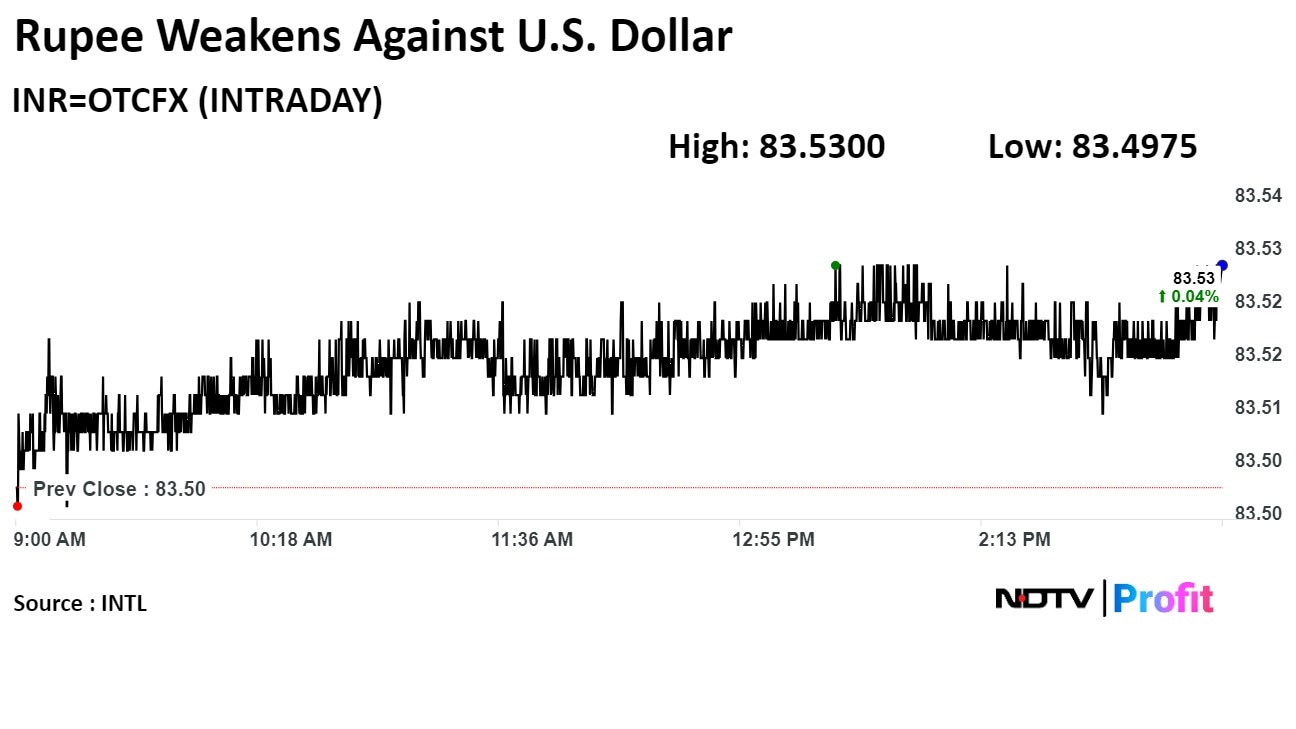

The local currency weakened by 3 paise to close at 83.52 against the U.S dollar.

It closed at 83.49 on Friday.

Source: Bloomberg

The local currency weakened by 3 paise to close at 83.52 against the U.S dollar.

It closed at 83.49 on Friday.

Source: Bloomberg

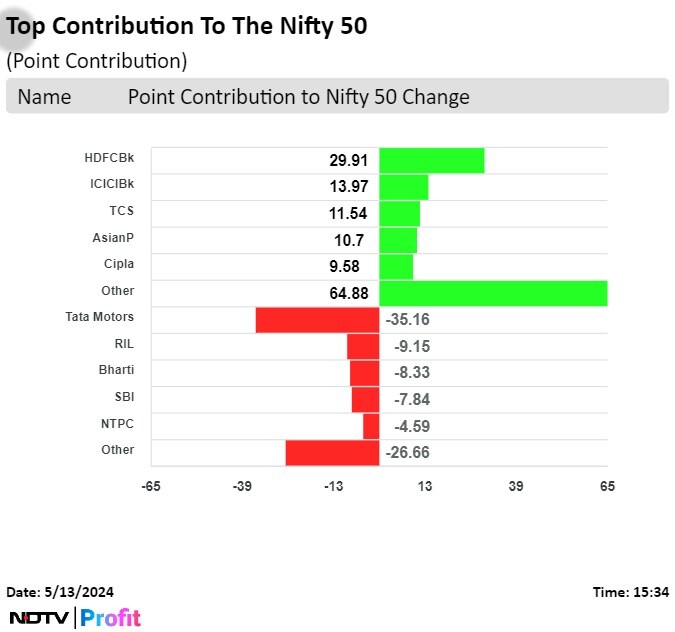

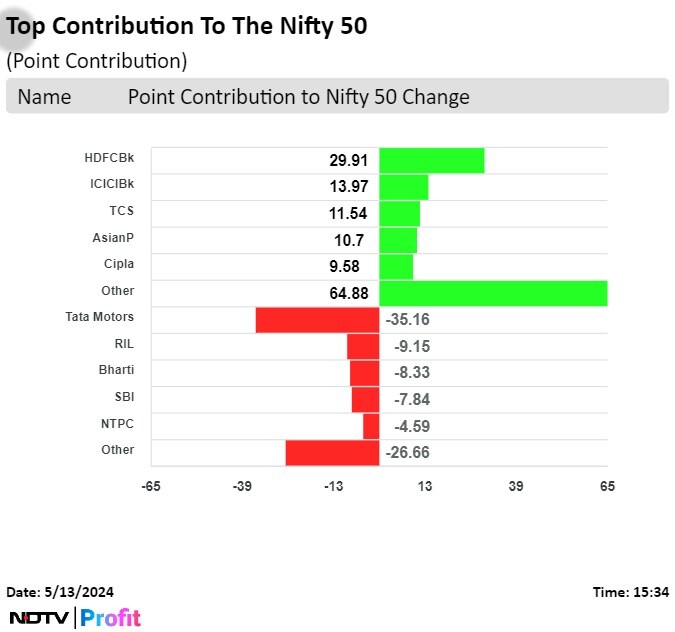

India's benchmark indices recovered from the day's low to end higher for a second consecutive session as heavyweight HDFC Bank Ltd., ICICI Bank Ltd., and Tata Consultancy Services Ltd. rose.

The NSE Nifty 50 settled 48.85 points or 0.22% higher at 22,104.05, and the S&P BSE Sensex ended 111.66 points or 0.15% higher at 72,776.13.

During the day, the NSE Nifty 50 declined 1.06%, or 234.15 points, to 21,821.05, and the S&P BSE Sensex fell 1.10%, or 798.46 points, to 71,866.01.

The NSE Nifty 50 recovered nearly 299 points from the day's low, and the S&P BSE recouped 910.12 points.

India's benchmark indices recovered from the day's low to end higher for a second consecutive session as heavyweight HDFC Bank Ltd., ICICI Bank Ltd., and Tata Consultancy Services Ltd. rose.

The NSE Nifty 50 settled 48.85 points or 0.22% higher at 22,104.05, and the S&P BSE Sensex ended 111.66 points or 0.15% higher at 72,776.13.

During the day, the NSE Nifty 50 declined 1.06%, or 234.15 points, to 21,821.05, and the S&P BSE Sensex fell 1.10%, or 798.46 points, to 71,866.01.

The NSE Nifty 50 recovered nearly 299 points from the day's low, and the S&P BSE recouped 910.12 points.

India's benchmark indices recovered from the day's low to end higher for a second consecutive session as heavyweight HDFC Bank Ltd., ICICI Bank Ltd., and Tata Consultancy Services Ltd. rose.

The NSE Nifty 50 settled 48.85 points or 0.22% higher at 22,104.05, and the S&P BSE Sensex ended 111.66 points or 0.15% higher at 72,776.13.

During the day, the NSE Nifty 50 declined 1.06%, or 234.15 points, to 21,821.05, and the S&P BSE Sensex fell 1.10%, or 798.46 points, to 71,866.01.

The NSE Nifty 50 recovered nearly 299 points from the day's low, and the S&P BSE recouped 910.12 points.

India's benchmark indices recovered from the day's low to end higher for a second consecutive session as heavyweight HDFC Bank Ltd., ICICI Bank Ltd., and Tata Consultancy Services Ltd. rose.

The NSE Nifty 50 settled 48.85 points or 0.22% higher at 22,104.05, and the S&P BSE Sensex ended 111.66 points or 0.15% higher at 72,776.13.

During the day, the NSE Nifty 50 declined 1.06%, or 234.15 points, to 21,821.05, and the S&P BSE Sensex fell 1.10%, or 798.46 points, to 71,866.01.

The NSE Nifty 50 recovered nearly 299 points from the day's low, and the S&P BSE recouped 910.12 points.

"Indian equities commenced the week on a tepid note and in the opening trade itself, the Index lost its psychological support of 22,000 to test crucial support of 21,830. After oscillating around the support level, a V-shaped recovery was seen in the markets which pushed the Index higher to reclaim the level of 22,000. With gains of 48.85 points, Nifty50 settled the day at 22,104.05," said Aditya Gaggar, director, Progressive Shares.

Pharma and Metal counters contributed the most in the recovery followed by Banking counters while the Auto sector was in the reverse gear in today's trade. Disparity was seen in the Broader markets where Midcaps gained over 0.40% to outperform the Benchmark Index while Smallcaps ended the session in red and underperformed. On the daily time frame, the Index successfully held its support of 21,830 and reversed to form a bullish candlestick pattern. As per the pattern, it seems that the short-term bottom is placed. Once the Index gives a convincing move above the immediate hurdle of 22,250, then we can consider a reversal of the trend.

India's benchmark indices recovered from the day's low to end higher for a second consecutive session as heavyweight HDFC Bank Ltd., ICICI Bank Ltd., and Tata Consultancy Services Ltd. rose.

The NSE Nifty 50 settled 48.85 points or 0.22% higher at 22,104.05, and the S&P BSE Sensex ended 111.66 points or 0.15% higher at 72,776.13.

During the day, the NSE Nifty 50 declined 1.06%, or 234.15 points, to 21,821.05, and the S&P BSE Sensex fell 1.10%, or 798.46 points, to 71,866.01.

The NSE Nifty 50 recovered nearly 299 points from the day's low, and the S&P BSE recouped 910.12 points.

India's benchmark indices recovered from the day's low to end higher for a second consecutive session as heavyweight HDFC Bank Ltd., ICICI Bank Ltd., and Tata Consultancy Services Ltd. rose.

The NSE Nifty 50 settled 48.85 points or 0.22% higher at 22,104.05, and the S&P BSE Sensex ended 111.66 points or 0.15% higher at 72,776.13.

During the day, the NSE Nifty 50 declined 1.06%, or 234.15 points, to 21,821.05, and the S&P BSE Sensex fell 1.10%, or 798.46 points, to 71,866.01.

The NSE Nifty 50 recovered nearly 299 points from the day's low, and the S&P BSE recouped 910.12 points.

India's benchmark indices recovered from the day's low to end higher for a second consecutive session as heavyweight HDFC Bank Ltd., ICICI Bank Ltd., and Tata Consultancy Services Ltd. rose.

The NSE Nifty 50 settled 48.85 points or 0.22% higher at 22,104.05, and the S&P BSE Sensex ended 111.66 points or 0.15% higher at 72,776.13.

During the day, the NSE Nifty 50 declined 1.06%, or 234.15 points, to 21,821.05, and the S&P BSE Sensex fell 1.10%, or 798.46 points, to 71,866.01.

The NSE Nifty 50 recovered nearly 299 points from the day's low, and the S&P BSE recouped 910.12 points.

India's benchmark indices recovered from the day's low to end higher for a second consecutive session as heavyweight HDFC Bank Ltd., ICICI Bank Ltd., and Tata Consultancy Services Ltd. rose.

The NSE Nifty 50 settled 48.85 points or 0.22% higher at 22,104.05, and the S&P BSE Sensex ended 111.66 points or 0.15% higher at 72,776.13.

During the day, the NSE Nifty 50 declined 1.06%, or 234.15 points, to 21,821.05, and the S&P BSE Sensex fell 1.10%, or 798.46 points, to 71,866.01.

The NSE Nifty 50 recovered nearly 299 points from the day's low, and the S&P BSE recouped 910.12 points.

"Indian equities commenced the week on a tepid note and in the opening trade itself, the Index lost its psychological support of 22,000 to test crucial support of 21,830. After oscillating around the support level, a V-shaped recovery was seen in the markets which pushed the Index higher to reclaim the level of 22,000. With gains of 48.85 points, Nifty50 settled the day at 22,104.05," said Aditya Gaggar, director, Progressive Shares.

Pharma and Metal counters contributed the most in the recovery followed by Banking counters while the Auto sector was in the reverse gear in today's trade. Disparity was seen in the Broader markets where Midcaps gained over 0.40% to outperform the Benchmark Index while Smallcaps ended the session in red and underperformed. On the daily time frame, the Index successfully held its support of 21,830 and reversed to form a bullish candlestick pattern. As per the pattern, it seems that the short-term bottom is placed. Once the Index gives a convincing move above the immediate hurdle of 22,250, then we can consider a reversal of the trend.

.png)

HDFC Bank Ltd., ICICI Bank Ltd., Tata Consultancy Services Ltd., Asian Paints Ltd., and Cipla Ltd. added to the index.

Tata Motors Ltd., Reliance Industries Ltd., Bharti Airtel Ltd., State Bank of India, and NTPC weighed on the benchmark.

India's benchmark indices recovered from the day's low to end higher for a second consecutive session as heavyweight HDFC Bank Ltd., ICICI Bank Ltd., and Tata Consultancy Services Ltd. rose.

The NSE Nifty 50 settled 48.85 points or 0.22% higher at 22,104.05, and the S&P BSE Sensex ended 111.66 points or 0.15% higher at 72,776.13.

During the day, the NSE Nifty 50 declined 1.06%, or 234.15 points, to 21,821.05, and the S&P BSE Sensex fell 1.10%, or 798.46 points, to 71,866.01.

The NSE Nifty 50 recovered nearly 299 points from the day's low, and the S&P BSE recouped 910.12 points.

India's benchmark indices recovered from the day's low to end higher for a second consecutive session as heavyweight HDFC Bank Ltd., ICICI Bank Ltd., and Tata Consultancy Services Ltd. rose.

The NSE Nifty 50 settled 48.85 points or 0.22% higher at 22,104.05, and the S&P BSE Sensex ended 111.66 points or 0.15% higher at 72,776.13.

During the day, the NSE Nifty 50 declined 1.06%, or 234.15 points, to 21,821.05, and the S&P BSE Sensex fell 1.10%, or 798.46 points, to 71,866.01.

The NSE Nifty 50 recovered nearly 299 points from the day's low, and the S&P BSE recouped 910.12 points.

India's benchmark indices recovered from the day's low to end higher for a second consecutive session as heavyweight HDFC Bank Ltd., ICICI Bank Ltd., and Tata Consultancy Services Ltd. rose.

The NSE Nifty 50 settled 48.85 points or 0.22% higher at 22,104.05, and the S&P BSE Sensex ended 111.66 points or 0.15% higher at 72,776.13.

During the day, the NSE Nifty 50 declined 1.06%, or 234.15 points, to 21,821.05, and the S&P BSE Sensex fell 1.10%, or 798.46 points, to 71,866.01.

The NSE Nifty 50 recovered nearly 299 points from the day's low, and the S&P BSE recouped 910.12 points.

India's benchmark indices recovered from the day's low to end higher for a second consecutive session as heavyweight HDFC Bank Ltd., ICICI Bank Ltd., and Tata Consultancy Services Ltd. rose.

The NSE Nifty 50 settled 48.85 points or 0.22% higher at 22,104.05, and the S&P BSE Sensex ended 111.66 points or 0.15% higher at 72,776.13.

During the day, the NSE Nifty 50 declined 1.06%, or 234.15 points, to 21,821.05, and the S&P BSE Sensex fell 1.10%, or 798.46 points, to 71,866.01.

The NSE Nifty 50 recovered nearly 299 points from the day's low, and the S&P BSE recouped 910.12 points.

"Indian equities commenced the week on a tepid note and in the opening trade itself, the Index lost its psychological support of 22,000 to test crucial support of 21,830. After oscillating around the support level, a V-shaped recovery was seen in the markets which pushed the Index higher to reclaim the level of 22,000. With gains of 48.85 points, Nifty50 settled the day at 22,104.05," said Aditya Gaggar, director, Progressive Shares.

Pharma and Metal counters contributed the most in the recovery followed by Banking counters while the Auto sector was in the reverse gear in today's trade. Disparity was seen in the Broader markets where Midcaps gained over 0.40% to outperform the Benchmark Index while Smallcaps ended the session in red and underperformed. On the daily time frame, the Index successfully held its support of 21,830 and reversed to form a bullish candlestick pattern. As per the pattern, it seems that the short-term bottom is placed. Once the Index gives a convincing move above the immediate hurdle of 22,250, then we can consider a reversal of the trend.

India's benchmark indices recovered from the day's low to end higher for a second consecutive session as heavyweight HDFC Bank Ltd., ICICI Bank Ltd., and Tata Consultancy Services Ltd. rose.

The NSE Nifty 50 settled 48.85 points or 0.22% higher at 22,104.05, and the S&P BSE Sensex ended 111.66 points or 0.15% higher at 72,776.13.

During the day, the NSE Nifty 50 declined 1.06%, or 234.15 points, to 21,821.05, and the S&P BSE Sensex fell 1.10%, or 798.46 points, to 71,866.01.

The NSE Nifty 50 recovered nearly 299 points from the day's low, and the S&P BSE recouped 910.12 points.

India's benchmark indices recovered from the day's low to end higher for a second consecutive session as heavyweight HDFC Bank Ltd., ICICI Bank Ltd., and Tata Consultancy Services Ltd. rose.

The NSE Nifty 50 settled 48.85 points or 0.22% higher at 22,104.05, and the S&P BSE Sensex ended 111.66 points or 0.15% higher at 72,776.13.

During the day, the NSE Nifty 50 declined 1.06%, or 234.15 points, to 21,821.05, and the S&P BSE Sensex fell 1.10%, or 798.46 points, to 71,866.01.

The NSE Nifty 50 recovered nearly 299 points from the day's low, and the S&P BSE recouped 910.12 points.

India's benchmark indices recovered from the day's low to end higher for a second consecutive session as heavyweight HDFC Bank Ltd., ICICI Bank Ltd., and Tata Consultancy Services Ltd. rose.

The NSE Nifty 50 settled 48.85 points or 0.22% higher at 22,104.05, and the S&P BSE Sensex ended 111.66 points or 0.15% higher at 72,776.13.

During the day, the NSE Nifty 50 declined 1.06%, or 234.15 points, to 21,821.05, and the S&P BSE Sensex fell 1.10%, or 798.46 points, to 71,866.01.

The NSE Nifty 50 recovered nearly 299 points from the day's low, and the S&P BSE recouped 910.12 points.

India's benchmark indices recovered from the day's low to end higher for a second consecutive session as heavyweight HDFC Bank Ltd., ICICI Bank Ltd., and Tata Consultancy Services Ltd. rose.

The NSE Nifty 50 settled 48.85 points or 0.22% higher at 22,104.05, and the S&P BSE Sensex ended 111.66 points or 0.15% higher at 72,776.13.

During the day, the NSE Nifty 50 declined 1.06%, or 234.15 points, to 21,821.05, and the S&P BSE Sensex fell 1.10%, or 798.46 points, to 71,866.01.

The NSE Nifty 50 recovered nearly 299 points from the day's low, and the S&P BSE recouped 910.12 points.

"Indian equities commenced the week on a tepid note and in the opening trade itself, the Index lost its psychological support of 22,000 to test crucial support of 21,830. After oscillating around the support level, a V-shaped recovery was seen in the markets which pushed the Index higher to reclaim the level of 22,000. With gains of 48.85 points, Nifty50 settled the day at 22,104.05," said Aditya Gaggar, director, Progressive Shares.

Pharma and Metal counters contributed the most in the recovery followed by Banking counters while the Auto sector was in the reverse gear in today's trade. Disparity was seen in the Broader markets where Midcaps gained over 0.40% to outperform the Benchmark Index while Smallcaps ended the session in red and underperformed. On the daily time frame, the Index successfully held its support of 21,830 and reversed to form a bullish candlestick pattern. As per the pattern, it seems that the short-term bottom is placed. Once the Index gives a convincing move above the immediate hurdle of 22,250, then we can consider a reversal of the trend.

.png)

HDFC Bank Ltd., ICICI Bank Ltd., Tata Consultancy Services Ltd., Asian Paints Ltd., and Cipla Ltd. added to the index.

Tata Motors Ltd., Reliance Industries Ltd., Bharti Airtel Ltd., State Bank of India, and NTPC weighed on the benchmark.

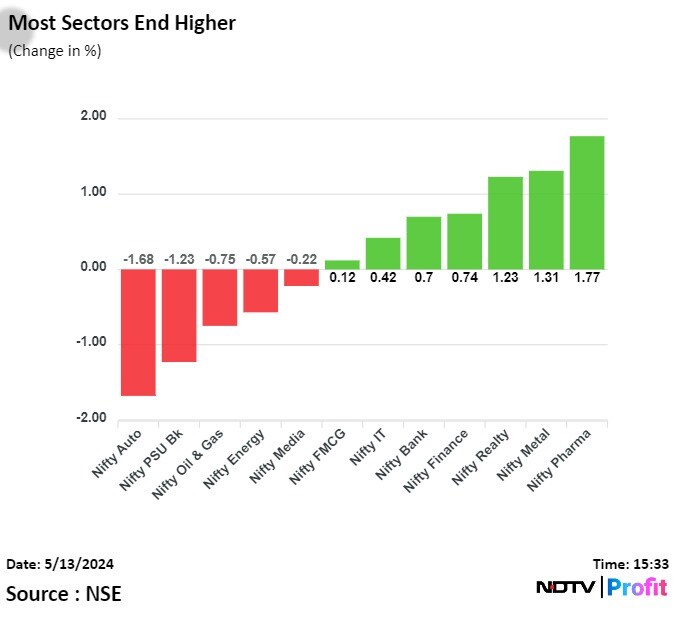

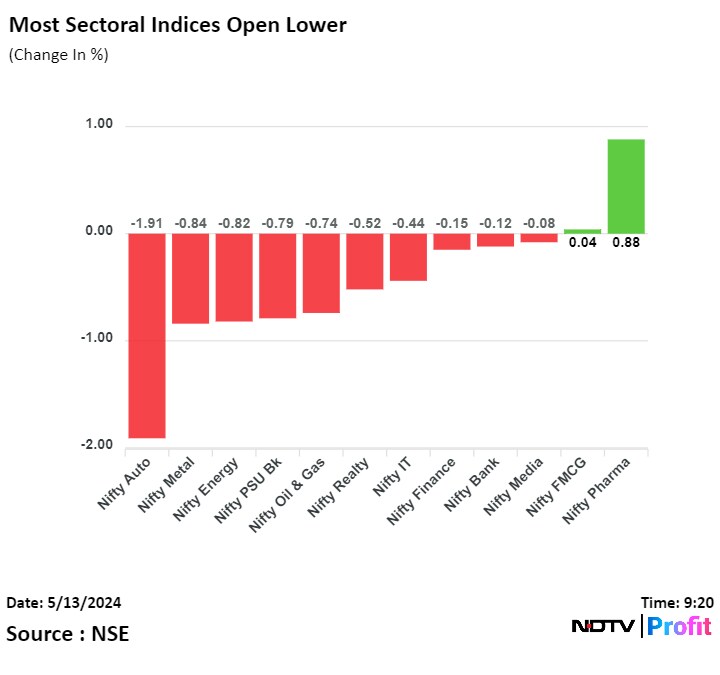

On NSE, seven sectors out of 12 ended higher, and five ended lower. The NSE Nifty Auto was the worst performing sector. The NSE Nifty Pharma index was the best performing sector.

India's benchmark indices recovered from the day's low to end higher for a second consecutive session as heavyweight HDFC Bank Ltd., ICICI Bank Ltd., and Tata Consultancy Services Ltd. rose.

The NSE Nifty 50 settled 48.85 points or 0.22% higher at 22,104.05, and the S&P BSE Sensex ended 111.66 points or 0.15% higher at 72,776.13.

During the day, the NSE Nifty 50 declined 1.06%, or 234.15 points, to 21,821.05, and the S&P BSE Sensex fell 1.10%, or 798.46 points, to 71,866.01.

The NSE Nifty 50 recovered nearly 299 points from the day's low, and the S&P BSE recouped 910.12 points.

India's benchmark indices recovered from the day's low to end higher for a second consecutive session as heavyweight HDFC Bank Ltd., ICICI Bank Ltd., and Tata Consultancy Services Ltd. rose.

The NSE Nifty 50 settled 48.85 points or 0.22% higher at 22,104.05, and the S&P BSE Sensex ended 111.66 points or 0.15% higher at 72,776.13.

During the day, the NSE Nifty 50 declined 1.06%, or 234.15 points, to 21,821.05, and the S&P BSE Sensex fell 1.10%, or 798.46 points, to 71,866.01.

The NSE Nifty 50 recovered nearly 299 points from the day's low, and the S&P BSE recouped 910.12 points.

India's benchmark indices recovered from the day's low to end higher for a second consecutive session as heavyweight HDFC Bank Ltd., ICICI Bank Ltd., and Tata Consultancy Services Ltd. rose.

The NSE Nifty 50 settled 48.85 points or 0.22% higher at 22,104.05, and the S&P BSE Sensex ended 111.66 points or 0.15% higher at 72,776.13.

