Most markets in Asia-Pacific region were trading higher in early trade on Wednesday, taking cues from overnight gains on Wall Street.

The S&P ASX 200 was trading 42.80 points or 0.56% higher at 7,624.40, and the KOSPI index 31.35 points or 1.22% up at 2,607.55 as of 6:30 a.m.

Bucking the trend, markets in Japan were trading in negative. The Nikkei 225 was 67.64 points or 0.19% lower at 36,093.02 as of 06:31 a.m.

The U.S. bond market bounced back after a two-day rout, with investors awaiting a slew of Federal Reserve speakers for clues on whether the latest economic reports will impact their rate outlook, reported Bloomberg.

Both the S&P 500 index and Nasdaq 100 rose by 0.23% each, on Tuesday. The Dow Jones Industrial Average rose by 0.37%.

Brent crude was trading 0.77% higher at $78.59 a barrel. Gold was lower by 0.07% at $2,034.77 an ounce.

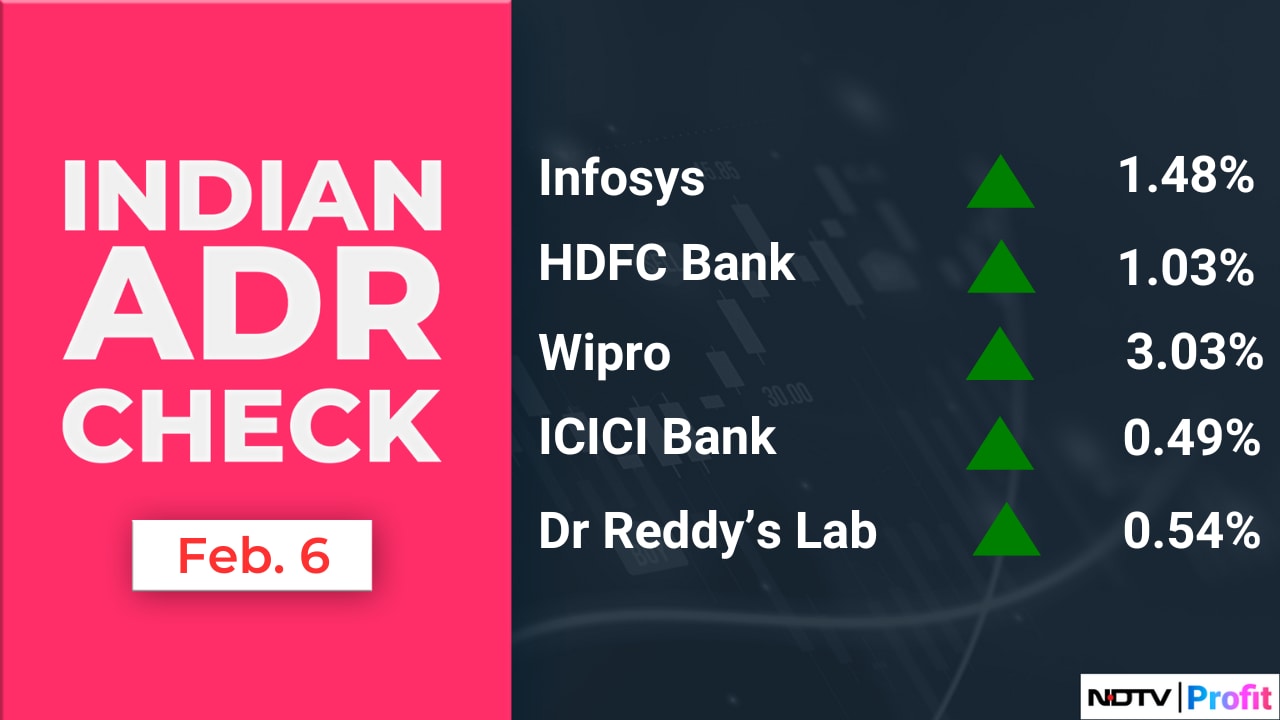

Indian benchmark equity indices ended higher on Tuesday, with shares of information technology companies contributing the most to gains.

The NSE Nifty 50 closed 157.7 points, or 0.72%, higher at 21,929.4, while the S&P BSE Sensex rose 454.67 points, or 0.63%, to end at 72,186.09.

