Overseas investors turned net sellers of Indian equities on Tuesday, after being buyers for three consecutive sessions.

Foreign portfolio investors offloaded stocks worth Rs 990.9 crore, according to provisional data from the National Stock Exchange.

Domestic institutional investors remained net buyers and mopped up equities worth Rs 104.2 crore, the NSE data showed.

Foreign institutions have been net buyers of Rs 6,827 crore worth of Indian equities so far in 2024, according to data from the National Securities Depository Ltd., updated till the previous trading day.

The yield on the 10-year bond closed flat at 7.19% on Tuesday.

Source: Bloomberg

The local currency strengthened 2 paise to close at 83.12 against the U.S dollar on Tuesday.

It closed at 83.14 on Monday.

Source: Bloomberg

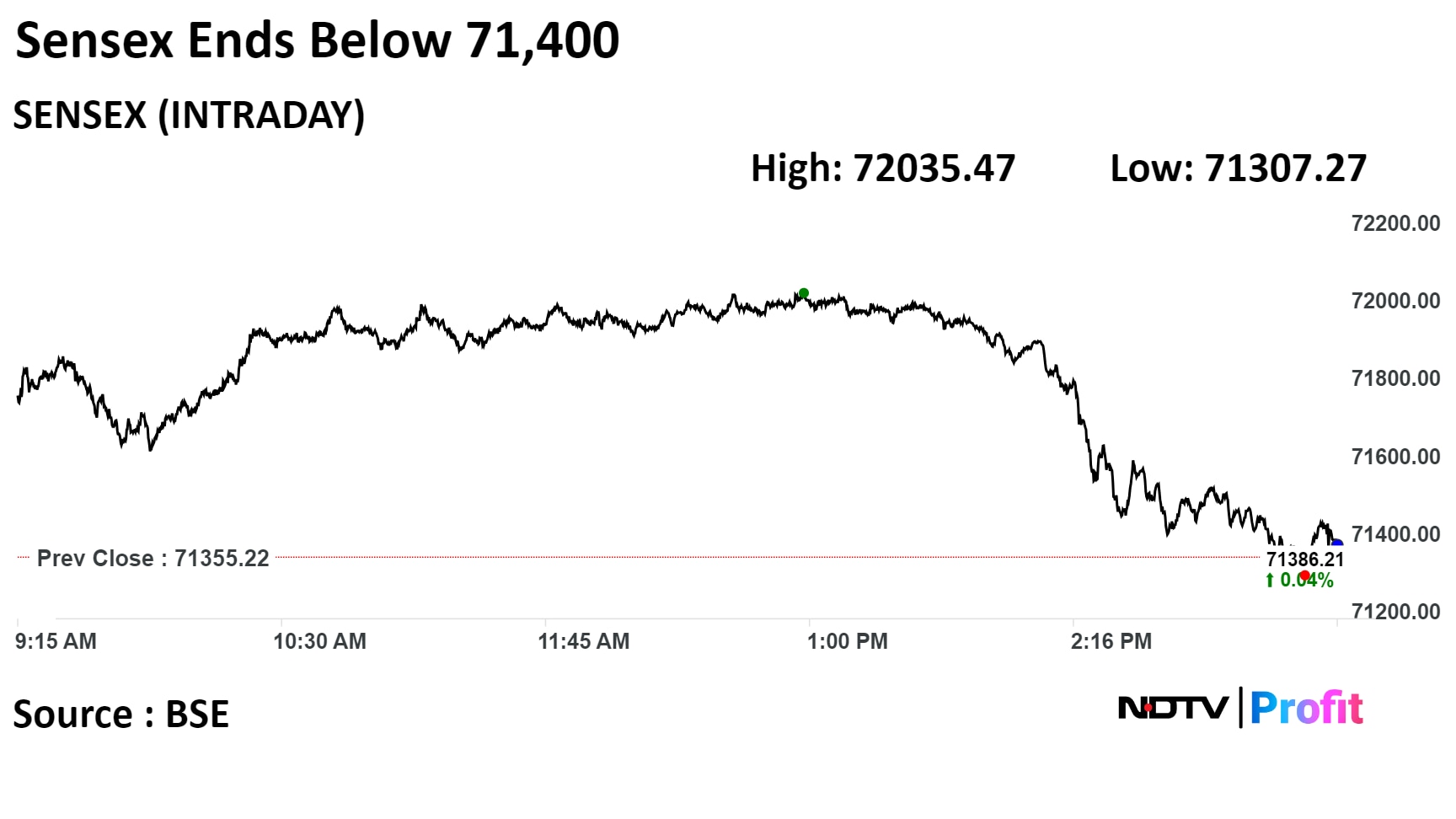

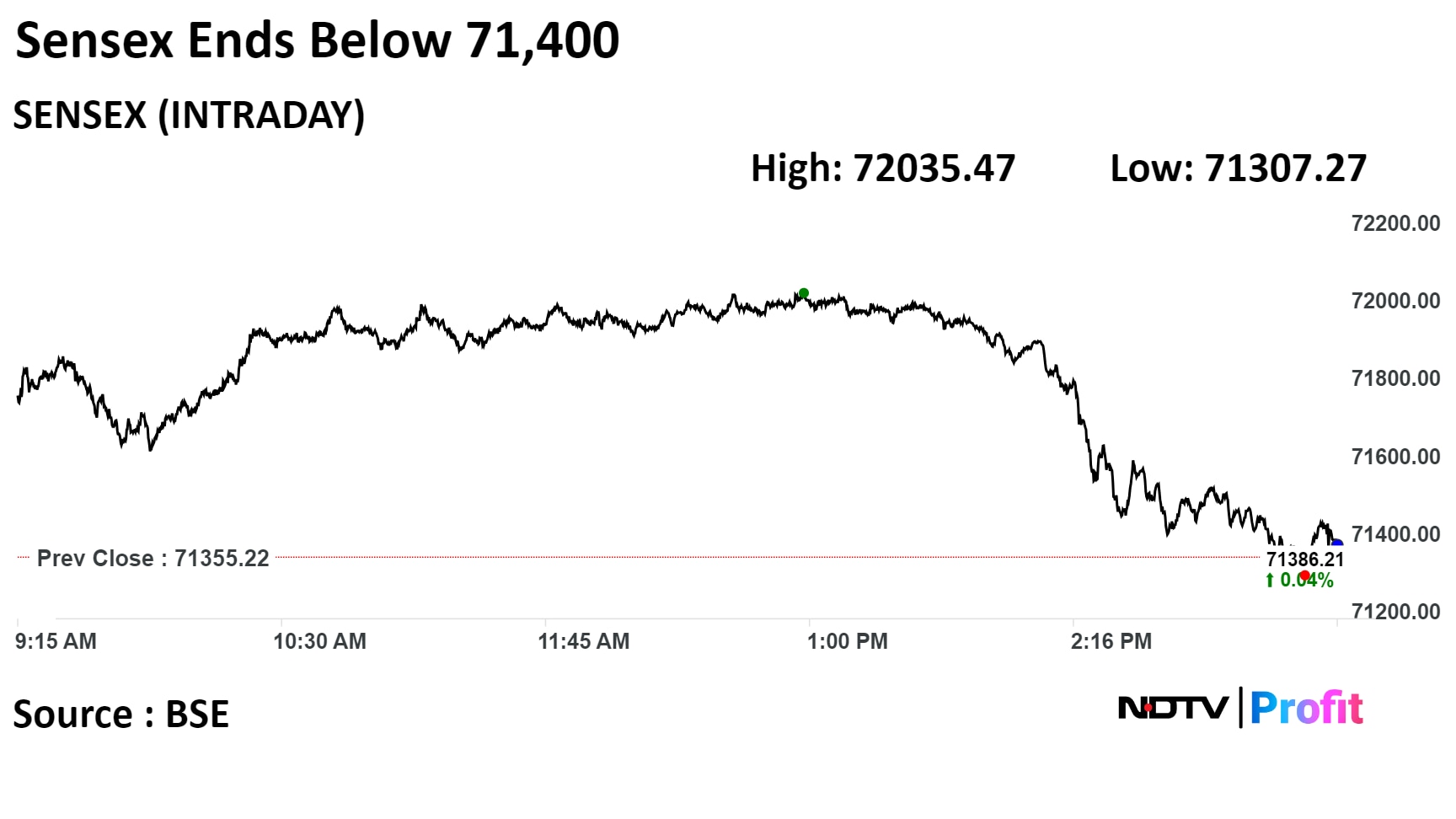

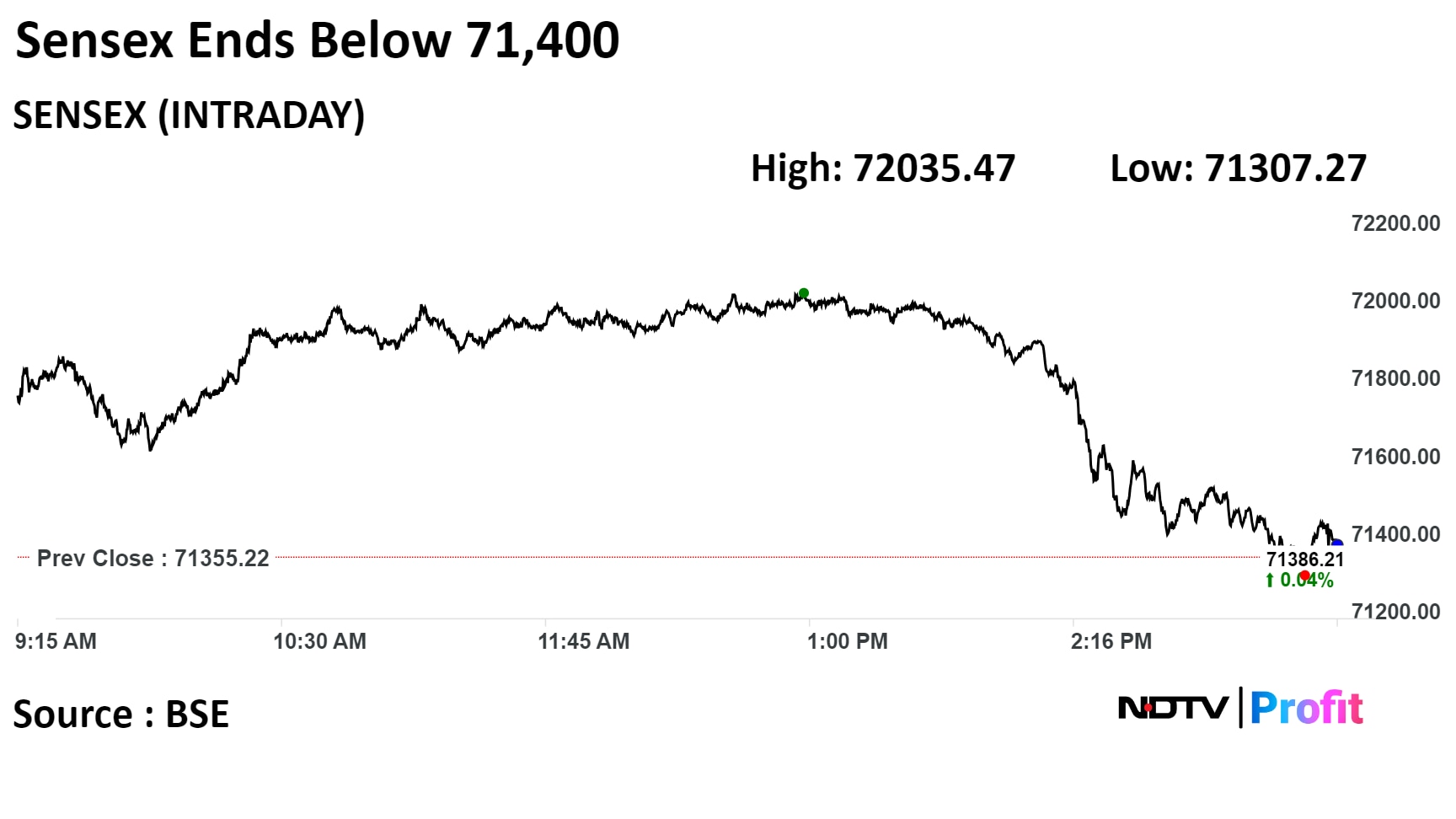

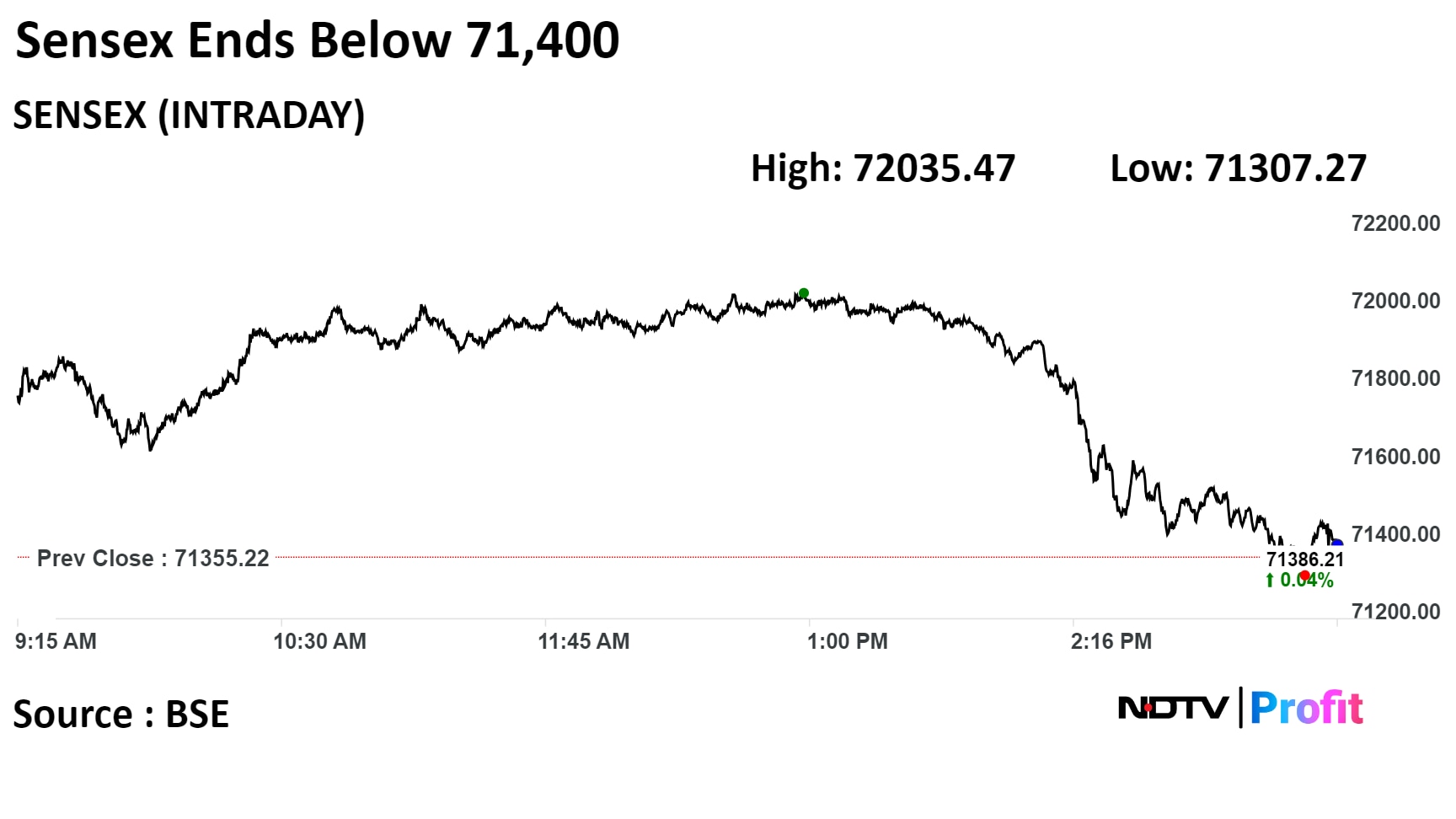

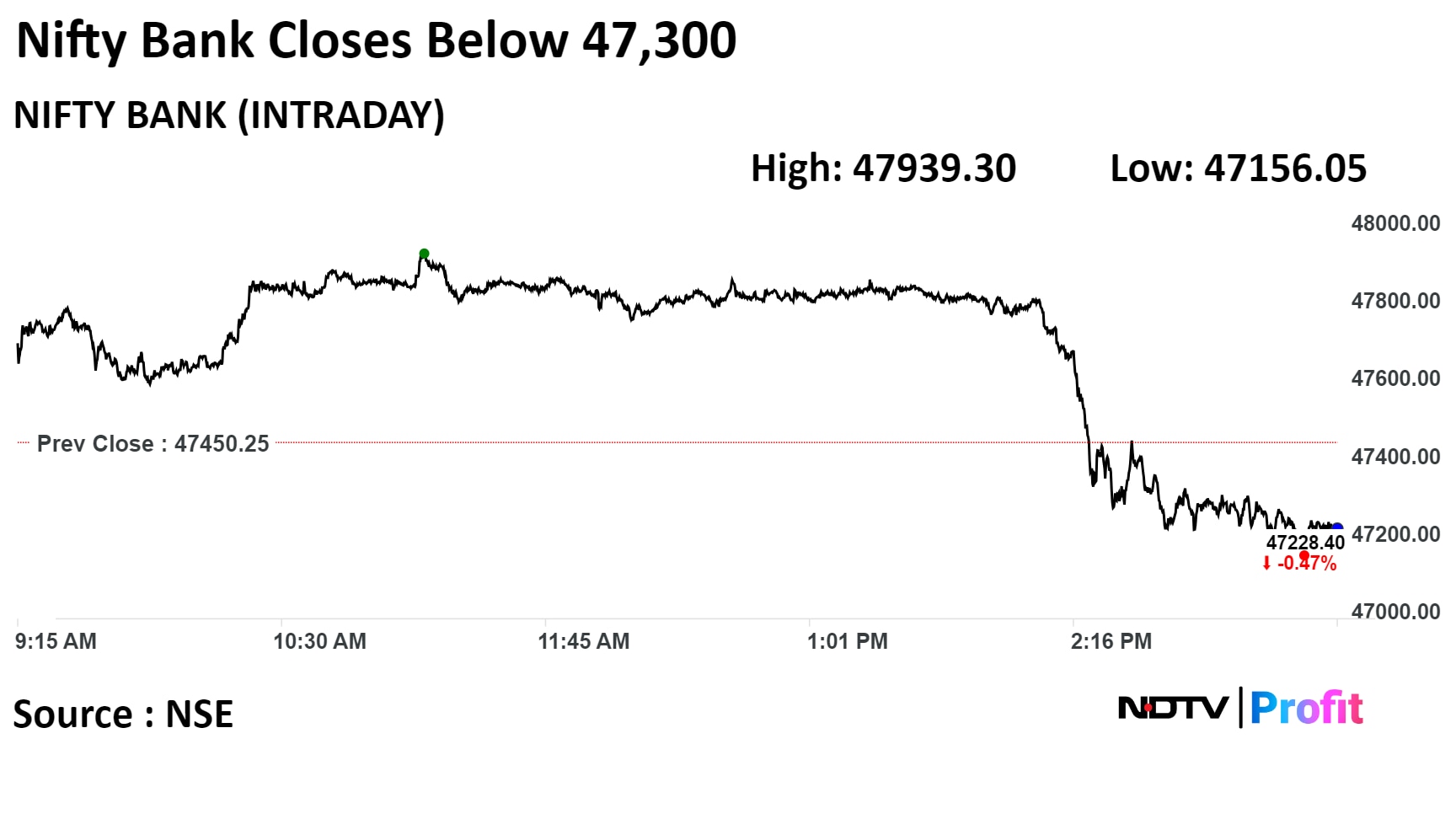

India's benchmark stock indices pared intraday gains and closed near day's lows on Tuesday, tracking losses in HDFC Bank Ltd, ICICI Bank Ltd, and Reliance Industries Ltd. Losses in financial services sector stocks also weighed on the benchmark indices.

