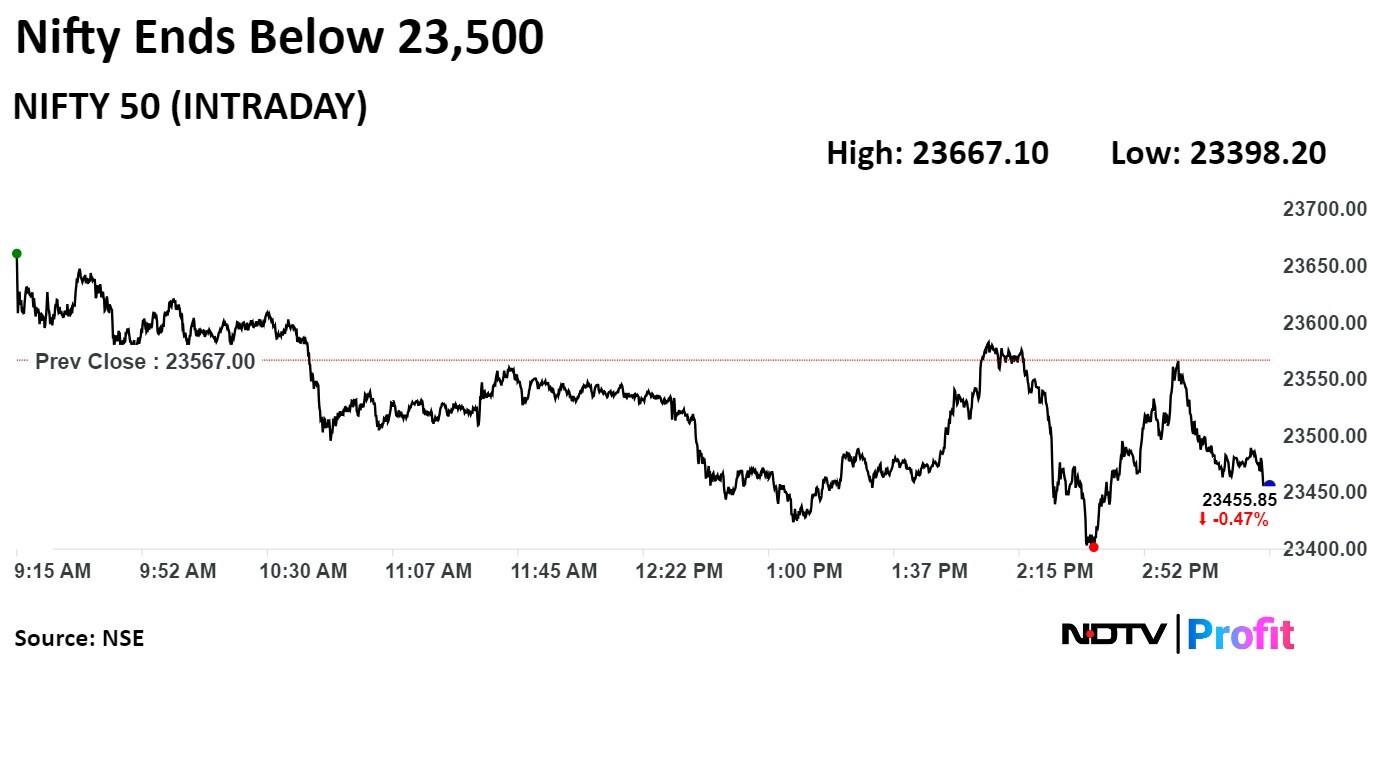

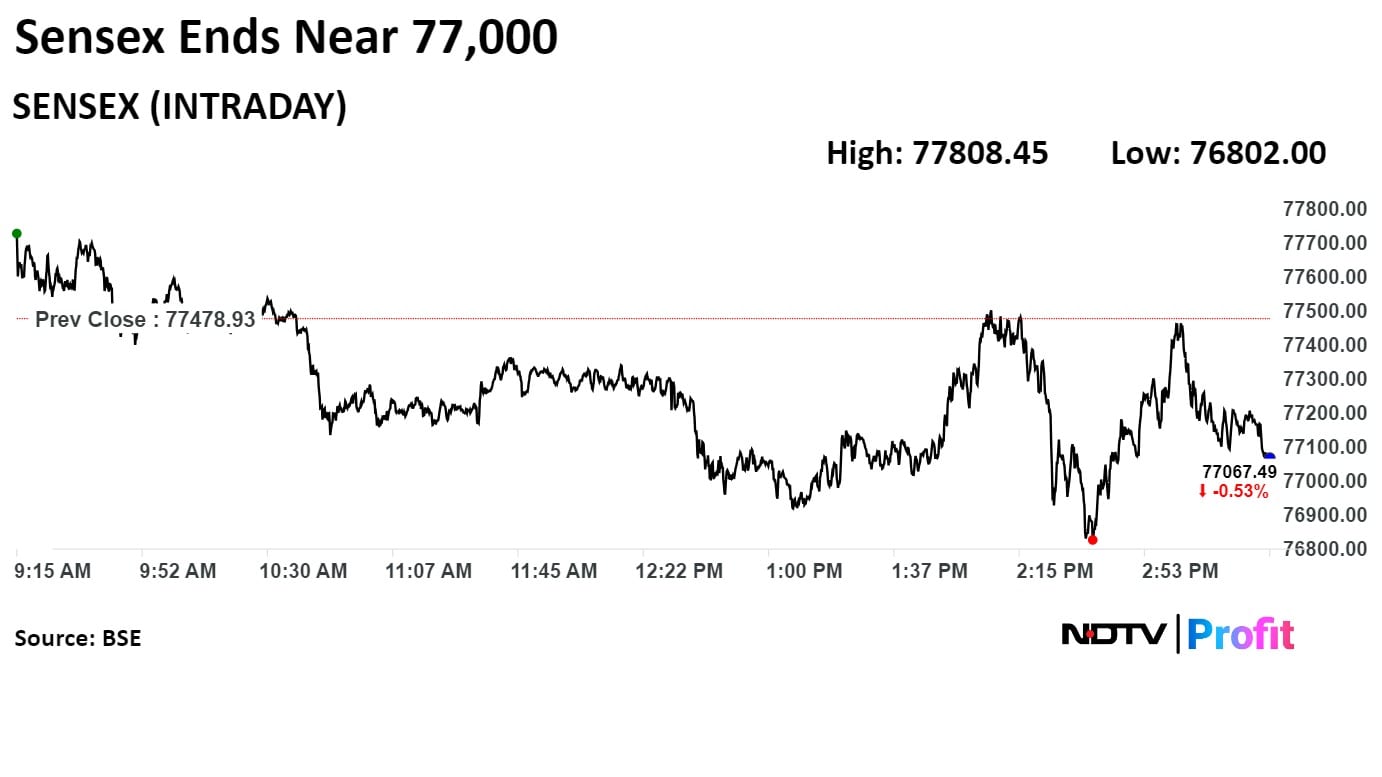

Benchmark equity indices rose for three weeks in a row to record their highest weekly close even as they fell on Friday. Today's fall was due to losses in the shares of heavyweights.

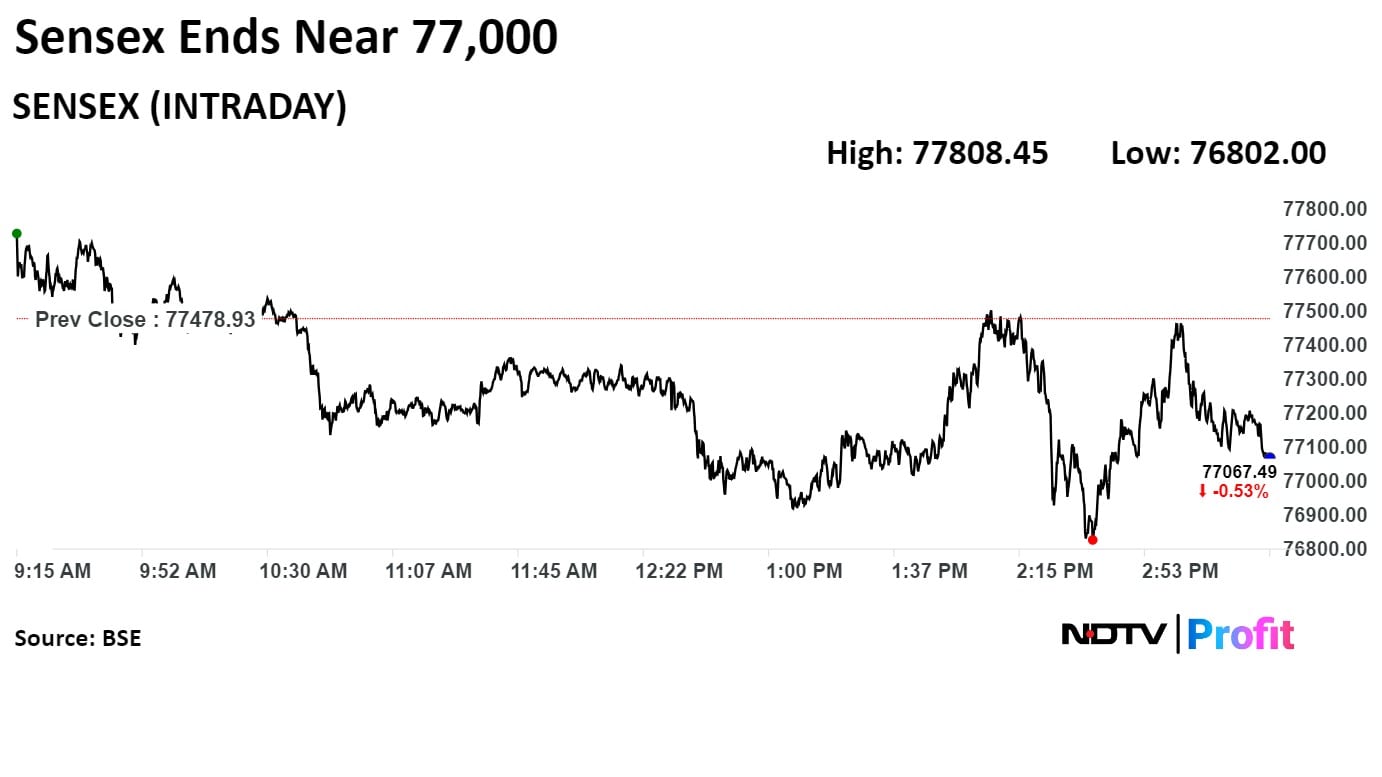

Today, the Nifty fell 111.15 points or 0.47% to close at 23,455.85, its highest weekly close and the Sensex fell 269.03 points or 0.35% to close the week at its highest level of 77,209.90.

"The domestic market witnessed minor profit booking amid concerns over the slow progress of the monsoon, resulting in underperformance in the FMCG sector," said Vinod Nair, head of research of Geojit Financial Services.

He added, "Attention is now focused on the upcoming GST meeting, where the potential rationalization of GST rates in certain sectors is under discussion."

Benchmark equity indices rose for three weeks in a row to record their highest weekly close even as they fell on Friday. Today's fall was due to losses in the shares of heavyweights.

Today, the Nifty fell 111.15 points or 0.47% to close at 23,455.85, its highest weekly close and the Sensex fell 269.03 points or 0.35% to close the week at its highest level of 77,209.90.

"The domestic market witnessed minor profit booking amid concerns over the slow progress of the monsoon, resulting in underperformance in the FMCG sector," said Vinod Nair, head of research of Geojit Financial Services.

He added, "Attention is now focused on the upcoming GST meeting, where the potential rationalization of GST rates in certain sectors is under discussion."

Benchmark equity indices rose for three weeks in a row to record their highest weekly close even as they fell on Friday. Today's fall was due to losses in the shares of heavyweights.

Today, the Nifty fell 111.15 points or 0.47% to close at 23,455.85, its highest weekly close and the Sensex fell 269.03 points or 0.35% to close the week at its highest level of 77,209.90.

"The domestic market witnessed minor profit booking amid concerns over the slow progress of the monsoon, resulting in underperformance in the FMCG sector," said Vinod Nair, head of research of Geojit Financial Services.

He added, "Attention is now focused on the upcoming GST meeting, where the potential rationalization of GST rates in certain sectors is under discussion."

Benchmark equity indices rose for three weeks in a row to record their highest weekly close even as they fell on Friday. Today's fall was due to losses in the shares of heavyweights.

Today, the Nifty fell 111.15 points or 0.47% to close at 23,455.85, its highest weekly close and the Sensex fell 269.03 points or 0.35% to close the week at its highest level of 77,209.90.

"The domestic market witnessed minor profit booking amid concerns over the slow progress of the monsoon, resulting in underperformance in the FMCG sector," said Vinod Nair, head of research of Geojit Financial Services.

He added, "Attention is now focused on the upcoming GST meeting, where the potential rationalization of GST rates in certain sectors is under discussion."

Benchmark equity indices rose for three weeks in a row to record their highest weekly close even as they fell on Friday. Today's fall was due to losses in the shares of heavyweights.

Today, the Nifty fell 111.15 points or 0.47% to close at 23,455.85, its highest weekly close and the Sensex fell 269.03 points or 0.35% to close the week at its highest level of 77,209.90.

"The domestic market witnessed minor profit booking amid concerns over the slow progress of the monsoon, resulting in underperformance in the FMCG sector," said Vinod Nair, head of research of Geojit Financial Services.

He added, "Attention is now focused on the upcoming GST meeting, where the potential rationalization of GST rates in certain sectors is under discussion."

Benchmark equity indices rose for three weeks in a row to record their highest weekly close even as they fell on Friday. Today's fall was due to losses in the shares of heavyweights.

Today, the Nifty fell 111.15 points or 0.47% to close at 23,455.85, its highest weekly close and the Sensex fell 269.03 points or 0.35% to close the week at its highest level of 77,209.90.

"The domestic market witnessed minor profit booking amid concerns over the slow progress of the monsoon, resulting in underperformance in the FMCG sector," said Vinod Nair, head of research of Geojit Financial Services.

He added, "Attention is now focused on the upcoming GST meeting, where the potential rationalization of GST rates in certain sectors is under discussion."

Benchmark equity indices rose for three weeks in a row to record their highest weekly close even as they fell on Friday. Today's fall was due to losses in the shares of heavyweights.

Today, the Nifty fell 111.15 points or 0.47% to close at 23,455.85, its highest weekly close and the Sensex fell 269.03 points or 0.35% to close the week at its highest level of 77,209.90.

"The domestic market witnessed minor profit booking amid concerns over the slow progress of the monsoon, resulting in underperformance in the FMCG sector," said Vinod Nair, head of research of Geojit Financial Services.

He added, "Attention is now focused on the upcoming GST meeting, where the potential rationalization of GST rates in certain sectors is under discussion."

Benchmark equity indices rose for three weeks in a row to record their highest weekly close even as they fell on Friday. Today's fall was due to losses in the shares of heavyweights.

Today, the Nifty fell 111.15 points or 0.47% to close at 23,455.85, its highest weekly close and the Sensex fell 269.03 points or 0.35% to close the week at its highest level of 77,209.90.

"The domestic market witnessed minor profit booking amid concerns over the slow progress of the monsoon, resulting in underperformance in the FMCG sector," said Vinod Nair, head of research of Geojit Financial Services.

He added, "Attention is now focused on the upcoming GST meeting, where the potential rationalization of GST rates in certain sectors is under discussion."

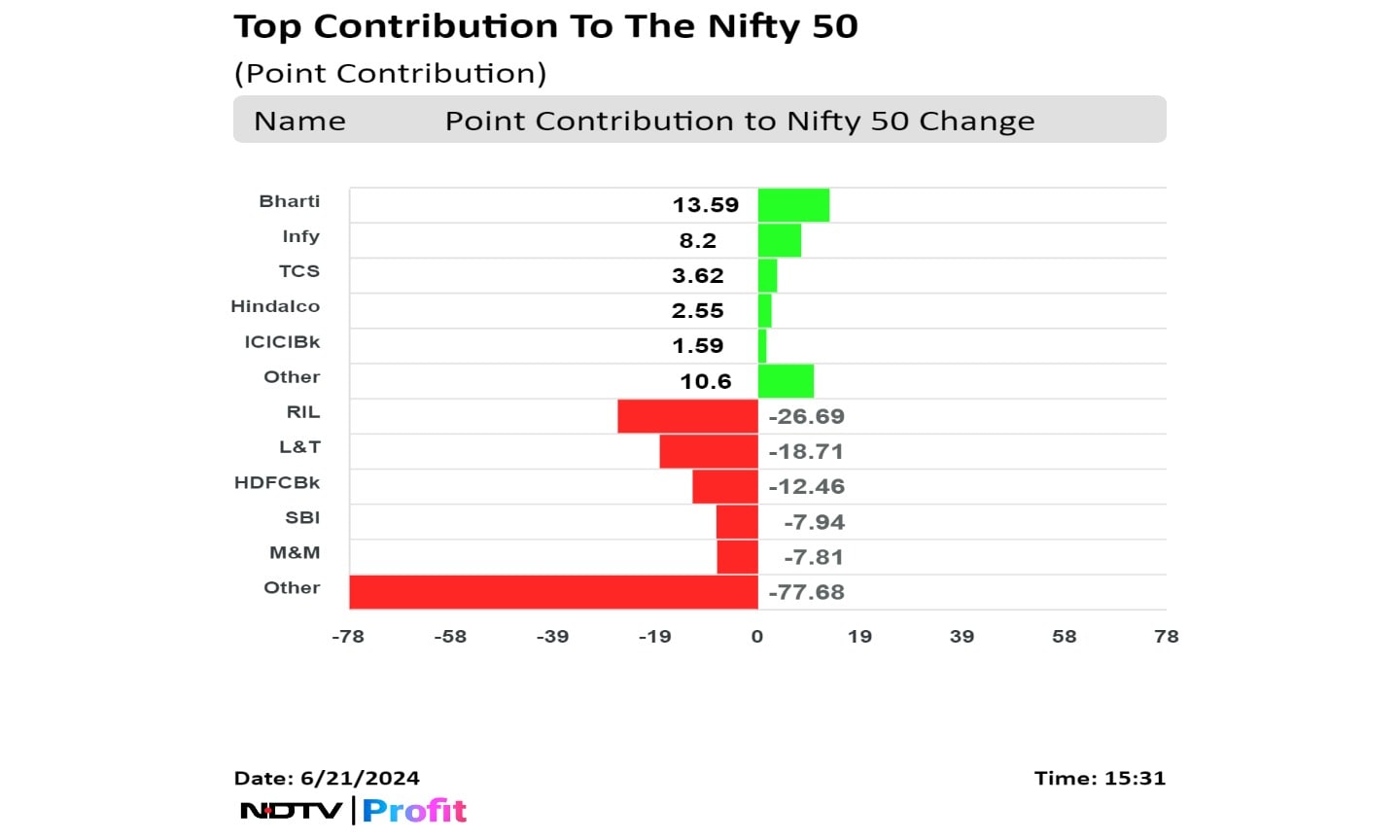

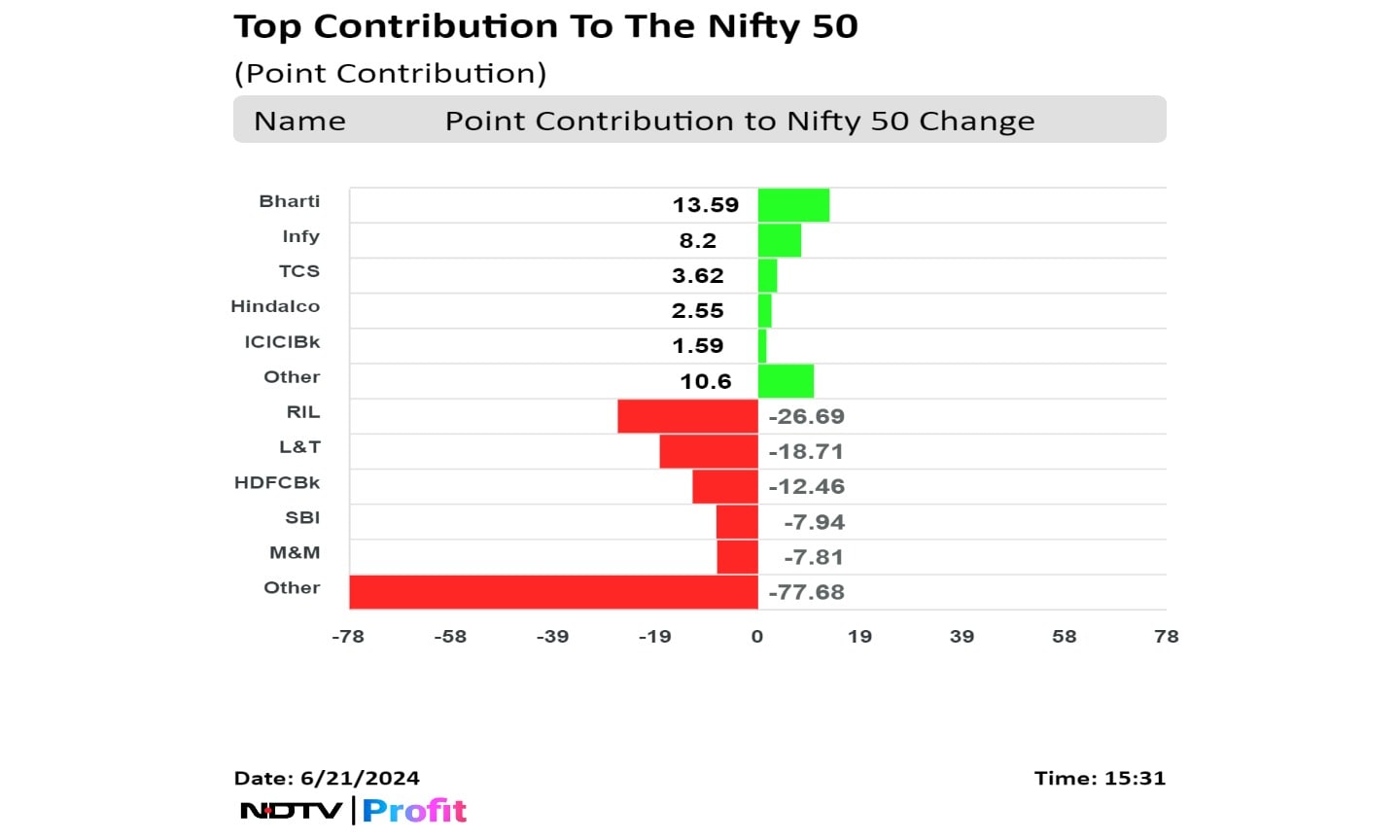

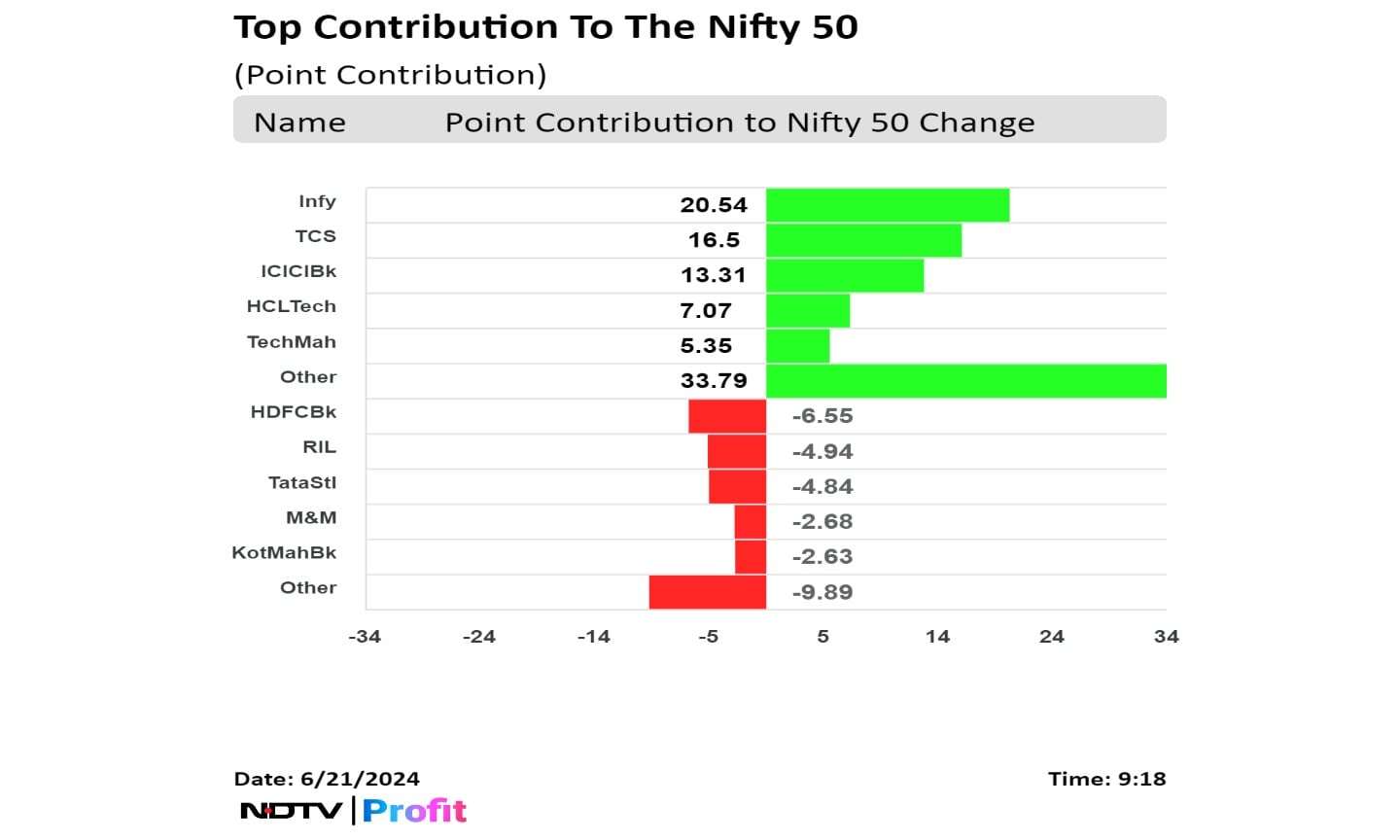

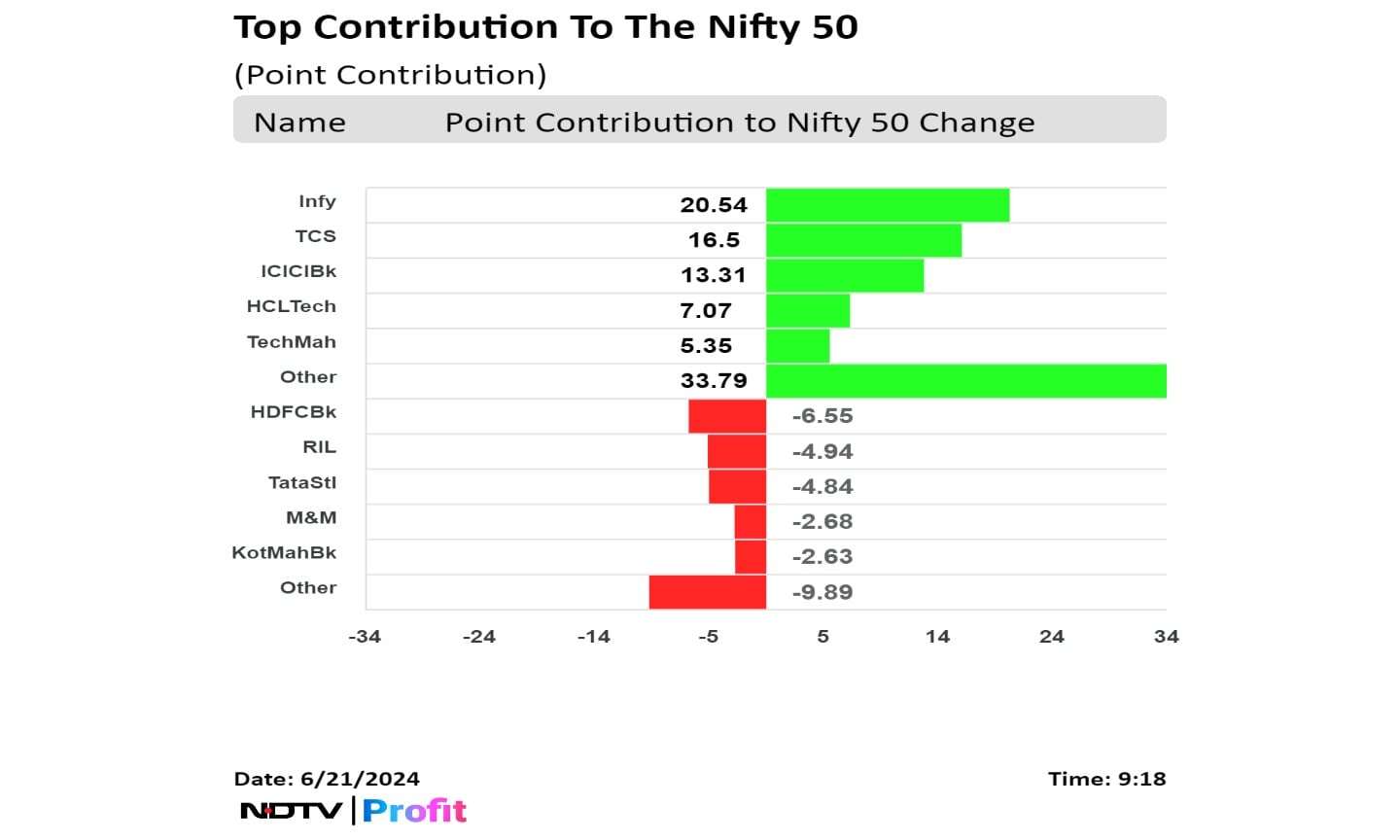

In Friday's session shares of Reliance Industries Ltd., Larsen & Toubro Ltd., HDFC Bank Ltd., State Bank Of India, and Mahindra & Mahindra Ltd dragged the Nifty lower.

While those of Bharti Airtel Ltd., Infosys Ltd., Tata Consultancy Services Ltd., Hindalco Industries Ltd. cushioned the fall.

Benchmark equity indices rose for three weeks in a row to record their highest weekly close even as they fell on Friday. Today's fall was due to losses in the shares of heavyweights.

Today, the Nifty fell 111.15 points or 0.47% to close at 23,455.85, its highest weekly close and the Sensex fell 269.03 points or 0.35% to close the week at its highest level of 77,209.90.