During the day, the NSE Nifty 50 declined 1.06%, or 234.15 points, to 21,821.05, and the S&P BSE Sensex fell 1.10%, or 798.46 points, to 71,866.01.

The NSE Nifty 50 recovered nearly 299 points from the day's low, and the S&P BSE recouped 910.12 points.

India's benchmark indices recovered from the day's low to end higher for a second consecutive session as heavyweight HDFC Bank Ltd., ICICI Bank Ltd., and Tata Consultancy Services Ltd. rose.

The NSE Nifty 50 settled 48.85 points or 0.22% higher at 22,104.05, and the S&P BSE Sensex ended 111.66 points or 0.15% higher at 72,776.13.

During the day, the NSE Nifty 50 declined 1.06%, or 234.15 points, to 21,821.05, and the S&P BSE Sensex fell 1.10%, or 798.46 points, to 71,866.01.

The NSE Nifty 50 recovered nearly 299 points from the day's low, and the S&P BSE recouped 910.12 points.

"Indian equities commenced the week on a tepid note and in the opening trade itself, the Index lost its psychological support of 22,000 to test crucial support of 21,830. After oscillating around the support level, a V-shaped recovery was seen in the markets which pushed the Index higher to reclaim the level of 22,000. With gains of 48.85 points, Nifty50 settled the day at 22,104.05," said Aditya Gaggar, director, Progressive Shares.

Pharma and Metal counters contributed the most in the recovery followed by Banking counters while the Auto sector was in the reverse gear in today's trade. Disparity was seen in the Broader markets where Midcaps gained over 0.40% to outperform the Benchmark Index while Smallcaps ended the session in red and underperformed. On the daily time frame, the Index successfully held its support of 21,830 and reversed to form a bullish candlestick pattern. As per the pattern, it seems that the short-term bottom is placed. Once the Index gives a convincing move above the immediate hurdle of 22,250, then we can consider a reversal of the trend.

India's benchmark indices recovered from the day's low to end higher for a second consecutive session as heavyweight HDFC Bank Ltd., ICICI Bank Ltd., and Tata Consultancy Services Ltd. rose.

The NSE Nifty 50 settled 48.85 points or 0.22% higher at 22,104.05, and the S&P BSE Sensex ended 111.66 points or 0.15% higher at 72,776.13.

During the day, the NSE Nifty 50 declined 1.06%, or 234.15 points, to 21,821.05, and the S&P BSE Sensex fell 1.10%, or 798.46 points, to 71,866.01.

The NSE Nifty 50 recovered nearly 299 points from the day's low, and the S&P BSE recouped 910.12 points.

India's benchmark indices recovered from the day's low to end higher for a second consecutive session as heavyweight HDFC Bank Ltd., ICICI Bank Ltd., and Tata Consultancy Services Ltd. rose.

The NSE Nifty 50 settled 48.85 points or 0.22% higher at 22,104.05, and the S&P BSE Sensex ended 111.66 points or 0.15% higher at 72,776.13.

During the day, the NSE Nifty 50 declined 1.06%, or 234.15 points, to 21,821.05, and the S&P BSE Sensex fell 1.10%, or 798.46 points, to 71,866.01.

The NSE Nifty 50 recovered nearly 299 points from the day's low, and the S&P BSE recouped 910.12 points.

India's benchmark indices recovered from the day's low to end higher for a second consecutive session as heavyweight HDFC Bank Ltd., ICICI Bank Ltd., and Tata Consultancy Services Ltd. rose.

The NSE Nifty 50 settled 48.85 points or 0.22% higher at 22,104.05, and the S&P BSE Sensex ended 111.66 points or 0.15% higher at 72,776.13.

During the day, the NSE Nifty 50 declined 1.06%, or 234.15 points, to 21,821.05, and the S&P BSE Sensex fell 1.10%, or 798.46 points, to 71,866.01.

The NSE Nifty 50 recovered nearly 299 points from the day's low, and the S&P BSE recouped 910.12 points.

India's benchmark indices recovered from the day's low to end higher for a second consecutive session as heavyweight HDFC Bank Ltd., ICICI Bank Ltd., and Tata Consultancy Services Ltd. rose.

The NSE Nifty 50 settled 48.85 points or 0.22% higher at 22,104.05, and the S&P BSE Sensex ended 111.66 points or 0.15% higher at 72,776.13.

During the day, the NSE Nifty 50 declined 1.06%, or 234.15 points, to 21,821.05, and the S&P BSE Sensex fell 1.10%, or 798.46 points, to 71,866.01.

The NSE Nifty 50 recovered nearly 299 points from the day's low, and the S&P BSE recouped 910.12 points.

"Indian equities commenced the week on a tepid note and in the opening trade itself, the Index lost its psychological support of 22,000 to test crucial support of 21,830. After oscillating around the support level, a V-shaped recovery was seen in the markets which pushed the Index higher to reclaim the level of 22,000. With gains of 48.85 points, Nifty50 settled the day at 22,104.05," said Aditya Gaggar, director, Progressive Shares.

Pharma and Metal counters contributed the most in the recovery followed by Banking counters while the Auto sector was in the reverse gear in today's trade. Disparity was seen in the Broader markets where Midcaps gained over 0.40% to outperform the Benchmark Index while Smallcaps ended the session in red and underperformed. On the daily time frame, the Index successfully held its support of 21,830 and reversed to form a bullish candlestick pattern. As per the pattern, it seems that the short-term bottom is placed. Once the Index gives a convincing move above the immediate hurdle of 22,250, then we can consider a reversal of the trend.

.png)

HDFC Bank Ltd., ICICI Bank Ltd., Tata Consultancy Services Ltd., Asian Paints Ltd., and Cipla Ltd. added to the index.

Tata Motors Ltd., Reliance Industries Ltd., Bharti Airtel Ltd., State Bank of India, and NTPC weighed on the benchmark.

India's benchmark indices recovered from the day's low to end higher for a second consecutive session as heavyweight HDFC Bank Ltd., ICICI Bank Ltd., and Tata Consultancy Services Ltd. rose.

The NSE Nifty 50 settled 48.85 points or 0.22% higher at 22,104.05, and the S&P BSE Sensex ended 111.66 points or 0.15% higher at 72,776.13.

During the day, the NSE Nifty 50 declined 1.06%, or 234.15 points, to 21,821.05, and the S&P BSE Sensex fell 1.10%, or 798.46 points, to 71,866.01.

The NSE Nifty 50 recovered nearly 299 points from the day's low, and the S&P BSE recouped 910.12 points.

India's benchmark indices recovered from the day's low to end higher for a second consecutive session as heavyweight HDFC Bank Ltd., ICICI Bank Ltd., and Tata Consultancy Services Ltd. rose.

The NSE Nifty 50 settled 48.85 points or 0.22% higher at 22,104.05, and the S&P BSE Sensex ended 111.66 points or 0.15% higher at 72,776.13.

During the day, the NSE Nifty 50 declined 1.06%, or 234.15 points, to 21,821.05, and the S&P BSE Sensex fell 1.10%, or 798.46 points, to 71,866.01.

The NSE Nifty 50 recovered nearly 299 points from the day's low, and the S&P BSE recouped 910.12 points.

India's benchmark indices recovered from the day's low to end higher for a second consecutive session as heavyweight HDFC Bank Ltd., ICICI Bank Ltd., and Tata Consultancy Services Ltd. rose.

The NSE Nifty 50 settled 48.85 points or 0.22% higher at 22,104.05, and the S&P BSE Sensex ended 111.66 points or 0.15% higher at 72,776.13.

During the day, the NSE Nifty 50 declined 1.06%, or 234.15 points, to 21,821.05, and the S&P BSE Sensex fell 1.10%, or 798.46 points, to 71,866.01.

The NSE Nifty 50 recovered nearly 299 points from the day's low, and the S&P BSE recouped 910.12 points.

India's benchmark indices recovered from the day's low to end higher for a second consecutive session as heavyweight HDFC Bank Ltd., ICICI Bank Ltd., and Tata Consultancy Services Ltd. rose.

The NSE Nifty 50 settled 48.85 points or 0.22% higher at 22,104.05, and the S&P BSE Sensex ended 111.66 points or 0.15% higher at 72,776.13.

During the day, the NSE Nifty 50 declined 1.06%, or 234.15 points, to 21,821.05, and the S&P BSE Sensex fell 1.10%, or 798.46 points, to 71,866.01.

The NSE Nifty 50 recovered nearly 299 points from the day's low, and the S&P BSE recouped 910.12 points.

"Indian equities commenced the week on a tepid note and in the opening trade itself, the Index lost its psychological support of 22,000 to test crucial support of 21,830. After oscillating around the support level, a V-shaped recovery was seen in the markets which pushed the Index higher to reclaim the level of 22,000. With gains of 48.85 points, Nifty50 settled the day at 22,104.05," said Aditya Gaggar, director, Progressive Shares.

Pharma and Metal counters contributed the most in the recovery followed by Banking counters while the Auto sector was in the reverse gear in today's trade. Disparity was seen in the Broader markets where Midcaps gained over 0.40% to outperform the Benchmark Index while Smallcaps ended the session in red and underperformed. On the daily time frame, the Index successfully held its support of 21,830 and reversed to form a bullish candlestick pattern. As per the pattern, it seems that the short-term bottom is placed. Once the Index gives a convincing move above the immediate hurdle of 22,250, then we can consider a reversal of the trend.

India's benchmark indices recovered from the day's low to end higher for a second consecutive session as heavyweight HDFC Bank Ltd., ICICI Bank Ltd., and Tata Consultancy Services Ltd. rose.

The NSE Nifty 50 settled 48.85 points or 0.22% higher at 22,104.05, and the S&P BSE Sensex ended 111.66 points or 0.15% higher at 72,776.13.

During the day, the NSE Nifty 50 declined 1.06%, or 234.15 points, to 21,821.05, and the S&P BSE Sensex fell 1.10%, or 798.46 points, to 71,866.01.

The NSE Nifty 50 recovered nearly 299 points from the day's low, and the S&P BSE recouped 910.12 points.

India's benchmark indices recovered from the day's low to end higher for a second consecutive session as heavyweight HDFC Bank Ltd., ICICI Bank Ltd., and Tata Consultancy Services Ltd. rose.

The NSE Nifty 50 settled 48.85 points or 0.22% higher at 22,104.05, and the S&P BSE Sensex ended 111.66 points or 0.15% higher at 72,776.13.

During the day, the NSE Nifty 50 declined 1.06%, or 234.15 points, to 21,821.05, and the S&P BSE Sensex fell 1.10%, or 798.46 points, to 71,866.01.

The NSE Nifty 50 recovered nearly 299 points from the day's low, and the S&P BSE recouped 910.12 points.

India's benchmark indices recovered from the day's low to end higher for a second consecutive session as heavyweight HDFC Bank Ltd., ICICI Bank Ltd., and Tata Consultancy Services Ltd. rose.

The NSE Nifty 50 settled 48.85 points or 0.22% higher at 22,104.05, and the S&P BSE Sensex ended 111.66 points or 0.15% higher at 72,776.13.

During the day, the NSE Nifty 50 declined 1.06%, or 234.15 points, to 21,821.05, and the S&P BSE Sensex fell 1.10%, or 798.46 points, to 71,866.01.

The NSE Nifty 50 recovered nearly 299 points from the day's low, and the S&P BSE recouped 910.12 points.

India's benchmark indices recovered from the day's low to end higher for a second consecutive session as heavyweight HDFC Bank Ltd., ICICI Bank Ltd., and Tata Consultancy Services Ltd. rose.

The NSE Nifty 50 settled 48.85 points or 0.22% higher at 22,104.05, and the S&P BSE Sensex ended 111.66 points or 0.15% higher at 72,776.13.

During the day, the NSE Nifty 50 declined 1.06%, or 234.15 points, to 21,821.05, and the S&P BSE Sensex fell 1.10%, or 798.46 points, to 71,866.01.

The NSE Nifty 50 recovered nearly 299 points from the day's low, and the S&P BSE recouped 910.12 points.

"Indian equities commenced the week on a tepid note and in the opening trade itself, the Index lost its psychological support of 22,000 to test crucial support of 21,830. After oscillating around the support level, a V-shaped recovery was seen in the markets which pushed the Index higher to reclaim the level of 22,000. With gains of 48.85 points, Nifty50 settled the day at 22,104.05," said Aditya Gaggar, director, Progressive Shares.

Pharma and Metal counters contributed the most in the recovery followed by Banking counters while the Auto sector was in the reverse gear in today's trade. Disparity was seen in the Broader markets where Midcaps gained over 0.40% to outperform the Benchmark Index while Smallcaps ended the session in red and underperformed. On the daily time frame, the Index successfully held its support of 21,830 and reversed to form a bullish candlestick pattern. As per the pattern, it seems that the short-term bottom is placed. Once the Index gives a convincing move above the immediate hurdle of 22,250, then we can consider a reversal of the trend.

.png)

HDFC Bank Ltd., ICICI Bank Ltd., Tata Consultancy Services Ltd., Asian Paints Ltd., and Cipla Ltd. added to the index.

Tata Motors Ltd., Reliance Industries Ltd., Bharti Airtel Ltd., State Bank of India, and NTPC weighed on the benchmark.

On NSE, seven sectors out of 12 ended higher, and five ended lower. The NSE Nifty Auto was the worst performing sector. The NSE Nifty Pharma index was the best performing sector.

Broader markets ended on a mixed note. The S&P BSE Midcap ended 0.36% higher, and the S&P BSE Smallcap settled 0.23% lower.

On BSE, seven sectors declined and thirteen advanced out 20. The S&P BSE Auto was the worst performing sector, and the S&P BSE Services emerged as the top performing sector

Market breadth was skewed in favour of the sellers. Around 2,176 stocks declined, 1,780 stocks advanced, and 131 remained unchanged on BSE.

Revenue rose 21.65% to Rs 252.52 crore from Rs 207.57 crore

Ebitda grew 41.16% to Rs 35.97 crore from Rs 25.48 crore

Margin rose 196 basis points to 14.24% from 12.27%

Net profit rose 58.35% to Rs 21.03 crore from Rs 13.28 crore

Revenue rose 16.17% to Rs 106.9 crore from Rs 92.02 crore

Ebit rose 9.57% to Rs 35.35 crore from Rs 32.26 crore

Ebit margin fell 198 basis points to 33.06% from 35.05%

Net profit rose 23.22% to Rs 38.25 crore from Rs 31.04 crore

Board approves final dividend of Rs 3.5/share

Reported revenue rose 32% to Rs 12,079 crore

Reported net profit rose 33% to Rs 812 crore

MF quarterly average AUM rose 21% to Rs 3.32 lakh crore

NBFC disbursements rose 16% to Rs 18,123 crore

NBFC loan portfolio rose 31% to Rs 1.06 lakh crore

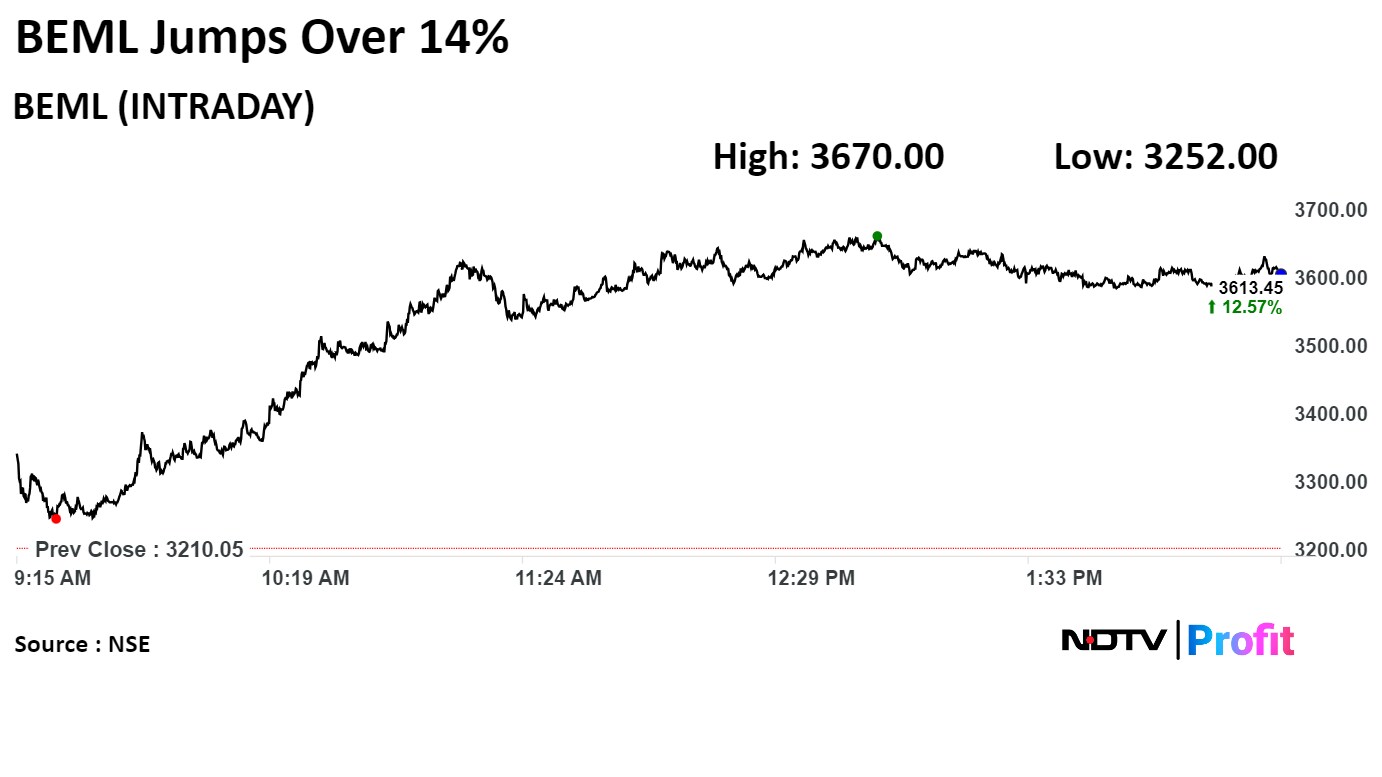

BEML Ltd. jumped over 14% on Monday after the company reported nearly 63% surge in its net profit.

Its consolidated annual net profit grew 62.84% on the year to Rs 256.8 crore in January-March from Rs 157.7 crore.

BEML Ltd. jumped 14.33% to Rs. 3,670.00, the highest level since May 3. It was trading 12.81% higher at Rs 3,616.95 as of 2:37 p.m., as compared to 0.29% advance in the NSE Nifty 50 index.

The scrip gained 157.12% in 12 months, and on year-to-date basis, it has risen 27.95%. Total traded volume so far in the day stood at 11 times its 30-day average. The relative strength index was at 60.32.

Out of five analysts tracking the company, three maintain a 'buy' rating, one recommend a 'hold,' and one suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside/downside of 18.2%.

BEML Ltd. jumped over 14% on Monday after the company reported nearly 63% surge in its net profit.

Its consolidated annual net profit grew 62.84% on the year to Rs 256.8 crore in January-March from Rs 157.7 crore.

BEML Ltd. jumped 14.33% to Rs. 3,670.00, the highest level since May 3. It was trading 12.81% higher at Rs 3,616.95 as of 2:37 p.m., as compared to 0.29% advance in the NSE Nifty 50 index.

The scrip gained 157.12% in 12 months, and on year-to-date basis, it has risen 27.95%. Total traded volume so far in the day stood at 11 times its 30-day average. The relative strength index was at 60.32.

Out of five analysts tracking the company, three maintain a 'buy' rating, one recommend a 'hold,' and one suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside/downside of 18.2%.

