Overseas investors remained net sellers of Indian equities for the fourth consecutive day on Saturday.

Foreign portfolio investors offloaded equities worth Rs 545.6 crore, according to provisional data from the National Stock Exchange.

Domestic institutional investors turned net sellers after four days and offloaded stocks worth Rs 719.3 crore, the NSE data showed.

Net profit: Rs 10271 crore vs Rs 8312 crore YoY

NII: Rs 18,679 crore vs Rs 16,465 crore YoY

GNPA: 2.3% vs 2.48% QoQ

NNPA: 0.44% vs 0.43% QoQ

Benchmark equity indices closed lower today as shares of Hindustan Unilever and Reliance Industries dragged after their Q3 results.

The Nifty index closed 50.60 points or 0.23% lower at 21571.80 while the Sensex lost 259.58 points or 0.36% to close at 71423.65.

"The Nifty opened higher and remained volatile throughout the day. The overall consolidation phase may persist for the next few days or until the Nifty stays within the range of 21500-21700, Rupak De, Senior Technical Analyst, LKP Securities.

He added that only a decisive breakout on either side could initiate a directional move. "A significant decline below 21500 might trigger a correction towards 21300 and below. Conversely, a robust breakout above 21700 is needed for a resumption of the uptrend," De added.

Benchmark equity indices closed lower today as shares of Hindustan Unilever and Reliance Industries dragged after their Q3 results.

The Nifty index closed 50.60 points or 0.23% lower at 21571.80 while the Sensex lost 259.58 points or 0.36% to close at 71423.65.

"The Nifty opened higher and remained volatile throughout the day. The overall consolidation phase may persist for the next few days or until the Nifty stays within the range of 21500-21700, Rupak De, Senior Technical Analyst, LKP Securities.

He added that only a decisive breakout on either side could initiate a directional move. "A significant decline below 21500 might trigger a correction towards 21300 and below. Conversely, a robust breakout above 21700 is needed for a resumption of the uptrend," De added.

Benchmark equity indices closed lower today as shares of Hindustan Unilever and Reliance Industries dragged after their Q3 results.

The Nifty index closed 50.60 points or 0.23% lower at 21571.80 while the Sensex lost 259.58 points or 0.36% to close at 71423.65.

"The Nifty opened higher and remained volatile throughout the day. The overall consolidation phase may persist for the next few days or until the Nifty stays within the range of 21500-21700, Rupak De, Senior Technical Analyst, LKP Securities.

He added that only a decisive breakout on either side could initiate a directional move. "A significant decline below 21500 might trigger a correction towards 21300 and below. Conversely, a robust breakout above 21700 is needed for a resumption of the uptrend," De added.

Benchmark equity indices closed lower today as shares of Hindustan Unilever and Reliance Industries dragged after their Q3 results.

The Nifty index closed 50.60 points or 0.23% lower at 21571.80 while the Sensex lost 259.58 points or 0.36% to close at 71423.65.

"The Nifty opened higher and remained volatile throughout the day. The overall consolidation phase may persist for the next few days or until the Nifty stays within the range of 21500-21700, Rupak De, Senior Technical Analyst, LKP Securities.

He added that only a decisive breakout on either side could initiate a directional move. "A significant decline below 21500 might trigger a correction towards 21300 and below. Conversely, a robust breakout above 21700 is needed for a resumption of the uptrend," De added.

Benchmark equity indices closed lower today as shares of Hindustan Unilever and Reliance Industries dragged after their Q3 results.

The Nifty index closed 50.60 points or 0.23% lower at 21571.80 while the Sensex lost 259.58 points or 0.36% to close at 71423.65.

"The Nifty opened higher and remained volatile throughout the day. The overall consolidation phase may persist for the next few days or until the Nifty stays within the range of 21500-21700, Rupak De, Senior Technical Analyst, LKP Securities.

He added that only a decisive breakout on either side could initiate a directional move. "A significant decline below 21500 might trigger a correction towards 21300 and below. Conversely, a robust breakout above 21700 is needed for a resumption of the uptrend," De added.

Benchmark equity indices closed lower today as shares of Hindustan Unilever and Reliance Industries dragged after their Q3 results.

The Nifty index closed 50.60 points or 0.23% lower at 21571.80 while the Sensex lost 259.58 points or 0.36% to close at 71423.65.

"The Nifty opened higher and remained volatile throughout the day. The overall consolidation phase may persist for the next few days or until the Nifty stays within the range of 21500-21700, Rupak De, Senior Technical Analyst, LKP Securities.

He added that only a decisive breakout on either side could initiate a directional move. "A significant decline below 21500 might trigger a correction towards 21300 and below. Conversely, a robust breakout above 21700 is needed for a resumption of the uptrend," De added.

Benchmark equity indices closed lower today as shares of Hindustan Unilever and Reliance Industries dragged after their Q3 results.

The Nifty index closed 50.60 points or 0.23% lower at 21571.80 while the Sensex lost 259.58 points or 0.36% to close at 71423.65.

"The Nifty opened higher and remained volatile throughout the day. The overall consolidation phase may persist for the next few days or until the Nifty stays within the range of 21500-21700, Rupak De, Senior Technical Analyst, LKP Securities.

He added that only a decisive breakout on either side could initiate a directional move. "A significant decline below 21500 might trigger a correction towards 21300 and below. Conversely, a robust breakout above 21700 is needed for a resumption of the uptrend," De added.

Benchmark equity indices closed lower today as shares of Hindustan Unilever and Reliance Industries dragged after their Q3 results.

The Nifty index closed 50.60 points or 0.23% lower at 21571.80 while the Sensex lost 259.58 points or 0.36% to close at 71423.65.

"The Nifty opened higher and remained volatile throughout the day. The overall consolidation phase may persist for the next few days or until the Nifty stays within the range of 21500-21700, Rupak De, Senior Technical Analyst, LKP Securities.

He added that only a decisive breakout on either side could initiate a directional move. "A significant decline below 21500 might trigger a correction towards 21300 and below. Conversely, a robust breakout above 21700 is needed for a resumption of the uptrend," De added.

Shares of Hindustan Unilever Ltd., Reliance Industries Ltd., IndusInd Bank Ltd., Tata Consultancy Services Ltd., and HDFC Bank dragged the index.

Meanwhile, those of ICICI Bank Ltd., Bharti Airtel Ltd., Axis Bank Ltd., Coal India Ltd., and Larsen & Toubro Ltd., cushioned the fall.

Sectoral indices on the NSE closed mixed with Nifty PSU Bank gaining nearly 2%. Nifty FMCG lost the most.

The broader markets outperformed as the BSE MidCap rose 0.46%, while the BSE SmallCap was 0.41% higher. Eleven out of the 20 sectors compiled by the BSE advanced, while nine declined.

The market breadth was skewed in the favour of buyers. As many as 2,060 stocks advanced, 1,752 declined and 96 remained unchanged on the BSE.

Bharti Airtel files DRHP with SEBI

Bharti Hexacom IPO to offer up to 10 crore shares via OFS, no issue of fresh shares

