(Bloomberg) -- US stocks extended a rebound ahead of Friday data expected to show the Federal Reserve's preferred inflation metric is close to its target.

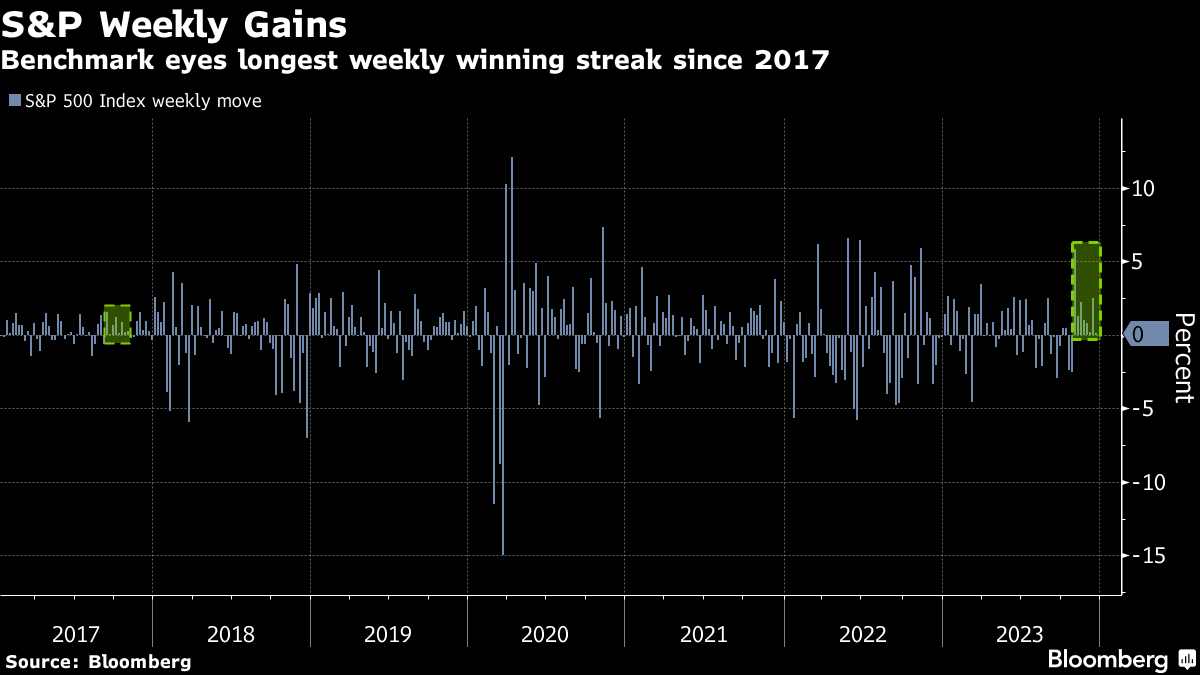

The S&P 500, up Thursday, is on the precipice of an eight-week winning streak — its longest in more than five years — if it can hold onto gains. The Nasdaq 100 index faces a similar challenge, the tech-heavy benchmark rose after Wednesday's bout of selling had knocked it off record highs.

Nike Inc. shares slipped around 5% in afterhours trading following a warning from the sneaker maker that revenue would soften in the latter half of the fiscal year. Peers, including Foot Locker Inc., also weakened in the postmarket session.

The VIX briefly rose above 14 for the first time since November, Wall Street's gauge of stock volatility has been trading near multi-year lows.

The Fed's preferred inflation metric, the so-called core personal-consumption expenditures price index, is broadly expected to hit the central bank's 2% target when the report comes out ahead of the US stock market open Friday.

Though the devil will be in the details on whether or not the data will back up the Fed Chair's recent pivot, according to Bloomberg Economics. A reassuring reading could alleviate some of the friction in the stock market.

Read more: US Inflation Report to Show Fed's Battle Is Now All But Complete

Some market watchers blamed Wednesday's swoon on so-called zero-day, or ODTE, options, noting that hefty “put” volumes likely added to the selloff as some option sellers balanced their books.

But the broader picture of slowing inflation and rate-cut bets mean such speed bumps will be short-lived, many argue.

Citigroup Inc. strategists advised buying into pullbacks, adding investors should “expect volatility ahead, but with an eventual Fed pivot as a north star.”

The global bond rally took a breather Thursady as the yield on the US two-year hovered around %. The rate on the US 10-year — tied to everything from mortgage to lending rates — edged up to %, its still down roughly 50 basis points this month.

“The theme of consolidation remains the most relevant impulse for a market that is quickly approaching the end of the year,” Ian Lyngen of BMO Capital Markets wrote. “Next week's price action will be largely irrelevant with the presumption of limited liquidity and even more limited conviction.”

Gross domestic product was revised lower to a 4.9% annualized rise in the third quarter, trailing economists' projections, the government's third estimate of the figures Thursday showed. Initial applications for US unemployment insurance rose last week by less than forecast, remaining near historic lows.

Numbers “were still in line with the narrative that a cooling economy will keep the Fed on track to cut rates in the not-too-distant future,” Chris Larkin, managing director of trading and investing at E*Trade from Morgan Stanley, said. “Right or wrong, that sentiment has played a big role in the market's recent surge, even though the Fed has been doing its best to temper expectations.”

Following the data, swaps traders are betting on at least six quarter point interest rate cuts from the US central bank by the end of next year, well ahead of the three policymakers signaled last week.

Friday brings UK GDP data, US consumer sentiment and in addition to personal spending data.

In commodities, oil prices retreated after three days of gains, as surging US production tempered the threat of Houthi attacks on ships in one of the world's most important waterways.

The US dollar resumed a slide, falling against all of its Group-of-10 peers Thursday.

Key events this week:

- Japan inflation, Friday

- UK GDP, Friday

- US personal income and spending, new home sales, durable goods, University of Michigan consumer sentiment index, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 rose 1% as of 4 p.m. New York time

- The Nasdaq 100 rose 1.2%

- The Dow Jones Industrial Average rose 0.9%

- The MSCI World index rose 0.7%

Currencies

- The Bloomberg Dollar Spot Index fell 0.6%

- The euro rose 0.6% to $1.1003

- The British pound rose 0.4% to $1.2687

- The Japanese yen rose 0.9% to 142.23 per dollar

Cryptocurrencies

- Bitcoin rose 0.8% to $43,777.83

- Ether rose 2.7% to $2,238.37

Bonds

- The yield on 10-year Treasuries advanced four basis points to 3.89%

- Germany's 10-year yield was little changed at 1.96%

- Britain's 10-year yield was little changed at 3.53%

Commodities

- West Texas Intermediate crude fell 0.3% to $74.01 a barrel

- Spot gold rose 0.6% to $2,044 an ounce

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Sujata Rao and Chiranjivi Chakraborty.

(A previous version corrected GDP data.)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.