Markets in Australia traded lower as investors await for the unemployment number, scheduled for release later today, for further cues about the Reserve Bank of Australia's monetary policy going forward.

Share indices in Japan, and South Korea edged higher. The Nikkei 225 0.29% higher at 35,579.21, and the KOSPI was 0.23% up at 2,441.46 as of 6:28 a.m. S&P ASX 200 was 0.51% down at 7,355.30.

Meanwhile, investors pulled back their rate cut expectation from the U.S. Federal Reserve after world's largest economy reported better-than-expected retail sales number for December, which weighed on risk-appetite.

CME FedWatch Tool showed, about 57% of Fed fund future traders are expecting the first rate cut in March 2024, compared to 63.1% traders on Wednesday.

Retail sales in U.S. increased 0.6% in December 2023, from 0.3% increase recorded in November. The numbers are higher than 0.4% estimated by economists.

U.S. stocks joined losses in risk assets as bond yields climbed on bets the Federal Reserve will be in no rush to cut rates as the economy shows signs of strength, reported Bloomberg.

Both the S&P 500 index and Nasdaq 100 fell 0.56% each , as of Wednesday. The Dow Jones Industrial Average declined by 0.25%.

Brent crude was trading 0.41% lower at $77.30 a barrel. Gold rose by 0.18% to $2,009.88 an ounce.

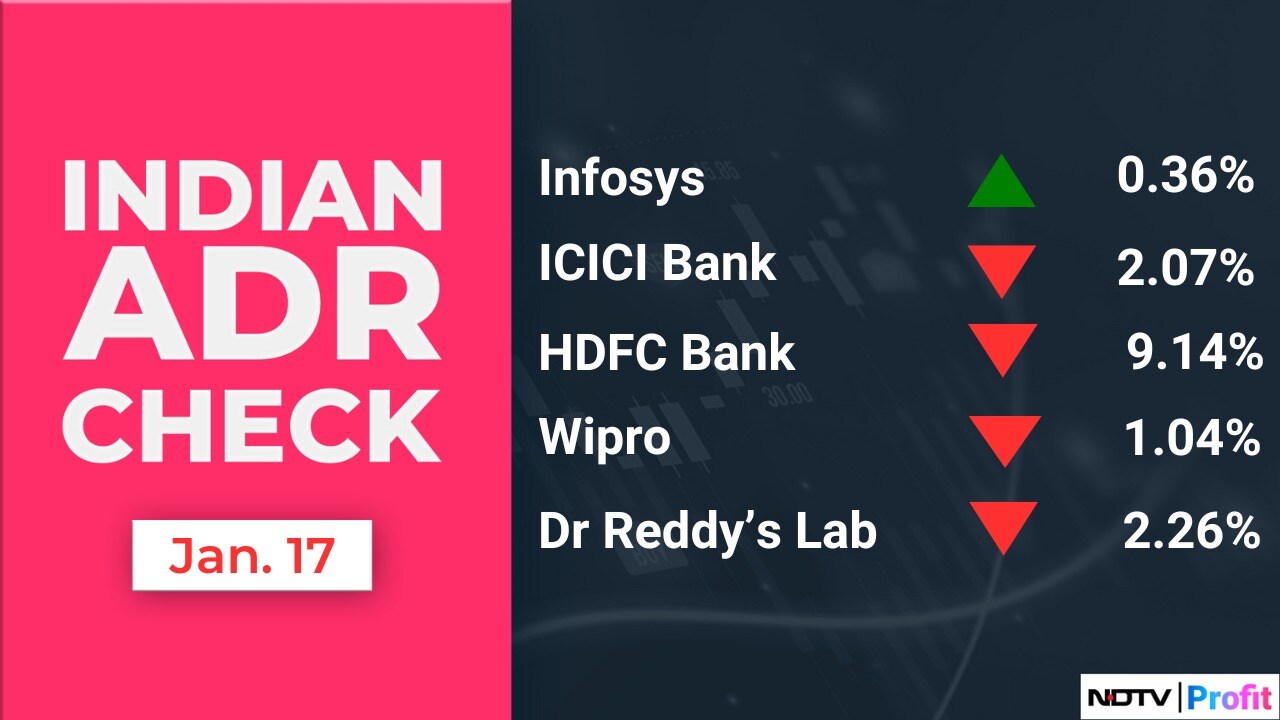

India's benchmark stock indices hit its biggest intraday fall in over a year on Wednesday due to panic selling in the shares of index heavyweight HDFC Bank Ltd.

The NSE Nifty 50 closed 460 points, or 2.09%, down at 21,571.95, while the S&P BSE Sensex fell 1,628 points, or 2.23%, to end at 71,500.76.

The Nifty 50 recorded its biggest fall since June 16, 2022, while the Sensex logged its biggest drop since Aug. 29, 2022.

Foreign portfolio investors recorded their highest-ever single-day selloff on Wednesday as they turned net sellers of Indian equities after two days.

