Overseas investors stay net buyers for the second consecutive day of Indian equities on Tuesday.

Foreign portfolio investors mopped up stocks worth Rs 656.57 crore, according to provisional data from the National Stock Exchange.

Domestic institutional investors stayed net sellers and sold equities worth Rs 369.29 crore, the NSE data showed.

Foreign institutions have been net buyers of Rs 5449 crore worth of Indian equities so far in 2023, according to data from the National Securities Depository Ltd., updated till the previous trading day.

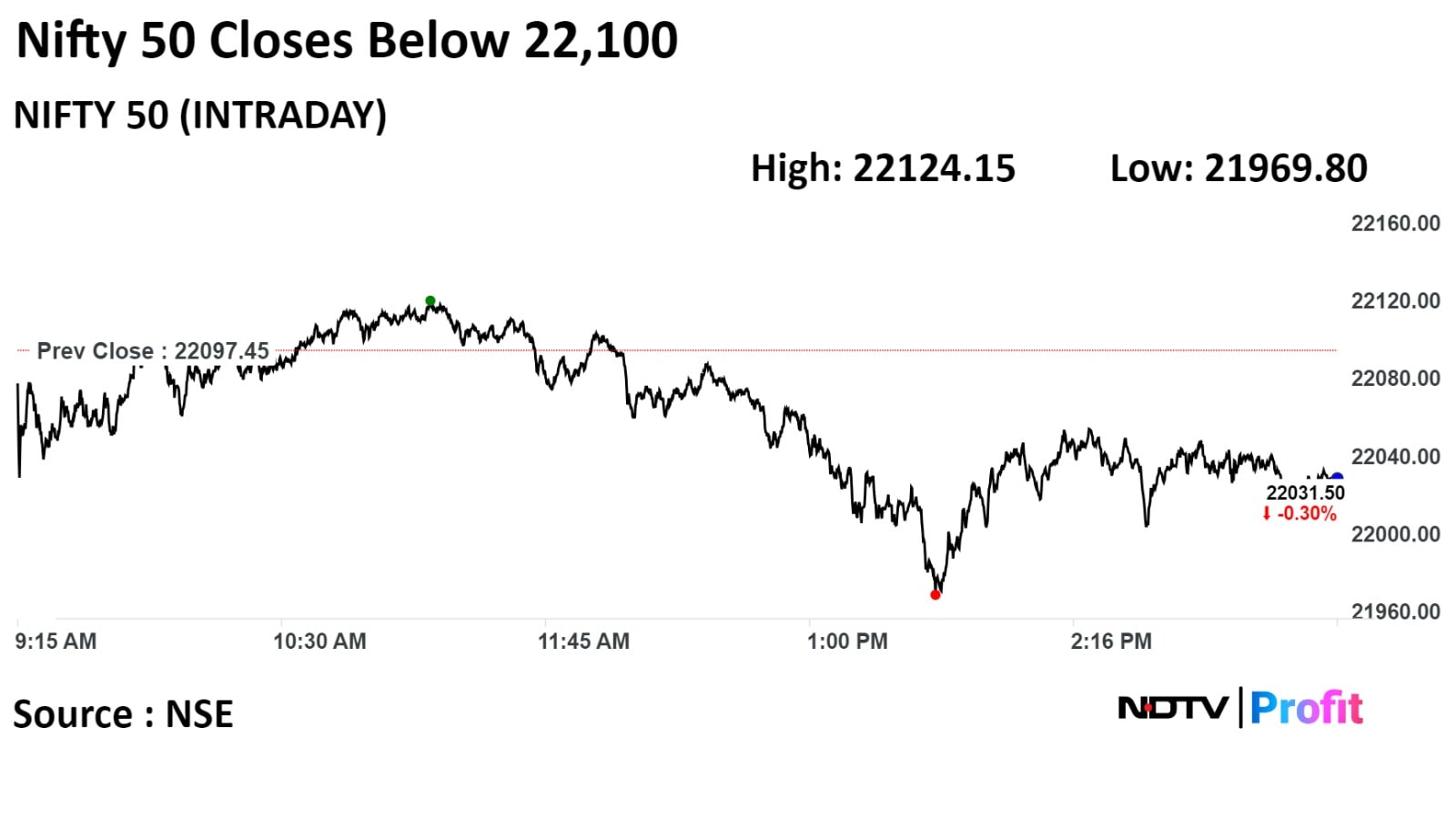

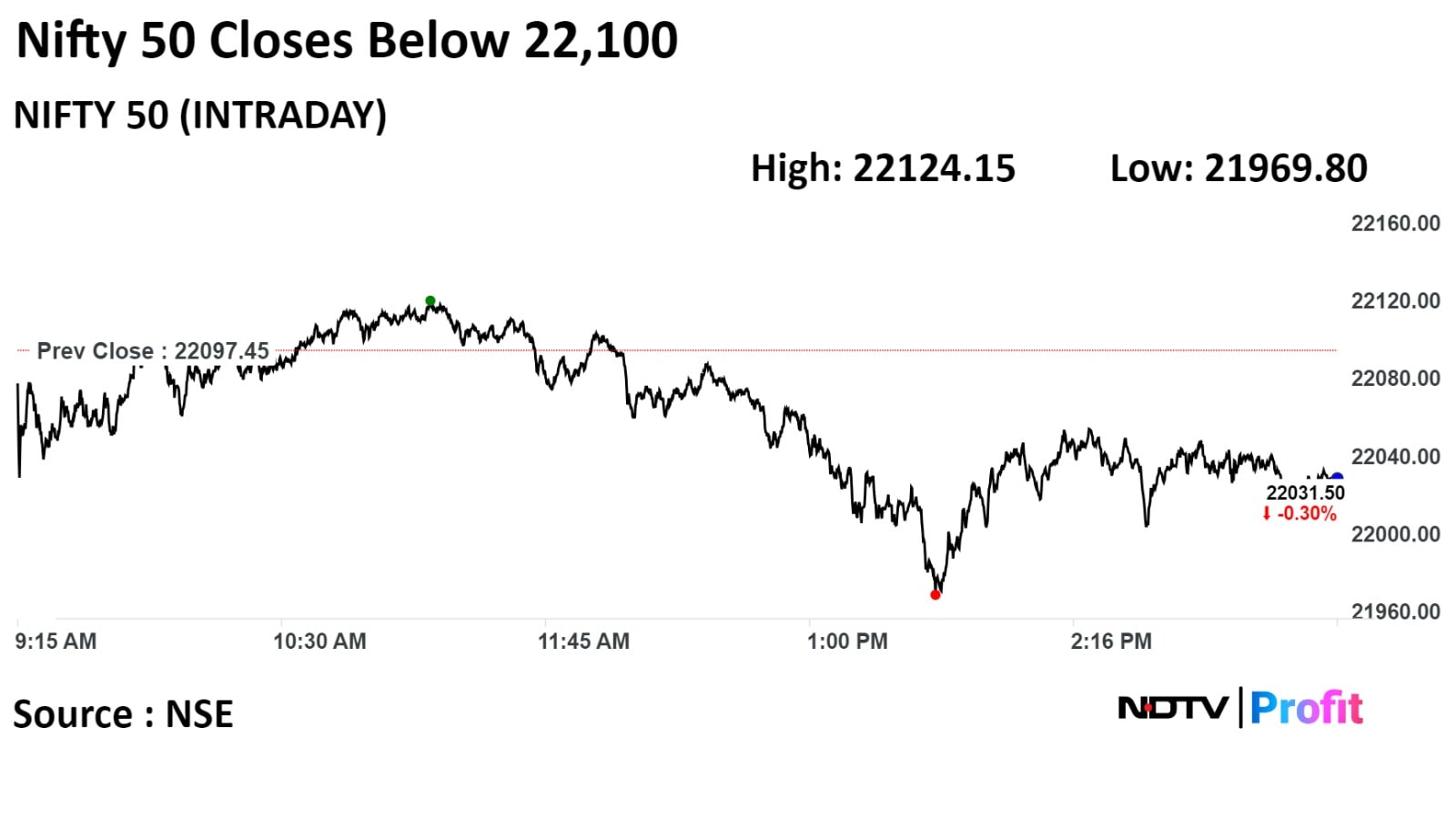

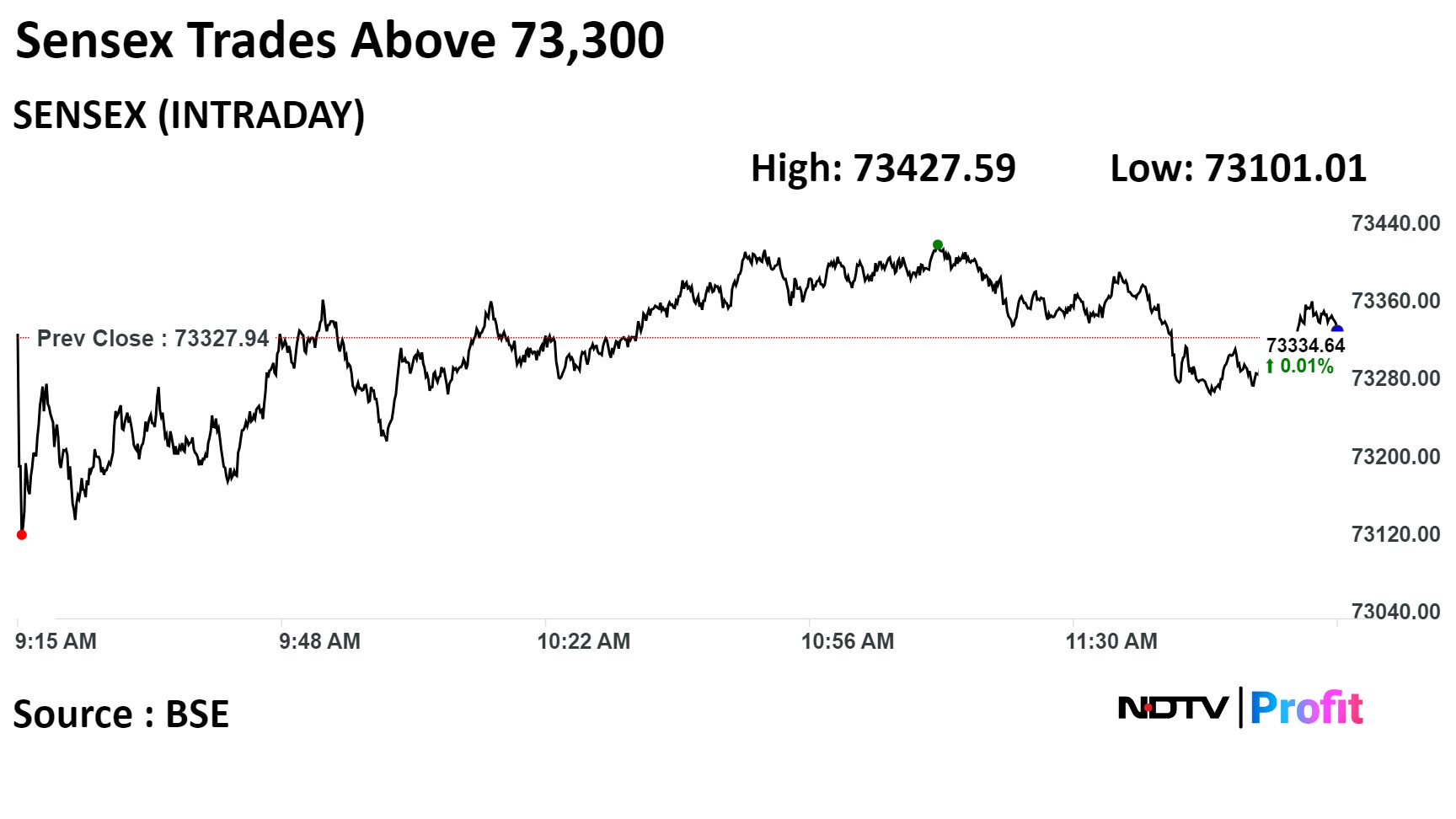

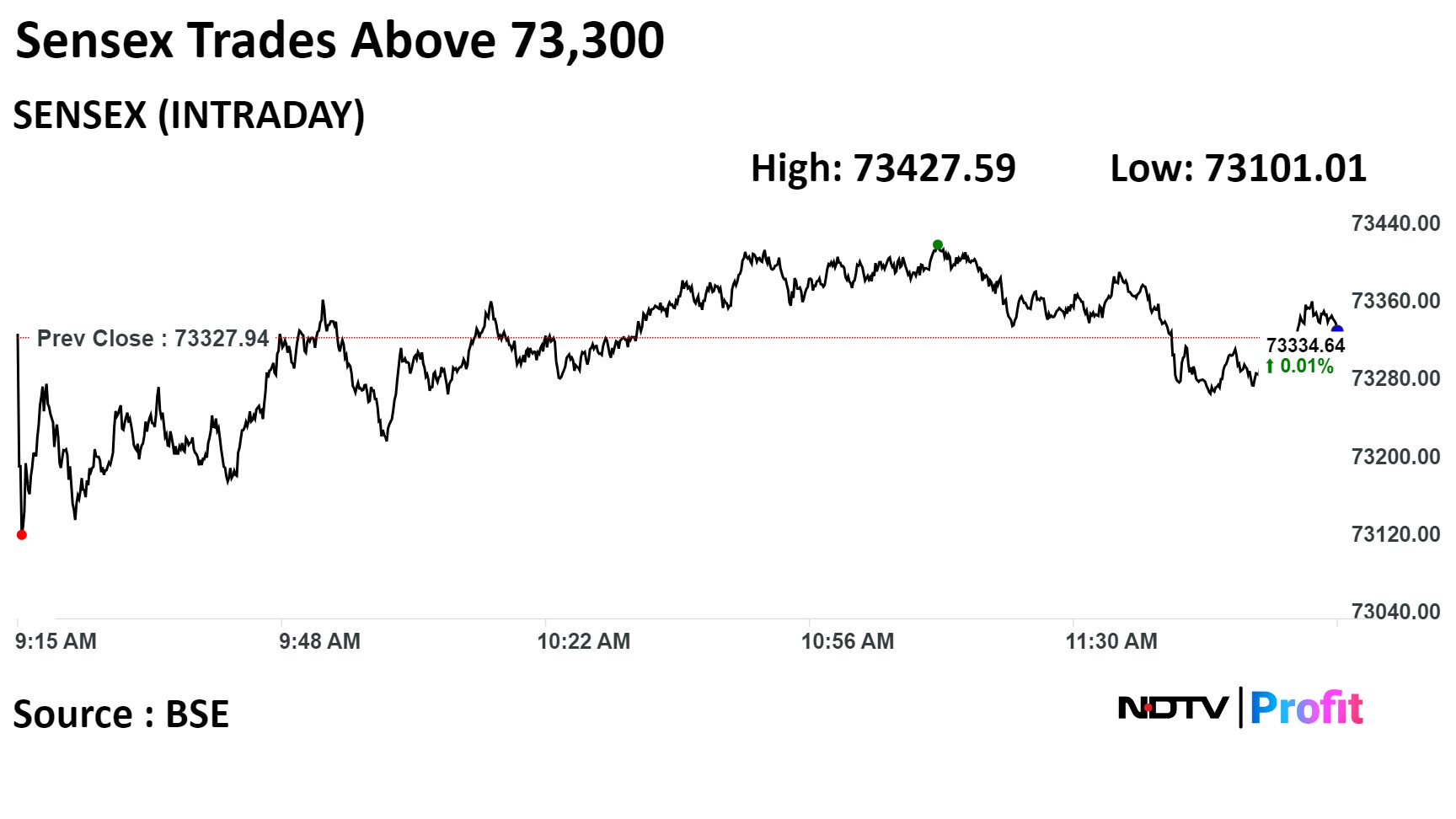

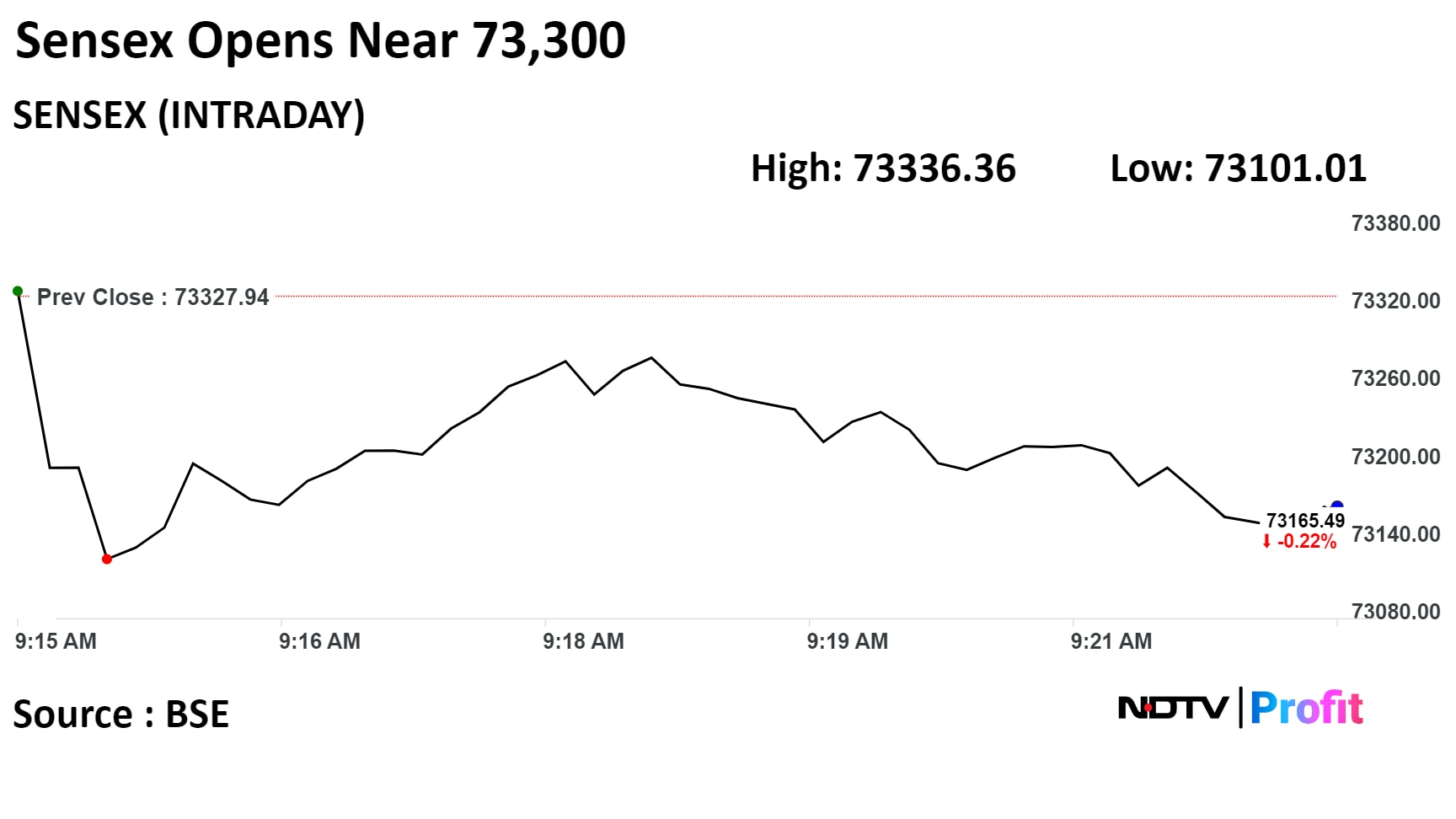

The NSE Nifty 50 closed 65 points or 0.29% lower at 22,032.30, while the S&P BSE Sensex ended 199 points or 0.27% down at 73,128.77.

The local currency weakened 19 paise to close at 83.08 against the U.S dollar on Tuesday.

It closed at 82.89 on Monday.

Source: Bloomberg

Snapping a five-day winning streak, domestic benchmark equity indices settled lower on Tuesday as losses in shares of Reliance Industries Ltd, Infosys Ltd, and Tata Consultancy Services Ltd.

The benchmark NSE Nifty 50 settled 65.15 points or 0.29% lower at 22,032.30, while the S&P BSE Sensex ended 199.16 points or 0.27% down at 73,128.77.

On Tuesday, the Nifty 50 index touched a record high of 22,124.15, and Sensex rose to a fresh high of 73,427.59.

"The broad market exhibited profit booking following a good performance by the IT sector amid weak global cues. Investors are contemplating whether the current euphoria in markets has gone farfetched, especially with elevated domestic valuations in mid & small caps. FII flows are mixed due to a lack of fresh triggers. Oil prices stayed firm amid undeterred geopolitical tensions. The latest IIP growth signals near-term softness," said Vinod Nair, head of research, Geojit Financial Services.

Snapping a five-day winning streak, domestic benchmark equity indices settled lower on Tuesday as losses in shares of Reliance Industries Ltd, Infosys Ltd, and Tata Consultancy Services Ltd.

The benchmark NSE Nifty 50 settled 65.15 points or 0.29% lower at 22,032.30, while the S&P BSE Sensex ended 199.16 points or 0.27% down at 73,128.77.

On Tuesday, the Nifty 50 index touched a record high of 22,124.15, and Sensex rose to a fresh high of 73,427.59.

"The broad market exhibited profit booking following a good performance by the IT sector amid weak global cues. Investors are contemplating whether the current euphoria in markets has gone farfetched, especially with elevated domestic valuations in mid & small caps. FII flows are mixed due to a lack of fresh triggers. Oil prices stayed firm amid undeterred geopolitical tensions. The latest IIP growth signals near-term softness," said Vinod Nair, head of research, Geojit Financial Services.