"The domestic market witnessed minor profit booking amid concerns over the slow progress of the monsoon, resulting in underperformance in the FMCG sector," said Vinod Nair, head of research of Geojit Financial Services.

He added, "Attention is now focused on the upcoming GST meeting, where the potential rationalization of GST rates in certain sectors is under discussion."

Benchmark equity indices rose for three weeks in a row to record their highest weekly close even as they fell on Friday. Today's fall was due to losses in the shares of heavyweights.

Today, the Nifty fell 111.15 points or 0.47% to close at 23,455.85, its highest weekly close and the Sensex fell 269.03 points or 0.35% to close the week at its highest level of 77,209.90.

"The domestic market witnessed minor profit booking amid concerns over the slow progress of the monsoon, resulting in underperformance in the FMCG sector," said Vinod Nair, head of research of Geojit Financial Services.

He added, "Attention is now focused on the upcoming GST meeting, where the potential rationalization of GST rates in certain sectors is under discussion."

Benchmark equity indices rose for three weeks in a row to record their highest weekly close even as they fell on Friday. Today's fall was due to losses in the shares of heavyweights.

Today, the Nifty fell 111.15 points or 0.47% to close at 23,455.85, its highest weekly close and the Sensex fell 269.03 points or 0.35% to close the week at its highest level of 77,209.90.

"The domestic market witnessed minor profit booking amid concerns over the slow progress of the monsoon, resulting in underperformance in the FMCG sector," said Vinod Nair, head of research of Geojit Financial Services.

He added, "Attention is now focused on the upcoming GST meeting, where the potential rationalization of GST rates in certain sectors is under discussion."

Benchmark equity indices rose for three weeks in a row to record their highest weekly close even as they fell on Friday. Today's fall was due to losses in the shares of heavyweights.

Today, the Nifty fell 111.15 points or 0.47% to close at 23,455.85, its highest weekly close and the Sensex fell 269.03 points or 0.35% to close the week at its highest level of 77,209.90.

"The domestic market witnessed minor profit booking amid concerns over the slow progress of the monsoon, resulting in underperformance in the FMCG sector," said Vinod Nair, head of research of Geojit Financial Services.

He added, "Attention is now focused on the upcoming GST meeting, where the potential rationalization of GST rates in certain sectors is under discussion."

Benchmark equity indices rose for three weeks in a row to record their highest weekly close even as they fell on Friday. Today's fall was due to losses in the shares of heavyweights.

Today, the Nifty fell 111.15 points or 0.47% to close at 23,455.85, its highest weekly close and the Sensex fell 269.03 points or 0.35% to close the week at its highest level of 77,209.90.

"The domestic market witnessed minor profit booking amid concerns over the slow progress of the monsoon, resulting in underperformance in the FMCG sector," said Vinod Nair, head of research of Geojit Financial Services.

He added, "Attention is now focused on the upcoming GST meeting, where the potential rationalization of GST rates in certain sectors is under discussion."

Benchmark equity indices rose for three weeks in a row to record their highest weekly close even as they fell on Friday. Today's fall was due to losses in the shares of heavyweights.

Today, the Nifty fell 111.15 points or 0.47% to close at 23,455.85, its highest weekly close and the Sensex fell 269.03 points or 0.35% to close the week at its highest level of 77,209.90.

"The domestic market witnessed minor profit booking amid concerns over the slow progress of the monsoon, resulting in underperformance in the FMCG sector," said Vinod Nair, head of research of Geojit Financial Services.

He added, "Attention is now focused on the upcoming GST meeting, where the potential rationalization of GST rates in certain sectors is under discussion."

Benchmark equity indices rose for three weeks in a row to record their highest weekly close even as they fell on Friday. Today's fall was due to losses in the shares of heavyweights.

Today, the Nifty fell 111.15 points or 0.47% to close at 23,455.85, its highest weekly close and the Sensex fell 269.03 points or 0.35% to close the week at its highest level of 77,209.90.

"The domestic market witnessed minor profit booking amid concerns over the slow progress of the monsoon, resulting in underperformance in the FMCG sector," said Vinod Nair, head of research of Geojit Financial Services.

He added, "Attention is now focused on the upcoming GST meeting, where the potential rationalization of GST rates in certain sectors is under discussion."

Benchmark equity indices rose for three weeks in a row to record their highest weekly close even as they fell on Friday. Today's fall was due to losses in the shares of heavyweights.

Today, the Nifty fell 111.15 points or 0.47% to close at 23,455.85, its highest weekly close and the Sensex fell 269.03 points or 0.35% to close the week at its highest level of 77,209.90.

"The domestic market witnessed minor profit booking amid concerns over the slow progress of the monsoon, resulting in underperformance in the FMCG sector," said Vinod Nair, head of research of Geojit Financial Services.

He added, "Attention is now focused on the upcoming GST meeting, where the potential rationalization of GST rates in certain sectors is under discussion."

In Friday's session shares of Reliance Industries Ltd., Larsen & Toubro Ltd., HDFC Bank Ltd., State Bank Of India, and Mahindra & Mahindra Ltd dragged the Nifty lower.

While those of Bharti Airtel Ltd., Infosys Ltd., Tata Consultancy Services Ltd., Hindalco Industries Ltd. cushioned the fall.

Broader markets ended on a mixed note on Friday. The S&P BSE Midcap ended 0.26% lower, and Smallcap settled 0.06% higher.

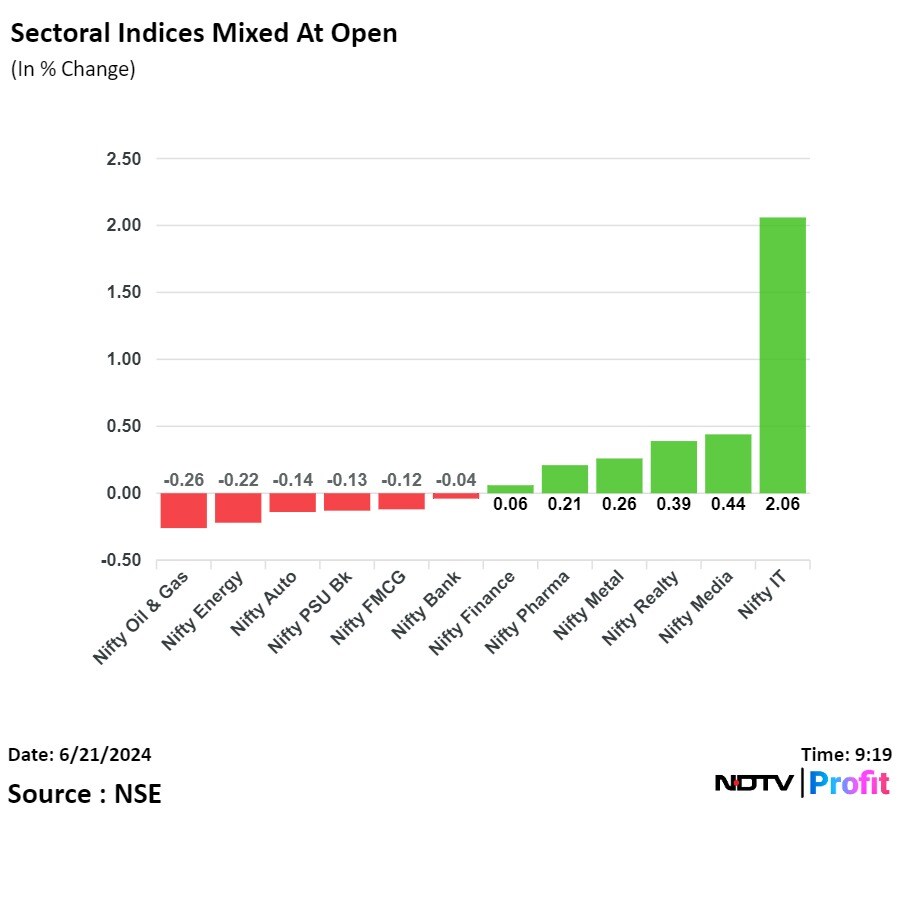

On BSE, 13 sectors declined and seven advanced out of 20. The S&P BSE Telecommunication rose the most, and the S&P BSE Oil & Gas declined the most.

Market breadth was skewed in favour of sellers, Around 2,081 stocks declined, 1,786 stocks rose, and 120 stocks remained unchanged on BSE.

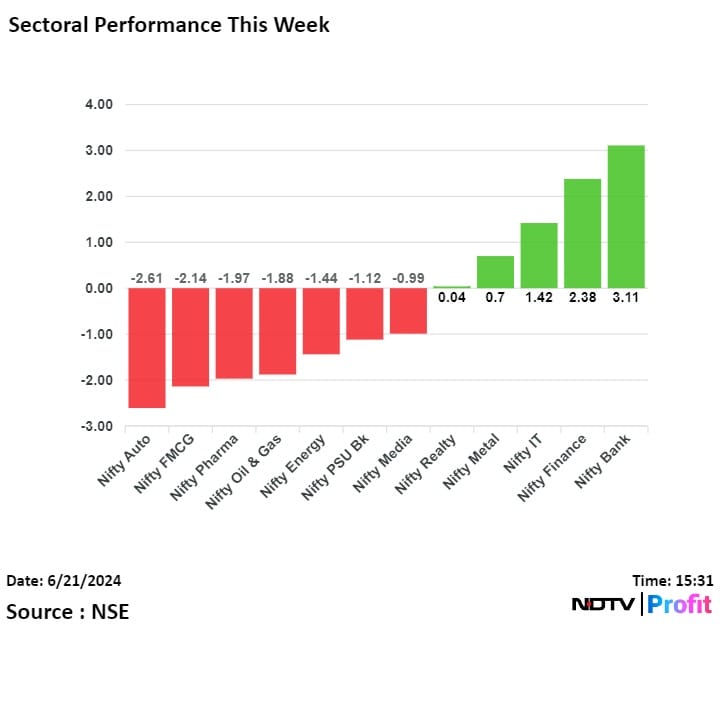

On a weekly basis, the Nifty gained 0.15%.

Most sectoral indices ended with weekly losses. Nifty Auto and Nifty FMCG were the top losers while Nifty Bank gained the most.

Benchmark equity indices rose for three weeks in a row to record their highest weekly close even as they fell on Friday. Today's fall was due to losses in the shares of heavyweights.

Today, the Nifty fell 111.15 points or 0.47% to close at 23,455.85, its highest weekly close and the Sensex fell 269.03 points or 0.35% to close the week at its highest level of 77,209.90.

"The domestic market witnessed minor profit booking amid concerns over the slow progress of the monsoon, resulting in underperformance in the FMCG sector," said Vinod Nair, head of research of Geojit Financial Services.

He added, "Attention is now focused on the upcoming GST meeting, where the potential rationalization of GST rates in certain sectors is under discussion."

Benchmark equity indices rose for three weeks in a row to record their highest weekly close even as they fell on Friday. Today's fall was due to losses in the shares of heavyweights.

Today, the Nifty fell 111.15 points or 0.47% to close at 23,455.85, its highest weekly close and the Sensex fell 269.03 points or 0.35% to close the week at its highest level of 77,209.90.

"The domestic market witnessed minor profit booking amid concerns over the slow progress of the monsoon, resulting in underperformance in the FMCG sector," said Vinod Nair, head of research of Geojit Financial Services.

He added, "Attention is now focused on the upcoming GST meeting, where the potential rationalization of GST rates in certain sectors is under discussion."

Benchmark equity indices rose for three weeks in a row to record their highest weekly close even as they fell on Friday. Today's fall was due to losses in the shares of heavyweights.

Today, the Nifty fell 111.15 points or 0.47% to close at 23,455.85, its highest weekly close and the Sensex fell 269.03 points or 0.35% to close the week at its highest level of 77,209.90.

"The domestic market witnessed minor profit booking amid concerns over the slow progress of the monsoon, resulting in underperformance in the FMCG sector," said Vinod Nair, head of research of Geojit Financial Services.

He added, "Attention is now focused on the upcoming GST meeting, where the potential rationalization of GST rates in certain sectors is under discussion."

Benchmark equity indices rose for three weeks in a row to record their highest weekly close even as they fell on Friday. Today's fall was due to losses in the shares of heavyweights.

Today, the Nifty fell 111.15 points or 0.47% to close at 23,455.85, its highest weekly close and the Sensex fell 269.03 points or 0.35% to close the week at its highest level of 77,209.90.

"The domestic market witnessed minor profit booking amid concerns over the slow progress of the monsoon, resulting in underperformance in the FMCG sector," said Vinod Nair, head of research of Geojit Financial Services.

He added, "Attention is now focused on the upcoming GST meeting, where the potential rationalization of GST rates in certain sectors is under discussion."

Benchmark equity indices rose for three weeks in a row to record their highest weekly close even as they fell on Friday. Today's fall was due to losses in the shares of heavyweights.

Today, the Nifty fell 111.15 points or 0.47% to close at 23,455.85, its highest weekly close and the Sensex fell 269.03 points or 0.35% to close the week at its highest level of 77,209.90.

"The domestic market witnessed minor profit booking amid concerns over the slow progress of the monsoon, resulting in underperformance in the FMCG sector," said Vinod Nair, head of research of Geojit Financial Services.

He added, "Attention is now focused on the upcoming GST meeting, where the potential rationalization of GST rates in certain sectors is under discussion."

Benchmark equity indices rose for three weeks in a row to record their highest weekly close even as they fell on Friday. Today's fall was due to losses in the shares of heavyweights.

Today, the Nifty fell 111.15 points or 0.47% to close at 23,455.85, its highest weekly close and the Sensex fell 269.03 points or 0.35% to close the week at its highest level of 77,209.90.

"The domestic market witnessed minor profit booking amid concerns over the slow progress of the monsoon, resulting in underperformance in the FMCG sector," said Vinod Nair, head of research of Geojit Financial Services.

He added, "Attention is now focused on the upcoming GST meeting, where the potential rationalization of GST rates in certain sectors is under discussion."

Benchmark equity indices rose for three weeks in a row to record their highest weekly close even as they fell on Friday. Today's fall was due to losses in the shares of heavyweights.

Today, the Nifty fell 111.15 points or 0.47% to close at 23,455.85, its highest weekly close and the Sensex fell 269.03 points or 0.35% to close the week at its highest level of 77,209.90.

"The domestic market witnessed minor profit booking amid concerns over the slow progress of the monsoon, resulting in underperformance in the FMCG sector," said Vinod Nair, head of research of Geojit Financial Services.

He added, "Attention is now focused on the upcoming GST meeting, where the potential rationalization of GST rates in certain sectors is under discussion."

Benchmark equity indices rose for three weeks in a row to record their highest weekly close even as they fell on Friday. Today's fall was due to losses in the shares of heavyweights.

Today, the Nifty fell 111.15 points or 0.47% to close at 23,455.85, its highest weekly close and the Sensex fell 269.03 points or 0.35% to close the week at its highest level of 77,209.90.

"The domestic market witnessed minor profit booking amid concerns over the slow progress of the monsoon, resulting in underperformance in the FMCG sector," said Vinod Nair, head of research of Geojit Financial Services.

He added, "Attention is now focused on the upcoming GST meeting, where the potential rationalization of GST rates in certain sectors is under discussion."

In Friday's session shares of Reliance Industries Ltd., Larsen & Toubro Ltd., HDFC Bank Ltd., State Bank Of India, and Mahindra & Mahindra Ltd dragged the Nifty lower.

While those of Bharti Airtel Ltd., Infosys Ltd., Tata Consultancy Services Ltd., Hindalco Industries Ltd. cushioned the fall.

Benchmark equity indices rose for three weeks in a row to record their highest weekly close even as they fell on Friday. Today's fall was due to losses in the shares of heavyweights.

Today, the Nifty fell 111.15 points or 0.47% to close at 23,455.85, its highest weekly close and the Sensex fell 269.03 points or 0.35% to close the week at its highest level of 77,209.90.

"The domestic market witnessed minor profit booking amid concerns over the slow progress of the monsoon, resulting in underperformance in the FMCG sector," said Vinod Nair, head of research of Geojit Financial Services.

He added, "Attention is now focused on the upcoming GST meeting, where the potential rationalization of GST rates in certain sectors is under discussion."

Benchmark equity indices rose for three weeks in a row to record their highest weekly close even as they fell on Friday. Today's fall was due to losses in the shares of heavyweights.

Today, the Nifty fell 111.15 points or 0.47% to close at 23,455.85, its highest weekly close and the Sensex fell 269.03 points or 0.35% to close the week at its highest level of 77,209.90.

"The domestic market witnessed minor profit booking amid concerns over the slow progress of the monsoon, resulting in underperformance in the FMCG sector," said Vinod Nair, head of research of Geojit Financial Services.

He added, "Attention is now focused on the upcoming GST meeting, where the potential rationalization of GST rates in certain sectors is under discussion."

Benchmark equity indices rose for three weeks in a row to record their highest weekly close even as they fell on Friday. Today's fall was due to losses in the shares of heavyweights.

Today, the Nifty fell 111.15 points or 0.47% to close at 23,455.85, its highest weekly close and the Sensex fell 269.03 points or 0.35% to close the week at its highest level of 77,209.90.

"The domestic market witnessed minor profit booking amid concerns over the slow progress of the monsoon, resulting in underperformance in the FMCG sector," said Vinod Nair, head of research of Geojit Financial Services.

He added, "Attention is now focused on the upcoming GST meeting, where the potential rationalization of GST rates in certain sectors is under discussion."

Benchmark equity indices rose for three weeks in a row to record their highest weekly close even as they fell on Friday. Today's fall was due to losses in the shares of heavyweights.

Today, the Nifty fell 111.15 points or 0.47% to close at 23,455.85, its highest weekly close and the Sensex fell 269.03 points or 0.35% to close the week at its highest level of 77,209.90.

"The domestic market witnessed minor profit booking amid concerns over the slow progress of the monsoon, resulting in underperformance in the FMCG sector," said Vinod Nair, head of research of Geojit Financial Services.

He added, "Attention is now focused on the upcoming GST meeting, where the potential rationalization of GST rates in certain sectors is under discussion."

Benchmark equity indices rose for three weeks in a row to record their highest weekly close even as they fell on Friday. Today's fall was due to losses in the shares of heavyweights.

Today, the Nifty fell 111.15 points or 0.47% to close at 23,455.85, its highest weekly close and the Sensex fell 269.03 points or 0.35% to close the week at its highest level of 77,209.90.

"The domestic market witnessed minor profit booking amid concerns over the slow progress of the monsoon, resulting in underperformance in the FMCG sector," said Vinod Nair, head of research of Geojit Financial Services.

He added, "Attention is now focused on the upcoming GST meeting, where the potential rationalization of GST rates in certain sectors is under discussion."

Benchmark equity indices rose for three weeks in a row to record their highest weekly close even as they fell on Friday. Today's fall was due to losses in the shares of heavyweights.

Today, the Nifty fell 111.15 points or 0.47% to close at 23,455.85, its highest weekly close and the Sensex fell 269.03 points or 0.35% to close the week at its highest level of 77,209.90.

"The domestic market witnessed minor profit booking amid concerns over the slow progress of the monsoon, resulting in underperformance in the FMCG sector," said Vinod Nair, head of research of Geojit Financial Services.

He added, "Attention is now focused on the upcoming GST meeting, where the potential rationalization of GST rates in certain sectors is under discussion."

Benchmark equity indices rose for three weeks in a row to record their highest weekly close even as they fell on Friday. Today's fall was due to losses in the shares of heavyweights.

Today, the Nifty fell 111.15 points or 0.47% to close at 23,455.85, its highest weekly close and the Sensex fell 269.03 points or 0.35% to close the week at its highest level of 77,209.90.

"The domestic market witnessed minor profit booking amid concerns over the slow progress of the monsoon, resulting in underperformance in the FMCG sector," said Vinod Nair, head of research of Geojit Financial Services.

He added, "Attention is now focused on the upcoming GST meeting, where the potential rationalization of GST rates in certain sectors is under discussion."

Benchmark equity indices rose for three weeks in a row to record their highest weekly close even as they fell on Friday. Today's fall was due to losses in the shares of heavyweights.

Today, the Nifty fell 111.15 points or 0.47% to close at 23,455.85, its highest weekly close and the Sensex fell 269.03 points or 0.35% to close the week at its highest level of 77,209.90.

"The domestic market witnessed minor profit booking amid concerns over the slow progress of the monsoon, resulting in underperformance in the FMCG sector," said Vinod Nair, head of research of Geojit Financial Services.

He added, "Attention is now focused on the upcoming GST meeting, where the potential rationalization of GST rates in certain sectors is under discussion."

In Friday's session shares of Reliance Industries Ltd., Larsen & Toubro Ltd., HDFC Bank Ltd., State Bank Of India, and Mahindra & Mahindra Ltd dragged the Nifty lower.

While those of Bharti Airtel Ltd., Infosys Ltd., Tata Consultancy Services Ltd., Hindalco Industries Ltd. cushioned the fall.

Broader markets ended on a mixed note on Friday. The S&P BSE Midcap ended 0.26% lower, and Smallcap settled 0.06% higher.

On BSE, 13 sectors declined and seven advanced out of 20. The S&P BSE Telecommunication rose the most, and the S&P BSE Oil & Gas declined the most.

Market breadth was skewed in favour of sellers, Around 2,081 stocks declined, 1,786 stocks rose, and 120 stocks remained unchanged on BSE.

On a weekly basis, the Nifty gained 0.15%.

Most sectoral indices ended with weekly losses. Nifty Auto and Nifty FMCG were the top losers while Nifty Bank gained the most.

Management outlined strong FY24 operating performance, 27% 5-Yr CAGR,

Adani Portfolio achieved USD10bn EBITDA in FY24, growing 40%+ YoY

Management does not see a refinancing risk at the group level

Views its leverage position as strong enough for the next leg of growth

Hopes to capitalise on large consumer base with Adani's Infra platform businesses

Adani's core Infra platform already clocking 350mn users.

Group is eyeing $100 billion of capex over the next decade towards energy transition and digital infra

Buy on ACC Ltd: a target price Rs 3,045, which implied an upside 17%

Adani Energy Solutions Ltd.: target price Rs 1,365, which implied an upside of 35%

Adani Enterprises Ltd.: target price Rs 3,800, which implied an upside of 19%

Ambuja Cements Ltd.: target price Rs 735, which implied an upside of 12%

AstraZeneca Pharma India has unsuccessfully completes exploration phase for search of buyer to act as a Contract Manufacturing Organisation.

The company will now explore a buyer for its manufacturing site and exit in due course.

Source: Exchange filing

GRM Overseas has approved raising up to Rs 136.5 crore via warrants.

Source: Exchange filing

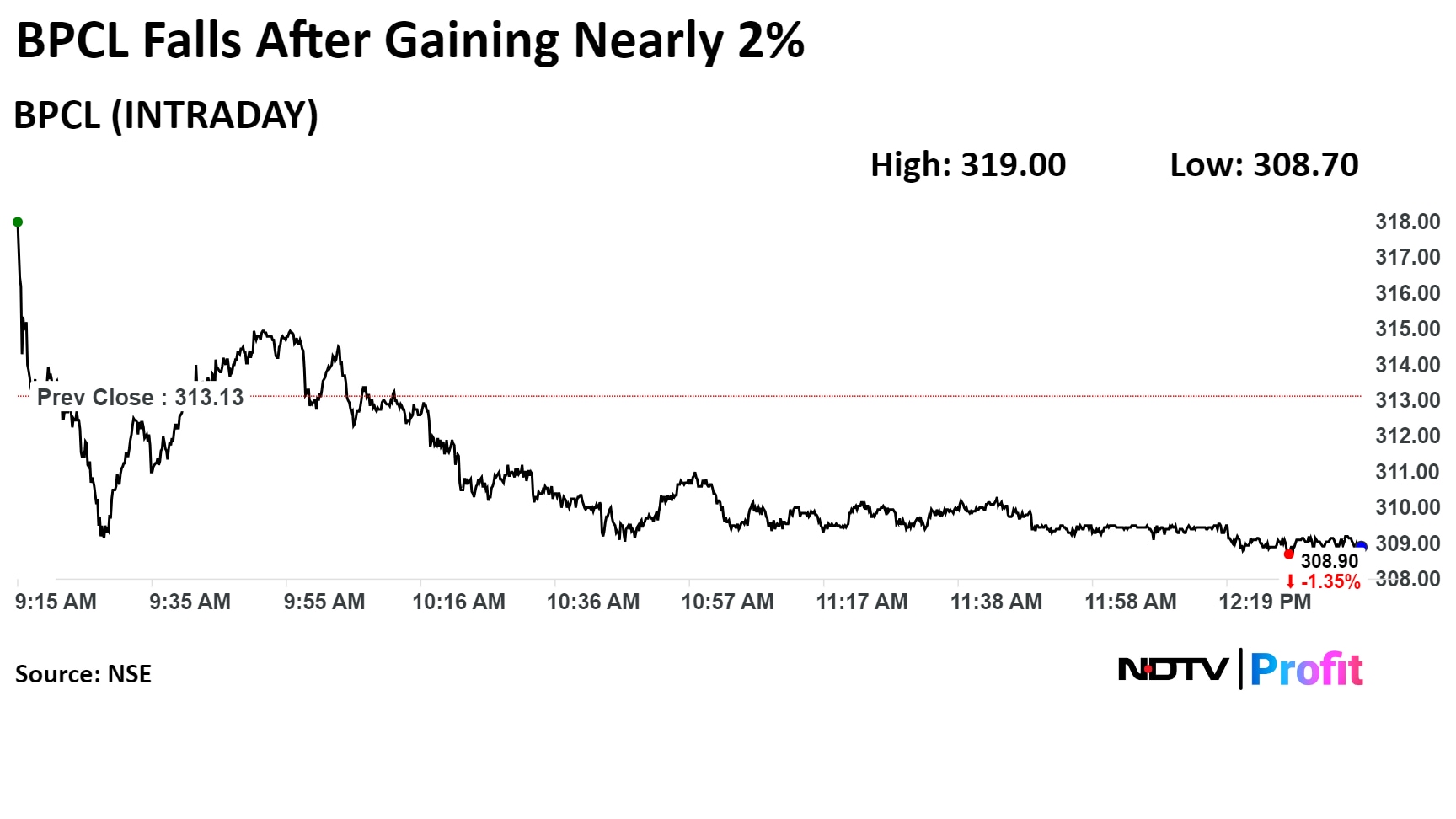

Shares of Bharat Petroleum Corp. gained nearly 2% on Friday after turning ex-date for the bonus issue.

Shares of BPCL rose as much as 1.88% to Rs 319 apiece, the highest level since May 29. It erased gains to trade 1.32% lower at Rs 309.00 apiece as of 12:34 p.m. This compares to a 0.20% decline in the NSE Nifty 50 Index.

The stock has risen by 65.77% in the last 12 months. The total traded volume so far today was 3.0 times its 30-day average. The relative strength index was 49.91.

Out of 33 analysts tracking the company, 18 maintain a 'buy' rating, five recommend a 'hold,' and 10 suggest a 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 75.5%.

Shares of Bharat Petroleum Corp. gained nearly 2% on Friday after turning ex-date for the bonus issue.

Shares of BPCL rose as much as 1.88% to Rs 319 apiece, the highest level since May 29. It erased gains to trade 1.32% lower at Rs 309.00 apiece as of 12:34 p.m. This compares to a 0.20% decline in the NSE Nifty 50 Index.

The stock has risen by 65.77% in the last 12 months. The total traded volume so far today was 3.0 times its 30-day average. The relative strength index was 49.91.

Out of 33 analysts tracking the company, 18 maintain a 'buy' rating, five recommend a 'hold,' and 10 suggest a 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 75.5%.

Piramal Enterprises Ltd. has its 4.8% equity change hands in a bunch.

The company's 1.09 crore shares were traded in a bunch trade.

Buyers and sellers are unknown as of now.

Source: Bloomberg

Kirloskar Pneumatic Ltd. has signed a MoU to acquire 54.55% stake in Systems & Components India for Rs 15 crore.

Source: Exchange filing

European shares declined Friday after data showed the manufacturing activity in the region declined more than expected raising concern about its economic recovery.

Eurozone's flash manufacturing Purchasing Manager's Index declined to 45.6 in June compared to 47.9 estimated by a Bloomberg survey. The number is also lower than 47.3 reading in May, Bloomberg reported.

European shares declined Friday after data showed the manufacturing activity in the region declined more than expected raising concern about its economic recovery.

Eurozone's flash manufacturing Purchasing Manager's Index declined to 45.6 in June compared to 47.9 estimated by a Bloomberg survey. The number is also lower than 47.3 reading in May, Bloomberg reported.

Marathon Nextgen Realty Ltd. approved fundraising proposal up to aggregate amount of Rs 500 crore.

The company's board has also appointed Suyash Bhise as CFO.

Source: Exchange filing

Accenture narrows FY24 guidance

Expects revenue growth from the consulting business to turn positive in 4Q

Client cautiousness due to macro uncertainties is weighing on tech spending Clients continue to prioritise cost take-out projects

Discretionary spends remain weak

Accenture is focusing on investments in its Gen AI team

It plans to increase data and AI workforce to 80k by 2026-end (currently 55,000)

Believes discretionary demand is unlikely to recover meaningfully in FY25F for India IT

Maintains our cautious stance.

Revenue growth for large-caps should improve in FY25, driven by cost take-out deals

Buy: Cognizant and TechM, Coforge, Birlasoft and eClerx

Reduce: TCS, Wipro, LTIMindtree, LTTS and Mphasis

Stock is not rated

Narrows FY24 guidance but maintain the midpoint of 2% growth

Strong booking throw positive impact on Indian IT

Demand of Indian IT though does not appear to be improved

Slowdown in discretionary spends, emphasis on cost takeout deals continue

Japan and consulting which was good for Accenture not relevant for Indian IT

Reaffirmed its commitment to the highest priority states of Uttar Pradesh and Uttarakhand.

Will soon add L900 layer to its spectrum to enhance indoor network experience.

Will be beneficial in areas with dense building infrastructure.

Better network in areas where signal penetration is a challenge.

Source: Vodafone Idea Press release

JM Financial Ltd. has clarified SEBI order doesn't relate to any other activities other than those mentioned, including acting as lead manager to public issues.

Quantifiable financial impact of SEBI order can't be ascertained yet.

Committed to cooperate with SEBI for resolution of the matter.

Source: Exchange filing

Axis Bank Ltd. had its 0.6% equity change hands in a bunch trade.

Buyers and sellers are unknown.

