-The local currency strengthened by 3 paise to close at 83.32 against the US dollar.

-It closed at 83.35 on Wednesday.

Source:Cogencis

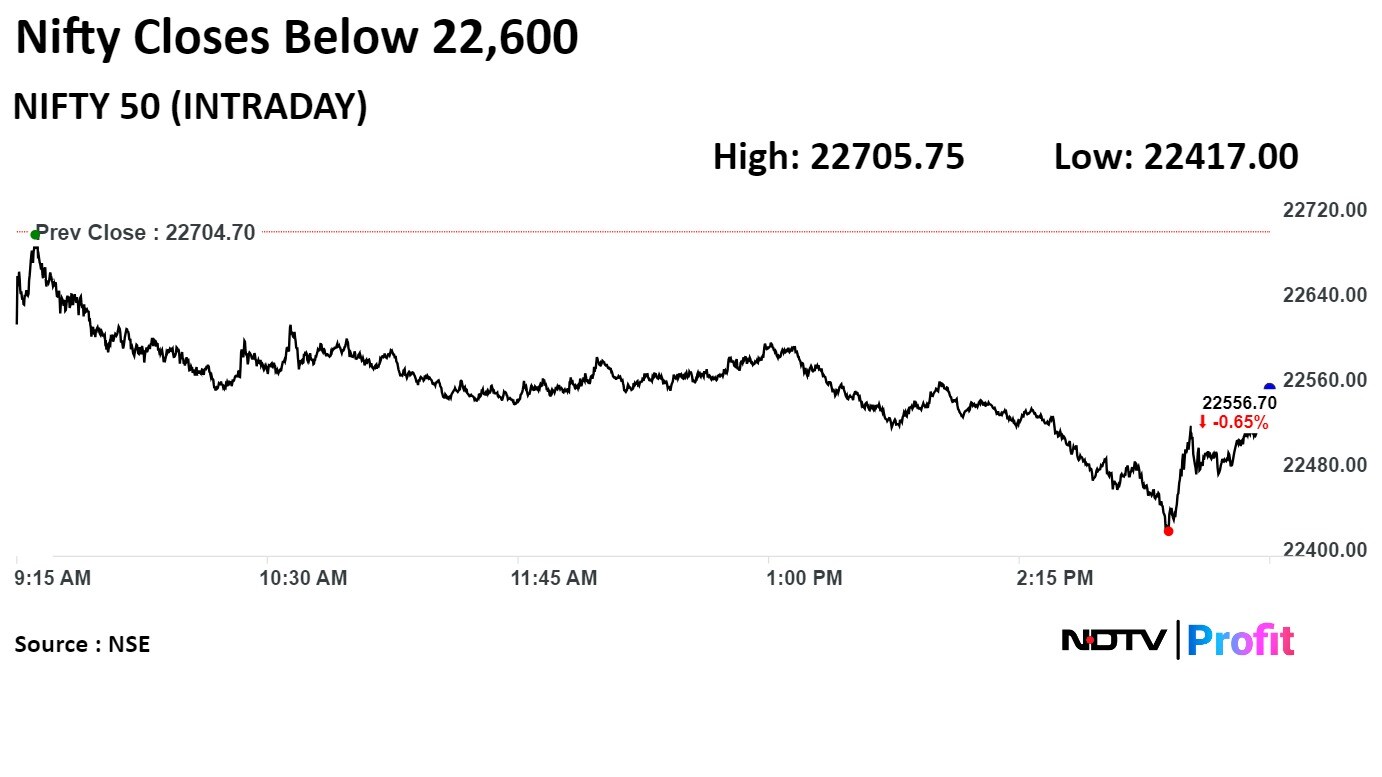

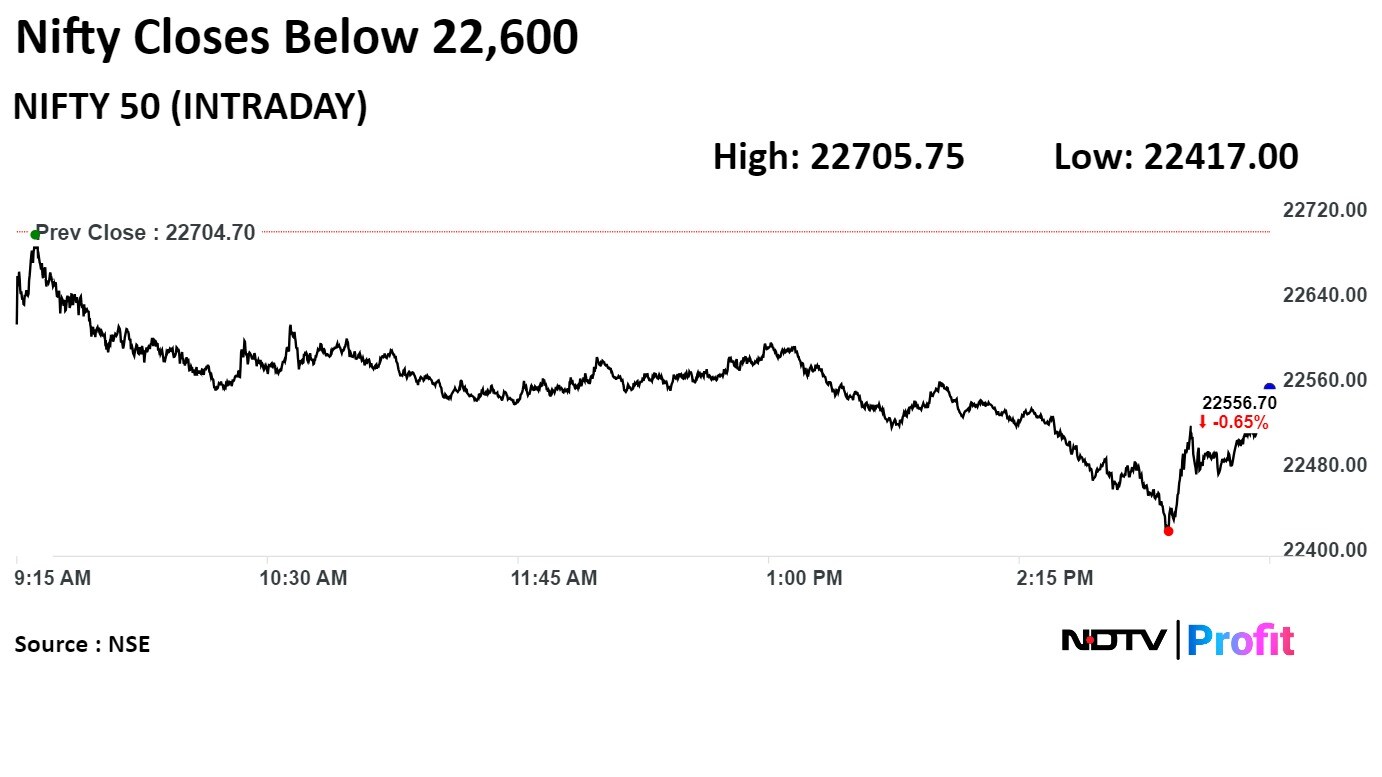

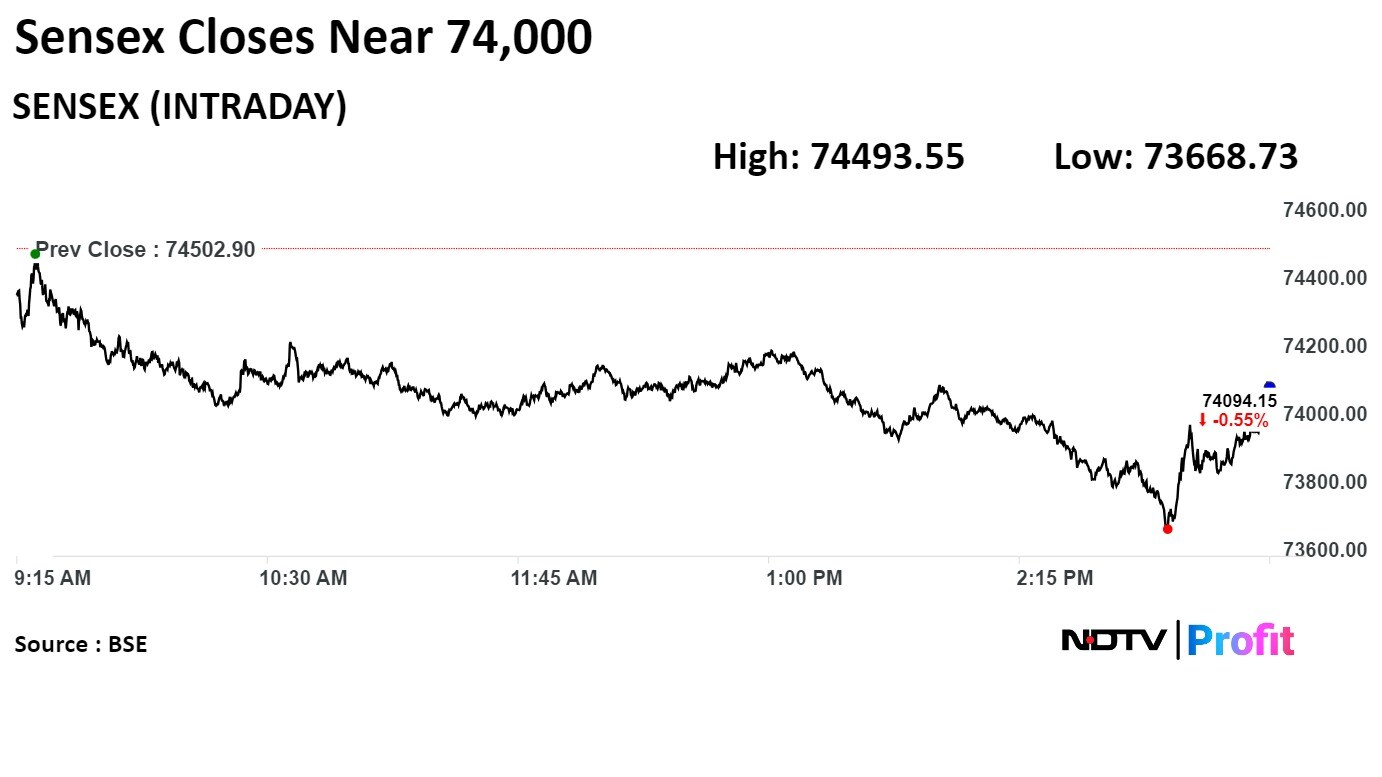

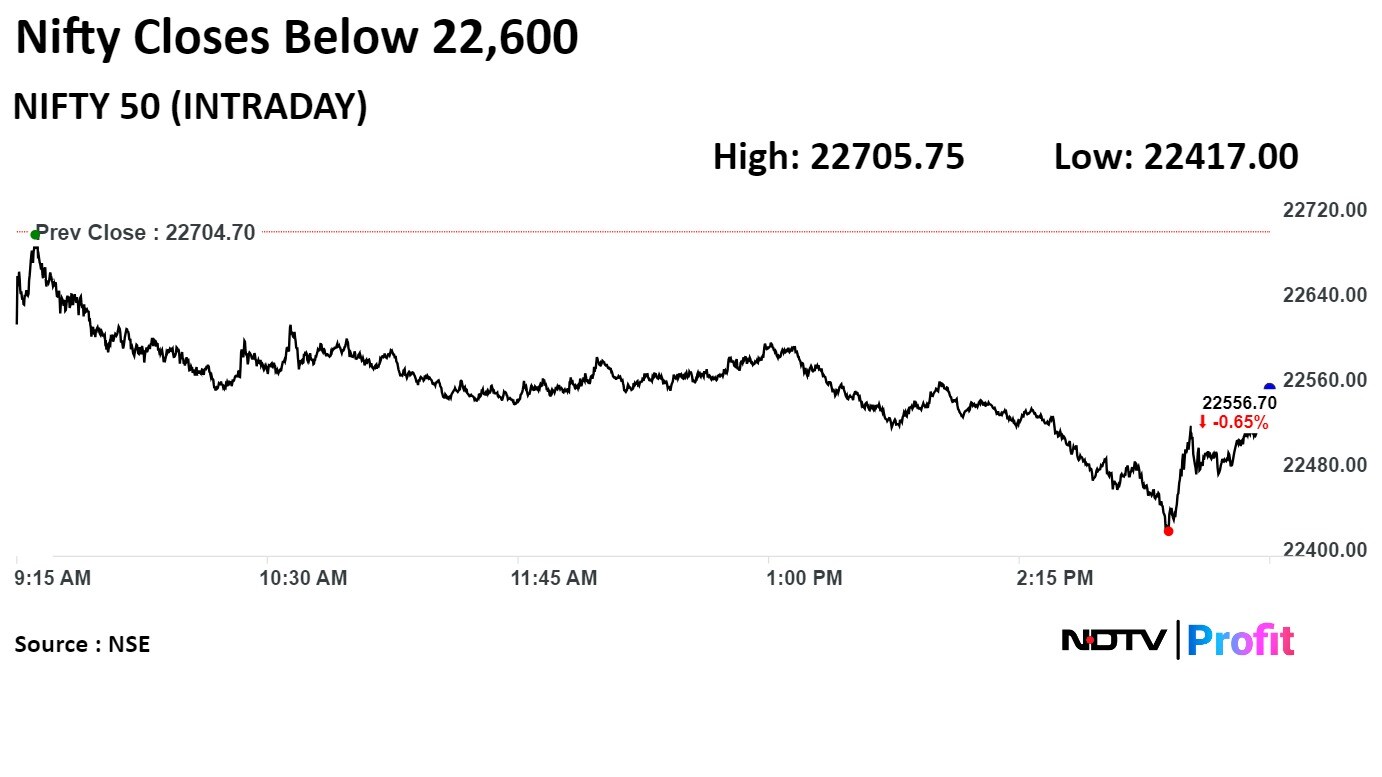

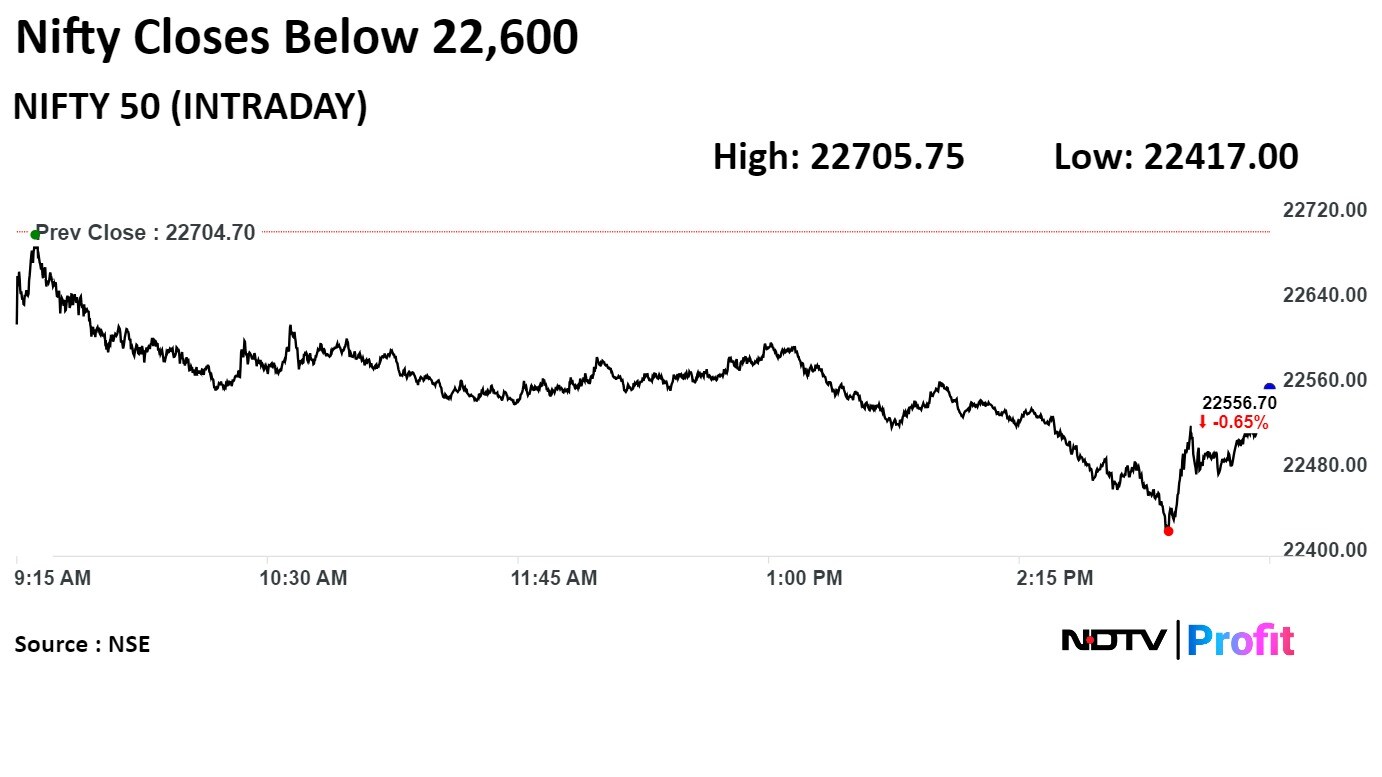

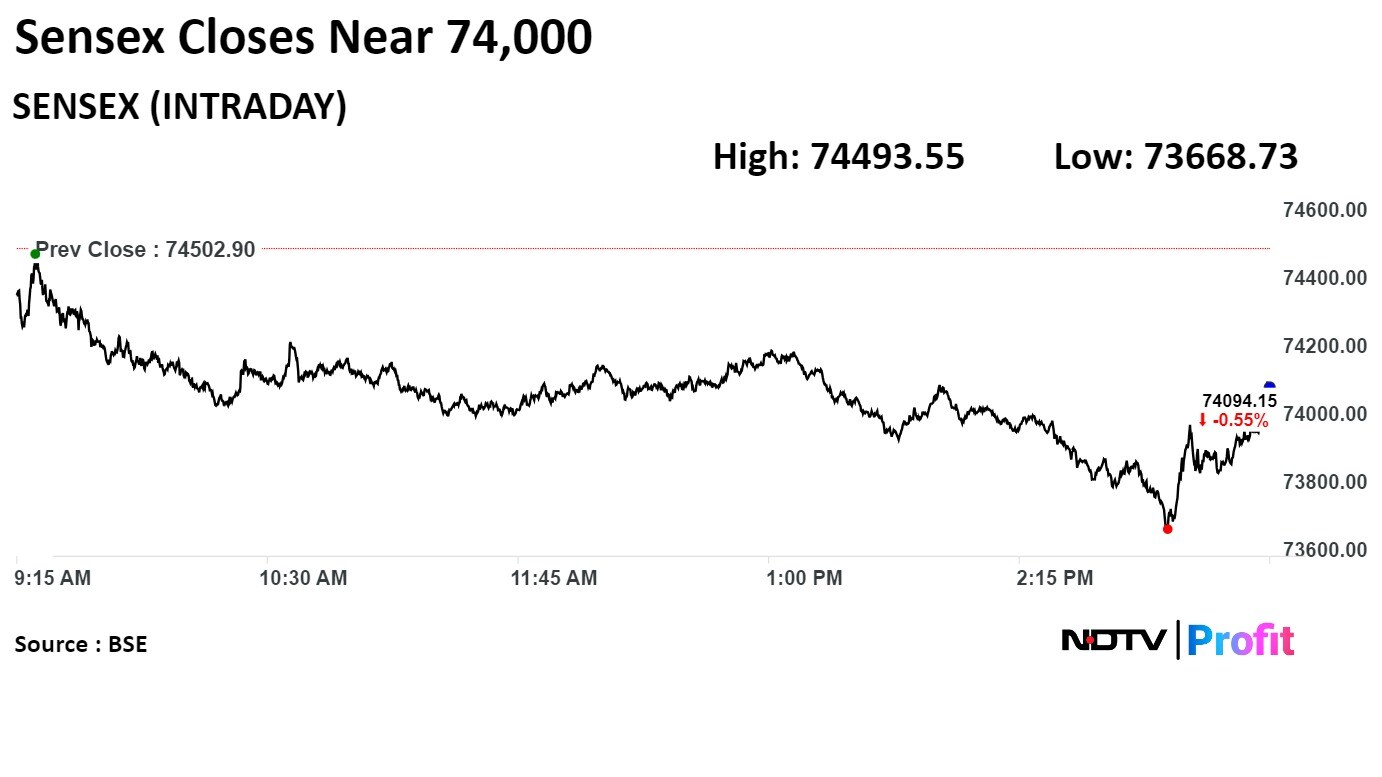

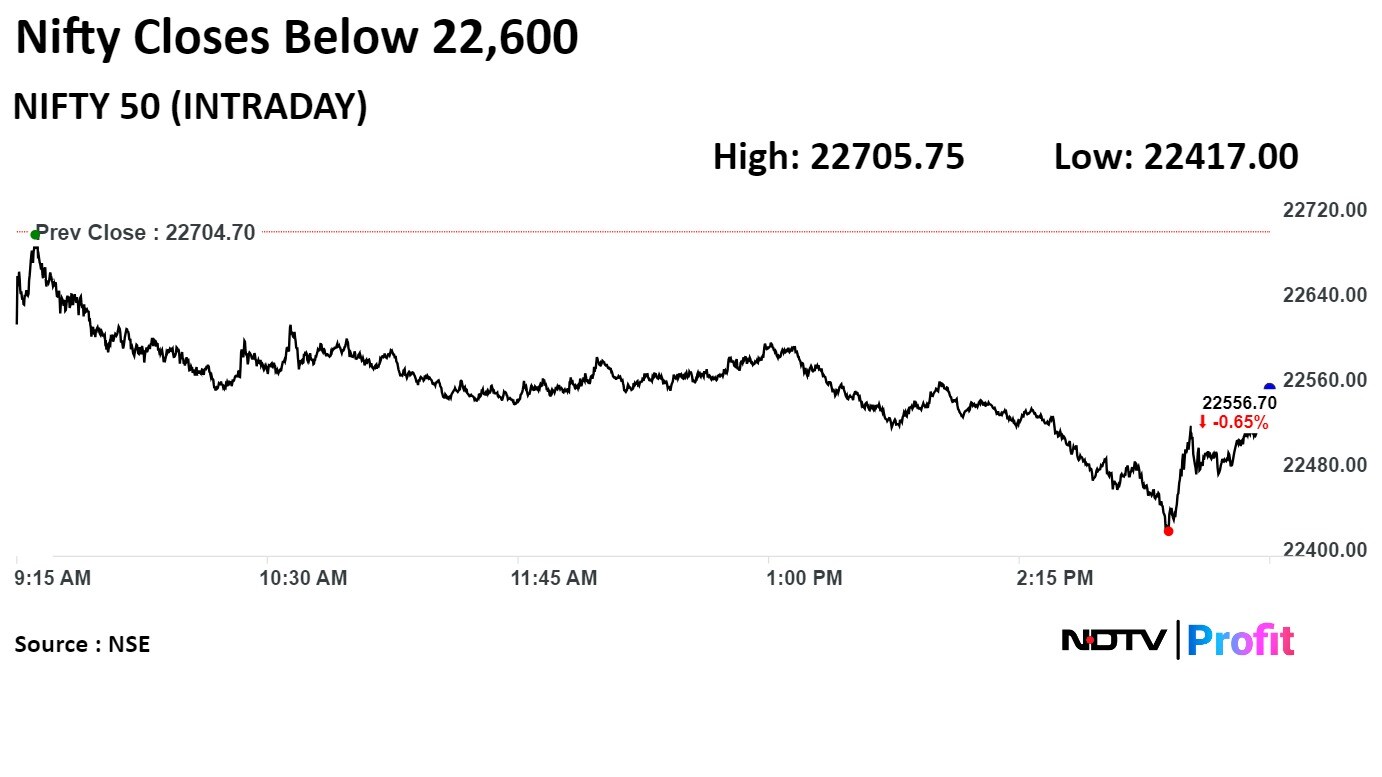

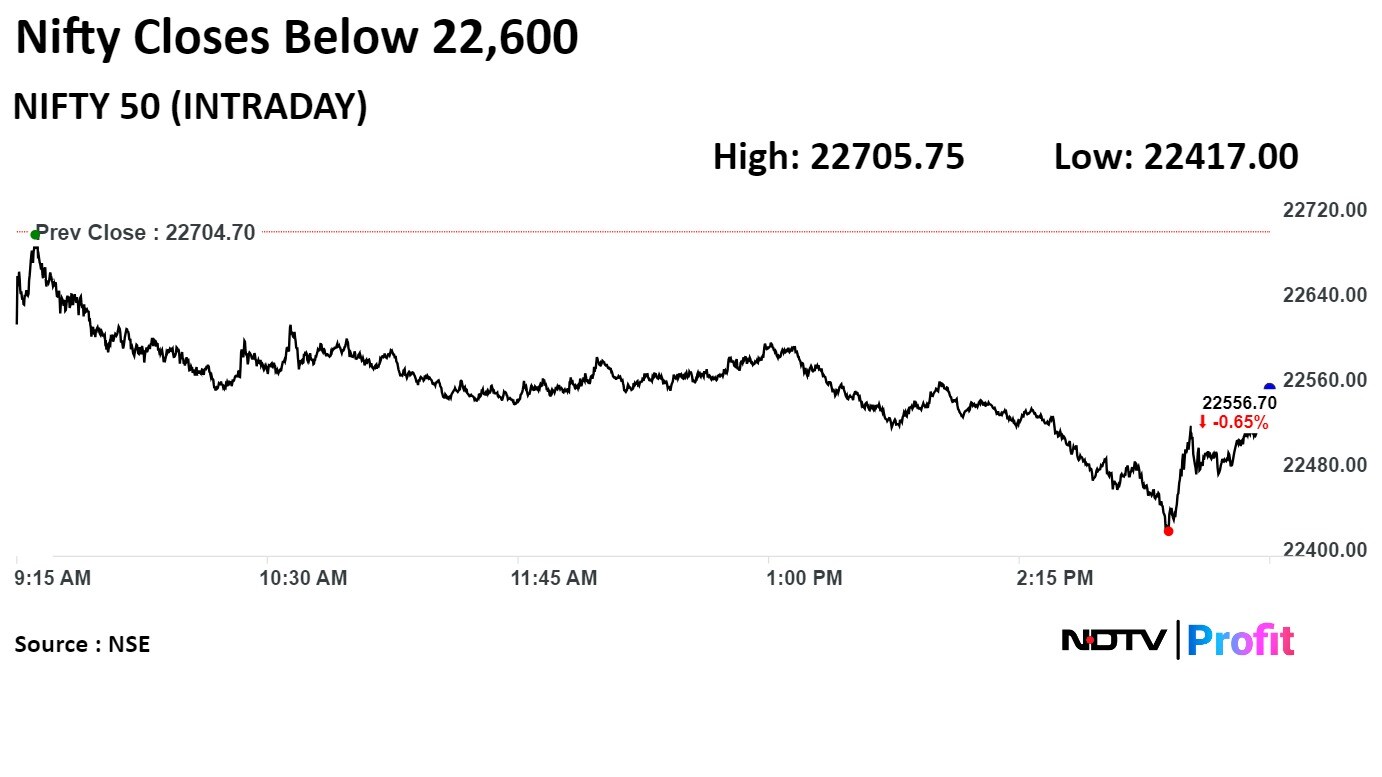

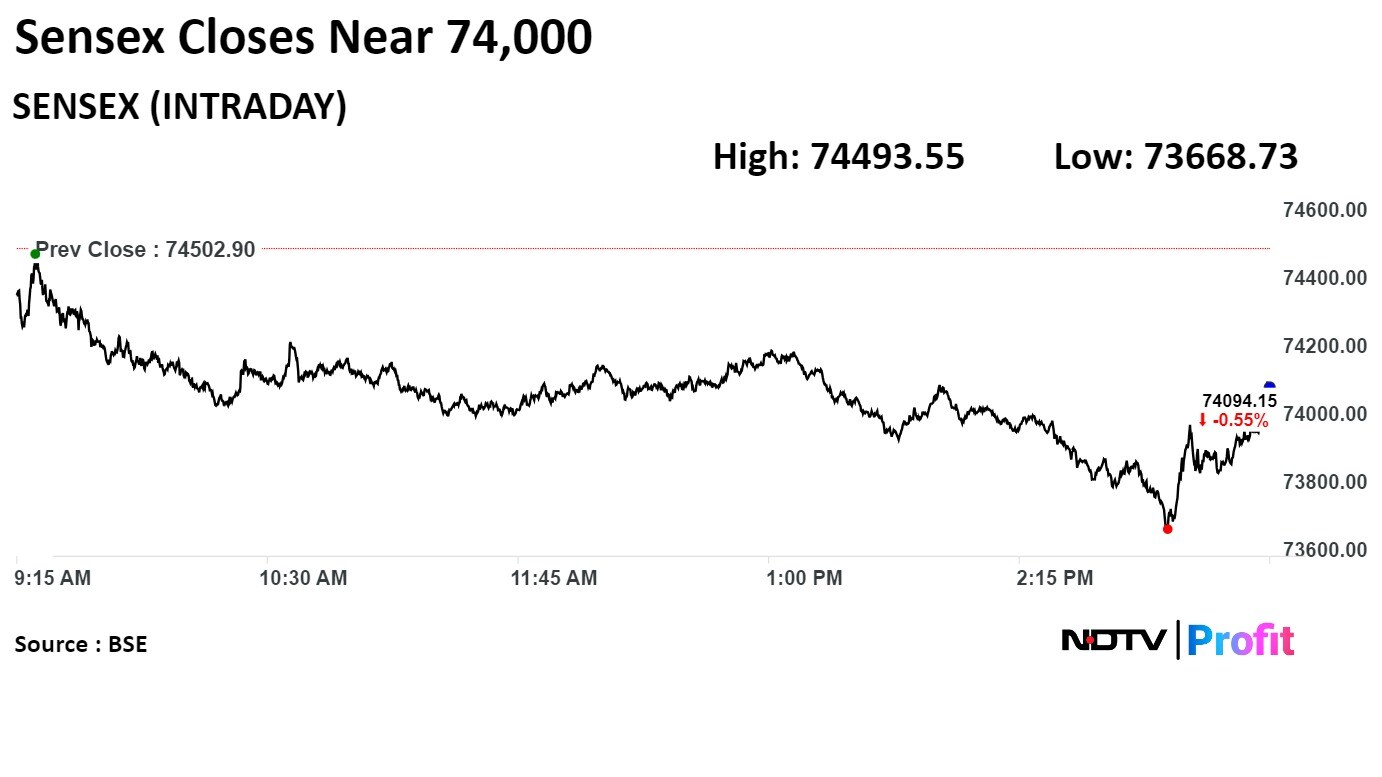

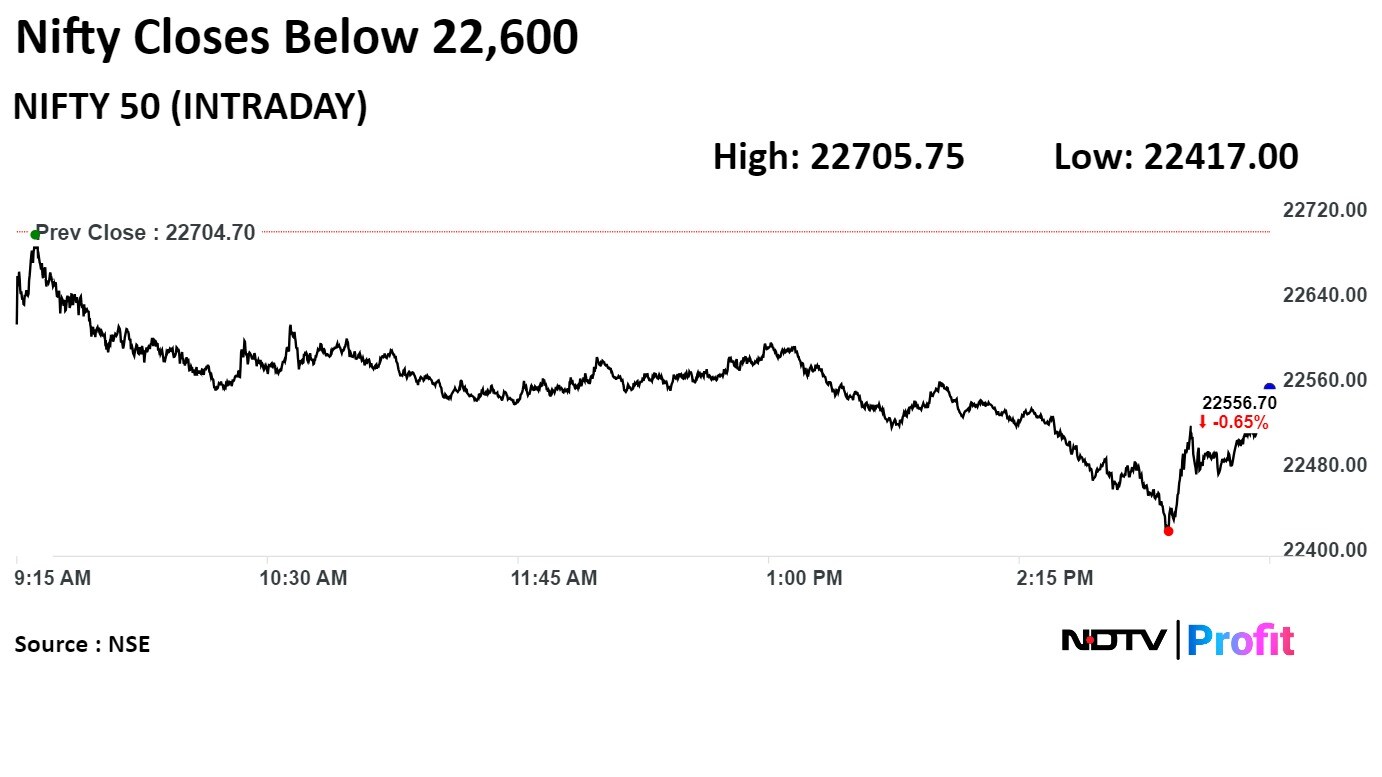

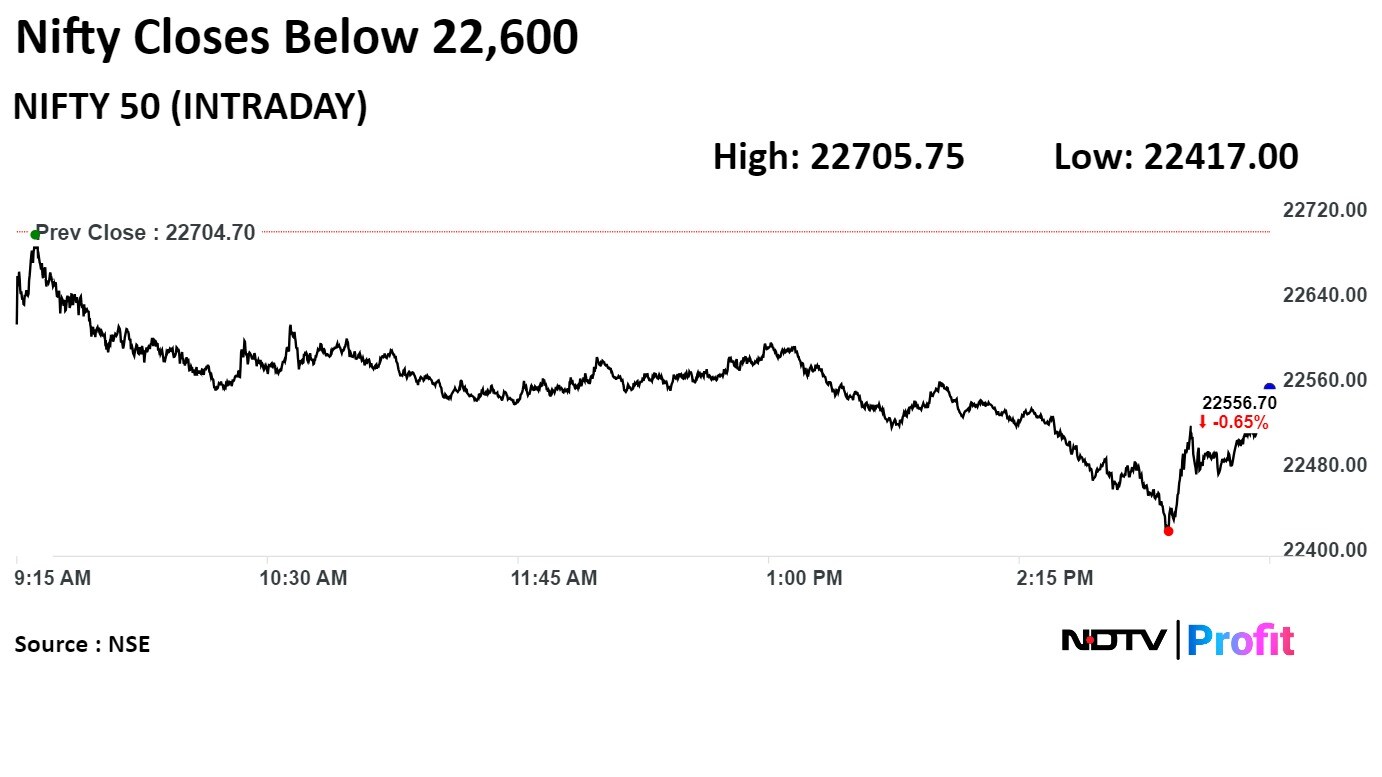

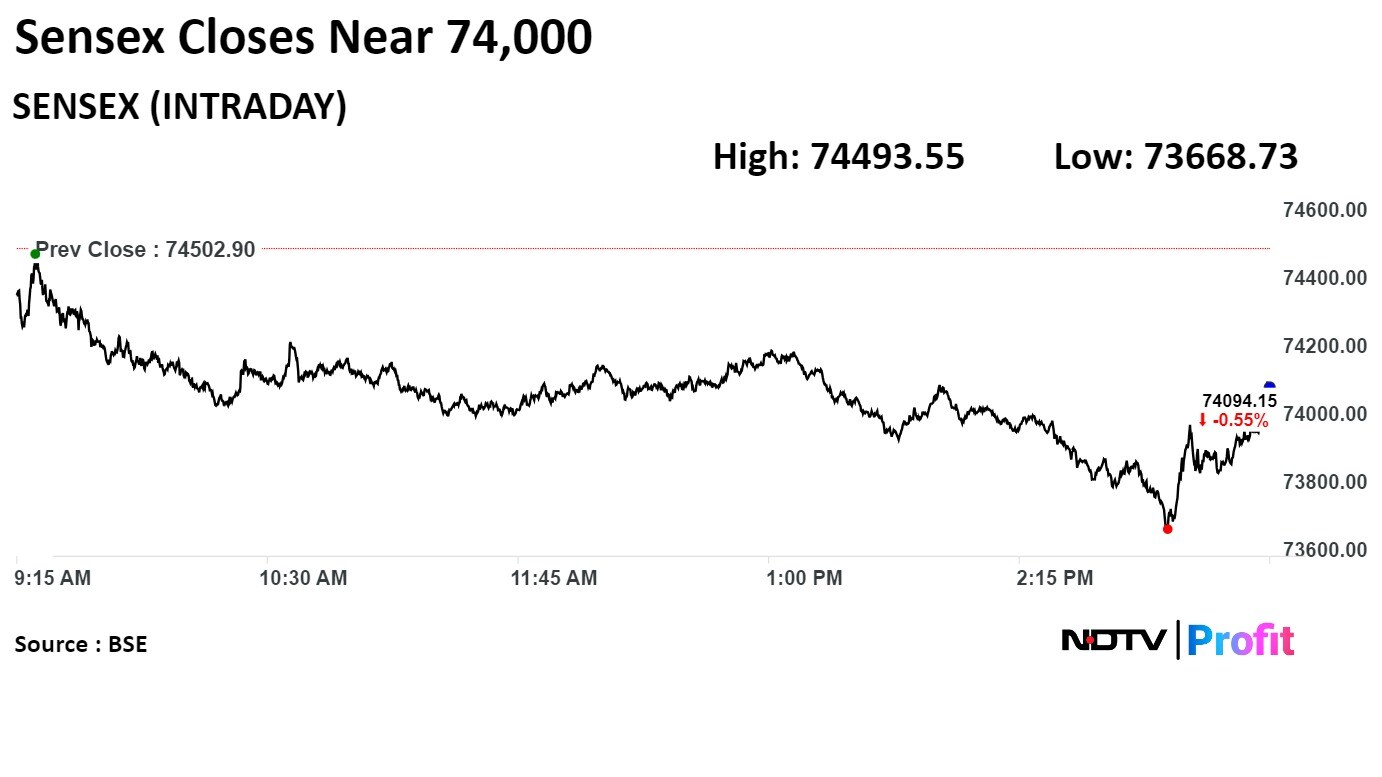

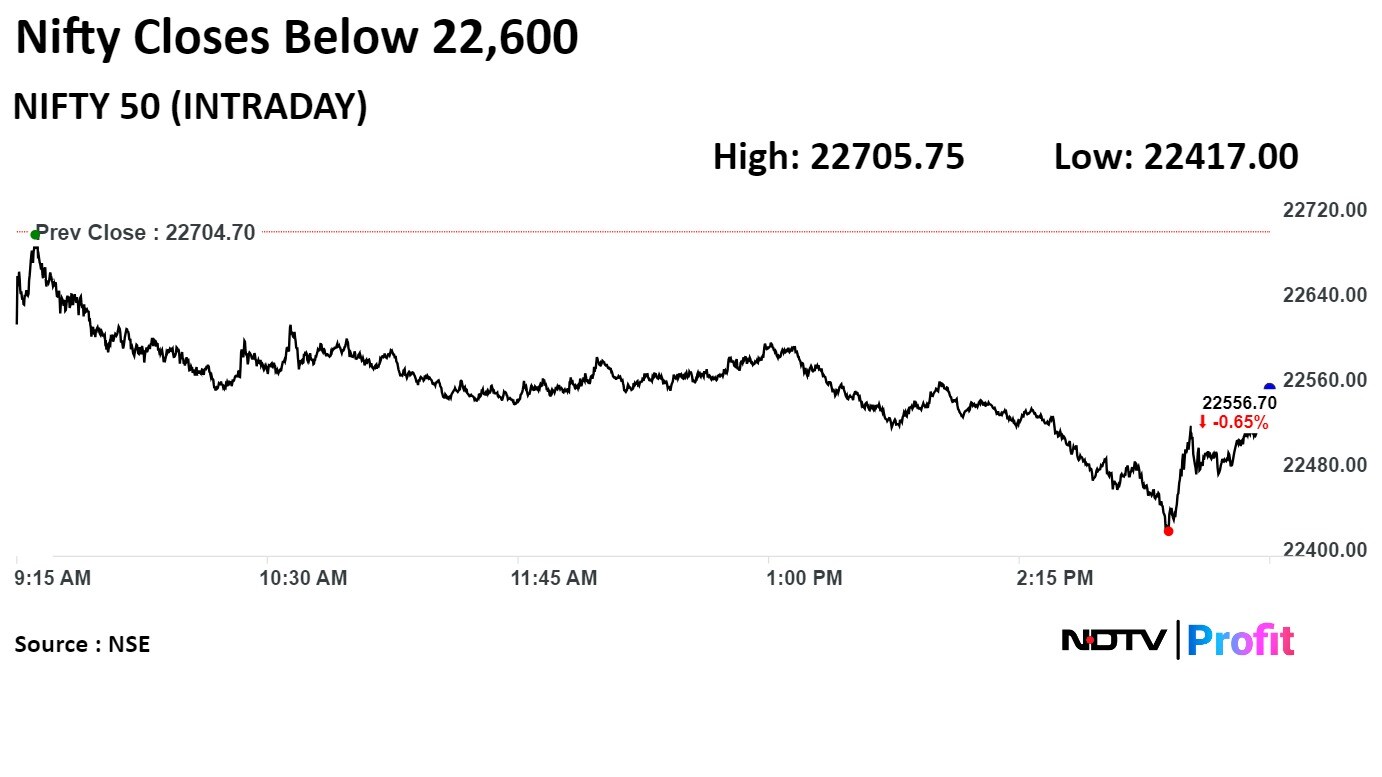

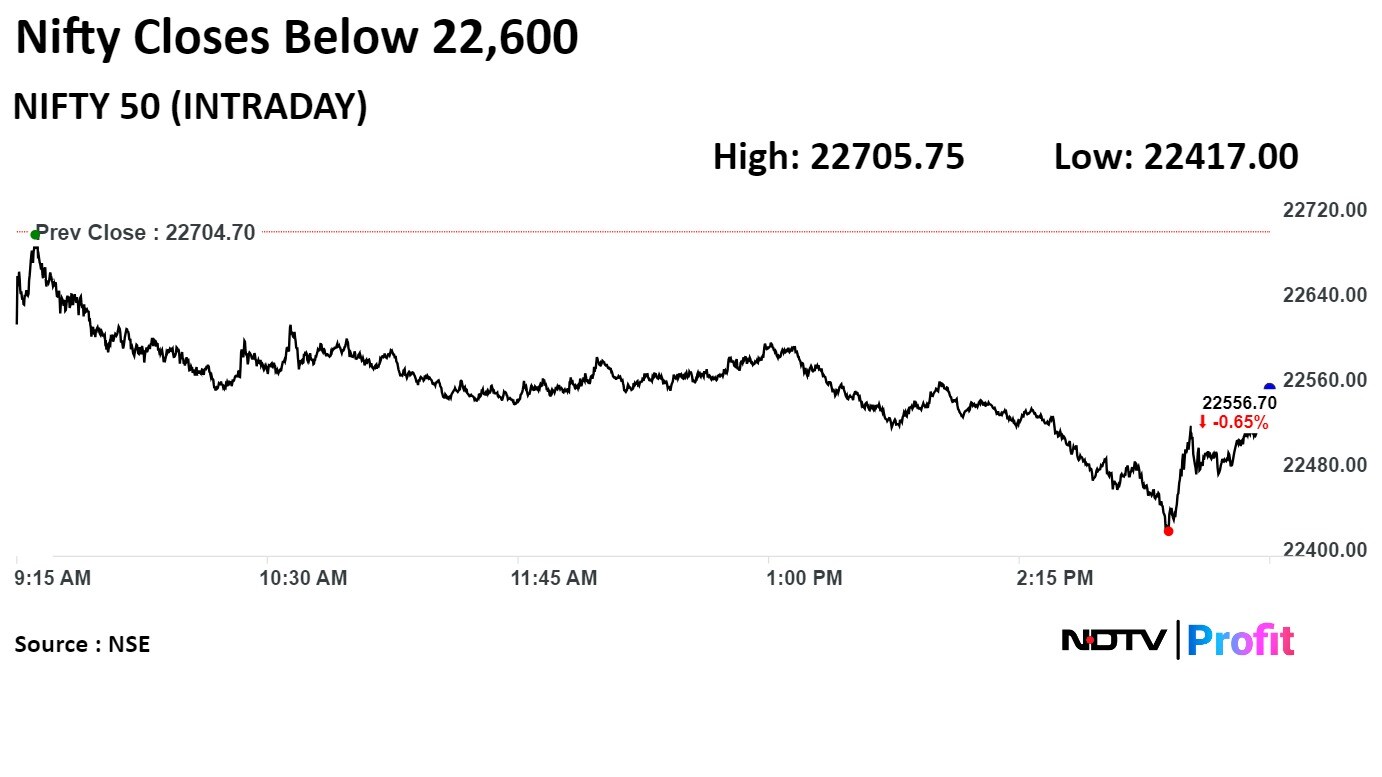

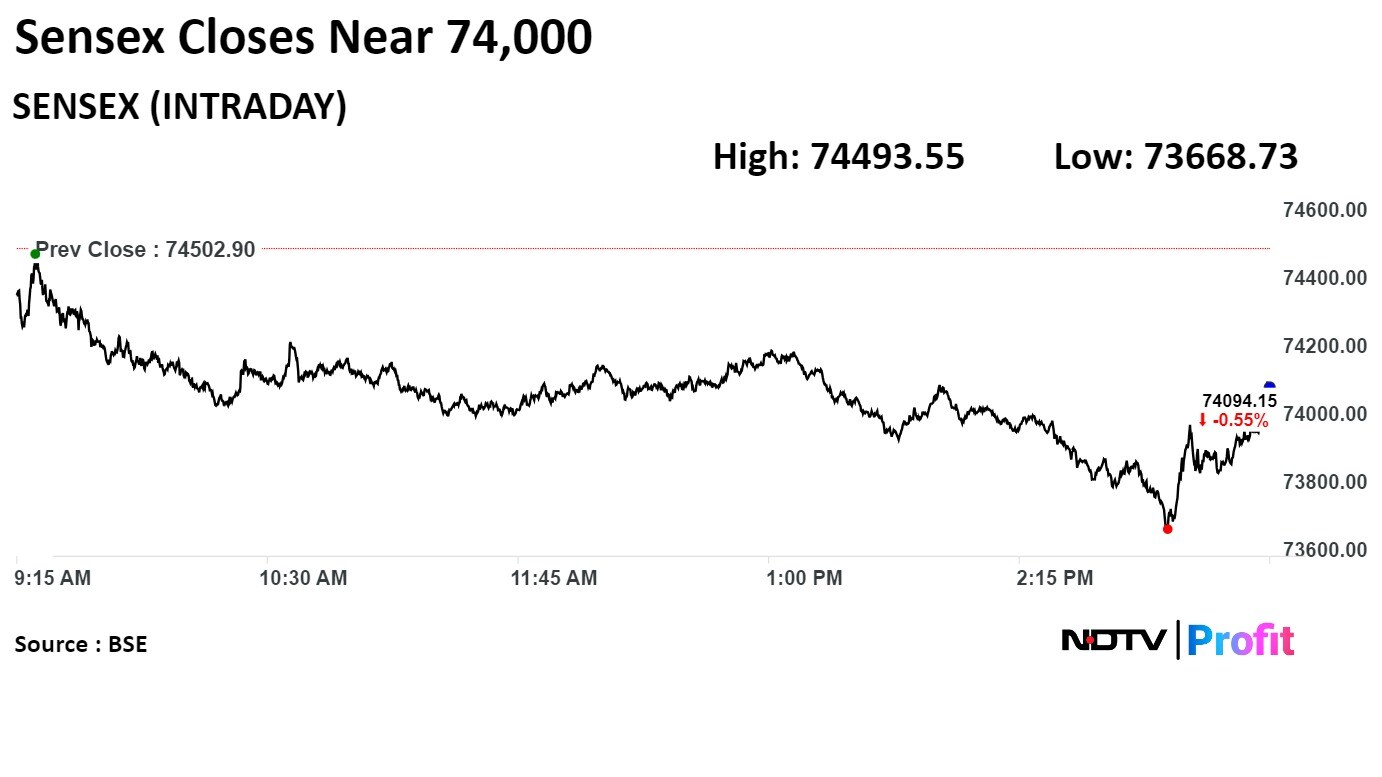

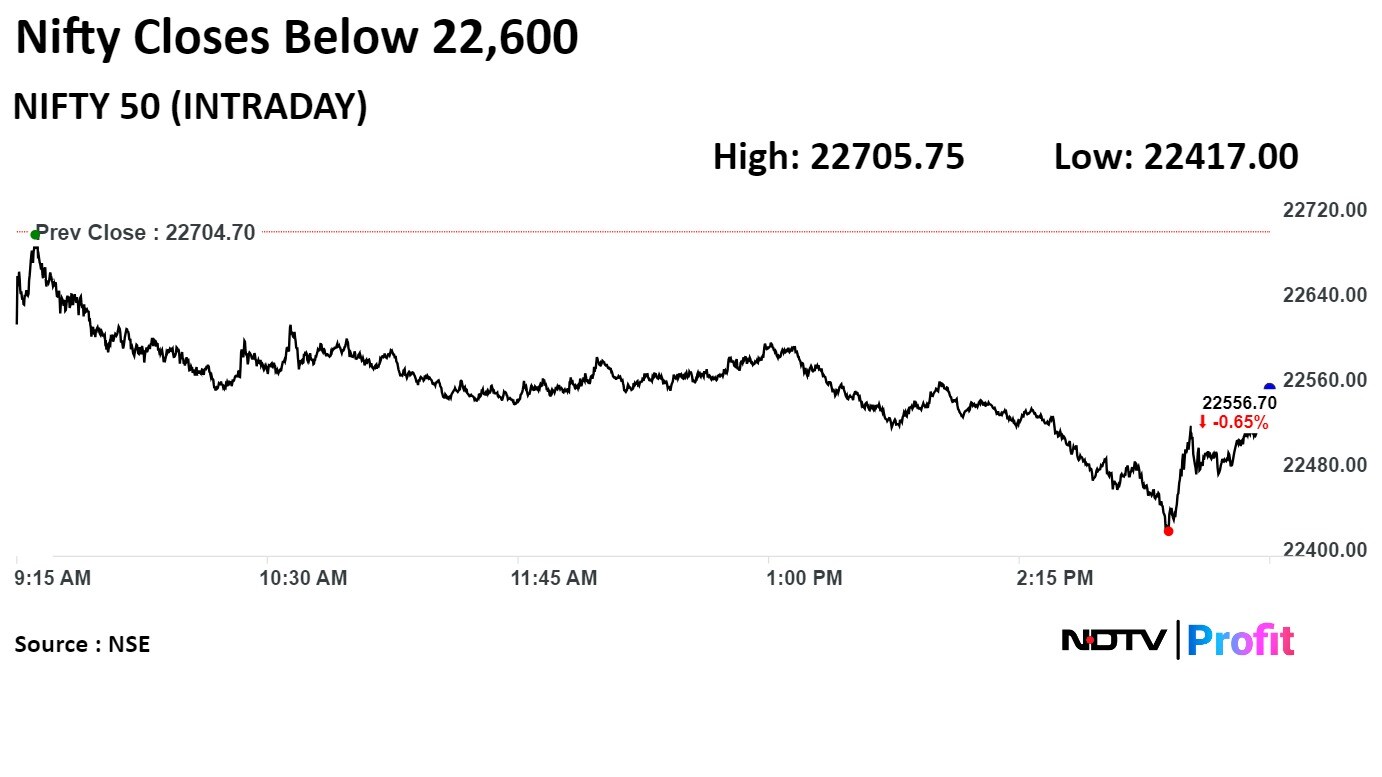

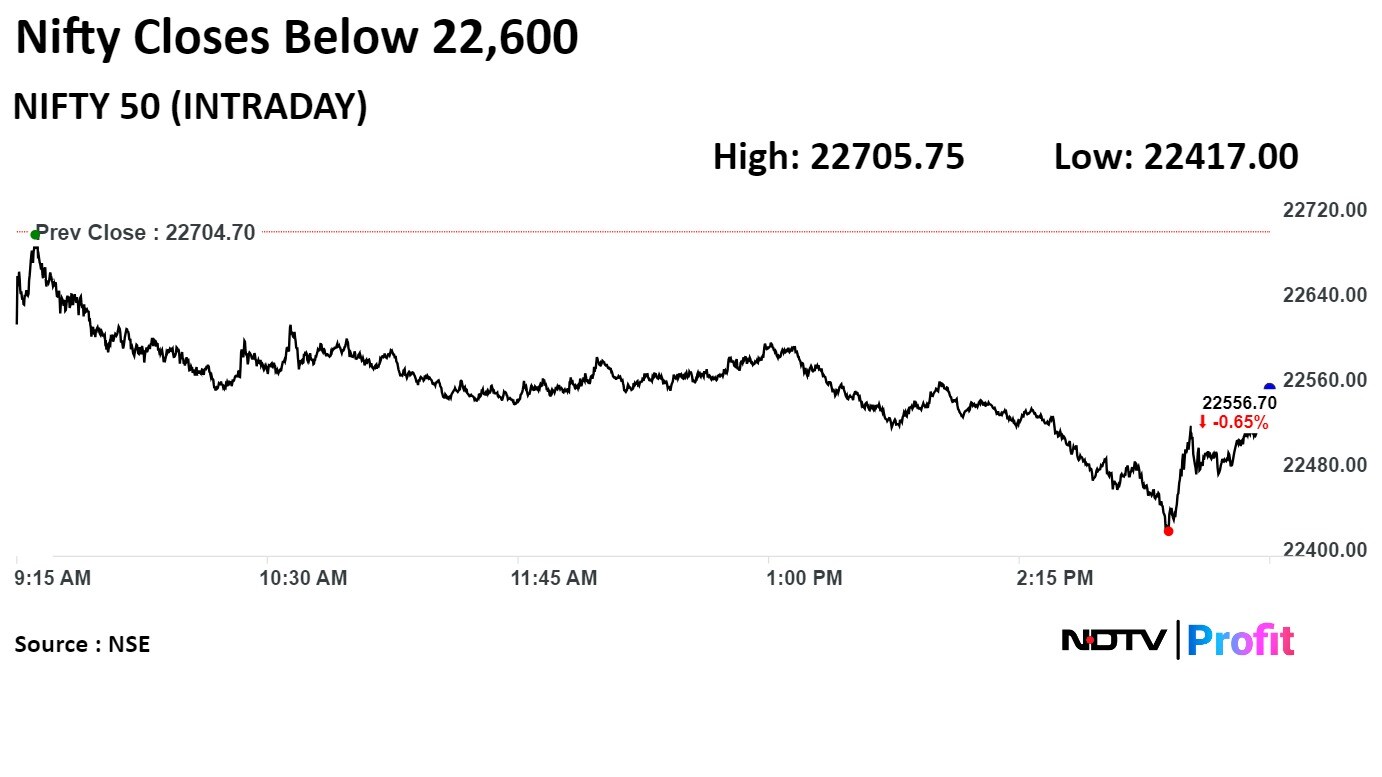

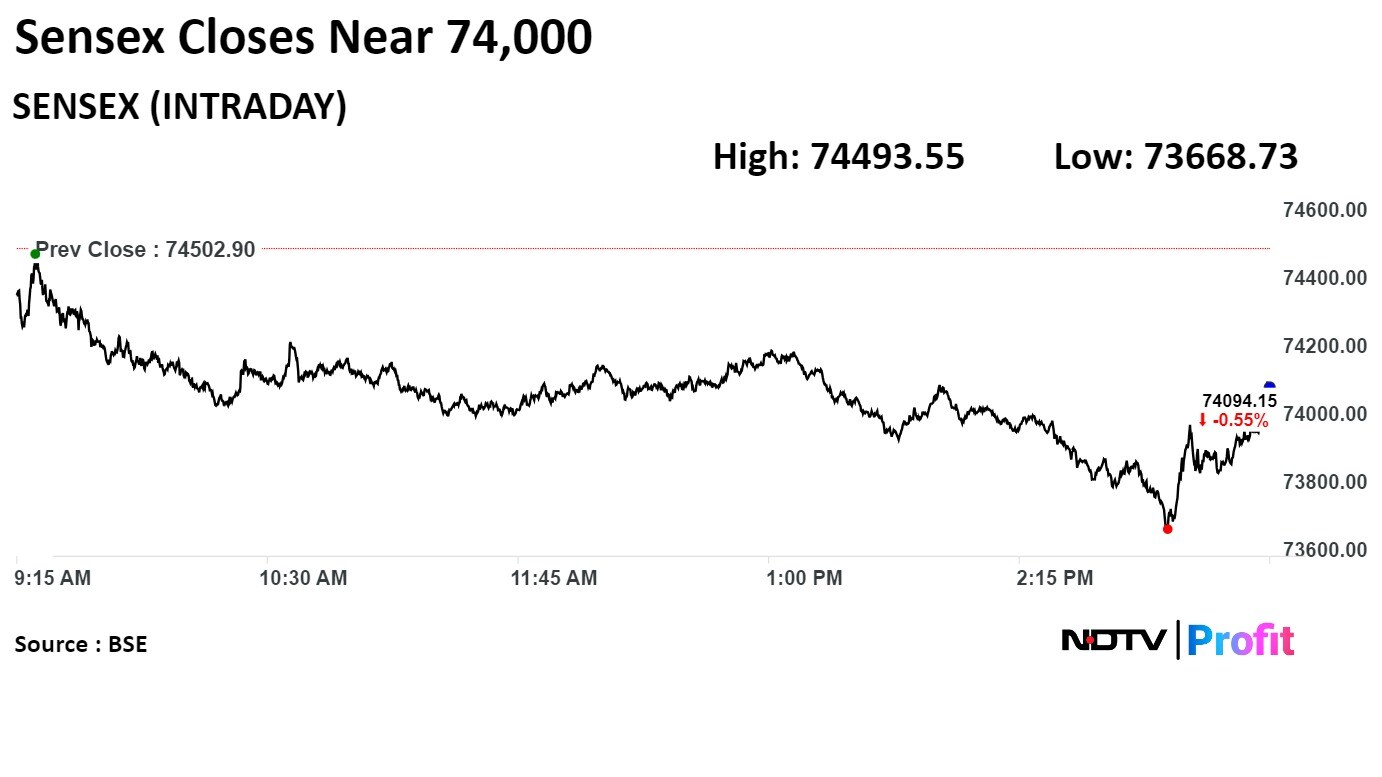

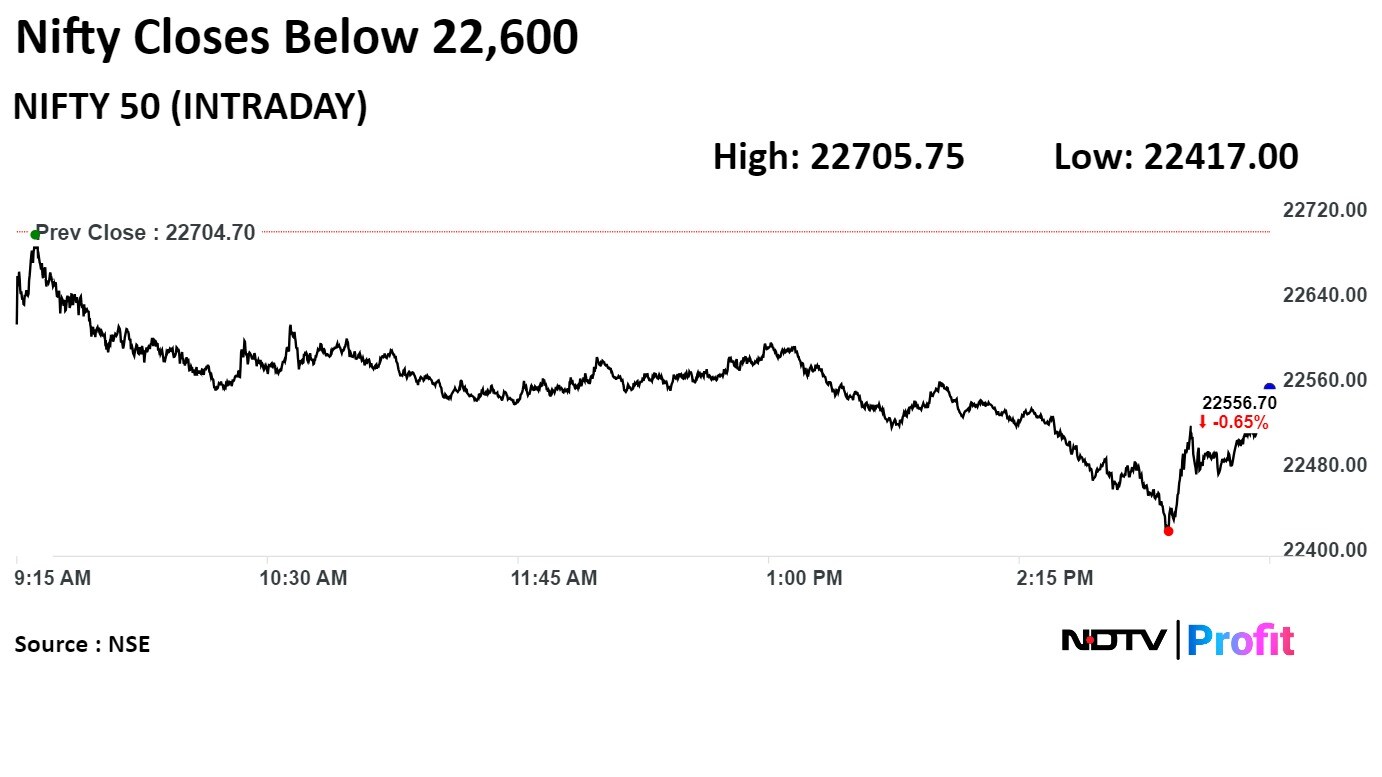

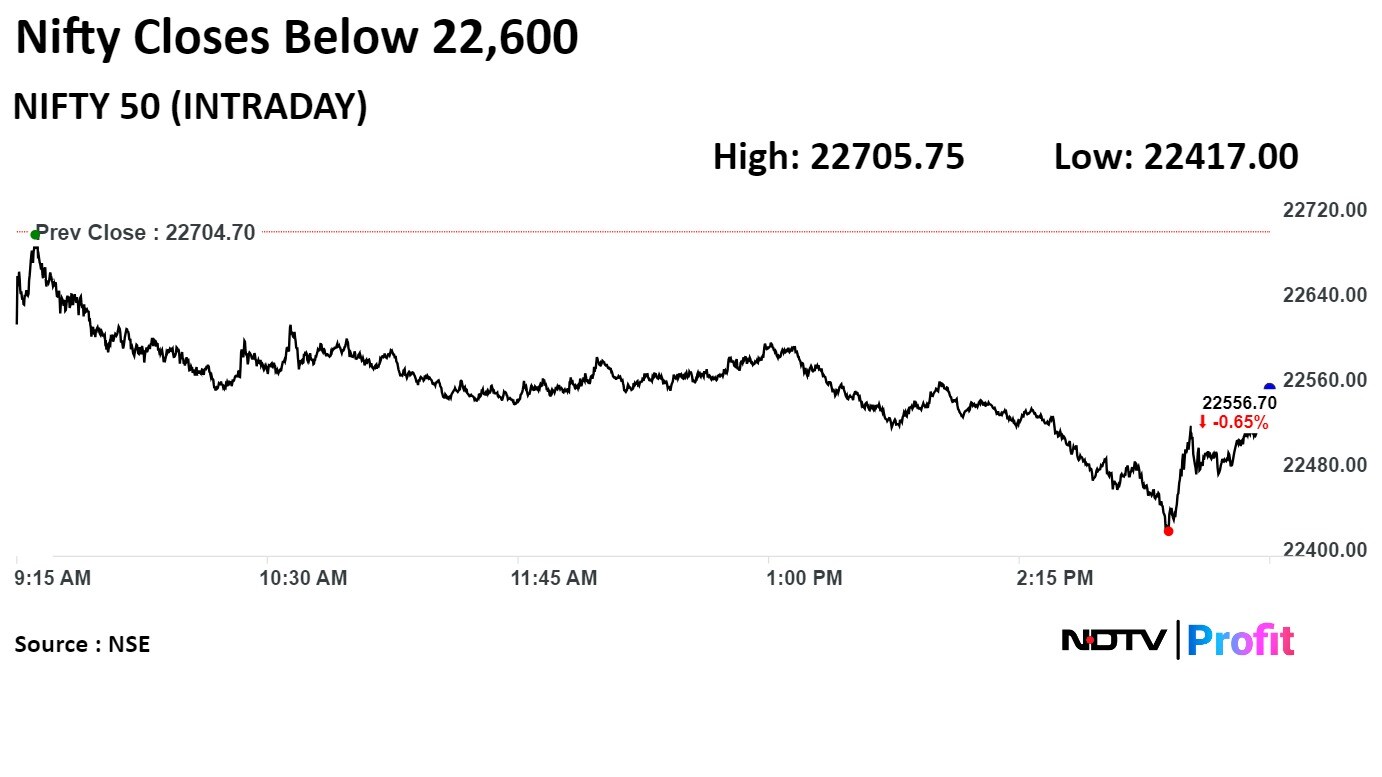

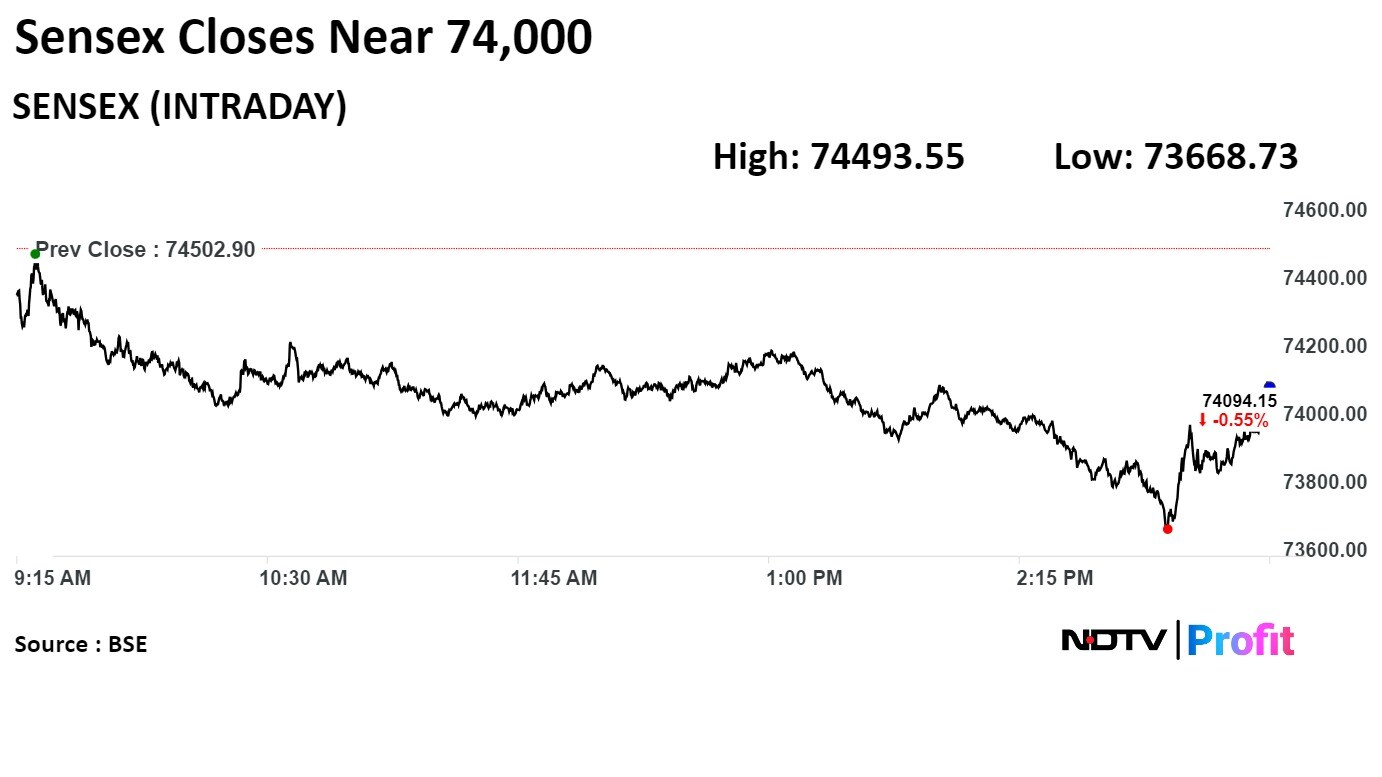

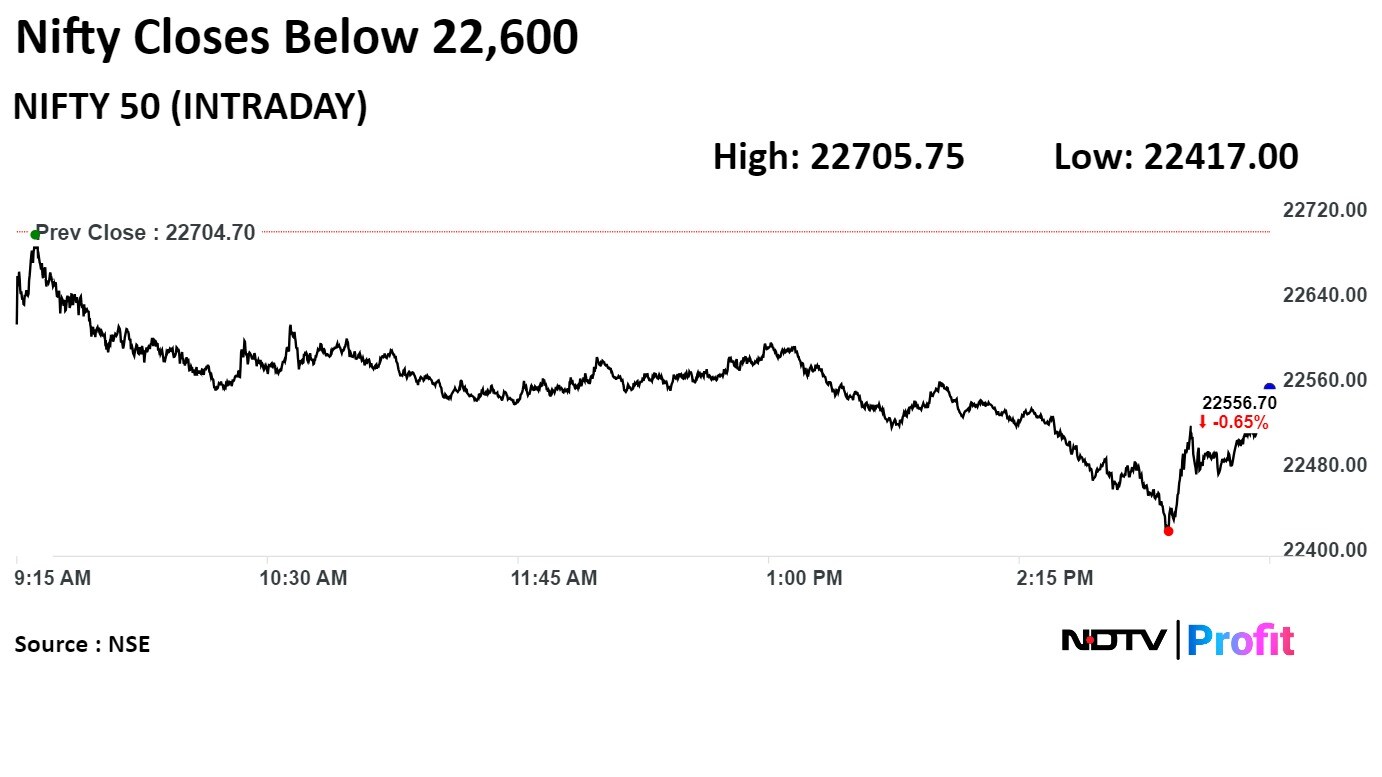

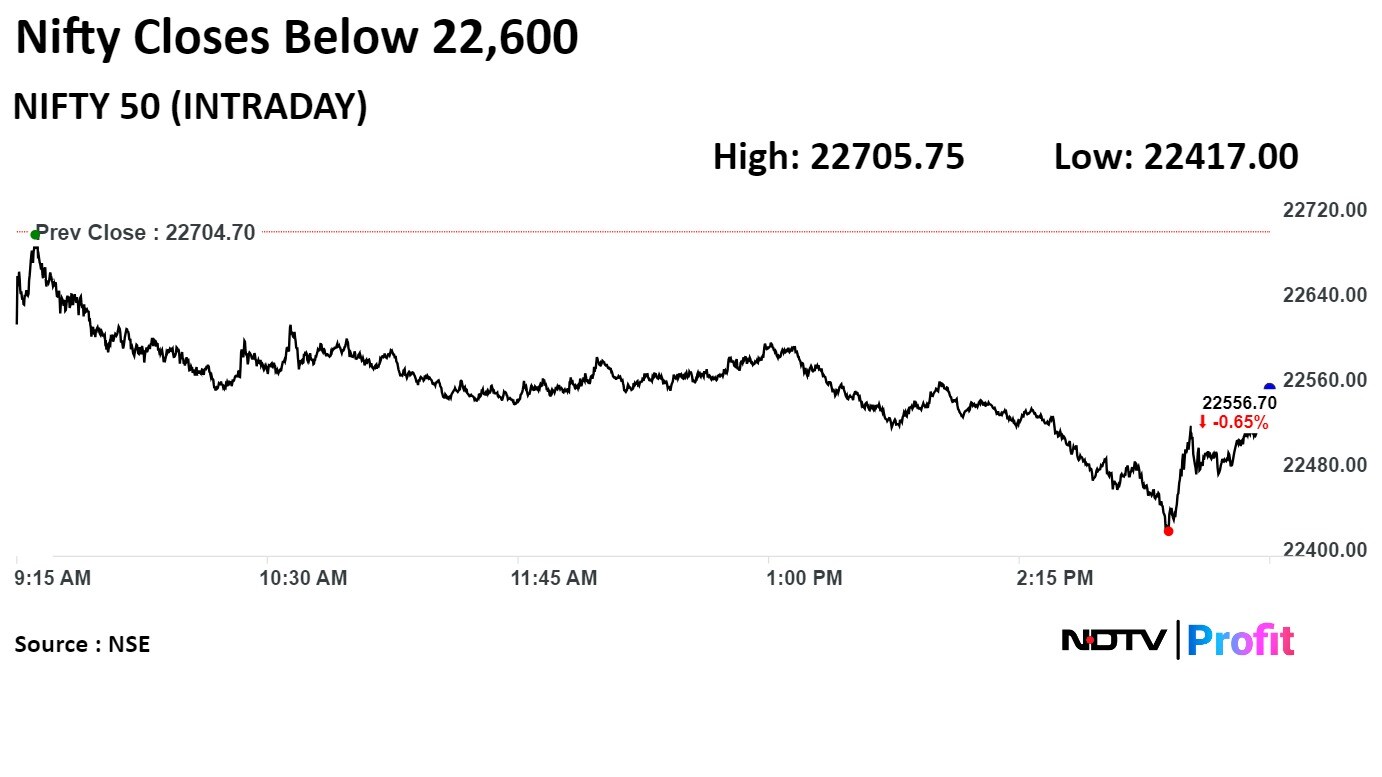

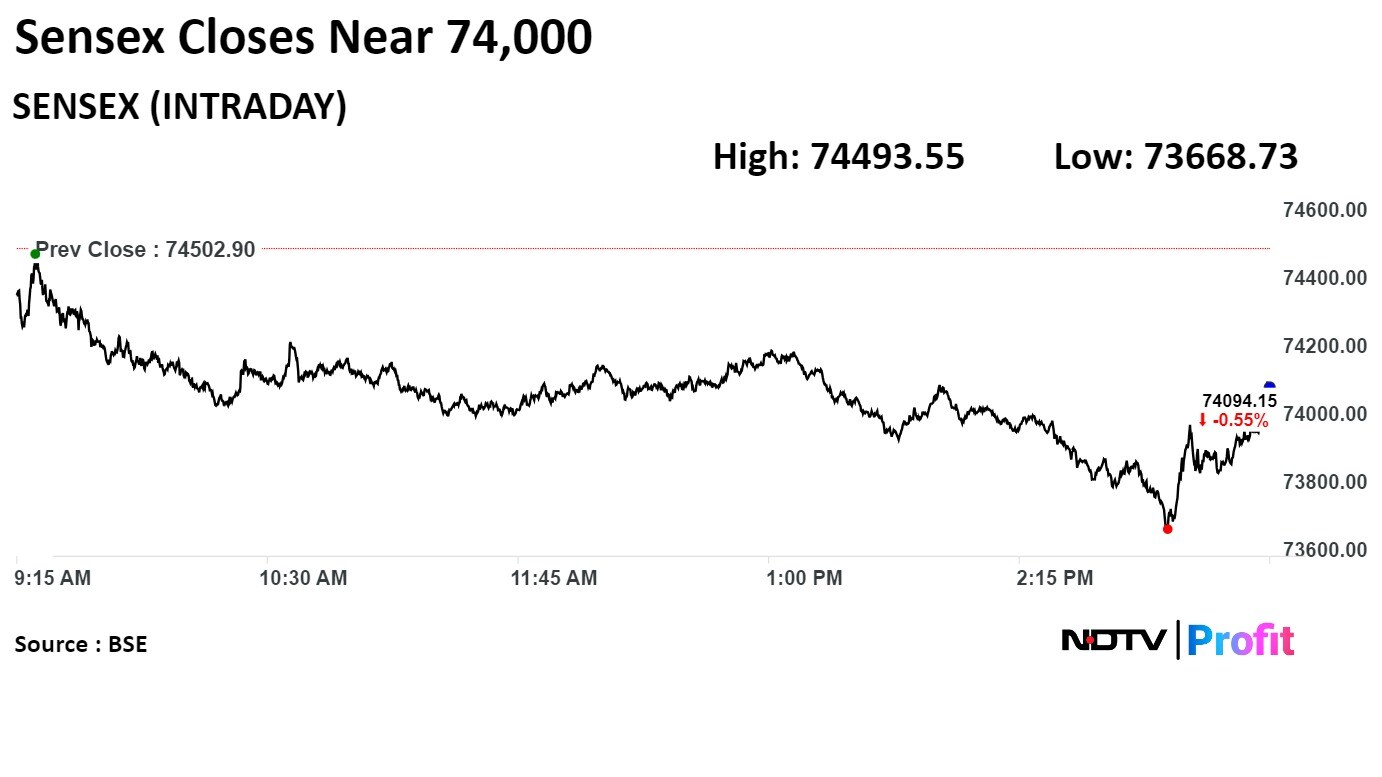

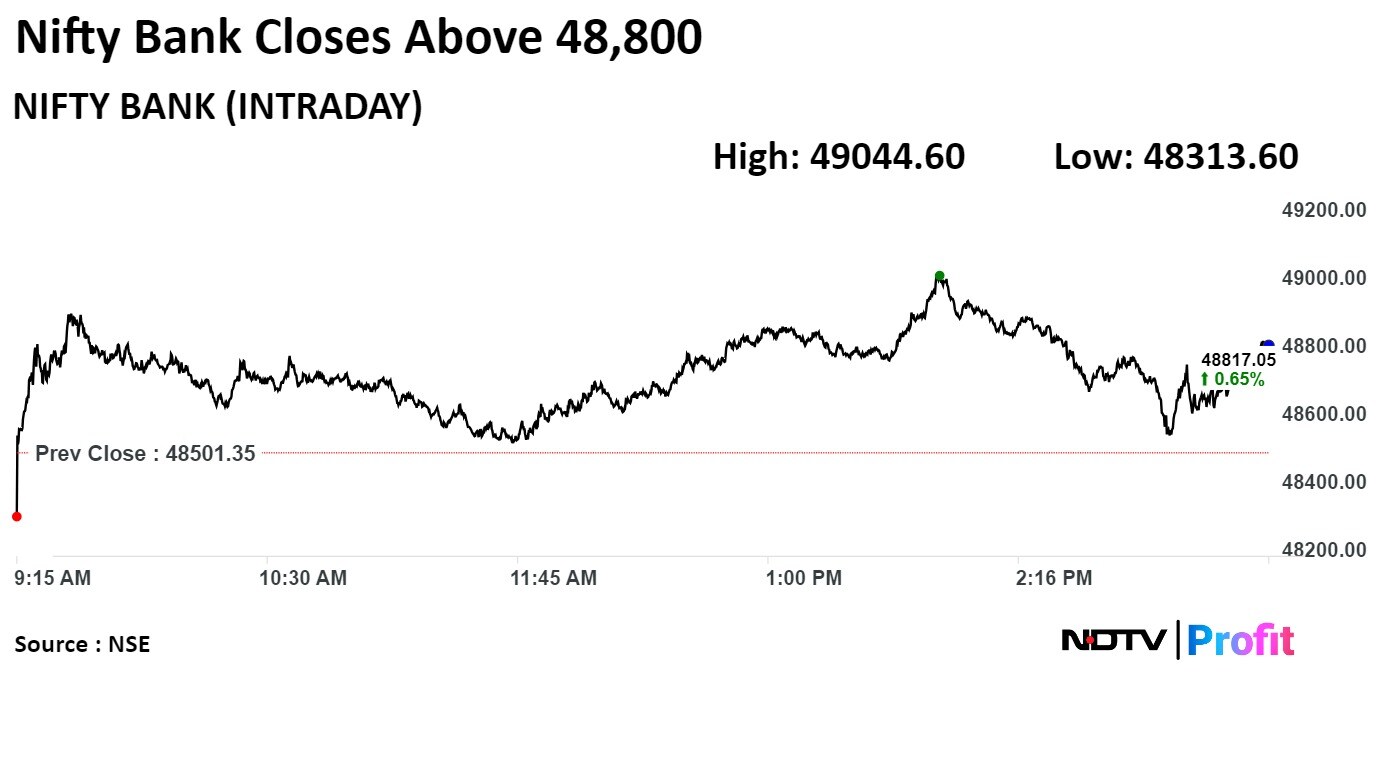

Benchmark equity indices fell for the fifth consecutive session today as heavyweights weighed on them with both the Nifty and the Sensex closing at their lowest level in seven sessions.

The Nifty closed at 22,488.65, down by 216.05 points or 0.95% and the Sensex fell 617.30 points or 0.83% at 73,885.60.

"Bears remained in the driver's seat as Nifty50 began the monthly expiry day lower at 22,650, following the weak global equities," said Aditya Gaggar, director of Progressive Shares. "The immediate support is placed at 22,390 while 22,700 will be considered a strong hurdle."

Benchmark equity indices fell for the fifth consecutive session today as heavyweights weighed on them with both the Nifty and the Sensex closing at their lowest level in seven sessions.

The Nifty closed at 22,488.65, down by 216.05 points or 0.95% and the Sensex fell 617.30 points or 0.83% at 73,885.60.

"Bears remained in the driver's seat as Nifty50 began the monthly expiry day lower at 22,650, following the weak global equities," said Aditya Gaggar, director of Progressive Shares. "The immediate support is placed at 22,390 while 22,700 will be considered a strong hurdle."

Benchmark equity indices fell for the fifth consecutive session today as heavyweights weighed on them with both the Nifty and the Sensex closing at their lowest level in seven sessions.

The Nifty closed at 22,488.65, down by 216.05 points or 0.95% and the Sensex fell 617.30 points or 0.83% at 73,885.60.

"Bears remained in the driver's seat as Nifty50 began the monthly expiry day lower at 22,650, following the weak global equities," said Aditya Gaggar, director of Progressive Shares. "The immediate support is placed at 22,390 while 22,700 will be considered a strong hurdle."

Benchmark equity indices fell for the fifth consecutive session today as heavyweights weighed on them with both the Nifty and the Sensex closing at their lowest level in seven sessions.

The Nifty closed at 22,488.65, down by 216.05 points or 0.95% and the Sensex fell 617.30 points or 0.83% at 73,885.60.

"Bears remained in the driver's seat as Nifty50 began the monthly expiry day lower at 22,650, following the weak global equities," said Aditya Gaggar, director of Progressive Shares. "The immediate support is placed at 22,390 while 22,700 will be considered a strong hurdle."

Benchmark equity indices fell for the fifth consecutive session today as heavyweights weighed on them with both the Nifty and the Sensex closing at their lowest level in seven sessions.

