The yield on the 10-year bond closed 4 bps lower at 7.16% on Friday.

Source: Bloomberg

The local currency strengthened 33 paise to close at 83 against the U.S dollar on Friday.

It strengthened to 82.95, the most since Sept. 22 when rupee was at 82.83

Source: Bloomberg

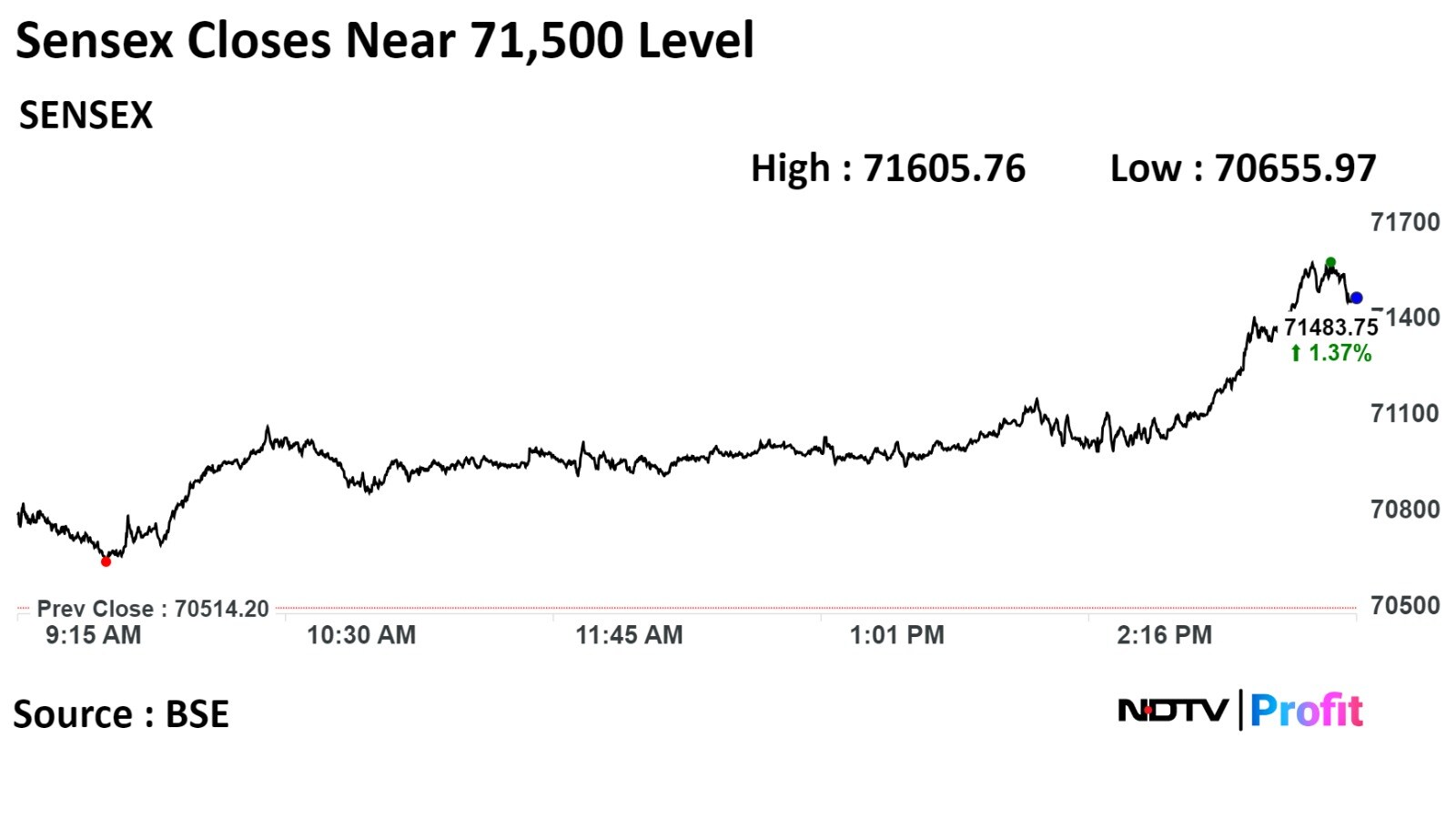

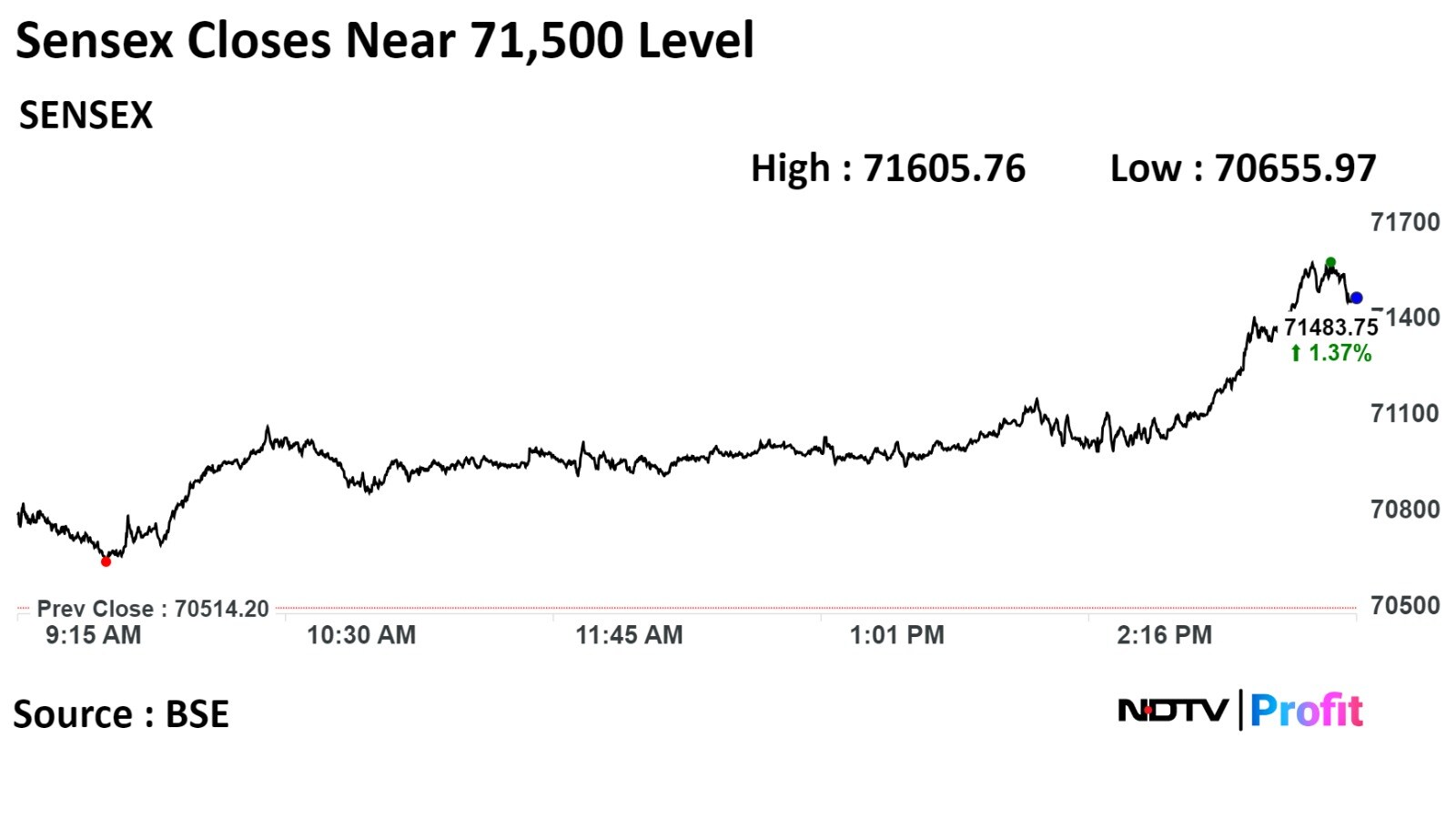

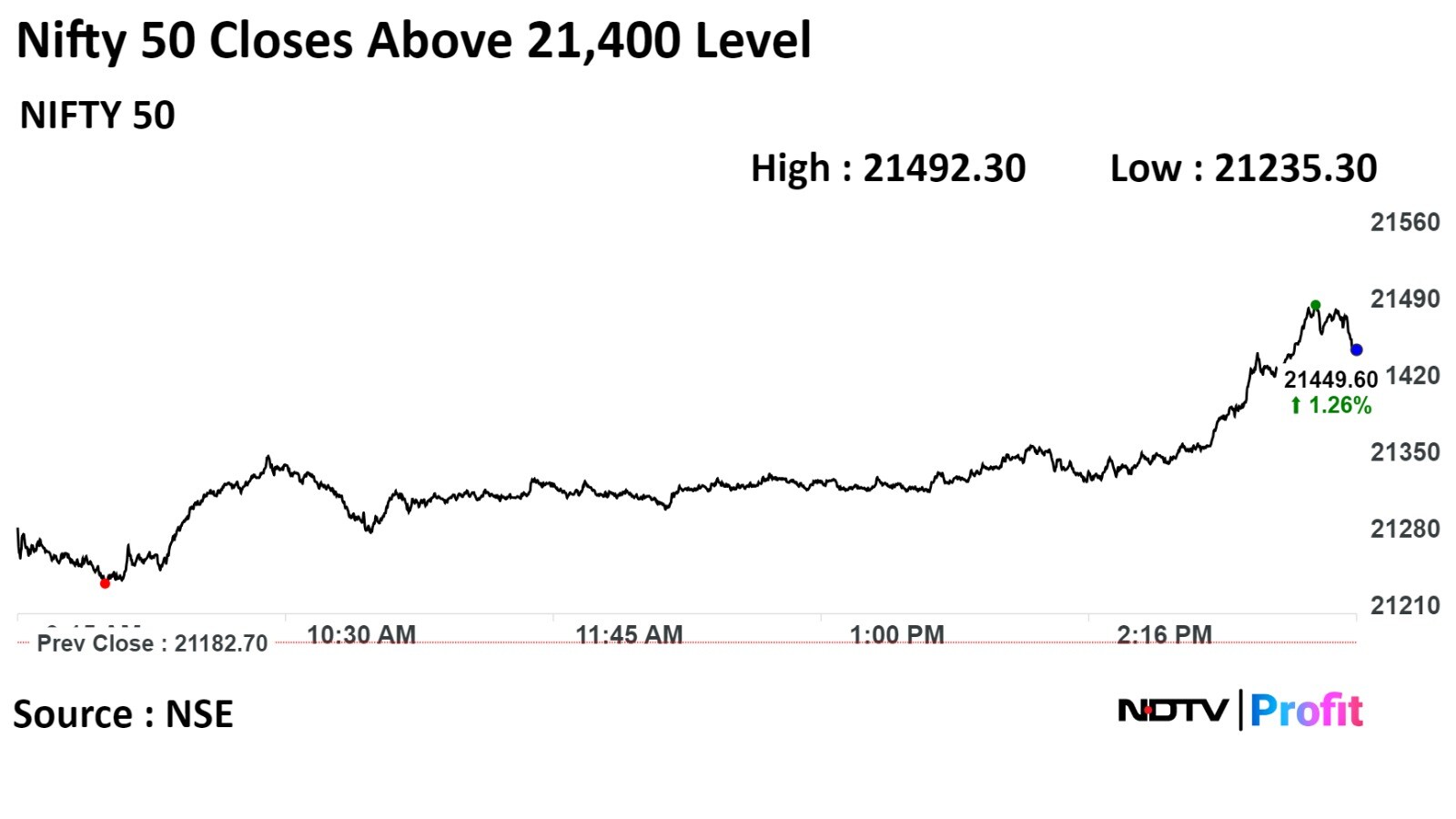

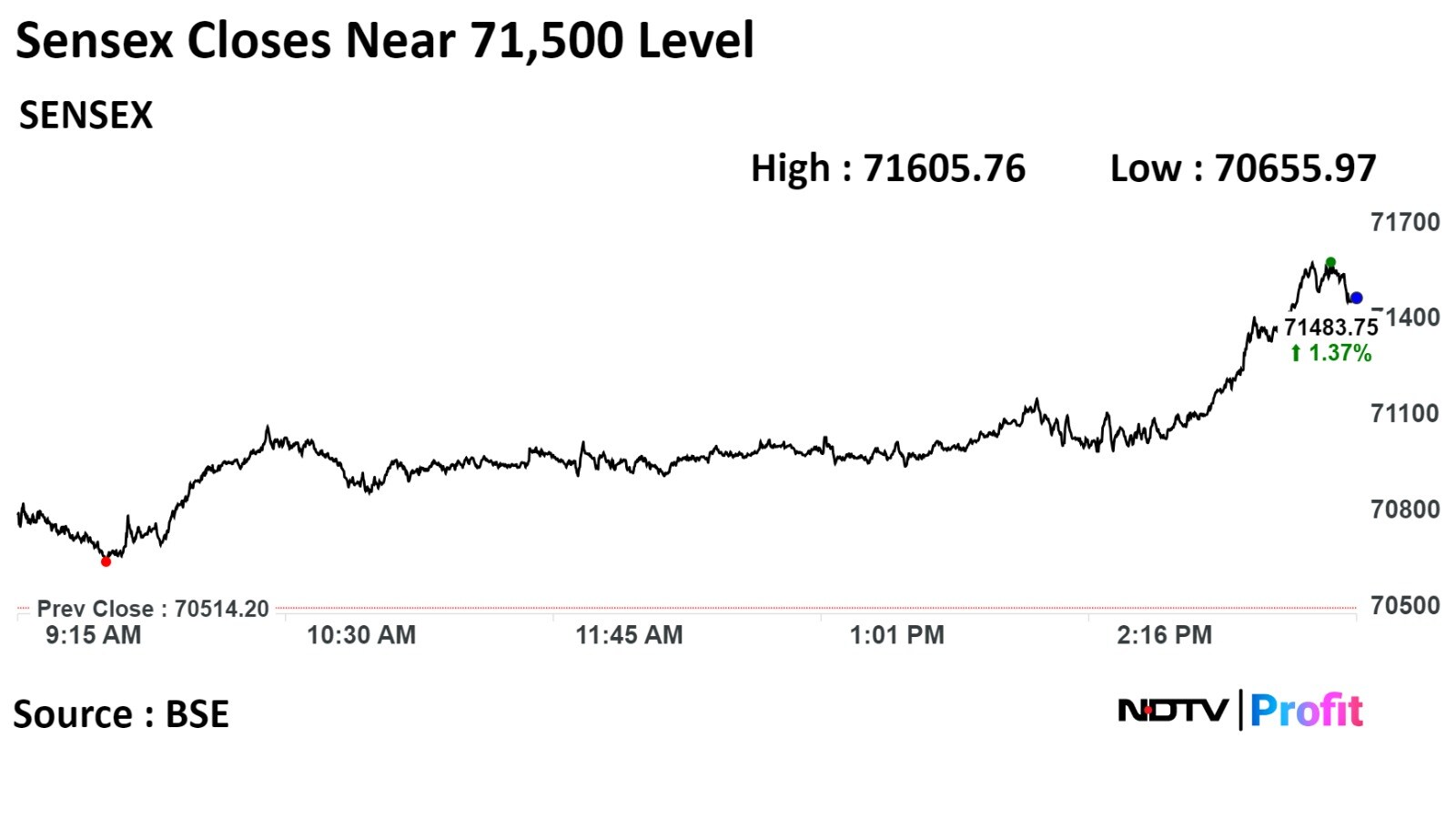

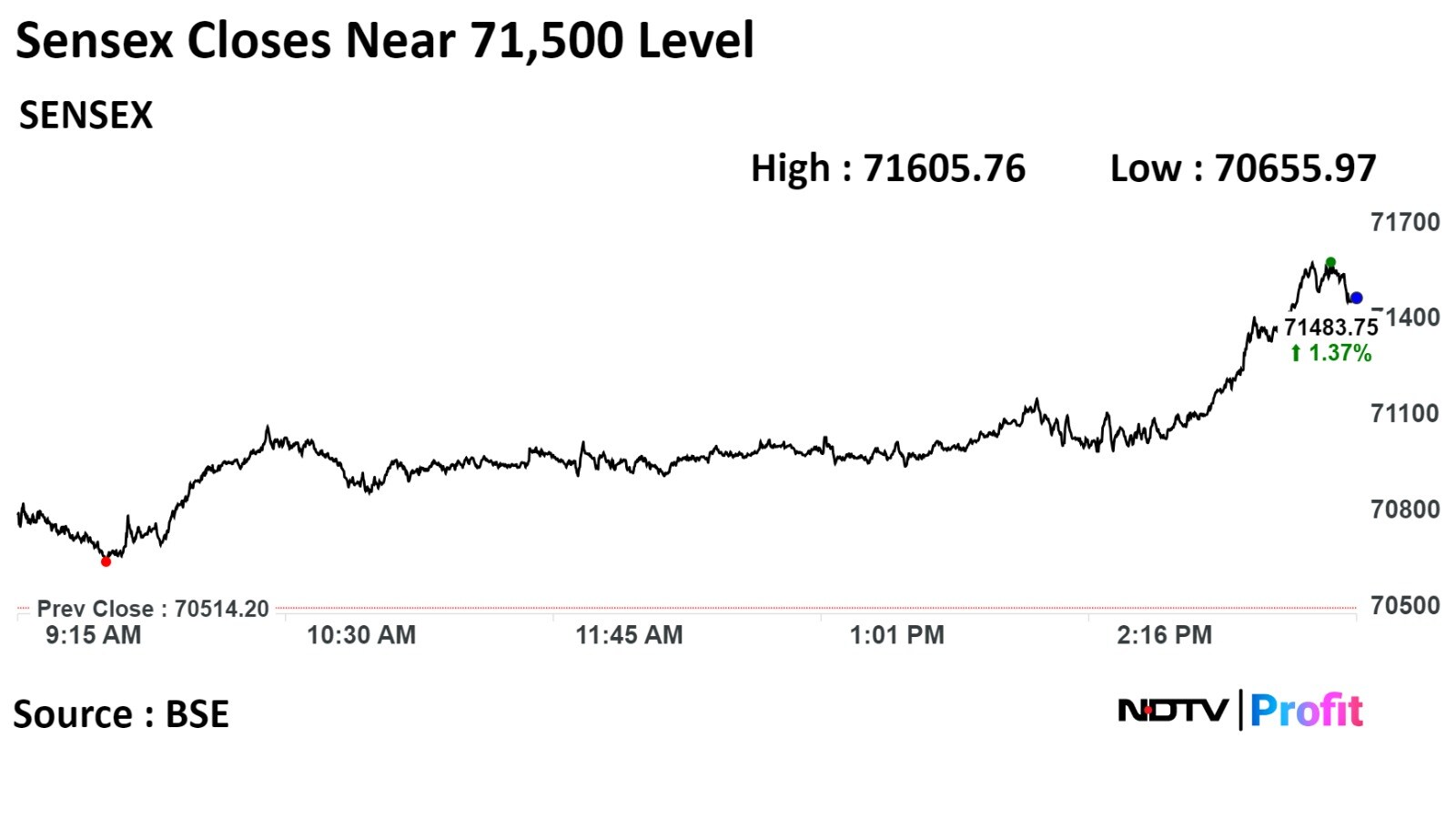

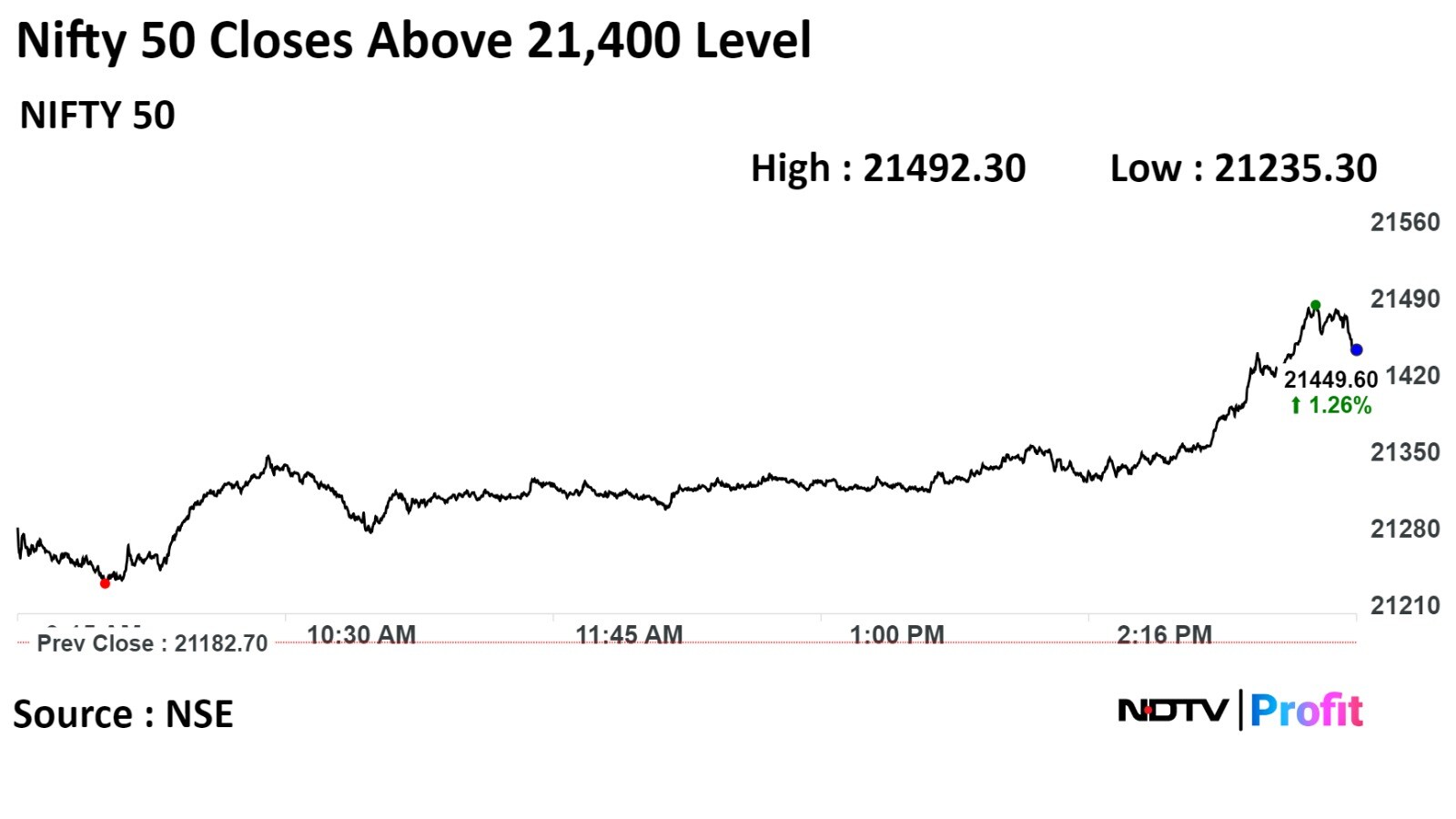

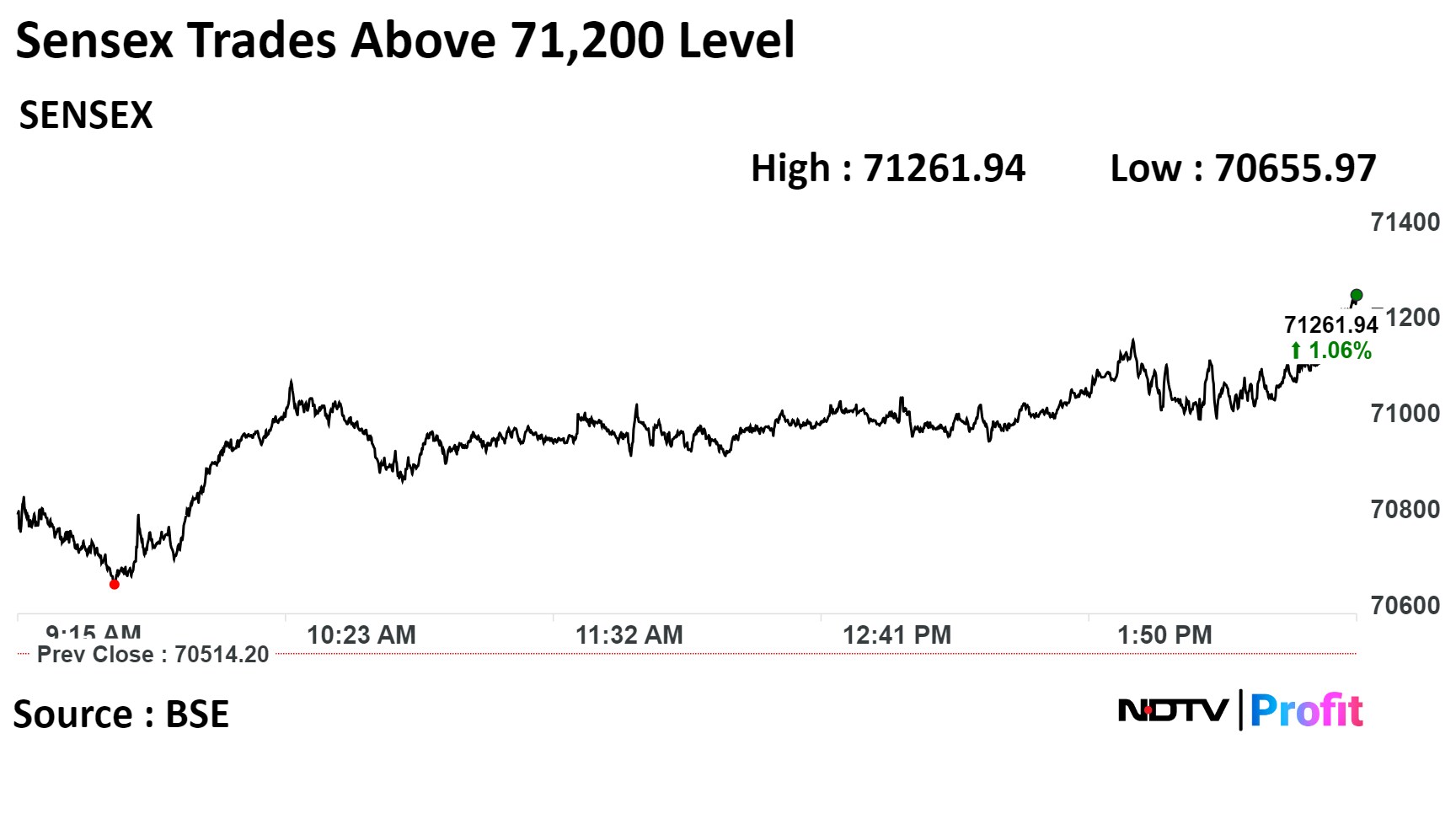

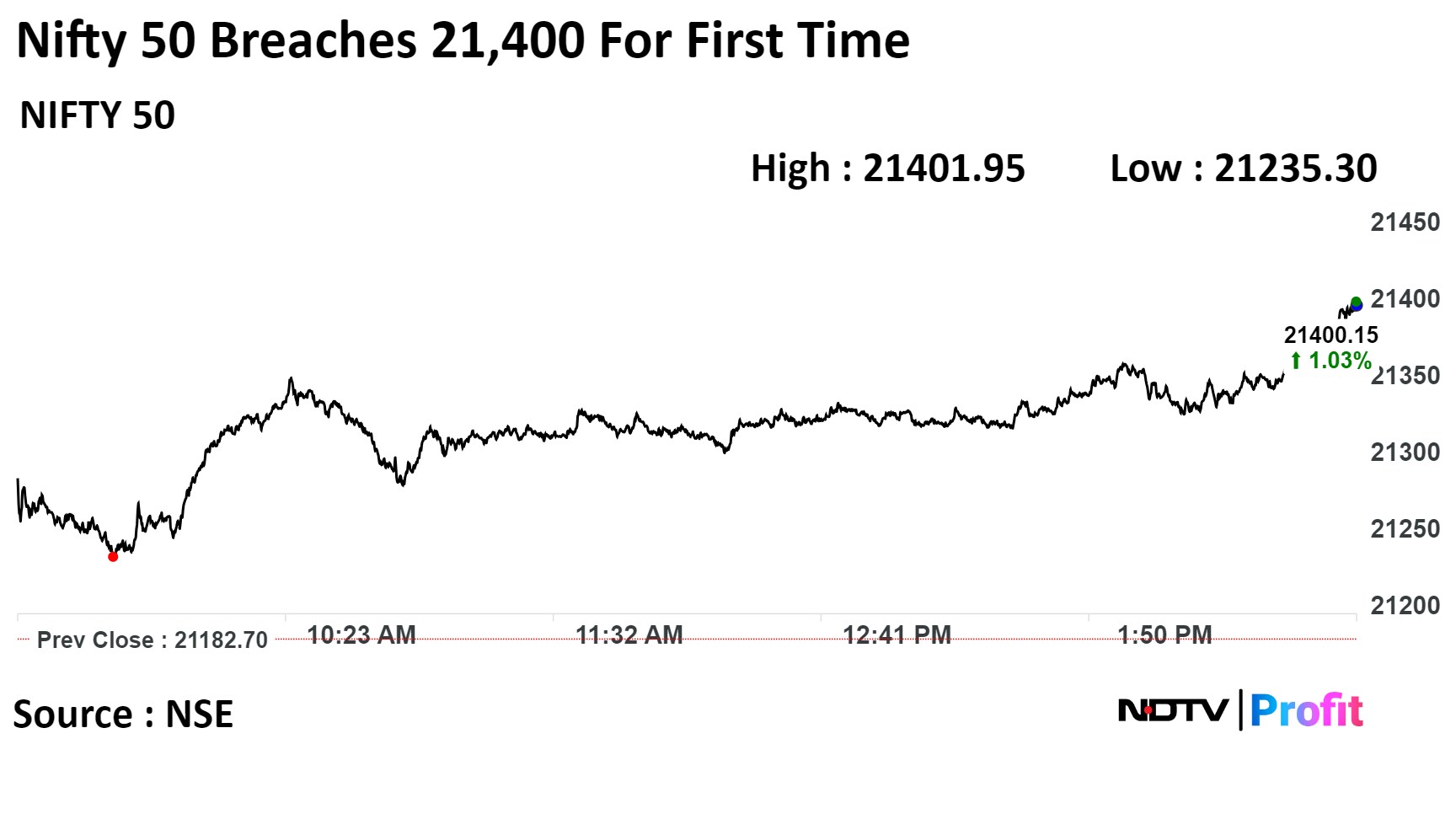

Indian benchmark indices surged to record high, and ended higher for seventh consecutive weeks on Friday as as Infosys Ltd., Tata Consultancy Ltd., Reliance Industries Ltd. gained.

The NSE Nifty 50 settled 1.29% or 273.95 points higher at 21,456.65, while The S&P BSE Sensex ended 1.37% or 969.55 points at 71,483.75 on Friday.