Source: Bloomberg

Power Grid Corp Ltd. has approved forming a joint venture with Rajasthan Rajya Vidyut Prasaran Nigam for intra-state transmission system.

Source: Exchange filing

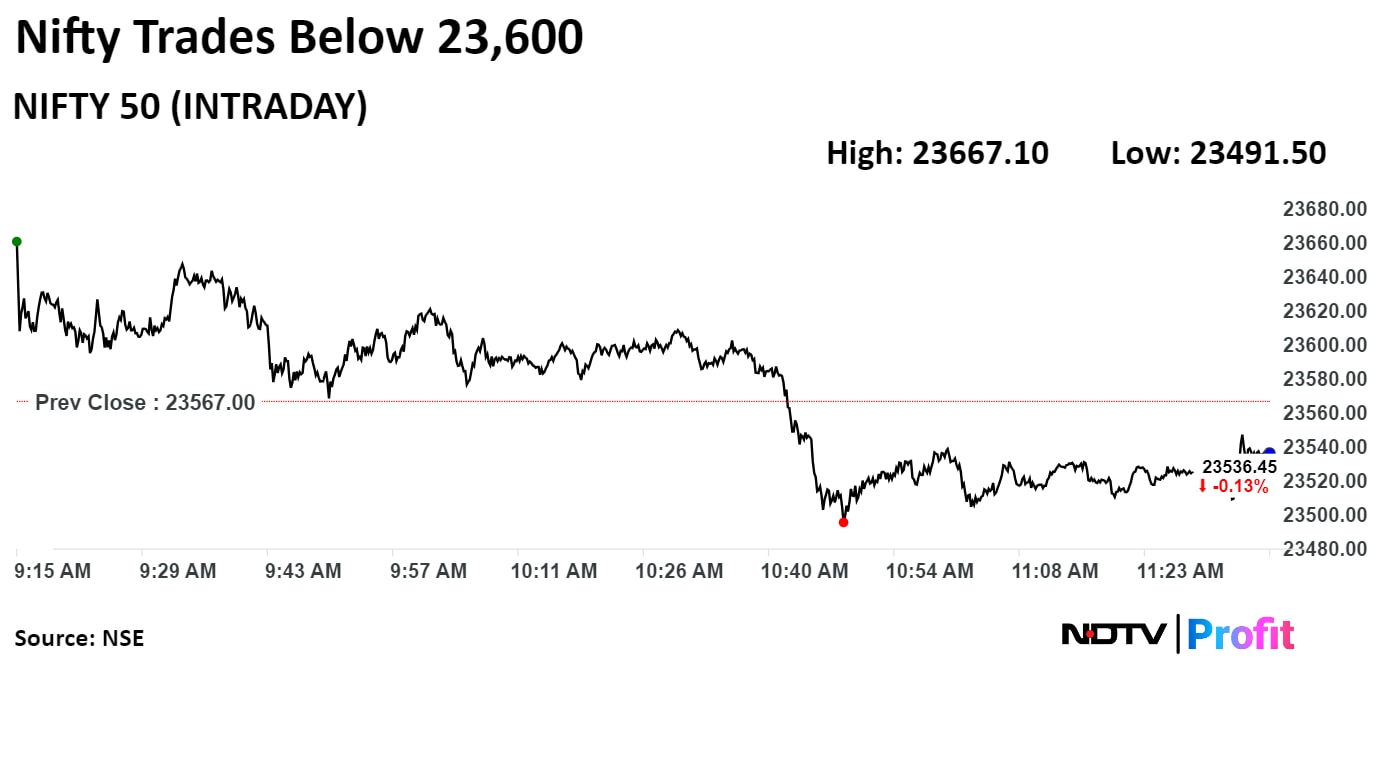

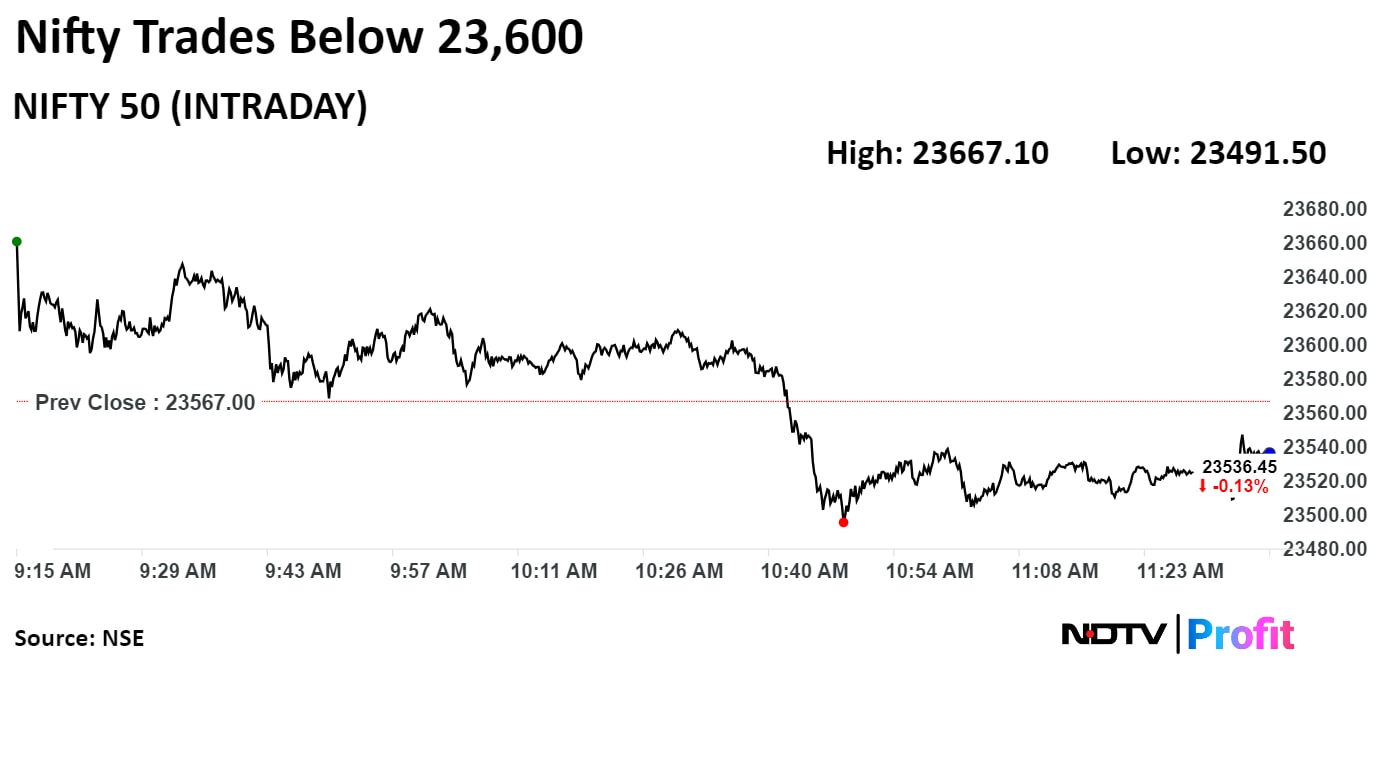

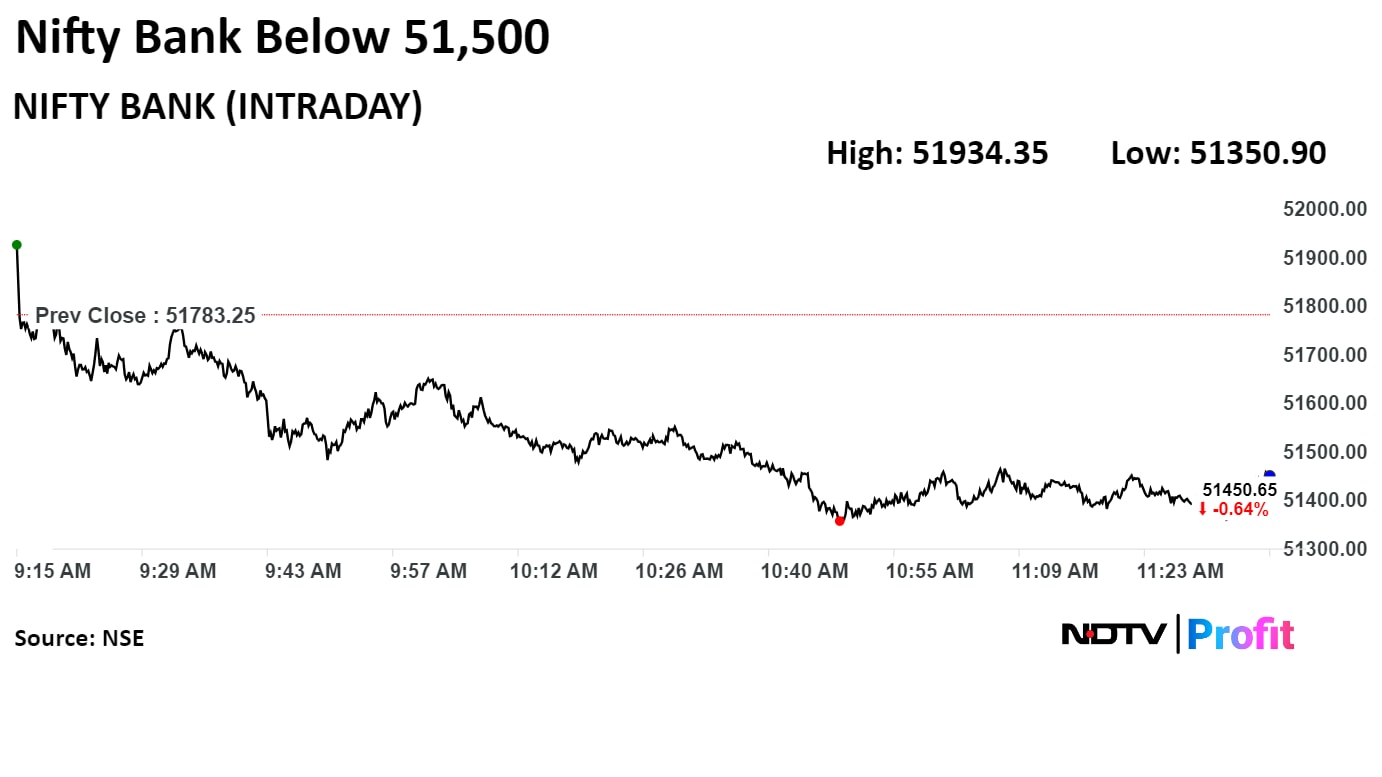

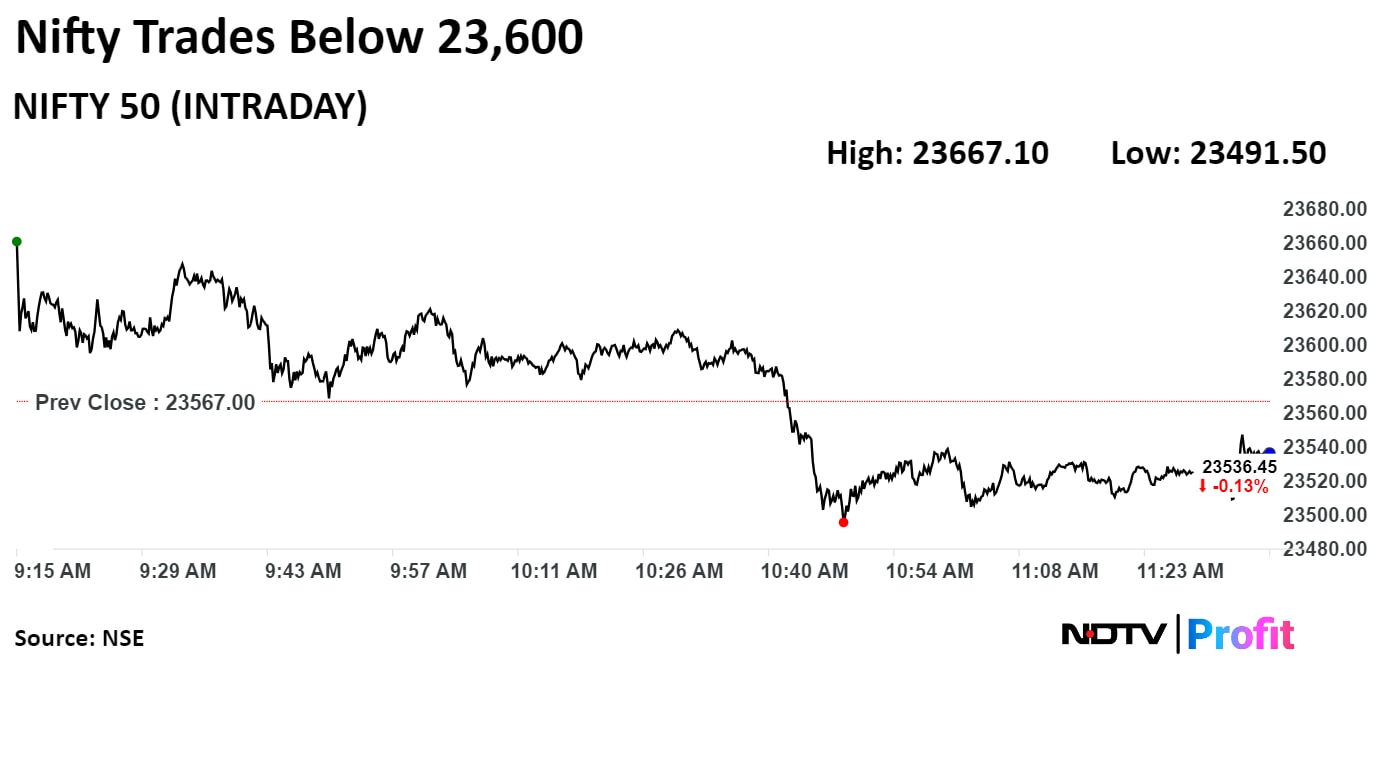

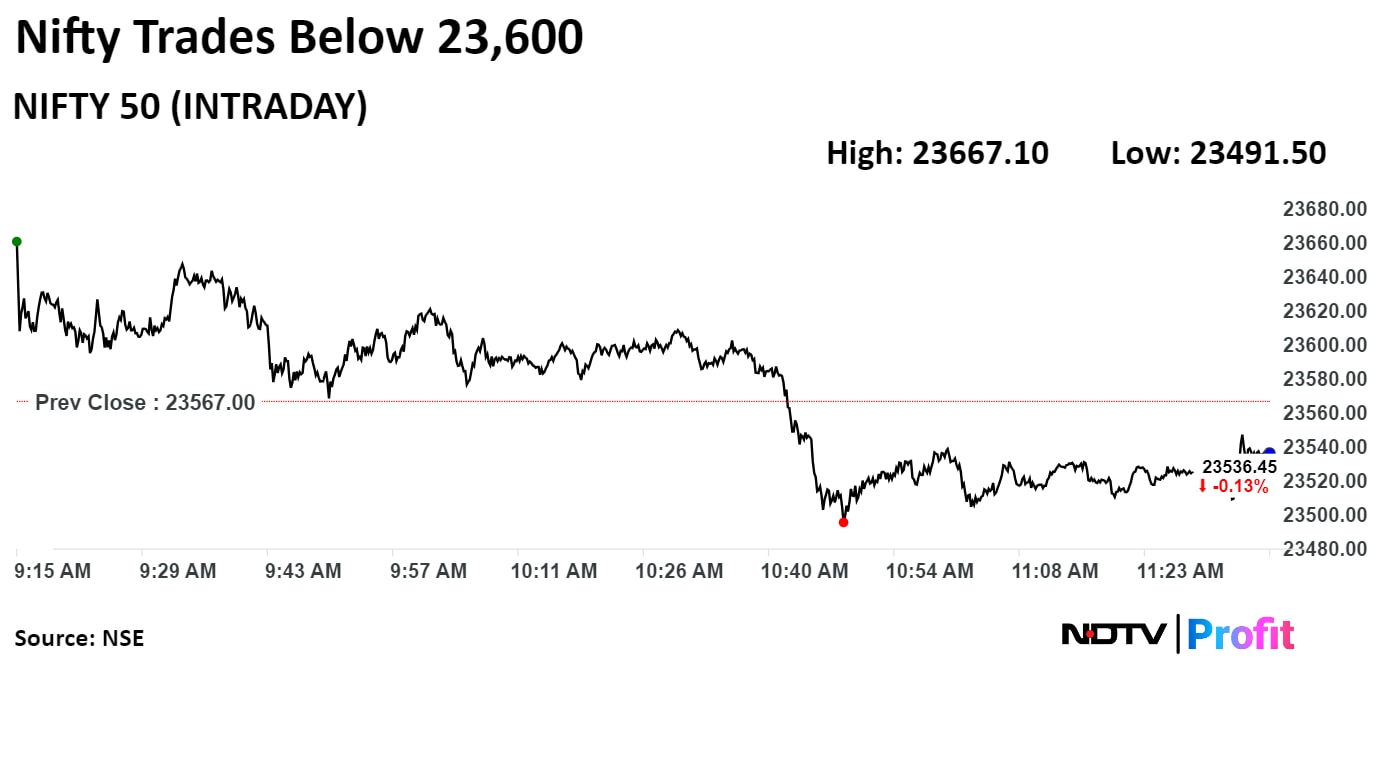

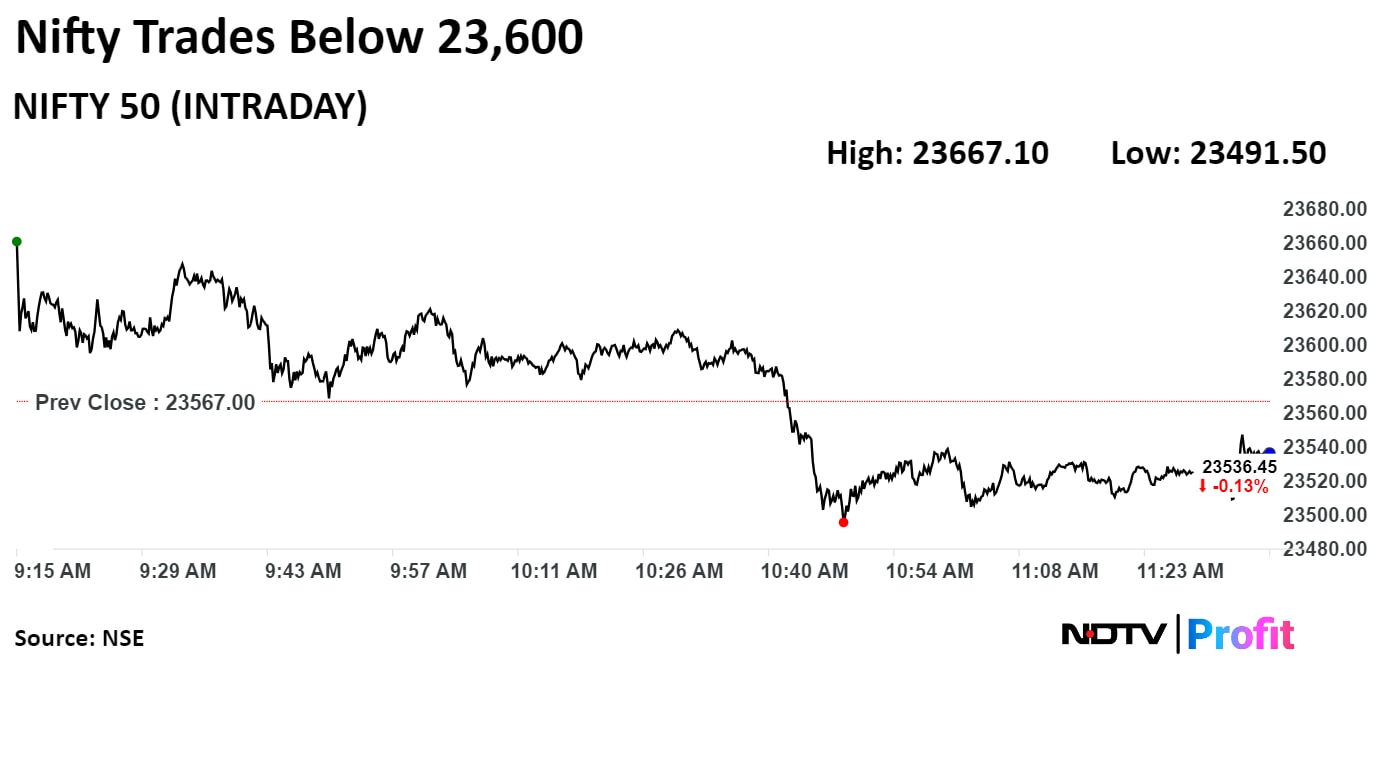

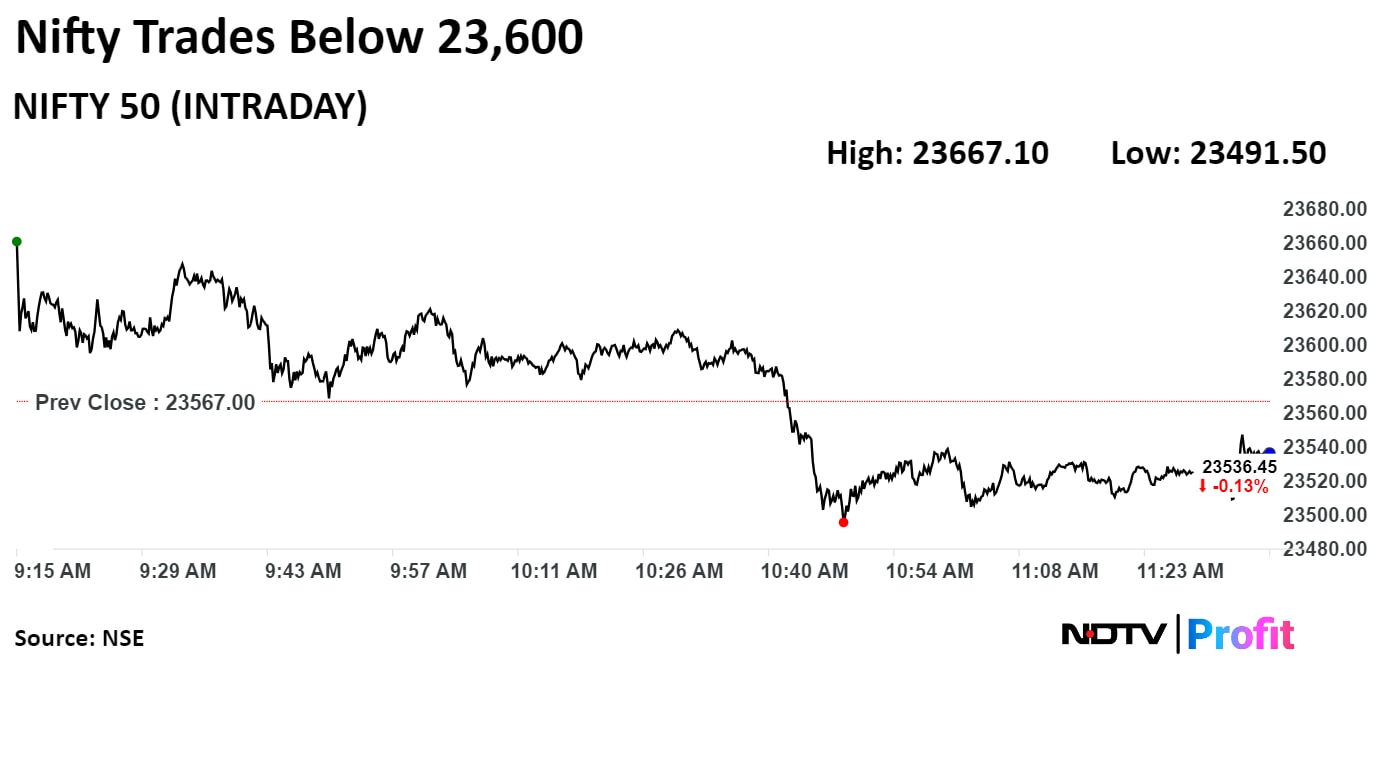

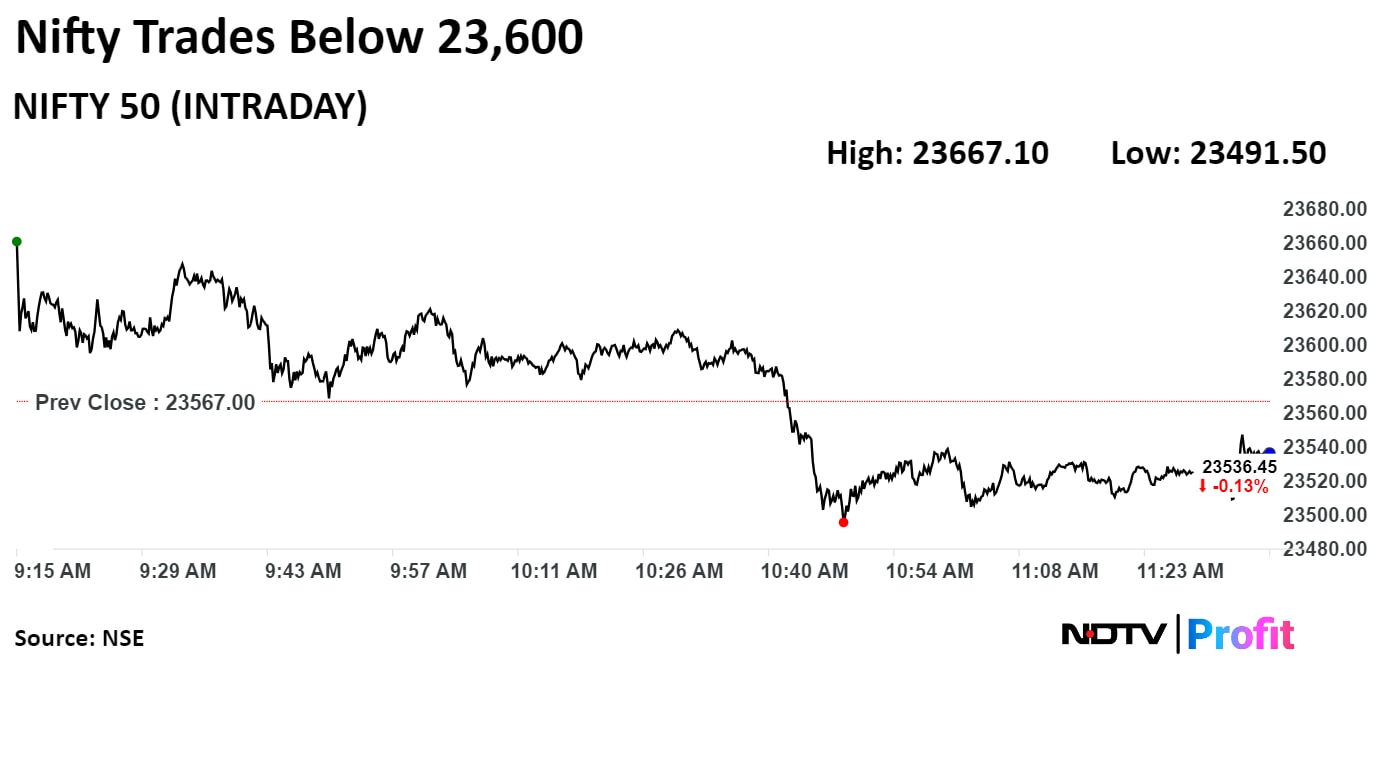

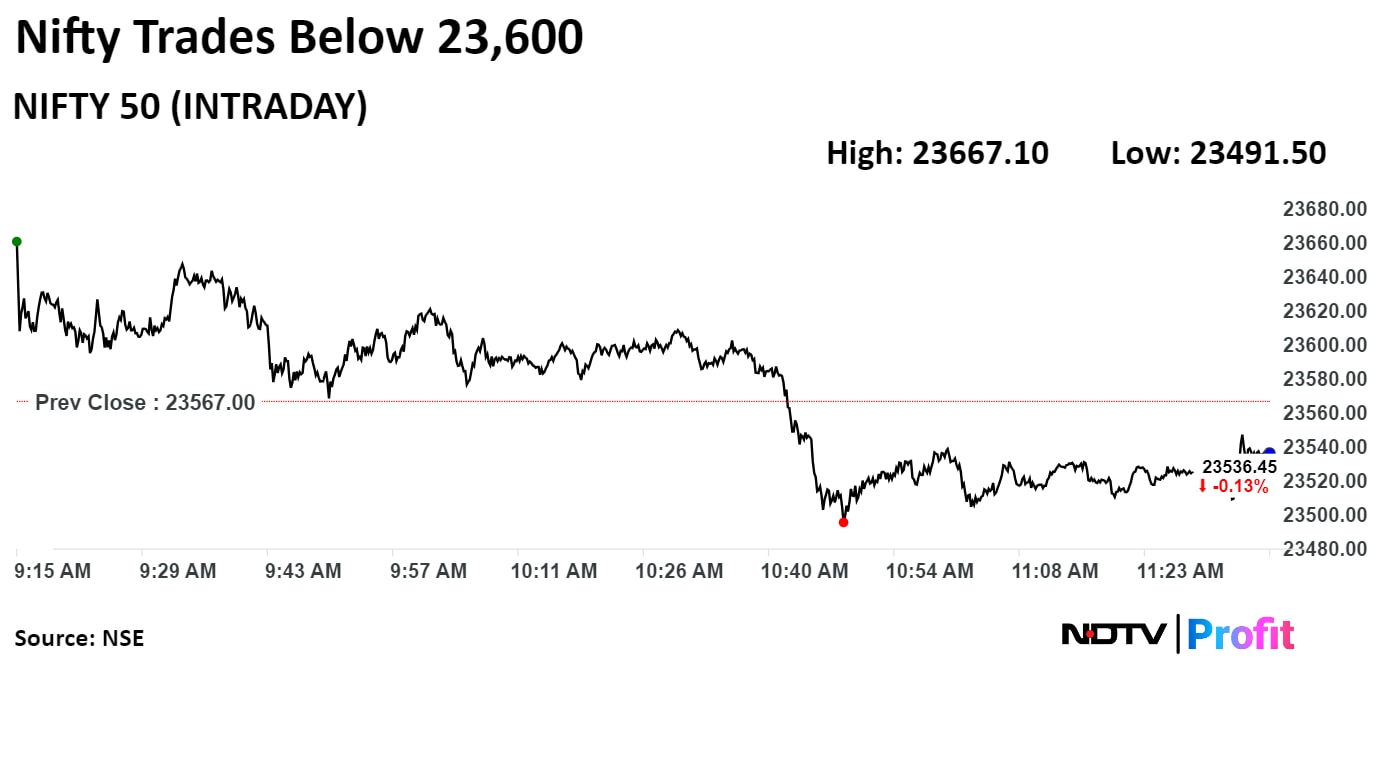

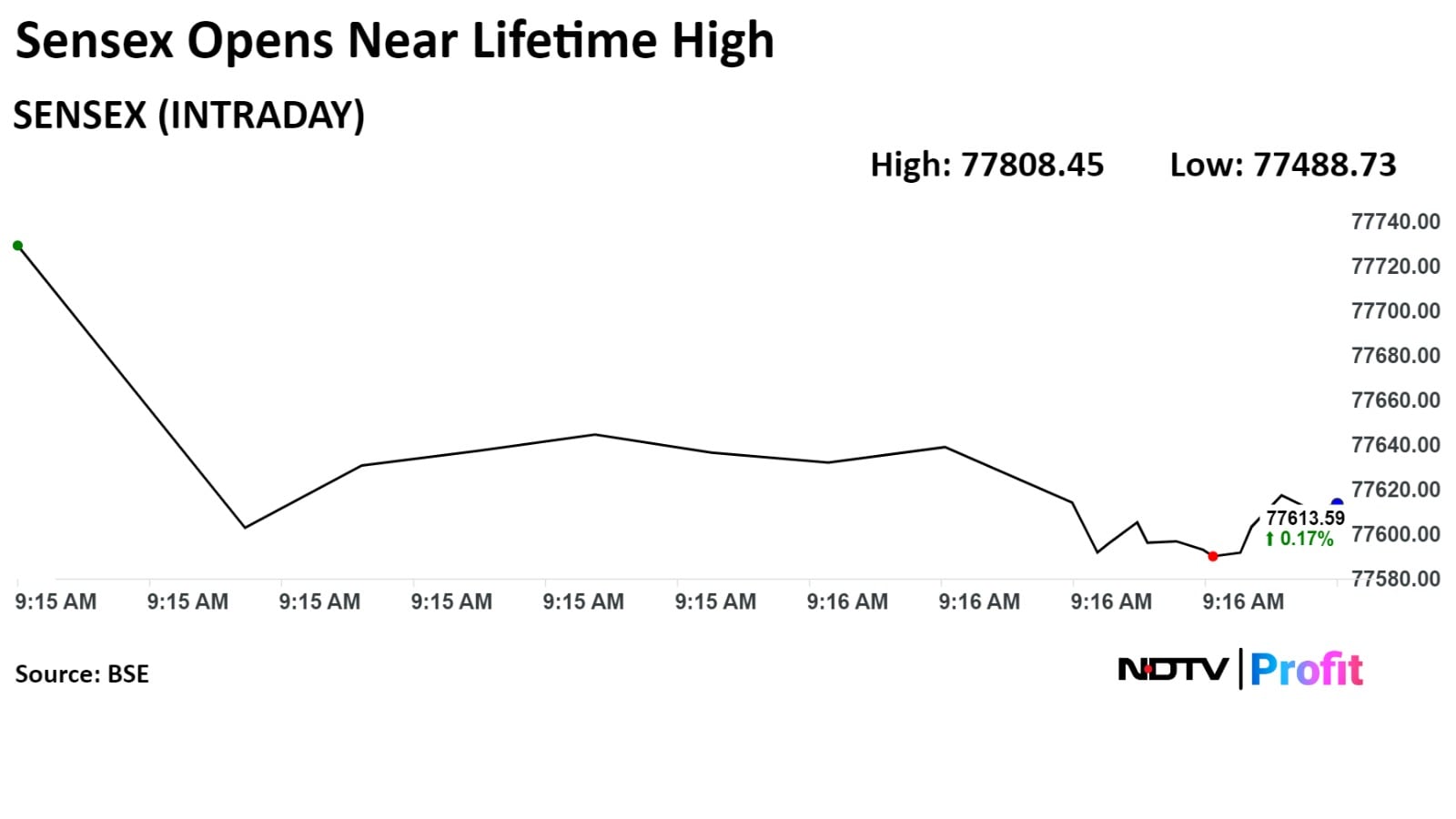

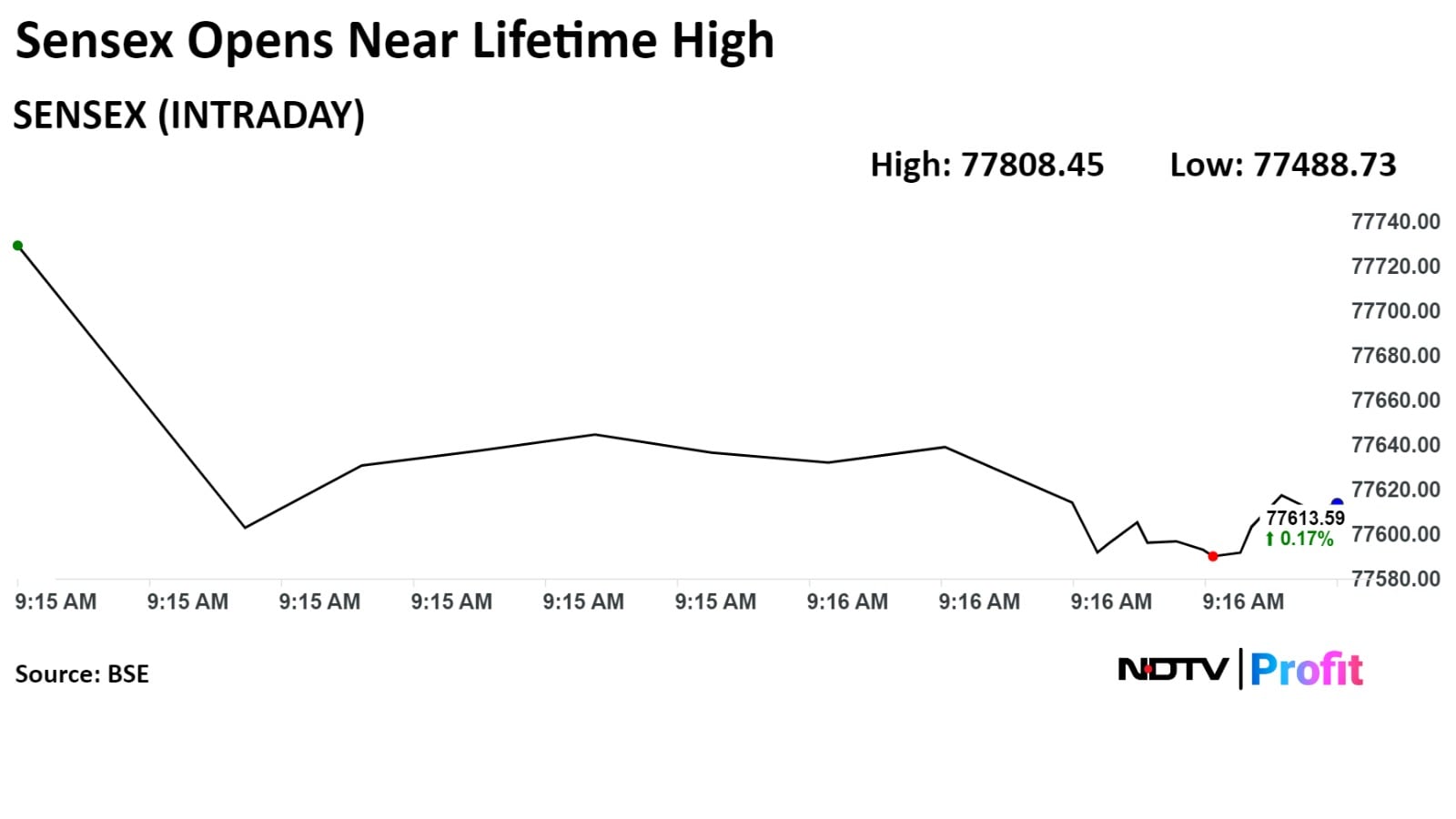

