The yield on the 10-year bond closed flat at 7.06%.

Source: Bloomberg

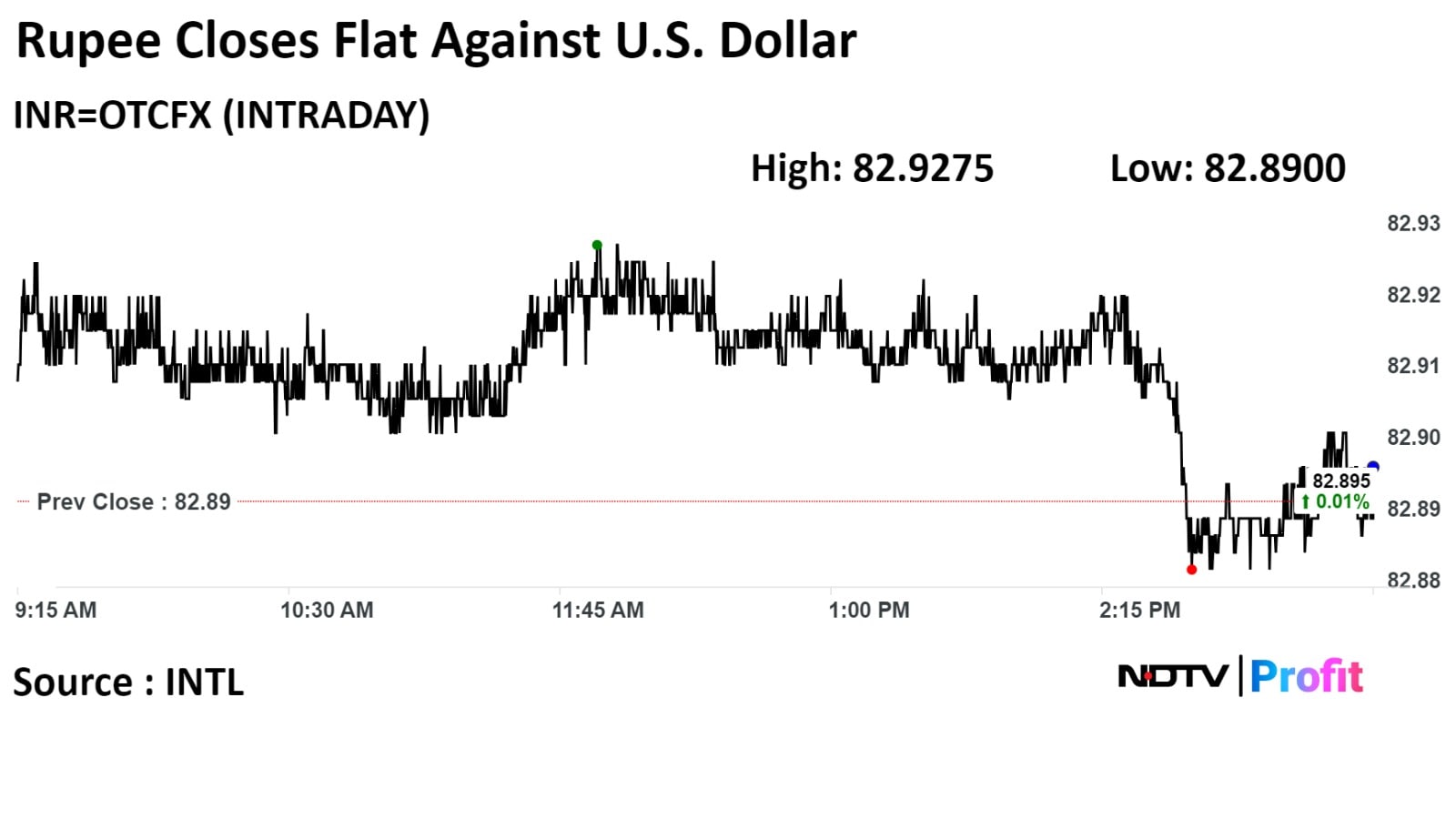

The local currency closed flat at 82.89 against the U.S. Dollar.

Source: Bloomberg

The local currency closed flat at 82.89 against the U.S. Dollar.

Source: Bloomberg

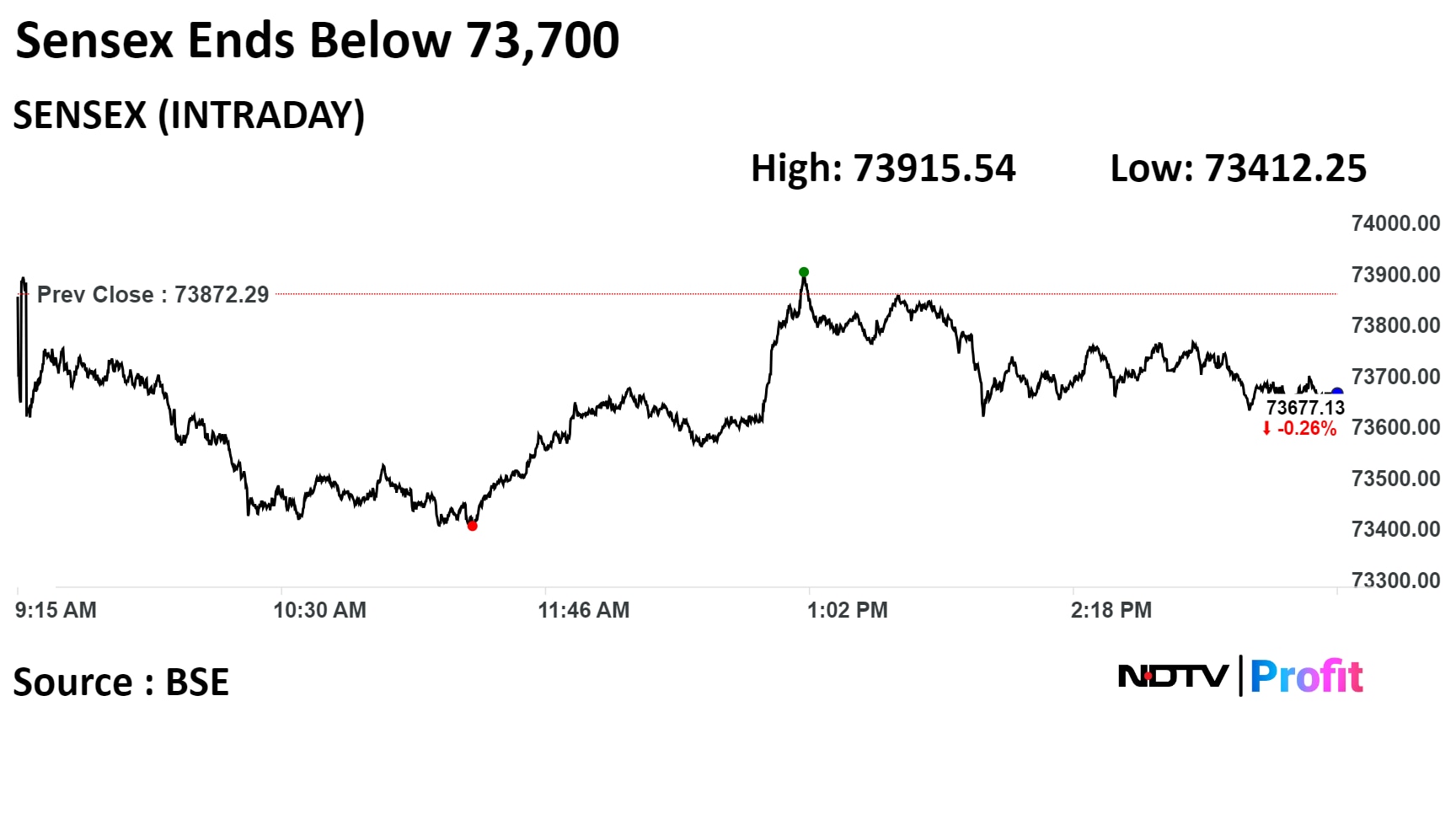

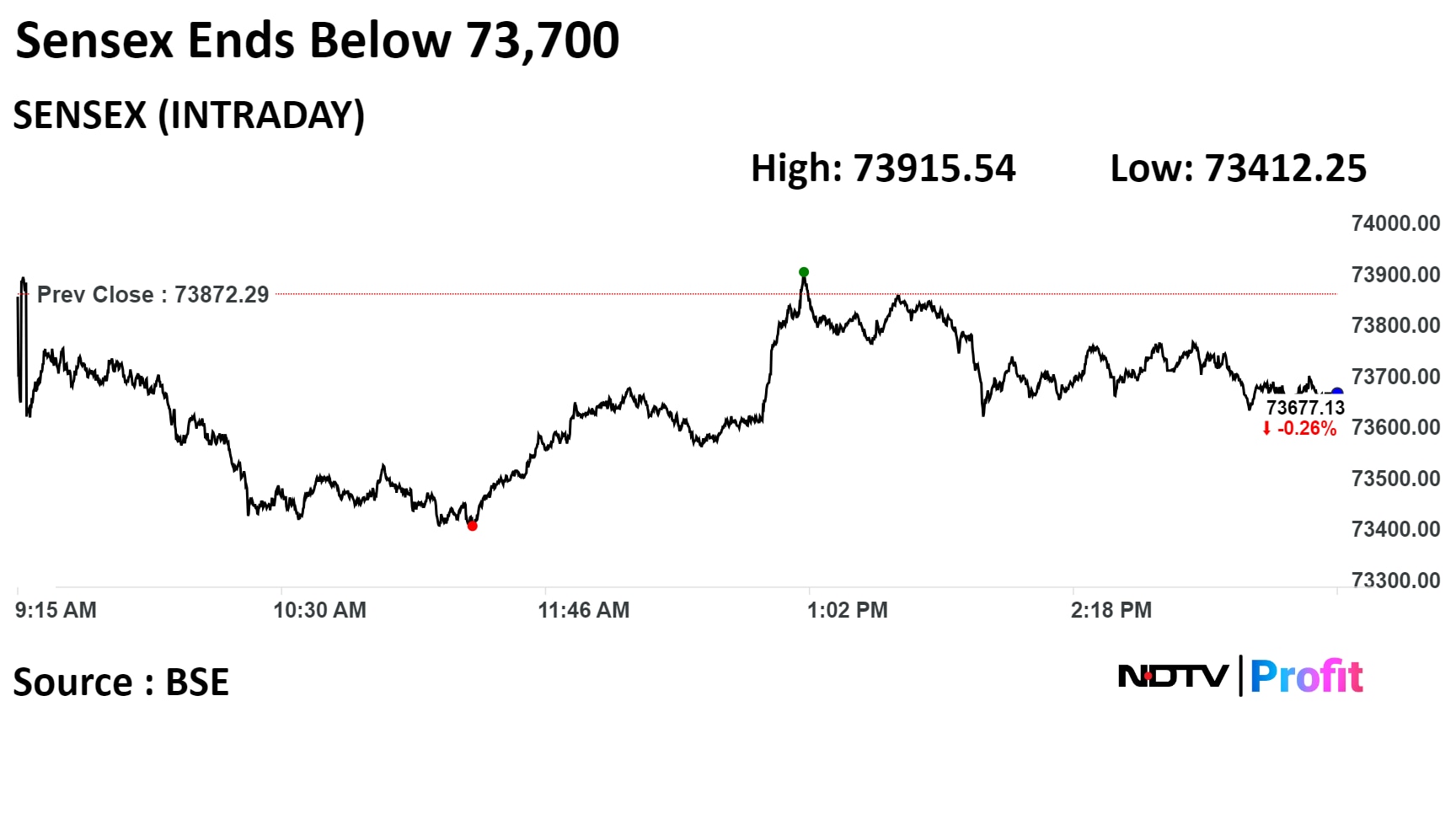

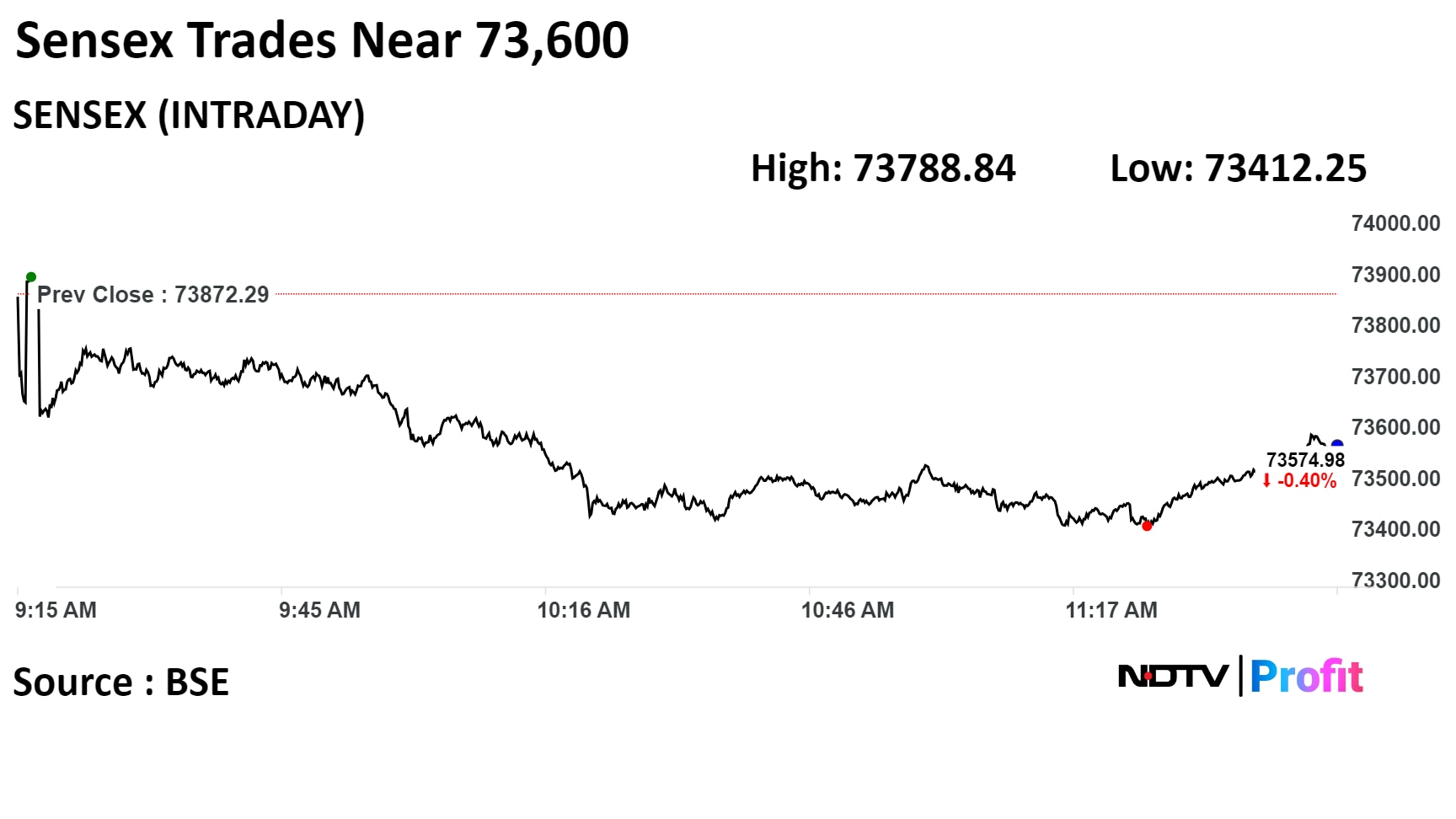

India's benchmark stock indices ended lower on Tuesday, snapping four days of gains, weighed by losses in Infosys Ltd. and Bajaj Finance Ltd.

The NSE Nifty 50 settled 49.3 points or 0.22%, lower at 22,356.3, and the S&P BSE Sensex declined 195.16 points or 0.26%, to end at 73,677.13.

During the day, the Nifty fell as much as 0.61% to 22,269.15, while the Sensex declined 0.62% to 73,412.25.

"For traders now, the 22,275 level of the Nifty would act as a sacrosanct support zone. As long as the index is trading above this level, positive momentum is likely to continue, according to Shrikant Chouhan, head of equity research at Kotak Securities Ltd. "Above the same, the market (Nifty 50) could move towards 22,450–22,500. On the flip side, below 22,275, the uptrend would be vulnerable."