The Nifty closed at 22,488.65, down by 216.05 points or 0.95% and the Sensex fell 617.30 points or 0.83% at 73,885.60.

"Bears remained in the driver's seat as Nifty50 began the monthly expiry day lower at 22,650, following the weak global equities," said Aditya Gaggar, director of Progressive Shares. "The immediate support is placed at 22,390 while 22,700 will be considered a strong hurdle."

Benchmark equity indices fell for the fifth consecutive session today as heavyweights weighed on them with both the Nifty and the Sensex closing at their lowest level in seven sessions.

The Nifty closed at 22,488.65, down by 216.05 points or 0.95% and the Sensex fell 617.30 points or 0.83% at 73,885.60.

"Bears remained in the driver's seat as Nifty50 began the monthly expiry day lower at 22,650, following the weak global equities," said Aditya Gaggar, director of Progressive Shares. "The immediate support is placed at 22,390 while 22,700 will be considered a strong hurdle."

Benchmark equity indices fell for the fifth consecutive session today as heavyweights weighed on them with both the Nifty and the Sensex closing at their lowest level in seven sessions.

The Nifty closed at 22,488.65, down by 216.05 points or 0.95% and the Sensex fell 617.30 points or 0.83% at 73,885.60.

"Bears remained in the driver's seat as Nifty50 began the monthly expiry day lower at 22,650, following the weak global equities," said Aditya Gaggar, director of Progressive Shares. "The immediate support is placed at 22,390 while 22,700 will be considered a strong hurdle."

Benchmark equity indices fell for the fifth consecutive session today as heavyweights weighed on them with both the Nifty and the Sensex closing at their lowest level in seven sessions.

The Nifty closed at 22,488.65, down by 216.05 points or 0.95% and the Sensex fell 617.30 points or 0.83% at 73,885.60.

"Bears remained in the driver's seat as Nifty50 began the monthly expiry day lower at 22,650, following the weak global equities," said Aditya Gaggar, director of Progressive Shares. "The immediate support is placed at 22,390 while 22,700 will be considered a strong hurdle."

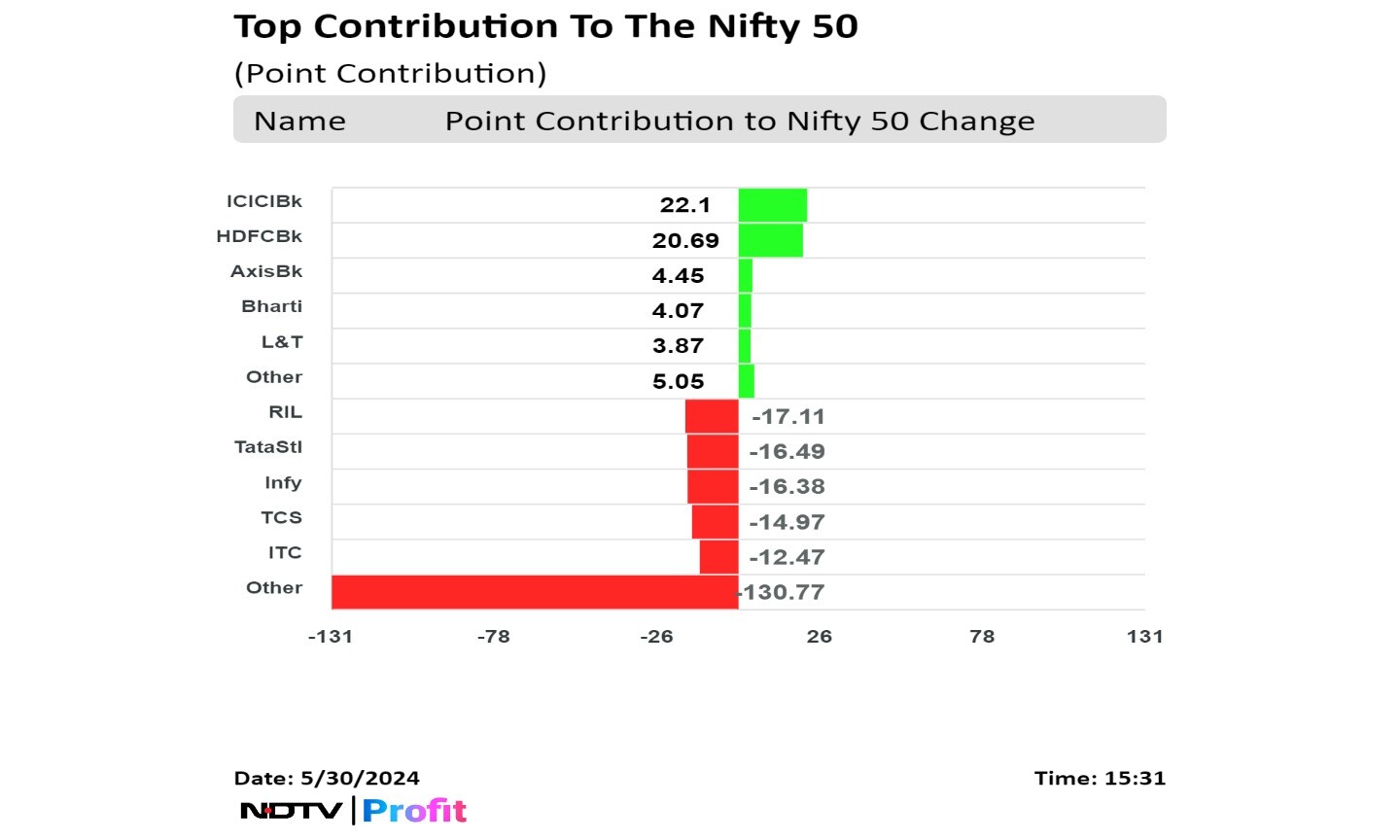

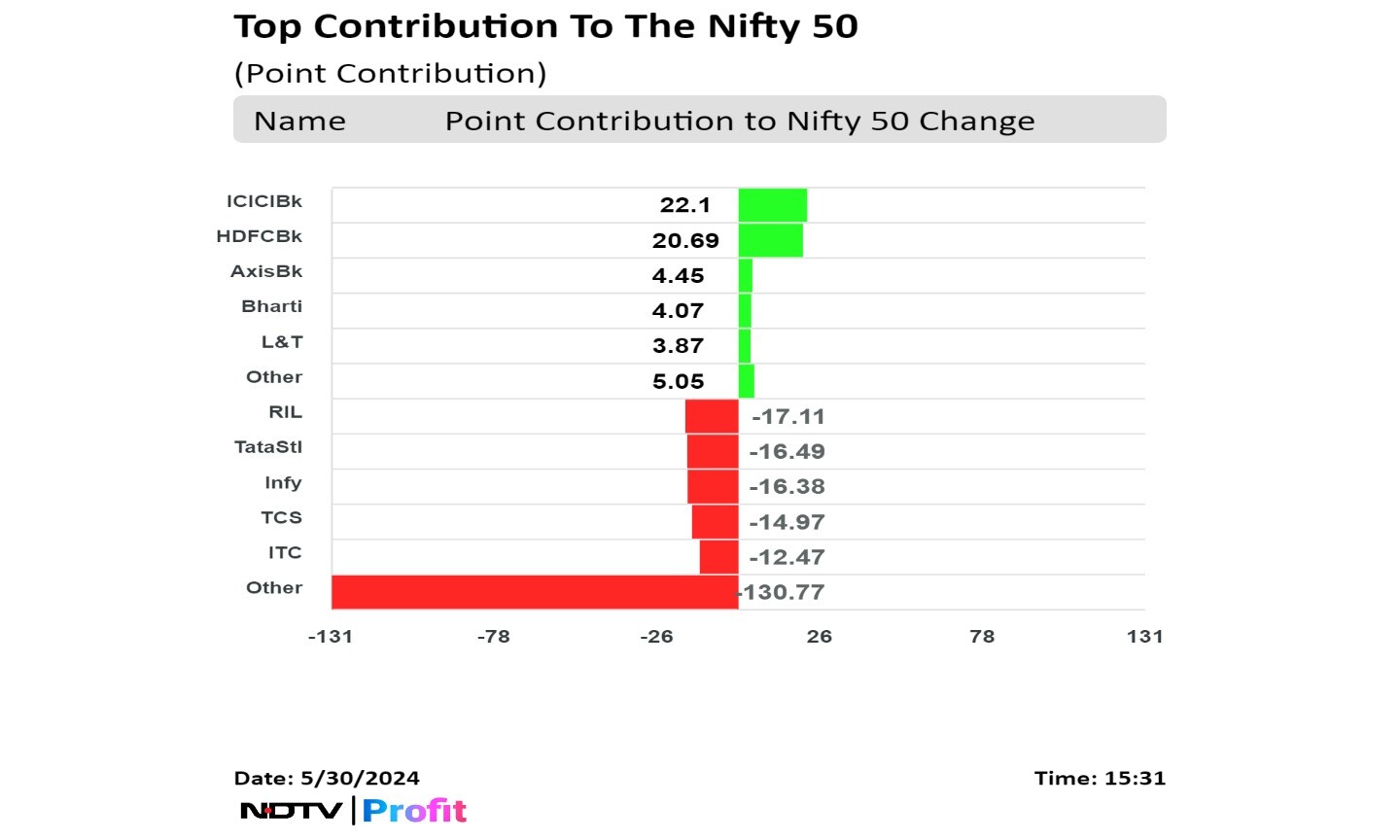

Shares of Reliance Industries Ltd., Tata Steel Ltd., Infosys Ltd., Tata Consultancy Services Ltd., and ITC Ltd. weighed on the Nifty.

While those of ICICI Bank Ltd., HDFC Bank Ltd., Axis Bank Ltd., Bharti Airtel Ltd., and Larsen & Toubro Ltd. cushioned the fall.

Benchmark equity indices fell for the fifth consecutive session today as heavyweights weighed on them with both the Nifty and the Sensex closing at their lowest level in seven sessions.

The Nifty closed at 22,488.65, down by 216.05 points or 0.95% and the Sensex fell 617.30 points or 0.83% at 73,885.60.

"Bears remained in the driver's seat as Nifty50 began the monthly expiry day lower at 22,650, following the weak global equities," said Aditya Gaggar, director of Progressive Shares. "The immediate support is placed at 22,390 while 22,700 will be considered a strong hurdle."

Benchmark equity indices fell for the fifth consecutive session today as heavyweights weighed on them with both the Nifty and the Sensex closing at their lowest level in seven sessions.

The Nifty closed at 22,488.65, down by 216.05 points or 0.95% and the Sensex fell 617.30 points or 0.83% at 73,885.60.

"Bears remained in the driver's seat as Nifty50 began the monthly expiry day lower at 22,650, following the weak global equities," said Aditya Gaggar, director of Progressive Shares. "The immediate support is placed at 22,390 while 22,700 will be considered a strong hurdle."