Revenue fell 15% to Rs 14,078 crore from Rs16,569 crore

Ebitda margin fell 330 basis points to 13.1% from 16.4%

Ebitda fell 32% Rs 1,848 crore from Rs 2,722 crore

Net loss at Rs 80 crore vs profit of Rs1,080 crore

One time loss of Rs 105 crore in Q4

Revenue up 19% at Rs 4,490 crore from Rs 3,778 crore

Ebitda down 8.3% at Rs 451 crore from Rs 492 crore

Margin fell 300 basis points to 10% from 13%

Net profit down 43% at Rs 271 crore from Rs 477 crore

Revenue rose 17.35% to Rs 276.12 crore from Rs 235.29 crore

Ebitda rose 32.75% to Rs 53.22 crore from Rs 40.09 crore

Margin rose 223 basis points to 19.27% from 17.03%

Net profit rose 44.01% to Rs 44.07 crore from Rs 30.6 crore

Revenue rose 2.46% to Rs 548.8 crore from Rs 535.6 crore

Ebitda rose 5.01 to Rs 94.98 crore from Rs 90.45 crore

Margin rose 41 basis points to 17.3% from 16.88%

Net profit rose 19.77% to Rs 75.7 crore from Rs 63.2 crore

Board recommends dividend of Rs 60/share

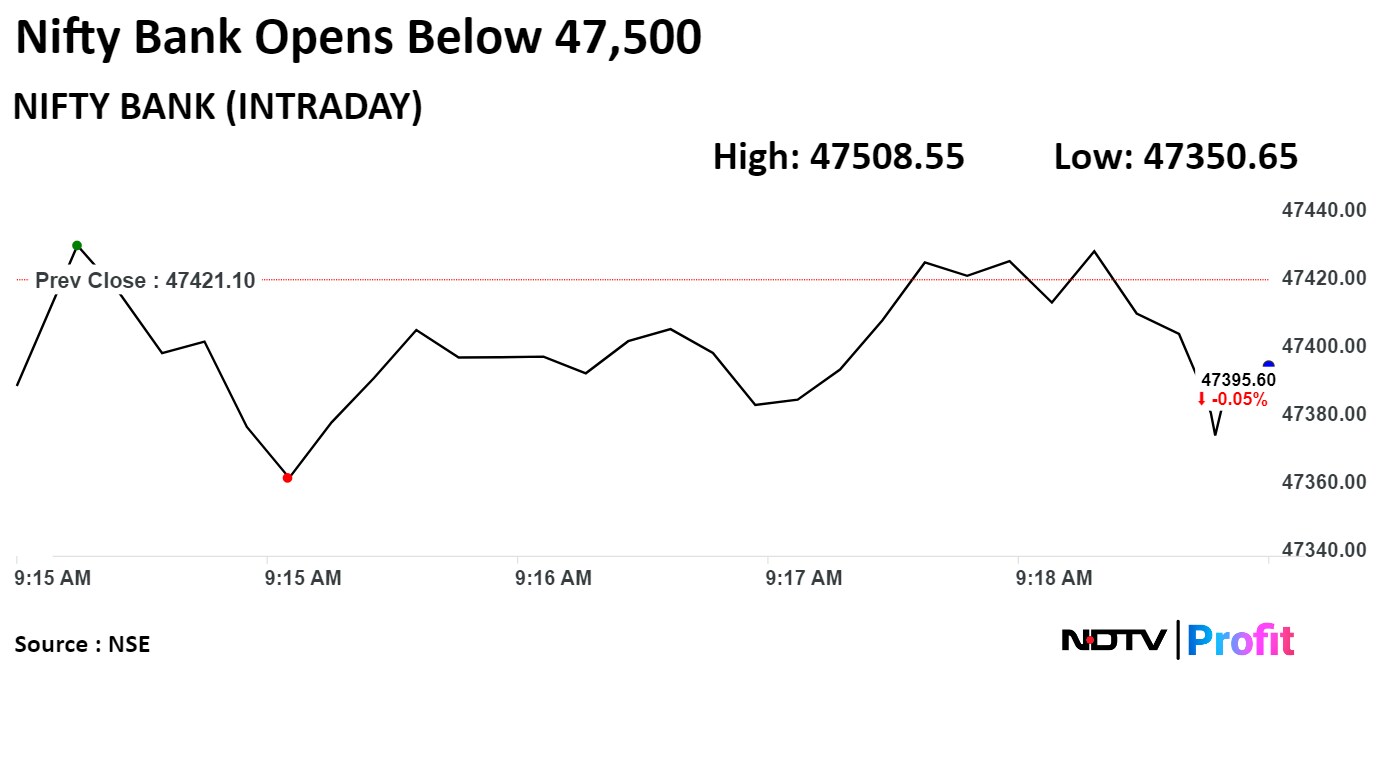

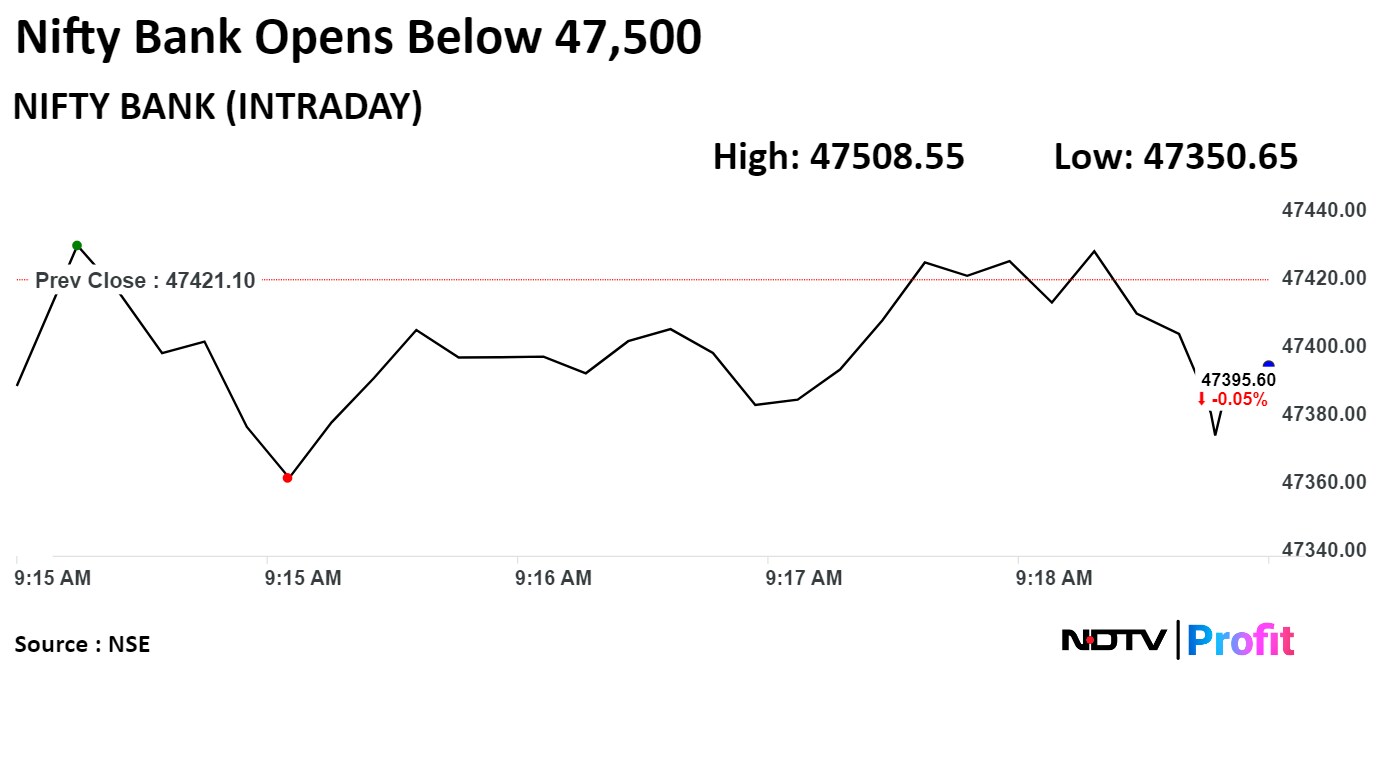

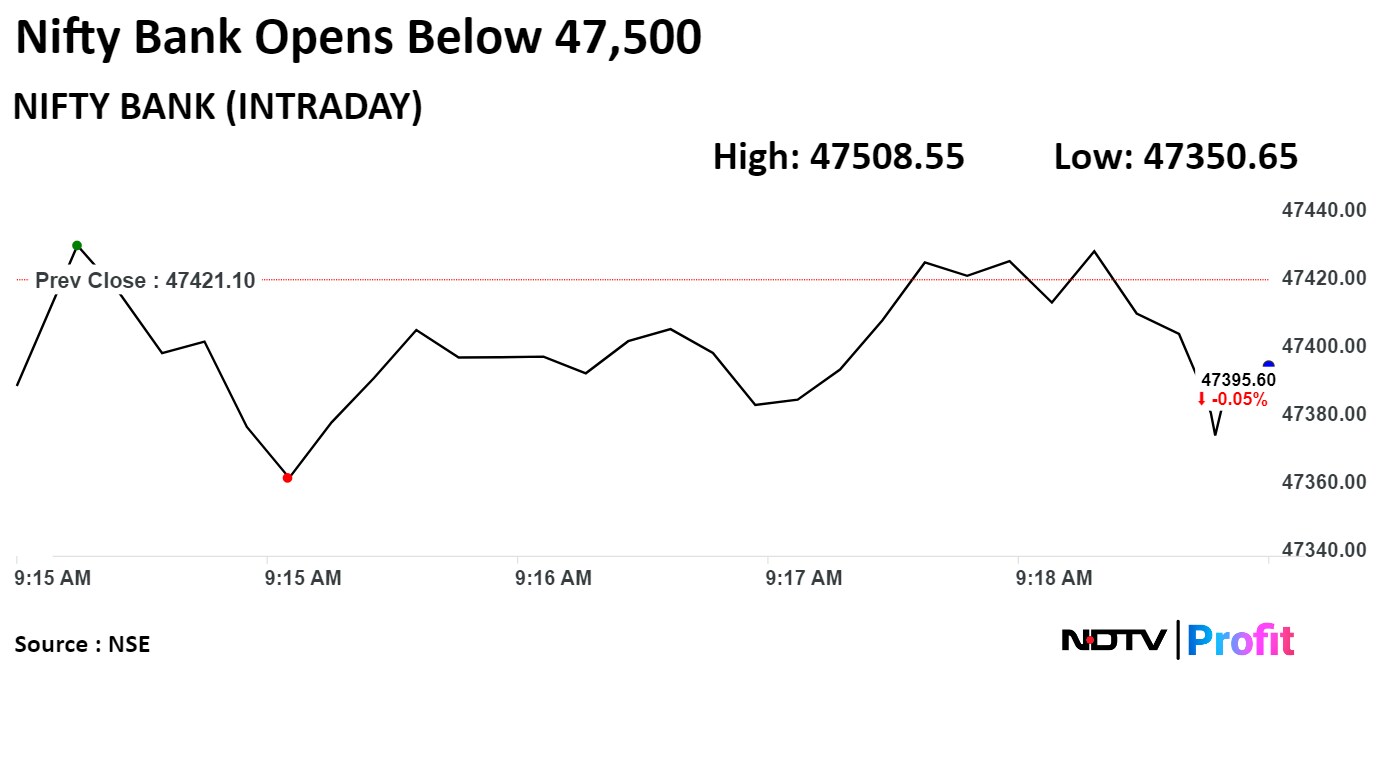

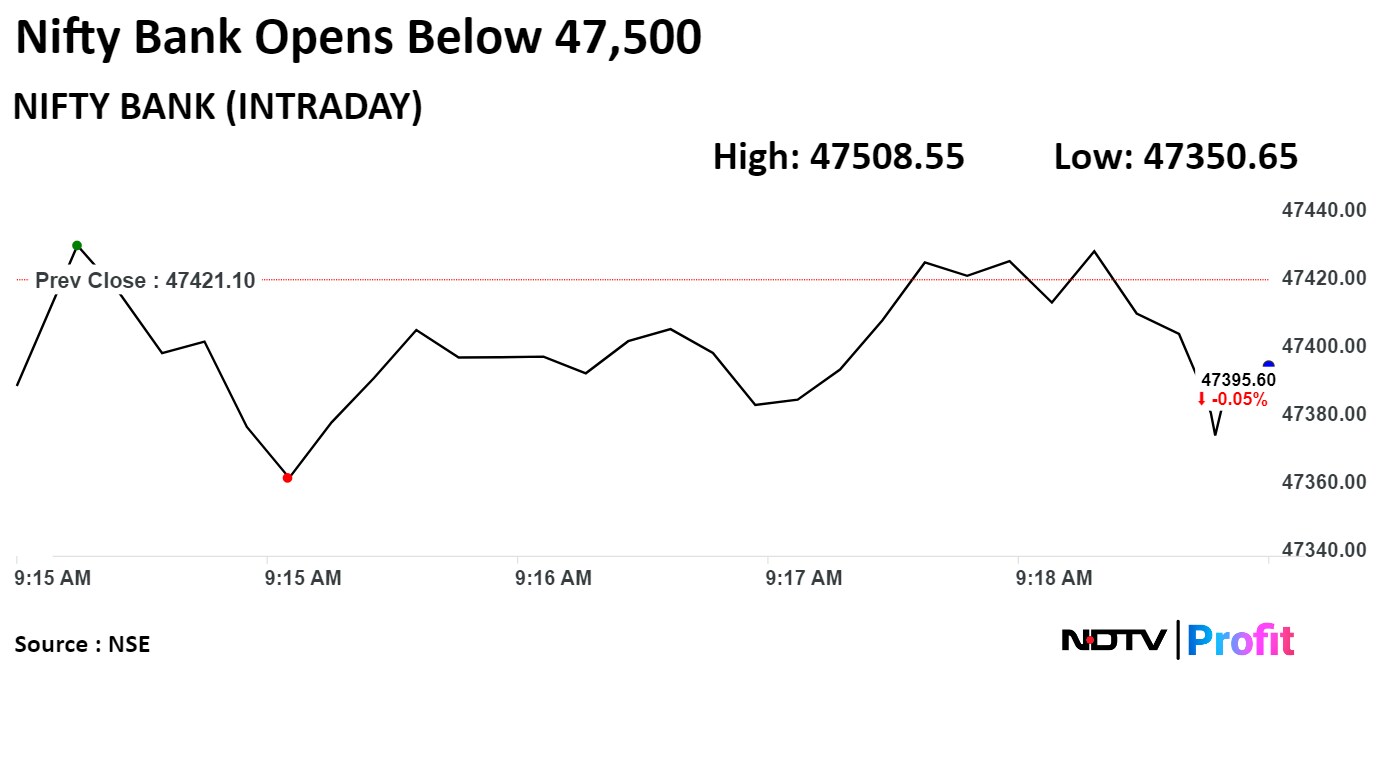

The NSE Nifty Bank recovered 472.25 points from the day's low. It was trading 61.45 points or 0.13% higher at 47,482.55 as of 12:36 p.m.

The NSE Nifty Bank recovered 472.25 points from the day's low. It was trading 61.45 points or 0.13% higher at 47,482.55 as of 12:36 p.m.

KPI Green Energy Ltd. approved raising up to Rs 1,000 crore via QIP

Source: Exchange filing

Total production at 70,025 units, up 19%

Total sales at 68,614 units, up 13%

Total exports at 1,857 units, up 2%

Source: Exchange filing

Revenue up 11% to Rs 4,398 crore from Rs 3,953 crore

Ebitda up 24% at Rs 989 crore from Rs 798 crore

Margin up 230 bps at 22.5% from 20.2%

Net profit up 25 X% at Rs 548 crore from Rs 439 crore

Revenue up 11% to Rs 4,398 crore from Rs 3,953 crore

Ebitda up 24% at Rs 989 crore from Rs 798 crore

Margin up 230 bps at 22.5% from 20.2%

Net profit up 25 X% at Rs 548 crore from Rs 439 crore

Thangamayil Jewellery saw 45% YoY growth in Akshaya Tritiya sales in May 2024

Highest ever Akshaya Tritiya sales at Rs 157.3 crore in 2024 vs Rs 108.5 crore in 2023

Gold sales volumes rose 24.5% YoY

Source: Exchange filing

Risk appetite through higher loan growth to remain a consideration for banks' creditworthiness

Sustainable risk-adjusted returns also important

Past volatility weighed heavily on banks' performance in a weaker operating environment

Asset quality pressures from the previous credit cycle now subsiding

RBI's recent measures reinforced improvements in governance, risk management etc.

Measures fostered caution towards risk-taking, but effectiveness yet to be proven

Bharti Airtel Ltd. signed a pact with Google Cloud for collaboration on cloud adoption and gen AI solutions.

More than 300 employees to be trained to on both Google Cloud and digital services.

Source: Exchange filing

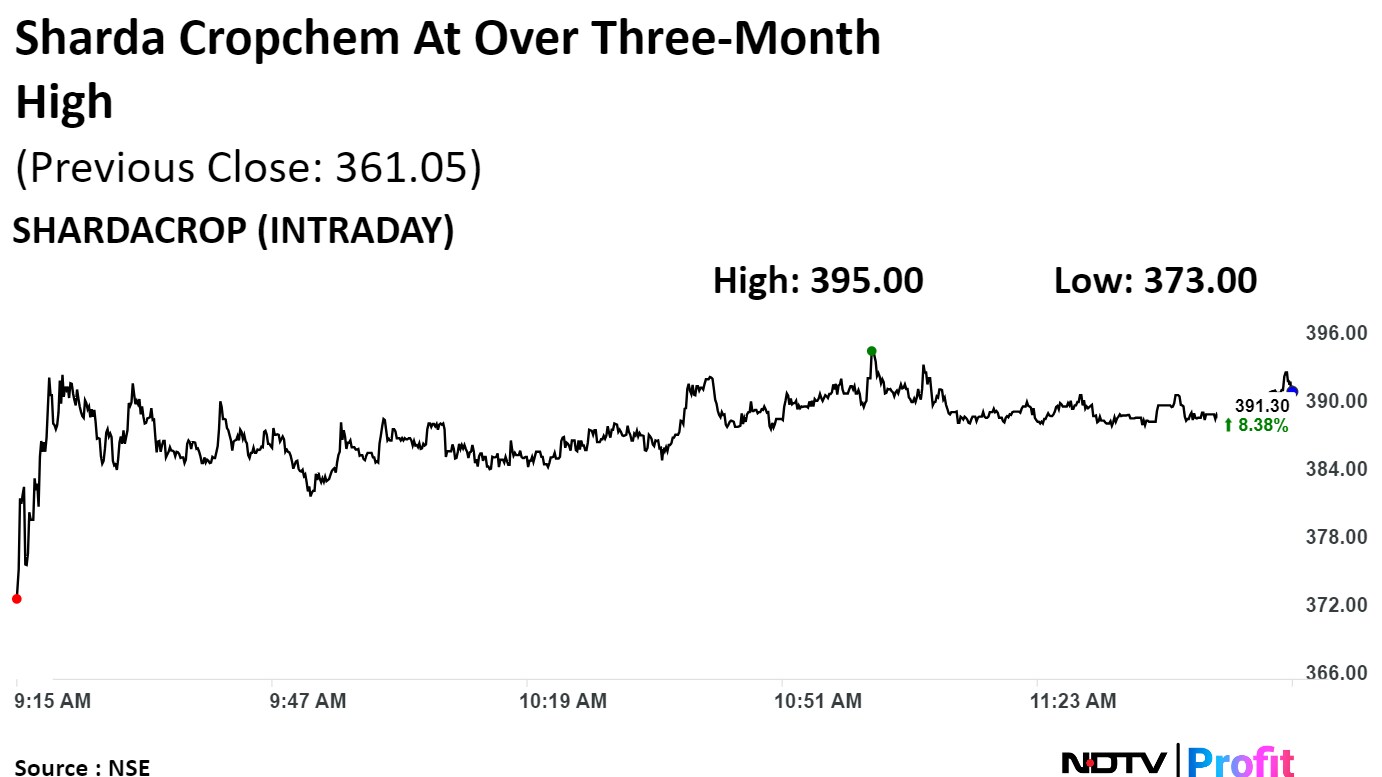

Sharda Cropchem Ltd. rose to over two-month high on Monday after the company surprised the street with its better-than-expect fourth quarter earning.

The pesticide producer's consolidated net profit fell 27.84% on the year to Rs 143 crore during January-March, which is higher than Rs 63 crore net profit a Bloomberg Survey forecasted.

Sharda Cropchem Ltd. rose as much as 9.40% to Rs 395.00, the highest level since Feb 2. It was trading 7.82% higher at Rs 389.30 as compared to 0.43% decline in the NSE Nifty 50 index as of 11:45 a.m.

The scrip declined 22.73% in 12 months, and on year-to-date basis, it has declined 13.06%. Total traded volume so far in the day stood at 21 times its 30-day average. The relative strength index was at 66.57.

Out of seven analysts tracking the company, four maintain a 'buy' rating, three recommend a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an upside of 18.5%.

Sharda Cropchem Ltd. rose to over two-month high on Monday after the company surprised the street with its better-than-expect fourth quarter earning.

The pesticide producer's consolidated net profit fell 27.84% on the year to Rs 143 crore during January-March, which is higher than Rs 63 crore net profit a Bloomberg Survey forecasted.

Sharda Cropchem Ltd. rose as much as 9.40% to Rs 395.00, the highest level since Feb 2. It was trading 7.82% higher at Rs 389.30 as compared to 0.43% decline in the NSE Nifty 50 index as of 11:45 a.m.

The scrip declined 22.73% in 12 months, and on year-to-date basis, it has declined 13.06%. Total traded volume so far in the day stood at 21 times its 30-day average. The relative strength index was at 66.57.

Out of seven analysts tracking the company, four maintain a 'buy' rating, three recommend a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an upside of 18.5%.

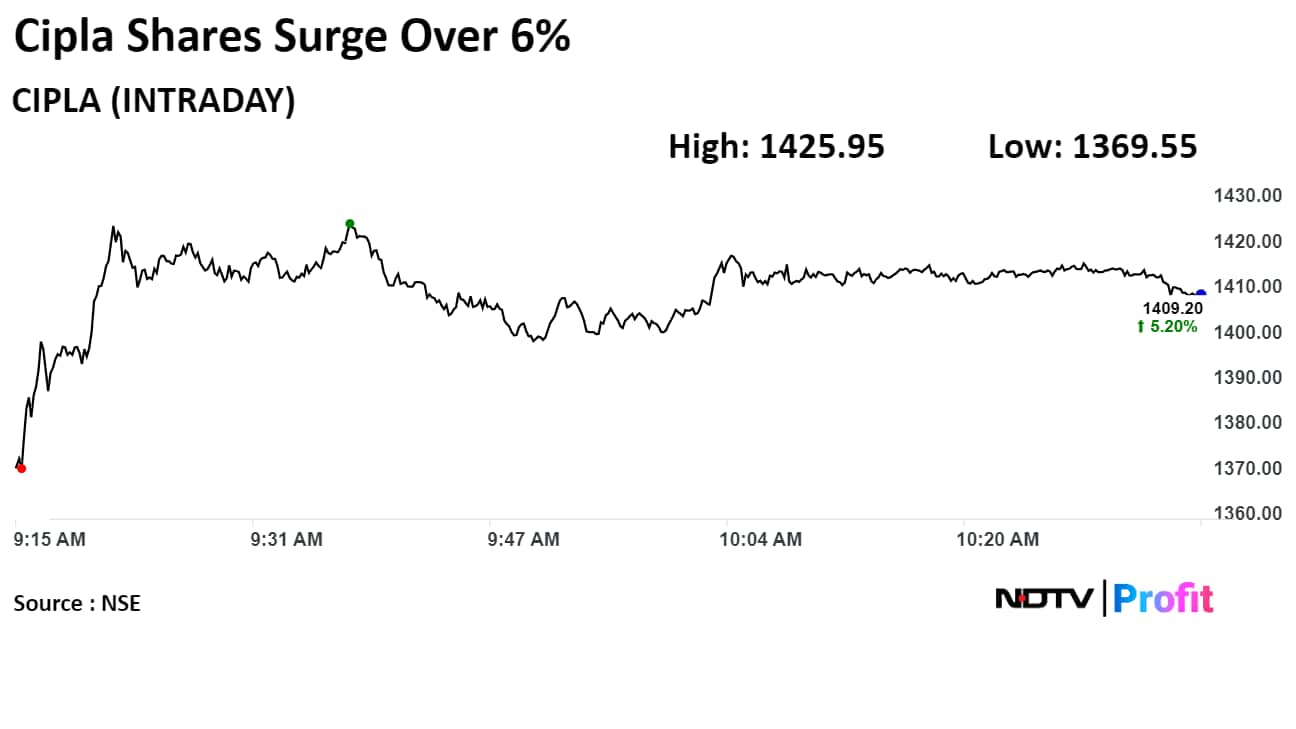

Shares of Cipla Ltd. surged over 6% on Monday after the drugmaker's consolidated net profit in the fourth quarter of financial year 2024 beat analysts' estimates.

Cipla's stock rose as much as 6.45% during the day to Rs 1,425.95 apiece on the NSE. It was trading 5.53% higher at Rs 1,413.6 per share, compared to a 0.89% decline in the benchmark Nifty at 10:34 a.m.

The share price has risen 53.2% in the last 12 months and 10% on a year-to-date basis. The total traded volume so far in the day stood at 15 times its 30-day average. The relative strength index was at 51.

Twenty-six out of the 38 analysts tracking the company have a 'buy' rating on the stock, six recommend 'hold' and as many suggest 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 4.4%.

Shares of Cipla Ltd. surged over 6% on Monday after the drugmaker's consolidated net profit in the fourth quarter of financial year 2024 beat analysts' estimates.

Cipla's stock rose as much as 6.45% during the day to Rs 1,425.95 apiece on the NSE. It was trading 5.53% higher at Rs 1,413.6 per share, compared to a 0.89% decline in the benchmark Nifty at 10:34 a.m.

The share price has risen 53.2% in the last 12 months and 10% on a year-to-date basis. The total traded volume so far in the day stood at 15 times its 30-day average. The relative strength index was at 51.

Twenty-six out of the 38 analysts tracking the company have a 'buy' rating on the stock, six recommend 'hold' and as many suggest 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 4.4%.

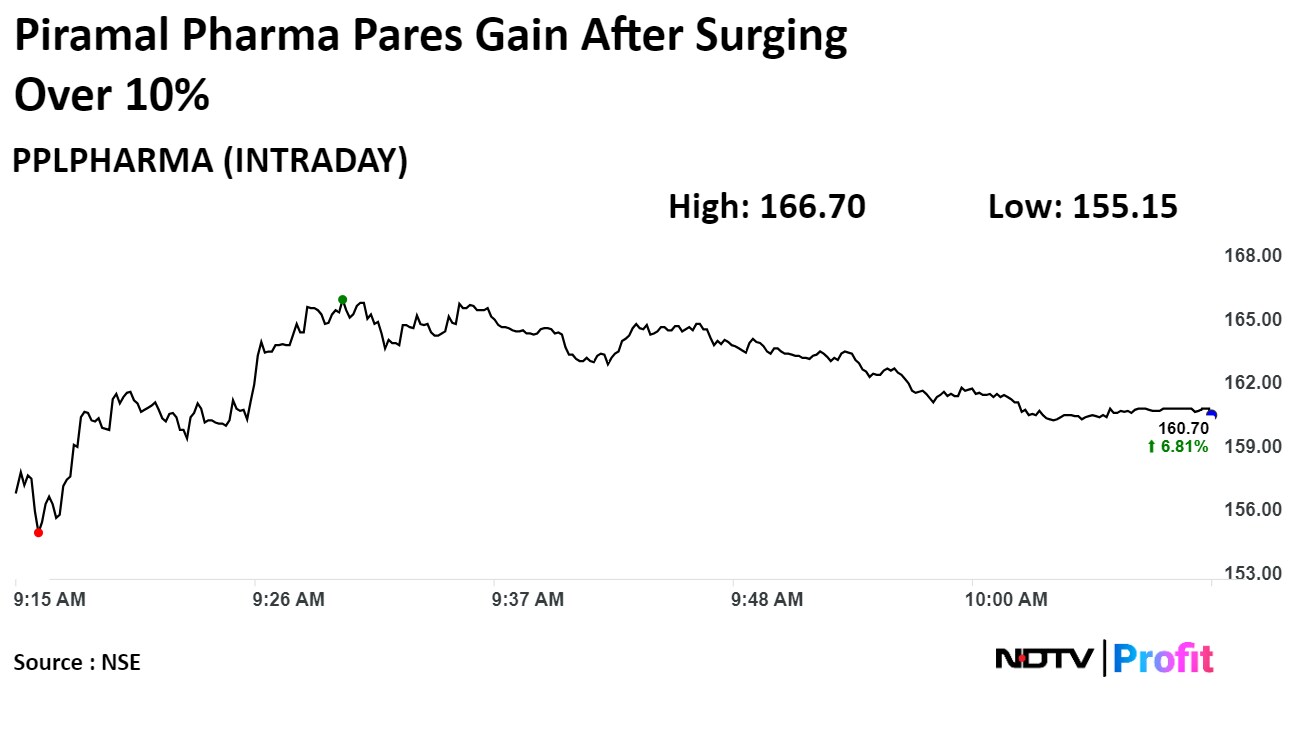

Shares of Piramal Pharma Ltd. surged to a 52-week high on Monday after the company's profit doubled in the fourth quarter.

Shares of Piramal Pharma rose as much as 10.8% before paring gains to trade 7.01% higher at 10:08 a.m., compared to a 0.94% decline in the benchmark Nifty 50.

The stock has risen 122% in the last 12 months and 14.6% year-to-date. Total traded volume so far in the day stood at 19 times its 30-day average. The relative strength index was at 68.

All seven analysts tracking the company have a 'buy' rating on the stock, according to Bloomberg data. The average of 12-month analysts' price targets implies a potential upside of 3.7%.

Shares of Piramal Pharma Ltd. surged to a 52-week high on Monday after the company's profit doubled in the fourth quarter.

Shares of Piramal Pharma rose as much as 10.8% before paring gains to trade 7.01% higher at 10:08 a.m., compared to a 0.94% decline in the benchmark Nifty 50.

The stock has risen 122% in the last 12 months and 14.6% year-to-date. Total traded volume so far in the day stood at 19 times its 30-day average. The relative strength index was at 68.

All seven analysts tracking the company have a 'buy' rating on the stock, according to Bloomberg data. The average of 12-month analysts' price targets implies a potential upside of 3.7%.

Shares of Bank of India declined 12.43% to Rs 121.50, the lowest level since Jan 12.

The scrip gained 55.51% in 12 months, and on year-to-date basis, it has risen 8.7%. Total traded volume so far in the day stood at 5.0 times its 30-day average. The relative strength index was at 29.41, which implied the stock is oversold.

Out of five analysts tracking the company, three maintain a 'buy' rating, one recommends a 'hold,' and one suggests 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 28.4%.

Shares of Bank of India declined 12.43% to Rs 121.50, the lowest level since Jan 12.

The scrip gained 55.51% in 12 months, and on year-to-date basis, it has risen 8.7%. Total traded volume so far in the day stood at 5.0 times its 30-day average. The relative strength index was at 29.41, which implied the stock is oversold.

Out of five analysts tracking the company, three maintain a 'buy' rating, one recommends a 'hold,' and one suggests 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 28.4%.

Shares of Neuland Laboratories Ltd. tumbled nearly 15% to the lowest since April 9 on Monday after its profit declined 20% in the quarter ended March 2024, but beat analysts' estimates.

Shares of Neuland Laboratories fell 14.73% to Rs 6,088.10 apiece, touching the lowest level since April 9. It was trading 14.6% lower at Rs 6,124.50 as of 10:28 a.m., compared to 0.82% decline the NSE Nifty 50 index.