Source: Exchange Filing

Consolidated revenue at Rs 2,934.8 crore, up 20.5%

Consolidated Ebitda at Rs 625.1 crore vs Rs 247.3 crore

Consolidated margin at 21.29% vs 10.15%

Consolidated net profit at Rs 283.8 crore vs Rs 37.15 crore

Net profit at Rs 3,589.9 crore, up 60% YoY

Gross NPA at 4.83% vs 6.38% QoQ

Net NPA at 1.08% vs 1.30% QoQ

NII at Rs 9,168 crore, up 6% YoY

Net profit at Rs 200.1 crore, up 32% YoY

Total income at Rs 901.9 crore, up 27% YoY

Gross NPA at 0.91%; Net NPA at 0.49%

Source: Exchange Filing

Consolidated revenue at Rs 232.7 crore, up 16.4%

Consolidated Ebitda at Rs 34.23 cr vs Rs 37.76 cr, down 9.4%

Consolidated margin at 14.71% vs 18.88%

Consolidated net profit at Rs 19.68 crore, down 10.5%

Approves reappointment for 3 years effective March 16

Source: Exchange Filing

Net profit at Rs 1,458.2 crore, up 57% YoY

Gross NPA at 4.69% vs 4.90% QoQ

Net NPA at 0.34% vs 0.39% QoQ

NII at Rs 3,434.5 crore, up 17% YoY

Consolidated revenue at Rs 138.8 crore, up 3.89%

Consolidated Ebitda at Rs 16.73 crore, up 23.4%

Consolidated margin at 12.05% vs 10.15%

Consolidated net profit at Rs 6.68 crore, up 67.8%

Gets CDSCO nod to import formulations of new drug

Source: Exchange Filing

Sis Ltd at 18.43 times its 30 day average

Hindustan Foods at 8.26 times its 30 day average

Rites Ltd at 5.97 times its 30 day average

Ceat Ltd at 4.37 times its 30 day average

Ganesh Housing Corporation at 4 times its 30 day average

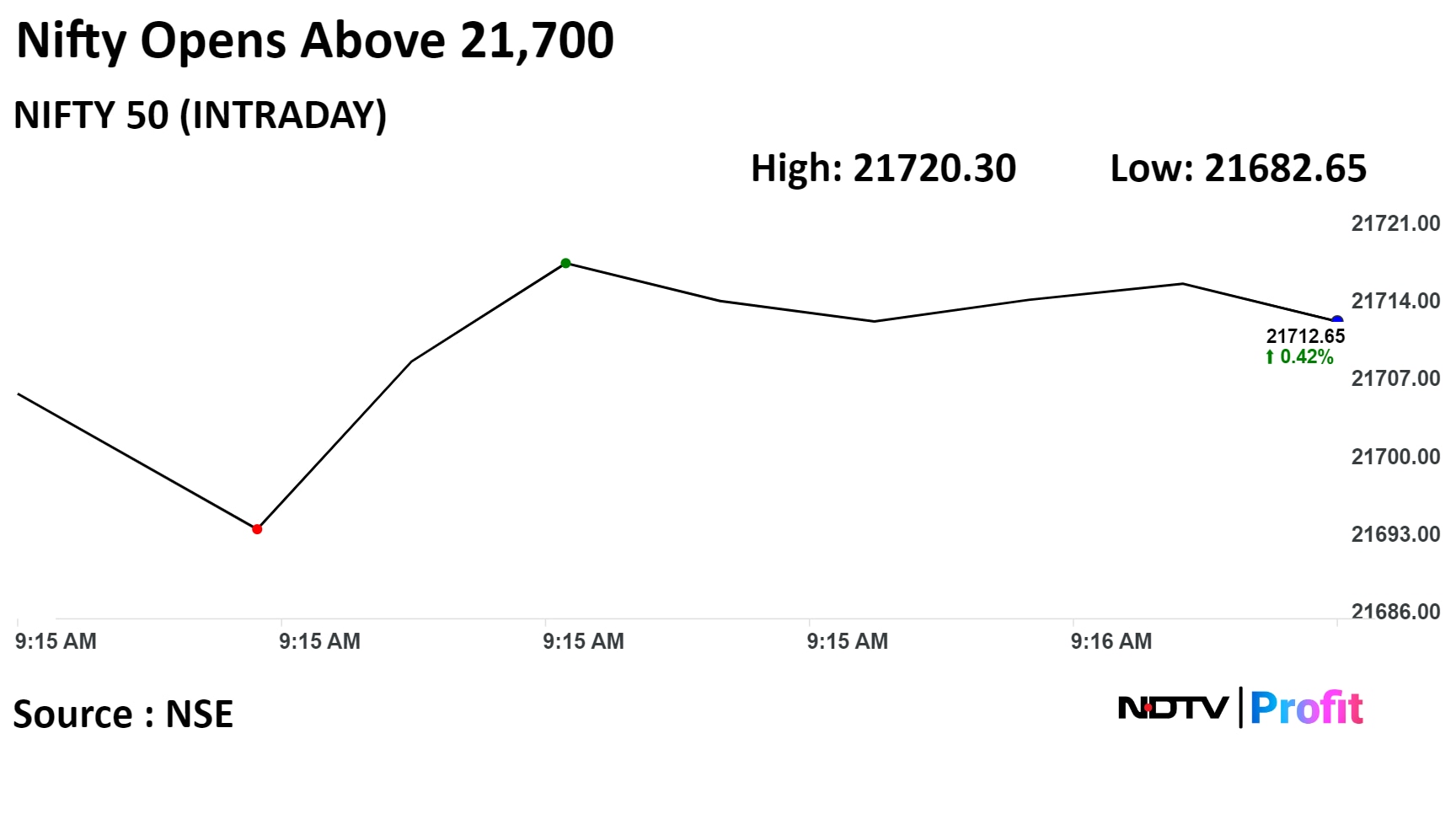

India's benchmark stock indices were trading higher through midday during the special trading session on Saturday, as shares of ICICI Bank Ltd., Bharti Airtel Ltd., and Larsen & Toubro Ltd. gained.

As of 12:12 p.m. the S&P BSE Sensex was 535.28 points, or 0.75% higher at 71,722.14, while the NSE Nifty 50 was 183.85 points, or 0.86% higher at 21,646.10.