The benchmark BSE Sensex ended 0.043% or 30.99 points higher at 71,386.21, and the NSE Nifty 50 closed 0.15% or 31.85 points up at 21,544.85.

Intraday, the benchmark BSE Sensex rose 0.95% or 680.25 points to 72,035.47, while the NSE Nifty 50 gained 0.98% or 211.45 points to 21,724.45.

India's benchmark stock indices pared intraday gains and closed near day's lows on Tuesday, tracking losses in HDFC Bank Ltd, ICICI Bank Ltd, and Reliance Industries Ltd. Losses in financial services sector stocks also weighed on the benchmark indices.

The benchmark BSE Sensex ended 0.043% or 30.99 points higher at 71,386.21, and the NSE Nifty 50 closed 0.15% or 31.85 points up at 21,544.85.

Intraday, the benchmark BSE Sensex rose 0.95% or 680.25 points to 72,035.47, while the NSE Nifty 50 gained 0.98% or 211.45 points to 21,724.45.

India's benchmark stock indices pared intraday gains and closed near day's lows on Tuesday, tracking losses in HDFC Bank Ltd, ICICI Bank Ltd, and Reliance Industries Ltd. Losses in financial services sector stocks also weighed on the benchmark indices.

The benchmark BSE Sensex ended 0.043% or 30.99 points higher at 71,386.21, and the NSE Nifty 50 closed 0.15% or 31.85 points up at 21,544.85.

Intraday, the benchmark BSE Sensex rose 0.95% or 680.25 points to 72,035.47, while the NSE Nifty 50 gained 0.98% or 211.45 points to 21,724.45.

India's benchmark stock indices pared intraday gains and closed near day's lows on Tuesday, tracking losses in HDFC Bank Ltd, ICICI Bank Ltd, and Reliance Industries Ltd. Losses in financial services sector stocks also weighed on the benchmark indices.

The benchmark BSE Sensex ended 0.043% or 30.99 points higher at 71,386.21, and the NSE Nifty 50 closed 0.15% or 31.85 points up at 21,544.85.

Intraday, the benchmark BSE Sensex rose 0.95% or 680.25 points to 72,035.47, while the NSE Nifty 50 gained 0.98% or 211.45 points to 21,724.45.

"Despite opening on a positive note, the Nifty 50 index continues to face hurdle near 21750 -21800 zone. The trend was resilient until the selling pressure mounted in the second half. The present trend appears to have engulfed in an anxious sentiment, however the support of 21500 keeps floating the upside bias. While the index succeeded to close in green, the trend remains fragile," said Avdhut Bagkar, technical and derivatives analyst at StoxBox said.