Snapping a five-day winning streak, domestic benchmark equity indices settled lower on Tuesday as losses in shares of Reliance Industries Ltd, Infosys Ltd, and Tata Consultancy Services Ltd.

The benchmark NSE Nifty 50 settled 65.15 points or 0.29% lower at 22,032.30, while the S&P BSE Sensex ended 199.16 points or 0.27% down at 73,128.77.

On Tuesday, the Nifty 50 index touched a record high of 22,124.15, and Sensex rose to a fresh high of 73,427.59.

"The broad market exhibited profit booking following a good performance by the IT sector amid weak global cues. Investors are contemplating whether the current euphoria in markets has gone farfetched, especially with elevated domestic valuations in mid & small caps. FII flows are mixed due to a lack of fresh triggers. Oil prices stayed firm amid undeterred geopolitical tensions. The latest IIP growth signals near-term softness," said Vinod Nair, head of research, Geojit Financial Services.

Snapping a five-day winning streak, domestic benchmark equity indices settled lower on Tuesday as losses in shares of Reliance Industries Ltd, Infosys Ltd, and Tata Consultancy Services Ltd.

The benchmark NSE Nifty 50 settled 65.15 points or 0.29% lower at 22,032.30, while the S&P BSE Sensex ended 199.16 points or 0.27% down at 73,128.77.

On Tuesday, the Nifty 50 index touched a record high of 22,124.15, and Sensex rose to a fresh high of 73,427.59.

"The broad market exhibited profit booking following a good performance by the IT sector amid weak global cues. Investors are contemplating whether the current euphoria in markets has gone farfetched, especially with elevated domestic valuations in mid & small caps. FII flows are mixed due to a lack of fresh triggers. Oil prices stayed firm amid undeterred geopolitical tensions. The latest IIP growth signals near-term softness," said Vinod Nair, head of research, Geojit Financial Services.

Reliance Industries Ltd, Infosys Ltd, Tata Consultancy Services Ltd, HCL Technologies Ltd, and NTPC Ltd weighed on the indices.

HDFC Bank Ltd, ITC Ltd, Larsen & Toubro Ltd, Titan Company Ltd, and Tata Steel Ltd contributed positively to the indices.

On NSE, seven out of 12 sectors declined, while five advanced. Nifty Realty declined 1.7% to become the worst performer. Nifty IT snapped its two-day rally and fell 1.28% to emerge as the second worst performer.

The Nifty Metal index rose 0.99% to be come the top performer among sectoral indices.

Broader markets also fell. The BSE Midcap was down 0.31%, while the Smallcap was 0.43% lower.

Thirteen out of the 20 sectors compiled by BSE Ltd. declined, while seven advanced. Realty and Utilities fell the most.