The scrip gained 106.86% in 12 months and 16.21% so far this year. The total traded volume so far in the day stood at 7.5 times its 30-day average. The relative strength index was at 33.34.

Both the analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 33.8%.

Shares of Neuland Laboratories Ltd. tumbled nearly 15% to the lowest since April 9 on Monday after its profit declined 20% in the quarter ended March 2024, but beat analysts' estimates.

Shares of Neuland Laboratories fell 14.73% to Rs 6,088.10 apiece, touching the lowest level since April 9. It was trading 14.6% lower at Rs 6,124.50 as of 10:28 a.m., compared to 0.82% decline the NSE Nifty 50 index.

The scrip gained 106.86% in 12 months and 16.21% so far this year. The total traded volume so far in the day stood at 7.5 times its 30-day average. The relative strength index was at 33.34.

Both the analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 33.8%.

Indegene Ltd., listed today on NSE, declined 19.53% to Rs 527.10. It was the listed at Rs 655.00. As of 10:43 a.m., the stock was 19.01% lower at Rs 530.50, as compared to 1.02% decline in the NSE Nifty 50 index.

Home Minister Amit Shah is not so worried about markets' recent fall. Benchmarks have declined more in the past as well, thus linking their movements directly to elections isn't wise, he said in an interview with Vikas Bhadauria, national affairs editor, NDTV India

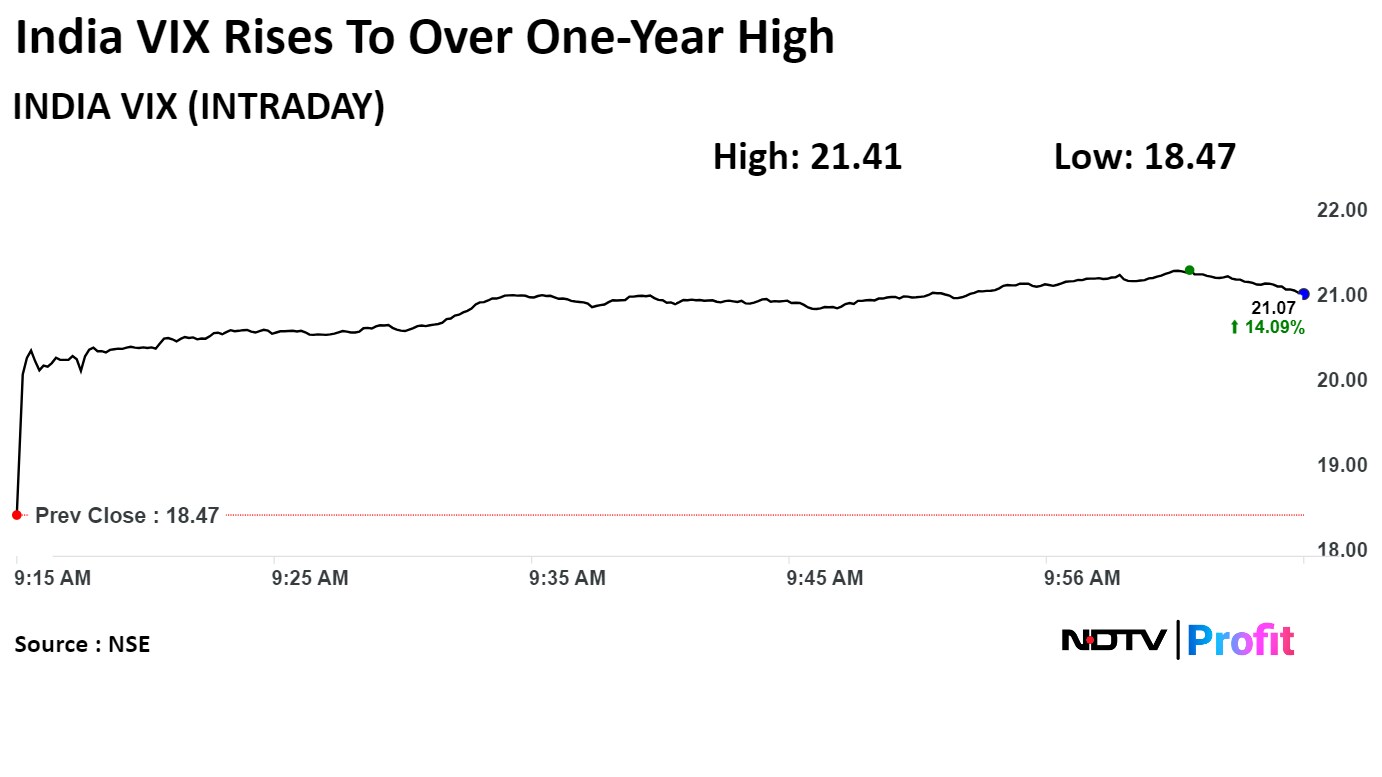

The India NSE Volatility jumped 10.80% to 21.41, the highest level since Oct 3, 2022. As of 10:15 a.m., the index was 12.87% higher at 20.86.

The India NSE Volatility jumped 10.80% to 21.41, the highest level since Oct 3, 2022. As of 10:15 a.m., the index was 12.87% higher at 20.86.

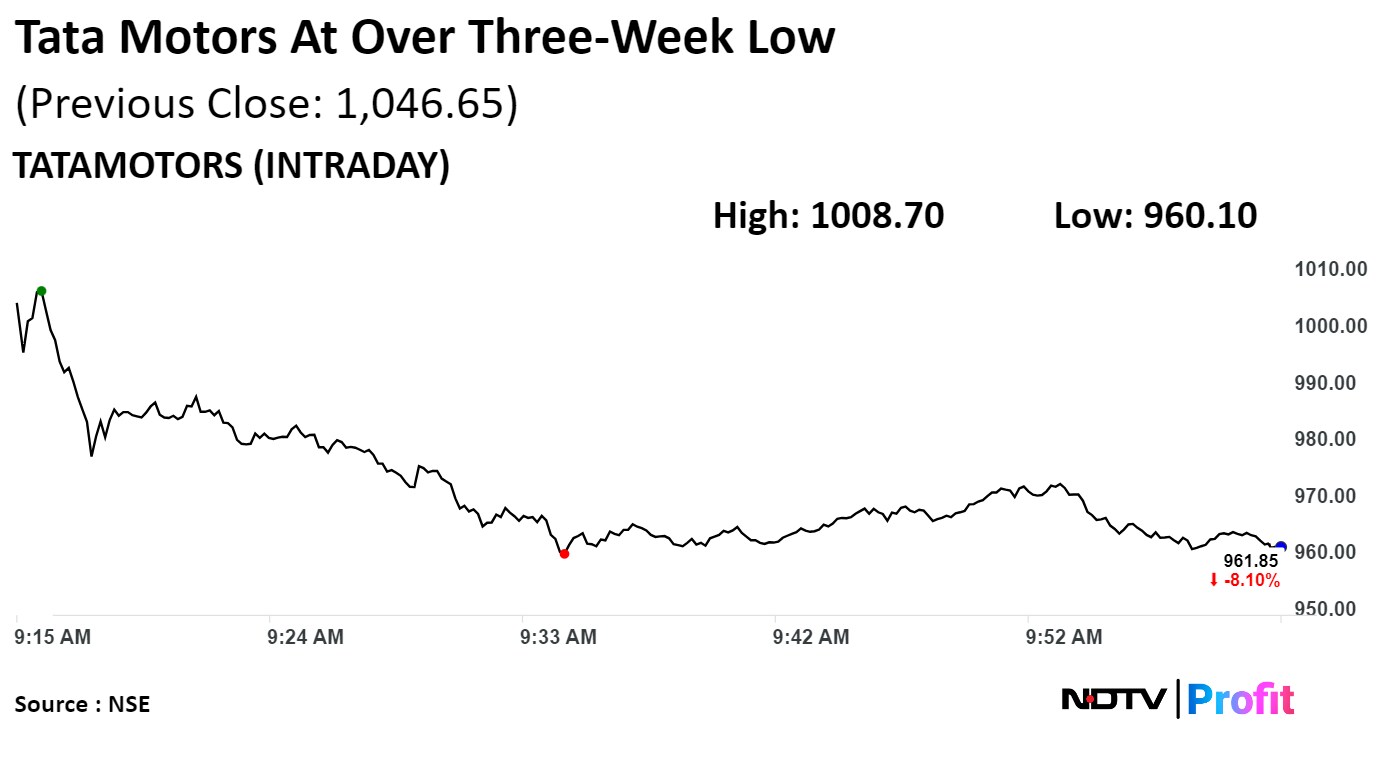

Tata Motors Ltd.'s Ebitda during January-March rose 32.81% on the year to Rs 16,995 crore compared to Rs 17,407 crore analysts forecasted in a Bloomberg's survey.

Tata Motors Ltd.'s shares declined as much as 8.27% to Rs 960.10 apiece, the lowest level since April 19. It was trading 7.89% lower at Rs 963.65 apiece, as of 09:56 a.m. This compares to a 0.87% decline in the NSE Nifty 50 Index.

It has risen 83.10% in 12 months. Total traded volume so far in the day stood at 12 times its 30-day average. The relative strength index was at 43.71

Out of 34 analysts tracking the company, 21 maintain a 'buy' rating, six recommend a 'hold,' and seven suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 10.3%.

Tata Motors Ltd.'s Ebitda during January-March rose 32.81% on the year to Rs 16,995 crore compared to Rs 17,407 crore analysts forecasted in a Bloomberg's survey.

Tata Motors Ltd.'s shares declined as much as 8.27% to Rs 960.10 apiece, the lowest level since April 19. It was trading 7.89% lower at Rs 963.65 apiece, as of 09:56 a.m. This compares to a 0.87% decline in the NSE Nifty 50 Index.

It has risen 83.10% in 12 months. Total traded volume so far in the day stood at 12 times its 30-day average. The relative strength index was at 43.71

Out of 34 analysts tracking the company, 21 maintain a 'buy' rating, six recommend a 'hold,' and seven suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 10.3%.

On NSE, Indegene listed at Rs 655, 44.91% premium

On BSE, the company's stock listed at RS 659.70, 45.95% premium

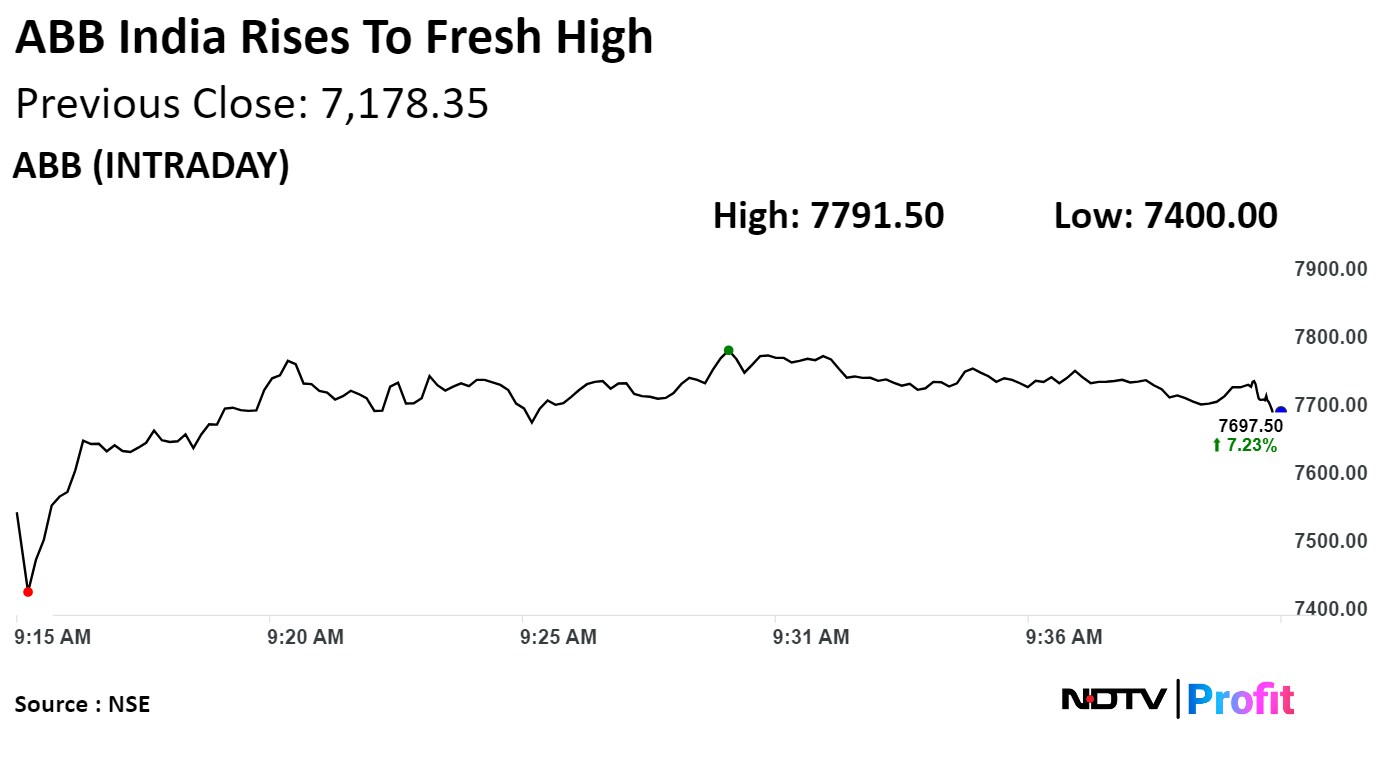

Shares of ABB India Ltd. rose as much as 8.54% to Rs 7,791.50, the highest level since its listing on Jan 8, 2010. It was trading 6.86% higher at Rs 7,670.15 as of 09:44 a.m., as compared to 0.91%T decline in the NSE Nifty 50 index.

The company's net profit surged 87.54% on the year to Rs 459 crore during January-March.

Shares of ABB India Ltd. rose as much as 8.54% to Rs 7,791.50, the highest level since its listing on Jan 8, 2010. It was trading 6.86% higher at Rs 7,670.15 as of 09:44 a.m., as compared to 0.91%T decline in the NSE Nifty 50 index.

The company's net profit surged 87.54% on the year to Rs 459 crore during January-March.