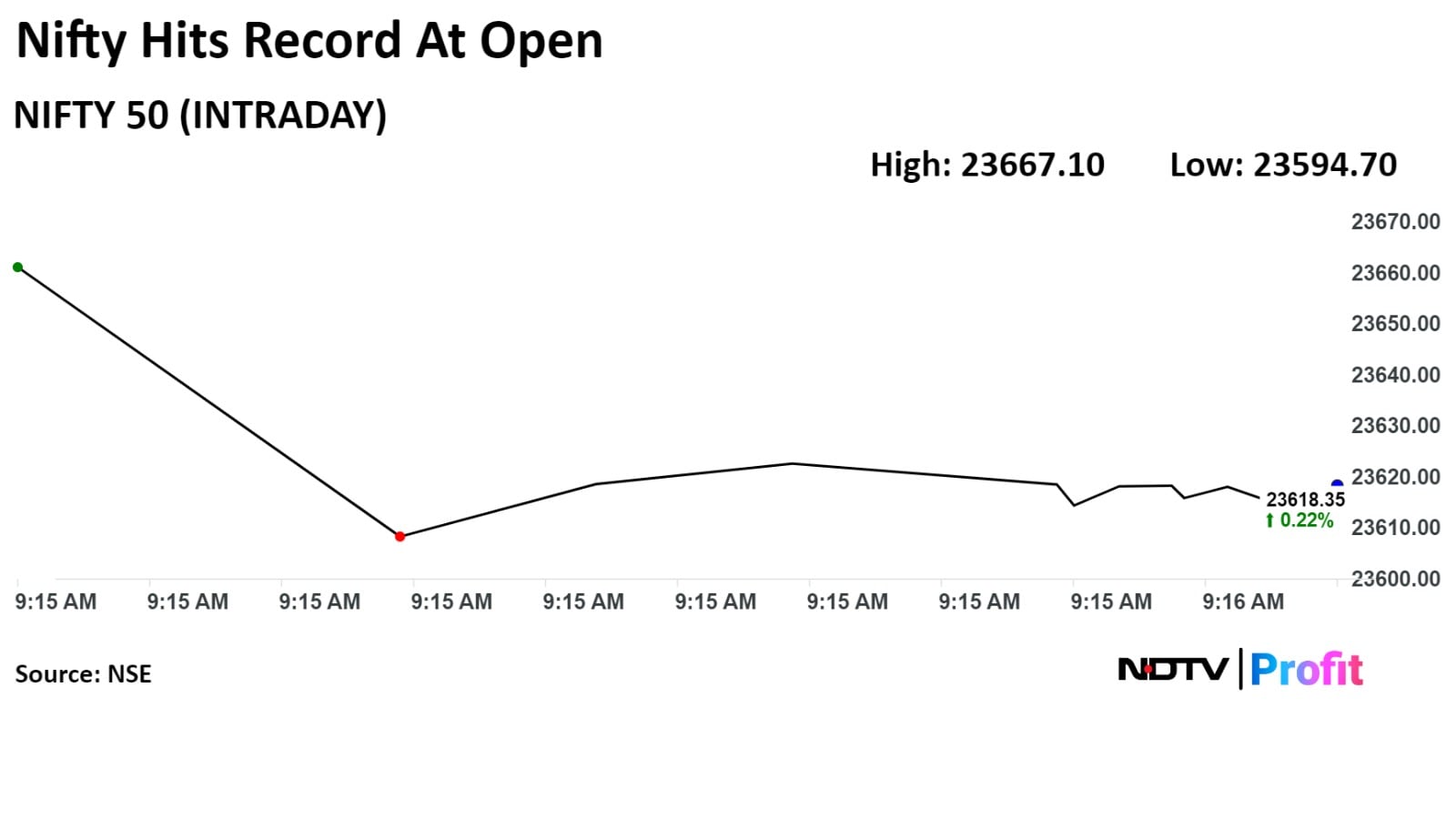

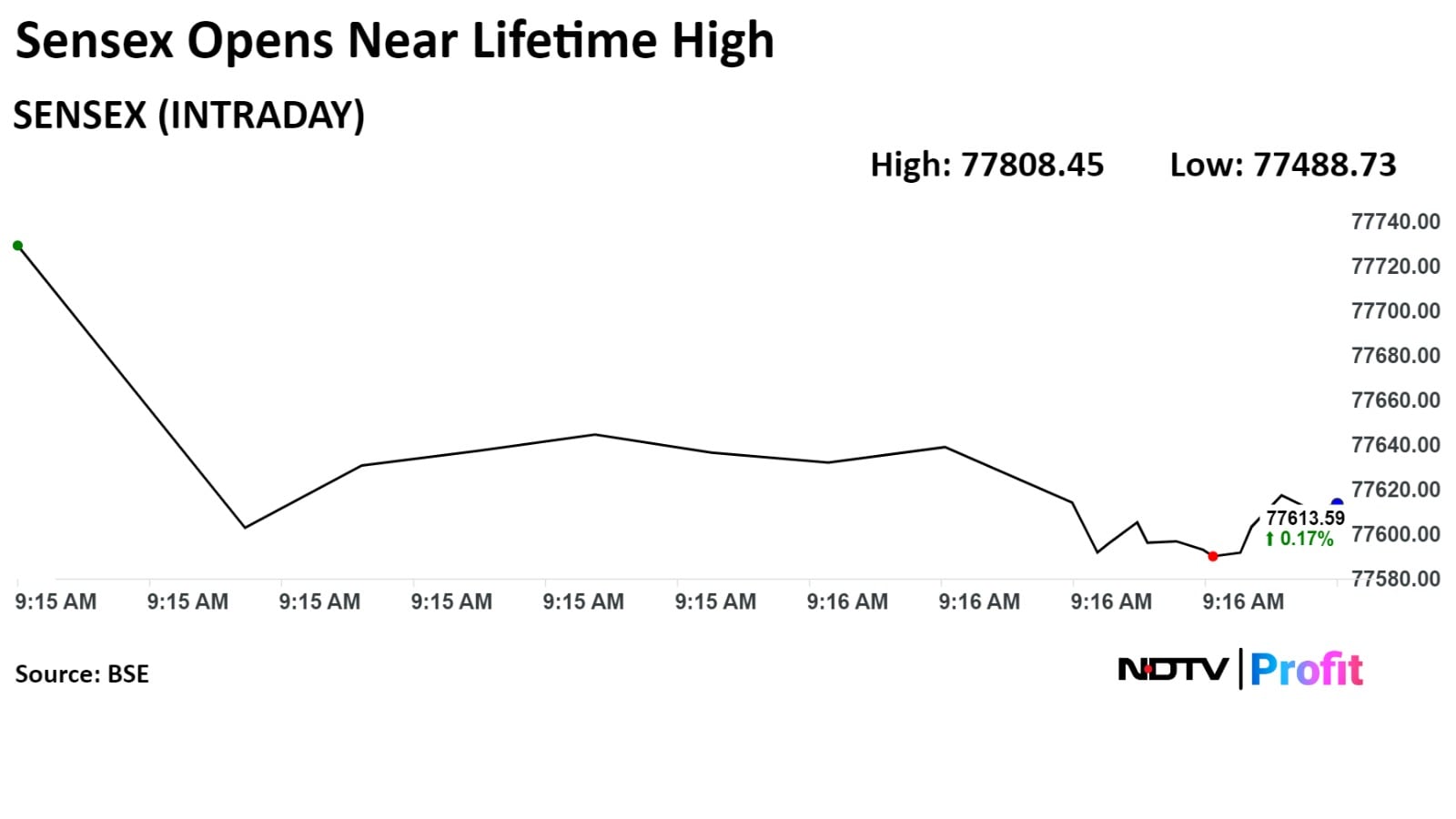

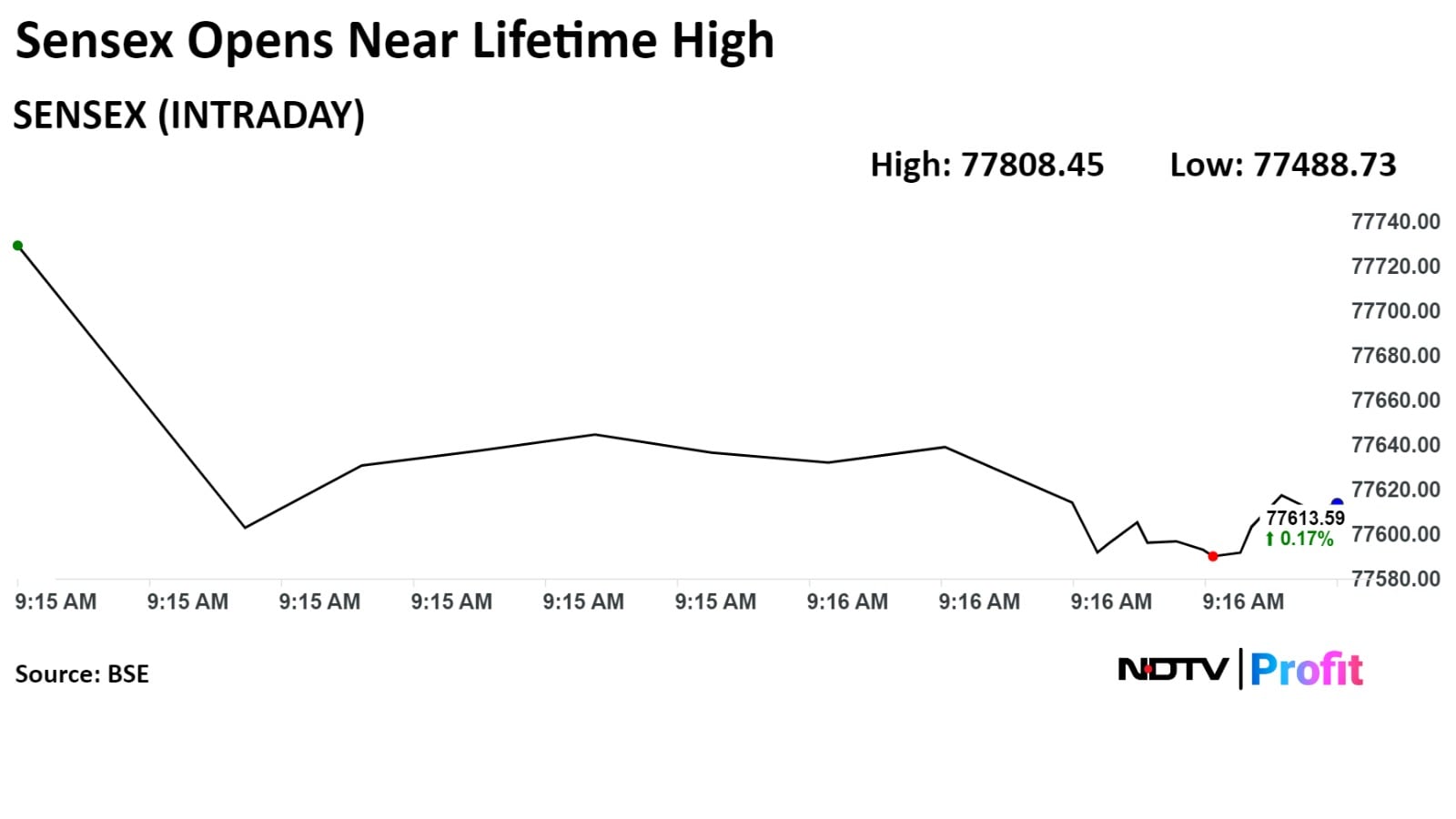

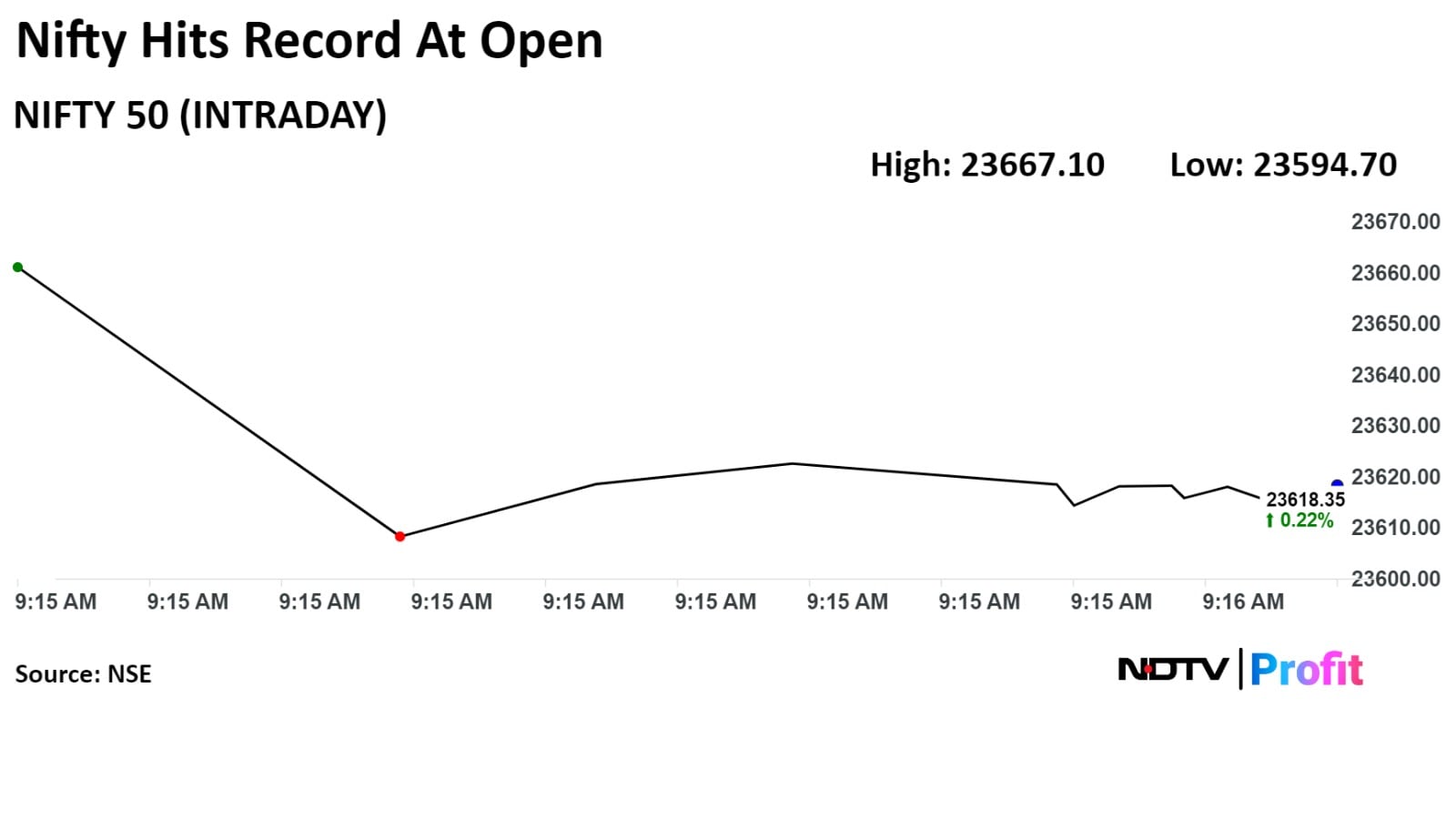

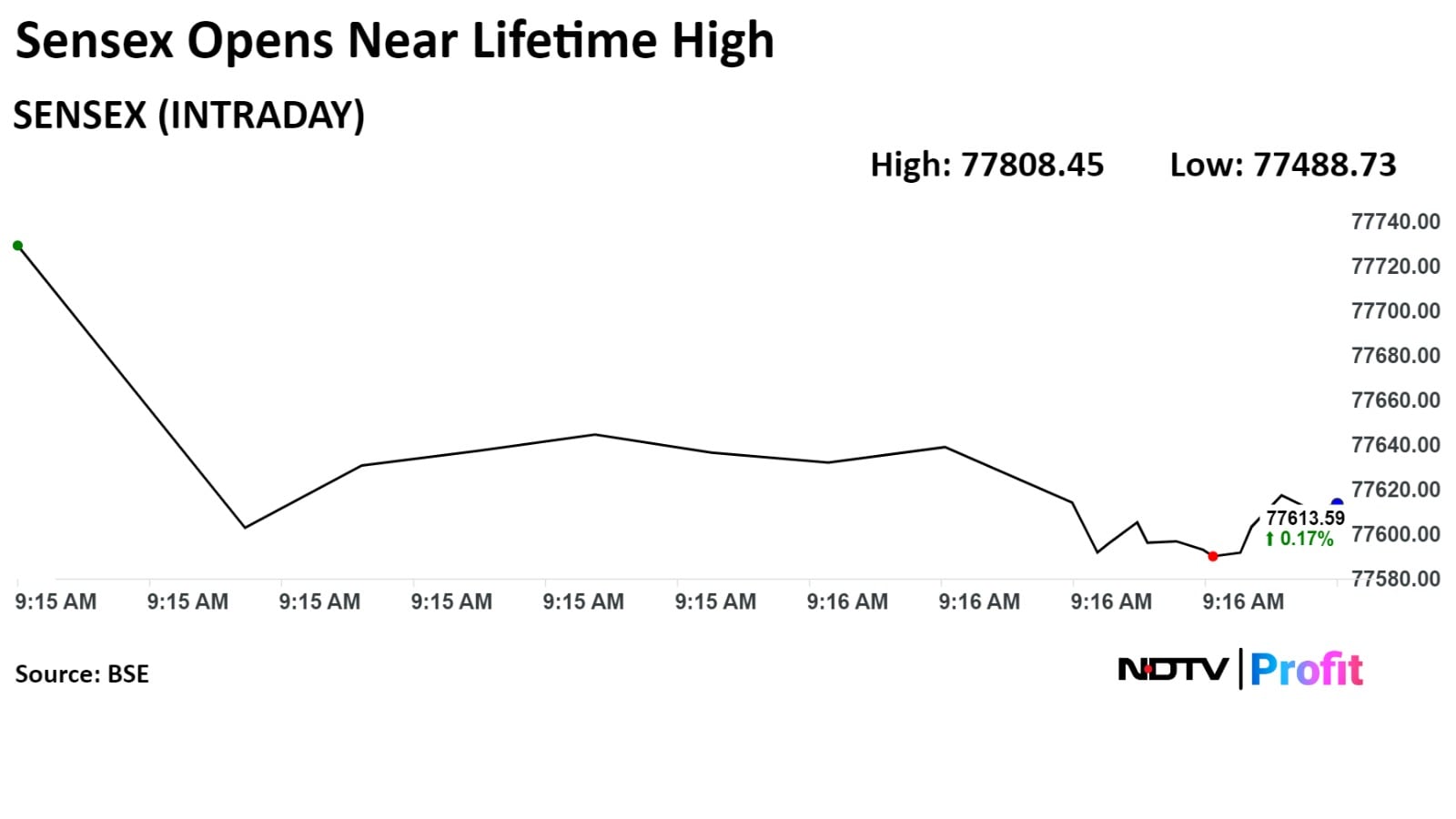

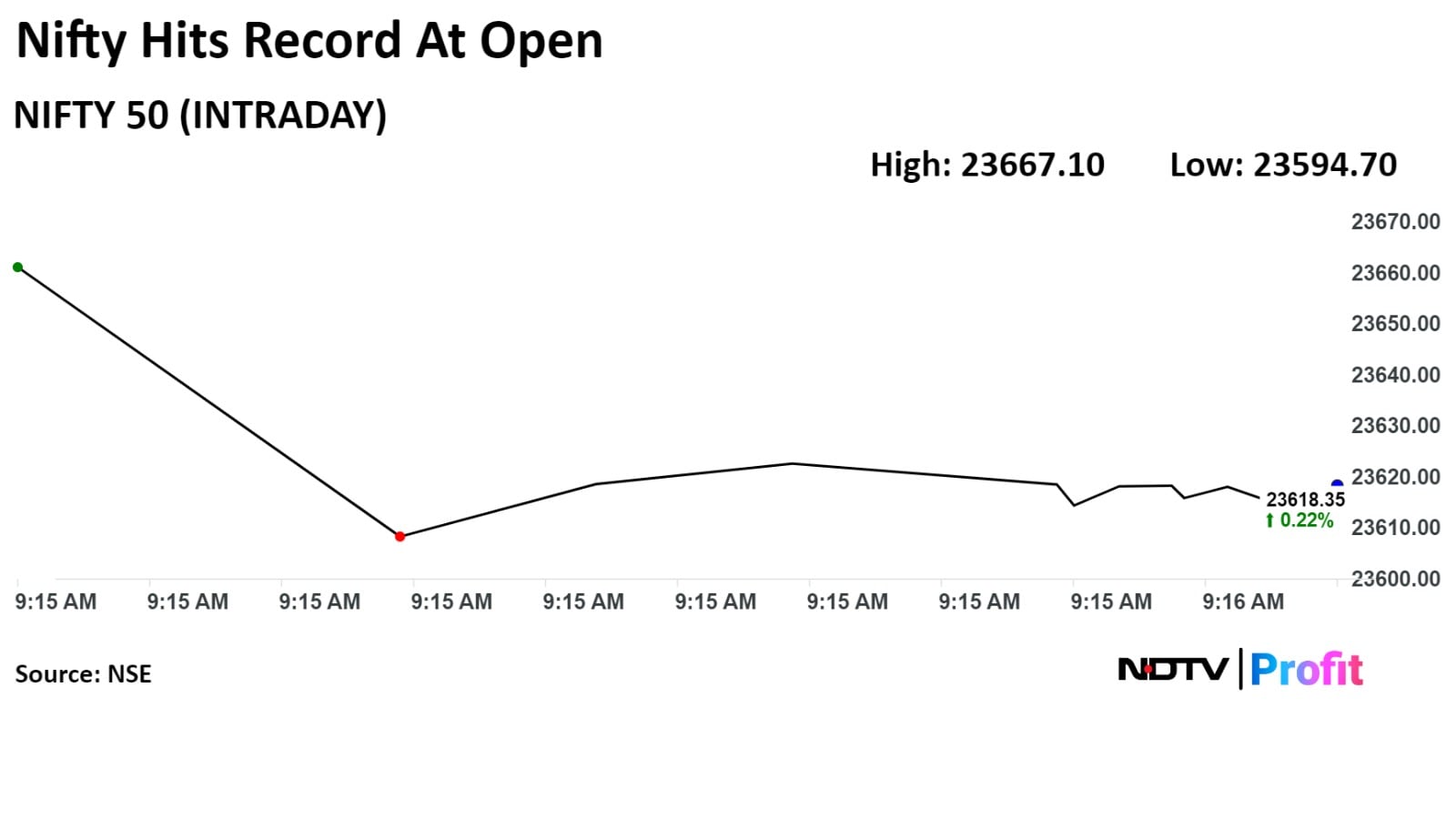

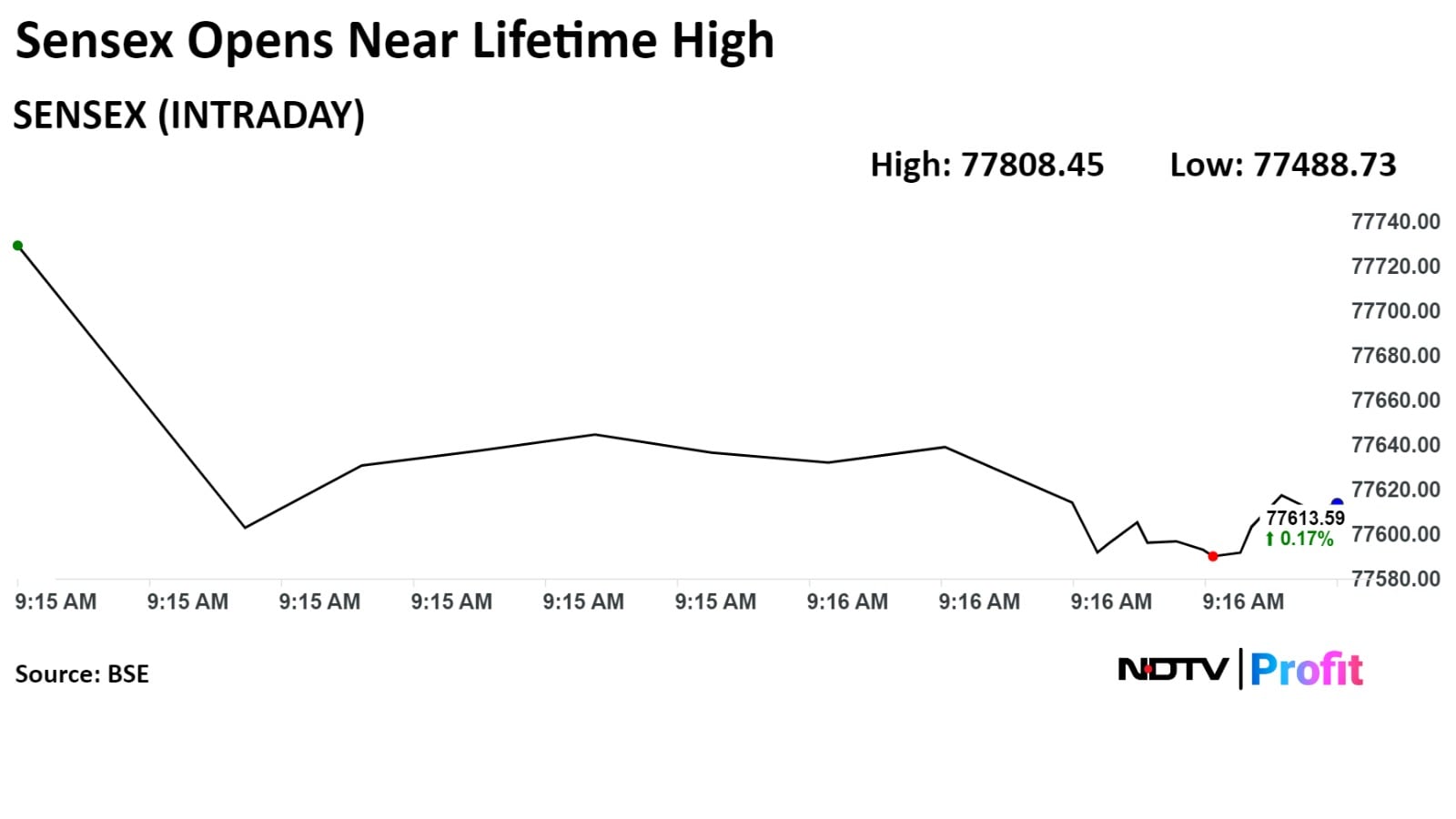

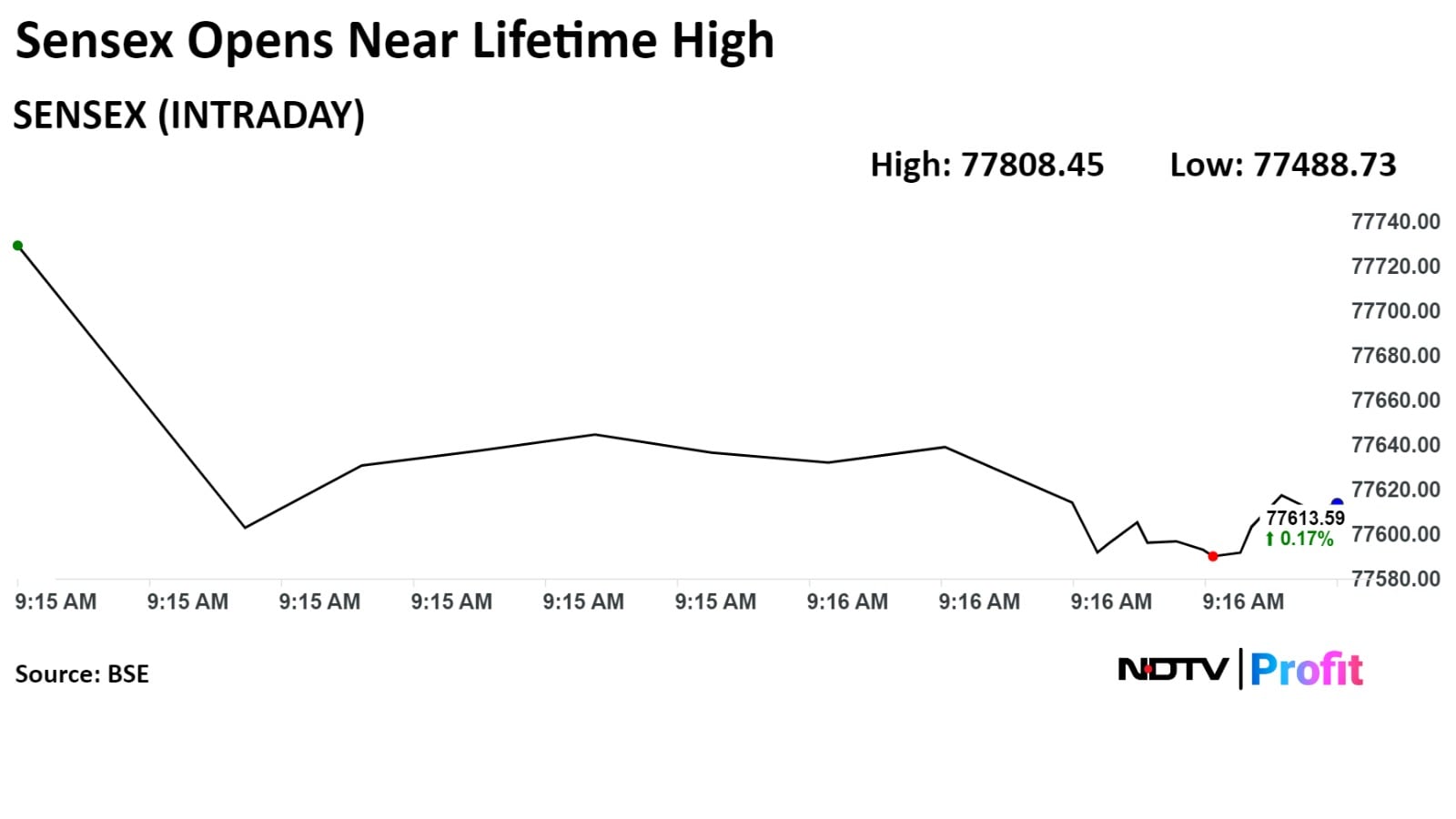

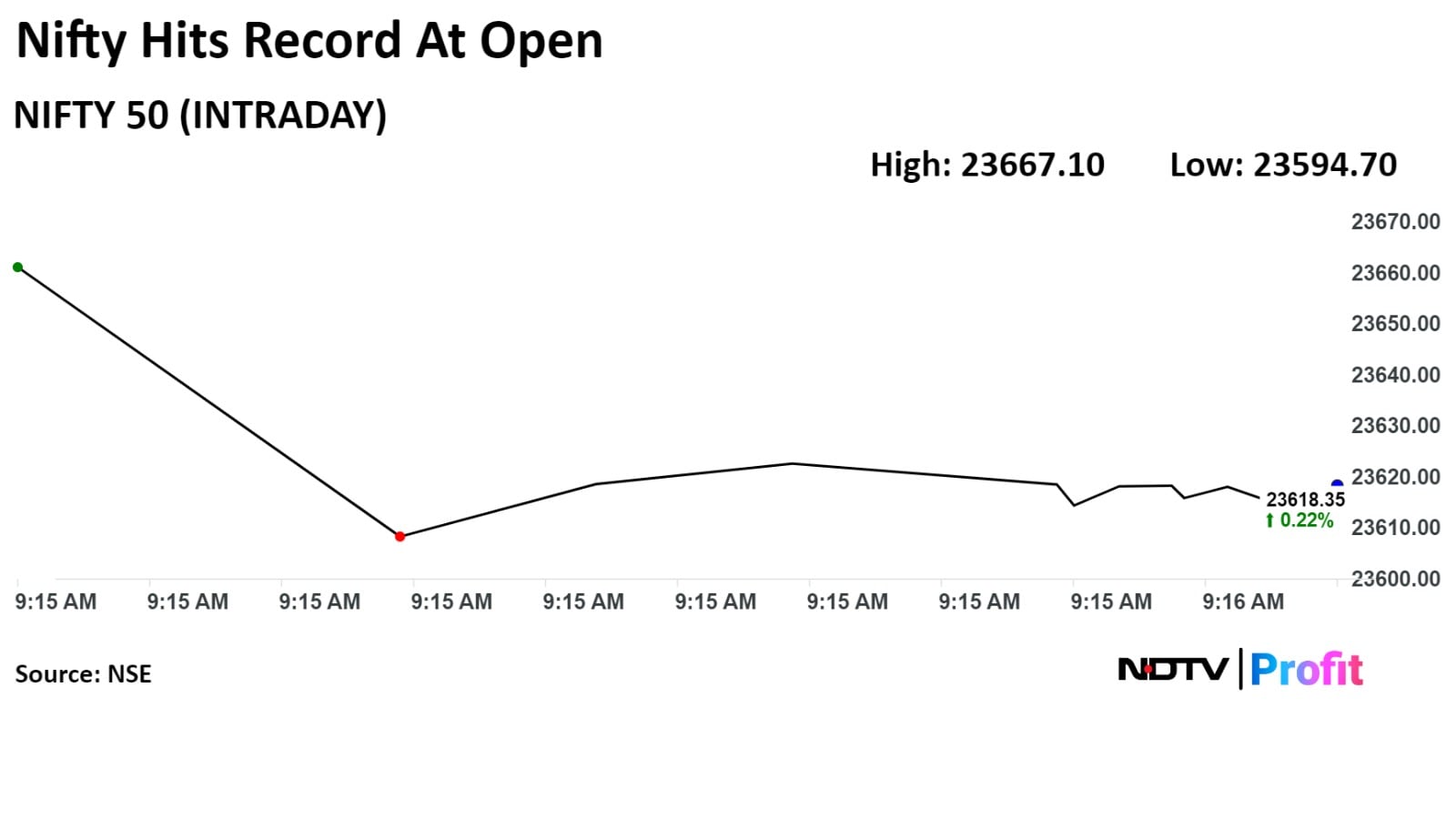

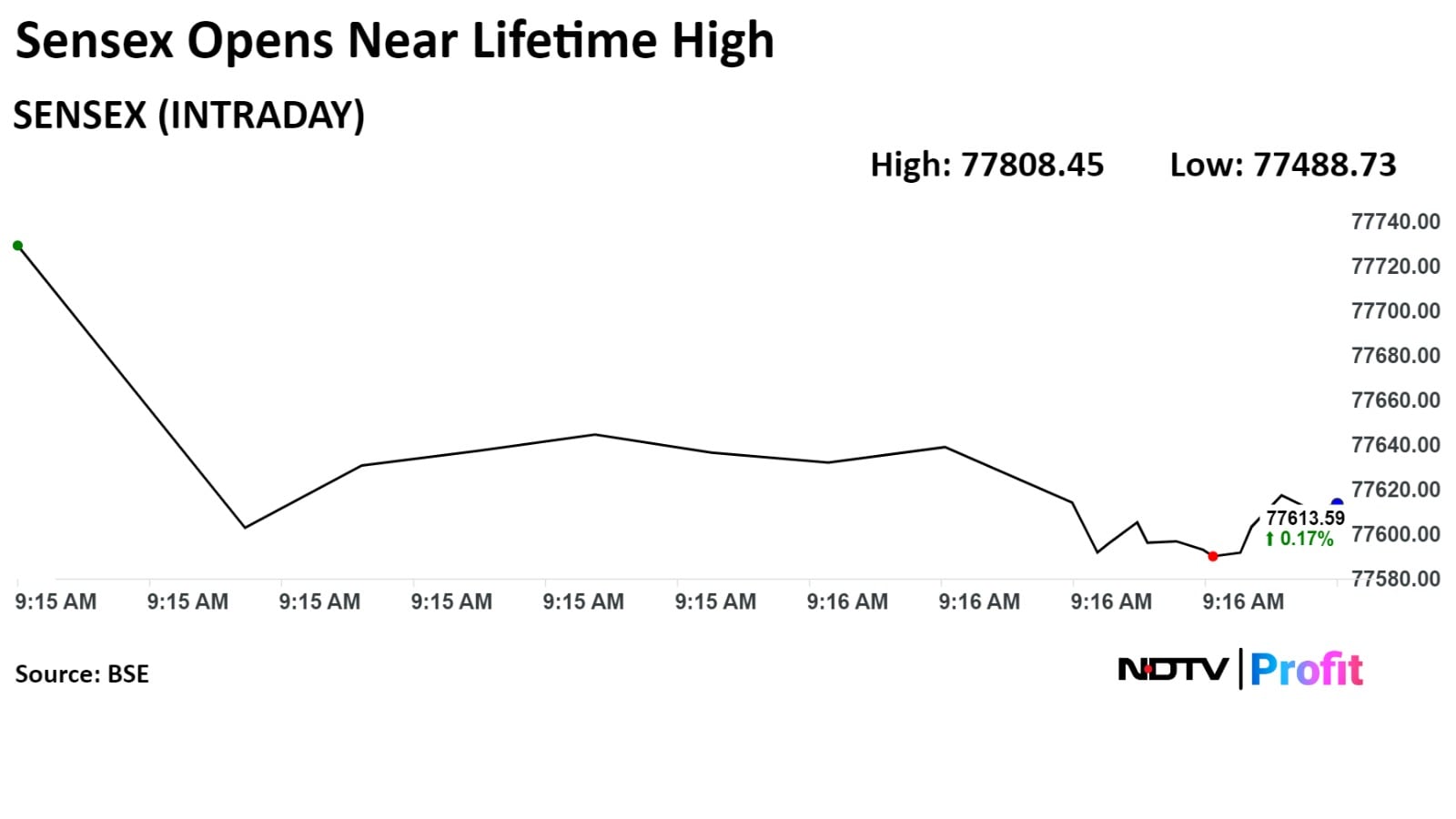

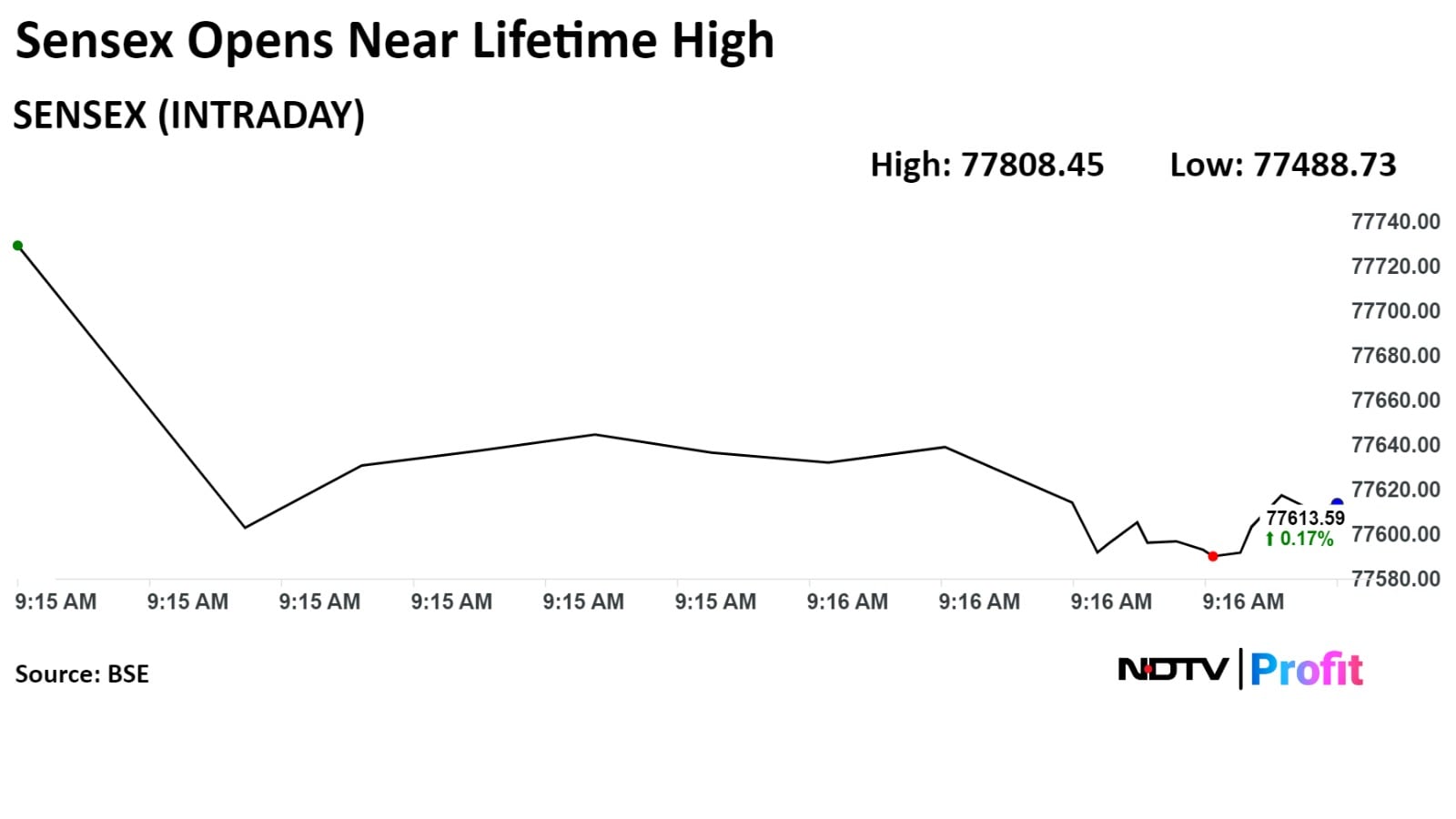

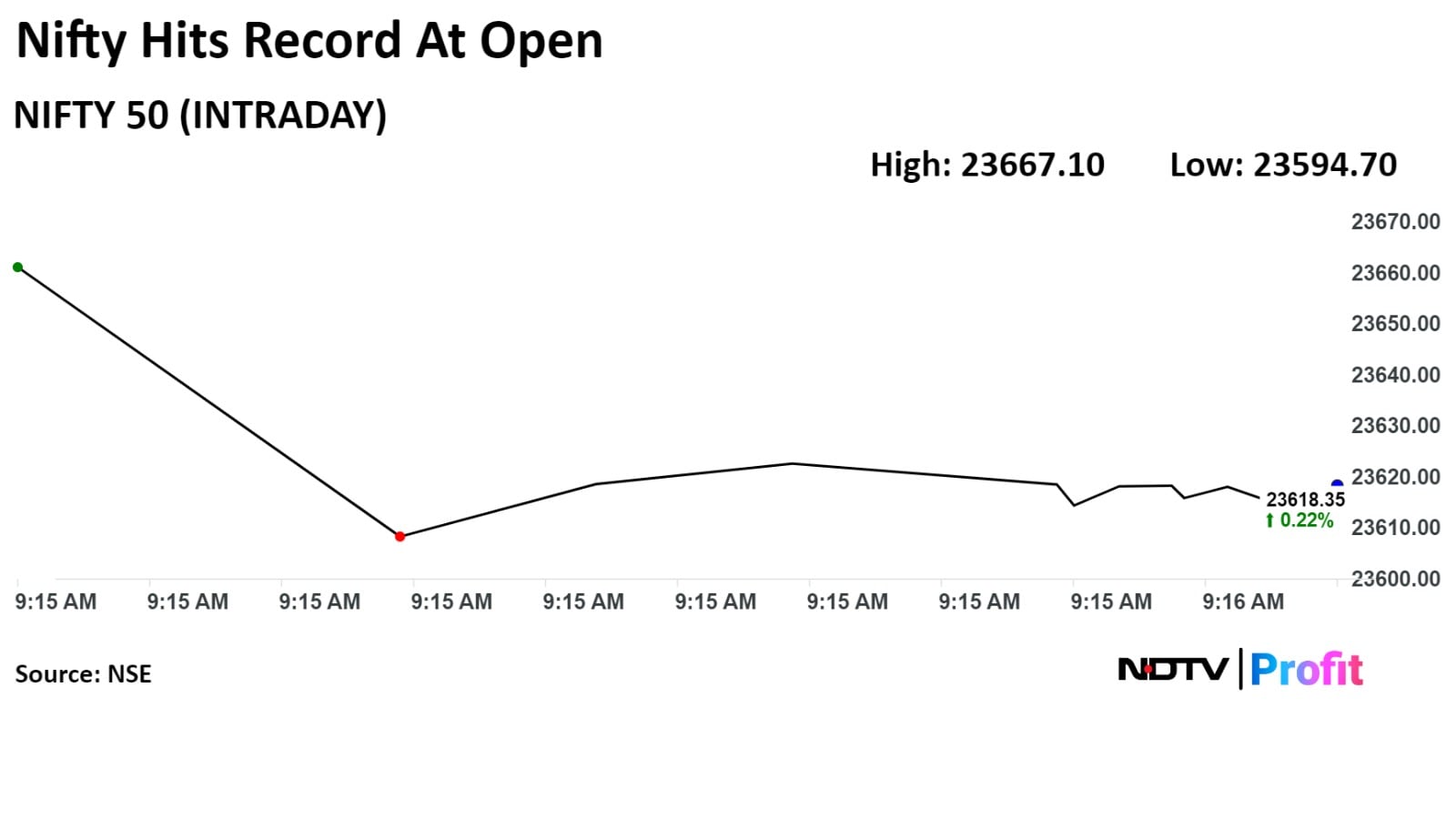

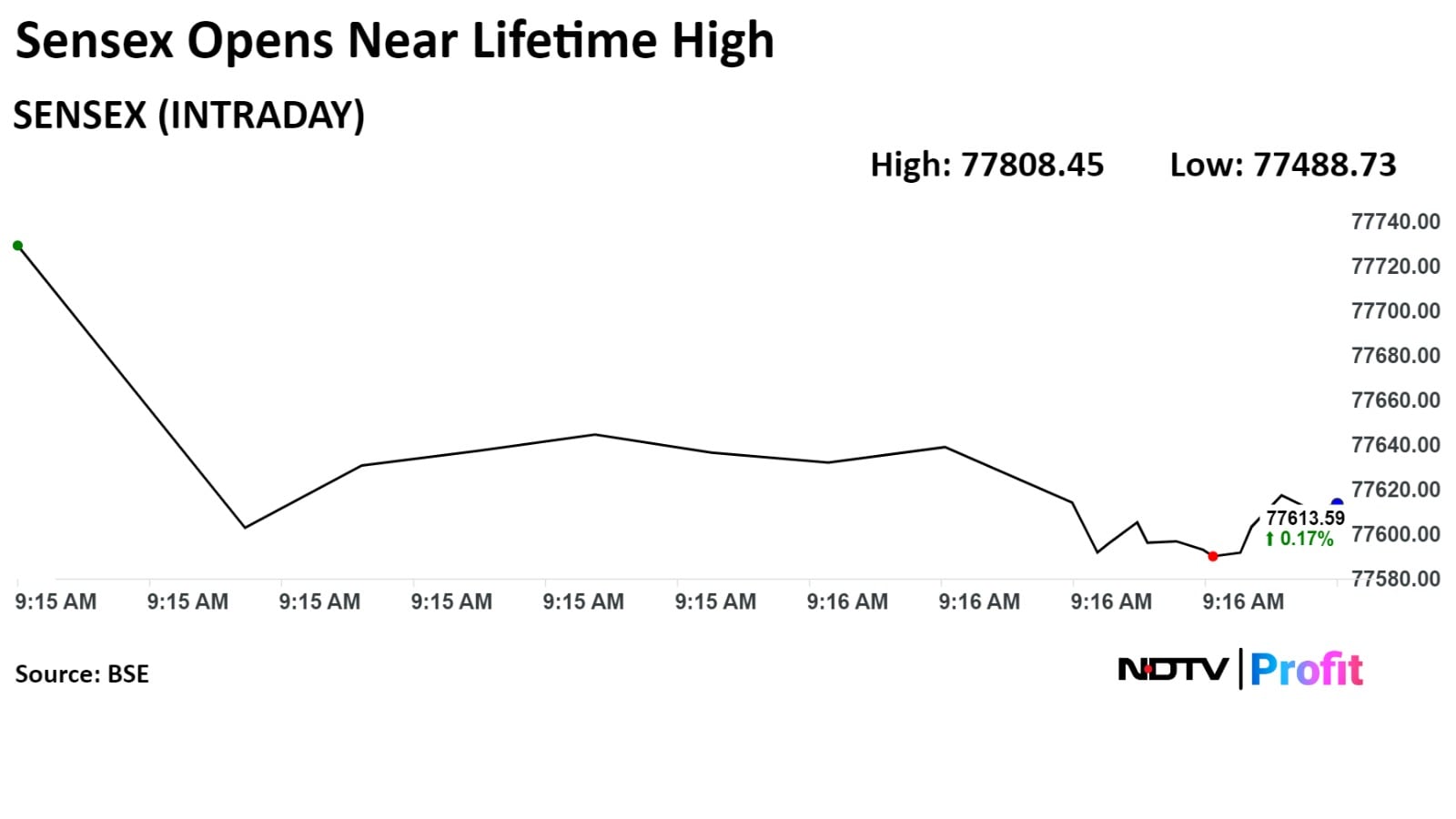

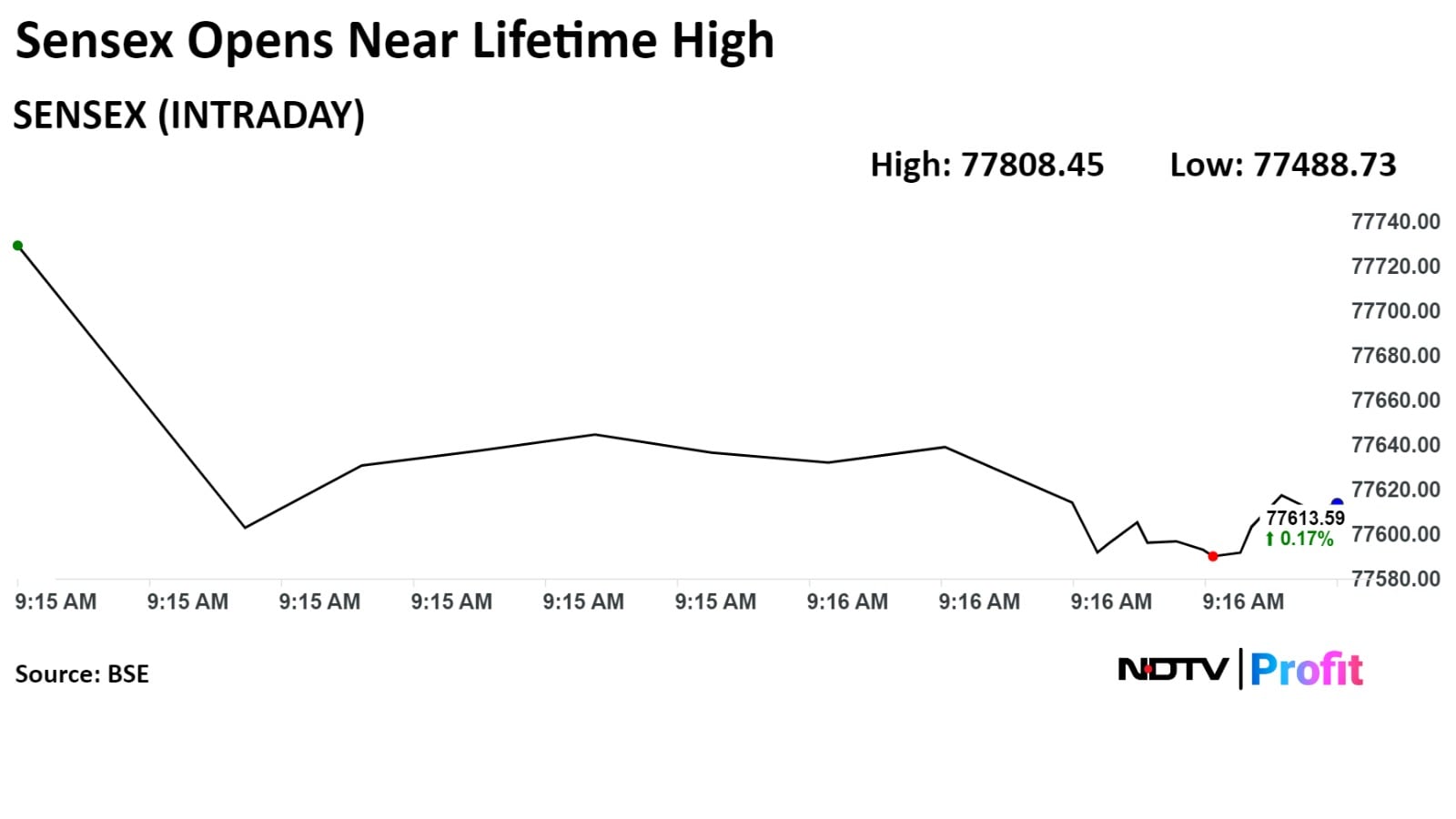

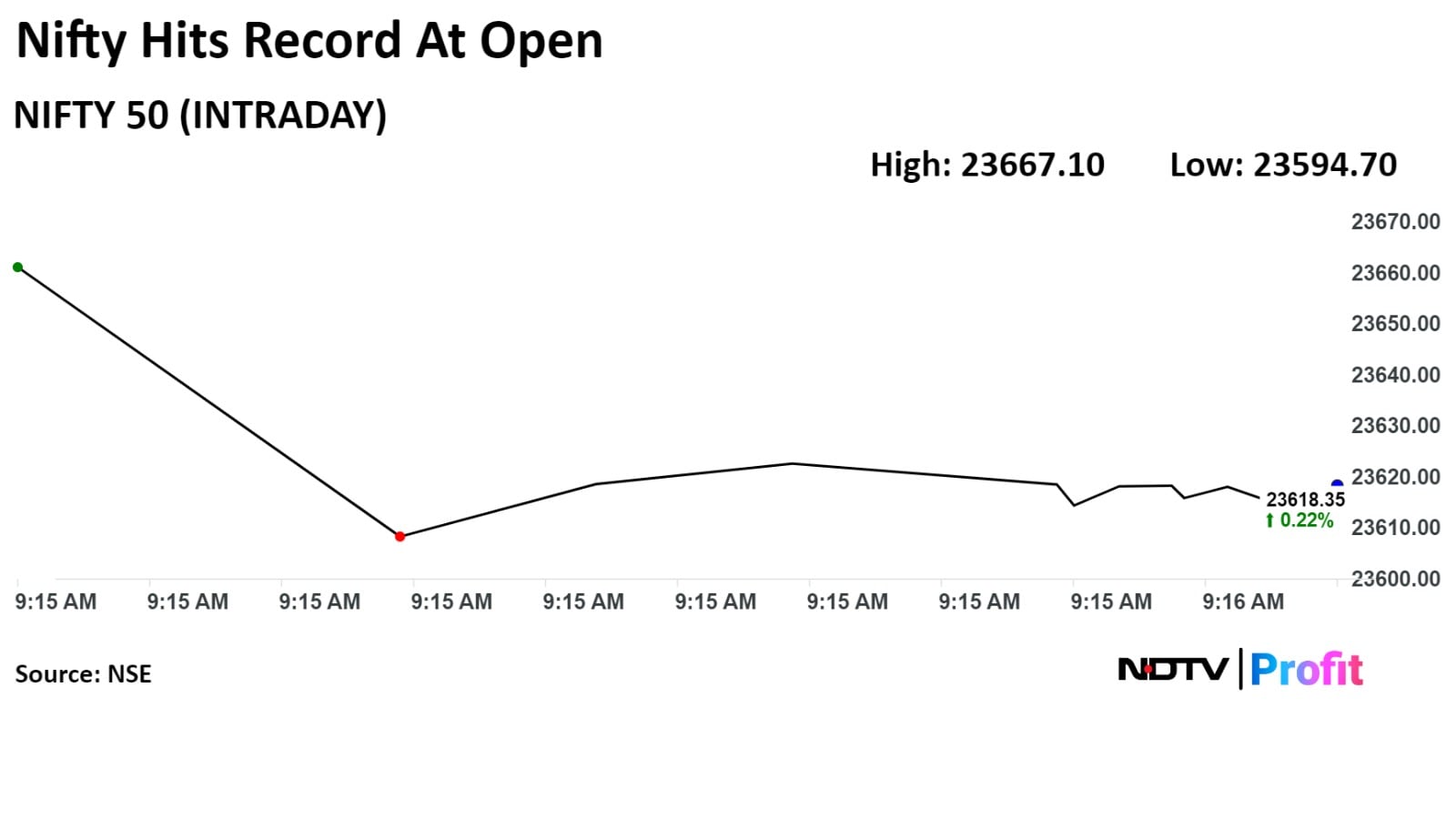