Benchmark equity indices fell for the fifth consecutive session today as heavyweights weighed on them with both the Nifty and the Sensex closing at their lowest level in seven sessions.

The Nifty closed at 22,488.65, down by 216.05 points or 0.95% and the Sensex fell 617.30 points or 0.83% at 73,885.60.

"Bears remained in the driver's seat as Nifty50 began the monthly expiry day lower at 22,650, following the weak global equities," said Aditya Gaggar, director of Progressive Shares. "The immediate support is placed at 22,390 while 22,700 will be considered a strong hurdle."

Benchmark equity indices fell for the fifth consecutive session today as heavyweights weighed on them with both the Nifty and the Sensex closing at their lowest level in seven sessions.

The Nifty closed at 22,488.65, down by 216.05 points or 0.95% and the Sensex fell 617.30 points or 0.83% at 73,885.60.

"Bears remained in the driver's seat as Nifty50 began the monthly expiry day lower at 22,650, following the weak global equities," said Aditya Gaggar, director of Progressive Shares. "The immediate support is placed at 22,390 while 22,700 will be considered a strong hurdle."

Benchmark equity indices fell for the fifth consecutive session today as heavyweights weighed on them with both the Nifty and the Sensex closing at their lowest level in seven sessions.

The Nifty closed at 22,488.65, down by 216.05 points or 0.95% and the Sensex fell 617.30 points or 0.83% at 73,885.60.

"Bears remained in the driver's seat as Nifty50 began the monthly expiry day lower at 22,650, following the weak global equities," said Aditya Gaggar, director of Progressive Shares. "The immediate support is placed at 22,390 while 22,700 will be considered a strong hurdle."

Benchmark equity indices fell for the fifth consecutive session today as heavyweights weighed on them with both the Nifty and the Sensex closing at their lowest level in seven sessions.

The Nifty closed at 22,488.65, down by 216.05 points or 0.95% and the Sensex fell 617.30 points or 0.83% at 73,885.60.

"Bears remained in the driver's seat as Nifty50 began the monthly expiry day lower at 22,650, following the weak global equities," said Aditya Gaggar, director of Progressive Shares. "The immediate support is placed at 22,390 while 22,700 will be considered a strong hurdle."

Benchmark equity indices fell for the fifth consecutive session today as heavyweights weighed on them with both the Nifty and the Sensex closing at their lowest level in seven sessions.

The Nifty closed at 22,488.65, down by 216.05 points or 0.95% and the Sensex fell 617.30 points or 0.83% at 73,885.60.

"Bears remained in the driver's seat as Nifty50 began the monthly expiry day lower at 22,650, following the weak global equities," said Aditya Gaggar, director of Progressive Shares. "The immediate support is placed at 22,390 while 22,700 will be considered a strong hurdle."

Benchmark equity indices fell for the fifth consecutive session today as heavyweights weighed on them with both the Nifty and the Sensex closing at their lowest level in seven sessions.

The Nifty closed at 22,488.65, down by 216.05 points or 0.95% and the Sensex fell 617.30 points or 0.83% at 73,885.60.

"Bears remained in the driver's seat as Nifty50 began the monthly expiry day lower at 22,650, following the weak global equities," said Aditya Gaggar, director of Progressive Shares. "The immediate support is placed at 22,390 while 22,700 will be considered a strong hurdle."

Shares of Reliance Industries Ltd., Tata Steel Ltd., Infosys Ltd., Tata Consultancy Services Ltd., and ITC Ltd. weighed on the Nifty.

While those of ICICI Bank Ltd., HDFC Bank Ltd., Axis Bank Ltd., Bharti Airtel Ltd., and Larsen & Toubro Ltd. cushioned the fall.