India's benchmark stock indices pared intraday gains and closed near day's lows on Tuesday, tracking losses in HDFC Bank Ltd, ICICI Bank Ltd, and Reliance Industries Ltd. Losses in financial services sector stocks also weighed on the benchmark indices.

The benchmark BSE Sensex ended 0.043% or 30.99 points higher at 71,386.21, and the NSE Nifty 50 closed 0.15% or 31.85 points up at 21,544.85.

Intraday, the benchmark BSE Sensex rose 0.95% or 680.25 points to 72,035.47, while the NSE Nifty 50 gained 0.98% or 211.45 points to 21,724.45.

India's benchmark stock indices pared intraday gains and closed near day's lows on Tuesday, tracking losses in HDFC Bank Ltd, ICICI Bank Ltd, and Reliance Industries Ltd. Losses in financial services sector stocks also weighed on the benchmark indices.

The benchmark BSE Sensex ended 0.043% or 30.99 points higher at 71,386.21, and the NSE Nifty 50 closed 0.15% or 31.85 points up at 21,544.85.

Intraday, the benchmark BSE Sensex rose 0.95% or 680.25 points to 72,035.47, while the NSE Nifty 50 gained 0.98% or 211.45 points to 21,724.45.

India's benchmark stock indices pared intraday gains and closed near day's lows on Tuesday, tracking losses in HDFC Bank Ltd, ICICI Bank Ltd, and Reliance Industries Ltd. Losses in financial services sector stocks also weighed on the benchmark indices.

The benchmark BSE Sensex ended 0.043% or 30.99 points higher at 71,386.21, and the NSE Nifty 50 closed 0.15% or 31.85 points up at 21,544.85.

Intraday, the benchmark BSE Sensex rose 0.95% or 680.25 points to 72,035.47, while the NSE Nifty 50 gained 0.98% or 211.45 points to 21,724.45.

India's benchmark stock indices pared intraday gains and closed near day's lows on Tuesday, tracking losses in HDFC Bank Ltd, ICICI Bank Ltd, and Reliance Industries Ltd. Losses in financial services sector stocks also weighed on the benchmark indices.

The benchmark BSE Sensex ended 0.043% or 30.99 points higher at 71,386.21, and the NSE Nifty 50 closed 0.15% or 31.85 points up at 21,544.85.

Intraday, the benchmark BSE Sensex rose 0.95% or 680.25 points to 72,035.47, while the NSE Nifty 50 gained 0.98% or 211.45 points to 21,724.45.

"Despite opening on a positive note, the Nifty 50 index continues to face hurdle near 21750 -21800 zone. The trend was resilient until the selling pressure mounted in the second half. The present trend appears to have engulfed in an anxious sentiment, however the support of 21500 keeps floating the upside bias. While the index succeeded to close in green, the trend remains fragile," said Avdhut Bagkar, technical and derivatives analyst at StoxBox said.

HDFC Bank Ltd, Reliance Industries Ltd, ICICI Bank Ltd, Axis Bank Ltd, and Asian Paints Ltd exerted pressure on benchmark indices.

Larsen & Toubro Ltd, Bharti Airtel Ltd, Infosys Ltd, Adani Ports and Special Economic Zone Ltd and Sun Pharmaceutical Industries Ltd added positively to the indices.

On NSE, five out of 12 sectors fell, while seven sectors gained. Nifty Media declined 3.44% and was the top dragger among sectoral indices. Nifty Realty rose 2.42% to emerge as the top gainer among sectoral indices.

The broader markets ended on a mixed note on BSE. The S&P BSE Smallcap Indexadvanced 0.37%, whereas S&P BSE MidCap Index was 0.07% higher. On BSE, five out of 20 sectors declined, while 15 advanced.

S&P BSE Bankex index declined 0.45% and was the top loser among sectoral indices, while S&P BSE Realty index rose 2.52% to become the top gainer among sectoral indices.

Market breadth was skewed in favour of the buyers. Around 2245 stocks gained, 1601 stocks declined, while 98 remained unchanged on BSE.

Sairam Prasad named as CEO of unit Suzlon Global Services effective Jan 16

Current CEO of Suzlon Global Services, Ishwar Chand Mangal, to be CEO of New Business

Source: Exchange filing

Tiger Logistics' board approved splitting of 1 share into 10

Source: Exchange Filing

AU Small Finance Bank has 10.2 lakh shares changed hands in a large trade

The lender's 0.2% equity changed hands at Rs 779.5 apiece

Buyers and sellers not known immediately

Source: Bloomberg

Dr Reddy's Laboratories Ltd issued a clarification on media reports of recall of 8,000 bottles of drug in US over packaging error

Tacrolimus capsule recall safety impact negligible

Source: Exchange Filing

Adani Ports and Special Economic Zone Ltd raised Rs 500 crore via allotment of NCDs on private placement basis

Source: Exchange Filing

Call option on captioned Basel III tier 2 bonds tranche C

Aggregate amount worth Rs 600 crore

Source: Exchange filing

Indus Tower has 22 lakh shares changed hands in a large trade

The company's 0.1% equity changed hands at Rs 212.75 apiece

Buyers and sellers not known immediately

Source: Bloomberg

Tata Power Renewable has signed two MoUs with Tamil Nadu Govt

MoUs with Tamil Nadu Govt has investment potential of `73,800 cr

Tata Power Renewable is planning to develop 10,000 MW of renewable energy power projects

Tata Power Renewable to develop renewable energy projects in 5 to 7 years

Source: Exchange Filing

Sustainable Energy Infra Trust allots units to Mahindra & Mahindra Ltd, and its arm

Company to hold 73.9% stake in Sustainable Energy Infra Trust, arm to hold 15.7% stake

Source: Exchange Filing

NHPC has 10.1 lakh shares changed hands in a large trade

The company has 0.01% equity changed hands at Rs 70.9 apiece

Buyers and sellers not known immediately

Source: Bloomberg

Zee Entertainment Enterprises Ltd said article on Sony looking to end $10 bn deal is factually incorrect

