Asia-Pacific markets rose on Thursday mirroring similar overnight moves on the Wall Street as US economic data and Federal Reserve's June policy meeting minutes supported traders' rate cuts hopes.

The Nikkei 225 was trading 115.84 points or 0.29% higher at 40,696.60, and the S&P ASX 200 was trading 73.60 points or 0.95% higher at 7,813.50 as of 06:54 a.m.

US stocks rose on Wednesday in a truncated session ahead of holiday with the Nasdaq composite scaling a fresh high. The Nasdaq Composite settled 0.88% higher. The S&P 500 ended 0.51% higher, while Dow Jones Industrial Average closed 0.06% lower.

Brent crude was trading 0.50% lower at $86.99 a barrel. Gold rose 0.22% to $2,361.43 an ounce.

The GIFT Nifty was trading 15.5 points or 0.06% higher at 24,459.00 as of 06:58 a.m.

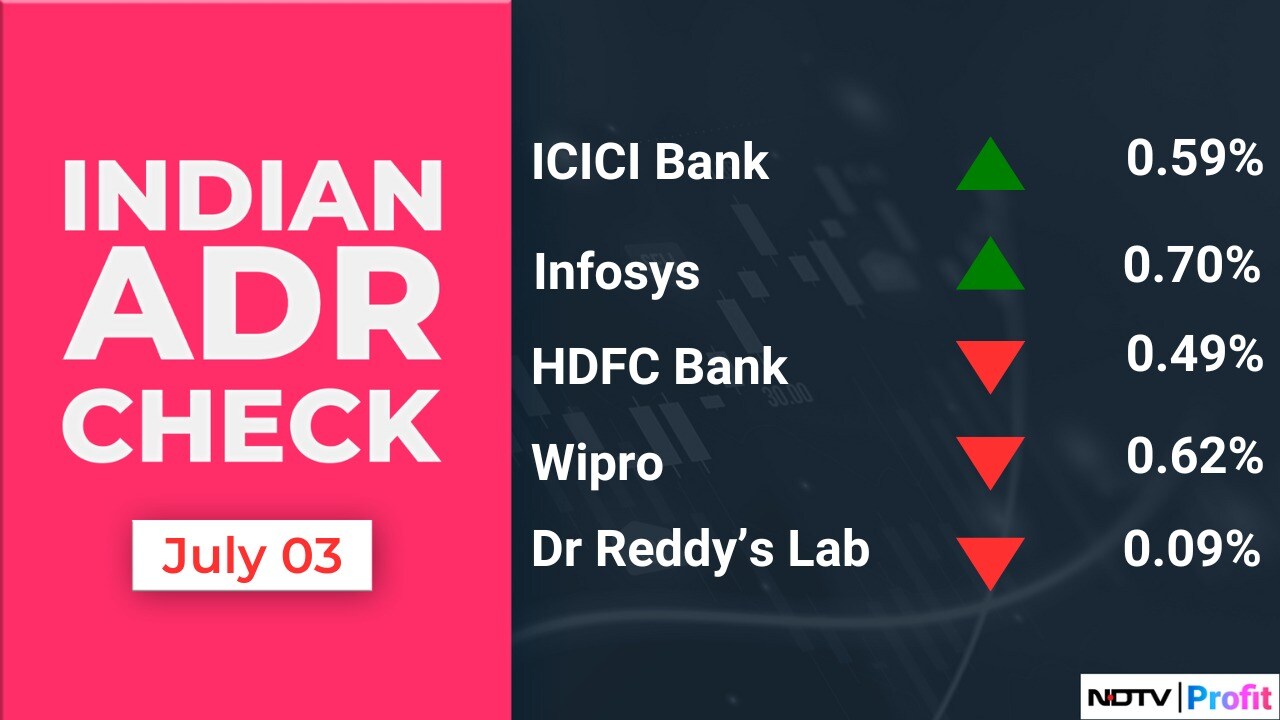

Indian benchmarks settled at fresh closing highs on Wednesday, tracking sharp gains in heavyweight HDFC Bank Ltd. and ICICI Bank Ltd.

The NSE Nifty 50 settled 162.65 points, or 0.67%, higher at 24,286.50, and the S&P BSE Sensex ended 545.34 points, or 0.69%, up at 79,986.80.

Overseas investors turned net buyers on Wednesday after three days of selling. Foreign portfolio investors mopped up stocks worth Rs 5,483.6 crore, while domestic institutional investors turned net sellers after three sessions and offloaded equities worth Rs 924.4 crore, according to provisional data from the National Stock Exchange.

The Indian currency weakened 3 paise to close at Rs 83.53 against the US dollar.

Stocks to Watch

Bajaj Finance: The company reported new loans grew by 10% year-on-year to 10.97 million, AUM grew by 31% year-on-year to 3.54 lakh crore, and deposit book at up 26% year-on-year at 62,750 crores for the end of Q1 FY25.

Vedanta: The company reported aluminum production up 3% year-on-year at 596 kt, while Saleable zinc production up 1% year-on-year at 262 kt, Saleable steel production up 10% year-on-year at 356 kt, YoY, Overall power sales at 4,791 MU, up 13% YoY for the end of Q1 FY25.