Market breadth was skewed in favour of sellers. Around 2,506 stocks fell, 1,334 stocks rose, and 89 remained unchanged

Increased stake to 2.79% in Dec. 2023 from 1.58% in Sept. 2023

Bought 15.1 crore shares in Q3

Current holding value at Rs 16,436 crore vs Rs 8,744.3 crore as on Sept. 29

Source: Exchange Filing

Liquidity is tight and deposit growth is coming at a high price, said Shyam Srinivasan, managing director & CEO, Federal Bank

Deposit growth is from client money as opposed to buying bulk in market

Near-time margin impact is expected

Long-term guidance on return ratios remain intact

Regulator not inclined to offer one-year extensions for MD & CEO post

Board will submit candidates' names to RBI by end-April or early May

Alert: On Jan. 5, RBI asked the bank to submit at least two fresh names for the MD & CEO post

Source: Federal Bank Q3FY24 Press Conference

The unit has an annual installed capacity of 15000 MT.

Source: Exchange Filing

Business updates reflect LDR expansion and LCR contraction

NIM downside expected

Margins hit on Kotak Mahindra Bank, HDFC Bank, Axis Bank, Federal Bank and ICICI Bank for FY25E/26E

Unsecured credit to moderate; system credit growth at 13%-14% in FY24-26E

Operating leverage and benign credit cost to support RoA and drive valuations

Consolidated revenue at Rs 92.02 crore, up 1.03%

Consolidated Ebitda at Rs 36.07 crore, down 11.84%

Consolidated Margin at 39.19%, down 571 bps

Consolidated net profit at Rs 31.04 crore, down 6.22%

DP Eurasia has accepted the offer for JFN's acquisition of additional 30.3% stake

To acquire DP Eurasia shares at 110 pence apiece

Source: Exchange Filing

Limited levers for RoA stability

Wage revision, normalisation of credit cost and risk volatility from unsecured Xpress Credit and opex to play in

RoA likely to be below 1%

Rating 'sell' with target price of Rs 600

Scrips of FSN E-Commerce Ventures Ltd, popularly known as Nykaa, fell as much as 5.20% to Rs 170.50 apiece, the lowest level since Jan 9 after 16.4 lakh shares or 0.1% equity changed hands in a large trade at Rs 171.85 apiece. Buyers and sellers are not immediately known.

It traded 4.59% lower at Rs 171.60 apiece, as of 1:49 p.m. This compares to a 0.33% decline in the NSE Nifty 50 Index.

It has risen 22.01% in 12 months. Total traded volume so far in the day stood at 1.4 times its 30-day average. The relative strength index was at 46.72.

Out of 24 analysts tracking the company, five maintain a 'buy' rating, five recommend a 'hold,' and five suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 4.7%.

Scrips of FSN E-Commerce Ventures Ltd, popularly known as Nykaa, fell as much as 5.20% to Rs 170.50 apiece, the lowest level since Jan 9 after 16.4 lakh shares or 0.1% equity changed hands in a large trade at Rs 171.85 apiece. Buyers and sellers are not immediately known.

It traded 4.59% lower at Rs 171.60 apiece, as of 1:49 p.m. This compares to a 0.33% decline in the NSE Nifty 50 Index.

It has risen 22.01% in 12 months. Total traded volume so far in the day stood at 1.4 times its 30-day average. The relative strength index was at 46.72.

Out of 24 analysts tracking the company, five maintain a 'buy' rating, five recommend a 'hold,' and five suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 4.7%.

16.4 lakh shares changed hands in a large trade

0.1% equity changed hands at Rs 171.85 apiece

Buyers and sellers not known immediately

Source: Bloomberg

Revenue at Rs 323.65 crore, up 10.37%

Ebit at Rs 70.14 crore, up 40.08%

Margin at 21.67%, up 459 bps

Net profit at Rs 68.35 crore, up 43.02%

Net profit at Rs 1,006.7 crore vs Rs 803.61 crore YoY

Net NPA at 0.64%, flat QoQ

Gross NPA at 2.29% vs 2.26% QoQ

NII at Rs 2123.4 crore, up 9% YoY

Consolidated revenue at Rs 1,052.51 crore, up 1.5%

Consolidated net profit at Rs 108.78 crore, up 66.8%

Consolidated Ebitda at Rs 173.9 crore, up 65.8%

Consolidated margin at 16.52% vs 10.11%

Net profit at Rs 1,035.5 crore, up 34% YoY

Gross NPA at 2.04% vs 2.19% QoQ

Net NPA at 0.22% vs 0.23% QoQ

NII at Rs 2,465.76 crore, up 25% YoY

Aster DM Healthcare at 8.16x its 30 day avg

ITI at 7.71x its 30 day avg

Capri Global Capital at 5.67x its 30 day avg

PNC Infratech at 5.25x its 30 day avg

MOIL at 4.24x its 30 day avg

JM Financial at 4.01x its 30 day avg

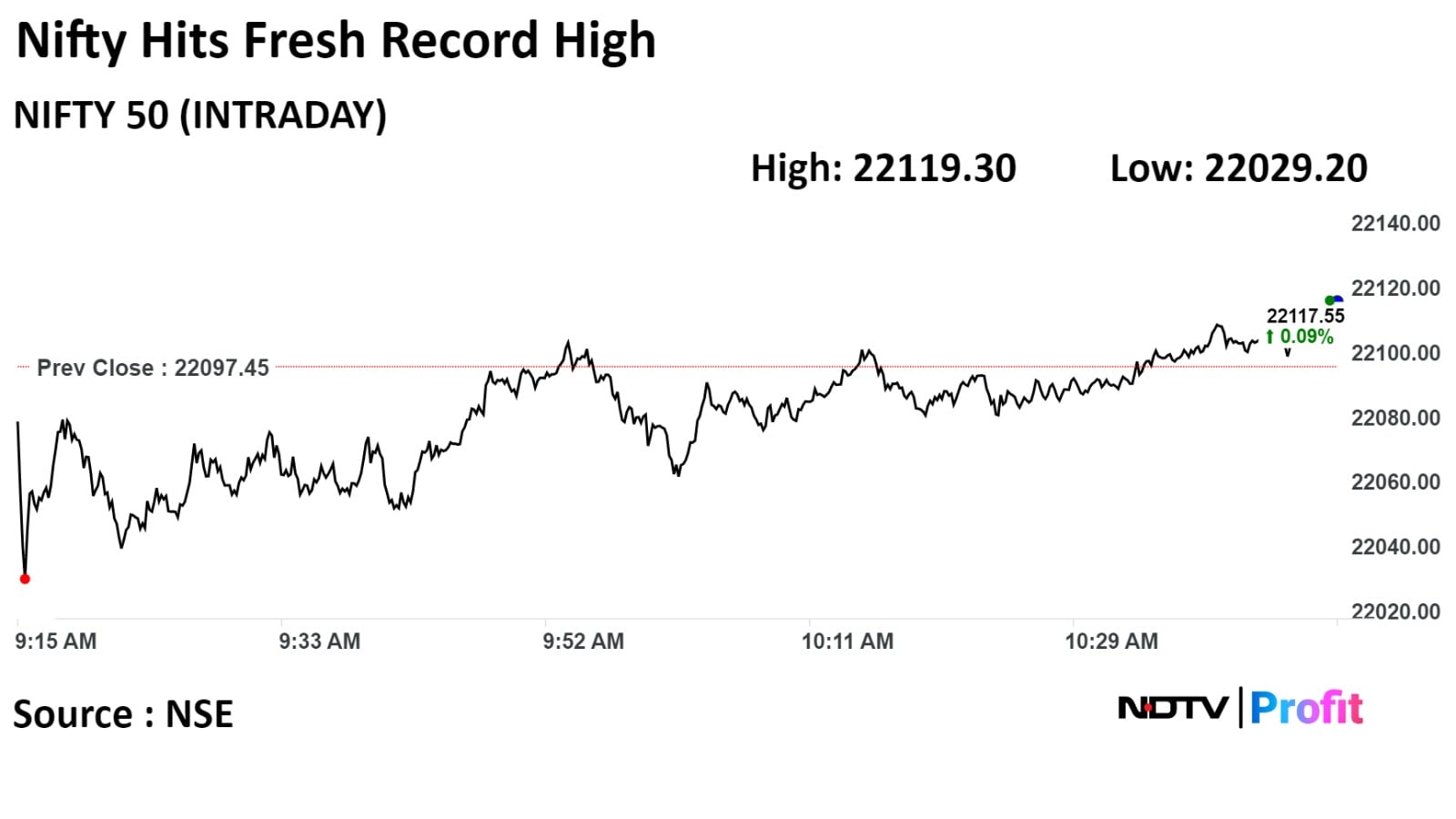

Benchmarks came off their life highs and traded flat through the midday due to a correction in shares of IT companies.

As of 12:05 p.m., Nifty 50 was up 65 points or 0.03% at 22,098.10 and the Sensex traded flat at 73,327.10. Intraday, both Nifty and Sensex hit life highs of 22,124.15 points and 73,427.59 points respectively.

"We have observed that markets tend to perform better six months ahead of election results are announced," said Apurva Sheth, head of market perspectives & research at SAMCO Securities.

"As 2024 is an election year, markets should remain buoyant but one must also expect volatility to shoot up as we get closer to the election results," he said.

Benchmarks came off their life highs and traded flat through the midday due to a correction in shares of IT companies.

As of 12:05 p.m., Nifty 50 was up 65 points or 0.03% at 22,098.10 and the Sensex traded flat at 73,327.10. Intraday, both Nifty and Sensex hit life highs of 22,124.15 points and 73,427.59 points respectively.

"We have observed that markets tend to perform better six months ahead of election results are announced," said Apurva Sheth, head of market perspectives & research at SAMCO Securities.

"As 2024 is an election year, markets should remain buoyant but one must also expect volatility to shoot up as we get closer to the election results," he said.

Benchmarks came off their life highs and traded flat through the midday due to a correction in shares of IT companies.

As of 12:05 p.m., Nifty 50 was up 65 points or 0.03% at 22,098.10 and the Sensex traded flat at 73,327.10. Intraday, both Nifty and Sensex hit life highs of 22,124.15 points and 73,427.59 points respectively.

"We have observed that markets tend to perform better six months ahead of election results are announced," said Apurva Sheth, head of market perspectives & research at SAMCO Securities.

"As 2024 is an election year, markets should remain buoyant but one must also expect volatility to shoot up as we get closer to the election results," he said.

Benchmarks came off their life highs and traded flat through the midday due to a correction in shares of IT companies.

As of 12:05 p.m., Nifty 50 was up 65 points or 0.03% at 22,098.10 and the Sensex traded flat at 73,327.10. Intraday, both Nifty and Sensex hit life highs of 22,124.15 points and 73,427.59 points respectively.

"We have observed that markets tend to perform better six months ahead of election results are announced," said Apurva Sheth, head of market perspectives & research at SAMCO Securities.

"As 2024 is an election year, markets should remain buoyant but one must also expect volatility to shoot up as we get closer to the election results," he said.

Benchmarks came off their life highs and traded flat through the midday due to a correction in shares of IT companies.

As of 12:05 p.m., Nifty 50 was up 65 points or 0.03% at 22,098.10 and the Sensex traded flat at 73,327.10. Intraday, both Nifty and Sensex hit life highs of 22,124.15 points and 73,427.59 points respectively.

"We have observed that markets tend to perform better six months ahead of election results are announced," said Apurva Sheth, head of market perspectives & research at SAMCO Securities.

"As 2024 is an election year, markets should remain buoyant but one must also expect volatility to shoot up as we get closer to the election results," he said.

Benchmarks came off their life highs and traded flat through the midday due to a correction in shares of IT companies.

As of 12:05 p.m., Nifty 50 was up 65 points or 0.03% at 22,098.10 and the Sensex traded flat at 73,327.10. Intraday, both Nifty and Sensex hit life highs of 22,124.15 points and 73,427.59 points respectively.

"We have observed that markets tend to perform better six months ahead of election results are announced," said Apurva Sheth, head of market perspectives & research at SAMCO Securities.

"As 2024 is an election year, markets should remain buoyant but one must also expect volatility to shoot up as we get closer to the election results," he said.

Benchmarks came off their life highs and traded flat through the midday due to a correction in shares of IT companies.

As of 12:05 p.m., Nifty 50 was up 65 points or 0.03% at 22,098.10 and the Sensex traded flat at 73,327.10. Intraday, both Nifty and Sensex hit life highs of 22,124.15 points and 73,427.59 points respectively.

"We have observed that markets tend to perform better six months ahead of election results are announced," said Apurva Sheth, head of market perspectives & research at SAMCO Securities.

"As 2024 is an election year, markets should remain buoyant but one must also expect volatility to shoot up as we get closer to the election results," he said.

Benchmarks came off their life highs and traded flat through the midday due to a correction in shares of IT companies.