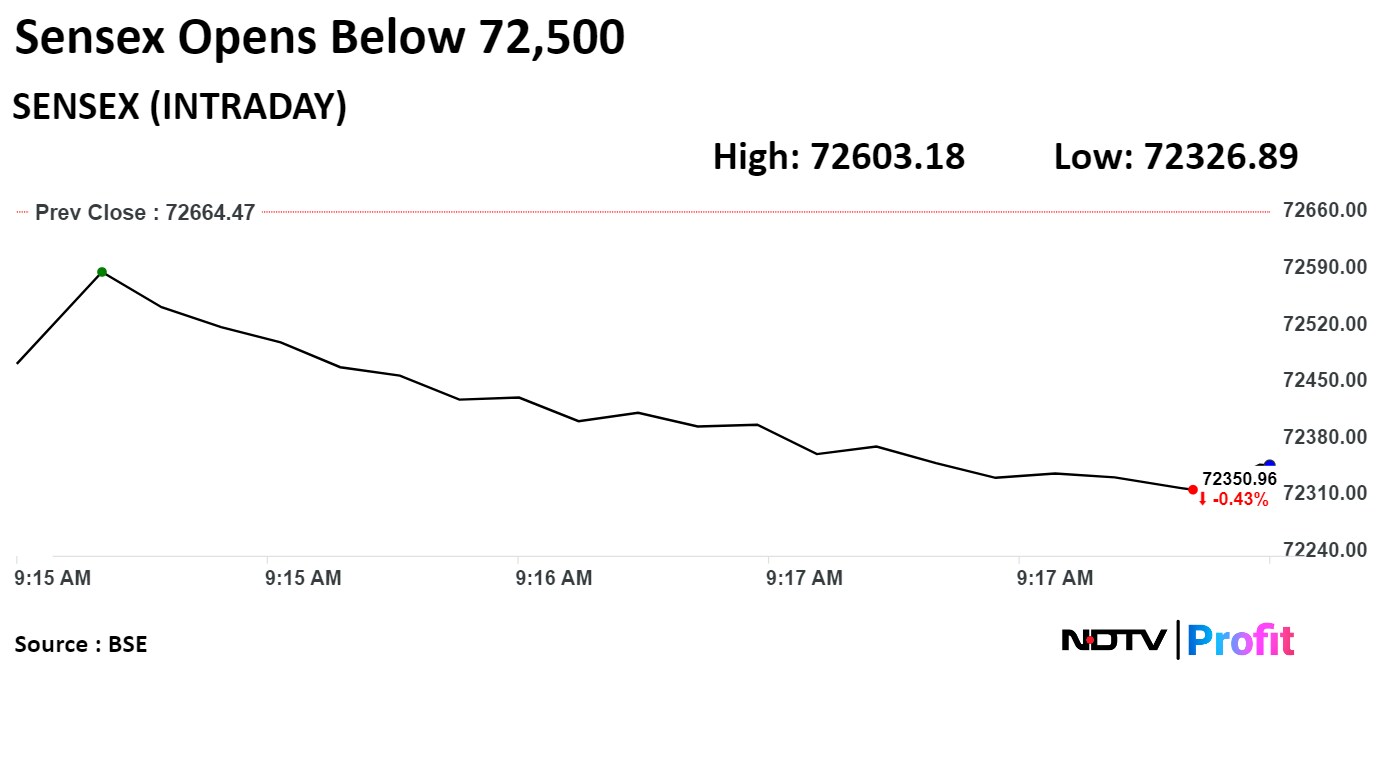

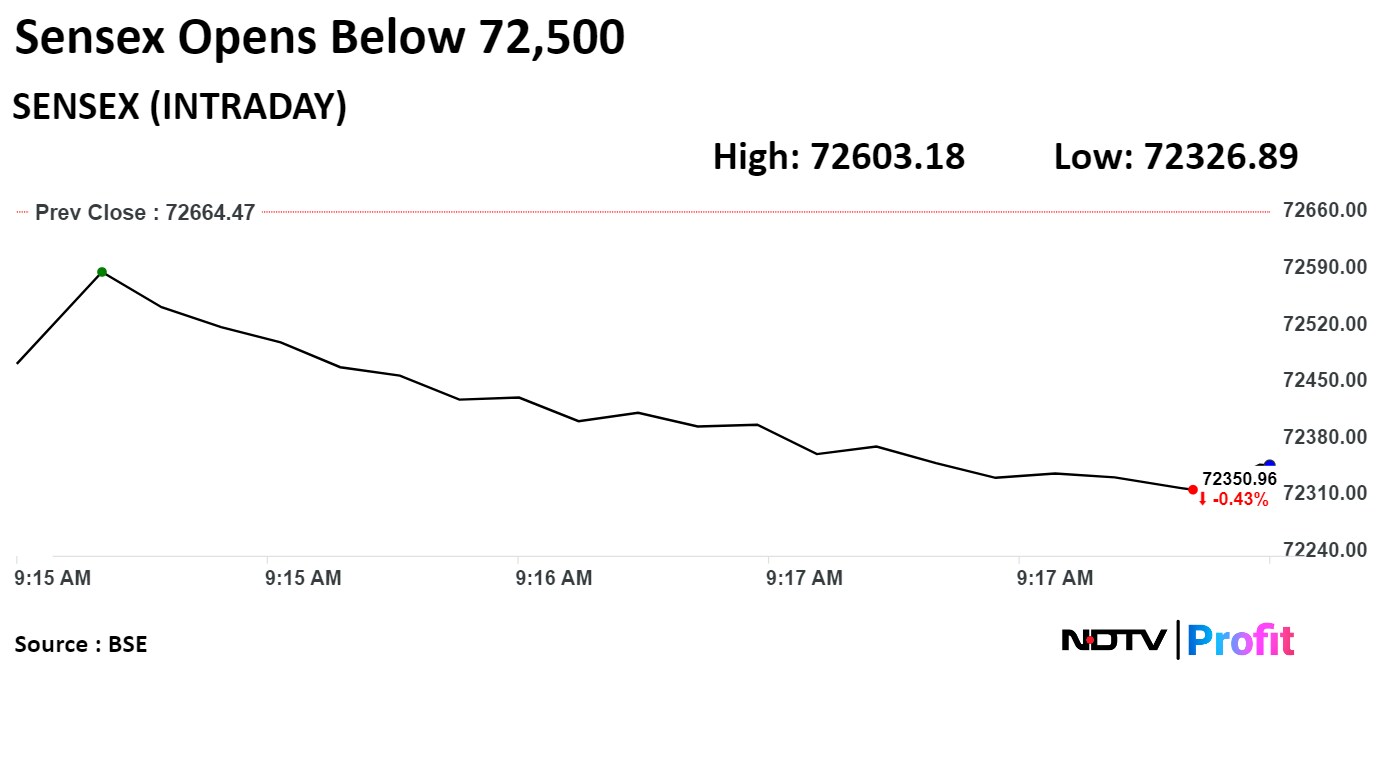

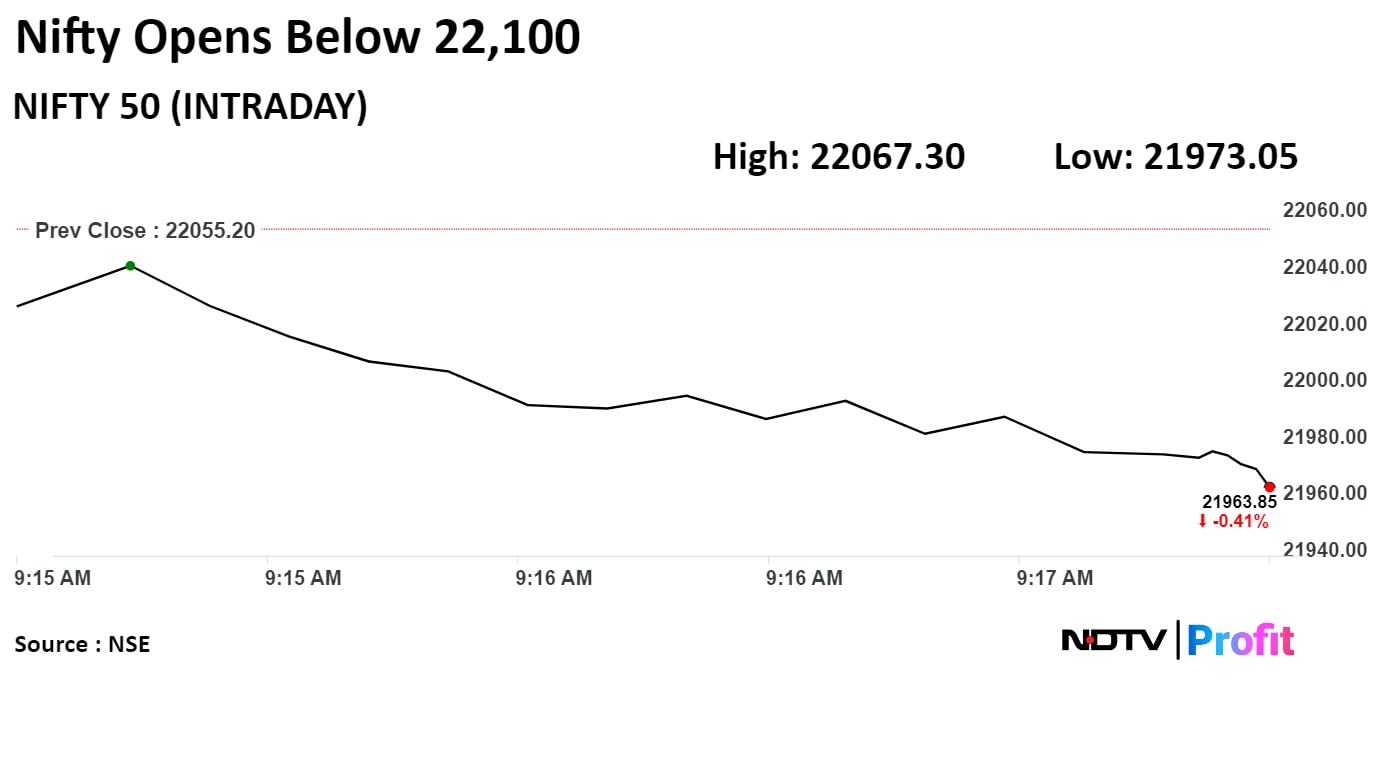

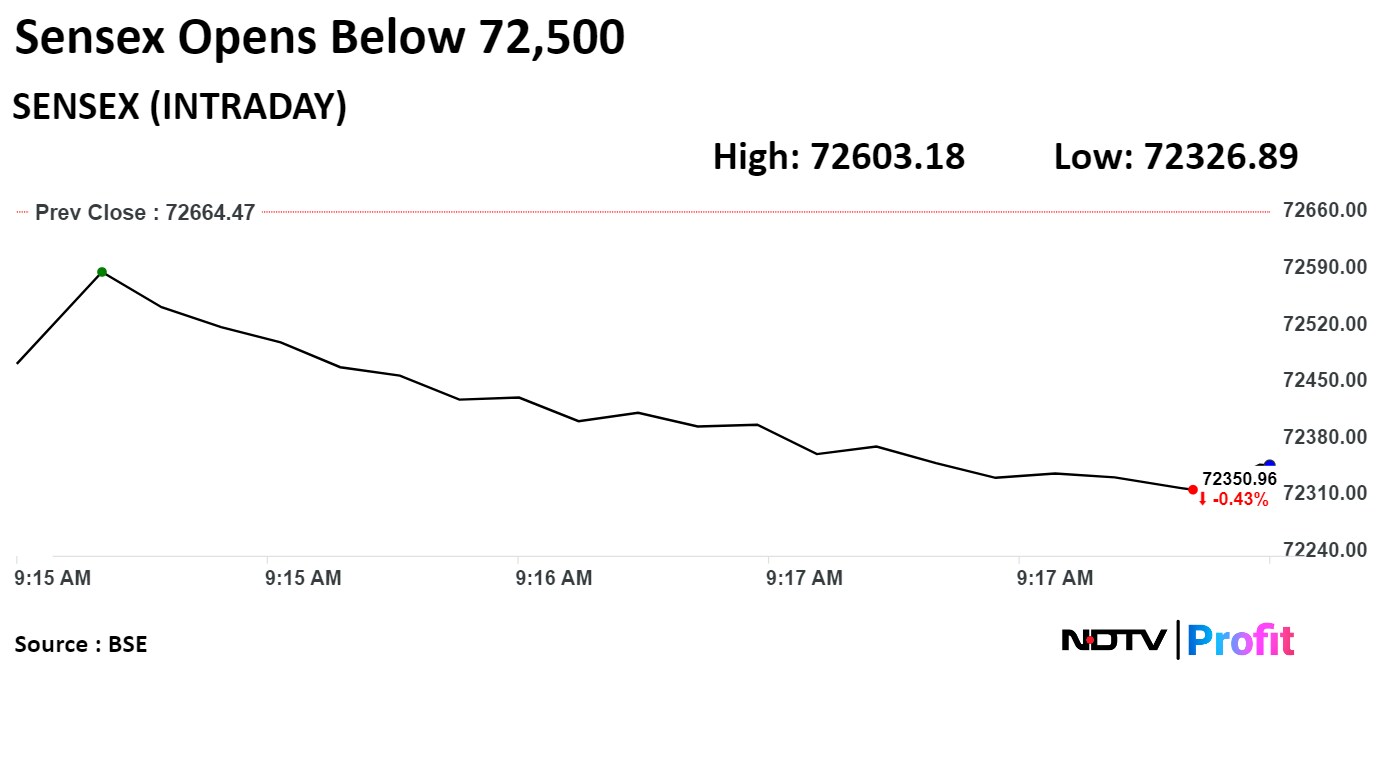

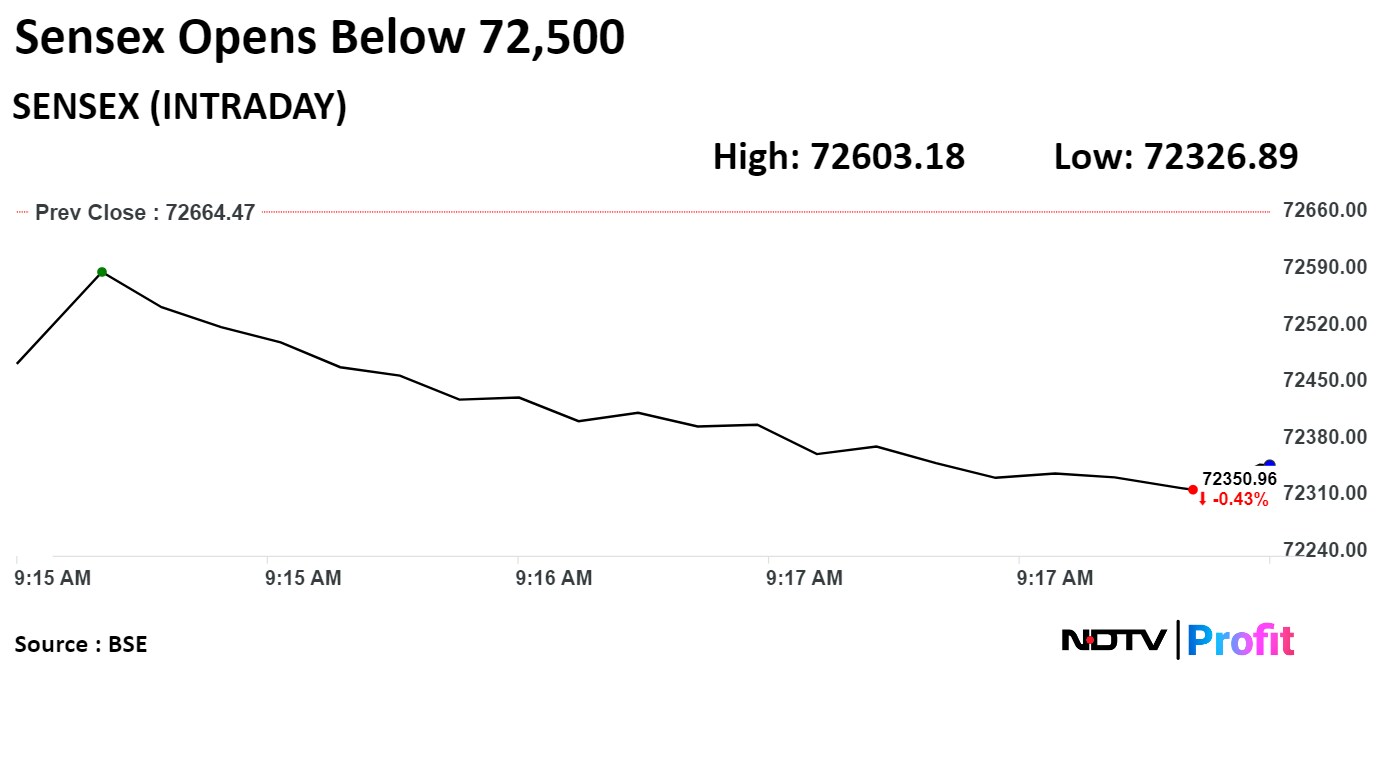

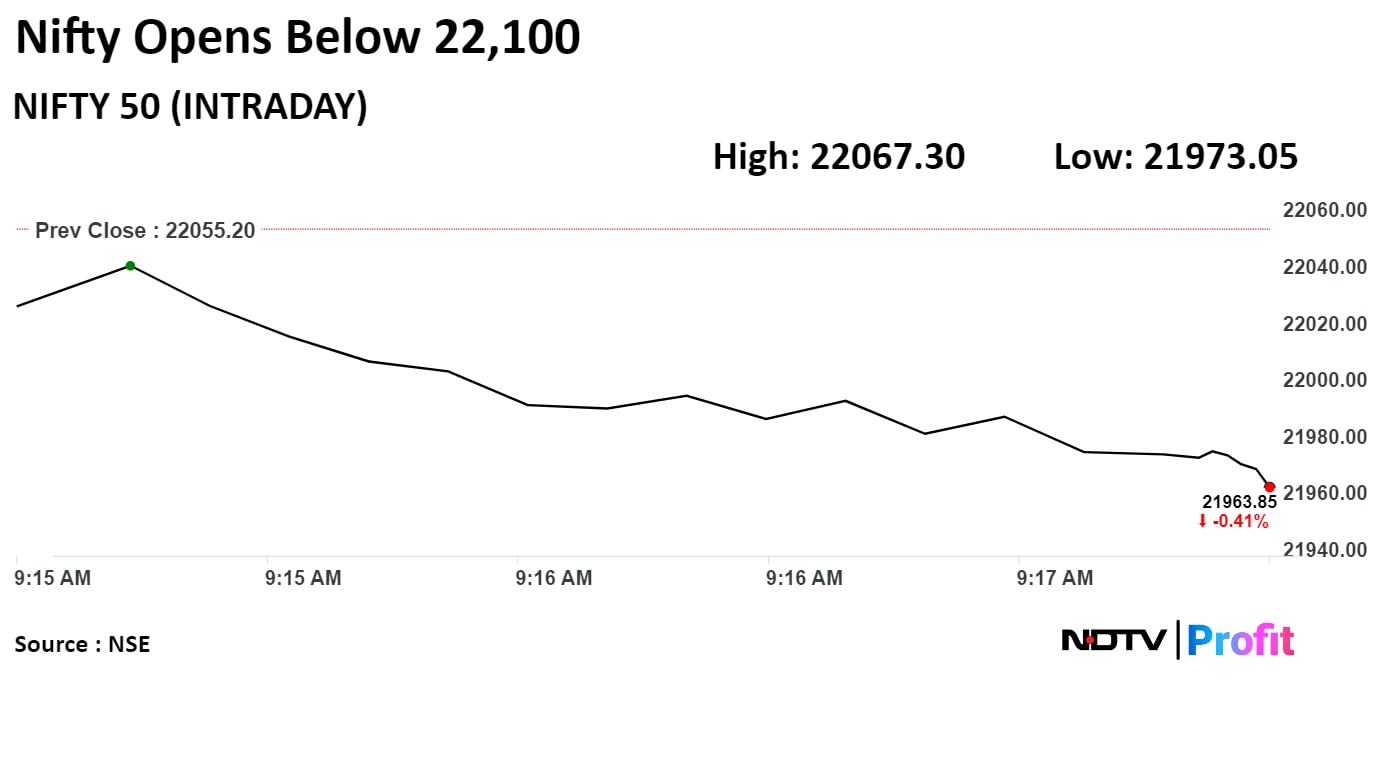

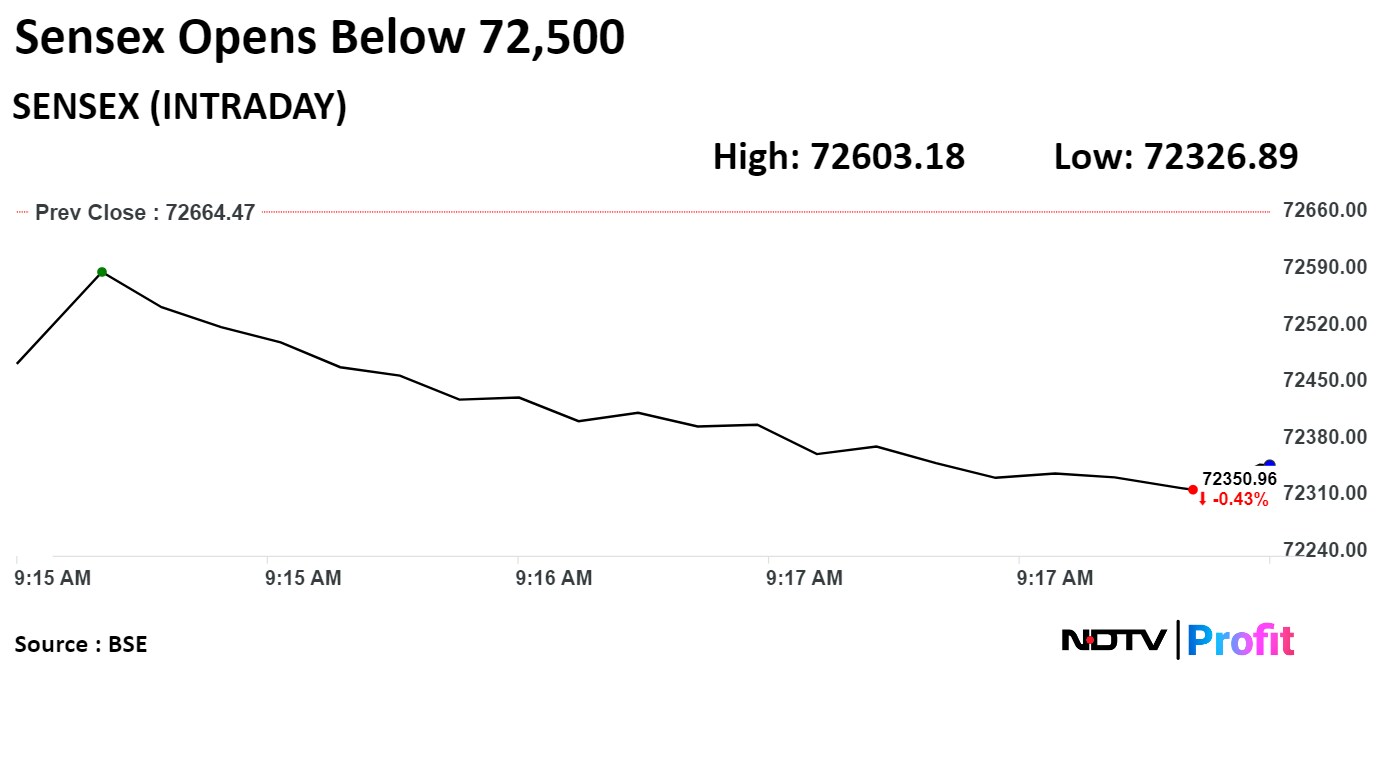

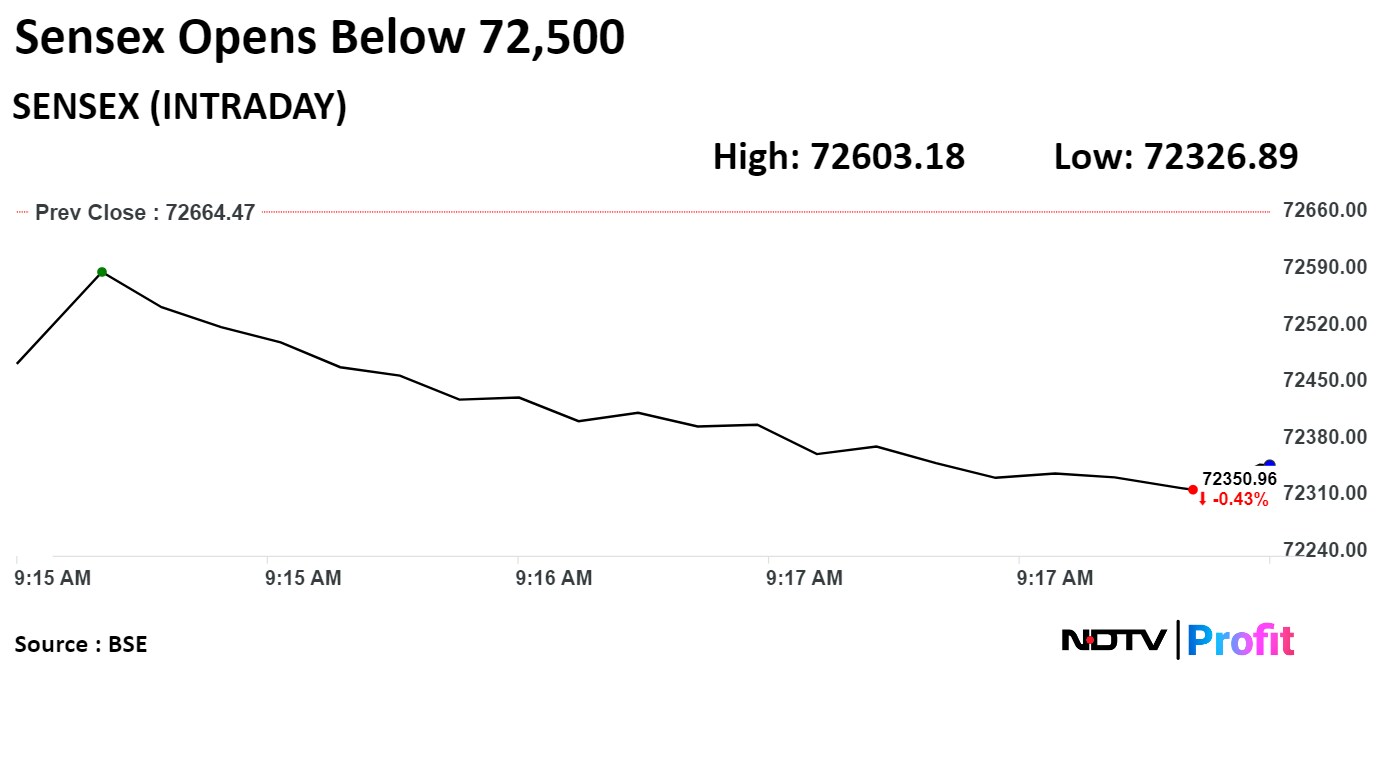

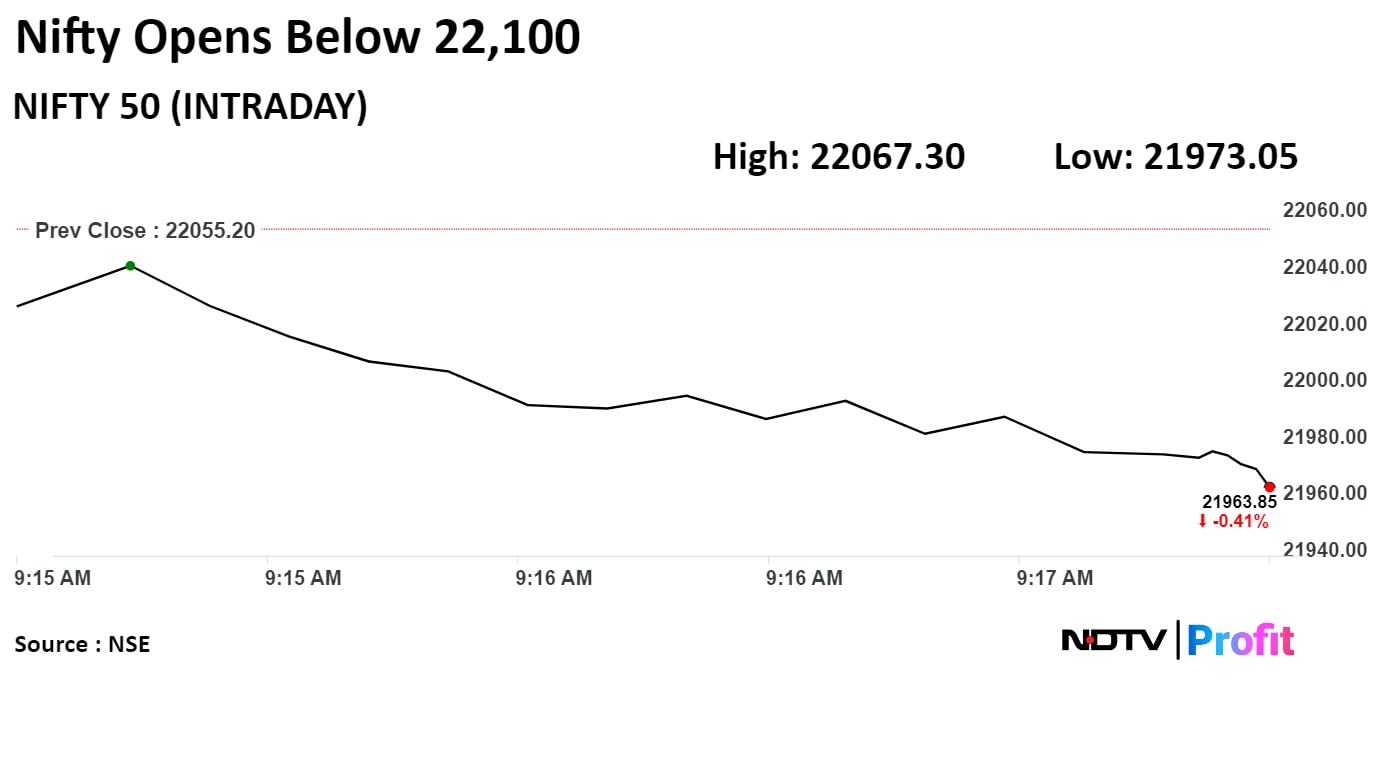

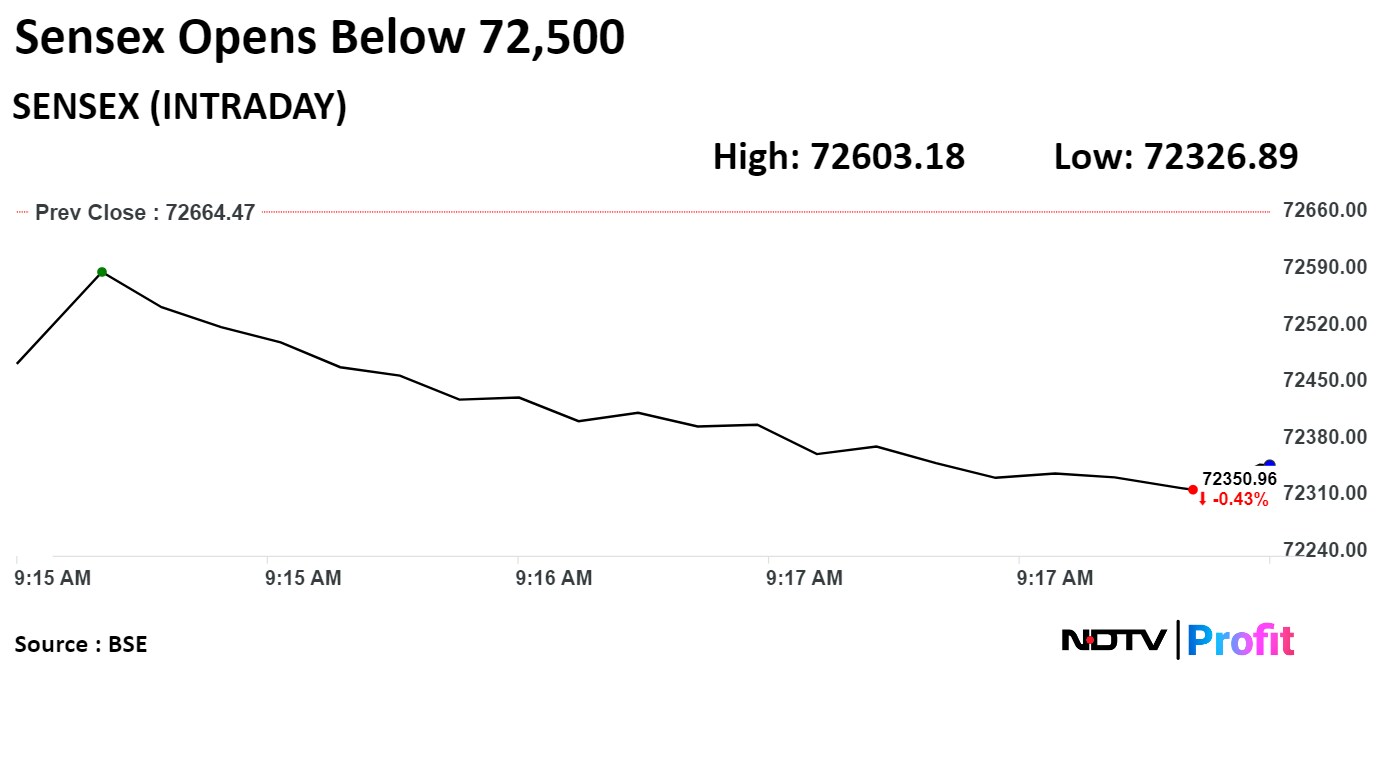

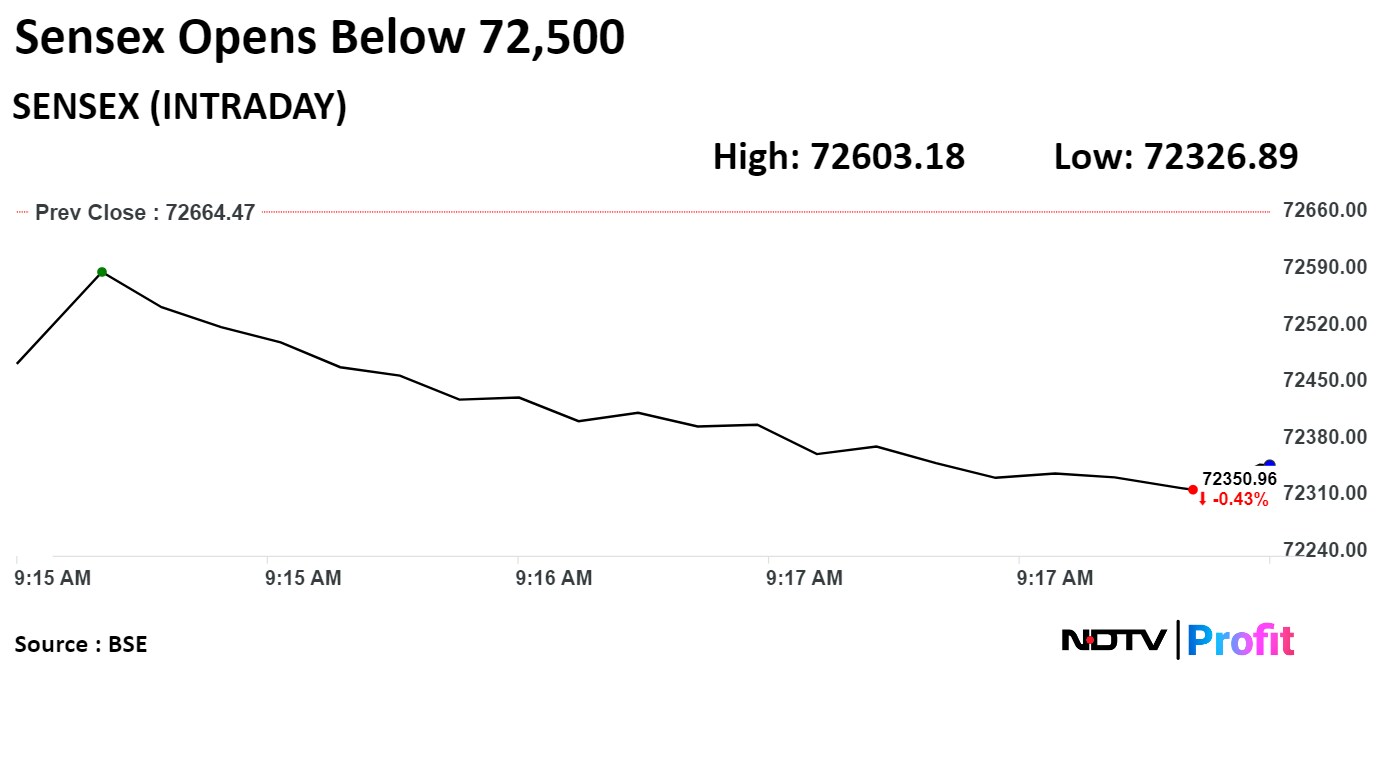

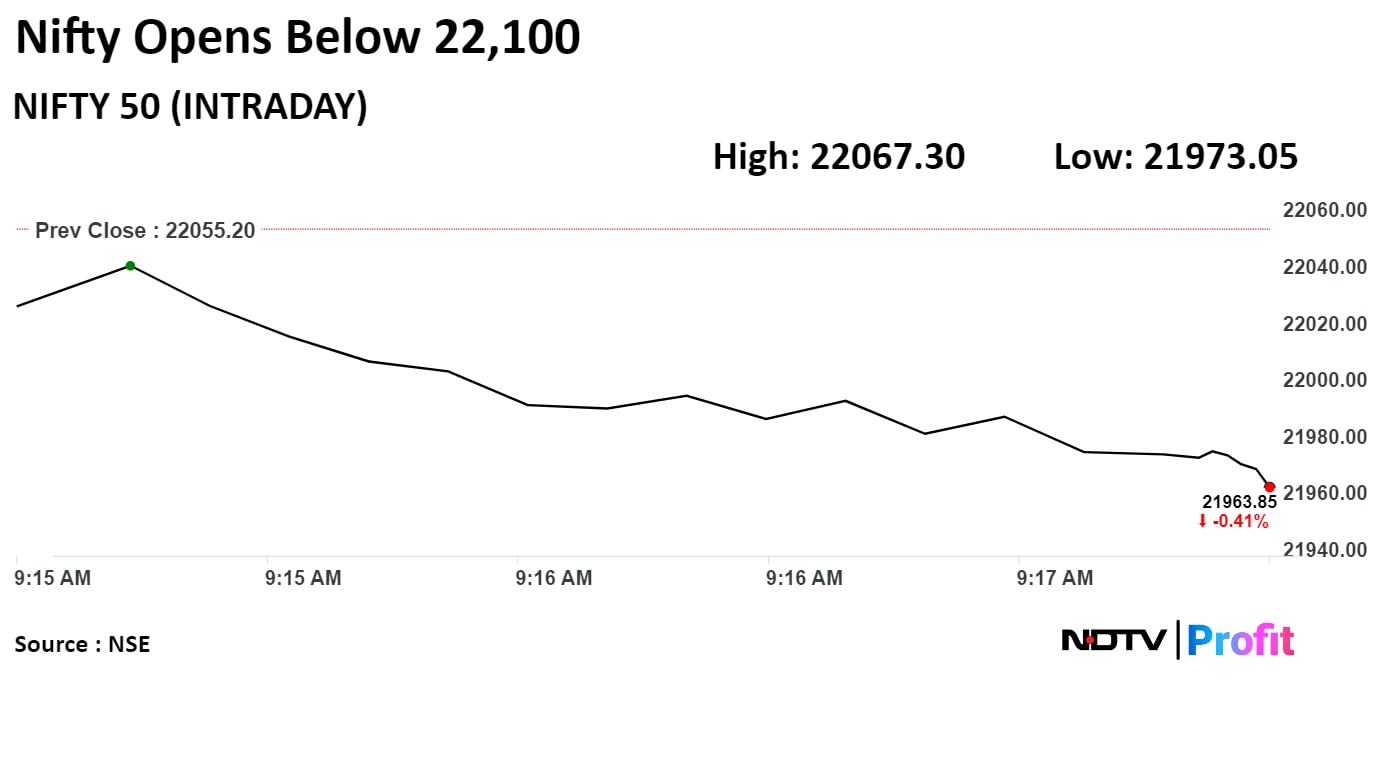

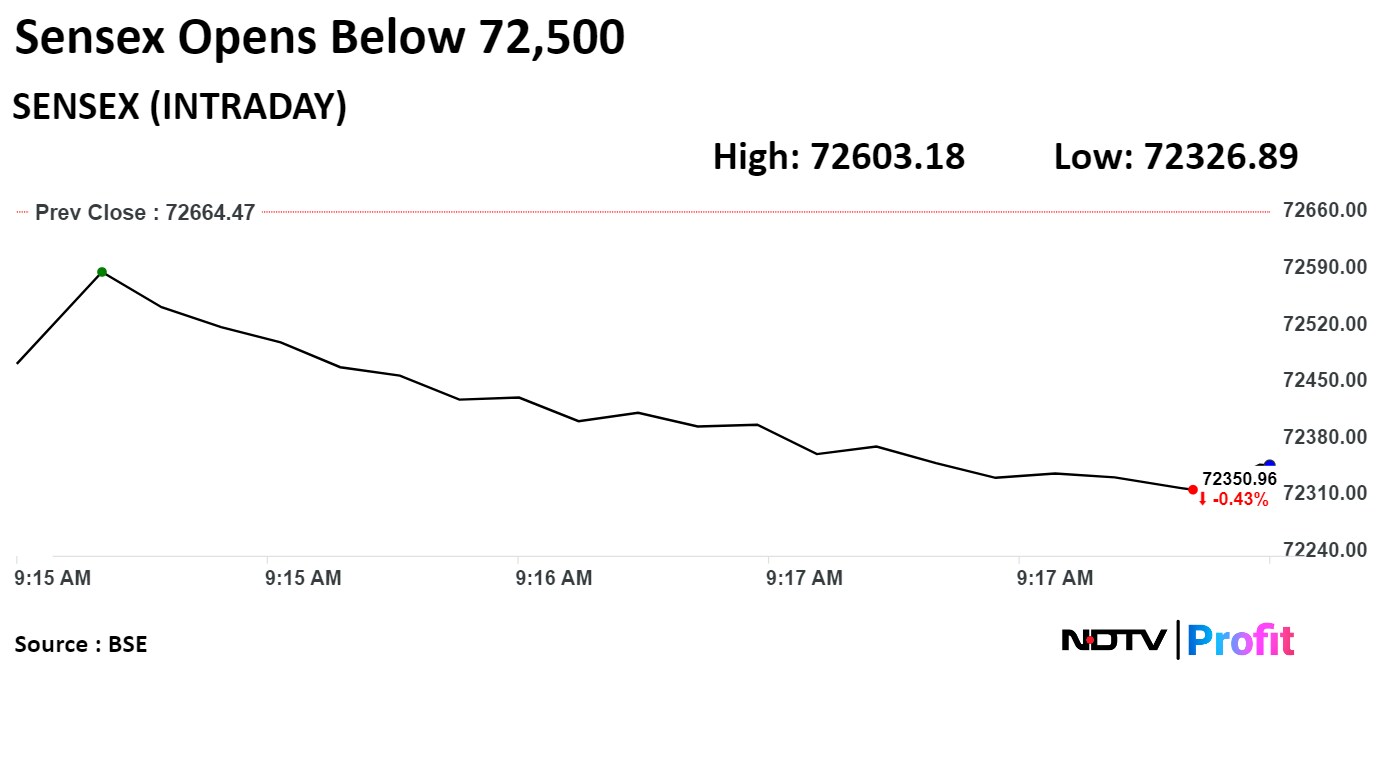

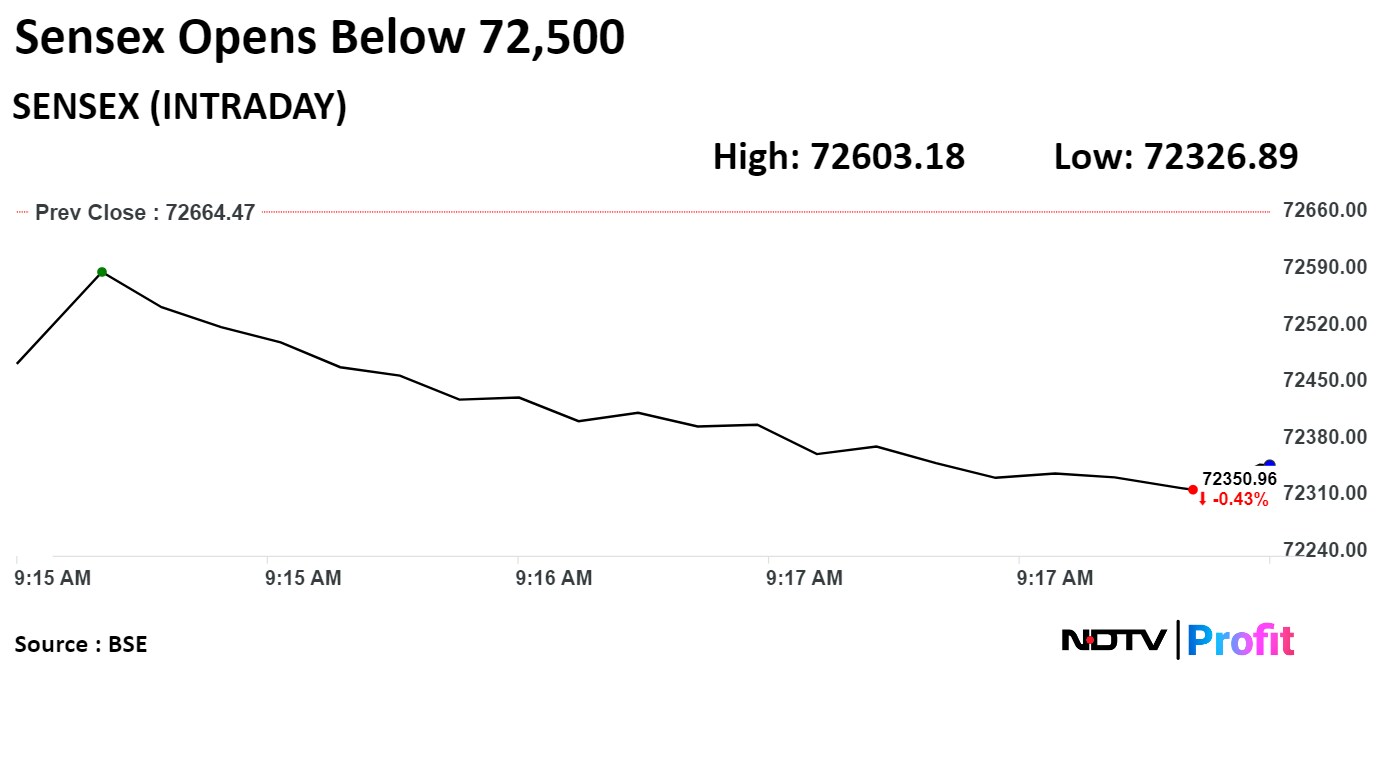

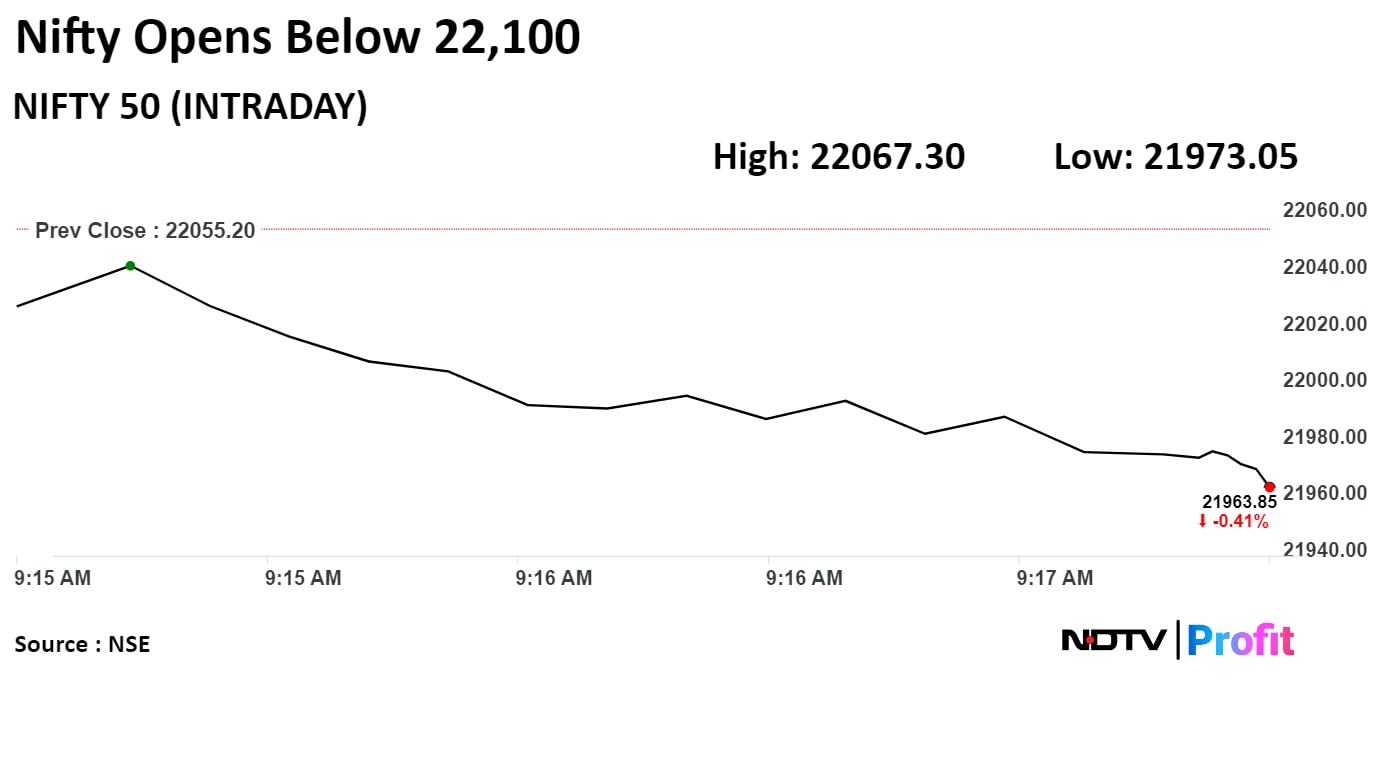

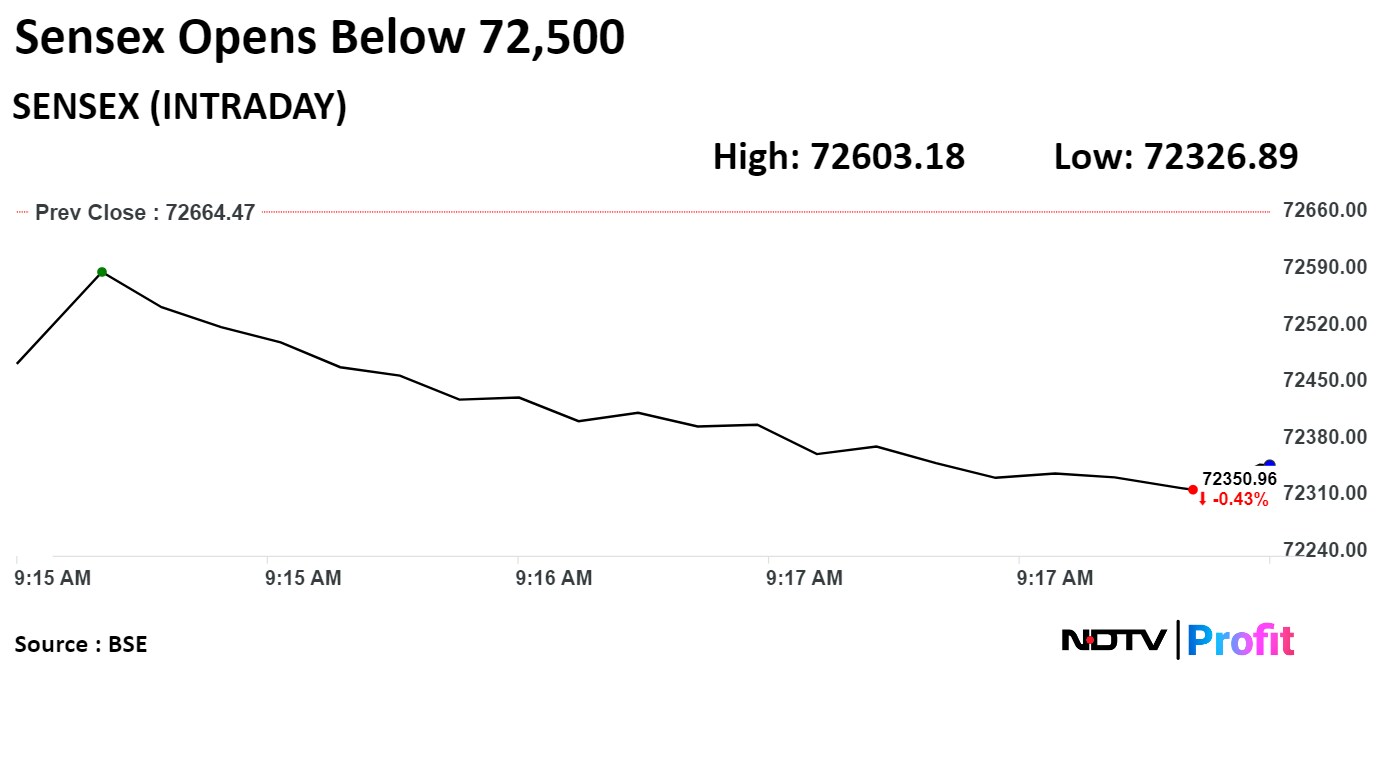

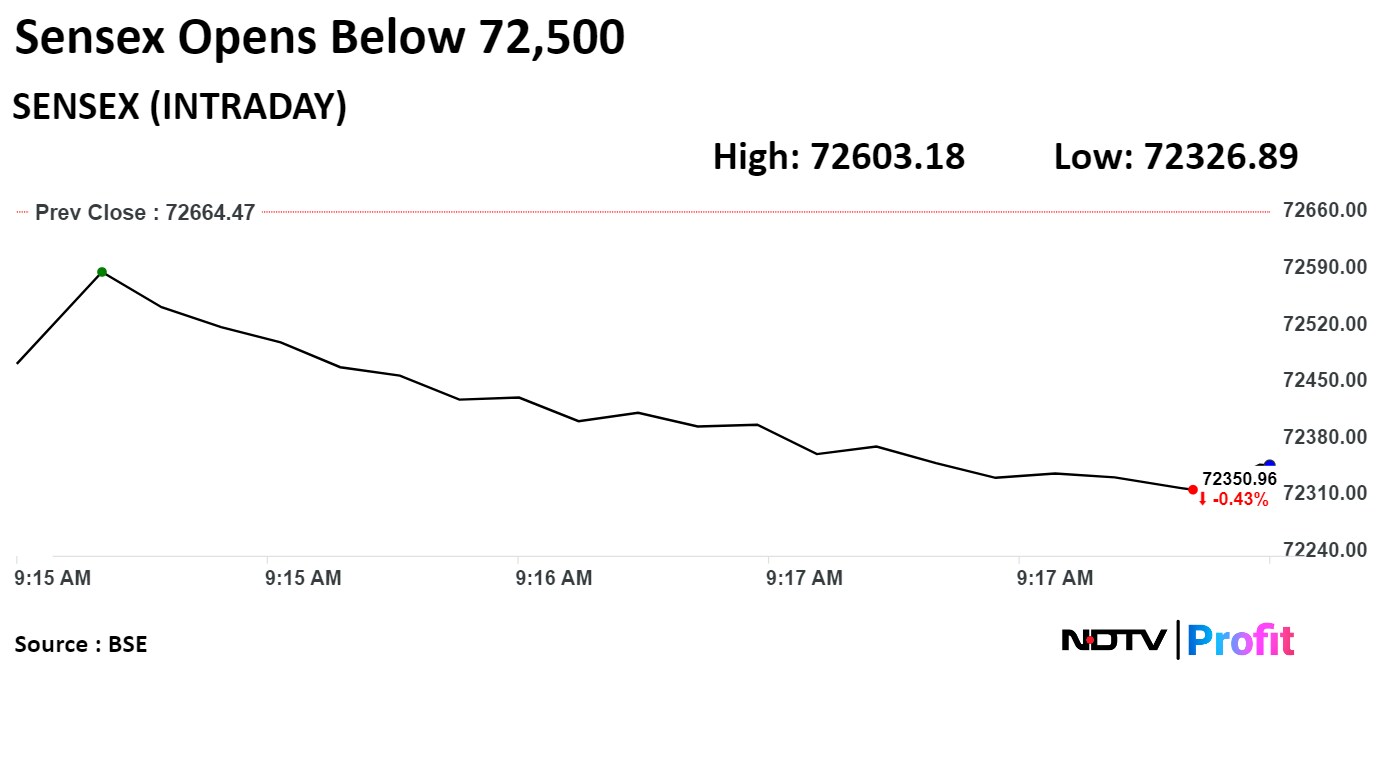

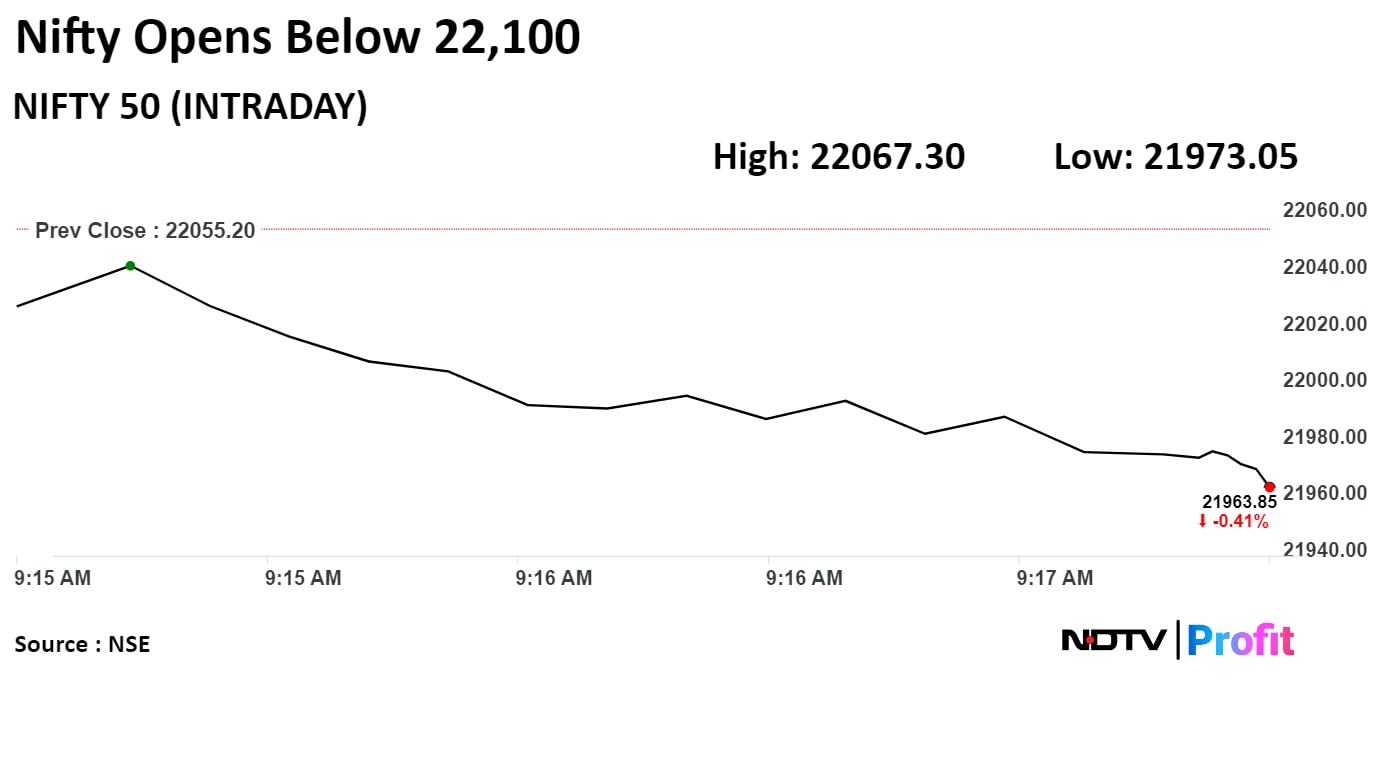

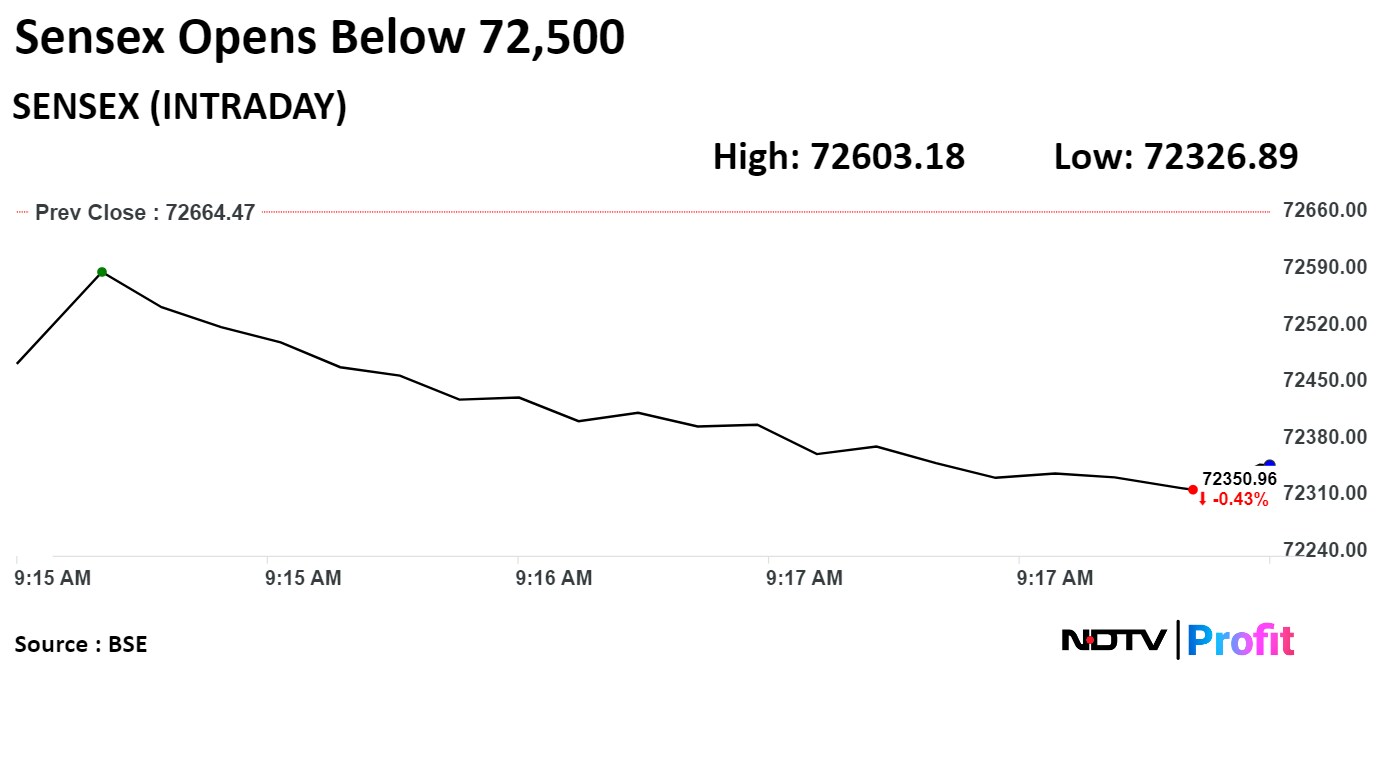

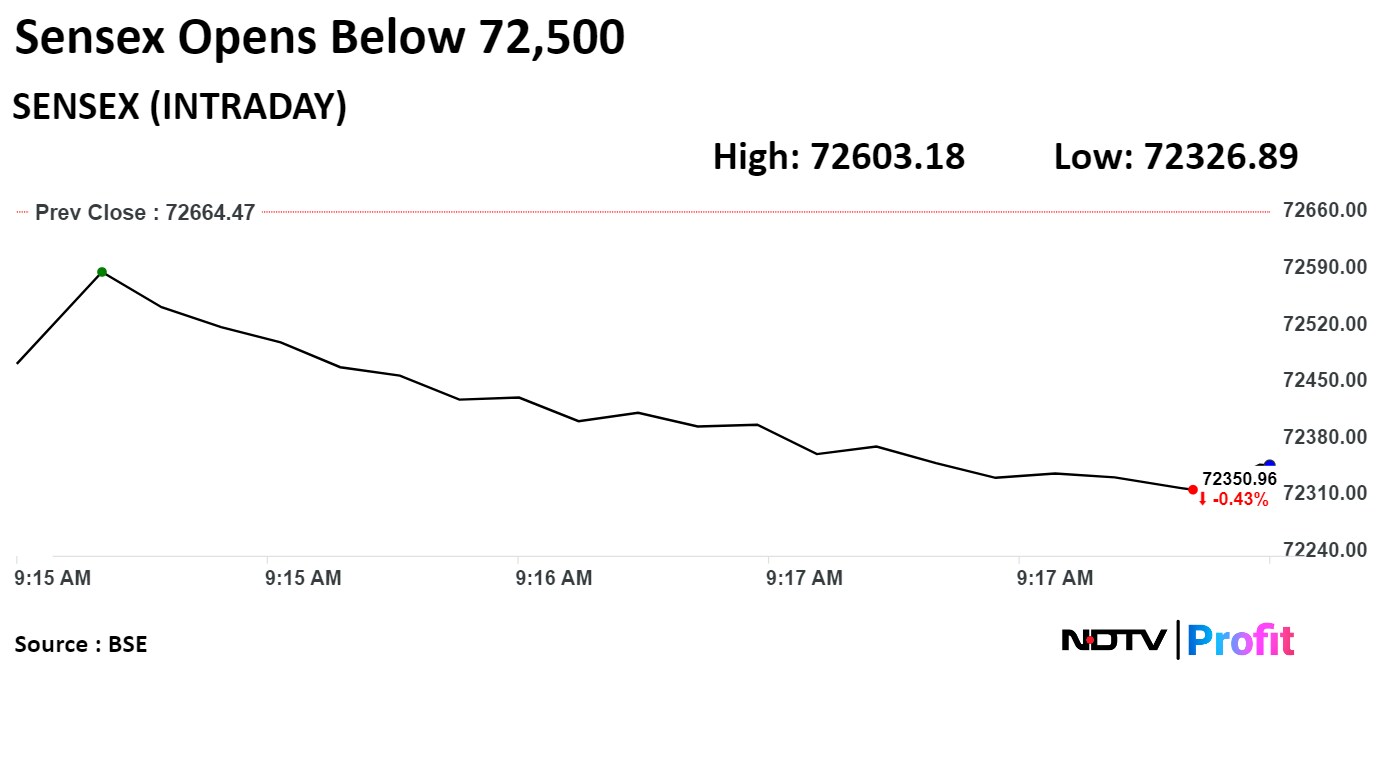

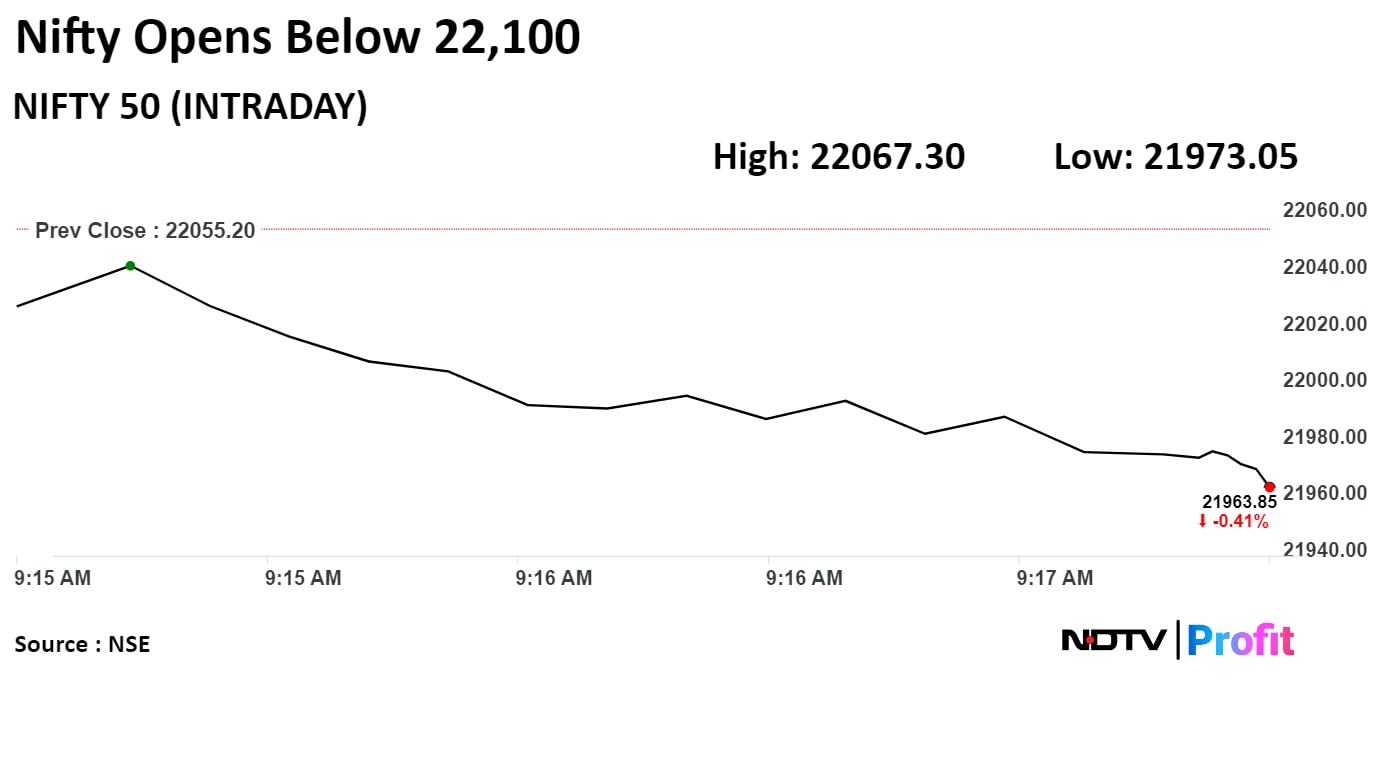

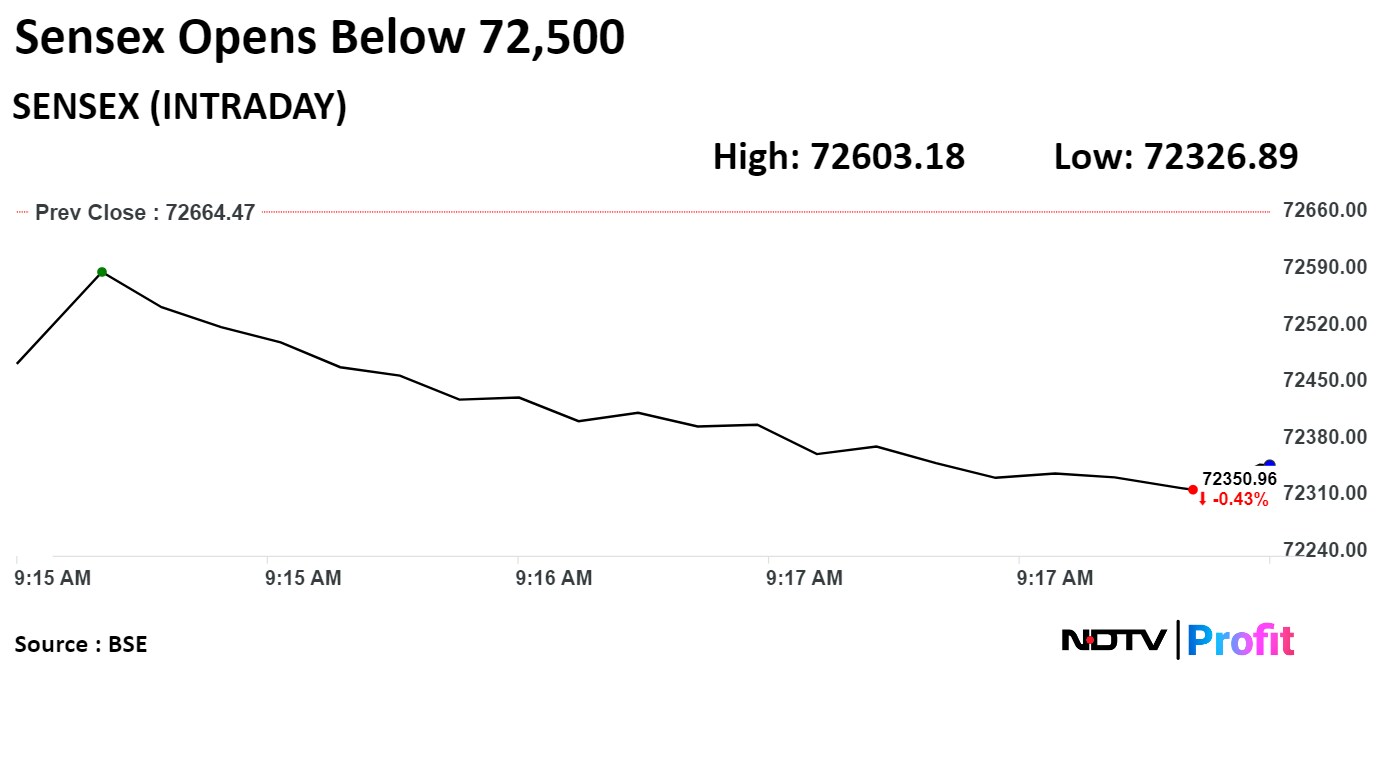

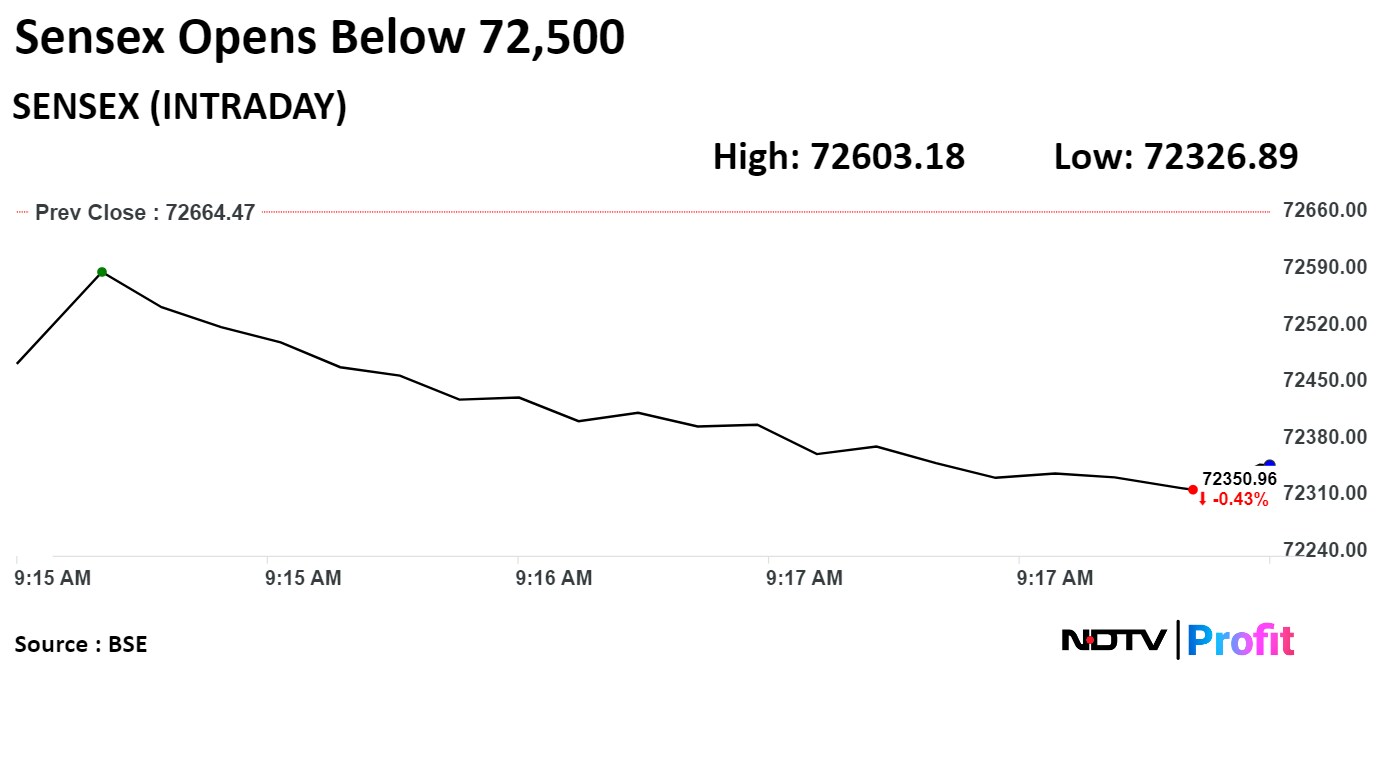

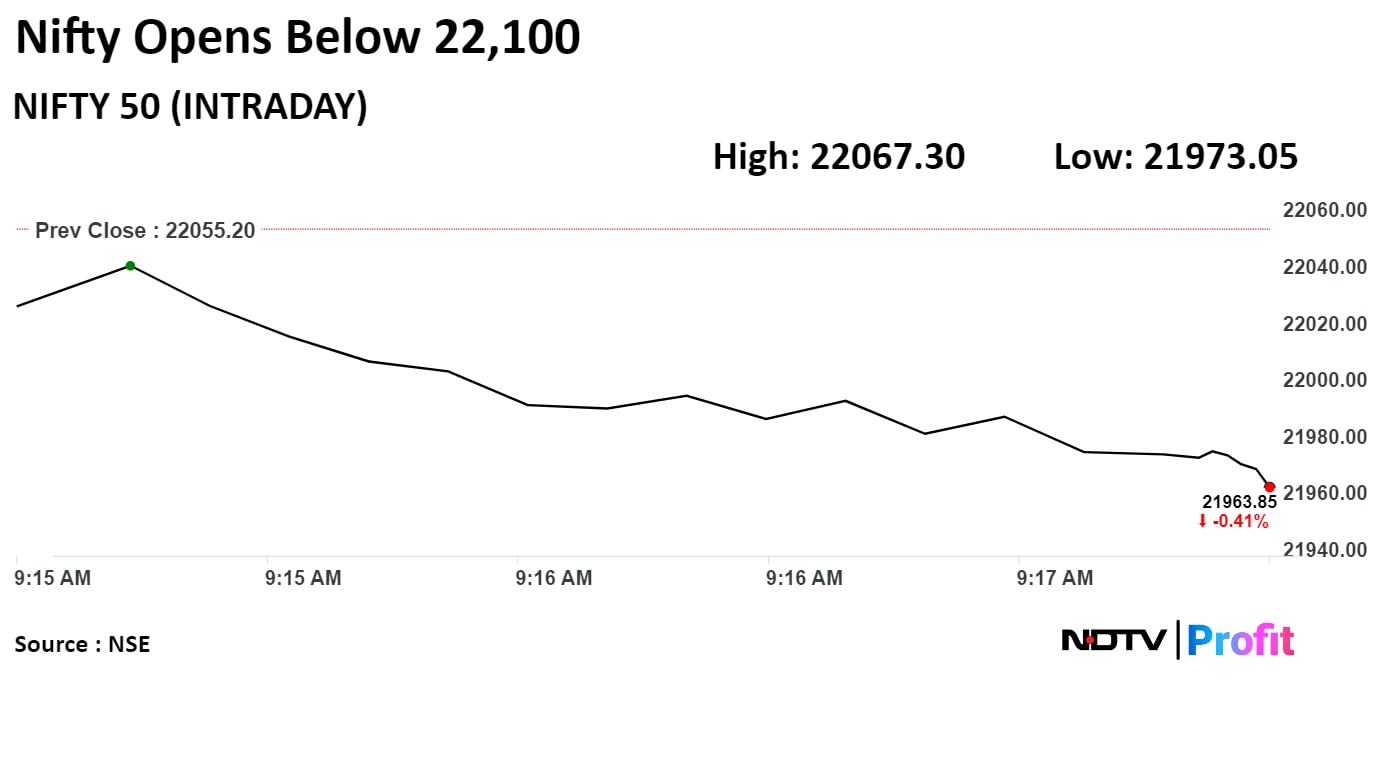

India's benchmark erased gains from previous session at open as share prices of Tata Motors Ltd., Reliance Industries Ltd. dragged.

As of 09:23 a.m., the NSE Nifty 50 was trading 114.75 points or 0.52% lower at 21,940.45, and the S&P BSE Sensex was 428.10 points or 0.59% down at 72,236.37.

The NSE Nifty 50 index opened at 22,033.05, compared to Friday's close of 22,055.2. The S&P BSE Sensex opened at 72,481.62 as compared to previous close of 72,664.47.

"We are of the view that, the short-term texture of the market is still on the weak side but due to temporary oversold conditions, we could see one pullback rally from the current levels," said Amol Athawale, vice president, technical research, Kotak Securities.

For traders now, 22,000/72,500 and 21,950/72,300 are important support levels. Above the same, the market could bounce back up to 22,200/73,000, Athawale said.

Further upside may also continue which could life the market till 50 day SMA or 22y,300/73300. On the flip side, fresh selling possible only after dismissal of 21,950/72,300, below which the market could correct till 21800-21700/71800-71500. For Bank Nifty, after a sharp correction currently it is trading near 50 day SMA. For the traders 47,500 would be the key level to watch out, above the same it could bounce back till 20 day SMA or 48200. On the flip side, below 47,500 the chances of hitting 47,100-47,000 would turn bright, he added.

India's benchmark erased gains from previous session at open as share prices of Tata Motors Ltd., Reliance Industries Ltd. dragged.

As of 09:23 a.m., the NSE Nifty 50 was trading 114.75 points or 0.52% lower at 21,940.45, and the S&P BSE Sensex was 428.10 points or 0.59% down at 72,236.37.

The NSE Nifty 50 index opened at 22,033.05, compared to Friday's close of 22,055.2. The S&P BSE Sensex opened at 72,481.62 as compared to previous close of 72,664.47.

