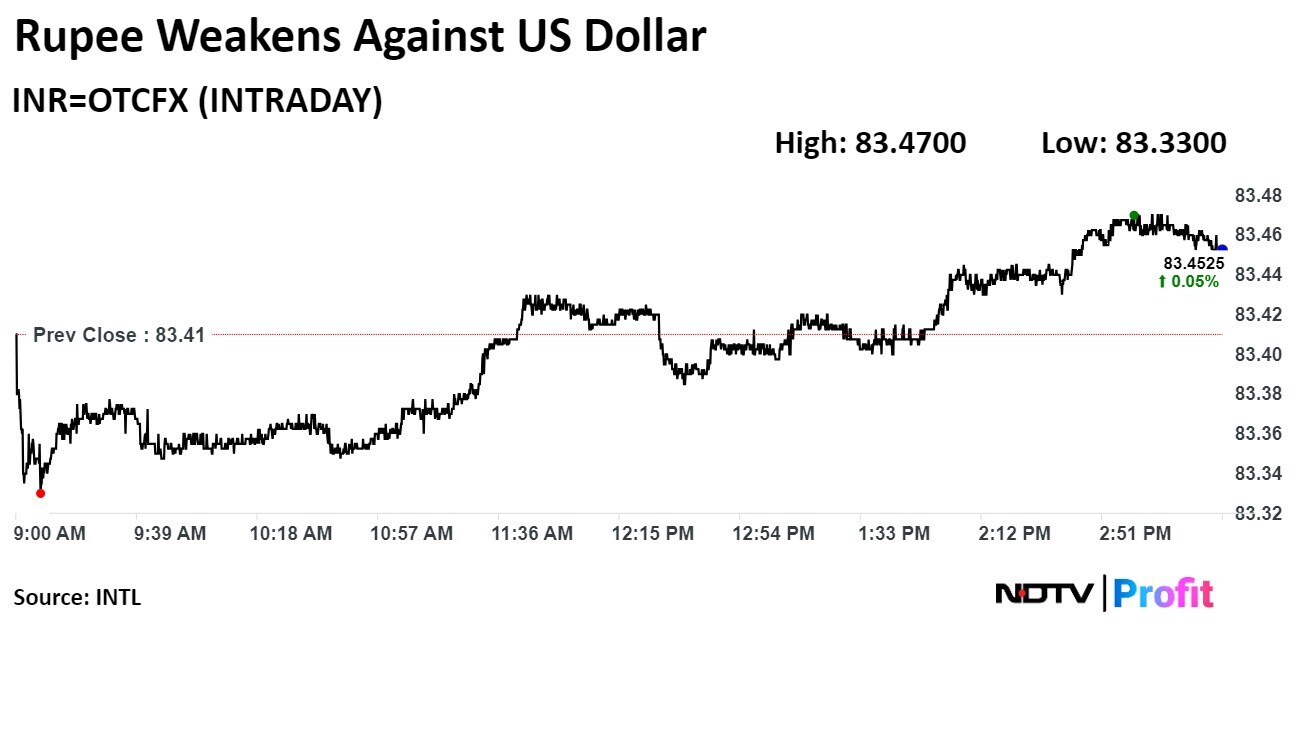

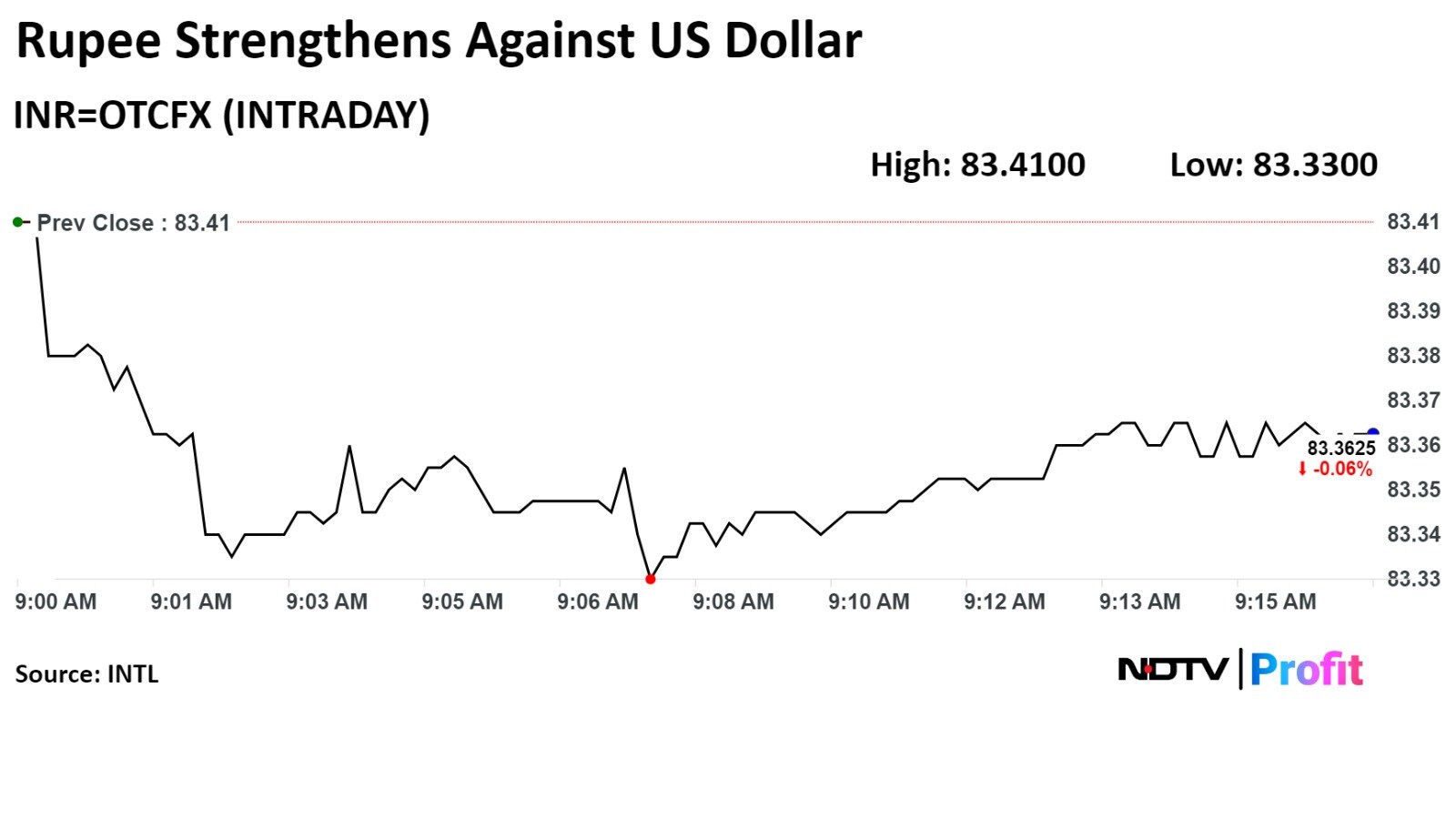

The local currency weakened 4 paise to close at 83.45 against the US dollar.

It closed at 83.41 on Tuesday.

Source: Bloomberg

The local currency weakened 4 paise to close at 83.45 against the US dollar.

It closed at 83.41 on Tuesday.