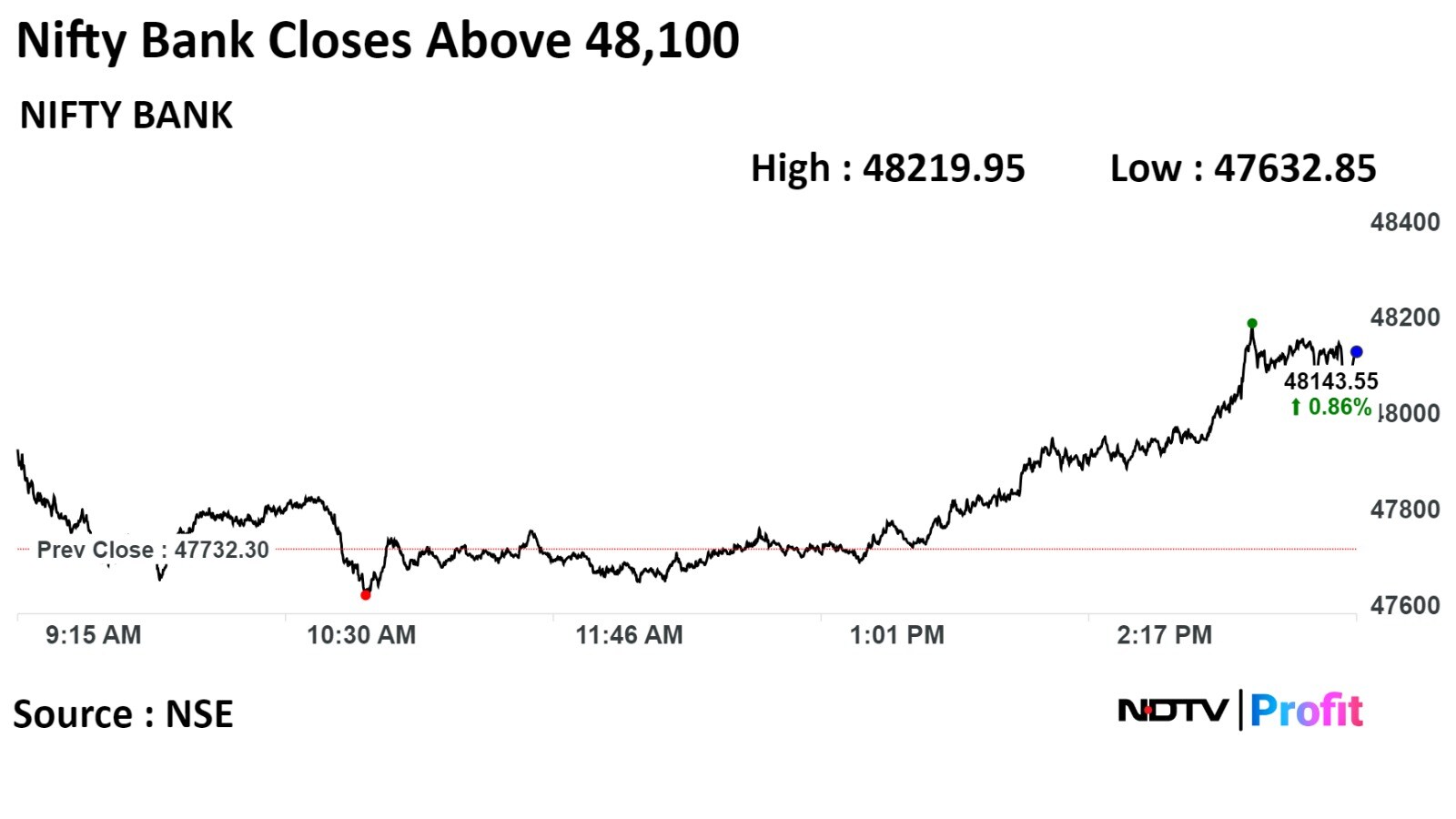

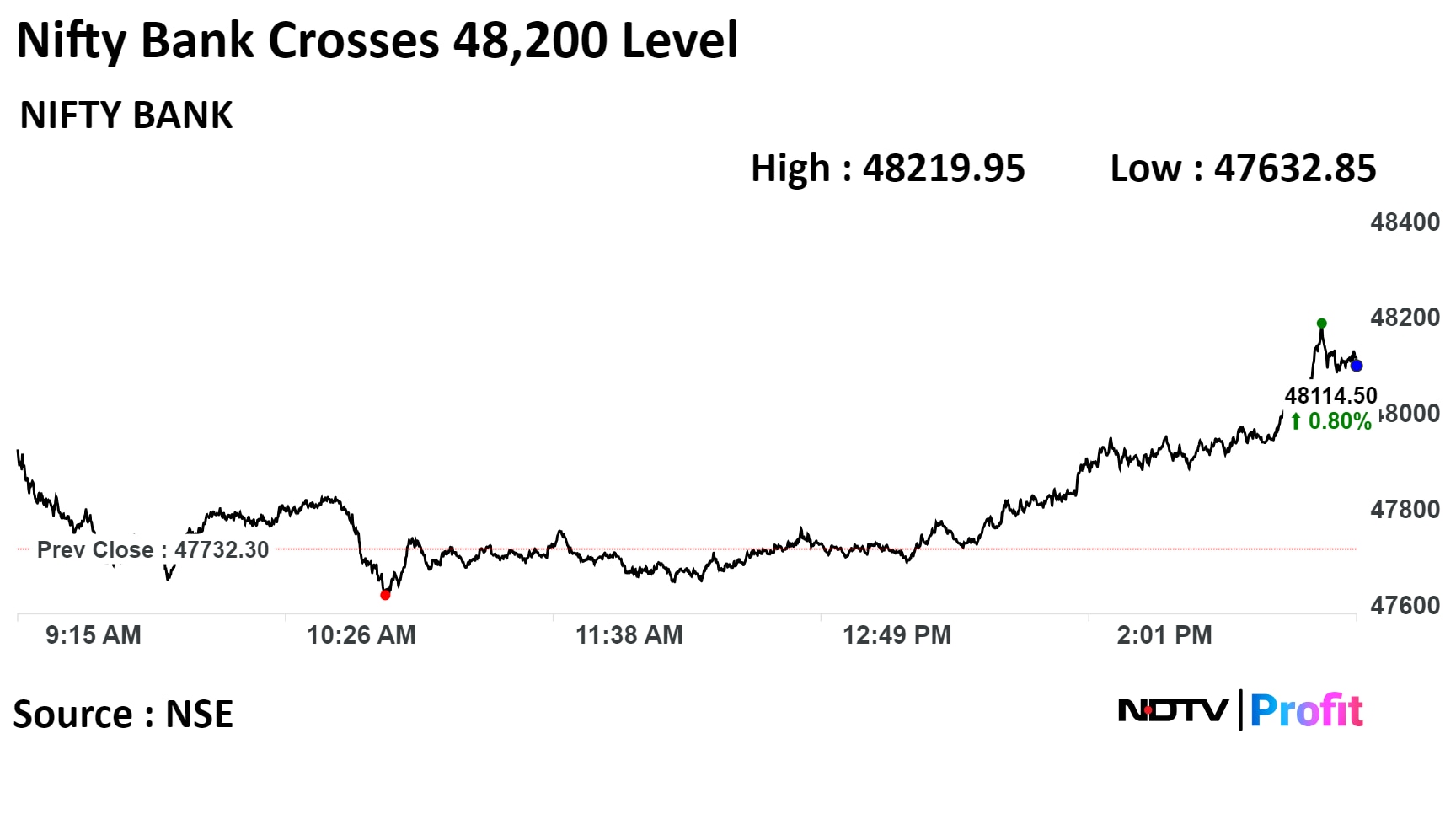

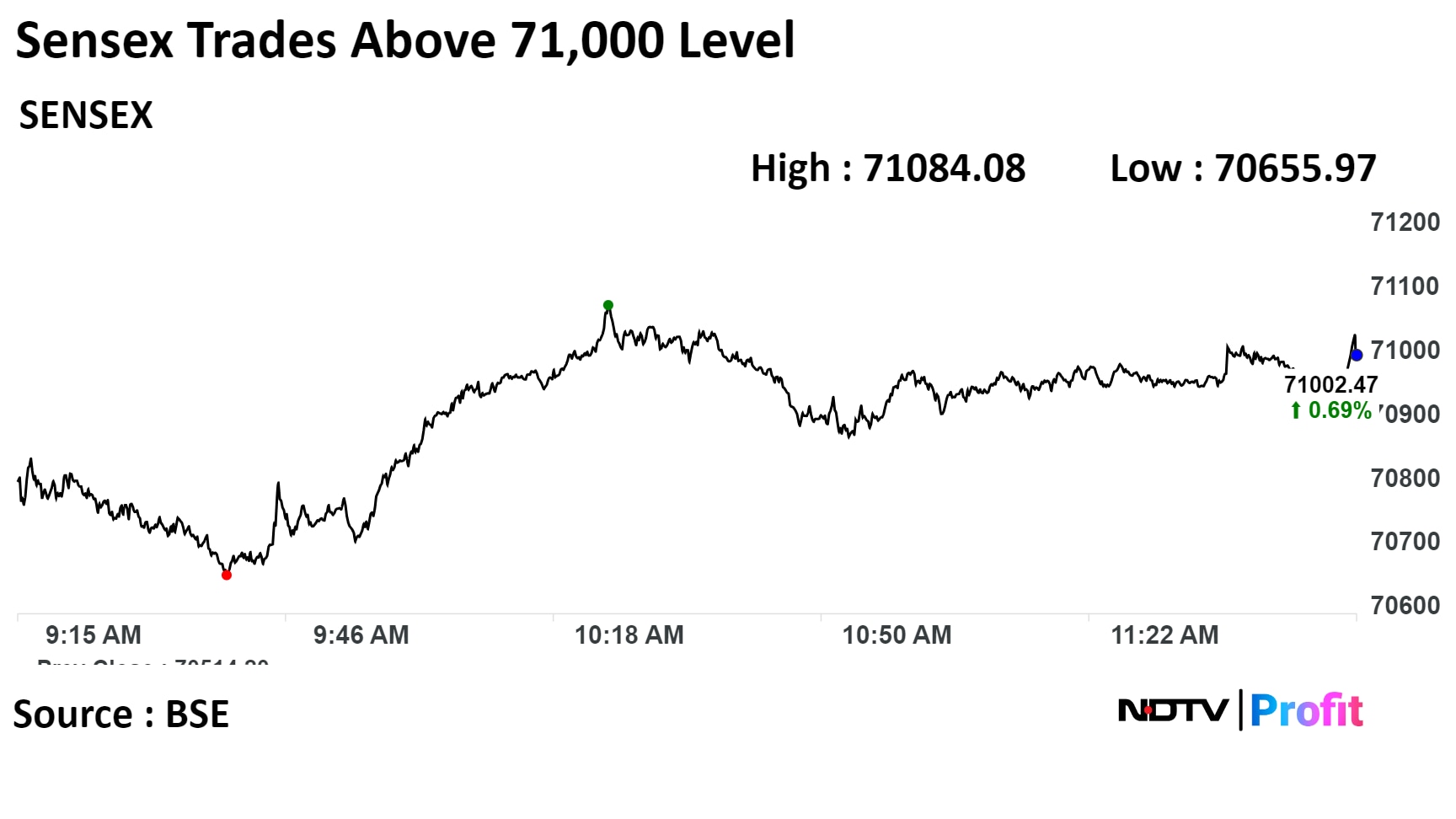

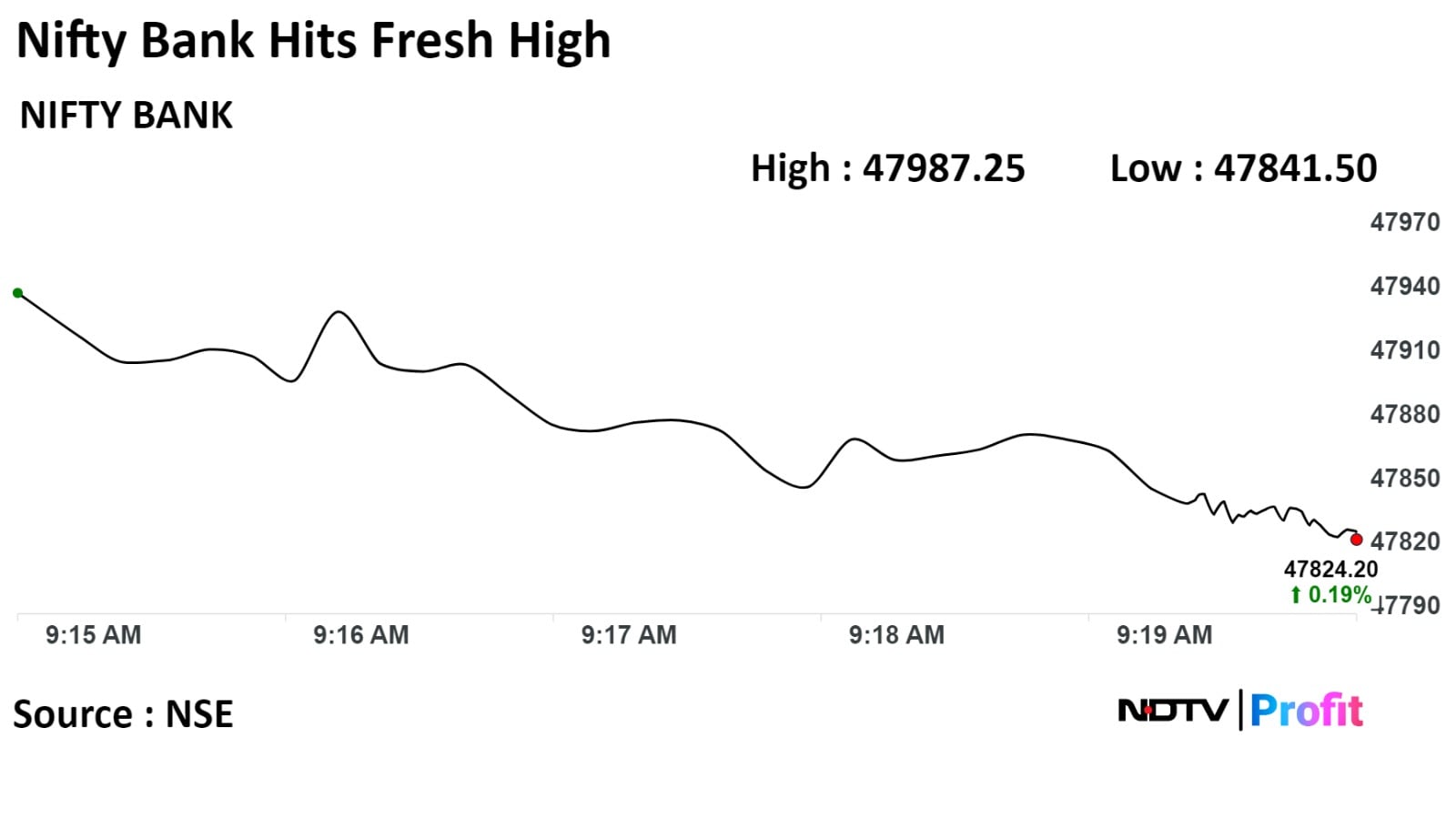

The Nifty Bank also for the first time breached 48,200 level for the first time on Friday during the last leg of the trade. The index settled 0.86% or 411.25 at 48,143.55

"The buoyancy continued in the market as investors were expecting the clouds over US economic growth to recede by H2CY24 and that the economy would achieve a soft landing aided by normalization in monetary policy. The USD/INR witnessed a steep fall on account of the prospects of interest rates being cut next year. The IT index outperformed expectations of a rise in demand in the US economy," said Vinod Nair, head of research at Geojit Financial Services.