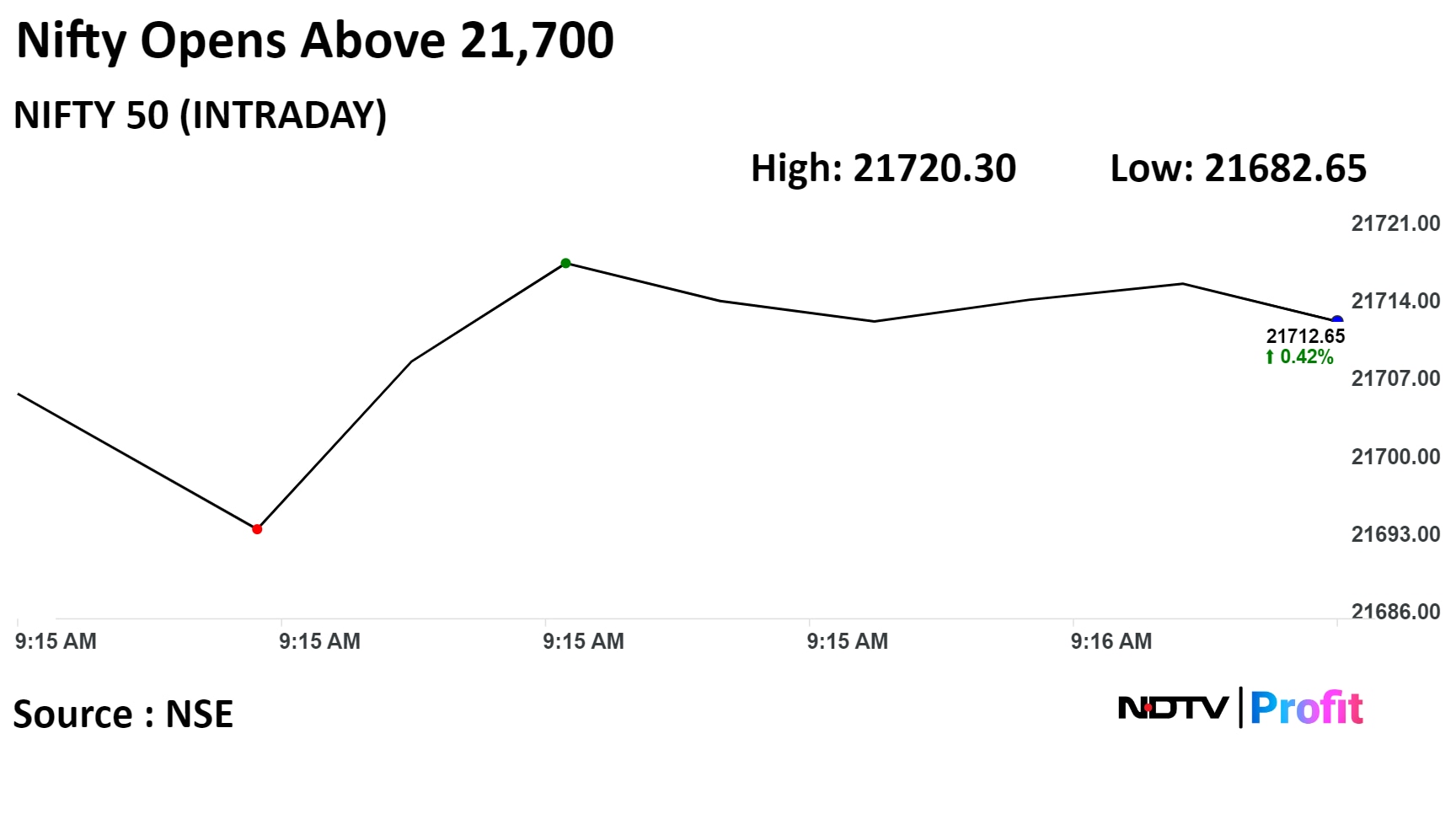

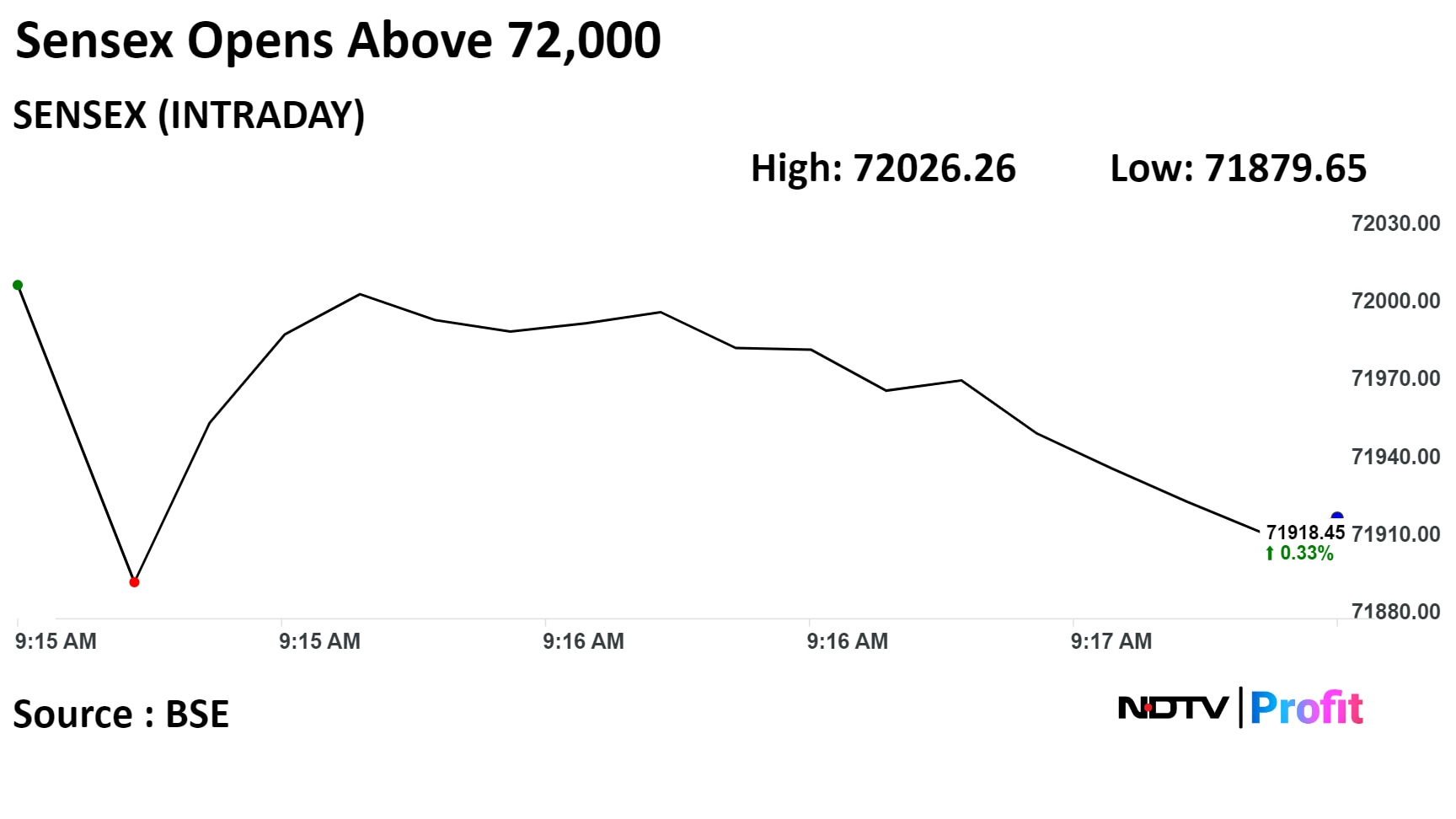

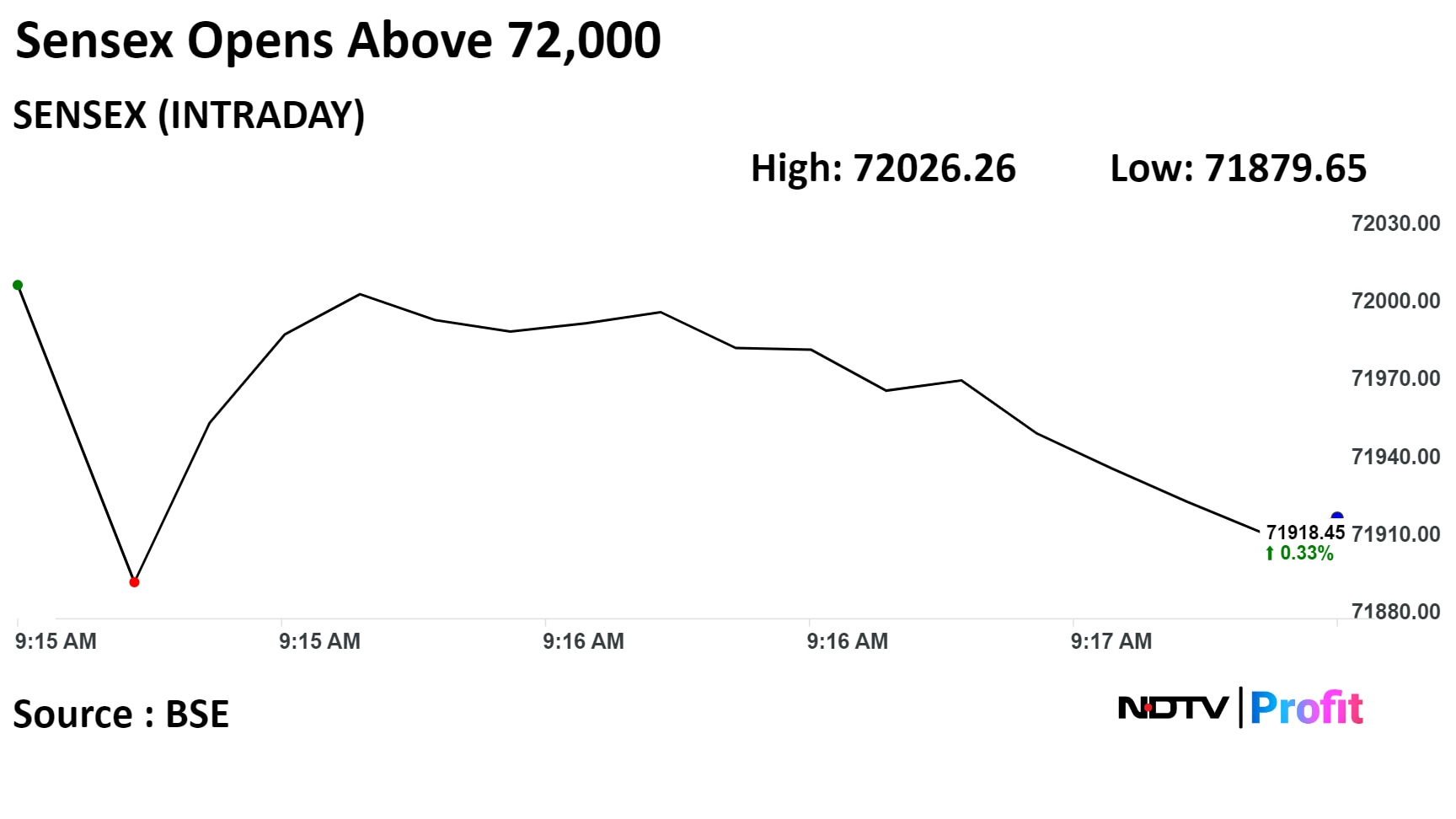

Intraday, the Sensex rose to 72,026.26, while the Nifty 50 touched a high of 21,720.30.

"The Indian stock market witnessed a commendable recovery driven by positive global sentiments yesterday. This optimistic trend has extended into today as well," said Shrey Jain, founder and chief executive officer of SAS Online.

Following a gap-up opening, it is expected that the Nifty will consolidate around its current levels. Even with possible short-term ups and downs, the larger trend indicates that it's a good idea to sell when prices are going up, Jain said.

India's benchmark stock indices were trading higher through midday during the special trading session on Saturday, as shares of ICICI Bank Ltd., Bharti Airtel Ltd., and Larsen & Toubro Ltd. gained.

As of 12:12 p.m. the S&P BSE Sensex was 535.28 points, or 0.75% higher at 71,722.14, while the NSE Nifty 50 was 183.85 points, or 0.86% higher at 21,646.10.

Intraday, the Sensex rose to 72,026.26, while the Nifty 50 touched a high of 21,720.30.

"The Indian stock market witnessed a commendable recovery driven by positive global sentiments yesterday. This optimistic trend has extended into today as well," said Shrey Jain, founder and chief executive officer of SAS Online.

Following a gap-up opening, it is expected that the Nifty will consolidate around its current levels. Even with possible short-term ups and downs, the larger trend indicates that it's a good idea to sell when prices are going up, Jain said.

India's benchmark stock indices were trading higher through midday during the special trading session on Saturday, as shares of ICICI Bank Ltd., Bharti Airtel Ltd., and Larsen & Toubro Ltd. gained.

As of 12:12 p.m. the S&P BSE Sensex was 535.28 points, or 0.75% higher at 71,722.14, while the NSE Nifty 50 was 183.85 points, or 0.86% higher at 21,646.10.

Intraday, the Sensex rose to 72,026.26, while the Nifty 50 touched a high of 21,720.30.

"The Indian stock market witnessed a commendable recovery driven by positive global sentiments yesterday. This optimistic trend has extended into today as well," said Shrey Jain, founder and chief executive officer of SAS Online.

Following a gap-up opening, it is expected that the Nifty will consolidate around its current levels. Even with possible short-term ups and downs, the larger trend indicates that it's a good idea to sell when prices are going up, Jain said.

India's benchmark stock indices were trading higher through midday during the special trading session on Saturday, as shares of ICICI Bank Ltd., Bharti Airtel Ltd., and Larsen & Toubro Ltd. gained.

As of 12:12 p.m. the S&P BSE Sensex was 535.28 points, or 0.75% higher at 71,722.14, while the NSE Nifty 50 was 183.85 points, or 0.86% higher at 21,646.10.

Intraday, the Sensex rose to 72,026.26, while the Nifty 50 touched a high of 21,720.30.

"The Indian stock market witnessed a commendable recovery driven by positive global sentiments yesterday. This optimistic trend has extended into today as well," said Shrey Jain, founder and chief executive officer of SAS Online.

Following a gap-up opening, it is expected that the Nifty will consolidate around its current levels. Even with possible short-term ups and downs, the larger trend indicates that it's a good idea to sell when prices are going up, Jain said.

India's benchmark stock indices were trading higher through midday during the special trading session on Saturday, as shares of ICICI Bank Ltd., Bharti Airtel Ltd., and Larsen & Toubro Ltd. gained.

As of 12:12 p.m. the S&P BSE Sensex was 535.28 points, or 0.75% higher at 71,722.14, while the NSE Nifty 50 was 183.85 points, or 0.86% higher at 21,646.10.

Intraday, the Sensex rose to 72,026.26, while the Nifty 50 touched a high of 21,720.30.

"The Indian stock market witnessed a commendable recovery driven by positive global sentiments yesterday. This optimistic trend has extended into today as well," said Shrey Jain, founder and chief executive officer of SAS Online.

Following a gap-up opening, it is expected that the Nifty will consolidate around its current levels. Even with possible short-term ups and downs, the larger trend indicates that it's a good idea to sell when prices are going up, Jain said.

India's benchmark stock indices were trading higher through midday during the special trading session on Saturday, as shares of ICICI Bank Ltd., Bharti Airtel Ltd., and Larsen & Toubro Ltd. gained.

As of 12:12 p.m. the S&P BSE Sensex was 535.28 points, or 0.75% higher at 71,722.14, while the NSE Nifty 50 was 183.85 points, or 0.86% higher at 21,646.10.

Intraday, the Sensex rose to 72,026.26, while the Nifty 50 touched a high of 21,720.30.

"The Indian stock market witnessed a commendable recovery driven by positive global sentiments yesterday. This optimistic trend has extended into today as well," said Shrey Jain, founder and chief executive officer of SAS Online.

Following a gap-up opening, it is expected that the Nifty will consolidate around its current levels. Even with possible short-term ups and downs, the larger trend indicates that it's a good idea to sell when prices are going up, Jain said.

India's benchmark stock indices were trading higher through midday during the special trading session on Saturday, as shares of ICICI Bank Ltd., Bharti Airtel Ltd., and Larsen & Toubro Ltd. gained.

As of 12:12 p.m. the S&P BSE Sensex was 535.28 points, or 0.75% higher at 71,722.14, while the NSE Nifty 50 was 183.85 points, or 0.86% higher at 21,646.10.

Intraday, the Sensex rose to 72,026.26, while the Nifty 50 touched a high of 21,720.30.

"The Indian stock market witnessed a commendable recovery driven by positive global sentiments yesterday. This optimistic trend has extended into today as well," said Shrey Jain, founder and chief executive officer of SAS Online.

Following a gap-up opening, it is expected that the Nifty will consolidate around its current levels. Even with possible short-term ups and downs, the larger trend indicates that it's a good idea to sell when prices are going up, Jain said.

India's benchmark stock indices were trading higher through midday during the special trading session on Saturday, as shares of ICICI Bank Ltd., Bharti Airtel Ltd., and Larsen & Toubro Ltd. gained.

As of 12:12 p.m. the S&P BSE Sensex was 535.28 points, or 0.75% higher at 71,722.14, while the NSE Nifty 50 was 183.85 points, or 0.86% higher at 21,646.10.

Intraday, the Sensex rose to 72,026.26, while the Nifty 50 touched a high of 21,720.30.

"The Indian stock market witnessed a commendable recovery driven by positive global sentiments yesterday. This optimistic trend has extended into today as well," said Shrey Jain, founder and chief executive officer of SAS Online.

Following a gap-up opening, it is expected that the Nifty will consolidate around its current levels. Even with possible short-term ups and downs, the larger trend indicates that it's a good idea to sell when prices are going up, Jain said.

Bharti Airtel Ltd., ICICI Bank Ltd., ITC Ltd., Larsen & Toubro Ltd. and NTPC Ltd. were positively contributing to changes in the Nifty.

Adani Enterprises Ltd., Hindustan Unilever Ltd., HDFC Bank Ltd., IndusInd Bank Ltd. and Nestle India Ltd. weighed on the index.

Five of the 12 sectors compiled by the NSE declined and seven advanced.

The Nifty media rose 1.48% to become the top gainer, while Nifty FMCG fell 0.70%, becoming the top loser.

Broader markets outperformed benchmark indices; the S&P BSE Midcap gained 0.59% and the S&P BSE Smallcap rose 0.64%.

Fifteen of the 20 sectors compiled by the BSE advanced, while five declined. S&P BSE Utilities rose the most.

The market breadth was skewed in favour of buyers. Around 2,138 stocks rose, 1,520 stocks declined, and 142 remained unchanged on BSE.

Disclaimer: NDTV Profit is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Net profit at Rs 3,005 crore, up 7.6% YoY

Net profit at Rs 3,005 crore vs Bloomberg estimates of Rs 3,164.3 crore

Net interest income at Rs 6,553.5 crore, up 16% YoY

Gross NPA at 1.73% vs 1.72% QoQ

Net NPA at 0.34% vs 0.37% QoQ

Provided Rs 190 crore against AIF investments

Provided Rs 65 crore against security receipts

Net interest margin stands at 5.22%, unchanged sequentially

Net profit at Rs 3,005 crore, up 7.6% YoY

Net profit at Rs 3,005 crore vs Bloomberg estimates of Rs 3,164.3 crore

Net interest income at Rs 6,553.5 crore, up 16% YoY

Gross NPA at 1.73% vs 1.72% QoQ

Net NPA at 0.34% vs 0.37% QoQ

Provided Rs 190 crore against AIF investments

Provided Rs 65 crore against security receipts

Net interest margin stands at 5.22%, unchanged sequentially

Gets order worth Rs 414 crore from IIT Bhubaneswar.

Source: Exchange Filing

PTC India Financial Services Ltd gained 14.18% to Rs 53.95 apiece, the highest level since May 26, 2015. It trading 12.59% higher at Rs 53.20 apiece, as of 11:36 a.m. This compares to a 0.15% advance in the NSE Nifty 50 Index.