Source: Bloomberg

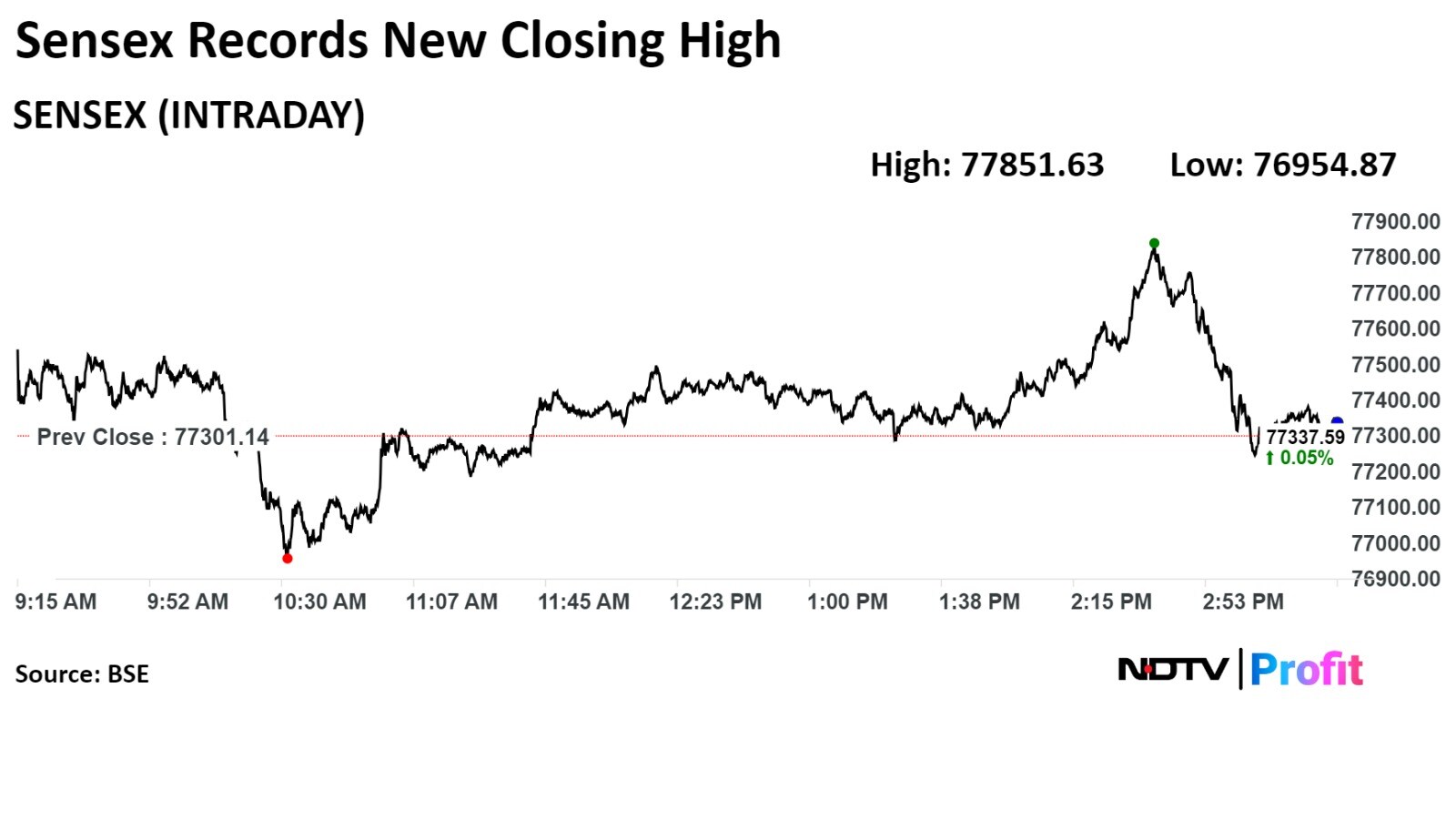

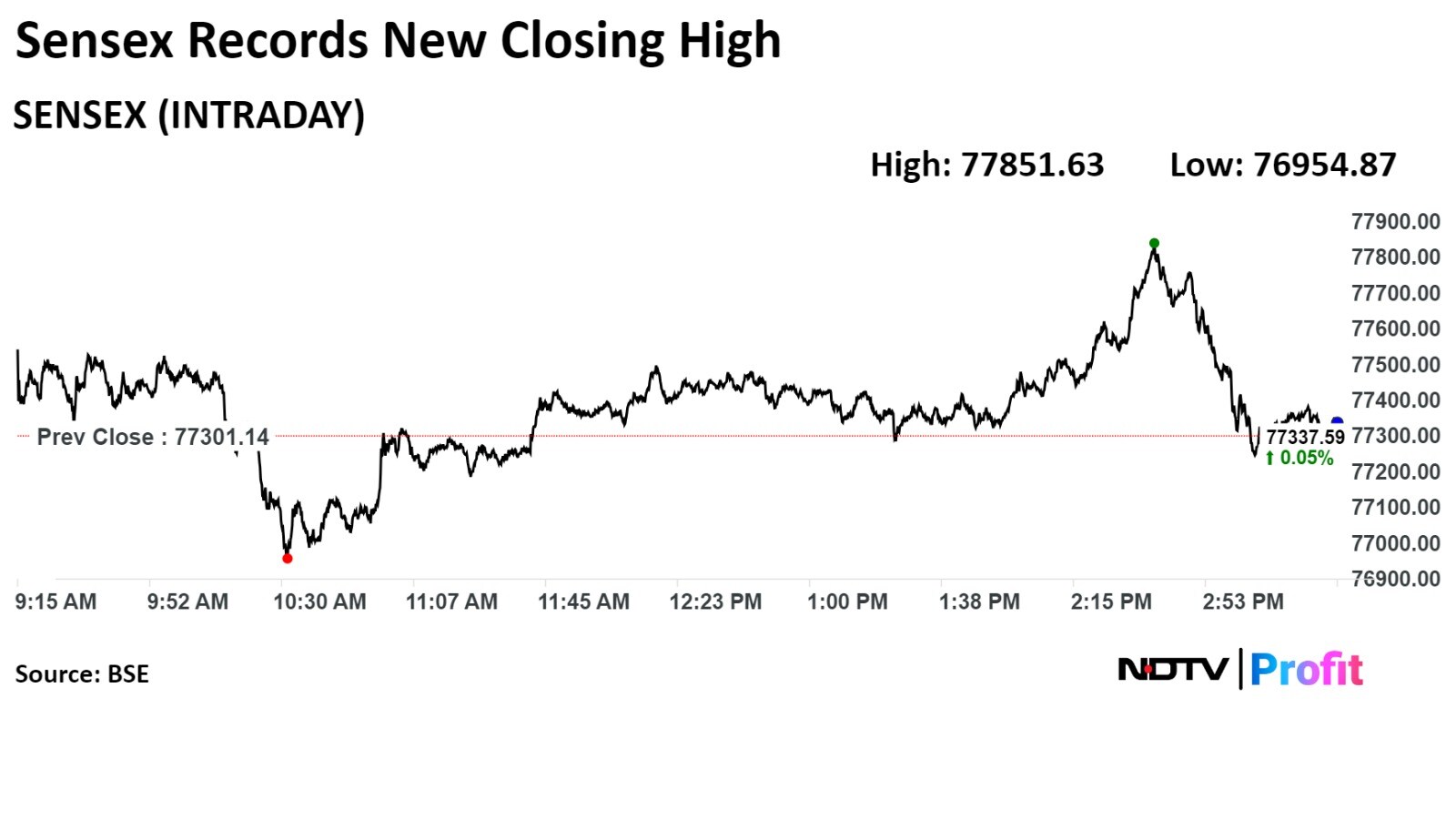

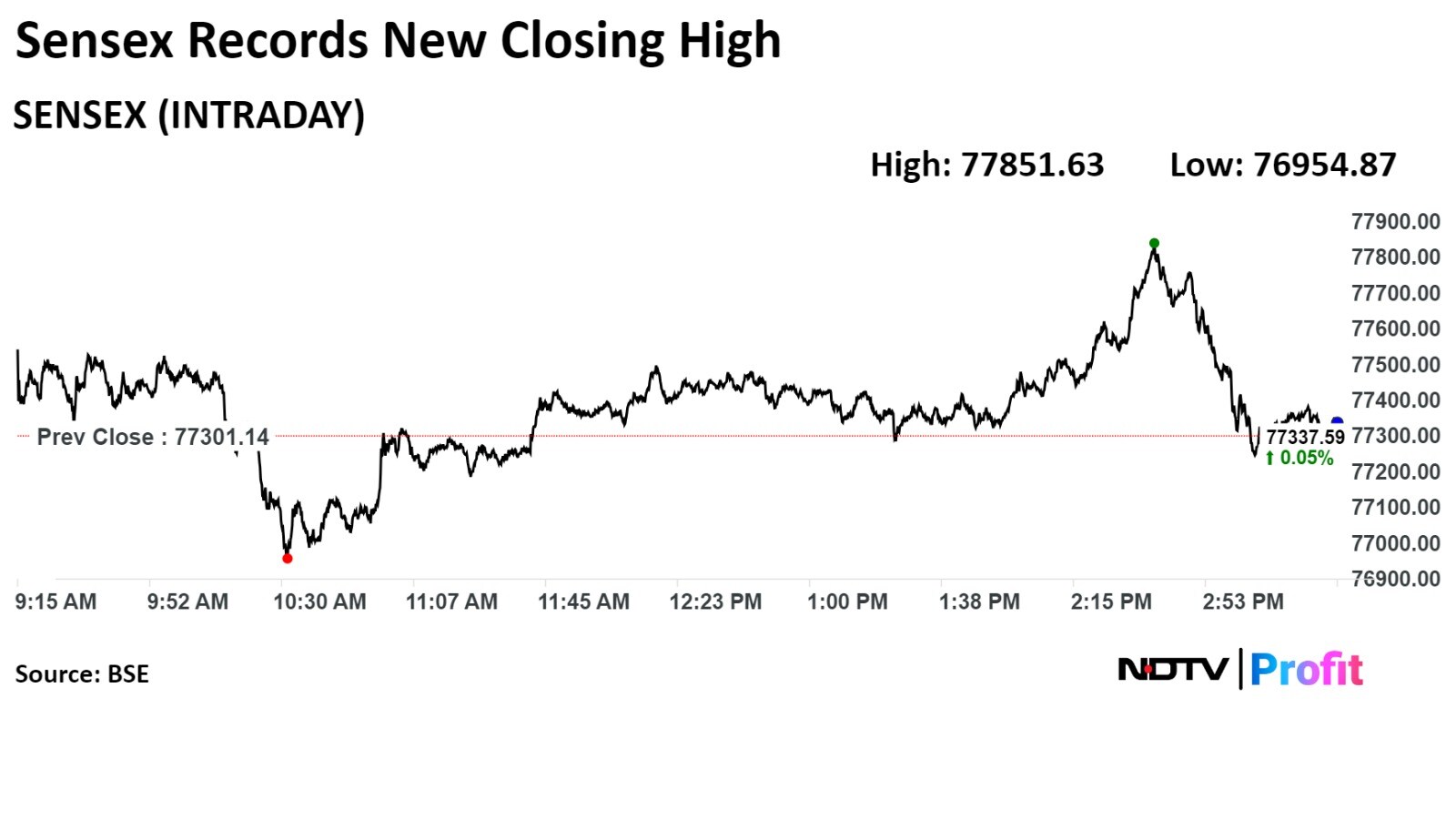

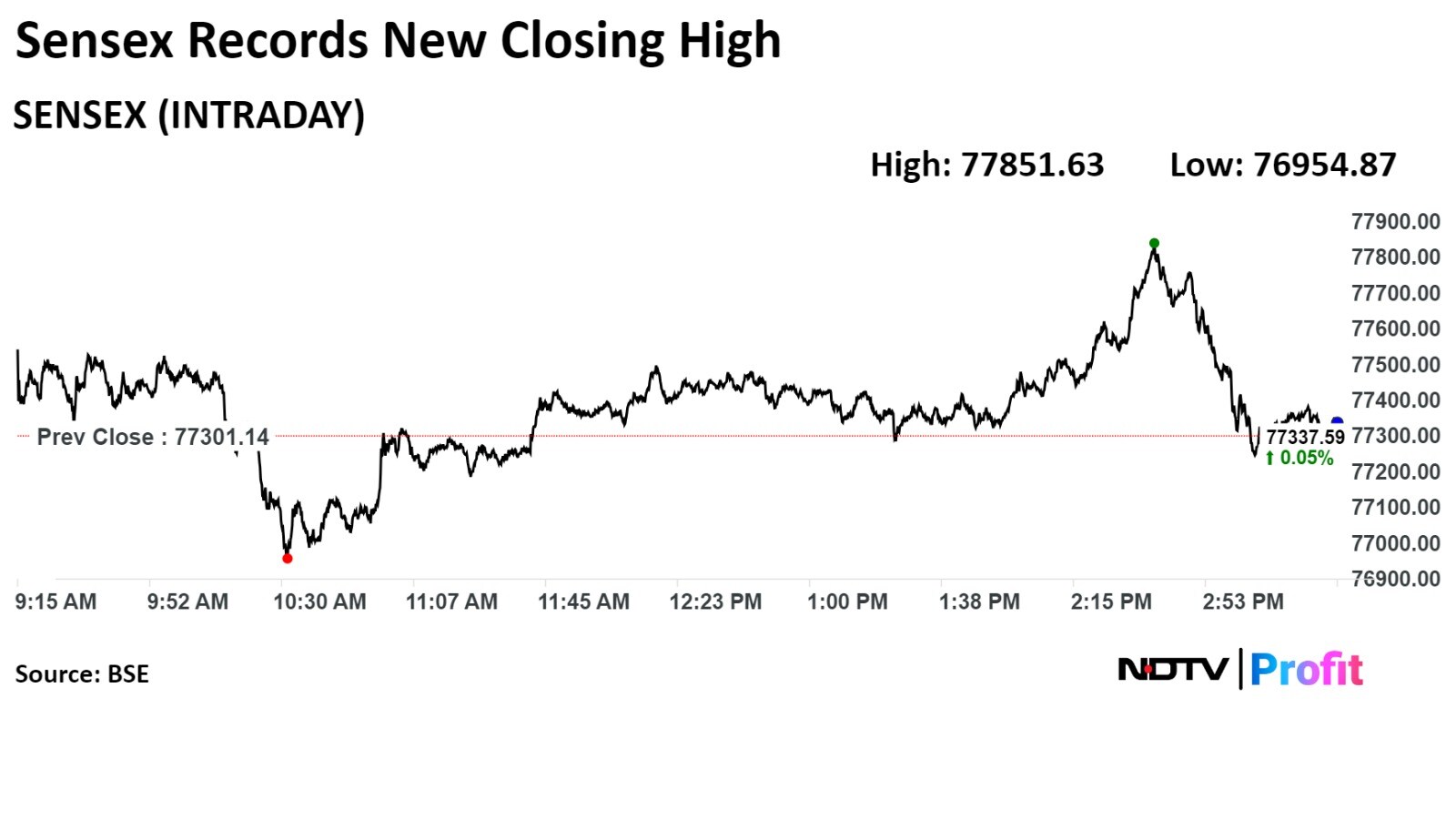

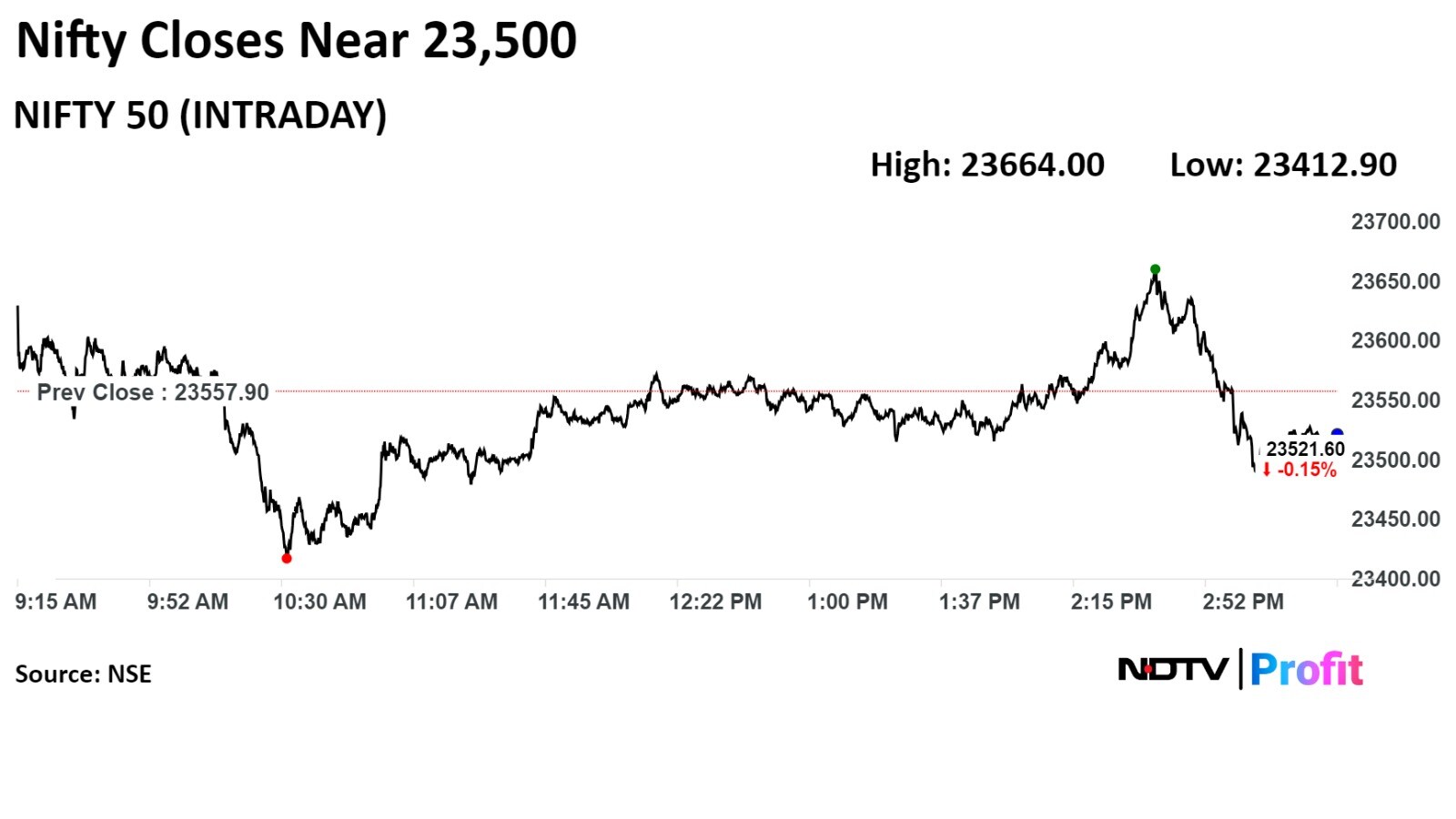

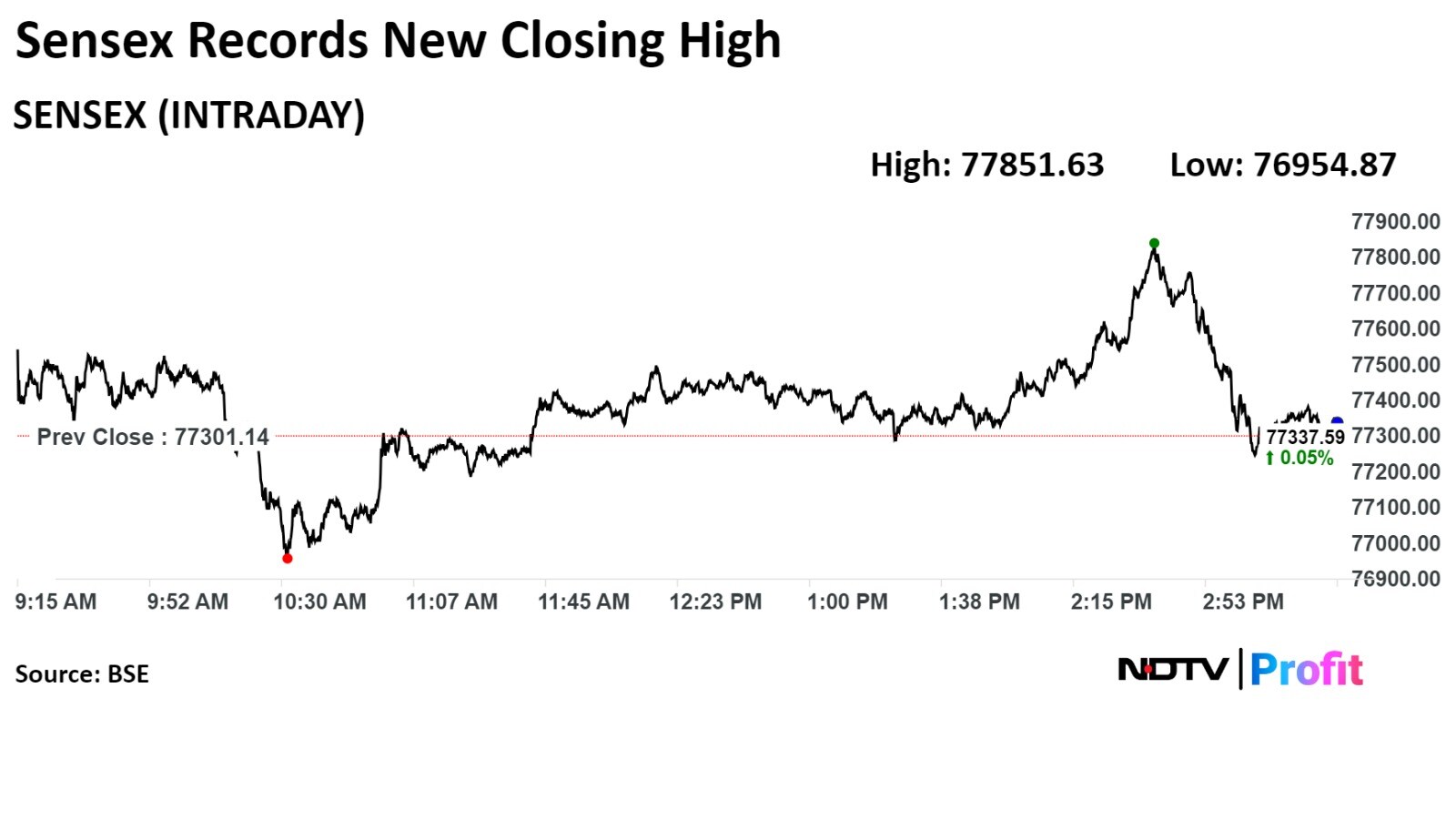

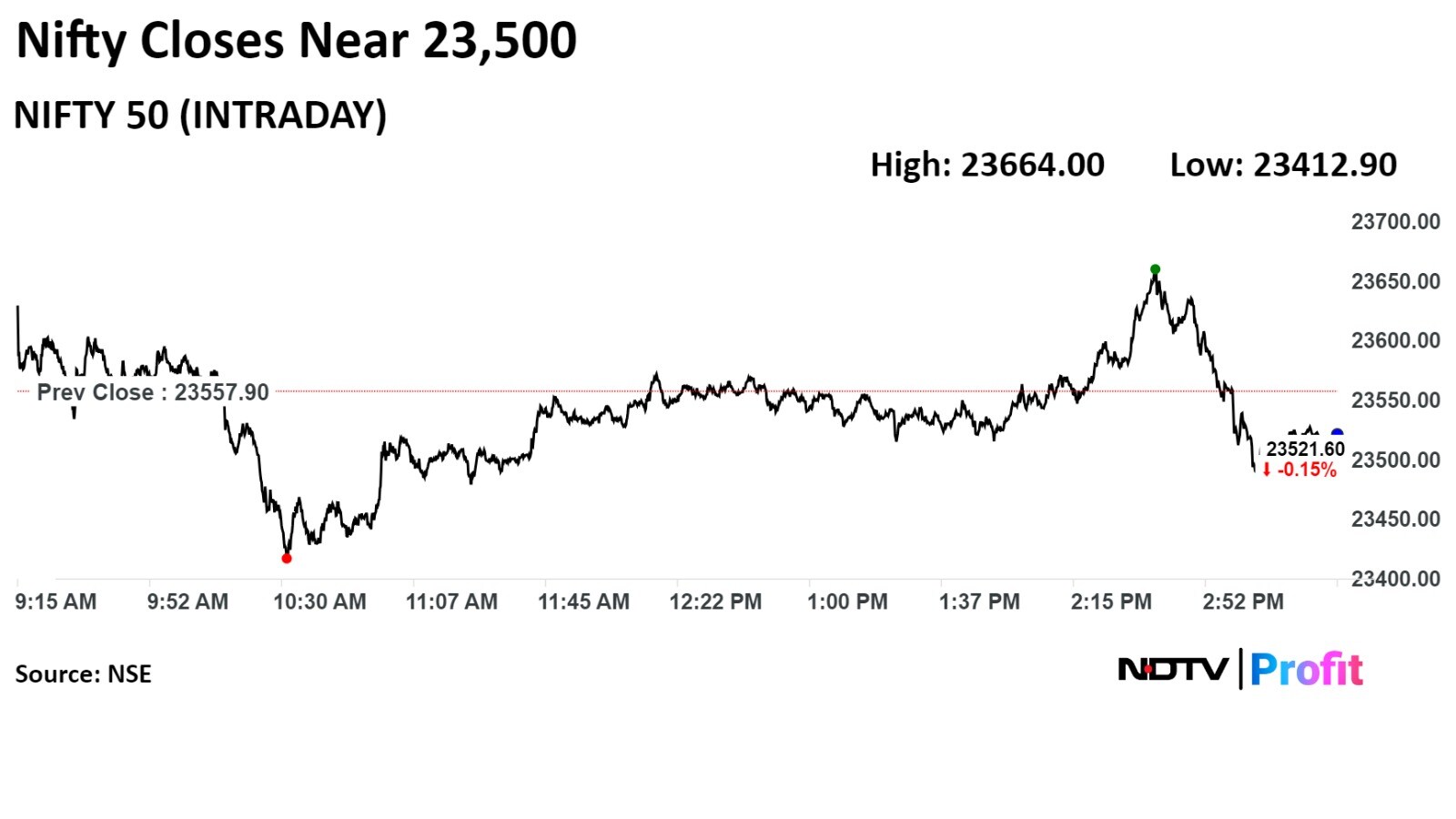

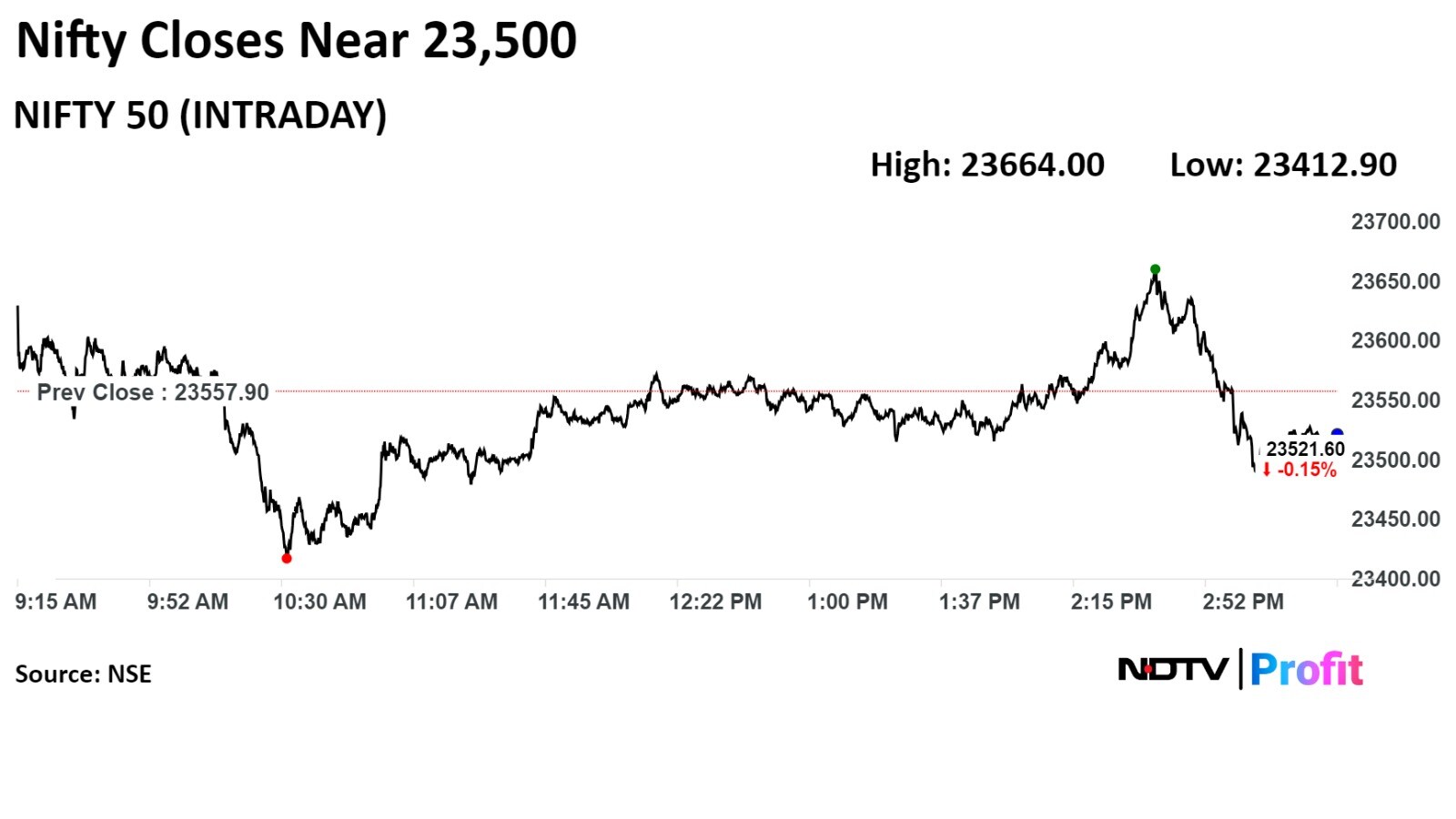

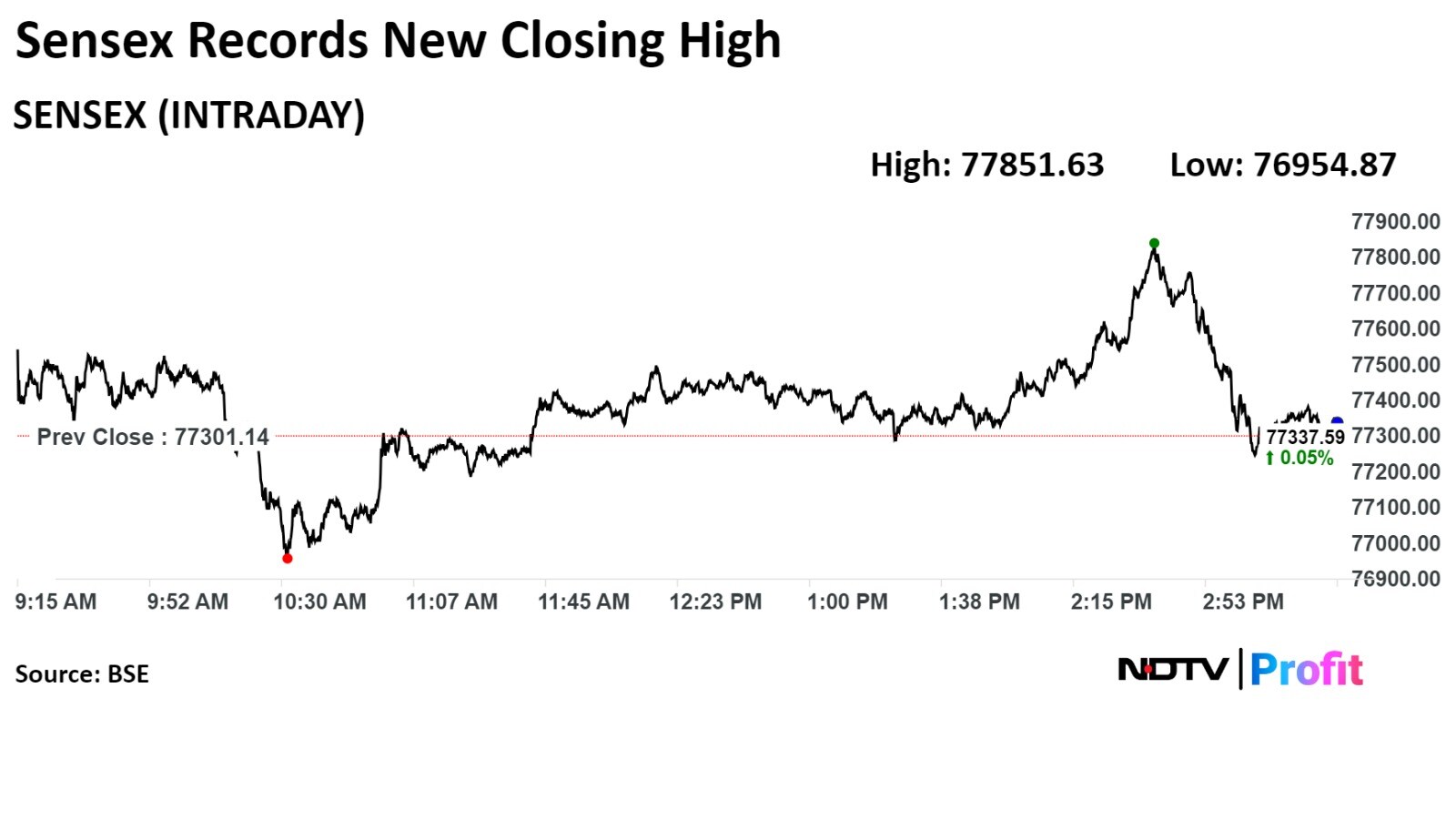

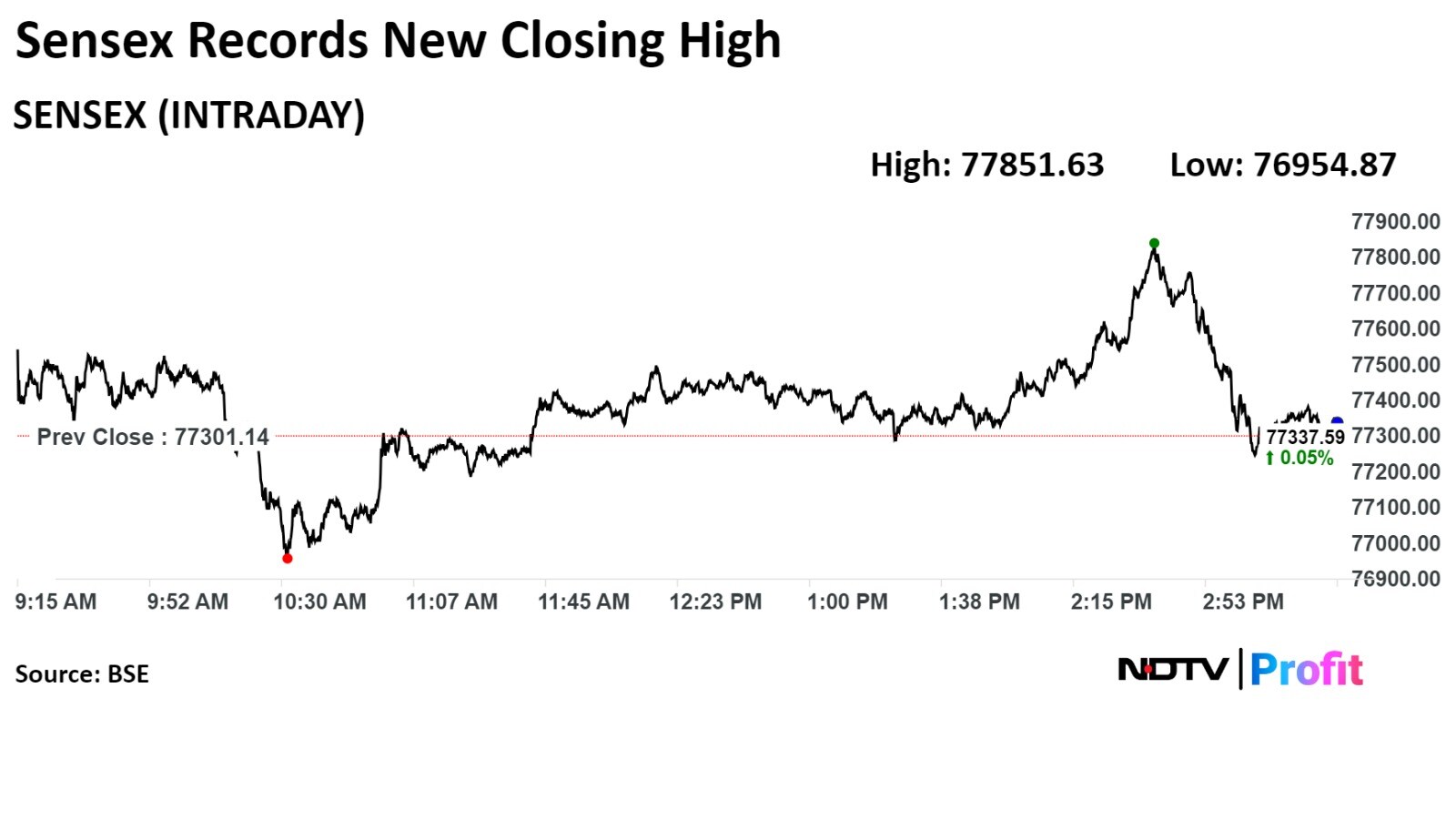

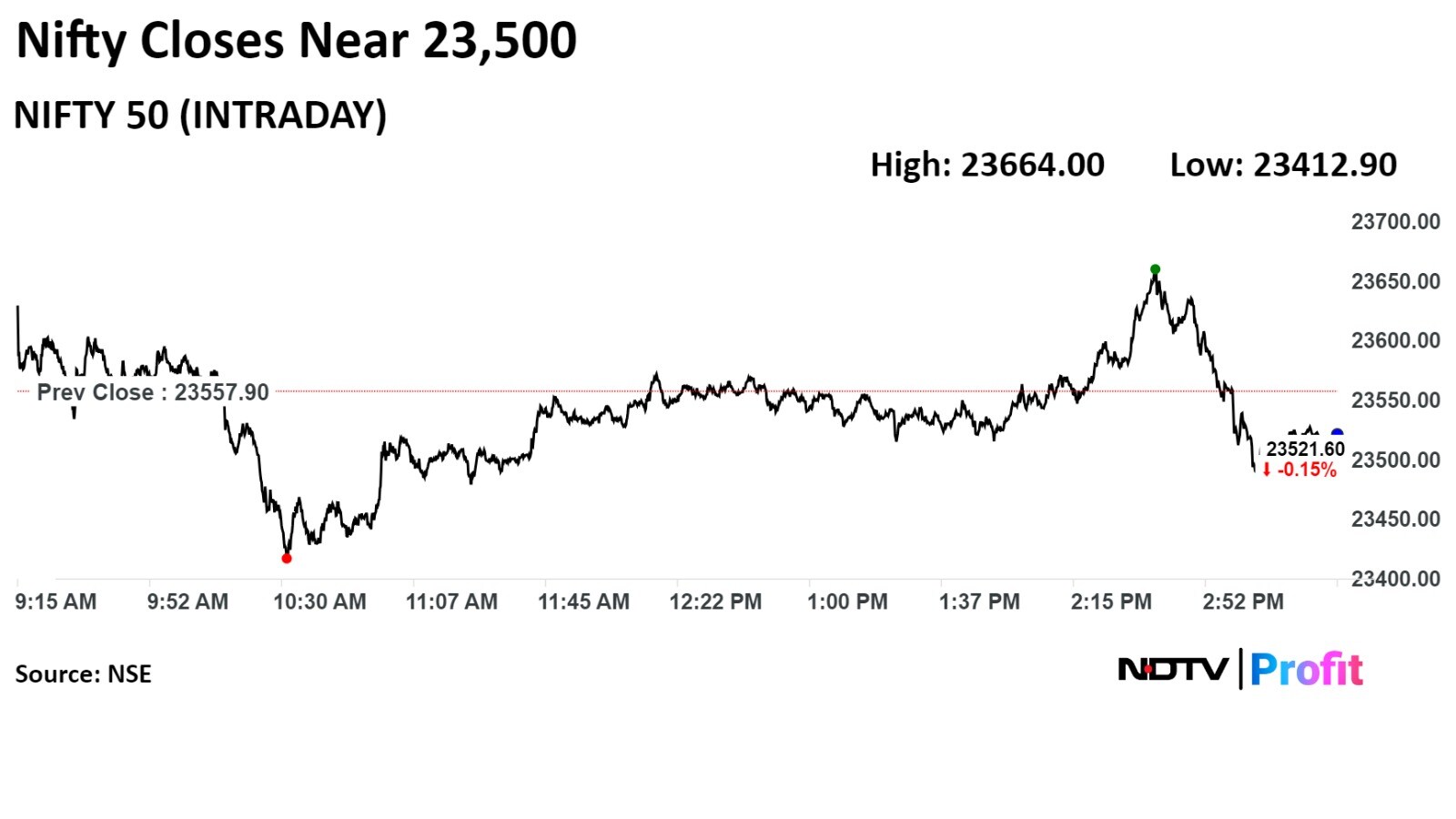

Indian benchmarks shed their early gains to settle mixed on bank futures expiry day as Larsen & Toubro Ltd., Reliance Industries dragged, while banks' stocks supported.