Indian benchmark indices surged to record high, and ended higher for seventh consecutive weeks on Friday as as Infosys Ltd., Tata Consultancy Ltd., Reliance Industries Ltd. gained.

The NSE Nifty 50 settled 1.29% or 273.95 points higher at 21,456.65, while The S&P BSE Sensex ended 1.37% or 969.55 points at 71,483.75 on Friday.

The Nifty Bank also for the first time breached 48,200 level for the first time on Friday during the last leg of the trade. The index settled 0.86% or 411.25 at 48,143.55

"The buoyancy continued in the market as investors were expecting the clouds over US economic growth to recede by H2CY24 and that the economy would achieve a soft landing aided by normalization in monetary policy. The USD/INR witnessed a steep fall on account of the prospects of interest rates being cut next year. The IT index outperformed expectations of a rise in demand in the US economy," said Vinod Nair, head of research at Geojit Financial Services.

Indian benchmark indices surged to record high, and ended higher for seventh consecutive weeks on Friday as as Infosys Ltd., Tata Consultancy Ltd., Reliance Industries Ltd. gained.

The NSE Nifty 50 settled 1.29% or 273.95 points higher at 21,456.65, while The S&P BSE Sensex ended 1.37% or 969.55 points at 71,483.75 on Friday.

The Nifty Bank also for the first time breached 48,200 level for the first time on Friday during the last leg of the trade. The index settled 0.86% or 411.25 at 48,143.55

"The buoyancy continued in the market as investors were expecting the clouds over US economic growth to recede by H2CY24 and that the economy would achieve a soft landing aided by normalization in monetary policy. The USD/INR witnessed a steep fall on account of the prospects of interest rates being cut next year. The IT index outperformed expectations of a rise in demand in the US economy," said Vinod Nair, head of research at Geojit Financial Services.

Indian benchmark indices surged to record high, and ended higher for seventh consecutive weeks on Friday as as Infosys Ltd., Tata Consultancy Ltd., Reliance Industries Ltd. gained.

The NSE Nifty 50 settled 1.29% or 273.95 points higher at 21,456.65, while The S&P BSE Sensex ended 1.37% or 969.55 points at 71,483.75 on Friday.

The Nifty Bank also for the first time breached 48,200 level for the first time on Friday during the last leg of the trade. The index settled 0.86% or 411.25 at 48,143.55

"The buoyancy continued in the market as investors were expecting the clouds over US economic growth to recede by H2CY24 and that the economy would achieve a soft landing aided by normalization in monetary policy. The USD/INR witnessed a steep fall on account of the prospects of interest rates being cut next year. The IT index outperformed expectations of a rise in demand in the US economy," said Vinod Nair, head of research at Geojit Financial Services.

Indian benchmark indices surged to record high, and ended higher for seventh consecutive weeks on Friday as as Infosys Ltd., Tata Consultancy Ltd., Reliance Industries Ltd. gained.

The NSE Nifty 50 settled 1.29% or 273.95 points higher at 21,456.65, while The S&P BSE Sensex ended 1.37% or 969.55 points at 71,483.75 on Friday.

The Nifty Bank also for the first time breached 48,200 level for the first time on Friday during the last leg of the trade. The index settled 0.86% or 411.25 at 48,143.55

"The buoyancy continued in the market as investors were expecting the clouds over US economic growth to recede by H2CY24 and that the economy would achieve a soft landing aided by normalization in monetary policy. The USD/INR witnessed a steep fall on account of the prospects of interest rates being cut next year. The IT index outperformed expectations of a rise in demand in the US economy," said Vinod Nair, head of research at Geojit Financial Services.

Indian benchmark indices surged to record high, and ended higher for seventh consecutive weeks on Friday as as Infosys Ltd., Tata Consultancy Ltd., Reliance Industries Ltd. gained.

The NSE Nifty 50 settled 1.29% or 273.95 points higher at 21,456.65, while The S&P BSE Sensex ended 1.37% or 969.55 points at 71,483.75 on Friday.

The Nifty Bank also for the first time breached 48,200 level for the first time on Friday during the last leg of the trade. The index settled 0.86% or 411.25 at 48,143.55

"The buoyancy continued in the market as investors were expecting the clouds over US economic growth to recede by H2CY24 and that the economy would achieve a soft landing aided by normalization in monetary policy. The USD/INR witnessed a steep fall on account of the prospects of interest rates being cut next year. The IT index outperformed expectations of a rise in demand in the US economy," said Vinod Nair, head of research at Geojit Financial Services.

Indian benchmark indices surged to record high, and ended higher for seventh consecutive weeks on Friday as as Infosys Ltd., Tata Consultancy Ltd., Reliance Industries Ltd. gained.

The NSE Nifty 50 settled 1.29% or 273.95 points higher at 21,456.65, while The S&P BSE Sensex ended 1.37% or 969.55 points at 71,483.75 on Friday.

The Nifty Bank also for the first time breached 48,200 level for the first time on Friday during the last leg of the trade. The index settled 0.86% or 411.25 at 48,143.55

"The buoyancy continued in the market as investors were expecting the clouds over US economic growth to recede by H2CY24 and that the economy would achieve a soft landing aided by normalization in monetary policy. The USD/INR witnessed a steep fall on account of the prospects of interest rates being cut next year. The IT index outperformed expectations of a rise in demand in the US economy," said Vinod Nair, head of research at Geojit Financial Services.

Indian benchmark indices surged to record high, and ended higher for seventh consecutive weeks on Friday as as Infosys Ltd., Tata Consultancy Ltd., Reliance Industries Ltd. gained.

The NSE Nifty 50 settled 1.29% or 273.95 points higher at 21,456.65, while The S&P BSE Sensex ended 1.37% or 969.55 points at 71,483.75 on Friday.

The Nifty Bank also for the first time breached 48,200 level for the first time on Friday during the last leg of the trade. The index settled 0.86% or 411.25 at 48,143.55

"The buoyancy continued in the market as investors were expecting the clouds over US economic growth to recede by H2CY24 and that the economy would achieve a soft landing aided by normalization in monetary policy. The USD/INR witnessed a steep fall on account of the prospects of interest rates being cut next year. The IT index outperformed expectations of a rise in demand in the US economy," said Vinod Nair, head of research at Geojit Financial Services.

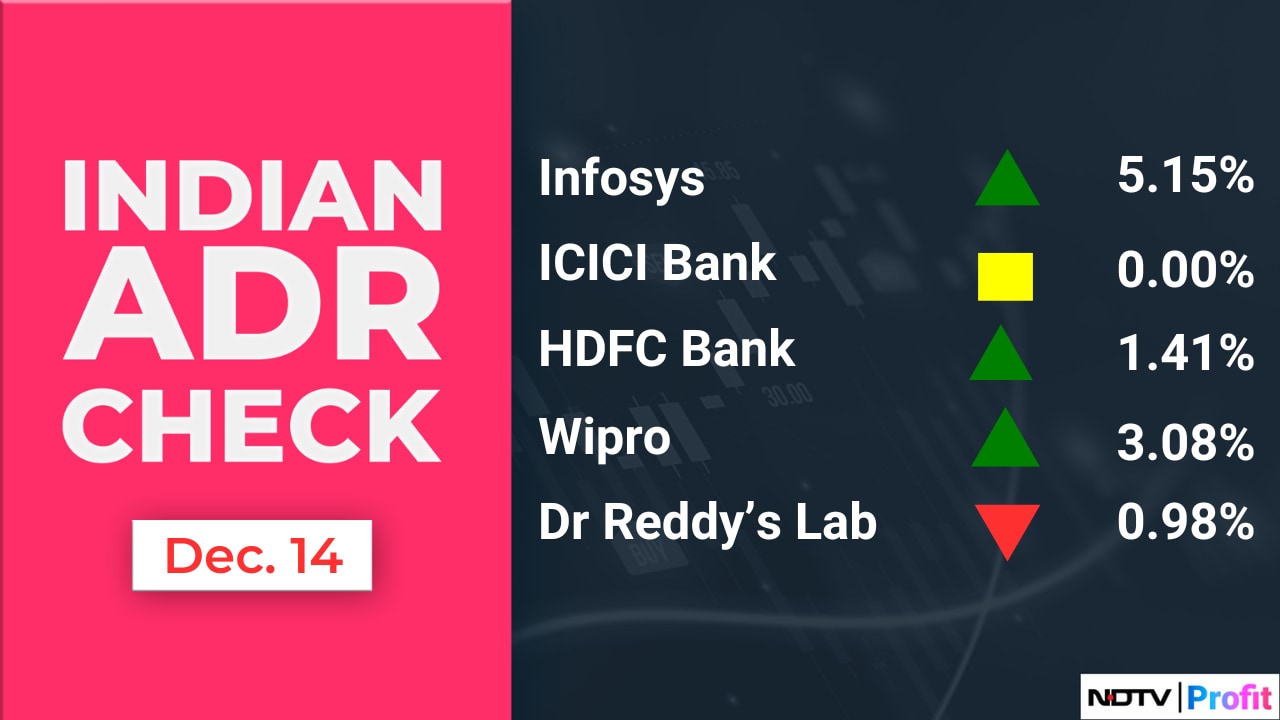

Infosys Ltd., Tata Consultancy Services Ltd., Reliance Industries Ltd., State Bank of India, and HCL Technologies added positively to the indices.

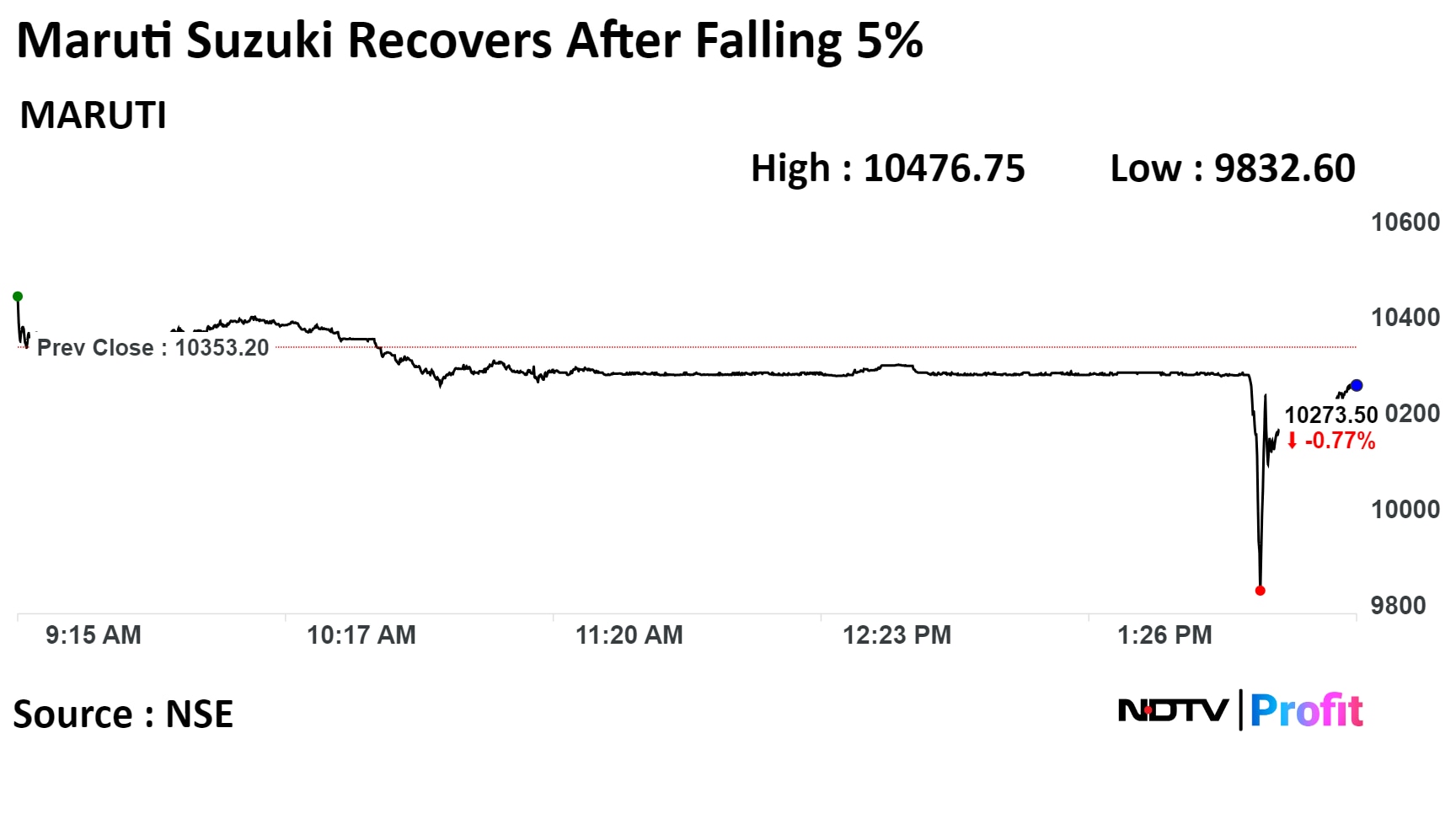

Bharti Airtel Ltd., ITC Ltd., Kotak Mahindra Bank Ltd., HDFC Life Insurance Ltd., and Maruti Suzuki Ltd. were weighing on the indices.

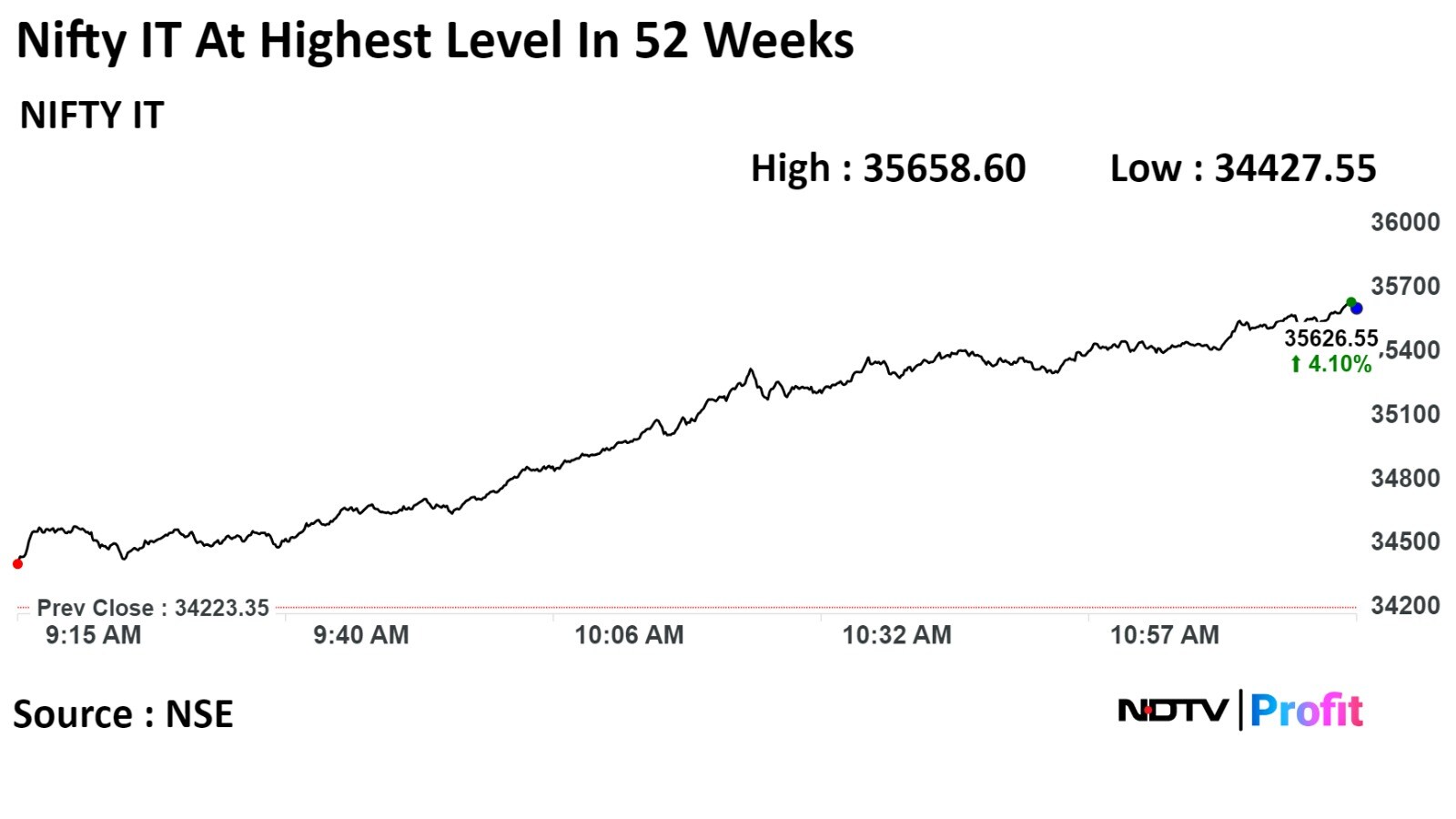

All sectors advanced this week with the Nifty IT emerging as the top gainer with 7.16% weekly gains.

The broader markets underperformed as the BSE MidCap rose 0.17%, while the BSE SmallCap was 0.25% higher. Six out of the 20 sectors compiled by the BSE advanced, while 14 declined.

The market breadth was skewed in the favour of buyers. About 1,963 stocks advanced, 1,804 declined, and 121 were unchanged.

The local currency strengthened 33 paise to trade at 82.99 against the U.S dollar on Friday. It strengthened the most since Sept 22, when rupee was at 82.83 level

It closed at 83.33 on Thursday.

Source: Bloomberg

Maruti Suzuki shares fall 5% intraday

Maruti Suzuki sees sharpest intraday fall since Sep. 26, 2022

Maruti Suzuki shares recover over 4% from day's low

Maruti Suzuki shares fall 5% intraday

Maruti Suzuki sees sharpest intraday fall since Sep. 26, 2022

Maruti Suzuki shares recover over 4% from day's low

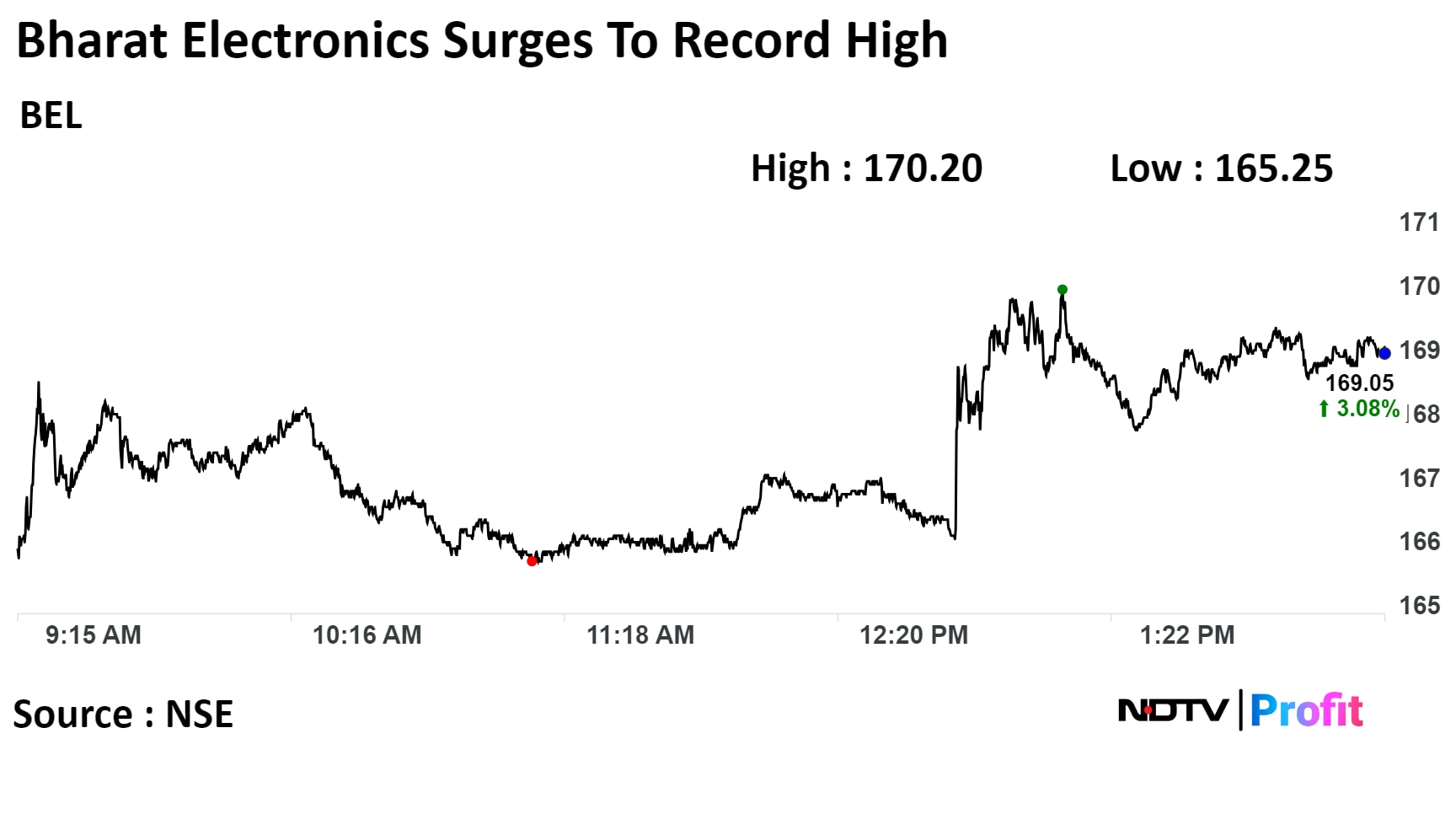

Shares of Bharat Electronics Ltd. soared over 3% to touch an all-time high after the Ministry of Defense signed an contract Friday with the company for procurement of electronic fuzes for the Indian army, according to a press release by the ministry.