As of 12:05 p.m., Nifty 50 was up 65 points or 0.03% at 22,098.10 and the Sensex traded flat at 73,327.10. Intraday, both Nifty and Sensex hit life highs of 22,124.15 points and 73,427.59 points respectively.

"We have observed that markets tend to perform better six months ahead of election results are announced," said Apurva Sheth, head of market perspectives & research at SAMCO Securities.

"As 2024 is an election year, markets should remain buoyant but one must also expect volatility to shoot up as we get closer to the election results," he said.

Shares of Titan Company Ltd., Maruti Suzuki Ltd., Bharat Petroleum Corp Ltd., Larsen & Toubro Ltd., and Tata Motors Ltd., contributed the most to the gains.

Meanwhile, those of Infosys Ltd., HCLTechnologies Ltd., NTPC Ltd., Tata Consultancy Services Ltd., and Reliance Industries Ltd., pulled the index lower.

Sectoral indices were mixed with Nifty Oil & Gas gaining the most by nearly 1% and Nifty Realty lost 1.23%.

The broader markets outperformed; the S&P BSE MidCap Index was up 0.18%, whereas S&P BSE SmallCap Index was 0.22% higher.

Twelve out of 20 sectors compiled by BSE advanced, while eight sectors declined. S&P BSE Consumer Durables rose the most.

Market breadth was skewed in favour of sellers. Around 1889 stocks fell, 1775 stocks rose, and 136 remained unchanged.

Gets Orders from Delhi and Jharkhand

Source: Exchange Filing

Q3 hybrid sale of energy rises by 100% YoY

9-month hybrid portfolio CUF at 41.5% with 750 bps improvement YoY backed by 99.4% plant availability

9-month wind portfolio CUF at 32.2% with 510 bps improvement YoY backed by 95.9% plant availability

9-month consistent high solar portfolio CUF at 24% backed by 99.7% plant availability

Q3 sale of energy falls by 2% YoY

9-month sale of energy at 16,293 mn units, up 59% YoY

Operational capacity at 8,478 MW, up 16% YoY

Source: Exchange Filing

Gets Project from North Western Railway

Source: Exchange Filing

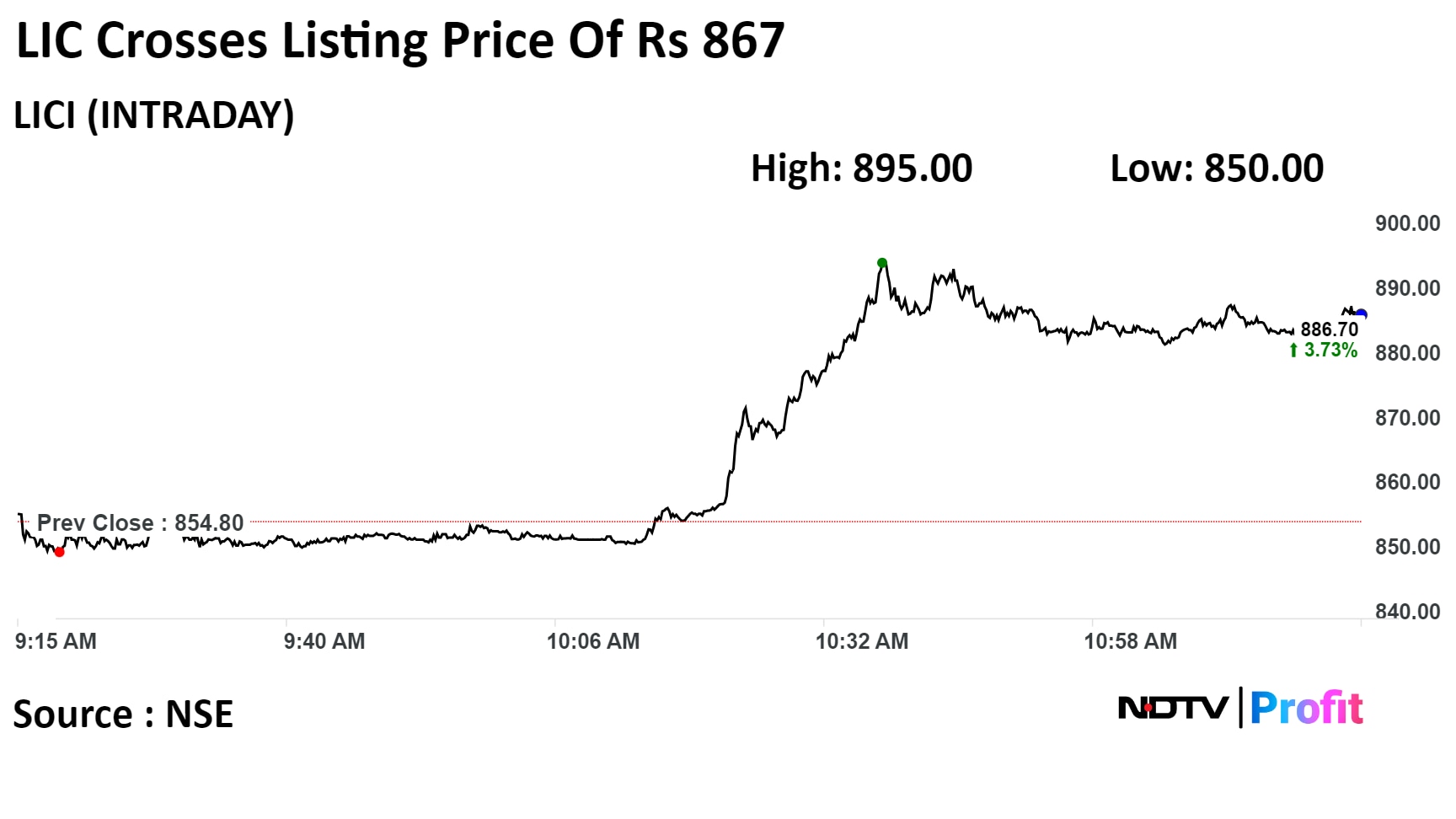

Shares of Life Insurance Corp. Of India jumped to hit its 52-week high and hit a 52-week high of Rs 895. This is the first time that the stock crossed its listing price of Rs 867 per share.

Shares of Life Insurance Corp. Of India jumped to hit its 52-week high and hit a 52-week high of Rs 895. This is the first time that the stock crossed its listing price of Rs 867 per share.

It has risen 25.49% in the last twelve months. Total traded volume so far in the day stood at 2.3 times its 30-day average. The relative strength index was at 71.29, indicating that the stock may be overbought.

Out of 19 analysts tracking the company, 13 maintain a 'buy' rating, five recommend a 'hold,' and one suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 0.9%.

L&T Construction gets order valued between Rs 10,000-15,000 crore to build electrification system

L&T Construction order for Mumbai-Ahmedabad high speed rail project

Source: Exchange Filing

Banks prioritise growth over NIMs; core growth drivers show mixed trend

Lower rates to support loan growth in H2CY24

Deposit rates continue to rise, liquidity deficit at 7yr high

Liquidity shortage of 1.3lk cr in Dec23

13.8 lakh shares changed hands in a large trade

0.01% equity changed hands at Rs 140.3 apiece

Buyers and sellers not known immediately

Source: Bloomberg

Reiterate buy on Dr Reddy's laboratories and Aurobindo Pharma in Pharma

Buy on Apollo hospitals Enterprise and Fortis Healthcare in hospitals

Expects flattish quarter with stable pricing in US generics

Expects weak seasonality in hospitals with festival season and impact from floods in certain markets

Expects strongest quarter from ARPB(gRevlimid), Gland (US, low base for cenexi)

Expects muted quarter in India focused stocks (Alkem, Mankind) and Cipla

20.4 lakh shares changed hands in a large trade

0.03% equity changed hands at Rs 51.45 apiece

Buyers and sellers not known immediately

Source: Bloomberg

Lists at a premium of 11.8% on NSE

Lists at Rs 372 on BSE vs issue price of Rs 331

Lists at a premium of 12.4% on BSE

Source: Exchanges

Shares of PNC Infratech Ltd. jumped to hit their lifetime high today after the company announced that it along with subsidiary PNC Infra Holdings Ltd have executed definitive agreements with Highways Infrastructure Trust to divest 12 of the Company’s road assets.

Shares of PNC Infratech Ltd. jumped to hit their lifetime high today after the company announced that it along with subsidiary PNC Infra Holdings Ltd have executed definitive agreements with Highways Infrastructure Trust to divest 12 of the Company’s road assets.

Initiates coverage with 'buy', price target of Rs 1,202

To benefit from Indian Railways' Rs 75,000-crore rail infra spend plan

Robust revenue visibility for next ~4 years on Rs 28,200-crore order book

Ebitda margin to hover at 11.3%-11.7% in FY24-FY26, with RoE of 24-25%

Forecast Revenue/Ebitda/PAT 35%/43%/54% CAGR over FY23-FY26, respectively

Key risk: Change in the govt. policy or any sharp fall in IR capex

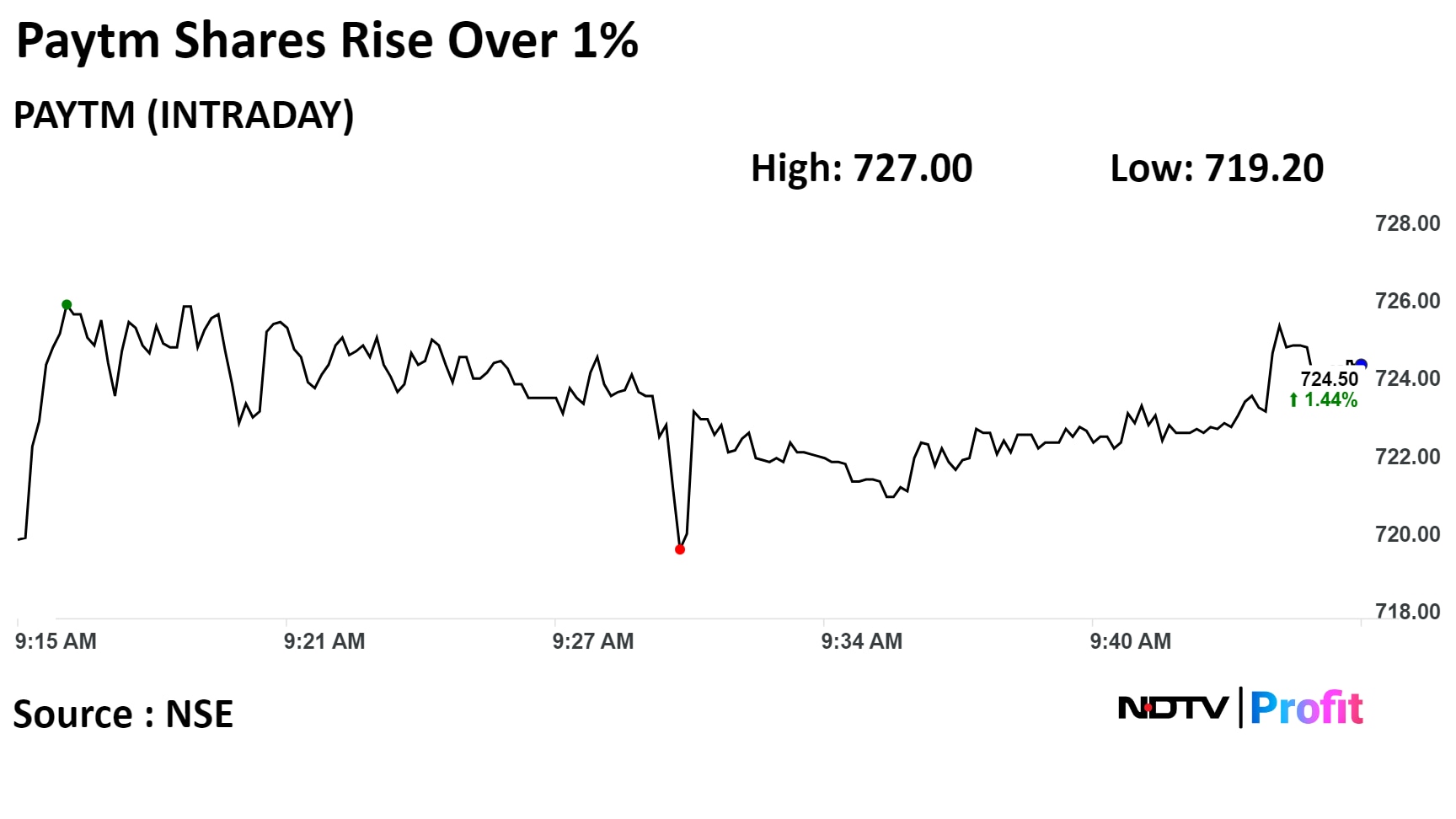

UBS Research has initiated a 'buy' on Paytm with a target price of Rs 900, implying an upside of 24.48%. Paytm has built a formidable payment business with large customer and merchant bases and market-leading payment infrastructure, according to the brokerage.