Stocks in the Asia-Pacific region closed in red as China’s new targets and measures to build confidence in its economy received a lukewarm response from markets. Hong Kong's Hang Seng fell the most by over 2.61%, while S&P ASX closed lower by 0.15% on Tuesday.

Brent crude was trading 0.08% higher at $82.88 a barrel. Gold was higher by 0.49% at $2,124.94 an ounce.

India's benchmark stock indices ended lower on Tuesday, snapping four days of gains, weighed by losses in Infosys Ltd. and Bajaj Finance Ltd.

The NSE Nifty 50 settled 49.3 points or 0.22%, lower at 22,356.3, and the S&P BSE Sensex declined 195.16 points or 0.26%, to end at 73,677.13.

During the day, the Nifty fell as much as 0.61% to 22,269.15, while the Sensex declined 0.62% to 73,412.25.

"For traders now, the 22,275 level of the Nifty would act as a sacrosanct support zone. As long as the index is trading above this level, positive momentum is likely to continue, according to Shrikant Chouhan, head of equity research at Kotak Securities Ltd. "Above the same, the market (Nifty 50) could move towards 22,450–22,500. On the flip side, below 22,275, the uptrend would be vulnerable."

Stocks in the Asia-Pacific region closed in red as China’s new targets and measures to build confidence in its economy received a lukewarm response from markets. Hong Kong's Hang Seng fell the most by over 2.61%, while S&P ASX closed lower by 0.15% on Tuesday.

Brent crude was trading 0.08% higher at $82.88 a barrel. Gold was higher by 0.49% at $2,124.94 an ounce.

India's benchmark stock indices ended lower on Tuesday, snapping four days of gains, weighed by losses in Infosys Ltd. and Bajaj Finance Ltd.

The NSE Nifty 50 settled 49.3 points or 0.22%, lower at 22,356.3, and the S&P BSE Sensex declined 195.16 points or 0.26%, to end at 73,677.13.

During the day, the Nifty fell as much as 0.61% to 22,269.15, while the Sensex declined 0.62% to 73,412.25.

"For traders now, the 22,275 level of the Nifty would act as a sacrosanct support zone. As long as the index is trading above this level, positive momentum is likely to continue, according to Shrikant Chouhan, head of equity research at Kotak Securities Ltd. "Above the same, the market (Nifty 50) could move towards 22,450–22,500. On the flip side, below 22,275, the uptrend would be vulnerable."

Stocks in the Asia-Pacific region closed in red as China’s new targets and measures to build confidence in its economy received a lukewarm response from markets. Hong Kong's Hang Seng fell the most by over 2.61%, while S&P ASX closed lower by 0.15% on Tuesday.

Brent crude was trading 0.08% higher at $82.88 a barrel. Gold was higher by 0.49% at $2,124.94 an ounce.

India's benchmark stock indices ended lower on Tuesday, snapping four days of gains, weighed by losses in Infosys Ltd. and Bajaj Finance Ltd.

The NSE Nifty 50 settled 49.3 points or 0.22%, lower at 22,356.3, and the S&P BSE Sensex declined 195.16 points or 0.26%, to end at 73,677.13.

During the day, the Nifty fell as much as 0.61% to 22,269.15, while the Sensex declined 0.62% to 73,412.25.

"For traders now, the 22,275 level of the Nifty would act as a sacrosanct support zone. As long as the index is trading above this level, positive momentum is likely to continue, according to Shrikant Chouhan, head of equity research at Kotak Securities Ltd. "Above the same, the market (Nifty 50) could move towards 22,450–22,500. On the flip side, below 22,275, the uptrend would be vulnerable."

Stocks in the Asia-Pacific region closed in red as China’s new targets and measures to build confidence in its economy received a lukewarm response from markets. Hong Kong's Hang Seng fell the most by over 2.61%, while S&P ASX closed lower by 0.15% on Tuesday.

Brent crude was trading 0.08% higher at $82.88 a barrel. Gold was higher by 0.49% at $2,124.94 an ounce.

India's benchmark stock indices ended lower on Tuesday, snapping four days of gains, weighed by losses in Infosys Ltd. and Bajaj Finance Ltd.

The NSE Nifty 50 settled 49.3 points or 0.22%, lower at 22,356.3, and the S&P BSE Sensex declined 195.16 points or 0.26%, to end at 73,677.13.

During the day, the Nifty fell as much as 0.61% to 22,269.15, while the Sensex declined 0.62% to 73,412.25.

"For traders now, the 22,275 level of the Nifty would act as a sacrosanct support zone. As long as the index is trading above this level, positive momentum is likely to continue, according to Shrikant Chouhan, head of equity research at Kotak Securities Ltd. "Above the same, the market (Nifty 50) could move towards 22,450–22,500. On the flip side, below 22,275, the uptrend would be vulnerable."

Stocks in the Asia-Pacific region closed in red as China’s new targets and measures to build confidence in its economy received a lukewarm response from markets. Hong Kong's Hang Seng fell the most by over 2.61%, while S&P ASX closed lower by 0.15% on Tuesday.

Brent crude was trading 0.08% higher at $82.88 a barrel. Gold was higher by 0.49% at $2,124.94 an ounce.

India's benchmark stock indices ended lower on Tuesday, snapping four days of gains, weighed by losses in Infosys Ltd. and Bajaj Finance Ltd.

The NSE Nifty 50 settled 49.3 points or 0.22%, lower at 22,356.3, and the S&P BSE Sensex declined 195.16 points or 0.26%, to end at 73,677.13.

During the day, the Nifty fell as much as 0.61% to 22,269.15, while the Sensex declined 0.62% to 73,412.25.

"For traders now, the 22,275 level of the Nifty would act as a sacrosanct support zone. As long as the index is trading above this level, positive momentum is likely to continue, according to Shrikant Chouhan, head of equity research at Kotak Securities Ltd. "Above the same, the market (Nifty 50) could move towards 22,450–22,500. On the flip side, below 22,275, the uptrend would be vulnerable."

Stocks in the Asia-Pacific region closed in red as China’s new targets and measures to build confidence in its economy received a lukewarm response from markets. Hong Kong's Hang Seng fell the most by over 2.61%, while S&P ASX closed lower by 0.15% on Tuesday.

Brent crude was trading 0.08% higher at $82.88 a barrel. Gold was higher by 0.49% at $2,124.94 an ounce.

India's benchmark stock indices ended lower on Tuesday, snapping four days of gains, weighed by losses in Infosys Ltd. and Bajaj Finance Ltd.

The NSE Nifty 50 settled 49.3 points or 0.22%, lower at 22,356.3, and the S&P BSE Sensex declined 195.16 points or 0.26%, to end at 73,677.13.

During the day, the Nifty fell as much as 0.61% to 22,269.15, while the Sensex declined 0.62% to 73,412.25.

"For traders now, the 22,275 level of the Nifty would act as a sacrosanct support zone. As long as the index is trading above this level, positive momentum is likely to continue, according to Shrikant Chouhan, head of equity research at Kotak Securities Ltd. "Above the same, the market (Nifty 50) could move towards 22,450–22,500. On the flip side, below 22,275, the uptrend would be vulnerable."

Stocks in the Asia-Pacific region closed in red as China’s new targets and measures to build confidence in its economy received a lukewarm response from markets. Hong Kong's Hang Seng fell the most by over 2.61%, while S&P ASX closed lower by 0.15% on Tuesday.

Brent crude was trading 0.08% higher at $82.88 a barrel. Gold was higher by 0.49% at $2,124.94 an ounce.

India's benchmark stock indices ended lower on Tuesday, snapping four days of gains, weighed by losses in Infosys Ltd. and Bajaj Finance Ltd.

The NSE Nifty 50 settled 49.3 points or 0.22%, lower at 22,356.3, and the S&P BSE Sensex declined 195.16 points or 0.26%, to end at 73,677.13.

During the day, the Nifty fell as much as 0.61% to 22,269.15, while the Sensex declined 0.62% to 73,412.25.

"For traders now, the 22,275 level of the Nifty would act as a sacrosanct support zone. As long as the index is trading above this level, positive momentum is likely to continue, according to Shrikant Chouhan, head of equity research at Kotak Securities Ltd. "Above the same, the market (Nifty 50) could move towards 22,450–22,500. On the flip side, below 22,275, the uptrend would be vulnerable."

Stocks in the Asia-Pacific region closed in red as China’s new targets and measures to build confidence in its economy received a lukewarm response from markets. Hong Kong's Hang Seng fell the most by over 2.61%, while S&P ASX closed lower by 0.15% on Tuesday.

Brent crude was trading 0.08% higher at $82.88 a barrel. Gold was higher by 0.49% at $2,124.94 an ounce.

Shares of Infosys Ltd., Bajaj Finance Ltd., Tata Consultancy Sevices Ltd., Reliance Industries Ltd., and Bajaj Finserv Ltd. declined the most on the Nifty 50.

Bharti Airtel Ltd., HDFC Bank Ltd., Tata Motors Ltd., State Bank of India, and Sun Pharmaceuticals Ltd. rose the most.

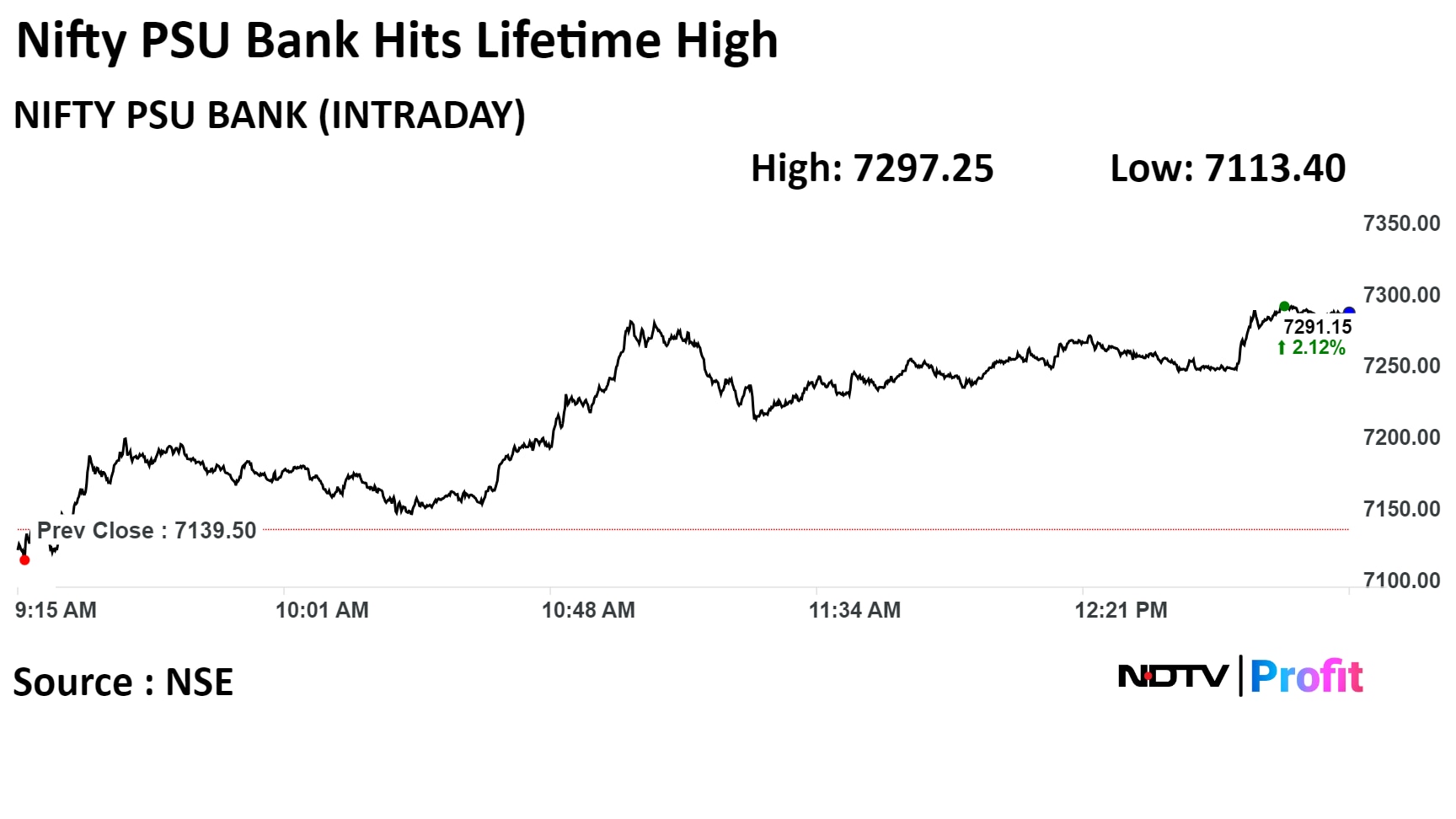

Most Nifty sectors ended higher with Nifty PSU Bank and Nifty Auto advancing the most. Nifty IT and Nifty Media declined the most by 1.59% and 1.37%, respectively.

The broader markets also ended lower along with the benchmark indices. as the BSE MidCap declined by 0.17% and the SmallCap ended 0.63% lower.

On the BSE, 10 out of the 20 sectors ended lower. The BSE Services index rose 1.30% to become the best-performing sector, while the BSE Information Technology fell 1.61% to become the worst performer.

Market breadth was skewed in favour of sellers. Around 2,559 stocks fell, 1,281 rose, and 93 stocks remained unchanged on BSE.

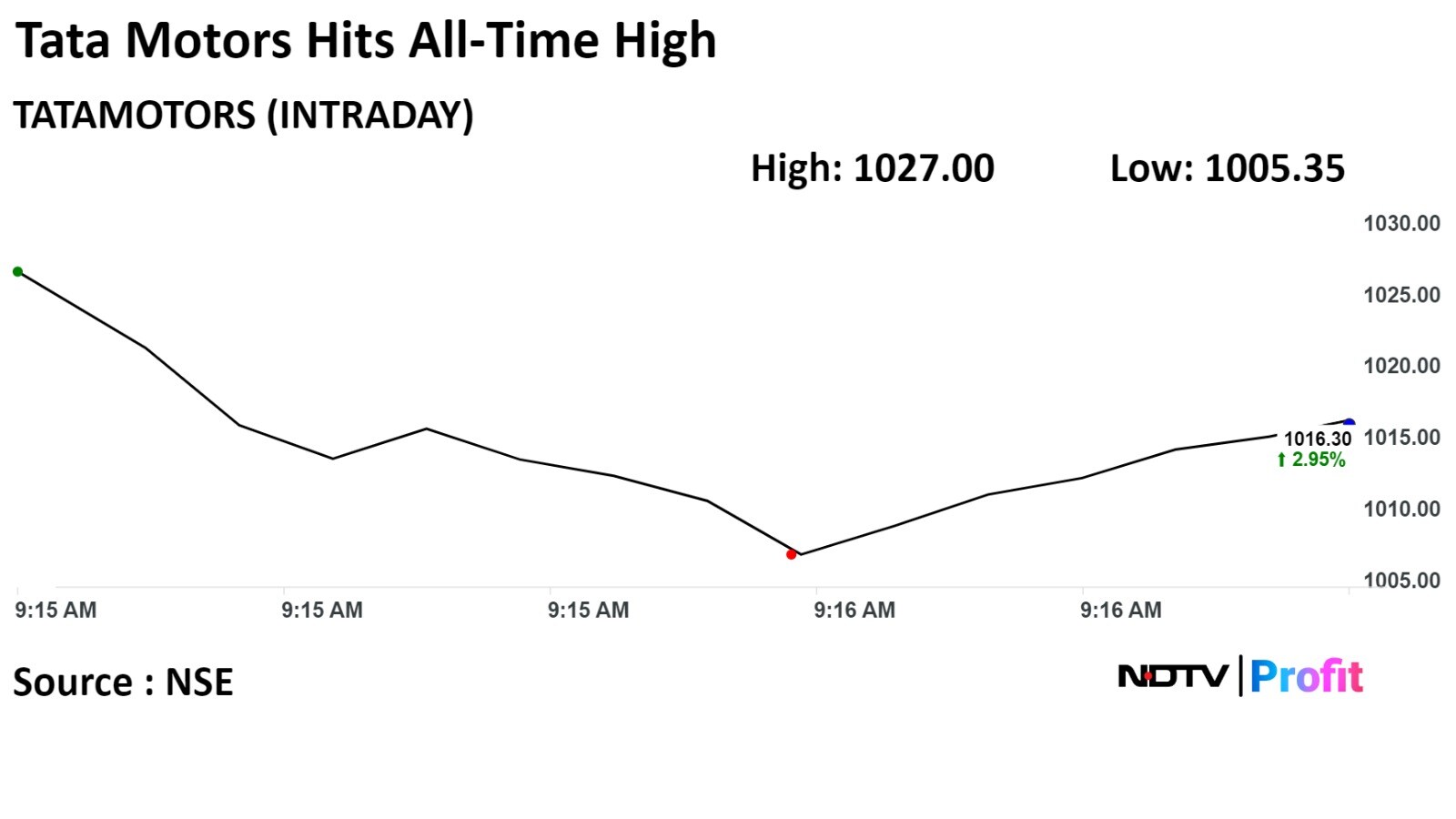

JLR sales up 35% YoY to 2,225 units in Feb 2024

Jaguar sales up 1.4 times YoY to 738 units in Feb 2024

Land Rover sales up 11.7% YoY to 1,517 units in Feb 2024

JLR’s UK market share at 2.62% vs 2.24% a year ago

Source: UK’s vehicle data website

JV gets LoA for construction project

Total project cost valued at Rs 393 crore

Co's share in project value at Rs 345 crore

Source: Exchange Filing

Plant to be commissioned via wholly-owned subsidiary in Gujarat

Source: Exchange Filing

In a press announcement, Bloomberg said "Indian FAR bonds will be included in the Bloomberg EM Local Currency Government indices with an initial weight of 10% of their full market value on January 31, 2025."