According to the contract, Ministry of Defense will procure electronic fuzes for the Indian Army for 10 years at a total cost of Rs 5,336.25 crore from the Bharat Electronics Ltd's Pune unit , the press release said.

Electronic fuzes are integral part of the calibre artillery guns.

Shares of Bharat Electronics Ltd. soared over 3% to touch an all-time high after the Ministry of Defense signed an contract Friday with the company for procurement of electronic fuzes for the Indian army, according to a press release by the ministry.

According to the contract, Ministry of Defense will procure electronic fuzes for the Indian Army for 10 years at a total cost of Rs 5,336.25 crore from the Bharat Electronics Ltd's Pune unit , the press release said.

Electronic fuzes are integral part of the calibre artillery guns.

The scrip rose as much as 3.78% to Rs 170.20 apiece, the highest level since Mar 2, 1993 when it was listed on BSE. It was trading 3.23% higher at Rs 169.30 apiece, as of 2:08 p.m. This compares to a 0.76 advance in the NSE Nifty 50 Index.

It has risen 69.07% on a year-to-date basis. Total traded volume so far in the day stood at 2.2times its 30-day average. The relative strength index was at 80.30, which implied the stock is overbought.

Out of 29 analysts tracking the company, 23 maintain a 'buy' rating, four recommend a 'hold,' and two suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 5.7%.

Nov trade deficit at $20.58 bn vs $22.06 bn

Nov exports at $33.90 bn vs $34.89 bn

Nov imports at $54.48 bn vs $56.95 bn

Apr-Nov exports at $278.80 bn vs $298.21 bn

Apr-Nov imports at $445.15 bn vs $487.42 bn

The local currency strengthened 24 paise to trade at 83.09 against the U.S dollar on Friday. It strengthened the most since Oct 25, when it was at 83.06 level

It closed at 83.33 on Thursday.

Source: Bloomberg

Axis Bank Ltd's Ashish Kotecha, nominee of Bain Capital affiliated entities, to no longer be non-executive director.

Kotecha ceases to be non-executive director as stake of Bain Capital falls below 2% as of Dec 14.

Source: Exchange filing

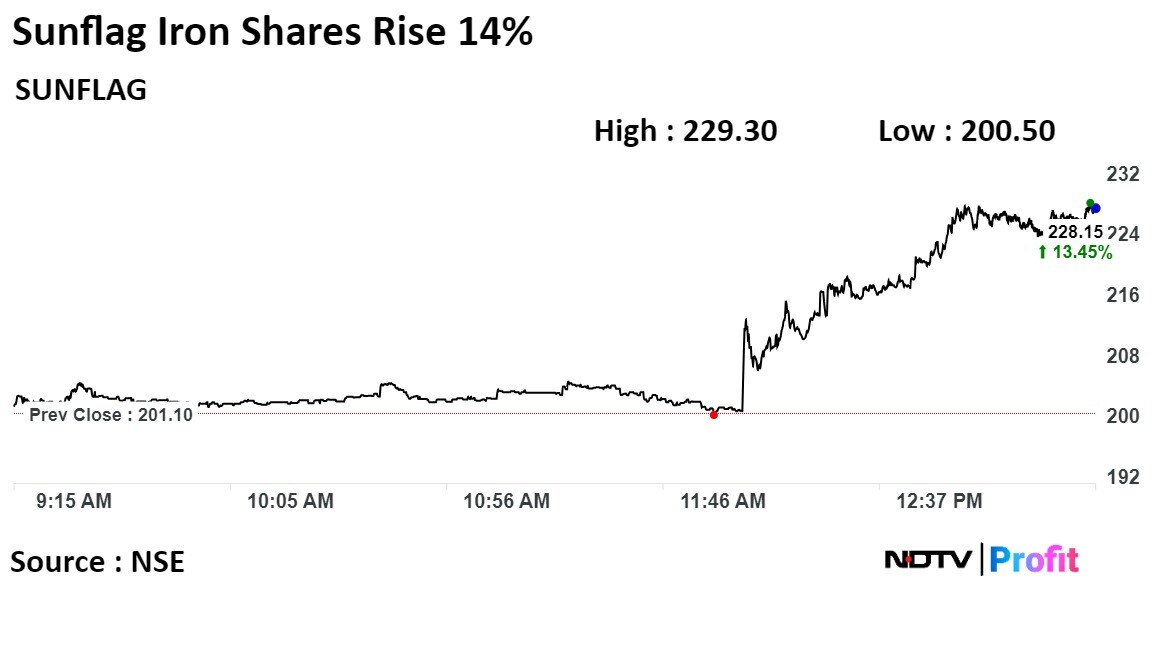

The shares of Sunflag Iron and Steel Co. Ltd. rose on Friday after the company received a letter of intent from the Maharashtra government for composite licence for six Iron ore block.

The shares of Sunflag Iron and Steel Co. Ltd. rose on Friday after the company received a letter of intent from the Maharashtra government for composite licence for six Iron ore block.

Sunflag Iron shares rose as much as 14.02% to Rs 229.30 apiece, it last traded at this level on Aug. 10, 2023. It pared gains to trade 12.53% higher at Rs 226.30 apiece, as of 1:23 a.m. This compares to a 0.072% advance in the NSE Nifty 50 Index.

It has risen 101.78% on a year-to-date basis. Total traded volume so far in the day stood at 16 times its 30-day average. The relative strength index was at 71