UBS Research has initiated a 'buy' on Paytm with a target price of Rs 900, implying an upside of 24.48%. Paytm has built a formidable payment business with large customer and merchant bases and market-leading payment infrastructure, according to the brokerage.

Paytm's stock rose as much as 1.86% intraday to Rs 727.50 apiece. It was trading 1.82% higher at Rs 727.20 apiece, compared to a 0.06% decline in the benchmark Nifty 50 at 9:58 a.m.

Eleven out of the 16 analysts tracking the company have a 'buy' rating on the stock and five suggest a 'hold', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 30.8%.

- Downgrade to sell with target price of Rs 700

- Outlook remains subdued with tough macroeconomy , tight budgets for large, global pharma cos and muted VC funding for biotech

- Cos performance has diverged from other CRO, suggesting market is not fully pricing these headwinds

- Anticipate more downside to stock led by earnings cut and risk of soft FY25 guidance

- Expects 18% revenue CAGR and 31.5% Ebitda Margins,

-Positive on Syngene's structural story but find risk reward unattractive

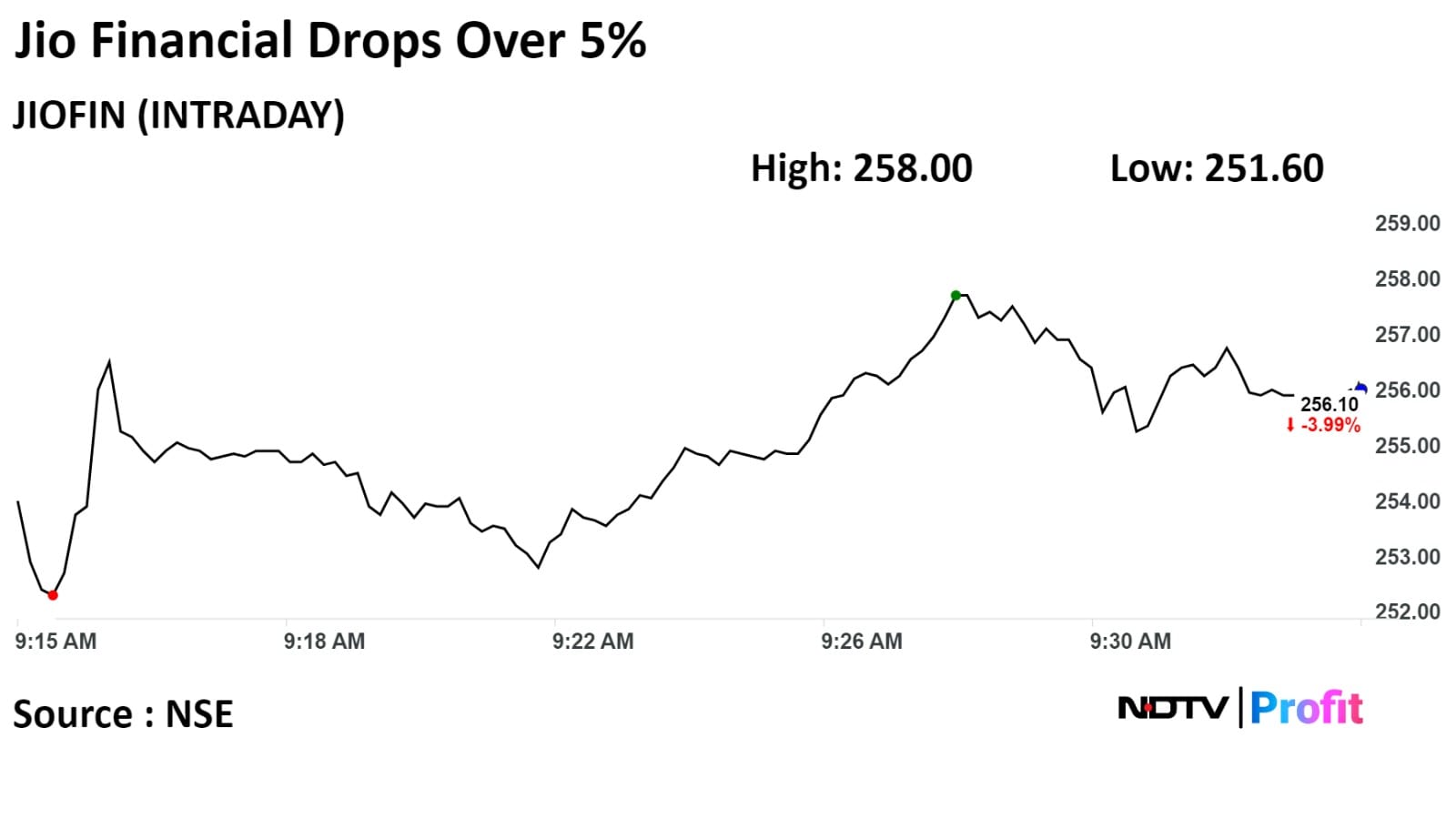

Shares of Jio Financial Services Ltd fell 5.67% on Monday after the company reported its standalone profit declined 20.6% in Oct-Dec period due to a rise in its operating expenses.

Shares of Jio Financial Services Ltd fell 5.67% on Monday after the company reported its standalone profit declined 20.6% in Oct-Dec period due to a rise in its operating expenses.

- Prefers Infosys with Target price of Rs 1685

-Prefers HCLT with target price of Rs 1570

- Large IT stocks up 5-10% as top 4 companies have reported earnings

- Management comments have been balanced, words like pent up and green shoots have created optimism

- Headcount reductions continue and deal TCV trends are moderate pointing to gradual recovery