Intraday, the Nifty gained as much as 0.83% and the Sensex rose as much as 0.7%.

Overseas investors remained net buyers of Indian equities for the third consecutive session on Tuesday. Foreign portfolio investors mopped up stocks worth Rs 92.5 crore, while domestic institutional investors turned net sellers and offloaded equities worth Rs 1,096.3 crore, the NSE data showed.

The Indian rupee closed flat at Rs 83.05 against the U.S. dollar.

Earnings Post Market Hours

Britannia Industries Q3 FY24 (Consolidated, YoY)

Revenue up 1.4% to Rs 4,256.3 crore vs Rs 4196.8 crore (Bloomberg estimate Rs 4,296.2 crore)

Ebitda up 0.4% to Rs 821.09 crore vs Rs 817.58 crore (Bloomberg estimate Rs 813.1 crore).

Margin at 19.3% vs 19.5% (Bloomberg estimate 18.9%).

Net profit down 40.4% to Rs 555.6 crore vs Rs 932.4 crore (Bloomberg estimate Rs 552.8 crore).

Navin Fluorine Q3 Earnings FY24 (Consolidated, YoY)

Revenue down 10.96% at Rs 501.82 crore vs Rs 563.58 crore (Bloomberg estimate: Rs 522.42 crore).

Ebitda down 51.37% at Rs 75.67 crore vs Rs 155.58 crore (Bloomberg estimate: Rs 121.98 crore).

Margin down 1,252 bps at 15.07% vs 27.6% (Bloomberg estimate: 23.30%).

Net profit down 26.78% at Rs 78.02 crore vs Rs 106.56 crore (Bloomberg estimate: Rs 63.88 crore).

Eveready Industries Q3 Earnings FY24 (Consolidated, YoY)

Revenue down 7.7% at Rs 304.91 crore vs Rs 330.43 crore.

Ebitda up 3% at Rs 24.7 crore vs Rs 24 crore.

Margin up 84 bps at 8.09% vs 7.25%.

Net profit up 54.6% at Rs 8.41 crore vs Rs 5.44 crore.

FSN E-Commerce Ventures Q3 Earnings FY24 (Consolidated, QoQ)

Revenue up 18.7% at Rs 1,789 crore vs Rs 1,507 crore (Bloomberg estimate: Rs 1,790.10 crore).

Ebitda up 22.5% at Rs 98.7 crore vs Rs 80.6 crore (Bloomberg estimate: Rs 115.9 crore).

Margin up 16 bps at 5.5% vs 5.53% (Bloomberg estimate: 6.5%).

Net profit at Rs 17.4 crore vs Rs 7.8 crore (Bloomberg estimate: Rs 32.55 crore).

Approves further investment of up to Rs 150 crore in Nykaa Fashion via rights issue.

V-Mart Retail Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 14.43% at Rs 889.05 crore vs Rs 776.88 crore (Bloomberg estimate: Rs 888.94 crore).

Ebitda up 15.44% at Rs 119.69 crore vs Rs 103.68 crore (Bloomberg estimate: Rs 106.04 crore).

Margin up 11 bps at 13.46% vs 13.34% (Bloomberg estimate: 11.90%).

Net profit up 41.36% at Rs 28.23 crore vs Rs 19.97 crore (Bloomberg estimate: Rs 16.46 crore).

Godawari Power and Ispat Q3 Earnings FY24 (Consolidated, YoY)

Revenue down 10.54% at Rs 1,308.92 crore vs Rs 1,462.99 crore.

Ebitda up 80.36% at Rs 330.91 crore vs Rs 183.47 crore.

Margin up 1,274 bps at 25.28% vs 12.54%.

Net profit up 79.05% at Rs 229.16 crore vs Rs 127.98 crore.

JB Chemicals Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 6.53% at Rs 844.51 crore vs Rs 792.71 crore (Bloomberg estimate: Rs 860.43 crore).

Ebitda up 27.66% at Rs 223.12 crore vs Rs 174.77 crore (Bloomberg estimate: Rs 213.40 crore).

Margin up 437 bps at 26.42% vs 22.04% (Bloomberg estimate: 24.80%).

