(Bloomberg) -- US equities slumped as the debt ceiling impasse swings into focus dragging on investor sentiment. The dollar edged higher.

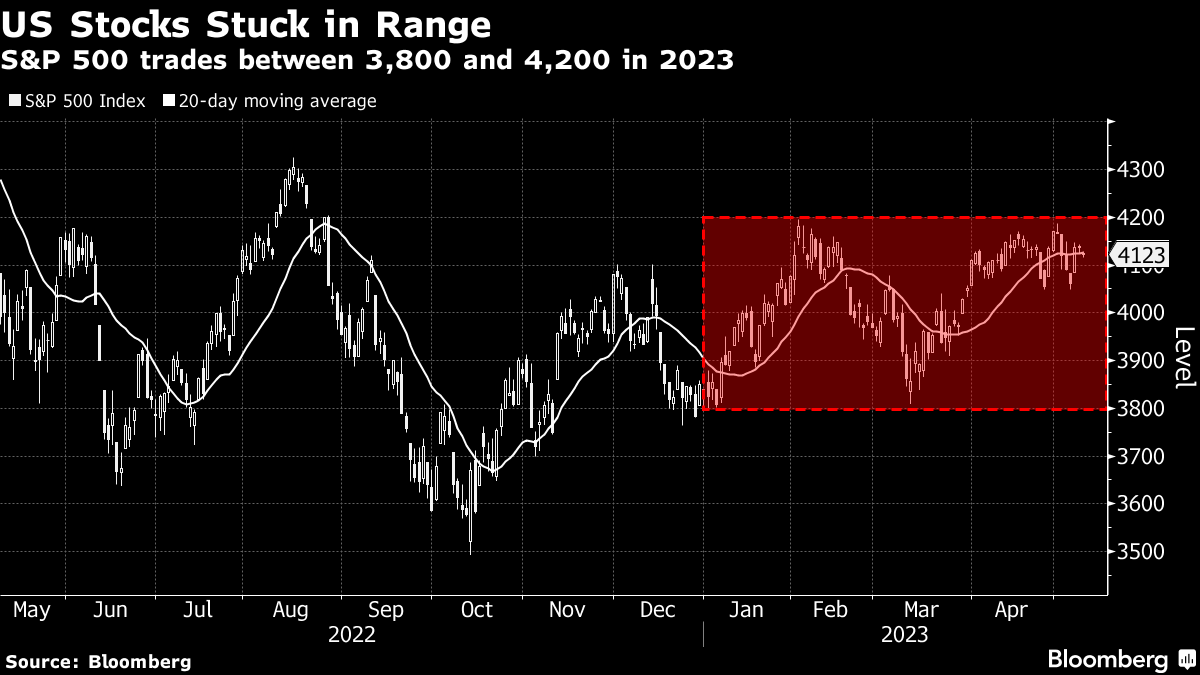

The S&P 500 traded down on Tuesday while the tech-heavy Nasdaq 100 slid . The gauges have been stuck in narrow trading ranges for over a month as traders weigh the potential end of the Federal Reserve's interest rate hiking cycle against the possibility of an economic slowdown. PacWest Bancorp fell as concerns about regional lenders linger.

Sentiment was also hurt by a report showing a steep drop in Chinese imports last month, a sign that the economy's recovery from Covid lockdown isn't as strong as many had hoped. Oil fell to $ a barrel.

Investors are tracking efforts in Washington to end a standoff over the US debt ceiling, with President Joe Biden due to sit down with House Speaker Kevin McCarthy Tuesday as the two face pressure to forge a deal.

“The meeting is unlikely to generate major breakthroughs on the debt-ceiling impasse, though it might finally focus more attention on the issue,” Art Hogan, chief market strategist at B. Riley Wealth Management, wrote. “The most likley senario is Congress will pass an extension until September 30, when the fiscal year ends. This would set up a larger battle on the 2024 budget and the debt ceiling, all at once.”

Meanwhile, the S&P 500 has been stuck trading between 3,800 and 4,200 this year. Equities could finally break out of range and move higher if, “data points more convincingly towards a soft landing, there are no more regional bank failures, core inflation drops faster than expected, the Fed confirms the pause and a debt ceiling deal is reached,” said Tom Essaye, founder of The Sevens Report newsletter.

Bears, according to Jonathan Krinsky, chief market technician at BTIG, are looking for the benchmark to fall below 3,800.

“The bullish argument is that the market is so resilient and it can't crack despite all the widely known problems,” Krinsky wrote. On the other hand, “if the market is so strong, why hasn't it been able to break out above 4,200 despite spending so much time just below it, a VIX that broke below 16, and many tech names up over 20% YTD? The reason is breadth and credit.”

A Fed poll of lending officers on Monday showed that credit conditions tightened a little more in the first quarter while demand for loans weakened.

New York Fed President John Williams said he was closely monitoring credit conditions at an event Tuesday. He saw little chance of a rate cut this year while he was more circumspect on the likelihood of a Fed pause. Swaps suggest traders are expecting at least a half point cut in 2023.

Focus will next turn to the monthly US inflation report, due Wednesday. Economists expect headline CPI to rise by 5% on a year-on-year basis, showing that price pressures are still uncomfortably high for the Federal Reserve.

Yields on the policy-sensitive two-year traded at % with the 10-year at %. An index of dollar strength climbed, while gold rose.

Among individual stocks, Palantir Technologies Inc. rallied after saying that demand for its new artificial intelligence tool is “without precedent.” PayPal Holdings Inc. dropped after disappointing guidance.

Key events this week:

- US President Joe Biden scheduled to meet with congressional leaders on debt limit, Tuesday

- US CPI, Wednesday

- China PPI, CPI, Thursday

- UK BOE rate decision, industrial production, GDP, Thursday

- US PPI, initial jobless claims, Thursday

- Group of Seven finance minister and central bank governors meet in Japan, Thursday

- US University of Michigan consumer sentiment, Friday

- Fed Governor Philip Jefferson and St. Louis Fed President James Bullard participate in panel discussion on monetary policy at Stanford University, Friday.

Some of the main moves in markets:

Stocks

- The S&P 500 fell 0.4% as of 12:54 p.m. New York time

- The Nasdaq 100 fell 0.6%

- The Dow Jones Industrial Average fell 0.2%

- The MSCI World index fell 0.5%

Currencies

- The Bloomberg Dollar Spot Index rose 0.2%

- The euro fell 0.4% to $1.0957

- The British pound was little changed at $1.2609

- The Japanese yen fell 0.1% to 135.26 per dollar

Cryptocurrencies

- Bitcoin was little changed at $27,574.59

- Ether rose 0.2% to $1,845.74

Bonds

- The yield on 10-year Treasuries advanced two basis points to 3.53%

- Germany's 10-year yield advanced three basis points to 2.35%

- Britain's 10-year yield advanced seven basis points to 3.86%

Commodities

- West Texas Intermediate crude fell 0.8% to $72.55 a barrel

- Gold futures rose 0.2% to $2,036.90 an ounce

This story was produced with the assistance of Bloomberg Automation.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.