In a press announcement, Bloomberg said "Indian FAR bonds will be included in the Bloomberg EM Local Currency Government indices with an initial weight of 10% of their full market value on January 31, 2025."

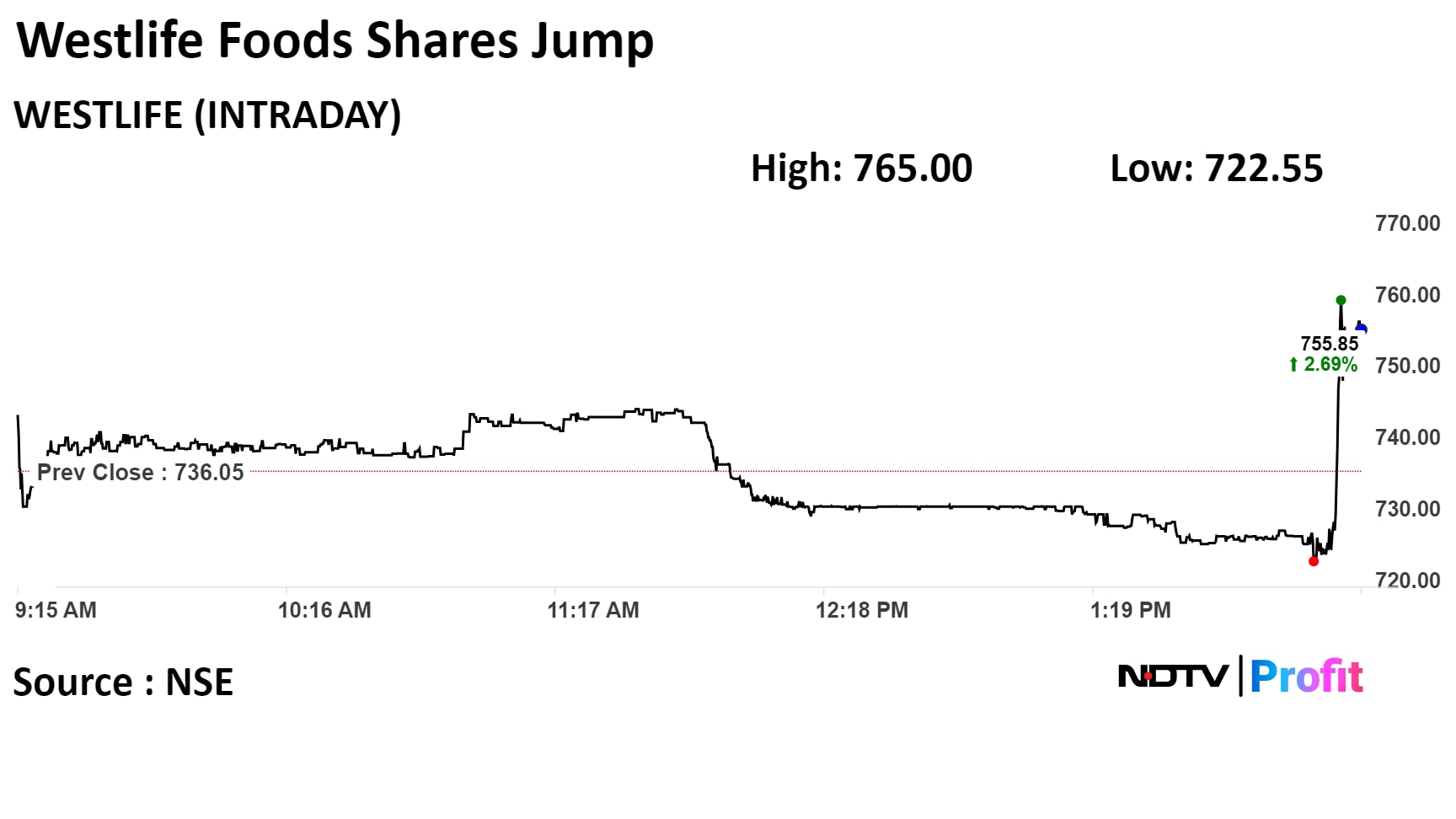

Westlife Foodworld shares jumped after the company said the Food Safety and Standards Authority of India under the administration of the Ministry of Health and Family Welfare has verified the cheese used by McDonald’s India as ‘100% Real Cheese’.

Westlife Foodworld shares jumped after the company said the Food Safety and Standards Authority of India under the administration of the Ministry of Health and Family Welfare has verified the cheese used by McDonald’s India as ‘100% Real Cheese’.

80 lakh shares changed hands in a large trade

0.1% equity changed hands at Rs 1,091.15 apiece

Buyers and sellers not known immediately

Source: Bloomberg

Gets order for construction of Burhner Project Dam

Gets order worth Rs 117 crore from GMDC for overhaul of Akrimota Thermal Power Station

Source: Exchange Filing

"However, the Company has been disclosing the required / relevant information in its quarterly results as well as Results Presentations and is therefore of the opinion that the aforesaid SCN is not likely to have any material impact on the financial, operational or other activities of the Company as these information’s are already in the public domain."

Source: Exchange Filing

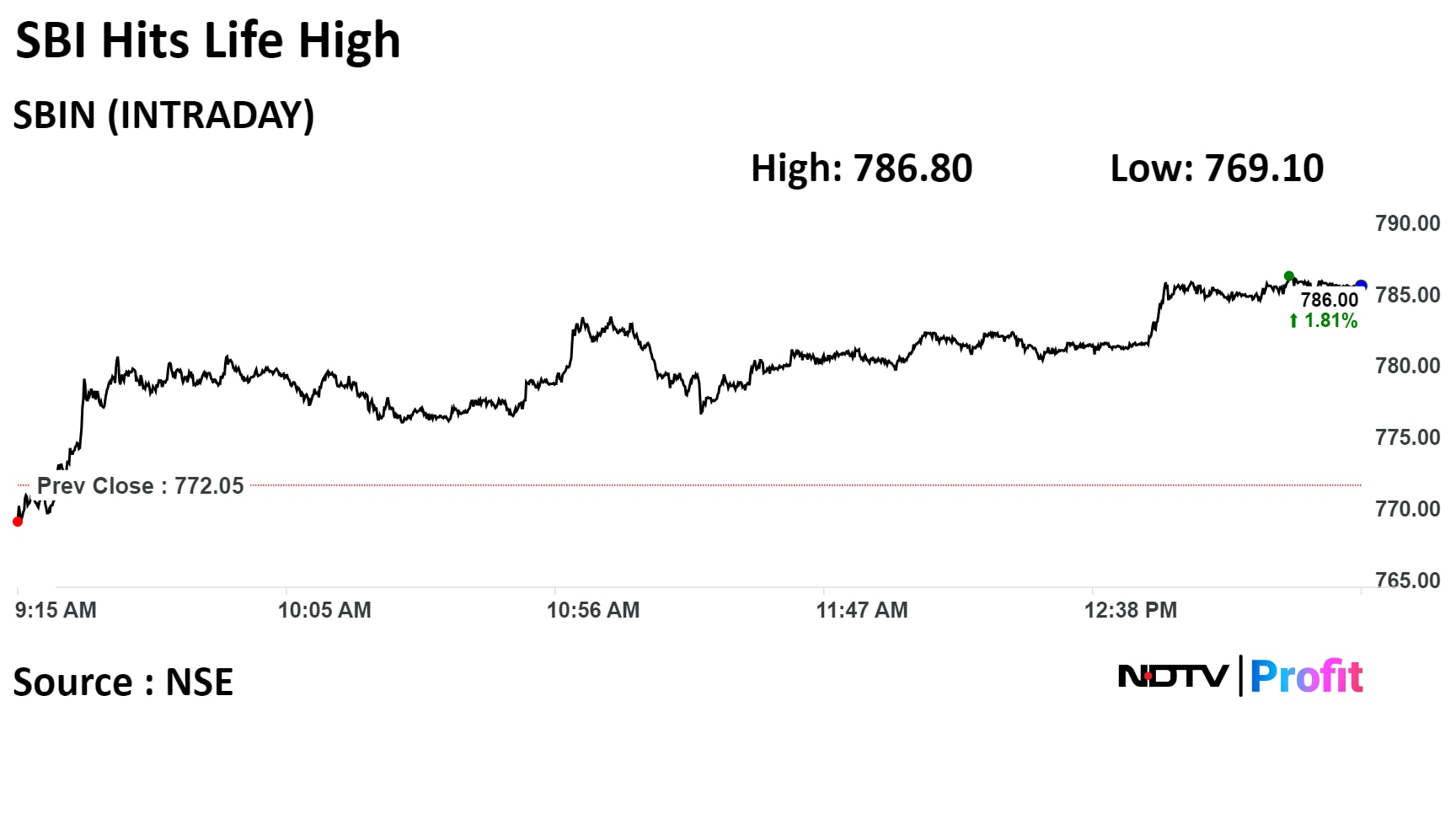

The scrip rose as much as 1.91% to Rs 786.80 apiece, its highest level. It pared gains to trade 1.66% higher at Rs 784.75 apiece, as of 1:49 p.m.This compares to a 0.1% decline in the NSE Nifty 50 Index.

It has risen 49.82% in the last twelve months. Total traded volume so far in the day stood at 0.51 times its 30-day average. The relative strength index was at 72.86, indicating that the stock may be overbought.

Out of 52 analysts tracking the company, 43 maintain a 'buy' rating, six recommend 'hold' and three suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 2.8%.

The scrip rose as much as 1.91% to Rs 786.80 apiece, its highest level. It pared gains to trade 1.66% higher at Rs 784.75 apiece, as of 1:49 p.m.This compares to a 0.1% decline in the NSE Nifty 50 Index.

It has risen 49.82% in the last twelve months. Total traded volume so far in the day stood at 0.51 times its 30-day average. The relative strength index was at 72.86, indicating that the stock may be overbought.

Out of 52 analysts tracking the company, 43 maintain a 'buy' rating, six recommend 'hold' and three suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 2.8%.

11.4 lakh shares changed hands in a large trade

0.02% equity changed hands at Rs 211.05 apiece

Buyers and sellers not known immediately

Source: Bloomberg

34 lakh shares changed hands in a large trade

0.1% equity changed hands at Rs 70.55 apiece

Buyers and sellers not known immediately

Source: Bloomberg

12.4 lakh shares changed hands in a large trade

0.02% equity changed hands at Rs 193.6 apiece

Buyers and sellers not known immediately

Source: Bloomberg

Inter-bank call money rate at 6.49% on Tuesday

Government's month-end spending over last few days supports liquidity, say dealers

End of government borrowing for FY24 also helped liquidity

Source: RBI

Announces multi-year partnership with UK's Carnival for precision quality engineering

Pact for enhancing quality engineering and testing capabilities of Carnival's cruise ships

Source: Exchange filing

Gabapentin tablets are a generic of Neurontin tablets

Source: Exchange Filing

Gabapentin tablets are a generic of Neurontin tablets

Source: Exchange Filing

The IPO was subscribed 1.02 times, as of 12:44 p.m. on Tuesday.

Institutional investors: Nil.

Non-institutional investors: 0.77 times, or 77%.

Retail investors: 1.70 times.

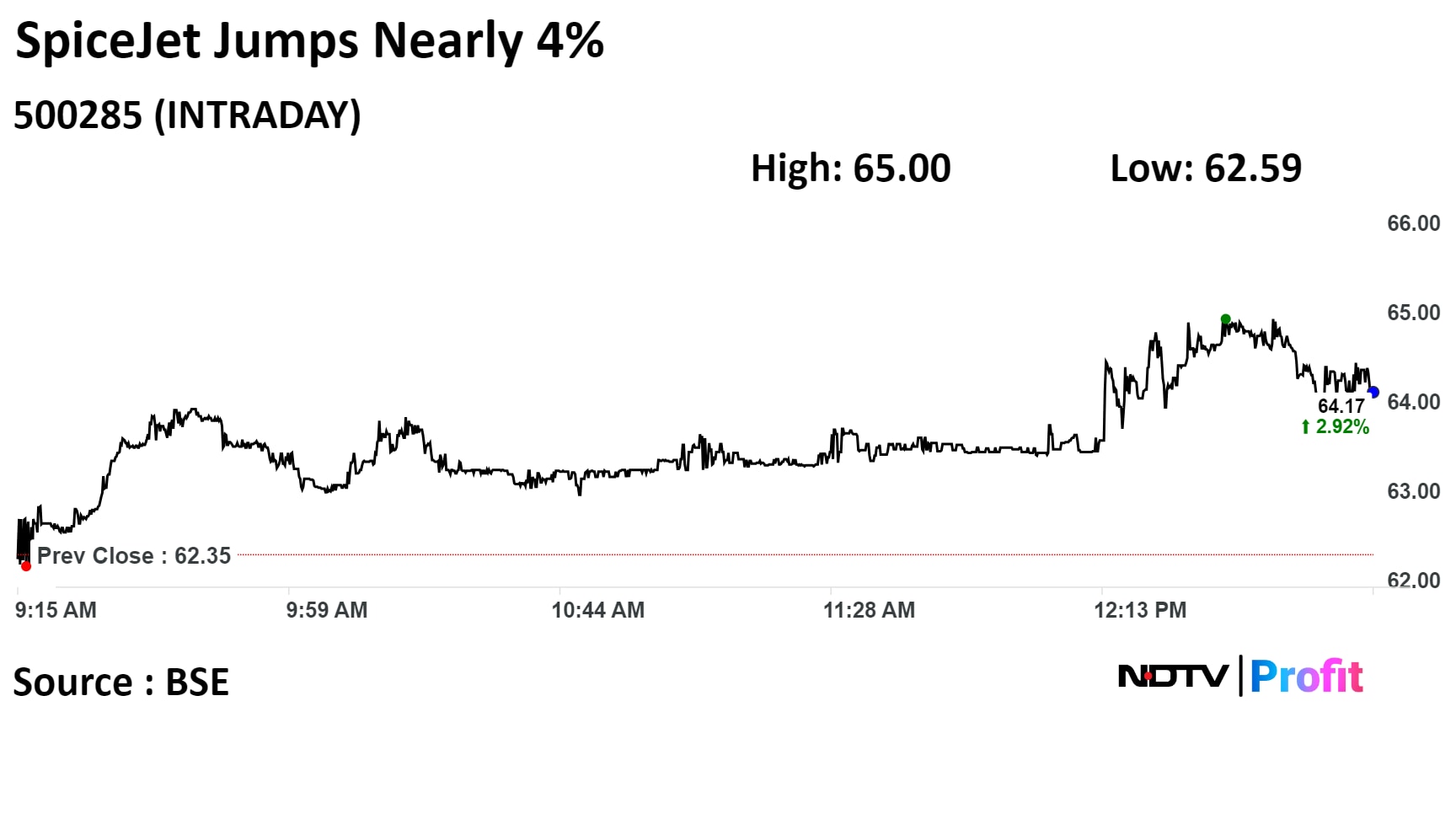

Shares of spice jet rose over 4% after the airlines settled a Rs 93 crore dispute with the aircraft leasing firm, Cross Ocean Partner.