"We are of the view that, the short-term texture of the market is still on the weak side but due to temporary oversold conditions, we could see one pullback rally from the current levels," said Amol Athawale, vice president, technical research, Kotak Securities.

For traders now, 22,000/72,500 and 21,950/72,300 are important support levels. Above the same, the market could bounce back up to 22,200/73,000, Athawale said.

Further upside may also continue which could life the market till 50 day SMA or 22y,300/73300. On the flip side, fresh selling possible only after dismissal of 21,950/72,300, below which the market could correct till 21800-21700/71800-71500. For Bank Nifty, after a sharp correction currently it is trading near 50 day SMA. For the traders 47,500 would be the key level to watch out, above the same it could bounce back till 20 day SMA or 48200. On the flip side, below 47,500 the chances of hitting 47,100-47,000 would turn bright, he added.

India's benchmark erased gains from previous session at open as share prices of Tata Motors Ltd., Reliance Industries Ltd. dragged.

As of 09:23 a.m., the NSE Nifty 50 was trading 114.75 points or 0.52% lower at 21,940.45, and the S&P BSE Sensex was 428.10 points or 0.59% down at 72,236.37.

The NSE Nifty 50 index opened at 22,033.05, compared to Friday's close of 22,055.2. The S&P BSE Sensex opened at 72,481.62 as compared to previous close of 72,664.47.

"We are of the view that, the short-term texture of the market is still on the weak side but due to temporary oversold conditions, we could see one pullback rally from the current levels," said Amol Athawale, vice president, technical research, Kotak Securities.

For traders now, 22,000/72,500 and 21,950/72,300 are important support levels. Above the same, the market could bounce back up to 22,200/73,000, Athawale said.

Further upside may also continue which could life the market till 50 day SMA or 22y,300/73300. On the flip side, fresh selling possible only after dismissal of 21,950/72,300, below which the market could correct till 21800-21700/71800-71500. For Bank Nifty, after a sharp correction currently it is trading near 50 day SMA. For the traders 47,500 would be the key level to watch out, above the same it could bounce back till 20 day SMA or 48200. On the flip side, below 47,500 the chances of hitting 47,100-47,000 would turn bright, he added.

India's benchmark erased gains from previous session at open as share prices of Tata Motors Ltd., Reliance Industries Ltd. dragged.

As of 09:23 a.m., the NSE Nifty 50 was trading 114.75 points or 0.52% lower at 21,940.45, and the S&P BSE Sensex was 428.10 points or 0.59% down at 72,236.37.

The NSE Nifty 50 index opened at 22,033.05, compared to Friday's close of 22,055.2. The S&P BSE Sensex opened at 72,481.62 as compared to previous close of 72,664.47.

"We are of the view that, the short-term texture of the market is still on the weak side but due to temporary oversold conditions, we could see one pullback rally from the current levels," said Amol Athawale, vice president, technical research, Kotak Securities.