Biocon Ltd. said it's not evaluating any divestment options for APIs business

Report of company mulling API business sale speculative

API is strategic business segment, a key growth driver

Source: Exchange Filing

Air traffic rose 9% year-on-year to 1.27 crore

Market share of airlines in November Vs October

IndiGo at 61.8% Vs 62.6%

Air India at 10.5% Vs 10.5%

Vistara 9.4% Vs 9.7%

AIX Connect (formerly AirAsia India) at 6.6% Vs 6.6%

SpiceJet at 6.2% Vs 5%

Akasa Air at 4.2% Vs 4.2%

Source: DGCA

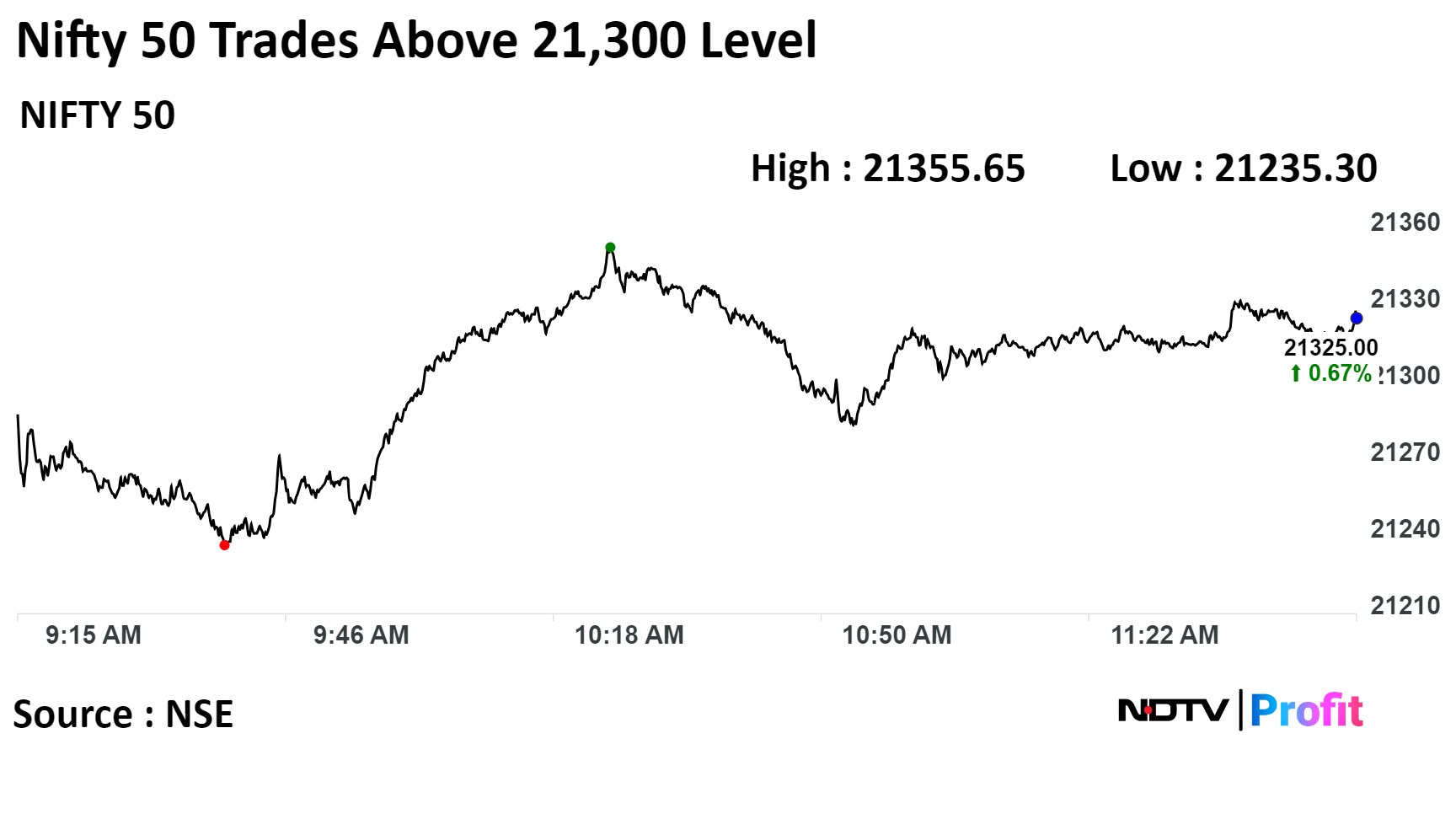

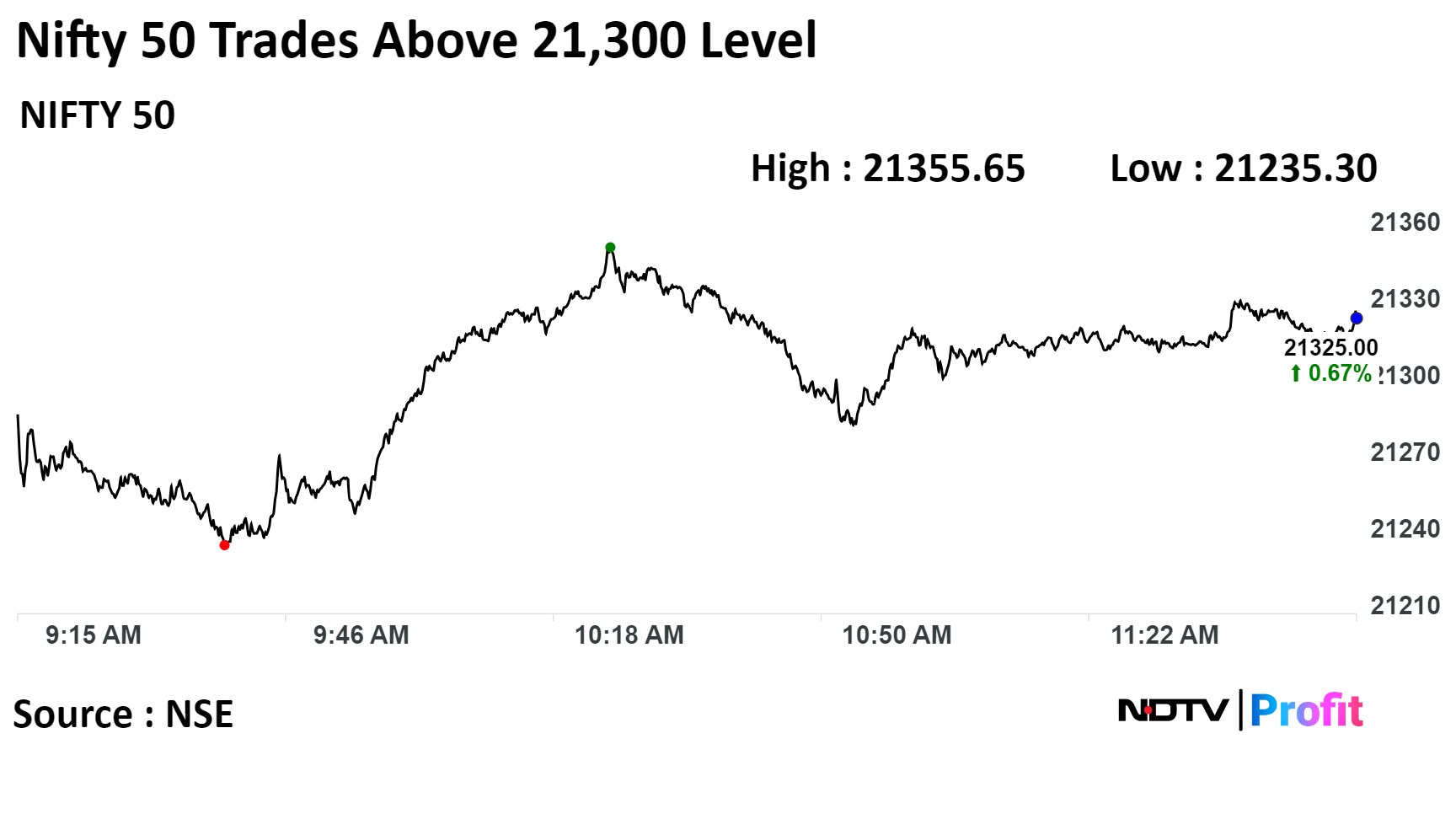

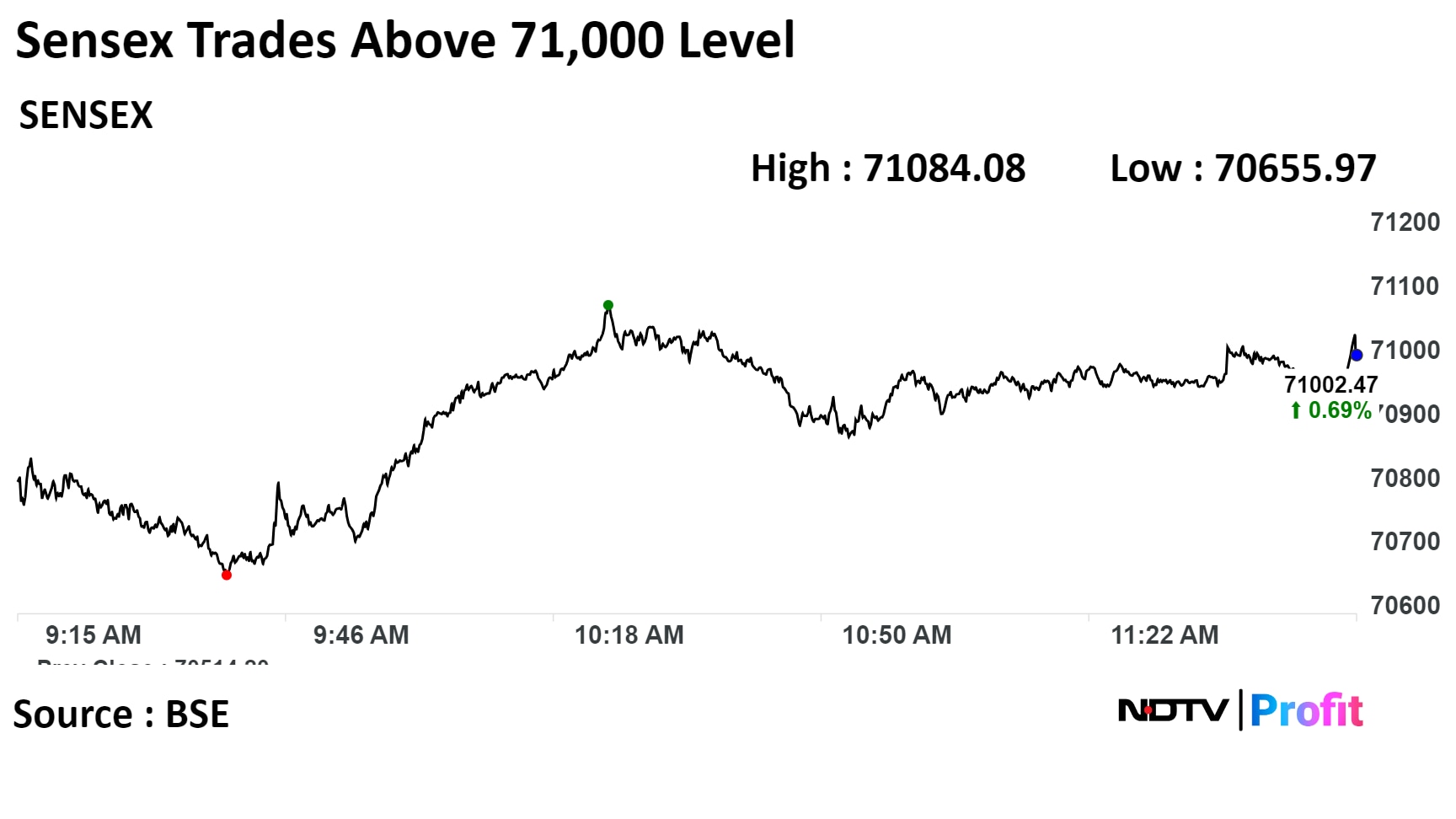

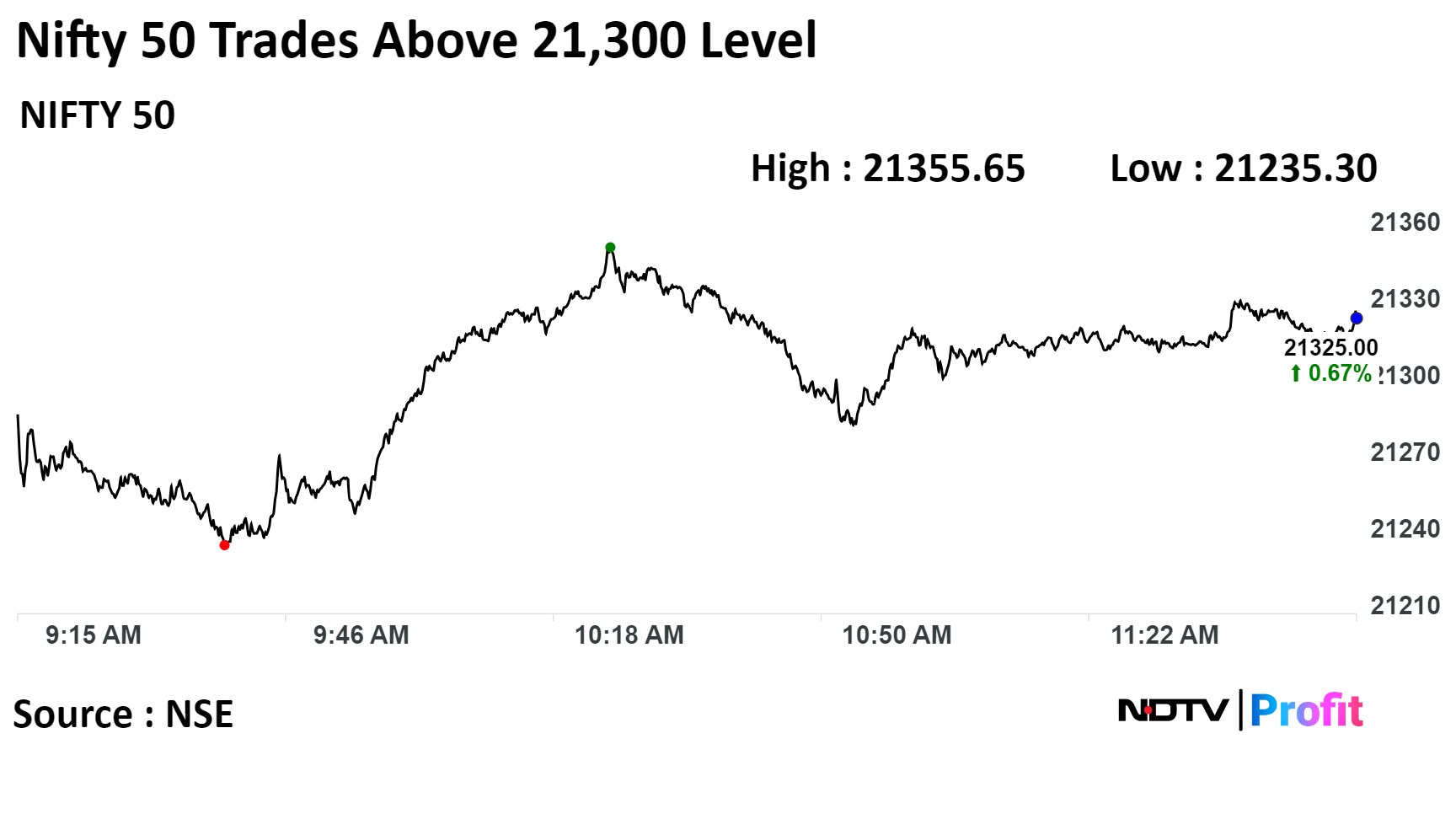

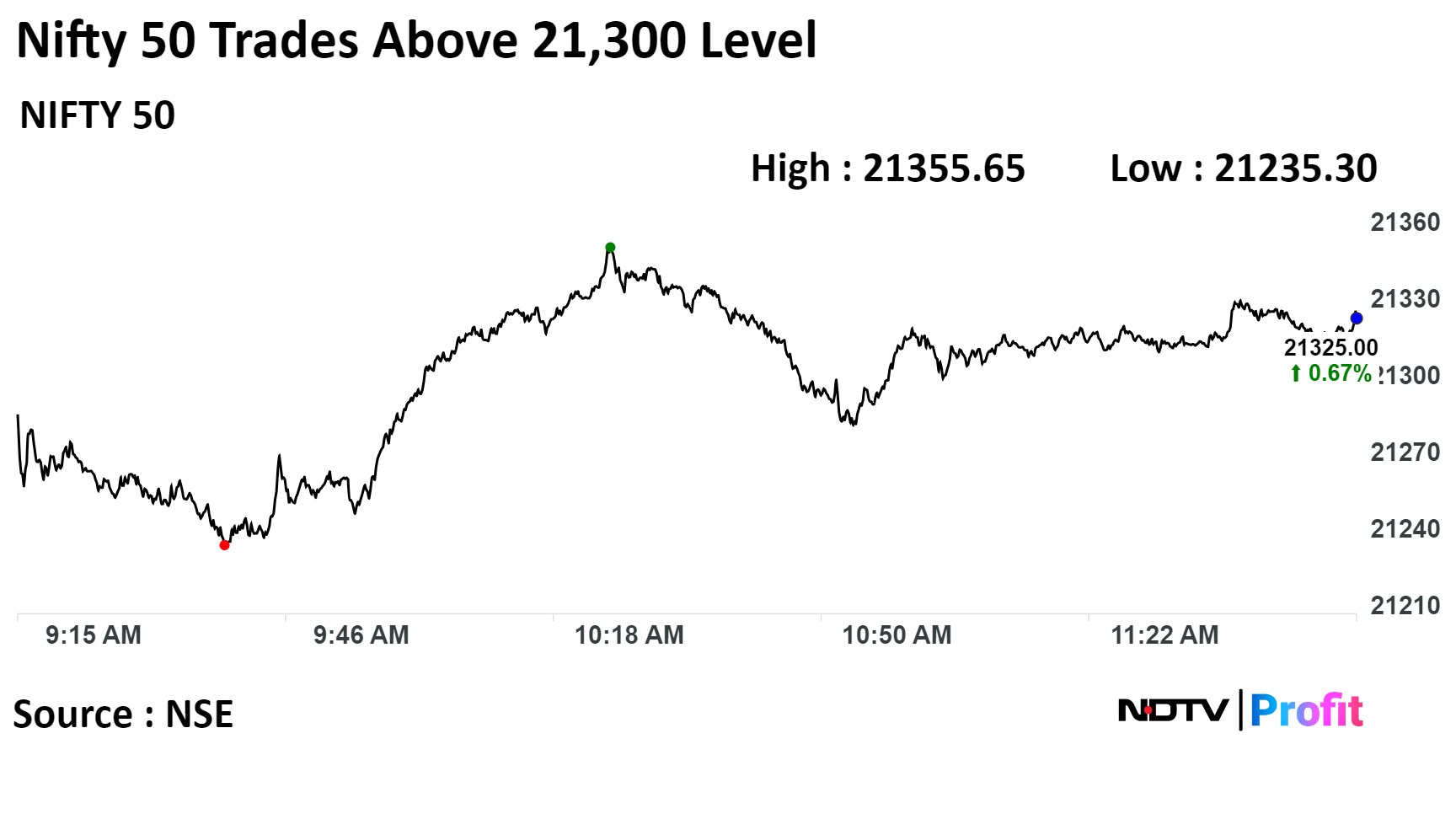

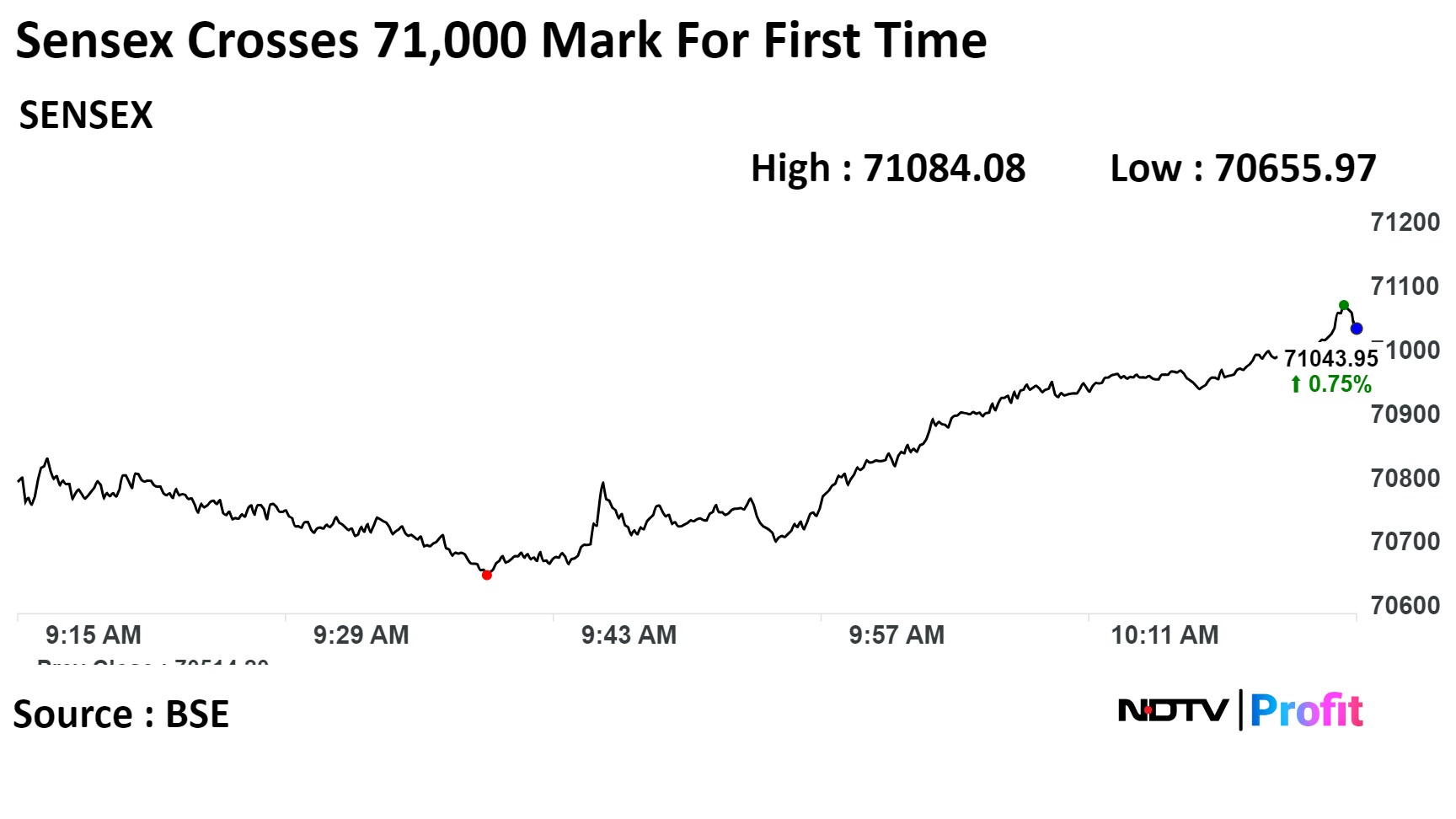

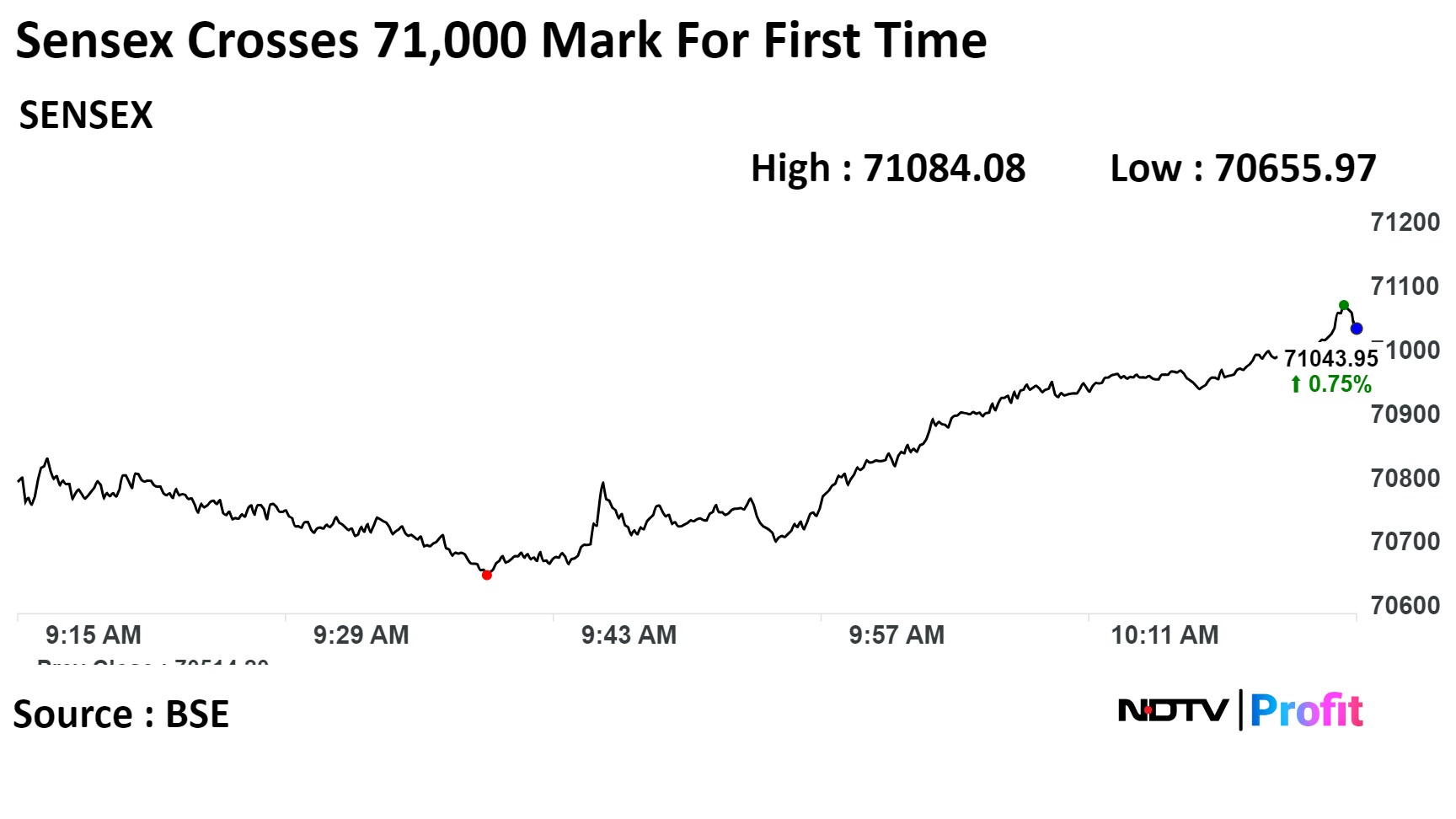

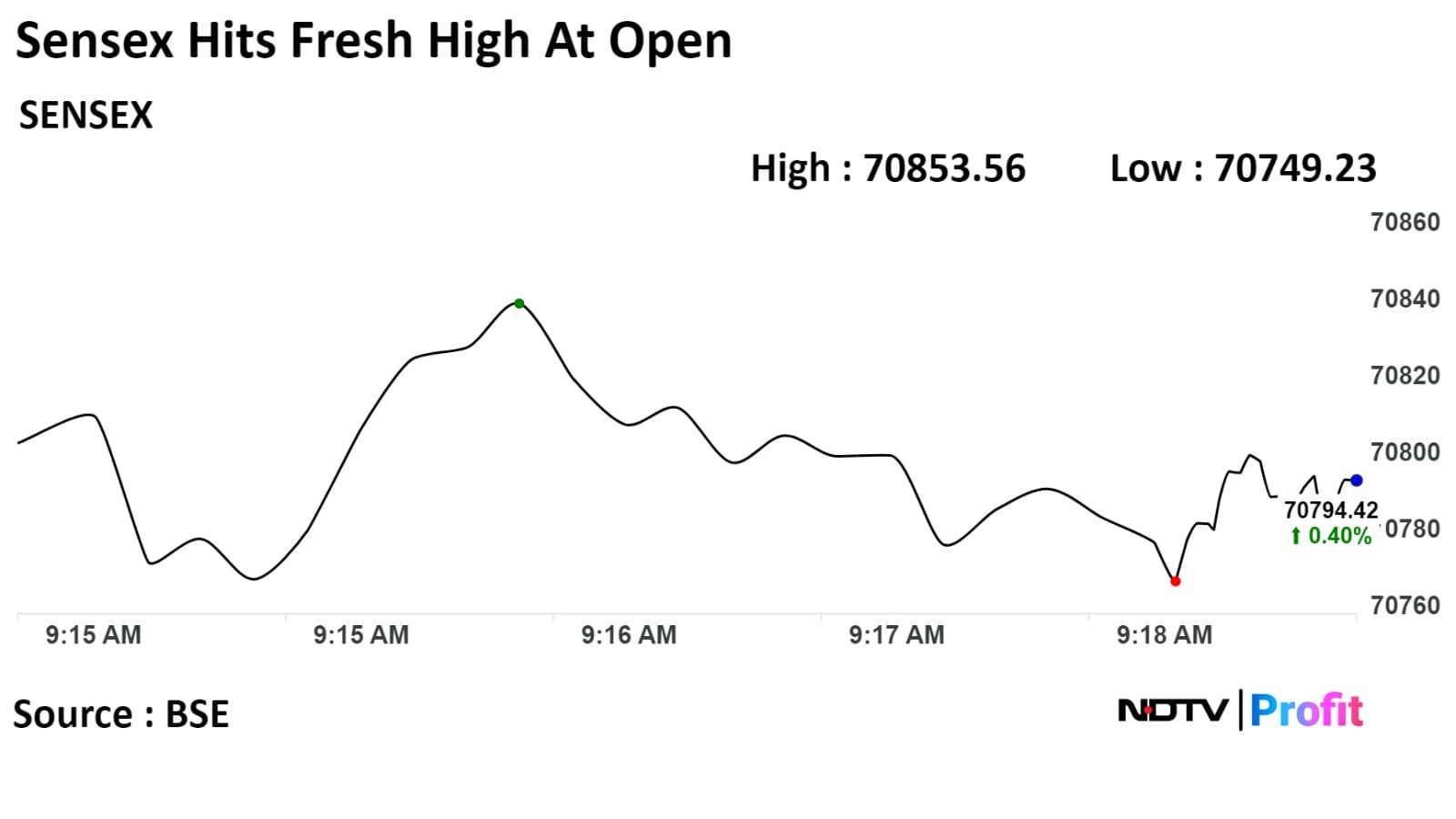

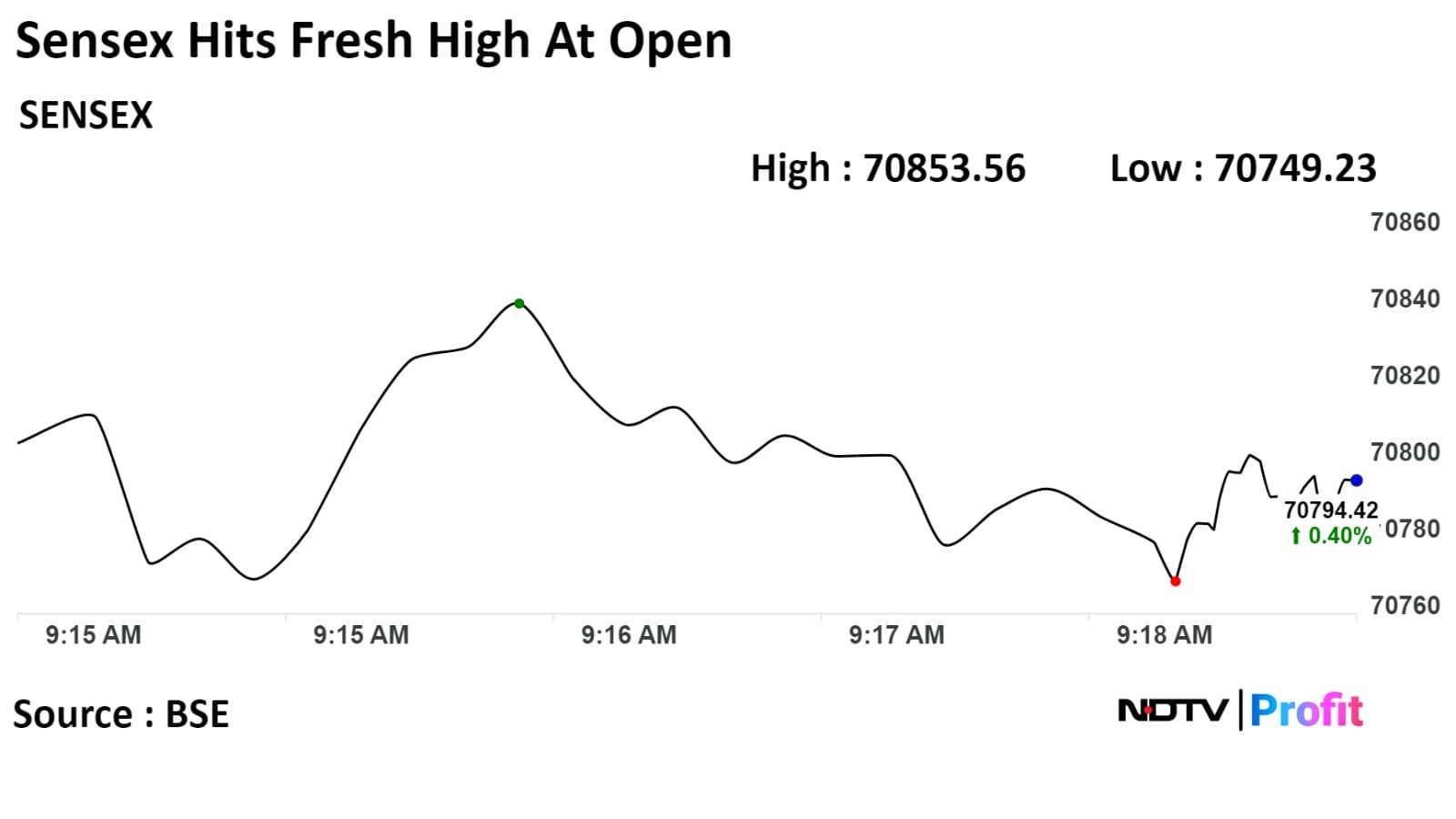

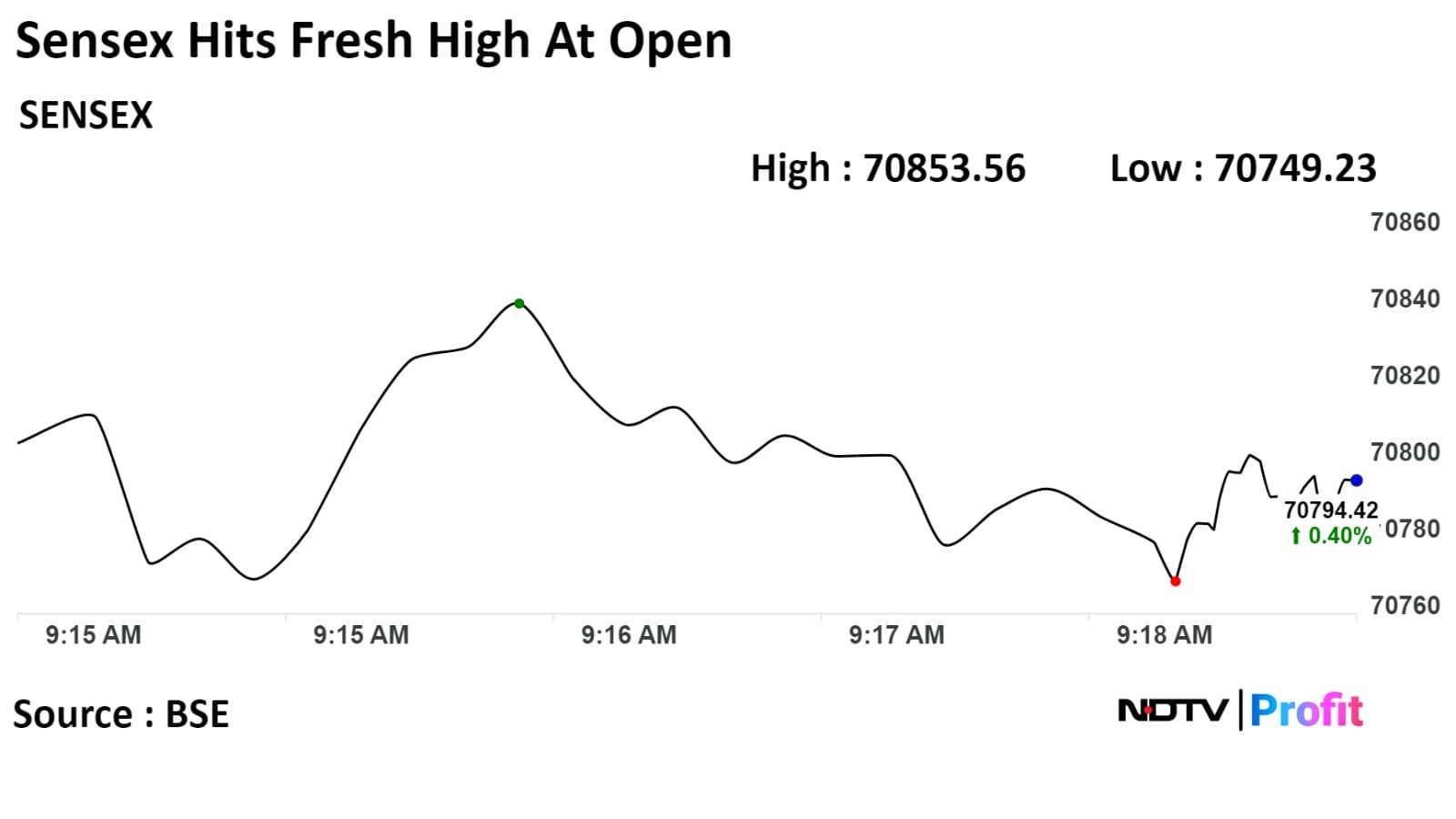

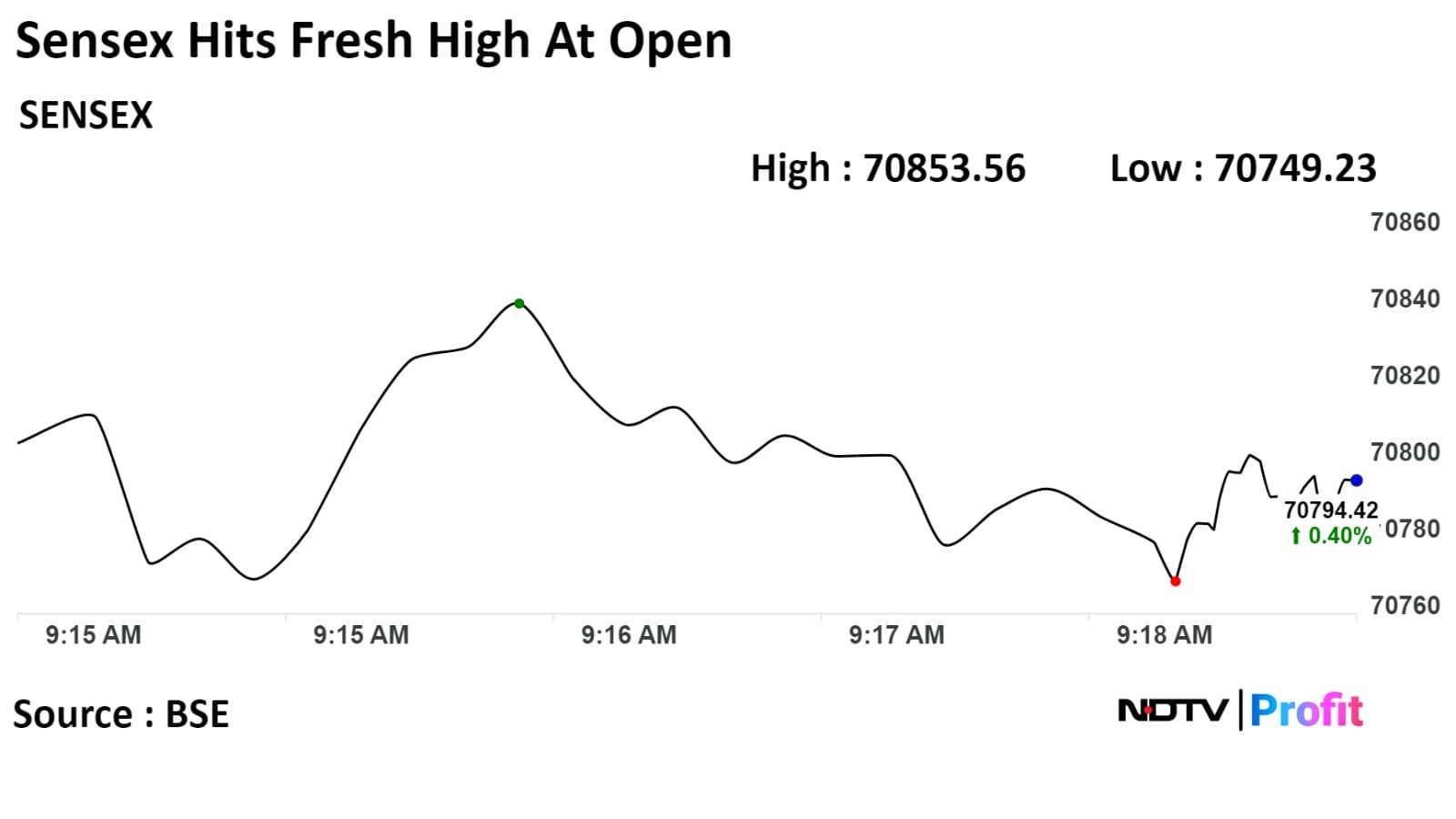

Indian benchmark indices continued their record rally for the second consecutive session on Friday, with the Sensex jumping by as much as 500 points and Nifty rising around 170 points, intraday.

The Nifty 50 hit another record high at 21,355.65, and the Sensex marked 71,084.08 as its lifetime high.

As of 11:45 a.m., the S&P BSE Sensex rose 462.86 points, or 0.66% at 70,977.06, while the NSE Nifty 50 was up 143.70 points or 0.68% at 21,326.40.

Shares of information technology companies tracked their global peers and led gains.

"Fueled by positive global market sentiments, following the Fed indication of a rate cut, the market is poised to sustain its upward trajectory today," said Shrey Jain, founder and chief executive officer of SAS Online.

Indian benchmark indices continued their record rally for the second consecutive session on Friday, with the Sensex jumping by as much as 500 points and Nifty rising around 170 points, intraday.

The Nifty 50 hit another record high at 21,355.65, and the Sensex marked 71,084.08 as its lifetime high.

As of 11:45 a.m., the S&P BSE Sensex rose 462.86 points, or 0.66% at 70,977.06, while the NSE Nifty 50 was up 143.70 points or 0.68% at 21,326.40.

Shares of information technology companies tracked their global peers and led gains.

"Fueled by positive global market sentiments, following the Fed indication of a rate cut, the market is poised to sustain its upward trajectory today," said Shrey Jain, founder and chief executive officer of SAS Online.

Indian benchmark indices continued their record rally for the second consecutive session on Friday, with the Sensex jumping by as much as 500 points and Nifty rising around 170 points, intraday.

The Nifty 50 hit another record high at 21,355.65, and the Sensex marked 71,084.08 as its lifetime high.

As of 11:45 a.m., the S&P BSE Sensex rose 462.86 points, or 0.66% at 70,977.06, while the NSE Nifty 50 was up 143.70 points or 0.68% at 21,326.40.

Shares of information technology companies tracked their global peers and led gains.

"Fueled by positive global market sentiments, following the Fed indication of a rate cut, the market is poised to sustain its upward trajectory today," said Shrey Jain, founder and chief executive officer of SAS Online.

Indian benchmark indices continued their record rally for the second consecutive session on Friday, with the Sensex jumping by as much as 500 points and Nifty rising around 170 points, intraday.

The Nifty 50 hit another record high at 21,355.65, and the Sensex marked 71,084.08 as its lifetime high.

As of 11:45 a.m., the S&P BSE Sensex rose 462.86 points, or 0.66% at 70,977.06, while the NSE Nifty 50 was up 143.70 points or 0.68% at 21,326.40.

Shares of information technology companies tracked their global peers and led gains.

"Fueled by positive global market sentiments, following the Fed indication of a rate cut, the market is poised to sustain its upward trajectory today," said Shrey Jain, founder and chief executive officer of SAS Online.

Indian benchmark indices continued their record rally for the second consecutive session on Friday, with the Sensex jumping by as much as 500 points and Nifty rising around 170 points, intraday.

The Nifty 50 hit another record high at 21,355.65, and the Sensex marked 71,084.08 as its lifetime high.

As of 11:45 a.m., the S&P BSE Sensex rose 462.86 points, or 0.66% at 70,977.06, while the NSE Nifty 50 was up 143.70 points or 0.68% at 21,326.40.

Shares of information technology companies tracked their global peers and led gains.

"Fueled by positive global market sentiments, following the Fed indication of a rate cut, the market is poised to sustain its upward trajectory today," said Shrey Jain, founder and chief executive officer of SAS Online.

Indian benchmark indices continued their record rally for the second consecutive session on Friday, with the Sensex jumping by as much as 500 points and Nifty rising around 170 points, intraday.

The Nifty 50 hit another record high at 21,355.65, and the Sensex marked 71,084.08 as its lifetime high.

As of 11:45 a.m., the S&P BSE Sensex rose 462.86 points, or 0.66% at 70,977.06, while the NSE Nifty 50 was up 143.70 points or 0.68% at 21,326.40.

Shares of information technology companies tracked their global peers and led gains.

"Fueled by positive global market sentiments, following the Fed indication of a rate cut, the market is poised to sustain its upward trajectory today," said Shrey Jain, founder and chief executive officer of SAS Online.

Indian benchmark indices continued their record rally for the second consecutive session on Friday, with the Sensex jumping by as much as 500 points and Nifty rising around 170 points, intraday.

The Nifty 50 hit another record high at 21,355.65, and the Sensex marked 71,084.08 as its lifetime high.