FPIs offloaded equities worth Rs 10,578.1 crore, according to provisional data from the National Stock Exchange. The previous highest-ever single-day selloff was Rs 9,691 crore on Nov. 3, 2017.

Domestic institutional investors stayed net buyers and mopped up equities worth Rs 4,006.4 crore, the NSE data showed.

The Indian rupee weakened 6 paise to close at Rs 83.14 against the U.S. dollar on Wednesday.

Earnings Post Market Hours

IIFL Finance Q3 FY24 (Consolidated, YoY)

Revenue at Rs 2,647.48 crore vs Rs 2,120.86 crore, up 24.83%.

Net profit at Rs 545.19 crore vs Rs 423.21 crore, up 28.82%.

Gross NPA: 1.71% vs 1.84% (QoQ).

Net NPA: 0.87% vs 1.02% (QoQ).

Announced an interim dividend of Rs 4 per equity share on record date of Jan. 25.

LTIMindtree Q3 FY24 (Consolidated, QoQ)

Revenue at Rs 9,016.6 crore vs Rs 8,905.4 crore, up 1.24% (Bloomberg estimate Rs 9,076.7 crore).

EBIT at Rs 1,385.9 crore vs Rs 1,423.1 crore, down 2.62% (Bloomberg estimate: Rs 1,458 crore).

Margin at 15.37% vs 15.98% (Bloomberg estimate: 15.9%).

Net profit up 0.6% at Rs 1,169.3 crore vs Rs 1,162.3 crore (Bloomberg estimate: Rs 1,191.3 crore)

Happiest Minds Q3 FY24 (Consolidated, QoQ)

Revenue at Rs 409.9 crore vs Rs 406.6 crore, up 0.8% (Bloomberg estimate: Rs 410.7 crore).

EBIT at Rs 66.1 crore vs Rs 68.1 crore, down 2.9% (Bloomberg estimate: Rs 69 crore).

Margin at 16.12% vs 16.74% (Bloomberg estimate: 16.8%).

Net profit at Rs 59.6 crore vs Rs 58.5 crore, up 1.9% (Bloomberg estimate: Rs 59.5 crore).

Alok Industries Q3 FY24 (Consolidated, YoY)

Revenue at Rs 1,253.03 crore vs Rs 1,717.6 crore, down 27.05%.

Ebitda loss at Rs 5.5 crore vs loss of Rs 42.4 crore.

Net loss at Rs 229.92 crore vs loss of Rs 249.83 crore.

ICICI Prudential Life Insurance Q3 FY24 (Consolidated, YoY)

Net premium income at Rs 9,928.8 crore vs Rs 9,464.5 crore, up 4.9%.

Net profit at Rs 226.92 crore vs Rs 221.56 crore, up 2.4%.

VNB at Rs 436 crore vs Rs 618 crore, down 29.4%.

VNB margin at 22.8% vs 33.9% YoY.

AUM at Rs 2.8 lakh crore vs Rs 2.5 lakh crore, up 12%.

Oracle Financial Services Software Q3 FY24 (Consolidated, QoQ)

Revenue at Rs 1,823.6 crore vs Rs 1,444.5 crore, up 26.2%.

EBIT at Rs 849.6 crore vs Rs 539.1 crore, up 57.6%.

Margin at 46.58% vs 37.32%, up 926 bps.

Net profit at Rs 740.8 crore vs Rs 417.4 crore, up 77.5%.

Earnings In Focus

360 ONE WAM, Accelya Solutions India, Finolex Industries, Home First Finance, IndiaMART InterMESH, IndusInd Bank, Innova Captab, Jindal Stainless, Mastek, Metro Brands, Polycab India, Poonawalla Fincorp, Ramkrishna Forgings, Shoppers Stop, South Indian Bank, Supreme Petrochem, Sterling and Wilson Renewable Energy, and Tata Communications.

Stocks To Watch

NHPC: The government to sell up to 3.5% stake via offer for sale on Jan. 18 and 19. The floor price of the offer for sale was set at Rs 66 per share, indicating a discount of 9.6% to the current market price.

Adani Enterprises: The company has signed a Memorandum of Understanding with the Maharashtra government to set up a 1-gigawatt hyperscale data centre at an investment of Rs 50,000 crore over the next 10 years.

Shriram Finance: The company raised $750 million through social bonds from international bond markets.

Nazara Tech: The company plans to raise up to Rs 250 crore via a preferential issue of shares at Rs 872.15 apiece. The company acquired a 10.77% stake in social influencer platform Kofluence Tech Pvt. for Rs 32.41 crore.

Indiabulls Housing Finance: The company approved raising up to Rs 5,000 crore via an equity issue.

Natco Pharma: The company invested $2 million in the Delhi-based biotech startup Cellogen Therapeutics.

Zaggle Prepaid Ocean Services: The company signed a contract worth Rs 200 crore with Torrent Gas — for implementing close loop fleet program.

Sundaram Finance: The company has exposure to alternate investment funds of Rs 270.28 crore as of Jan. 18.

