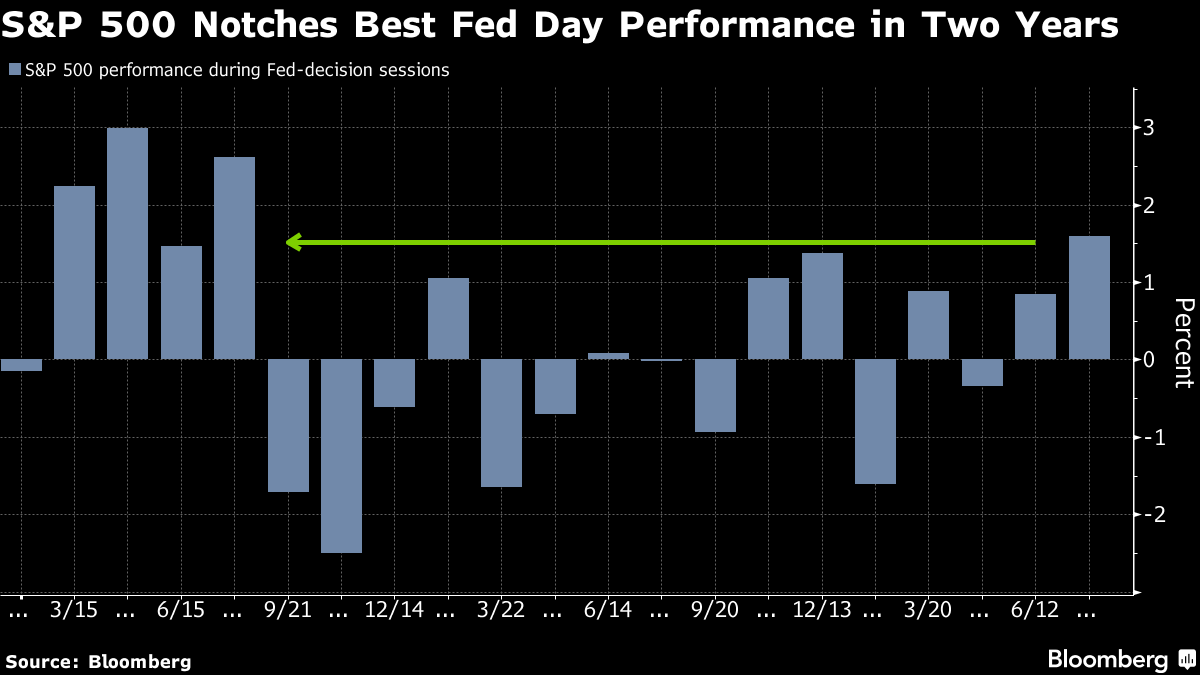

(Bloomberg) -- Dovish comments from Jerome Powell helped extend a rally in stocks that started with a surge in key technology companies, with the market scoring its best Federal Reserve day in two years.

Equities staged a powerful rebound, with the Nasdaq 100 up 3%. Nvidia Corp. surged 13% — adding a record $329 billion in value — after a bullish analyst call. In late trading, Meta Platforms Inc. soared on a sales beat. Qualcomm Inc., the world's biggest seller of smartphone processors, gave a strong revenue forecast. Treasury yields slipped alongside the dollar.

In a press conference, Powell said officials could cut rates “as soon as” September. And the Fed statement also brought quite a few language tweaks. Notably, the committee shifted to saying it is “attentive to the risks to both sides of its dual mandate,” rather than prior wording focused just on inflation.

“The press conference is somewhat more dovish than the statement,” said Neil Dutta at Renaissance Macro Research. “It definitely sounds like they are just waiting for the sake of waiting. After all, by his own admission, all the data are already pointing in the direction he wants to see!”

A $563 billion exchange-traded fund tracking the S&P 500 (ticker: SPY) climbed 1.6%. Along with a 1% gain in an ETF of longer-dated Treasuries (ticker: TLT), Wednesday's cross-asset rally was the largest of the year for such sessions when monetary policy was announced. A Bloomberg gauge of the “Magnificent Seven” megacaps jumped 3.5%. The Russell 2000 of small firms added 0.5%.