As of 11:45 a.m., the S&P BSE Sensex rose 462.86 points, or 0.66% at 70,977.06, while the NSE Nifty 50 was up 143.70 points or 0.68% at 21,326.40.

Shares of information technology companies tracked their global peers and led gains.

"Fueled by positive global market sentiments, following the Fed indication of a rate cut, the market is poised to sustain its upward trajectory today," said Shrey Jain, founder and chief executive officer of SAS Online.

Indian benchmark indices continued their record rally for the second consecutive session on Friday, with the Sensex jumping by as much as 500 points and Nifty rising around 170 points, intraday.

The Nifty 50 hit another record high at 21,355.65, and the Sensex marked 71,084.08 as its lifetime high.

As of 11:45 a.m., the S&P BSE Sensex rose 462.86 points, or 0.66% at 70,977.06, while the NSE Nifty 50 was up 143.70 points or 0.68% at 21,326.40.

Shares of information technology companies tracked their global peers and led gains.

"Fueled by positive global market sentiments, following the Fed indication of a rate cut, the market is poised to sustain its upward trajectory today," said Shrey Jain, founder and chief executive officer of SAS Online.

Hindalco Industries Ltd., HCL Technologies Ltd., Infosys Ltd., Tech Mahindra Ltd., and Tata Consultancy Services Ltd. were positively contributing to changes in the Nifty.

While, Axis Bank Ltd., Bharti Airtel Ltd., HDFC Life Insurance Co., ITC Ltd. and Kotak Mahindra Bank Ltd. were negatively contributing to the change.

Most sectoral indices rose on the NSE, with Nifty IT jumping by more than 4%, followed by Nifty Metal, which rose 1.75%.

Five sectoral indices fell, including Nifty FMCG, Financial Services, Realty, PSU Bank, and Bank.

The broader markets were mixed; the BSE MidCap was flat, while the BSE SmallCap was 0.72% higher.

Sixteen of the 20 sectors compiled by BSE advanced, while four declined.

The market breadth was skewed in the favour of buyers. About 2,028 stocks advanced, 1,585 declined, and 151 were unchanged.

Samvardhana Motherson International Ltd. approved acquisition of Lumen Group

Unit to buy Lumen Group for A$ 93 million

Source: Bloomberg

Sunflag Iron received a Letter of Intent from Maharashtra Govt for composite licence

Composite licence for 6 iron ore block over area of 658 hectares

Source: Exchange Filing

10.3 lakh shares changed hands in a large trade

0.1% equity changed hands at Rs 438.60 apiece

Buyers and sellers not known immediately

Source: Bloomberg

15.7 lakh shares changed hands in a large trade

0.02% equity changed hands at Rs 148.35 apiece

Buyers and sellers not known immediately

Source: Bloomberg

50.4 lakh shares or 0.1% equity changed hands in two large trades

Buyers and sellers not known immediately

Source: Bloomberg

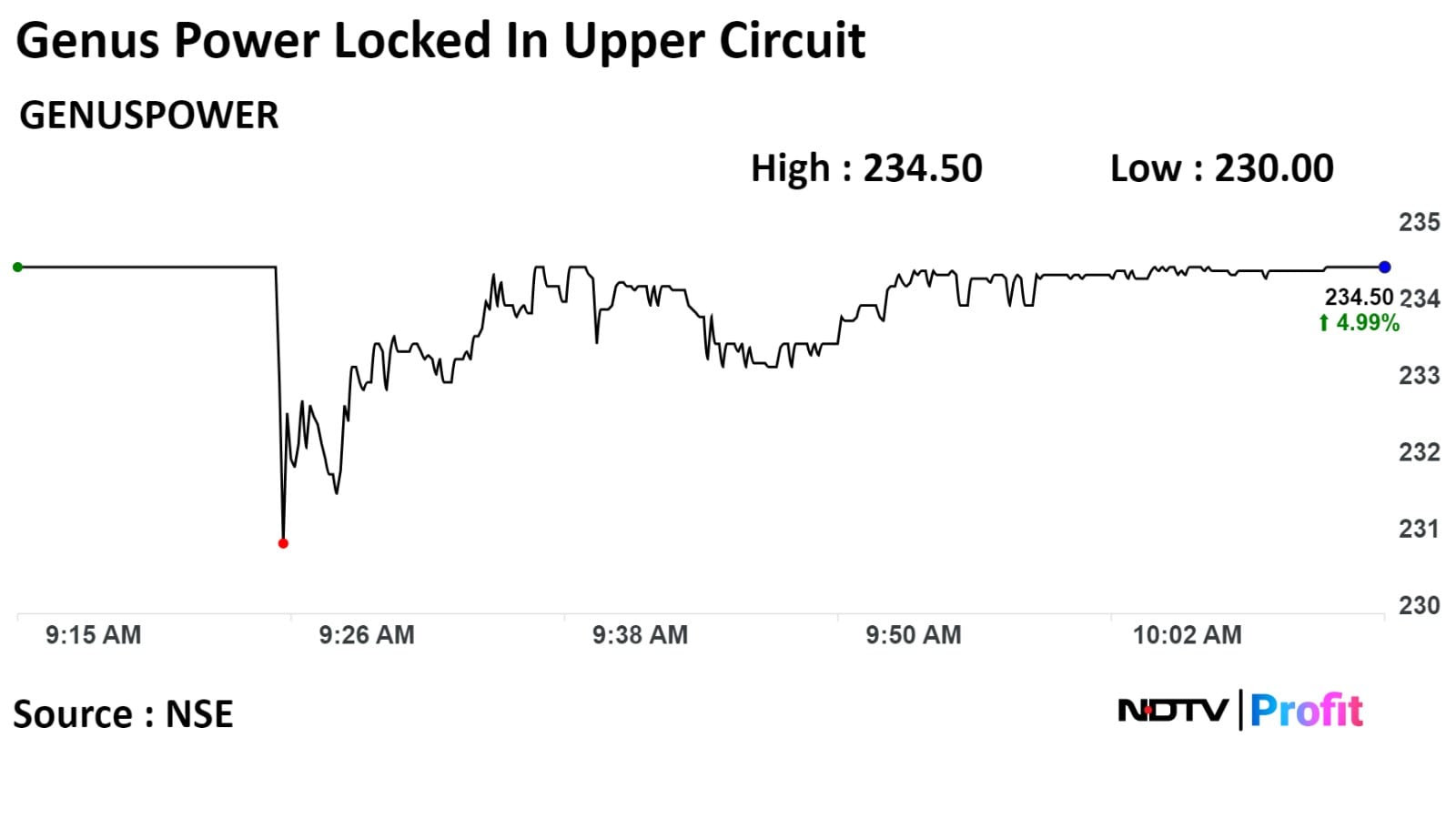

Shares of Genus Power Infrastructures Ltd. were locked in an upper circuit of 5% on Friday said it has received a Rs 1,026.31 Crore order for the appointment of advanced metering infrastructure service providers.

The Letter of Award include design of advance metering infrastructure system with supply, installation and commissioning with FMS of about a million Smart Prepaid Meters, system meters including DT Meters with corresponding energy accounting on DBFOOT basis, the filing said.

"With the addition of the recent order, our total order book has now surpassed the significant milestone of Rs. 20,000 crore," the company said.

Shares of Genus Power Infrastructures Ltd. were locked in an upper circuit of 5% on Friday said it has received a Rs 1,026.31 Crore order for the appointment of advanced metering infrastructure service providers.

The Letter of Award include design of advance metering infrastructure system with supply, installation and commissioning with FMS of about a million Smart Prepaid Meters, system meters including DT Meters with corresponding energy accounting on DBFOOT basis, the filing said.

"With the addition of the recent order, our total order book has now surpassed the significant milestone of Rs. 20,000 crore," the company said.

On the NSE, Genus Power's stock was trading 4.99% higher at Rs 234.50 apiece compared to a 0.64% advance in the benchmark Nifty 50 as of 10.44 a.m.

The share price has risen 176.04% on a year-to-date basis. The total traded volume so far in the day stood at 7.7 times its 30-day average. The relative strength index was at 49.8.

Two analysts tracking Genus Power maintain a 'buy' rating on the stock, according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 17.27%.

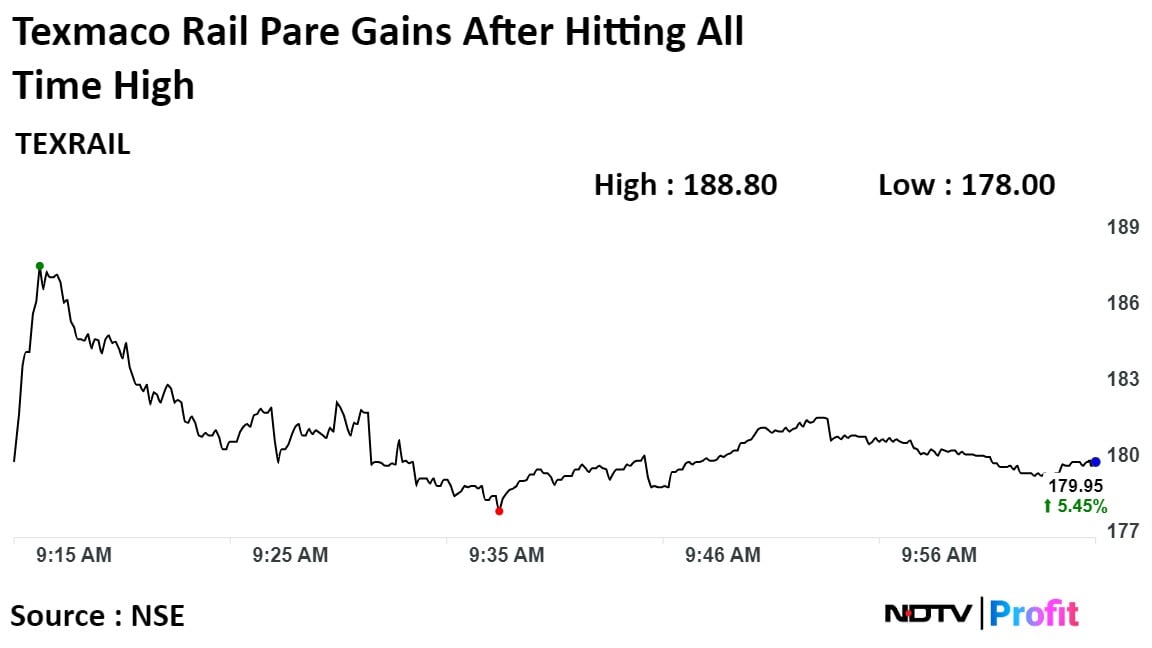

The shares of Texmaco Rail & Engineering Ltd. rose on Friday after it won an award worth Rs 1,374.41 crore for supply of wagons.

Texmaco Rail received an order from the Ministry of Railways for the manufacture and supply of 3,400 BOXNS wagons, the comapny announced through an exchange filing.

The shares of Texmaco Rail & Engineering Ltd. rose on Friday after it won an award worth Rs 1,374.41 crore for supply of wagons.

Texmaco Rail received an order from the Ministry of Railways for the manufacture and supply of 3,400 BOXNS wagons, the comapny announced through an exchange filing.

Texmaco Rail shares rose as much as 10.64% to Rs 188.80 apiece to reach its all time high. It pared gains to trade 5.60% higher at Rs 180.20 apiece, as of 10:00 a.m. This compares to a 0.072% advance in the NSE Nifty 50 Index.

It has risen 217.28% on a year-to-date basis. Total traded volume so far in the day stood at 9.9 times its 30-day average. The relative strength index was at 79.

The 1 analyst tracking the company maintains a 'buy' rating according to Bloomberg data. The average 12-month consensus price target implies an upside of 220.7%.

J Kumar Infraprojects won an order worth Rs 583 crore to construct four-lane elevated corridor in Chennai.