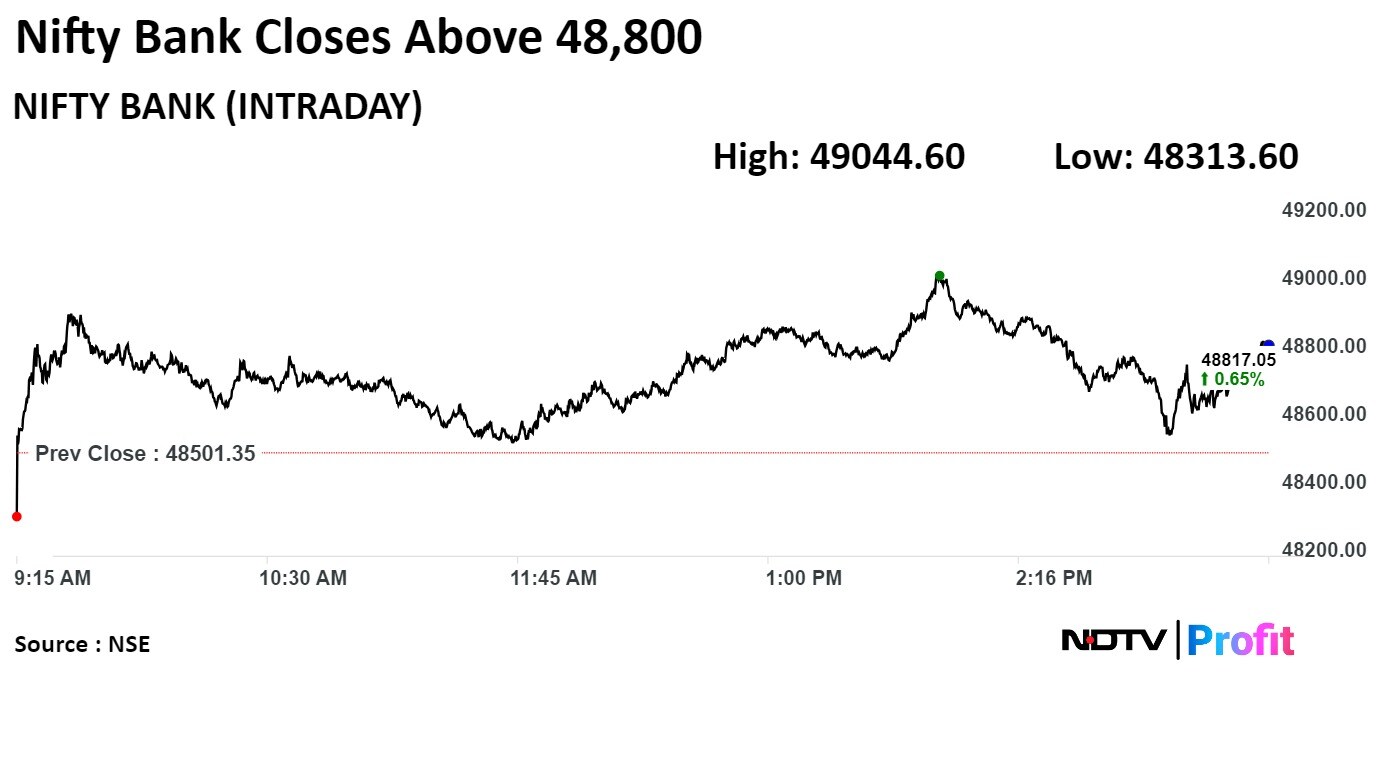

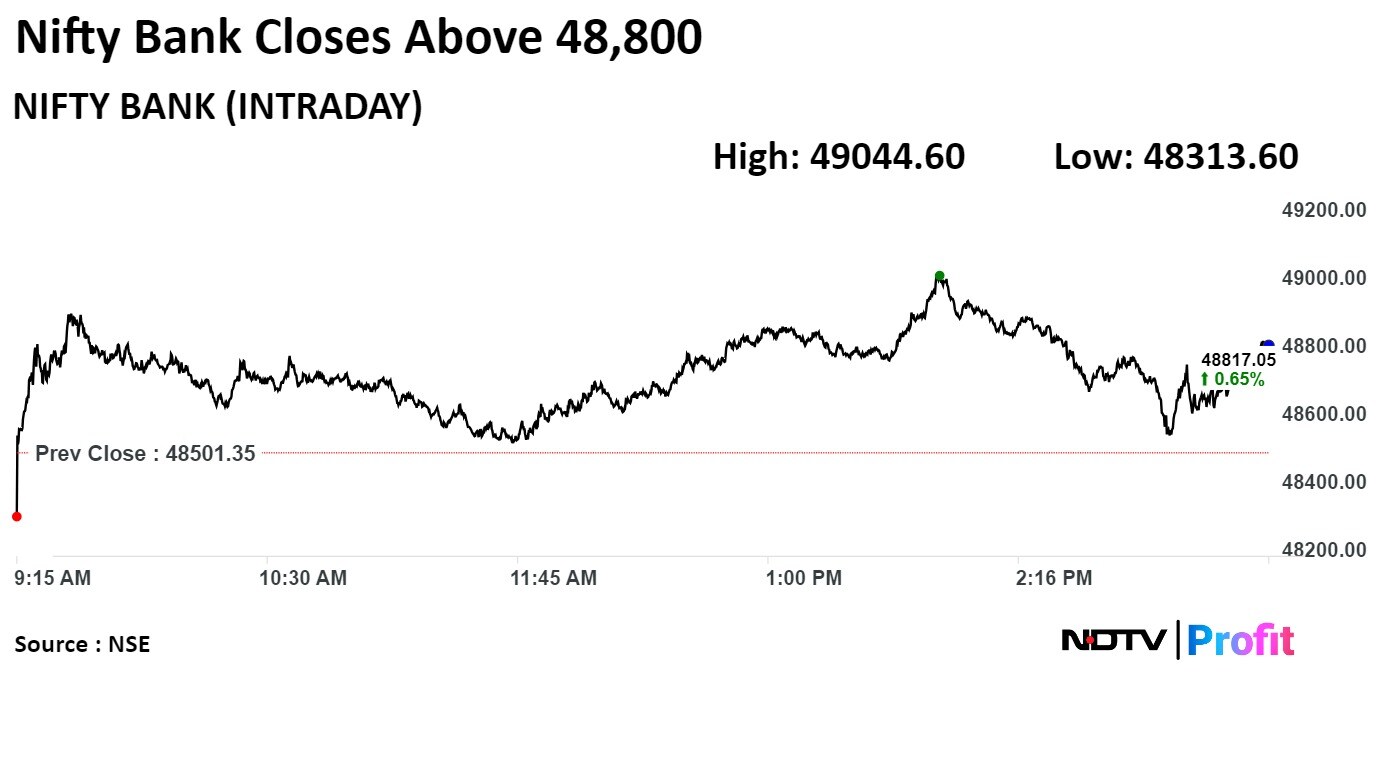

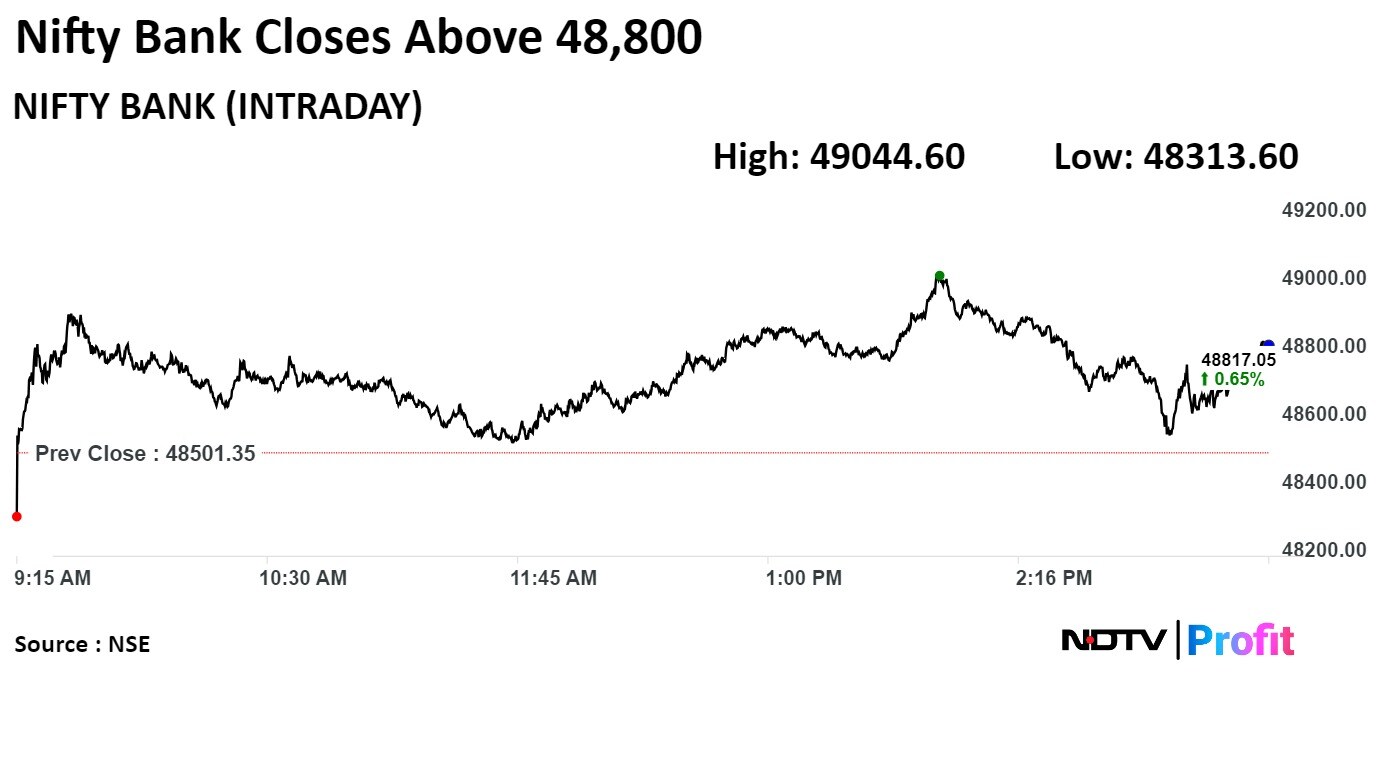

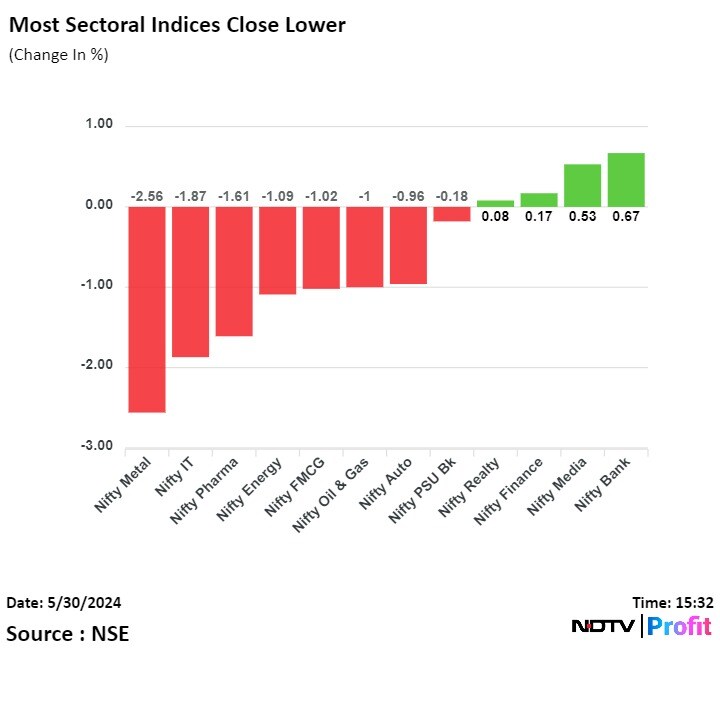

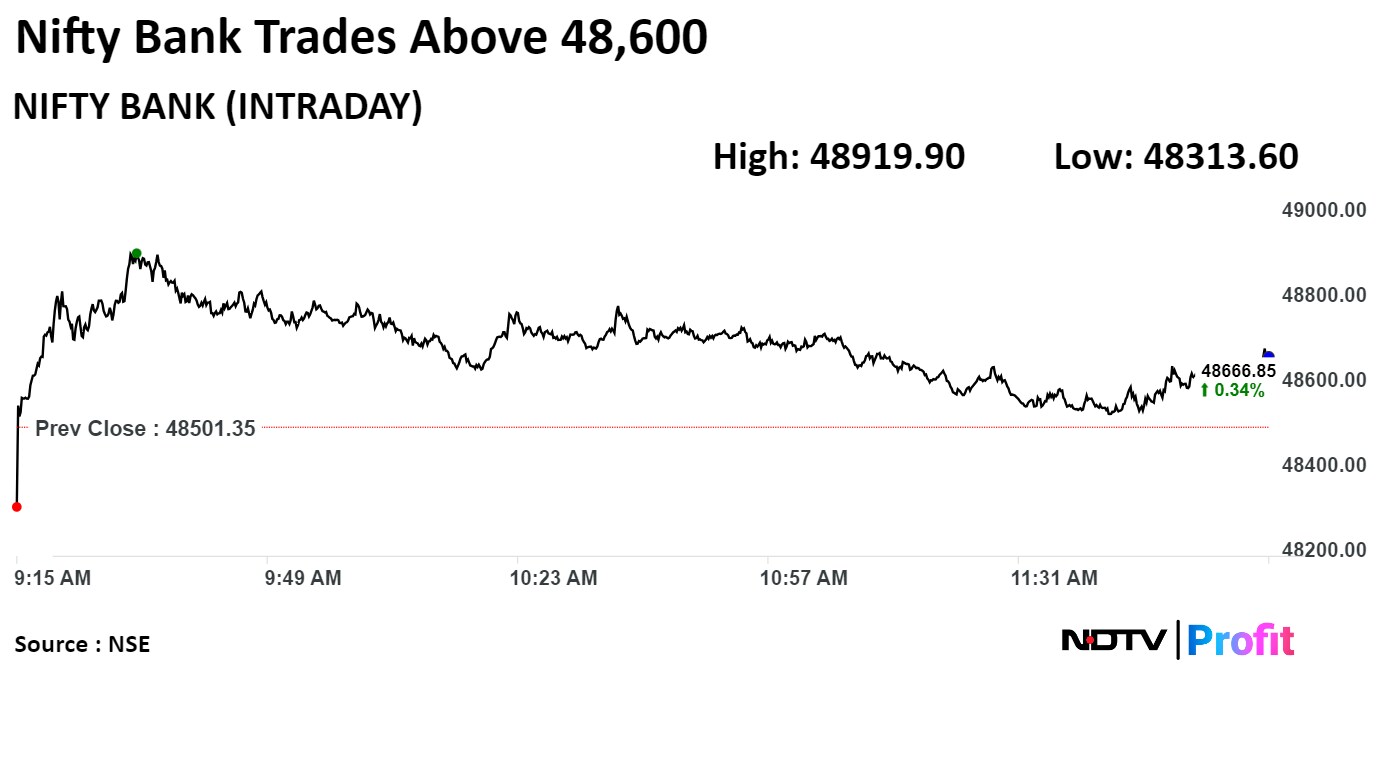

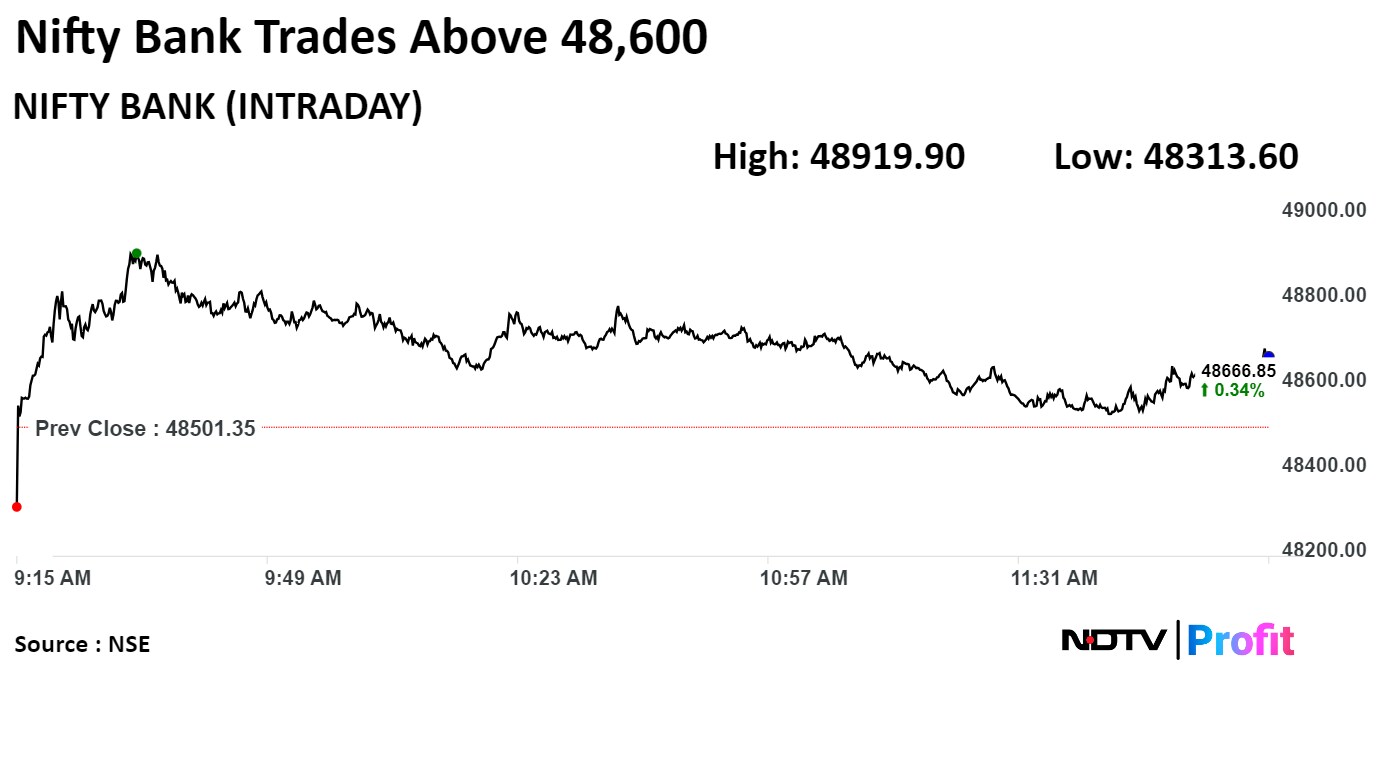

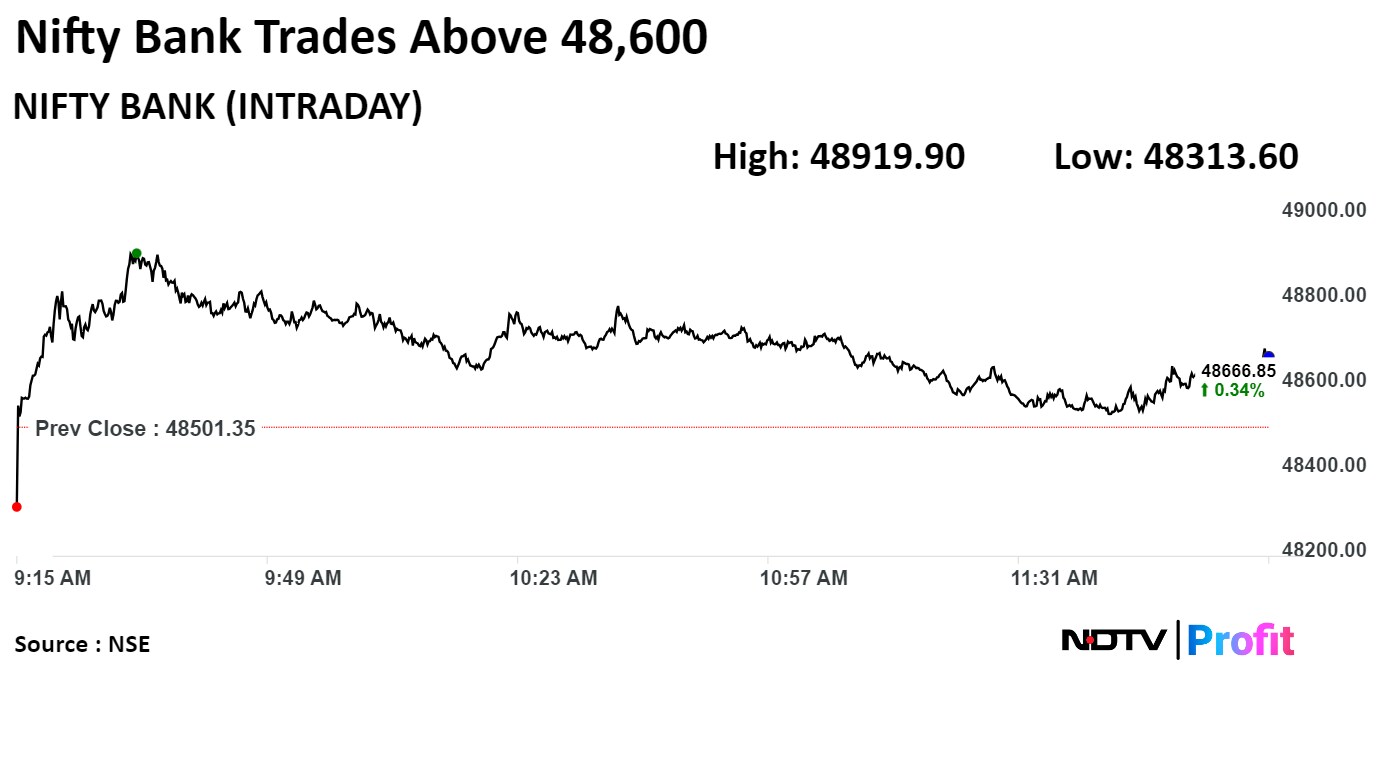

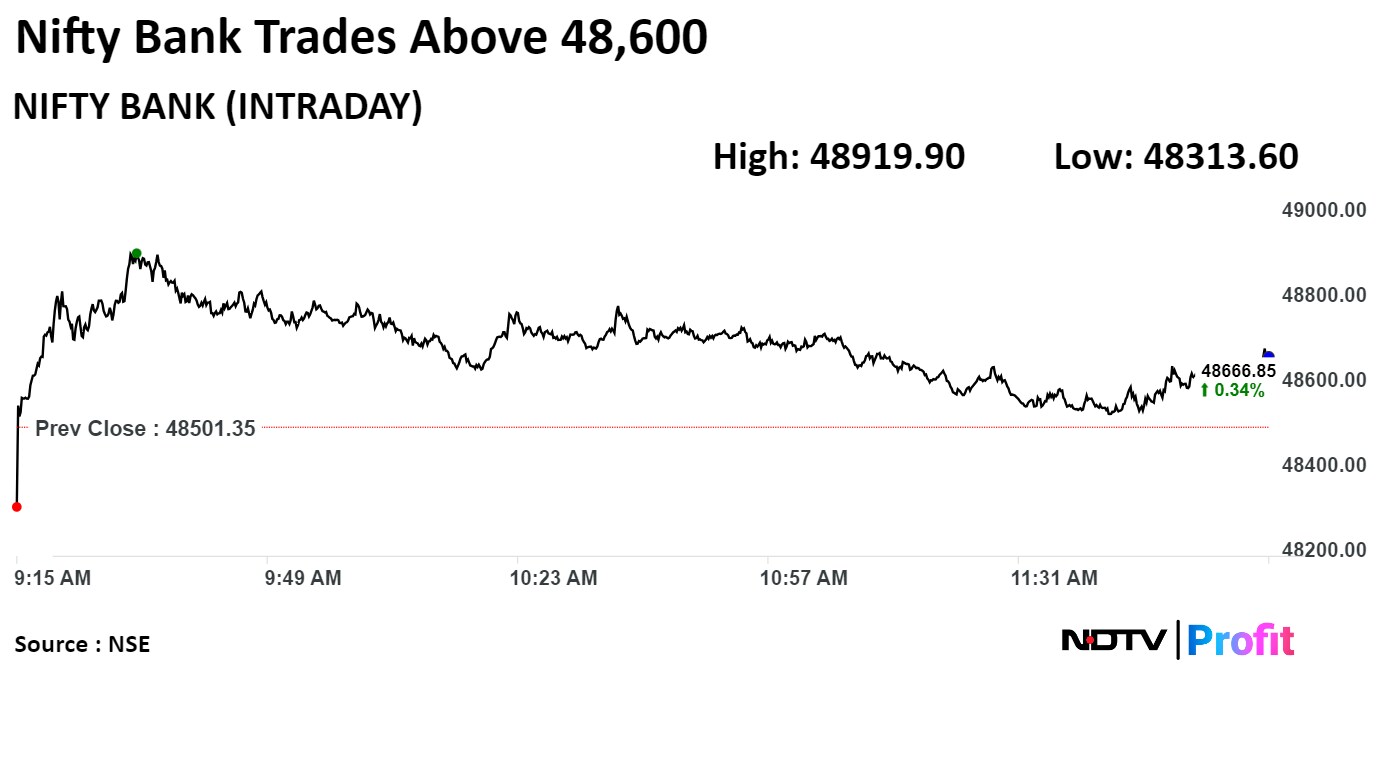

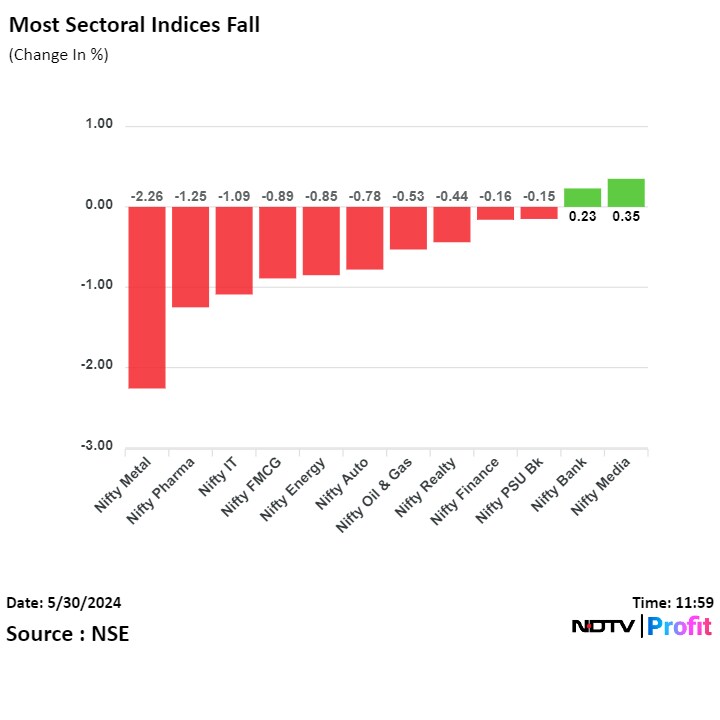

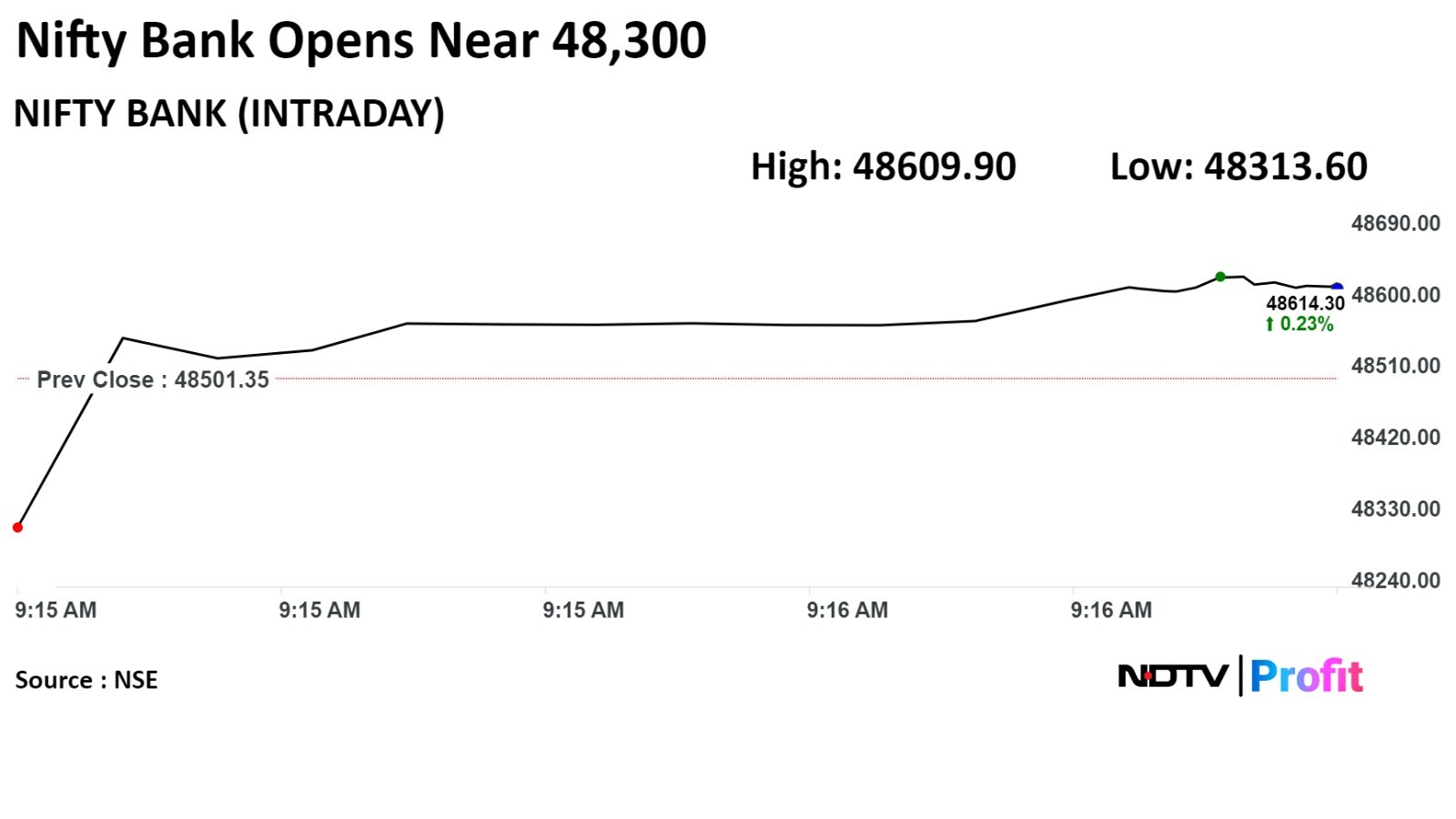

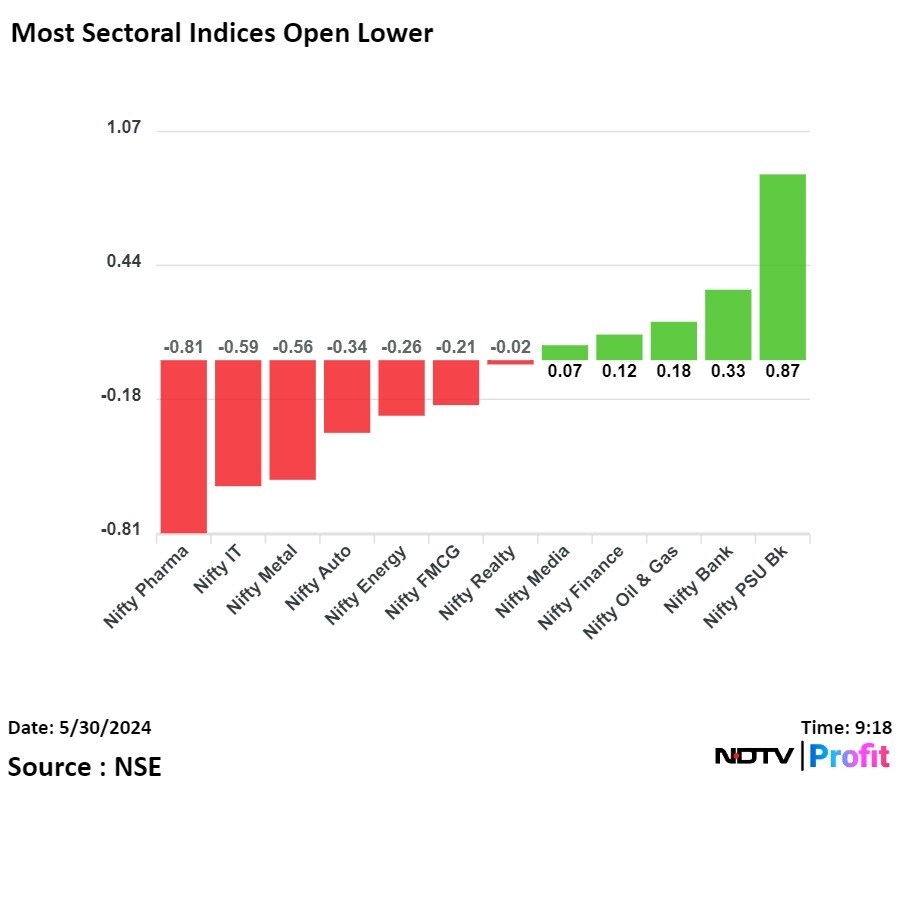

Most sectoral indices ended lower with Nifty Metal and Nifty IT losing the most. Nifty Bank and Nifty Media were the top gainers on the NSE.

Benchmark equity indices fell for the fifth consecutive session today as heavyweights weighed on them with both the Nifty and the Sensex closing at their lowest level in seven sessions.

The Nifty closed at 22,488.65, down by 216.05 points or 0.95% and the Sensex fell 617.30 points or 0.83% at 73,885.60.

"Bears remained in the driver's seat as Nifty50 began the monthly expiry day lower at 22,650, following the weak global equities," said Aditya Gaggar, director of Progressive Shares. "The immediate support is placed at 22,390 while 22,700 will be considered a strong hurdle."

Benchmark equity indices fell for the fifth consecutive session today as heavyweights weighed on them with both the Nifty and the Sensex closing at their lowest level in seven sessions.

The Nifty closed at 22,488.65, down by 216.05 points or 0.95% and the Sensex fell 617.30 points or 0.83% at 73,885.60.

"Bears remained in the driver's seat as Nifty50 began the monthly expiry day lower at 22,650, following the weak global equities," said Aditya Gaggar, director of Progressive Shares. "The immediate support is placed at 22,390 while 22,700 will be considered a strong hurdle."

Benchmark equity indices fell for the fifth consecutive session today as heavyweights weighed on them with both the Nifty and the Sensex closing at their lowest level in seven sessions.

The Nifty closed at 22,488.65, down by 216.05 points or 0.95% and the Sensex fell 617.30 points or 0.83% at 73,885.60.

"Bears remained in the driver's seat as Nifty50 began the monthly expiry day lower at 22,650, following the weak global equities," said Aditya Gaggar, director of Progressive Shares. "The immediate support is placed at 22,390 while 22,700 will be considered a strong hurdle."

Benchmark equity indices fell for the fifth consecutive session today as heavyweights weighed on them with both the Nifty and the Sensex closing at their lowest level in seven sessions.

The Nifty closed at 22,488.65, down by 216.05 points or 0.95% and the Sensex fell 617.30 points or 0.83% at 73,885.60.

"Bears remained in the driver's seat as Nifty50 began the monthly expiry day lower at 22,650, following the weak global equities," said Aditya Gaggar, director of Progressive Shares. "The immediate support is placed at 22,390 while 22,700 will be considered a strong hurdle."

Benchmark equity indices fell for the fifth consecutive session today as heavyweights weighed on them with both the Nifty and the Sensex closing at their lowest level in seven sessions.

The Nifty closed at 22,488.65, down by 216.05 points or 0.95% and the Sensex fell 617.30 points or 0.83% at 73,885.60.

"Bears remained in the driver's seat as Nifty50 began the monthly expiry day lower at 22,650, following the weak global equities," said Aditya Gaggar, director of Progressive Shares. "The immediate support is placed at 22,390 while 22,700 will be considered a strong hurdle."

Benchmark equity indices fell for the fifth consecutive session today as heavyweights weighed on them with both the Nifty and the Sensex closing at their lowest level in seven sessions.

The Nifty closed at 22,488.65, down by 216.05 points or 0.95% and the Sensex fell 617.30 points or 0.83% at 73,885.60.

"Bears remained in the driver's seat as Nifty50 began the monthly expiry day lower at 22,650, following the weak global equities," said Aditya Gaggar, director of Progressive Shares. "The immediate support is placed at 22,390 while 22,700 will be considered a strong hurdle."

Benchmark equity indices fell for the fifth consecutive session today as heavyweights weighed on them with both the Nifty and the Sensex closing at their lowest level in seven sessions.

The Nifty closed at 22,488.65, down by 216.05 points or 0.95% and the Sensex fell 617.30 points or 0.83% at 73,885.60.

"Bears remained in the driver's seat as Nifty50 began the monthly expiry day lower at 22,650, following the weak global equities," said Aditya Gaggar, director of Progressive Shares. "The immediate support is placed at 22,390 while 22,700 will be considered a strong hurdle."

Benchmark equity indices fell for the fifth consecutive session today as heavyweights weighed on them with both the Nifty and the Sensex closing at their lowest level in seven sessions.

The Nifty closed at 22,488.65, down by 216.05 points or 0.95% and the Sensex fell 617.30 points or 0.83% at 73,885.60.

"Bears remained in the driver's seat as Nifty50 began the monthly expiry day lower at 22,650, following the weak global equities," said Aditya Gaggar, director of Progressive Shares. "The immediate support is placed at 22,390 while 22,700 will be considered a strong hurdle."

Shares of Reliance Industries Ltd., Tata Steel Ltd., Infosys Ltd., Tata Consultancy Services Ltd., and ITC Ltd. weighed on the Nifty.

While those of ICICI Bank Ltd., HDFC Bank Ltd., Axis Bank Ltd., Bharti Airtel Ltd., and Larsen & Toubro Ltd. cushioned the fall.

Benchmark equity indices fell for the fifth consecutive session today as heavyweights weighed on them with both the Nifty and the Sensex closing at their lowest level in seven sessions.

The Nifty closed at 22,488.65, down by 216.05 points or 0.95% and the Sensex fell 617.30 points or 0.83% at 73,885.60.

"Bears remained in the driver's seat as Nifty50 began the monthly expiry day lower at 22,650, following the weak global equities," said Aditya Gaggar, director of Progressive Shares. "The immediate support is placed at 22,390 while 22,700 will be considered a strong hurdle."

Benchmark equity indices fell for the fifth consecutive session today as heavyweights weighed on them with both the Nifty and the Sensex closing at their lowest level in seven sessions.

The Nifty closed at 22,488.65, down by 216.05 points or 0.95% and the Sensex fell 617.30 points or 0.83% at 73,885.60.

"Bears remained in the driver's seat as Nifty50 began the monthly expiry day lower at 22,650, following the weak global equities," said Aditya Gaggar, director of Progressive Shares. "The immediate support is placed at 22,390 while 22,700 will be considered a strong hurdle."

Benchmark equity indices fell for the fifth consecutive session today as heavyweights weighed on them with both the Nifty and the Sensex closing at their lowest level in seven sessions.

The Nifty closed at 22,488.65, down by 216.05 points or 0.95% and the Sensex fell 617.30 points or 0.83% at 73,885.60.

"Bears remained in the driver's seat as Nifty50 began the monthly expiry day lower at 22,650, following the weak global equities," said Aditya Gaggar, director of Progressive Shares. "The immediate support is placed at 22,390 while 22,700 will be considered a strong hurdle."

Benchmark equity indices fell for the fifth consecutive session today as heavyweights weighed on them with both the Nifty and the Sensex closing at their lowest level in seven sessions.

The Nifty closed at 22,488.65, down by 216.05 points or 0.95% and the Sensex fell 617.30 points or 0.83% at 73,885.60.

"Bears remained in the driver's seat as Nifty50 began the monthly expiry day lower at 22,650, following the weak global equities," said Aditya Gaggar, director of Progressive Shares. "The immediate support is placed at 22,390 while 22,700 will be considered a strong hurdle."

Benchmark equity indices fell for the fifth consecutive session today as heavyweights weighed on them with both the Nifty and the Sensex closing at their lowest level in seven sessions.

The Nifty closed at 22,488.65, down by 216.05 points or 0.95% and the Sensex fell 617.30 points or 0.83% at 73,885.60.

"Bears remained in the driver's seat as Nifty50 began the monthly expiry day lower at 22,650, following the weak global equities," said Aditya Gaggar, director of Progressive Shares. "The immediate support is placed at 22,390 while 22,700 will be considered a strong hurdle."

Benchmark equity indices fell for the fifth consecutive session today as heavyweights weighed on them with both the Nifty and the Sensex closing at their lowest level in seven sessions.

The Nifty closed at 22,488.65, down by 216.05 points or 0.95% and the Sensex fell 617.30 points or 0.83% at 73,885.60.

"Bears remained in the driver's seat as Nifty50 began the monthly expiry day lower at 22,650, following the weak global equities," said Aditya Gaggar, director of Progressive Shares. "The immediate support is placed at 22,390 while 22,700 will be considered a strong hurdle."

Benchmark equity indices fell for the fifth consecutive session today as heavyweights weighed on them with both the Nifty and the Sensex closing at their lowest level in seven sessions.

The Nifty closed at 22,488.65, down by 216.05 points or 0.95% and the Sensex fell 617.30 points or 0.83% at 73,885.60.

"Bears remained in the driver's seat as Nifty50 began the monthly expiry day lower at 22,650, following the weak global equities," said Aditya Gaggar, director of Progressive Shares. "The immediate support is placed at 22,390 while 22,700 will be considered a strong hurdle."

Benchmark equity indices fell for the fifth consecutive session today as heavyweights weighed on them with both the Nifty and the Sensex closing at their lowest level in seven sessions.

The Nifty closed at 22,488.65, down by 216.05 points or 0.95% and the Sensex fell 617.30 points or 0.83% at 73,885.60.

"Bears remained in the driver's seat as Nifty50 began the monthly expiry day lower at 22,650, following the weak global equities," said Aditya Gaggar, director of Progressive Shares. "The immediate support is placed at 22,390 while 22,700 will be considered a strong hurdle."

Shares of Reliance Industries Ltd., Tata Steel Ltd., Infosys Ltd., Tata Consultancy Services Ltd., and ITC Ltd. weighed on the Nifty.

While those of ICICI Bank Ltd., HDFC Bank Ltd., Axis Bank Ltd., Bharti Airtel Ltd., and Larsen & Toubro Ltd. cushioned the fall.

Most sectoral indices ended lower with Nifty Metal and Nifty IT losing the most. Nifty Bank and Nifty Media were the top gainers on the NSE.

Broader markets underperformed benchmarks. The S&P BSE Midcap declined 1.21%, and the S&P BSE Smallcap fell 1.33%.

On BSE, 19 sectoral indices closed lower and one ended in the positive out of 20. The S&P BSE Metal was the top loser, while the S&P BSE Bankex emerged out to be the top gainer.

Market breadth was skewed in favour of sellers. Around 2,597 stocks declined, 1,213 stocks rose, and 107 stocks remained unchanged on BSE.

IDFC First Bank has approved preferential issue worth Rs 3,200 crore

The lender approved issue of shares on a preferential basis at Rs 80.63 per share

Allotees for preferential issue include LIC, HDFC Life, Aditya Birla Sun Life & Bajaj Allianz

Allotees for preferential issue also include ICICI Lombard and SBI General Insurance

The private lender is to raise Rs 3,200 crore via preferential allotment of 39.7 crore shares

Source: Exchange filing

FDI inflows fall 3.49% to $44 billion in FY24 from $46.03 billion in FY23

Top inflows from Singapore at $11.77 billion accounting for 26% of all inflows

Source: Department for Promotion of Industry and Internal Trade

Applicant should be set up as a not-for-profit company

Should represent FinTech sector with membership across all entities

Should have a minimum net worth of Rs 2 crore within 1 year after recognition as an SRO-FT or before start of operations

Must have systems for managing ‘user harm’ instances

Alert: SRO stands for Self-regulatory organisation

Source: RBI notification

PVR Inox Ltd. has appointed Gaurav Sharma as CFO effective August 1.

Source: Exchange filing

The S&P BSE Sensex declined 0.78% to 73,925.34 as Tata Steel Ltd., Tech Mahindra Ltd. dragged.. It was trading 559.10 points or 0.75% lower at 73,943.80 as of 2:28 p.m.

The S&P BSE Sensex declined 0.78% to 73,925.34 as Tata Steel Ltd., Tech Mahindra Ltd. dragged.. It was trading 559.10 points or 0.75% lower at 73,943.80 as of 2:28 p.m.

.png)

JV to be formed in India for warehousing and trucking services

Source: Exchange Filing

Sharat Sinha as CEO of Airtel Business effective June 3

Source: Exchange filing

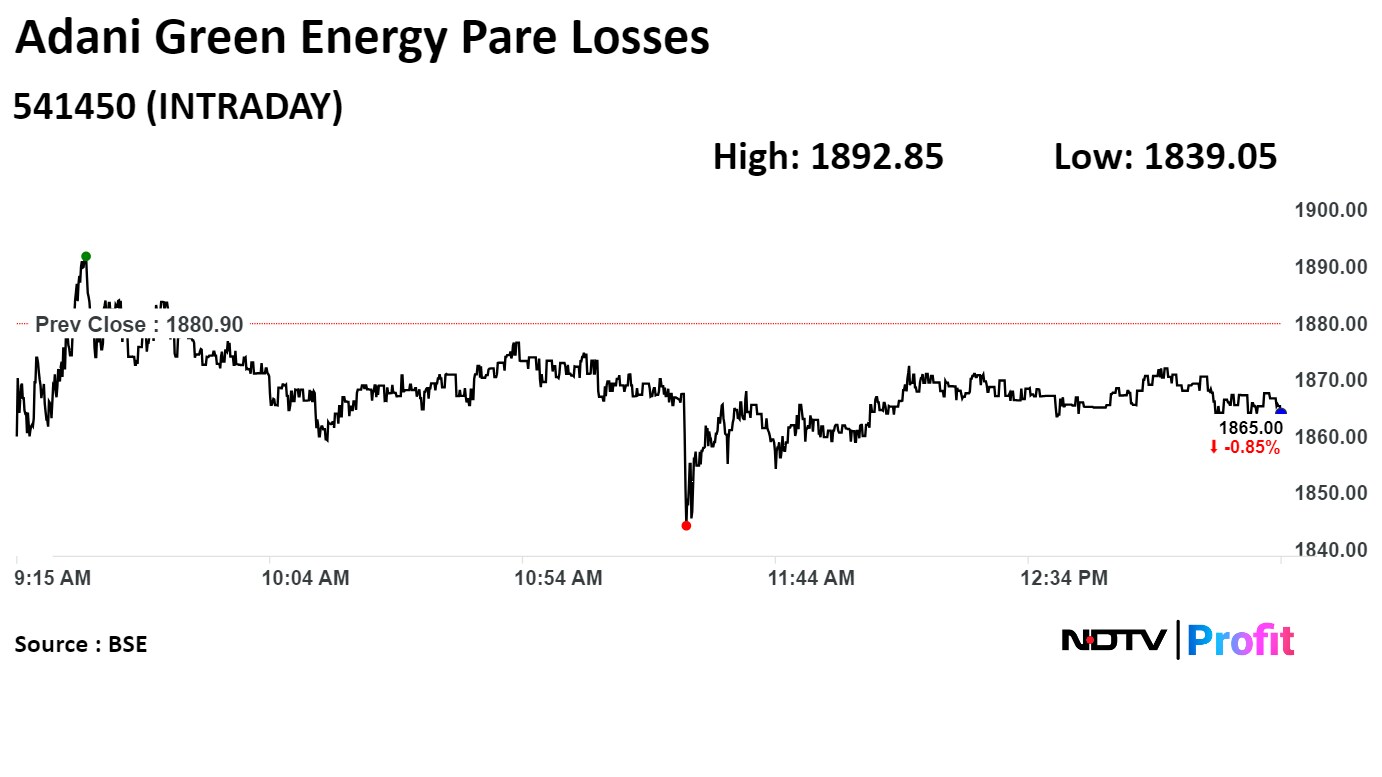

Fitch Ratings has assigned a 'BBB-' rating to Adani Green Energy Ltd. Restricted Group 1's 18-year fully amortising senior secured notes, due in 2042, on a strong credit profile. The rating agency also has a stable outlook for the Adani Group company.

Fitch Ratings has assigned a 'BBB-' rating to Adani Green Energy Ltd. Restricted Group 1's 18-year fully amortising senior secured notes, due in 2042, on a strong credit profile. The rating agency also has a stable outlook for the Adani Group company.

Looking to share construction market practices - 33 construction centres planned, helps move the value chain

Relining of Blast Furnace 6 weighed on product mix and cost profile

Early closure of coke ovens will weigh on RM costs and bulk gases in near term

Spent Rs 18,207 cr on capex in FY24

Will spend Rs 16,000 cr capex in FY25, most of which will be spent on Kalinganagar expansion and UK de-carbonisation

The benchmark stock indices extended losses on Thursday as Reliance Industries Ltd., Tata Steel Ltd., and Infosys Ltd. declined. The NSE Nifty 50 was trading 134.65 points or 0.59% down at 22,570.05, and the S&P BSE Sensex was 410.01 points or 0.55% lower at 74,092.89 as of 12:24 p.m.

The Nifty opened 0.38% lower at 22,617.45, and the Sensex opened 0.18% down at 74,365.88. During the day, it declined as much as 0.72% to 22,540.90, and the Sensex fell 0.67% to 74,004.31.

For the past four consecutive sessions, the Nifty remained under pressure. The India VIX is at an elevated level and that is definitely a cause of concern, according to Nilesh Jain, assistant vice president of technical and derivative research at Centrum Broking. "It basically indicates that markets are going to witness some amount of selling pressure."

"The immediate hurdle for the Nifty is now placed at 22,800. Today's data of the expiry shows that 22,500 should provide some amount of support," Jain told NDTV Profit.

The benchmark stock indices extended losses on Thursday as Reliance Industries Ltd., Tata Steel Ltd., and Infosys Ltd. declined. The NSE Nifty 50 was trading 134.65 points or 0.59% down at 22,570.05, and the S&P BSE Sensex was 410.01 points or 0.55% lower at 74,092.89 as of 12:24 p.m.

The Nifty opened 0.38% lower at 22,617.45, and the Sensex opened 0.18% down at 74,365.88. During the day, it declined as much as 0.72% to 22,540.90, and the Sensex fell 0.67% to 74,004.31.

For the past four consecutive sessions, the Nifty remained under pressure. The India VIX is at an elevated level and that is definitely a cause of concern, according to Nilesh Jain, assistant vice president of technical and derivative research at Centrum Broking. "It basically indicates that markets are going to witness some amount of selling pressure."

"The immediate hurdle for the Nifty is now placed at 22,800. Today's data of the expiry shows that 22,500 should provide some amount of support," Jain told NDTV Profit.

The benchmark stock indices extended losses on Thursday as Reliance Industries Ltd., Tata Steel Ltd., and Infosys Ltd. declined. The NSE Nifty 50 was trading 134.65 points or 0.59% down at 22,570.05, and the S&P BSE Sensex was 410.01 points or 0.55% lower at 74,092.89 as of 12:24 p.m.

The Nifty opened 0.38% lower at 22,617.45, and the Sensex opened 0.18% down at 74,365.88. During the day, it declined as much as 0.72% to 22,540.90, and the Sensex fell 0.67% to 74,004.31.

For the past four consecutive sessions, the Nifty remained under pressure. The India VIX is at an elevated level and that is definitely a cause of concern, according to Nilesh Jain, assistant vice president of technical and derivative research at Centrum Broking. "It basically indicates that markets are going to witness some amount of selling pressure."

"The immediate hurdle for the Nifty is now placed at 22,800. Today's data of the expiry shows that 22,500 should provide some amount of support," Jain told NDTV Profit.

The benchmark stock indices extended losses on Thursday as Reliance Industries Ltd., Tata Steel Ltd., and Infosys Ltd. declined. The NSE Nifty 50 was trading 134.65 points or 0.59% down at 22,570.05, and the S&P BSE Sensex was 410.01 points or 0.55% lower at 74,092.89 as of 12:24 p.m.

