(Bloomberg) -- Stocks rose and bonds fell as data showed the US economy is holding strong despite elevated Federal Reserve rates. Nvidia Corp. sank 3% after its outlook failed to inspire.

For all the hype around Nvidia's results, a slide in its shares was unable to prevent the equity market from pushing higher. Buoyed by economic figures underscoring consumer resilience, the S&P 500 extended its August advance and the Nasdaq 100 climbed 1.3%. Those figures gained even more importance in the run-up to the Fed's preferred inflation gauge. The report is expected to show the core personal consumption expenditures price index is successfully appriaching the central bank's 2% goal.

Gross domestic product rose at a 3% annualized rate during the April-June period, up from the previous estimate of 2.8%. The economy's main growth engine — personal spending — advanced 2.9%, versus the prior estimate of 2.3%. A separate government report out Thursday showed initial applications for unemployment benefits were little changed at 231,000.

“The message of this morning's data is ‘steady as she goes',” said Chris Larkin at E*Trade from Morgan Stanley. “Weekly jobless claims were slightly lower than last week and GDP was revised slightly higher. The economy doesn't appear to be falling off a cliff, and in the current market, good news is good. There was nothing here to make the Fed rethink its plan to cut rates next month.”

To Bret Kenwell at eToro, the data helped reassure investors that the economy is “not teetering on an economic cliff.”

“While we're not necessarily out of the woods, the US economy is more resilient than many realize,” Kenwell says. “Today's report should give investors confidence that the Fed can still orchestrate a soft landing.”

The S&P 500 rose to around 5,640. A Bloomberg gauge of the “Magnificent Seven” megacaps climbed 1.3%. The Russell 2000 of smaller firms added 0.8%. HP Inc. jumped 5% after the hardware maker reported its first sales increase in two years. Dollar General Inc. plunged 25% after the discount retailer cut its sales forecast.

Treasury 10-year yields advanced four basis points to 3.88%. That's ahead of a $44 billion seven-year US sale. Swap traders slightly trimmed bets on Fed cuts after the GDP release, while still expecting around 100 basis points of cuts for 2024. The dollar gained, while heading toward its worst month in 2024. Oil and gold climbed.

At LPL Financial, Jeff Roach says downward revisions to inflation accompanying an upward revision to spending builds the case for a “soft landing.”

“Growth is solid, labor demand has moderated, layoffs have steadied, and inflation gauges are easing,” said Jim Baird at Plante Moran Financial Advisors. “That's a solid combination for the Fed to reverse course and a potential Goldilocks scenario that has quelled recession concerns and provided new support for a potential soft landing.”