RailTel Corp: The company received an order worth Rs 82.41 crore from South Central Railway in the Secunderabad Division.

Balaji Amines: The company received BIS certification for the product Morpholine from the Bureau of Indian Standards.

Intellect Design Arena: The company received approval to set up its branch office at GIFT City.

Manali Petrochemicals: The company has resumed operations at its Manali Plant.

OnMobile Technologies: The company has appointed Sreejith Chandrasekharan as Chief Technology Officer.

ZF Commercial Vehicle Control Systems India: RS Rajagopal Sastry has resigned from the position of CFO.

Avenue Supermarts: The company has opened two new stores in Tirupur (Tamil Nadu) and Sehore (Madhya Pradesh). The total number of stores as of today stands at 344.

Uniparts India: The company has been awarded an order of $1.2 million from Doosan Bobcat North America for the supply of construction equipment parts. The award is subject to the execution of the purchase order.

Keystone Realtors: The company will acquire 50% of the Ajmera Realty unit, Ajmera Luxe Realty for Rs 50,000.

IPO Offerings

Medi Assist Healthcare: The public issue was subscribed 16.25 times on day 3. The bids were led by institutional investors (40.14 times), non-institutional investors (14.85 times), and retail investors (3.19 times).

Block Deals

Jindal Saw: Cresta Fund sold 18 lakh shares (0.56%), while Nippon India Mutual Fund - Small Cap Fund bought 10 lakh shares (0.31%), BNP Paribas Arbitrage bought 3.99 lakh shares (0.12%), Societe Generale bought 1.99 lakh shares (0.06%) at Rs 519 apiece.

Pricol: Minda Corp. sold 1.83 lakh shares (15.07%) for Rs 343.5 apiece. TNTBC as The Trustee of Nomura India Stock Mother Fund bought 30.97 lakh shares (2.54%), Fidelity Funds India Focus Fund bought 30.7 lakh shares (2.51%), Aditya Birla Sun Life Insurance bought 30.3 lakh shares (2.48%), ICICI Prudential Mutual Fund bought 17.5 lakh shares (1.43%), Tata Mutual Fund bought 17.49 lakh shares (1.43%), Goldman Sachs India bought 14.9 lakh shares (1.22%), and among others at Rs 343.5 apiece.

Bulk Deals

Tourism Finance Corp: Alpana Mundra sold 7.6 lakh shares (0.85%) at Rs 169.32 apiece and Vivek Mundra sold 9.3 lakh shares (1.03%) at Rs 172 apiece.

Hi-Tech Pipes: Ajay Kumar and Sons sold 11.13 lakh shares (0.85%) and Parveen Bansal sold 9 lakh shares (0.68%) at Rs 140.09 apiece.

Who's Meeting Whom

Jyothy Labs: To meet analysts and investors on Feb. 12.

Steelcast: To meet analysts and investors on Jan. 22.

Supreme Petrochem: To meet analysts and investors on Jan. 23.

Puravankara: To meet analysts and investors on Jan. 23.

Trading Tweaks

Price band revised from 20% to 10%: Dredging Corporation of India.

Ex/record date buyback: Chambal Fertilisers and Chemicals.

Moved into short-term ASM framework: Dredging Corporation of India, Global Surfaces.

Moved out of short-term ASM framework: Amines and Plasticizers, Sula Vineyards, Transindia Real Estate, Trident.

F&O Cues

Nifty January futures down by 2.01% to 21,589.55 at a premium of 17.6 points.

Nifty January futures open interest down by 8.55%.

Nifty Bank January futures down by 4.2% to 46,159.25 at a premium of 94.8 points.

Nifty Bank January futures open interest up by 19.75%.

Nifty Options Jan 18 Expiry: Maximum Call open interest at 21,800 and Maximum Put open interest at 21,0000.

Bank Nifty Options Jan 25 Expiry: Maximum Call Open Interest at 49,000 and Maximum Put open interest at 36,500.

Securities in the ban period: Aditya Birla Fashion and Retail, Ashok Leyland, Bandhan Bank, Chambal Fertilizers, Delta Corp, Hindustan Copper, Indian Energy Exchange, Metropolis Healthcare, National Aluminium, Polycab India, PVRINOX, SAIL, Zee Entertainment.

Money Market Update

The Indian rupee weakened 6 paise to close at 83.14 against the U.S dollar on Wednesday.

Research Reports

Cipla - Striving For Sustainable Growth Beyond FY24: Motilal Oswal

Interim Budget 2024-25 Preview - 5.2% Or 5.4% Of GDP For FY25BE? Motilal Oswal's Analysis

Ethos - The Timeless Elegance: Axis Securities Initiates Coverage With A 'Buy'

PNB Housing Finance - Tide Has Turned, Smooth Ride Ahead: Motilal Oswal

Construction Sector Q3 Results Preview - Resumption Of Project Awarding Augurs Well: Nirmal Bang

(Disclaimer: New Delhi Television is a subsidiary of AMG Media Networks Ltd, an Adani Group Company.)

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.