Shares of spice jet rose over 4% after the airlines settled a Rs 93 crore dispute with the aircraft leasing firm, Cross Ocean Partner.

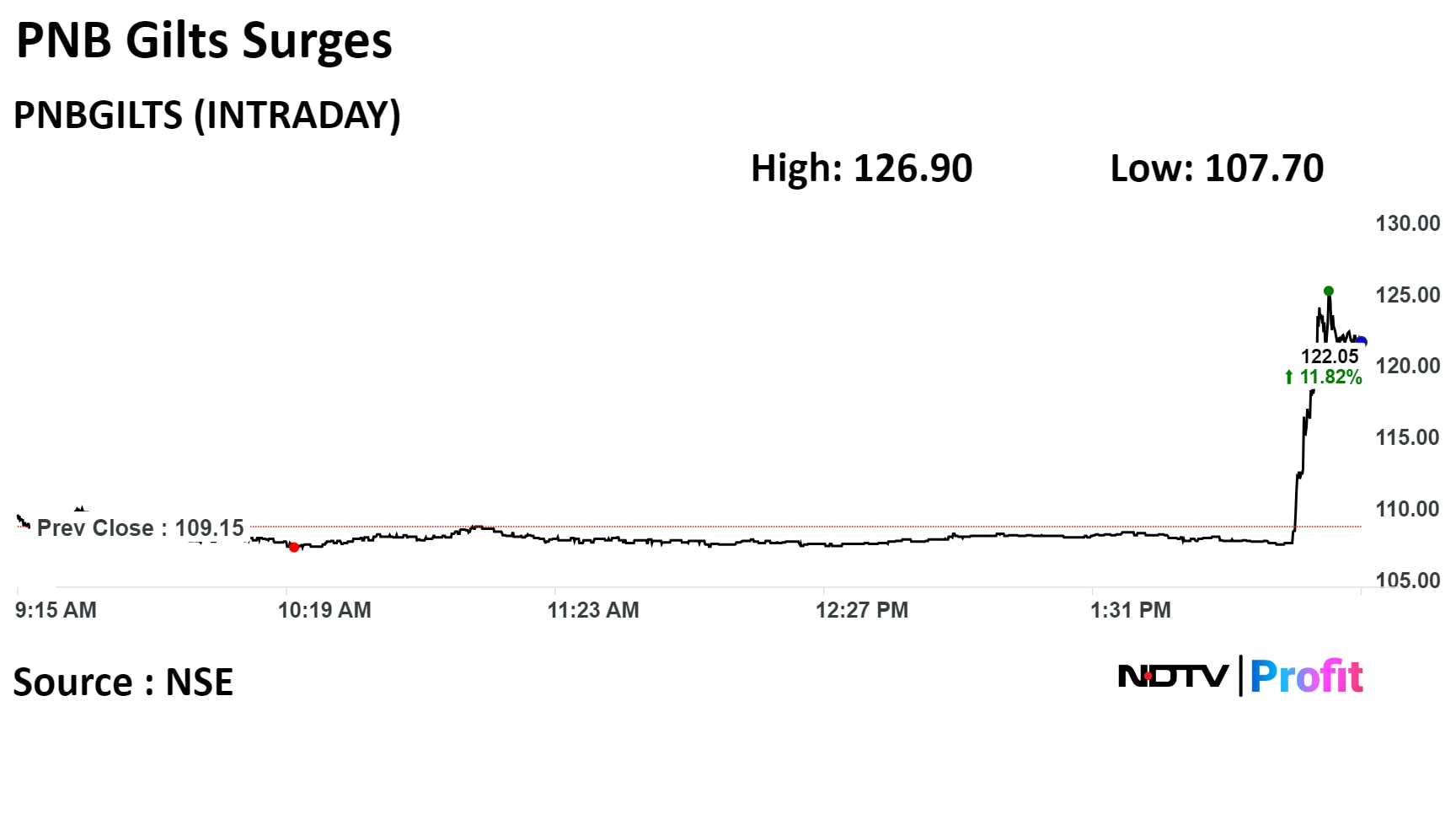

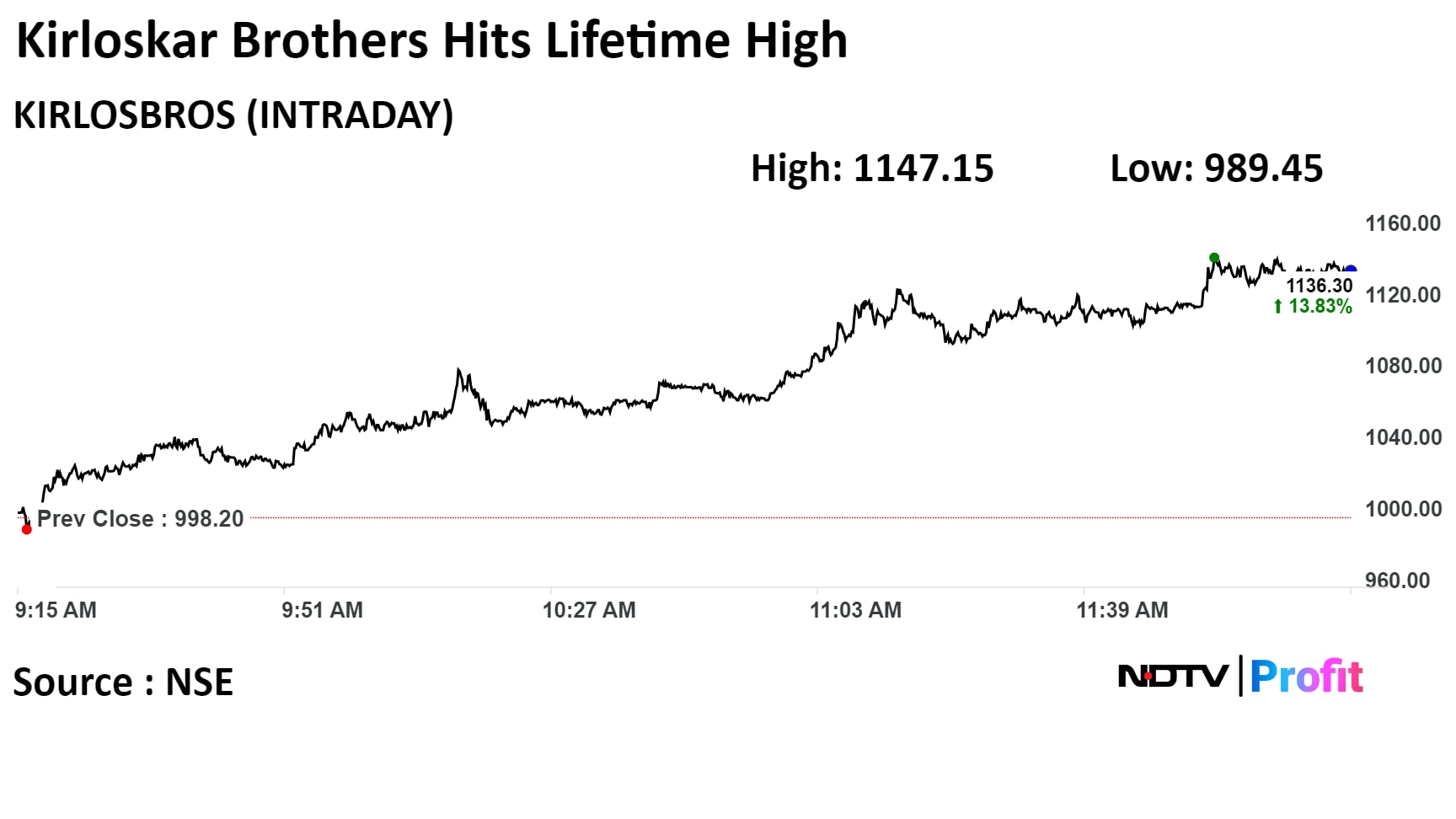

The scrip rose as much as 14.92% to Rs 1,084.2 apiece, its highest level. It pared gains to trade 13.25% higher at Rs 1,130 apiece, as of 12:17 p.m. This compares to a 0.3% decline in the NSE Nifty 50 Index.

It has risen 173.48% in the last twelve months. Total traded volume so far in the day stood at 13.54 times its 30-day average. The relative strength index was at 77.45, indicating that the stock may be overbought.

The scrip rose as much as 14.92% to Rs 1,084.2 apiece, its highest level. It pared gains to trade 13.25% higher at Rs 1,130 apiece, as of 12:17 p.m. This compares to a 0.3% decline in the NSE Nifty 50 Index.

It has risen 173.48% in the last twelve months. Total traded volume so far in the day stood at 13.54 times its 30-day average. The relative strength index was at 77.45, indicating that the stock may be overbought.

Promoters acquire shares worth Rs 1,644.7 crore via open market operations

Promoters acquire 164.5 crore shares between Feb 29 and March 4

Source: Exchange Filing

Partnership with Union Bank to boost rooftop solar adoption among residential consumers

Source: Exchange Filing

Benchmark equity indices remained lower but came off their lows through the midday after snapping their four-day record rally at open.

Shares of Tata Motors cushioned the fall led by the shares of IT companies and Reliance Industries.

At 11:51 a.m., Nifty traded at 22,327.70, down 77.90 points or 0.35% and the Sensex was down 293.53 points or 0.4% at 73,578.76.

"Any potential correction towards the 22300 levels could prompt fresh long positions," said Shrey Jain, founder and CEO of SAS Online.

Jain added that in the coming days, Nifty is expected to move towards the 22500 zone.

Benchmark equity indices remained lower but came off their lows through the midday after snapping their four-day record rally at open.

Shares of Tata Motors cushioned the fall led by the shares of IT companies and Reliance Industries.

At 11:51 a.m., Nifty traded at 22,327.70, down 77.90 points or 0.35% and the Sensex was down 293.53 points or 0.4% at 73,578.76.

"Any potential correction towards the 22300 levels could prompt fresh long positions," said Shrey Jain, founder and CEO of SAS Online.

Jain added that in the coming days, Nifty is expected to move towards the 22500 zone.

Benchmark equity indices remained lower but came off their lows through the midday after snapping their four-day record rally at open.

Shares of Tata Motors cushioned the fall led by the shares of IT companies and Reliance Industries.

At 11:51 a.m., Nifty traded at 22,327.70, down 77.90 points or 0.35% and the Sensex was down 293.53 points or 0.4% at 73,578.76.

"Any potential correction towards the 22300 levels could prompt fresh long positions," said Shrey Jain, founder and CEO of SAS Online.

Jain added that in the coming days, Nifty is expected to move towards the 22500 zone.

Benchmark equity indices remained lower but came off their lows through the midday after snapping their four-day record rally at open.

Shares of Tata Motors cushioned the fall led by the shares of IT companies and Reliance Industries.

At 11:51 a.m., Nifty traded at 22,327.70, down 77.90 points or 0.35% and the Sensex was down 293.53 points or 0.4% at 73,578.76.

"Any potential correction towards the 22300 levels could prompt fresh long positions," said Shrey Jain, founder and CEO of SAS Online.

Jain added that in the coming days, Nifty is expected to move towards the 22500 zone.

Benchmark equity indices remained lower but came off their lows through the midday after snapping their four-day record rally at open.

Shares of Tata Motors cushioned the fall led by the shares of IT companies and Reliance Industries.

At 11:51 a.m., Nifty traded at 22,327.70, down 77.90 points or 0.35% and the Sensex was down 293.53 points or 0.4% at 73,578.76.

"Any potential correction towards the 22300 levels could prompt fresh long positions," said Shrey Jain, founder and CEO of SAS Online.

Jain added that in the coming days, Nifty is expected to move towards the 22500 zone.

Benchmark equity indices remained lower but came off their lows through the midday after snapping their four-day record rally at open.

Shares of Tata Motors cushioned the fall led by the shares of IT companies and Reliance Industries.

At 11:51 a.m., Nifty traded at 22,327.70, down 77.90 points or 0.35% and the Sensex was down 293.53 points or 0.4% at 73,578.76.

"Any potential correction towards the 22300 levels could prompt fresh long positions," said Shrey Jain, founder and CEO of SAS Online.

Jain added that in the coming days, Nifty is expected to move towards the 22500 zone.

Benchmark equity indices remained lower but came off their lows through the midday after snapping their four-day record rally at open.

Shares of Tata Motors cushioned the fall led by the shares of IT companies and Reliance Industries.

At 11:51 a.m., Nifty traded at 22,327.70, down 77.90 points or 0.35% and the Sensex was down 293.53 points or 0.4% at 73,578.76.

"Any potential correction towards the 22300 levels could prompt fresh long positions," said Shrey Jain, founder and CEO of SAS Online.

Jain added that in the coming days, Nifty is expected to move towards the 22500 zone.

Benchmark equity indices remained lower but came off their lows through the midday after snapping their four-day record rally at open.

Shares of Tata Motors cushioned the fall led by the shares of IT companies and Reliance Industries.

At 11:51 a.m., Nifty traded at 22,327.70, down 77.90 points or 0.35% and the Sensex was down 293.53 points or 0.4% at 73,578.76.

"Any potential correction towards the 22300 levels could prompt fresh long positions," said Shrey Jain, founder and CEO of SAS Online.

Jain added that in the coming days, Nifty is expected to move towards the 22500 zone.

Shares of Infosys Ltd., Reliance Industries Ltd., Tata Consultancy Services Ltd., ICICI Bank Ltd., and HDFC Bank Ltd., dragged the Nifty.

Meanwhile, those of Tata Motors Ltd., State Bank Of India, Bharti Airtel Ltd., Mahindra & Mahindra Ltd., and Bajaj Auto Ltd. cushioned the fall.

Most sectoral indices were lower with Nifty Media and Nifty IT falling the most. Nifty PSU Bank and Nifty Auto gained.

Broader markets also fell. The S&P BSE Midcap wad 0.13% lower, and the S&P BSE Smallcap traded 0.45% lower.

On BSE, ten sectors declined and ten were higher. The S&P BSE Teck fell the most.

Market breadth was skewed in favour of sellers. Around 2,373 stocks fell, 1,291 rose, and 128 stocks remained unchanged on BSE.