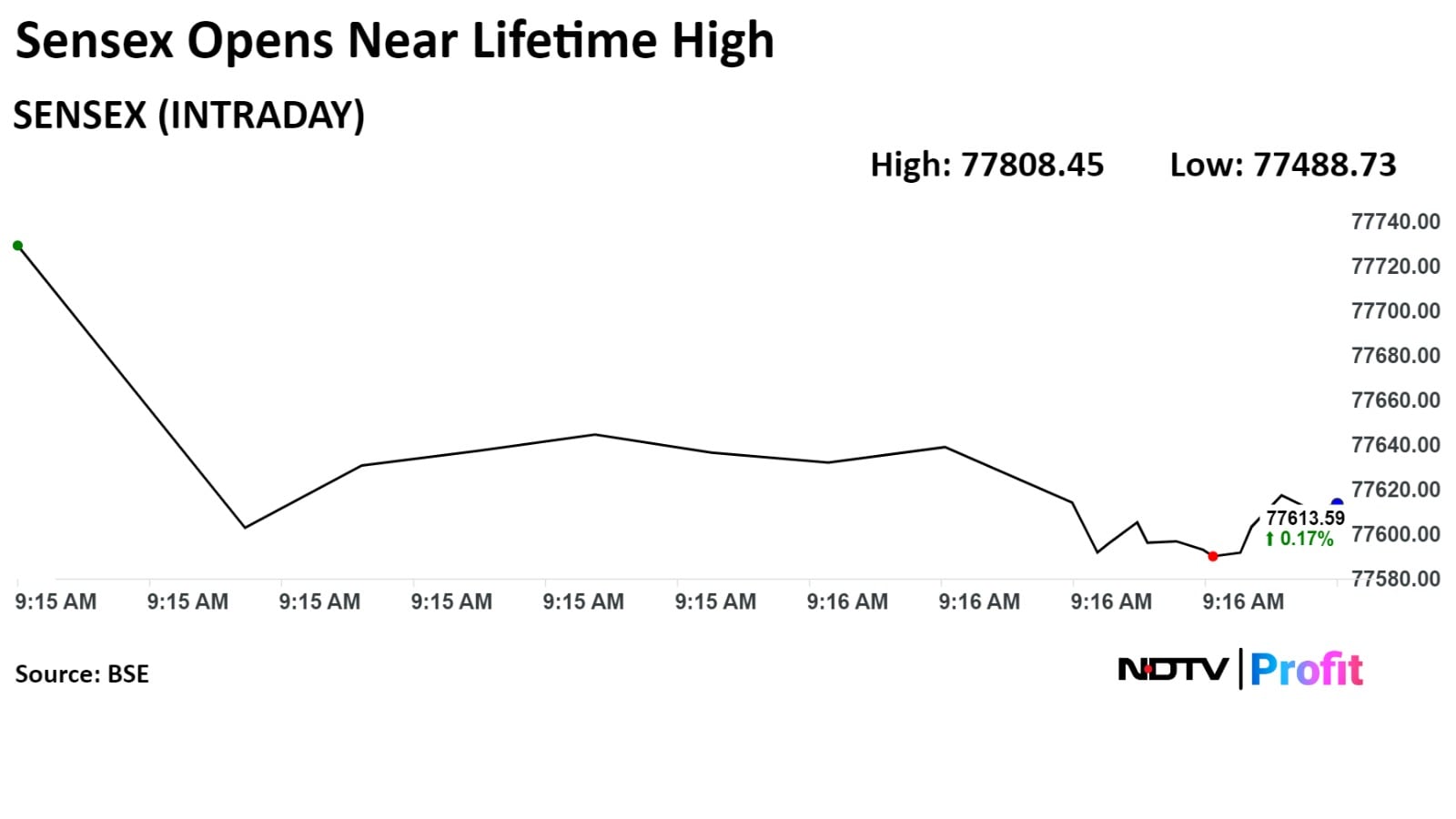

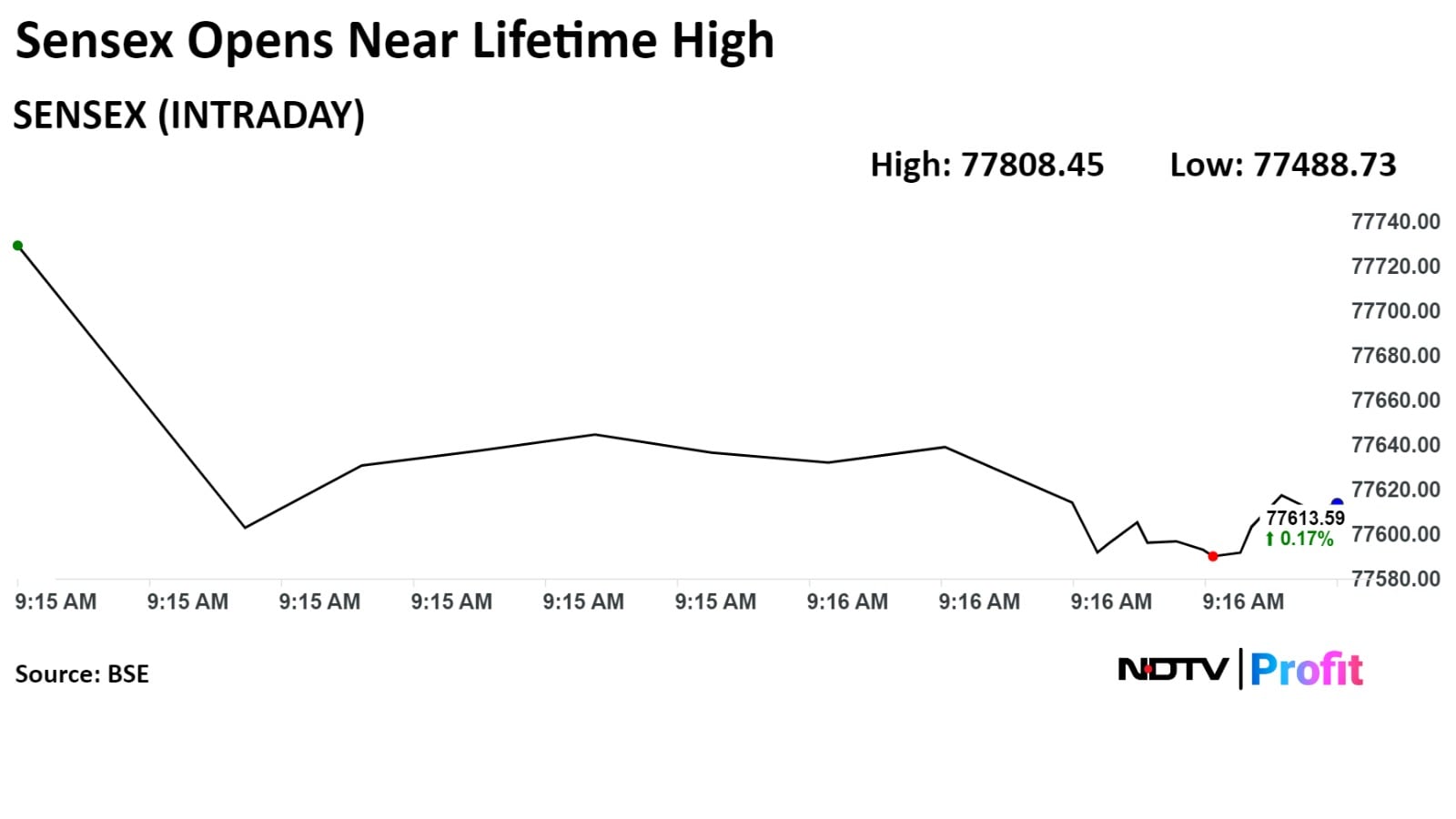

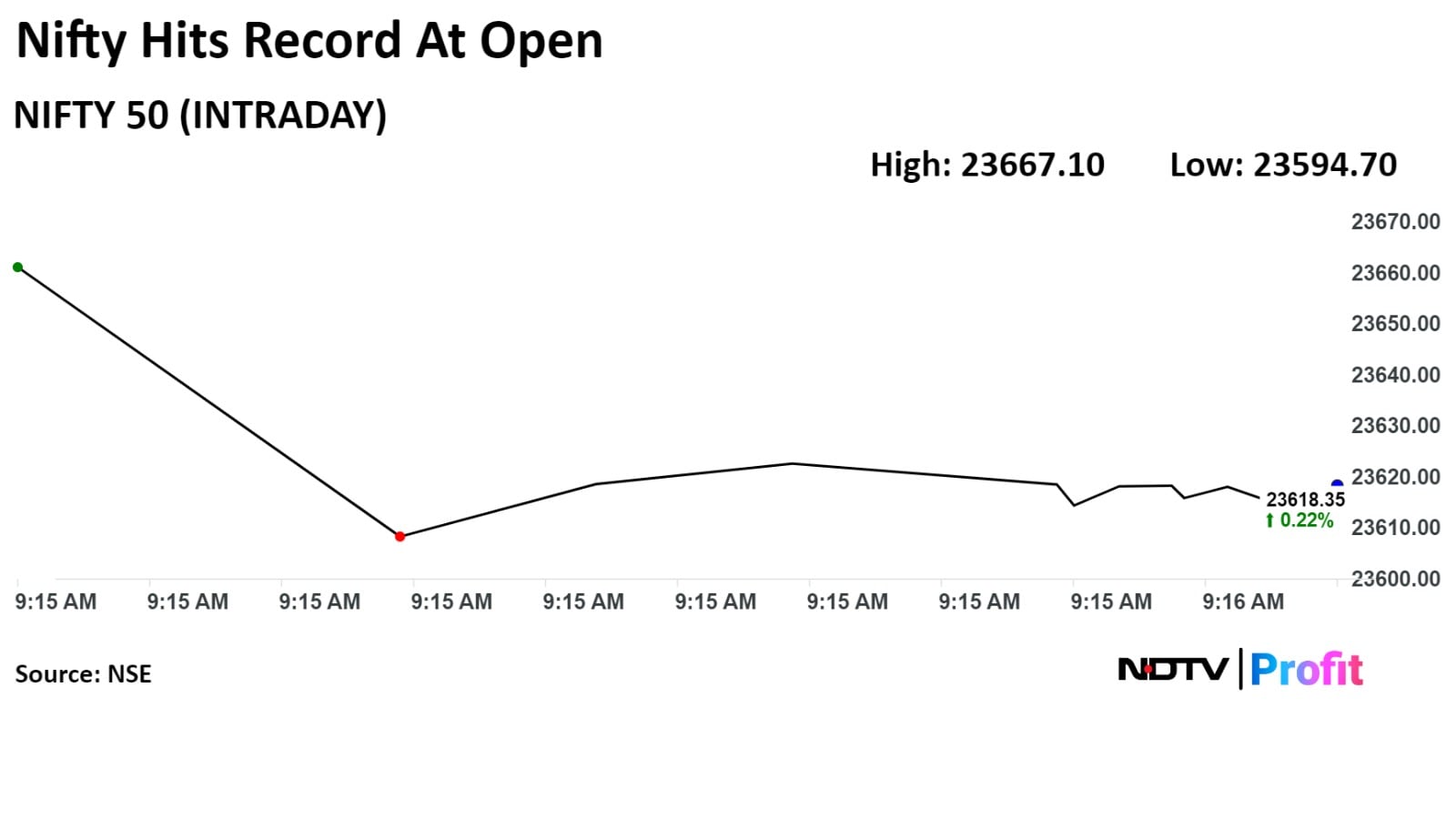

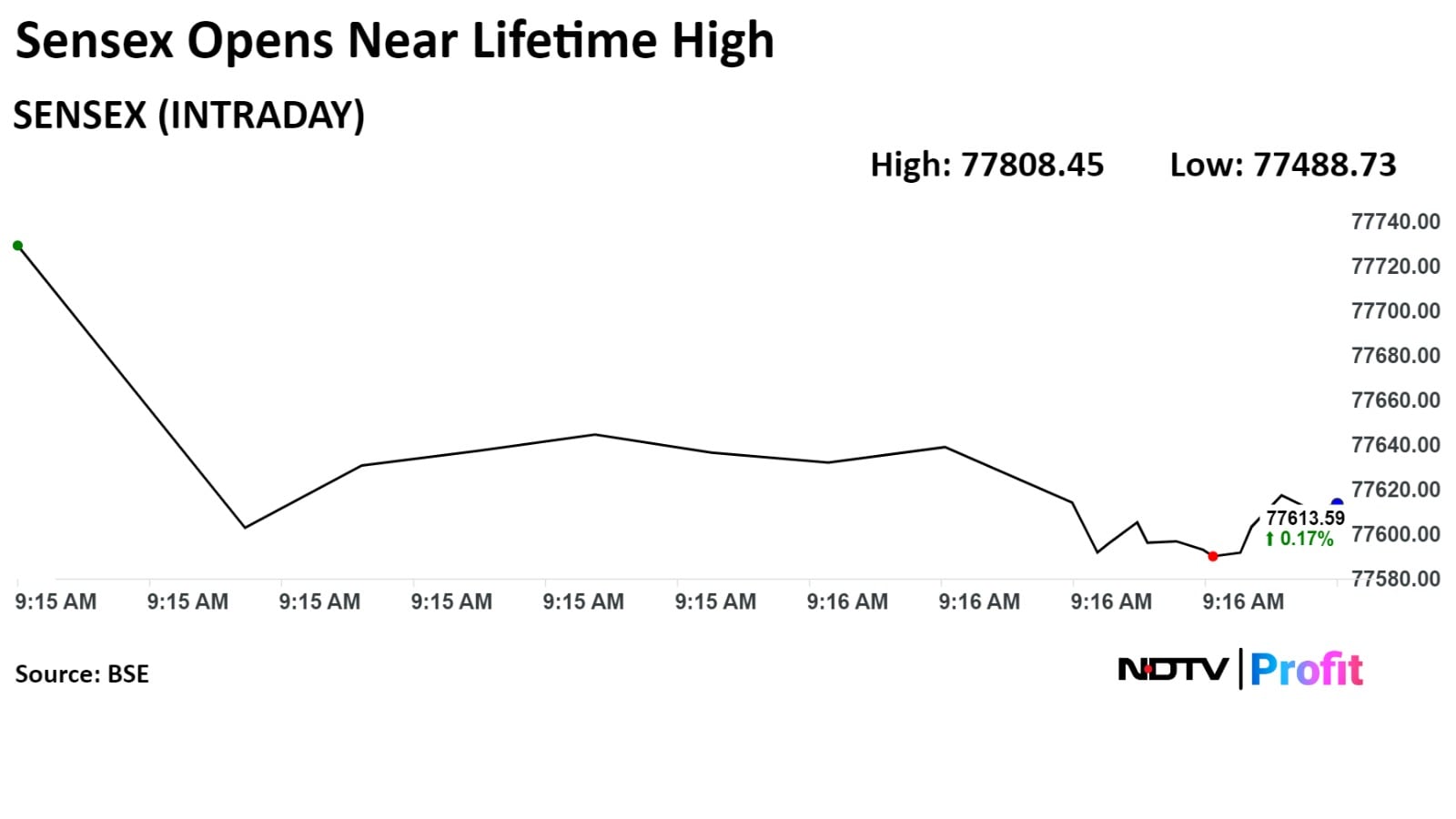

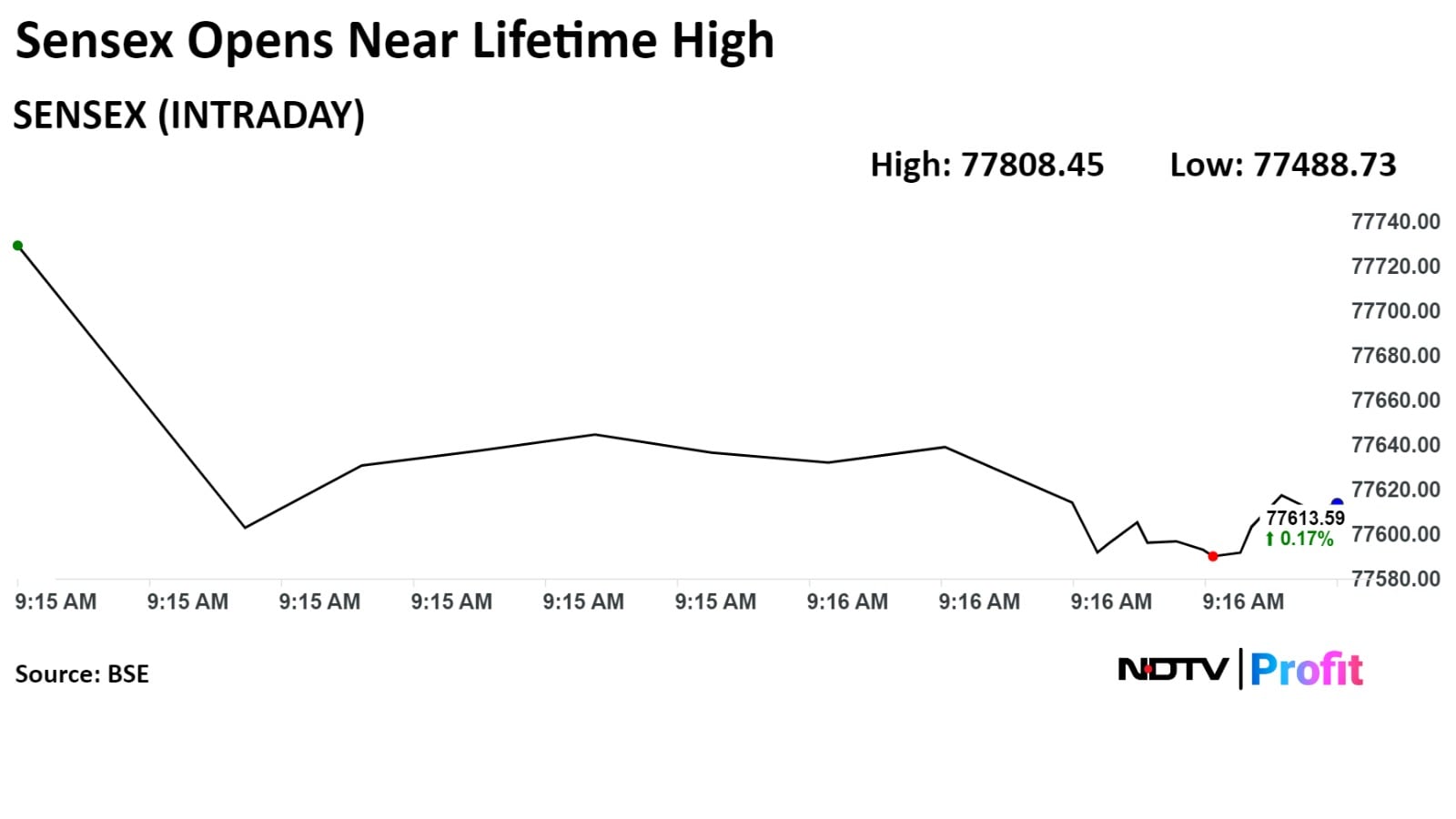

India's benchmark stock indices fell by midday on Friday, erasing earlier gains as heavyweights Reliance Industries Ltd. and HDFC Bank Ltd. dragged. Indices fell on likely profit booking after they hit fresh record high.

At 11:39 a.m., the NSE Nifty 50 was trading 19.00 points, or 0.1%, lower at 23,548.00, and the S&P BSE Sensex was trading 161.87 points, or 0.21%, down at 77,317.06.

Intraday, the Nifty rose 0.42% to hit a fresh record high of 23,667.10. The S&P BSE Sensex rose 0.43% to 77,808.45.

"It's more of a consolidation. The Nifty 50 is oscillating in a rising channel," said Aditya Agarwala, head of research and investments at Invest4edu. "On the upside, (for Nifty) 23,700–23,750 is the resistance and 23,500 is the support. Till the time the index doesn't break 23,500, a massive fall is not expected. Similarly, if the resistance level is not broken, no massive gain is expected."

"More or less, it will be a time-wise correction. Markets can continue to make new highs by a few marginal points. We prefer not to read too much into such highs," he told NDTV Profit.