It has risen 206.05% in 12 months. Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 79.22, which implied the stock is overbought.

PTC India Financial Services Ltd gained 14.18% to Rs 53.95 apiece, the highest level since May 26, 2015. It trading 12.59% higher at Rs 53.20 apiece, as of 11:36 a.m. This compares to a 0.15% advance in the NSE Nifty 50 Index.

It has risen 206.05% in 12 months. Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 79.22, which implied the stock is overbought.

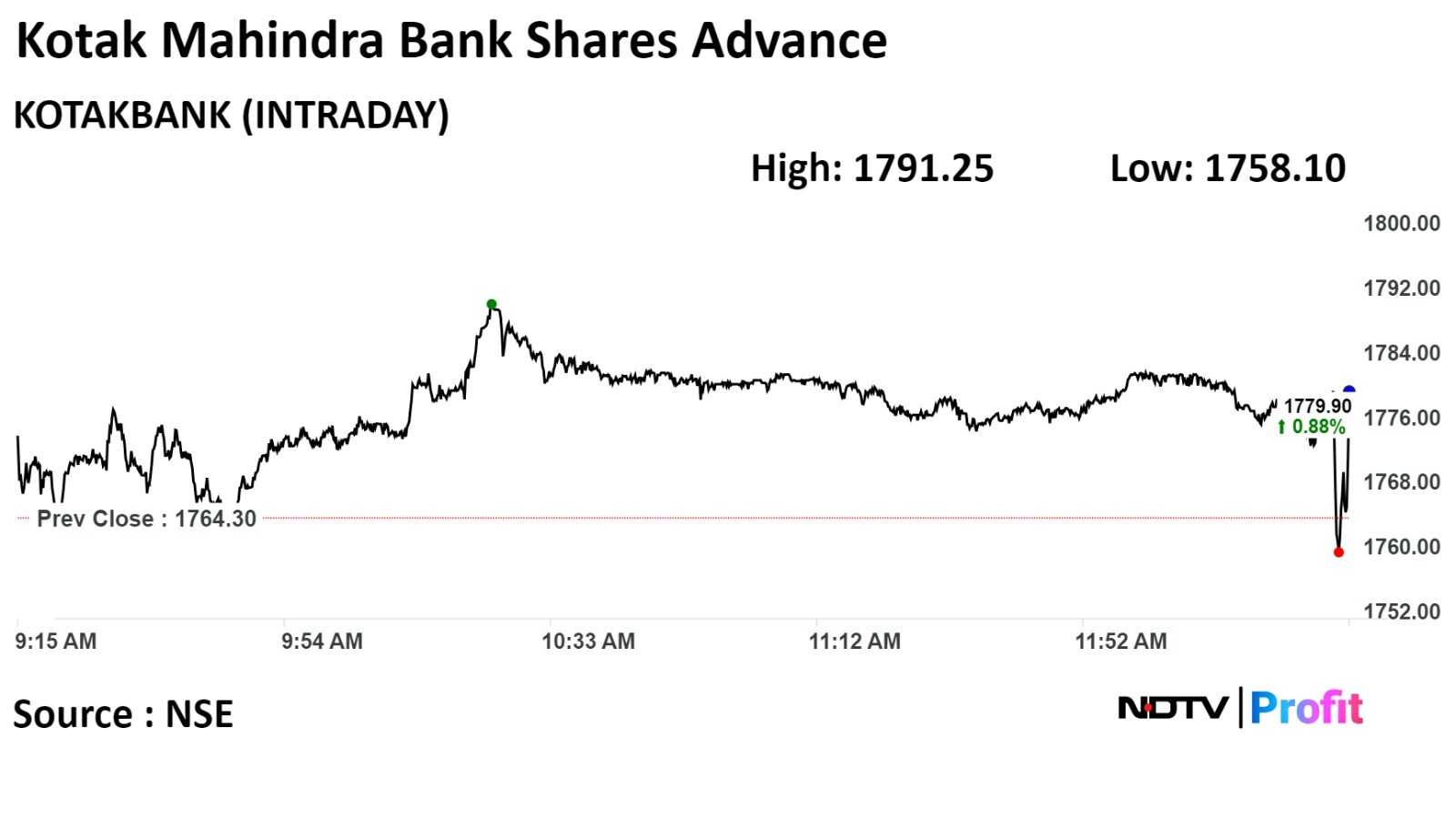

The scrip fell as much as 3.25% to Rs 2,482.10 apiece, the lowest level since Nov 17, 2023. It pared gains to trade 2.96% lower at Rs 2,489.80 apiece, as of 10:51 a.m. This compares to a 0.3% advance in the NSE Nifty 50 Index.

It has fallen 2.33% in the last twelve months. Total traded volume so far in the day stood at 2.1 times its 30-day average. The relative strength index was at 33.62.

The scrip fell as much as 3.25% to Rs 2,482.10 apiece, the lowest level since Nov 17, 2023. It pared gains to trade 2.96% lower at Rs 2,489.80 apiece, as of 10:51 a.m. This compares to a 0.3% advance in the NSE Nifty 50 Index.

It has fallen 2.33% in the last twelve months. Total traded volume so far in the day stood at 2.1 times its 30-day average. The relative strength index was at 33.62.

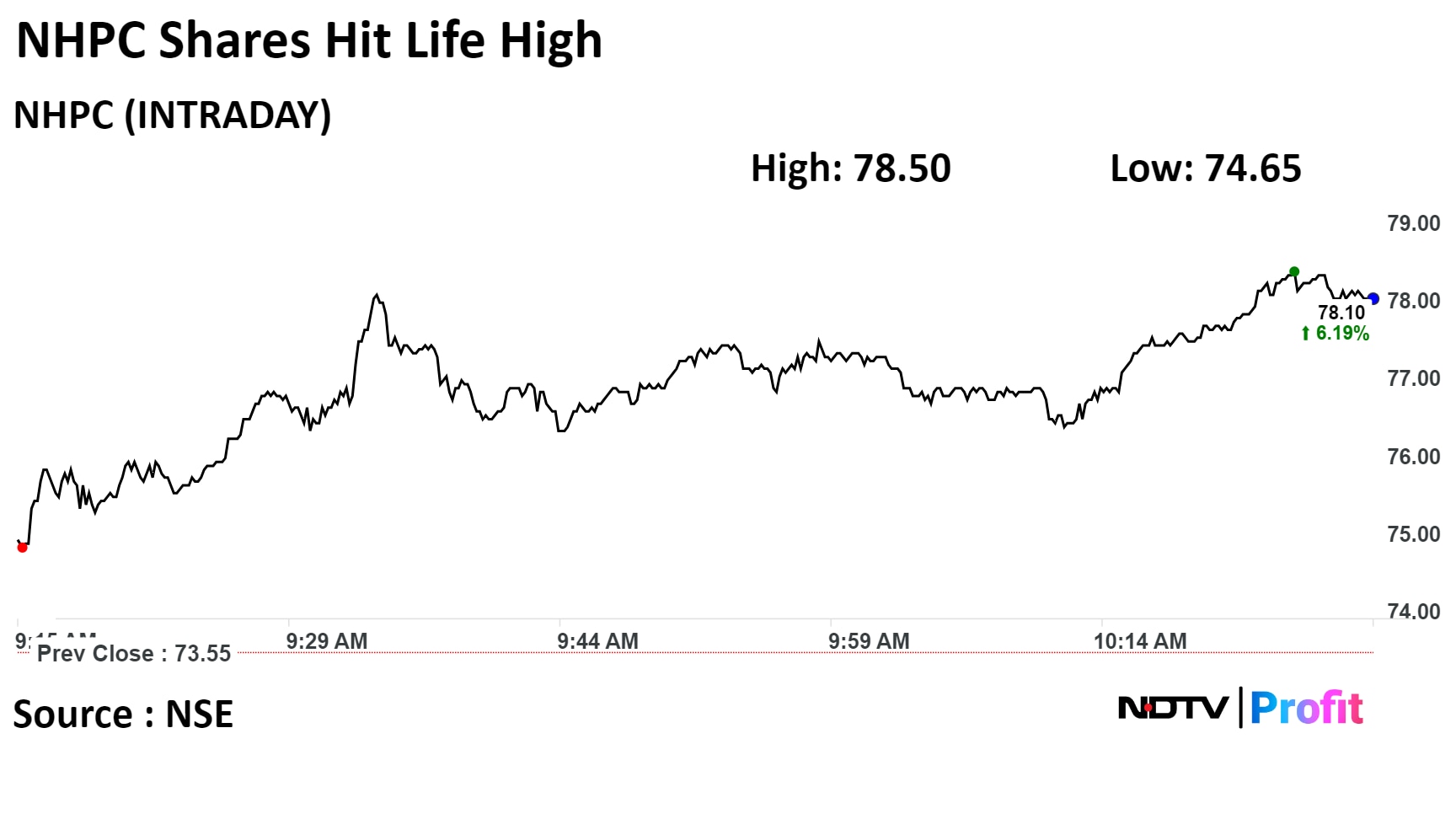

The scrip rose as much as 6.73% to Rs78.50 piece, the highest level. It pared gains to trade 6.25% higher at Rs 78.15 apiece, as of 10:35 a.m. This compares to a 0.24% advance in the NSE Nifty 50 Index.

It has risen 87.32% in the last twelve months. Total traded volume so far in the day stood at 4.3 times its 30-day average. The relative strength index was at 77.60, indicating that the stock may be overbought.

Out of nine analysts tracking the company, eight maintain a 'buy' rating, and one suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 16%.

The scrip rose as much as 6.73% to Rs78.50 piece, the highest level. It pared gains to trade 6.25% higher at Rs 78.15 apiece, as of 10:35 a.m. This compares to a 0.24% advance in the NSE Nifty 50 Index.

It has risen 87.32% in the last twelve months. Total traded volume so far in the day stood at 4.3 times its 30-day average. The relative strength index was at 77.60, indicating that the stock may be overbought.

Out of nine analysts tracking the company, eight maintain a 'buy' rating, and one suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 16%.