For traders now, 22,000/72,500 and 21,950/72,300 are important support levels. Above the same, the market could bounce back up to 22,200/73,000, Athawale said.

Further upside may also continue which could life the market till 50 day SMA or 22y,300/73300. On the flip side, fresh selling possible only after dismissal of 21,950/72,300, below which the market could correct till 21800-21700/71800-71500. For Bank Nifty, after a sharp correction currently it is trading near 50 day SMA. For the traders 47,500 would be the key level to watch out, above the same it could bounce back till 20 day SMA or 48200. On the flip side, below 47,500 the chances of hitting 47,100-47,000 would turn bright, he added.

India's benchmark erased gains from previous session at open as share prices of Tata Motors Ltd., Reliance Industries Ltd. dragged.

As of 09:23 a.m., the NSE Nifty 50 was trading 114.75 points or 0.52% lower at 21,940.45, and the S&P BSE Sensex was 428.10 points or 0.59% down at 72,236.37.

The NSE Nifty 50 index opened at 22,033.05, compared to Friday's close of 22,055.2. The S&P BSE Sensex opened at 72,481.62 as compared to previous close of 72,664.47.

"We are of the view that, the short-term texture of the market is still on the weak side but due to temporary oversold conditions, we could see one pullback rally from the current levels," said Amol Athawale, vice president, technical research, Kotak Securities.

For traders now, 22,000/72,500 and 21,950/72,300 are important support levels. Above the same, the market could bounce back up to 22,200/73,000, Athawale said.

Further upside may also continue which could life the market till 50 day SMA or 22y,300/73300. On the flip side, fresh selling possible only after dismissal of 21,950/72,300, below which the market could correct till 21800-21700/71800-71500. For Bank Nifty, after a sharp correction currently it is trading near 50 day SMA. For the traders 47,500 would be the key level to watch out, above the same it could bounce back till 20 day SMA or 48200. On the flip side, below 47,500 the chances of hitting 47,100-47,000 would turn bright, he added.

India's benchmark erased gains from previous session at open as share prices of Tata Motors Ltd., Reliance Industries Ltd. dragged.

As of 09:23 a.m., the NSE Nifty 50 was trading 114.75 points or 0.52% lower at 21,940.45, and the S&P BSE Sensex was 428.10 points or 0.59% down at 72,236.37.

The NSE Nifty 50 index opened at 22,033.05, compared to Friday's close of 22,055.2. The S&P BSE Sensex opened at 72,481.62 as compared to previous close of 72,664.47.

"We are of the view that, the short-term texture of the market is still on the weak side but due to temporary oversold conditions, we could see one pullback rally from the current levels," said Amol Athawale, vice president, technical research, Kotak Securities.