Gets LoI from Lanco Amarkantak's Resolution Professional approving co's resolution plan

Implementation of the resolution plan is subject to the LoI's terms and requisite approvals

Source: Exchange filing

Aavas Financiers at 65.61 times its 30 day average, down 5%

Balaji Amines at 10.5 times its 30 day average, up 6.7%

Muthoot Finance at 9.58 times its 30 day average, up 4%

SBFC Finance at 9.3 times its 30 day average, up 5%

Kirloskar Brothers at 8.2 times its 30 day average, up 10%

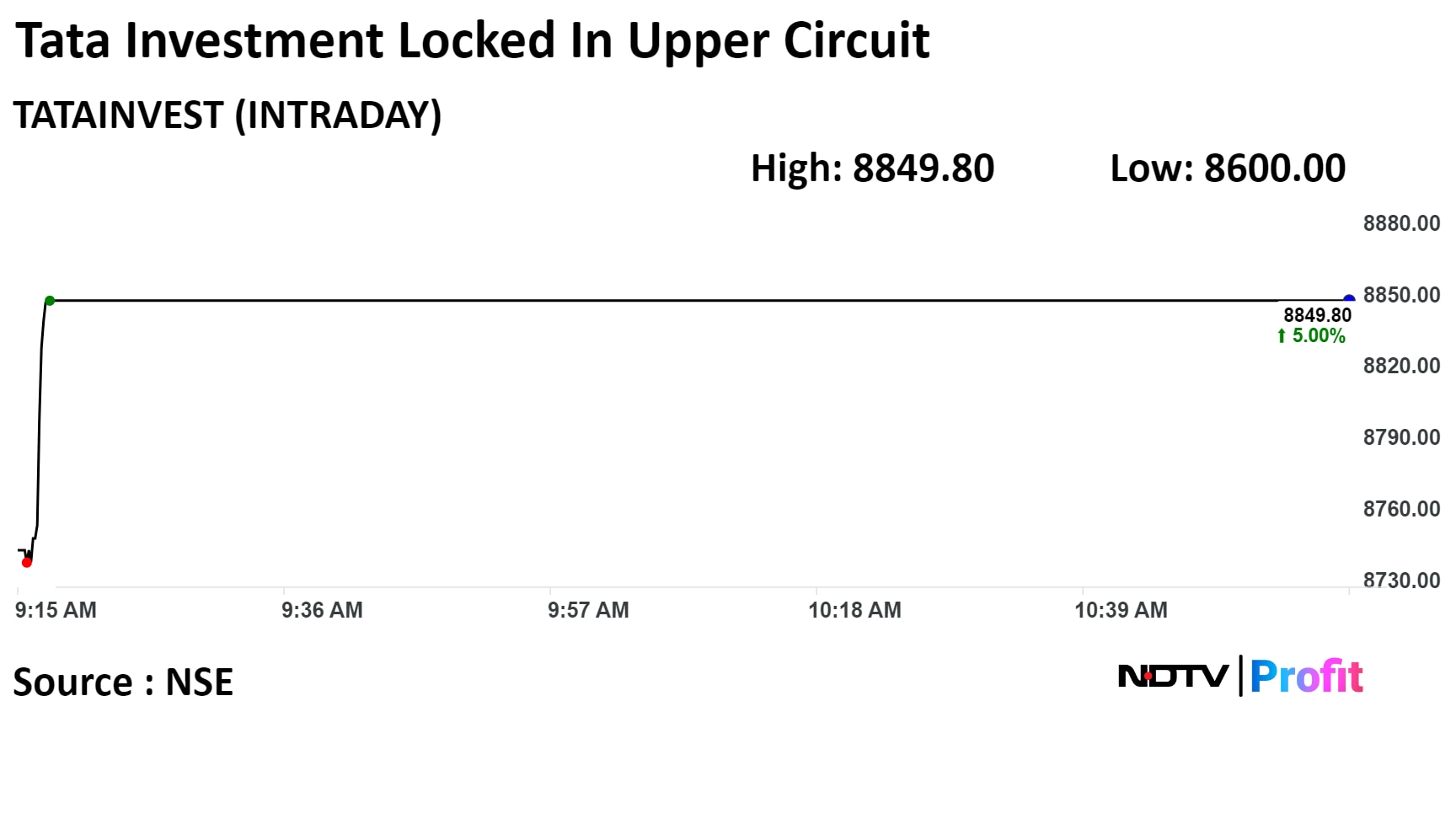

Shares of Tata Investment Corp Ltd. continued their rally in the fifth consecutive session with the stock jumping 5% in the fourth session straight.

In the five day rally, the stock has gained 26.7%. At 11:08, the stock was locked in its 5% upper circuit limit.

Shares of Tata Investment Corp Ltd. continued their rally in the fifth consecutive session with the stock jumping 5% in the fourth session straight.

In the five day rally, the stock has gained 26.7%. At 11:08, the stock was locked in its 5% upper circuit limit.

Fireside Ventures cuts stake in company to 5.52% from 7.57% earlier

Sells stake in 2 tranches via open market operations on Dec 5, 2023, and Feb 29, 2024

Source: Exchange filing

Gets API certification to manufacture electric resistance welded pipes

Source: Exchange filing

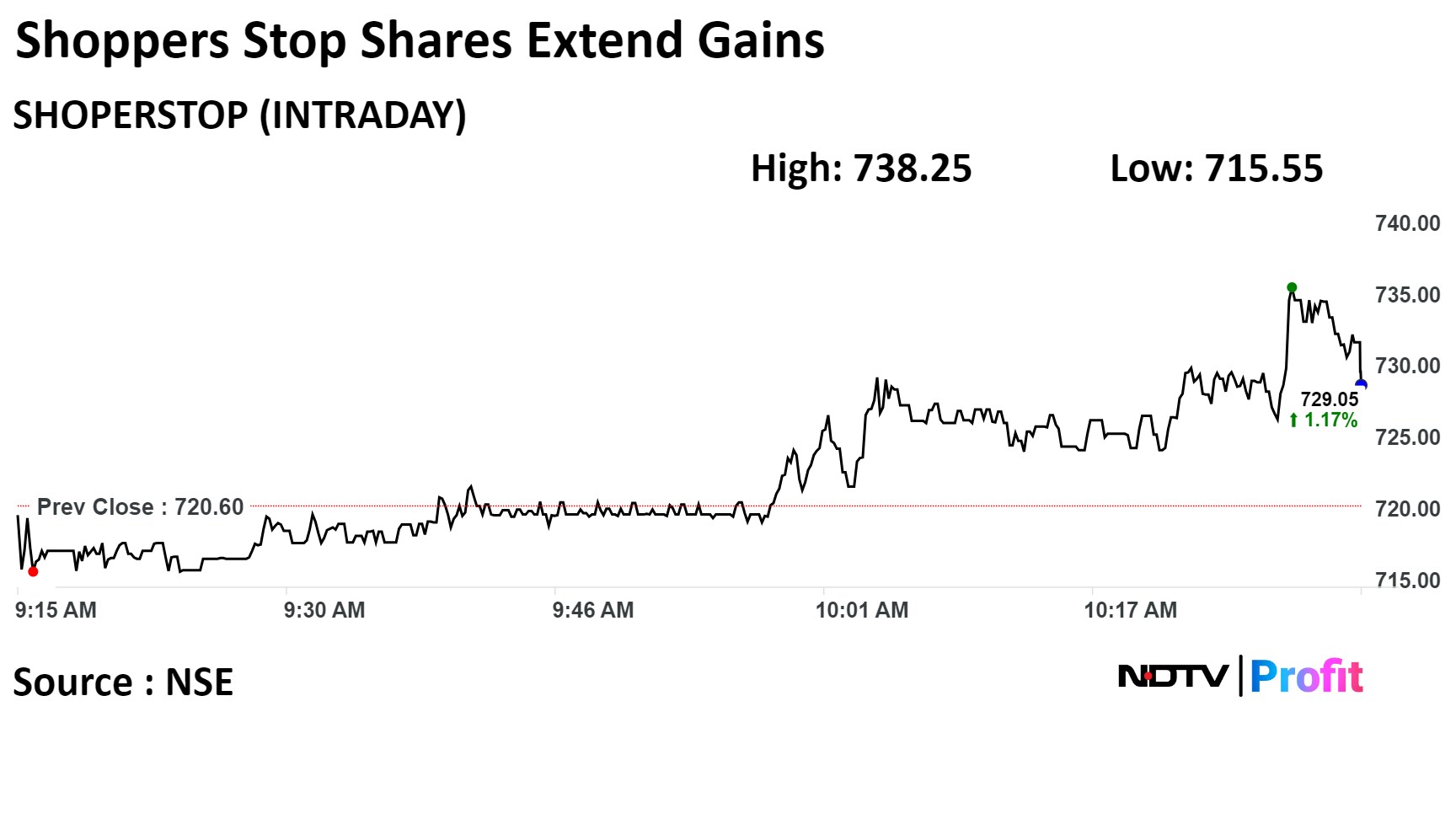

Shares of Shoppers Stop extended their gains after an exchange filing said that it has partnered with Ace Turtles to expand khaki brand Dockers in India.

Shares of Shoppers Stop extended their gains after an exchange filing said that it has partnered with Ace Turtles to expand khaki brand Dockers in India.

The scrip rose as much as 2.45% to Rs 738.25 apiece. Out of ten analysts tracking the company, five maintain a 'buy' rating, two recommend a 'hold,' and three suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 8.5%.

Shares of Capri Global Capital Ltd. surged over 19% and hit an all-time high after the stock turned ex date for the stock split and a bonus for the shareholders.

The company's board of directors at its meeting held on Jan. 27 announced a bonus issue in the ratio of 1:1 and a stock split from Rs 2 to Re 1 per share.

Capri Global Capital's stock rose as much as 19.98% during the day to hit an all time high of Rs 289.2 apiece on the NSE. It was trading 17.12% higher at Rs 282.30 apiece, compared to a 0.33% decline in the benchmark Nifty 50 as of 10:12 a.m.

It has risen 67% in the last 12 months. The total traded volume so far in the day stood at 12 times its 30-day average. The relative strength index was at 75.7.

One analyst tracking the company has a 'buy' rating on the stock, according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 184.4%.

CLSA India Pvt. downgraded Tata Consultancy Services Ltd. and HCL Technologies Ltd. on expensive valuations, saying the growth outlook remains weak at best for the information-technology sector.

"We believe mid-single digit revenue growth-guidance by HCL Technologies and Infosys in April 2024 would be a negative catalyst for Tata Consultancy Services, HCL Technologies and Wipro (all 'sell' rated),"

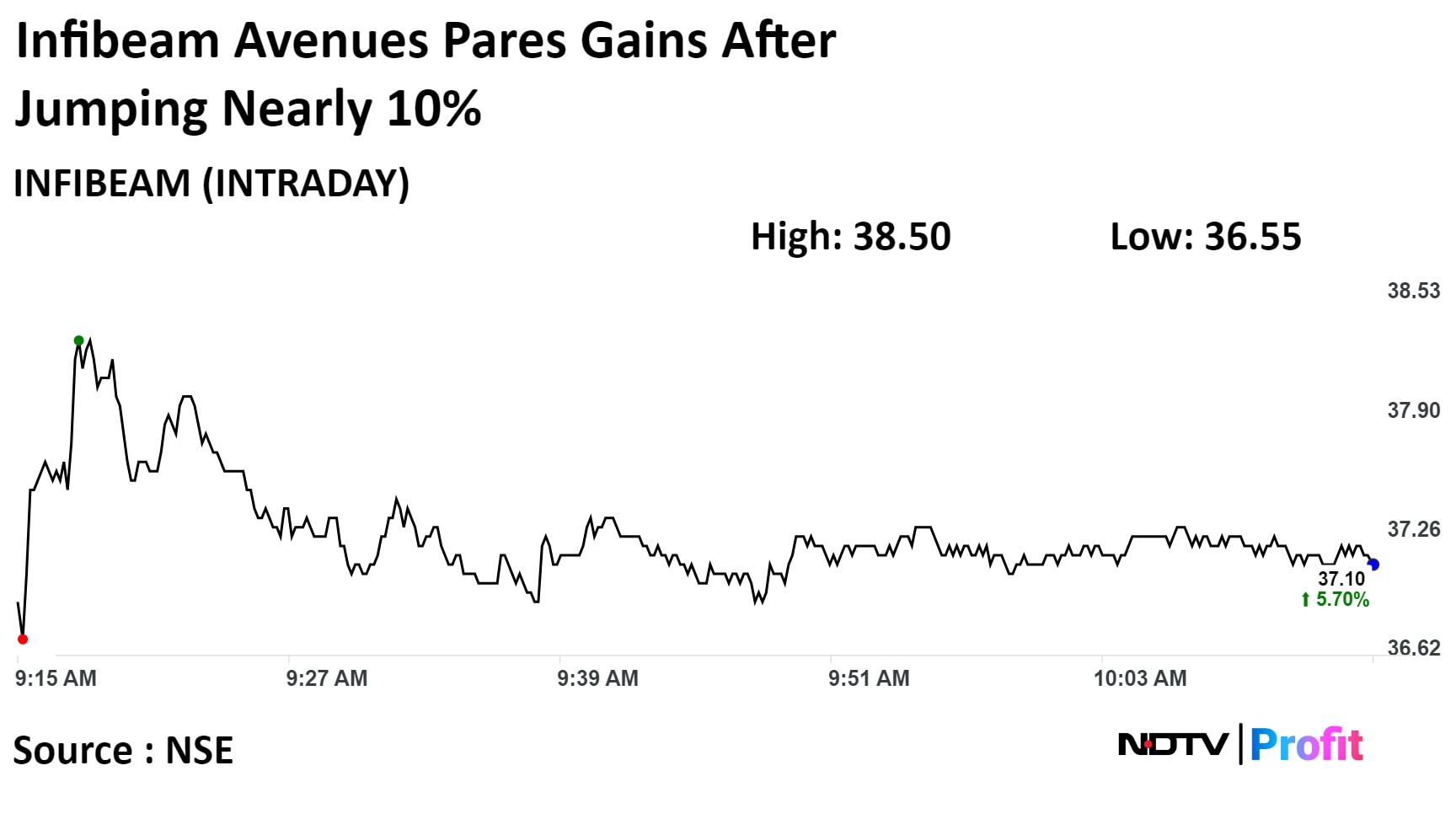

Shares of Infibeam Avenues jumped as much as 9.7% to Rs 38.5, its highest level since Feb 5 after getting final approval from RBI to operate as an online payment aggregator.

RBI authorisation allows the company to provide digital payments services to merchants across India. The company had received in-principle approval from RBI in Oct 2022.

Shares of Infibeam Avenues jumped as much as 9.7% to Rs 38.5, its highest level since Feb 5 after getting final approval from RBI to operate as an online payment aggregator.

RBI authorisation allows the company to provide digital payments services to merchants across India. The company had received in-principle approval from RBI in Oct 2022.

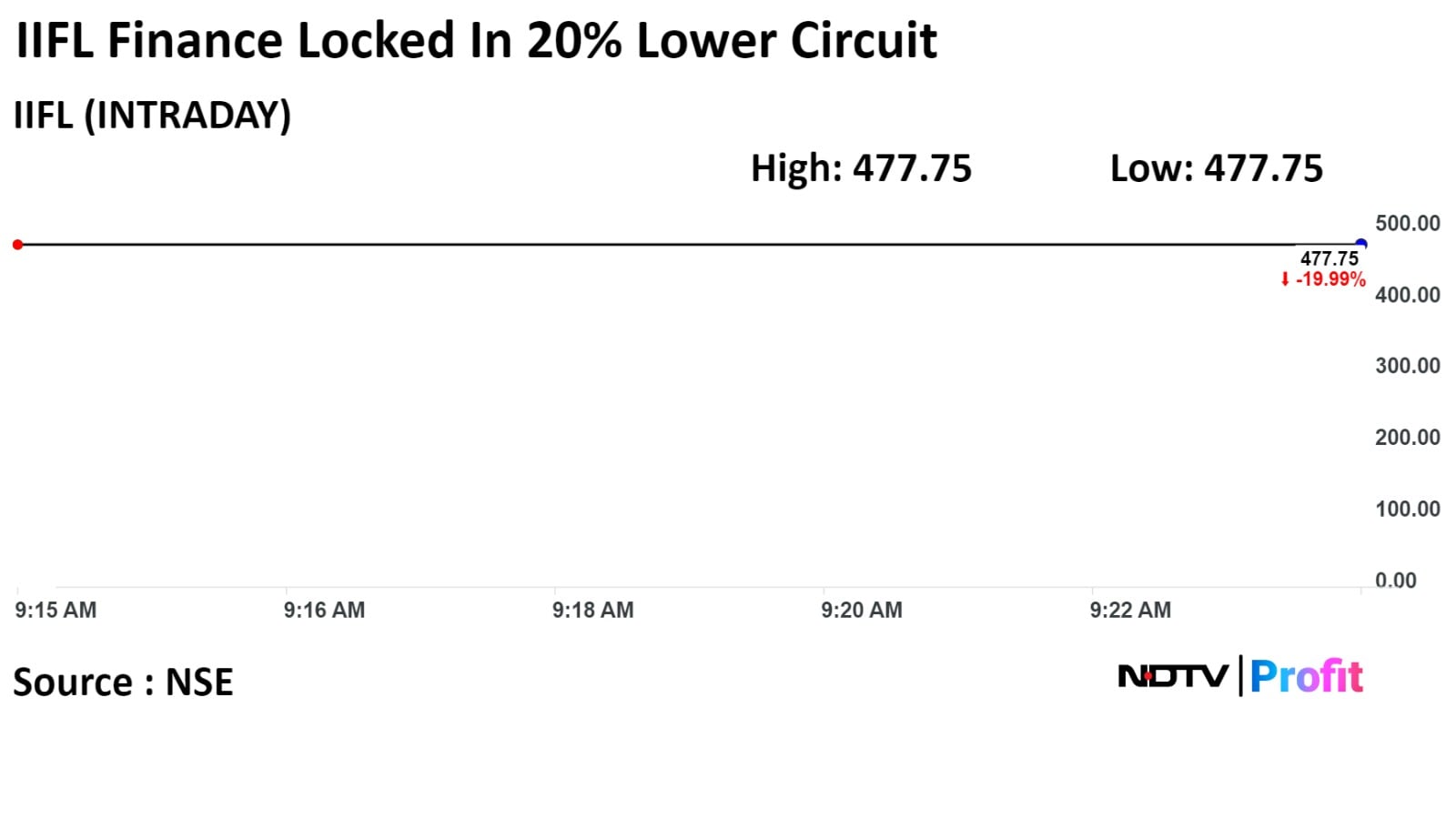

While the shares of IIFL Finance were locked in the lower circuit, its competitors' shares rose. Shares of Manappuram Finance Ltd. and Muthoot Finance Ltd. rose by as much as 6% and 4.9% respectively as of 9:40 a.m.