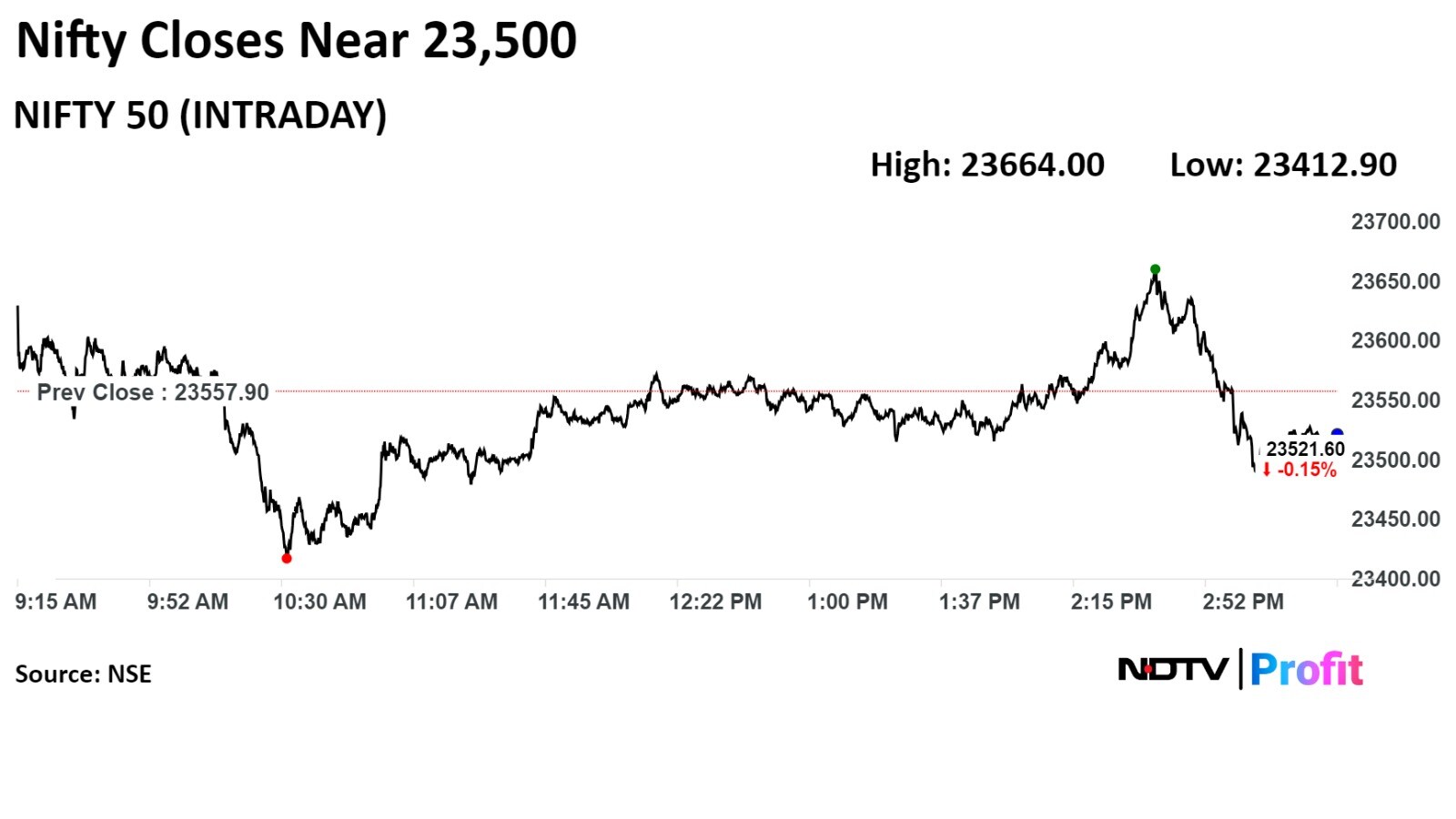

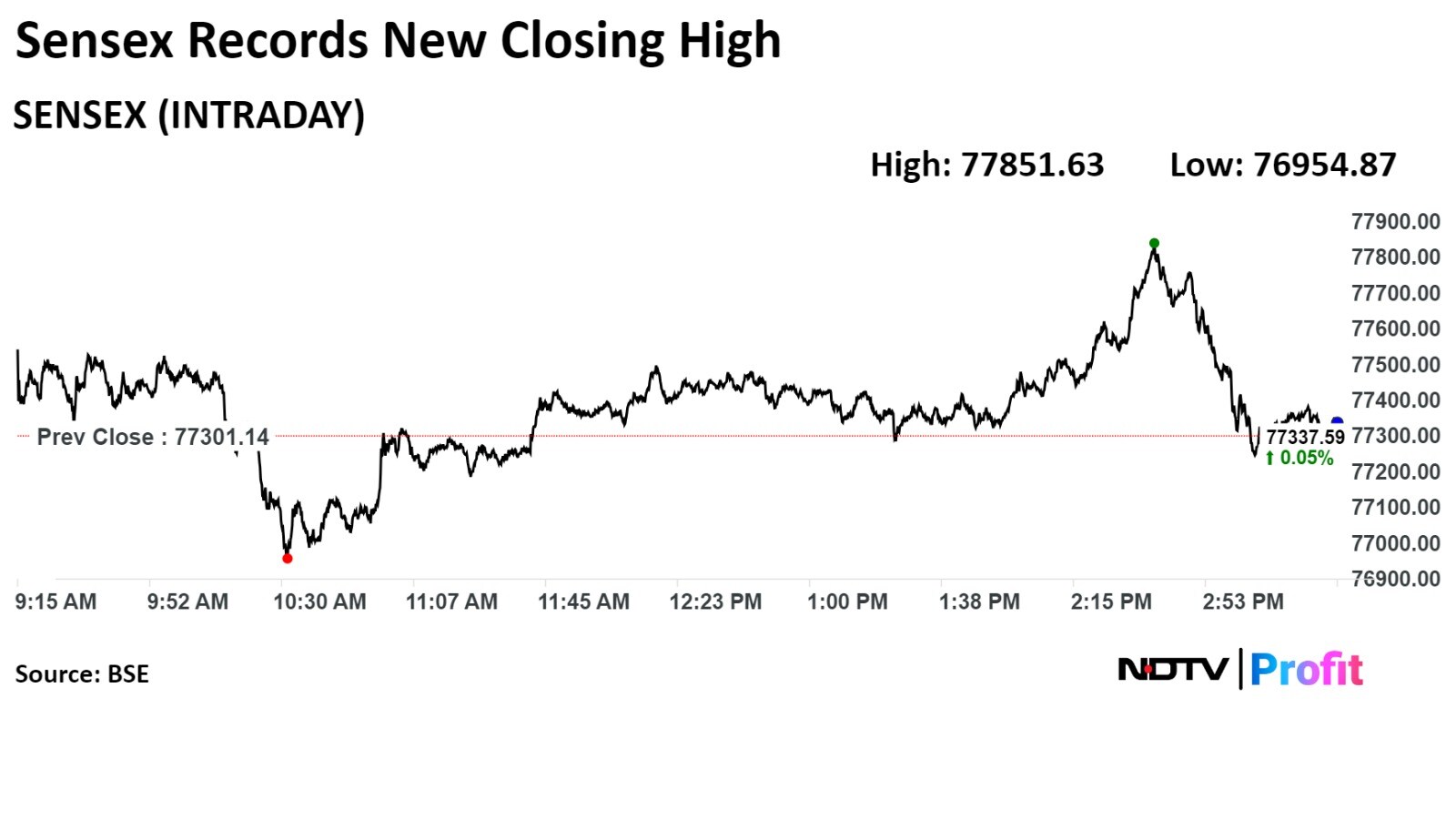

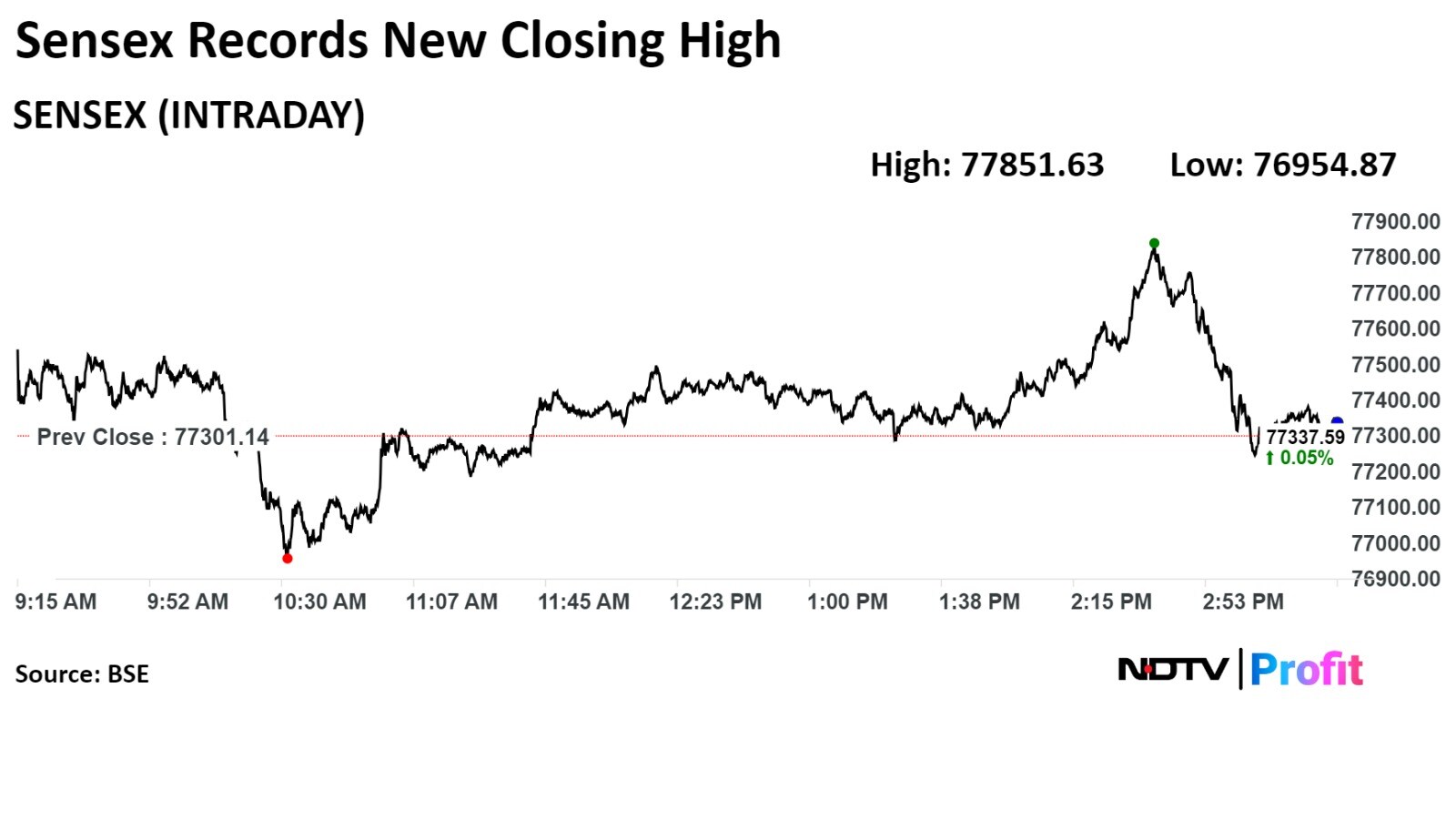

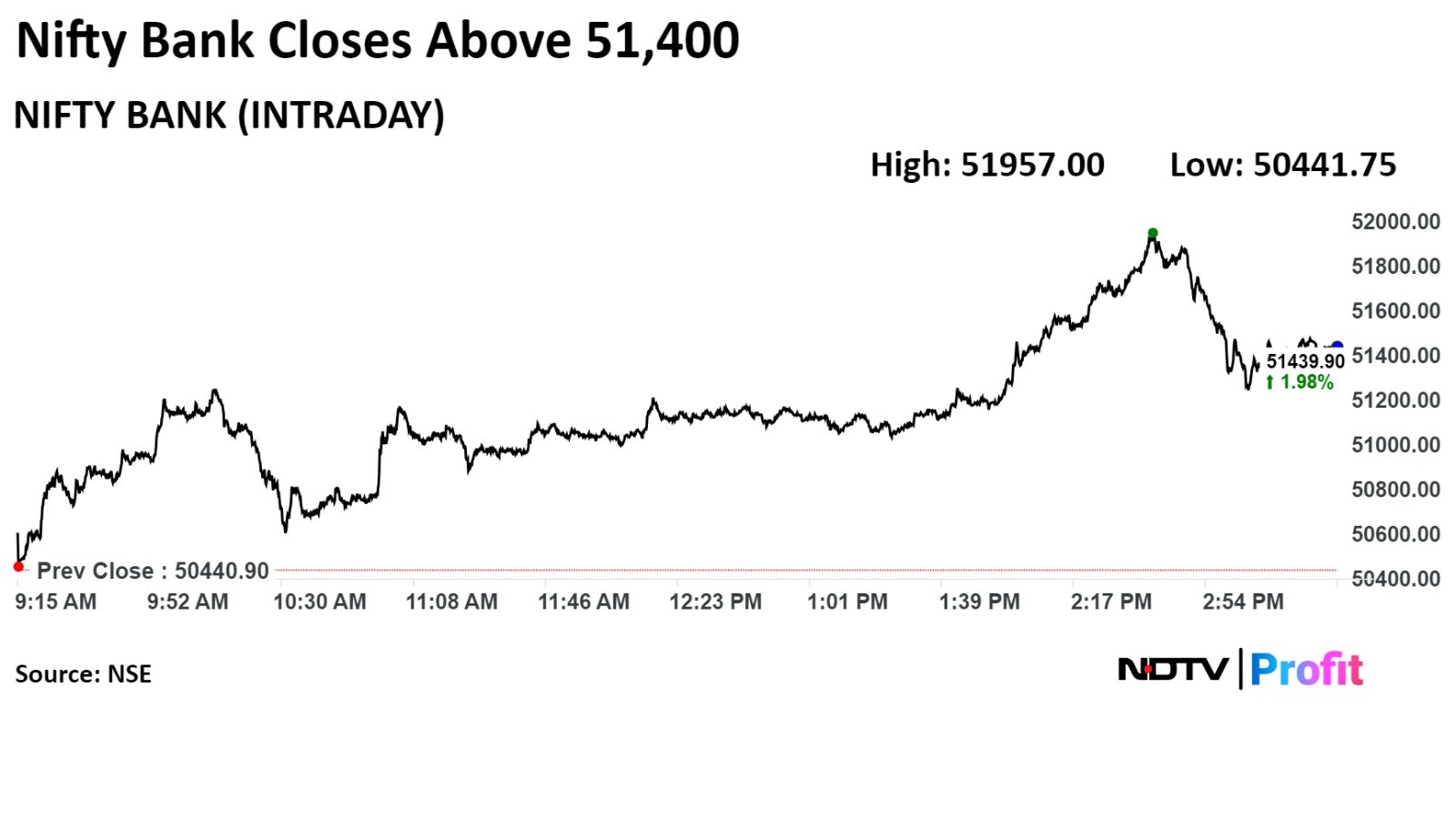

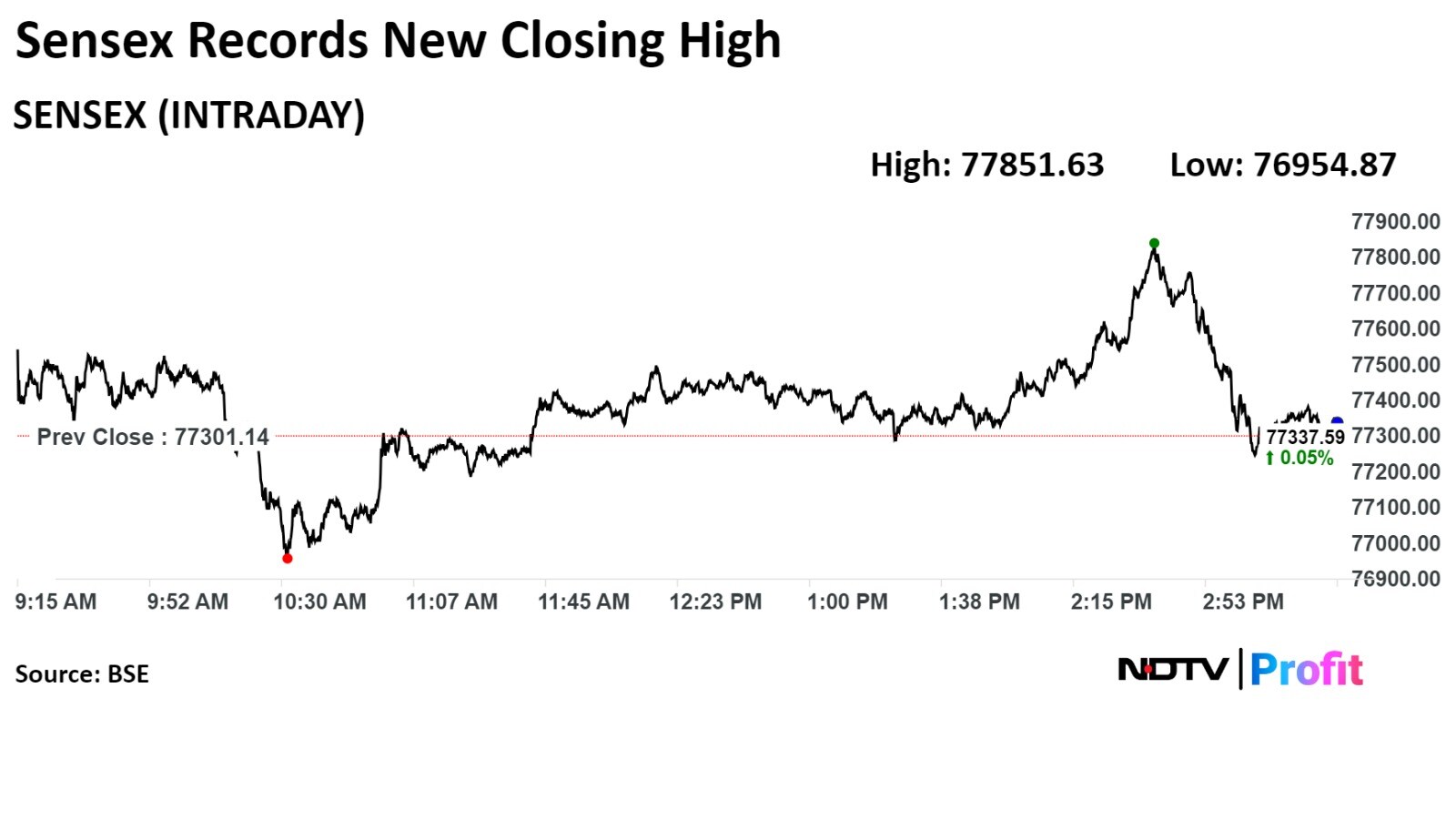

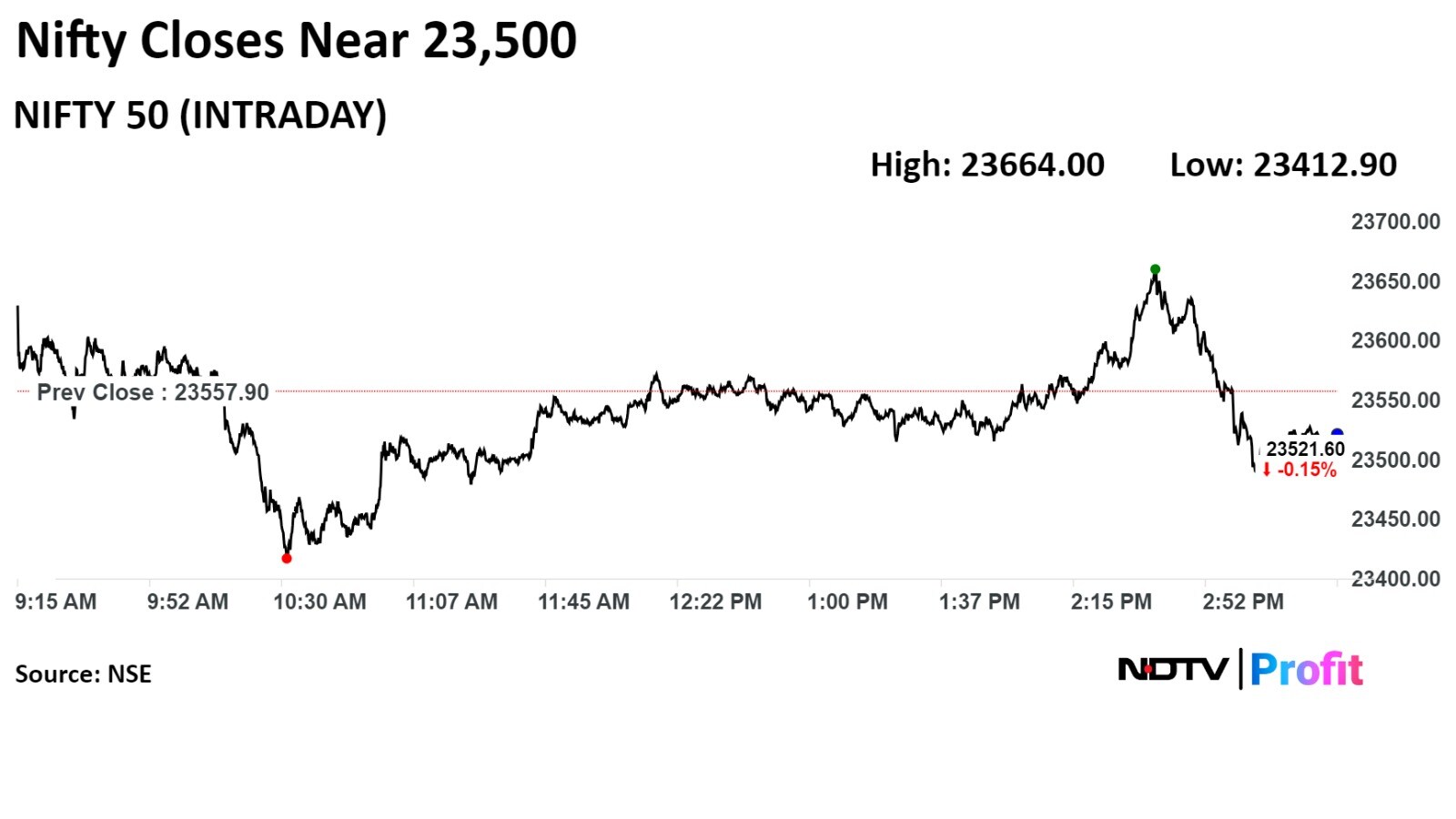

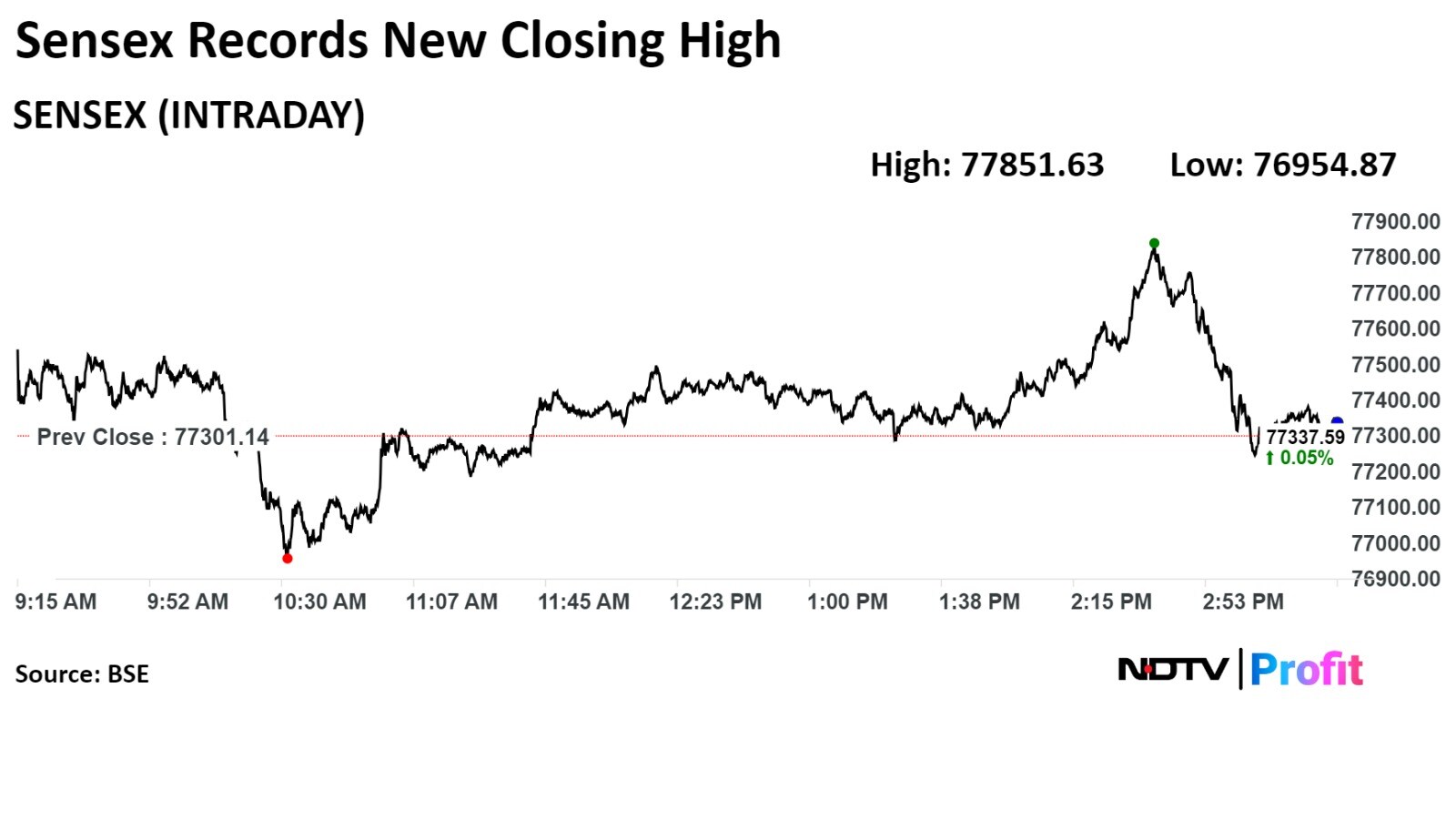

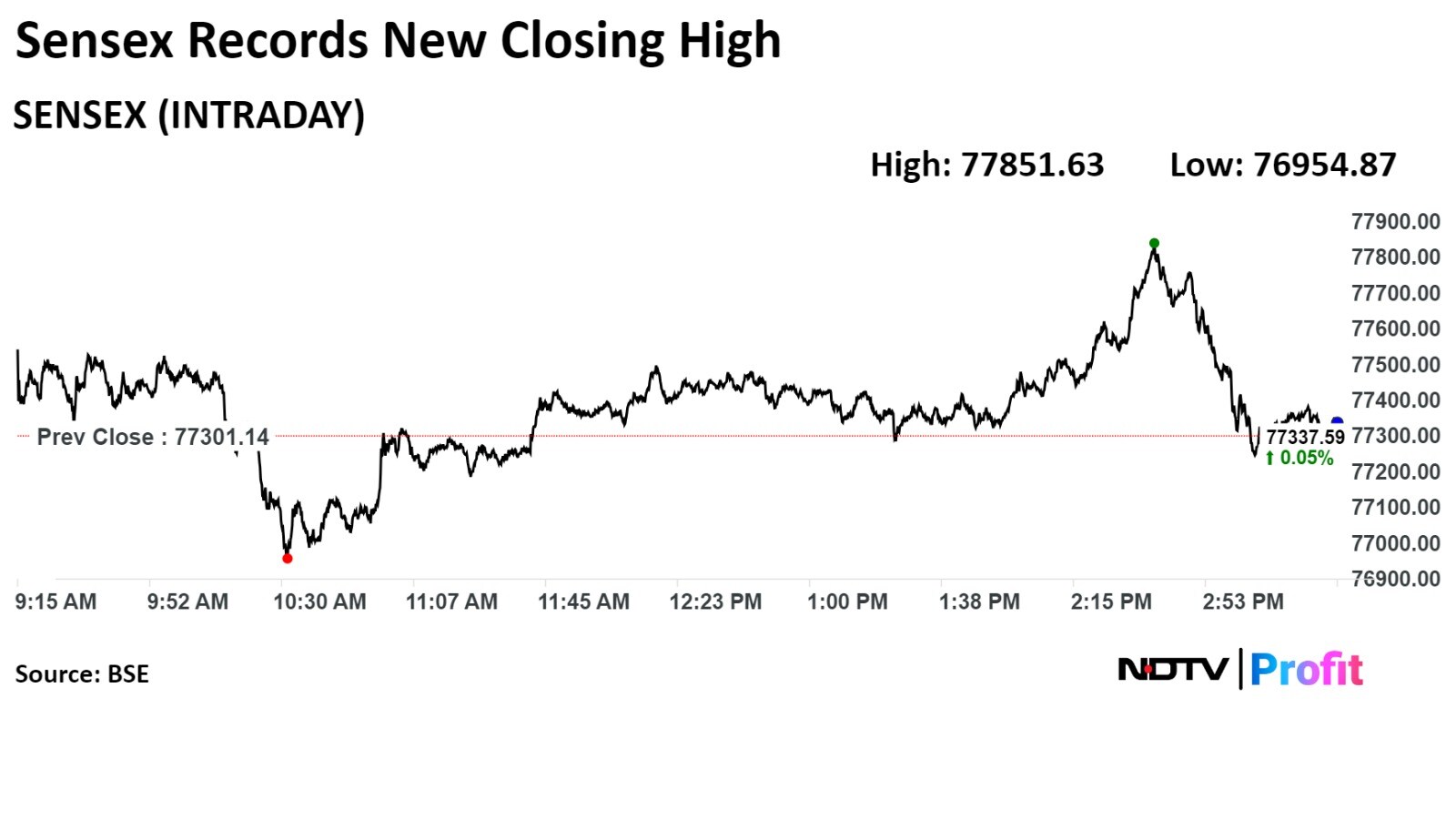

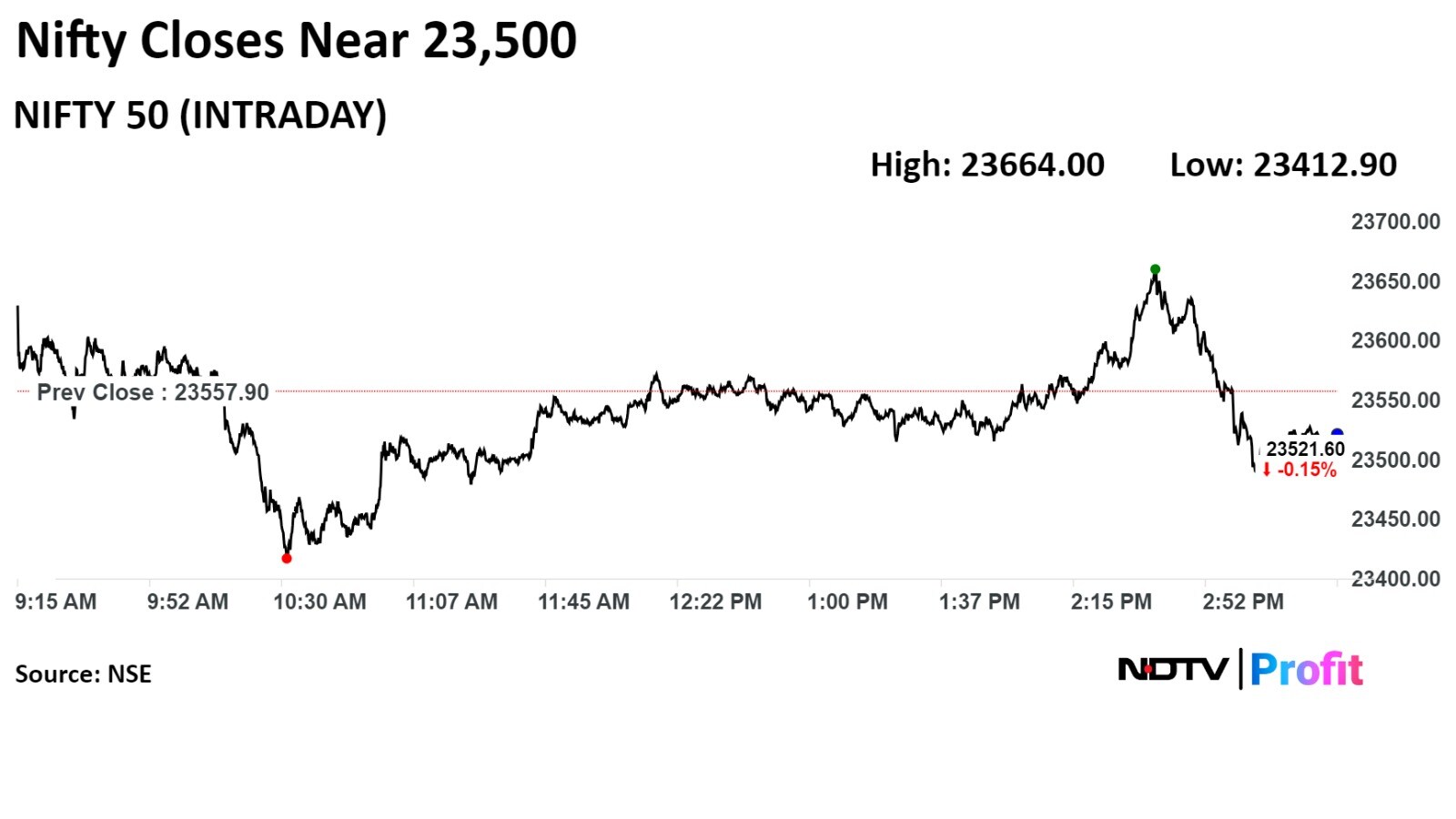

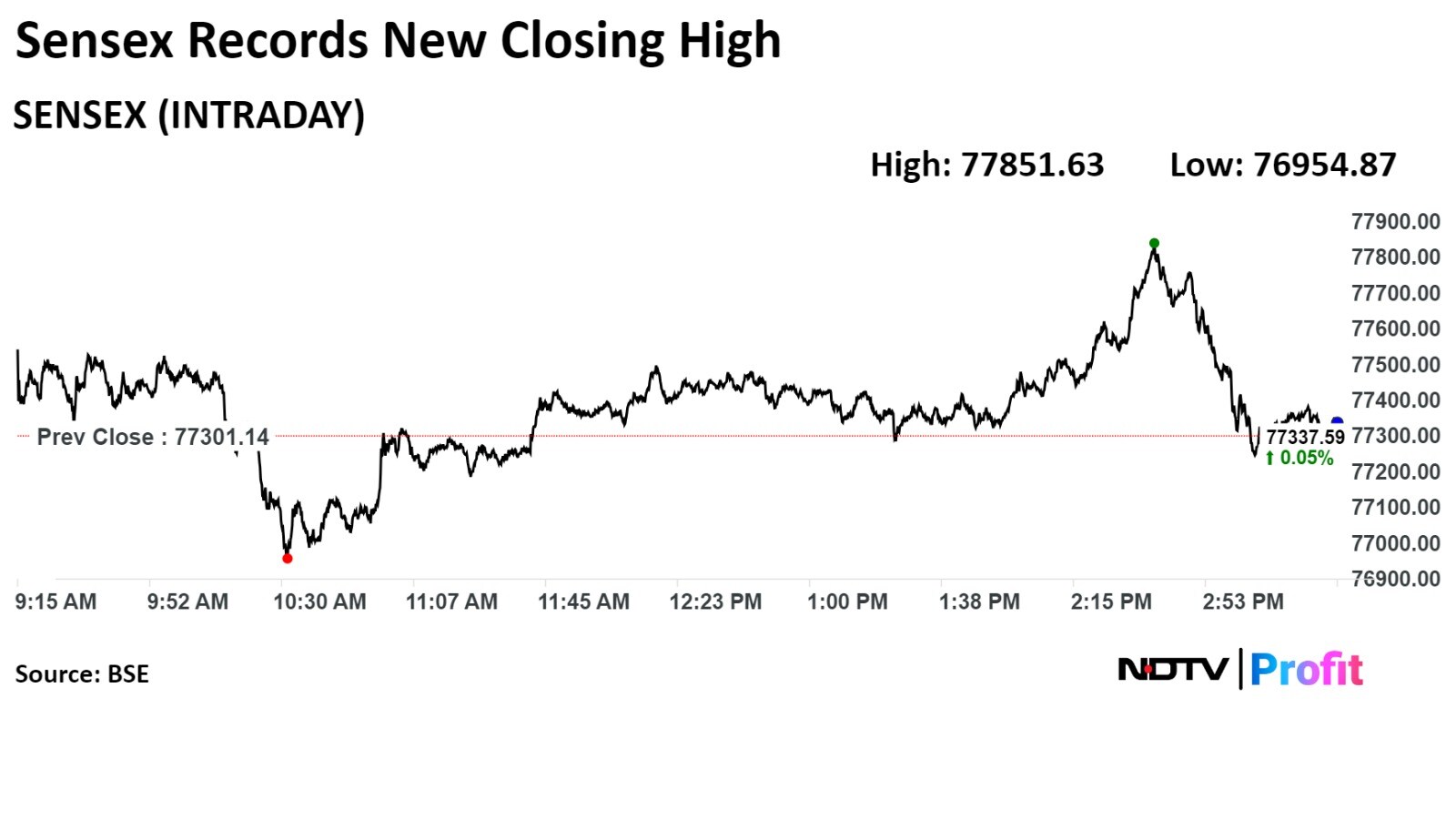

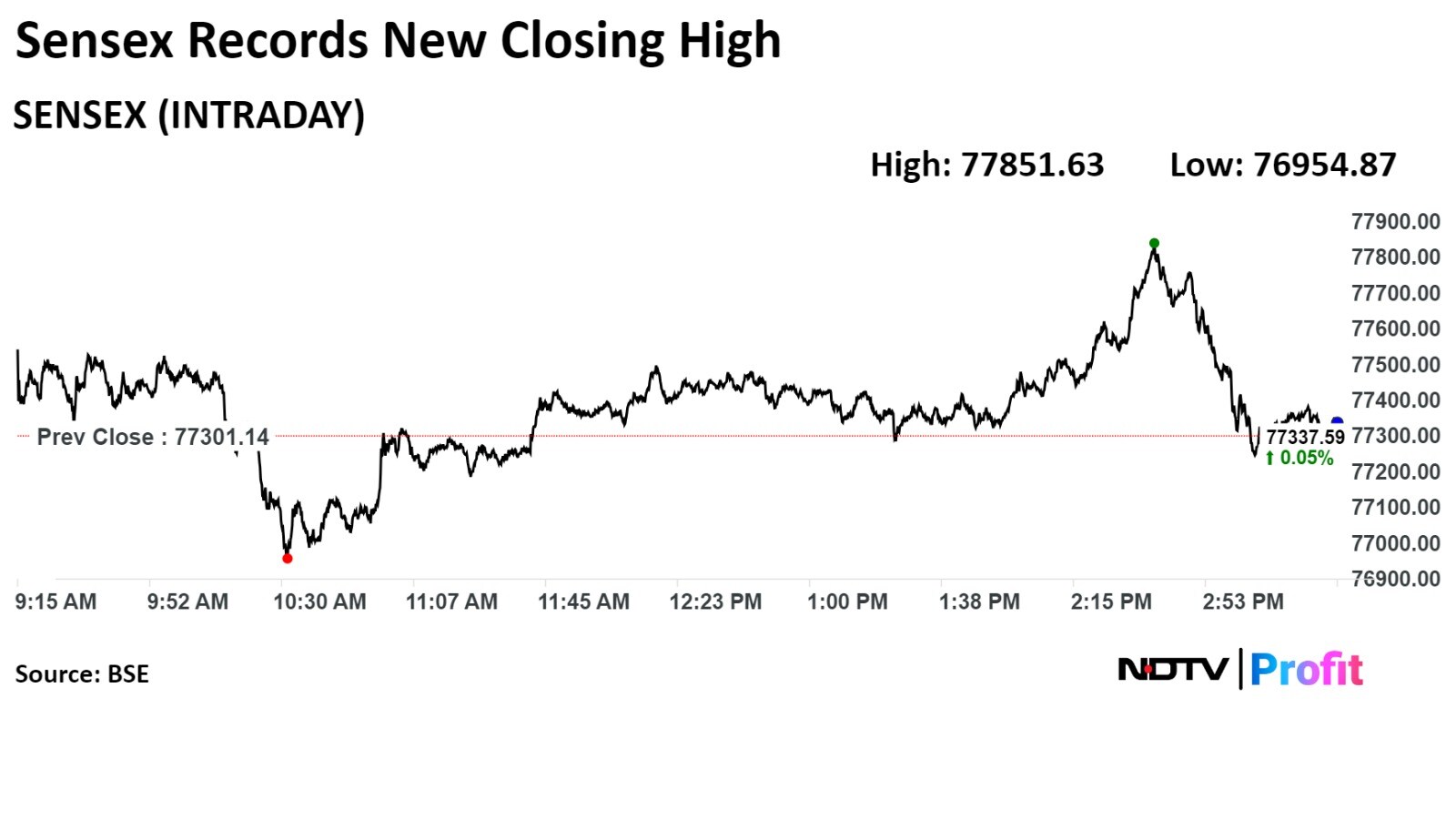

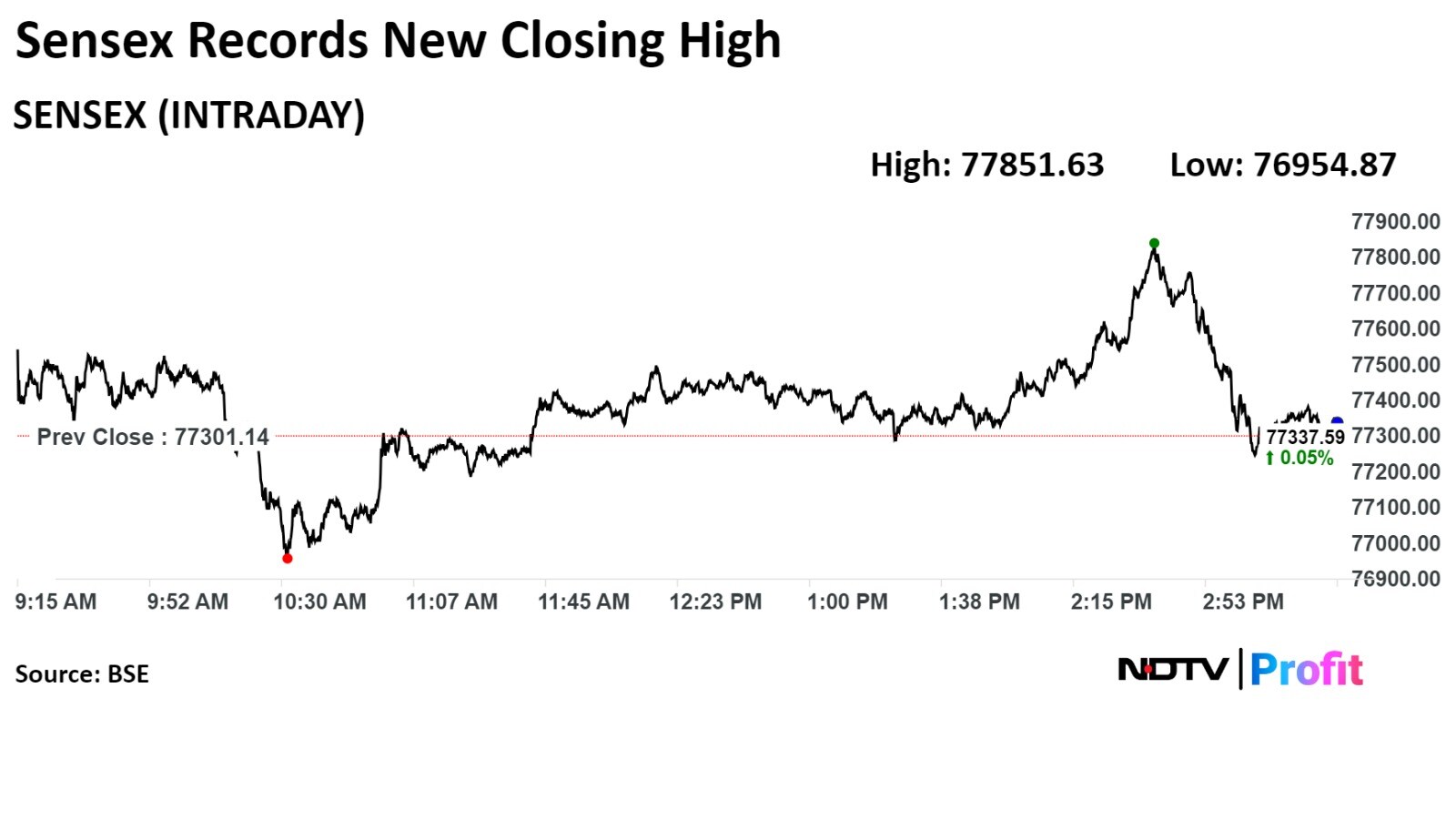

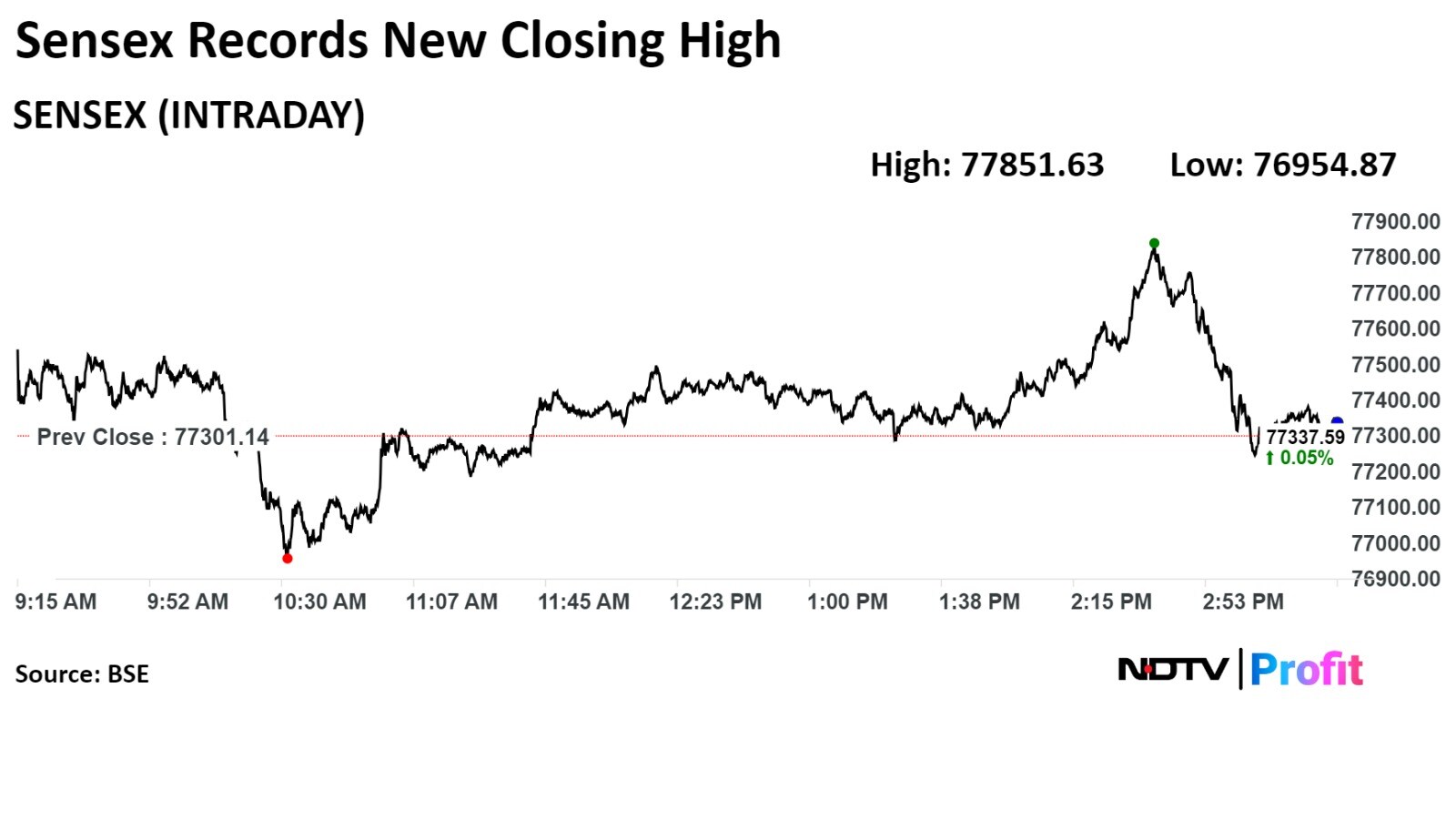

The NSE Nifty 50 settled 36.30 points or 0.15% lower at 23,521.60. The S&P BSE Sensex ended 36.45 points or 0.05% higher at 77,337.59, marking the highest closing level since its inception.

Intraday, the Nifty 50 index rose 0.45% to fresh high of 23,664.00, and the Sensex rose 0.71% to a fresh high of 77,851.63.

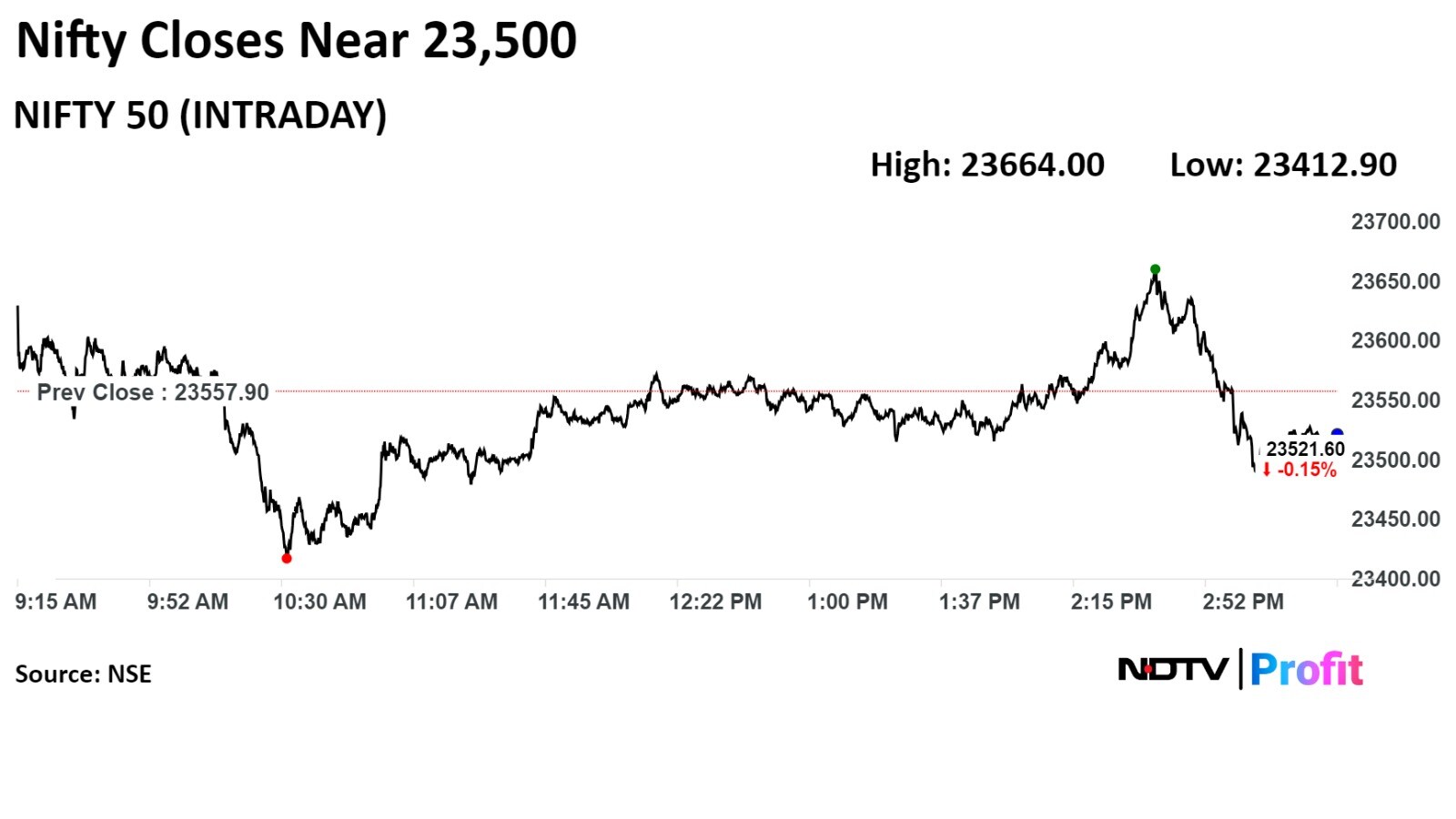

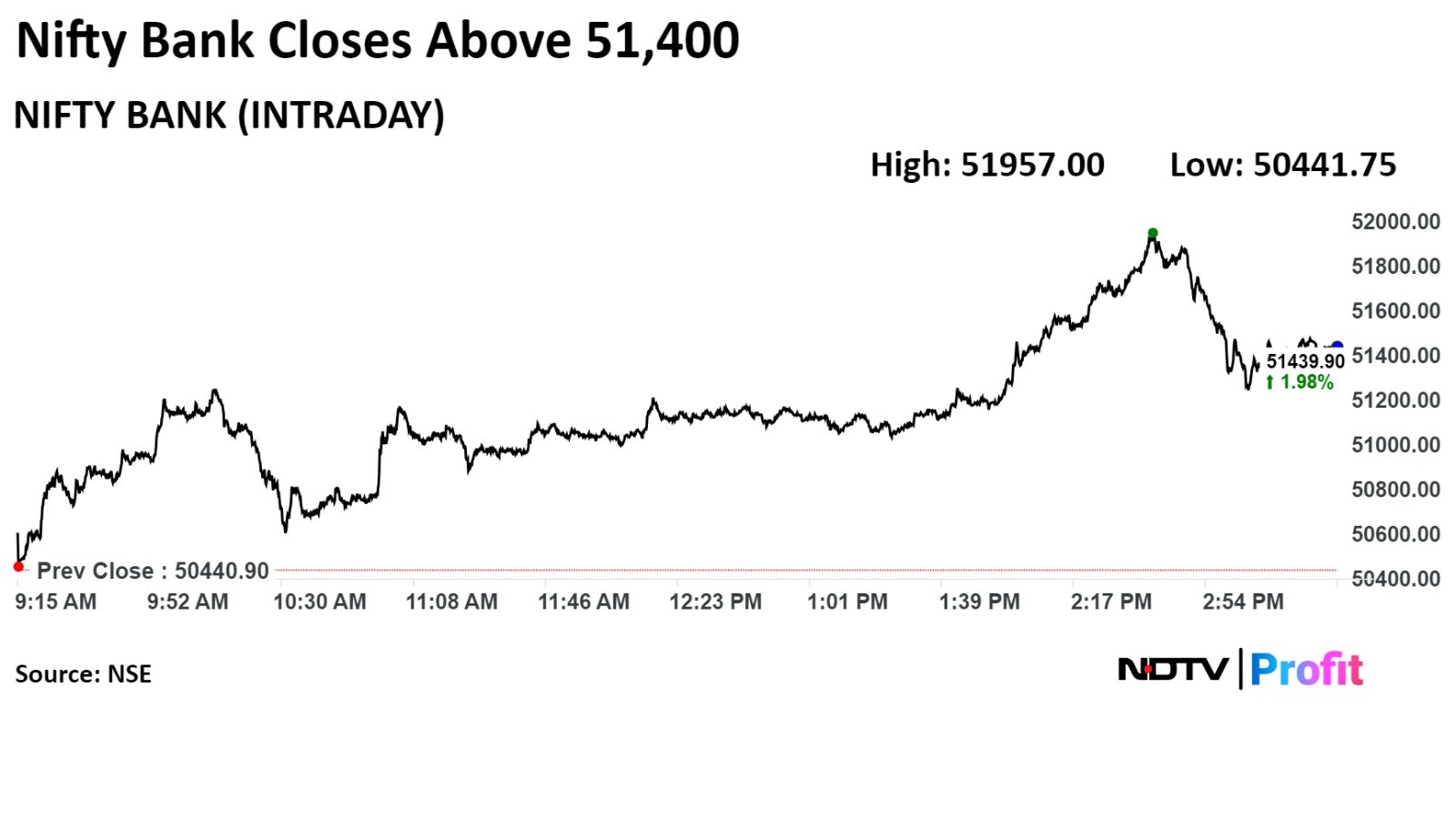

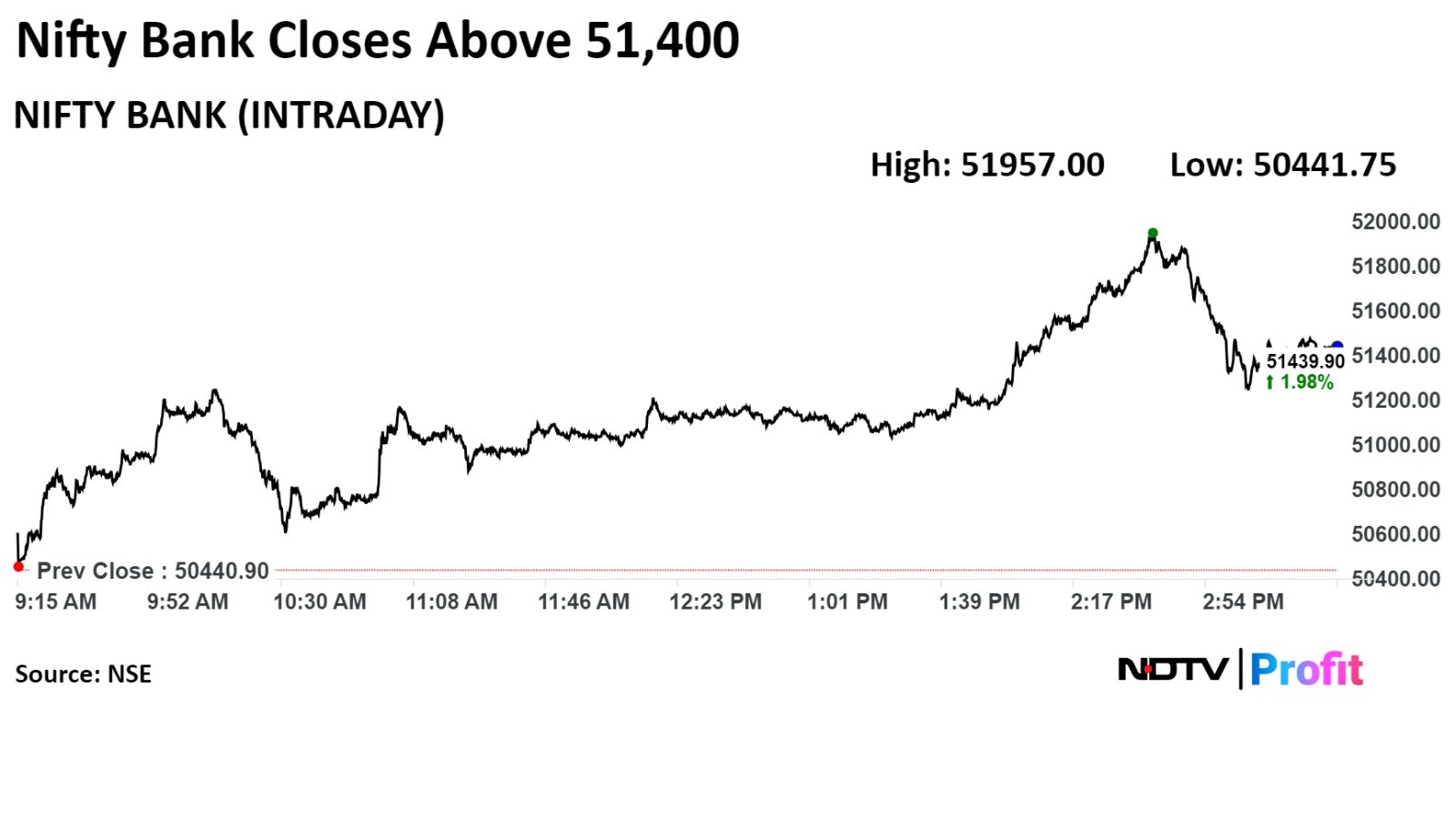

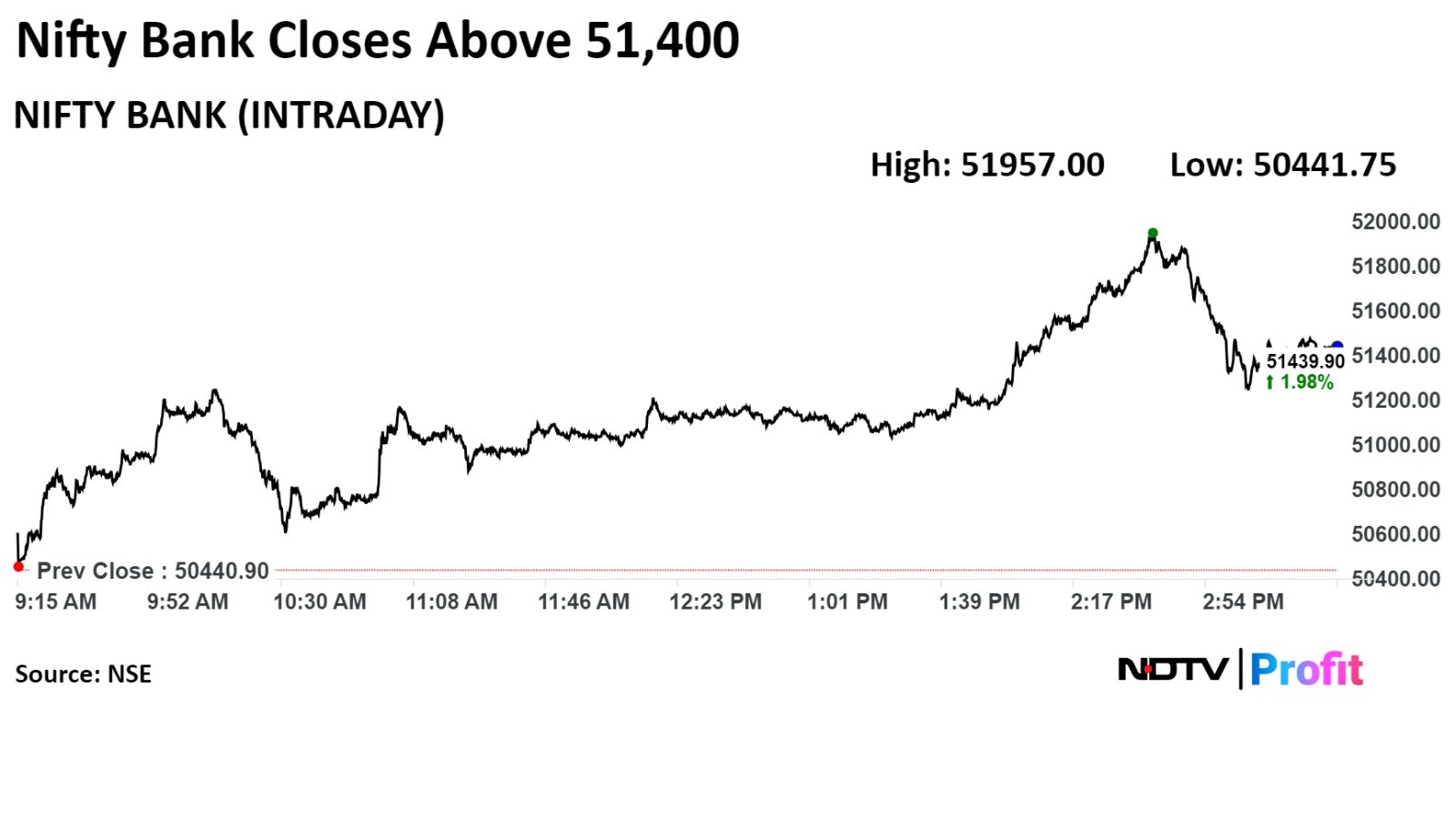

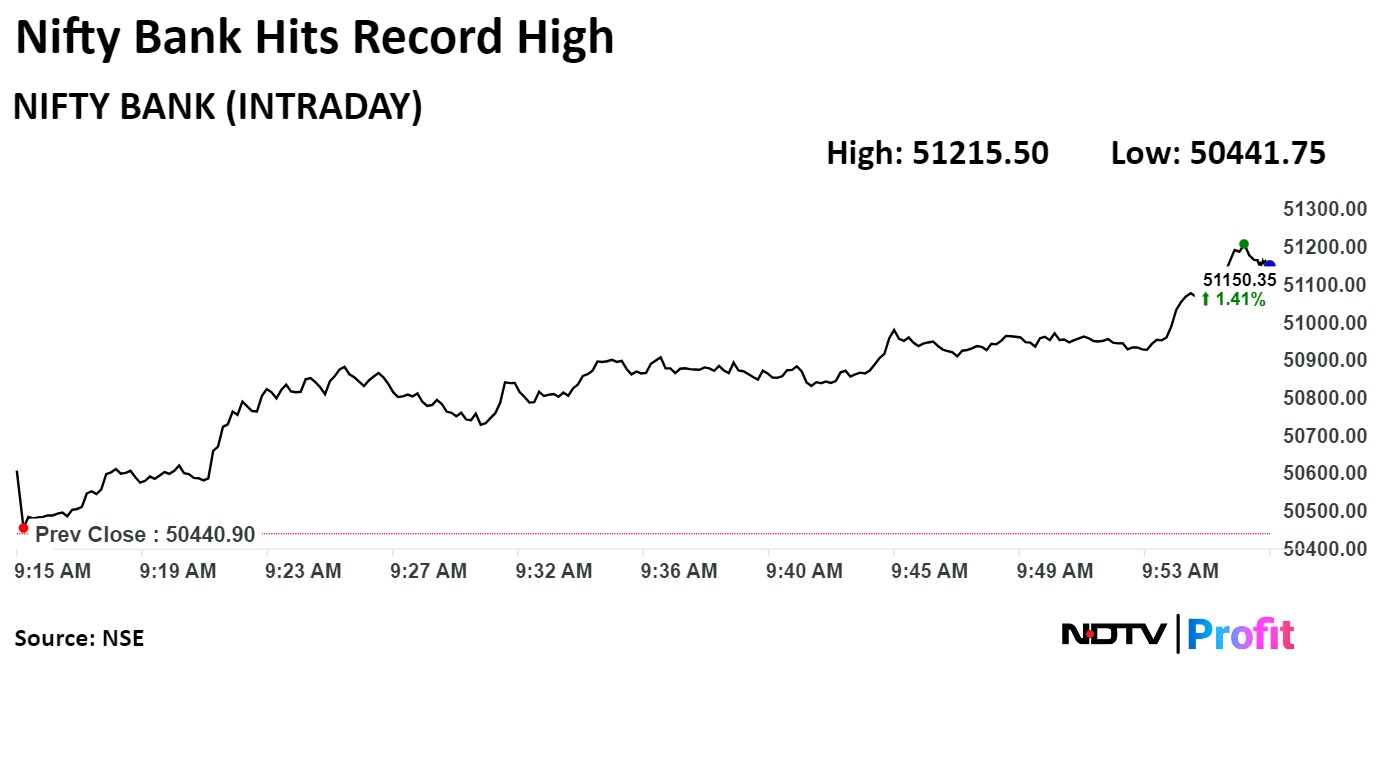

Meanwhile, the NSE Nifty Bank index retained its gains to settled at historic level of 51,398.05 on Wednesday. The index scaled a high of 51,957.00 in the morning.

India Volatility index settled 5.77% higher at 13.71 after falling to over one month low. The index slumped 10.30% to 11.63, the lowest level since April 29 in the morning.

“There has been a likely chase towards sectors which can be potential budget beneficiaries - with buying seen across Agriculture, Power, Cap Goods and Infra sectors. Expectations of order announcement in defence sector raised investor interest with shares like HAL, Mazgaon Dock, Garden Reach shipbuilders, Paras Defence up double digit over the last one week. We expect markets to remain at elevated levels and believe some rotation could be seen in Reliance, IT, Pharma and Banking sector," said Jaykrishna Gandhi, head, Business Development, Institutional Equities, Emkay Global Financial Services on markets.

Indian benchmarks shed their early gains to settle mixed on bank futures expiry day as Larsen & Toubro Ltd., Reliance Industries dragged, while banks' stocks supported.

The NSE Nifty 50 settled 36.30 points or 0.15% lower at 23,521.60. The S&P BSE Sensex ended 36.45 points or 0.05% higher at 77,337.59, marking the highest closing level since its inception.

Intraday, the Nifty 50 index rose 0.45% to fresh high of 23,664.00, and the Sensex rose 0.71% to a fresh high of 77,851.63.

Meanwhile, the NSE Nifty Bank index retained its gains to settled at historic level of 51,398.05 on Wednesday. The index scaled a high of 51,957.00 in the morning.

India Volatility index settled 5.77% higher at 13.71 after falling to over one month low. The index slumped 10.30% to 11.63, the lowest level since April 29 in the morning.

“There has been a likely chase towards sectors which can be potential budget beneficiaries - with buying seen across Agriculture, Power, Cap Goods and Infra sectors. Expectations of order announcement in defence sector raised investor interest with shares like HAL, Mazgaon Dock, Garden Reach shipbuilders, Paras Defence up double digit over the last one week. We expect markets to remain at elevated levels and believe some rotation could be seen in Reliance, IT, Pharma and Banking sector," said Jaykrishna Gandhi, head, Business Development, Institutional Equities, Emkay Global Financial Services on markets.

Indian benchmarks shed their early gains to settle mixed on bank futures expiry day as Larsen & Toubro Ltd., Reliance Industries dragged, while banks' stocks supported.

The NSE Nifty 50 settled 36.30 points or 0.15% lower at 23,521.60. The S&P BSE Sensex ended 36.45 points or 0.05% higher at 77,337.59, marking the highest closing level since its inception.

Intraday, the Nifty 50 index rose 0.45% to fresh high of 23,664.00, and the Sensex rose 0.71% to a fresh high of 77,851.63.

Meanwhile, the NSE Nifty Bank index retained its gains to settled at historic level of 51,398.05 on Wednesday. The index scaled a high of 51,957.00 in the morning.

India Volatility index settled 5.77% higher at 13.71 after falling to over one month low. The index slumped 10.30% to 11.63, the lowest level since April 29 in the morning.

“There has been a likely chase towards sectors which can be potential budget beneficiaries - with buying seen across Agriculture, Power, Cap Goods and Infra sectors. Expectations of order announcement in defence sector raised investor interest with shares like HAL, Mazgaon Dock, Garden Reach shipbuilders, Paras Defence up double digit over the last one week. We expect markets to remain at elevated levels and believe some rotation could be seen in Reliance, IT, Pharma and Banking sector," said Jaykrishna Gandhi, head, Business Development, Institutional Equities, Emkay Global Financial Services on markets.

Indian benchmarks shed their early gains to settle mixed on bank futures expiry day as Larsen & Toubro Ltd., Reliance Industries dragged, while banks' stocks supported.

The NSE Nifty 50 settled 36.30 points or 0.15% lower at 23,521.60. The S&P BSE Sensex ended 36.45 points or 0.05% higher at 77,337.59, marking the highest closing level since its inception.

Intraday, the Nifty 50 index rose 0.45% to fresh high of 23,664.00, and the Sensex rose 0.71% to a fresh high of 77,851.63.

Meanwhile, the NSE Nifty Bank index retained its gains to settled at historic level of 51,398.05 on Wednesday. The index scaled a high of 51,957.00 in the morning.

India Volatility index settled 5.77% higher at 13.71 after falling to over one month low. The index slumped 10.30% to 11.63, the lowest level since April 29 in the morning.

“There has been a likely chase towards sectors which can be potential budget beneficiaries - with buying seen across Agriculture, Power, Cap Goods and Infra sectors. Expectations of order announcement in defence sector raised investor interest with shares like HAL, Mazgaon Dock, Garden Reach shipbuilders, Paras Defence up double digit over the last one week. We expect markets to remain at elevated levels and believe some rotation could be seen in Reliance, IT, Pharma and Banking sector," said Jaykrishna Gandhi, head, Business Development, Institutional Equities, Emkay Global Financial Services on markets.