- Demand has likely bottomed out, expects slow recovery

- TCS/Infosys/Wipro/HCLT trading at higher valuation vs 5yr pre pandemic average

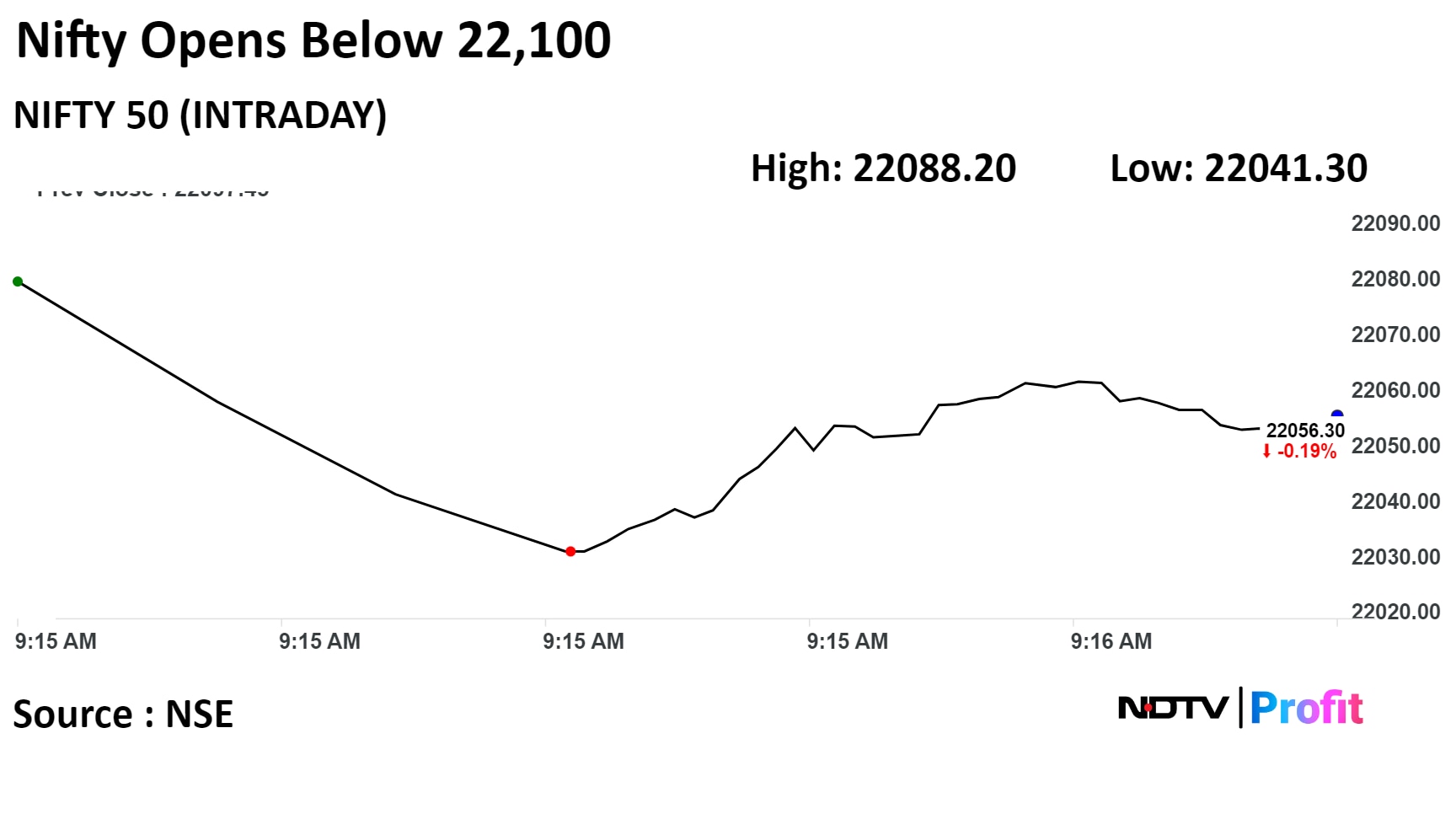

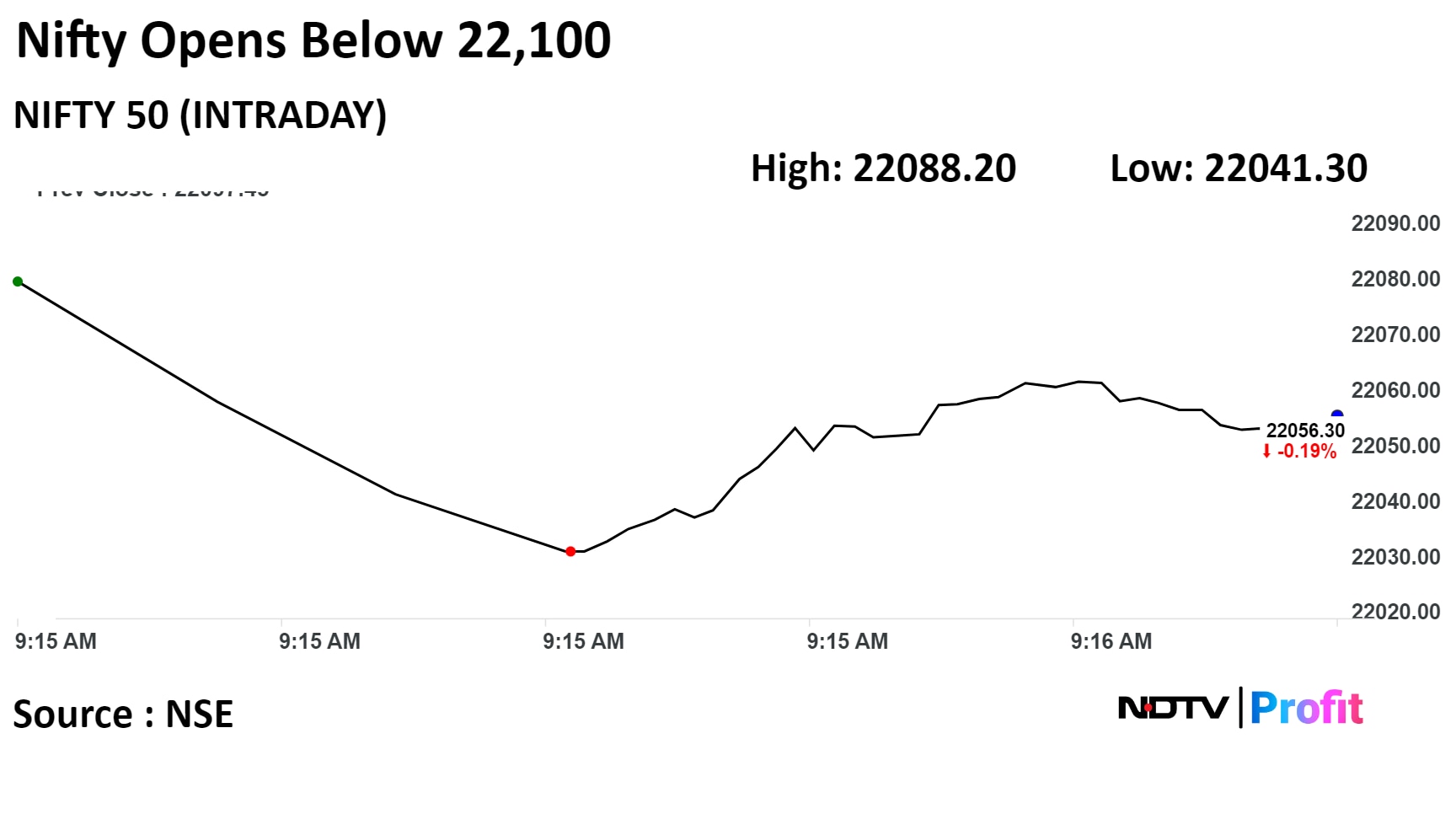

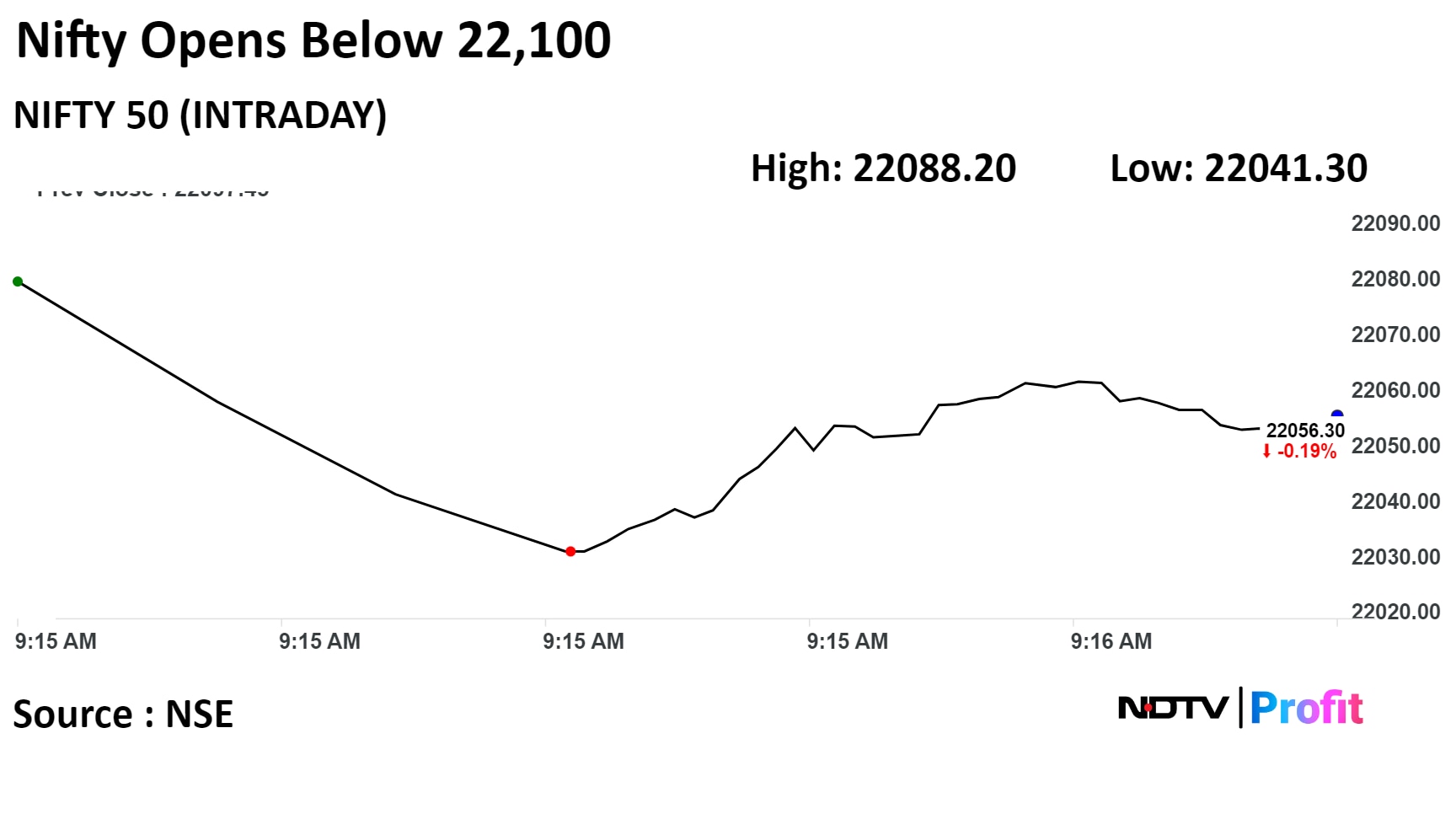

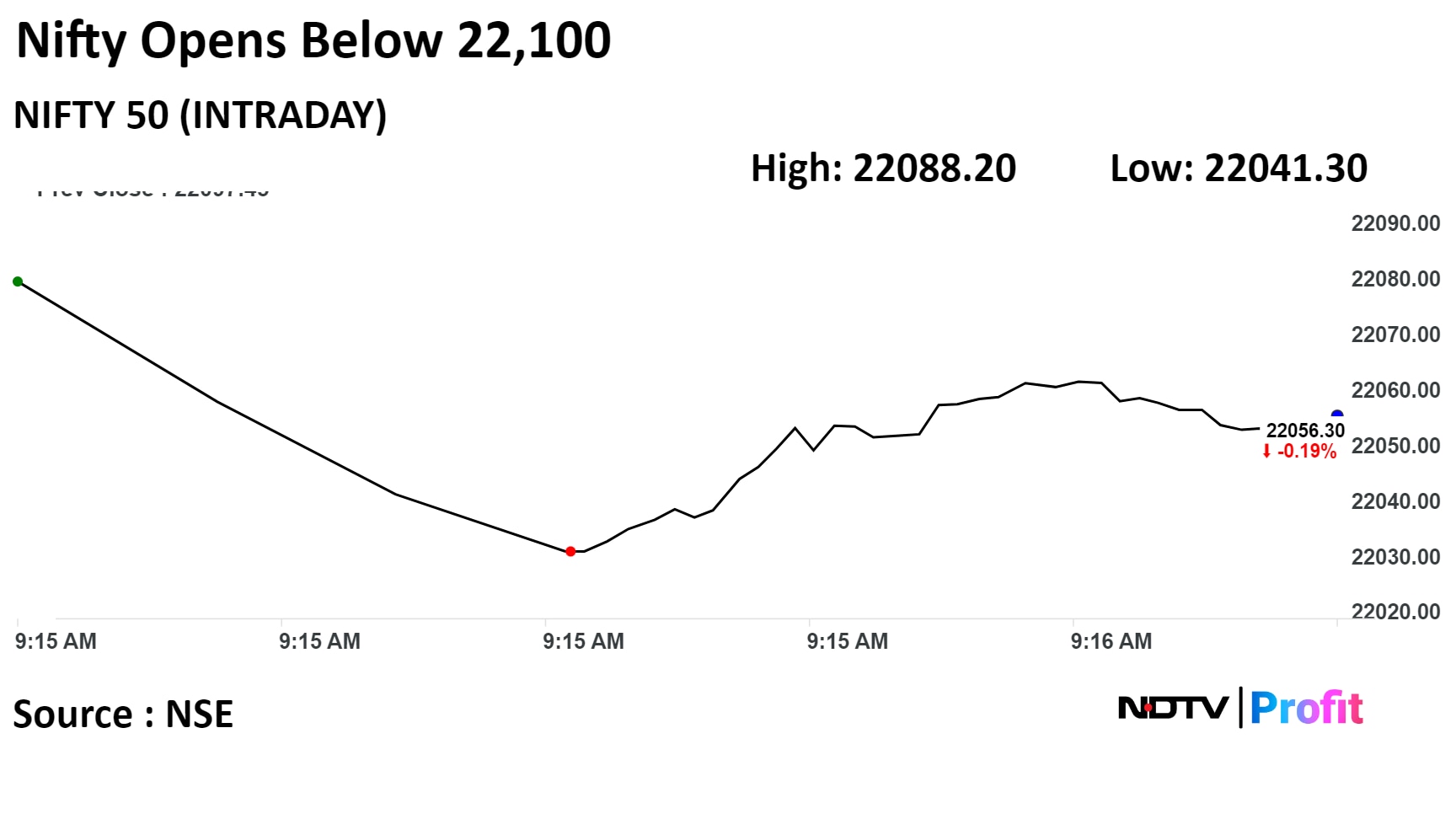

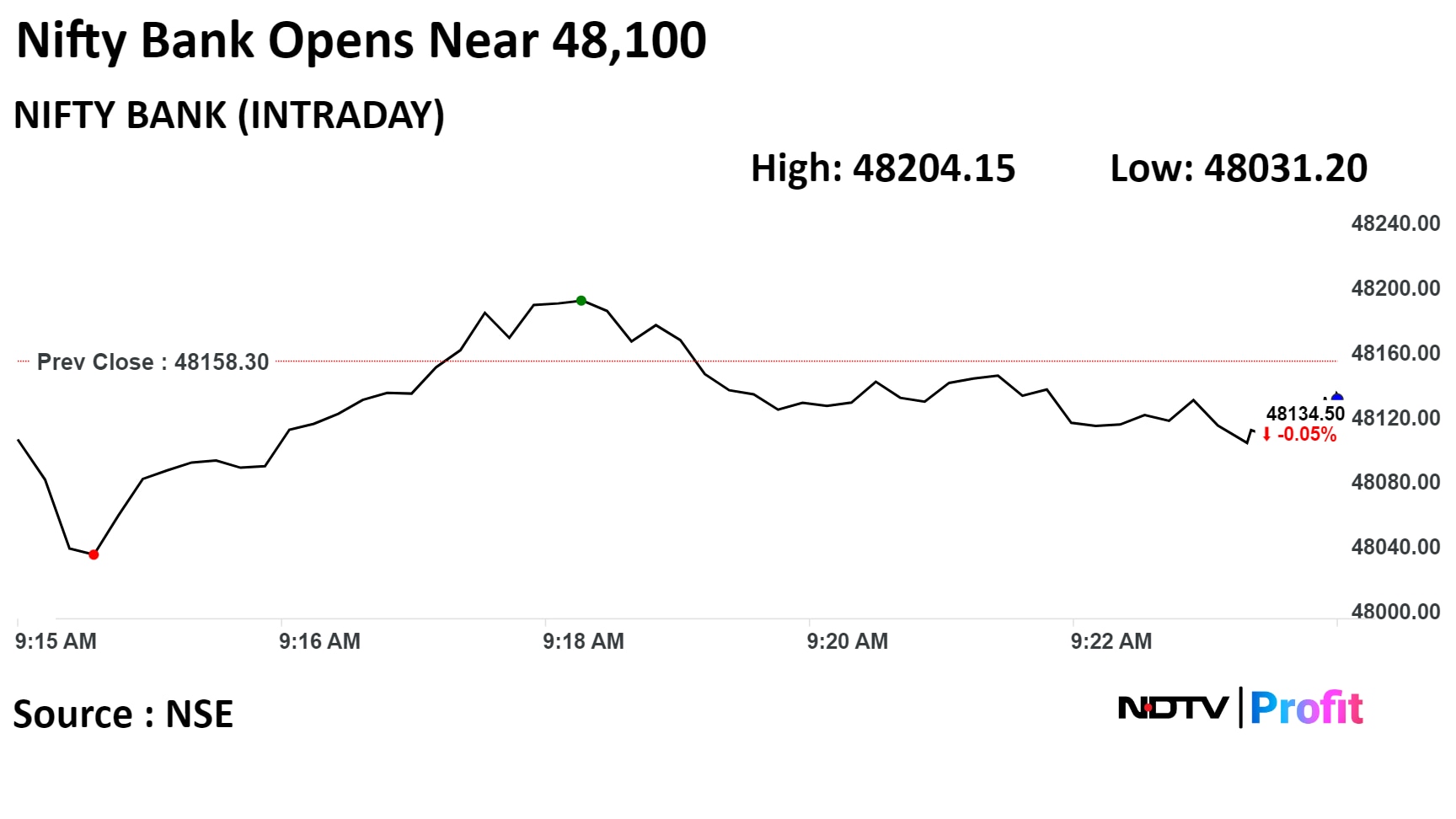

Indian benchmarks opened lower, snapping their five-day rally, as shares of IT companies and heavyweight Reliance Industries weighed on them.