The Nifty opened 0.38% lower at 22,617.45, and the Sensex opened 0.18% down at 74,365.88. During the day, it declined as much as 0.72% to 22,540.90, and the Sensex fell 0.67% to 74,004.31.

For the past four consecutive sessions, the Nifty remained under pressure. The India VIX is at an elevated level and that is definitely a cause of concern, according to Nilesh Jain, assistant vice president of technical and derivative research at Centrum Broking. "It basically indicates that markets are going to witness some amount of selling pressure."

"The immediate hurdle for the Nifty is now placed at 22,800. Today's data of the expiry shows that 22,500 should provide some amount of support," Jain told NDTV Profit.

.png)

The benchmark stock indices extended losses on Thursday as Reliance Industries Ltd., Tata Steel Ltd., and Infosys Ltd. declined. The NSE Nifty 50 was trading 134.65 points or 0.59% down at 22,570.05, and the S&P BSE Sensex was 410.01 points or 0.55% lower at 74,092.89 as of 12:24 p.m.

The Nifty opened 0.38% lower at 22,617.45, and the Sensex opened 0.18% down at 74,365.88. During the day, it declined as much as 0.72% to 22,540.90, and the Sensex fell 0.67% to 74,004.31.

For the past four consecutive sessions, the Nifty remained under pressure. The India VIX is at an elevated level and that is definitely a cause of concern, according to Nilesh Jain, assistant vice president of technical and derivative research at Centrum Broking. "It basically indicates that markets are going to witness some amount of selling pressure."

"The immediate hurdle for the Nifty is now placed at 22,800. Today's data of the expiry shows that 22,500 should provide some amount of support," Jain told NDTV Profit.

The benchmark stock indices extended losses on Thursday as Reliance Industries Ltd., Tata Steel Ltd., and Infosys Ltd. declined. The NSE Nifty 50 was trading 134.65 points or 0.59% down at 22,570.05, and the S&P BSE Sensex was 410.01 points or 0.55% lower at 74,092.89 as of 12:24 p.m.

The Nifty opened 0.38% lower at 22,617.45, and the Sensex opened 0.18% down at 74,365.88. During the day, it declined as much as 0.72% to 22,540.90, and the Sensex fell 0.67% to 74,004.31.

For the past four consecutive sessions, the Nifty remained under pressure. The India VIX is at an elevated level and that is definitely a cause of concern, according to Nilesh Jain, assistant vice president of technical and derivative research at Centrum Broking. "It basically indicates that markets are going to witness some amount of selling pressure."

"The immediate hurdle for the Nifty is now placed at 22,800. Today's data of the expiry shows that 22,500 should provide some amount of support," Jain told NDTV Profit.

The benchmark stock indices extended losses on Thursday as Reliance Industries Ltd., Tata Steel Ltd., and Infosys Ltd. declined. The NSE Nifty 50 was trading 134.65 points or 0.59% down at 22,570.05, and the S&P BSE Sensex was 410.01 points or 0.55% lower at 74,092.89 as of 12:24 p.m.

The Nifty opened 0.38% lower at 22,617.45, and the Sensex opened 0.18% down at 74,365.88. During the day, it declined as much as 0.72% to 22,540.90, and the Sensex fell 0.67% to 74,004.31.

For the past four consecutive sessions, the Nifty remained under pressure. The India VIX is at an elevated level and that is definitely a cause of concern, according to Nilesh Jain, assistant vice president of technical and derivative research at Centrum Broking. "It basically indicates that markets are going to witness some amount of selling pressure."

"The immediate hurdle for the Nifty is now placed at 22,800. Today's data of the expiry shows that 22,500 should provide some amount of support," Jain told NDTV Profit.

The benchmark stock indices extended losses on Thursday as Reliance Industries Ltd., Tata Steel Ltd., and Infosys Ltd. declined. The NSE Nifty 50 was trading 134.65 points or 0.59% down at 22,570.05, and the S&P BSE Sensex was 410.01 points or 0.55% lower at 74,092.89 as of 12:24 p.m.

The Nifty opened 0.38% lower at 22,617.45, and the Sensex opened 0.18% down at 74,365.88. During the day, it declined as much as 0.72% to 22,540.90, and the Sensex fell 0.67% to 74,004.31.

For the past four consecutive sessions, the Nifty remained under pressure. The India VIX is at an elevated level and that is definitely a cause of concern, according to Nilesh Jain, assistant vice president of technical and derivative research at Centrum Broking. "It basically indicates that markets are going to witness some amount of selling pressure."

"The immediate hurdle for the Nifty is now placed at 22,800. Today's data of the expiry shows that 22,500 should provide some amount of support," Jain told NDTV Profit.

.png)

RIL, Tata Steel, Infosys, Tata Consultancy Services Ltd. and ITC Ltd. weighed on the Nifty the most.

HDFC Bank Ltd., ICICI Bank Ltd., Bharti Airtel Ltd., Kotak Mahindra Bank Ltd., and Larsen & Toubro Ltd. led the gains.

The benchmark stock indices extended losses on Thursday as Reliance Industries Ltd., Tata Steel Ltd., and Infosys Ltd. declined. The NSE Nifty 50 was trading 134.65 points or 0.59% down at 22,570.05, and the S&P BSE Sensex was 410.01 points or 0.55% lower at 74,092.89 as of 12:24 p.m.

The Nifty opened 0.38% lower at 22,617.45, and the Sensex opened 0.18% down at 74,365.88. During the day, it declined as much as 0.72% to 22,540.90, and the Sensex fell 0.67% to 74,004.31.

For the past four consecutive sessions, the Nifty remained under pressure. The India VIX is at an elevated level and that is definitely a cause of concern, according to Nilesh Jain, assistant vice president of technical and derivative research at Centrum Broking. "It basically indicates that markets are going to witness some amount of selling pressure."

"The immediate hurdle for the Nifty is now placed at 22,800. Today's data of the expiry shows that 22,500 should provide some amount of support," Jain told NDTV Profit.

The benchmark stock indices extended losses on Thursday as Reliance Industries Ltd., Tata Steel Ltd., and Infosys Ltd. declined. The NSE Nifty 50 was trading 134.65 points or 0.59% down at 22,570.05, and the S&P BSE Sensex was 410.01 points or 0.55% lower at 74,092.89 as of 12:24 p.m.

The Nifty opened 0.38% lower at 22,617.45, and the Sensex opened 0.18% down at 74,365.88. During the day, it declined as much as 0.72% to 22,540.90, and the Sensex fell 0.67% to 74,004.31.

For the past four consecutive sessions, the Nifty remained under pressure. The India VIX is at an elevated level and that is definitely a cause of concern, according to Nilesh Jain, assistant vice president of technical and derivative research at Centrum Broking. "It basically indicates that markets are going to witness some amount of selling pressure."

"The immediate hurdle for the Nifty is now placed at 22,800. Today's data of the expiry shows that 22,500 should provide some amount of support," Jain told NDTV Profit.

The benchmark stock indices extended losses on Thursday as Reliance Industries Ltd., Tata Steel Ltd., and Infosys Ltd. declined. The NSE Nifty 50 was trading 134.65 points or 0.59% down at 22,570.05, and the S&P BSE Sensex was 410.01 points or 0.55% lower at 74,092.89 as of 12:24 p.m.

The Nifty opened 0.38% lower at 22,617.45, and the Sensex opened 0.18% down at 74,365.88. During the day, it declined as much as 0.72% to 22,540.90, and the Sensex fell 0.67% to 74,004.31.

For the past four consecutive sessions, the Nifty remained under pressure. The India VIX is at an elevated level and that is definitely a cause of concern, according to Nilesh Jain, assistant vice president of technical and derivative research at Centrum Broking. "It basically indicates that markets are going to witness some amount of selling pressure."

"The immediate hurdle for the Nifty is now placed at 22,800. Today's data of the expiry shows that 22,500 should provide some amount of support," Jain told NDTV Profit.

The benchmark stock indices extended losses on Thursday as Reliance Industries Ltd., Tata Steel Ltd., and Infosys Ltd. declined. The NSE Nifty 50 was trading 134.65 points or 0.59% down at 22,570.05, and the S&P BSE Sensex was 410.01 points or 0.55% lower at 74,092.89 as of 12:24 p.m.

The Nifty opened 0.38% lower at 22,617.45, and the Sensex opened 0.18% down at 74,365.88. During the day, it declined as much as 0.72% to 22,540.90, and the Sensex fell 0.67% to 74,004.31.

For the past four consecutive sessions, the Nifty remained under pressure. The India VIX is at an elevated level and that is definitely a cause of concern, according to Nilesh Jain, assistant vice president of technical and derivative research at Centrum Broking. "It basically indicates that markets are going to witness some amount of selling pressure."

"The immediate hurdle for the Nifty is now placed at 22,800. Today's data of the expiry shows that 22,500 should provide some amount of support," Jain told NDTV Profit.

.png)

The benchmark stock indices extended losses on Thursday as Reliance Industries Ltd., Tata Steel Ltd., and Infosys Ltd. declined. The NSE Nifty 50 was trading 134.65 points or 0.59% down at 22,570.05, and the S&P BSE Sensex was 410.01 points or 0.55% lower at 74,092.89 as of 12:24 p.m.

The Nifty opened 0.38% lower at 22,617.45, and the Sensex opened 0.18% down at 74,365.88. During the day, it declined as much as 0.72% to 22,540.90, and the Sensex fell 0.67% to 74,004.31.

For the past four consecutive sessions, the Nifty remained under pressure. The India VIX is at an elevated level and that is definitely a cause of concern, according to Nilesh Jain, assistant vice president of technical and derivative research at Centrum Broking. "It basically indicates that markets are going to witness some amount of selling pressure."

"The immediate hurdle for the Nifty is now placed at 22,800. Today's data of the expiry shows that 22,500 should provide some amount of support," Jain told NDTV Profit.

The benchmark stock indices extended losses on Thursday as Reliance Industries Ltd., Tata Steel Ltd., and Infosys Ltd. declined. The NSE Nifty 50 was trading 134.65 points or 0.59% down at 22,570.05, and the S&P BSE Sensex was 410.01 points or 0.55% lower at 74,092.89 as of 12:24 p.m.

The Nifty opened 0.38% lower at 22,617.45, and the Sensex opened 0.18% down at 74,365.88. During the day, it declined as much as 0.72% to 22,540.90, and the Sensex fell 0.67% to 74,004.31.

For the past four consecutive sessions, the Nifty remained under pressure. The India VIX is at an elevated level and that is definitely a cause of concern, according to Nilesh Jain, assistant vice president of technical and derivative research at Centrum Broking. "It basically indicates that markets are going to witness some amount of selling pressure."

"The immediate hurdle for the Nifty is now placed at 22,800. Today's data of the expiry shows that 22,500 should provide some amount of support," Jain told NDTV Profit.

The benchmark stock indices extended losses on Thursday as Reliance Industries Ltd., Tata Steel Ltd., and Infosys Ltd. declined. The NSE Nifty 50 was trading 134.65 points or 0.59% down at 22,570.05, and the S&P BSE Sensex was 410.01 points or 0.55% lower at 74,092.89 as of 12:24 p.m.

The Nifty opened 0.38% lower at 22,617.45, and the Sensex opened 0.18% down at 74,365.88. During the day, it declined as much as 0.72% to 22,540.90, and the Sensex fell 0.67% to 74,004.31.

For the past four consecutive sessions, the Nifty remained under pressure. The India VIX is at an elevated level and that is definitely a cause of concern, according to Nilesh Jain, assistant vice president of technical and derivative research at Centrum Broking. "It basically indicates that markets are going to witness some amount of selling pressure."

"The immediate hurdle for the Nifty is now placed at 22,800. Today's data of the expiry shows that 22,500 should provide some amount of support," Jain told NDTV Profit.

The benchmark stock indices extended losses on Thursday as Reliance Industries Ltd., Tata Steel Ltd., and Infosys Ltd. declined. The NSE Nifty 50 was trading 134.65 points or 0.59% down at 22,570.05, and the S&P BSE Sensex was 410.01 points or 0.55% lower at 74,092.89 as of 12:24 p.m.

The Nifty opened 0.38% lower at 22,617.45, and the Sensex opened 0.18% down at 74,365.88. During the day, it declined as much as 0.72% to 22,540.90, and the Sensex fell 0.67% to 74,004.31.

For the past four consecutive sessions, the Nifty remained under pressure. The India VIX is at an elevated level and that is definitely a cause of concern, according to Nilesh Jain, assistant vice president of technical and derivative research at Centrum Broking. "It basically indicates that markets are going to witness some amount of selling pressure."

"The immediate hurdle for the Nifty is now placed at 22,800. Today's data of the expiry shows that 22,500 should provide some amount of support," Jain told NDTV Profit.

.png)

RIL, Tata Steel, Infosys, Tata Consultancy Services Ltd. and ITC Ltd. weighed on the Nifty the most.

HDFC Bank Ltd., ICICI Bank Ltd., Bharti Airtel Ltd., Kotak Mahindra Bank Ltd., and Larsen & Toubro Ltd. led the gains.

.png)

Ten out of the 12 sectors on the NSE declined, with the Nifty Metal falling the most.

The benchmark stock indices extended losses on Thursday as Reliance Industries Ltd., Tata Steel Ltd., and Infosys Ltd. declined. The NSE Nifty 50 was trading 134.65 points or 0.59% down at 22,570.05, and the S&P BSE Sensex was 410.01 points or 0.55% lower at 74,092.89 as of 12:24 p.m.

The Nifty opened 0.38% lower at 22,617.45, and the Sensex opened 0.18% down at 74,365.88. During the day, it declined as much as 0.72% to 22,540.90, and the Sensex fell 0.67% to 74,004.31.

For the past four consecutive sessions, the Nifty remained under pressure. The India VIX is at an elevated level and that is definitely a cause of concern, according to Nilesh Jain, assistant vice president of technical and derivative research at Centrum Broking. "It basically indicates that markets are going to witness some amount of selling pressure."

"The immediate hurdle for the Nifty is now placed at 22,800. Today's data of the expiry shows that 22,500 should provide some amount of support," Jain told NDTV Profit.

The benchmark stock indices extended losses on Thursday as Reliance Industries Ltd., Tata Steel Ltd., and Infosys Ltd. declined. The NSE Nifty 50 was trading 134.65 points or 0.59% down at 22,570.05, and the S&P BSE Sensex was 410.01 points or 0.55% lower at 74,092.89 as of 12:24 p.m.

The Nifty opened 0.38% lower at 22,617.45, and the Sensex opened 0.18% down at 74,365.88. During the day, it declined as much as 0.72% to 22,540.90, and the Sensex fell 0.67% to 74,004.31.

For the past four consecutive sessions, the Nifty remained under pressure. The India VIX is at an elevated level and that is definitely a cause of concern, according to Nilesh Jain, assistant vice president of technical and derivative research at Centrum Broking. "It basically indicates that markets are going to witness some amount of selling pressure."

"The immediate hurdle for the Nifty is now placed at 22,800. Today's data of the expiry shows that 22,500 should provide some amount of support," Jain told NDTV Profit.

The benchmark stock indices extended losses on Thursday as Reliance Industries Ltd., Tata Steel Ltd., and Infosys Ltd. declined. The NSE Nifty 50 was trading 134.65 points or 0.59% down at 22,570.05, and the S&P BSE Sensex was 410.01 points or 0.55% lower at 74,092.89 as of 12:24 p.m.

The Nifty opened 0.38% lower at 22,617.45, and the Sensex opened 0.18% down at 74,365.88. During the day, it declined as much as 0.72% to 22,540.90, and the Sensex fell 0.67% to 74,004.31.

For the past four consecutive sessions, the Nifty remained under pressure. The India VIX is at an elevated level and that is definitely a cause of concern, according to Nilesh Jain, assistant vice president of technical and derivative research at Centrum Broking. "It basically indicates that markets are going to witness some amount of selling pressure."

"The immediate hurdle for the Nifty is now placed at 22,800. Today's data of the expiry shows that 22,500 should provide some amount of support," Jain told NDTV Profit.

The benchmark stock indices extended losses on Thursday as Reliance Industries Ltd., Tata Steel Ltd., and Infosys Ltd. declined. The NSE Nifty 50 was trading 134.65 points or 0.59% down at 22,570.05, and the S&P BSE Sensex was 410.01 points or 0.55% lower at 74,092.89 as of 12:24 p.m.

The Nifty opened 0.38% lower at 22,617.45, and the Sensex opened 0.18% down at 74,365.88. During the day, it declined as much as 0.72% to 22,540.90, and the Sensex fell 0.67% to 74,004.31.

For the past four consecutive sessions, the Nifty remained under pressure. The India VIX is at an elevated level and that is definitely a cause of concern, according to Nilesh Jain, assistant vice president of technical and derivative research at Centrum Broking. "It basically indicates that markets are going to witness some amount of selling pressure."

"The immediate hurdle for the Nifty is now placed at 22,800. Today's data of the expiry shows that 22,500 should provide some amount of support," Jain told NDTV Profit.

.png)

The benchmark stock indices extended losses on Thursday as Reliance Industries Ltd., Tata Steel Ltd., and Infosys Ltd. declined. The NSE Nifty 50 was trading 134.65 points or 0.59% down at 22,570.05, and the S&P BSE Sensex was 410.01 points or 0.55% lower at 74,092.89 as of 12:24 p.m.

The Nifty opened 0.38% lower at 22,617.45, and the Sensex opened 0.18% down at 74,365.88. During the day, it declined as much as 0.72% to 22,540.90, and the Sensex fell 0.67% to 74,004.31.

For the past four consecutive sessions, the Nifty remained under pressure. The India VIX is at an elevated level and that is definitely a cause of concern, according to Nilesh Jain, assistant vice president of technical and derivative research at Centrum Broking. "It basically indicates that markets are going to witness some amount of selling pressure."

"The immediate hurdle for the Nifty is now placed at 22,800. Today's data of the expiry shows that 22,500 should provide some amount of support," Jain told NDTV Profit.

The benchmark stock indices extended losses on Thursday as Reliance Industries Ltd., Tata Steel Ltd., and Infosys Ltd. declined. The NSE Nifty 50 was trading 134.65 points or 0.59% down at 22,570.05, and the S&P BSE Sensex was 410.01 points or 0.55% lower at 74,092.89 as of 12:24 p.m.

The Nifty opened 0.38% lower at 22,617.45, and the Sensex opened 0.18% down at 74,365.88. During the day, it declined as much as 0.72% to 22,540.90, and the Sensex fell 0.67% to 74,004.31.

For the past four consecutive sessions, the Nifty remained under pressure. The India VIX is at an elevated level and that is definitely a cause of concern, according to Nilesh Jain, assistant vice president of technical and derivative research at Centrum Broking. "It basically indicates that markets are going to witness some amount of selling pressure."

"The immediate hurdle for the Nifty is now placed at 22,800. Today's data of the expiry shows that 22,500 should provide some amount of support," Jain told NDTV Profit.

The benchmark stock indices extended losses on Thursday as Reliance Industries Ltd., Tata Steel Ltd., and Infosys Ltd. declined. The NSE Nifty 50 was trading 134.65 points or 0.59% down at 22,570.05, and the S&P BSE Sensex was 410.01 points or 0.55% lower at 74,092.89 as of 12:24 p.m.

The Nifty opened 0.38% lower at 22,617.45, and the Sensex opened 0.18% down at 74,365.88. During the day, it declined as much as 0.72% to 22,540.90, and the Sensex fell 0.67% to 74,004.31.

For the past four consecutive sessions, the Nifty remained under pressure. The India VIX is at an elevated level and that is definitely a cause of concern, according to Nilesh Jain, assistant vice president of technical and derivative research at Centrum Broking. "It basically indicates that markets are going to witness some amount of selling pressure."

"The immediate hurdle for the Nifty is now placed at 22,800. Today's data of the expiry shows that 22,500 should provide some amount of support," Jain told NDTV Profit.

The benchmark stock indices extended losses on Thursday as Reliance Industries Ltd., Tata Steel Ltd., and Infosys Ltd. declined. The NSE Nifty 50 was trading 134.65 points or 0.59% down at 22,570.05, and the S&P BSE Sensex was 410.01 points or 0.55% lower at 74,092.89 as of 12:24 p.m.

The Nifty opened 0.38% lower at 22,617.45, and the Sensex opened 0.18% down at 74,365.88. During the day, it declined as much as 0.72% to 22,540.90, and the Sensex fell 0.67% to 74,004.31.

For the past four consecutive sessions, the Nifty remained under pressure. The India VIX is at an elevated level and that is definitely a cause of concern, according to Nilesh Jain, assistant vice president of technical and derivative research at Centrum Broking. "It basically indicates that markets are going to witness some amount of selling pressure."

"The immediate hurdle for the Nifty is now placed at 22,800. Today's data of the expiry shows that 22,500 should provide some amount of support," Jain told NDTV Profit.

.png)

RIL, Tata Steel, Infosys, Tata Consultancy Services Ltd. and ITC Ltd. weighed on the Nifty the most.

HDFC Bank Ltd., ICICI Bank Ltd., Bharti Airtel Ltd., Kotak Mahindra Bank Ltd., and Larsen & Toubro Ltd. led the gains.

The benchmark stock indices extended losses on Thursday as Reliance Industries Ltd., Tata Steel Ltd., and Infosys Ltd. declined. The NSE Nifty 50 was trading 134.65 points or 0.59% down at 22,570.05, and the S&P BSE Sensex was 410.01 points or 0.55% lower at 74,092.89 as of 12:24 p.m.

The Nifty opened 0.38% lower at 22,617.45, and the Sensex opened 0.18% down at 74,365.88. During the day, it declined as much as 0.72% to 22,540.90, and the Sensex fell 0.67% to 74,004.31.

For the past four consecutive sessions, the Nifty remained under pressure. The India VIX is at an elevated level and that is definitely a cause of concern, according to Nilesh Jain, assistant vice president of technical and derivative research at Centrum Broking. "It basically indicates that markets are going to witness some amount of selling pressure."

"The immediate hurdle for the Nifty is now placed at 22,800. Today's data of the expiry shows that 22,500 should provide some amount of support," Jain told NDTV Profit.

The benchmark stock indices extended losses on Thursday as Reliance Industries Ltd., Tata Steel Ltd., and Infosys Ltd. declined. The NSE Nifty 50 was trading 134.65 points or 0.59% down at 22,570.05, and the S&P BSE Sensex was 410.01 points or 0.55% lower at 74,092.89 as of 12:24 p.m.

The Nifty opened 0.38% lower at 22,617.45, and the Sensex opened 0.18% down at 74,365.88. During the day, it declined as much as 0.72% to 22,540.90, and the Sensex fell 0.67% to 74,004.31.

For the past four consecutive sessions, the Nifty remained under pressure. The India VIX is at an elevated level and that is definitely a cause of concern, according to Nilesh Jain, assistant vice president of technical and derivative research at Centrum Broking. "It basically indicates that markets are going to witness some amount of selling pressure."

"The immediate hurdle for the Nifty is now placed at 22,800. Today's data of the expiry shows that 22,500 should provide some amount of support," Jain told NDTV Profit.

The benchmark stock indices extended losses on Thursday as Reliance Industries Ltd., Tata Steel Ltd., and Infosys Ltd. declined. The NSE Nifty 50 was trading 134.65 points or 0.59% down at 22,570.05, and the S&P BSE Sensex was 410.01 points or 0.55% lower at 74,092.89 as of 12:24 p.m.

The Nifty opened 0.38% lower at 22,617.45, and the Sensex opened 0.18% down at 74,365.88. During the day, it declined as much as 0.72% to 22,540.90, and the Sensex fell 0.67% to 74,004.31.

For the past four consecutive sessions, the Nifty remained under pressure. The India VIX is at an elevated level and that is definitely a cause of concern, according to Nilesh Jain, assistant vice president of technical and derivative research at Centrum Broking. "It basically indicates that markets are going to witness some amount of selling pressure."

"The immediate hurdle for the Nifty is now placed at 22,800. Today's data of the expiry shows that 22,500 should provide some amount of support," Jain told NDTV Profit.

The benchmark stock indices extended losses on Thursday as Reliance Industries Ltd., Tata Steel Ltd., and Infosys Ltd. declined. The NSE Nifty 50 was trading 134.65 points or 0.59% down at 22,570.05, and the S&P BSE Sensex was 410.01 points or 0.55% lower at 74,092.89 as of 12:24 p.m.

The Nifty opened 0.38% lower at 22,617.45, and the Sensex opened 0.18% down at 74,365.88. During the day, it declined as much as 0.72% to 22,540.90, and the Sensex fell 0.67% to 74,004.31.

For the past four consecutive sessions, the Nifty remained under pressure. The India VIX is at an elevated level and that is definitely a cause of concern, according to Nilesh Jain, assistant vice president of technical and derivative research at Centrum Broking. "It basically indicates that markets are going to witness some amount of selling pressure."

"The immediate hurdle for the Nifty is now placed at 22,800. Today's data of the expiry shows that 22,500 should provide some amount of support," Jain told NDTV Profit.

.png)

The benchmark stock indices extended losses on Thursday as Reliance Industries Ltd., Tata Steel Ltd., and Infosys Ltd. declined. The NSE Nifty 50 was trading 134.65 points or 0.59% down at 22,570.05, and the S&P BSE Sensex was 410.01 points or 0.55% lower at 74,092.89 as of 12:24 p.m.

The Nifty opened 0.38% lower at 22,617.45, and the Sensex opened 0.18% down at 74,365.88. During the day, it declined as much as 0.72% to 22,540.90, and the Sensex fell 0.67% to 74,004.31.

For the past four consecutive sessions, the Nifty remained under pressure. The India VIX is at an elevated level and that is definitely a cause of concern, according to Nilesh Jain, assistant vice president of technical and derivative research at Centrum Broking. "It basically indicates that markets are going to witness some amount of selling pressure."

"The immediate hurdle for the Nifty is now placed at 22,800. Today's data of the expiry shows that 22,500 should provide some amount of support," Jain told NDTV Profit.

The benchmark stock indices extended losses on Thursday as Reliance Industries Ltd., Tata Steel Ltd., and Infosys Ltd. declined. The NSE Nifty 50 was trading 134.65 points or 0.59% down at 22,570.05, and the S&P BSE Sensex was 410.01 points or 0.55% lower at 74,092.89 as of 12:24 p.m.

The Nifty opened 0.38% lower at 22,617.45, and the Sensex opened 0.18% down at 74,365.88. During the day, it declined as much as 0.72% to 22,540.90, and the Sensex fell 0.67% to 74,004.31.

For the past four consecutive sessions, the Nifty remained under pressure. The India VIX is at an elevated level and that is definitely a cause of concern, according to Nilesh Jain, assistant vice president of technical and derivative research at Centrum Broking. "It basically indicates that markets are going to witness some amount of selling pressure."

"The immediate hurdle for the Nifty is now placed at 22,800. Today's data of the expiry shows that 22,500 should provide some amount of support," Jain told NDTV Profit.

The benchmark stock indices extended losses on Thursday as Reliance Industries Ltd., Tata Steel Ltd., and Infosys Ltd. declined. The NSE Nifty 50 was trading 134.65 points or 0.59% down at 22,570.05, and the S&P BSE Sensex was 410.01 points or 0.55% lower at 74,092.89 as of 12:24 p.m.

The Nifty opened 0.38% lower at 22,617.45, and the Sensex opened 0.18% down at 74,365.88. During the day, it declined as much as 0.72% to 22,540.90, and the Sensex fell 0.67% to 74,004.31.

For the past four consecutive sessions, the Nifty remained under pressure. The India VIX is at an elevated level and that is definitely a cause of concern, according to Nilesh Jain, assistant vice president of technical and derivative research at Centrum Broking. "It basically indicates that markets are going to witness some amount of selling pressure."

"The immediate hurdle for the Nifty is now placed at 22,800. Today's data of the expiry shows that 22,500 should provide some amount of support," Jain told NDTV Profit.

The benchmark stock indices extended losses on Thursday as Reliance Industries Ltd., Tata Steel Ltd., and Infosys Ltd. declined. The NSE Nifty 50 was trading 134.65 points or 0.59% down at 22,570.05, and the S&P BSE Sensex was 410.01 points or 0.55% lower at 74,092.89 as of 12:24 p.m.

The Nifty opened 0.38% lower at 22,617.45, and the Sensex opened 0.18% down at 74,365.88. During the day, it declined as much as 0.72% to 22,540.90, and the Sensex fell 0.67% to 74,004.31.

For the past four consecutive sessions, the Nifty remained under pressure. The India VIX is at an elevated level and that is definitely a cause of concern, according to Nilesh Jain, assistant vice president of technical and derivative research at Centrum Broking. "It basically indicates that markets are going to witness some amount of selling pressure."

"The immediate hurdle for the Nifty is now placed at 22,800. Today's data of the expiry shows that 22,500 should provide some amount of support," Jain told NDTV Profit.

.png)

RIL, Tata Steel, Infosys, Tata Consultancy Services Ltd. and ITC Ltd. weighed on the Nifty the most.

HDFC Bank Ltd., ICICI Bank Ltd., Bharti Airtel Ltd., Kotak Mahindra Bank Ltd., and Larsen & Toubro Ltd. led the gains.

.png)

Ten out of the 12 sectors on the NSE declined, with the Nifty Metal falling the most.

The broader markets declined in line with the benchmarks as the BSE MidCap declined 0.70% and the SmallCap fell 0.83%.

Nineteen out of the 20 sectors on the BSE declined, with Metal falling the most and the Bankex rising the most among its peers.

The market breadth was skewed in favour of the sellers as 2,388 stocks declined, 1,254 rose and 123 remained unchanged on BSE.

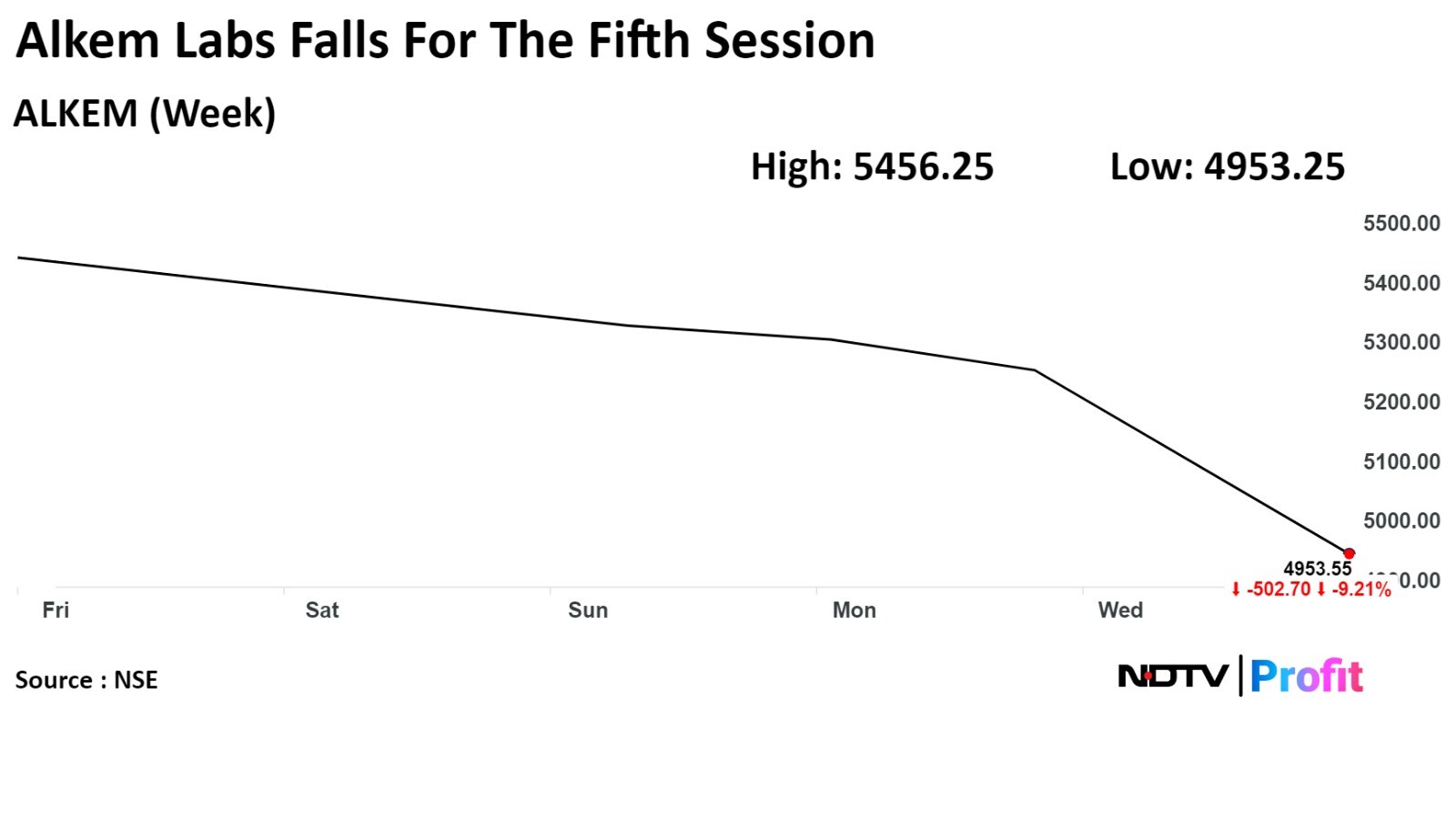

Shares of Alkem Laboratories Ltd. extended fell for the fifth consecutive session on Thursday after the company's net profit for the quarter ended March was lower than what analysts had expected. The stock has fallen nearly 9% from its closing price on the previous Thursday.

Shares of Alkem Laboratories Ltd. extended fell for the fifth consecutive session on Thursday after the company's net profit for the quarter ended March was lower than what analysts had expected. The stock has fallen nearly 9% from its closing price on the previous Thursday.

Shares of Uno Minda jumped 7.26% to Rs 928.95, the highest level since its listing on Feb 2, 2007. It was trading 0.55% higher at Rs 870.80 as of 1:19 p.m., as compared to 0.66% decline in the NSE Nifty 50 index.

Shares of Uno Minda jumped 7.26% to Rs 928.95, the highest level since its listing on Feb 2, 2007. It was trading 0.55% higher at Rs 870.80 as of 1:19 p.m., as compared to 0.66% decline in the NSE Nifty 50 index.

Alembic Pharmaceuticals Ltd. received US FDA final approval for Sacubitril and Valsartan Tablets.

Source: Exchange filing

Revenue up 15.3% at Rs 560 crore from Rs 486 crore

Ebitda flat at Rs 109.5 crore vs Rs 109.4 crore

Margin declined 290 basis points to 19.6% from 22.5%

Net profit fell 6.2% to Rs 77.6 crore from Rs 82.7 crore

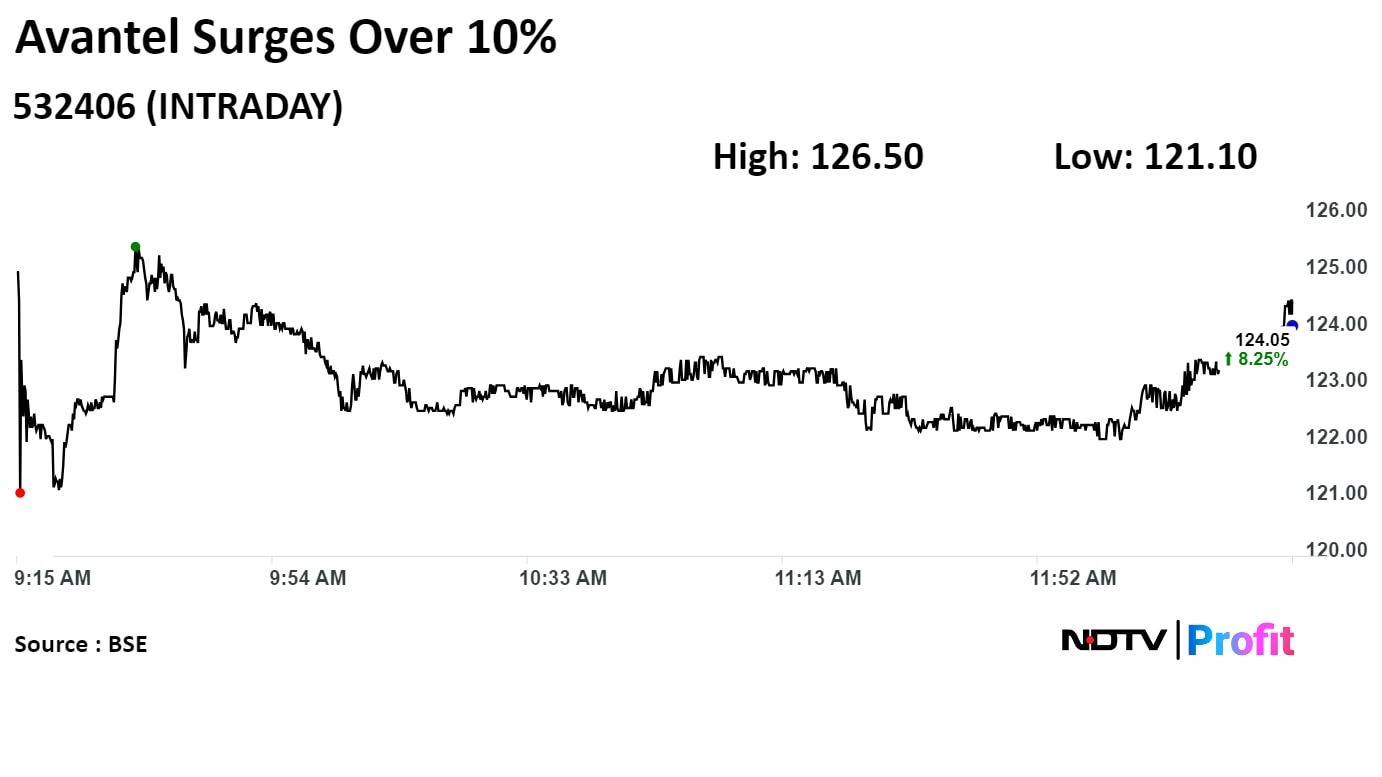

Shares of Aventel Ltd. jumped 10.38% to Rs 126.50. It pared gains to trade 8.60% higher at Rs 124.45 as of 12:33 p.m., as compared to 0.60% decline in the NSE Nifty 50 index.

Avantel received Rs 110 crore order from the Ministry of Defense to supply SATCOM equipment.