Source: Exchange Filing

17.1 lakh shares changed hands in a large trade

0.2% equity changed hands at Rs 393 apiece

Buyers and sellers not known immediately

Source: Bloomberg

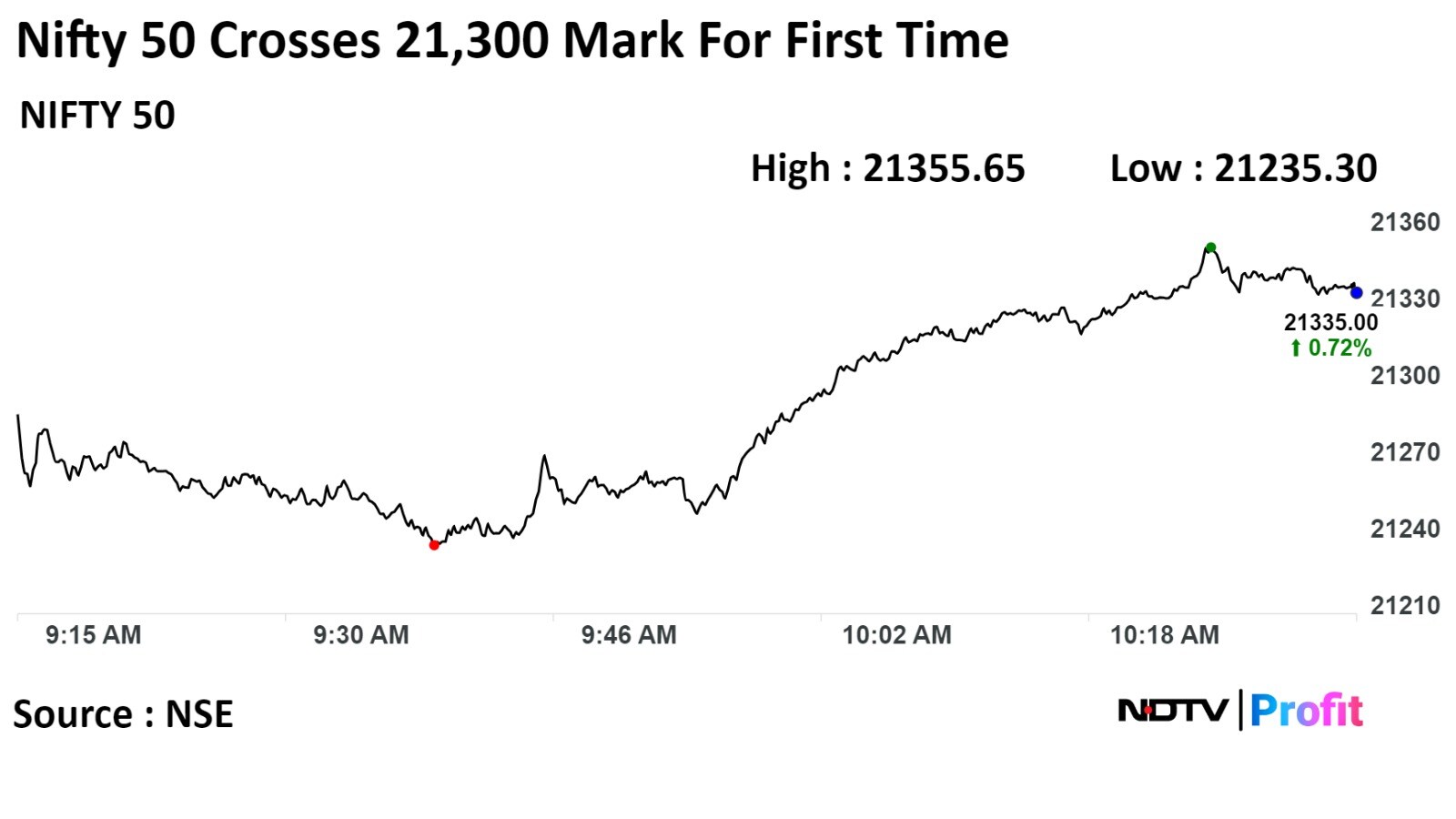

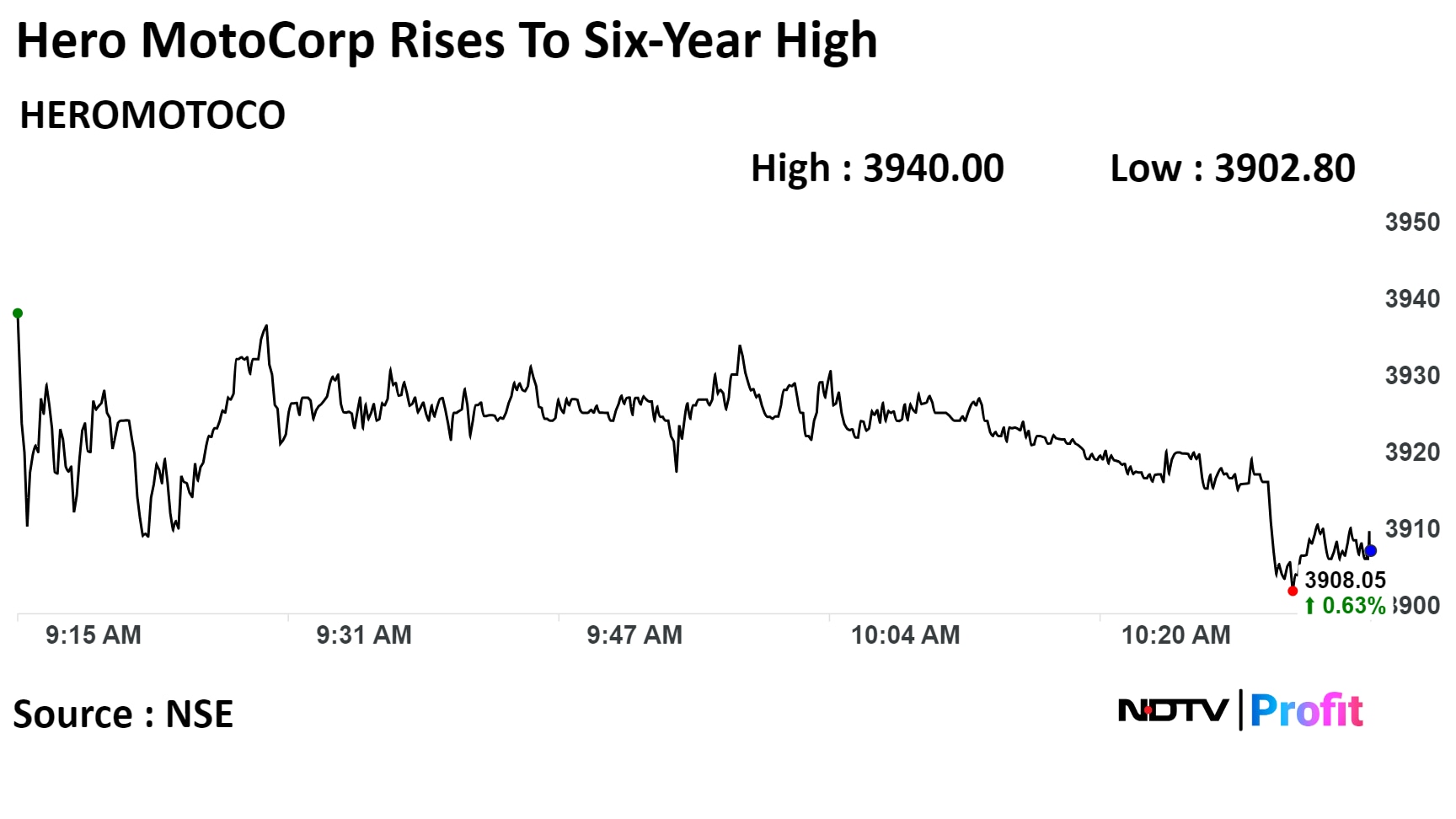

Shares of the Hero MotoCorp Ltd. rose to a six-year high on Friday after the company said to the exchanges, it has acquired additional 3% stake in the Ather Energy Private Ltd.

Further, Hero MotoCorp has appointed Vivek Anand as the chief financial officer with effect from March 1, 2024.

Shares of the Hero MotoCorp Ltd. rose to a six-year high on Friday after the company said to the exchanges, it has acquired additional 3% stake in the Ather Energy Private Ltd.

Further, Hero MotoCorp has appointed Vivek Anand as the chief financial officer with effect from March 1, 2024.

Shares of the company rose as much as 1.45% to Rs. 3,940 a apiece, the highest level since Sep 21, 2017. It was trading 0.76% higher at Rs 3,913 as of 10:39 a.m. This compares to a 0.67% advance in the NSE Nifty 50.

It has risen 43.13 % on a year-to-date basis. Total traded volume so far in the day stood at 0.2 times its 30-day average. The relative strength index was at 76.79.

Out of 46 analysts tracking the company, 27 maintain a 'buy' rating, 10 recommend a 'hold,' and nine suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 11.6%.

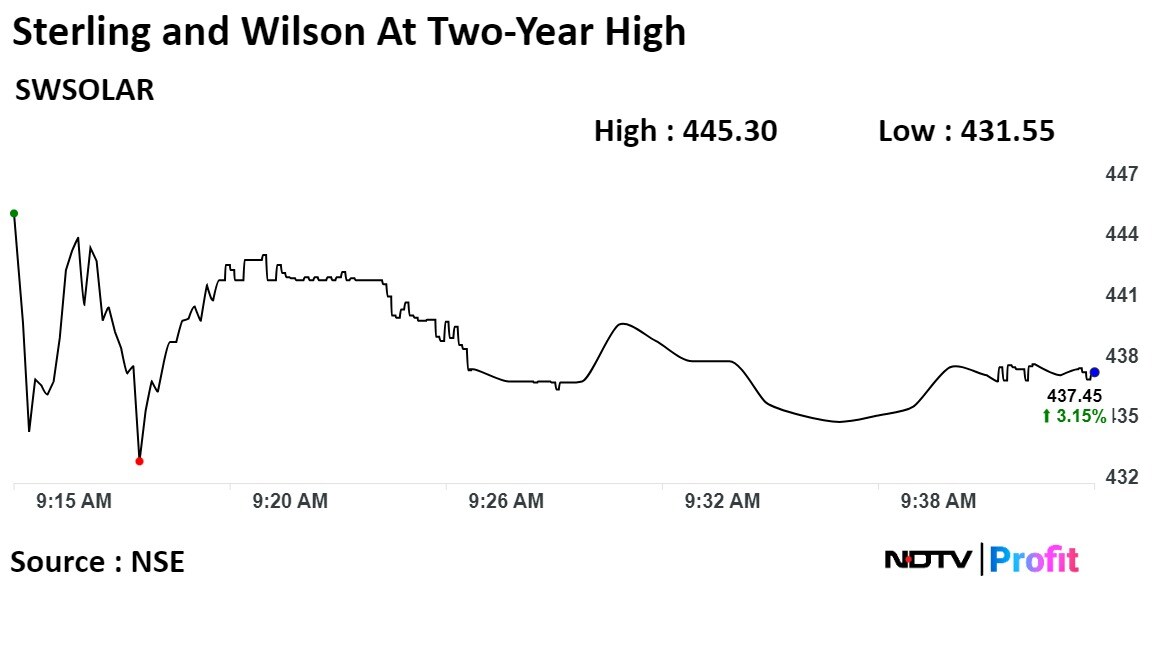

The shares of Sterling and Wilson Renewable Energy Ltd. rose on Friday as the company raises Rs 1,500 crore through Qualified Institutions placement route with a strong response from both domestic mutual funds and marquee global FIIs.

The shares of Sterling and Wilson Renewable Energy Ltd. rose on Friday as the company raises Rs 1,500 crore through Qualified Institutions placement route with a strong response from both domestic mutual funds and marquee global FIIs.

Sterling and Wilson Renewable Energy shares rose as much as 5% to 445.30 apiece, the highest in over two years. It last traded at this levels on Nov. 10 2021. It pared gains to trade 3.02% higher at Rs 436.90 apiece, as of 9:35 a.m. This compares to a 0.29% advance in the NSE Nifty 50 Index.

It has risen 62.9% on a year-to-date basis. Total traded volume so far in the day stood at 1.9 times its 30-day average. The relative strength index was at 82.

The 1 analysts tracking the company maintains a 'buy' rating according to Bloomberg data. The average 12-month consensus price target implies an upside of 49%.

Shares of Arvind Ltd rose as much as 9.69% to Rs 252.90 apiece, its lifetime high level.

The company's senior management will be attending meeting with ICICI Prudential MF, ICICI Prudential Life Insurance, GeeCee, CARE PMS, and Golden Myriad on 19th December, 2023 at Company’s plant situated at Santej, Gujarat as a part of plant visit, an exchange filing by the company said.

Shares of Arvind Ltd rose as much as 9.69% to Rs 252.90 apiece, its lifetime high level.

The company's senior management will be attending meeting with ICICI Prudential MF, ICICI Prudential Life Insurance, GeeCee, CARE PMS, and Golden Myriad on 19th December, 2023 at Company’s plant situated at Santej, Gujarat as a part of plant visit, an exchange filing by the company said.

It pared gains to trade 7% higher at Rs 246.70 apiece, as of 09.55 a.m. This compares to a 0.4% advance in the NSE Nifty 50 Index.

It has risen 172.02% on a year-to-date basis. Total traded volume so far in the day stood at 3.8 times its 30-day average. The relative strength index was at 71.99, indicating that the stock may be overbought.

Seven analysts tracking the company maintain a 'buy' rating' for the stock according to Bloomberg data. The average 12-month consensus price target implies an upside of 12.4%.

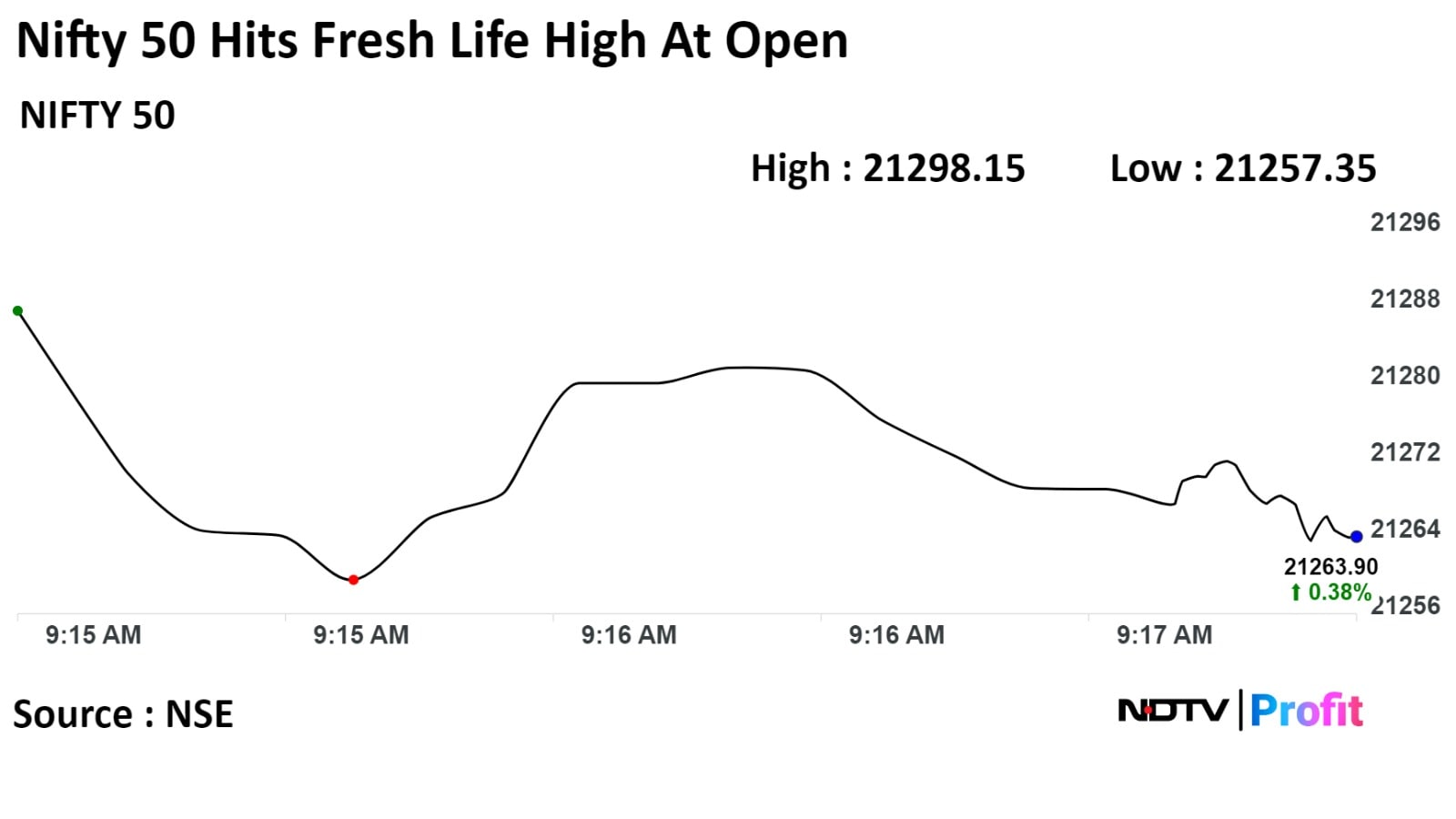

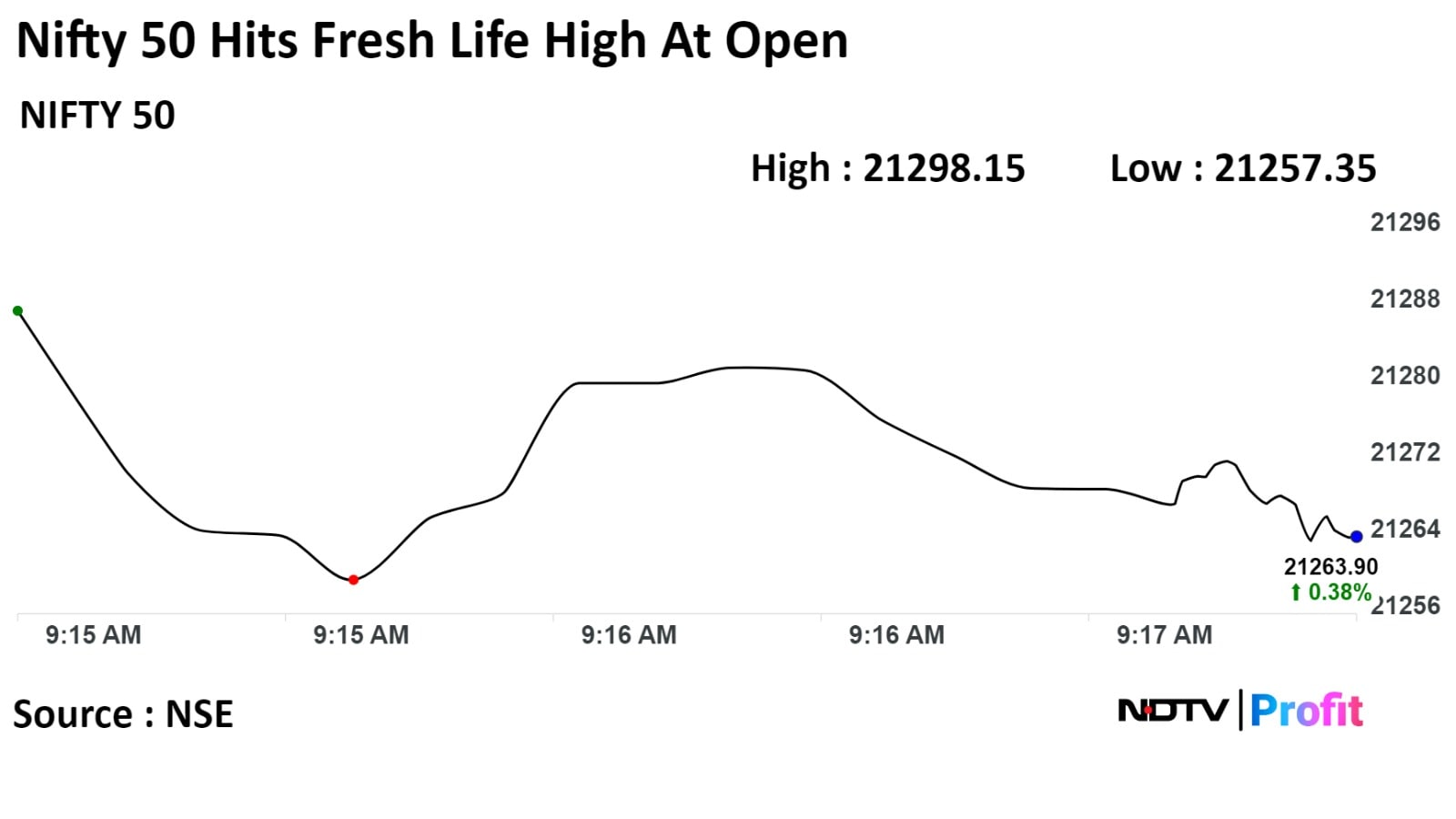

Indian benchmark indices opened at record high level for second day on Friday as Infosys Ltd., HDFC Bank Ltd., and Reliance Industries Ltd. led gains.

At 09:20 a.m. the NSE Nifty 50 index was 0.42% or 89.50 points higherat 21,272.10, while the BSE Sensex was up 0.43% or 303.05 points at 70,810.20.

Meanwhile, the Nifty Bank index also surged to a fresh high on Thursday.

"Wall Street experiences an early Christmas as the Fed hints at easing interest-rate policy in 2024. Nifty is poised to surge into uncharted territory, with a trading range of 20,500-21,500. Notably, the 21,400 mark emerges as a crucial resistance zone. Amidst a positive landscape, including a record Dow Jones close and FIIs investing Rs 20,494 crores in December, traders anticipate a bullish tone with hopes for an economic soft landing," said Prashanth Tapse, senior vice president, research, Mehta Equities Ltd.

"The recommended trades involve buying Nifty at CMP with targets at 21,300/21,551 and aggressive targets at 21,751-22,000. Similarly, Bank Nifty is suggested for purchase at CMP, with aggressive targets at 49,501-50,000."

Indian benchmark indices opened at record high level for second day on Friday as Infosys Ltd., HDFC Bank Ltd., and Reliance Industries Ltd. led gains.

At 09:20 a.m. the NSE Nifty 50 index was 0.42% or 89.50 points higherat 21,272.10, while the BSE Sensex was up 0.43% or 303.05 points at 70,810.20.

Meanwhile, the Nifty Bank index also surged to a fresh high on Thursday.

"Wall Street experiences an early Christmas as the Fed hints at easing interest-rate policy in 2024. Nifty is poised to surge into uncharted territory, with a trading range of 20,500-21,500. Notably, the 21,400 mark emerges as a crucial resistance zone. Amidst a positive landscape, including a record Dow Jones close and FIIs investing Rs 20,494 crores in December, traders anticipate a bullish tone with hopes for an economic soft landing," said Prashanth Tapse, senior vice president, research, Mehta Equities Ltd.

"The recommended trades involve buying Nifty at CMP with targets at 21,300/21,551 and aggressive targets at 21,751-22,000. Similarly, Bank Nifty is suggested for purchase at CMP, with aggressive targets at 49,501-50,000."

Indian benchmark indices opened at record high level for second day on Friday as Infosys Ltd., HDFC Bank Ltd., and Reliance Industries Ltd. led gains.

At 09:20 a.m. the NSE Nifty 50 index was 0.42% or 89.50 points higherat 21,272.10, while the BSE Sensex was up 0.43% or 303.05 points at 70,810.20.

Meanwhile, the Nifty Bank index also surged to a fresh high on Thursday.

"Wall Street experiences an early Christmas as the Fed hints at easing interest-rate policy in 2024. Nifty is poised to surge into uncharted territory, with a trading range of 20,500-21,500. Notably, the 21,400 mark emerges as a crucial resistance zone. Amidst a positive landscape, including a record Dow Jones close and FIIs investing Rs 20,494 crores in December, traders anticipate a bullish tone with hopes for an economic soft landing," said Prashanth Tapse, senior vice president, research, Mehta Equities Ltd.