At pre-open, the S&P BSE Sensex Index was up 4.01 points, or 0.01%, at 73,331.95 while the NSE Nifty 50 was 16.95 points or 0.08% lower at 22,080.50.

"In our opinion, the broad picture of the market is still positive, but due to temporary overbought conditions, we may see range-bound activity in the near term," said Shrikant Chouhan, head of equity research at Kotak Securities.

"For traders, key support levels would be 22000-21950/73000-72800, while key resistance zones may be 22150-22225/73500-73800. However, if the Nifty falls below 21950/72800, it may drop to 21850 or 21800 levels. The recommended strategy is to buy between 22000 and 21950, with a stop loss at 21800."

Indian benchmarks opened lower, snapping their five-day rally, as shares of IT companies and heavyweight Reliance Industries weighed on them.

At pre-open, the S&P BSE Sensex Index was up 4.01 points, or 0.01%, at 73,331.95 while the NSE Nifty 50 was 16.95 points or 0.08% lower at 22,080.50.

"In our opinion, the broad picture of the market is still positive, but due to temporary overbought conditions, we may see range-bound activity in the near term," said Shrikant Chouhan, head of equity research at Kotak Securities.

"For traders, key support levels would be 22000-21950/73000-72800, while key resistance zones may be 22150-22225/73500-73800. However, if the Nifty falls below 21950/72800, it may drop to 21850 or 21800 levels. The recommended strategy is to buy between 22000 and 21950, with a stop loss at 21800."

Indian benchmarks opened lower, snapping their five-day rally, as shares of IT companies and heavyweight Reliance Industries weighed on them.

At pre-open, the S&P BSE Sensex Index was up 4.01 points, or 0.01%, at 73,331.95 while the NSE Nifty 50 was 16.95 points or 0.08% lower at 22,080.50.

"In our opinion, the broad picture of the market is still positive, but due to temporary overbought conditions, we may see range-bound activity in the near term," said Shrikant Chouhan, head of equity research at Kotak Securities.

"For traders, key support levels would be 22000-21950/73000-72800, while key resistance zones may be 22150-22225/73500-73800. However, if the Nifty falls below 21950/72800, it may drop to 21850 or 21800 levels. The recommended strategy is to buy between 22000 and 21950, with a stop loss at 21800."

Indian benchmarks opened lower, snapping their five-day rally, as shares of IT companies and heavyweight Reliance Industries weighed on them.

At pre-open, the S&P BSE Sensex Index was up 4.01 points, or 0.01%, at 73,331.95 while the NSE Nifty 50 was 16.95 points or 0.08% lower at 22,080.50.

"In our opinion, the broad picture of the market is still positive, but due to temporary overbought conditions, we may see range-bound activity in the near term," said Shrikant Chouhan, head of equity research at Kotak Securities.

"For traders, key support levels would be 22000-21950/73000-72800, while key resistance zones may be 22150-22225/73500-73800. However, if the Nifty falls below 21950/72800, it may drop to 21850 or 21800 levels. The recommended strategy is to buy between 22000 and 21950, with a stop loss at 21800."

Indian benchmarks opened lower, snapping their five-day rally, as shares of IT companies and heavyweight Reliance Industries weighed on them.

At pre-open, the S&P BSE Sensex Index was up 4.01 points, or 0.01%, at 73,331.95 while the NSE Nifty 50 was 16.95 points or 0.08% lower at 22,080.50.

"In our opinion, the broad picture of the market is still positive, but due to temporary overbought conditions, we may see range-bound activity in the near term," said Shrikant Chouhan, head of equity research at Kotak Securities.

"For traders, key support levels would be 22000-21950/73000-72800, while key resistance zones may be 22150-22225/73500-73800. However, if the Nifty falls below 21950/72800, it may drop to 21850 or 21800 levels. The recommended strategy is to buy between 22000 and 21950, with a stop loss at 21800."

Indian benchmarks opened lower, snapping their five-day rally, as shares of IT companies and heavyweight Reliance Industries weighed on them.

At pre-open, the S&P BSE Sensex Index was up 4.01 points, or 0.01%, at 73,331.95 while the NSE Nifty 50 was 16.95 points or 0.08% lower at 22,080.50.

"In our opinion, the broad picture of the market is still positive, but due to temporary overbought conditions, we may see range-bound activity in the near term," said Shrikant Chouhan, head of equity research at Kotak Securities.

"For traders, key support levels would be 22000-21950/73000-72800, while key resistance zones may be 22150-22225/73500-73800. However, if the Nifty falls below 21950/72800, it may drop to 21850 or 21800 levels. The recommended strategy is to buy between 22000 and 21950, with a stop loss at 21800."

Indian benchmarks opened lower, snapping their five-day rally, as shares of IT companies and heavyweight Reliance Industries weighed on them.

At pre-open, the S&P BSE Sensex Index was up 4.01 points, or 0.01%, at 73,331.95 while the NSE Nifty 50 was 16.95 points or 0.08% lower at 22,080.50.

"In our opinion, the broad picture of the market is still positive, but due to temporary overbought conditions, we may see range-bound activity in the near term," said Shrikant Chouhan, head of equity research at Kotak Securities.

"For traders, key support levels would be 22000-21950/73000-72800, while key resistance zones may be 22150-22225/73500-73800. However, if the Nifty falls below 21950/72800, it may drop to 21850 or 21800 levels. The recommended strategy is to buy between 22000 and 21950, with a stop loss at 21800."

Indian benchmarks opened lower, snapping their five-day rally, as shares of IT companies and heavyweight Reliance Industries weighed on them.

At pre-open, the S&P BSE Sensex Index was up 4.01 points, or 0.01%, at 73,331.95 while the NSE Nifty 50 was 16.95 points or 0.08% lower at 22,080.50.

"In our opinion, the broad picture of the market is still positive, but due to temporary overbought conditions, we may see range-bound activity in the near term," said Shrikant Chouhan, head of equity research at Kotak Securities.

"For traders, key support levels would be 22000-21950/73000-72800, while key resistance zones may be 22150-22225/73500-73800. However, if the Nifty falls below 21950/72800, it may drop to 21850 or 21800 levels. The recommended strategy is to buy between 22000 and 21950, with a stop loss at 21800."

Shares of HDFC Bank Ltd., Reliance Industries Ltd., HCLTechnologies Ltd., Infosys Ltd., and Tata Consultancy Services Ltd. contributed the most to today's fall

While those of of Bajaj Finance Ltd., Tata Motors Ltd., Axis Bank Ltd., Bharti Airtel Ltd., and Bharat Petroleum Corp. Ltd. cushioned the downside.

Sectoral indices on the NSE were mixed. Nifty PSU Bank rose the most by 0.72% while Nifty IT fell 1% after rising consecutively in the last two sessions.

The broader markets outperformed; the S&P BSE MidCap Index was up 0.31%, whereas S&P BSE SmallCap Index was 0.2% higher.

Eleven out of 20 sectors compiled by BSE advanced, while nine sectors declined. S&P BSE Teck fell the most.

The market breadth was skewed in the favour of the buyers. About 1,840 stocks rose, 1,176 declined, while 77 remained unchanged on the BSE.

At pre-open, the S&P BSE Sensex Index was up 4.01 points, or 0.01%, at 73,331.95 while the NSE Nifty 50 was 16.95 points or 0.08% lower at 22,080.50.

The yield on the 10-year bond opened flat at 7.16% on Tuesday.

Source: Bloomberg

-The local currency weakened 5 paise to open at 82.94 against the U.S dollar on Tuesday.

-It closed at 82.89 on Monday.

Source: Bloomberg

Deposit-taking HFCs to maintain 15% of deposits in liquid assets (13% now)

Cap on deposits to be reduced to 1.5x net owned funds (from 3x)

Maturity of deposits raised will be capped at 60 months (120 months now)

Limited impact seen on covered HFCs

Plans to develop an insurance platform to maximize corporate agency license from IRDAI

Source: Exchange Filing

- Q3 profit fell 56% QoQ

- Gradual Ramp-up of Lending & Payments Businesses

- Capability building is largely done in unsecured PL and consumer durable loans

- See Jio Financial Services taking a balanced approach to growth

- See limited risk for BAF and banks, despite initial concern of increased competition

Initiated coverage; Buy; TP: 900

Expect moderating topline CAGR of 21% through FY28

Profitability dynamics improved, contribution margin rising

Think regulatory issues have passed for payments and expect Paytm to benefit

EBITDA margin to gradually reach 20%, expect EBITDA breakeven in FY25

Value business based on DCF basis similar metrics to global payment cos

U.S. Dollar Index at 102.77

U.S. 10-year bond yield at 4%

Brent crude down 0.23% to $77.97 per barrel

Nymex crude at $72.19 per barrel

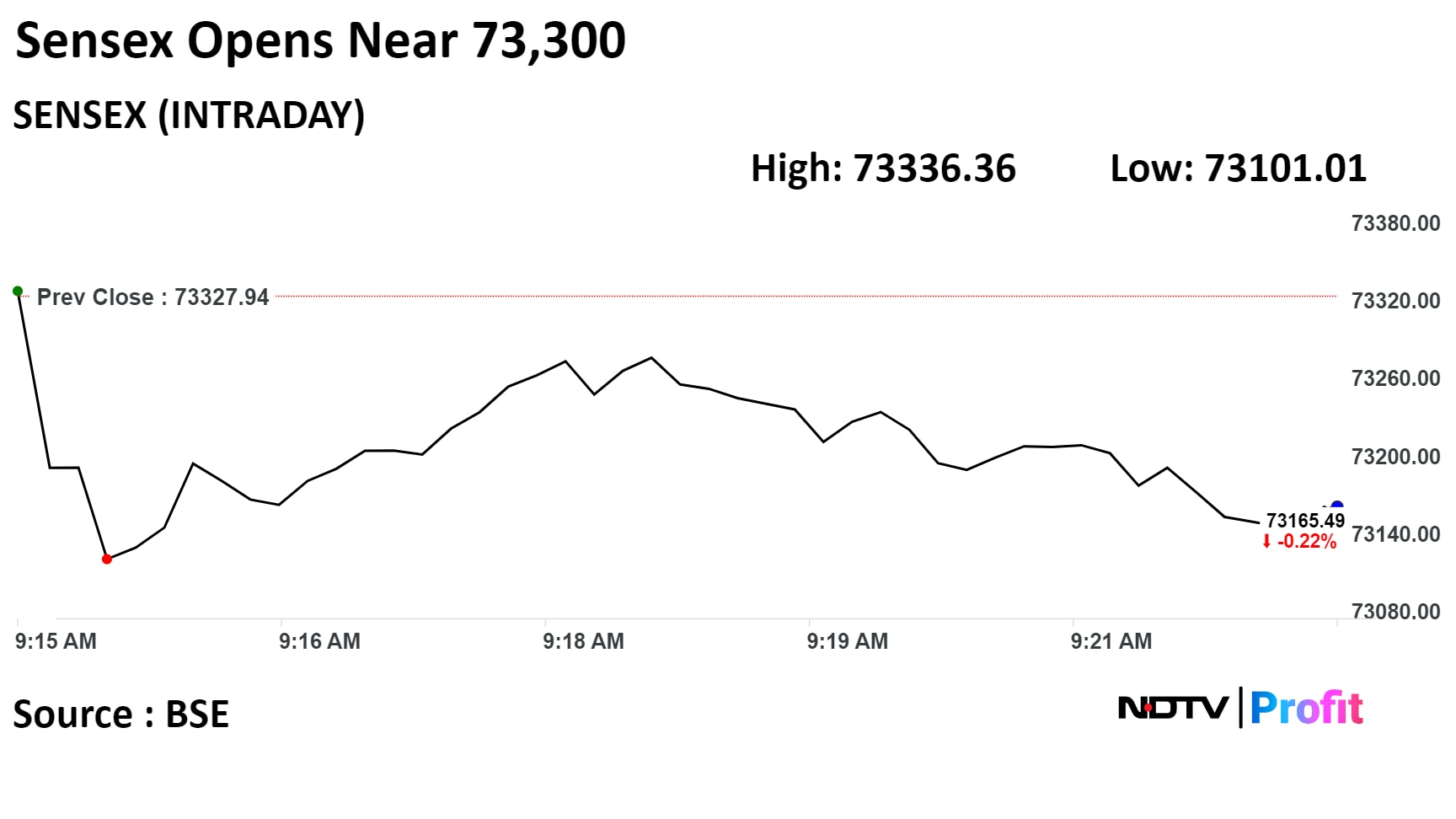

Gift Nifty down 0.22% to 22,103.50 as of 8:19 a.m.