Net profit up 25.89% at Rs 133.57 crore vs Rs 106.1 crore (Bloomberg estimate: Rs 133.70 crore).

Appointed Narayan Saraf as Chief Financial Officer, effective Feb. 23.

Board declares interim dividend of Rs 5.5 per share.

NLC India Q3 Earnings FY24 (Consolidated, YoY)

Revenue down 13.99% at Rs 3,164.4 crore vs Rs 3,679.01 crore.

Ebitda down 33.47% at Rs 904.7 crore vs Rs 1,359.71 crore.

Margin down 836 bps at 28.58% vs 36.95%.

Net profit at Rs 254.1 crore vs loss of Rs 396.4 crore.

Zaggle Prepaid Q3 Earnings FY24 (Consolidated, QoQ)

Revenue up 8.28% at Rs 199.51 crore vs Rs 184.24 crore.

EBIT up 47.22% at Rs 18.58 crore vs Rs 12.62 crore.

Margin up 246 bps at 9.31% vs 6.84%.

Net profit up 100.52% at Rs 15.22 crore vs Rs 7.59 crore.

P&G Health Q3 FY24 (Standalone, YoY)

Revenue flat at Rs 310 crore.

Ebitda down 6.6% at Rs 101.71 crore vs Rs 108.86 crore.

Margin down 230 bps at 32.8% vs 35.1%.

Net profit down 6.1% at Rs 72.1 crore vs Rs 76.8 crore.

Brigade Enterprise Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 43.08% at Rs 1,173.77 crore vs Rs 820.31 crore (Bloomberg estimate: Rs 1,053.15 crore).

Ebitda up 26.02% at Rs 262.04 crore vs Rs 207.92 crore (Bloomberg estimate: Rs 295.96 crore).

Margin down 302 bps at 22.32% vs 25.34% (Bloomberg estimate: 28.10%).

Net profit up 30.71% at Rs 55.79 crore vs Rs 42.68 crore (Bloomberg estimate: Rs 118.08 crore).

Approved raising Rs 1,500 crore via bonds and equity.

Berger Paints Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 6.98% at Rs 2,881.83 crore vs Rs 2,693.59 crore.

Ebitda up 37.29% at Rs 480.04 crore vs Rs 349.65 crore.

Margin up 367 bps at 16.65% vs 12.98%.

Net profit up 49.2% at Rs 300.16 crore vs Rs 201.17 crore.

AGI Greenpac Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 9.68% at Rs 622.26 crore vs Rs 567.3 crore.

Ebitda up 37.09% at Rs 150.19 crore vs Rs 109.55 crore.

Margin up 482 bps at 24.13% vs 19.31%.

Net profit up 26.09% at Rs 67.12 crore vs Rs 53.23 crore.

Anant Raj Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 47.59% at Rs 392.27 crore vs Rs 265.78 crore.

Ebitda up 70.67% at Rs 90.08 crore vs Rs 52.78 crore.

Margin up 310 bps at 22.96% vs 19.85%.

Net profit up 58.17% at Rs 71.43 crore vs Rs 45.16 crore.

Blue Jet Healtcare Q3 Earnings FY24 (YoY)

Revenue down 1.31% at Rs 166.76 crore vs Rs 168.96 crore.

Ebitda up 5.48% at Rs 54.59 crore vs Rs 51.75 crore.

Margin up 210 bps at 32.73% vs 30.62%.

Net profit down 14.44% at Rs 32.11 crore vs Rs 37.53 crore.

Prataap Snacks Q3 Earnings FY24 (YoY)

Revenue down 4.26% at Rs 408.31 crore vs Rs 426.45 crore.

Ebitda up 48.56% at Rs 34.75 crore vs Rs 23.39 crore.

Margin up 302 bps at 8.51% vs 5.48%.

Net profit up 105.52% at Rs 10.79 crore vs Rs 5.25 crore.

Max Financial Services Q3 Earnings FY24 (Consolidated, YoY)

Total income at Rs 12,359.19 crore vs Rs 8,898.35 crore, up 38.89%.

Net profit at Rs 171.21 crore vs Rs 269.35 crore, down 36.43%.

Max Life Insurance gets IRDAI nod to raise capital worth Rs 1,612 crore.