Brigade Enterprises: The company signed a joint development agreement for a 1.2 million sq ft residential project in Bengaluru. The project is to be spread over 8 acres, with a Gross Development Value of Rs 1,100 crore.

L&T Finance: The company reported Portfolio realisation at 95%, Retail disbursements up 33% year-on-year at Rs 14,830 crore, and Retail loan book up 31% year-on-year at Rs 84,440 crore.

Suryoday Small Finance Bank: The bank reported gross advances up 42% year-on-year at Rs 9,037 crore, deposits up 42% year-on-year at Rs 8,137 crore, CASA ratio at 17.7% vs 20.1% QoQ, while GNPA at 2.67% vs 2.80% QoQ.

Tata Steel: The company received NCLT's nod for the merger of Angul Energy into itself.

Bandhan Bank: The bank reported loans and advances at Rs up 21.8% year-on-year at Rs 1.03 lakh crore, deposits at Rs up 22.8% year-on-year at Rs 1.08 lakh crore, While CASA ratio at 36.0% vs 37.1% QoQ for the end of Q1 FY25.

GE T&D: The company received a €64 million order from France's Grid Solutions for the supply of high-voltage products.

Cochin Shipyard: The government appointed Jose VJ as Director of Finance for 3 years.

Persistent Systems: The company acquired a 100% stake in US-based software company Starfish Associates for $20.7 million.

Marico: The company partnered with Kaya to handle sales of its science-based personal care products.

ITD Cementation: Promoter Italian Thai Development Public Company is exploring the potential divestment of its investment in the company.

Indiabulls Real Estate: The company changed its name to Equinox India Developments effective from July 8 following approvals from stock exchanges.

Cello World: The company launched a qualified institutional placement to raise up to Rs 800 crore.

Carysil: The company raised Rs 125 crore via QIP and allotted 15.7 lakh shares at Rs 796 per share.

Zee Media Corporation: The Ministry of Corporate Affairs approved the incorporation of a new subsidiary called Pinews Digital. Pinews to carry out business of mainstream media, through Hyper Local App, driven by AI.

IPO Offering

Emcure Pharmaceuticals: The public issue was subscribed to 1.32 times on day 1. The bids were led by institutional investors (0.07 times), non-institutional investors (2.71 times), retail investors (1.39 times).

Bansal Wire Industries: The public issue was subscribed to times 1.76 on day 1. The bids were led by institutional investors (0.01 times), non-institutional investors (2.44 times), retail investors (2.47 times).

Bulk Deals

Ideaforge Technology: Think India Opportunities Master Fund LP sold 2.23 lakh shares (0.52%) at Rs 796.6 apiece.

Yatharth Hospital & Trauma Care Services: Plutus Wealth Management sold 25 lakh shares (2.91%) at Rs 405.07 apiece, while ICICI Prudential Mutual Fund bought 20 lakh shares (2.32%) at Rs 405 apiece.

Trading Tweaks

Price band Changes from 10% to 5%: Zen Technologies.

Price band Changes from 20% to 10%: Allied Digital Services, GM Breweries.

Ex/record Dividend: Tide Water Oil, Tata Power, Solar Industries, SKF India, Balaji Amines.

Ex/record AGM: Vedanta, Laurus Labs, Solar Industries India, Balaji Amines.

Ex/record Buyback: eClerx Services.

Moved in short-term Framework: DCX Systems, JK Paper, Nirman Agri Genetics.

Moved out short-term Framework: Cellecor Gadgets, Exicom Tele-Systems, Omaxe.

Who's Meeting Whom

Sky Gold: To meet analyst and Investors on July 8.

Dixon Technologies: To meet analyst and Investors on July 5.

Sansera Engineering: To meet analyst and Investors on July 8, 9.

F&O Cues

Nifty July futures up by 0.68% to 24,350 at a premium of 63.5 points.

Nifty July futures open interest down by 0.85%.

Nifty Bank July futures up by 1.39% to 53,091 at a premium of 2.4 points.

Nifty Bank July futures open interest up by 13.73%.

Nifty Options July 4 Expiry: Maximum Call open interest at 25,000 and Maximum Put open interest at 24,000.

Bank Nifty Options July 10 Expiry: Maximum Call Open Interest at 55,000 and Maximum Put open interest at 53,000.

Securities in ban period: India Cements, Hindustan Copper.

.jpg)

Money Market

The Indian currency weakened 3 paise to close at 83.53 against the US dollar.

Research Reports

IT Services Q1 Results Preview - Balancing Act, Yet Not Promising: Prabhudas Lilladher

Bansal Wire IPO - Investment Rationale, Issue Details, Key Strategies, Risks And More: DRChoksey

V-Mart - Meets Expectations Amid Signs Of Recovery; Limeroad Loss A Worry: Nirmal Bang

Galaxy Surfactant - Growth, Quality; Maintain Buy With A Target Price Of Rs 3,465: HDFC Securities

Shilchar Technologies - Niche Operations, Strong Margins: Anand Rathi

Emami - Growth Print To Improve; Comfort On Valuation: Motilal Oswal

JK Lakshmi Cement - Firing On All Cylinders: HDFC Securities

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.