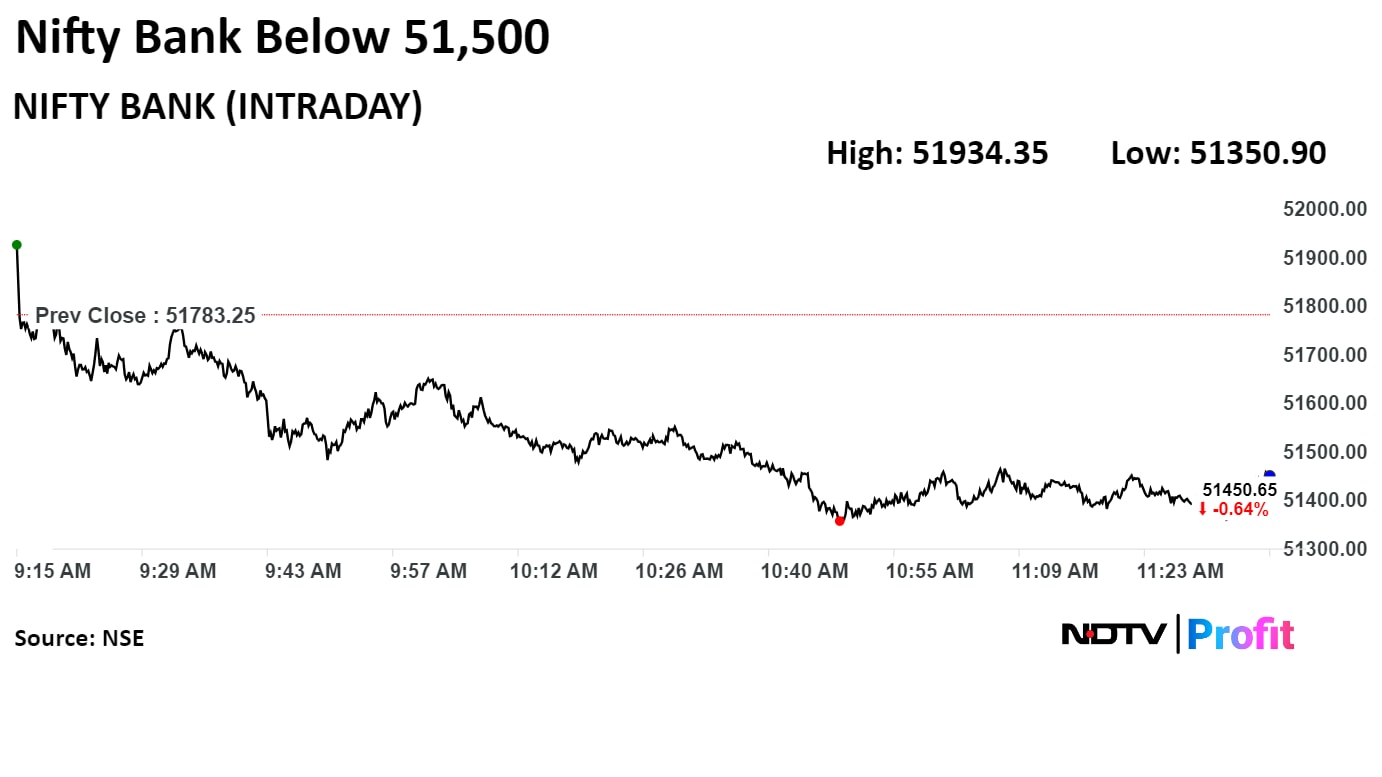

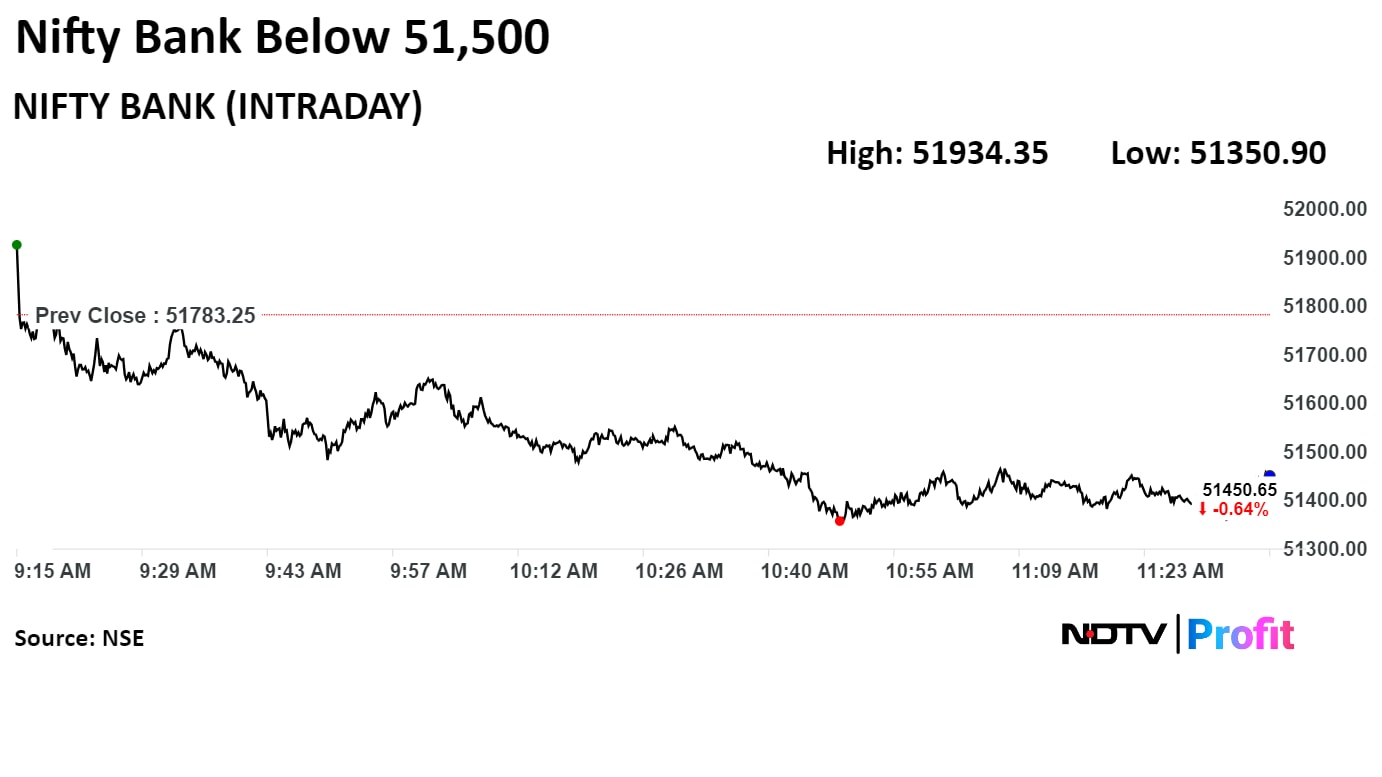

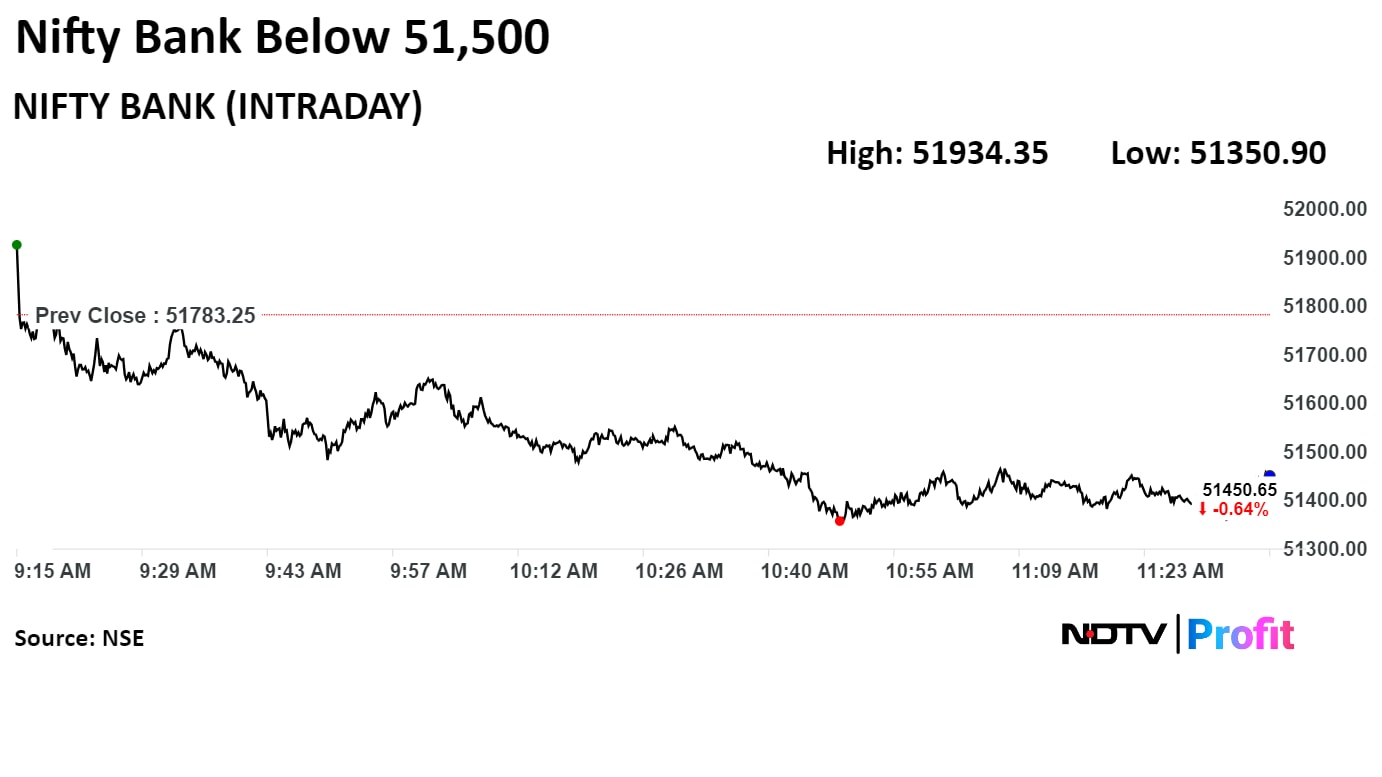

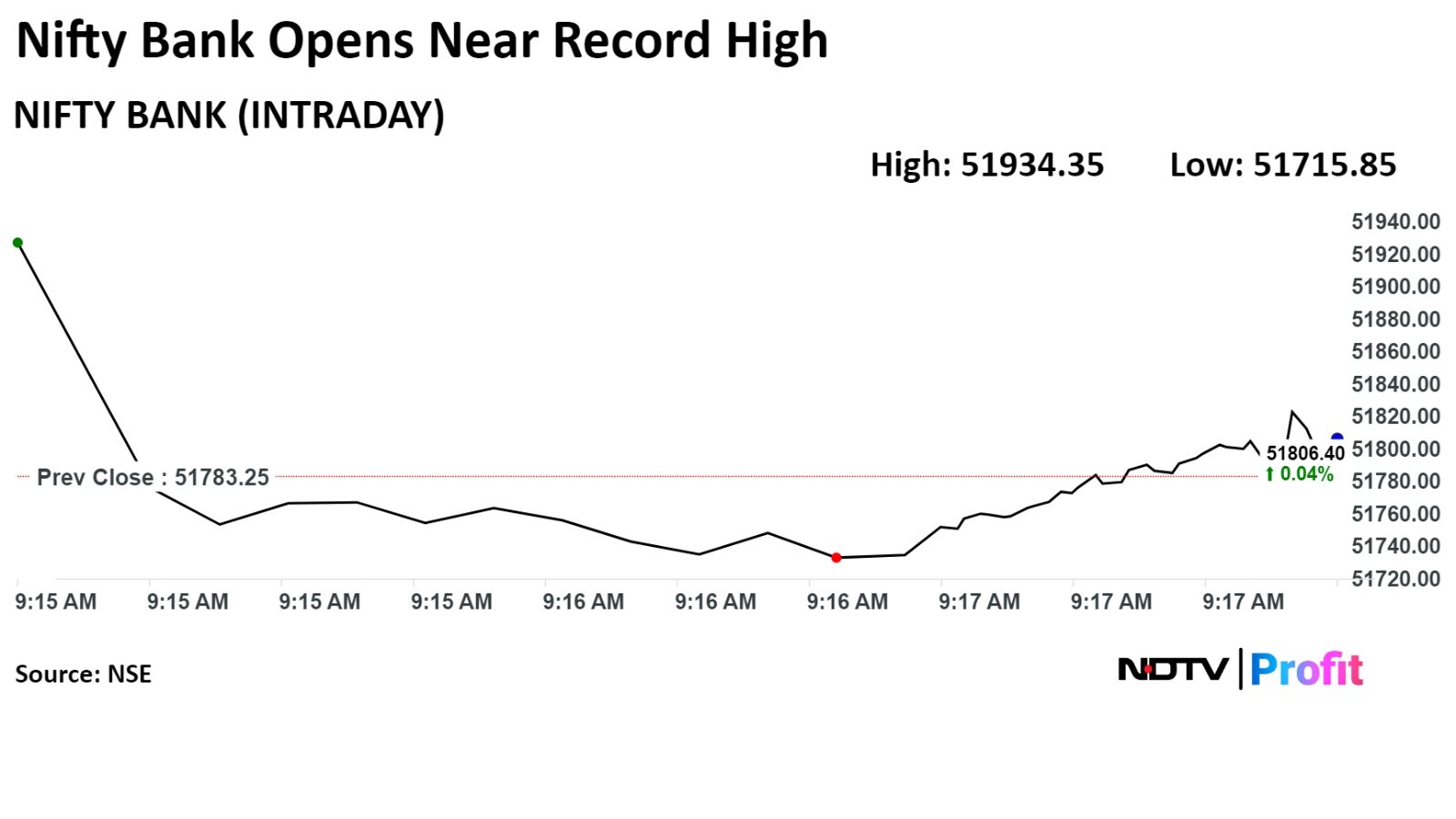

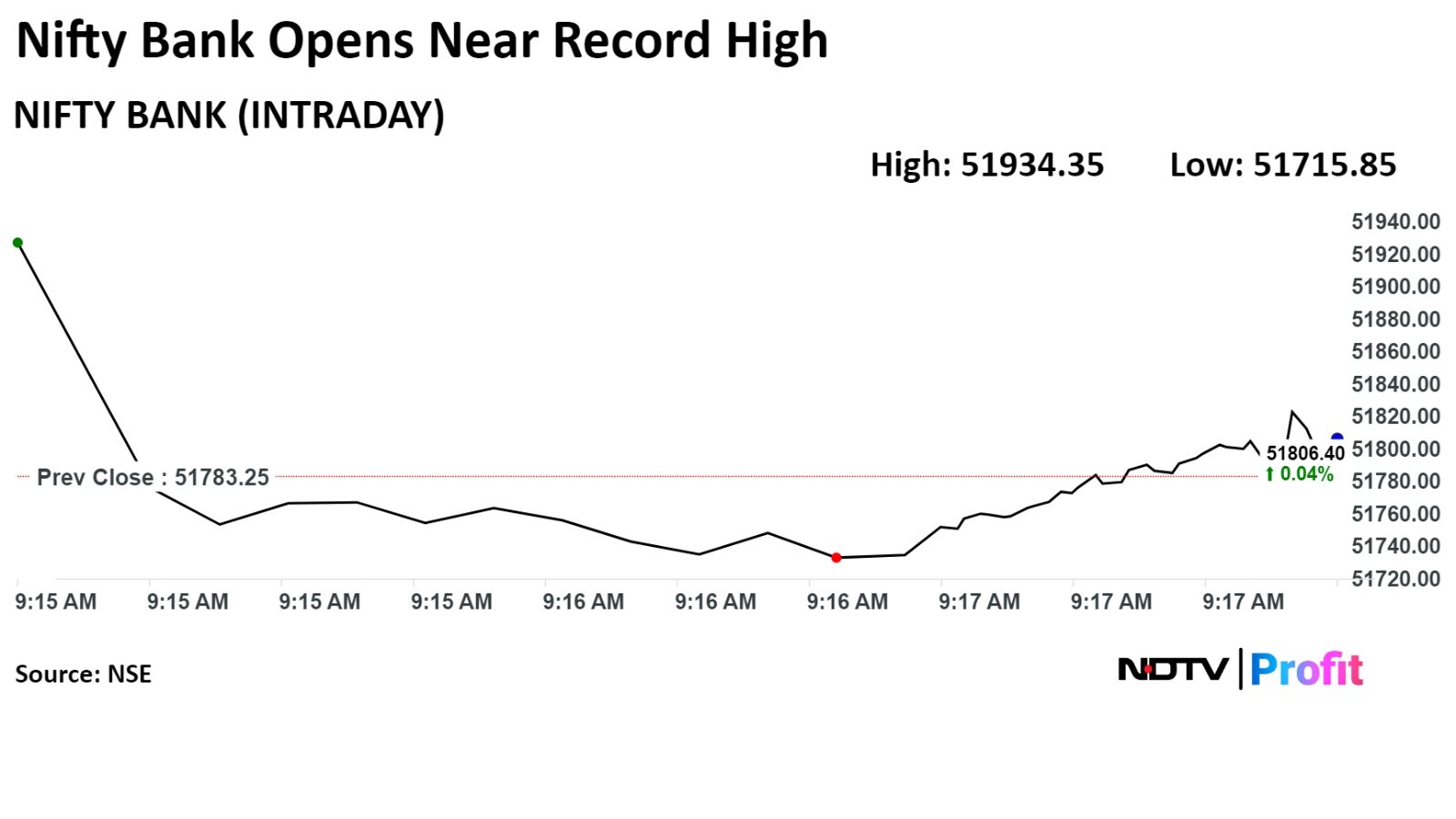

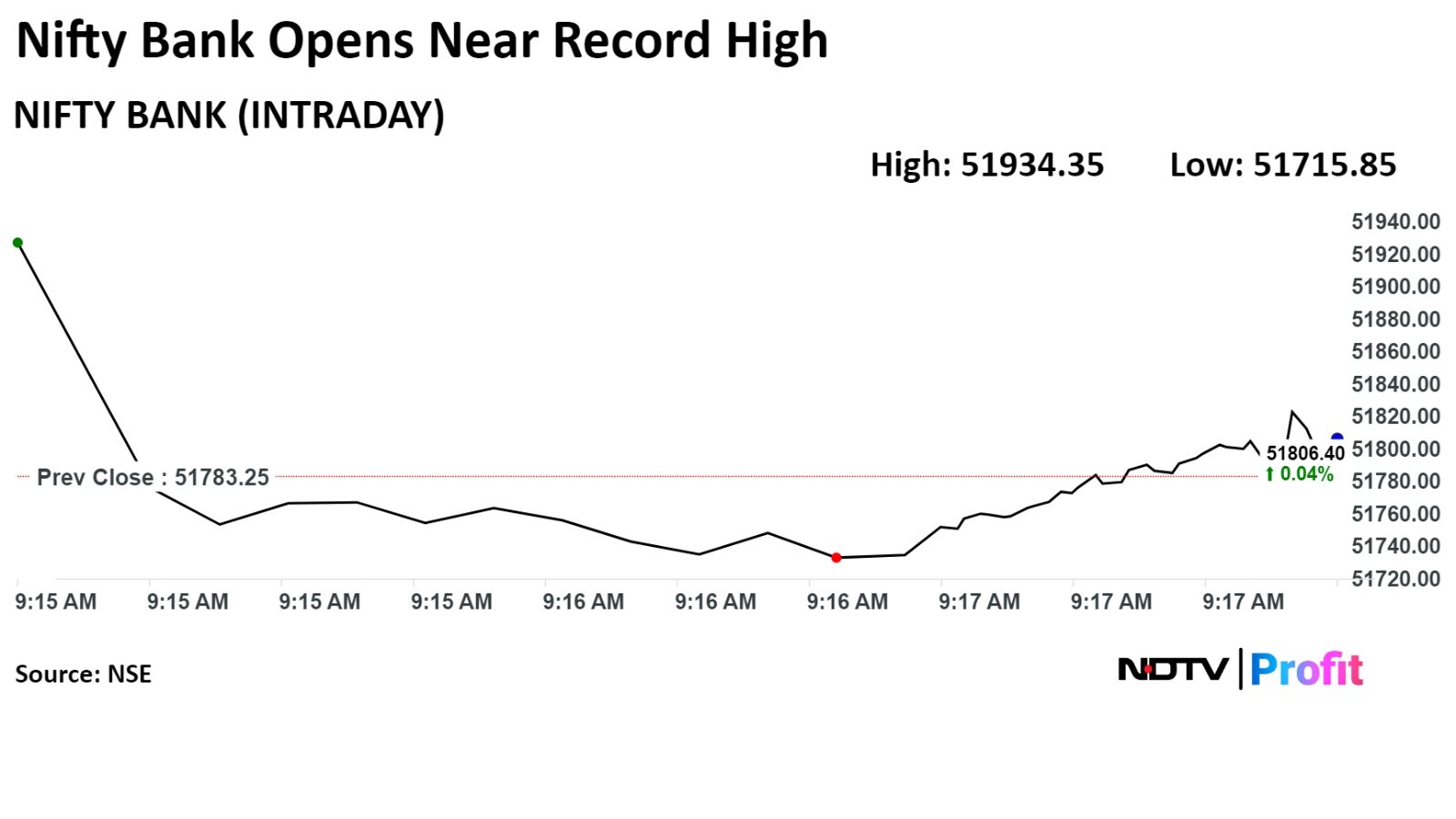

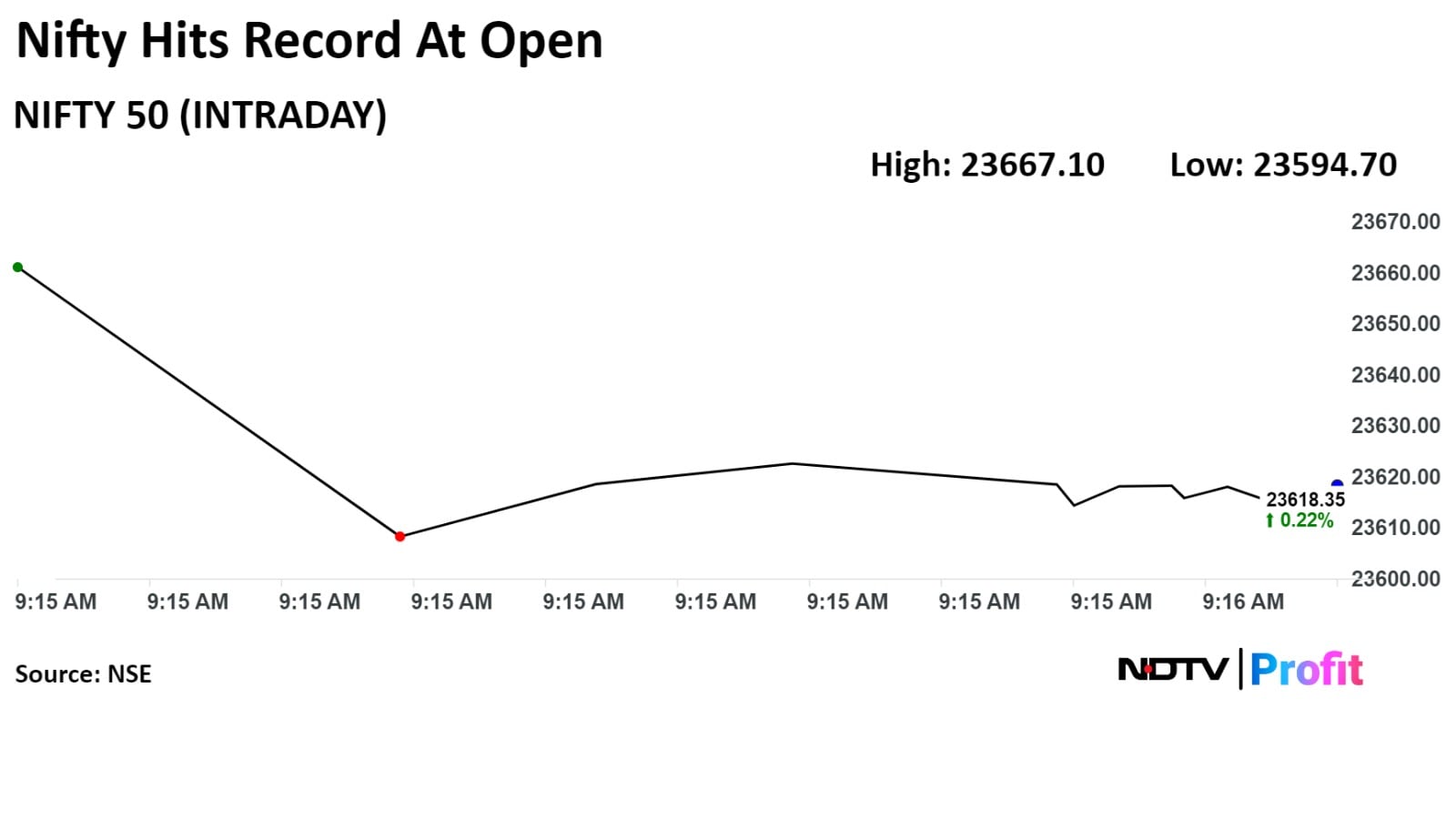

On the flipside, the Nifty Bank index, which had outperformed significantly on Thursday, is seeing some cooling off on Friday, Agarwala said. "The cool-off may extend by 200–300 points in this session or maybe next week. From there, markets may see another round of buying," he said.

India's benchmark stock indices fell by midday on Friday, erasing earlier gains as heavyweights Reliance Industries Ltd. and HDFC Bank Ltd. dragged. Indices fell on likely profit booking after they hit fresh record high.

At 11:39 a.m., the NSE Nifty 50 was trading 19.00 points, or 0.1%, lower at 23,548.00, and the S&P BSE Sensex was trading 161.87 points, or 0.21%, down at 77,317.06.

Intraday, the Nifty rose 0.42% to hit a fresh record high of 23,667.10. The S&P BSE Sensex rose 0.43% to 77,808.45.

"It's more of a consolidation. The Nifty 50 is oscillating in a rising channel," said Aditya Agarwala, head of research and investments at Invest4edu. "On the upside, (for Nifty) 23,700–23,750 is the resistance and 23,500 is the support. Till the time the index doesn't break 23,500, a massive fall is not expected. Similarly, if the resistance level is not broken, no massive gain is expected."

"More or less, it will be a time-wise correction. Markets can continue to make new highs by a few marginal points. We prefer not to read too much into such highs," he told NDTV Profit.

On the flipside, the Nifty Bank index, which had outperformed significantly on Thursday, is seeing some cooling off on Friday, Agarwala said. "The cool-off may extend by 200–300 points in this session or maybe next week. From there, markets may see another round of buying," he said.

India's benchmark stock indices fell by midday on Friday, erasing earlier gains as heavyweights Reliance Industries Ltd. and HDFC Bank Ltd. dragged. Indices fell on likely profit booking after they hit fresh record high.

At 11:39 a.m., the NSE Nifty 50 was trading 19.00 points, or 0.1%, lower at 23,548.00, and the S&P BSE Sensex was trading 161.87 points, or 0.21%, down at 77,317.06.

Intraday, the Nifty rose 0.42% to hit a fresh record high of 23,667.10. The S&P BSE Sensex rose 0.43% to 77,808.45.

"It's more of a consolidation. The Nifty 50 is oscillating in a rising channel," said Aditya Agarwala, head of research and investments at Invest4edu. "On the upside, (for Nifty) 23,700–23,750 is the resistance and 23,500 is the support. Till the time the index doesn't break 23,500, a massive fall is not expected. Similarly, if the resistance level is not broken, no massive gain is expected."

"More or less, it will be a time-wise correction. Markets can continue to make new highs by a few marginal points. We prefer not to read too much into such highs," he told NDTV Profit.

On the flipside, the Nifty Bank index, which had outperformed significantly on Thursday, is seeing some cooling off on Friday, Agarwala said. "The cool-off may extend by 200–300 points in this session or maybe next week. From there, markets may see another round of buying," he said.

India's benchmark stock indices fell by midday on Friday, erasing earlier gains as heavyweights Reliance Industries Ltd. and HDFC Bank Ltd. dragged. Indices fell on likely profit booking after they hit fresh record high.

At 11:39 a.m., the NSE Nifty 50 was trading 19.00 points, or 0.1%, lower at 23,548.00, and the S&P BSE Sensex was trading 161.87 points, or 0.21%, down at 77,317.06.

Intraday, the Nifty rose 0.42% to hit a fresh record high of 23,667.10. The S&P BSE Sensex rose 0.43% to 77,808.45.

"It's more of a consolidation. The Nifty 50 is oscillating in a rising channel," said Aditya Agarwala, head of research and investments at Invest4edu. "On the upside, (for Nifty) 23,700–23,750 is the resistance and 23,500 is the support. Till the time the index doesn't break 23,500, a massive fall is not expected. Similarly, if the resistance level is not broken, no massive gain is expected."

"More or less, it will be a time-wise correction. Markets can continue to make new highs by a few marginal points. We prefer not to read too much into such highs," he told NDTV Profit.

On the flipside, the Nifty Bank index, which had outperformed significantly on Thursday, is seeing some cooling off on Friday, Agarwala said. "The cool-off may extend by 200–300 points in this session or maybe next week. From there, markets may see another round of buying," he said.

India's benchmark stock indices fell by midday on Friday, erasing earlier gains as heavyweights Reliance Industries Ltd. and HDFC Bank Ltd. dragged. Indices fell on likely profit booking after they hit fresh record high.

At 11:39 a.m., the NSE Nifty 50 was trading 19.00 points, or 0.1%, lower at 23,548.00, and the S&P BSE Sensex was trading 161.87 points, or 0.21%, down at 77,317.06.

Intraday, the Nifty rose 0.42% to hit a fresh record high of 23,667.10. The S&P BSE Sensex rose 0.43% to 77,808.45.

"It's more of a consolidation. The Nifty 50 is oscillating in a rising channel," said Aditya Agarwala, head of research and investments at Invest4edu. "On the upside, (for Nifty) 23,700–23,750 is the resistance and 23,500 is the support. Till the time the index doesn't break 23,500, a massive fall is not expected. Similarly, if the resistance level is not broken, no massive gain is expected."

"More or less, it will be a time-wise correction. Markets can continue to make new highs by a few marginal points. We prefer not to read too much into such highs," he told NDTV Profit.

On the flipside, the Nifty Bank index, which had outperformed significantly on Thursday, is seeing some cooling off on Friday, Agarwala said. "The cool-off may extend by 200–300 points in this session or maybe next week. From there, markets may see another round of buying," he said.

India's benchmark stock indices fell by midday on Friday, erasing earlier gains as heavyweights Reliance Industries Ltd. and HDFC Bank Ltd. dragged. Indices fell on likely profit booking after they hit fresh record high.

At 11:39 a.m., the NSE Nifty 50 was trading 19.00 points, or 0.1%, lower at 23,548.00, and the S&P BSE Sensex was trading 161.87 points, or 0.21%, down at 77,317.06.

Intraday, the Nifty rose 0.42% to hit a fresh record high of 23,667.10. The S&P BSE Sensex rose 0.43% to 77,808.45.

"It's more of a consolidation. The Nifty 50 is oscillating in a rising channel," said Aditya Agarwala, head of research and investments at Invest4edu. "On the upside, (for Nifty) 23,700–23,750 is the resistance and 23,500 is the support. Till the time the index doesn't break 23,500, a massive fall is not expected. Similarly, if the resistance level is not broken, no massive gain is expected."

"More or less, it will be a time-wise correction. Markets can continue to make new highs by a few marginal points. We prefer not to read too much into such highs," he told NDTV Profit.

On the flipside, the Nifty Bank index, which had outperformed significantly on Thursday, is seeing some cooling off on Friday, Agarwala said. "The cool-off may extend by 200–300 points in this session or maybe next week. From there, markets may see another round of buying," he said.

India's benchmark stock indices fell by midday on Friday, erasing earlier gains as heavyweights Reliance Industries Ltd. and HDFC Bank Ltd. dragged. Indices fell on likely profit booking after they hit fresh record high.

At 11:39 a.m., the NSE Nifty 50 was trading 19.00 points, or 0.1%, lower at 23,548.00, and the S&P BSE Sensex was trading 161.87 points, or 0.21%, down at 77,317.06.

Intraday, the Nifty rose 0.42% to hit a fresh record high of 23,667.10. The S&P BSE Sensex rose 0.43% to 77,808.45.

"It's more of a consolidation. The Nifty 50 is oscillating in a rising channel," said Aditya Agarwala, head of research and investments at Invest4edu. "On the upside, (for Nifty) 23,700–23,750 is the resistance and 23,500 is the support. Till the time the index doesn't break 23,500, a massive fall is not expected. Similarly, if the resistance level is not broken, no massive gain is expected."

"More or less, it will be a time-wise correction. Markets can continue to make new highs by a few marginal points. We prefer not to read too much into such highs," he told NDTV Profit.

On the flipside, the Nifty Bank index, which had outperformed significantly on Thursday, is seeing some cooling off on Friday, Agarwala said. "The cool-off may extend by 200–300 points in this session or maybe next week. From there, markets may see another round of buying," he said.

India's benchmark stock indices fell by midday on Friday, erasing earlier gains as heavyweights Reliance Industries Ltd. and HDFC Bank Ltd. dragged. Indices fell on likely profit booking after they hit fresh record high.

At 11:39 a.m., the NSE Nifty 50 was trading 19.00 points, or 0.1%, lower at 23,548.00, and the S&P BSE Sensex was trading 161.87 points, or 0.21%, down at 77,317.06.

Intraday, the Nifty rose 0.42% to hit a fresh record high of 23,667.10. The S&P BSE Sensex rose 0.43% to 77,808.45.

"It's more of a consolidation. The Nifty 50 is oscillating in a rising channel," said Aditya Agarwala, head of research and investments at Invest4edu. "On the upside, (for Nifty) 23,700–23,750 is the resistance and 23,500 is the support. Till the time the index doesn't break 23,500, a massive fall is not expected. Similarly, if the resistance level is not broken, no massive gain is expected."

"More or less, it will be a time-wise correction. Markets can continue to make new highs by a few marginal points. We prefer not to read too much into such highs," he told NDTV Profit.

On the flipside, the Nifty Bank index, which had outperformed significantly on Thursday, is seeing some cooling off on Friday, Agarwala said. "The cool-off may extend by 200–300 points in this session or maybe next week. From there, markets may see another round of buying," he said.

HDFC Bank Ltd., Reliance Industries Ltd., Axis Bank Ltd., Larsen & Toubro Ltd., and Hindustan Unilever Ltd. weighed on the Nifty 50.

Infosys Ltd., Bharti Airtel Ltd., Tata Consultancy Services Ltd., Hindalco Industries Ltd., and NTPC Ltd. contributed to the index.

On the NSE, seven sectors declined and five sectors advanced. The NSE Nifty PSU Bank was the worst performer, and the NSE Nifty Media was the best performer.

India's benchmark stock indices fell by midday on Friday, erasing earlier gains as heavyweights Reliance Industries Ltd. and HDFC Bank Ltd. dragged. Indices fell on likely profit booking after they hit fresh record high.

At 11:39 a.m., the NSE Nifty 50 was trading 19.00 points, or 0.1%, lower at 23,548.00, and the S&P BSE Sensex was trading 161.87 points, or 0.21%, down at 77,317.06.

Intraday, the Nifty rose 0.42% to hit a fresh record high of 23,667.10. The S&P BSE Sensex rose 0.43% to 77,808.45.

"It's more of a consolidation. The Nifty 50 is oscillating in a rising channel," said Aditya Agarwala, head of research and investments at Invest4edu. "On the upside, (for Nifty) 23,700–23,750 is the resistance and 23,500 is the support. Till the time the index doesn't break 23,500, a massive fall is not expected. Similarly, if the resistance level is not broken, no massive gain is expected."

"More or less, it will be a time-wise correction. Markets can continue to make new highs by a few marginal points. We prefer not to read too much into such highs," he told NDTV Profit.

On the flipside, the Nifty Bank index, which had outperformed significantly on Thursday, is seeing some cooling off on Friday, Agarwala said. "The cool-off may extend by 200–300 points in this session or maybe next week. From there, markets may see another round of buying," he said.

India's benchmark stock indices fell by midday on Friday, erasing earlier gains as heavyweights Reliance Industries Ltd. and HDFC Bank Ltd. dragged. Indices fell on likely profit booking after they hit fresh record high.

At 11:39 a.m., the NSE Nifty 50 was trading 19.00 points, or 0.1%, lower at 23,548.00, and the S&P BSE Sensex was trading 161.87 points, or 0.21%, down at 77,317.06.

Intraday, the Nifty rose 0.42% to hit a fresh record high of 23,667.10. The S&P BSE Sensex rose 0.43% to 77,808.45.