"The recommended trades involve buying Nifty at CMP with targets at 21,300/21,551 and aggressive targets at 21,751-22,000. Similarly, Bank Nifty is suggested for purchase at CMP, with aggressive targets at 49,501-50,000."

Indian benchmark indices opened at record high level for second day on Friday as Infosys Ltd., HDFC Bank Ltd., and Reliance Industries Ltd. led gains.

At 09:20 a.m. the NSE Nifty 50 index was 0.42% or 89.50 points higherat 21,272.10, while the BSE Sensex was up 0.43% or 303.05 points at 70,810.20.

Meanwhile, the Nifty Bank index also surged to a fresh high on Thursday.

"Wall Street experiences an early Christmas as the Fed hints at easing interest-rate policy in 2024. Nifty is poised to surge into uncharted territory, with a trading range of 20,500-21,500. Notably, the 21,400 mark emerges as a crucial resistance zone. Amidst a positive landscape, including a record Dow Jones close and FIIs investing Rs 20,494 crores in December, traders anticipate a bullish tone with hopes for an economic soft landing," said Prashanth Tapse, senior vice president, research, Mehta Equities Ltd.

"The recommended trades involve buying Nifty at CMP with targets at 21,300/21,551 and aggressive targets at 21,751-22,000. Similarly, Bank Nifty is suggested for purchase at CMP, with aggressive targets at 49,501-50,000."

Indian benchmark indices opened at record high level for second day on Friday as Infosys Ltd., HDFC Bank Ltd., and Reliance Industries Ltd. led gains.

At 09:20 a.m. the NSE Nifty 50 index was 0.42% or 89.50 points higherat 21,272.10, while the BSE Sensex was up 0.43% or 303.05 points at 70,810.20.

Meanwhile, the Nifty Bank index also surged to a fresh high on Thursday.

"Wall Street experiences an early Christmas as the Fed hints at easing interest-rate policy in 2024. Nifty is poised to surge into uncharted territory, with a trading range of 20,500-21,500. Notably, the 21,400 mark emerges as a crucial resistance zone. Amidst a positive landscape, including a record Dow Jones close and FIIs investing Rs 20,494 crores in December, traders anticipate a bullish tone with hopes for an economic soft landing," said Prashanth Tapse, senior vice president, research, Mehta Equities Ltd.

"The recommended trades involve buying Nifty at CMP with targets at 21,300/21,551 and aggressive targets at 21,751-22,000. Similarly, Bank Nifty is suggested for purchase at CMP, with aggressive targets at 49,501-50,000."

Indian benchmark indices opened at record high level for second day on Friday as Infosys Ltd., HDFC Bank Ltd., and Reliance Industries Ltd. led gains.

At 09:20 a.m. the NSE Nifty 50 index was 0.42% or 89.50 points higherat 21,272.10, while the BSE Sensex was up 0.43% or 303.05 points at 70,810.20.

Meanwhile, the Nifty Bank index also surged to a fresh high on Thursday.

"Wall Street experiences an early Christmas as the Fed hints at easing interest-rate policy in 2024. Nifty is poised to surge into uncharted territory, with a trading range of 20,500-21,500. Notably, the 21,400 mark emerges as a crucial resistance zone. Amidst a positive landscape, including a record Dow Jones close and FIIs investing Rs 20,494 crores in December, traders anticipate a bullish tone with hopes for an economic soft landing," said Prashanth Tapse, senior vice president, research, Mehta Equities Ltd.

"The recommended trades involve buying Nifty at CMP with targets at 21,300/21,551 and aggressive targets at 21,751-22,000. Similarly, Bank Nifty is suggested for purchase at CMP, with aggressive targets at 49,501-50,000."

Indian benchmark indices opened at record high level for second day on Friday as Infosys Ltd., HDFC Bank Ltd., and Reliance Industries Ltd. led gains.

At 09:20 a.m. the NSE Nifty 50 index was 0.42% or 89.50 points higherat 21,272.10, while the BSE Sensex was up 0.43% or 303.05 points at 70,810.20.

Meanwhile, the Nifty Bank index also surged to a fresh high on Thursday.

"Wall Street experiences an early Christmas as the Fed hints at easing interest-rate policy in 2024. Nifty is poised to surge into uncharted territory, with a trading range of 20,500-21,500. Notably, the 21,400 mark emerges as a crucial resistance zone. Amidst a positive landscape, including a record Dow Jones close and FIIs investing Rs 20,494 crores in December, traders anticipate a bullish tone with hopes for an economic soft landing," said Prashanth Tapse, senior vice president, research, Mehta Equities Ltd.

"The recommended trades involve buying Nifty at CMP with targets at 21,300/21,551 and aggressive targets at 21,751-22,000. Similarly, Bank Nifty is suggested for purchase at CMP, with aggressive targets at 49,501-50,000."

Indian benchmark indices opened at record high level for second day on Friday as Infosys Ltd., HDFC Bank Ltd., and Reliance Industries Ltd. led gains.

At 09:20 a.m. the NSE Nifty 50 index was 0.42% or 89.50 points higherat 21,272.10, while the BSE Sensex was up 0.43% or 303.05 points at 70,810.20.

Meanwhile, the Nifty Bank index also surged to a fresh high on Thursday.

"Wall Street experiences an early Christmas as the Fed hints at easing interest-rate policy in 2024. Nifty is poised to surge into uncharted territory, with a trading range of 20,500-21,500. Notably, the 21,400 mark emerges as a crucial resistance zone. Amidst a positive landscape, including a record Dow Jones close and FIIs investing Rs 20,494 crores in December, traders anticipate a bullish tone with hopes for an economic soft landing," said Prashanth Tapse, senior vice president, research, Mehta Equities Ltd.

"The recommended trades involve buying Nifty at CMP with targets at 21,300/21,551 and aggressive targets at 21,751-22,000. Similarly, Bank Nifty is suggested for purchase at CMP, with aggressive targets at 49,501-50,000."

Infosys Ltd., Hindalco Industries Ltd., ITC Ltd., Tata Steel Ltd. JSW Steel Ltd. were adding positively to the index.

HDFC Bank Ltd., Nestle India Ltd., Kotak Mahindra Bank Ltd., HDFC Life Insurance Company Ltd., Axis Bank Ltd. Were adding negatively to the indices.

Most sectoral indices advances with the Nifty Metal emerging as the top gainer with 1.44% rise. Twelve sectors out of 14 sectors advanced on NSE, while two declined. The Nifty Financial Services index declining the most.

The S&P BSE MidCap underperformed compared to benchmark indices, posting only 0.13% gain. The S&P BSE SmallCap index outperformed benchmark indices and rose 0.53%. Around fifteen sectors out of 20 on BSE advanced, and five declined. BSE Metal and BSE Commodities rose the most.

Market breadth was skewed in the favour of the buyers. Around 2018 stocks advanced, 926 declined, and 109 remained unchanged.

The yield on the 10-year bond opened flat at 7.20% on Friday.

Source: Bloomberg

The local currency strengthened 3 paise to open at 83.30 against the U.S dollar on Friday.

It closed at 83.33 on Thursday.

Source: Bloomberg

At pre-open, the BSE Sensex was 0.41% or 289.93 at 70,804.13, while the NSE Nifty 50 was 0.49% or 104.75 at 21,287.45.

Adani Ports and Special Economic Zones Ltd. to divest 49% stake in Adani Ennore Container Terminal

The proposed transaction is to be completed within 3-4 months

Consideration of Rs 247 crore shall be received on completion of proposed divestment

Source: Exchange Filing

22.9 lakh shares or 2.33% equity changed hands in multiple pre-market large trades

Buyers and sellers not known immediately

Source: Bloomberg

Sterling and Wilson Renewable Energy raised Rs. 1,500 crore through Qualified Institutions Placement route

Bulk of the amount raised through QIP, will be utilised to pare down debt , said Global CEO Amit Jain.

Reduction of debt will provide Sterling & Wilson capital pursue fast-growing EPC markets in India, and abroad, says Global CEO Amit Jain.

Source: Exchange Filing

Motilal Oswal reiterates 'buy' rating with a target price of Rs 1,110 on Tata Consumer Products Ltd.

Strong domestic consumption drives tea sales for TATACONS

Motilal Oswal expects 5% volume growth in 2HFY24

Gross margins to stay range-bound amid stabilization in tea prices

Expects the gross margin to remain stable or improve slightly

Expects a revenue/EBITDA/PAT CAGR of 10%/15%/22% over FY23-26

Nomura retained 'buy' on ITC Ltd with Target Price of Rs 530

ITC showcased strong digital assets and digital-first cultureITC created a strong ecosystem backed by innovation

Nomura said ITC has become more agile, resilient, efficient, purposeful

ITC Made significant headway in creating a digital-first culture

ITC's medium-term outlook for FMCG and cigarettes remains strong

ITC new businesses of food-tech and nicotine exports show high growth potential

U.S. Dollar Index at 101.97

U.S. 10-year bond yield at 3.95%

Brent crude up 0.35% at $76.88 per barrel

Nymex crude up 0.35% at $71.83 per barrel

GIFT Nifty was down 0.09% at 21,423 as of 08:02 a.m.

Bitcoin was down 0.26% at $42,882.91

Ex/record date Buyback: Somany Ceramics.

Ex/record date AGM: Orissa Minerals Development Co., Suven Pharmaceuticals, Max Estates.

Moved into a short-term ASM framework: GMR Airport Infrastructure, GTL Infrastructure.

Moved Out of short-term ASM framework: Cantabil Retail India, Datamatics Global Services, Manoj Vaibhav Gems N Jewellers, Techno Electric and Engineering.

Nifty December futures up 1.4% to 21,327.65 at a premium of 144.95 points.

Nifty December futures open interest up by 18.5%.

Nifty Bank December futures up 1.34% to 48,029.60 at a premium of 297.3 points.

Nifty Bank December futures open interest down by 5.4%.

Nifty Options Dec. 21 Expiry: Maximum call open interest at 22,000 and maximum put open interest at 20,500.

Bank Nifty Options Dec. 20 Expiry: Maximum call open interest at 48,000 and maximum put open interest at 47,000.

Securities in ban period: Balrampur Chini Mills, Delta Corp, Hindustan Copper, Indiabulls Housing Finance, India Cements, Manappuram Finance, SAIL, and Zee Entertainment.

Dr Lal PathLabs: To meet investors and analysts on Dec. 20.

Nelcast: To meet investors and analysts on Dec. 21.

LT Foods: To meet investors and analysts on Dec. 19.

Alkem Laboratories: To meet investors and analysts on Dec. 20.

Triveni Engineering: To meet investors and analysts on Dec. 20.

Patel Engineering: To meet investors and analysts on Dec. 26.

Mold-Tek Packaging: To meet investors and analysts on Dec. 19.

Godrej Consumer: To meet investors and analysts on Dec. 19.

Tata Chemicals: To meet investors and analysts on Dec. 21.

Kalyan Jewellers: Promoter Trikkur Sitarama Iyer Kalyanaraman bought 15,685 shares on Dec. 13. Promoter group TS Balaraman sold 15,685 shares on Dec. 13.

Choice International: Promoter group NS Technical Consultancy bought 3.5 lakh shares on Dec. 13.

Advance Enzyme Technologies: Promoter group Advanced Vital Enzymes sold 2.74 lakh shares on Dec. 12.

Thirumalai Chemicals: Promoter group Narayan Santhanam sold 9,225 shares on Dec. 13.

Bharat Bijlee: Promoter group Anand J. Danani sold 7,539 shares on Dec. 13.

Shalimar Paints: Promoter group Hina Devi Goyal sold 99,880 shares between Dec.12 and 13.

Ajanta Pharma: Promoter Ravi Agrawal released a pledge of 28,607 shares on Dec. 13.

Sterling and Wilson Renewable Energy: Promoter Shapoorji Pallonji and Co. released a pledge of 51 lakh shares on Dec. 8.

Genus Power Infrastructure: Promoter Kailash Chandra Agarwal released a pledge of 25 lakh shares on Dec. 12.

SMS Pharmaceuticals: Promoter group Vamsi Krishna Potluri released a pledge of 12.62 lakh shares on Dec. 12. Promoter group Potluri Infra Projects LLP released a pledge of 38 lakh shares on Dec. 12.

Fusion Micro Finance: Honey Rose Investment sold 64.57 lakh shares (6.39%) and Creation Investments Fusion LLC sold 38.41 lakh shares (3.8%) at Rs 555.6 apiece. HDFC Mutual Fund bought 31.29 lakh shares (3.09%), Morgan Stanley Asia Singapore Pte bought 17.8 lakh shares (1.76%), Franklin Templeton Mutual Fund bought 9 lakh shares (0.89%), Societe Generale bought 8.8 lakh shares (0.87%), Kotak Mahindra Life Insurance bought 7.12 lakh shares (0.7%), Bajaj Allianz Life Insurance bought 6 lakh shares (0.59%) at Rs 555.6 apiece.

Onward Technologies: Onward Software Technologies Pvt. sold 10.99 lakh shares (4.9%) at Rs 563.75 apiece. Whiteoak Capital Mutual Fund bought 4.78 lakh shares (2.13%), White Oak India Equity Fund IV bought 2.21 lakh shares (0.98%), India Acorn India Acorn Fund Limited bought 2.21 lakh shares (0.98%), Ashoka India Equity Investment Trust PLC bought 1.77 lakh shares (0.79%) at Rs 563.75 apiece.

GMR Power and Urban Infra: ASN Investments sold 75 lakh shares (1.24%) at Rs 52.75 apiece and Setu Securities bought 40 lakh shares (0.66%) at Rs 52.5 apiece.

Senco Gold: Oman India Joint Investment Fund sold 6 lakh shares (0.77%) at Rs 746.19 apiece.

Zen Technologies: Tata AIA Life Insurance bought 20 lakh shares (2.37%) and Kishore Dutt Atluri sold 2.5 lakh shares (0.29%), Ravi Kumar Midathala sold 2.5 lakh shares (0.29%), Tara Dutt Atluri sold 15 lakh shares (1.78%) at Rs 725 apiece.

Inox India: The cryogenic tank maker’s public issue was subscribed 2.79 times on day 1. The bids were led by non-institutional investors (4.57 times), retail Investors (3.61 times) and institutional investors (0.04 times).

Doms Industries: The pencil maker's public issue was subscribed 15.20 times on day 2. The bids were led by retail Investors (41.18times), non-institutional investors (25.83 times), portion reserved for employees (17.85 times), and institutional investors (1.18 times).

India Shelter Finance: The company's public issue was subscribed 4.36 times on day 2. The bids were led by non-institutional investors (7.35 times), retail investors (5.08 times), and institutional investors (0.84 times).

Adani Enterprises: Israel-based defence electronics company Elbit Systems Ltd. picked up a 44% stake in an Adani Defence Systems and Technologies Ltd. unit to develop and manufacture various autonomous aerial technologies and systems for defence applications.

Hero MotoCorp: The two-wheeler maker appointed Vivek Anand as chief financial officer. The company also approved the additional acquisition of a 3% stake in Ather Energy for Rs 140 crore.

State Bank of India: The public sector lender to acquire 3.7 lakh shares (6.35% stake) of Canpac Trends at Rs 1,349 apiece.

Dr. Reddy's Laboratories: The company becomes the first Indian pharma company to debut on the Dow Jones Sustainability World Index.

Genus Power Infra: The company's unit received a letter of intent worth Rs 1,026 crore for the appointment of advanced metering infrastructure service providers for the supply, installation, and commissioning of a million smart prepaid metres.

Jupiter Wagons: The company received an order worth Rs 1,617 crore from the Ministry of Railways to manufacture and supply 4000 BOXNS wagons.

Mahindra and Mahindra Finance: The company said that it will enter the life, health, and general insurance segments to diversify its sources of income away from its primary vehicle lending business.

Texmaco Rail Engineering: The company received an order worth Rs 1,374.4 crore from the Ministry of Railways to manufacture and supply 3,400 BOXNS wagons.

Vedanta: The board will meet on Dec. 19 to consider NCD issuance on a private placement basis.

Bharat Heavy Electricals: The company signed a MoU with the Central Manufacturing Technology Institute for hydrogen value chain development and IIOT solutions for predictive maintenance of machines and manufacturing processes.

Jammu & Kashmir Bank: The company approved the closure of qualified institutional placement after raising 750 crores at an issue price of Rs 107.60 per equity share, which indicates a discount of 4.49% to the floor price of 112.66 per share.

Religare Enterprises: The RBI has rejected the company's proposal to buy an 87.5% stake in Religare Housing Development Finance Corp., a subsidiary company of Religare Finvest Ltd., and asked it to submit a fresh application.

Exide Industries: The company invested 100 crores in its unit, Exide Energy Solutions. The company’s total investment in its unit is Rs 1,780 crore.

Infibeam Avenues: The company announced its strategic foray into the capital markets and digital lending software market by acquiring a 49% stake in Pirimid Fintech for Rs 25 crore to solidify this strategic partnership.

Jayaswal Neco Industries: Kotak Strategic Situations India Fund to invest Rs 1,500 crore via NCDs as part of Rs 3,200 crore financing the company seeks for refinancing existing debt.

IRB Infra Trust: The company emerged as the preferred bidder for the project of tolling, operation, maintenance, and transfer of the Kota bypass and cable stay bridge toll. The company will pay a Rs 1,683 crore upfront concession fee to NHAI.

Mazagon Dock Shipbuilders: The company collaborated with NavAIt Kochi and launched the MDL solar electric boat, which is the nation's fastest solar-electric boat.

LTIMindtree: The company opened a new delivery centre in Mexico City as part of expanding its presence in Latin America.

Satin Credit Care Network: The company opened qualified institutional placement and set the floor price at Rs 242.81 per share, which indicates a discount of 2.31% to the stock's previous close of Rs 248.55 on the NSE.

Cochin Shipyard: The company fixed Jan. 10 as the record date to determine the eligibility of shareholders for a split in the ratio of 1:2.

Ami Organics: The company announced the inauguration of its manufacturing plant in Ankleshwar, Gujarat. It also signed another definitive agreement with Fermion to manufacture a couple of additional advanced pharmaceutical intermediates for Fermion.

India Pesticides: Anand Swarup Agarwal resigned from the position of chairman of the company.

Syrma SGS Technology: The company incorporated Syrma Strategic Electronics as a wholly-owned subsidiary company.

PB Fintech: Income tax officials visited unit Paisabazaar on Dec. 13 and 14 to inquire about vendors in Paisabazaar. The operations of the unit continue as usual and have not been impacted.

Sterling and Wilson: The company received a settlement amount of Rs 254.2 crore from Jinko Solar over an ongoing dispute.

Aditya Birla Capital: The company made an additional investment of Rs 50.99 crore in its unit, Aditya Birla Sun Life Insurance.

Paisalo Digital: The board will meet on Dec. 19 to consider fundraising.

Markets in the Asia-pacific region rose on Friday as optimism from the U.S. Federal Reserve's policy-meet outcome continued to weigh on the benchmark U.S. 10-year treasury yields.

Shares in Japan, South Korea, and Australia edged higher. The Nikkei was 1.19% up at 33,075.89, and Kospi was up 0.94% at 2,568.06 as of 07:30 a.m.

The possibility of monetary condition easing in the world's largest economy next year continued to exert pressure on the U.S. 10-year treasury yields.

A decline in safe-haven U.S. Treasury yields increases charm for risk assets like emerging markets' shares for investors.

The yield on the benchmark 10-year treasury note settled at 3.92% on Thursday, compared to 4.04%, according to data on the Department of Treasuries.

The S&P 500 index rose 0.26%, and the Nasdaq 100 fell 0.15% on Thursday. The Dow Jones Industrial Average rose 0.43%.

Brent crude was trading 0.21% higher at $76.78 a barrel. Gold was up 0.19% to $2,032.47 an ounce.

GIFT Nifty was down 0.09 at 21,423 as of 08:02 a.m.

India's benchmark indices closed at an all-time high on Thursday as the U.S. Federal Reserve raised hopes of an interest rate cut next year.

The NSE Nifty 50 ended 256 points, or 1.23%, higher at 21,182.70, while the S&P BSE Sensex closed 930 points, or 1.34%, up at 70,514.20.

The Nifty and the Sensex also hit an intraday record high of 21,210.90 and 70,602.89 points, respectively.

Overseas investors stayed net buyers of Indian equities for the fifth consecutive session on Thursday. Foreign portfolio investors mopped up stocks worth Rs 3,570.1 crore, while domestic institutional investors turned net buyers and bought equities worth Rs 553.2 crore, the NSE data showed.

The Indian rupee strengthened 7 paise to close at Rs 83.33 against the U.S. dollar on Thursday.

Markets in the Asia-pacific region rose on Friday as optimism from the U.S. Federal Reserve's policy-meet outcome continued to weigh on the benchmark U.S. 10-year treasury yields.

Shares in Japan, South Korea, and Australia edged higher. The Nikkei was 1.19% up at 33,075.89, and Kospi was up 0.94% at 2,568.06 as of 07:30 a.m.

The possibility of monetary condition easing in the world's largest economy next year continued to exert pressure on the U.S. 10-year treasury yields.

A decline in safe-haven U.S. Treasury yields increases charm for risk assets like emerging markets' shares for investors.

The yield on the benchmark 10-year treasury note settled at 3.92% on Thursday, compared to 4.04%, according to data on the Department of Treasuries.

The S&P 500 index rose 0.26%, and the Nasdaq 100 fell 0.15% on Thursday. The Dow Jones Industrial Average rose 0.43%.

Brent crude was trading 0.21% higher at $76.78 a barrel. Gold was up 0.19% to $2,032.47 an ounce.

GIFT Nifty was down 0.09 at 21,423 as of 08:02 a.m.

India's benchmark indices closed at an all-time high on Thursday as the U.S. Federal Reserve raised hopes of an interest rate cut next year.

The NSE Nifty 50 ended 256 points, or 1.23%, higher at 21,182.70, while the S&P BSE Sensex closed 930 points, or 1.34%, up at 70,514.20.

The Nifty and the Sensex also hit an intraday record high of 21,210.90 and 70,602.89 points, respectively.

Overseas investors stayed net buyers of Indian equities for the fifth consecutive session on Thursday. Foreign portfolio investors mopped up stocks worth Rs 3,570.1 crore, while domestic institutional investors turned net buyers and bought equities worth Rs 553.2 crore, the NSE data showed.

The Indian rupee strengthened 7 paise to close at Rs 83.33 against the U.S. dollar on Thursday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.