Shares of Aventel Ltd. jumped 10.38% to Rs 126.50. It pared gains to trade 8.60% higher at Rs 124.45 as of 12:33 p.m., as compared to 0.60% decline in the NSE Nifty 50 index.

Avantel received Rs 110 crore order from the Ministry of Defense to supply SATCOM equipment.

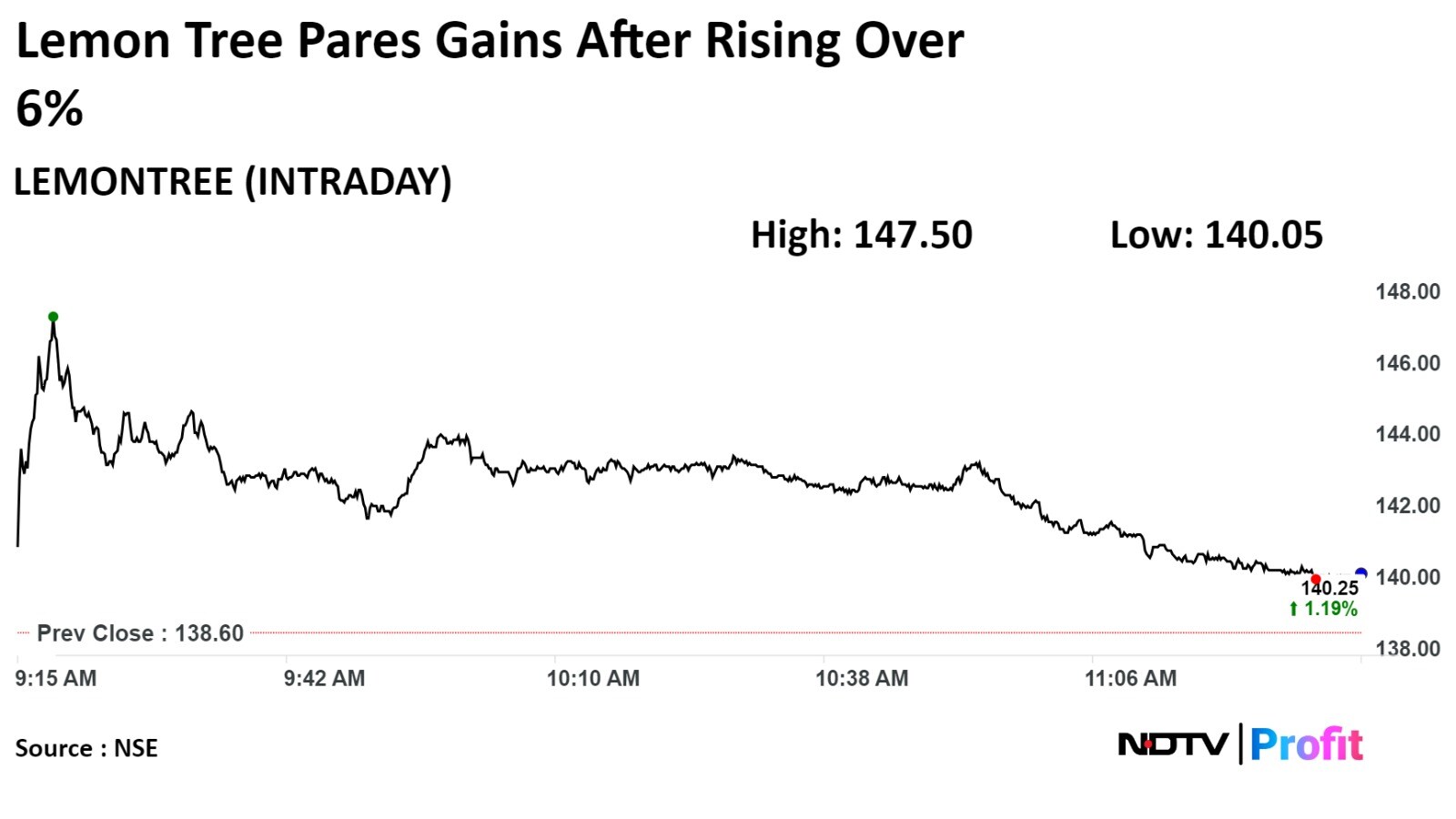

The scrip rose as much as 6.38% to Rs 147.5 apiece, the highest level since May 24. It pared gains to trade 1.15% higher at Rs 140.20 apiece, as of 11:36 a.m. This compares to a 0.66% decline in the NSE Nifty 50 Index.

It has risen 16.85% on a year-to-date basis and 45.86% in the last 12 months. Total traded volume so far in the day stood at 1.81 times its 30-day average. The relative strength index was at 43.91.

Out of 18 analysts tracking the company, 15 maintain a 'buy' rating, one recommend a 'hold,' and two suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 10.3%.

The scrip rose as much as 6.38% to Rs 147.5 apiece, the highest level since May 24. It pared gains to trade 1.15% higher at Rs 140.20 apiece, as of 11:36 a.m. This compares to a 0.66% decline in the NSE Nifty 50 Index.

It has risen 16.85% on a year-to-date basis and 45.86% in the last 12 months. Total traded volume so far in the day stood at 1.81 times its 30-day average. The relative strength index was at 43.91.

Out of 18 analysts tracking the company, 15 maintain a 'buy' rating, one recommend a 'hold,' and two suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 10.3%.

Jash Engineering Ltd.'s subsidiary opened a pens new manufacturing facility in Glasgow.

Source: Exchange filing

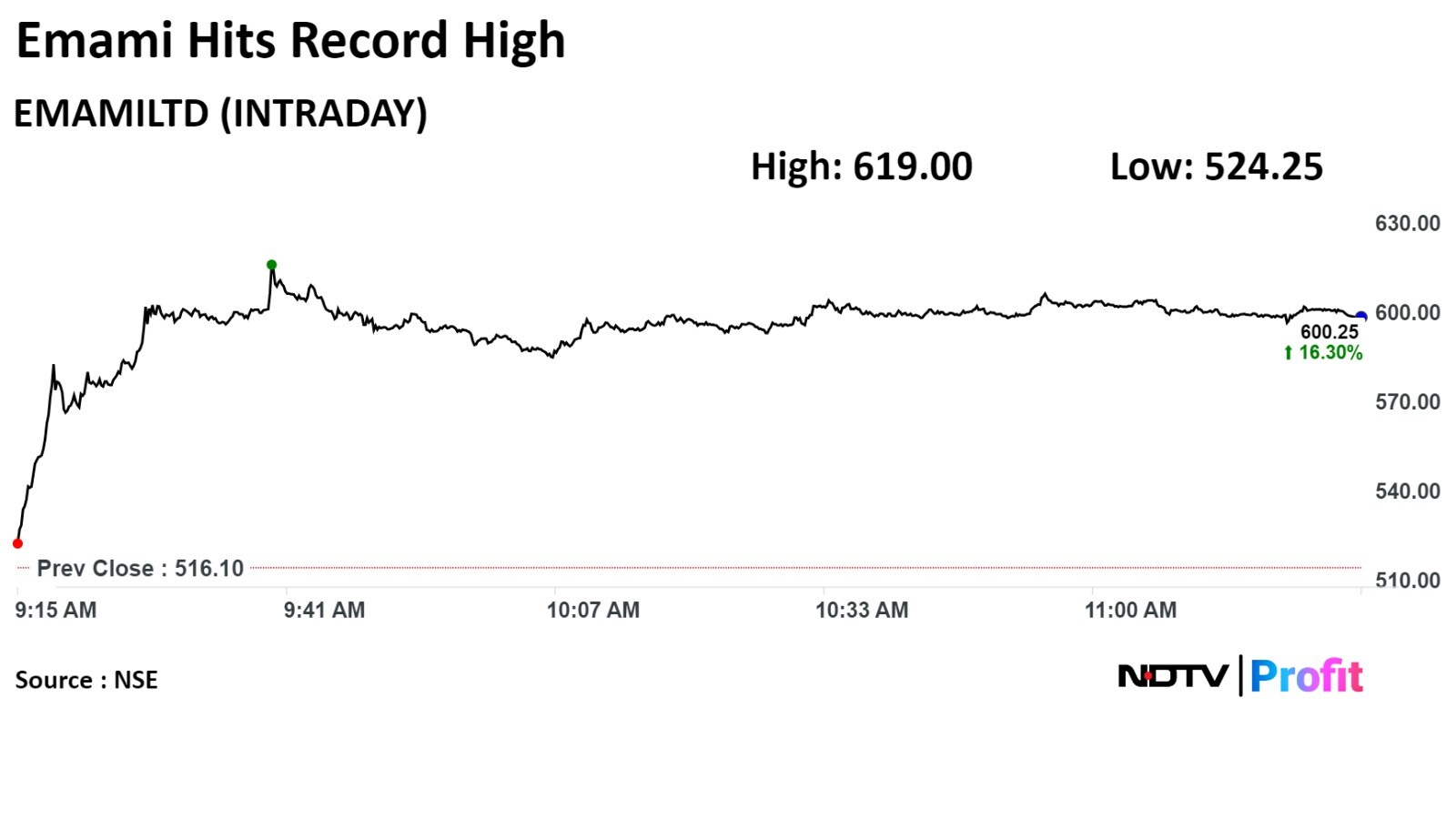

Shares of Emami Ltd. surged on Thursday after its net profit rose 3.6% to Rs 146.8 crore in the fourth quarter of financial year 2024.

Shares of Emami Ltd. surged on Thursday after its net profit rose 3.6% to Rs 146.8 crore in the fourth quarter of financial year 2024.

On Indian Economy

Real GDP growth for FY25 is projected at 7%

FY24 total expenditure at Rs 64,694 crore from Rs 1.48 lakh crore in FY23

Sustained 7% growth for three successive years on govt capex

Farm activity slowed in FY24 on uneven, deficient monsoon

Labour market conditions improved during FY23, FY24

IT sector remained muted in FY24 on global headwinds

On Inflation

Headline inflation is expected to moderate further

RBI's Finances

Income increased by 17.04%; Expenditure decreased by 56.3%

Rs 42,820 crore moved to contingency fund for FY24

Balance sheet rose by 11% to Rs 70.48 lakh crore in FY24

Forex transaction gains in FY24 at Rs 83,610 crore from Rs 1.03 lakh crore in FY23

FY24 foreign source income at Rs 1.87 lakh crore, up 23% YoY

On Liquidity

RBI plans to issue consolidated instructions on liquidity facility

Liquidity operations to be in sync with stance of monetary policy

To liberalise external commercial borrowing framework

On Global Conditions

Global economy growth may weaken below historical average in 2024

To review IFSC regulations under FEMA

On Non-Banking Financial Services' Management

Reviewing need for RBI nod for change in managements of HFCs & NBFCs

Source: Cogencis

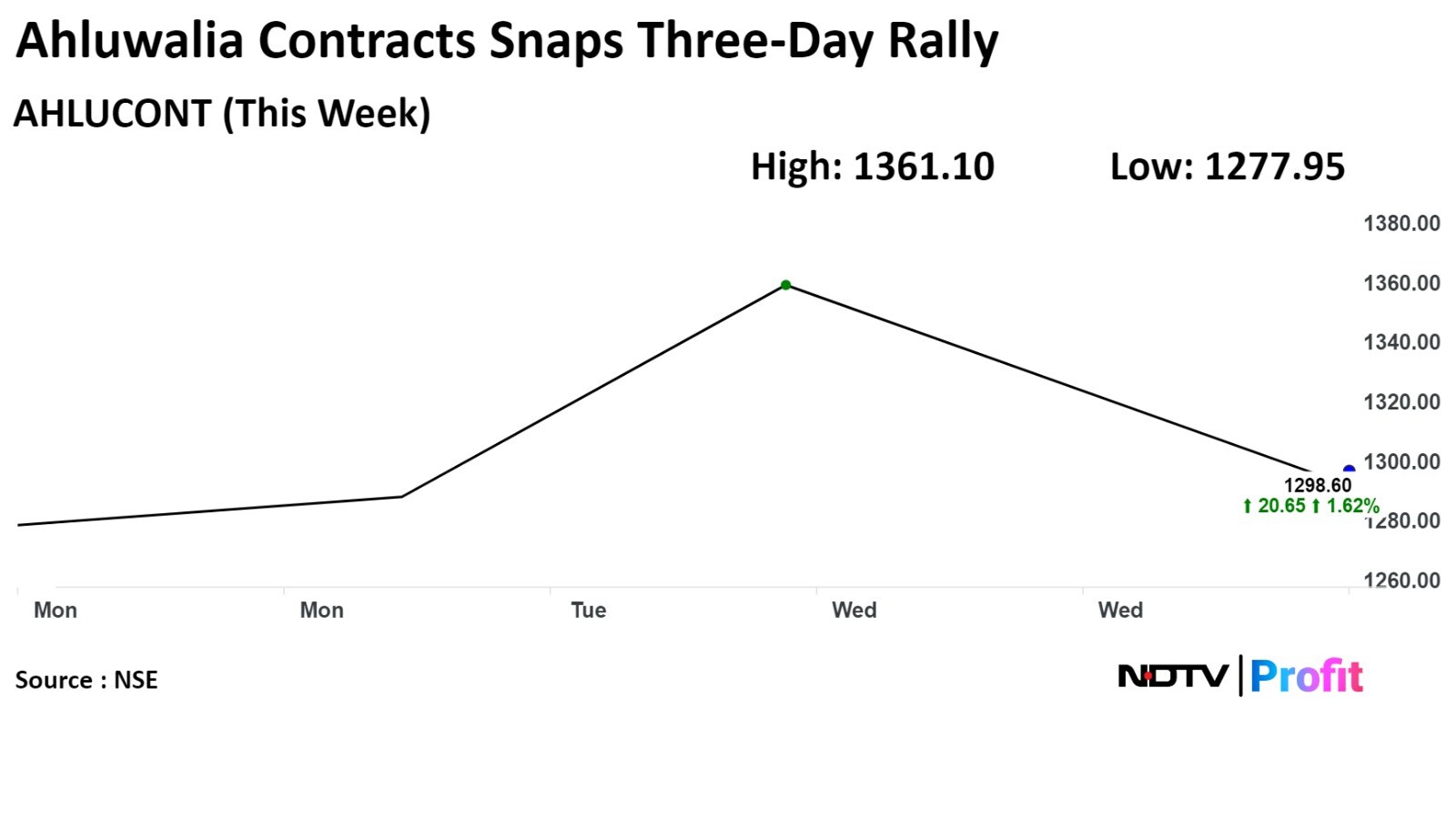

Ahluwalia Contracts Ltd. has declined 13.47% to Rs 1,177.75 apiece, the lowest level since May 16. It pared losses to trade 4.86% down at Rs 1,294.90 as of 11:19 a.m., as compared to 0.62% decline in the NSE Nifty 50 index.

It has risen 121.45% in 12 months, and it has risen 66.98% on year to date basis. Total traded volume so far in the day stood at 6.35 times its 30-day average. The relative strength index was at 65.92.

Ahluwalia Contracts Ltd. has declined 13.47% to Rs 1,177.75 apiece, the lowest level since May 16. It pared losses to trade 4.86% down at Rs 1,294.90 as of 11:19 a.m., as compared to 0.62% decline in the NSE Nifty 50 index.

It has risen 121.45% in 12 months, and it has risen 66.98% on year to date basis. Total traded volume so far in the day stood at 6.35 times its 30-day average. The relative strength index was at 65.92.

Shares of Tata Steel Ltd. declined to the lowest level in nearly two weeks after the company reported a 64.6% annual fall in its consolidated net profit.

Its consolidated net profit fell 64.6% on the year to Rs 555 crore in the quarter ended in March from Rs 1,566 crore as its revenues declined.

However, brokerages like Jefferies and Motilal Oswal maintained its rating as the company's Ebitda beat their estimates.

Shares of Tata Steel Ltd. declined to the lowest level in nearly two weeks after the company reported a 64.6% annual fall in its consolidated net profit.

Its consolidated net profit fell 64.6% on the year to Rs 555 crore in the quarter ended in March from Rs 1,566 crore as its revenues declined.

However, brokerages like Jefferies and Motilal Oswal maintained its rating as the company's Ebitda beat their estimates.

.png)

The scrip fell as much as 4.28% to Rs 166.80 apiece, the lowest level since May 17. It was trading 3.79% lower at Rs 167.65 apiece, as of 11:07 a.m. This compares to a 0.50% decline in the NSE Nifty 50 Index.

It has risen 56.94% in 12 months, and on year to date basis, it has risen 20.34%. Total traded volume so far in the day stood at 2.7 times its 30-day average. The relative strength index was at 49.74.

Out of 32 analysts tracking the company, 17 maintain a 'buy' rating, eight recommend a 'hold,' and seven suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 11.1%.

Southwest Monsoon has set in over Kerala and advanced into most parts of Northeast India today, the 30th May, 2024.

— India Meteorological Department (@Indiametdept) May 30, 2024

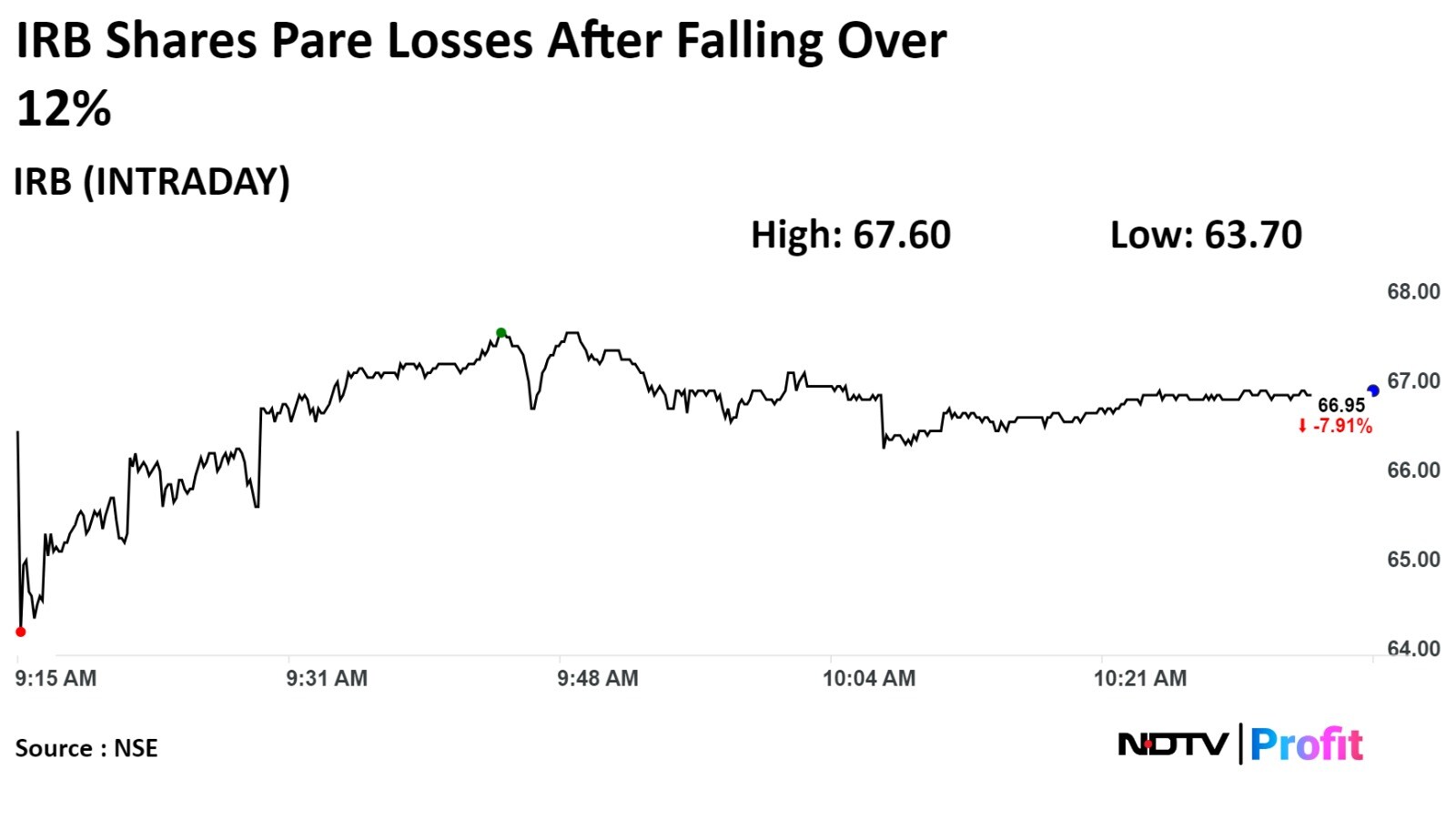

Shares of IRB Infrastructure Developers Ltd. fell after the multiple large trades on the bourses. On the NSE 4.15% stake in the company changed hands and 1.73% stake changed hands on the BSE.

Shares of IRB Infrastructure Developers Ltd. fell after the multiple large trades on the bourses. On the NSE 4.15% stake in the company changed hands and 1.73% stake changed hands on the BSE.

JSW Steel is going to launch indigenous steel product JSW Magsure.

The company aims to manufacture and market the zinc-magnesium-aluminium alloy coated product in the domestic market.

Source: Exchange filing

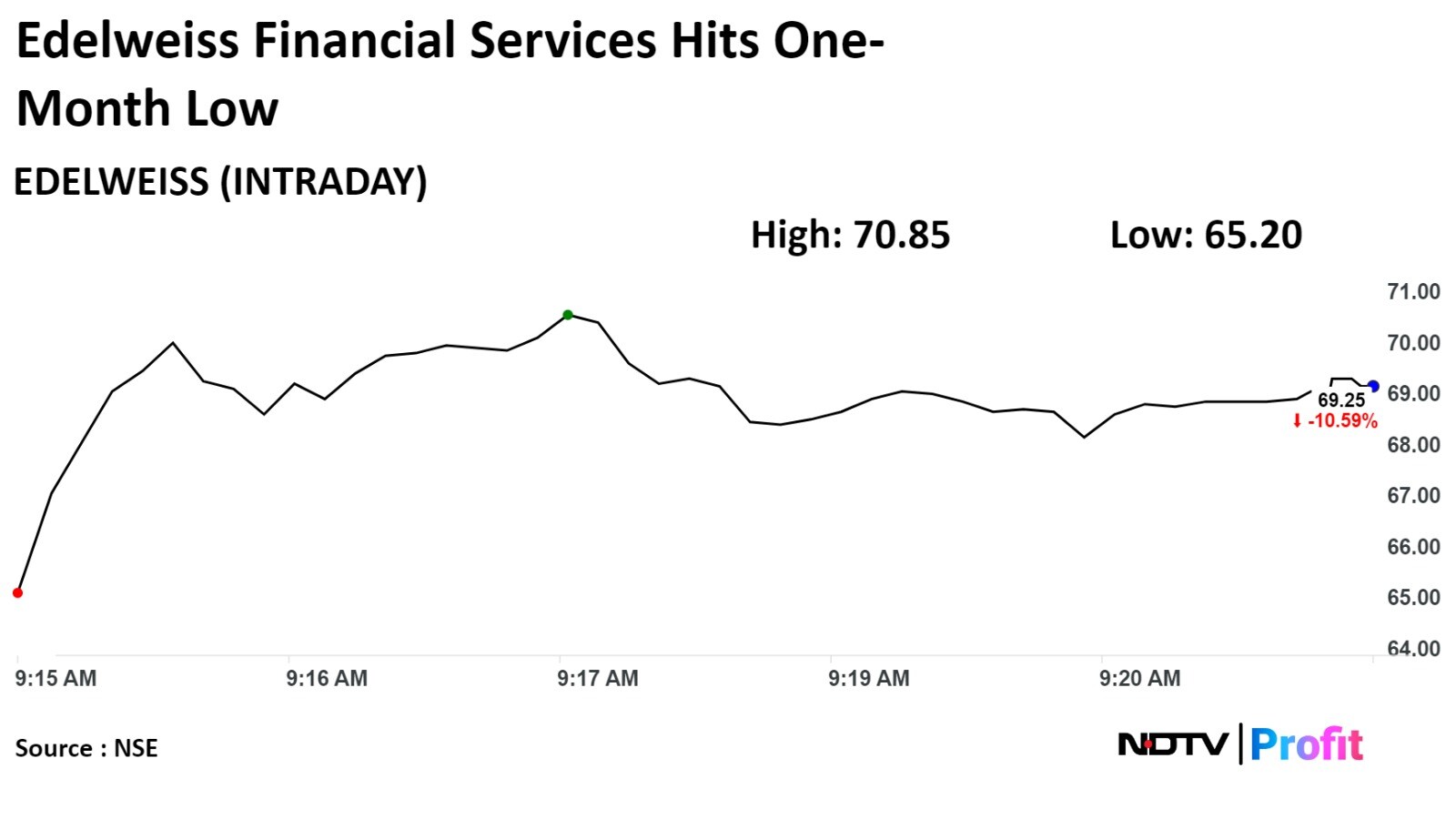

Shares of Edelweiss Financial Services Ltd. recorded their worst fall in over four years on Thursday after the Reserve Bank Of India announced severe business restrictions against two of the group's companies, owing to material supervisory concerns.

Shares of Edelweiss Financial Services Ltd. recorded their worst fall in over four years on Thursday after the Reserve Bank Of India announced severe business restrictions against two of the group's companies, owing to material supervisory concerns.

Shares of Awfis Space Solutions Ltd. listed at Rs 435 apiece on the National Stock Exchange, a premium of 13.5% to its IPO price of Rs 383 per share.

On the BSE, the stock debuted at Rs 432.25 per share, a 12.86% premium to the issue price.

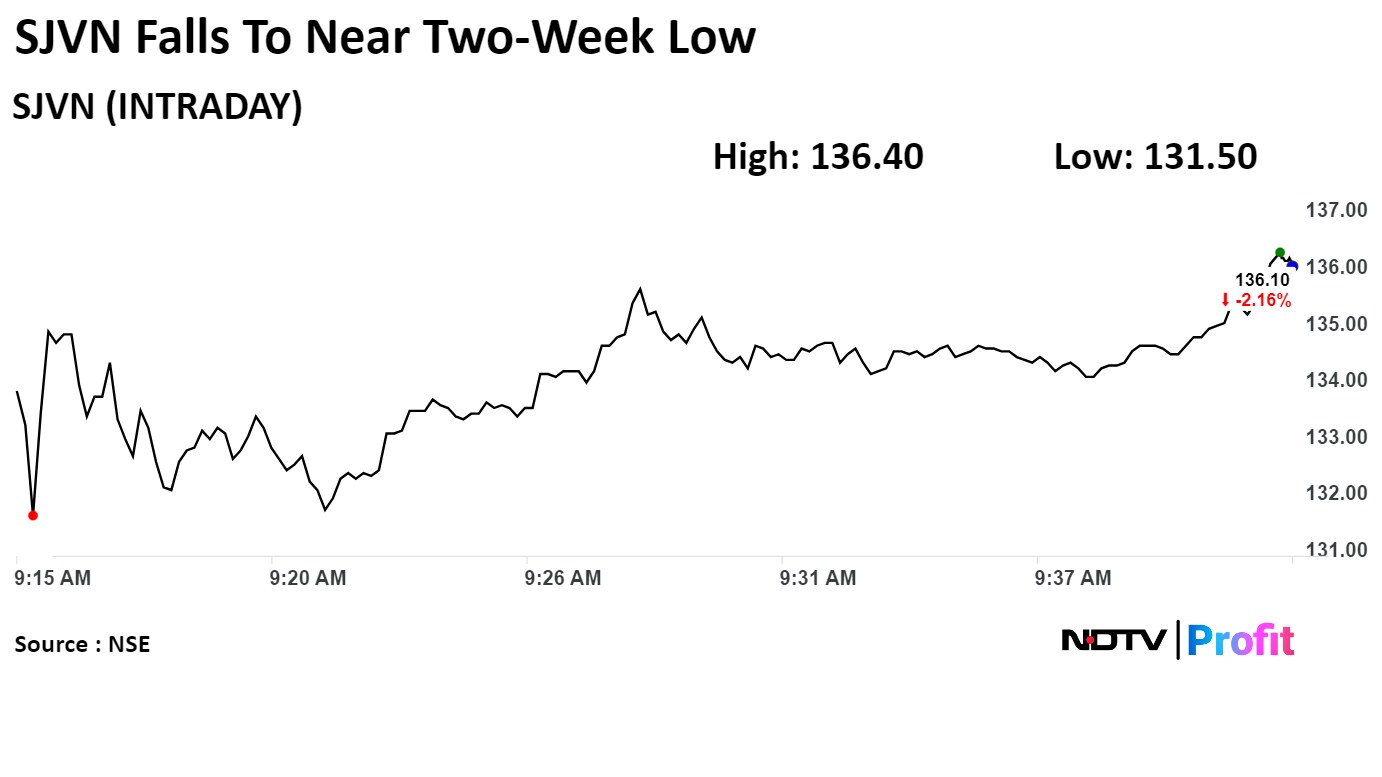

Shares of SJVN Ltd. declined to the lowest level in near two-week low after the company's revenue fell during January-March.

The scrip fell as much as 5.87% to Rs 131.50 apiece, the lowest level since May 17. It was trading 3.61% lower at Rs 134.65 apiece, as of 09:41 a.m. This compares to a 0.41% decline in the NSE Nifty 50 Index.

It has risen 275.73% in 12 months, and on year to date basis, it has risen 47.99%. Total traded volume so far in the day stood at 4.3 times its 30-day average. The relative strength index was at 48.87.

Out of five analysts tracking the company, two maintain a 'buy' rating, and three suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 16.4%.

Shares of SJVN Ltd. declined to the lowest level in near two-week low after the company's revenue fell during January-March.

The scrip fell as much as 5.87% to Rs 131.50 apiece, the lowest level since May 17. It was trading 3.61% lower at Rs 134.65 apiece, as of 09:41 a.m. This compares to a 0.41% decline in the NSE Nifty 50 Index.

It has risen 275.73% in 12 months, and on year to date basis, it has risen 47.99%. Total traded volume so far in the day stood at 4.3 times its 30-day average. The relative strength index was at 48.87.

Out of five analysts tracking the company, two maintain a 'buy' rating, and three suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 16.4%.