Company is committed to merger with Sony

Continuing to work towards closure of proposed merger

Source: Exchange Filing

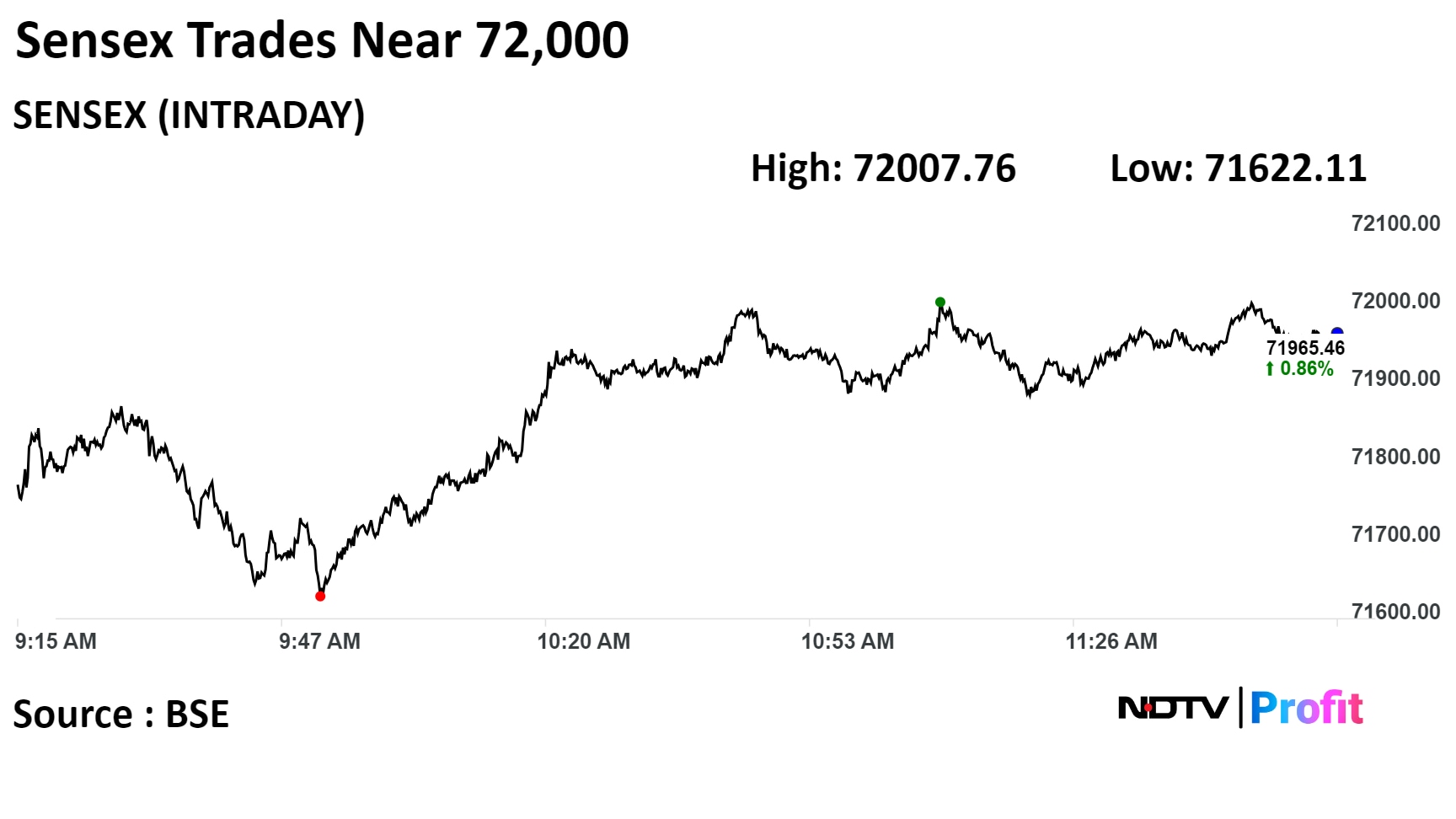

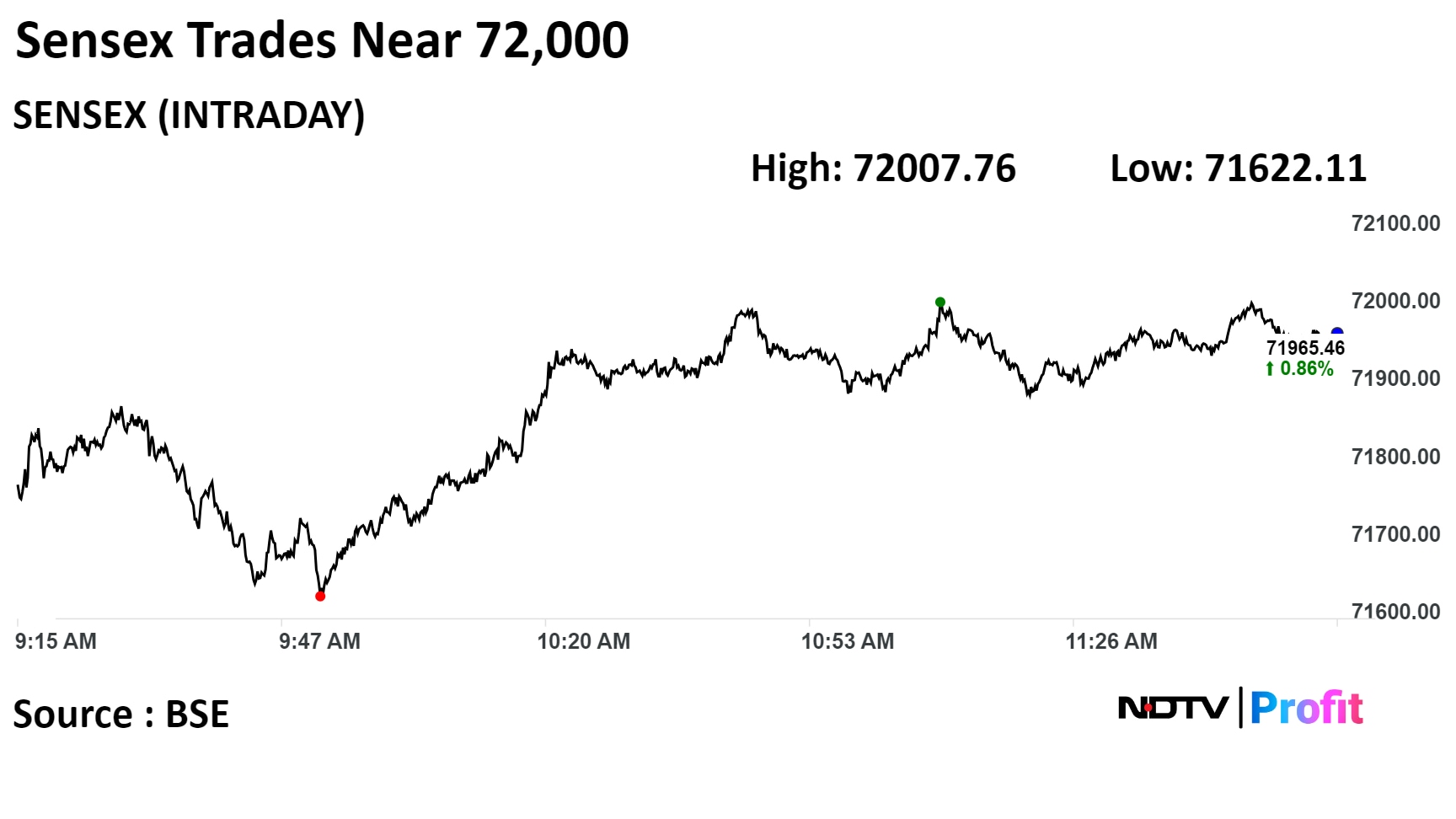

India's benchmark stock indices extended gains to trade near the day's high through midday on Tuesday, led by gains in Larsen & Toubro and IT stocks.

As of 12:00 noon, the S&P BSE Sensex traded 594.67 points, or 0.83%, higher at 71,949.89, and the NSE Nifty 50 gained 189.50 points, or 0.88%, to 21,702.50.

"Today, all sectoral indices are currently showing positive trends driven by favourable global signals," said Shrey Jain, founder and chief executive officer at SAS Online, a deep discount broker.

"The market (Nifty 50) is still stuck in the 21,500–21,800 range. Once the market crosses 21,800, it can move higher towards 22,000 and higher," said Deven Mehata, derivative analyst at Choice Broking. "Short-term traders should keep booking profits on the higher side and can purchase near the support with a strict stop loss of 21,475 on a closing basis."

India's benchmark stock indices extended gains to trade near the day's high through midday on Tuesday, led by gains in Larsen & Toubro and IT stocks.

As of 12:00 noon, the S&P BSE Sensex traded 594.67 points, or 0.83%, higher at 71,949.89, and the NSE Nifty 50 gained 189.50 points, or 0.88%, to 21,702.50.

"Today, all sectoral indices are currently showing positive trends driven by favourable global signals," said Shrey Jain, founder and chief executive officer at SAS Online, a deep discount broker.

"The market (Nifty 50) is still stuck in the 21,500–21,800 range. Once the market crosses 21,800, it can move higher towards 22,000 and higher," said Deven Mehata, derivative analyst at Choice Broking. "Short-term traders should keep booking profits on the higher side and can purchase near the support with a strict stop loss of 21,475 on a closing basis."