Indian benchmarks shed their early gains to settle mixed on bank futures expiry day as Larsen & Toubro Ltd., Reliance Industries dragged, while banks' stocks supported.

The NSE Nifty 50 settled 36.30 points or 0.15% lower at 23,521.60. The S&P BSE Sensex ended 36.45 points or 0.05% higher at 77,337.59, marking the highest closing level since its inception.

Intraday, the Nifty 50 index rose 0.45% to fresh high of 23,664.00, and the Sensex rose 0.71% to a fresh high of 77,851.63.

Meanwhile, the NSE Nifty Bank index retained its gains to settled at historic level of 51,398.05 on Wednesday. The index scaled a high of 51,957.00 in the morning.

India Volatility index settled 5.77% higher at 13.71 after falling to over one month low. The index slumped 10.30% to 11.63, the lowest level since April 29 in the morning.

“There has been a likely chase towards sectors which can be potential budget beneficiaries - with buying seen across Agriculture, Power, Cap Goods and Infra sectors. Expectations of order announcement in defence sector raised investor interest with shares like HAL, Mazgaon Dock, Garden Reach shipbuilders, Paras Defence up double digit over the last one week. We expect markets to remain at elevated levels and believe some rotation could be seen in Reliance, IT, Pharma and Banking sector," said Jaykrishna Gandhi, head, Business Development, Institutional Equities, Emkay Global Financial Services on markets.

Indian benchmarks shed their early gains to settle mixed on bank futures expiry day as Larsen & Toubro Ltd., Reliance Industries dragged, while banks' stocks supported.

The NSE Nifty 50 settled 36.30 points or 0.15% lower at 23,521.60. The S&P BSE Sensex ended 36.45 points or 0.05% higher at 77,337.59, marking the highest closing level since its inception.

Intraday, the Nifty 50 index rose 0.45% to fresh high of 23,664.00, and the Sensex rose 0.71% to a fresh high of 77,851.63.

Meanwhile, the NSE Nifty Bank index retained its gains to settled at historic level of 51,398.05 on Wednesday. The index scaled a high of 51,957.00 in the morning.

India Volatility index settled 5.77% higher at 13.71 after falling to over one month low. The index slumped 10.30% to 11.63, the lowest level since April 29 in the morning.

“There has been a likely chase towards sectors which can be potential budget beneficiaries - with buying seen across Agriculture, Power, Cap Goods and Infra sectors. Expectations of order announcement in defence sector raised investor interest with shares like HAL, Mazgaon Dock, Garden Reach shipbuilders, Paras Defence up double digit over the last one week. We expect markets to remain at elevated levels and believe some rotation could be seen in Reliance, IT, Pharma and Banking sector," said Jaykrishna Gandhi, head, Business Development, Institutional Equities, Emkay Global Financial Services on markets.

Indian benchmarks shed their early gains to settle mixed on bank futures expiry day as Larsen & Toubro Ltd., Reliance Industries dragged, while banks' stocks supported.

The NSE Nifty 50 settled 36.30 points or 0.15% lower at 23,521.60. The S&P BSE Sensex ended 36.45 points or 0.05% higher at 77,337.59, marking the highest closing level since its inception.

Intraday, the Nifty 50 index rose 0.45% to fresh high of 23,664.00, and the Sensex rose 0.71% to a fresh high of 77,851.63.

Meanwhile, the NSE Nifty Bank index retained its gains to settled at historic level of 51,398.05 on Wednesday. The index scaled a high of 51,957.00 in the morning.

India Volatility index settled 5.77% higher at 13.71 after falling to over one month low. The index slumped 10.30% to 11.63, the lowest level since April 29 in the morning.

“There has been a likely chase towards sectors which can be potential budget beneficiaries - with buying seen across Agriculture, Power, Cap Goods and Infra sectors. Expectations of order announcement in defence sector raised investor interest with shares like HAL, Mazgaon Dock, Garden Reach shipbuilders, Paras Defence up double digit over the last one week. We expect markets to remain at elevated levels and believe some rotation could be seen in Reliance, IT, Pharma and Banking sector," said Jaykrishna Gandhi, head, Business Development, Institutional Equities, Emkay Global Financial Services on markets.

Indian benchmarks shed their early gains to settle mixed on bank futures expiry day as Larsen & Toubro Ltd., Reliance Industries dragged, while banks' stocks supported.

The NSE Nifty 50 settled 36.30 points or 0.15% lower at 23,521.60. The S&P BSE Sensex ended 36.45 points or 0.05% higher at 77,337.59, marking the highest closing level since its inception.

Intraday, the Nifty 50 index rose 0.45% to fresh high of 23,664.00, and the Sensex rose 0.71% to a fresh high of 77,851.63.

Meanwhile, the NSE Nifty Bank index retained its gains to settled at historic level of 51,398.05 on Wednesday. The index scaled a high of 51,957.00 in the morning.

India Volatility index settled 5.77% higher at 13.71 after falling to over one month low. The index slumped 10.30% to 11.63, the lowest level since April 29 in the morning.

“There has been a likely chase towards sectors which can be potential budget beneficiaries - with buying seen across Agriculture, Power, Cap Goods and Infra sectors. Expectations of order announcement in defence sector raised investor interest with shares like HAL, Mazgaon Dock, Garden Reach shipbuilders, Paras Defence up double digit over the last one week. We expect markets to remain at elevated levels and believe some rotation could be seen in Reliance, IT, Pharma and Banking sector," said Jaykrishna Gandhi, head, Business Development, Institutional Equities, Emkay Global Financial Services on markets.

Reliance Industries Ltd., Larsen & Toubro Ltd., Bharti Airtel Ltd., Titan Co., and ITC Ltd. weighed on the benchmark index.

HDFC Bank Ltd., ICICI Bank Ltd., Axis Bank Ltd., Infosys Ltd., and Kotak Mahindra Bank Ltd. added to the index.

Indian benchmarks shed their early gains to settle mixed on bank futures expiry day as Larsen & Toubro Ltd., Reliance Industries dragged, while banks' stocks supported.

The NSE Nifty 50 settled 36.30 points or 0.15% lower at 23,521.60. The S&P BSE Sensex ended 36.45 points or 0.05% higher at 77,337.59, marking the highest closing level since its inception.

Intraday, the Nifty 50 index rose 0.45% to fresh high of 23,664.00, and the Sensex rose 0.71% to a fresh high of 77,851.63.

Meanwhile, the NSE Nifty Bank index retained its gains to settled at historic level of 51,398.05 on Wednesday. The index scaled a high of 51,957.00 in the morning.

India Volatility index settled 5.77% higher at 13.71 after falling to over one month low. The index slumped 10.30% to 11.63, the lowest level since April 29 in the morning.

“There has been a likely chase towards sectors which can be potential budget beneficiaries - with buying seen across Agriculture, Power, Cap Goods and Infra sectors. Expectations of order announcement in defence sector raised investor interest with shares like HAL, Mazgaon Dock, Garden Reach shipbuilders, Paras Defence up double digit over the last one week. We expect markets to remain at elevated levels and believe some rotation could be seen in Reliance, IT, Pharma and Banking sector," said Jaykrishna Gandhi, head, Business Development, Institutional Equities, Emkay Global Financial Services on markets.

Indian benchmarks shed their early gains to settle mixed on bank futures expiry day as Larsen & Toubro Ltd., Reliance Industries dragged, while banks' stocks supported.

The NSE Nifty 50 settled 36.30 points or 0.15% lower at 23,521.60. The S&P BSE Sensex ended 36.45 points or 0.05% higher at 77,337.59, marking the highest closing level since its inception.

Intraday, the Nifty 50 index rose 0.45% to fresh high of 23,664.00, and the Sensex rose 0.71% to a fresh high of 77,851.63.

Meanwhile, the NSE Nifty Bank index retained its gains to settled at historic level of 51,398.05 on Wednesday. The index scaled a high of 51,957.00 in the morning.

India Volatility index settled 5.77% higher at 13.71 after falling to over one month low. The index slumped 10.30% to 11.63, the lowest level since April 29 in the morning.

“There has been a likely chase towards sectors which can be potential budget beneficiaries - with buying seen across Agriculture, Power, Cap Goods and Infra sectors. Expectations of order announcement in defence sector raised investor interest with shares like HAL, Mazgaon Dock, Garden Reach shipbuilders, Paras Defence up double digit over the last one week. We expect markets to remain at elevated levels and believe some rotation could be seen in Reliance, IT, Pharma and Banking sector," said Jaykrishna Gandhi, head, Business Development, Institutional Equities, Emkay Global Financial Services on markets.

Indian benchmarks shed their early gains to settle mixed on bank futures expiry day as Larsen & Toubro Ltd., Reliance Industries dragged, while banks' stocks supported.

The NSE Nifty 50 settled 36.30 points or 0.15% lower at 23,521.60. The S&P BSE Sensex ended 36.45 points or 0.05% higher at 77,337.59, marking the highest closing level since its inception.

Intraday, the Nifty 50 index rose 0.45% to fresh high of 23,664.00, and the Sensex rose 0.71% to a fresh high of 77,851.63.

Meanwhile, the NSE Nifty Bank index retained its gains to settled at historic level of 51,398.05 on Wednesday. The index scaled a high of 51,957.00 in the morning.

India Volatility index settled 5.77% higher at 13.71 after falling to over one month low. The index slumped 10.30% to 11.63, the lowest level since April 29 in the morning.

“There has been a likely chase towards sectors which can be potential budget beneficiaries - with buying seen across Agriculture, Power, Cap Goods and Infra sectors. Expectations of order announcement in defence sector raised investor interest with shares like HAL, Mazgaon Dock, Garden Reach shipbuilders, Paras Defence up double digit over the last one week. We expect markets to remain at elevated levels and believe some rotation could be seen in Reliance, IT, Pharma and Banking sector," said Jaykrishna Gandhi, head, Business Development, Institutional Equities, Emkay Global Financial Services on markets.

Indian benchmarks shed their early gains to settle mixed on bank futures expiry day as Larsen & Toubro Ltd., Reliance Industries dragged, while banks' stocks supported.

The NSE Nifty 50 settled 36.30 points or 0.15% lower at 23,521.60. The S&P BSE Sensex ended 36.45 points or 0.05% higher at 77,337.59, marking the highest closing level since its inception.

Intraday, the Nifty 50 index rose 0.45% to fresh high of 23,664.00, and the Sensex rose 0.71% to a fresh high of 77,851.63.

Meanwhile, the NSE Nifty Bank index retained its gains to settled at historic level of 51,398.05 on Wednesday. The index scaled a high of 51,957.00 in the morning.

India Volatility index settled 5.77% higher at 13.71 after falling to over one month low. The index slumped 10.30% to 11.63, the lowest level since April 29 in the morning.

“There has been a likely chase towards sectors which can be potential budget beneficiaries - with buying seen across Agriculture, Power, Cap Goods and Infra sectors. Expectations of order announcement in defence sector raised investor interest with shares like HAL, Mazgaon Dock, Garden Reach shipbuilders, Paras Defence up double digit over the last one week. We expect markets to remain at elevated levels and believe some rotation could be seen in Reliance, IT, Pharma and Banking sector," said Jaykrishna Gandhi, head, Business Development, Institutional Equities, Emkay Global Financial Services on markets.

Indian benchmarks shed their early gains to settle mixed on bank futures expiry day as Larsen & Toubro Ltd., Reliance Industries dragged, while banks' stocks supported.

The NSE Nifty 50 settled 36.30 points or 0.15% lower at 23,521.60. The S&P BSE Sensex ended 36.45 points or 0.05% higher at 77,337.59, marking the highest closing level since its inception.

Intraday, the Nifty 50 index rose 0.45% to fresh high of 23,664.00, and the Sensex rose 0.71% to a fresh high of 77,851.63.

Meanwhile, the NSE Nifty Bank index retained its gains to settled at historic level of 51,398.05 on Wednesday. The index scaled a high of 51,957.00 in the morning.

India Volatility index settled 5.77% higher at 13.71 after falling to over one month low. The index slumped 10.30% to 11.63, the lowest level since April 29 in the morning.

“There has been a likely chase towards sectors which can be potential budget beneficiaries - with buying seen across Agriculture, Power, Cap Goods and Infra sectors. Expectations of order announcement in defence sector raised investor interest with shares like HAL, Mazgaon Dock, Garden Reach shipbuilders, Paras Defence up double digit over the last one week. We expect markets to remain at elevated levels and believe some rotation could be seen in Reliance, IT, Pharma and Banking sector," said Jaykrishna Gandhi, head, Business Development, Institutional Equities, Emkay Global Financial Services on markets.

Indian benchmarks shed their early gains to settle mixed on bank futures expiry day as Larsen & Toubro Ltd., Reliance Industries dragged, while banks' stocks supported.

The NSE Nifty 50 settled 36.30 points or 0.15% lower at 23,521.60. The S&P BSE Sensex ended 36.45 points or 0.05% higher at 77,337.59, marking the highest closing level since its inception.

Intraday, the Nifty 50 index rose 0.45% to fresh high of 23,664.00, and the Sensex rose 0.71% to a fresh high of 77,851.63.

Meanwhile, the NSE Nifty Bank index retained its gains to settled at historic level of 51,398.05 on Wednesday. The index scaled a high of 51,957.00 in the morning.

India Volatility index settled 5.77% higher at 13.71 after falling to over one month low. The index slumped 10.30% to 11.63, the lowest level since April 29 in the morning.

“There has been a likely chase towards sectors which can be potential budget beneficiaries - with buying seen across Agriculture, Power, Cap Goods and Infra sectors. Expectations of order announcement in defence sector raised investor interest with shares like HAL, Mazgaon Dock, Garden Reach shipbuilders, Paras Defence up double digit over the last one week. We expect markets to remain at elevated levels and believe some rotation could be seen in Reliance, IT, Pharma and Banking sector," said Jaykrishna Gandhi, head, Business Development, Institutional Equities, Emkay Global Financial Services on markets.

Indian benchmarks shed their early gains to settle mixed on bank futures expiry day as Larsen & Toubro Ltd., Reliance Industries dragged, while banks' stocks supported.

The NSE Nifty 50 settled 36.30 points or 0.15% lower at 23,521.60. The S&P BSE Sensex ended 36.45 points or 0.05% higher at 77,337.59, marking the highest closing level since its inception.

Intraday, the Nifty 50 index rose 0.45% to fresh high of 23,664.00, and the Sensex rose 0.71% to a fresh high of 77,851.63.

Meanwhile, the NSE Nifty Bank index retained its gains to settled at historic level of 51,398.05 on Wednesday. The index scaled a high of 51,957.00 in the morning.

India Volatility index settled 5.77% higher at 13.71 after falling to over one month low. The index slumped 10.30% to 11.63, the lowest level since April 29 in the morning.

“There has been a likely chase towards sectors which can be potential budget beneficiaries - with buying seen across Agriculture, Power, Cap Goods and Infra sectors. Expectations of order announcement in defence sector raised investor interest with shares like HAL, Mazgaon Dock, Garden Reach shipbuilders, Paras Defence up double digit over the last one week. We expect markets to remain at elevated levels and believe some rotation could be seen in Reliance, IT, Pharma and Banking sector," said Jaykrishna Gandhi, head, Business Development, Institutional Equities, Emkay Global Financial Services on markets.

Indian benchmarks shed their early gains to settle mixed on bank futures expiry day as Larsen & Toubro Ltd., Reliance Industries dragged, while banks' stocks supported.

The NSE Nifty 50 settled 36.30 points or 0.15% lower at 23,521.60. The S&P BSE Sensex ended 36.45 points or 0.05% higher at 77,337.59, marking the highest closing level since its inception.

Intraday, the Nifty 50 index rose 0.45% to fresh high of 23,664.00, and the Sensex rose 0.71% to a fresh high of 77,851.63.

Meanwhile, the NSE Nifty Bank index retained its gains to settled at historic level of 51,398.05 on Wednesday. The index scaled a high of 51,957.00 in the morning.

India Volatility index settled 5.77% higher at 13.71 after falling to over one month low. The index slumped 10.30% to 11.63, the lowest level since April 29 in the morning.

“There has been a likely chase towards sectors which can be potential budget beneficiaries - with buying seen across Agriculture, Power, Cap Goods and Infra sectors. Expectations of order announcement in defence sector raised investor interest with shares like HAL, Mazgaon Dock, Garden Reach shipbuilders, Paras Defence up double digit over the last one week. We expect markets to remain at elevated levels and believe some rotation could be seen in Reliance, IT, Pharma and Banking sector," said Jaykrishna Gandhi, head, Business Development, Institutional Equities, Emkay Global Financial Services on markets.

Reliance Industries Ltd., Larsen & Toubro Ltd., Bharti Airtel Ltd., Titan Co., and ITC Ltd. weighed on the benchmark index.

HDFC Bank Ltd., ICICI Bank Ltd., Axis Bank Ltd., Infosys Ltd., and Kotak Mahindra Bank Ltd. added to the index.

.png)

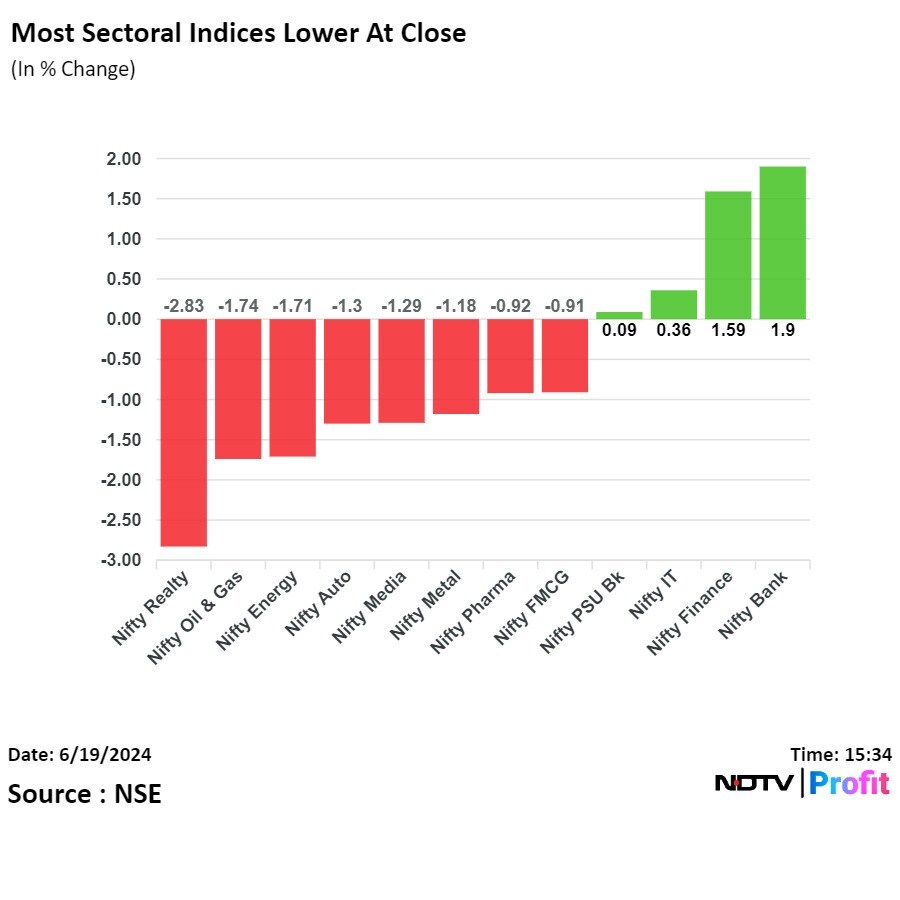

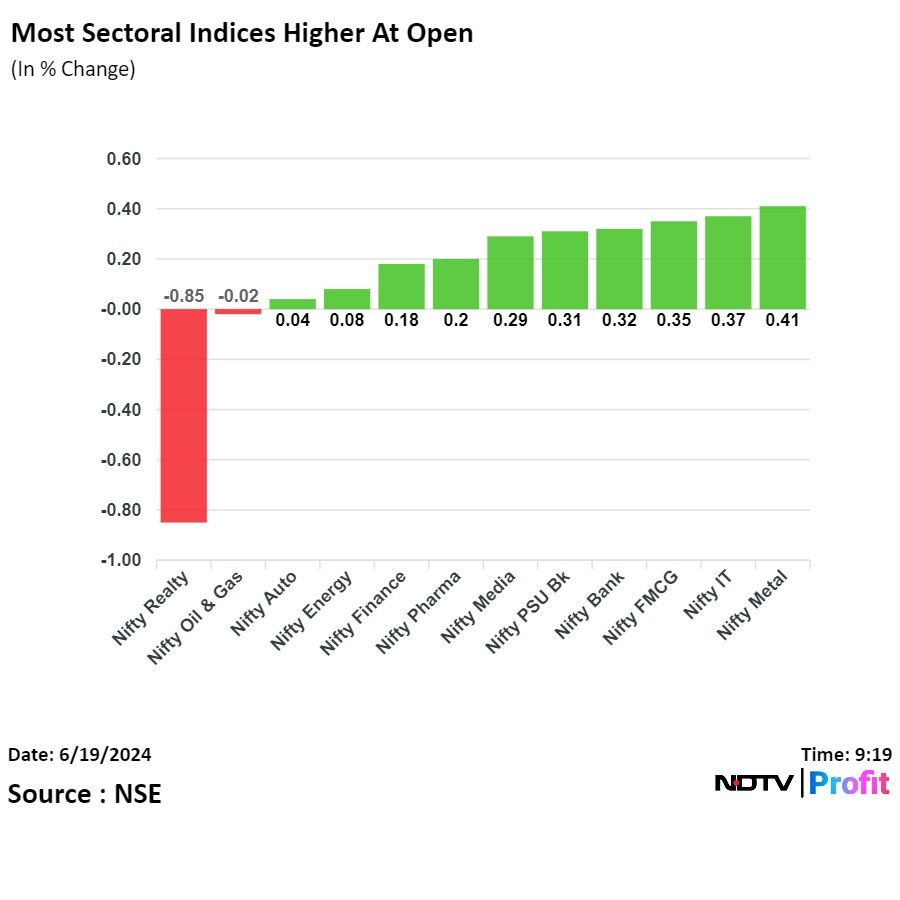

On NSE, six sectors declined, and four rose out of 12. The NSE Nifty Realty declined the most, and the NSE Nifty Bank rose the most.

"Mid and Smallcap led correction dragged the Index lower in the morning session to trade lower by over 100 points, but a strong dominance of the Banking counters helped the Index to recoup its losses and register a fresh high of 23,664 but another round of selling in the last hour of trade pulled the Index lower once again to settle the day at 23,516.00 with a loss of 41.90 points. Apart from Bank Nifty, the IT sector performed well while Energy and Realty corrected the most. On the daily timeframe, the Index has formed a Bearish Engulfing candle with a probable bearish divergence in RSI which indicates a temporary pause in its uptrend with the lower side being protected at 23,340 while today's high i.e. 23,660 will be considered as resistance," said Aditya Gaggar, director, Progressive Shares.

Indian benchmarks shed their early gains to settle mixed on bank futures expiry day as Larsen & Toubro Ltd., Reliance Industries dragged, while banks' stocks supported.

The NSE Nifty 50 settled 36.30 points or 0.15% lower at 23,521.60. The S&P BSE Sensex ended 36.45 points or 0.05% higher at 77,337.59, marking the highest closing level since its inception.

Intraday, the Nifty 50 index rose 0.45% to fresh high of 23,664.00, and the Sensex rose 0.71% to a fresh high of 77,851.63.

Meanwhile, the NSE Nifty Bank index retained its gains to settled at historic level of 51,398.05 on Wednesday. The index scaled a high of 51,957.00 in the morning.

India Volatility index settled 5.77% higher at 13.71 after falling to over one month low. The index slumped 10.30% to 11.63, the lowest level since April 29 in the morning.

“There has been a likely chase towards sectors which can be potential budget beneficiaries - with buying seen across Agriculture, Power, Cap Goods and Infra sectors. Expectations of order announcement in defence sector raised investor interest with shares like HAL, Mazgaon Dock, Garden Reach shipbuilders, Paras Defence up double digit over the last one week. We expect markets to remain at elevated levels and believe some rotation could be seen in Reliance, IT, Pharma and Banking sector," said Jaykrishna Gandhi, head, Business Development, Institutional Equities, Emkay Global Financial Services on markets.

Indian benchmarks shed their early gains to settle mixed on bank futures expiry day as Larsen & Toubro Ltd., Reliance Industries dragged, while banks' stocks supported.

The NSE Nifty 50 settled 36.30 points or 0.15% lower at 23,521.60. The S&P BSE Sensex ended 36.45 points or 0.05% higher at 77,337.59, marking the highest closing level since its inception.

Intraday, the Nifty 50 index rose 0.45% to fresh high of 23,664.00, and the Sensex rose 0.71% to a fresh high of 77,851.63.

Meanwhile, the NSE Nifty Bank index retained its gains to settled at historic level of 51,398.05 on Wednesday. The index scaled a high of 51,957.00 in the morning.

India Volatility index settled 5.77% higher at 13.71 after falling to over one month low. The index slumped 10.30% to 11.63, the lowest level since April 29 in the morning.

“There has been a likely chase towards sectors which can be potential budget beneficiaries - with buying seen across Agriculture, Power, Cap Goods and Infra sectors. Expectations of order announcement in defence sector raised investor interest with shares like HAL, Mazgaon Dock, Garden Reach shipbuilders, Paras Defence up double digit over the last one week. We expect markets to remain at elevated levels and believe some rotation could be seen in Reliance, IT, Pharma and Banking sector," said Jaykrishna Gandhi, head, Business Development, Institutional Equities, Emkay Global Financial Services on markets.

Indian benchmarks shed their early gains to settle mixed on bank futures expiry day as Larsen & Toubro Ltd., Reliance Industries dragged, while banks' stocks supported.

The NSE Nifty 50 settled 36.30 points or 0.15% lower at 23,521.60. The S&P BSE Sensex ended 36.45 points or 0.05% higher at 77,337.59, marking the highest closing level since its inception.

Intraday, the Nifty 50 index rose 0.45% to fresh high of 23,664.00, and the Sensex rose 0.71% to a fresh high of 77,851.63.

Meanwhile, the NSE Nifty Bank index retained its gains to settled at historic level of 51,398.05 on Wednesday. The index scaled a high of 51,957.00 in the morning.

India Volatility index settled 5.77% higher at 13.71 after falling to over one month low. The index slumped 10.30% to 11.63, the lowest level since April 29 in the morning.

“There has been a likely chase towards sectors which can be potential budget beneficiaries - with buying seen across Agriculture, Power, Cap Goods and Infra sectors. Expectations of order announcement in defence sector raised investor interest with shares like HAL, Mazgaon Dock, Garden Reach shipbuilders, Paras Defence up double digit over the last one week. We expect markets to remain at elevated levels and believe some rotation could be seen in Reliance, IT, Pharma and Banking sector," said Jaykrishna Gandhi, head, Business Development, Institutional Equities, Emkay Global Financial Services on markets.

Indian benchmarks shed their early gains to settle mixed on bank futures expiry day as Larsen & Toubro Ltd., Reliance Industries dragged, while banks' stocks supported.

The NSE Nifty 50 settled 36.30 points or 0.15% lower at 23,521.60. The S&P BSE Sensex ended 36.45 points or 0.05% higher at 77,337.59, marking the highest closing level since its inception.

Intraday, the Nifty 50 index rose 0.45% to fresh high of 23,664.00, and the Sensex rose 0.71% to a fresh high of 77,851.63.

Meanwhile, the NSE Nifty Bank index retained its gains to settled at historic level of 51,398.05 on Wednesday. The index scaled a high of 51,957.00 in the morning.

India Volatility index settled 5.77% higher at 13.71 after falling to over one month low. The index slumped 10.30% to 11.63, the lowest level since April 29 in the morning.

“There has been a likely chase towards sectors which can be potential budget beneficiaries - with buying seen across Agriculture, Power, Cap Goods and Infra sectors. Expectations of order announcement in defence sector raised investor interest with shares like HAL, Mazgaon Dock, Garden Reach shipbuilders, Paras Defence up double digit over the last one week. We expect markets to remain at elevated levels and believe some rotation could be seen in Reliance, IT, Pharma and Banking sector," said Jaykrishna Gandhi, head, Business Development, Institutional Equities, Emkay Global Financial Services on markets.

Indian benchmarks shed their early gains to settle mixed on bank futures expiry day as Larsen & Toubro Ltd., Reliance Industries dragged, while banks' stocks supported.

The NSE Nifty 50 settled 36.30 points or 0.15% lower at 23,521.60. The S&P BSE Sensex ended 36.45 points or 0.05% higher at 77,337.59, marking the highest closing level since its inception.

Intraday, the Nifty 50 index rose 0.45% to fresh high of 23,664.00, and the Sensex rose 0.71% to a fresh high of 77,851.63.

Meanwhile, the NSE Nifty Bank index retained its gains to settled at historic level of 51,398.05 on Wednesday. The index scaled a high of 51,957.00 in the morning.

India Volatility index settled 5.77% higher at 13.71 after falling to over one month low. The index slumped 10.30% to 11.63, the lowest level since April 29 in the morning.

“There has been a likely chase towards sectors which can be potential budget beneficiaries - with buying seen across Agriculture, Power, Cap Goods and Infra sectors. Expectations of order announcement in defence sector raised investor interest with shares like HAL, Mazgaon Dock, Garden Reach shipbuilders, Paras Defence up double digit over the last one week. We expect markets to remain at elevated levels and believe some rotation could be seen in Reliance, IT, Pharma and Banking sector," said Jaykrishna Gandhi, head, Business Development, Institutional Equities, Emkay Global Financial Services on markets.

Indian benchmarks shed their early gains to settle mixed on bank futures expiry day as Larsen & Toubro Ltd., Reliance Industries dragged, while banks' stocks supported.

The NSE Nifty 50 settled 36.30 points or 0.15% lower at 23,521.60. The S&P BSE Sensex ended 36.45 points or 0.05% higher at 77,337.59, marking the highest closing level since its inception.

Intraday, the Nifty 50 index rose 0.45% to fresh high of 23,664.00, and the Sensex rose 0.71% to a fresh high of 77,851.63.

Meanwhile, the NSE Nifty Bank index retained its gains to settled at historic level of 51,398.05 on Wednesday. The index scaled a high of 51,957.00 in the morning.

India Volatility index settled 5.77% higher at 13.71 after falling to over one month low. The index slumped 10.30% to 11.63, the lowest level since April 29 in the morning.

“There has been a likely chase towards sectors which can be potential budget beneficiaries - with buying seen across Agriculture, Power, Cap Goods and Infra sectors. Expectations of order announcement in defence sector raised investor interest with shares like HAL, Mazgaon Dock, Garden Reach shipbuilders, Paras Defence up double digit over the last one week. We expect markets to remain at elevated levels and believe some rotation could be seen in Reliance, IT, Pharma and Banking sector," said Jaykrishna Gandhi, head, Business Development, Institutional Equities, Emkay Global Financial Services on markets.

Indian benchmarks shed their early gains to settle mixed on bank futures expiry day as Larsen & Toubro Ltd., Reliance Industries dragged, while banks' stocks supported.

The NSE Nifty 50 settled 36.30 points or 0.15% lower at 23,521.60. The S&P BSE Sensex ended 36.45 points or 0.05% higher at 77,337.59, marking the highest closing level since its inception.

Intraday, the Nifty 50 index rose 0.45% to fresh high of 23,664.00, and the Sensex rose 0.71% to a fresh high of 77,851.63.

Meanwhile, the NSE Nifty Bank index retained its gains to settled at historic level of 51,398.05 on Wednesday. The index scaled a high of 51,957.00 in the morning.

India Volatility index settled 5.77% higher at 13.71 after falling to over one month low. The index slumped 10.30% to 11.63, the lowest level since April 29 in the morning.

“There has been a likely chase towards sectors which can be potential budget beneficiaries - with buying seen across Agriculture, Power, Cap Goods and Infra sectors. Expectations of order announcement in defence sector raised investor interest with shares like HAL, Mazgaon Dock, Garden Reach shipbuilders, Paras Defence up double digit over the last one week. We expect markets to remain at elevated levels and believe some rotation could be seen in Reliance, IT, Pharma and Banking sector," said Jaykrishna Gandhi, head, Business Development, Institutional Equities, Emkay Global Financial Services on markets.

Indian benchmarks shed their early gains to settle mixed on bank futures expiry day as Larsen & Toubro Ltd., Reliance Industries dragged, while banks' stocks supported.

The NSE Nifty 50 settled 36.30 points or 0.15% lower at 23,521.60. The S&P BSE Sensex ended 36.45 points or 0.05% higher at 77,337.59, marking the highest closing level since its inception.

Intraday, the Nifty 50 index rose 0.45% to fresh high of 23,664.00, and the Sensex rose 0.71% to a fresh high of 77,851.63.

Meanwhile, the NSE Nifty Bank index retained its gains to settled at historic level of 51,398.05 on Wednesday. The index scaled a high of 51,957.00 in the morning.

India Volatility index settled 5.77% higher at 13.71 after falling to over one month low. The index slumped 10.30% to 11.63, the lowest level since April 29 in the morning.

“There has been a likely chase towards sectors which can be potential budget beneficiaries - with buying seen across Agriculture, Power, Cap Goods and Infra sectors. Expectations of order announcement in defence sector raised investor interest with shares like HAL, Mazgaon Dock, Garden Reach shipbuilders, Paras Defence up double digit over the last one week. We expect markets to remain at elevated levels and believe some rotation could be seen in Reliance, IT, Pharma and Banking sector," said Jaykrishna Gandhi, head, Business Development, Institutional Equities, Emkay Global Financial Services on markets.

Reliance Industries Ltd., Larsen & Toubro Ltd., Bharti Airtel Ltd., Titan Co., and ITC Ltd. weighed on the benchmark index.

HDFC Bank Ltd., ICICI Bank Ltd., Axis Bank Ltd., Infosys Ltd., and Kotak Mahindra Bank Ltd. added to the index.

Indian benchmarks shed their early gains to settle mixed on bank futures expiry day as Larsen & Toubro Ltd., Reliance Industries dragged, while banks' stocks supported.

The NSE Nifty 50 settled 36.30 points or 0.15% lower at 23,521.60. The S&P BSE Sensex ended 36.45 points or 0.05% higher at 77,337.59, marking the highest closing level since its inception.

Intraday, the Nifty 50 index rose 0.45% to fresh high of 23,664.00, and the Sensex rose 0.71% to a fresh high of 77,851.63.

Meanwhile, the NSE Nifty Bank index retained its gains to settled at historic level of 51,398.05 on Wednesday. The index scaled a high of 51,957.00 in the morning.

India Volatility index settled 5.77% higher at 13.71 after falling to over one month low. The index slumped 10.30% to 11.63, the lowest level since April 29 in the morning.

“There has been a likely chase towards sectors which can be potential budget beneficiaries - with buying seen across Agriculture, Power, Cap Goods and Infra sectors. Expectations of order announcement in defence sector raised investor interest with shares like HAL, Mazgaon Dock, Garden Reach shipbuilders, Paras Defence up double digit over the last one week. We expect markets to remain at elevated levels and believe some rotation could be seen in Reliance, IT, Pharma and Banking sector," said Jaykrishna Gandhi, head, Business Development, Institutional Equities, Emkay Global Financial Services on markets.

Indian benchmarks shed their early gains to settle mixed on bank futures expiry day as Larsen & Toubro Ltd., Reliance Industries dragged, while banks' stocks supported.

The NSE Nifty 50 settled 36.30 points or 0.15% lower at 23,521.60. The S&P BSE Sensex ended 36.45 points or 0.05% higher at 77,337.59, marking the highest closing level since its inception.

Intraday, the Nifty 50 index rose 0.45% to fresh high of 23,664.00, and the Sensex rose 0.71% to a fresh high of 77,851.63.

Meanwhile, the NSE Nifty Bank index retained its gains to settled at historic level of 51,398.05 on Wednesday. The index scaled a high of 51,957.00 in the morning.

India Volatility index settled 5.77% higher at 13.71 after falling to over one month low. The index slumped 10.30% to 11.63, the lowest level since April 29 in the morning.

“There has been a likely chase towards sectors which can be potential budget beneficiaries - with buying seen across Agriculture, Power, Cap Goods and Infra sectors. Expectations of order announcement in defence sector raised investor interest with shares like HAL, Mazgaon Dock, Garden Reach shipbuilders, Paras Defence up double digit over the last one week. We expect markets to remain at elevated levels and believe some rotation could be seen in Reliance, IT, Pharma and Banking sector," said Jaykrishna Gandhi, head, Business Development, Institutional Equities, Emkay Global Financial Services on markets.

Indian benchmarks shed their early gains to settle mixed on bank futures expiry day as Larsen & Toubro Ltd., Reliance Industries dragged, while banks' stocks supported.

The NSE Nifty 50 settled 36.30 points or 0.15% lower at 23,521.60. The S&P BSE Sensex ended 36.45 points or 0.05% higher at 77,337.59, marking the highest closing level since its inception.

Intraday, the Nifty 50 index rose 0.45% to fresh high of 23,664.00, and the Sensex rose 0.71% to a fresh high of 77,851.63.

Meanwhile, the NSE Nifty Bank index retained its gains to settled at historic level of 51,398.05 on Wednesday. The index scaled a high of 51,957.00 in the morning.

India Volatility index settled 5.77% higher at 13.71 after falling to over one month low. The index slumped 10.30% to 11.63, the lowest level since April 29 in the morning.

“There has been a likely chase towards sectors which can be potential budget beneficiaries - with buying seen across Agriculture, Power, Cap Goods and Infra sectors. Expectations of order announcement in defence sector raised investor interest with shares like HAL, Mazgaon Dock, Garden Reach shipbuilders, Paras Defence up double digit over the last one week. We expect markets to remain at elevated levels and believe some rotation could be seen in Reliance, IT, Pharma and Banking sector," said Jaykrishna Gandhi, head, Business Development, Institutional Equities, Emkay Global Financial Services on markets.

Indian benchmarks shed their early gains to settle mixed on bank futures expiry day as Larsen & Toubro Ltd., Reliance Industries dragged, while banks' stocks supported.

The NSE Nifty 50 settled 36.30 points or 0.15% lower at 23,521.60. The S&P BSE Sensex ended 36.45 points or 0.05% higher at 77,337.59, marking the highest closing level since its inception.

Intraday, the Nifty 50 index rose 0.45% to fresh high of 23,664.00, and the Sensex rose 0.71% to a fresh high of 77,851.63.

Meanwhile, the NSE Nifty Bank index retained its gains to settled at historic level of 51,398.05 on Wednesday. The index scaled a high of 51,957.00 in the morning.

India Volatility index settled 5.77% higher at 13.71 after falling to over one month low. The index slumped 10.30% to 11.63, the lowest level since April 29 in the morning.

“There has been a likely chase towards sectors which can be potential budget beneficiaries - with buying seen across Agriculture, Power, Cap Goods and Infra sectors. Expectations of order announcement in defence sector raised investor interest with shares like HAL, Mazgaon Dock, Garden Reach shipbuilders, Paras Defence up double digit over the last one week. We expect markets to remain at elevated levels and believe some rotation could be seen in Reliance, IT, Pharma and Banking sector," said Jaykrishna Gandhi, head, Business Development, Institutional Equities, Emkay Global Financial Services on markets.

Indian benchmarks shed their early gains to settle mixed on bank futures expiry day as Larsen & Toubro Ltd., Reliance Industries dragged, while banks' stocks supported.

The NSE Nifty 50 settled 36.30 points or 0.15% lower at 23,521.60. The S&P BSE Sensex ended 36.45 points or 0.05% higher at 77,337.59, marking the highest closing level since its inception.

Intraday, the Nifty 50 index rose 0.45% to fresh high of 23,664.00, and the Sensex rose 0.71% to a fresh high of 77,851.63.

Meanwhile, the NSE Nifty Bank index retained its gains to settled at historic level of 51,398.05 on Wednesday. The index scaled a high of 51,957.00 in the morning.

India Volatility index settled 5.77% higher at 13.71 after falling to over one month low. The index slumped 10.30% to 11.63, the lowest level since April 29 in the morning.

“There has been a likely chase towards sectors which can be potential budget beneficiaries - with buying seen across Agriculture, Power, Cap Goods and Infra sectors. Expectations of order announcement in defence sector raised investor interest with shares like HAL, Mazgaon Dock, Garden Reach shipbuilders, Paras Defence up double digit over the last one week. We expect markets to remain at elevated levels and believe some rotation could be seen in Reliance, IT, Pharma and Banking sector," said Jaykrishna Gandhi, head, Business Development, Institutional Equities, Emkay Global Financial Services on markets.