Rate buy with price target of Rs 2,805 (earlier Rs 2,905)

Q3 revenue, Ebita flat YoY on high base, volume growth in-line

Gainer market share of ~200bps

See investments continue despite macro issues

To emerge stronger as environment normalises

Lower earnings estimates by 2-6%

Rate underperform with price target of Rs 220

Ebitda, PAT in-line with estimates

Zinc CoP down 4% QoQ to $1,095/t on softened coal price, better grades

Zinc prices to trade at marginal costs without more meaningful supply cuts

Capacity to be expanded to 5.94 lk MTPA from 4.95 lk MTPA

Source: Exchange Filing

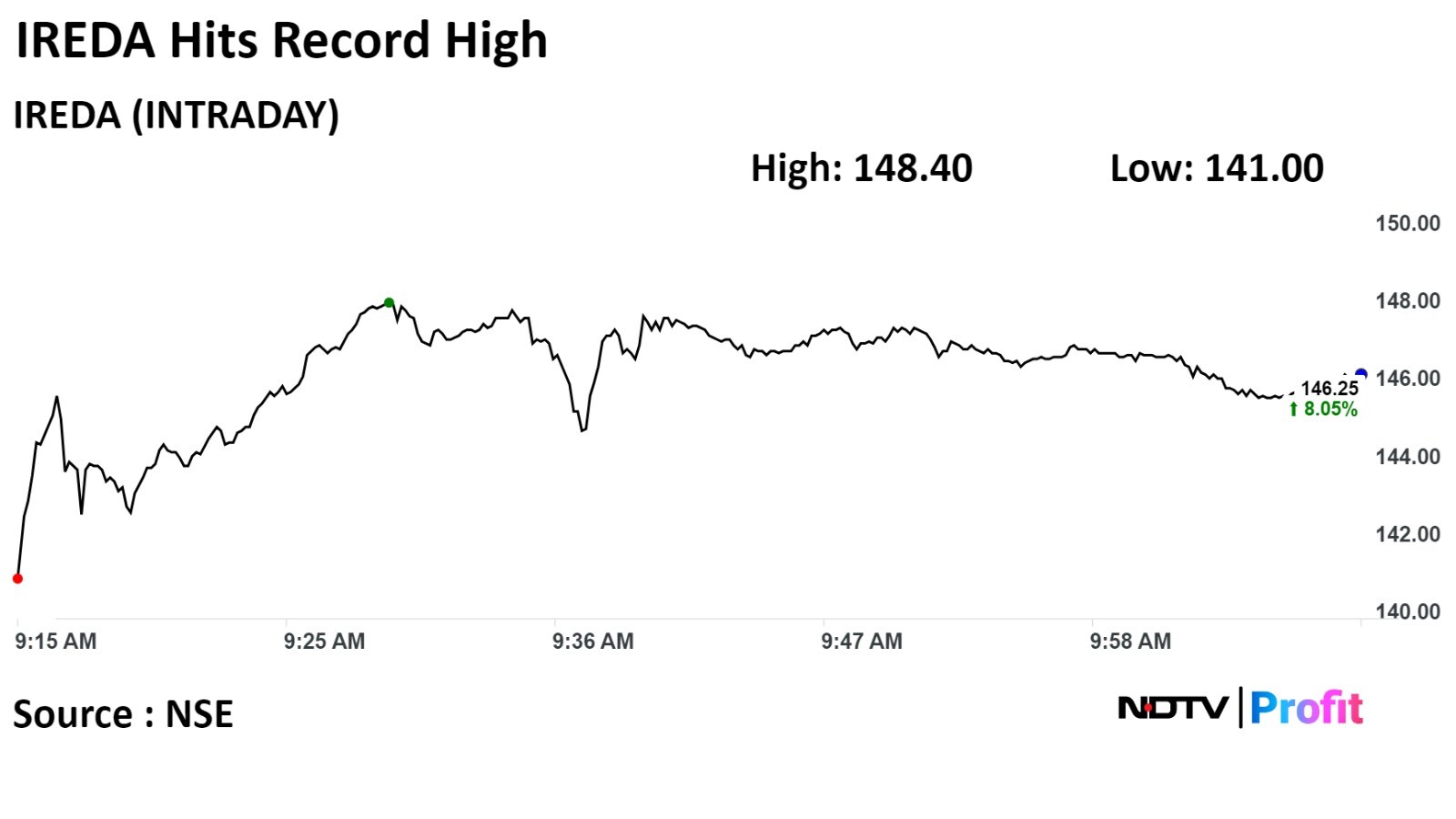

Indian Renewable Energy Development Agency Ltd. shares rose over over 9% to hit an all-time high. It rose as much as 9.64% at Rs 148.40.

The relative strength index was at 83, indicating that stock may be overbought.

The one analyst tracking the company has a 'sell' rating. The average 12-month consensus price target implies a downside of 45.7%.

Indian Renewable Energy Development Agency Ltd. shares rose over over 9% to hit an all-time high. It rose as much as 9.64% at Rs 148.40.

The relative strength index was at 83, indicating that stock may be overbought.

The one analyst tracking the company has a 'sell' rating. The average 12-month consensus price target implies a downside of 45.7%.

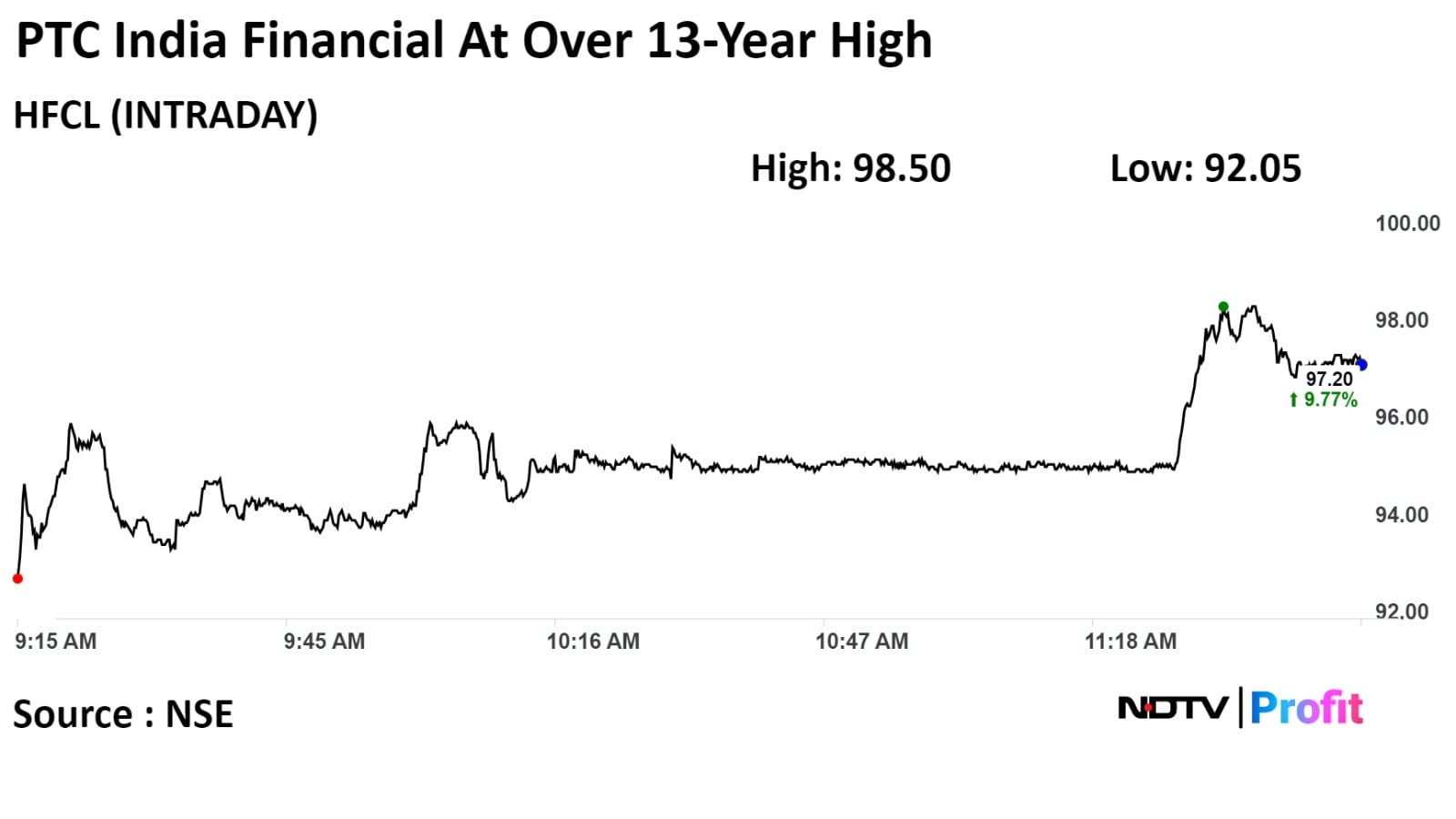

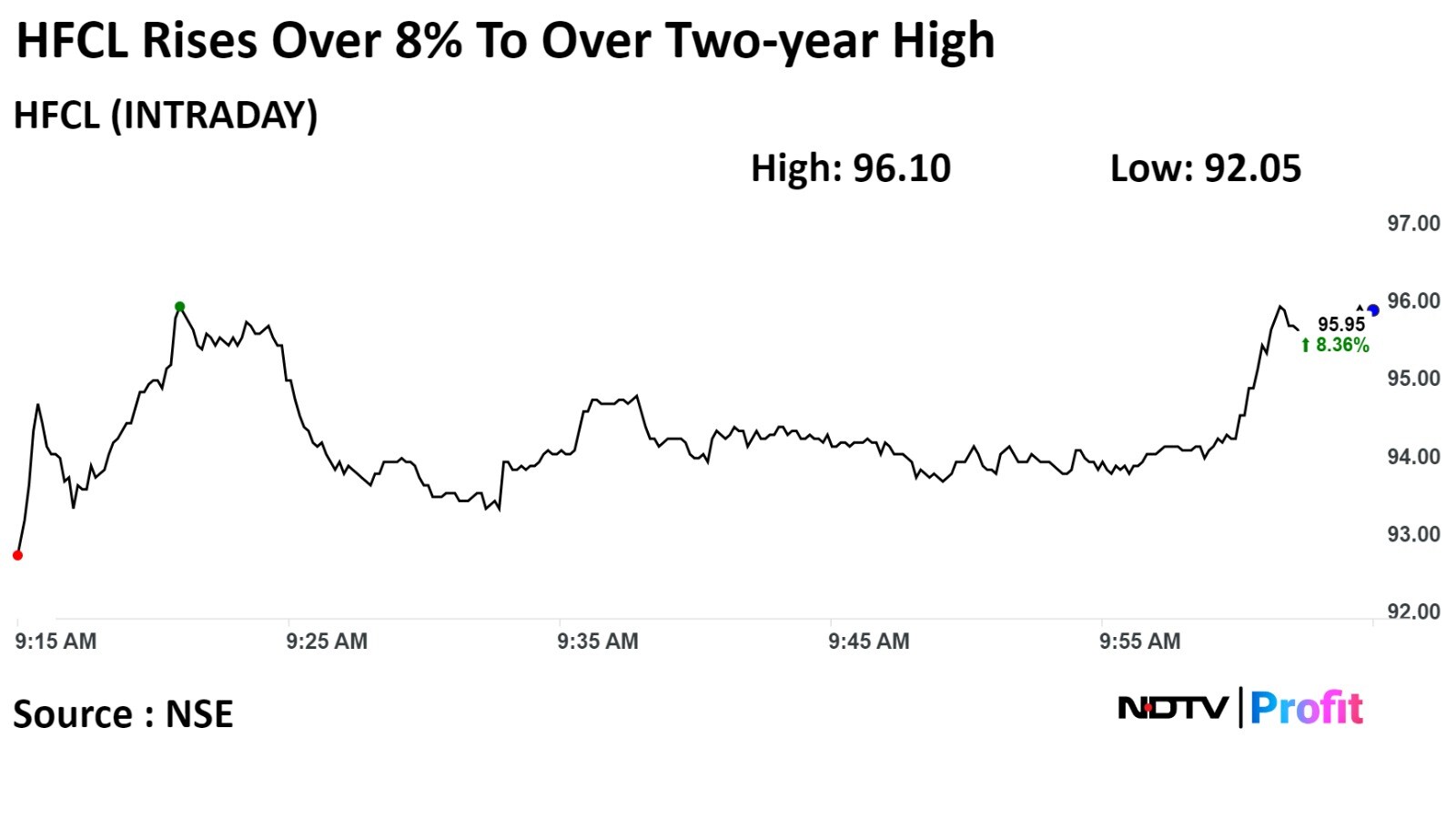

Shares of HFCL rose over 8% to over two-year high after the company informed the exchanges it has bagged an order worth Rs 623 crore from telecom service provider.