India's benchmark stock indices extended gains to trade near the day's high through midday on Tuesday, led by gains in Larsen & Toubro and IT stocks.

As of 12:00 noon, the S&P BSE Sensex traded 594.67 points, or 0.83%, higher at 71,949.89, and the NSE Nifty 50 gained 189.50 points, or 0.88%, to 21,702.50.

"Today, all sectoral indices are currently showing positive trends driven by favourable global signals," said Shrey Jain, founder and chief executive officer at SAS Online, a deep discount broker.

"The market (Nifty 50) is still stuck in the 21,500–21,800 range. Once the market crosses 21,800, it can move higher towards 22,000 and higher," said Deven Mehata, derivative analyst at Choice Broking. "Short-term traders should keep booking profits on the higher side and can purchase near the support with a strict stop loss of 21,475 on a closing basis."

India's benchmark stock indices extended gains to trade near the day's high through midday on Tuesday, led by gains in Larsen & Toubro and IT stocks.

As of 12:00 noon, the S&P BSE Sensex traded 594.67 points, or 0.83%, higher at 71,949.89, and the NSE Nifty 50 gained 189.50 points, or 0.88%, to 21,702.50.

"Today, all sectoral indices are currently showing positive trends driven by favourable global signals," said Shrey Jain, founder and chief executive officer at SAS Online, a deep discount broker.

"The market (Nifty 50) is still stuck in the 21,500–21,800 range. Once the market crosses 21,800, it can move higher towards 22,000 and higher," said Deven Mehata, derivative analyst at Choice Broking. "Short-term traders should keep booking profits on the higher side and can purchase near the support with a strict stop loss of 21,475 on a closing basis."

India's benchmark stock indices extended gains to trade near the day's high through midday on Tuesday, led by gains in Larsen & Toubro and IT stocks.

As of 12:00 noon, the S&P BSE Sensex traded 594.67 points, or 0.83%, higher at 71,949.89, and the NSE Nifty 50 gained 189.50 points, or 0.88%, to 21,702.50.

"Today, all sectoral indices are currently showing positive trends driven by favourable global signals," said Shrey Jain, founder and chief executive officer at SAS Online, a deep discount broker.

"The market (Nifty 50) is still stuck in the 21,500–21,800 range. Once the market crosses 21,800, it can move higher towards 22,000 and higher," said Deven Mehata, derivative analyst at Choice Broking. "Short-term traders should keep booking profits on the higher side and can purchase near the support with a strict stop loss of 21,475 on a closing basis."

India's benchmark stock indices extended gains to trade near the day's high through midday on Tuesday, led by gains in Larsen & Toubro and IT stocks.

As of 12:00 noon, the S&P BSE Sensex traded 594.67 points, or 0.83%, higher at 71,949.89, and the NSE Nifty 50 gained 189.50 points, or 0.88%, to 21,702.50.

"Today, all sectoral indices are currently showing positive trends driven by favourable global signals," said Shrey Jain, founder and chief executive officer at SAS Online, a deep discount broker.

"The market (Nifty 50) is still stuck in the 21,500–21,800 range. Once the market crosses 21,800, it can move higher towards 22,000 and higher," said Deven Mehata, derivative analyst at Choice Broking. "Short-term traders should keep booking profits on the higher side and can purchase near the support with a strict stop loss of 21,475 on a closing basis."

India's benchmark stock indices extended gains to trade near the day's high through midday on Tuesday, led by gains in Larsen & Toubro and IT stocks.

As of 12:00 noon, the S&P BSE Sensex traded 594.67 points, or 0.83%, higher at 71,949.89, and the NSE Nifty 50 gained 189.50 points, or 0.88%, to 21,702.50.

"Today, all sectoral indices are currently showing positive trends driven by favourable global signals," said Shrey Jain, founder and chief executive officer at SAS Online, a deep discount broker.

"The market (Nifty 50) is still stuck in the 21,500–21,800 range. Once the market crosses 21,800, it can move higher towards 22,000 and higher," said Deven Mehata, derivative analyst at Choice Broking. "Short-term traders should keep booking profits on the higher side and can purchase near the support with a strict stop loss of 21,475 on a closing basis."

India's benchmark stock indices extended gains to trade near the day's high through midday on Tuesday, led by gains in Larsen & Toubro and IT stocks.

As of 12:00 noon, the S&P BSE Sensex traded 594.67 points, or 0.83%, higher at 71,949.89, and the NSE Nifty 50 gained 189.50 points, or 0.88%, to 21,702.50.

"Today, all sectoral indices are currently showing positive trends driven by favourable global signals," said Shrey Jain, founder and chief executive officer at SAS Online, a deep discount broker.

"The market (Nifty 50) is still stuck in the 21,500–21,800 range. Once the market crosses 21,800, it can move higher towards 22,000 and higher," said Deven Mehata, derivative analyst at Choice Broking. "Short-term traders should keep booking profits on the higher side and can purchase near the support with a strict stop loss of 21,475 on a closing basis."

Shares of Infosys Ltd., HDFC Bank Ltd., Larsen & Toubro Ltd., ICICI Bank Ltd., and Tata Consultancy Services Ltd., were contributing to the Nifty 50.

Meanwhile, those of Nestle India Ltd., Asian Paints Ltd., Oil and Natural Gas Corp. Ltd., Britannia Industries Ltd., and UltraTech Cement Ltd., weighed on the index.

All sectoral indices gained except Nifty Media, which fell due to losses in Zee Entertainment Enterprises. Nifty IT, Nifty Auto, Nifty Realty gained over 1%.

The broader markets also traded higher, with the BSE MidCap rising 0.40% and the BSE SmallCap gaining 0.81% through midday on Tuesday.

Nineteen sectoral indices compiled by the BSE advanced, S&P BSE Telecommunication traded flat.

The market breadth was skewed in favour of the buyers. As many as 2,532 stocks advanced, 1,169 declined and 131 remained unchanged on the BSE.

Total premium of private life insurers at Rs 15,602 crore vs Rs 14,980 crore, up 4.1%

SBI Life total premium at Rs 4,607 crore, up 21%

Max Life total premium at Rs 1,214 crore, up 17.7%

ICICI Pru Life total premium at Rs 1,497 crore, up 3%

HDFC Life total premium at Rs 2,843 crore, up 3.3%

Bajaj Allianz Life total premium at Rs 962 crore, up 3.5%

LIC individual single premium at Rs 2,000 crore, down 16%

LIC Group Single Premium at Rs 17,602 crore, up 195%

The scrip fell as much as 6.23% to Rs 5,011.10 apiece, the lowest level since Nov 2, 2023. It trading 5.66% lower at Rs 302.30 apiece, as of 12:24 p.m. This compares to a 0.89% advance in the NSE Nifty 50 Index.

It has risen 90.49% in 12 months. Total traded volume so far in the day stood at 7.4 times its 30-day average. The relative strength index was at XX.

Out of 31 analysts tracking the company, 19 maintain a 'buy' rating, six recommend a 'hold,' and six suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 10.6%.

The scrip fell as much as 6.23% to Rs 5,011.10 apiece, the lowest level since Nov 2, 2023. It trading 5.66% lower at Rs 302.30 apiece, as of 12:24 p.m. This compares to a 0.89% advance in the NSE Nifty 50 Index.

It has risen 90.49% in 12 months. Total traded volume so far in the day stood at 7.4 times its 30-day average. The relative strength index was at XX.

Out of 31 analysts tracking the company, 19 maintain a 'buy' rating, six recommend a 'hold,' and six suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 10.6%.