Indian benchmarks shed their early gains to settle mixed on bank futures expiry day as Larsen & Toubro Ltd., Reliance Industries dragged, while banks' stocks supported.

The NSE Nifty 50 settled 36.30 points or 0.15% lower at 23,521.60. The S&P BSE Sensex ended 36.45 points or 0.05% higher at 77,337.59, marking the highest closing level since its inception.

Intraday, the Nifty 50 index rose 0.45% to fresh high of 23,664.00, and the Sensex rose 0.71% to a fresh high of 77,851.63.

Meanwhile, the NSE Nifty Bank index retained its gains to settled at historic level of 51,398.05 on Wednesday. The index scaled a high of 51,957.00 in the morning.

India Volatility index settled 5.77% higher at 13.71 after falling to over one month low. The index slumped 10.30% to 11.63, the lowest level since April 29 in the morning.

“There has been a likely chase towards sectors which can be potential budget beneficiaries - with buying seen across Agriculture, Power, Cap Goods and Infra sectors. Expectations of order announcement in defence sector raised investor interest with shares like HAL, Mazgaon Dock, Garden Reach shipbuilders, Paras Defence up double digit over the last one week. We expect markets to remain at elevated levels and believe some rotation could be seen in Reliance, IT, Pharma and Banking sector," said Jaykrishna Gandhi, head, Business Development, Institutional Equities, Emkay Global Financial Services on markets.

Indian benchmarks shed their early gains to settle mixed on bank futures expiry day as Larsen & Toubro Ltd., Reliance Industries dragged, while banks' stocks supported.

The NSE Nifty 50 settled 36.30 points or 0.15% lower at 23,521.60. The S&P BSE Sensex ended 36.45 points or 0.05% higher at 77,337.59, marking the highest closing level since its inception.

Intraday, the Nifty 50 index rose 0.45% to fresh high of 23,664.00, and the Sensex rose 0.71% to a fresh high of 77,851.63.

Meanwhile, the NSE Nifty Bank index retained its gains to settled at historic level of 51,398.05 on Wednesday. The index scaled a high of 51,957.00 in the morning.

India Volatility index settled 5.77% higher at 13.71 after falling to over one month low. The index slumped 10.30% to 11.63, the lowest level since April 29 in the morning.

“There has been a likely chase towards sectors which can be potential budget beneficiaries - with buying seen across Agriculture, Power, Cap Goods and Infra sectors. Expectations of order announcement in defence sector raised investor interest with shares like HAL, Mazgaon Dock, Garden Reach shipbuilders, Paras Defence up double digit over the last one week. We expect markets to remain at elevated levels and believe some rotation could be seen in Reliance, IT, Pharma and Banking sector," said Jaykrishna Gandhi, head, Business Development, Institutional Equities, Emkay Global Financial Services on markets.

Indian benchmarks shed their early gains to settle mixed on bank futures expiry day as Larsen & Toubro Ltd., Reliance Industries dragged, while banks' stocks supported.

The NSE Nifty 50 settled 36.30 points or 0.15% lower at 23,521.60. The S&P BSE Sensex ended 36.45 points or 0.05% higher at 77,337.59, marking the highest closing level since its inception.

Intraday, the Nifty 50 index rose 0.45% to fresh high of 23,664.00, and the Sensex rose 0.71% to a fresh high of 77,851.63.

Meanwhile, the NSE Nifty Bank index retained its gains to settled at historic level of 51,398.05 on Wednesday. The index scaled a high of 51,957.00 in the morning.

India Volatility index settled 5.77% higher at 13.71 after falling to over one month low. The index slumped 10.30% to 11.63, the lowest level since April 29 in the morning.

“There has been a likely chase towards sectors which can be potential budget beneficiaries - with buying seen across Agriculture, Power, Cap Goods and Infra sectors. Expectations of order announcement in defence sector raised investor interest with shares like HAL, Mazgaon Dock, Garden Reach shipbuilders, Paras Defence up double digit over the last one week. We expect markets to remain at elevated levels and believe some rotation could be seen in Reliance, IT, Pharma and Banking sector," said Jaykrishna Gandhi, head, Business Development, Institutional Equities, Emkay Global Financial Services on markets.

Reliance Industries Ltd., Larsen & Toubro Ltd., Bharti Airtel Ltd., Titan Co., and ITC Ltd. weighed on the benchmark index.

HDFC Bank Ltd., ICICI Bank Ltd., Axis Bank Ltd., Infosys Ltd., and Kotak Mahindra Bank Ltd. added to the index.

.png)

On NSE, six sectors declined, and four rose out of 12. The NSE Nifty Realty declined the most, and the NSE Nifty Bank rose the most.

"Mid and Smallcap led correction dragged the Index lower in the morning session to trade lower by over 100 points, but a strong dominance of the Banking counters helped the Index to recoup its losses and register a fresh high of 23,664 but another round of selling in the last hour of trade pulled the Index lower once again to settle the day at 23,516.00 with a loss of 41.90 points. Apart from Bank Nifty, the IT sector performed well while Energy and Realty corrected the most. On the daily timeframe, the Index has formed a Bearish Engulfing candle with a probable bearish divergence in RSI which indicates a temporary pause in its uptrend with the lower side being protected at 23,340 while today's high i.e. 23,660 will be considered as resistance," said Aditya Gaggar, director, Progressive Shares.

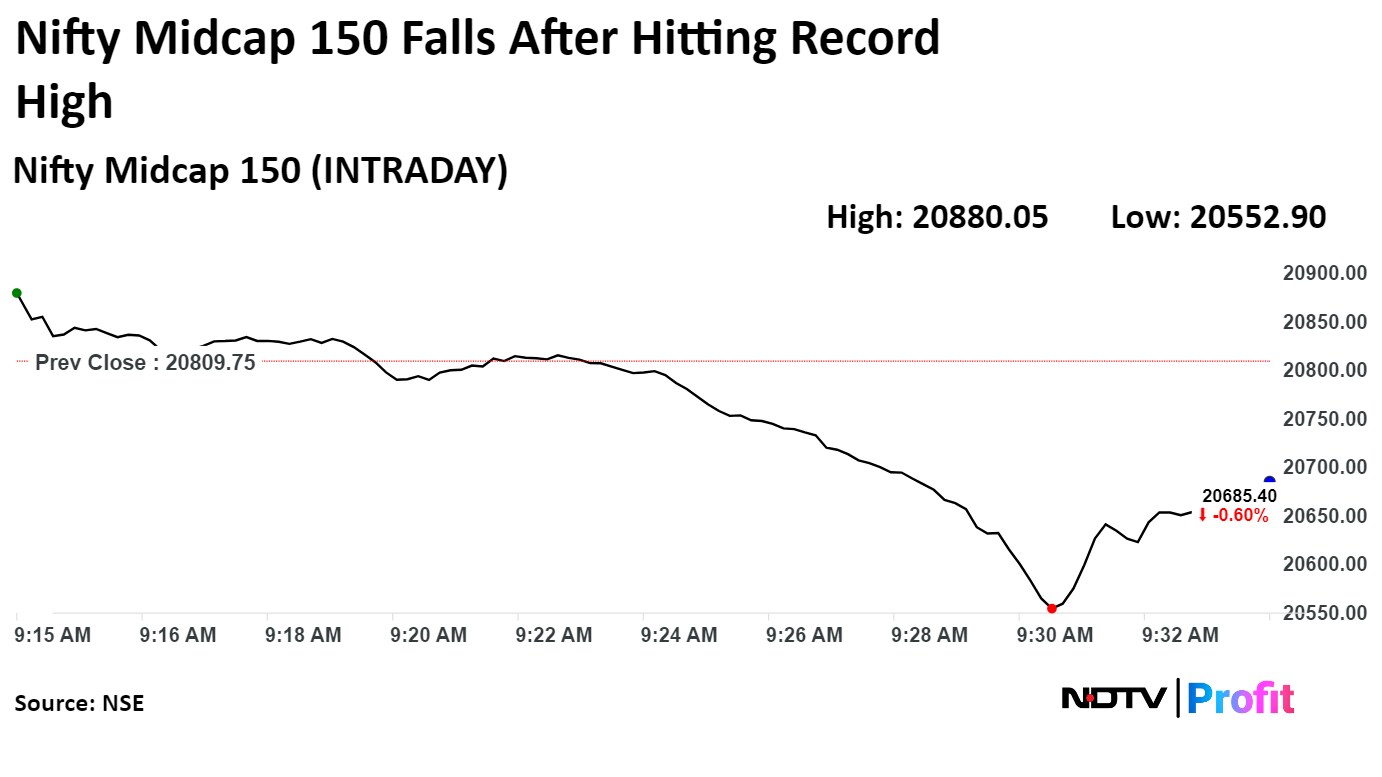

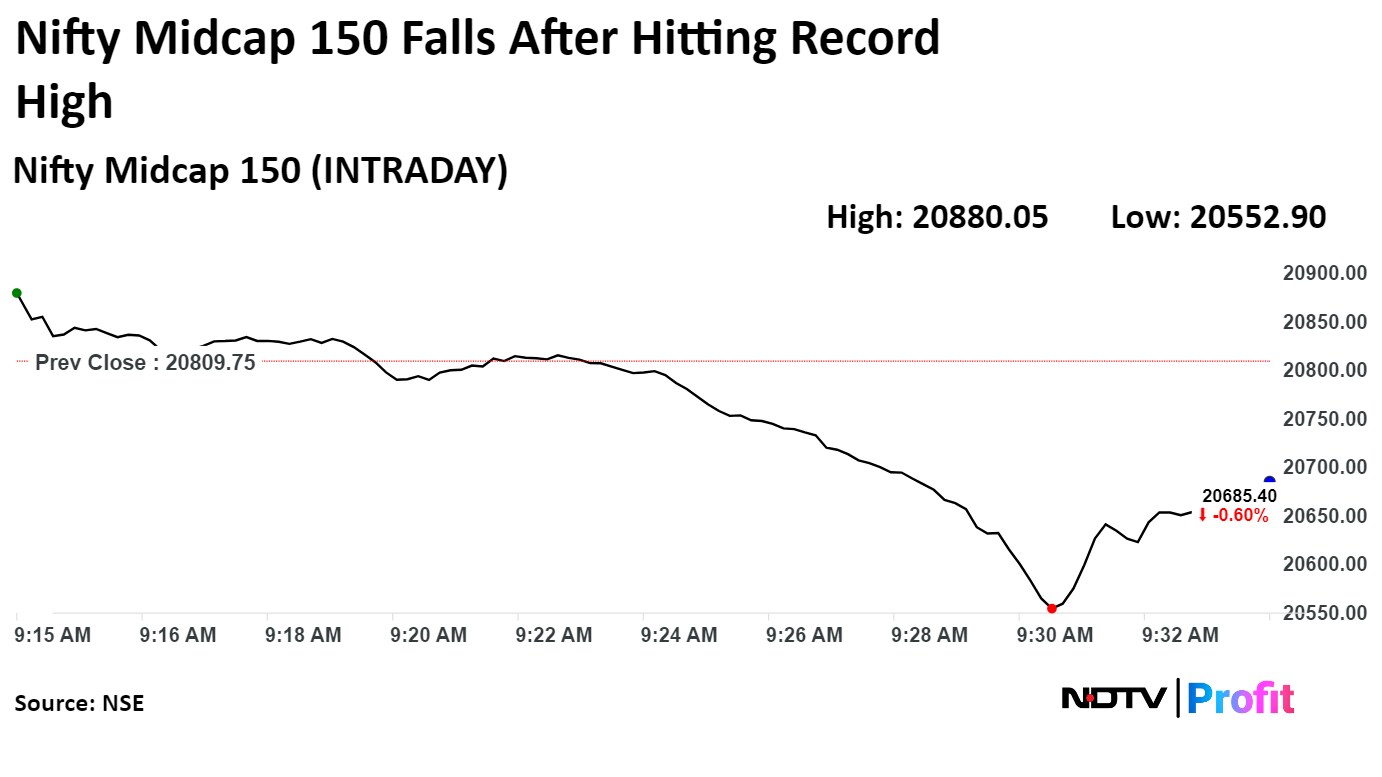

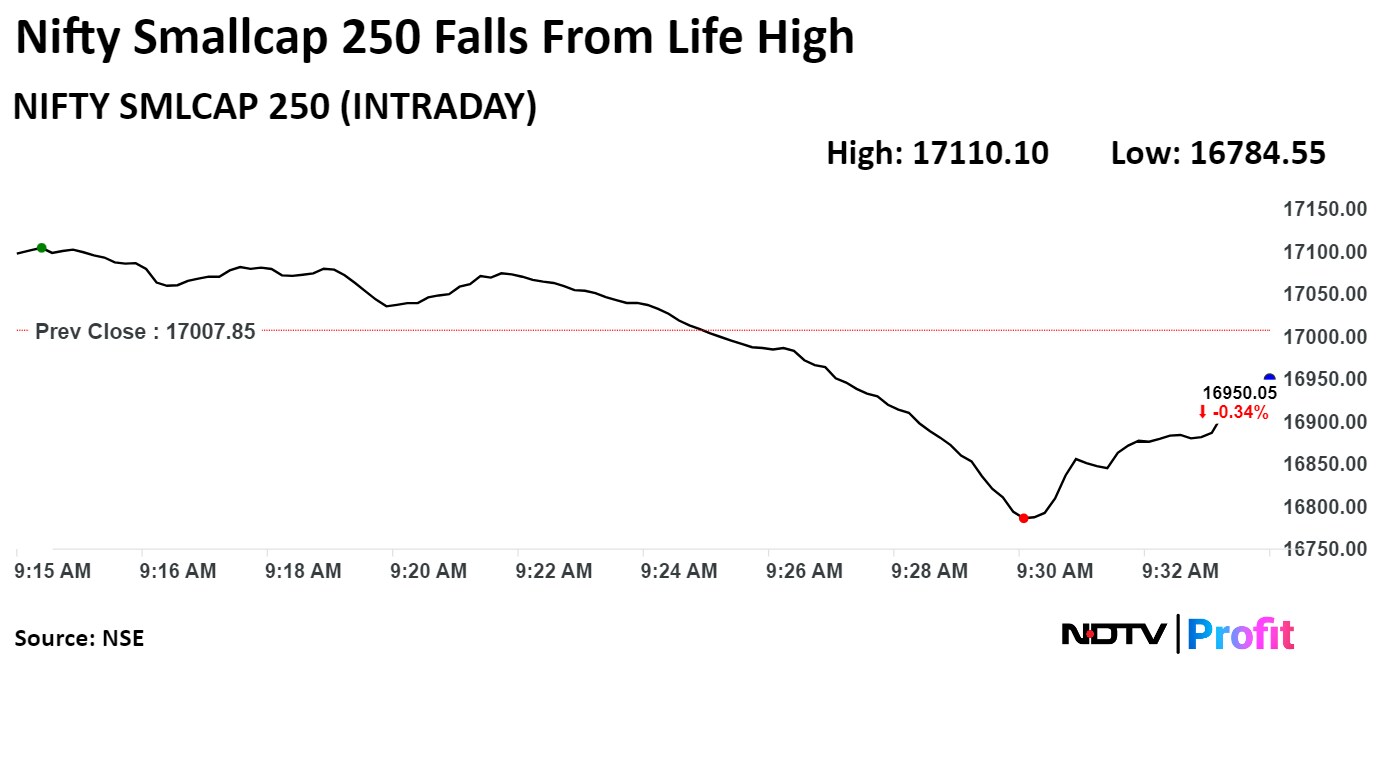

Broader markets underperformed. The S&P BSE Midcap and Smallcap settled 0.91% and 0.58% lower, respectively.

On BSE, 17 sectors declined, three rose out of 20. The S&P BSE Realty was the top loser and S&P BSE Bankex rose the most.

Market breadth was skewed in favour of sellers. Around 2,223 stocks declined, 1,647 stocks advanced, and 104 stocks remained unchanged on BSE.

.png)

.png)

ZF Commercial Vehicle Control Systems India Ltd.'s Promoter WABCO Asia sells 7.5% stake in the company.

Source: Exchange filing

Coal India Ltd. is to tap coal from abandoned underground mines mines through private operators.

Cumulative peak rated capacity of 23 selected underground mines is 34.14 million ton per annum.

Underground mines have total extractable reserves estimated at 635 million ton.

Source: Exchange filing

Escorts Kubota withdrew interest to set up plant in Rajasthan.

The company is exploring alternate options for new plant.

Source: Exchange filing

India's banking gauge added nearly Rs 85,000 crore in investors wealth on Wednesday. HDFC Bank Ltd., Axis Bank Ltd., and ICICI Bank Ltd. led the gains in the index.

India's banking gauge added nearly Rs 85,000 crore in investors wealth on Wednesday. HDFC Bank Ltd., Axis Bank Ltd., and ICICI Bank Ltd. led the gains in the index.

.png)

Axis Bank Ltd. has approved increasing stake in Max Life Insurance Co. to 19.99% from 19.02% for Rs 336 crore.

Source: Exchange filing

State Bank of India's Central Board approves raising Rs 20,000 cr via long term bonds during FY25.

Source: Exchange filing

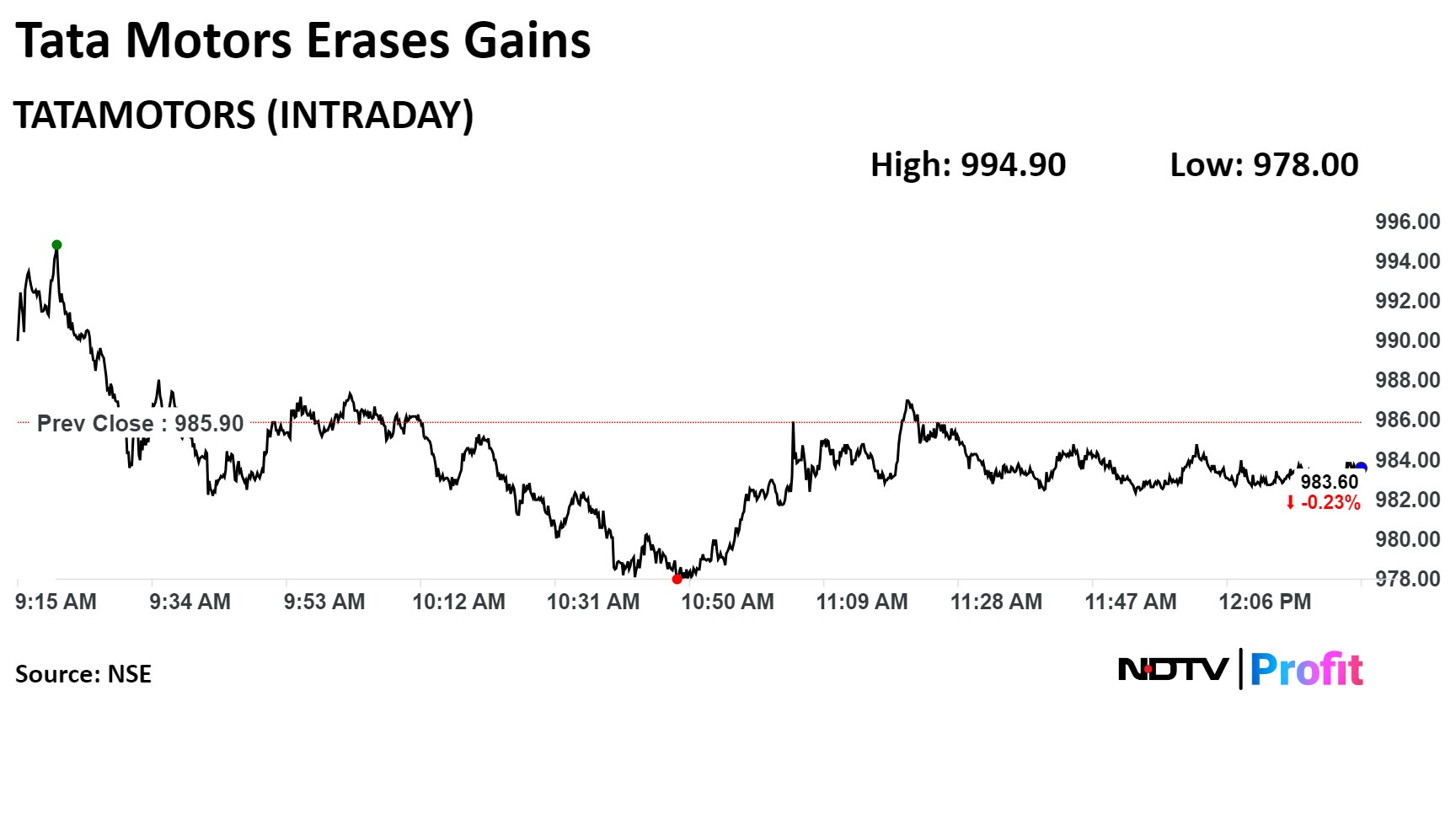

Shares of Tata Motors Ltd. fell on Wednesday after it increased the prices of its commercial vehicles by 2%, effective July 1. The price increase is to offset the impact of rising commodity prices.

Shares of Tata Motors Ltd. fell on Wednesday after it increased the prices of its commercial vehicles by 2%, effective July 1. The price increase is to offset the impact of rising commodity prices.

Shares of the company fell as much as 0.91% to Rs 994.90 apiece. It pared losses to trade 0.29% lower at Rs 983.15 apiece as of 12:20 p.m. This compares to a 0.04 decline in the NSE Nifty 50 Index.

The stock has risen 26.04% on a year-to-date basis and 65.06% in the last 12 months, according to NSE data. Total traded volume so far in the day stood at 0.39 times its 30-day average. The relative strength index was at 54.57.

Out of 33 analysts tracking the company, 21 maintain a 'buy' rating, eight recommend a 'hold,' and four suggest a 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 11.3%.

Shares of Delta Corp Ltd. jumped 17.13% to Rs 154.90, the highest level since Jan 12. It pared gains to trade 11.76% to Rs 147.80 as of 1:27 p.m., as compared to 0.09% decline in the NSE Nifty 50 index.

The stock gained amid a chatter that the Goods and Service Tax Council may review the decision to levy 28% tax on online gaming services on its meeting on Saturday.

The scrip gained 41.72% in 12 months, and 1.4% on year to date basis. Total traded volume so far in the day on NSE stood at 19.30 times its 30-day average. The relative strength index was at 78.37, which implied the stock is overbought.

Shares of Delta Corp Ltd. jumped 17.13% to Rs 154.90, the highest level since Jan 12. It pared gains to trade 11.76% to Rs 147.80 as of 1:27 p.m., as compared to 0.09% decline in the NSE Nifty 50 index.

The stock gained amid a chatter that the Goods and Service Tax Council may review the decision to levy 28% tax on online gaming services on its meeting on Saturday.

The scrip gained 41.72% in 12 months, and 1.4% on year to date basis. Total traded volume so far in the day on NSE stood at 19.30 times its 30-day average. The relative strength index was at 78.37, which implied the stock is overbought.

The Appointment Committee of Cabinet has approves appointment of Rajesh Dwivedi as CFO of Bharat Heavy Electricals Ltd.

The company received the intimation from the Ministry of Heavy Industries.

Source: Exchange filing

Sandhar Technologies Ltd. has detected cyber-incident which affected a few systems

Technical team has initiated necessary precautions and protocols.

No confidential information or data has been breached.

Source: Exchange filing

Shares of Kalyan Jewellers India Ltd. surged over 5% on Wednesday after Motilal Oswal initiated coverage on the stock with a 'buy' rating, citing an average profitability of 41% over the next two fiscal year due to enhanced market footprint, cash flow and reduce debt.

Exicom Tele-Systems is in pact with Hubject to set up regional EV charging platform in India.

Source: Exchange filing

Bharti Airtel Ltd. has acquired 2.69 crore Indus Towers Ltd.'s shares worth 1% equity via 'on-market' transaction.

Source: Exchange filing

Aditya Birla Fashion and Retail Ltd. will buy 16% stake in Universal Sportsbiz with option for path to majority stake acquisition.

Alert: Universal Sportsbiz markets apparel and accessories under the WROGN brand

Source: Exchange filing

Aditya Birla Fashion and Retail Ltd. will buy 16% stake in Universal Sportsbiz with option for path to majority stake acquisition.

Alert: Universal Sportsbiz markets apparel and accessories under the WROGN brand

Source: Exchange filing

.png)

HCL Technologies Ltd. is in pact with Tecnotree to co-develop 5G-led genAI solutions for telecom industry.

Source: Exchange filing

Tata Motors Ltd. will increase price of commercial vehicles by up to 2% from July due to rising commodity costs.

Source: Exchange filing

The scrip fell as much as 9.62% to Rs 311.40 apiece, the lowest level since April 4, 2024. It pared losses to trade 4.27% lower at Rs 328.95 apiece, as of 10:15 a.m. This compares to a 0.08% advance in the NSE Nifty 50 Index.

It has risen 65.26% on a year-to-date basis, and has risen to 164.70% in the last 12 months, according to NSE data. Total traded volume so far in the day stood at 41.18 times its 30-day average. The relative strength index was at 44.65.

Out of 20 analysts tracking the company, 8 maintain a 'buy' rating, 7 recommend a 'hold,' and 5 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 8%.

The scrip fell as much as 9.62% to Rs 311.40 apiece, the lowest level since April 4, 2024. It pared losses to trade 4.27% lower at Rs 328.95 apiece, as of 10:15 a.m. This compares to a 0.08% advance in the NSE Nifty 50 Index.

It has risen 65.26% on a year-to-date basis, and has risen to 164.70% in the last 12 months, according to NSE data. Total traded volume so far in the day stood at 41.18 times its 30-day average. The relative strength index was at 44.65.

Out of 20 analysts tracking the company, 8 maintain a 'buy' rating, 7 recommend a 'hold,' and 5 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 8%.

.png)

Shares of Gland Pharma fell for the sixth consecutive session today after a Bloomberg reported Fosun Pharma will reduce its stake in the company by 5%.

Shares of Gland Pharma fell for the sixth consecutive session today after a Bloomberg reported Fosun Pharma will reduce its stake in the company by 5%.

.png)

Bajaj Finance's stock fell as much as 1.09% during the day to Rs 7,255 apiece on the NSE. It was trading 0.73% lower at Rs 7,281.3 apiece, compared to a 0.01% decline in the benchmark Nifty 50 as of 9:44 a.m.

It has declined by 1.37% in the last 12 months and 0.54% on a year-to-date basis. The relative strength index was at 50.

Twenty-eight out of the 36 analysts tracking the company have a 'buy' rating on the stock, five recommend a 'hold' and three suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 15%.

Bajaj Finance's stock fell as much as 1.09% during the day to Rs 7,255 apiece on the NSE. It was trading 0.73% lower at Rs 7,281.3 apiece, compared to a 0.01% decline in the benchmark Nifty 50 as of 9:44 a.m.

It has declined by 1.37% in the last 12 months and 0.54% on a year-to-date basis. The relative strength index was at 50.

Twenty-eight out of the 36 analysts tracking the company have a 'buy' rating on the stock, five recommend a 'hold' and three suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 15%.

.jpeg)

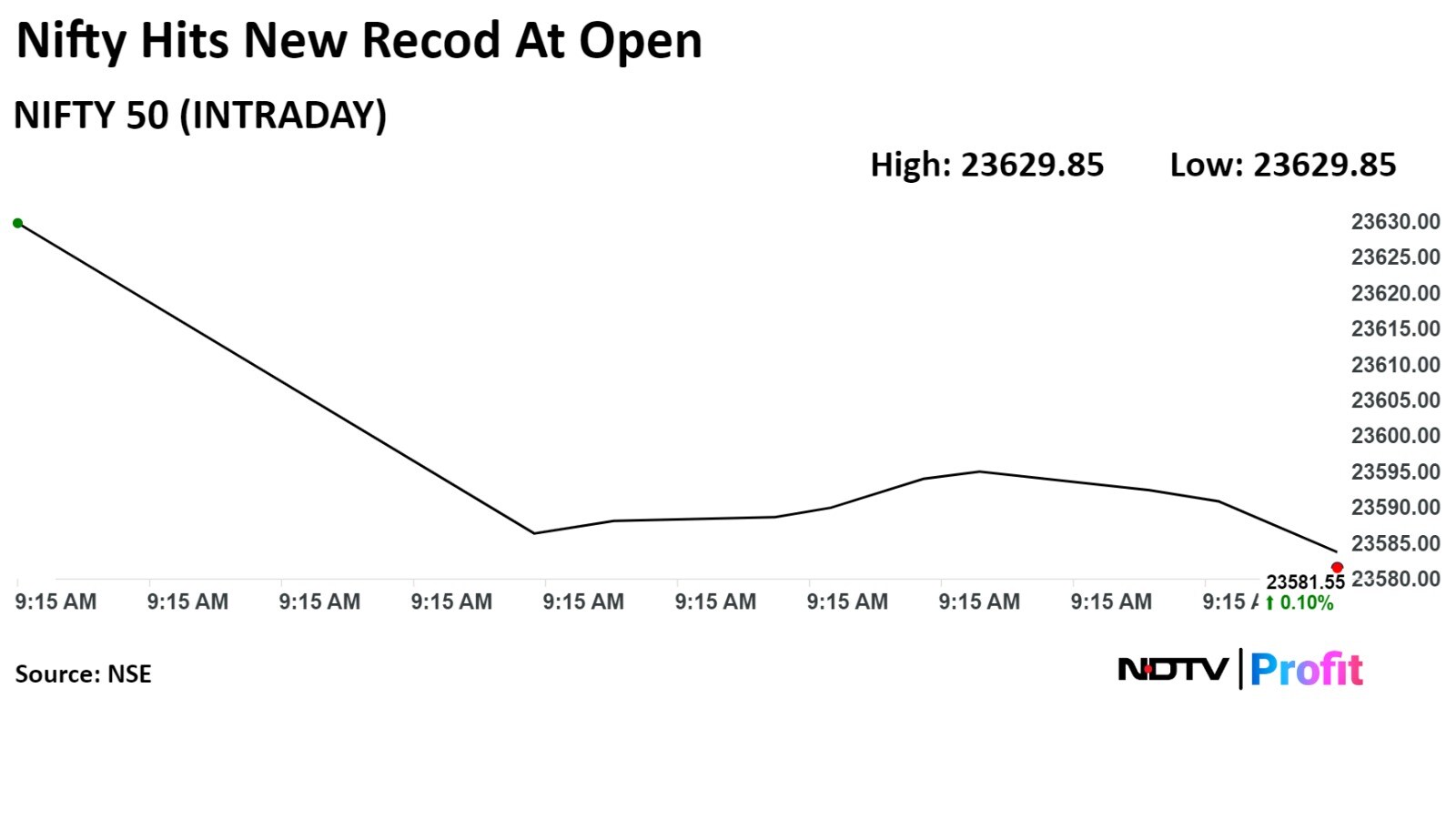

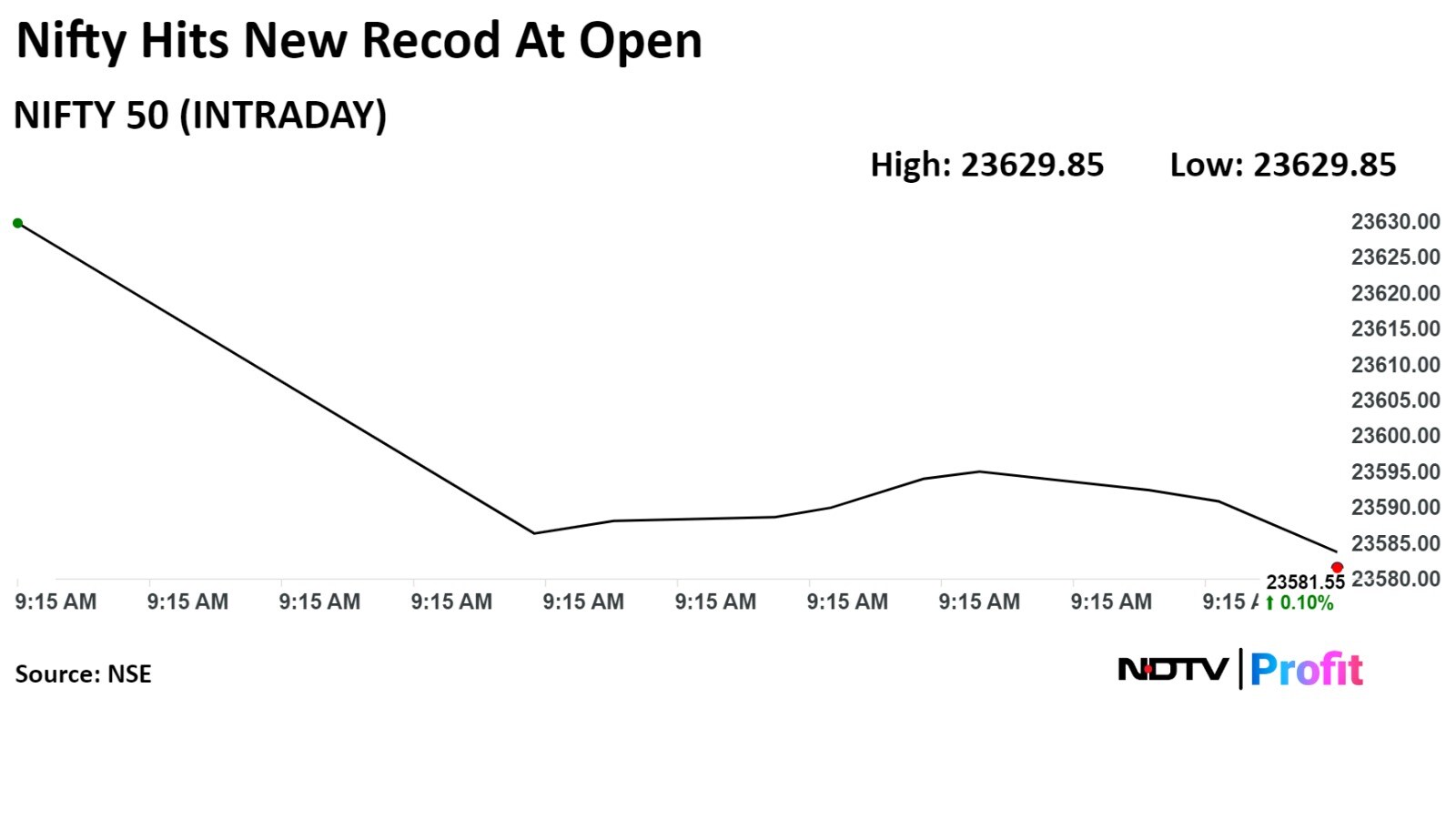

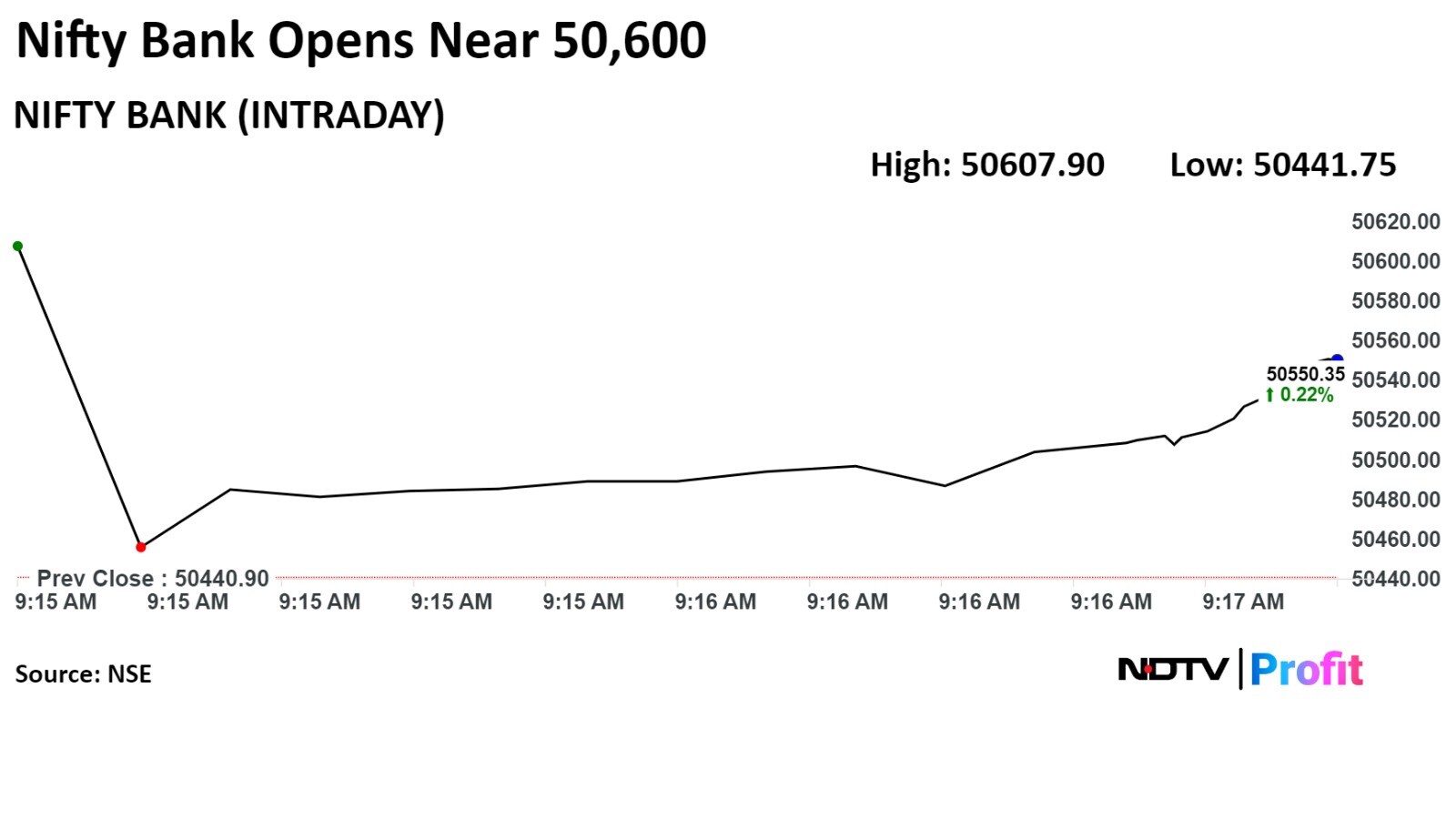

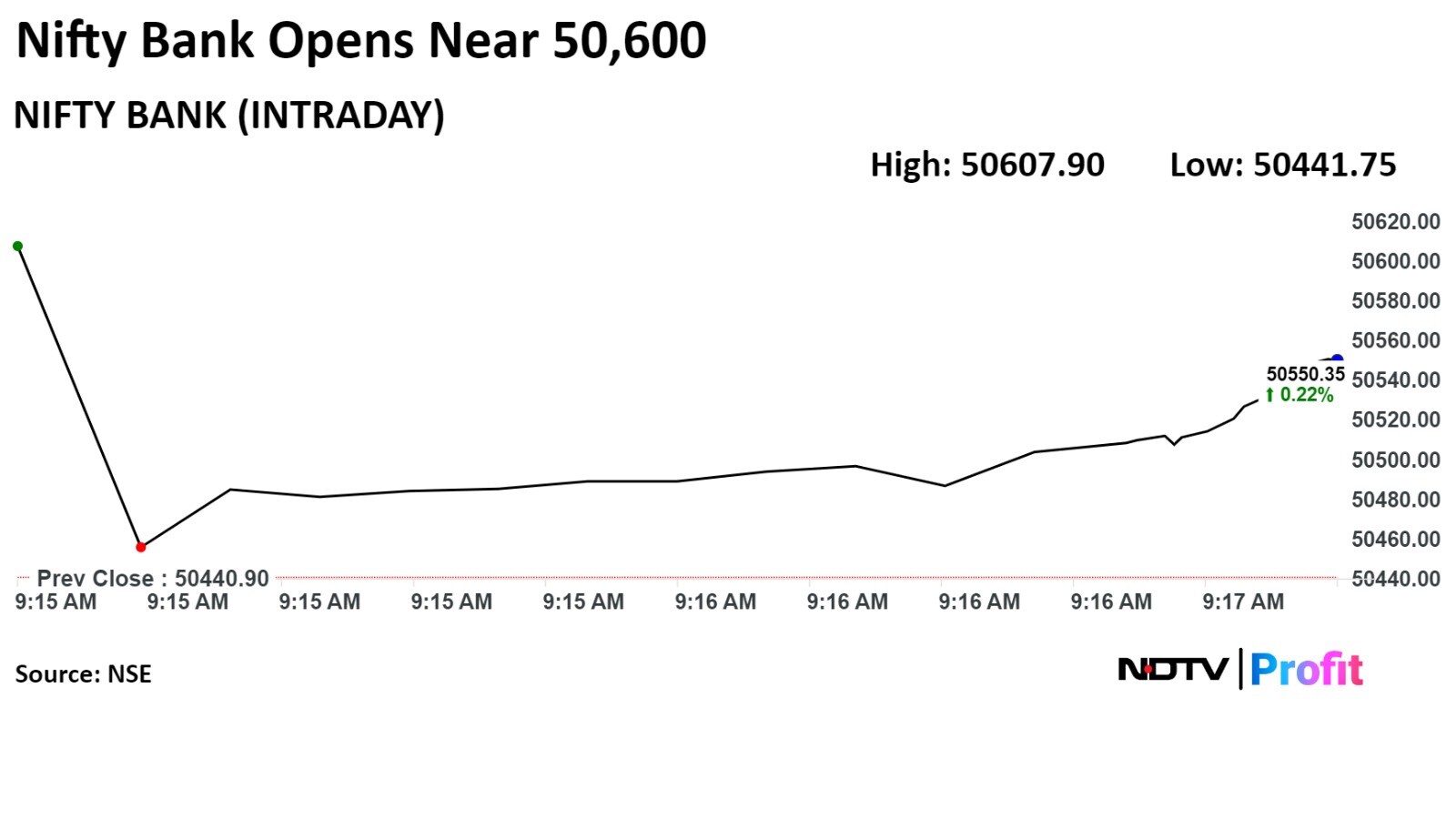

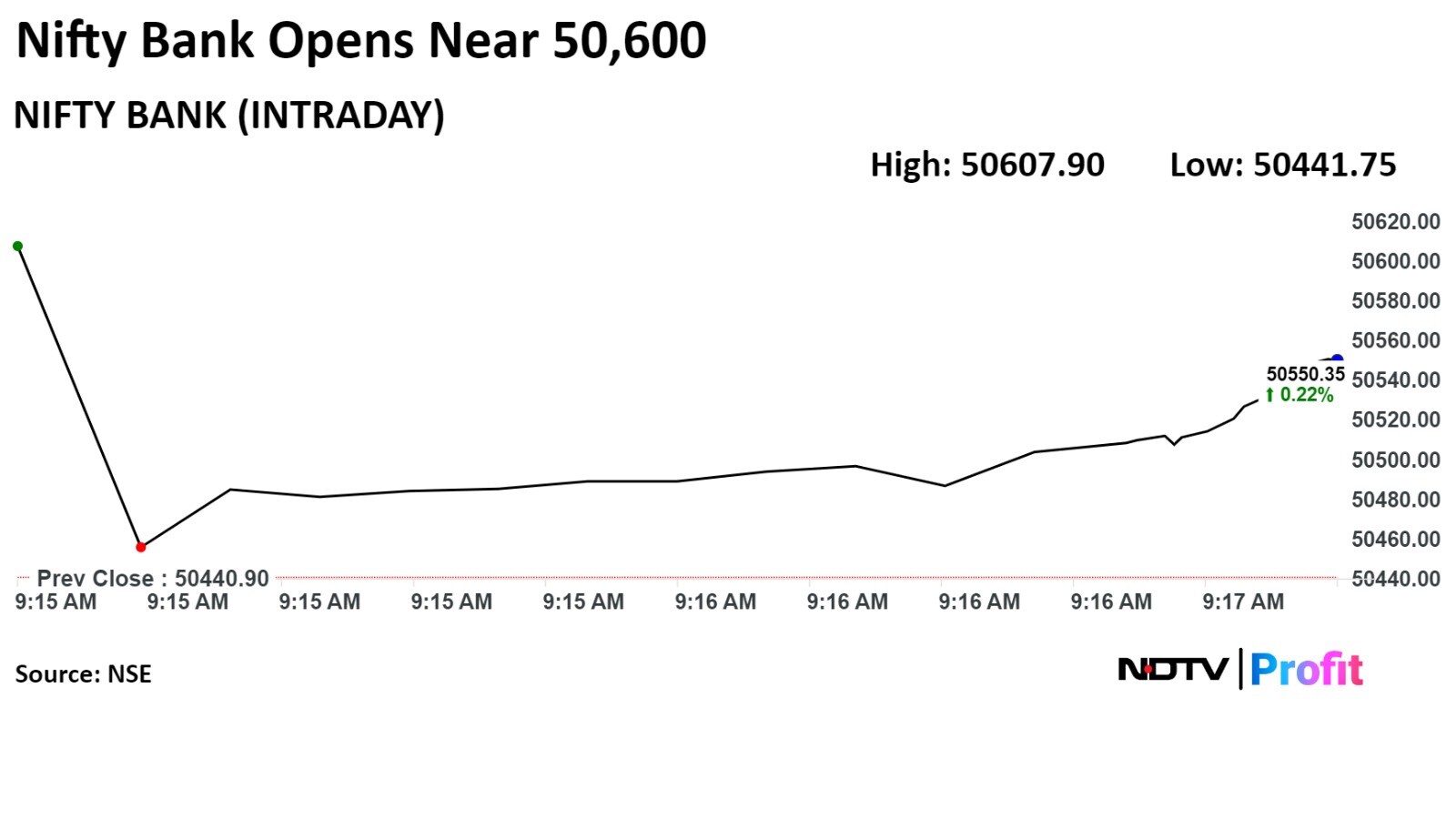

The NSE Nifty Bank rose 1.54% to record high of 51,215.50 as ICICI Bank Ltd., and HDFC Bank led gains. The index was trading 1.43% higher at 51,164.15.