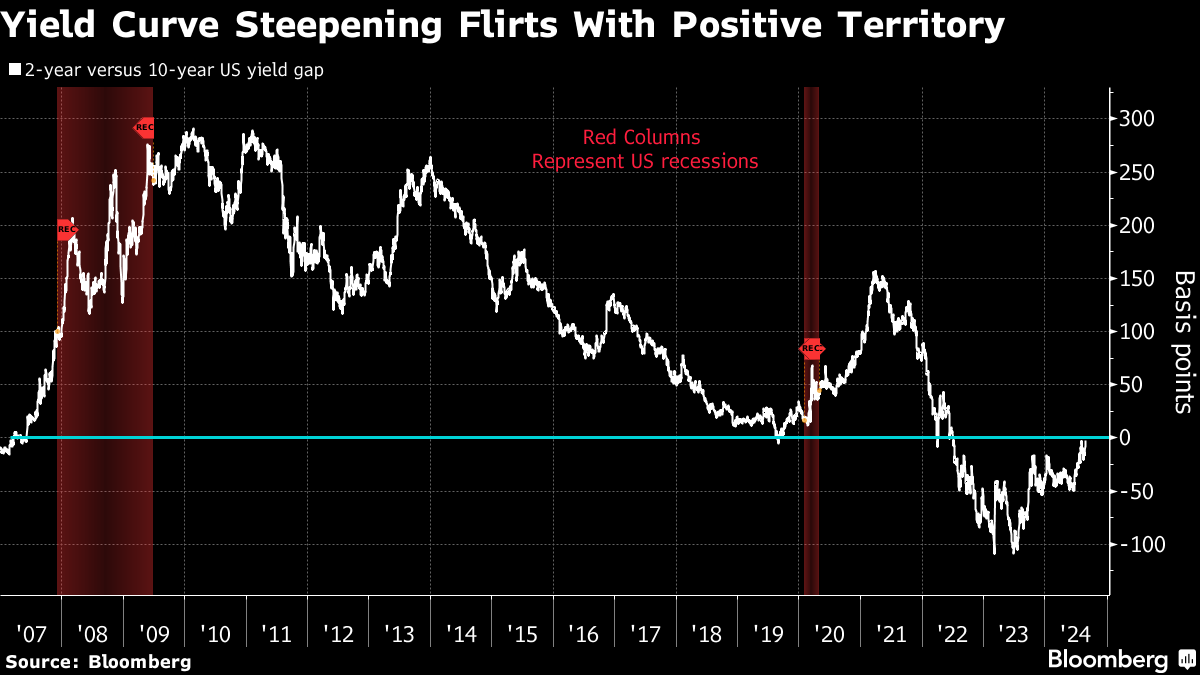

Longer-maturity yields rose more than shorter ones, leaving a closely watched spread just shy of regaining a normal, positive slope. The margin by which US two-year yields exceed 10-year yields dwindled to around two basis points.

A year ago the two-year was around 80 basis points higher than the 10-year, reflecting expectations that Fed rate hikes above 5% would tame inflation and possibly cause a recession.

Corporate Highlights:

- Gap Inc. beat sales expectations for the second quarter, suggesting that an overhaul by new Chief Executive Officer Richard Dickson is working.

- Best Buy Co. raised its earnings guidance for the year, a sign that its turnaround efforts are starting to bear fruit as consumers begin upgrading Covid-era purchases with new products incorporating innovations like artificial intelligence.

- CrowdStrike Holdings Inc. reported second-quarter sales that topped analysts' estimates, indicating that a global IT outage it caused last month didn't have an immediate impact on results.

- United Airlines Holdings Inc. has raised concerns with the Biden administration over how the pending $1.9 billion merger of Alaska Air Group Inc. and Hawaiian Holdings Inc. could affect its business relationships with Hawaiian.

- The Netherlands plans to limit ASML Holding NV's ability to repair and maintain its semiconductor equipment in China, a potentially painful blow to Beijing's efforts to develop a world-class chip industry.

- Nokia Oyj's mobile networks assets are drawing preliminary interest from suitors including Samsung Electronics Co. amid increasing pressure to find new growth in the troubled telecom equipment sector, people with knowledge of the matter said.

- Reliance Industries Ltd. said it will consider a bonus issue of shares — the first in seven years — as its billionaire-chairman Mukesh Ambani looks to attract small shareholders amid a continuing diversification into consumer-facing businesses.

Key events this week:

- Japan unemployment, Tokyo CPI, industrial production, retail sales, Friday

- Eurozone CPI, unemployment, Friday

- US personal income, spending, PCE; consumer sentiment, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.8% as of 11:14 a.m. New York time

- The Nasdaq 100 rose 1.3%

- The Dow Jones Industrial Average rose 0.7%

- The Stoxx Europe 600 rose 0.8%

- The MSCI World Index rose 0.6%

Currencies

- The Bloomberg Dollar Spot Index rose 0.2%

- The euro fell 0.4% to $1.1074

- The British pound fell 0.2% to $1.3161

- The Japanese yen fell 0.5% to 145.27 per dollar

Cryptocurrencies

- Bitcoin rose 2.7% to $60,946.91

- Ether rose 1.5% to $2,576.05

Bonds

- The yield on 10-year Treasuries advanced four basis points to 3.88%

- Germany's 10-year yield advanced two basis points to 2.28%

- Britain's 10-year yield advanced two basis points to 4.02%

Commodities

- West Texas Intermediate crude rose 2.3% to $76.25 a barrel

- Spot gold rose 0.8% to $2,523.98 an ounce

This story was produced with the assistance of Bloomberg Automation.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.