Johnson Controls - Hitachi Air Conditioning India at 6.75x its 30 day average

Galaxy Surfactants at 6.61x its 30 day average

Trident Ltd at 6.38x its 30 day average

Ashoka Buildcon at 5.72x its 30 day average

Gateway Distriparks at 4.61x its 30 day average

Fsn E-Commerce Ventures Ltd at 4.37x its 30 day average

Airtel Business to power 20 million smart meters for Adani Energy via IoT solutions

Alert: Airtel Business is a B2B arm of Bharti Airtel

Source: Exchange Filing

UCO Bank will hike its 1-month to 1-year Marginal Cost Of Funds Based Lending Rate by 5 bps from Jan 10.

Source: Exchange Filing

Zee and Punit Goenka both keen to close the merger

Good faith negotiations between parties are still on

Negotiations can go in any direction at this stage

Punit not keen to hold onto the chair as is being portrayed

Co keen on implementing scheme that shareholders have improved

Alert: Any change in scheme document will send scheme back to regulatory desk & shareholders for re approvals

Sources close to the deal said to NDTV Profit

Coal India Ltd has extended its fuel supply pact tenure to 10 years for non-regulated sector.

Source: Exchange Filing

Gateway Distriparks Ltd has 28.9 lakh shares changed hands in two large trades

The company's 0.6% equity changed hands at a price range of Rs 110 to Rs 110.45 apiece

Buyers and sellers not known immediately

Source: Bloomberg

Infibeam Avenues Ltd inked a pact with Gujarat for Rs 2,000 crore proposed investment

Source: Bloomberg

Japan's benchmark index Nikkei 225 outperformed July's peak, and closed at 34-year high on Tuesday, Bloomberg reported.

Nikkei 225 settled 1.24% or 412.23 points higher at 33,789.65 on Tuesday.

Signs Rs 16,000 crore worth accords at road financing conference

Signs MoU with Dilip Buildcon, GMR Power, CDS Infra Projects, DP Jain

Source: Exchange Filing

IndusInd introduced UPI-enabled 'IndusInd Bank Samman RuPay Credit Card' for government staff

Source: Exchange Filing

Datamatics Global Services Ltd partenered with OutSystems for low-code platform.

Source: Exchange Filing

Bharat Forge Ltd signed an non-binding MoU with Tamil Nadu Govt for investment of Rs 1,000 crore over 5 years

The investment would be used to expand manufacturing footprint in the state

Source: Exchange Filing

Shares of Gujarat State Fertilizers & Chemicals Ltd jumped nearly 12% and touched a life-time high on Tuesday as the company's an ammonium sulphate manufacturing plant in Vadodara started production, according exchange filing.

The new manufacturing plant added annual capacity of 1,32,000 MT of ammonium sulphate, the exchange filing said.

Shares of Gujarat State Fertilizers & Chemicals Ltd jumped nearly 12% and touched a life-time high on Tuesday as the company's an ammonium sulphate manufacturing plant in Vadodara started production, according exchange filing.

The new manufacturing plant added annual capacity of 1,32,000 MT of ammonium sulphate, the exchange filing said.

The scrip rose as much as 11.72% to Rs 305.90 apiece, the highest level since its listing on BSE on Sep 26, 1996. It pared gains to trade 7.50% higher at Rs 294.40 apiece, as of 11:25 a.m. This compares to a 0.80% advancein the NSE Nifty 50 Index.

It has risen 103.46% in 12 months. Total traded volume so far in the day stood at 3.9 times its 30-day average. The relative strength index was at 73.27, which implied the stock is overbought.

Two analysts tracking the company, maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an downside of 7.3%.

HDFC Life Insurance Co received Rs 17.87 crore GST demand and penalty of Rs 1.79 crore from Chennai GST Authority

The company said it will contest the order further by appealing before the Appellate Authority.

Source: Exchange Filing

Adani Group stocks added as much as Rs 49,881.10 crore in investor wealth, taking their total market capitalisation to Rs 15.57 lakh crore, intraday.

At 10:54 AM, the shares added Rs 34,845 crore in market value taking the capitalisation to Rs 15.43 lakh crore.

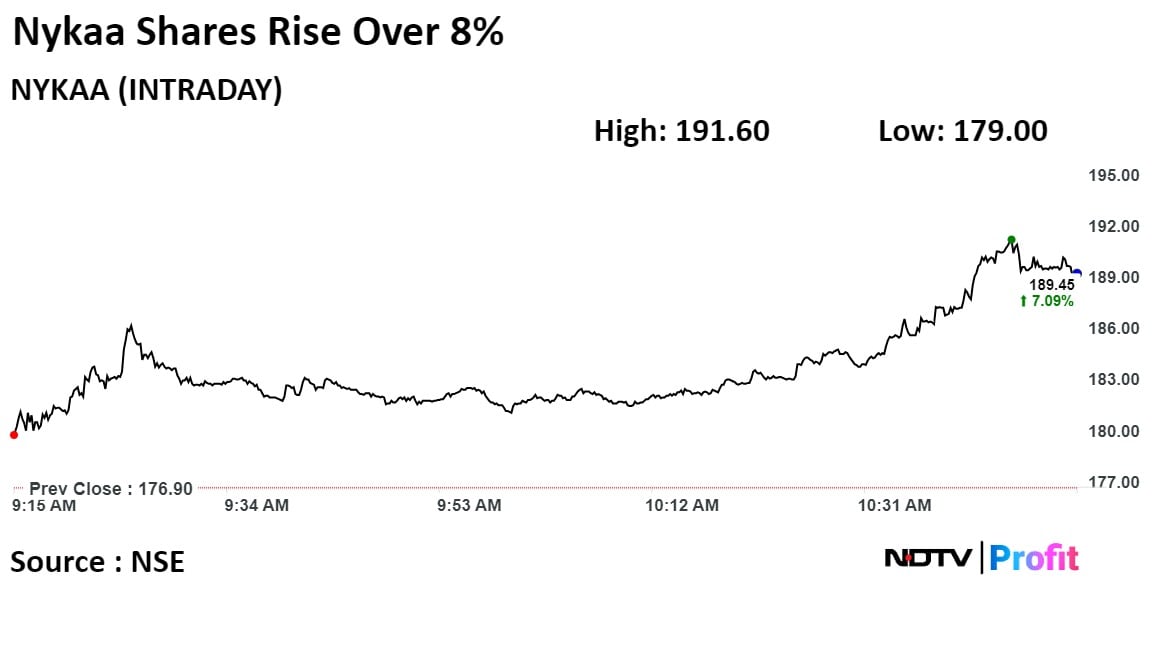

FSN E-Commerce Ventures Ltd., commonly known as Nyka rose to a 52-week high on Tuesday after HSBC Global Research upgraded the target price.

HSBC maintained a 'buy' rating on FSN E-Commerce Ventures Ltd , and raised its target price by 44.2% to Rs.250 .

This comes after the company reported strong growth in Q3. Nykaa expects the BPC vertical's gross merchandise value growth to be in the mid-twenties and the net sales value growth to be around 20% on YoY basis. In its business update on Monday the company also added that Nykaa Fashion has seen strong growth in Q3 with the GMV growth expected to be around 40% and the NSV growth to be in the low thirties.

FSN E-Commerce Ventures Ltd., commonly known as Nyka rose to a 52-week high on Tuesday after HSBC Global Research upgraded the target price.

HSBC maintained a 'buy' rating on FSN E-Commerce Ventures Ltd , and raised its target price by 44.2% to Rs.250 .

This comes after the company reported strong growth in Q3. Nykaa expects the BPC vertical's gross merchandise value growth to be in the mid-twenties and the net sales value growth to be around 20% on YoY basis. In its business update on Monday the company also added that Nykaa Fashion has seen strong growth in Q3 with the GMV growth expected to be around 40% and the NSV growth to be in the low thirties.