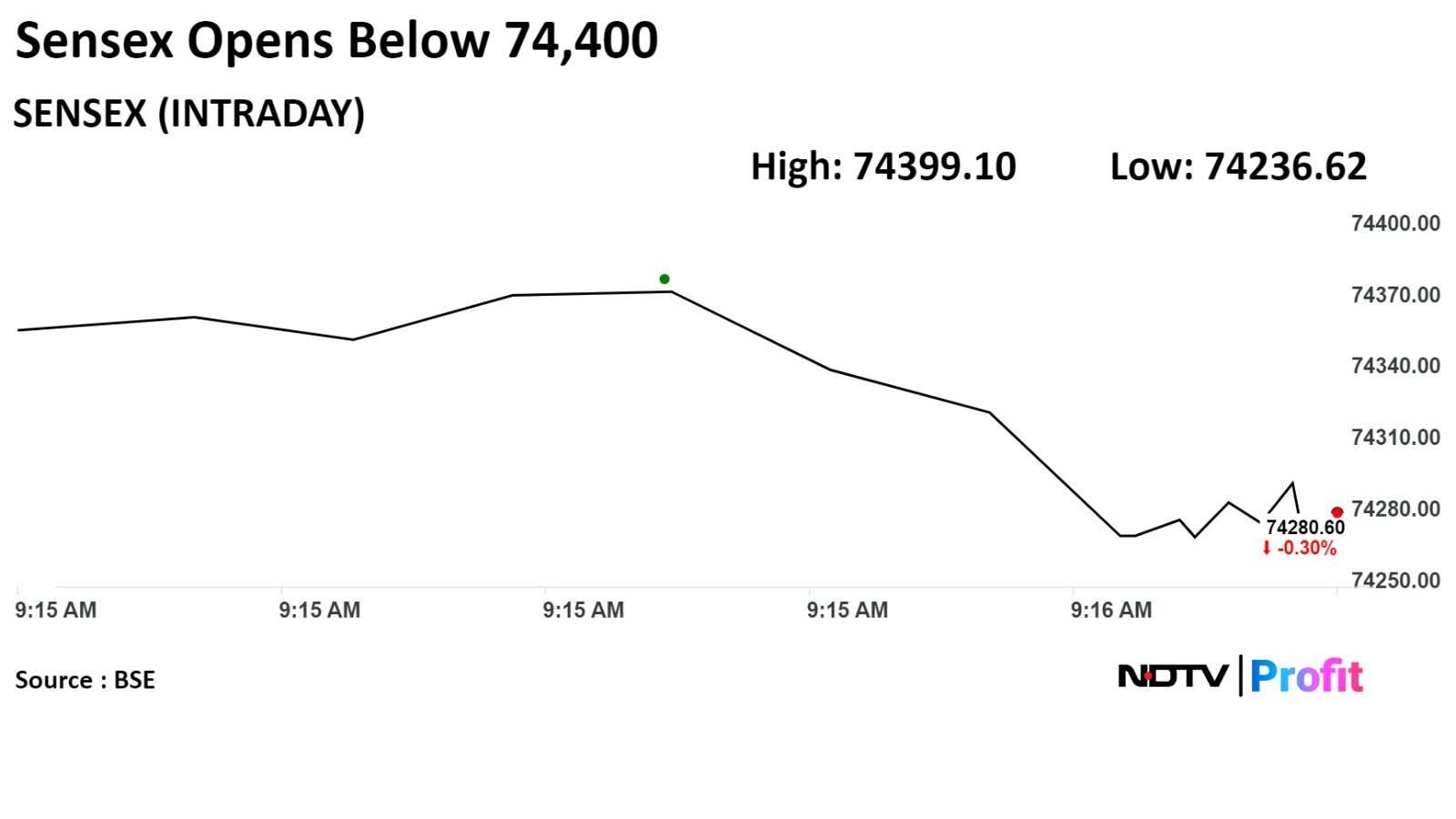

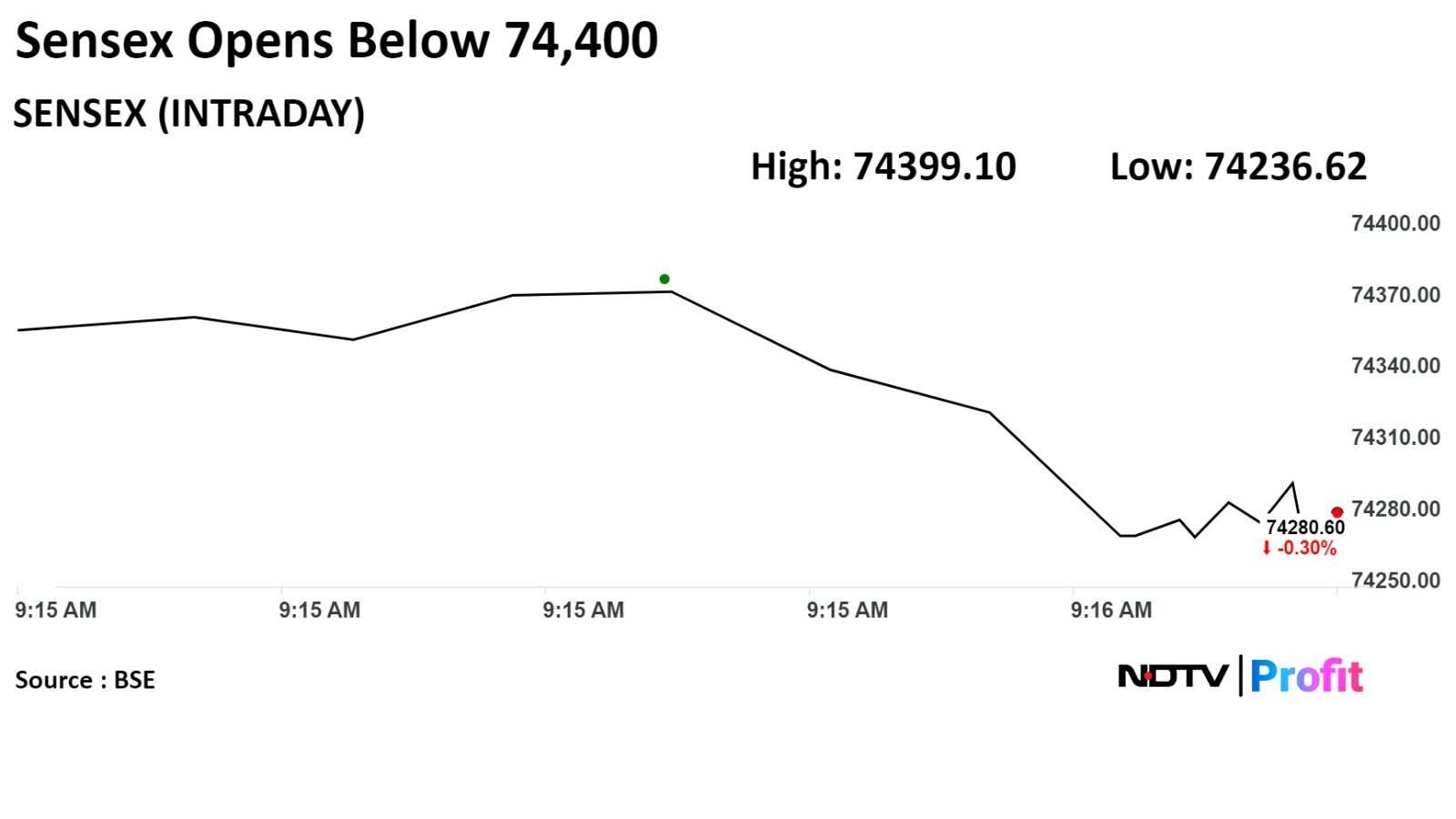

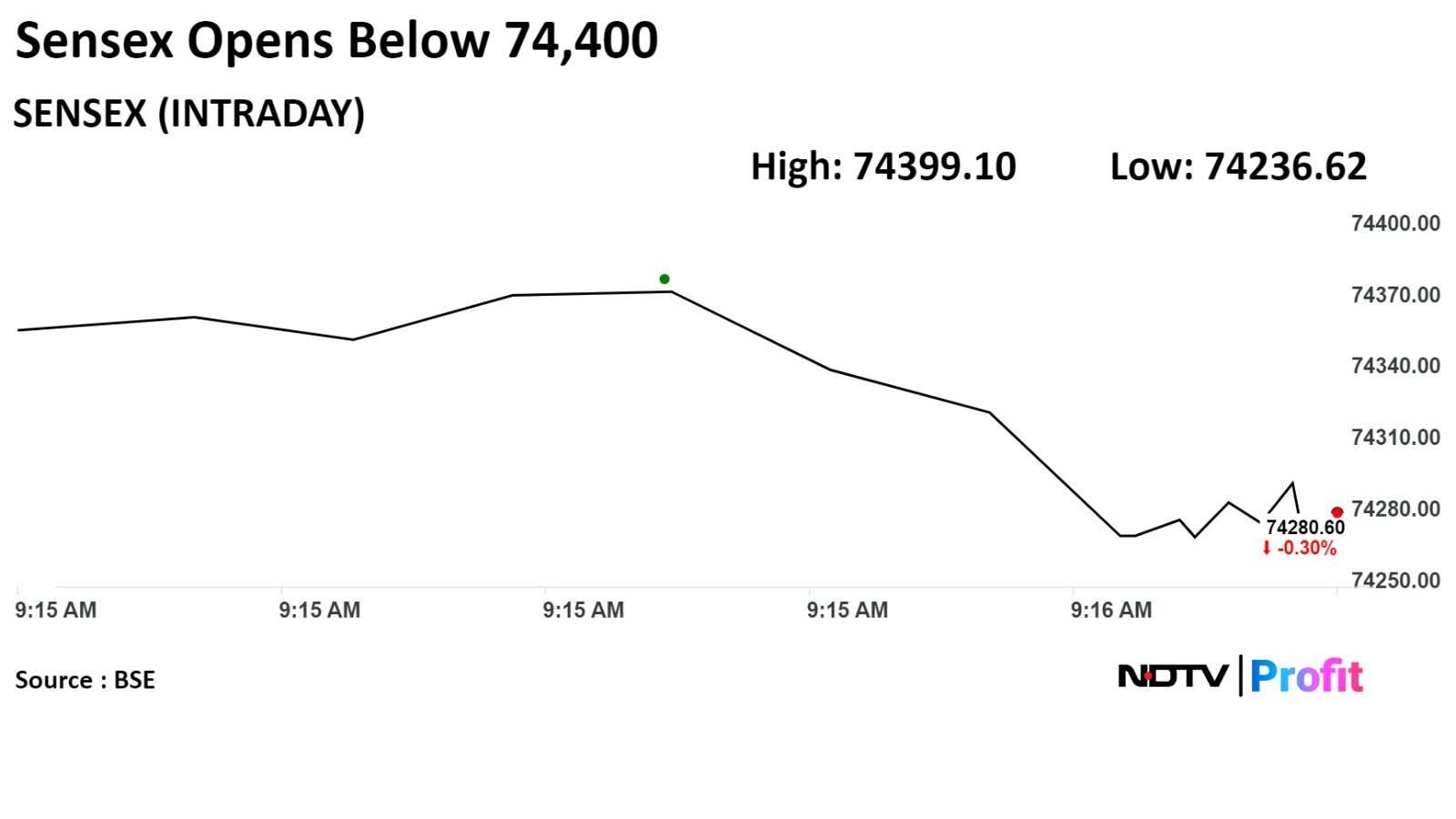

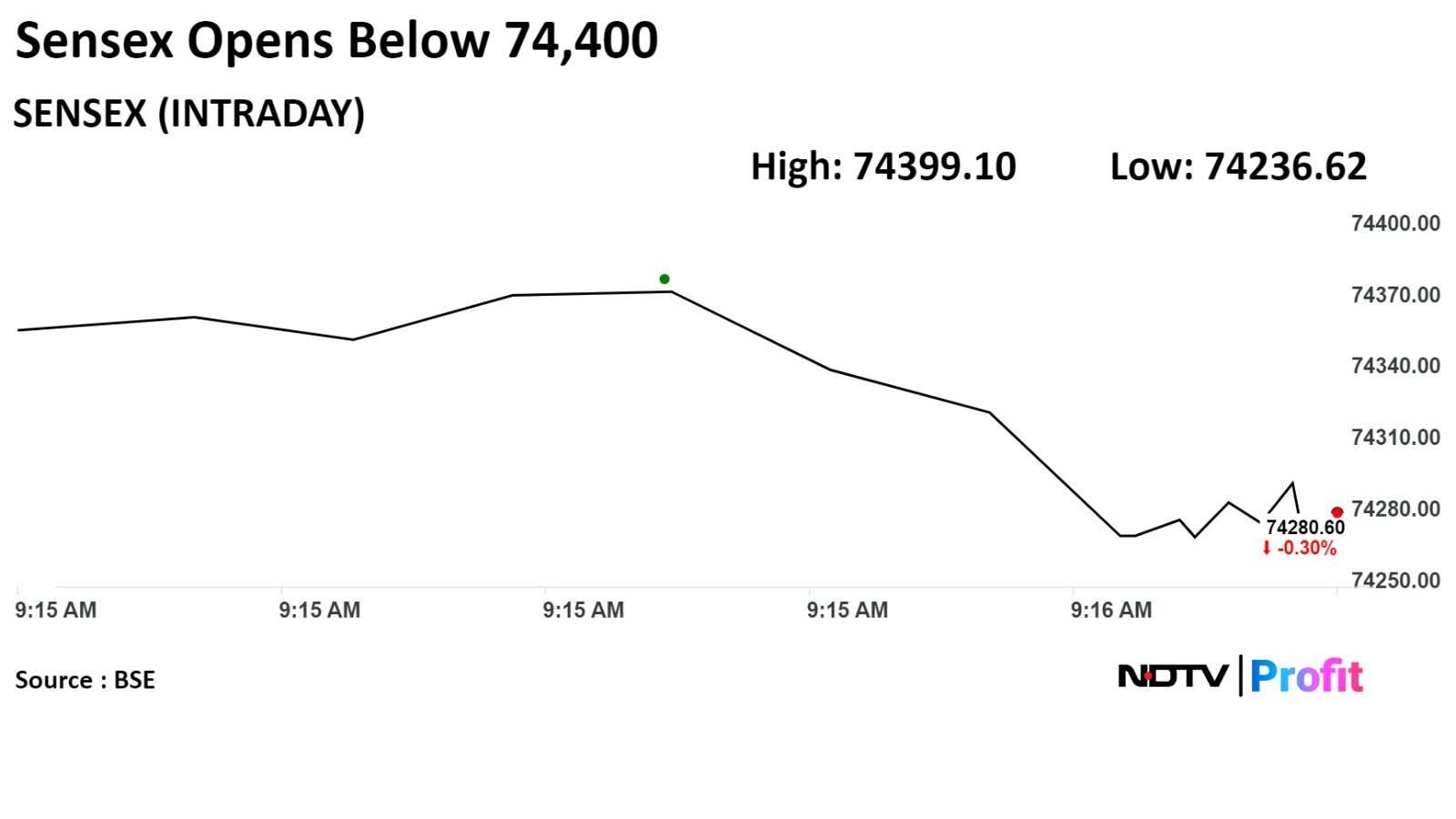

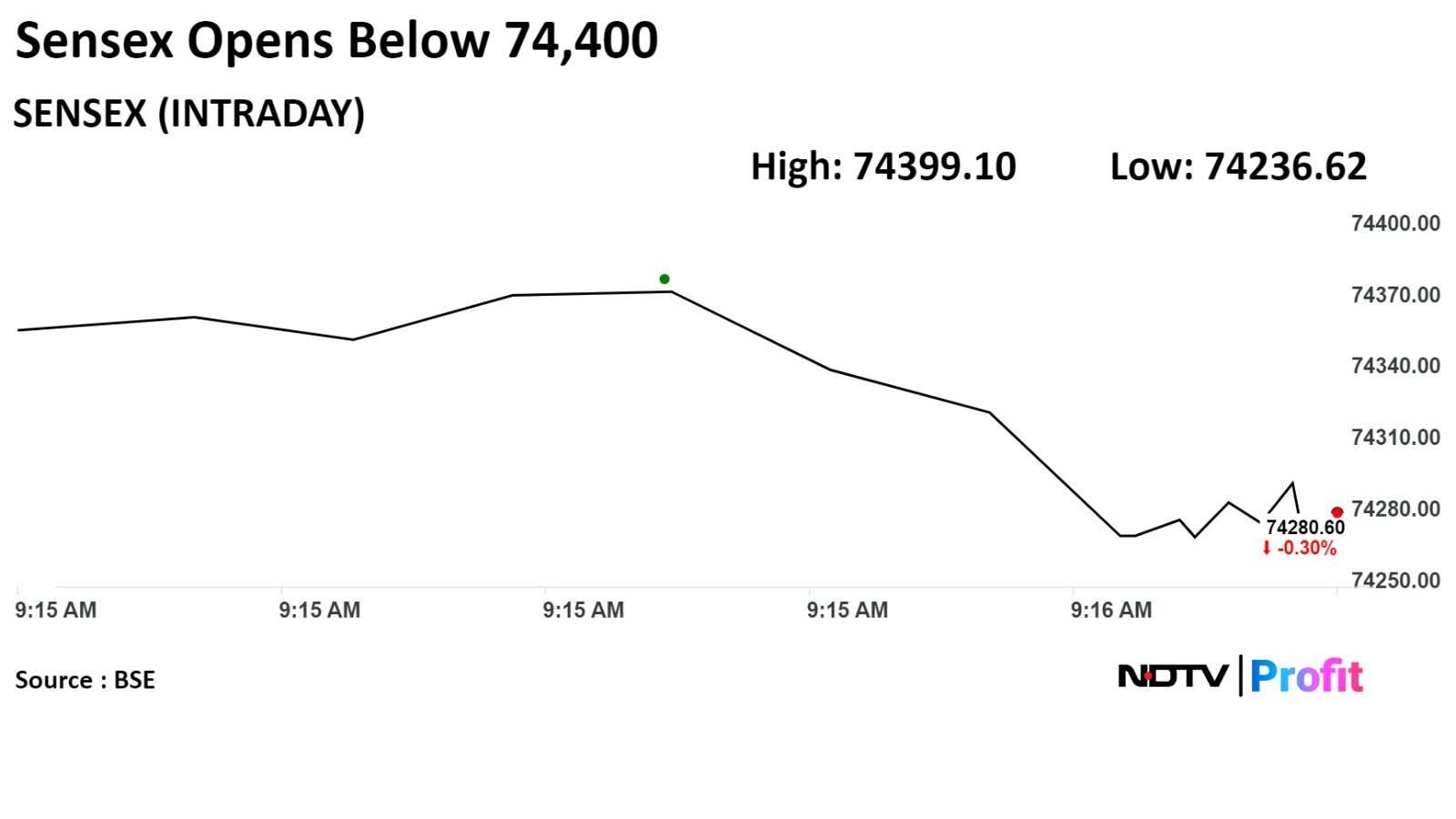

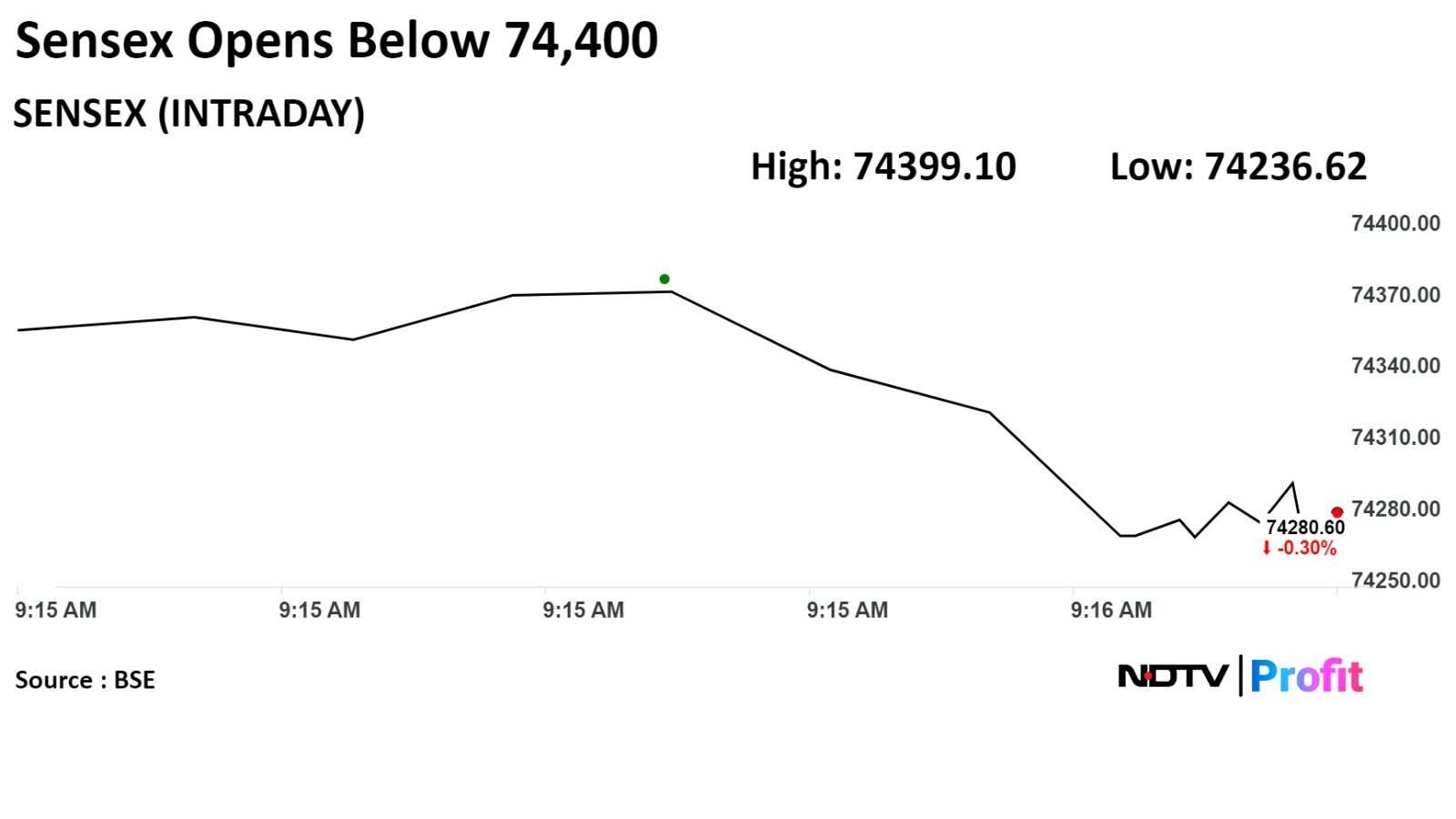

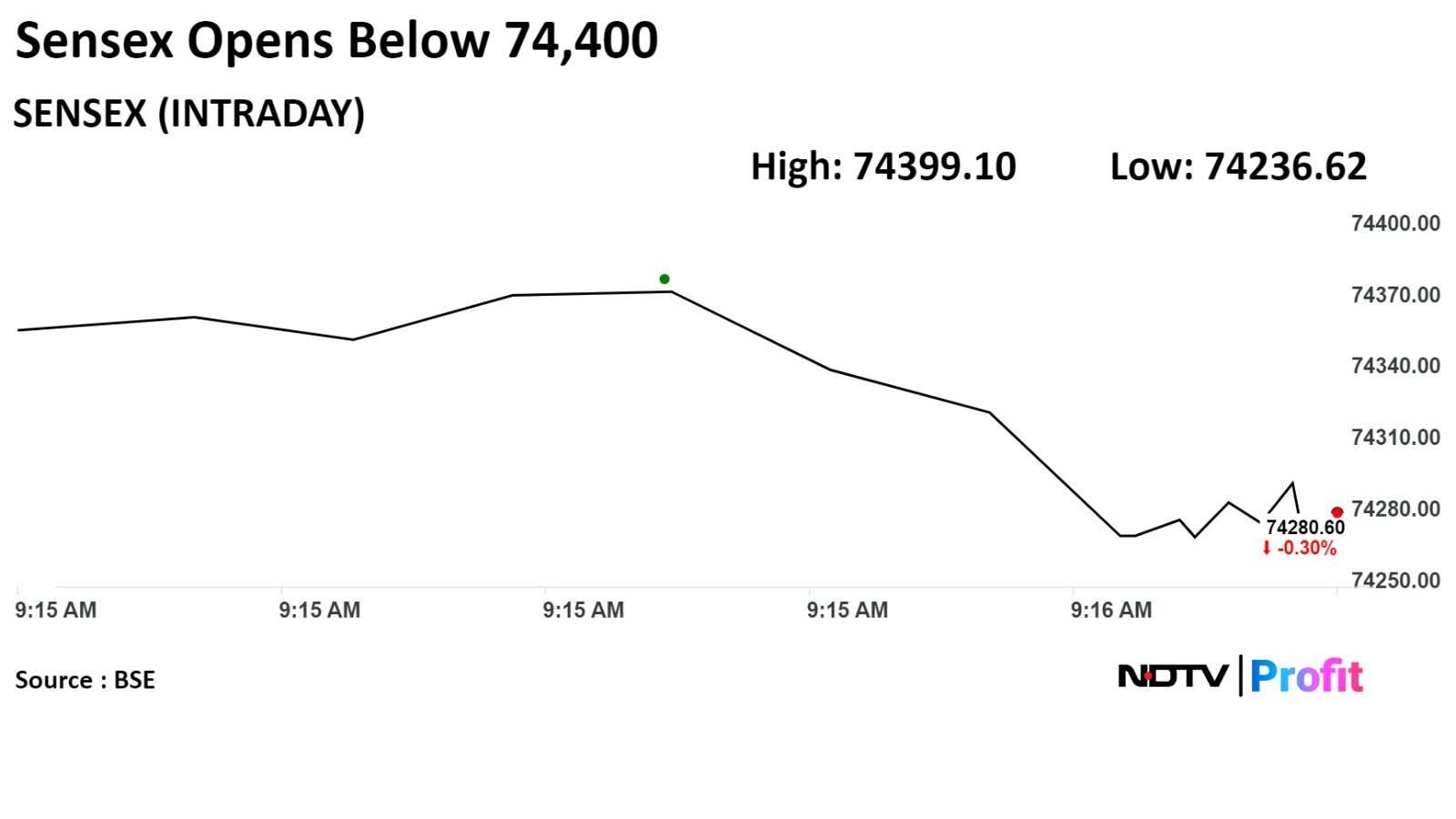

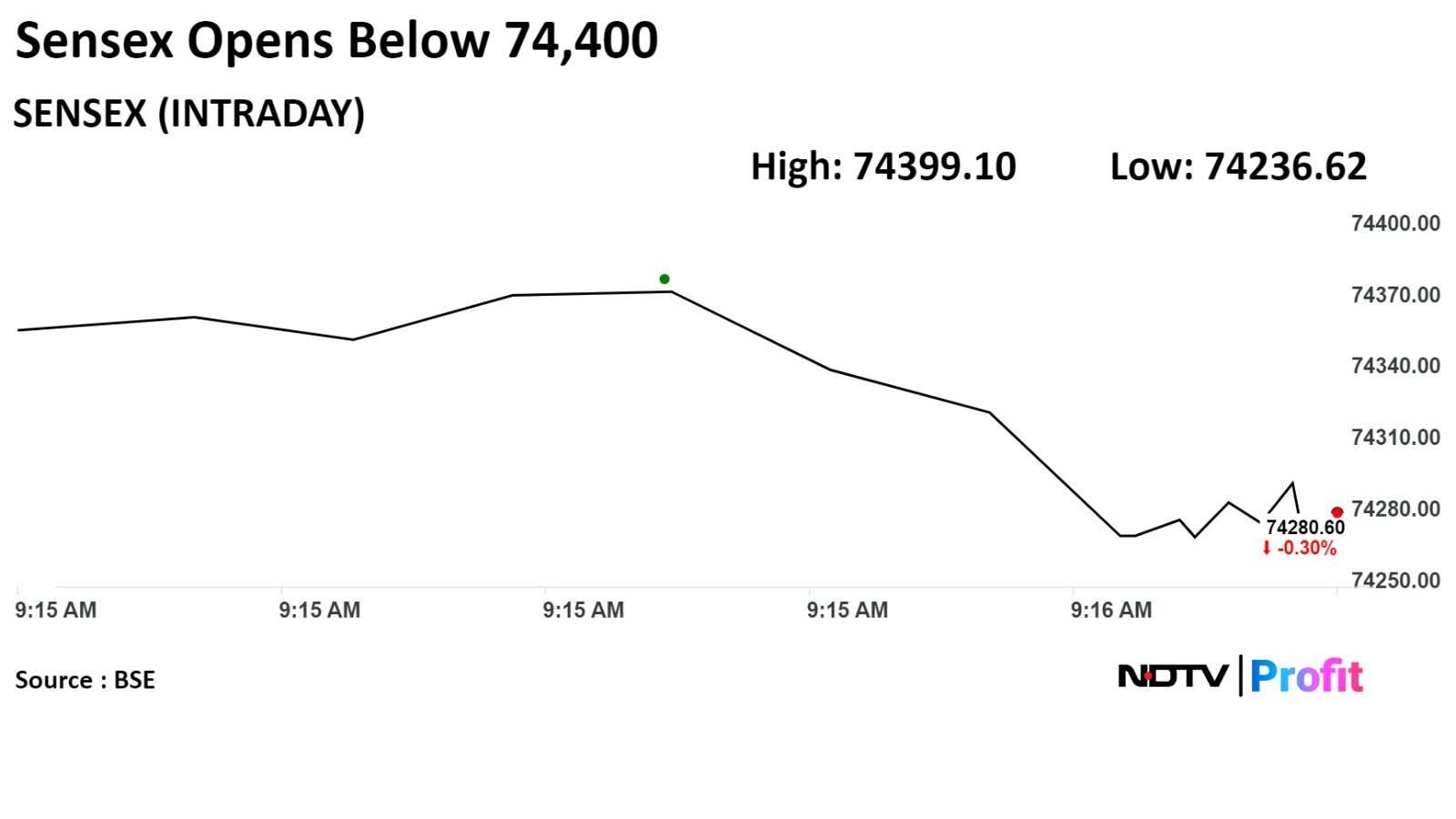

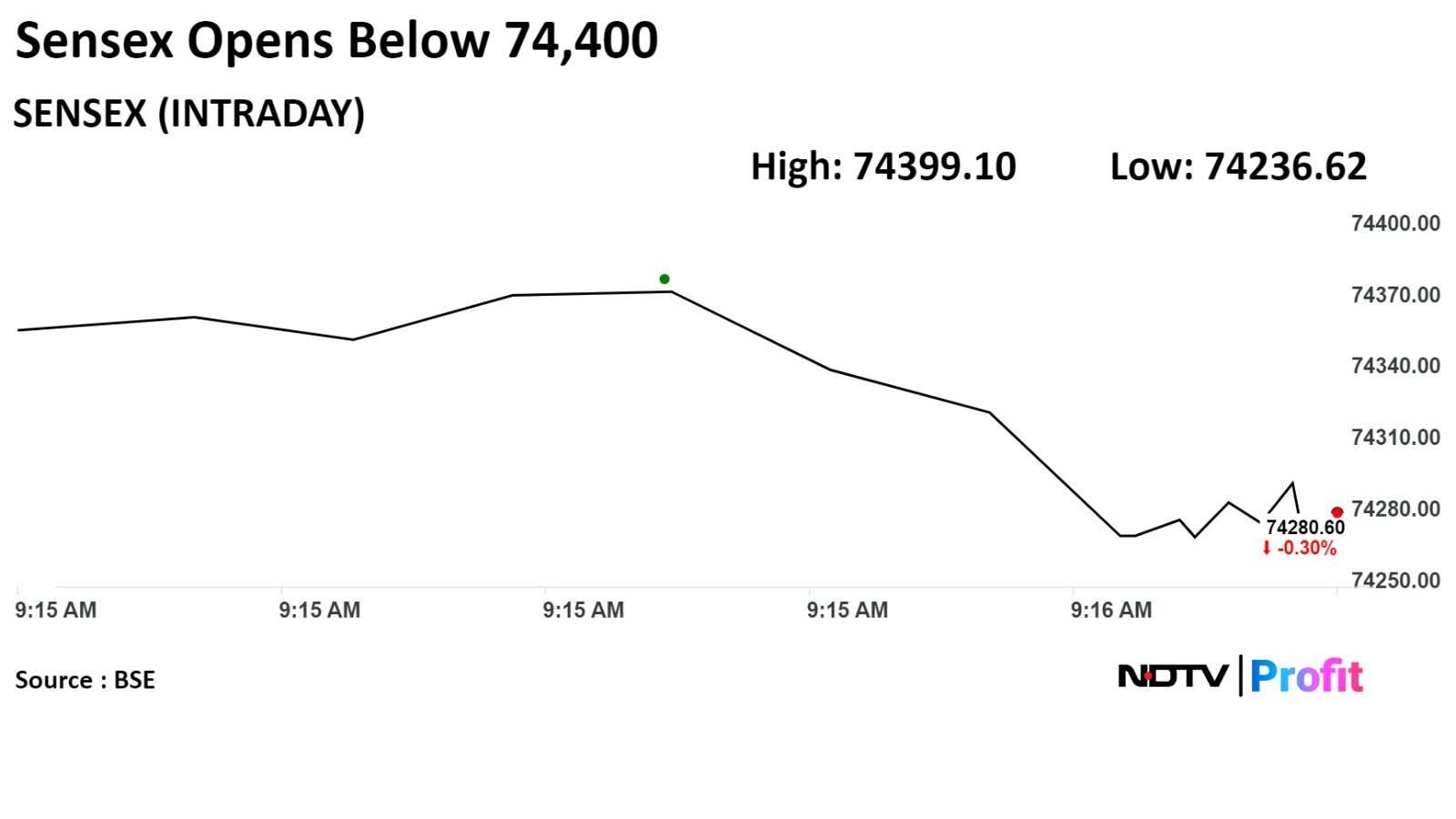

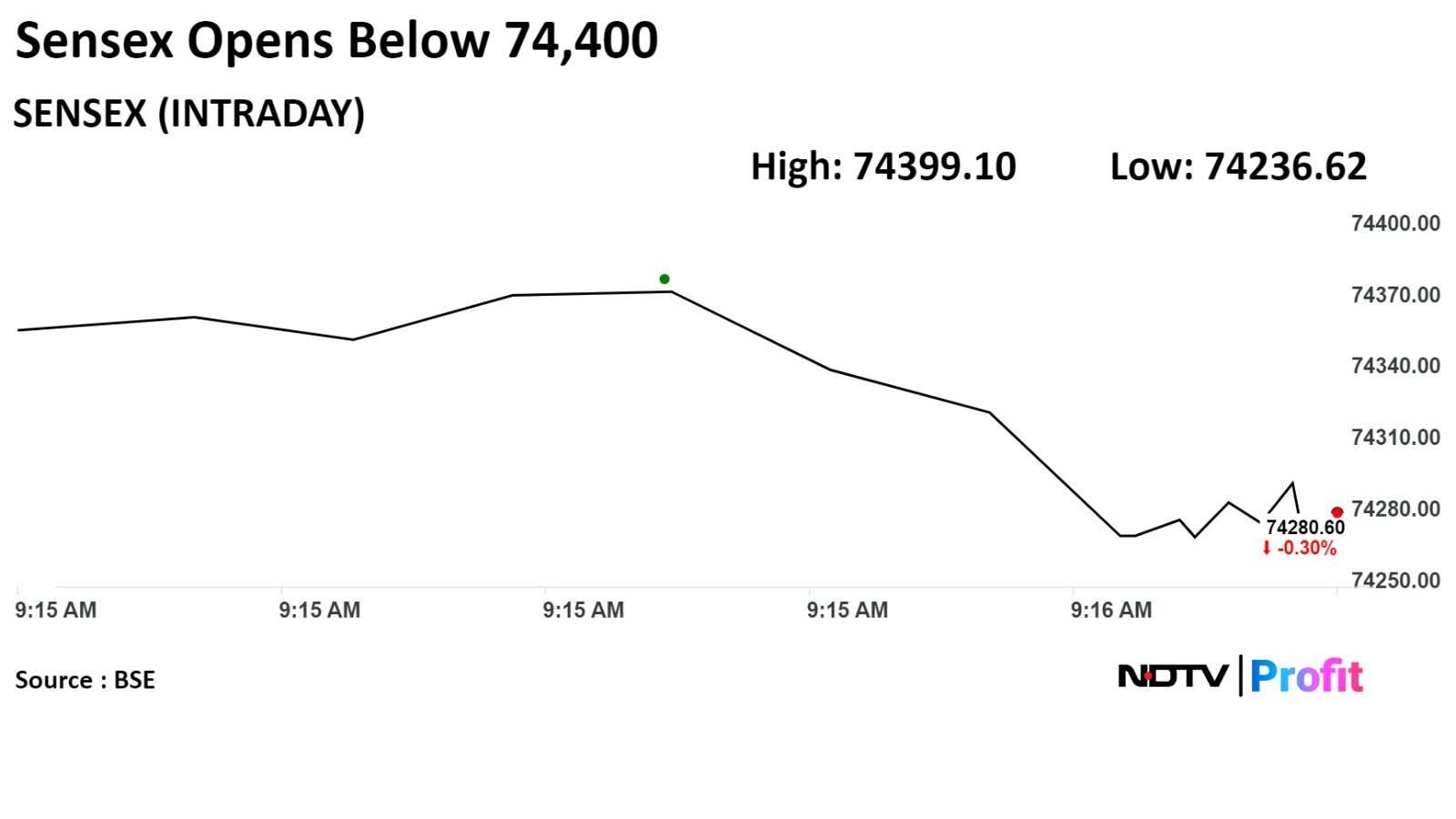

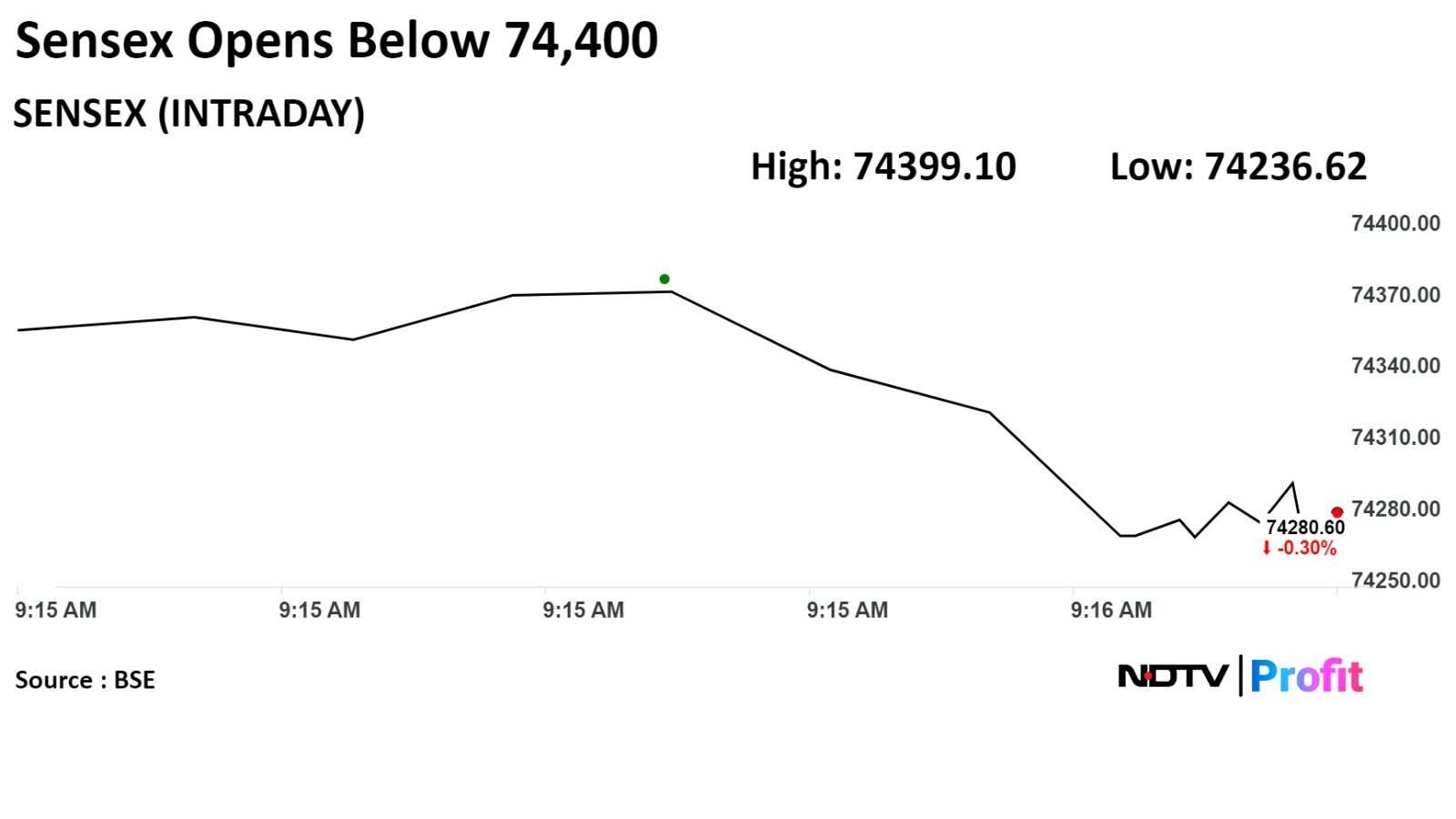

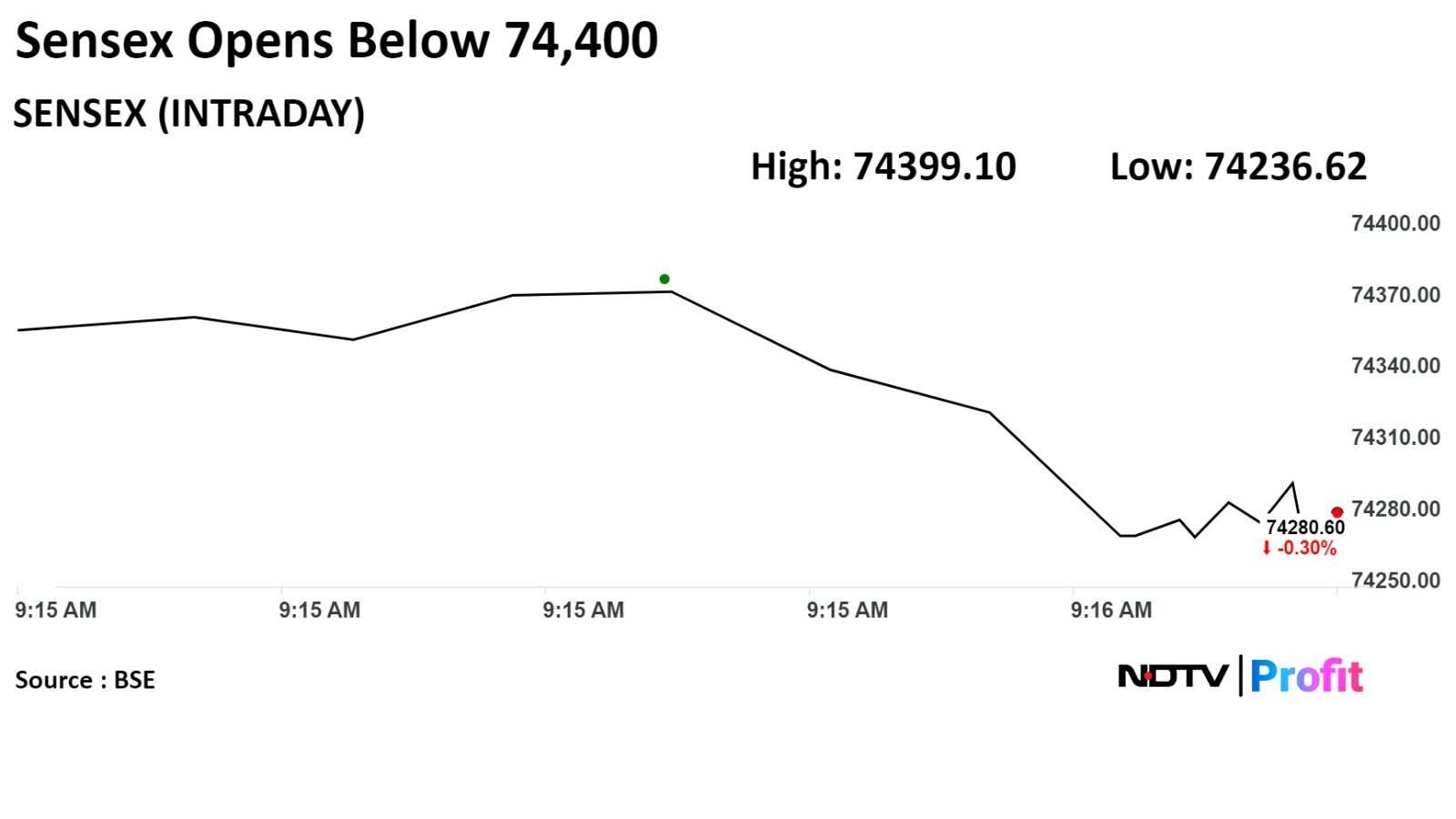

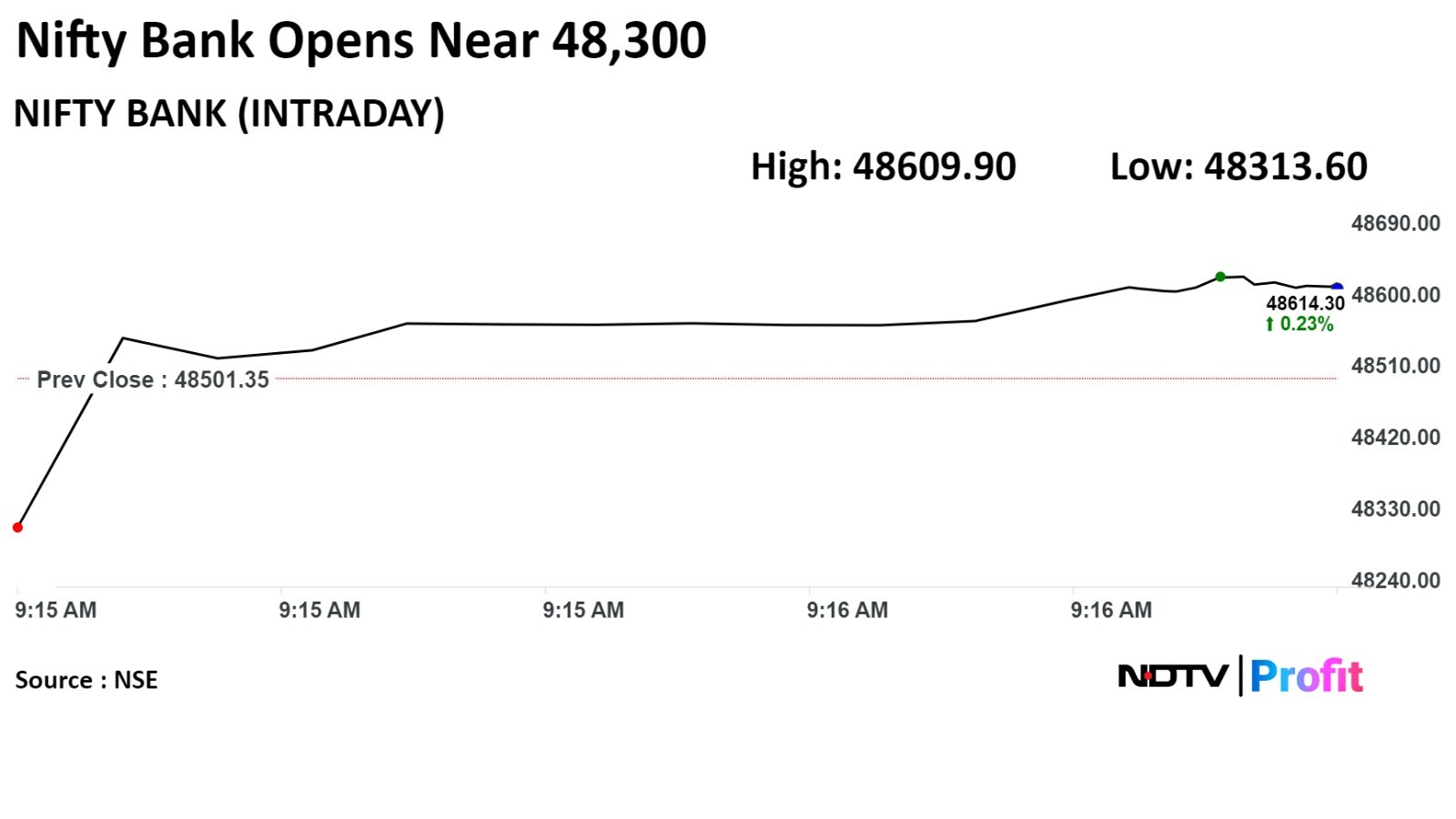

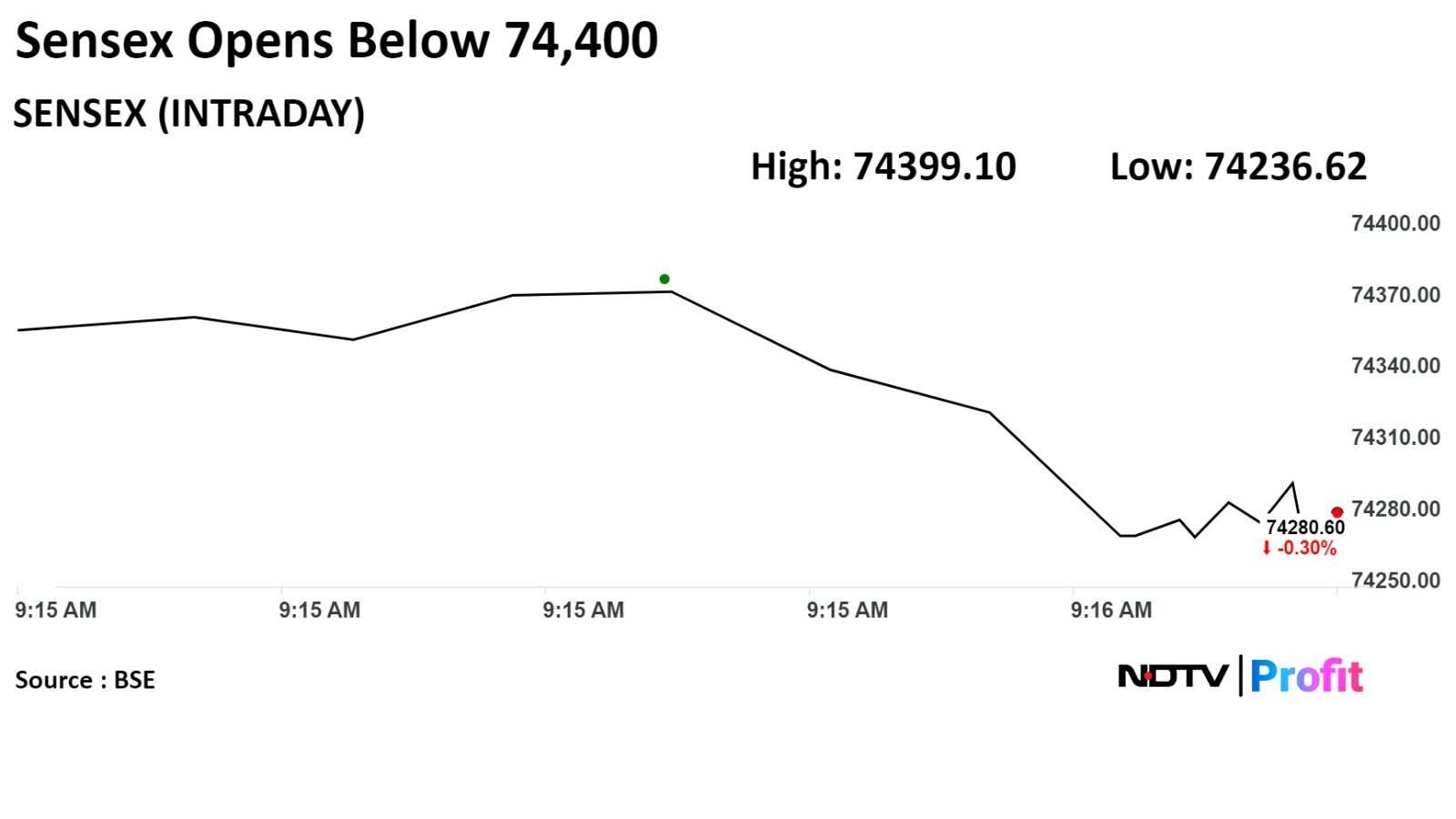

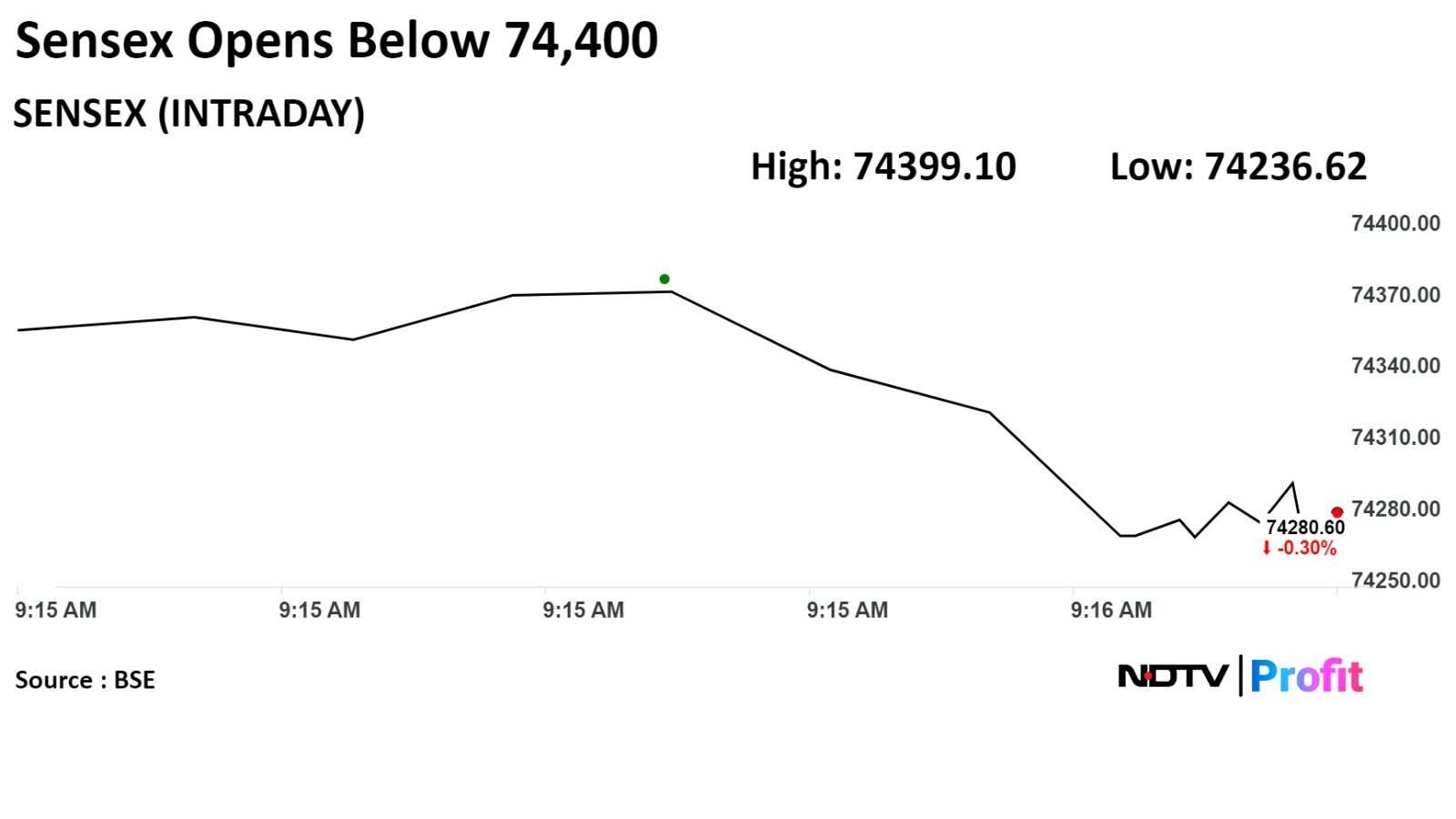

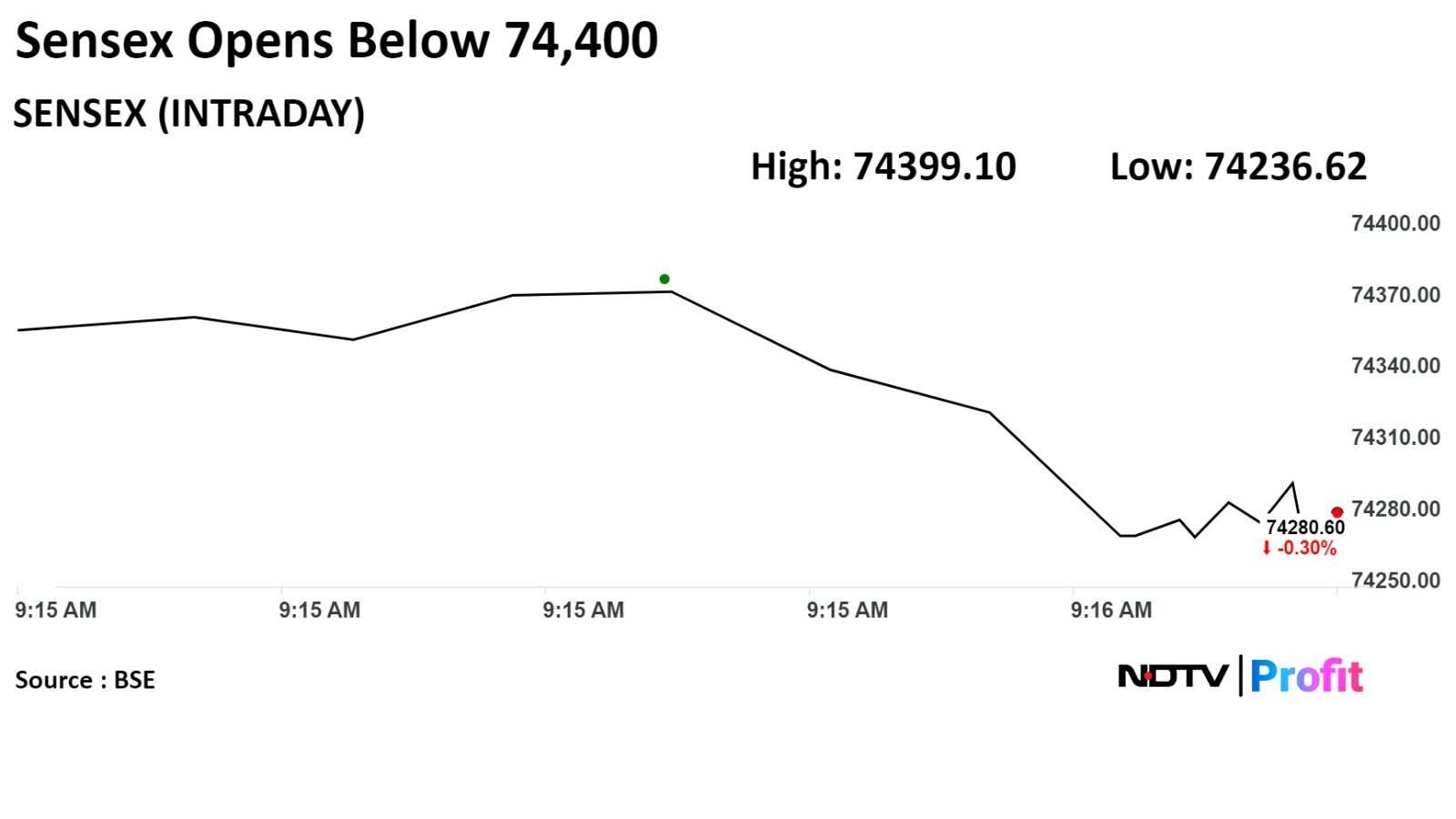

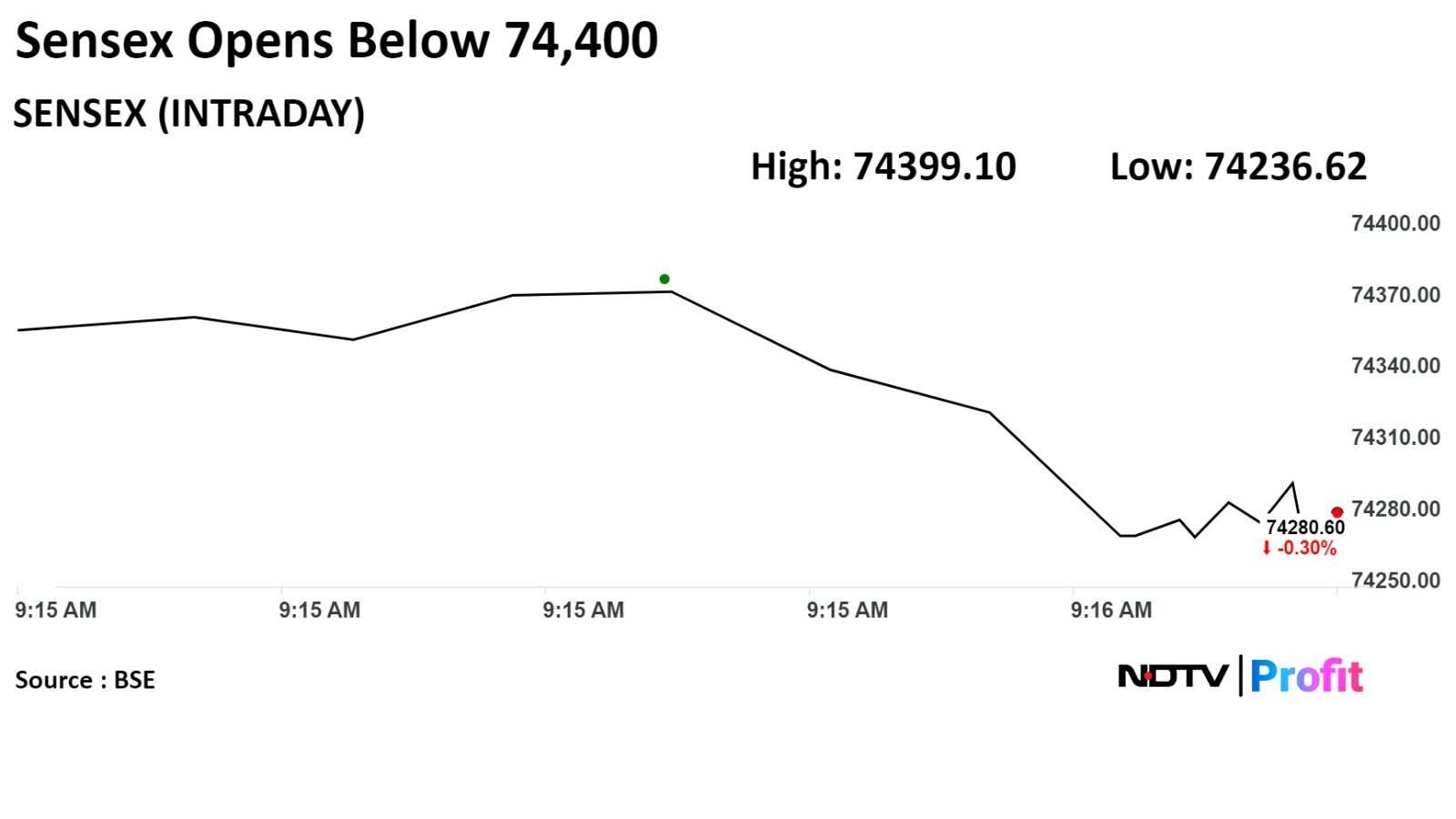

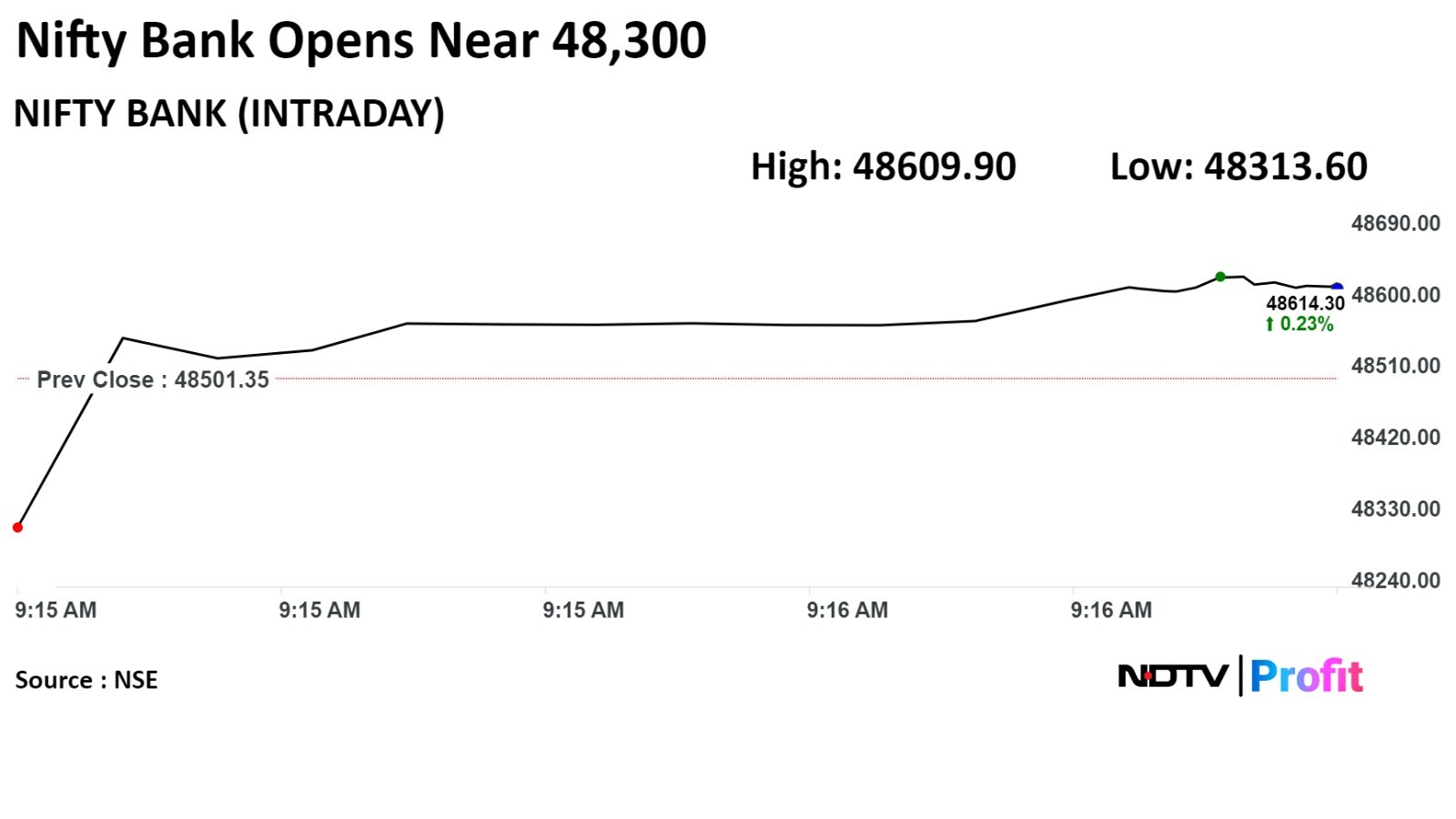

India's benchmark indices opened lower on Thursday as Tata Steel Ltd., HDFC Bank Ltd. declined.

As of 09:16 a.m., the NSE Nifty 50 was 61.95 points or 0.27% lower at 22,642.75, and the S&P BSE Sensex was 222.93 points or 0.30% down at 74,279.97.

The NSE Nifty 50 has broken on the downside from its inside range of the previous day and closed near the support of 22,650 levels, said Vikas Jain, a senior research analyst at Reliance Securities.

On the higher side crossover of 22,800 will trigger sharp covering with respect to the monthly expiry and the next support would be 22,480 being the 20 day average, Jain said.

RSI has reversed below from its average line on daily charts and oversold on hourly charts so could expect some pullback to test the higher range. Highest call OI is at 22,800 strike while the downside the highest put OI is at 22,500 for the monthly expiry, he added.

India's benchmark indices opened lower on Thursday as Tata Steel Ltd., HDFC Bank Ltd. declined.

As of 09:16 a.m., the NSE Nifty 50 was 61.95 points or 0.27% lower at 22,642.75, and the S&P BSE Sensex was 222.93 points or 0.30% down at 74,279.97.

The NSE Nifty 50 has broken on the downside from its inside range of the previous day and closed near the support of 22,650 levels, said Vikas Jain, a senior research analyst at Reliance Securities.

On the higher side crossover of 22,800 will trigger sharp covering with respect to the monthly expiry and the next support would be 22,480 being the 20 day average, Jain said.

RSI has reversed below from its average line on daily charts and oversold on hourly charts so could expect some pullback to test the higher range. Highest call OI is at 22,800 strike while the downside the highest put OI is at 22,500 for the monthly expiry, he added.

India's benchmark indices opened lower on Thursday as Tata Steel Ltd., HDFC Bank Ltd. declined.

As of 09:16 a.m., the NSE Nifty 50 was 61.95 points or 0.27% lower at 22,642.75, and the S&P BSE Sensex was 222.93 points or 0.30% down at 74,279.97.

The NSE Nifty 50 has broken on the downside from its inside range of the previous day and closed near the support of 22,650 levels, said Vikas Jain, a senior research analyst at Reliance Securities.

On the higher side crossover of 22,800 will trigger sharp covering with respect to the monthly expiry and the next support would be 22,480 being the 20 day average, Jain said.

RSI has reversed below from its average line on daily charts and oversold on hourly charts so could expect some pullback to test the higher range. Highest call OI is at 22,800 strike while the downside the highest put OI is at 22,500 for the monthly expiry, he added.

India's benchmark indices opened lower on Thursday as Tata Steel Ltd., HDFC Bank Ltd. declined.

As of 09:16 a.m., the NSE Nifty 50 was 61.95 points or 0.27% lower at 22,642.75, and the S&P BSE Sensex was 222.93 points or 0.30% down at 74,279.97.

The NSE Nifty 50 has broken on the downside from its inside range of the previous day and closed near the support of 22,650 levels, said Vikas Jain, a senior research analyst at Reliance Securities.

On the higher side crossover of 22,800 will trigger sharp covering with respect to the monthly expiry and the next support would be 22,480 being the 20 day average, Jain said.

RSI has reversed below from its average line on daily charts and oversold on hourly charts so could expect some pullback to test the higher range. Highest call OI is at 22,800 strike while the downside the highest put OI is at 22,500 for the monthly expiry, he added.

.jpeg)

India's benchmark indices opened lower on Thursday as Tata Steel Ltd., HDFC Bank Ltd. declined.

As of 09:16 a.m., the NSE Nifty 50 was 61.95 points or 0.27% lower at 22,642.75, and the S&P BSE Sensex was 222.93 points or 0.30% down at 74,279.97.

The NSE Nifty 50 has broken on the downside from its inside range of the previous day and closed near the support of 22,650 levels, said Vikas Jain, a senior research analyst at Reliance Securities.

On the higher side crossover of 22,800 will trigger sharp covering with respect to the monthly expiry and the next support would be 22,480 being the 20 day average, Jain said.

RSI has reversed below from its average line on daily charts and oversold on hourly charts so could expect some pullback to test the higher range. Highest call OI is at 22,800 strike while the downside the highest put OI is at 22,500 for the monthly expiry, he added.

India's benchmark indices opened lower on Thursday as Tata Steel Ltd., HDFC Bank Ltd. declined.

As of 09:16 a.m., the NSE Nifty 50 was 61.95 points or 0.27% lower at 22,642.75, and the S&P BSE Sensex was 222.93 points or 0.30% down at 74,279.97.

The NSE Nifty 50 has broken on the downside from its inside range of the previous day and closed near the support of 22,650 levels, said Vikas Jain, a senior research analyst at Reliance Securities.

On the higher side crossover of 22,800 will trigger sharp covering with respect to the monthly expiry and the next support would be 22,480 being the 20 day average, Jain said.