Shares of HFCL rose over 8% to over two-year high after the company informed the exchanges it has bagged an order worth Rs 623 crore from telecom service provider.

HFCL Ltd rose as much as 8.5% to Rs 96.10 apiece, the highest level since Jan 17, 2022. It was trading 7.28% higher at Rs 95.00 apiece, as of 10:16 a.m. This compares to a 0.16% advance in the NSE Nifty 50 Index.

It has risen 32.87% in 12 months. Total traded volume so far in the day stood at 2.8 times its 30-day average. The relative strength index was at 69.44.

One analyst tracking the company maintains 'Buy' on the company, according to Bloomberg data.

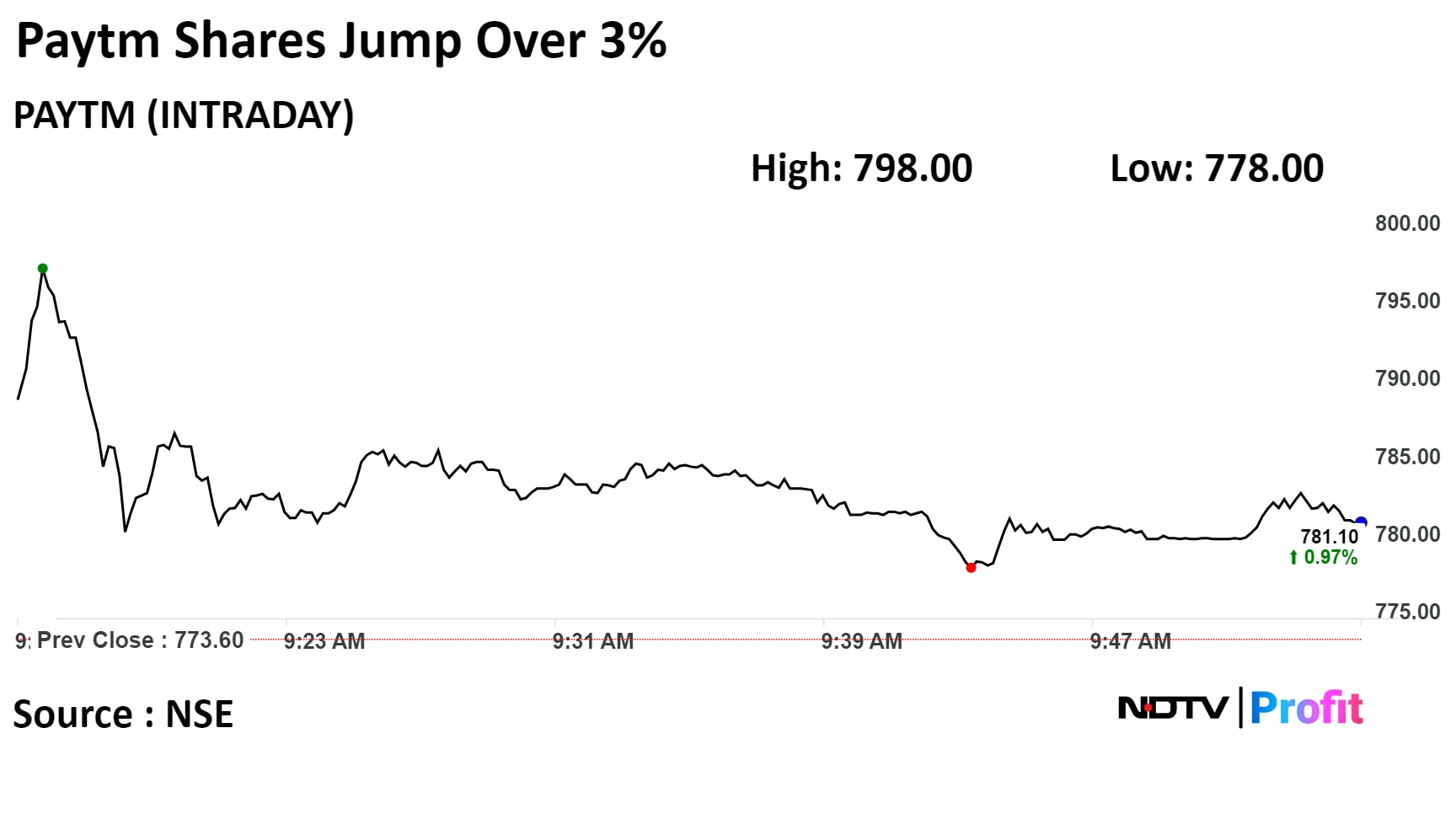

Shares of One 97 Communications Ltd. jumped a day after the company reported that, on a quarter on quarter basis, its revenue grew and losses narrowed in December quarter.

Shares of One 97 Communications Ltd. jumped a day after the company reported that, on a quarter on quarter basis, its revenue grew and losses narrowed in December quarter.

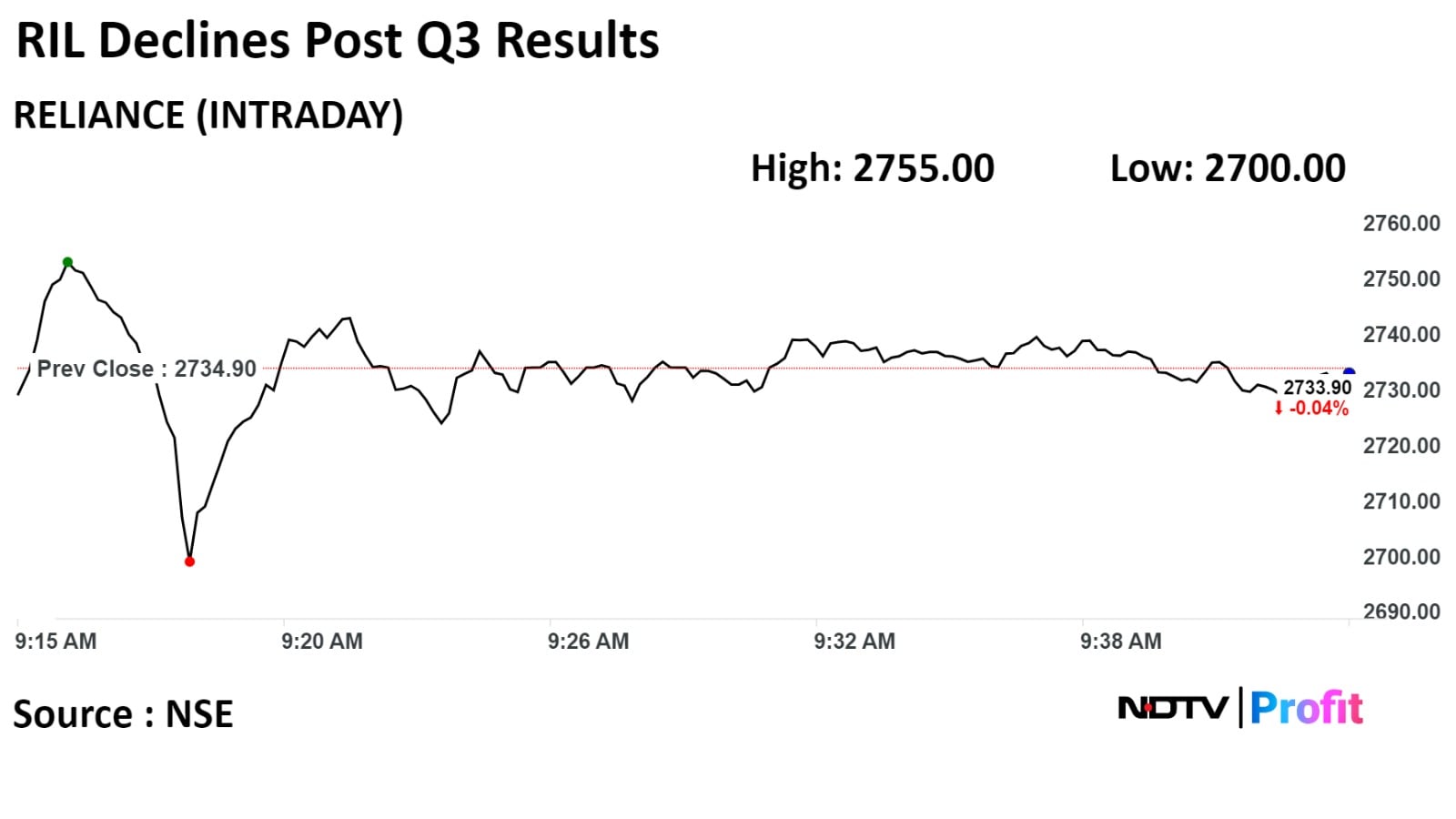

Shares of Reliance Industries Ltd declined in the Saturday session after the company's net profit for the Oct-Dec period declined 0.74%, missing analysts' expectation.

The oil refinery posted Rs17,265 crore net profit in third quarter, against Bloomberg's estimate of Rs 18,080.30 crore net profit for the period.

Shares of Reliance Industries Ltd declined in the Saturday session after the company's net profit for the Oct-Dec period declined 0.74%, missing analysts' expectation.

The oil refinery posted Rs17,265 crore net profit in third quarter, against Bloomberg's estimate of Rs 18,080.30 crore net profit for the period.

Benchmark indices extended gains from Friday and opened higher on the back of gains in HDFC Bank and ICICI Bank.

At pre-open, the Nifty 50 Index was up 83.75 points or 0.39% at 21,706.15 while the S&P BSE Sensex was at 72,008.30, higher by 325.07 points or 0.45%.

"The overall bias for the index remains fragile despite scaling over the 21656 yesterday, its 20-exponential moving average, as major hurdle floats between 21800-218500 levels," said Avdhut Bagkar, technical and derivatives analyst at StoxBox.

He added, "On the downside, 21550- 21550 zone keeps bolstering the upward bias, and if the index succeeds to overcome 21850, further upside to 22000 cannot be ruled out."

Benchmark indices extended gains from Friday and opened higher on the back of gains in HDFC Bank and ICICI Bank.

At pre-open, the Nifty 50 Index was up 83.75 points or 0.39% at 21,706.15 while the S&P BSE Sensex was at 72,008.30, higher by 325.07 points or 0.45%.

"The overall bias for the index remains fragile despite scaling over the 21656 yesterday, its 20-exponential moving average, as major hurdle floats between 21800-218500 levels," said Avdhut Bagkar, technical and derivatives analyst at StoxBox.

He added, "On the downside, 21550- 21550 zone keeps bolstering the upward bias, and if the index succeeds to overcome 21850, further upside to 22000 cannot be ruled out."