Redington Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 8.44% at Rs 23,504.97 crore vs Rs 21,674.31 crore (Bloomberg estimate: Rs 24,979.65 crore).

Ebitda down 11.03% at Rs 517.3 crore vs Rs 581.42 crore (Bloomberg estimate: Rs 548.78 crore).

Margin down 48 bps at 2.2% vs 2.68% (Bloomberg estimate: 2.20%).

Net profit down 11.42% at Rs 347.88 crore vs Rs 392.75 crore (Bloomberg estimate: Rs 323.8 crore).

Cigniti Technologies Q3 Earnings FY24 (Consolidated, QoQ)

Revenue at Rs 468.02 crore vs Rs 451.83 crore, up 3.58%.

EBIT at Rs 56.73 crore vs Rs 57.24 crore, down 0.9%.

Margin at 12.12% vs 12.66%, down 54 bps.

Net profit at Rs 48.04 crore vs Rs 45.86 crore, up 4.75%.

EID Parry Q3 Earnings FY24 (Consolidated, YoY)

Revenue down 21.63% at Rs 7,770.14 crore vs Rs 9,913.9 crore.

Ebitda down 53.83% at Rs 420.98 crore vs Rs 911.67 crore.

Margin down 377 bps at 5.41% vs 9.19%.

Net profit down 55.04% at Rs 216.52 crore vs Rs 481.6 crore.

Endurance Technology Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 22.23% at Rs 2,561.1 crore vs Rs 2,095.2 crore (Bloomberg estimate: Rs 2,625.48 crore).

Ebitda up 24.85% at Rs 298.99 crore vs Rs 239.47 crore (Bloomberg estimate: Rs 336.69 crore).

Margin up 24 bps at 11.67% vs 11.42% (Bloomberg estimate: 12.8%).

Net profit up 40.7% at Rs 152.28 crore vs Rs 108.23 crore (Bloomberg estimate: Rs 165.69 crore).

EIH Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 26.4% at Rs 741.26 crore vs Rs 586.41 crore.

Ebitda up 55.2% at Rs 324.39 crore vs Rs 209.01 crore.

Margin up 811 bps at 43.76% vs 35.64%.

Net profit up 52.19% at Rs 229.94 crore vs Rs 151.08 crore.

Nazara Technologies Q3 Earnings FY24 (Consolidated, QoQ)

Revenue up 7.79% at Rs 320.4 crore vs Rs 297.24 crore.

EBIT up 82.15% at Rs 21.13 crore vs Rs 11.6 crore.

Margin up 269 bps at 6.59% vs 3.9%.

Net profit up 22.08% at Rs 29.52 crore vs Rs 24.18 crore.

Dollar Industries Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 15.54% at Rs 329.69 crore vs Rs 285.34 crore.

Ebitda up 65.89% at Rs 32.2 crore vs Rs 19.41 crore.

Margin up 296 bps at 9.76% vs 6.8%.

Net profit up 102.74% at Rs 17.72 crore vs Rs 8.74 crore.

Gujarat State Fertilizers & Chemicals Q3 FY24 (Consolidated, YoY)

Revenue down 42.29% at Rs 2,007.75 crore vs Rs 3,478.99 crore (Bloomberg estimate: Rs 2,363.2 crore).

Ebitda down 68.9% at Rs 107.61 crore vs Rs 345.76 crore (Bloomberg estimate: Rs 219.80 crore).

Margin at 5.35% vs 9.93% (Bloomberg estimate: 9.3%).

Net profit down 71.21% at Rs 117.99 crore vs Rs 409.93 crore (Bloomberg estimate: Rs 141.7 crore).

Hawkins Cookers Q3 FY24 (Consolidated, YoY)

Revenue up 6.46% at Rs 272.4 crore vs Rs 255.87 crore.

Ebitda up 6.62% at Rs 26.87 crore vs Rs 25.2 crore.

Margin at 9.86% vs 9.84%.

Net profit up 8.95% at Rs 19.71 crore vs Rs 18.09 crore.

IOL Chemicals and Pharma Q3 FY24 (Consolidated, YoY)

Revenue down 0.6% at Rs 520.39 crore vs Rs 523.48 crore (Bloomberg estimate: Rs 635.5 crore).

