(Bloomberg) -- Stocks traded mixed as investor attention moved from US politics to a wave of company earnings, with tech heavyweights Tesla Inc. and Alphabet Inc. due to report later Tuesday.

S&P 500 futures fluctuated as NXP Semiconductors NV sank after giving weak guidance, while General Electric Co. climbed in premarket trading on an increase in second-quarter profit. In Europe, the Stoxx 600 Index was 0.3% higher as German software firm SAP SE rose the most since January and Swiss computer accessories maker Logitech International SA jumped.

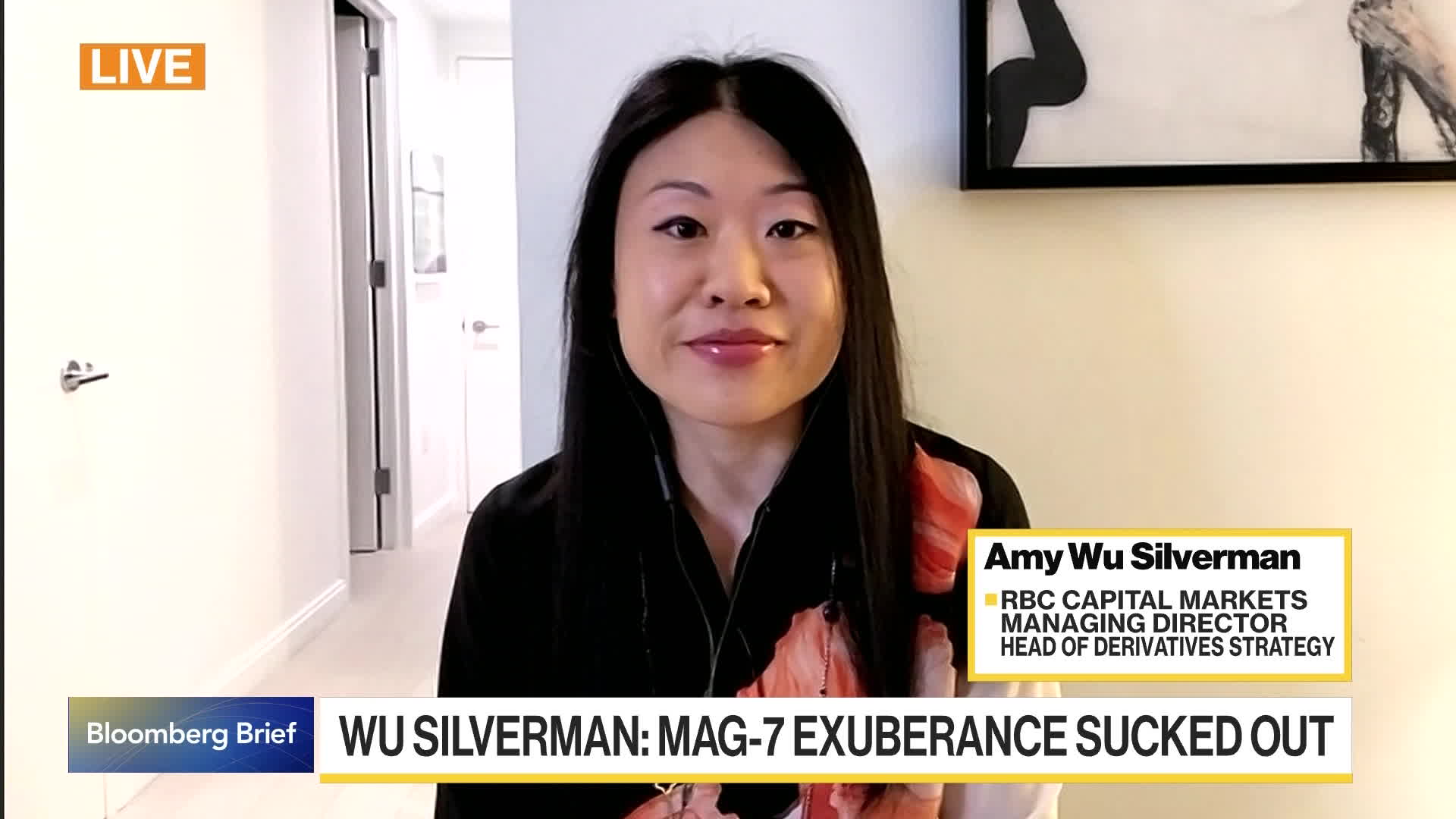

Companies representing 29% of the S&P 500's market value are due to report this week and Tesla and Alphabet are the first of the so-called Magnificent Seven tech giants to post earnings this quarter. With valuations among technology firms still high after last week's retreat, investors are looking for more evidence that their businesses are on track and the euphoria around artificial intelligence is justified.