Exicom Tele-Systems lists at Rs 265 apiece on the NSE, 86% premium to IPO price

Exicom Tele-Systems lists at Rs 264 apiece on the BSE, 85% premium to IPO price

Source: Exchanges

Shares of Platinum Industries Ltd. were listed at Rs 228 apiece on the BSE, a premium of 33.3% over their IPO price of Rs 171 apiece.

On the NSE, the stock debuted at Rs 225, a 31.5% premium.

Shares of IIFL Finance Ltd. hit a 20% lower circuit on Tuesday after the Reserve Bank of India banned the company from disbursing gold loans with immediate effect.

Shares of IIFL Finance Ltd. hit a 20% lower circuit on Tuesday after the Reserve Bank of India banned the company from disbursing gold loans with immediate effect.

IIFL Finance's stock fell as much as 19.99% during the day to hit a lower circuit of Rs 477.75 apiece on the NSE. This is compared to a 0.12% decline in the benchmark Nifty 50 as of 9:25 a.m.

It has risen 5.25% in the past 12 months. The total traded volume so far in the day stood at 43 times its 30-day average. The relative strength index was at 26.5.

All seven analysts tracking IIFL Finance have a 'buy' rating on the stock, according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 34.3%.

Shares of Tata Motors rose to as much as 4.03% to an all-time high of Rs 1,027 apiece on the NSE. The stock is trading 3.58% higher at Rs 1,022 per share, compared to a 0.24% decline in the benchmark Nifty 50 at 9:15 a.m.

The relative strength index was at 75, indicating that stock may be overbought.

Of the 34 analysts tracking the company, 26 maintain a 'buy', five recommend a 'hold,' and three suggest a 'sell', according to Bloomberg data.

Shares of Tata Motors rose to as much as 4.03% to an all-time high of Rs 1,027 apiece on the NSE. The stock is trading 3.58% higher at Rs 1,022 per share, compared to a 0.24% decline in the benchmark Nifty 50 at 9:15 a.m.

The relative strength index was at 75, indicating that stock may be overbought.

Of the 34 analysts tracking the company, 26 maintain a 'buy', five recommend a 'hold,' and three suggest a 'sell', according to Bloomberg data.