For traders now, 22,000/72,500 and 21,950/72,300 are important support levels. Above the same, the market could bounce back up to 22,200/73,000, Athawale said.

Further upside may also continue which could life the market till 50 day SMA or 22y,300/73300. On the flip side, fresh selling possible only after dismissal of 21,950/72,300, below which the market could correct till 21800-21700/71800-71500. For Bank Nifty, after a sharp correction currently it is trading near 50 day SMA. For the traders 47,500 would be the key level to watch out, above the same it could bounce back till 20 day SMA or 48200. On the flip side, below 47,500 the chances of hitting 47,100-47,000 would turn bright, he added.

India's benchmark erased gains from previous session at open as share prices of Tata Motors Ltd., Reliance Industries Ltd. dragged.

As of 09:23 a.m., the NSE Nifty 50 was trading 114.75 points or 0.52% lower at 21,940.45, and the S&P BSE Sensex was 428.10 points or 0.59% down at 72,236.37.

The NSE Nifty 50 index opened at 22,033.05, compared to Friday's close of 22,055.2. The S&P BSE Sensex opened at 72,481.62 as compared to previous close of 72,664.47.

"We are of the view that, the short-term texture of the market is still on the weak side but due to temporary oversold conditions, we could see one pullback rally from the current levels," said Amol Athawale, vice president, technical research, Kotak Securities.

For traders now, 22,000/72,500 and 21,950/72,300 are important support levels. Above the same, the market could bounce back up to 22,200/73,000, Athawale said.

Further upside may also continue which could life the market till 50 day SMA or 22y,300/73300. On the flip side, fresh selling possible only after dismissal of 21,950/72,300, below which the market could correct till 21800-21700/71800-71500. For Bank Nifty, after a sharp correction currently it is trading near 50 day SMA. For the traders 47,500 would be the key level to watch out, above the same it could bounce back till 20 day SMA or 48200. On the flip side, below 47,500 the chances of hitting 47,100-47,000 would turn bright, he added.

India's benchmark erased gains from previous session at open as share prices of Tata Motors Ltd., Reliance Industries Ltd. dragged.

As of 09:23 a.m., the NSE Nifty 50 was trading 114.75 points or 0.52% lower at 21,940.45, and the S&P BSE Sensex was 428.10 points or 0.59% down at 72,236.37.

The NSE Nifty 50 index opened at 22,033.05, compared to Friday's close of 22,055.2. The S&P BSE Sensex opened at 72,481.62 as compared to previous close of 72,664.47.

"We are of the view that, the short-term texture of the market is still on the weak side but due to temporary oversold conditions, we could see one pullback rally from the current levels," said Amol Athawale, vice president, technical research, Kotak Securities.

For traders now, 22,000/72,500 and 21,950/72,300 are important support levels. Above the same, the market could bounce back up to 22,200/73,000, Athawale said.

Further upside may also continue which could life the market till 50 day SMA or 22y,300/73300. On the flip side, fresh selling possible only after dismissal of 21,950/72,300, below which the market could correct till 21800-21700/71800-71500. For Bank Nifty, after a sharp correction currently it is trading near 50 day SMA. For the traders 47,500 would be the key level to watch out, above the same it could bounce back till 20 day SMA or 48200. On the flip side, below 47,500 the chances of hitting 47,100-47,000 would turn bright, he added.

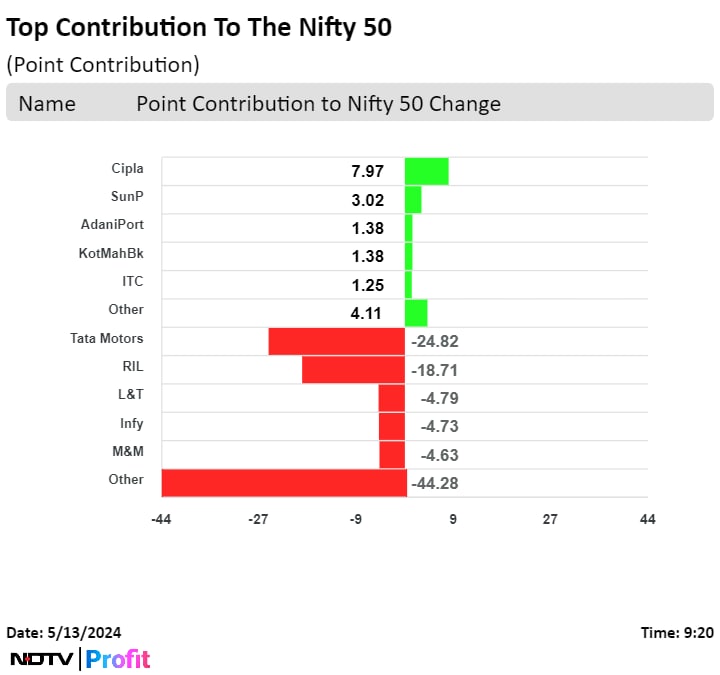

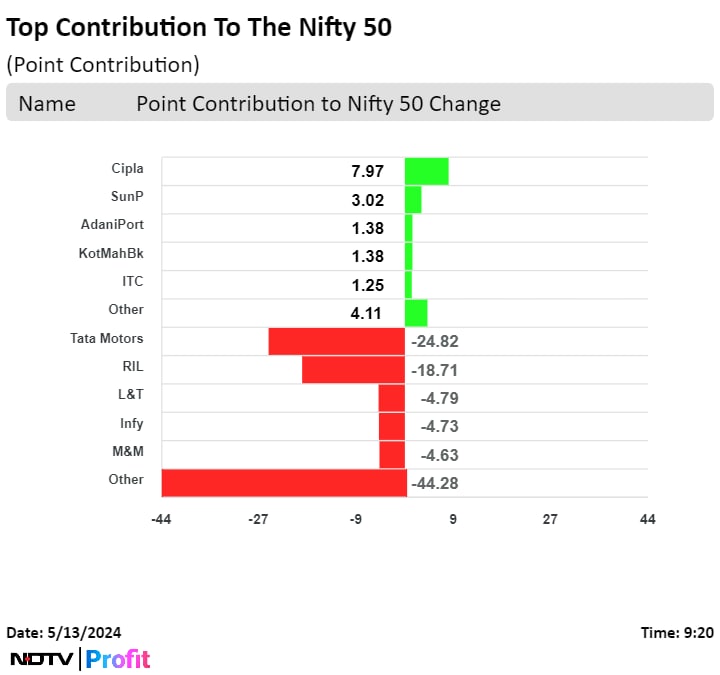

Tata Motors Ltd., Reliance Industries Ltd., Larsen & Toubro Ltd., Infosys Ltd., and Mahindra & Mahindra Ltd. dragged the benchmark.

Cipla Ltd., Sun Pharmaceutical Industries Ltd., Adani Ports & Special Economic Zones Ltd., Kotak Mahindra Bank Ltd., and ITC Ltd. added to the index.

India's benchmark erased gains from previous session at open as share prices of Tata Motors Ltd., Reliance Industries Ltd. dragged.

As of 09:23 a.m., the NSE Nifty 50 was trading 114.75 points or 0.52% lower at 21,940.45, and the S&P BSE Sensex was 428.10 points or 0.59% down at 72,236.37.

The NSE Nifty 50 index opened at 22,033.05, compared to Friday's close of 22,055.2. The S&P BSE Sensex opened at 72,481.62 as compared to previous close of 72,664.47.

"We are of the view that, the short-term texture of the market is still on the weak side but due to temporary oversold conditions, we could see one pullback rally from the current levels," said Amol Athawale, vice president, technical research, Kotak Securities.

For traders now, 22,000/72,500 and 21,950/72,300 are important support levels. Above the same, the market could bounce back up to 22,200/73,000, Athawale said.

Further upside may also continue which could life the market till 50 day SMA or 22y,300/73300. On the flip side, fresh selling possible only after dismissal of 21,950/72,300, below which the market could correct till 21800-21700/71800-71500. For Bank Nifty, after a sharp correction currently it is trading near 50 day SMA. For the traders 47,500 would be the key level to watch out, above the same it could bounce back till 20 day SMA or 48200. On the flip side, below 47,500 the chances of hitting 47,100-47,000 would turn bright, he added.

India's benchmark erased gains from previous session at open as share prices of Tata Motors Ltd., Reliance Industries Ltd. dragged.

As of 09:23 a.m., the NSE Nifty 50 was trading 114.75 points or 0.52% lower at 21,940.45, and the S&P BSE Sensex was 428.10 points or 0.59% down at 72,236.37.

The NSE Nifty 50 index opened at 22,033.05, compared to Friday's close of 22,055.2. The S&P BSE Sensex opened at 72,481.62 as compared to previous close of 72,664.47.

"We are of the view that, the short-term texture of the market is still on the weak side but due to temporary oversold conditions, we could see one pullback rally from the current levels," said Amol Athawale, vice president, technical research, Kotak Securities.

For traders now, 22,000/72,500 and 21,950/72,300 are important support levels. Above the same, the market could bounce back up to 22,200/73,000, Athawale said.

Further upside may also continue which could life the market till 50 day SMA or 22y,300/73300. On the flip side, fresh selling possible only after dismissal of 21,950/72,300, below which the market could correct till 21800-21700/71800-71500. For Bank Nifty, after a sharp correction currently it is trading near 50 day SMA. For the traders 47,500 would be the key level to watch out, above the same it could bounce back till 20 day SMA or 48200. On the flip side, below 47,500 the chances of hitting 47,100-47,000 would turn bright, he added.

India's benchmark erased gains from previous session at open as share prices of Tata Motors Ltd., Reliance Industries Ltd. dragged.

As of 09:23 a.m., the NSE Nifty 50 was trading 114.75 points or 0.52% lower at 21,940.45, and the S&P BSE Sensex was 428.10 points or 0.59% down at 72,236.37.

The NSE Nifty 50 index opened at 22,033.05, compared to Friday's close of 22,055.2. The S&P BSE Sensex opened at 72,481.62 as compared to previous close of 72,664.47.

"We are of the view that, the short-term texture of the market is still on the weak side but due to temporary oversold conditions, we could see one pullback rally from the current levels," said Amol Athawale, vice president, technical research, Kotak Securities.

For traders now, 22,000/72,500 and 21,950/72,300 are important support levels. Above the same, the market could bounce back up to 22,200/73,000, Athawale said.

Further upside may also continue which could life the market till 50 day SMA or 22y,300/73300. On the flip side, fresh selling possible only after dismissal of 21,950/72,300, below which the market could correct till 21800-21700/71800-71500. For Bank Nifty, after a sharp correction currently it is trading near 50 day SMA. For the traders 47,500 would be the key level to watch out, above the same it could bounce back till 20 day SMA or 48200. On the flip side, below 47,500 the chances of hitting 47,100-47,000 would turn bright, he added.

India's benchmark erased gains from previous session at open as share prices of Tata Motors Ltd., Reliance Industries Ltd. dragged.

As of 09:23 a.m., the NSE Nifty 50 was trading 114.75 points or 0.52% lower at 21,940.45, and the S&P BSE Sensex was 428.10 points or 0.59% down at 72,236.37.

The NSE Nifty 50 index opened at 22,033.05, compared to Friday's close of 22,055.2. The S&P BSE Sensex opened at 72,481.62 as compared to previous close of 72,664.47.

"We are of the view that, the short-term texture of the market is still on the weak side but due to temporary oversold conditions, we could see one pullback rally from the current levels," said Amol Athawale, vice president, technical research, Kotak Securities.

For traders now, 22,000/72,500 and 21,950/72,300 are important support levels. Above the same, the market could bounce back up to 22,200/73,000, Athawale said.

Further upside may also continue which could life the market till 50 day SMA or 22y,300/73300. On the flip side, fresh selling possible only after dismissal of 21,950/72,300, below which the market could correct till 21800-21700/71800-71500. For Bank Nifty, after a sharp correction currently it is trading near 50 day SMA. For the traders 47,500 would be the key level to watch out, above the same it could bounce back till 20 day SMA or 48200. On the flip side, below 47,500 the chances of hitting 47,100-47,000 would turn bright, he added.

India's benchmark erased gains from previous session at open as share prices of Tata Motors Ltd., Reliance Industries Ltd. dragged.

As of 09:23 a.m., the NSE Nifty 50 was trading 114.75 points or 0.52% lower at 21,940.45, and the S&P BSE Sensex was 428.10 points or 0.59% down at 72,236.37.

The NSE Nifty 50 index opened at 22,033.05, compared to Friday's close of 22,055.2. The S&P BSE Sensex opened at 72,481.62 as compared to previous close of 72,664.47.

"We are of the view that, the short-term texture of the market is still on the weak side but due to temporary oversold conditions, we could see one pullback rally from the current levels," said Amol Athawale, vice president, technical research, Kotak Securities.

For traders now, 22,000/72,500 and 21,950/72,300 are important support levels. Above the same, the market could bounce back up to 22,200/73,000, Athawale said.

Further upside may also continue which could life the market till 50 day SMA or 22y,300/73300. On the flip side, fresh selling possible only after dismissal of 21,950/72,300, below which the market could correct till 21800-21700/71800-71500. For Bank Nifty, after a sharp correction currently it is trading near 50 day SMA. For the traders 47,500 would be the key level to watch out, above the same it could bounce back till 20 day SMA or 48200. On the flip side, below 47,500 the chances of hitting 47,100-47,000 would turn bright, he added.

India's benchmark erased gains from previous session at open as share prices of Tata Motors Ltd., Reliance Industries Ltd. dragged.

As of 09:23 a.m., the NSE Nifty 50 was trading 114.75 points or 0.52% lower at 21,940.45, and the S&P BSE Sensex was 428.10 points or 0.59% down at 72,236.37.

The NSE Nifty 50 index opened at 22,033.05, compared to Friday's close of 22,055.2. The S&P BSE Sensex opened at 72,481.62 as compared to previous close of 72,664.47.

"We are of the view that, the short-term texture of the market is still on the weak side but due to temporary oversold conditions, we could see one pullback rally from the current levels," said Amol Athawale, vice president, technical research, Kotak Securities.

For traders now, 22,000/72,500 and 21,950/72,300 are important support levels. Above the same, the market could bounce back up to 22,200/73,000, Athawale said.

Further upside may also continue which could life the market till 50 day SMA or 22y,300/73300. On the flip side, fresh selling possible only after dismissal of 21,950/72,300, below which the market could correct till 21800-21700/71800-71500. For Bank Nifty, after a sharp correction currently it is trading near 50 day SMA. For the traders 47,500 would be the key level to watch out, above the same it could bounce back till 20 day SMA or 48200. On the flip side, below 47,500 the chances of hitting 47,100-47,000 would turn bright, he added.

India's benchmark erased gains from previous session at open as share prices of Tata Motors Ltd., Reliance Industries Ltd. dragged.

As of 09:23 a.m., the NSE Nifty 50 was trading 114.75 points or 0.52% lower at 21,940.45, and the S&P BSE Sensex was 428.10 points or 0.59% down at 72,236.37.

The NSE Nifty 50 index opened at 22,033.05, compared to Friday's close of 22,055.2. The S&P BSE Sensex opened at 72,481.62 as compared to previous close of 72,664.47.

"We are of the view that, the short-term texture of the market is still on the weak side but due to temporary oversold conditions, we could see one pullback rally from the current levels," said Amol Athawale, vice president, technical research, Kotak Securities.

For traders now, 22,000/72,500 and 21,950/72,300 are important support levels. Above the same, the market could bounce back up to 22,200/73,000, Athawale said.

Further upside may also continue which could life the market till 50 day SMA or 22y,300/73300. On the flip side, fresh selling possible only after dismissal of 21,950/72,300, below which the market could correct till 21800-21700/71800-71500. For Bank Nifty, after a sharp correction currently it is trading near 50 day SMA. For the traders 47,500 would be the key level to watch out, above the same it could bounce back till 20 day SMA or 48200. On the flip side, below 47,500 the chances of hitting 47,100-47,000 would turn bright, he added.

India's benchmark erased gains from previous session at open as share prices of Tata Motors Ltd., Reliance Industries Ltd. dragged.

As of 09:23 a.m., the NSE Nifty 50 was trading 114.75 points or 0.52% lower at 21,940.45, and the S&P BSE Sensex was 428.10 points or 0.59% down at 72,236.37.

The NSE Nifty 50 index opened at 22,033.05, compared to Friday's close of 22,055.2. The S&P BSE Sensex opened at 72,481.62 as compared to previous close of 72,664.47.

"We are of the view that, the short-term texture of the market is still on the weak side but due to temporary oversold conditions, we could see one pullback rally from the current levels," said Amol Athawale, vice president, technical research, Kotak Securities.

For traders now, 22,000/72,500 and 21,950/72,300 are important support levels. Above the same, the market could bounce back up to 22,200/73,000, Athawale said.

Further upside may also continue which could life the market till 50 day SMA or 22y,300/73300. On the flip side, fresh selling possible only after dismissal of 21,950/72,300, below which the market could correct till 21800-21700/71800-71500. For Bank Nifty, after a sharp correction currently it is trading near 50 day SMA. For the traders 47,500 would be the key level to watch out, above the same it could bounce back till 20 day SMA or 48200. On the flip side, below 47,500 the chances of hitting 47,100-47,000 would turn bright, he added.

Tata Motors Ltd., Reliance Industries Ltd., Larsen & Toubro Ltd., Infosys Ltd., and Mahindra & Mahindra Ltd. dragged the benchmark.

Cipla Ltd., Sun Pharmaceutical Industries Ltd., Adani Ports & Special Economic Zones Ltd., Kotak Mahindra Bank Ltd., and ITC Ltd. added to the index.

On NSE, 10 sectors out of 12 opened in red, while two rose. The NSE Nifty Auto index declined nearly 2% during open to become the worst performing sector. The NSE Nifty Pharma was the best performing sector.

India's benchmark erased gains from previous session at open as share prices of Tata Motors Ltd., Reliance Industries Ltd. dragged.

As of 09:23 a.m., the NSE Nifty 50 was trading 114.75 points or 0.52% lower at 21,940.45, and the S&P BSE Sensex was 428.10 points or 0.59% down at 72,236.37.

The NSE Nifty 50 index opened at 22,033.05, compared to Friday's close of 22,055.2. The S&P BSE Sensex opened at 72,481.62 as compared to previous close of 72,664.47.

"We are of the view that, the short-term texture of the market is still on the weak side but due to temporary oversold conditions, we could see one pullback rally from the current levels," said Amol Athawale, vice president, technical research, Kotak Securities.

For traders now, 22,000/72,500 and 21,950/72,300 are important support levels. Above the same, the market could bounce back up to 22,200/73,000, Athawale said.

Further upside may also continue which could life the market till 50 day SMA or 22y,300/73300. On the flip side, fresh selling possible only after dismissal of 21,950/72,300, below which the market could correct till 21800-21700/71800-71500. For Bank Nifty, after a sharp correction currently it is trading near 50 day SMA. For the traders 47,500 would be the key level to watch out, above the same it could bounce back till 20 day SMA or 48200. On the flip side, below 47,500 the chances of hitting 47,100-47,000 would turn bright, he added.

India's benchmark erased gains from previous session at open as share prices of Tata Motors Ltd., Reliance Industries Ltd. dragged.

As of 09:23 a.m., the NSE Nifty 50 was trading 114.75 points or 0.52% lower at 21,940.45, and the S&P BSE Sensex was 428.10 points or 0.59% down at 72,236.37.

The NSE Nifty 50 index opened at 22,033.05, compared to Friday's close of 22,055.2. The S&P BSE Sensex opened at 72,481.62 as compared to previous close of 72,664.47.

"We are of the view that, the short-term texture of the market is still on the weak side but due to temporary oversold conditions, we could see one pullback rally from the current levels," said Amol Athawale, vice president, technical research, Kotak Securities.

For traders now, 22,000/72,500 and 21,950/72,300 are important support levels. Above the same, the market could bounce back up to 22,200/73,000, Athawale said.

Further upside may also continue which could life the market till 50 day SMA or 22y,300/73300. On the flip side, fresh selling possible only after dismissal of 21,950/72,300, below which the market could correct till 21800-21700/71800-71500. For Bank Nifty, after a sharp correction currently it is trading near 50 day SMA. For the traders 47,500 would be the key level to watch out, above the same it could bounce back till 20 day SMA or 48200. On the flip side, below 47,500 the chances of hitting 47,100-47,000 would turn bright, he added.

India's benchmark erased gains from previous session at open as share prices of Tata Motors Ltd., Reliance Industries Ltd. dragged.

As of 09:23 a.m., the NSE Nifty 50 was trading 114.75 points or 0.52% lower at 21,940.45, and the S&P BSE Sensex was 428.10 points or 0.59% down at 72,236.37.

The NSE Nifty 50 index opened at 22,033.05, compared to Friday's close of 22,055.2. The S&P BSE Sensex opened at 72,481.62 as compared to previous close of 72,664.47.

"We are of the view that, the short-term texture of the market is still on the weak side but due to temporary oversold conditions, we could see one pullback rally from the current levels," said Amol Athawale, vice president, technical research, Kotak Securities.

For traders now, 22,000/72,500 and 21,950/72,300 are important support levels. Above the same, the market could bounce back up to 22,200/73,000, Athawale said.

Further upside may also continue which could life the market till 50 day SMA or 22y,300/73300. On the flip side, fresh selling possible only after dismissal of 21,950/72,300, below which the market could correct till 21800-21700/71800-71500. For Bank Nifty, after a sharp correction currently it is trading near 50 day SMA. For the traders 47,500 would be the key level to watch out, above the same it could bounce back till 20 day SMA or 48200. On the flip side, below 47,500 the chances of hitting 47,100-47,000 would turn bright, he added.

India's benchmark erased gains from previous session at open as share prices of Tata Motors Ltd., Reliance Industries Ltd. dragged.

As of 09:23 a.m., the NSE Nifty 50 was trading 114.75 points or 0.52% lower at 21,940.45, and the S&P BSE Sensex was 428.10 points or 0.59% down at 72,236.37.

The NSE Nifty 50 index opened at 22,033.05, compared to Friday's close of 22,055.2. The S&P BSE Sensex opened at 72,481.62 as compared to previous close of 72,664.47.

"We are of the view that, the short-term texture of the market is still on the weak side but due to temporary oversold conditions, we could see one pullback rally from the current levels," said Amol Athawale, vice president, technical research, Kotak Securities.

For traders now, 22,000/72,500 and 21,950/72,300 are important support levels. Above the same, the market could bounce back up to 22,200/73,000, Athawale said.

Further upside may also continue which could life the market till 50 day SMA or 22y,300/73300. On the flip side, fresh selling possible only after dismissal of 21,950/72,300, below which the market could correct till 21800-21700/71800-71500. For Bank Nifty, after a sharp correction currently it is trading near 50 day SMA. For the traders 47,500 would be the key level to watch out, above the same it could bounce back till 20 day SMA or 48200. On the flip side, below 47,500 the chances of hitting 47,100-47,000 would turn bright, he added.

India's benchmark erased gains from previous session at open as share prices of Tata Motors Ltd., Reliance Industries Ltd. dragged.

As of 09:23 a.m., the NSE Nifty 50 was trading 114.75 points or 0.52% lower at 21,940.45, and the S&P BSE Sensex was 428.10 points or 0.59% down at 72,236.37.

The NSE Nifty 50 index opened at 22,033.05, compared to Friday's close of 22,055.2. The S&P BSE Sensex opened at 72,481.62 as compared to previous close of 72,664.47.

"We are of the view that, the short-term texture of the market is still on the weak side but due to temporary oversold conditions, we could see one pullback rally from the current levels," said Amol Athawale, vice president, technical research, Kotak Securities.

For traders now, 22,000/72,500 and 21,950/72,300 are important support levels. Above the same, the market could bounce back up to 22,200/73,000, Athawale said.

Further upside may also continue which could life the market till 50 day SMA or 22y,300/73300. On the flip side, fresh selling possible only after dismissal of 21,950/72,300, below which the market could correct till 21800-21700/71800-71500. For Bank Nifty, after a sharp correction currently it is trading near 50 day SMA. For the traders 47,500 would be the key level to watch out, above the same it could bounce back till 20 day SMA or 48200. On the flip side, below 47,500 the chances of hitting 47,100-47,000 would turn bright, he added.

India's benchmark erased gains from previous session at open as share prices of Tata Motors Ltd., Reliance Industries Ltd. dragged.

As of 09:23 a.m., the NSE Nifty 50 was trading 114.75 points or 0.52% lower at 21,940.45, and the S&P BSE Sensex was 428.10 points or 0.59% down at 72,236.37.

The NSE Nifty 50 index opened at 22,033.05, compared to Friday's close of 22,055.2. The S&P BSE Sensex opened at 72,481.62 as compared to previous close of 72,664.47.

"We are of the view that, the short-term texture of the market is still on the weak side but due to temporary oversold conditions, we could see one pullback rally from the current levels," said Amol Athawale, vice president, technical research, Kotak Securities.

For traders now, 22,000/72,500 and 21,950/72,300 are important support levels. Above the same, the market could bounce back up to 22,200/73,000, Athawale said.

Further upside may also continue which could life the market till 50 day SMA or 22y,300/73300. On the flip side, fresh selling possible only after dismissal of 21,950/72,300, below which the market could correct till 21800-21700/71800-71500. For Bank Nifty, after a sharp correction currently it is trading near 50 day SMA. For the traders 47,500 would be the key level to watch out, above the same it could bounce back till 20 day SMA or 48200. On the flip side, below 47,500 the chances of hitting 47,100-47,000 would turn bright, he added.

India's benchmark erased gains from previous session at open as share prices of Tata Motors Ltd., Reliance Industries Ltd. dragged.

As of 09:23 a.m., the NSE Nifty 50 was trading 114.75 points or 0.52% lower at 21,940.45, and the S&P BSE Sensex was 428.10 points or 0.59% down at 72,236.37.