Ebitda up 3.91% at Rs 44.35 crore vs Rs 42.68 crore (Bloomberg estimate: Rs 85.8 crore).

Margin at 8.52% vs 8.15% (Bloomberg estimate: 13.5%).

Net profit down 2.94% at Rs 23.08 crore vs Rs 23.78 crore (Bloomberg estimate: Rs 56 crore).

Radico Khaitan Q3 FY24 (Consolidated, YoY)

Revenue up 34.1% at Rs 1,160.92 crore vs Rs 792.16 crore.

Ebitda up 47.45% at Rs 142.81 crore vs Rs 96.85 crore.

Margin at 12.3% vs 12.22%.

Net profit up 22.73% at Rs 75.15 crore vs Rs 61.23 crore.

Tata Teleservices Q3 FY24 (Consolidated, YoY)

Revenue up 3.21% at Rs 296.03 crore vs Rs 286.8 crore.

Ebitda loss at Rs 274.43 crore vs loss of Rs 277.72 crore.

Net loss at Rs 307.72 crore vs loss of Rs 309.81 crore.

Lemon Tree Hotels Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 23.6% at Rs 288.69 crore vs Rs 233.55 crore (Bloomberg estimate: Rs 282.23 crore).

Ebitda up 10.49% at Rs 139.74 crore vs Rs 126.47 crore (Bloomberg estimate: Rs 139.24 crore).

Margin down 574 bps at 48.4% vs 54.15% (Bloomberg estimate: 49.30%).

Net profit down 9.87% at Rs 43.79 crore vs Rs 48.59 crore (Bloomberg estimate: Rs 45.13 crore).

Timken India Q3 Earnings (FY24)

Revenue up 0.45% at Rs 612.21 crore vs Rs 609.44 crore (Bloomberg estimate: Rs 642.5 crore).

Ebitda down 1.18% at Rs 102.48 crore vs Rs 103.7 crore (Bloomberg estimate: Rs 122.93 crore).

Margin down 27 bps at 16.73% vs 17.01% (Bloomberg estimate: 19.10%).

Net profit down 4.29% at Rs 67.53 crore vs Rs 70.56 crore (Bloomberg estimate: Rs 94.03 crore).

Vakrangee Q3 Earnings FY24 (Consolidated, QoQ)

Revenue up 0.03% at Rs 51.56 crore vs Rs 51.54 crore.

EBIT up 17.34% at Rs 2.3 crore vs Rs 1.96 crore.

Margin up 65 bps at 4.46% vs 3.8%.

Net profit up 853.84% at Rs 1.24 crore vs Rs 0.13 crore.

Earnings In Focus

Aarti Pharmalabs, AIA Engineering, Apollo Tyres, Ashoka Buildcon, Aditya Vision, Borosil Renewables, Cummins India, Dreamfolks Services, Electronics Mart India, EPL, FDC, Gujarat Fluorochemicals, Fortis Healthcare, First Source Solution, General Insurance Corporation of India, Guajarat Industries Power, GMR Power and Urban Infra, Gujarat Narmada Valley Fertilizers & Chemicals, HBL Power Systems, Hemisphere Properties India, HMT, India Pesticides, Jamna Auto Industries, JK Paper, Kalpataru Projects International, Lupin, Manappuram Finance, Navneet Education, Nestle India, Nocil, PDS, Piccadily Agro Industries, Power Grid Corporation of India, Protean eGov Technologies, Religare Enterprises, Safari Industries (India), Sanghvi Movers, Shivalik Bimetal Controls, Shalby, Sobha, Solar Industries India, Star Cement, Tata Consumer Products, Trent, UNO Minda, and Varroc Engineering.

Stocks To Watch

UPL: Moody's Investors Service downgraded the company's senior unsecured rating to 'Ba1' from 'Baa3' on deterioration in the agrochemical industry fundamentals.

JB Chemicals & Pharmaceuticals: The company appointed Narayan Saraf as chief financial officer effective Feb. 23.

Biocon: The company received USFDA tentative approval for Dasatinib tablets, which are used in the treatment of the Philadelphia chromosome.

Lupin: The company received USFDA approval from ANDA for bromfenac ophthalmic solution, which is a generic of bromsite.