The NSE Nifty Bank rose 1.54% to record high of 51,215.50 as ICICI Bank Ltd., and HDFC Bank led gains. The index was trading 1.43% higher at 51,164.15.

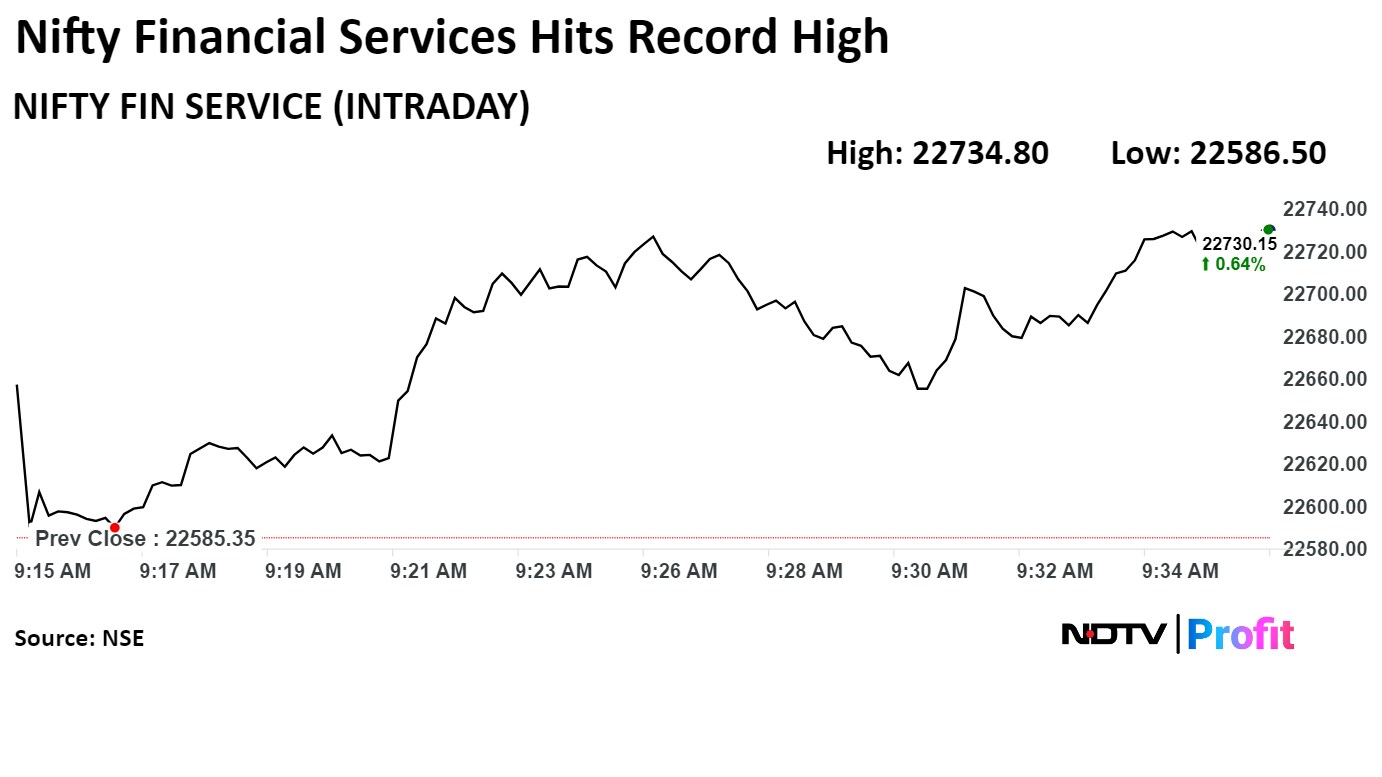

The NSE Nifty Financial Services index rose 0.66% to fresh high of 22,660.05. The index was trading 0.60% higher at 22,720.25 as of 09:39 a.m.

The NSE Nifty Financial Services index rose 0.66% to fresh high of 22,660.05. The index was trading 0.60% higher at 22,720.25 as of 09:39 a.m.