"It's more of a consolidation. The Nifty 50 is oscillating in a rising channel," said Aditya Agarwala, head of research and investments at Invest4edu. "On the upside, (for Nifty) 23,700–23,750 is the resistance and 23,500 is the support. Till the time the index doesn't break 23,500, a massive fall is not expected. Similarly, if the resistance level is not broken, no massive gain is expected."

"More or less, it will be a time-wise correction. Markets can continue to make new highs by a few marginal points. We prefer not to read too much into such highs," he told NDTV Profit.

On the flipside, the Nifty Bank index, which had outperformed significantly on Thursday, is seeing some cooling off on Friday, Agarwala said. "The cool-off may extend by 200–300 points in this session or maybe next week. From there, markets may see another round of buying," he said.

India's benchmark stock indices fell by midday on Friday, erasing earlier gains as heavyweights Reliance Industries Ltd. and HDFC Bank Ltd. dragged. Indices fell on likely profit booking after they hit fresh record high.

At 11:39 a.m., the NSE Nifty 50 was trading 19.00 points, or 0.1%, lower at 23,548.00, and the S&P BSE Sensex was trading 161.87 points, or 0.21%, down at 77,317.06.

Intraday, the Nifty rose 0.42% to hit a fresh record high of 23,667.10. The S&P BSE Sensex rose 0.43% to 77,808.45.

"It's more of a consolidation. The Nifty 50 is oscillating in a rising channel," said Aditya Agarwala, head of research and investments at Invest4edu. "On the upside, (for Nifty) 23,700–23,750 is the resistance and 23,500 is the support. Till the time the index doesn't break 23,500, a massive fall is not expected. Similarly, if the resistance level is not broken, no massive gain is expected."

"More or less, it will be a time-wise correction. Markets can continue to make new highs by a few marginal points. We prefer not to read too much into such highs," he told NDTV Profit.

On the flipside, the Nifty Bank index, which had outperformed significantly on Thursday, is seeing some cooling off on Friday, Agarwala said. "The cool-off may extend by 200–300 points in this session or maybe next week. From there, markets may see another round of buying," he said.

India's benchmark stock indices fell by midday on Friday, erasing earlier gains as heavyweights Reliance Industries Ltd. and HDFC Bank Ltd. dragged. Indices fell on likely profit booking after they hit fresh record high.

At 11:39 a.m., the NSE Nifty 50 was trading 19.00 points, or 0.1%, lower at 23,548.00, and the S&P BSE Sensex was trading 161.87 points, or 0.21%, down at 77,317.06.

Intraday, the Nifty rose 0.42% to hit a fresh record high of 23,667.10. The S&P BSE Sensex rose 0.43% to 77,808.45.

"It's more of a consolidation. The Nifty 50 is oscillating in a rising channel," said Aditya Agarwala, head of research and investments at Invest4edu. "On the upside, (for Nifty) 23,700–23,750 is the resistance and 23,500 is the support. Till the time the index doesn't break 23,500, a massive fall is not expected. Similarly, if the resistance level is not broken, no massive gain is expected."

"More or less, it will be a time-wise correction. Markets can continue to make new highs by a few marginal points. We prefer not to read too much into such highs," he told NDTV Profit.

On the flipside, the Nifty Bank index, which had outperformed significantly on Thursday, is seeing some cooling off on Friday, Agarwala said. "The cool-off may extend by 200–300 points in this session or maybe next week. From there, markets may see another round of buying," he said.

India's benchmark stock indices fell by midday on Friday, erasing earlier gains as heavyweights Reliance Industries Ltd. and HDFC Bank Ltd. dragged. Indices fell on likely profit booking after they hit fresh record high.

At 11:39 a.m., the NSE Nifty 50 was trading 19.00 points, or 0.1%, lower at 23,548.00, and the S&P BSE Sensex was trading 161.87 points, or 0.21%, down at 77,317.06.

Intraday, the Nifty rose 0.42% to hit a fresh record high of 23,667.10. The S&P BSE Sensex rose 0.43% to 77,808.45.

"It's more of a consolidation. The Nifty 50 is oscillating in a rising channel," said Aditya Agarwala, head of research and investments at Invest4edu. "On the upside, (for Nifty) 23,700–23,750 is the resistance and 23,500 is the support. Till the time the index doesn't break 23,500, a massive fall is not expected. Similarly, if the resistance level is not broken, no massive gain is expected."

"More or less, it will be a time-wise correction. Markets can continue to make new highs by a few marginal points. We prefer not to read too much into such highs," he told NDTV Profit.

On the flipside, the Nifty Bank index, which had outperformed significantly on Thursday, is seeing some cooling off on Friday, Agarwala said. "The cool-off may extend by 200–300 points in this session or maybe next week. From there, markets may see another round of buying," he said.

India's benchmark stock indices fell by midday on Friday, erasing earlier gains as heavyweights Reliance Industries Ltd. and HDFC Bank Ltd. dragged. Indices fell on likely profit booking after they hit fresh record high.

At 11:39 a.m., the NSE Nifty 50 was trading 19.00 points, or 0.1%, lower at 23,548.00, and the S&P BSE Sensex was trading 161.87 points, or 0.21%, down at 77,317.06.

Intraday, the Nifty rose 0.42% to hit a fresh record high of 23,667.10. The S&P BSE Sensex rose 0.43% to 77,808.45.

"It's more of a consolidation. The Nifty 50 is oscillating in a rising channel," said Aditya Agarwala, head of research and investments at Invest4edu. "On the upside, (for Nifty) 23,700–23,750 is the resistance and 23,500 is the support. Till the time the index doesn't break 23,500, a massive fall is not expected. Similarly, if the resistance level is not broken, no massive gain is expected."

"More or less, it will be a time-wise correction. Markets can continue to make new highs by a few marginal points. We prefer not to read too much into such highs," he told NDTV Profit.

On the flipside, the Nifty Bank index, which had outperformed significantly on Thursday, is seeing some cooling off on Friday, Agarwala said. "The cool-off may extend by 200–300 points in this session or maybe next week. From there, markets may see another round of buying," he said.

India's benchmark stock indices fell by midday on Friday, erasing earlier gains as heavyweights Reliance Industries Ltd. and HDFC Bank Ltd. dragged. Indices fell on likely profit booking after they hit fresh record high.

At 11:39 a.m., the NSE Nifty 50 was trading 19.00 points, or 0.1%, lower at 23,548.00, and the S&P BSE Sensex was trading 161.87 points, or 0.21%, down at 77,317.06.

Intraday, the Nifty rose 0.42% to hit a fresh record high of 23,667.10. The S&P BSE Sensex rose 0.43% to 77,808.45.

"It's more of a consolidation. The Nifty 50 is oscillating in a rising channel," said Aditya Agarwala, head of research and investments at Invest4edu. "On the upside, (for Nifty) 23,700–23,750 is the resistance and 23,500 is the support. Till the time the index doesn't break 23,500, a massive fall is not expected. Similarly, if the resistance level is not broken, no massive gain is expected."

"More or less, it will be a time-wise correction. Markets can continue to make new highs by a few marginal points. We prefer not to read too much into such highs," he told NDTV Profit.

On the flipside, the Nifty Bank index, which had outperformed significantly on Thursday, is seeing some cooling off on Friday, Agarwala said. "The cool-off may extend by 200–300 points in this session or maybe next week. From there, markets may see another round of buying," he said.

India's benchmark stock indices fell by midday on Friday, erasing earlier gains as heavyweights Reliance Industries Ltd. and HDFC Bank Ltd. dragged. Indices fell on likely profit booking after they hit fresh record high.

At 11:39 a.m., the NSE Nifty 50 was trading 19.00 points, or 0.1%, lower at 23,548.00, and the S&P BSE Sensex was trading 161.87 points, or 0.21%, down at 77,317.06.

Intraday, the Nifty rose 0.42% to hit a fresh record high of 23,667.10. The S&P BSE Sensex rose 0.43% to 77,808.45.

"It's more of a consolidation. The Nifty 50 is oscillating in a rising channel," said Aditya Agarwala, head of research and investments at Invest4edu. "On the upside, (for Nifty) 23,700–23,750 is the resistance and 23,500 is the support. Till the time the index doesn't break 23,500, a massive fall is not expected. Similarly, if the resistance level is not broken, no massive gain is expected."

"More or less, it will be a time-wise correction. Markets can continue to make new highs by a few marginal points. We prefer not to read too much into such highs," he told NDTV Profit.

On the flipside, the Nifty Bank index, which had outperformed significantly on Thursday, is seeing some cooling off on Friday, Agarwala said. "The cool-off may extend by 200–300 points in this session or maybe next week. From there, markets may see another round of buying," he said.

HDFC Bank Ltd., Reliance Industries Ltd., Axis Bank Ltd., Larsen & Toubro Ltd., and Hindustan Unilever Ltd. weighed on the Nifty 50.

Infosys Ltd., Bharti Airtel Ltd., Tata Consultancy Services Ltd., Hindalco Industries Ltd., and NTPC Ltd. contributed to the index.

On the NSE, seven sectors declined and five sectors advanced. The NSE Nifty PSU Bank was the worst performer, and the NSE Nifty Media was the best performer.

.png)

India's benchmark stock indices fell by midday on Friday, erasing earlier gains as heavyweights Reliance Industries Ltd. and HDFC Bank Ltd. dragged. Indices fell on likely profit booking after they hit fresh record high.

At 11:39 a.m., the NSE Nifty 50 was trading 19.00 points, or 0.1%, lower at 23,548.00, and the S&P BSE Sensex was trading 161.87 points, or 0.21%, down at 77,317.06.

Intraday, the Nifty rose 0.42% to hit a fresh record high of 23,667.10. The S&P BSE Sensex rose 0.43% to 77,808.45.

"It's more of a consolidation. The Nifty 50 is oscillating in a rising channel," said Aditya Agarwala, head of research and investments at Invest4edu. "On the upside, (for Nifty) 23,700–23,750 is the resistance and 23,500 is the support. Till the time the index doesn't break 23,500, a massive fall is not expected. Similarly, if the resistance level is not broken, no massive gain is expected."

"More or less, it will be a time-wise correction. Markets can continue to make new highs by a few marginal points. We prefer not to read too much into such highs," he told NDTV Profit.

On the flipside, the Nifty Bank index, which had outperformed significantly on Thursday, is seeing some cooling off on Friday, Agarwala said. "The cool-off may extend by 200–300 points in this session or maybe next week. From there, markets may see another round of buying," he said.

India's benchmark stock indices fell by midday on Friday, erasing earlier gains as heavyweights Reliance Industries Ltd. and HDFC Bank Ltd. dragged. Indices fell on likely profit booking after they hit fresh record high.

At 11:39 a.m., the NSE Nifty 50 was trading 19.00 points, or 0.1%, lower at 23,548.00, and the S&P BSE Sensex was trading 161.87 points, or 0.21%, down at 77,317.06.

Intraday, the Nifty rose 0.42% to hit a fresh record high of 23,667.10. The S&P BSE Sensex rose 0.43% to 77,808.45.

"It's more of a consolidation. The Nifty 50 is oscillating in a rising channel," said Aditya Agarwala, head of research and investments at Invest4edu. "On the upside, (for Nifty) 23,700–23,750 is the resistance and 23,500 is the support. Till the time the index doesn't break 23,500, a massive fall is not expected. Similarly, if the resistance level is not broken, no massive gain is expected."

"More or less, it will be a time-wise correction. Markets can continue to make new highs by a few marginal points. We prefer not to read too much into such highs," he told NDTV Profit.

On the flipside, the Nifty Bank index, which had outperformed significantly on Thursday, is seeing some cooling off on Friday, Agarwala said. "The cool-off may extend by 200–300 points in this session or maybe next week. From there, markets may see another round of buying," he said.

India's benchmark stock indices fell by midday on Friday, erasing earlier gains as heavyweights Reliance Industries Ltd. and HDFC Bank Ltd. dragged. Indices fell on likely profit booking after they hit fresh record high.

At 11:39 a.m., the NSE Nifty 50 was trading 19.00 points, or 0.1%, lower at 23,548.00, and the S&P BSE Sensex was trading 161.87 points, or 0.21%, down at 77,317.06.

Intraday, the Nifty rose 0.42% to hit a fresh record high of 23,667.10. The S&P BSE Sensex rose 0.43% to 77,808.45.

"It's more of a consolidation. The Nifty 50 is oscillating in a rising channel," said Aditya Agarwala, head of research and investments at Invest4edu. "On the upside, (for Nifty) 23,700–23,750 is the resistance and 23,500 is the support. Till the time the index doesn't break 23,500, a massive fall is not expected. Similarly, if the resistance level is not broken, no massive gain is expected."

"More or less, it will be a time-wise correction. Markets can continue to make new highs by a few marginal points. We prefer not to read too much into such highs," he told NDTV Profit.

On the flipside, the Nifty Bank index, which had outperformed significantly on Thursday, is seeing some cooling off on Friday, Agarwala said. "The cool-off may extend by 200–300 points in this session or maybe next week. From there, markets may see another round of buying," he said.

India's benchmark stock indices fell by midday on Friday, erasing earlier gains as heavyweights Reliance Industries Ltd. and HDFC Bank Ltd. dragged. Indices fell on likely profit booking after they hit fresh record high.

At 11:39 a.m., the NSE Nifty 50 was trading 19.00 points, or 0.1%, lower at 23,548.00, and the S&P BSE Sensex was trading 161.87 points, or 0.21%, down at 77,317.06.

Intraday, the Nifty rose 0.42% to hit a fresh record high of 23,667.10. The S&P BSE Sensex rose 0.43% to 77,808.45.

"It's more of a consolidation. The Nifty 50 is oscillating in a rising channel," said Aditya Agarwala, head of research and investments at Invest4edu. "On the upside, (for Nifty) 23,700–23,750 is the resistance and 23,500 is the support. Till the time the index doesn't break 23,500, a massive fall is not expected. Similarly, if the resistance level is not broken, no massive gain is expected."

"More or less, it will be a time-wise correction. Markets can continue to make new highs by a few marginal points. We prefer not to read too much into such highs," he told NDTV Profit.

On the flipside, the Nifty Bank index, which had outperformed significantly on Thursday, is seeing some cooling off on Friday, Agarwala said. "The cool-off may extend by 200–300 points in this session or maybe next week. From there, markets may see another round of buying," he said.

India's benchmark stock indices fell by midday on Friday, erasing earlier gains as heavyweights Reliance Industries Ltd. and HDFC Bank Ltd. dragged. Indices fell on likely profit booking after they hit fresh record high.

At 11:39 a.m., the NSE Nifty 50 was trading 19.00 points, or 0.1%, lower at 23,548.00, and the S&P BSE Sensex was trading 161.87 points, or 0.21%, down at 77,317.06.

Intraday, the Nifty rose 0.42% to hit a fresh record high of 23,667.10. The S&P BSE Sensex rose 0.43% to 77,808.45.

"It's more of a consolidation. The Nifty 50 is oscillating in a rising channel," said Aditya Agarwala, head of research and investments at Invest4edu. "On the upside, (for Nifty) 23,700–23,750 is the resistance and 23,500 is the support. Till the time the index doesn't break 23,500, a massive fall is not expected. Similarly, if the resistance level is not broken, no massive gain is expected."

"More or less, it will be a time-wise correction. Markets can continue to make new highs by a few marginal points. We prefer not to read too much into such highs," he told NDTV Profit.

On the flipside, the Nifty Bank index, which had outperformed significantly on Thursday, is seeing some cooling off on Friday, Agarwala said. "The cool-off may extend by 200–300 points in this session or maybe next week. From there, markets may see another round of buying," he said.

India's benchmark stock indices fell by midday on Friday, erasing earlier gains as heavyweights Reliance Industries Ltd. and HDFC Bank Ltd. dragged. Indices fell on likely profit booking after they hit fresh record high.

At 11:39 a.m., the NSE Nifty 50 was trading 19.00 points, or 0.1%, lower at 23,548.00, and the S&P BSE Sensex was trading 161.87 points, or 0.21%, down at 77,317.06.

Intraday, the Nifty rose 0.42% to hit a fresh record high of 23,667.10. The S&P BSE Sensex rose 0.43% to 77,808.45.

"It's more of a consolidation. The Nifty 50 is oscillating in a rising channel," said Aditya Agarwala, head of research and investments at Invest4edu. "On the upside, (for Nifty) 23,700–23,750 is the resistance and 23,500 is the support. Till the time the index doesn't break 23,500, a massive fall is not expected. Similarly, if the resistance level is not broken, no massive gain is expected."

"More or less, it will be a time-wise correction. Markets can continue to make new highs by a few marginal points. We prefer not to read too much into such highs," he told NDTV Profit.

On the flipside, the Nifty Bank index, which had outperformed significantly on Thursday, is seeing some cooling off on Friday, Agarwala said. "The cool-off may extend by 200–300 points in this session or maybe next week. From there, markets may see another round of buying," he said.

India's benchmark stock indices fell by midday on Friday, erasing earlier gains as heavyweights Reliance Industries Ltd. and HDFC Bank Ltd. dragged. Indices fell on likely profit booking after they hit fresh record high.

At 11:39 a.m., the NSE Nifty 50 was trading 19.00 points, or 0.1%, lower at 23,548.00, and the S&P BSE Sensex was trading 161.87 points, or 0.21%, down at 77,317.06.

Intraday, the Nifty rose 0.42% to hit a fresh record high of 23,667.10. The S&P BSE Sensex rose 0.43% to 77,808.45.

"It's more of a consolidation. The Nifty 50 is oscillating in a rising channel," said Aditya Agarwala, head of research and investments at Invest4edu. "On the upside, (for Nifty) 23,700–23,750 is the resistance and 23,500 is the support. Till the time the index doesn't break 23,500, a massive fall is not expected. Similarly, if the resistance level is not broken, no massive gain is expected."

"More or less, it will be a time-wise correction. Markets can continue to make new highs by a few marginal points. We prefer not to read too much into such highs," he told NDTV Profit.

On the flipside, the Nifty Bank index, which had outperformed significantly on Thursday, is seeing some cooling off on Friday, Agarwala said. "The cool-off may extend by 200–300 points in this session or maybe next week. From there, markets may see another round of buying," he said.

India's benchmark stock indices fell by midday on Friday, erasing earlier gains as heavyweights Reliance Industries Ltd. and HDFC Bank Ltd. dragged. Indices fell on likely profit booking after they hit fresh record high.

At 11:39 a.m., the NSE Nifty 50 was trading 19.00 points, or 0.1%, lower at 23,548.00, and the S&P BSE Sensex was trading 161.87 points, or 0.21%, down at 77,317.06.

Intraday, the Nifty rose 0.42% to hit a fresh record high of 23,667.10. The S&P BSE Sensex rose 0.43% to 77,808.45.

"It's more of a consolidation. The Nifty 50 is oscillating in a rising channel," said Aditya Agarwala, head of research and investments at Invest4edu. "On the upside, (for Nifty) 23,700–23,750 is the resistance and 23,500 is the support. Till the time the index doesn't break 23,500, a massive fall is not expected. Similarly, if the resistance level is not broken, no massive gain is expected."

"More or less, it will be a time-wise correction. Markets can continue to make new highs by a few marginal points. We prefer not to read too much into such highs," he told NDTV Profit.

On the flipside, the Nifty Bank index, which had outperformed significantly on Thursday, is seeing some cooling off on Friday, Agarwala said. "The cool-off may extend by 200–300 points in this session or maybe next week. From there, markets may see another round of buying," he said.

HDFC Bank Ltd., Reliance Industries Ltd., Axis Bank Ltd., Larsen & Toubro Ltd., and Hindustan Unilever Ltd. weighed on the Nifty 50.

Infosys Ltd., Bharti Airtel Ltd., Tata Consultancy Services Ltd., Hindalco Industries Ltd., and NTPC Ltd. contributed to the index.

On the NSE, seven sectors declined and five sectors advanced. The NSE Nifty PSU Bank was the worst performer, and the NSE Nifty Media was the best performer.

India's benchmark stock indices fell by midday on Friday, erasing earlier gains as heavyweights Reliance Industries Ltd. and HDFC Bank Ltd. dragged. Indices fell on likely profit booking after they hit fresh record high.

At 11:39 a.m., the NSE Nifty 50 was trading 19.00 points, or 0.1%, lower at 23,548.00, and the S&P BSE Sensex was trading 161.87 points, or 0.21%, down at 77,317.06.

Intraday, the Nifty rose 0.42% to hit a fresh record high of 23,667.10. The S&P BSE Sensex rose 0.43% to 77,808.45.

"It's more of a consolidation. The Nifty 50 is oscillating in a rising channel," said Aditya Agarwala, head of research and investments at Invest4edu. "On the upside, (for Nifty) 23,700–23,750 is the resistance and 23,500 is the support. Till the time the index doesn't break 23,500, a massive fall is not expected. Similarly, if the resistance level is not broken, no massive gain is expected."

"More or less, it will be a time-wise correction. Markets can continue to make new highs by a few marginal points. We prefer not to read too much into such highs," he told NDTV Profit.

On the flipside, the Nifty Bank index, which had outperformed significantly on Thursday, is seeing some cooling off on Friday, Agarwala said. "The cool-off may extend by 200–300 points in this session or maybe next week. From there, markets may see another round of buying," he said.

India's benchmark stock indices fell by midday on Friday, erasing earlier gains as heavyweights Reliance Industries Ltd. and HDFC Bank Ltd. dragged. Indices fell on likely profit booking after they hit fresh record high.

At 11:39 a.m., the NSE Nifty 50 was trading 19.00 points, or 0.1%, lower at 23,548.00, and the S&P BSE Sensex was trading 161.87 points, or 0.21%, down at 77,317.06.

Intraday, the Nifty rose 0.42% to hit a fresh record high of 23,667.10. The S&P BSE Sensex rose 0.43% to 77,808.45.

"It's more of a consolidation. The Nifty 50 is oscillating in a rising channel," said Aditya Agarwala, head of research and investments at Invest4edu. "On the upside, (for Nifty) 23,700–23,750 is the resistance and 23,500 is the support. Till the time the index doesn't break 23,500, a massive fall is not expected. Similarly, if the resistance level is not broken, no massive gain is expected."

"More or less, it will be a time-wise correction. Markets can continue to make new highs by a few marginal points. We prefer not to read too much into such highs," he told NDTV Profit.

On the flipside, the Nifty Bank index, which had outperformed significantly on Thursday, is seeing some cooling off on Friday, Agarwala said. "The cool-off may extend by 200–300 points in this session or maybe next week. From there, markets may see another round of buying," he said.

India's benchmark stock indices fell by midday on Friday, erasing earlier gains as heavyweights Reliance Industries Ltd. and HDFC Bank Ltd. dragged. Indices fell on likely profit booking after they hit fresh record high.

At 11:39 a.m., the NSE Nifty 50 was trading 19.00 points, or 0.1%, lower at 23,548.00, and the S&P BSE Sensex was trading 161.87 points, or 0.21%, down at 77,317.06.

Intraday, the Nifty rose 0.42% to hit a fresh record high of 23,667.10. The S&P BSE Sensex rose 0.43% to 77,808.45.

"It's more of a consolidation. The Nifty 50 is oscillating in a rising channel," said Aditya Agarwala, head of research and investments at Invest4edu. "On the upside, (for Nifty) 23,700–23,750 is the resistance and 23,500 is the support. Till the time the index doesn't break 23,500, a massive fall is not expected. Similarly, if the resistance level is not broken, no massive gain is expected."

"More or less, it will be a time-wise correction. Markets can continue to make new highs by a few marginal points. We prefer not to read too much into such highs," he told NDTV Profit.

On the flipside, the Nifty Bank index, which had outperformed significantly on Thursday, is seeing some cooling off on Friday, Agarwala said. "The cool-off may extend by 200–300 points in this session or maybe next week. From there, markets may see another round of buying," he said.

India's benchmark stock indices fell by midday on Friday, erasing earlier gains as heavyweights Reliance Industries Ltd. and HDFC Bank Ltd. dragged. Indices fell on likely profit booking after they hit fresh record high.

At 11:39 a.m., the NSE Nifty 50 was trading 19.00 points, or 0.1%, lower at 23,548.00, and the S&P BSE Sensex was trading 161.87 points, or 0.21%, down at 77,317.06.

Intraday, the Nifty rose 0.42% to hit a fresh record high of 23,667.10. The S&P BSE Sensex rose 0.43% to 77,808.45.

"It's more of a consolidation. The Nifty 50 is oscillating in a rising channel," said Aditya Agarwala, head of research and investments at Invest4edu. "On the upside, (for Nifty) 23,700–23,750 is the resistance and 23,500 is the support. Till the time the index doesn't break 23,500, a massive fall is not expected. Similarly, if the resistance level is not broken, no massive gain is expected."

"More or less, it will be a time-wise correction. Markets can continue to make new highs by a few marginal points. We prefer not to read too much into such highs," he told NDTV Profit.

On the flipside, the Nifty Bank index, which had outperformed significantly on Thursday, is seeing some cooling off on Friday, Agarwala said. "The cool-off may extend by 200–300 points in this session or maybe next week. From there, markets may see another round of buying," he said.

India's benchmark stock indices fell by midday on Friday, erasing earlier gains as heavyweights Reliance Industries Ltd. and HDFC Bank Ltd. dragged. Indices fell on likely profit booking after they hit fresh record high.

At 11:39 a.m., the NSE Nifty 50 was trading 19.00 points, or 0.1%, lower at 23,548.00, and the S&P BSE Sensex was trading 161.87 points, or 0.21%, down at 77,317.06.

Intraday, the Nifty rose 0.42% to hit a fresh record high of 23,667.10. The S&P BSE Sensex rose 0.43% to 77,808.45.

"It's more of a consolidation. The Nifty 50 is oscillating in a rising channel," said Aditya Agarwala, head of research and investments at Invest4edu. "On the upside, (for Nifty) 23,700–23,750 is the resistance and 23,500 is the support. Till the time the index doesn't break 23,500, a massive fall is not expected. Similarly, if the resistance level is not broken, no massive gain is expected."

"More or less, it will be a time-wise correction. Markets can continue to make new highs by a few marginal points. We prefer not to read too much into such highs," he told NDTV Profit.

On the flipside, the Nifty Bank index, which had outperformed significantly on Thursday, is seeing some cooling off on Friday, Agarwala said. "The cool-off may extend by 200–300 points in this session or maybe next week. From there, markets may see another round of buying," he said.

India's benchmark stock indices fell by midday on Friday, erasing earlier gains as heavyweights Reliance Industries Ltd. and HDFC Bank Ltd. dragged. Indices fell on likely profit booking after they hit fresh record high.

At 11:39 a.m., the NSE Nifty 50 was trading 19.00 points, or 0.1%, lower at 23,548.00, and the S&P BSE Sensex was trading 161.87 points, or 0.21%, down at 77,317.06.

Intraday, the Nifty rose 0.42% to hit a fresh record high of 23,667.10. The S&P BSE Sensex rose 0.43% to 77,808.45.

"It's more of a consolidation. The Nifty 50 is oscillating in a rising channel," said Aditya Agarwala, head of research and investments at Invest4edu. "On the upside, (for Nifty) 23,700–23,750 is the resistance and 23,500 is the support. Till the time the index doesn't break 23,500, a massive fall is not expected. Similarly, if the resistance level is not broken, no massive gain is expected."

"More or less, it will be a time-wise correction. Markets can continue to make new highs by a few marginal points. We prefer not to read too much into such highs," he told NDTV Profit.

On the flipside, the Nifty Bank index, which had outperformed significantly on Thursday, is seeing some cooling off on Friday, Agarwala said. "The cool-off may extend by 200–300 points in this session or maybe next week. From there, markets may see another round of buying," he said.

India's benchmark stock indices fell by midday on Friday, erasing earlier gains as heavyweights Reliance Industries Ltd. and HDFC Bank Ltd. dragged. Indices fell on likely profit booking after they hit fresh record high.

At 11:39 a.m., the NSE Nifty 50 was trading 19.00 points, or 0.1%, lower at 23,548.00, and the S&P BSE Sensex was trading 161.87 points, or 0.21%, down at 77,317.06.

Intraday, the Nifty rose 0.42% to hit a fresh record high of 23,667.10. The S&P BSE Sensex rose 0.43% to 77,808.45.

"It's more of a consolidation. The Nifty 50 is oscillating in a rising channel," said Aditya Agarwala, head of research and investments at Invest4edu. "On the upside, (for Nifty) 23,700–23,750 is the resistance and 23,500 is the support. Till the time the index doesn't break 23,500, a massive fall is not expected. Similarly, if the resistance level is not broken, no massive gain is expected."

"More or less, it will be a time-wise correction. Markets can continue to make new highs by a few marginal points. We prefer not to read too much into such highs," he told NDTV Profit.

On the flipside, the Nifty Bank index, which had outperformed significantly on Thursday, is seeing some cooling off on Friday, Agarwala said. "The cool-off may extend by 200–300 points in this session or maybe next week. From there, markets may see another round of buying," he said.

India's benchmark stock indices fell by midday on Friday, erasing earlier gains as heavyweights Reliance Industries Ltd. and HDFC Bank Ltd. dragged. Indices fell on likely profit booking after they hit fresh record high.

At 11:39 a.m., the NSE Nifty 50 was trading 19.00 points, or 0.1%, lower at 23,548.00, and the S&P BSE Sensex was trading 161.87 points, or 0.21%, down at 77,317.06.

Intraday, the Nifty rose 0.42% to hit a fresh record high of 23,667.10. The S&P BSE Sensex rose 0.43% to 77,808.45.

"It's more of a consolidation. The Nifty 50 is oscillating in a rising channel," said Aditya Agarwala, head of research and investments at Invest4edu. "On the upside, (for Nifty) 23,700–23,750 is the resistance and 23,500 is the support. Till the time the index doesn't break 23,500, a massive fall is not expected. Similarly, if the resistance level is not broken, no massive gain is expected."

"More or less, it will be a time-wise correction. Markets can continue to make new highs by a few marginal points. We prefer not to read too much into such highs," he told NDTV Profit.

On the flipside, the Nifty Bank index, which had outperformed significantly on Thursday, is seeing some cooling off on Friday, Agarwala said. "The cool-off may extend by 200–300 points in this session or maybe next week. From there, markets may see another round of buying," he said.

HDFC Bank Ltd., Reliance Industries Ltd., Axis Bank Ltd., Larsen & Toubro Ltd., and Hindustan Unilever Ltd. weighed on the Nifty 50.

Infosys Ltd., Bharti Airtel Ltd., Tata Consultancy Services Ltd., Hindalco Industries Ltd., and NTPC Ltd. contributed to the index.