Benchmark indices extended gains from Friday and opened higher on the back of gains in HDFC Bank and ICICI Bank.

At pre-open, the Nifty 50 Index was up 83.75 points or 0.39% at 21,706.15 while the S&P BSE Sensex was at 72,008.30, higher by 325.07 points or 0.45%.

"The overall bias for the index remains fragile despite scaling over the 21656 yesterday, its 20-exponential moving average, as major hurdle floats between 21800-218500 levels," said Avdhut Bagkar, technical and derivatives analyst at StoxBox.

He added, "On the downside, 21550- 21550 zone keeps bolstering the upward bias, and if the index succeeds to overcome 21850, further upside to 22000 cannot be ruled out."

Benchmark indices extended gains from Friday and opened higher on the back of gains in HDFC Bank and ICICI Bank.

At pre-open, the Nifty 50 Index was up 83.75 points or 0.39% at 21,706.15 while the S&P BSE Sensex was at 72,008.30, higher by 325.07 points or 0.45%.

"The overall bias for the index remains fragile despite scaling over the 21656 yesterday, its 20-exponential moving average, as major hurdle floats between 21800-218500 levels," said Avdhut Bagkar, technical and derivatives analyst at StoxBox.

He added, "On the downside, 21550- 21550 zone keeps bolstering the upward bias, and if the index succeeds to overcome 21850, further upside to 22000 cannot be ruled out."

Benchmark indices extended gains from Friday and opened higher on the back of gains in HDFC Bank and ICICI Bank.

At pre-open, the Nifty 50 Index was up 83.75 points or 0.39% at 21,706.15 while the S&P BSE Sensex was at 72,008.30, higher by 325.07 points or 0.45%.

"The overall bias for the index remains fragile despite scaling over the 21656 yesterday, its 20-exponential moving average, as major hurdle floats between 21800-218500 levels," said Avdhut Bagkar, technical and derivatives analyst at StoxBox.

He added, "On the downside, 21550- 21550 zone keeps bolstering the upward bias, and if the index succeeds to overcome 21850, further upside to 22000 cannot be ruled out."

Benchmark indices extended gains from Friday and opened higher on the back of gains in HDFC Bank and ICICI Bank.

At pre-open, the Nifty 50 Index was up 83.75 points or 0.39% at 21,706.15 while the S&P BSE Sensex was at 72,008.30, higher by 325.07 points or 0.45%.

"The overall bias for the index remains fragile despite scaling over the 21656 yesterday, its 20-exponential moving average, as major hurdle floats between 21800-218500 levels," said Avdhut Bagkar, technical and derivatives analyst at StoxBox.

He added, "On the downside, 21550- 21550 zone keeps bolstering the upward bias, and if the index succeeds to overcome 21850, further upside to 22000 cannot be ruled out."

Benchmark indices extended gains from Friday and opened higher on the back of gains in HDFC Bank and ICICI Bank.

At pre-open, the Nifty 50 Index was up 83.75 points or 0.39% at 21,706.15 while the S&P BSE Sensex was at 72,008.30, higher by 325.07 points or 0.45%.

"The overall bias for the index remains fragile despite scaling over the 21656 yesterday, its 20-exponential moving average, as major hurdle floats between 21800-218500 levels," said Avdhut Bagkar, technical and derivatives analyst at StoxBox.

He added, "On the downside, 21550- 21550 zone keeps bolstering the upward bias, and if the index succeeds to overcome 21850, further upside to 22000 cannot be ruled out."

Benchmark indices extended gains from Friday and opened higher on the back of gains in HDFC Bank and ICICI Bank.

At pre-open, the Nifty 50 Index was up 83.75 points or 0.39% at 21,706.15 while the S&P BSE Sensex was at 72,008.30, higher by 325.07 points or 0.45%.

"The overall bias for the index remains fragile despite scaling over the 21656 yesterday, its 20-exponential moving average, as major hurdle floats between 21800-218500 levels," said Avdhut Bagkar, technical and derivatives analyst at StoxBox.

He added, "On the downside, 21550- 21550 zone keeps bolstering the upward bias, and if the index succeeds to overcome 21850, further upside to 22000 cannot be ruled out."

Shares of HDFC Bank Ltd., ICICI Bank Ltd., Infosys Ltd., Axis Bank Ltd., and ITC Ltd., contributed the most to the gains.

Meanwhile, those of Reliance Industries Ltd. and Hindustan Unilever Ltd., capped the upside.

All sectoral indices on the Nifty 50 rose except Nifty FMCG, which fell 0.32%. Nifty Media gained over 1%.

The broader markets outperformed as the BSE MidCap rose 0.70%, while the BSE SmallCap was 0.63% higher. Nineteen out of the 20 sectors compiled by the BSE advanced, while S&P BSE Fast Moving Consumer Goods fell.

The market breadth was skewed in the favour of buyers. As many as 2,063 stocks advanced, 725 declined and 93 remained unchanged on the BSE.

At pre-open, the Nifty 50 Index was up 83.75 points or 0.39% at 21,706.15 while the S&P BSE Sensex was at 72,008.30, higher by 325.07 points or 0.45%.

Maintain Reduce at revised TP of Rs 257

Sees Q3 EBITDA in line with expectations driven by lower cost of production

Trims FY24 EBITDA by 3% factoring in lower zinc prices

Management maintains its silver guidance at 7250-750t in FY24

Expects silver volume of 755t/790t in FY24E/25E

Expects zinc CoP guidance at lower end of USD 1,125–1,175/t in FY24

Sees further reduction in zinc CoP guidance to USD1,000/t over medium term

Citi Research

Maintains "Buy" at target of Rs 11700

Hybrid coal costs to fall 7-8% over next 6 months

Estimate 12% volume CAGR through FY23-26

3rd capacity expansion phase has addition of 21.9mtpa

Capacity CAGR of 10% over FY24-27

To acquire Kesoram’s cement business via shares and debt takeover

Revise FY24/25/26 cons EBITDA estimates by -5%/-1%/+1%

Motilal Oswal

Maintains "Buy" at target of Rs 12000

Management optimistic about demand growth prospects

Expects capacity utilization to improve to 80-85% in Q4 vs 77% in Q3

Demand up in most markets except North region

FY24/25 capex at Rs 9,000 crore on expansion plans

Estimate volume CAGR of 10% over FY23-26

Emkay

ADD; TP: 2700

Q3 results stood 3% below our and 5% below street’s expectations

Demand slowdown, competitive pressure, distribution stress, rising royalty rates likely to have overhang on valuations

Demand setting unexciting, demand recovery a hope on emergence of tailwinds

Co able to hold margin at 23.3%

HUL was able to hold on to EBITDA margin at 23.3%

Nuvama

BUY; TP: 3105

HUL posted muted Q3FY24 below our / street estimates

Miss on sales, weak revenue due to price cuts to pass on benefit of commodity deflation

Volumes grew 2% YoY, gross margin up 400bps

Cut FY24E/25E EPS by 5%/3%

Systematix

Maintains "hold" at Rs 2825 target

Q3 earnings marginally below muted expectations

Expect revenue/EBITDA/PAT growth of 8.5%/10.8%/12% over FY24-26

Positive on premiumization potential and marketing focus

Weak demand, high competition, no pricing lever remain near-term

headwinds

Higher royalty, A&P, GSK OTC business going away to limit

margin improvement

Downgrades rating to Neutral from Buy with revised TP of Rs 2,910

Raises FY24-26E EBITDA by 2-5% led by Jio, retail and O2C

Believes stock recent outperformance makes risk/reward more balanced

Sees overall Q3 performance in line with stronger oil & gas offsetting weaker O2C

Sees Jio and retail reporting softer sequential growth

Believes consolidated EBITDA/net income at Rs 407/173bn were overall in-line

U.S. Dollar Index at 103.29 at Friday close

U.S. 10-year bond yield at 4.12% as of Friday

Brent crude down 0.68% at $78.56 per barrel

Nymex crude down 0.90% at $73.41 per barrel

Bitcoin was down 0.29% at $42,515.25

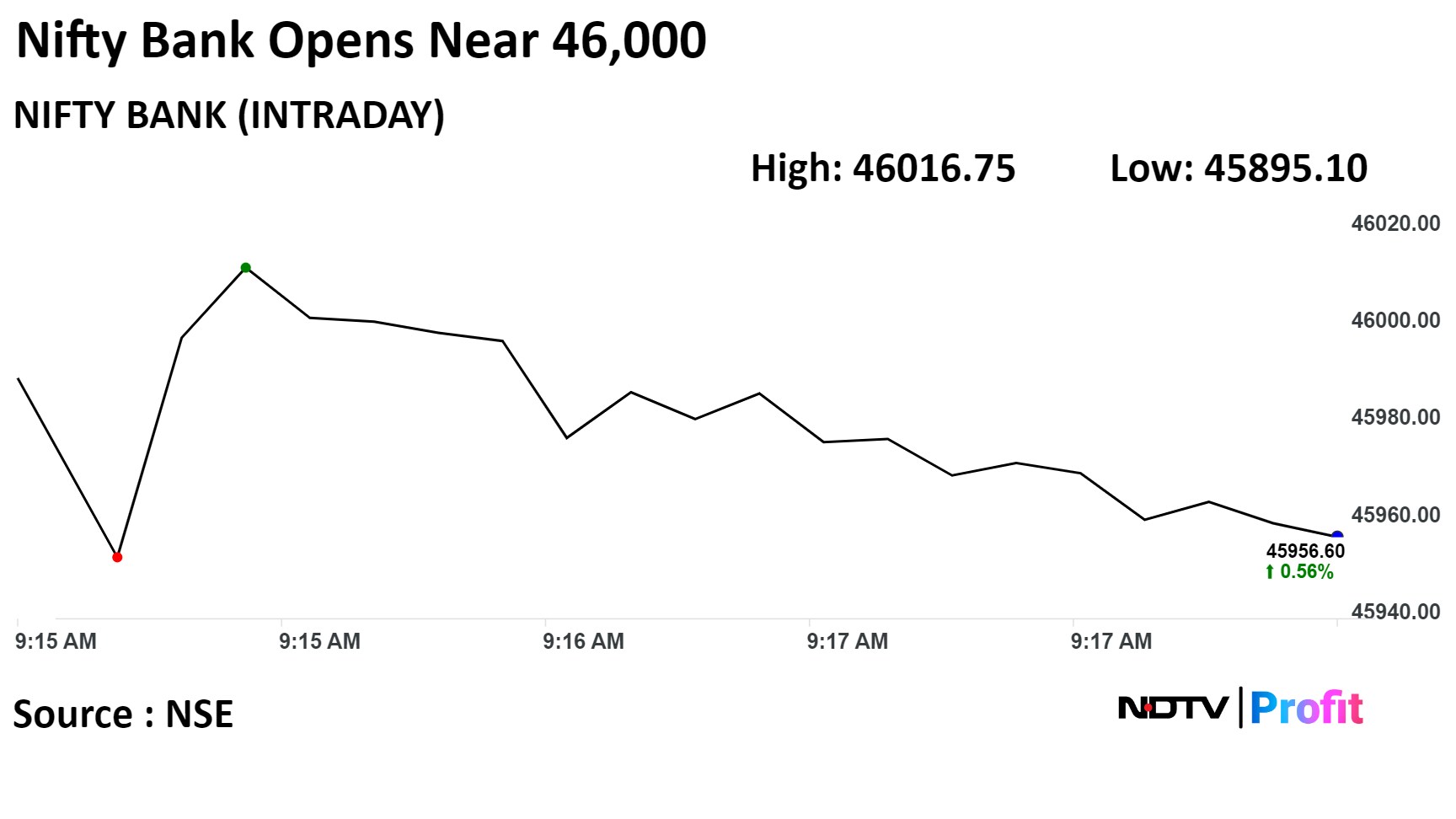

Nifty January futures up by 0.69% to 21,672.15 at a premium of 49.75 points.