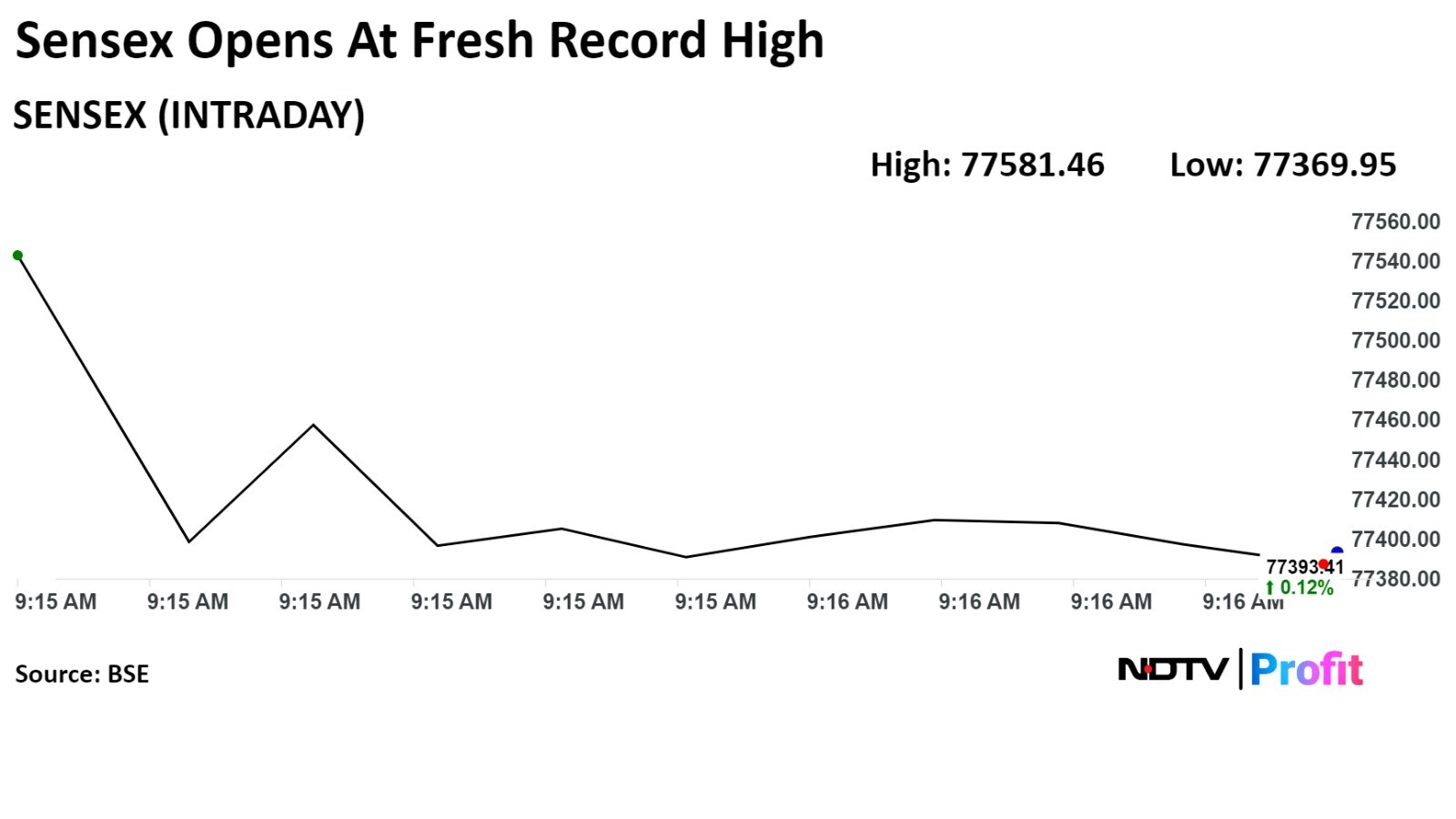

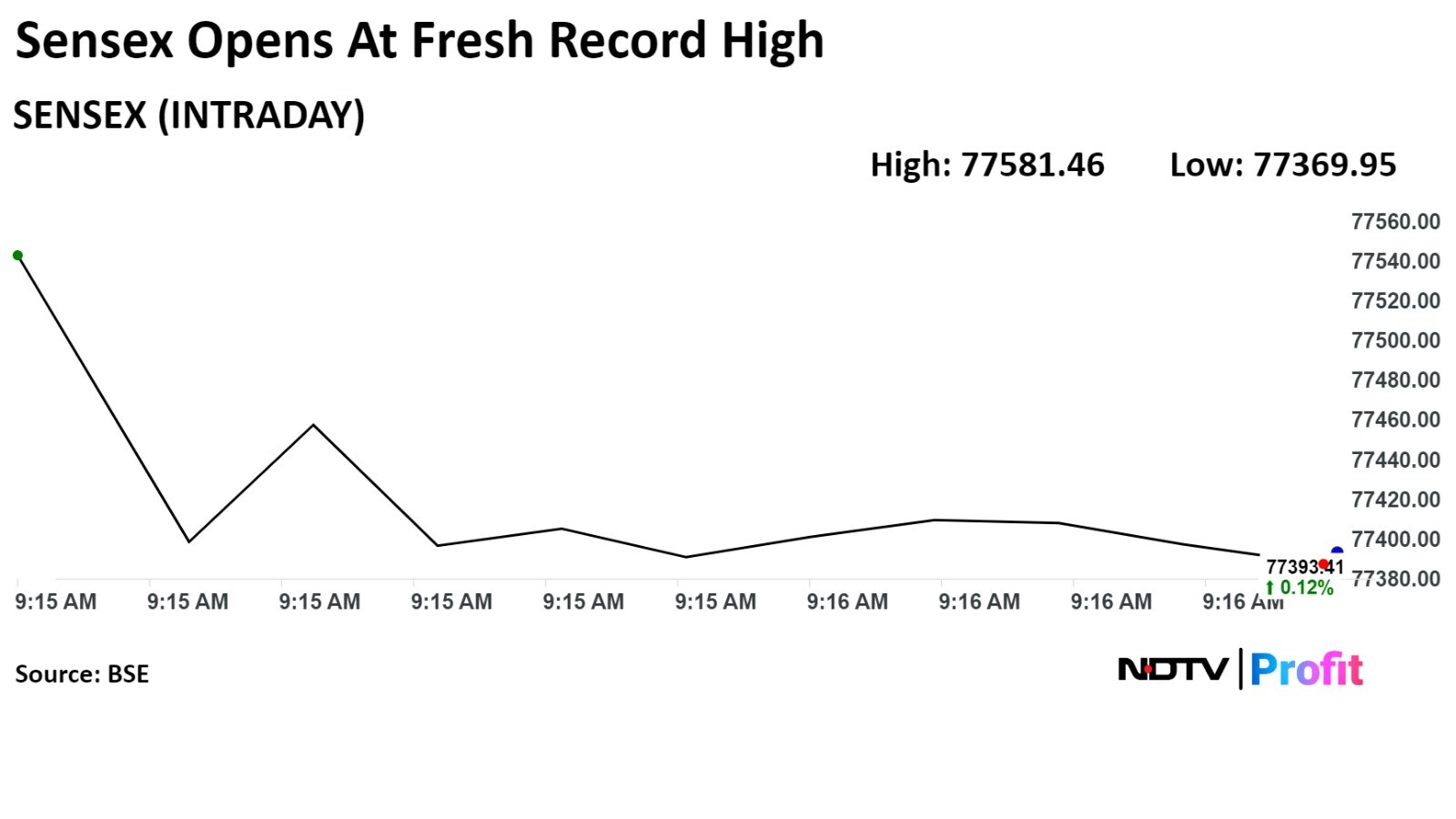

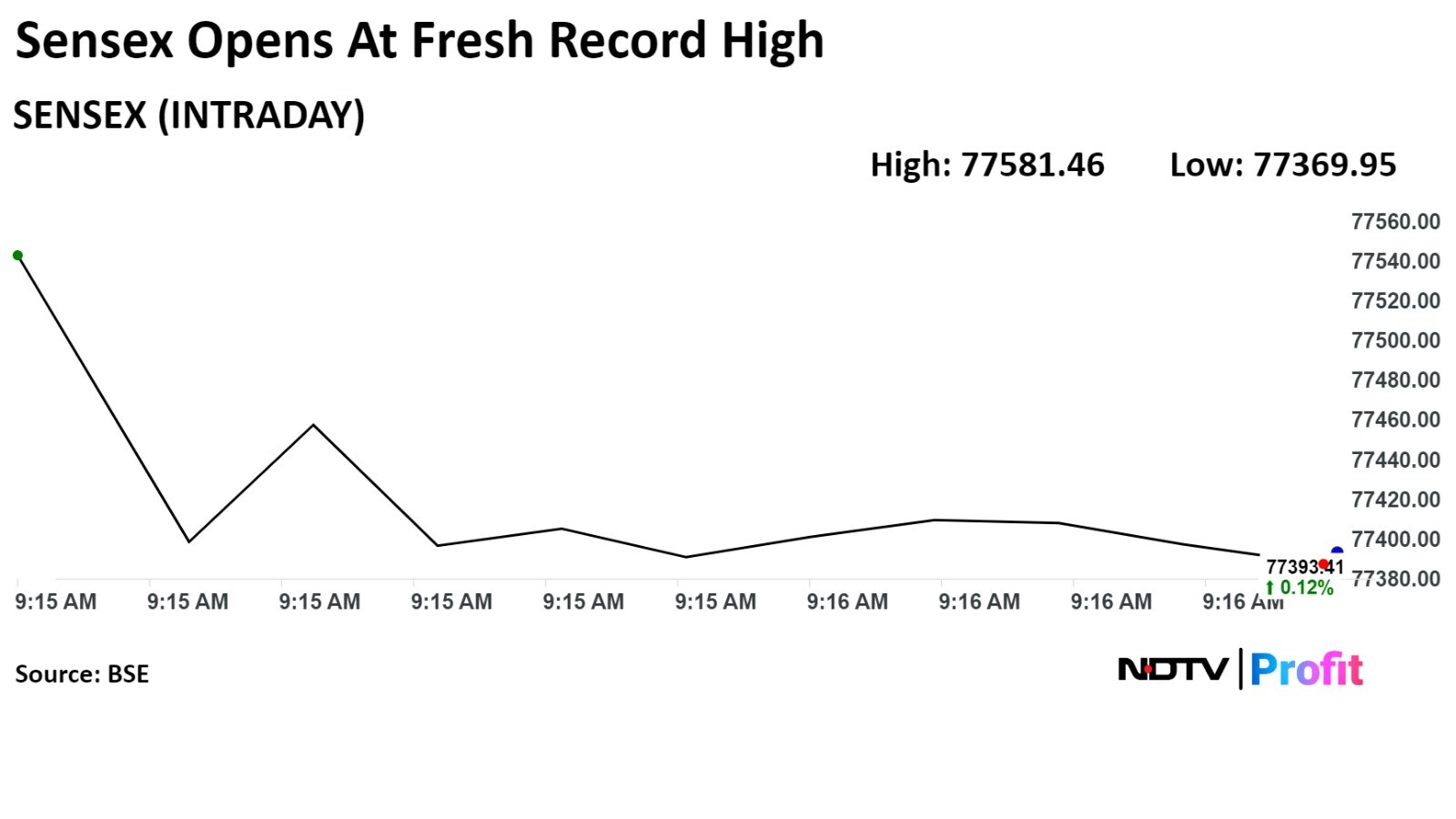

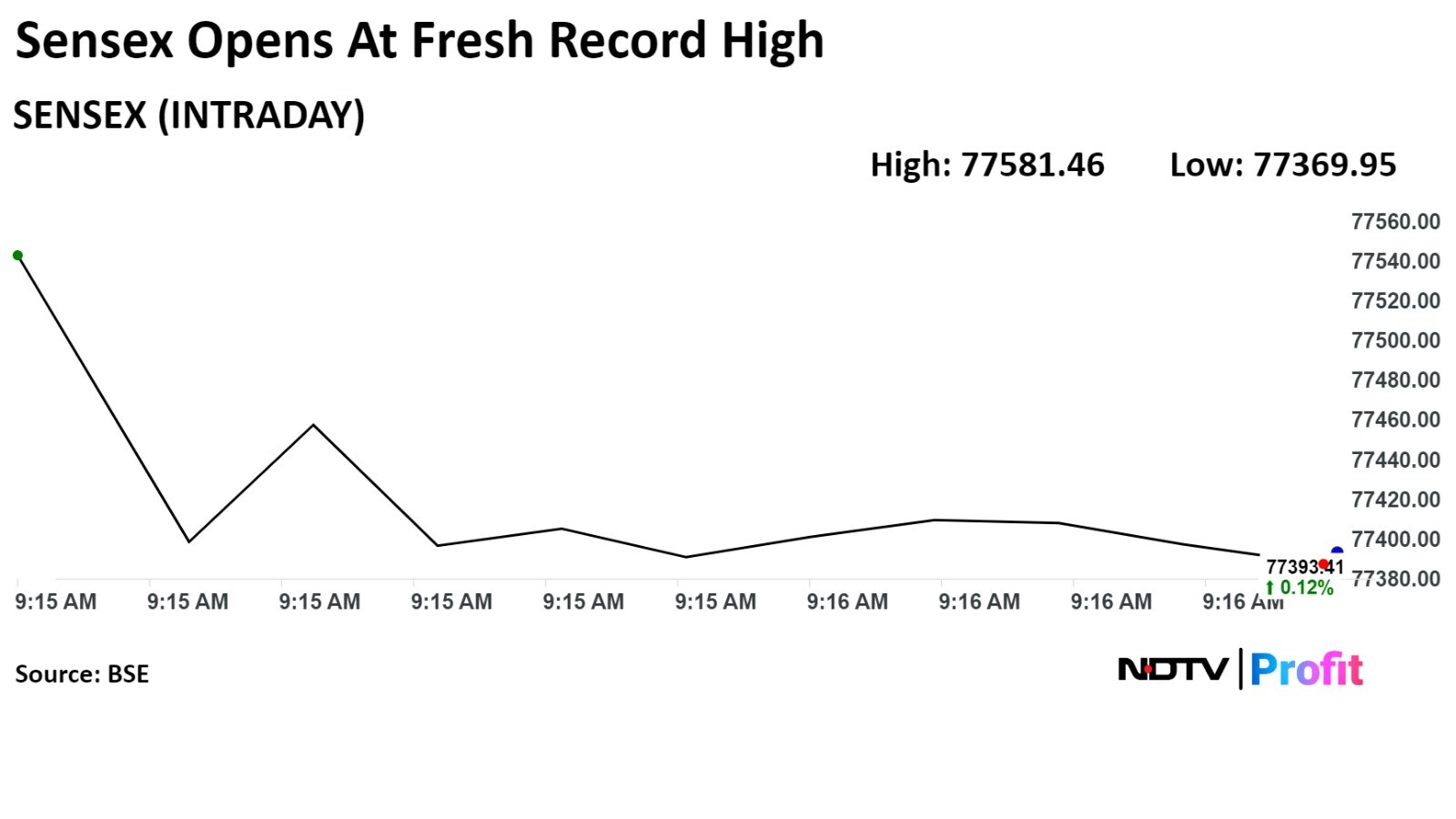

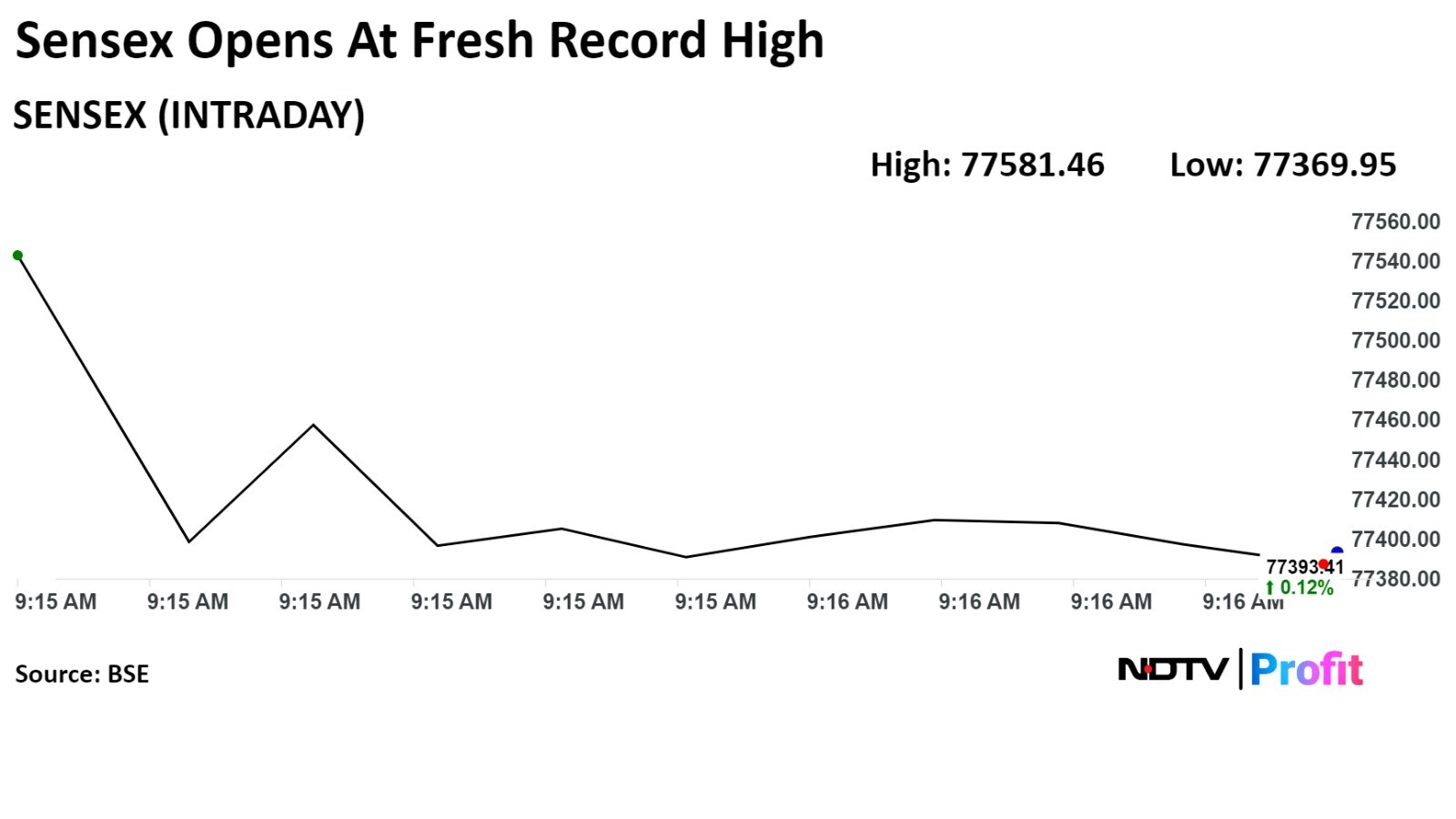

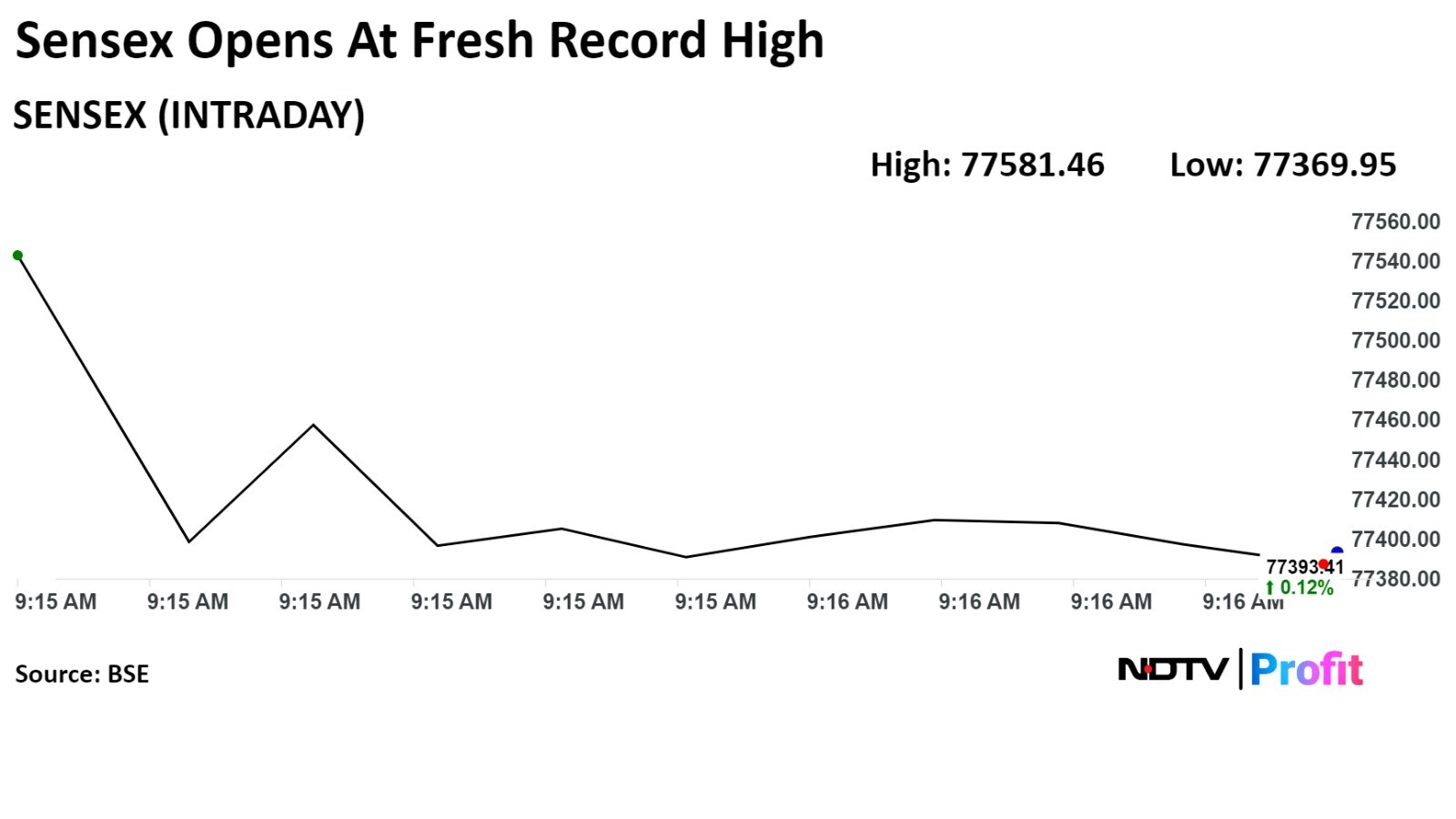

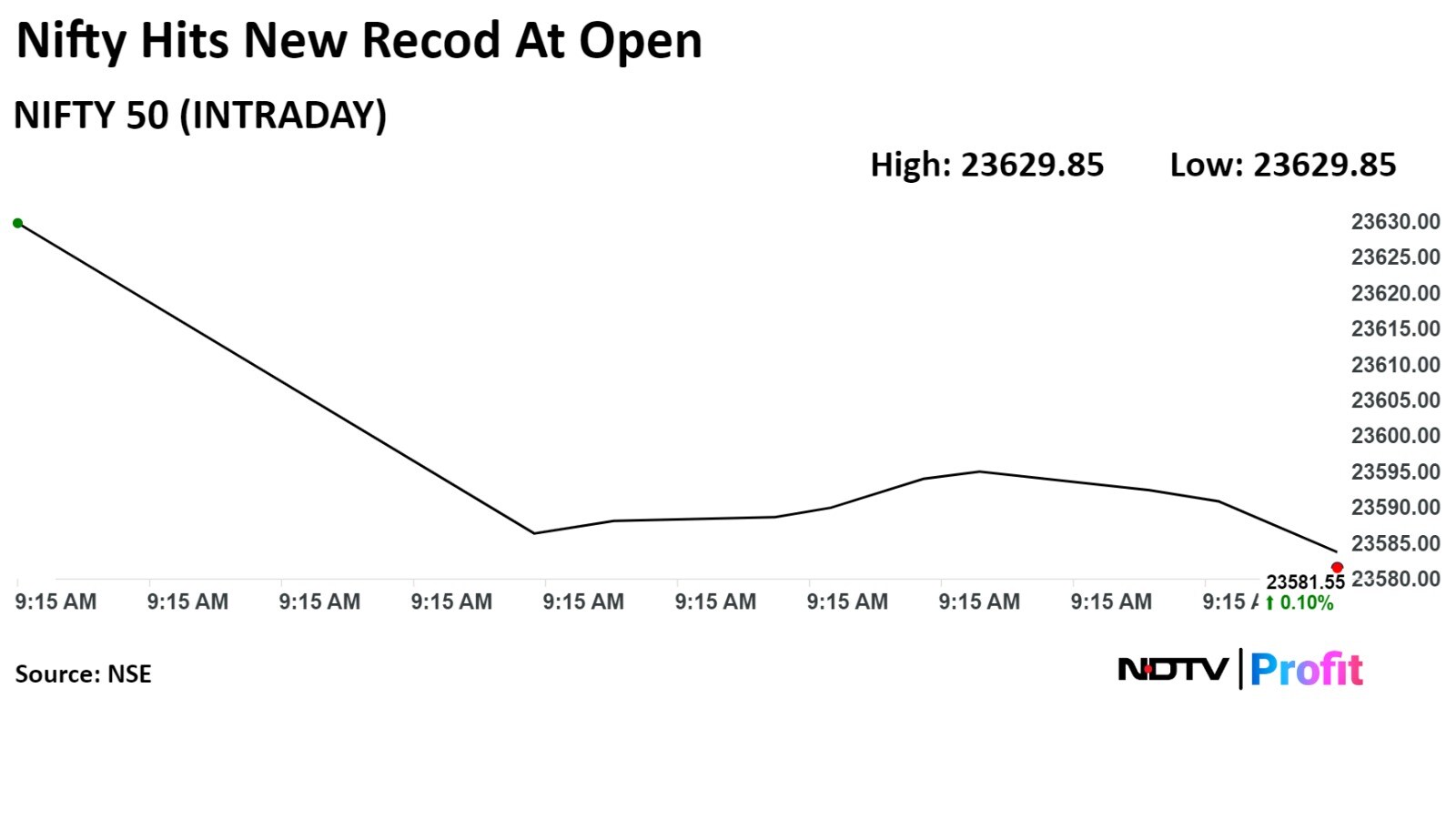

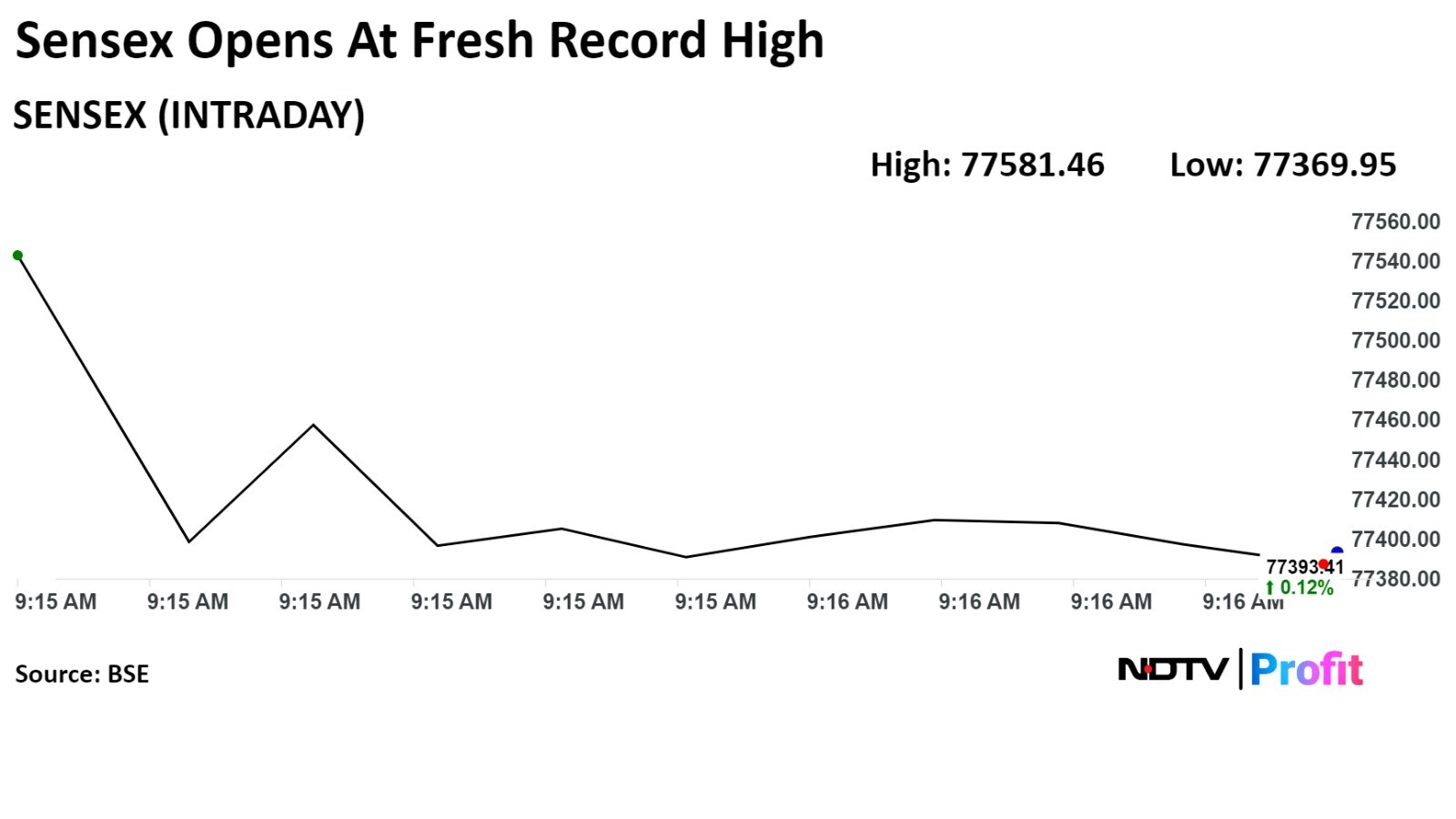

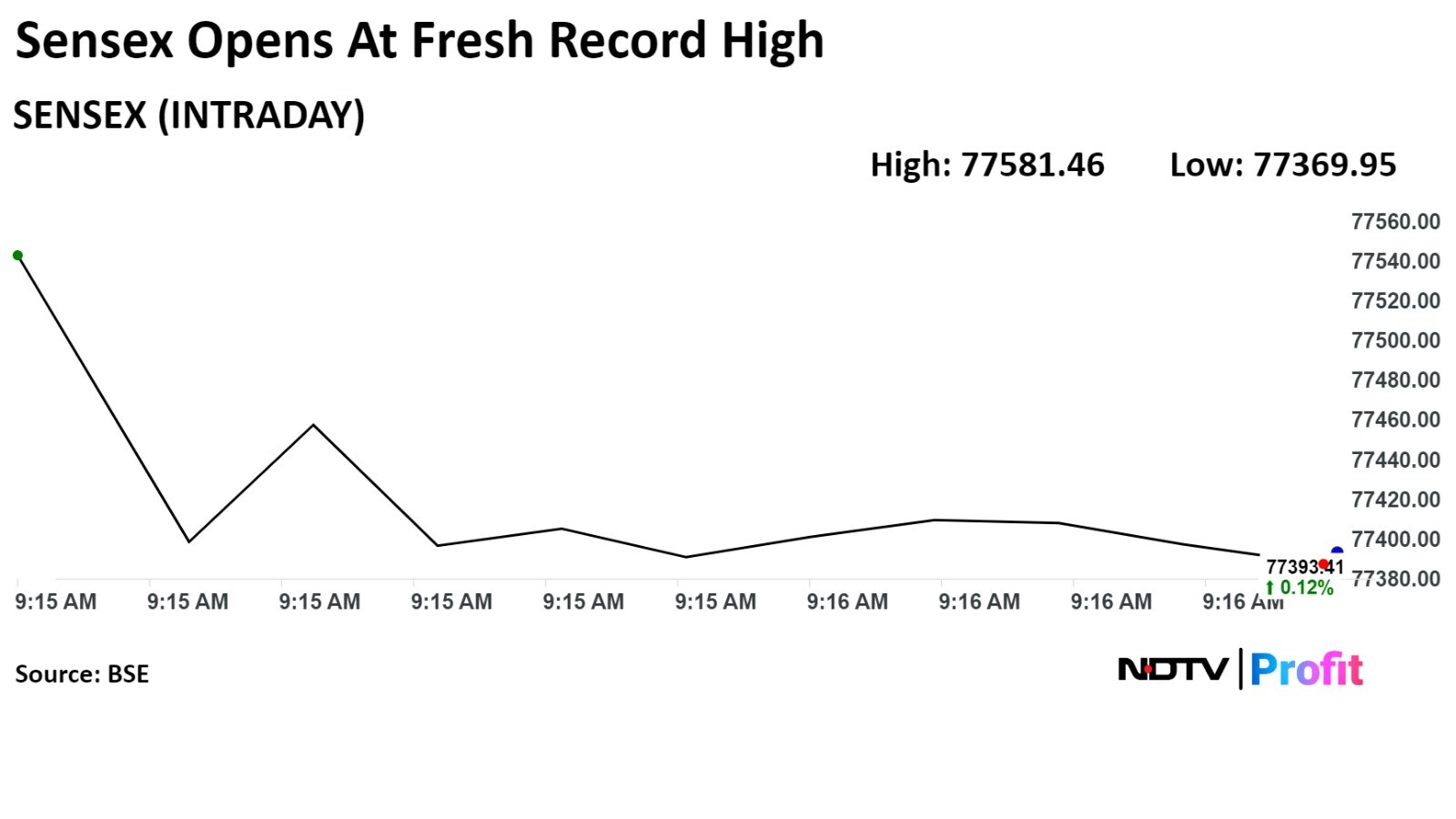

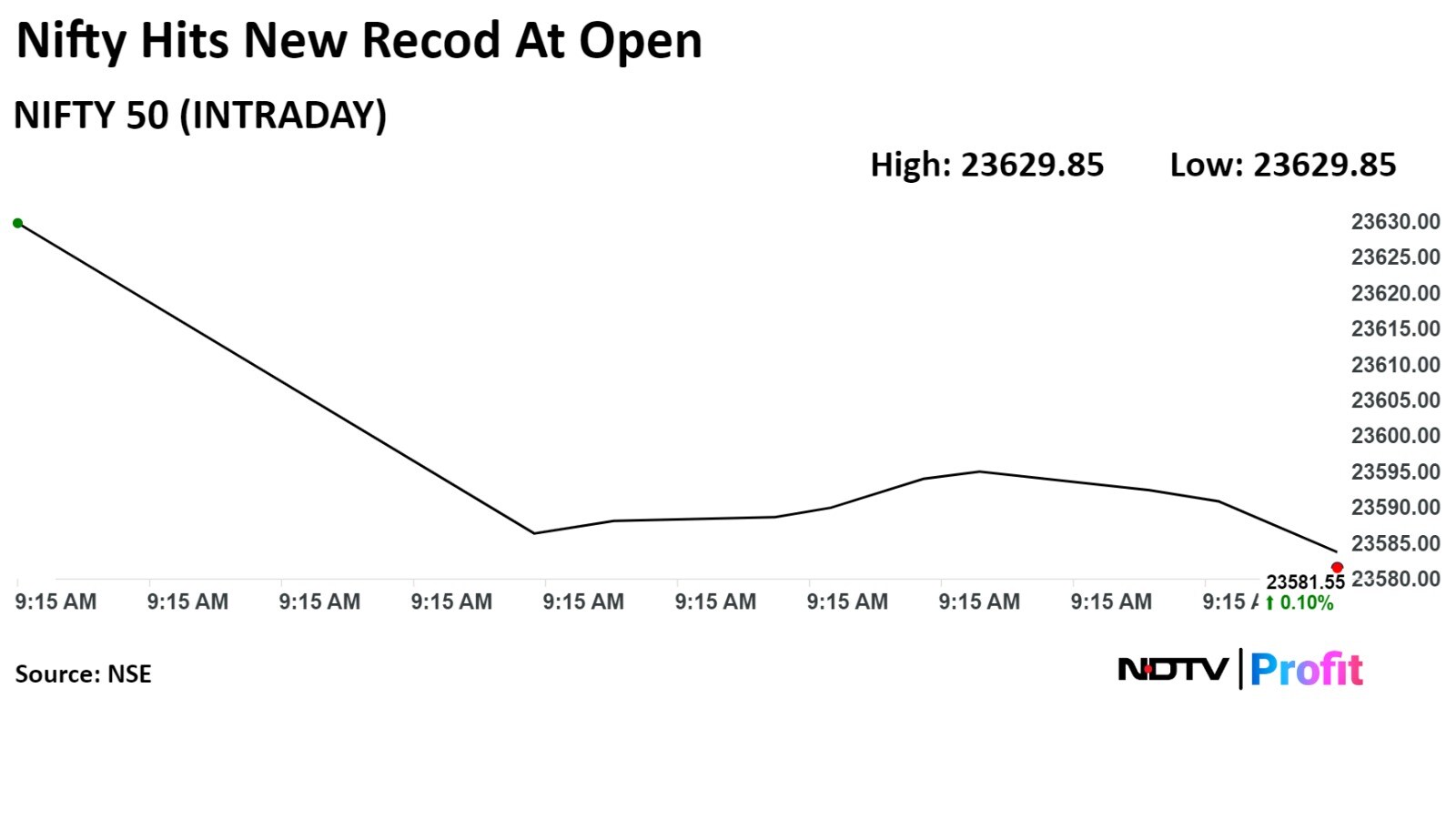

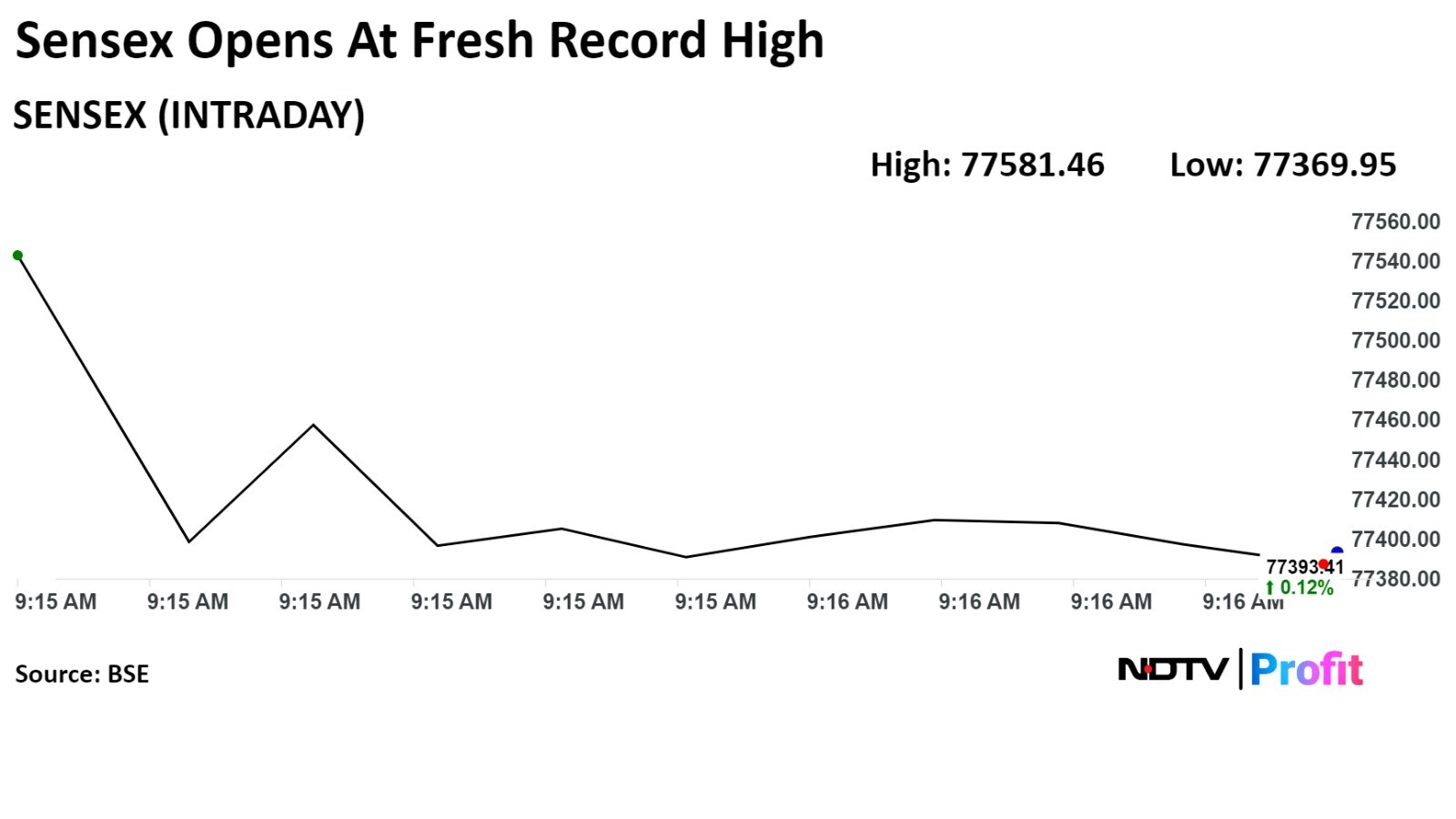

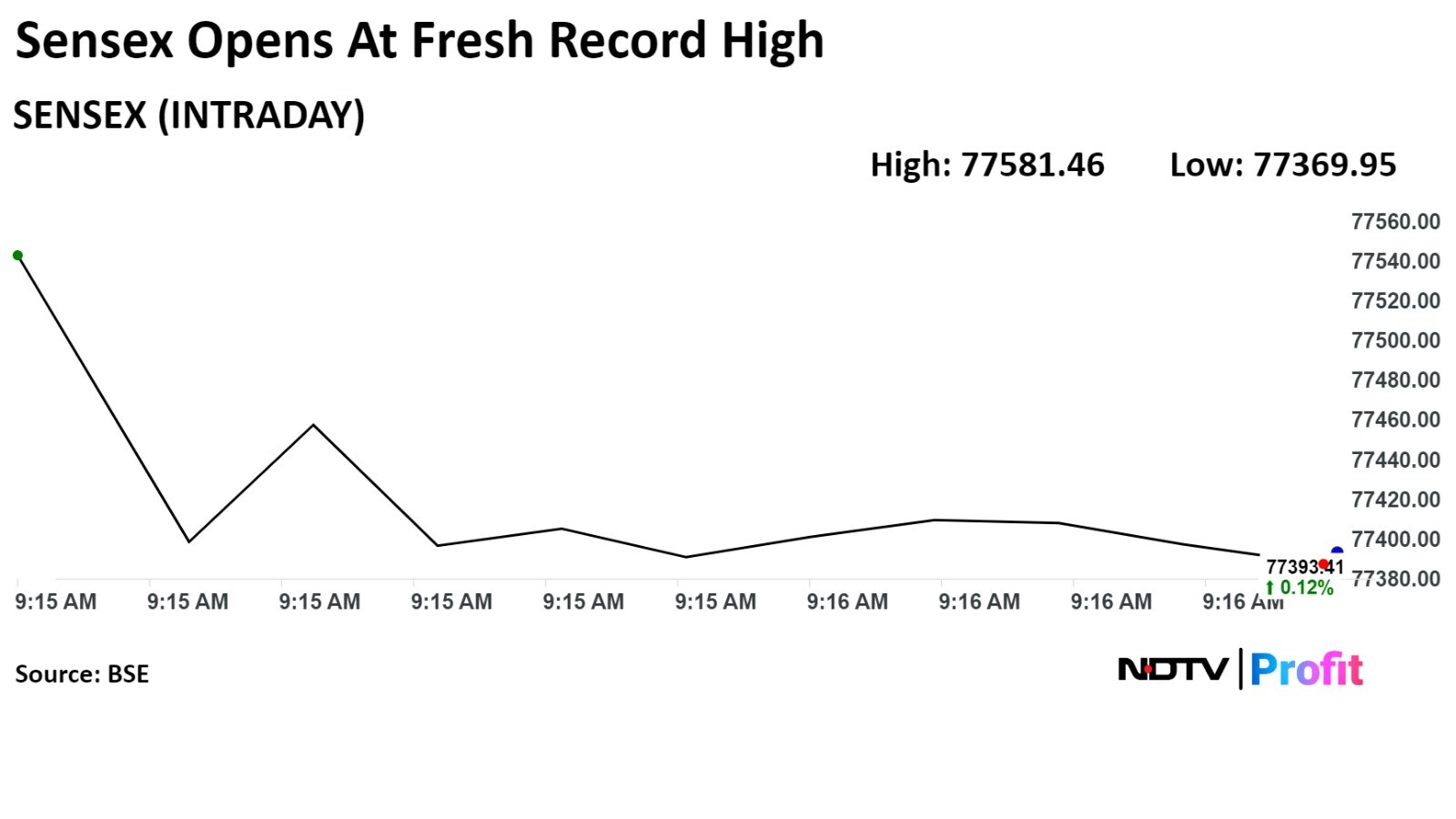

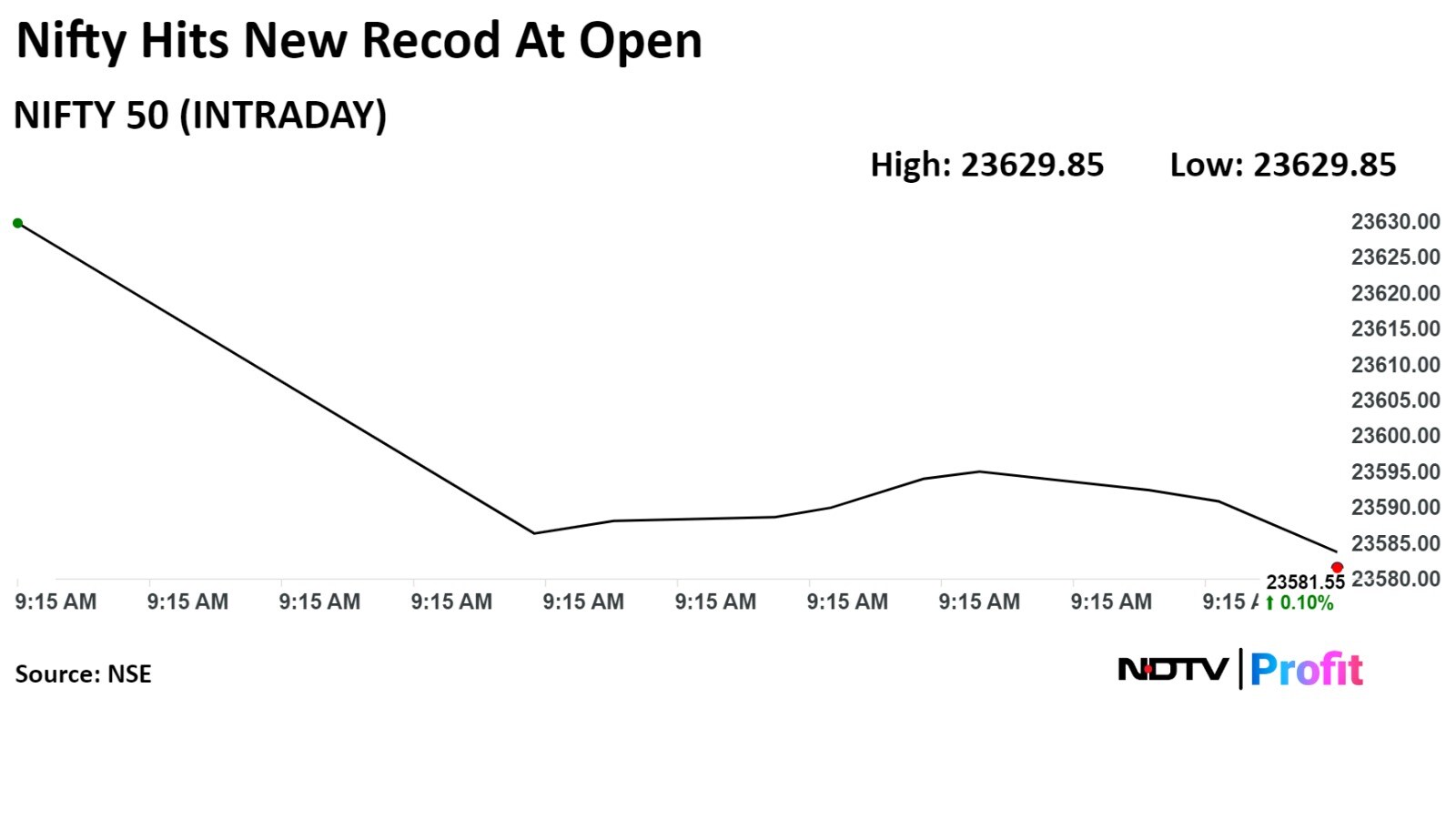

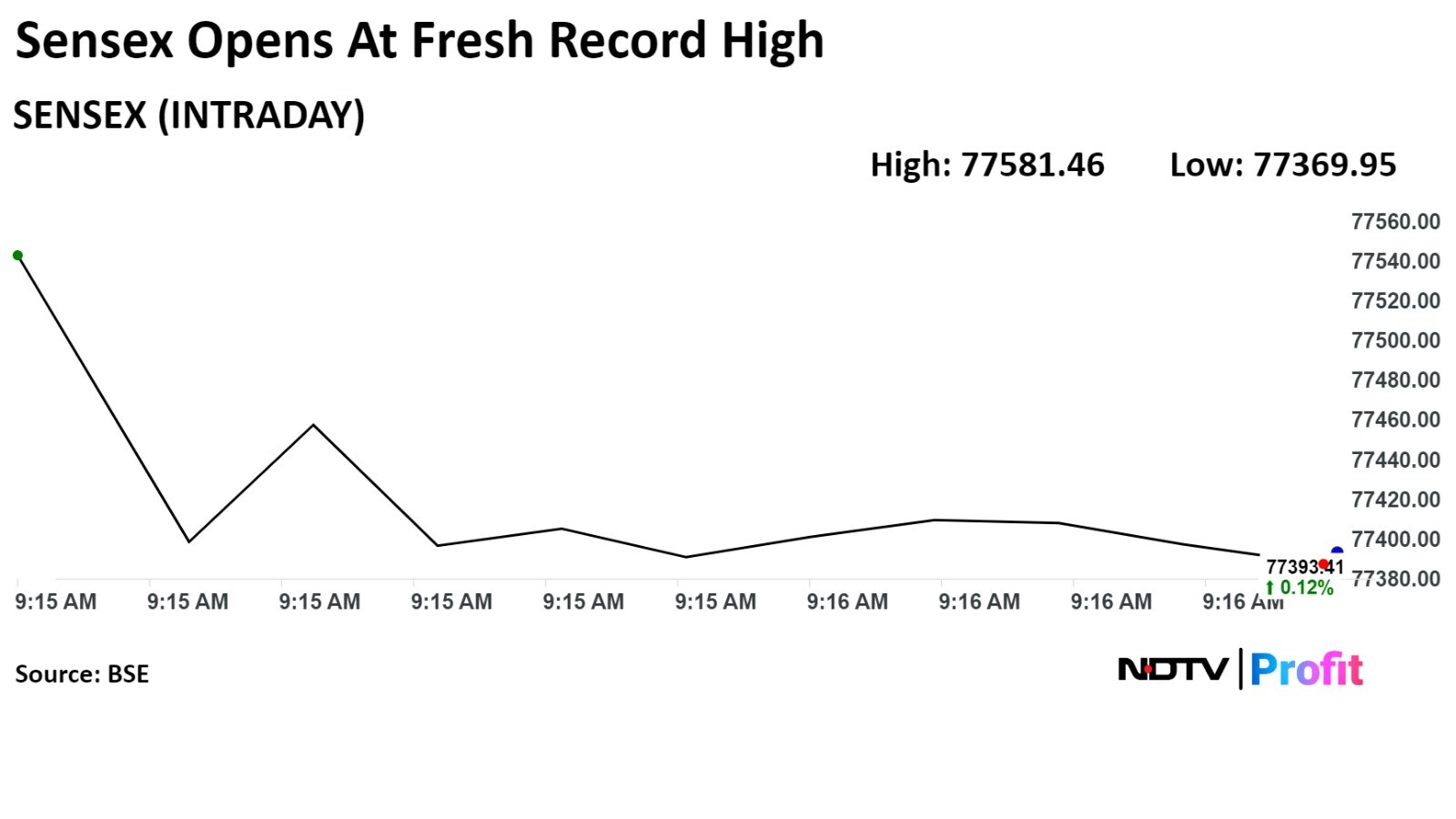

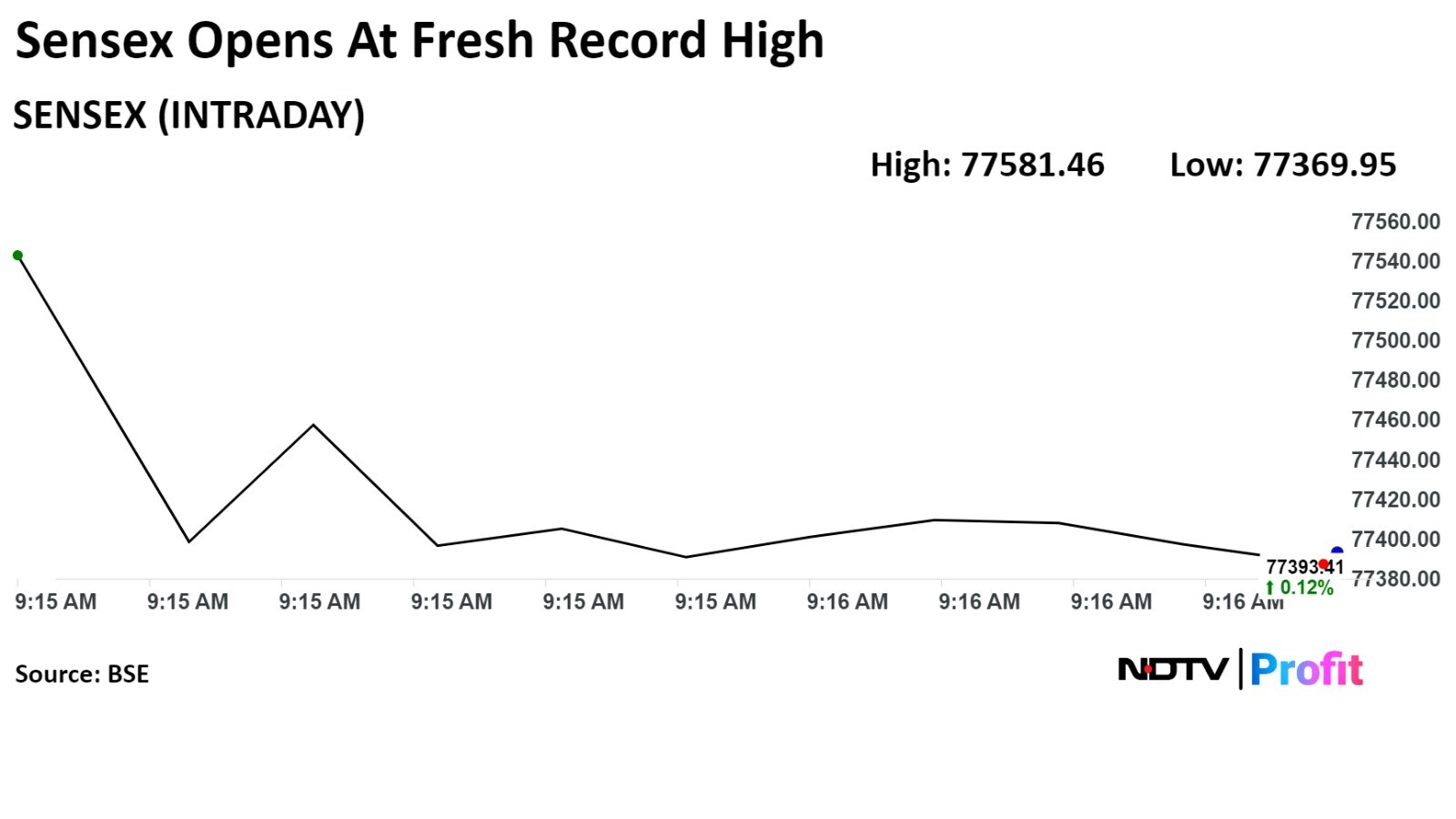

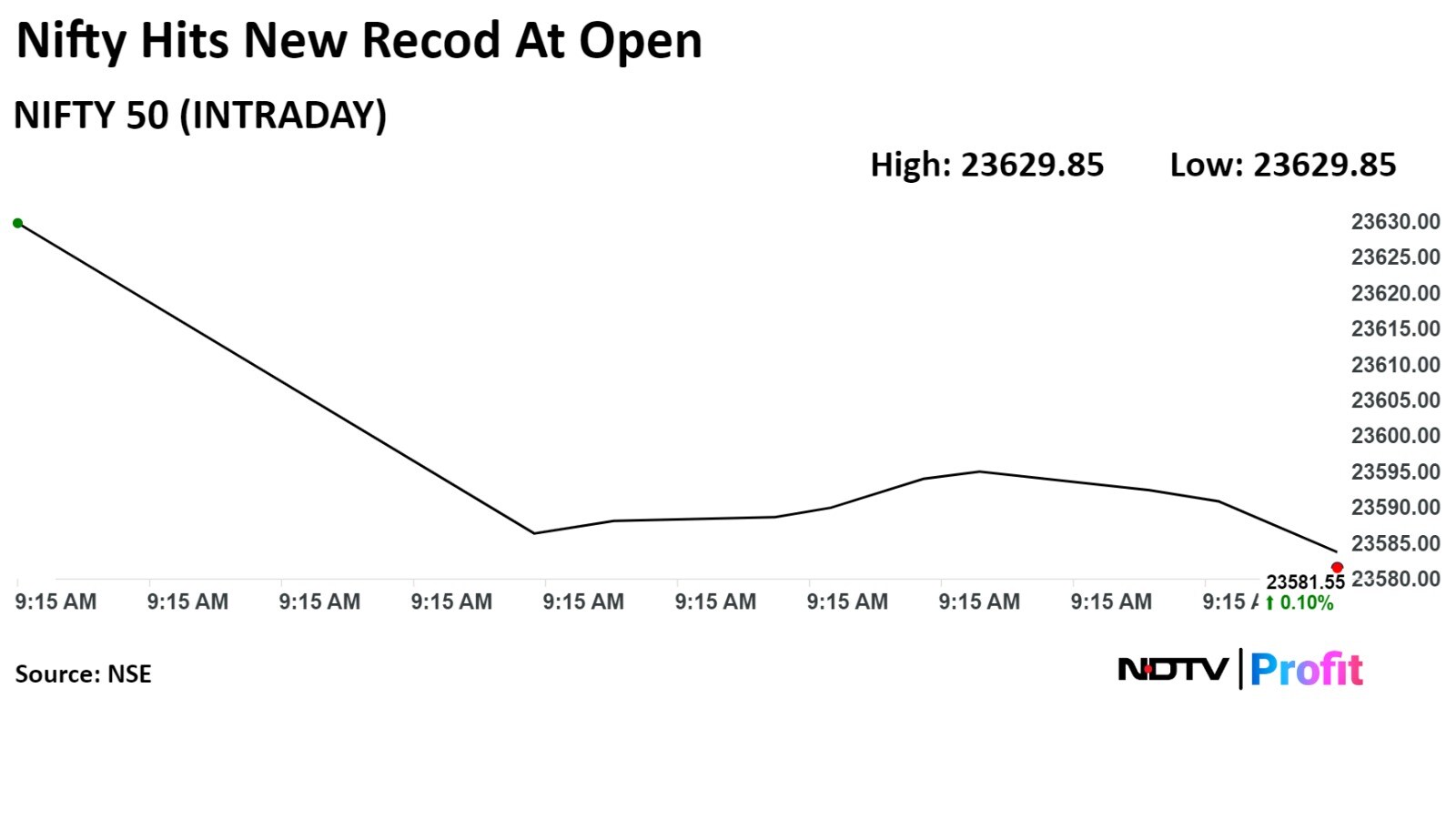

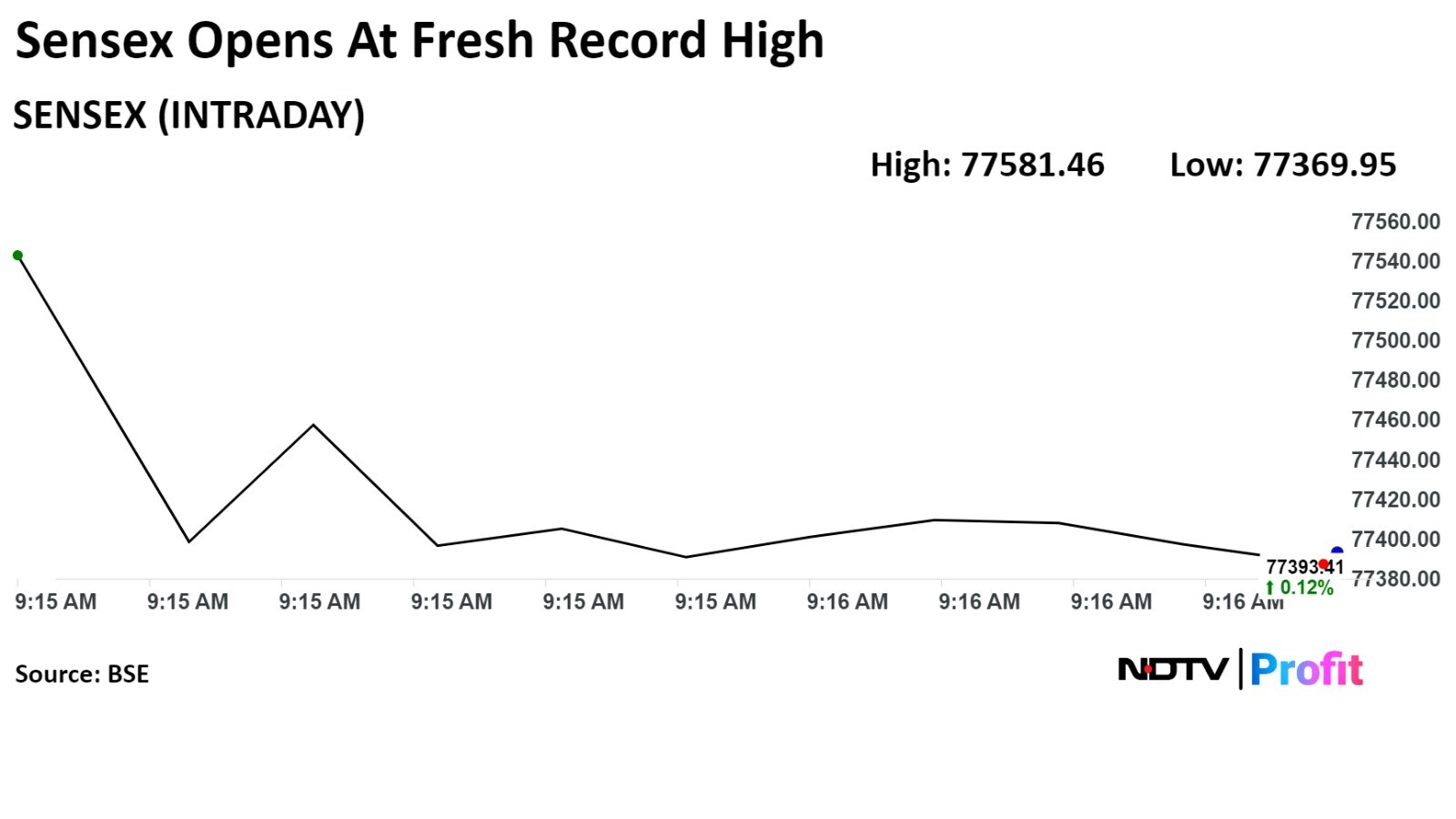

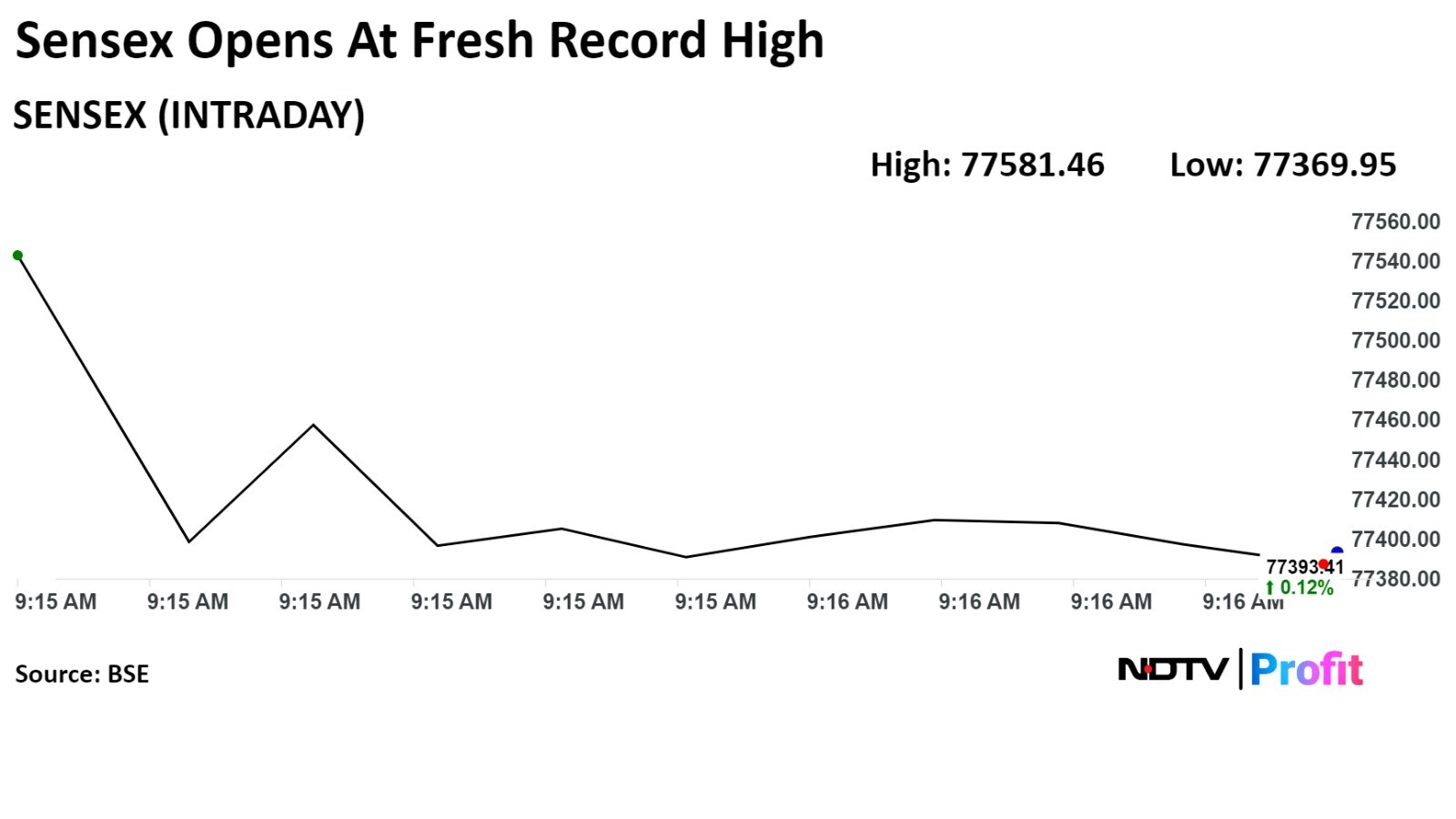

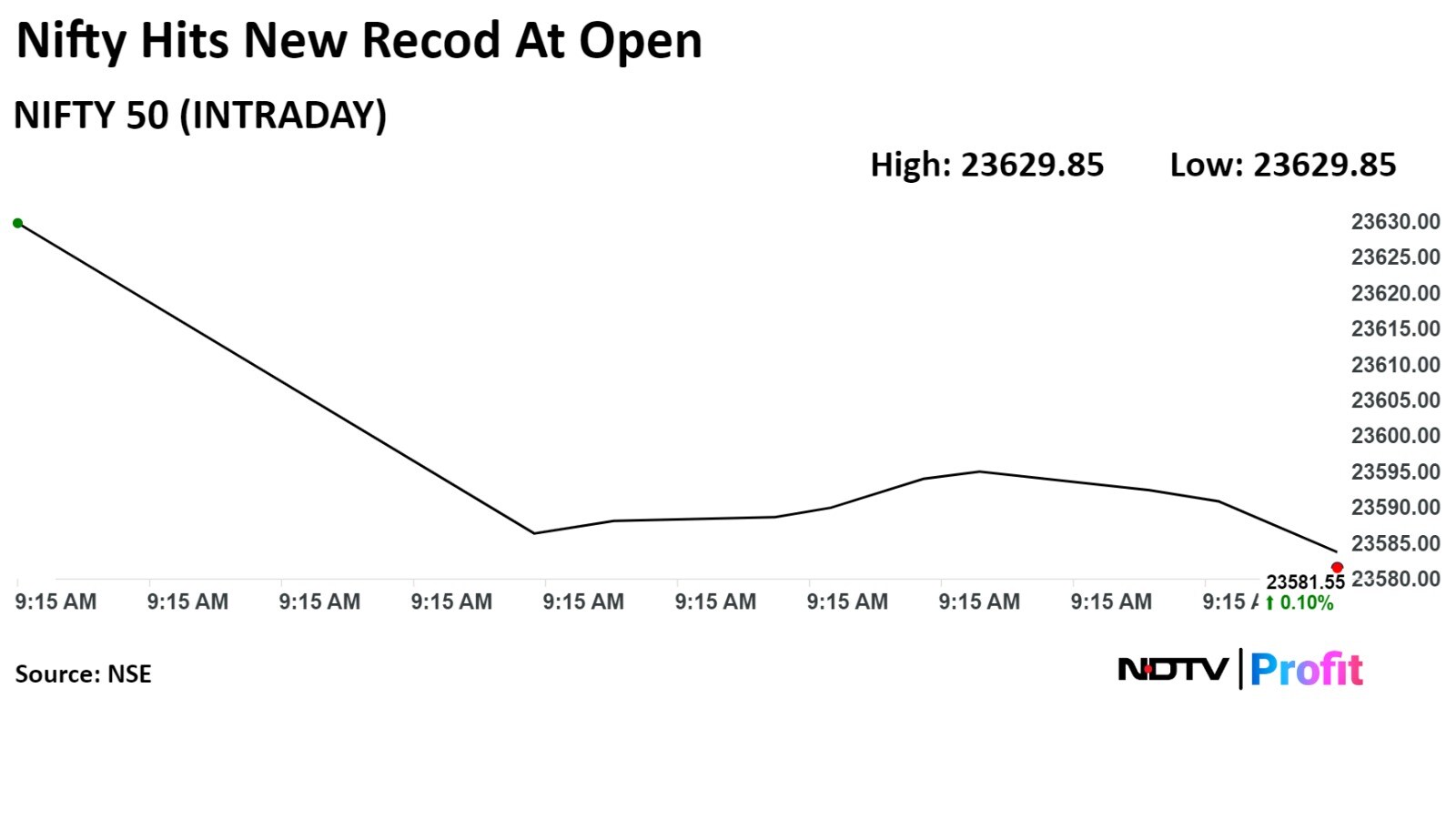

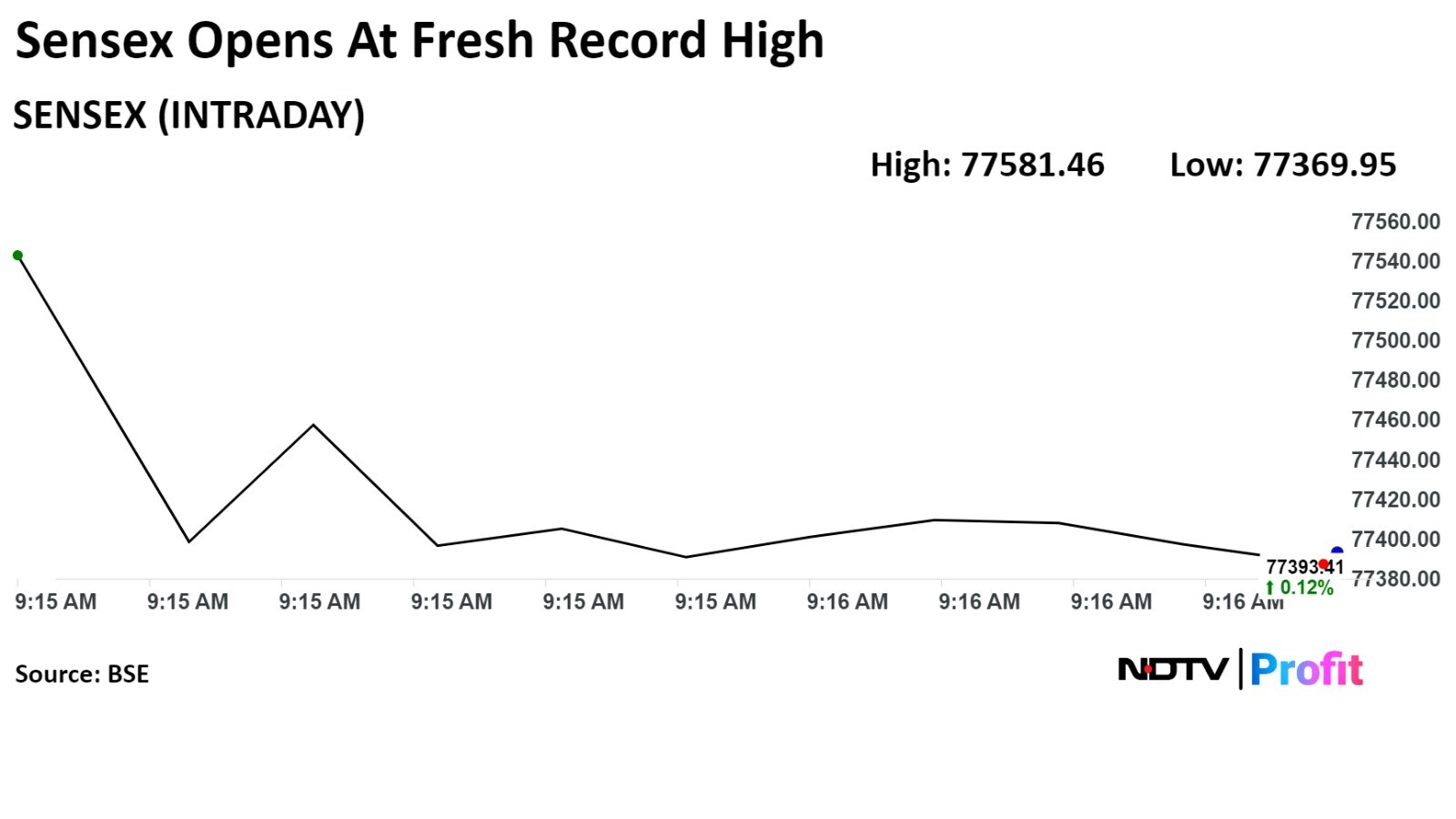

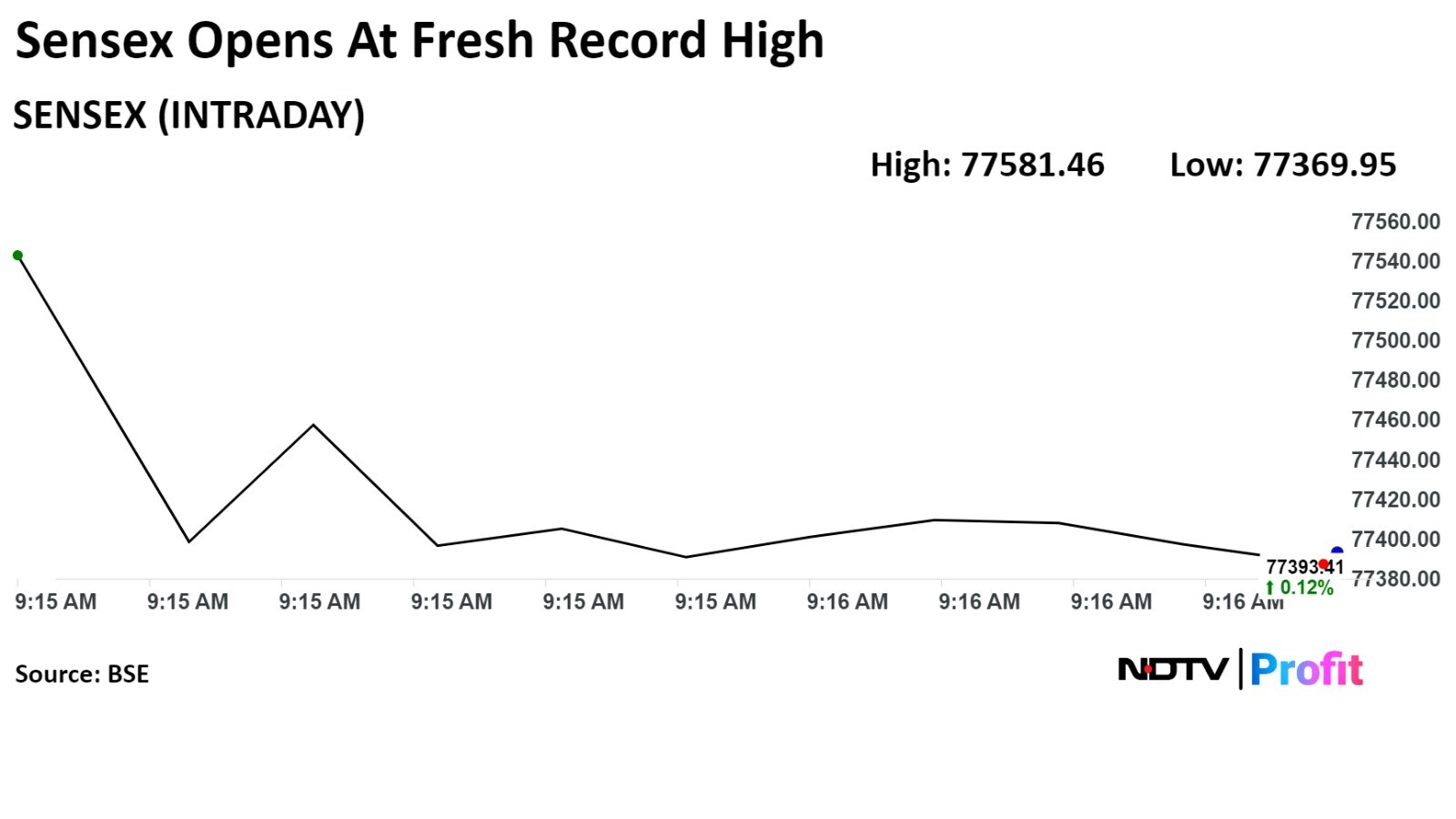

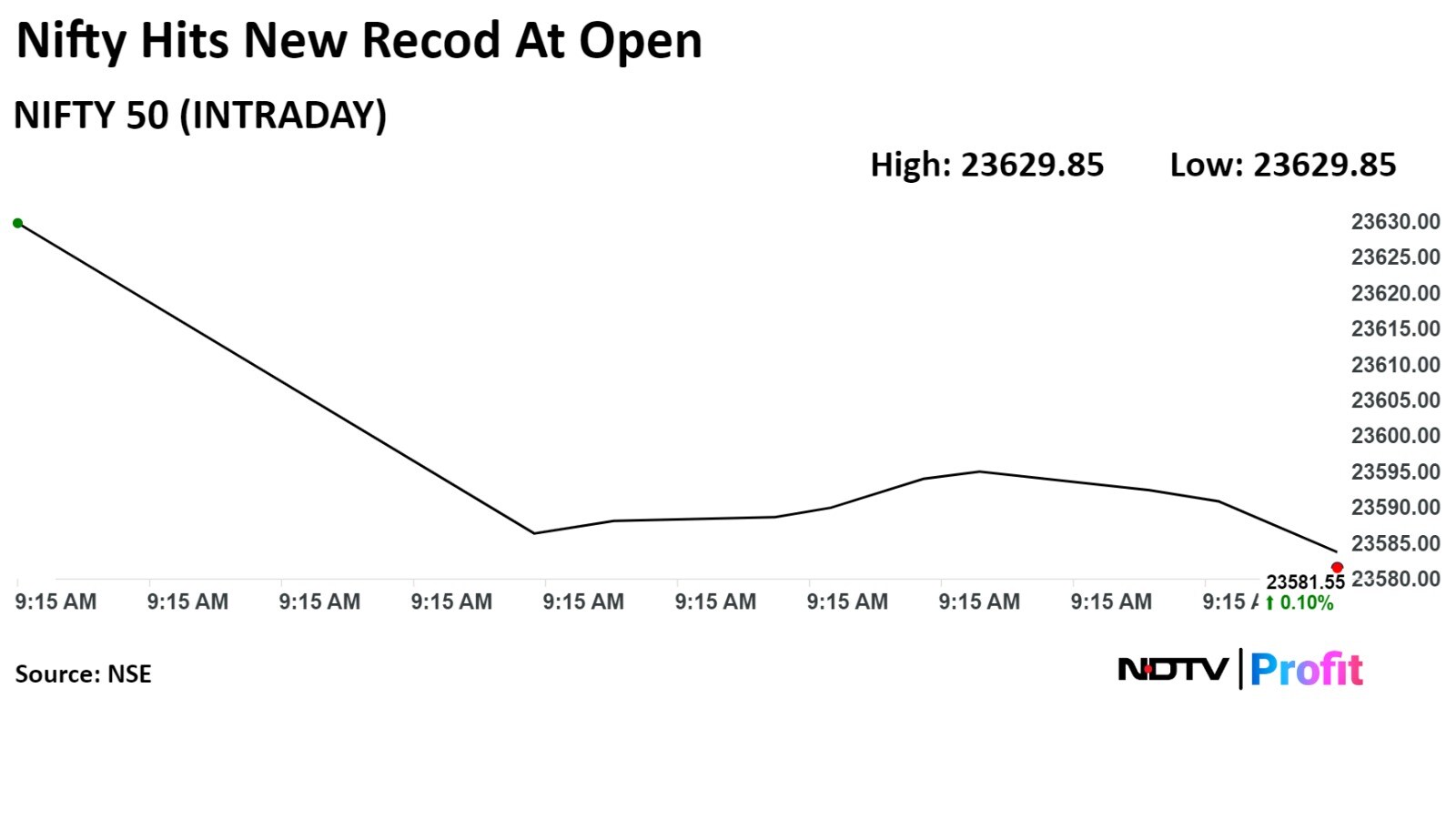

Indian benchmarks touched fresh highs at open for second session in a row as ICICI Bank Ltd., Infosys Ltd. rose.

As of 09:18 a.m., the NSE Nifty 50 was trading 37.95 points or 0.16% higher at 23,595.85, and the S&P BSE Sensex was trading 158.78 points or 0.21% higher at 77,459.92.

Shortly after opening, the Nifty 50 index rose 0.31% to fresh high of 23,630.85, and the S&P BSE Sensex rose 0.36% to 77,581.46.

"A rangebound trade comes to an end on a positive note at 23,558. With bearish candles, the Index has been registering new highs; thus, we recommend remaining light on Index positions and focus on sector specific approach," said Aditya Gaggar, director, Progressive Shares.

Indian benchmarks touched fresh highs at open for second session in a row as ICICI Bank Ltd., Infosys Ltd. rose.

As of 09:18 a.m., the NSE Nifty 50 was trading 37.95 points or 0.16% higher at 23,595.85, and the S&P BSE Sensex was trading 158.78 points or 0.21% higher at 77,459.92.

Shortly after opening, the Nifty 50 index rose 0.31% to fresh high of 23,630.85, and the S&P BSE Sensex rose 0.36% to 77,581.46.

"A rangebound trade comes to an end on a positive note at 23,558. With bearish candles, the Index has been registering new highs; thus, we recommend remaining light on Index positions and focus on sector specific approach," said Aditya Gaggar, director, Progressive Shares.

Indian benchmarks touched fresh highs at open for second session in a row as ICICI Bank Ltd., Infosys Ltd. rose.

As of 09:18 a.m., the NSE Nifty 50 was trading 37.95 points or 0.16% higher at 23,595.85, and the S&P BSE Sensex was trading 158.78 points or 0.21% higher at 77,459.92.

Shortly after opening, the Nifty 50 index rose 0.31% to fresh high of 23,630.85, and the S&P BSE Sensex rose 0.36% to 77,581.46.

"A rangebound trade comes to an end on a positive note at 23,558. With bearish candles, the Index has been registering new highs; thus, we recommend remaining light on Index positions and focus on sector specific approach," said Aditya Gaggar, director, Progressive Shares.

Indian benchmarks touched fresh highs at open for second session in a row as ICICI Bank Ltd., Infosys Ltd. rose.

As of 09:18 a.m., the NSE Nifty 50 was trading 37.95 points or 0.16% higher at 23,595.85, and the S&P BSE Sensex was trading 158.78 points or 0.21% higher at 77,459.92.

Shortly after opening, the Nifty 50 index rose 0.31% to fresh high of 23,630.85, and the S&P BSE Sensex rose 0.36% to 77,581.46.

"A rangebound trade comes to an end on a positive note at 23,558. With bearish candles, the Index has been registering new highs; thus, we recommend remaining light on Index positions and focus on sector specific approach," said Aditya Gaggar, director, Progressive Shares.

Indian benchmarks touched fresh highs at open for second session in a row as ICICI Bank Ltd., Infosys Ltd. rose.

As of 09:18 a.m., the NSE Nifty 50 was trading 37.95 points or 0.16% higher at 23,595.85, and the S&P BSE Sensex was trading 158.78 points or 0.21% higher at 77,459.92.

Shortly after opening, the Nifty 50 index rose 0.31% to fresh high of 23,630.85, and the S&P BSE Sensex rose 0.36% to 77,581.46.

"A rangebound trade comes to an end on a positive note at 23,558. With bearish candles, the Index has been registering new highs; thus, we recommend remaining light on Index positions and focus on sector specific approach," said Aditya Gaggar, director, Progressive Shares.

Indian benchmarks touched fresh highs at open for second session in a row as ICICI Bank Ltd., Infosys Ltd. rose.

As of 09:18 a.m., the NSE Nifty 50 was trading 37.95 points or 0.16% higher at 23,595.85, and the S&P BSE Sensex was trading 158.78 points or 0.21% higher at 77,459.92.

Shortly after opening, the Nifty 50 index rose 0.31% to fresh high of 23,630.85, and the S&P BSE Sensex rose 0.36% to 77,581.46.

"A rangebound trade comes to an end on a positive note at 23,558. With bearish candles, the Index has been registering new highs; thus, we recommend remaining light on Index positions and focus on sector specific approach," said Aditya Gaggar, director, Progressive Shares.

Indian benchmarks touched fresh highs at open for second session in a row as ICICI Bank Ltd., Infosys Ltd. rose.

As of 09:18 a.m., the NSE Nifty 50 was trading 37.95 points or 0.16% higher at 23,595.85, and the S&P BSE Sensex was trading 158.78 points or 0.21% higher at 77,459.92.

Shortly after opening, the Nifty 50 index rose 0.31% to fresh high of 23,630.85, and the S&P BSE Sensex rose 0.36% to 77,581.46.

"A rangebound trade comes to an end on a positive note at 23,558. With bearish candles, the Index has been registering new highs; thus, we recommend remaining light on Index positions and focus on sector specific approach," said Aditya Gaggar, director, Progressive Shares.

Indian benchmarks touched fresh highs at open for second session in a row as ICICI Bank Ltd., Infosys Ltd. rose.

As of 09:18 a.m., the NSE Nifty 50 was trading 37.95 points or 0.16% higher at 23,595.85, and the S&P BSE Sensex was trading 158.78 points or 0.21% higher at 77,459.92.

Shortly after opening, the Nifty 50 index rose 0.31% to fresh high of 23,630.85, and the S&P BSE Sensex rose 0.36% to 77,581.46.

"A rangebound trade comes to an end on a positive note at 23,558. With bearish candles, the Index has been registering new highs; thus, we recommend remaining light on Index positions and focus on sector specific approach," said Aditya Gaggar, director, Progressive Shares.

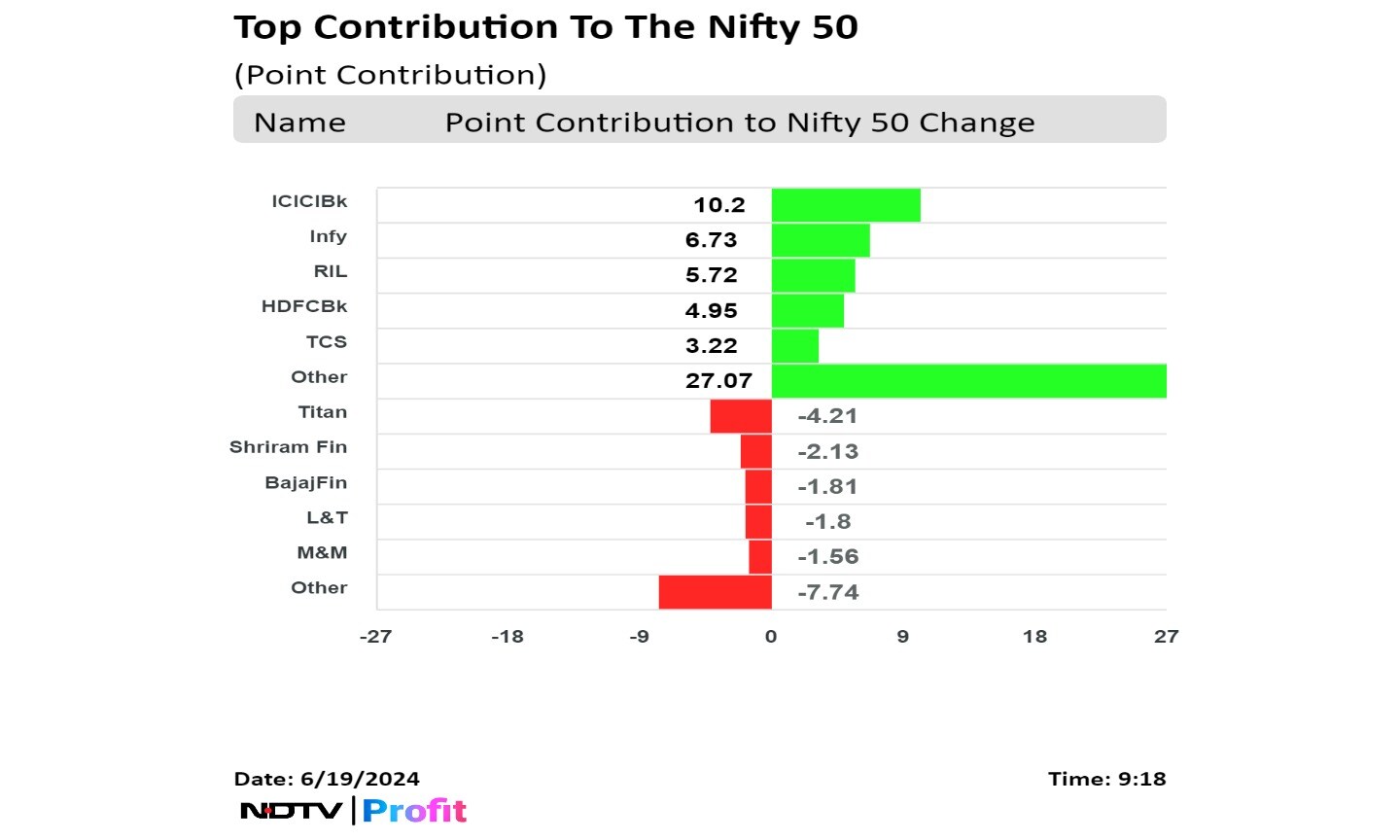

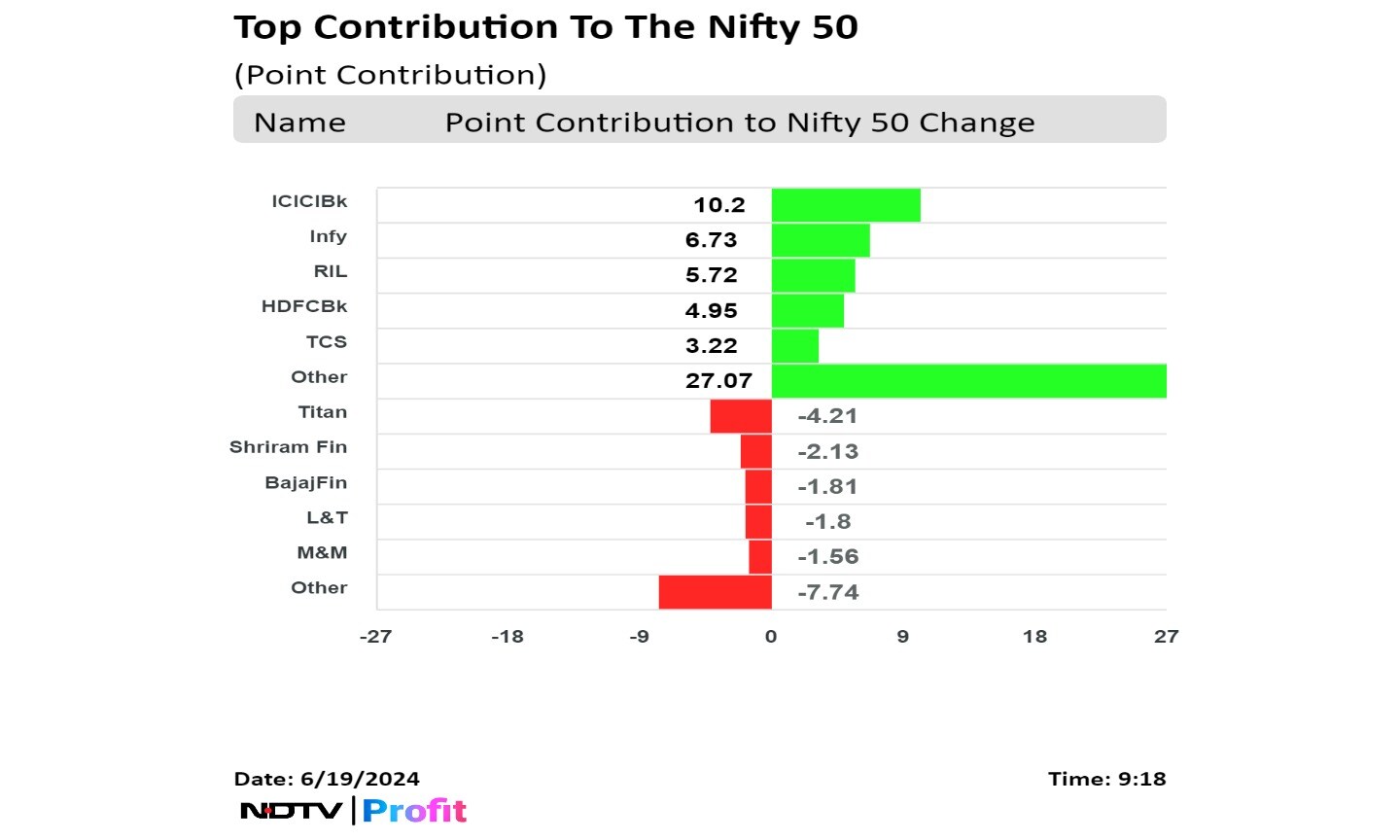

ICICI Bank Ltd., Infosys Ltd., Reliance Industries Ltd., HDFC Bank Ltd., and Tata Consultancy Services Ltd. added to the benchmark index.

Titan Co., Shriram Finance Ltd., Bajaj Finance Ltd., Larsen & Toubro Ltd., and Mahindra & Mahindra Ltd. limited the gains in the index.

Indian benchmarks touched fresh highs at open for second session in a row as ICICI Bank Ltd., Infosys Ltd. rose.

As of 09:18 a.m., the NSE Nifty 50 was trading 37.95 points or 0.16% higher at 23,595.85, and the S&P BSE Sensex was trading 158.78 points or 0.21% higher at 77,459.92.

Shortly after opening, the Nifty 50 index rose 0.31% to fresh high of 23,630.85, and the S&P BSE Sensex rose 0.36% to 77,581.46.

"A rangebound trade comes to an end on a positive note at 23,558. With bearish candles, the Index has been registering new highs; thus, we recommend remaining light on Index positions and focus on sector specific approach," said Aditya Gaggar, director, Progressive Shares.

Indian benchmarks touched fresh highs at open for second session in a row as ICICI Bank Ltd., Infosys Ltd. rose.

As of 09:18 a.m., the NSE Nifty 50 was trading 37.95 points or 0.16% higher at 23,595.85, and the S&P BSE Sensex was trading 158.78 points or 0.21% higher at 77,459.92.

Shortly after opening, the Nifty 50 index rose 0.31% to fresh high of 23,630.85, and the S&P BSE Sensex rose 0.36% to 77,581.46.

"A rangebound trade comes to an end on a positive note at 23,558. With bearish candles, the Index has been registering new highs; thus, we recommend remaining light on Index positions and focus on sector specific approach," said Aditya Gaggar, director, Progressive Shares.

Indian benchmarks touched fresh highs at open for second session in a row as ICICI Bank Ltd., Infosys Ltd. rose.

As of 09:18 a.m., the NSE Nifty 50 was trading 37.95 points or 0.16% higher at 23,595.85, and the S&P BSE Sensex was trading 158.78 points or 0.21% higher at 77,459.92.

Shortly after opening, the Nifty 50 index rose 0.31% to fresh high of 23,630.85, and the S&P BSE Sensex rose 0.36% to 77,581.46.

"A rangebound trade comes to an end on a positive note at 23,558. With bearish candles, the Index has been registering new highs; thus, we recommend remaining light on Index positions and focus on sector specific approach," said Aditya Gaggar, director, Progressive Shares.

Indian benchmarks touched fresh highs at open for second session in a row as ICICI Bank Ltd., Infosys Ltd. rose.

As of 09:18 a.m., the NSE Nifty 50 was trading 37.95 points or 0.16% higher at 23,595.85, and the S&P BSE Sensex was trading 158.78 points or 0.21% higher at 77,459.92.

Shortly after opening, the Nifty 50 index rose 0.31% to fresh high of 23,630.85, and the S&P BSE Sensex rose 0.36% to 77,581.46.

"A rangebound trade comes to an end on a positive note at 23,558. With bearish candles, the Index has been registering new highs; thus, we recommend remaining light on Index positions and focus on sector specific approach," said Aditya Gaggar, director, Progressive Shares.

Indian benchmarks touched fresh highs at open for second session in a row as ICICI Bank Ltd., Infosys Ltd. rose.

As of 09:18 a.m., the NSE Nifty 50 was trading 37.95 points or 0.16% higher at 23,595.85, and the S&P BSE Sensex was trading 158.78 points or 0.21% higher at 77,459.92.

Shortly after opening, the Nifty 50 index rose 0.31% to fresh high of 23,630.85, and the S&P BSE Sensex rose 0.36% to 77,581.46.

"A rangebound trade comes to an end on a positive note at 23,558. With bearish candles, the Index has been registering new highs; thus, we recommend remaining light on Index positions and focus on sector specific approach," said Aditya Gaggar, director, Progressive Shares.

Indian benchmarks touched fresh highs at open for second session in a row as ICICI Bank Ltd., Infosys Ltd. rose.