RSI has reversed below from its average line on daily charts and oversold on hourly charts so could expect some pullback to test the higher range. Highest call OI is at 22,800 strike while the downside the highest put OI is at 22,500 for the monthly expiry, he added.

India's benchmark indices opened lower on Thursday as Tata Steel Ltd., HDFC Bank Ltd. declined.

As of 09:16 a.m., the NSE Nifty 50 was 61.95 points or 0.27% lower at 22,642.75, and the S&P BSE Sensex was 222.93 points or 0.30% down at 74,279.97.

The NSE Nifty 50 has broken on the downside from its inside range of the previous day and closed near the support of 22,650 levels, said Vikas Jain, a senior research analyst at Reliance Securities.

On the higher side crossover of 22,800 will trigger sharp covering with respect to the monthly expiry and the next support would be 22,480 being the 20 day average, Jain said.

RSI has reversed below from its average line on daily charts and oversold on hourly charts so could expect some pullback to test the higher range. Highest call OI is at 22,800 strike while the downside the highest put OI is at 22,500 for the monthly expiry, he added.

India's benchmark indices opened lower on Thursday as Tata Steel Ltd., HDFC Bank Ltd. declined.

As of 09:16 a.m., the NSE Nifty 50 was 61.95 points or 0.27% lower at 22,642.75, and the S&P BSE Sensex was 222.93 points or 0.30% down at 74,279.97.

The NSE Nifty 50 has broken on the downside from its inside range of the previous day and closed near the support of 22,650 levels, said Vikas Jain, a senior research analyst at Reliance Securities.

On the higher side crossover of 22,800 will trigger sharp covering with respect to the monthly expiry and the next support would be 22,480 being the 20 day average, Jain said.

RSI has reversed below from its average line on daily charts and oversold on hourly charts so could expect some pullback to test the higher range. Highest call OI is at 22,800 strike while the downside the highest put OI is at 22,500 for the monthly expiry, he added.

.jpeg)

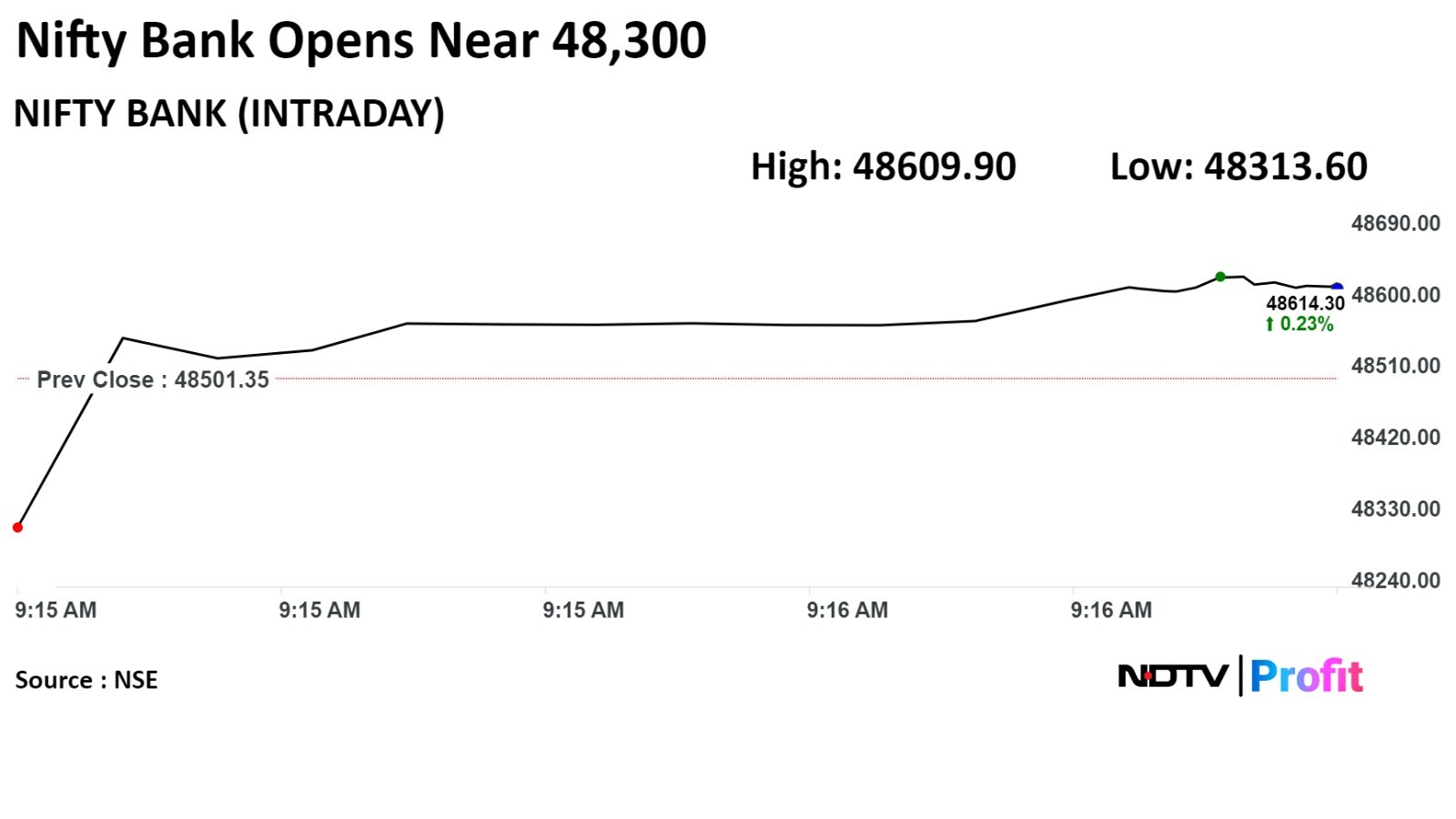

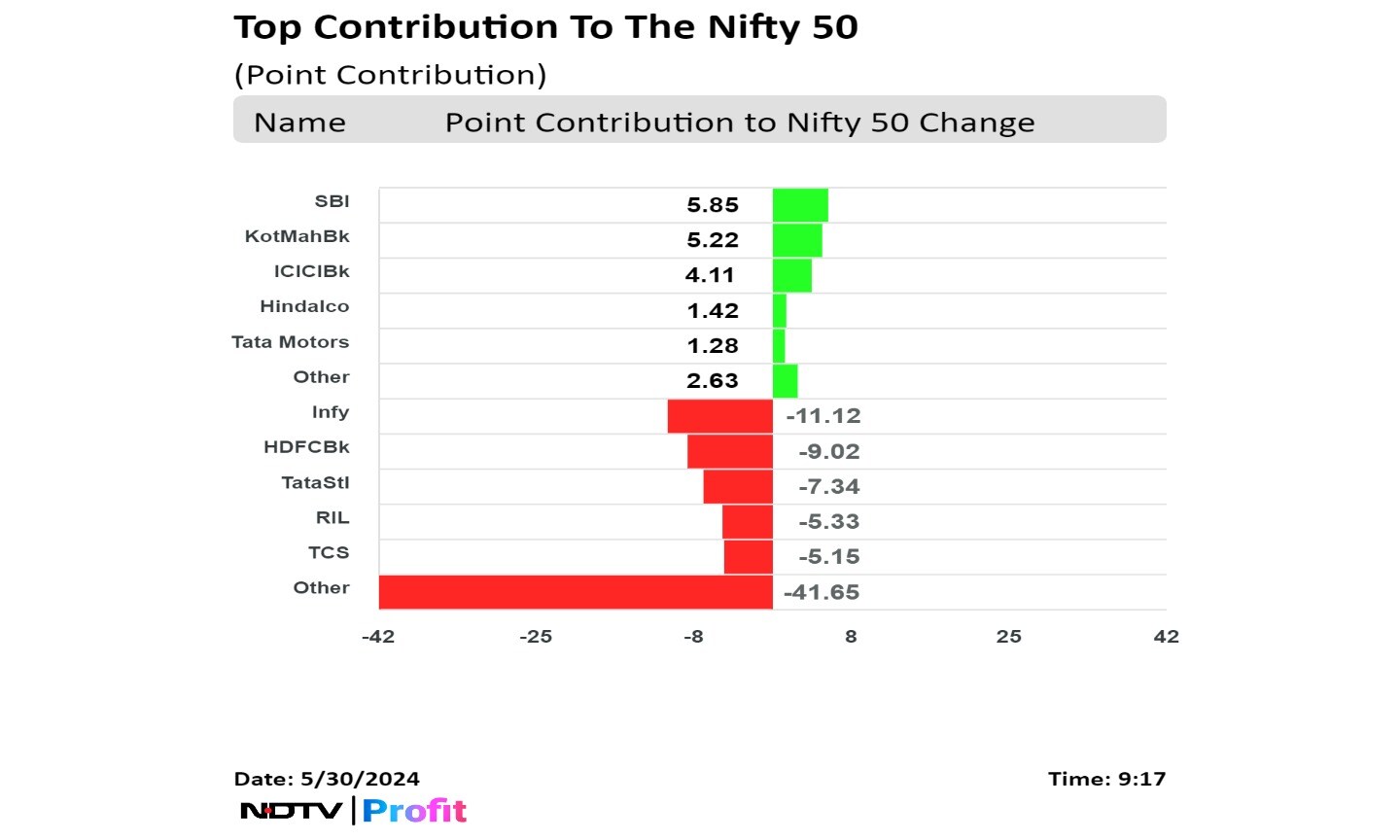

Infosys Ltd., HDFC Bank Ltd., Tata Steel Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd. pressured the benchmark.

State Bank of India, Kotak Mahindra Bank Ltd., ICICI Bank Ltd., Hindalco Industries Ltd., and Tata Motors Ltd. limited losses in the index.

India's benchmark indices opened lower on Thursday as Tata Steel Ltd., HDFC Bank Ltd. declined.

As of 09:16 a.m., the NSE Nifty 50 was 61.95 points or 0.27% lower at 22,642.75, and the S&P BSE Sensex was 222.93 points or 0.30% down at 74,279.97.

The NSE Nifty 50 has broken on the downside from its inside range of the previous day and closed near the support of 22,650 levels, said Vikas Jain, a senior research analyst at Reliance Securities.

On the higher side crossover of 22,800 will trigger sharp covering with respect to the monthly expiry and the next support would be 22,480 being the 20 day average, Jain said.

RSI has reversed below from its average line on daily charts and oversold on hourly charts so could expect some pullback to test the higher range. Highest call OI is at 22,800 strike while the downside the highest put OI is at 22,500 for the monthly expiry, he added.

India's benchmark indices opened lower on Thursday as Tata Steel Ltd., HDFC Bank Ltd. declined.

As of 09:16 a.m., the NSE Nifty 50 was 61.95 points or 0.27% lower at 22,642.75, and the S&P BSE Sensex was 222.93 points or 0.30% down at 74,279.97.

The NSE Nifty 50 has broken on the downside from its inside range of the previous day and closed near the support of 22,650 levels, said Vikas Jain, a senior research analyst at Reliance Securities.

On the higher side crossover of 22,800 will trigger sharp covering with respect to the monthly expiry and the next support would be 22,480 being the 20 day average, Jain said.

RSI has reversed below from its average line on daily charts and oversold on hourly charts so could expect some pullback to test the higher range. Highest call OI is at 22,800 strike while the downside the highest put OI is at 22,500 for the monthly expiry, he added.

India's benchmark indices opened lower on Thursday as Tata Steel Ltd., HDFC Bank Ltd. declined.

As of 09:16 a.m., the NSE Nifty 50 was 61.95 points or 0.27% lower at 22,642.75, and the S&P BSE Sensex was 222.93 points or 0.30% down at 74,279.97.

The NSE Nifty 50 has broken on the downside from its inside range of the previous day and closed near the support of 22,650 levels, said Vikas Jain, a senior research analyst at Reliance Securities.

On the higher side crossover of 22,800 will trigger sharp covering with respect to the monthly expiry and the next support would be 22,480 being the 20 day average, Jain said.

RSI has reversed below from its average line on daily charts and oversold on hourly charts so could expect some pullback to test the higher range. Highest call OI is at 22,800 strike while the downside the highest put OI is at 22,500 for the monthly expiry, he added.

India's benchmark indices opened lower on Thursday as Tata Steel Ltd., HDFC Bank Ltd. declined.

As of 09:16 a.m., the NSE Nifty 50 was 61.95 points or 0.27% lower at 22,642.75, and the S&P BSE Sensex was 222.93 points or 0.30% down at 74,279.97.

The NSE Nifty 50 has broken on the downside from its inside range of the previous day and closed near the support of 22,650 levels, said Vikas Jain, a senior research analyst at Reliance Securities.

On the higher side crossover of 22,800 will trigger sharp covering with respect to the monthly expiry and the next support would be 22,480 being the 20 day average, Jain said.