The advance in bonds gained pace late in the day as Mideast tensions stoked flight-to-safety buying and spurred a rally in oil. Treasuries notched a third straight month of gains — the longest winning run since 2021. The yen rose as the Bank of Japan raised rates and announced plans to cut bond purchases.

“Powell has become increasingly adept at not showing all of his cards,” said Chris Zaccarelli at Independent Advisor Alliance. “Ultimately, the market is counting on the rate-cutting cycle beginning in September – despite how many times Powell tried to keep the Fed's options open.”

The changes in the Fed statement solidify a shift in tone among several policymakers, including Powell, recognizing growing risks to the labor market. They are also likely to reinforce expectations among economists and investors for a rate cut at the central bank's Sept. 17-18 gathering.

“Powell so wants to say today ‘let's do it' — but at the same time, he knows he doesn't have to commit just yet before he gets more time and data,” said Peter Boockvar at the Boock Report.

To Ronald Temple at Lazard, the Fed “has clearly telegraphed” a September interest-rate cut.

“While I believe a July rate cut could have been justified by slowing inflation, easing labor market tightness, and moderating growth, I think the case will be even more compelling in seven weeks,” he noted.

Swap traders are still fully pricing in a quarter point cut in September — and a total of almost 70 basis points worth of reductions for the year.

Given markets were already fully priced for a September cut, neither the Fed's statement nor Powell's remarks dramatically changed the rate path into the bond market, said Tiffany Wilding at Pacific Investment Management Co.

“The data has moved in Powell's direction and now he's getting ready to follow,” said David Russell at TradeStation. “Jobs data on Friday and CPI in two weeks are the next big items. If those go well, we could get clearer messaging from Powell at Jackson Hole in late August.”

Corporate Highlights:

- Billionaire Bill Ackman's Pershing Square has withdrawn an initial public offering for a US closed-end fund, after sharply downsizing a $25 billion fundraising target and facing difficult questions from investors.

- EBay Inc. posted quarterly results that exceeded analysts' estimates, demonstrating that a focus on niche categories is helping it navigate intense competition from Amazon.com Inc., Walmart Inc. and Temu.

- Arm Holdings Plc shares tumbled in late trading after the chip company held off on boosting its annual forecast, raising concerns that it's not confident in its growth prospects.

- American International Group Inc. booked a loss in the second quarter due to accounting charges tied to the formal separation of life and retirement business Corebridge Financial Inc.

- Walt Disney Co. is planning a fresh round of job cuts in its TV division, part of an effort to reduce costs in a shrinking part of its business, according to people with knowledge of the matter.

- Carvana Co. reported stronger vehicle sales and revenue than Wall Street expected in the second quarter, pushing the used-car retailer to a surprise profit.

- In his first comments as Boeing Co.'s next chief executive officer, Kelly Ortberg said “there is much work to be done” — and the company was swift to reinforce that point.

Key events this week:

- Eurozone S&P Global Eurozone Manufacturing PMI, unemployment, Thursday

- US initial jobless claims, ISM Manufacturing, Thursday

- Amazon, Apple earnings, Thursday

- Bank of England rate decision, Thursday

- US employment, factory orders, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 rose 1.6% as of 4 p.m. New York time

- The Nasdaq 100 rose 3%

- The Dow Jones Industrial Average rose 0.2%

- The MSCI World Index rose 1.7%

Currencies

- The Bloomberg Dollar Spot Index fell 0.6%

- The euro was little changed at $1.0820

- The British pound rose 0.1% to $1.2853

- The Japanese yen rose 1.9% to 149.80 per dollar

Cryptocurrencies

- Bitcoin fell 1.7% to $65,043.01

- Ether fell 0.8% to $3,253.76

Bonds

- The yield on 10-year Treasuries declined 11 basis points to 4.03%

- Germany's 10-year yield declined four basis points to 2.30%

- Britain's 10-year yield declined seven basis points to 3.97%

Commodities

- West Texas Intermediate crude rose 4.9% to $78.38 a barrel

- Spot gold rose 1.6% to $2,449.50 an ounce

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Lu Wang and Jessica Menton.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.