As of 09:18 a.m., the NSE Nifty 50 was trading 37.95 points or 0.16% higher at 23,595.85, and the S&P BSE Sensex was trading 158.78 points or 0.21% higher at 77,459.92.

Shortly after opening, the Nifty 50 index rose 0.31% to fresh high of 23,630.85, and the S&P BSE Sensex rose 0.36% to 77,581.46.

"A rangebound trade comes to an end on a positive note at 23,558. With bearish candles, the Index has been registering new highs; thus, we recommend remaining light on Index positions and focus on sector specific approach," said Aditya Gaggar, director, Progressive Shares.

Indian benchmarks touched fresh highs at open for second session in a row as ICICI Bank Ltd., Infosys Ltd. rose.

As of 09:18 a.m., the NSE Nifty 50 was trading 37.95 points or 0.16% higher at 23,595.85, and the S&P BSE Sensex was trading 158.78 points or 0.21% higher at 77,459.92.

Shortly after opening, the Nifty 50 index rose 0.31% to fresh high of 23,630.85, and the S&P BSE Sensex rose 0.36% to 77,581.46.

"A rangebound trade comes to an end on a positive note at 23,558. With bearish candles, the Index has been registering new highs; thus, we recommend remaining light on Index positions and focus on sector specific approach," said Aditya Gaggar, director, Progressive Shares.

Indian benchmarks touched fresh highs at open for second session in a row as ICICI Bank Ltd., Infosys Ltd. rose.

As of 09:18 a.m., the NSE Nifty 50 was trading 37.95 points or 0.16% higher at 23,595.85, and the S&P BSE Sensex was trading 158.78 points or 0.21% higher at 77,459.92.

Shortly after opening, the Nifty 50 index rose 0.31% to fresh high of 23,630.85, and the S&P BSE Sensex rose 0.36% to 77,581.46.

"A rangebound trade comes to an end on a positive note at 23,558. With bearish candles, the Index has been registering new highs; thus, we recommend remaining light on Index positions and focus on sector specific approach," said Aditya Gaggar, director, Progressive Shares.

ICICI Bank Ltd., Infosys Ltd., Reliance Industries Ltd., HDFC Bank Ltd., and Tata Consultancy Services Ltd. added to the benchmark index.

Titan Co., Shriram Finance Ltd., Bajaj Finance Ltd., Larsen & Toubro Ltd., and Mahindra & Mahindra Ltd. limited the gains in the index.

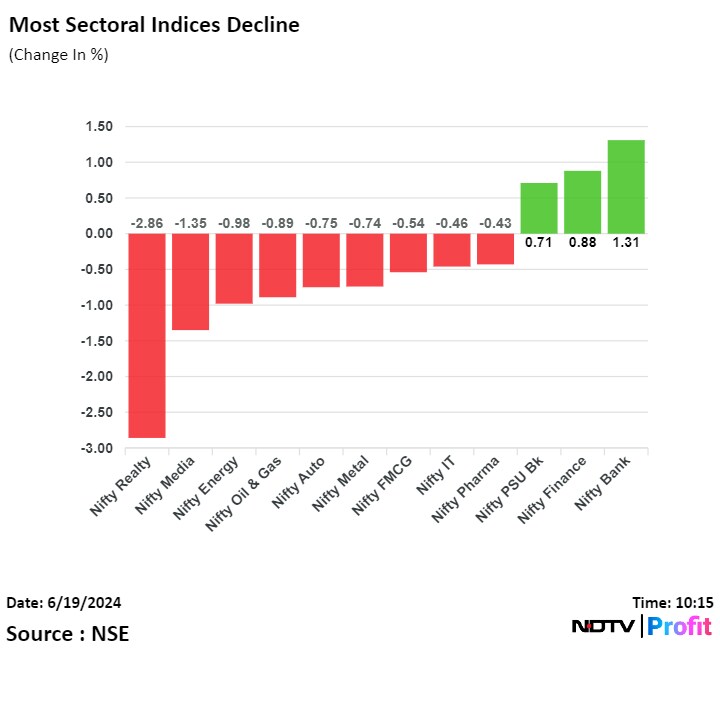

On NSE, nine sectors advanced, two remained flat, and one declined out of 12. The NSE Nifty Metal rose the most, and the NSE Nifty Realty fell the most.

"The IT sector is forming a bullish Pennant and Pole pattern, post the breakout, one can expect a sharp rally. With the buying frenzy in Defense stocks, we advocate booking partial profits in it as almost all of them are in the extremely overbought territory. Fertilizer stocks have shown some buying traction and some of them have given a strong breakout which indicates an extension of the current move," Gaggar said.

Indian benchmarks touched fresh highs at open for second session in a row as ICICI Bank Ltd., Infosys Ltd. rose.

As of 09:18 a.m., the NSE Nifty 50 was trading 37.95 points or 0.16% higher at 23,595.85, and the S&P BSE Sensex was trading 158.78 points or 0.21% higher at 77,459.92.

Shortly after opening, the Nifty 50 index rose 0.31% to fresh high of 23,630.85, and the S&P BSE Sensex rose 0.36% to 77,581.46.

"A rangebound trade comes to an end on a positive note at 23,558. With bearish candles, the Index has been registering new highs; thus, we recommend remaining light on Index positions and focus on sector specific approach," said Aditya Gaggar, director, Progressive Shares.

Indian benchmarks touched fresh highs at open for second session in a row as ICICI Bank Ltd., Infosys Ltd. rose.

As of 09:18 a.m., the NSE Nifty 50 was trading 37.95 points or 0.16% higher at 23,595.85, and the S&P BSE Sensex was trading 158.78 points or 0.21% higher at 77,459.92.

Shortly after opening, the Nifty 50 index rose 0.31% to fresh high of 23,630.85, and the S&P BSE Sensex rose 0.36% to 77,581.46.

"A rangebound trade comes to an end on a positive note at 23,558. With bearish candles, the Index has been registering new highs; thus, we recommend remaining light on Index positions and focus on sector specific approach," said Aditya Gaggar, director, Progressive Shares.

Indian benchmarks touched fresh highs at open for second session in a row as ICICI Bank Ltd., Infosys Ltd. rose.

As of 09:18 a.m., the NSE Nifty 50 was trading 37.95 points or 0.16% higher at 23,595.85, and the S&P BSE Sensex was trading 158.78 points or 0.21% higher at 77,459.92.

Shortly after opening, the Nifty 50 index rose 0.31% to fresh high of 23,630.85, and the S&P BSE Sensex rose 0.36% to 77,581.46.

"A rangebound trade comes to an end on a positive note at 23,558. With bearish candles, the Index has been registering new highs; thus, we recommend remaining light on Index positions and focus on sector specific approach," said Aditya Gaggar, director, Progressive Shares.

Indian benchmarks touched fresh highs at open for second session in a row as ICICI Bank Ltd., Infosys Ltd. rose.

As of 09:18 a.m., the NSE Nifty 50 was trading 37.95 points or 0.16% higher at 23,595.85, and the S&P BSE Sensex was trading 158.78 points or 0.21% higher at 77,459.92.

Shortly after opening, the Nifty 50 index rose 0.31% to fresh high of 23,630.85, and the S&P BSE Sensex rose 0.36% to 77,581.46.

"A rangebound trade comes to an end on a positive note at 23,558. With bearish candles, the Index has been registering new highs; thus, we recommend remaining light on Index positions and focus on sector specific approach," said Aditya Gaggar, director, Progressive Shares.

Indian benchmarks touched fresh highs at open for second session in a row as ICICI Bank Ltd., Infosys Ltd. rose.

As of 09:18 a.m., the NSE Nifty 50 was trading 37.95 points or 0.16% higher at 23,595.85, and the S&P BSE Sensex was trading 158.78 points or 0.21% higher at 77,459.92.

Shortly after opening, the Nifty 50 index rose 0.31% to fresh high of 23,630.85, and the S&P BSE Sensex rose 0.36% to 77,581.46.

"A rangebound trade comes to an end on a positive note at 23,558. With bearish candles, the Index has been registering new highs; thus, we recommend remaining light on Index positions and focus on sector specific approach," said Aditya Gaggar, director, Progressive Shares.

Indian benchmarks touched fresh highs at open for second session in a row as ICICI Bank Ltd., Infosys Ltd. rose.

As of 09:18 a.m., the NSE Nifty 50 was trading 37.95 points or 0.16% higher at 23,595.85, and the S&P BSE Sensex was trading 158.78 points or 0.21% higher at 77,459.92.

Shortly after opening, the Nifty 50 index rose 0.31% to fresh high of 23,630.85, and the S&P BSE Sensex rose 0.36% to 77,581.46.

"A rangebound trade comes to an end on a positive note at 23,558. With bearish candles, the Index has been registering new highs; thus, we recommend remaining light on Index positions and focus on sector specific approach," said Aditya Gaggar, director, Progressive Shares.

Indian benchmarks touched fresh highs at open for second session in a row as ICICI Bank Ltd., Infosys Ltd. rose.

As of 09:18 a.m., the NSE Nifty 50 was trading 37.95 points or 0.16% higher at 23,595.85, and the S&P BSE Sensex was trading 158.78 points or 0.21% higher at 77,459.92.

Shortly after opening, the Nifty 50 index rose 0.31% to fresh high of 23,630.85, and the S&P BSE Sensex rose 0.36% to 77,581.46.

"A rangebound trade comes to an end on a positive note at 23,558. With bearish candles, the Index has been registering new highs; thus, we recommend remaining light on Index positions and focus on sector specific approach," said Aditya Gaggar, director, Progressive Shares.

Indian benchmarks touched fresh highs at open for second session in a row as ICICI Bank Ltd., Infosys Ltd. rose.

As of 09:18 a.m., the NSE Nifty 50 was trading 37.95 points or 0.16% higher at 23,595.85, and the S&P BSE Sensex was trading 158.78 points or 0.21% higher at 77,459.92.

Shortly after opening, the Nifty 50 index rose 0.31% to fresh high of 23,630.85, and the S&P BSE Sensex rose 0.36% to 77,581.46.

"A rangebound trade comes to an end on a positive note at 23,558. With bearish candles, the Index has been registering new highs; thus, we recommend remaining light on Index positions and focus on sector specific approach," said Aditya Gaggar, director, Progressive Shares.

ICICI Bank Ltd., Infosys Ltd., Reliance Industries Ltd., HDFC Bank Ltd., and Tata Consultancy Services Ltd. added to the benchmark index.

Titan Co., Shriram Finance Ltd., Bajaj Finance Ltd., Larsen & Toubro Ltd., and Mahindra & Mahindra Ltd. limited the gains in the index.

Indian benchmarks touched fresh highs at open for second session in a row as ICICI Bank Ltd., Infosys Ltd. rose.

As of 09:18 a.m., the NSE Nifty 50 was trading 37.95 points or 0.16% higher at 23,595.85, and the S&P BSE Sensex was trading 158.78 points or 0.21% higher at 77,459.92.

Shortly after opening, the Nifty 50 index rose 0.31% to fresh high of 23,630.85, and the S&P BSE Sensex rose 0.36% to 77,581.46.

"A rangebound trade comes to an end on a positive note at 23,558. With bearish candles, the Index has been registering new highs; thus, we recommend remaining light on Index positions and focus on sector specific approach," said Aditya Gaggar, director, Progressive Shares.

Indian benchmarks touched fresh highs at open for second session in a row as ICICI Bank Ltd., Infosys Ltd. rose.

As of 09:18 a.m., the NSE Nifty 50 was trading 37.95 points or 0.16% higher at 23,595.85, and the S&P BSE Sensex was trading 158.78 points or 0.21% higher at 77,459.92.

Shortly after opening, the Nifty 50 index rose 0.31% to fresh high of 23,630.85, and the S&P BSE Sensex rose 0.36% to 77,581.46.

"A rangebound trade comes to an end on a positive note at 23,558. With bearish candles, the Index has been registering new highs; thus, we recommend remaining light on Index positions and focus on sector specific approach," said Aditya Gaggar, director, Progressive Shares.

Indian benchmarks touched fresh highs at open for second session in a row as ICICI Bank Ltd., Infosys Ltd. rose.

As of 09:18 a.m., the NSE Nifty 50 was trading 37.95 points or 0.16% higher at 23,595.85, and the S&P BSE Sensex was trading 158.78 points or 0.21% higher at 77,459.92.

Shortly after opening, the Nifty 50 index rose 0.31% to fresh high of 23,630.85, and the S&P BSE Sensex rose 0.36% to 77,581.46.