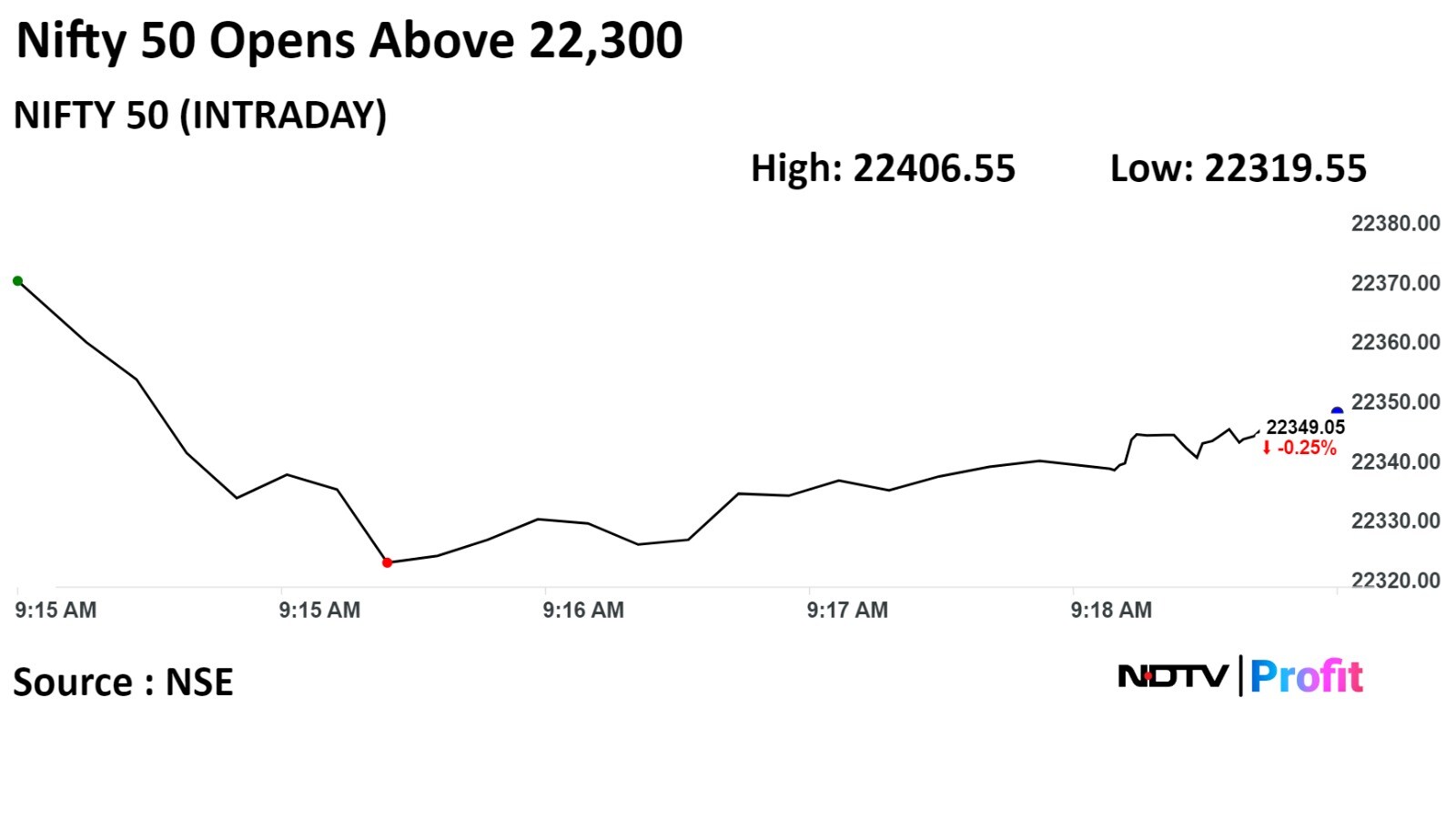

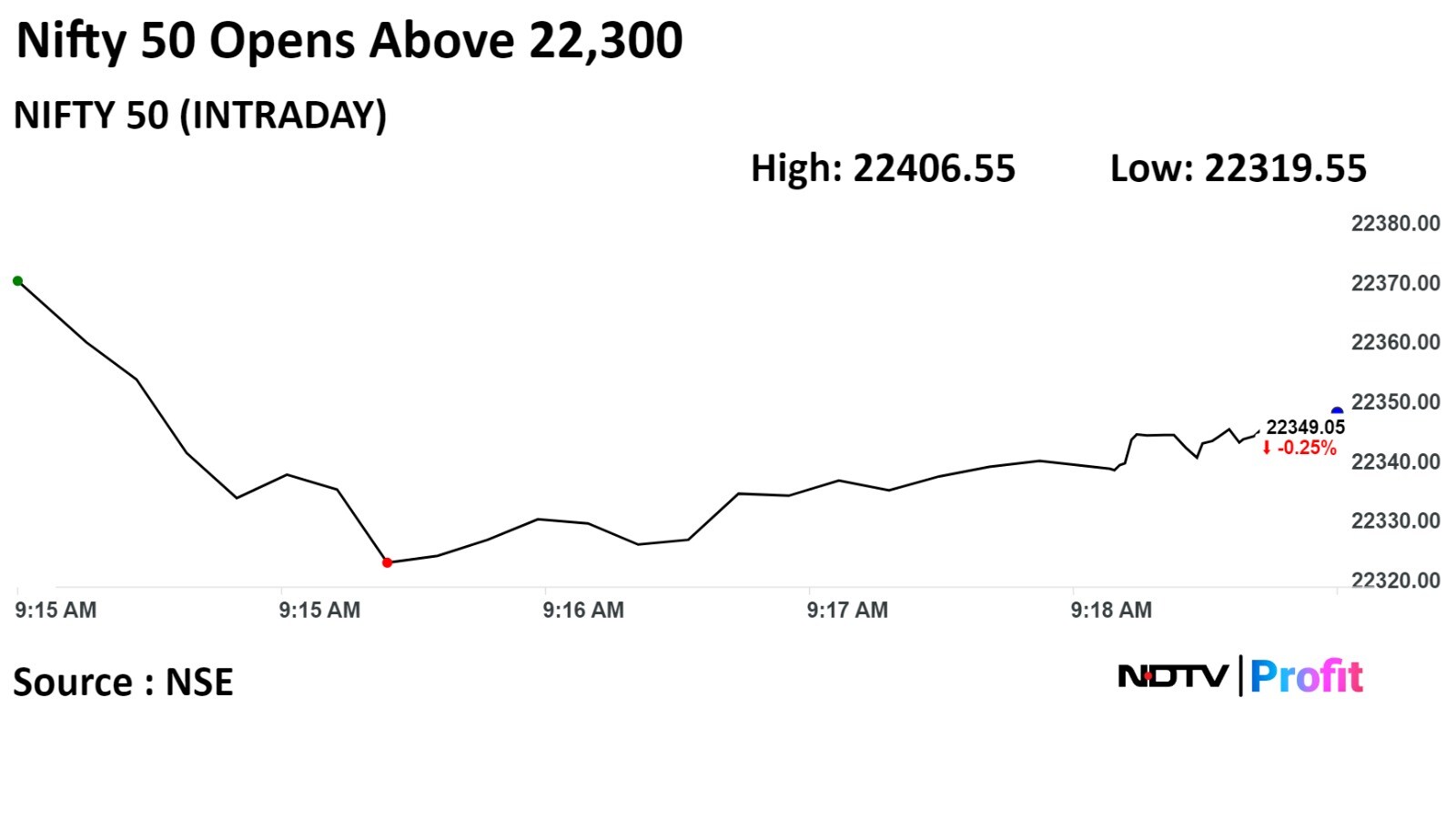

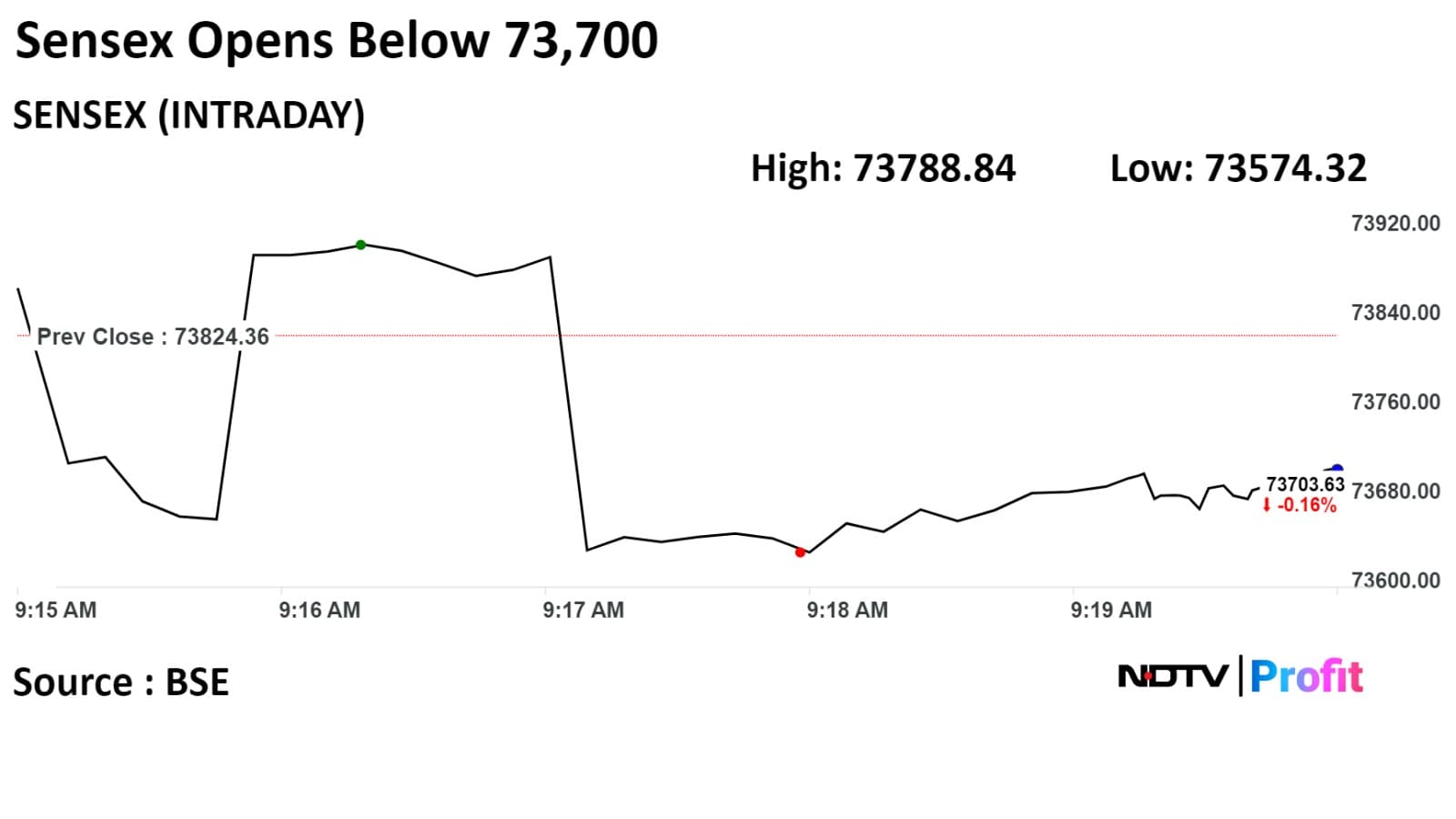

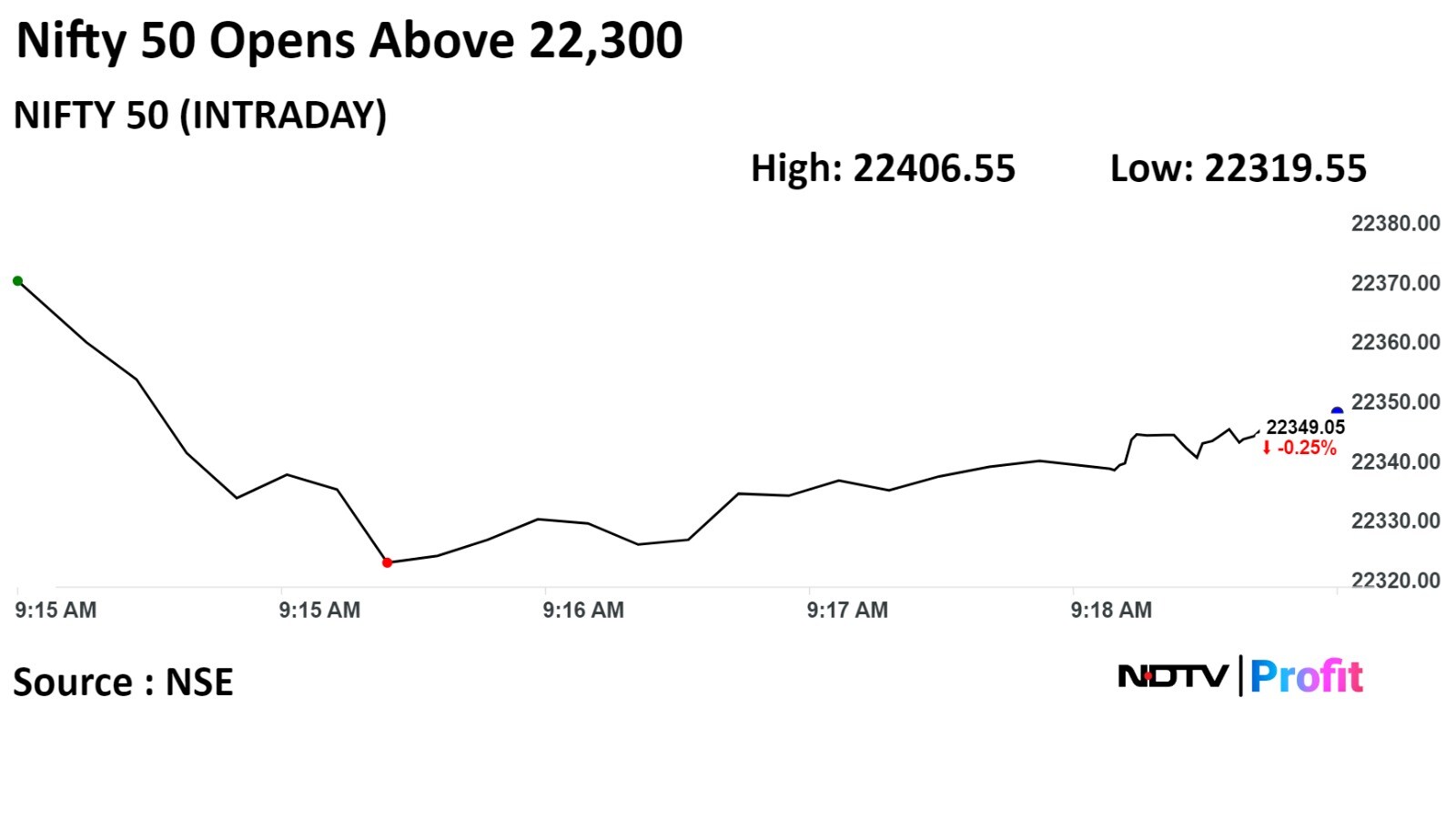

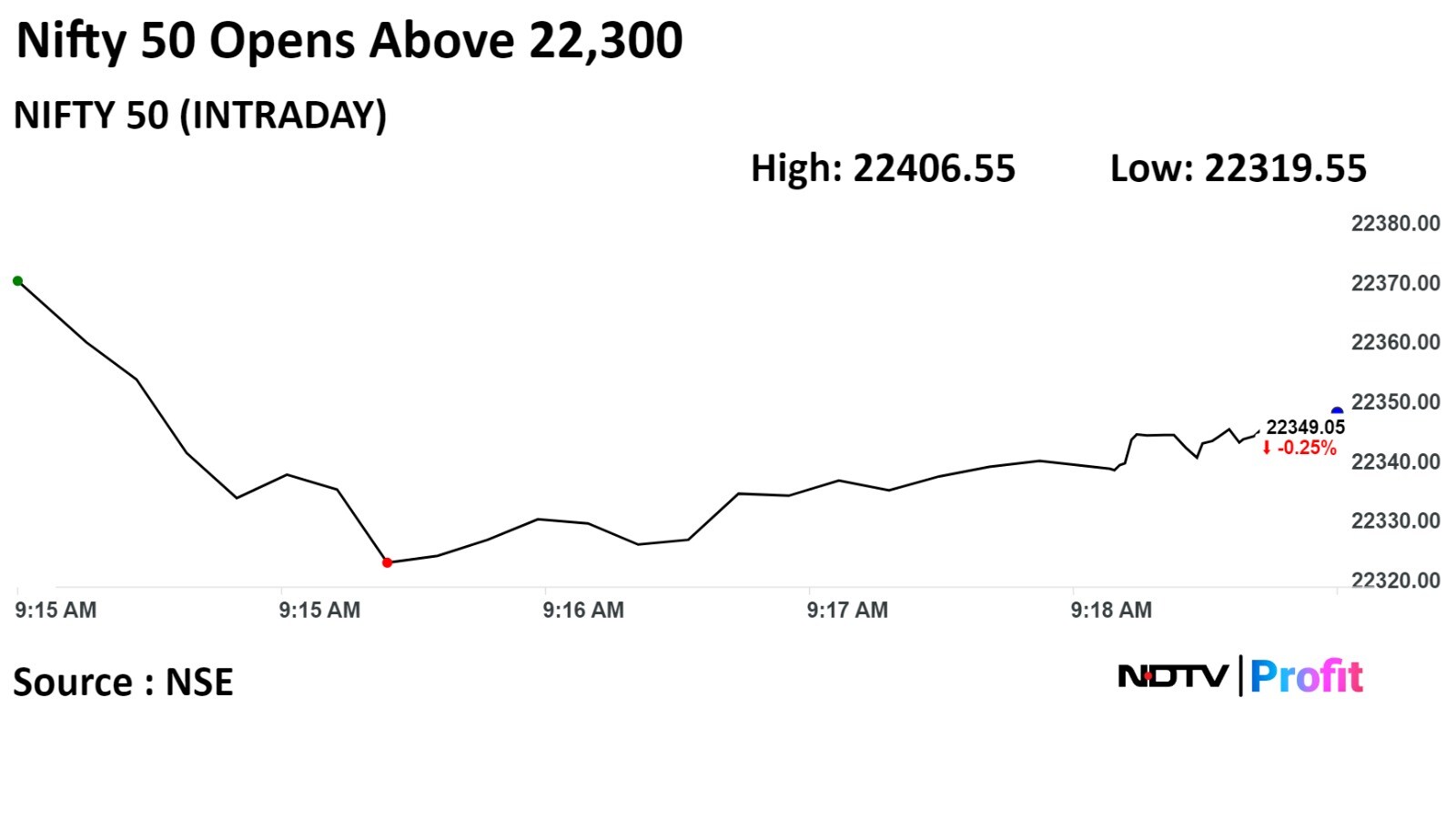

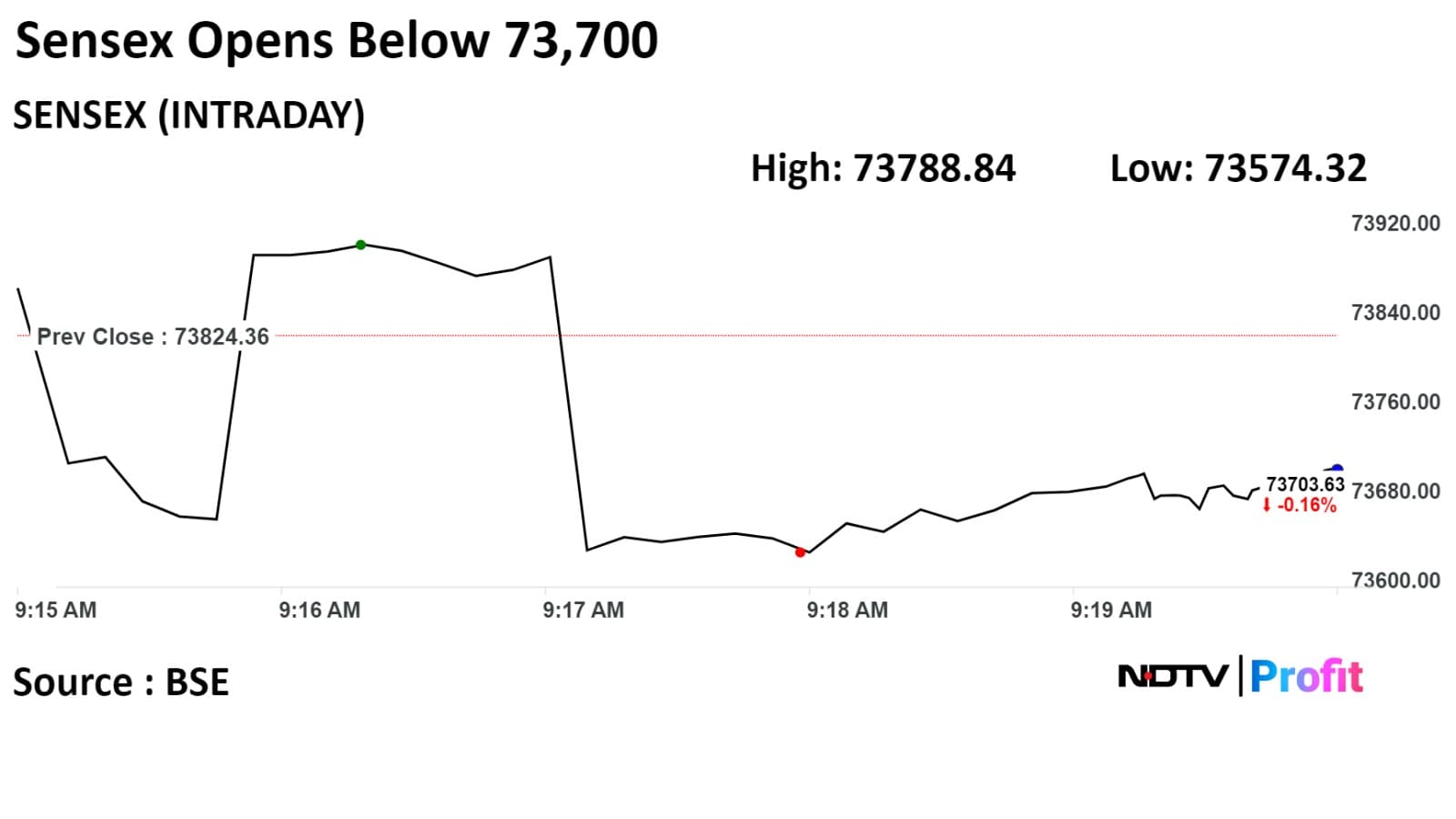

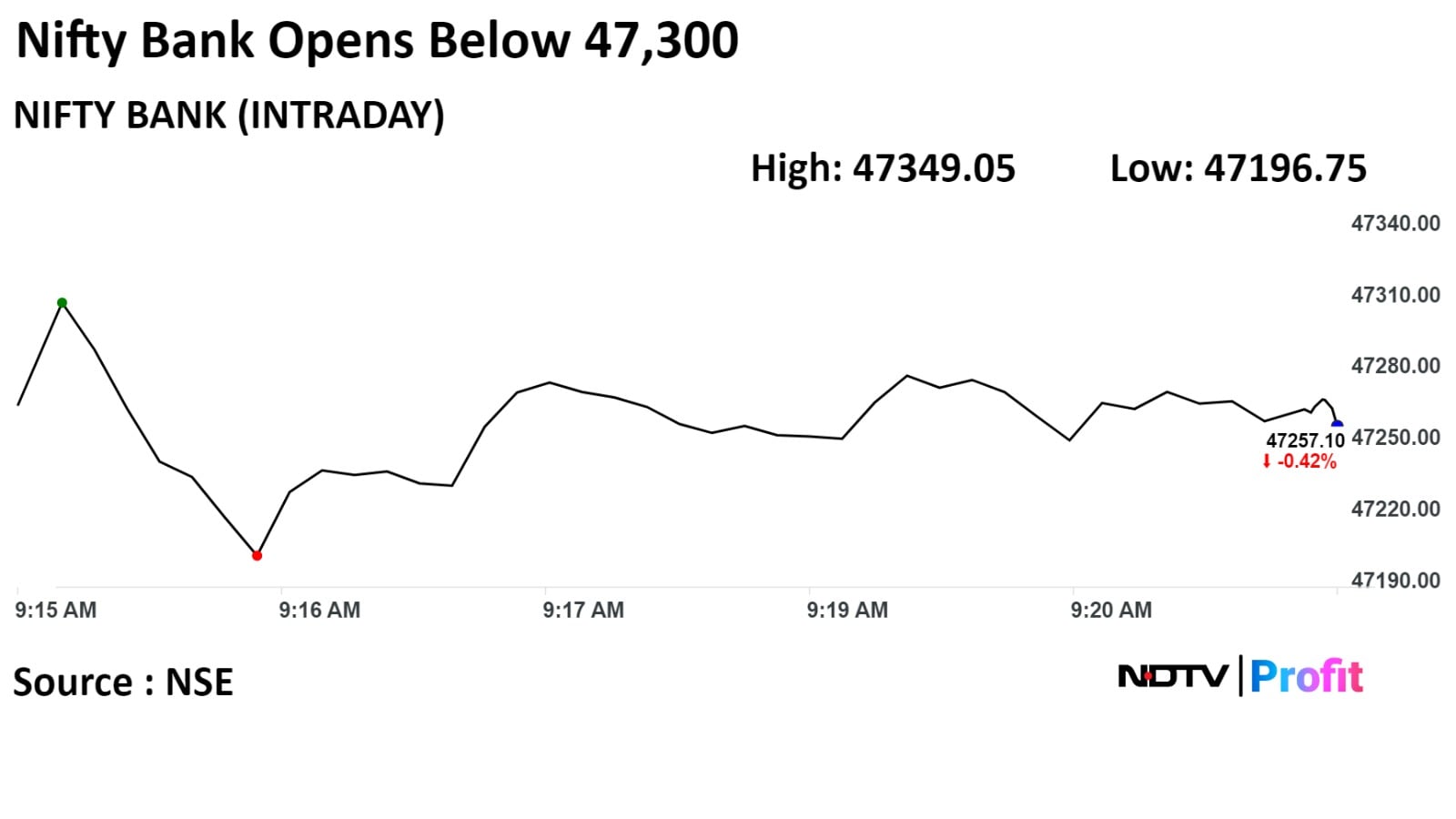

Benchmark equity indices opened lower, snapping their four-day rally as shares of HDFC Bank and ICICI Bank dragged.

At pre-open, the S&P BSE Sensex Index was down 104.87 or 0.14% at 73,767.42 while the NSE Nifty 50 was at 22,371.25, down 34.35 points or 0.15%.

"The Nifty 50 index is attempting to absorb all of the selling pressure emerging around 22450 -22500 levels, suggesting efforts to take out the fragile sentiment," said by Avdhut Bagkar Technical and Derivatives Analyst, StoxBox. "The price action denotes a positive stance and unless 22000 is breached, the upside momentum retains a bullish undertone."

Benchmark equity indices opened lower, snapping their four-day rally as shares of HDFC Bank and ICICI Bank dragged.

At pre-open, the S&P BSE Sensex Index was down 104.87 or 0.14% at 73,767.42 while the NSE Nifty 50 was at 22,371.25, down 34.35 points or 0.15%.

"The Nifty 50 index is attempting to absorb all of the selling pressure emerging around 22450 -22500 levels, suggesting efforts to take out the fragile sentiment," said by Avdhut Bagkar Technical and Derivatives Analyst, StoxBox. "The price action denotes a positive stance and unless 22000 is breached, the upside momentum retains a bullish undertone."

Benchmark equity indices opened lower, snapping their four-day rally as shares of HDFC Bank and ICICI Bank dragged.

At pre-open, the S&P BSE Sensex Index was down 104.87 or 0.14% at 73,767.42 while the NSE Nifty 50 was at 22,371.25, down 34.35 points or 0.15%.

"The Nifty 50 index is attempting to absorb all of the selling pressure emerging around 22450 -22500 levels, suggesting efforts to take out the fragile sentiment," said by Avdhut Bagkar Technical and Derivatives Analyst, StoxBox. "The price action denotes a positive stance and unless 22000 is breached, the upside momentum retains a bullish undertone."

Benchmark equity indices opened lower, snapping their four-day rally as shares of HDFC Bank and ICICI Bank dragged.

At pre-open, the S&P BSE Sensex Index was down 104.87 or 0.14% at 73,767.42 while the NSE Nifty 50 was at 22,371.25, down 34.35 points or 0.15%.

"The Nifty 50 index is attempting to absorb all of the selling pressure emerging around 22450 -22500 levels, suggesting efforts to take out the fragile sentiment," said by Avdhut Bagkar Technical and Derivatives Analyst, StoxBox. "The price action denotes a positive stance and unless 22000 is breached, the upside momentum retains a bullish undertone."

Benchmark equity indices opened lower, snapping their four-day rally as shares of HDFC Bank and ICICI Bank dragged.

At pre-open, the S&P BSE Sensex Index was down 104.87 or 0.14% at 73,767.42 while the NSE Nifty 50 was at 22,371.25, down 34.35 points or 0.15%.

"The Nifty 50 index is attempting to absorb all of the selling pressure emerging around 22450 -22500 levels, suggesting efforts to take out the fragile sentiment," said by Avdhut Bagkar Technical and Derivatives Analyst, StoxBox. "The price action denotes a positive stance and unless 22000 is breached, the upside momentum retains a bullish undertone."