Bitcoin was down 0.38% to $42,526.72

Nifty January futures up by 0.88% to 22,133.30 at a premium of 35.85 points.

Nifty January futures open interest up by 3.8%.

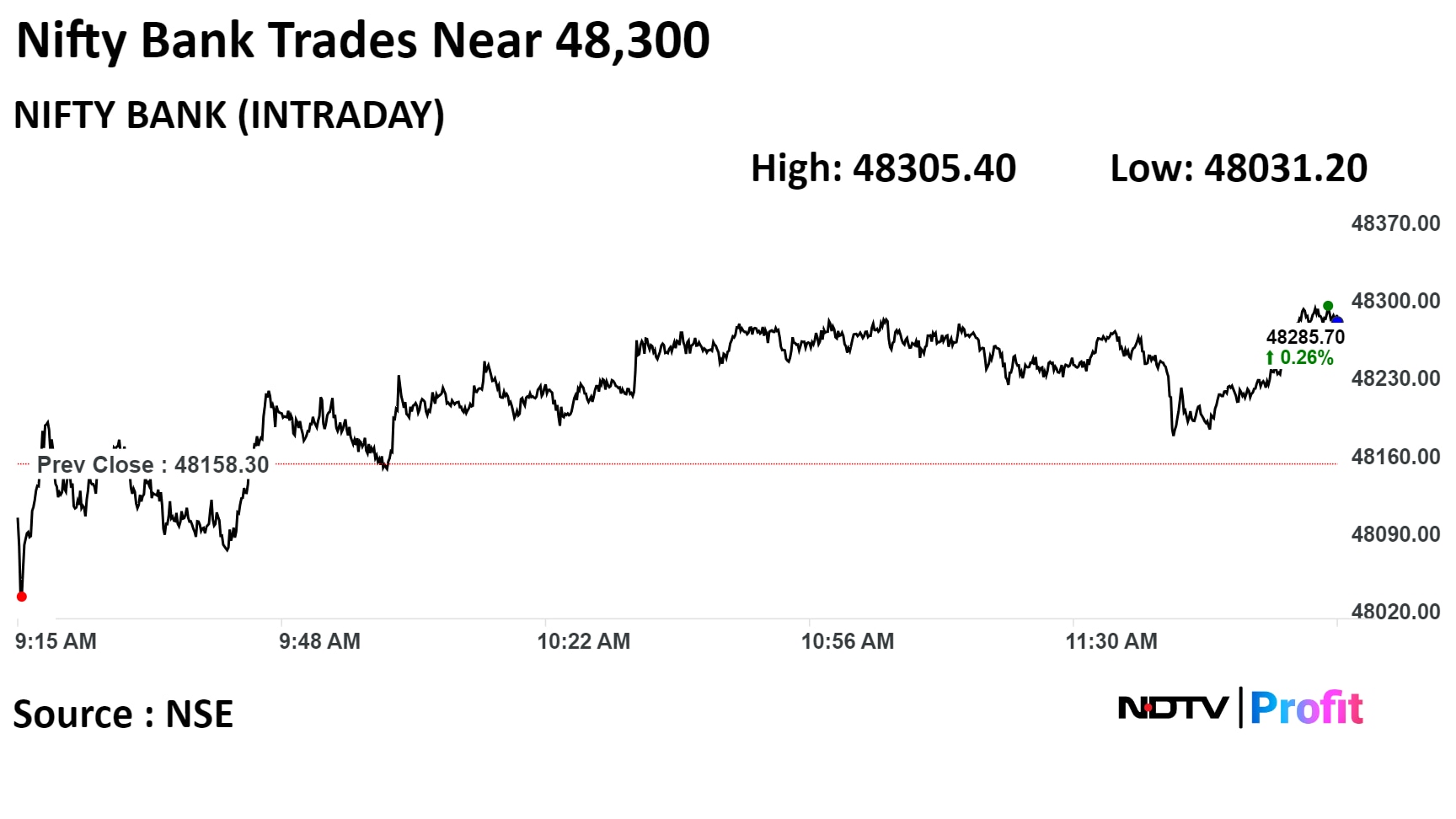

Nifty Bank futures in January futures up by 1.11% to 48,306.25 at a premium of 147.95 points.

Nifty Bank January futures open interest up by 0.66%.

Nifty Options Jan., 18 Expiry: Maximum Call open interest at 22,500 and Maximum Put open interest at 19,650.

Bank Nifty Options Jan. 17 Expiry: Maximum Call Open Interest at49,500 and Maximum Put open interest at 47,000.

Securities in ban period: Bandhan Bank, Bharat Heavy Electronics, Biocon, Chambal Fertilizers, Delta Corp, Escorts Kubota, Hindustan Copper, India Cements, Indus Tower, Metropolis Healthcare, Piramal Enterprise, Polycab India, PVRINOX, SAIL, and Zee Entertainment.

Zomato: Motilal Oswal Mutual Fund sold 4.5 crore shares (0.52%) while Societe Generale bought 3.3 core shares (0.38%), among others, at Rs 138.15 apiece.

Hi-Tech Pipes: Ajay Kumar & Sons sold 24 lakh shares (1.83%), while Bandhan Core Equity Fund bought 14 lakh shares (1.07%) at Rs 148.5 apiece.

Motisons Jewellers: Umesh Parasmal Pagariya sold 7.78 lakh shares (0.79%) at Rs 235.85 apiece.

Jyoti CNC Automation: The company's shares will debut on the stock exchanges on Tuesday at an issue price of Rs 331 apiece. The Rs 1,000-crore IPO was subscribed 38.53 times on its third and final day. The Bids were led by institutional investors (44.13 times), non-institutional investors (36.48 times), retail investors (26.17 times) and portions reserved for employees (12.47 times).

Medi Assist Healthcare: The public issue was subscribed 0.54 times on day 1. The bids were led by retail investors (0.89 times), non-institutional investors (0.45 times) and no bids were raised by institutional investors.

Bank of Baroda: The bank will issue long-term infrastructure bonds worth Rs 5,000 crore in the second tranche.

Nalco: India’s Khanij Bidesh India and Argentina’s Catamarca Minera Y Energetica Sociedad DEL ESTADO signed an agreement for the first-ever exploration and mining of lithium. The estimated project cost is Rs 200 crore.

PNC Infratech: The company, with its arm, executed definitive agreements with Highways Infrastructure Trust to divest 12 of the company’s road assets and one toll concession in the states of Uttar Pradesh, Madhya Pradesh, Karnataka, and Rajasthan. The enterprise value of the transaction is Rs 9,005.7 crore.

Patanjali Foods: The company, in its Q3 business update, reported that the food and FMCG segments accounted for 32% of total revenues, edible oils' sequential volume growth was seen in single digits, and branded sales continued to contribute 75% of the total edible oil sales volume.

Life Insurance Corp.: The company has temporarily closed its Mauritius branch due to ongoing Cyclone Belal in Mauritius.

Sarda Energy and Minerals: The company received an order worth Rs 150 crore from Gensol Engineering for the installation of a 50 MW solar power plant in Chhattisgarh.

BLS International Services: The company, through its arm, signed a definitive agreement to acquire a 100% stake in iDATA, a Turkey-based visa and consular services provider, to expand the existing business in new geographies and with new client governments.

Aster DM: Affinity Holdings and Alpha GCC aim to complete the sale of the Gulf business deal soon. The dividend from the upfront payment of $903 million is seen at Rs 110 to Rs 120 per share.

Usha Martin: The company’s Thailand-based arm will acquire a 50% stake in Tesac Usha wire rope company for Baht 74.45 million from Kobelco Wire Company.

HPL Electric and Power: The company bagged deals worth Rs 240 crore from leading AMISP clients for smart metres.

Easy Trip Planners: The company embarked on a nationwide roadshow spanning multiple cities.

InterGlobe Aviation: The company’s local passenger market share stood at 61.8% vs. 61.8% in November.

SpiceJet: The company’s local passenger market share stood at 5.6% vs. 6.2% in November.

Cosmo First: The company announced that Cosmo Plastech, which manufactures rigid sheets, Thermoforming and injection moulding, has attained Food Safety System Certification 22000, a mandatory requirement for the packaging material coming in direct contact with food.

Rail Vikas Nigam: The company emerged as the lowest bidder for supply, installation, testing and commissioning of 11 KV line-associated works. The consideration for the order is Rs 251 crore.

Trident: The company appointed Deepak Singhal as chief executive officer for the paper, energy and chemicals business.

Omaxe: The company successfully closed the loan facility obtained by Omaxe Heritage from Varde Partners, much before its scheduled closure. The company has fully repaid the loan amount of Rs 440 crore, along with accrued interest on the same.

HDFC Bank, Federal Bank, Gallant Ispat, Hathway Cable & Datacom, Himadri Specialty Chemical, ICICI Lombard GIC, ICICI Securities, Jindal Saw, L&T Technology Services, Bank of Maharashtra, CE Info Systems, National Standard (India), Network18 Media and Investments, Newgen Software Technologies, and TV18 Broadcast.

Jio Financial Services Q3 FY24 (Standalone, QoQ)

Total income at Rs 134.08 crore vs Rs 148.9 crore, down 10%.

Net profit at Rs 70.48 crore vs Rs 88.76 crore, down 20.6%.

Angel One Q3 FY24 (Standalone, YoY)

Total income at Rs 1,055.6 crore vs Rs 756.3 crore, up 39.57% YoY.

Net profit at Rs 262.8 crore vs Rs 226.7 crore, up 15.92% YoY.

Choice International Q3 FY24 (Consolidated, YoY)

Revenue at Rs 209.78 crore vs Rs 98.43 crore, up 113% YoY.

Net profit at Rs 40.28 crore vs Rs 13.9 crore, up 190%.

Kesoram Industries Q3 FY24 (Consolidated, YoY)

Revenue at Rs 960.65 crore vs Rs 986.12 crore, down 2.59%.

Net loss at Rs 48.86 crore vs loss of Rs 47.98 crore.

Ebitda at Rs 101.75 crore vs Rs 79.7 crore, up 27.66%.

Margin at 10.59% vs 8.08%.

Most stock indices in Asia-Pacific declined in early trade on Tuesday amid a lack of overnight cues from U.S. markets due to the holiday. CSI 300 was the only index that rose.

China will be in focus for its GDP number, scheduled for release on Wednesday. The economy is expected to grow at a 5.3% annual rate, compared to the 4.9% pace recorded in the preceding quarter.

Japan's benchmark indices snapped their record-breaking rally after the country reported its corporate goods price index remained unchanged in December on an annualised basis, compared to a decline expected by market participants.

Brent crude fell 0.23% to $77.97 per barrel. Gold was down 0.26% at $2,051.14 an ounce.

The January futures contract of the GIFT Nifty index traded 0.22% lower aqt 22,103.50 as of 8:19 a.m.

India's benchmark stock indices ended at a fresh record closing high for the second day in a row on Monday, led by gains in HDFC Bank Ltd., Reliance Industries Ltd., and Infosys Ltd. The NSE Nifty 50 ended 0.99%, or 202.90 points, higher at 22,097.45, while the S&P BSE Sensex gained 1.05%, or 759.48 points, to close at 73,327.94.

Overseas investors turned net buyers of Indian equities on Monday after being sellers for four consecutive sessions. Foreign portfolio investors mopped up equities worth Rs 1,085.7 crore, while domestic institutional investors offloaded stocks worth Rs 820.7 crore, the NSE data showed.

The Indian rupee strengthened 3 paise to close at Rs 82.89 against the U.S. dollar on Monday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.