(Bloomberg) -- Wall Street went all in on stocks and bonds this week after Jerome Powell the Federal Reserve affirmed it's ready to shift to rate cuts.

The US central bank left its benchmark rate unchanged as policymakers pivoted away from further rate hikes, instead penciling in three rate cuts for next year. The Nasdaq 100 closed at an all-time high — it last traded at a record price two years ago. The S&P 500 and the tech-heavy gauge both notched seven-week winning streaks on the back of the Fed's about-face.

Even pushback from New York Fed President John Williams, who told CNBC on Friday it was “premature” to be thinking about a March rate cut, failed to squelch the rally.

The S&P 500 ended the day unchanged while logging a 2.5% weekly climb. The Dow Jones Industrial Average benchmark advanced , setting its third consecutive record high. US Treasuries advanced across the curve, though Friday's trading was mixed.

“We view his comments as an effort to guide to a slower slope of normalization over several years as well as a challenge to the strong market bets on March for the first cut,” Krishna Guha, vice chairman at Evercore ISI, said. Guha views the first rate cut as more likely to come in May or June.

Williams' Atlanta counterpart, Raphael Bostic told Reuters he was only penciling in two quarter-percentage-point rate cuts in the latter half of 2024. Swaps traders were eying as many as six rates cuts for next year.

“The S&P 500 has rallied more than 10% in less than two months so some digestion of the rally is needed,” Tom Essaye, the founder of The Sevens Report newsletter, wrote. That “likely will come in the near term, especially if Fed officials rhetorically push back on the market's enthusiasm in the next week or two.”

The dollar advanced snapping a three-day slide. The yield on the 10-year bond — the benchmark for everything from mortgages to corporate debt — broke below 4% for the first time since August this week.

“Bond yields have been markedly volatile this year as market participants try to determine what the new normal for interest rates will be,” Carol Schleif, chief investment officer of BMO Family Office wrote. “We suspect the longer term new normal for the 10-year Treasury yield to range between 4% and 4.5%.”

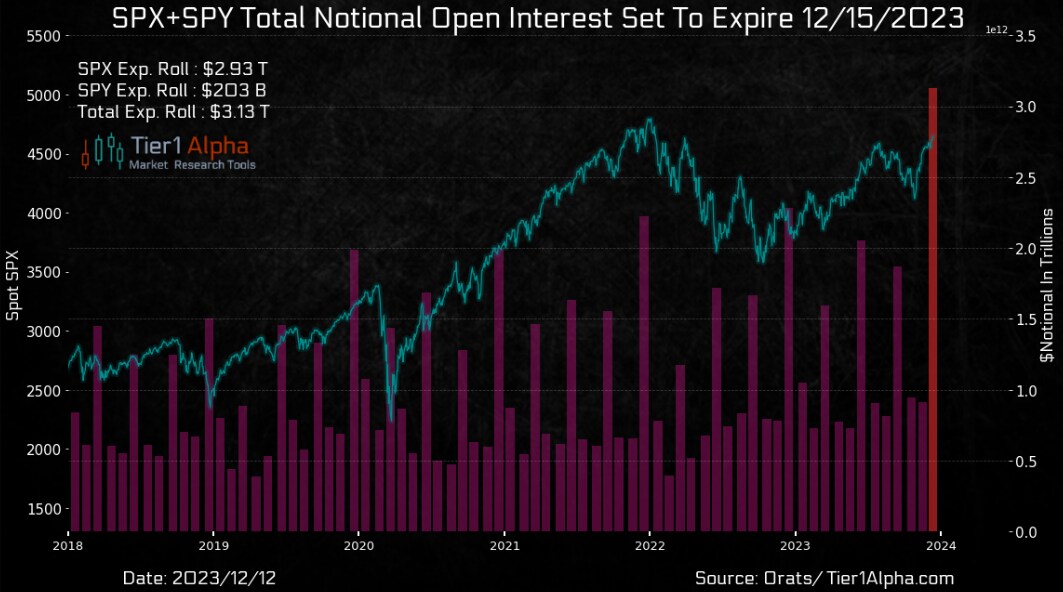

Traders also had to contend with the year's largest quarterly options and futures expiry and its potential to spark volatility. A staggering $5.4 trillion of contracts tied to stocks and indexes went off the board today, according to an estimate from Rocky Fishman, founder of derivatives analytical firm Asym 500.

Read more: A $5 Trillion Option Expiry Looms as S&P 500 Eyes All-Time High

Even with Williams tamping down some of the market's ebullience, the Fed's tone this week was more dovish than that from European peers. European Central Bank Governing Council member Madis Muller said Friday that markets are getting ahead of themselves in betting that the ECB will start cutting interest rates in the first half of next year. On Thursday, ECB President Christine Lagarde said the bank had not discussed rate cuts at all.

“The contrast between the resilient US economy adopting a dovish stance and faltering European economies holding on to a hawkish position gives the impression that something is amiss,” Ipek Ozkardeskaya, a senior analyst at Swissquote, wrote in a note to clients.

Some of the main moves in markets:

Stocks

- The S&P 500 was little changed as of 4 p.m. New York time

- The Nasdaq 100 rose 0.5%

- The Dow Jones Industrial Average rose 0.2%

- The MSCI World index was little changed

Currencies

- The Bloomberg Dollar Spot Index rose 0.4%

- The euro fell 0.9% to $1.0893

- The British pound fell 0.7% to $1.2674

- The Japanese yen fell 0.2% to 142.24 per dollar

Cryptocurrencies

- Bitcoin fell 1.7% to $42,242.83

- Ether fell 2.1% to $2,251.65

Bonds

- The yield on 10-year Treasuries was little changed at 3.91%

- Germany's 10-year yield declined 10 basis points to 2.02%

- Britain's 10-year yield declined 10 basis points to 3.69%

Commodities

- West Texas Intermediate crude rose 0.2% to $71.69 a barrel

- Spot gold fell 0.9% to $2,018.37 an ounce

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Cecile Gutscher, Carly Wanna, Jan-Patrick Barnert, Kwaku Gyasi and Naomi Tajitsu.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.