About 16% of the companies in the S&P 500 have reported so far, according to data compiled by Bloomberg Intelligence, and most have beaten earnings-per-share expectations. Analysts are predicting that index earnings grew 9% in the second quarter from a year earlier.

Analysts are keen for details of Tesla's robotaxi service, while Google parent Alphabet is expected to see a sales boost from its cloud unit.

At the same time, US election developments remain front and center, with Kamala Harris now having more than enough pledged delegates to clinch the Democratic presidential nomination. On the data front, US readings on the economy are due later in the week as well as the Federal Reserve's preferred inflation gauge.

“The earnings season is now shifting gear,” said Andrea Tueni, head of sales trading at Saxo Banque France. “This will be this week's focus before inflation on Friday. I don't see a repricing of the ‘Trump trade' taking place just yet.”

The dollar traded steady while yields on US Treasuries ticked lower.

Yen Gains

In Asia, the yen strengthened against the dollar as traders look set to trim their carry positions during the summer holiday season. Some Bank of Japan officials are open to raising rates at the July meeting while others see weakness in consumer spending complicating their decision, according to people familiar with the matter.

In commodities, oil was steady near a six-week low.

Corporate Highlights:

- Coca-Cola Co. raised its full-year outlook as higher prices bolstered the soft-drink giant's performance.

- General Electric Co. reported a jump in second-quarter profit and raised its guidance for the year as the newly independent jet-engine manufacturer capitalized on strong demand for maintenance services during the busy summer travel season.

- Spotify Technology SA, the Swedish audio-streaming giant, reported second-quarter subscriber growth that exceeded analysts' projections after rolling out price increases.

- LVMH, the world's largest luxury group, is seen reporting an increase in second-quarter sales when it posts results after markets close on Tuesday.

- Porsche shares fell the most on record after the company lowered its outlook for the year, saying a shortage of aluminum parts could cause it to stop production of some models, adding to pressure from slowing sales in China.

- Cybersecurity startup Wiz Inc. has turned down a takeover bid of as much as $23 billion from Alphabet Inc., sticking instead with a plan for an initial public offering.

- Toyota Motor Corp. will buy back ¥806.8 billion ($5.2 billion) worth of its stock from major Japanese banks and insurers as part of a broader push to unwind strategic shareholdings with financial partners.

Key events this week:

- Eurozone consumer confidence, Tuesday

- US existing home sales, Tuesday

- Alphabet, Tesla, LVMH earnings, Tuesday

- Canada rate decision, Wednesday

- US new home sales, S&P Global PMI, Wednesday

- IBM, Deutsche Bank earnings, Wednesday

- Germany IFO business climate, Thursday

- US GDP, initial jobless claims, durable goods, Thursday

- US personal income, PCE, University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures fell 0.1% as of 8:32 a.m. New York time

- Nasdaq 100 futures fell 0.3%

- Futures on the Dow Jones Industrial Average were little changed

- The Stoxx Europe 600 rose 0.2%

- The MSCI World Index was little changed

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro fell 0.3% to $1.0859

- The British pound fell 0.1% to $1.2914

- The Japanese yen rose 0.5% to 156.20 per dollar

Cryptocurrencies

- Bitcoin fell 2.5% to $66,476.43

- Ether was little changed at $3,491.65

Bonds

- The yield on 10-year Treasuries declined two basis points to 4.24%

- Germany's 10-year yield declined four basis points to 2.45%

- Britain's 10-year yield declined two basis points to 4.14%

Commodities

- West Texas Intermediate crude fell 0.7% to $77.85 a barrel

- Spot gold rose 0.3% to $2,404.71 an ounce

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Winnie Hsu and Farah Elbahrawy.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.