Power Finance Corp: The company incorporated Bhadla-III and Bikaner-III transmission as a wholly owned subsidiary for the development of transmission system strengthening for interconnections of the Bhadla III and Bikaner-II complexes.

Yasho Industries: The company begins a trial run at the Bharuch unit for manufacturing industrial chemicals.

Karnataka Bank: The company received an RBI nod for exercising the call option on bonds.

Mahindra Lifespace Developers: The company received an Irdai nod for a Rs 1,612 crore capital infusion by Axis Bank, subject to CCI approval.

Mahindra Life: The company received a Rs 2.3 crore penalty for non-adherence to forest norms.

IPO Offerings

Rashi Peripherals: The information and communications technology products distributor will offer its shares for bidding on Wednesday. The price band is set from Rs 295 to Rs 311 per share. The Rs 600 crore IPO comprises only a fresh issue. The company has raised Rs 180 crore from anchor investors.

Jana Small Finance Bank: The small finance bank will offer its shares for bidding on Wednesday. The price band is set for Rs 393 to Rs 414 per share. The 570 crore IPO includes both a fresh issue of Rs 462 crore and an offer for sale of 108 crore. The company has raised Rs 166.95 crore from anchor investors.

Capital Small Finance Bank: The small finance bank will offer its shares for bidding on Wednesday. The price band is set for Rs 445 to Rs 468 per share apiece. The 523.07 crore IPO includes both a fresh issue of Rs 450.00 crore and an offer for sale of 73.07 crore. The company has raised Rs 157 crore from anchor investors.

Apeejay Surrendra Park Hotels: The public issue was subscribed to 5.82 times on day 2. The bids were led by retail investors (13.14 times), non-institutional investors (10.35 times) and institutional investors (1.26 times) and reserved for employees (2.09 times).

Bulk Deals

Krishna Institute of Medical Sciences: India Advantage Fund sold 10.7 lakh shares (1.33%), while SBI Life Insurance bought 11.49 lakh shares (1.43%) at Rs 2085 apiece.

Global Surfaces: Vikasa India EIF I Fund - Incube Global Opportunities sold 2.2 lakh shares (0.51%) at Rs 300.21 apiece.

HFCL: MN Ventures sold 75 lakh shares (0.52%) at Rs 98.01 apiece.

Tourism Finance Corp: Shruti Mohta sold 10.66 lakh shares (1.18%) at Rs 220.39 apiece.

Insider Trades

Steel Strips Wheels: Promoter Sunena Garg sold 14.63 lakh shares on Feb. 5.

Paisalo Digital: Promoter group Equilibrated Venture Cflow bought 18.06 lakh shares on Feb. 6.

Who's Meeting Whom

Indoco Remedies: To meet analysts and investors on Feb.19.

Bikaji Foods: To meet analysts and investors on Feb. 14.

Fusion Micro Finance: To meet analysts and investors on Feb. 7.

RBL Bank: To meet analysts and investors on Feb. 7.

Flair Writing: To meet analysts and investors on Feb. 13.

Computer Age Management Services: To meet analysts and investors on Feb. 15, 21.

Accelya Solutions: To meet analysts and investors on Feb. 9 and 12.

Happy Forgings: To meet analysts and investors on Feb. 12.

Adani Wilmar: To meet analysts and investors on Feb. 12 and 13.

F&O Cues

Nifty February futures up by 0.91% to 21,979.55 at a premium of 50.55 points.

Nifty February futures open interest up by 2.16%.

Nifty Bank February futures down by 0.02% to 45,971 at a premium of 280.2 points.

Nifty Bank February futures open interest up by 7.9%.

Nifty Options Feb. 8 Expiry: Maximum Call open interest at 22,500 and Maximum Put open interest at 21,000.

Bank Nifty Options Feb. 7 Expiry: Maximum Call Open Interest at 48,000 and Maximum Put open interest at 44,000.

Securities in the ban period: Ashok Leyland, Hindustan Copper, India Cements, Indus Tower, National Aluminium, UPL, Zee Entertainment Enterprise.

Money Market Update

The Indian rupee closed flat at Rs 83.05 against the U.S. dollar.

Disclaimer: NDTV is a subsidiary of AMG Media Networks Ltd, an Adani Group company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.