Nifty January futures open interest up by 0.7%.

Nifty Bank January futures down by 0.06% to 45,797.20 at a premium of 96.05 points.

Nifty Bank January futures open interest down by 1.6%.

Nifty Options Jan 25 Expiry: Maximum Call open interest at 22,500 and Maximum Put open interest at 20,500.

Bank Nifty Options Jan 25 Expiry: Maximum Call Open Interest at 50,000 and Maximum Put open interest at 43,000.

Securities in the ban period: Aditya Birla Fashion and Retail, Balrampur Chini Mills, Delta Corp, Hindustan Copper, Indian Energy Exchange, National Aluminium, Oracle Financial Services Software, Polycab India, RBL Bank, SAIL, Zee Entertainment.

Tata Steel: The company will commence statutory consultation as part of its plan to transform and restructure its U.K. business.

HFCL: The company received a purchase order worth of Rs 623 crore from a telecom service provider for the supply of 5G telecom networking equipment.

Zee Entertainment: The company issued a clarification on media reports of Sony's board to take a call on a $10 bn merger with Zee Entertainment on Friday. It said that it is not aware of any board meeting held or proposed to be held by Sony India and added that the company is committed to the merger with Sony.

KPI Green Energy: The company’s unit received an order for a 5.60 MW solar project from a domestic entity.

Hardwyn India: The company's subsidiary Slim-X plans to generate -revenue of Rs 100 crore in the next two years.

One 97 Communication: The company approved joint development pact with ACE Builders for the development of the IT/ITES complex in Noida and approved the incorporation of one or more subsidiaries in GIFT City.

Shilpa Medicare: The company's NDA Product PEMRYDI RTU (Pemetrexed Injection) received product-specific code J* from the U.S. Centers for Medicare & Medicaid Services. PEMRYDI RTU is used as a drug in the treatment of non-small cell lung cancer in combination with other chemotherapy agents.

Star Health and Allied Insurance: N. Chittibab resigned from the position of chief innovation officer and key managerial personnel.

Navkar Corp: The company said that there are no negotiations taking place that require disclosure under the SEBI.

Prataap Snacks: The company issued a clarification that it is not in negotiations with Haldiram's for a stake sale.

Rico Auto Industries: The company unit signed a licensing agreement for the transfer of technology with DRDO.

Fortis Healthcare: The company's unit Agilus Diagnostics received notice from Delhi's anti-corruption bureau in the Mohalla Clinics’ case.

Life Insurance Corp: The company announced the new product launch of LIC’s Jeevan Dhara-II.

Prakash Industries: The company received permission to establish Bhaskarpara commercial coal mine in Chhattisgarh from the Chhattisgarh Environment board.

All Cargo Logistics: The company’s unit incorporated a new wholly owned subsidiary in the name of U.K. Terminals.

Borosil: The company acquired an additional 0.75% stake in Goel Scientific Glass Works at a total consideration of Rs 14.39 lakh. The company’s shareholding in Goel Scientific has increased from 94.73% to 95.48%.

EPACK Durable: The public issue was subscribed 0.77 times on day 1. The bids were led by retail investors (1.17 times), non-institutional investors (0.82 times) and institutional investors (0.01 times).

IndusInd Bank: BNP Paribas Arbitrage sold 25.5 lakh shares (0.32%); Goldman Sachs (Singapore) PTE ODI bought 25.5 lakh shares (0.32%) at Rs 1,560 apiece.

Liberty Shoes: Societe Generale bought 1.05 lakh shares (0.62%) at Rs 370.78 apiece.

Hindustan Unilever Q3 FY24 (Consolidated, YoY)

Revenue at Rs 15,567 crore vs Rs 15,597 crore, down 0.2% (Bloomberg estimate: Rs 15,642.18 crore).

Ebitda at Rs 3,666 crore vs Rs 3,694 crore, down 0.76% (Bloomberg estimate: Rs 3,734.23 crore).

Margin at 23.54% vs 23.68%, down 13 bps (Bloomberg estimate: 23.90%).

Net profit at Rs 2,508 crore vs Rs 2,481 crore, up 1.08% (Bloomberg estimate: Rs 2,664.50 crore).

Reliance Industries Q3 FY24 (Consolidated, YoY)

Revenue at Rs 2,25,086 crore vs Rs 2,31,886 crore, down 2.98% (Bloomberg estimates Rs 2,33,892.84 crore)

Ebitda at Rs 40,656 crore vs Rs 40,968 crore, down 0.77% (Bloomberg estimates Rs 40,412.86 crore)

Margin at 18.06% vs 17.66% (Bloomberg estimates 17.30%)

Net profit at Rs 17,265 crore vs Rs 17,394 crore, down 0.74% (Bloomberg estimate 18,080.30 crore)

RBL Bank Q3 FY24 (Standalone, YoY)

NII at Rs 1,545.9 crore vs Rs 1,277.3 crore, up 21% (YoY).

Net profit at Rs 233.1 crore vs Rs 208.9 crore, up 11.6% (YoY) (Bloomberg estimate: Rs 315.7 crore).

GNPA at 3.12% vs 3.12% (QoQ).

NNPA at 0.80% vs 0.78% (QoQ).

One 97 Communications Q3 FY24 (Consolidated, QoQ)

Revenue at Rs 2850.5 crore vs Rs 2518.6 crore, up 13.17% (Bloomberg estimate Rs 2,727 crore)

Ebitda loss at Rs 159.5 crore vs loss of Rs 231 crore (Bloomberg estimate Rs -52.57 crore)

Net loss at Rs 221.7 crore vs loss of Rs 291.7 crore. (Bloomberg estimate Rs -254.9 crore)

CreditAcess Grameen Q3 FY24 (Consolidated, YoY)

Revenue at Rs 1,292.2 crore vs Rs 907.9 crore, up 42.32%.

Net profit at Rs 353.43 crore vs Rs 215.76 crore, up 63.8%.

Board approves fundraise of up to Rs 2,000 crore via NCDs in different tranches.

CESC Q3 FY24 (Consolidated, YoY)

Revenue at Rs 3,244 crore vs Rs 3,129 crore, up 3.67%.

Ebitda at Rs 346 crore vs Rs 496 crore, down 30.25%.

Ebitda margin at 10.66% vs 15.85%.

Net profit at Rs 301 crore vs Rs 336 crore, down 10.41%.

Board approves interim dividend of Rs 4.5 per share.

Tejas Networks Q3 FY24 (Consolidated, YoY)

Revenue at Rs 559.96 crore vs Rs 274.55 crore, up 103.95%.

Ebitda loss at Rs 7.51 crore vs profit of Rs 8.01 crore.

Net loss at Rs 44.87 crore vs loss of Rs 15.15 crore.

Indian Renewable Energy Development Agency, ICICI Bank, Kotak Mahindra Bank, Union Bank of India, IDBI Bank, Persistent Systems, JK Cement, Jammu and Kashmir Bank, Can Fin Homes, Waaree Renewable Technologies, Rajratan Global Wire.

Equity and derivatives markets will have normal working hours from 9:15 a.m. to 3:30 p.m. on Saturday, without the planned disaster recovery movements, according to national bourses.

Indices in the U.S pushed higher on Friday as a drop in Treasury volatility continued to bode well for risk-taking on Wall Street, Bloomberg reported. The S&P 500 index rose to hit its new lifetime closing high of 4,839.81 points driven by a rally in technology stocks.

Other Asian and European indices ended on a mixed note on Friday as investors assessed Japan's inflation data and European Central Bank's commentary.

Japan's headline inflation rate cooled to 2.6% from 2.8% in November while core inflation rate — which strips out prices of fresh food — fell to 2.3% from November’s 2.5%.

European Central Bank president Christine Lagarde signalled that borrowing costs would come down in the summer rather than spring.

Brent crude was trading 0.68% lower at $78.56 a barrel. Gold was higher by 0.30% at $2,029.49 an ounce.

India's benchmark indices snapped a three-day losing streak to end higher on Friday on likely short covering and bargain hunting by investors. However, for both indices, it was the worst week in two months.

The S&P BSE Sensex ended 496.37 points, or 0.70%, higher at 71,683.23, while the NSE Nifty 50 rose 160.15 points, or 0.75%, to end at 21,622.40. The Sensex hit an intraday high of 71,895.64, and the Nifty 50 touched 21,670.60.

Overseas investors remained net sellers of Indian equities for the third consecutive session on Friday. Foreign portfolio investors offloaded equities worth Rs 3,689.7 crore, while domestic institutional investors stayed net buyers for the fourth straight day and mopped up stocks worth Rs 2,638.4 crore, the NSE data showed.

The Indian rupee strengthened 5 paise to close at Rs 83.07 against the U.S. dollar on Friday.

Equity and derivatives markets will have normal working hours from 9:15 a.m. to 3:30 p.m. on Saturday, without the planned disaster recovery movements, according to national bourses.

Indices in the U.S pushed higher on Friday as a drop in Treasury volatility continued to bode well for risk-taking on Wall Street, Bloomberg reported. The S&P 500 index rose to hit its new lifetime closing high of 4,839.81 points driven by a rally in technology stocks.

Other Asian and European indices ended on a mixed note on Friday as investors assessed Japan's inflation data and European Central Bank's commentary.

Japan's headline inflation rate cooled to 2.6% from 2.8% in November while core inflation rate — which strips out prices of fresh food — fell to 2.3% from November’s 2.5%.

European Central Bank president Christine Lagarde signalled that borrowing costs would come down in the summer rather than spring.

Brent crude was trading 0.68% lower at $78.56 a barrel. Gold was higher by 0.30% at $2,029.49 an ounce.

India's benchmark indices snapped a three-day losing streak to end higher on Friday on likely short covering and bargain hunting by investors. However, for both indices, it was the worst week in two months.

The S&P BSE Sensex ended 496.37 points, or 0.70%, higher at 71,683.23, while the NSE Nifty 50 rose 160.15 points, or 0.75%, to end at 21,622.40. The Sensex hit an intraday high of 71,895.64, and the Nifty 50 touched 21,670.60.

Overseas investors remained net sellers of Indian equities for the third consecutive session on Friday. Foreign portfolio investors offloaded equities worth Rs 3,689.7 crore, while domestic institutional investors stayed net buyers for the fourth straight day and mopped up stocks worth Rs 2,638.4 crore, the NSE data showed.

The Indian rupee strengthened 5 paise to close at Rs 83.07 against the U.S. dollar on Friday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.