Benchmark equity indices opened lower, snapping their four-day rally as shares of HDFC Bank and ICICI Bank dragged.

At pre-open, the S&P BSE Sensex Index was down 104.87 or 0.14% at 73,767.42 while the NSE Nifty 50 was at 22,371.25, down 34.35 points or 0.15%.

"The Nifty 50 index is attempting to absorb all of the selling pressure emerging around 22450 -22500 levels, suggesting efforts to take out the fragile sentiment," said by Avdhut Bagkar Technical and Derivatives Analyst, StoxBox. "The price action denotes a positive stance and unless 22000 is breached, the upside momentum retains a bullish undertone."

Benchmark equity indices opened lower, snapping their four-day rally as shares of HDFC Bank and ICICI Bank dragged.

At pre-open, the S&P BSE Sensex Index was down 104.87 or 0.14% at 73,767.42 while the NSE Nifty 50 was at 22,371.25, down 34.35 points or 0.15%.

"The Nifty 50 index is attempting to absorb all of the selling pressure emerging around 22450 -22500 levels, suggesting efforts to take out the fragile sentiment," said by Avdhut Bagkar Technical and Derivatives Analyst, StoxBox. "The price action denotes a positive stance and unless 22000 is breached, the upside momentum retains a bullish undertone."

Benchmark equity indices opened lower, snapping their four-day rally as shares of HDFC Bank and ICICI Bank dragged.

At pre-open, the S&P BSE Sensex Index was down 104.87 or 0.14% at 73,767.42 while the NSE Nifty 50 was at 22,371.25, down 34.35 points or 0.15%.

"The Nifty 50 index is attempting to absorb all of the selling pressure emerging around 22450 -22500 levels, suggesting efforts to take out the fragile sentiment," said by Avdhut Bagkar Technical and Derivatives Analyst, StoxBox. "The price action denotes a positive stance and unless 22000 is breached, the upside momentum retains a bullish undertone."

Shares of ICICI Bank Ltd., Reliance Industries Ltd., HDFC Bank Ltd., Tata Consultancy Services Ltd., and Infosys Ltd. dragged the Nifty.

Meanwhile, those of Tata Motors Ltd., ITC Ltd., Bharti Airtel Ltd., Mahindra & Mahindra Ltd., and UPL Ltd. minimized the losses.

All sectoral indices fell except Nifty Auto which gained 0.8%. Nifty Media fell over 1%.

Broader markets outperformed. The S&P BSE Midcap was 0.28% higher, and the S&P BSE Smallcap was 0.05% higher.

On BSE, six sectors declined and fourteen were higher. The S&P BSE Auto jumped the most.

Market breadth was skewed in favour of buyers. Around 1,576 stocks advanced, 1,377 fell, and 95 stocks remained unchanged on BSE.

At pre-open, the S&P BSE Sensex Index was down 104.87 or 0.14% at 73,767.42 while the NSE Nifty 50 was at 22,371.25, down 34.35 points or 0.15%.

Gets LoI for expansion of master gas phase in Saudi Arabia

Project involves laying of over 800 km of lateral gas pipeline

Source: Exchange filing

The yield on the 10-year bond opened flat at 7.06%.

Source: Bloomberg

The local currency opened flat at 82.90 against the U.S. Dollar.

Source: Bloomberg

Intel pact for providing AI solutions, including Cellular Vehicle-to-Everything application

Source: Exchange filing

Nomura Maintains 'Neutral' on Ceat at Rs 2751 target

Chennai Plant Visit Takeaways:

Capacity expansion scope of 40k PCR tires/ day and 3000 truck radial tyres/ day

Higher export ramp up at plant on faster SKU rollout, shorter product development

Ceat expects 2W replacement demand to pick up over next 2 years

Truck radial tyre demand to remain weak over next few

quarters

Company expects exports to see good traction led by US entry

Recent uptick in crude and rubber prices to to come in Q1FY25

Expects Ceat to deliver 8% revenue CAGR over FY24-26

Expects Ceat's EBITDA margins to stabilize at 13% over FY25-26

Motilal Oswal Maintains BUY on Ceat at Rs 3290 target

Chennai Plant Visit Takeaways:

Stable domestic OEM outlook, replacement demand pickup, softening RM prices to help margins in FY24

Focus on V/2W/OHT/exports to help margins

Capex plans to benefit FCF and be long-term growth catalyst

Current EPS does not fully capture new capacity ramp-up and capex plans

RM costs could see an uptick in 1QFY25

Exports contribution target at 25% of revenues vs 18% in FY23

Price target of Rs 570 (earlier Rs 500)

Conditions apt to take the bold call

Confident of increasing relevance upon assessment of ecommerce ecosystem, recent developments

Peers have limited tools from unrelenting pricing pressure of Delhivery

Delhivery business model will magnify gains from volume gains

See revenue CAGR of ~20% over FY2024E-32E, adj. Ebitda margin of 50-250 bps

Buyback for raising up to Rs 4,000 crore

Buyback entitlement for reserved category set at 7 shares for every 27 held on record date

Buyback entitlement for general category set at 1 share for every 82 held on record date

Source: Exchange filing

Land parcel to have an estimated revenue potential of about Rs 3,000 crore

Source: Exchange filing

Bank has co-lending relationships with few NBFCs starting May 2021

Bank's gold co-lending arrangement with IIFL Finance has been in existence since August 2021

As of now, Bank's portfolio performance has been satisfactory

Have due diligence process to give reasonable assurance on the co-lending portfolio

Source: Exchange filing

Jefferies maintains buy on IIFL Finance with a TP of Rs 765 per share

IIFL Gold loan constitutes 32% of consol AUM

Prolonged restrictions can cause impact on earnings

Gold loans have higher ROA and higher run down rates

Gold loans is 63% of co-lending AUM

Spreads on co-lending gold loans higher at 8-9% vs 2-3% in housing loans

Restriction stays for ~9months: impact on FY25 EPS at 25-30% and ROE of 5-5.5%

JP Morgan

Rating: Overweight; TP unchanged at Rs 1,000

Revises bull case for the stock to Rs 1,200

Demerger another step in simplifying structure

Tata Motors CV multiples could expand post demerger

More clarity needed on synergies in PV businesses

Nomura

Rating: Hold; TP unchanged at Rs 900

CV valuation seen at 12X EV/EBITDA, or ~20% premium to Ashok Leyland

This implies ~35% of SOTP from CV business, implying value/share of Rs 330

PV valuation seen at 5X EV/EBITDA, or ~25% discount to Maruti Suzuki

EV valuation seen at $3.6 billion as of last funding by TPG

Nuvama

No immediate impact of demerger on passive indices

CV to be smaller entity, PV to command higher valuation

Merger of DVR to get completed in 6-8 months from now

Sentiment positive as demerger follows subsidiarisation in 2022

Potential risk of roll cost contraction near completion of demerger

Emkay Downgrades To Reduce

Downgrade to Reduce, TP raised to Rs 950 (vs Rs 925 earlier)

Demerger shows PV, CV units can operate on self-sustaining cash flows

Target price raised to account for potential pure-play optionality in CVs

Downgrade shows limited upside after recent run-up

Investec

Rating: Hold; TP unchanged at Rs 900

CV valuation seen at 12X EV/EBITDA, or ~20% premium to Ashok Leyland

This implies ~35% of SOTP from CV business, implying value/share of Rs 330

PV valuation seen at 5X EV/EBITDA, or ~25% discount to Maruti Suzuki

EV valuation seen at $3.6 billion as of last funding by TPG

Motilal Oswal

Downgrade Tata Motors to Neutral from BUY with an unchanged TP of INR1,000

Demerger into two separate entities seems to be a step in right direction

For PV business they factor in 8.5% volume growth in FY25E/FY26E each

For Indian CV business they factor in 6% volume growth in FY25E/FY26E each

For JLR they factor in 7% volume growth in FY25E/FY26E each

Expects the consolidated entity to become net cash by FY26E

U.S. Dollar Index at 103.87

U.S. 10-year bond yield at 4.22%

Brent crude down 0.07% at $82.74 per barrel

Nymex crude down 0.17% at $78.61 per barrel

GIFT Nifty was down 25 points or 0.11% at 22,494.

Bitcoin was up 1.59% at $68,567.13

Nifty March futures down by 0% to 22,500.95 at a premium of 95.35 points.

Nifty March futures open interest down by 0.22%.

Nifty Bank March futures up by 0.05% to 47,685.65 at a premium of 229.55 points.

Nifty Bank March futures open interest down by 0.8.

Nifty Options March 7 Expiry: Maximum Call open interest at 23,000 and Maximum Put open interest at 22,000.

Bank Nifty Options March 6 Expiry: Maximum Call Open Interest at 49,000 and Maximum Put open interest at 47,000.

Securities in ban period: Zeel.

Price Band changes from 10% to 5%: Balaji Telefilms, Wockhardt.

Price Band changes from 20% to 10%: Data Patterns.

Ex/record bonus issue: Capri Global Capital.

Moved into short-term ASM framework: Action Construction Equipment.

Moved out short-term ASM framework: Bf Utilities.

Exicom Tele-Systems: The company's shares will debut on the stock exchanges on Wednesday at an issue price of Rs 142 apiece. The Rs 429 crore IPO was subscribed 129.54 times on its third and final day. Bids were led by institutional investors (121.8 times), retail investors (119.59 times), and non-institutional investors (153.22 times).

Platinum Industries: The company's shares will debut on the stock exchanges on Wednesday at an issue price of Rs 171 apiece. The Rs 235.32 crore IPO was subscribed 2.08 times on its third and final day. Bids were led by institutional investors (151 times), retail investors (50.99 times), and non-institutional investors (141.83 times).

R K Swamy: The public issue was subscribed to 2.19 times on day 1. The bids were led by non-institutional investors (2.97 times), retail investors (7.87 times), and institutional investors (0.01 times).

Mukka Proteins: The public issue was subscribed to 136.99 times on day 3. The bids were led by non-institutional investors (250.38 times), retail investors (58.25 times), and institutional investors (189.28 times).

Swan Energy: Leading Light Fund VCC The Triumph Fund sold 25.18 lakh shares (0.95%) at Rs 721.09 apiece.

Tourism Finance Corp: Shruti Mohta bought 4.75 lakh shares (0.52%) at Rs 227.06 apiece.

Chambal Fertilizers: Promoter Zuari Industries created a pledge of 34.75 lakh shares on Feb. 28.

Tata Motors: The company has approved a proposal to split the company into two separate listed entities for passenger and commercial vehicles as it looks to boost growth and improve accountability.

IIFL Finance: The Reserve Bank of India has directed the company to cease and desist from disbursing gold loans with immediate effect. However, the company can continue servicing its existing loans.

State Bank of India: The public sector bank has filed a plea before the Supreme Court seeking an extension of its March 6 deadline to furnish data pertaining to the electoral bonds scheme.

Macrotech Developers: The company has launched its qualified institutional placement to raise Rs 3,300 crore.

AU Small Finance Bank: The Reserve Bank of India has approved the merger of Fincare Small Finance Bank with the company.

Jio Financials Services: Promoters Sikka Ports and Terminals, Jamnagar Utilities and Power will acquire up to 14 crore shares of the company.

Elantas Beck India: The company will enter into a contract manufacturing arrangement with ACTEGA GmbH, a sister company of the ALTANA Group, to supply commercial shipments.

Brigade Enterprises: The company announced the launch of Dioro at Brigade El Dorado. The project size is around 6.1 million square feet, with a potential revenue value of Rs 380 crore.

Jindal Stainless: The company commenced the maiden usage of green hydrogen in its stainless-steel plant in Hisar, Haryana.

Easy Trip Planners: The company with Punjab National Bank has introduced the PNB EMT Co-branded Credit Card. This card offers rewards for travel-related spending, including flights, hotels, and holiday packages.

Cyient: The company partnered with Mass Medic to accelerate MedTech innovation.

Oil and Natural Gas Corp.: The company appointed Nandan Verma as the executive director.

NTPC: The company’s unit signed a joint venture agreement with Uttar Pradesh Rajya Vidyut Utpadan Nigam for the development of renewable power parks and projects in Uttar Pradesh.

AGS Transact Technologies: The company’s digital payments brand Ongo has partnered with Patanjali Ayurved to launch open-loop cobranded prepaid cards. These prepaid cards can be accepted on any device on the Rupay network in India.

Tanla Platforms: The company announced the launch of Messaging as a Platform for Telcos to support Google Rich Business Messaging.

LTIMindtree: The company's product division, Fosfor, announced the launch of the Fosfor Decision Cloud.

NBCC: The company’s unit received an order worth Rs 92 crore from the Post Graduate Institute of Medical Education and Research, Chandigarh.

Garden Reach Shipbuilders & Engineers: The company has signed a Memorandum of Understanding with the Indian Register of Shipping to develop green energy and autonomous vessels.

Krishna Institute of Medical Sciences: The company will establish a new 300-bed multi-specialty hospital in Thane, Mumbai, with an investment of approximately Rs 500 crore.

Thomas Cook: The company’s subsidiary has acquired a 50% stake in 500 FT Investment L.L.C., UAE, to establish a travel-related business.

Mishtann Foods: The company has received in-principal approval from BSE for a proposed rights issue of equity shares for an amount not exceeding Rs 49.90 crore.

Asian markets were mixed after falling in the early trade with China's CSI 300 rebounded from its day's low to trade higher. Australia's S&P /ASX 200 also erased most of its losses and were trading flat. Taiwan's Taiex added 0.6% while Hong Kong's Hang Seng fell 1.4%.

China has set an ambitious growth target of 5% in 2024, raising expectations for officials to unleash more stimulus as they try to lift confidence in a slowing economy.

The relentless rally in U.S. stocks took a breather on Monday, with traders awaiting this week’s batch of job data and remarks from key Federal Reserve officials for clues on the interest-rate outlook, according to Bloomberg.

Brent crude was trading 0.14% lower at $82.68 a barrel. Gold was lower by 0.09% at $2,112.61 an ounce.

The March futures contract of the GIFT Nifty index traded 25 points or 0.11% lower at 22,494.

India's benchmark indices ended at a fresh record closing high for the third day in a row on Monday, led by index heavyweights Reliance Industries Ltd., ICICI Bank Ltd. and NTPC Ltd.

The NSE Nifty 50 settled at 27.20 points or 0.12%, higher at 22,405.60, and the S&P BSE Sensex gained 66.14 points or 0.09%, to end at 73,872.29. The Nifty hit a fresh record high of 22,440.90 and the Sensex touched a lifetime high of 73,990.13.

Overseas investors turned net sellers of Indian equities on Monday after two sessions of buying. Foreign portfolio investors sold stocks worth Rs 564.1 crore, while domestic institutional investors bought equities worth Rs 3,542.8 crore, the NSE data showed.

The Indian rupee closed flat at 82.89 against the U.S. dollar.

Asian markets were mixed after falling in the early trade with China's CSI 300 rebounded from its day's low to trade higher. Australia's S&P /ASX 200 also erased most of its losses and were trading flat. Taiwan's Taiex added 0.6% while Hong Kong's Hang Seng fell 1.4%.

China has set an ambitious growth target of 5% in 2024, raising expectations for officials to unleash more stimulus as they try to lift confidence in a slowing economy.

The relentless rally in U.S. stocks took a breather on Monday, with traders awaiting this week’s batch of job data and remarks from key Federal Reserve officials for clues on the interest-rate outlook, according to Bloomberg.

Brent crude was trading 0.14% lower at $82.68 a barrel. Gold was lower by 0.09% at $2,112.61 an ounce.

The March futures contract of the GIFT Nifty index traded 25 points or 0.11% lower at 22,494.

India's benchmark indices ended at a fresh record closing high for the third day in a row on Monday, led by index heavyweights Reliance Industries Ltd., ICICI Bank Ltd. and NTPC Ltd.

The NSE Nifty 50 settled at 27.20 points or 0.12%, higher at 22,405.60, and the S&P BSE Sensex gained 66.14 points or 0.09%, to end at 73,872.29. The Nifty hit a fresh record high of 22,440.90 and the Sensex touched a lifetime high of 73,990.13.

Overseas investors turned net sellers of Indian equities on Monday after two sessions of buying. Foreign portfolio investors sold stocks worth Rs 564.1 crore, while domestic institutional investors bought equities worth Rs 3,542.8 crore, the NSE data showed.

The Indian rupee closed flat at 82.89 against the U.S. dollar.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.