The scrip continued its rally on Tuesday and rose as much as 8.31% to 191.60 apiece, the highest level since Jan. 8. It was trading 7.97% higher at Rs 191 apiece, as of 10:48 a.m. This compares to a 0.83% advance in the NSE Nifty 50 Index.

It has risen 24.16% in the last 12 months. Total traded volume so far in the day stood at 6.9 times its 30-day average. The relative strength index was at 71.15.

Out of 24 analysts tracking the company, 14 maintain a 'buy' rating, 5 recommend a 'hold,' and 5 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 19.3%.

Overall subscription at 0.44x as of 10:39 am

NII subscription at 0.37x as of 10:39 am

Retail subscription at 1.88x as of 10:39 am

Source: BSE

Shares of Larsen & Toubro Ltd. hit a record high on Tuesday. The scrip as much as 2.65% at Rs 3,593.75.

The company wins a significant order for its Buildings & Factories Business. Significant order category comes between Rs 1,000 to Rs 2,500 crore.

According to Citi Research note Larsen & Toubro Ltd.'s third quarter revenue is expected to grow on the back of strong order inflows and execution.

The brokerage expects a 14% year-on-year increase in revenue for the September-December quarter of FY24, it said in a Jan. 7 note.

The infra-to-tech conglomerate is the brokerage's top pick. Citi has raised its target price on the stock to Rs 4,082 from Rs 3,547 earlier.

Shares of Larsen & Toubro Ltd. hit a record high on Tuesday. The scrip as much as 2.65% at Rs 3,593.75.

The company wins a significant order for its Buildings & Factories Business. Significant order category comes between Rs 1,000 to Rs 2,500 crore.

According to Citi Research note Larsen & Toubro Ltd.'s third quarter revenue is expected to grow on the back of strong order inflows and execution.

The brokerage expects a 14% year-on-year increase in revenue for the September-December quarter of FY24, it said in a Jan. 7 note.

The infra-to-tech conglomerate is the brokerage's top pick. Citi has raised its target price on the stock to Rs 4,082 from Rs 3,547 earlier.

Shares of the company rose as much as 2.54% to Rs 3,590 apiece to hit life high. It was trading 2.51% higher at Rs 3,588.85 apiece compared to a 0.88% advance in the benchmark Nifty 50 at 12:11 p.m

It has risen 69.15% in the last 12 months. The relative strength index was at 68.

Of the 36 analysts tracking the company, 33 maintain a 'buy', one recommend a 'hold', and two suggest a 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 2.8%

Coal India Ltd 10.3 lakh shares changed hands in a large trade

The company's 0.02% equity changed hands at Rs 384.15 apiece

Buyers and sellers not known immediately

Source: Bloomberg

Aether Industries Ltd joined hands with H.B. Fuller, Saudi Aramco Technologies Co to produce Polyols Tech.

It's also the first commercialisation of sustainable Converge polyols tech

Source: Exchange Filing

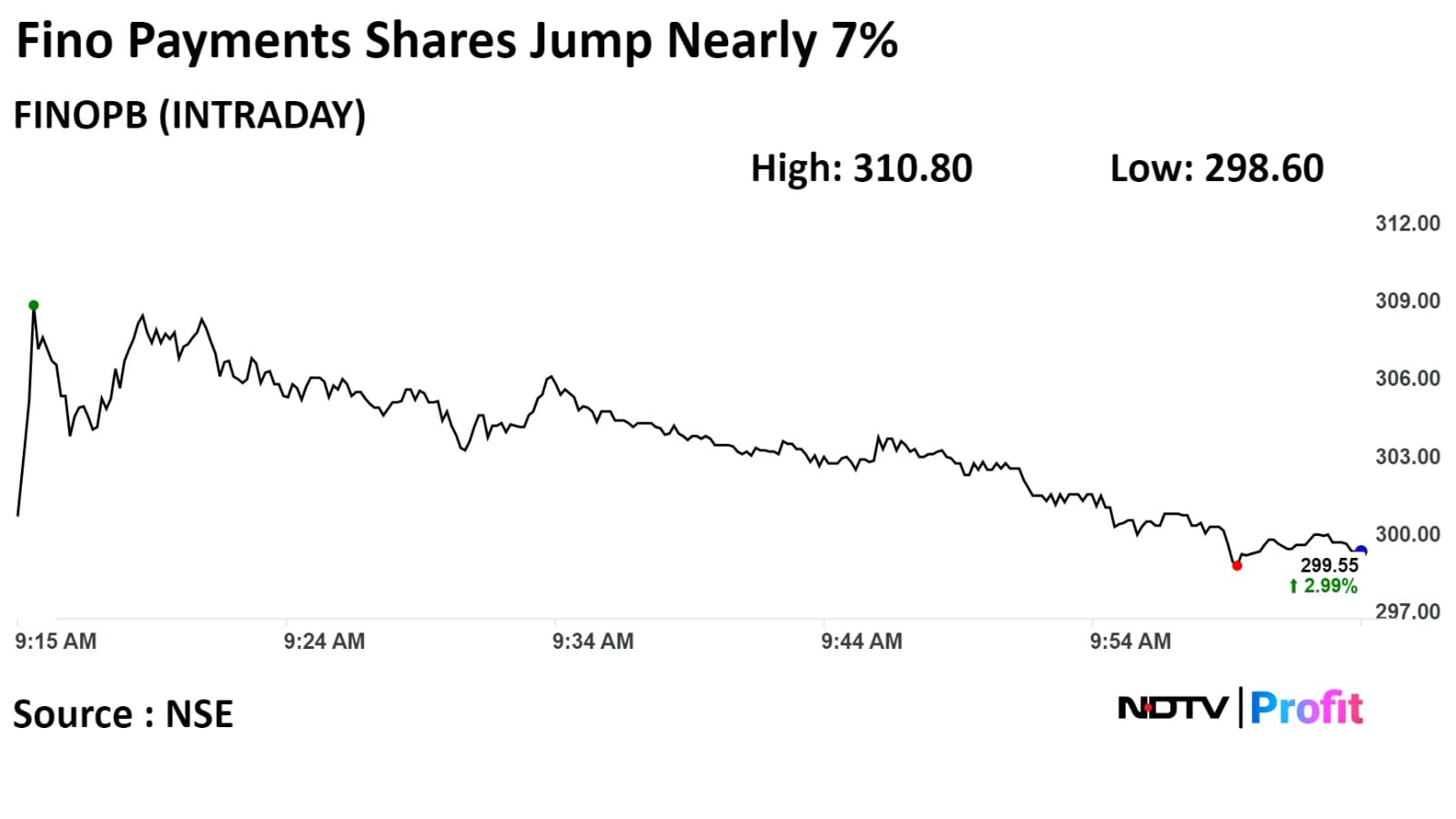

Shares of Fino Payments Bank surged a day after an RBI statement disclosed that the bank applied for a small finance bank under the Guidelines for ‘on tap’ licensing of Small Finance Banks in the Private Sector.

Shares of Fino Payments Bank surged a day after an RBI statement disclosed that the bank applied for a small finance bank under the Guidelines for ‘on tap’ licensing of Small Finance Banks in the Private Sector.

The scrip rose as much as 6.86% to Rs 310.80 apiece, the highest level since Nov 2. It pared gains to trade 2.7% higher at Rs 298.70 apiece, as of 10:09 a.m. This compares to a 0.6% advance in the NSE Nifty 50 Index.

It has risen 11.2% in the last twelve months. Total traded volume so far in the day stood at 9.5 times its 30-day average. The relative strength index was at 70.37, indicating that the stock may be overbought.

The two analysts tracking the company, one maintain a 'buy' rating according to Bloomberg data. The average 12-month consensus price target implies an upside of 33.9%.

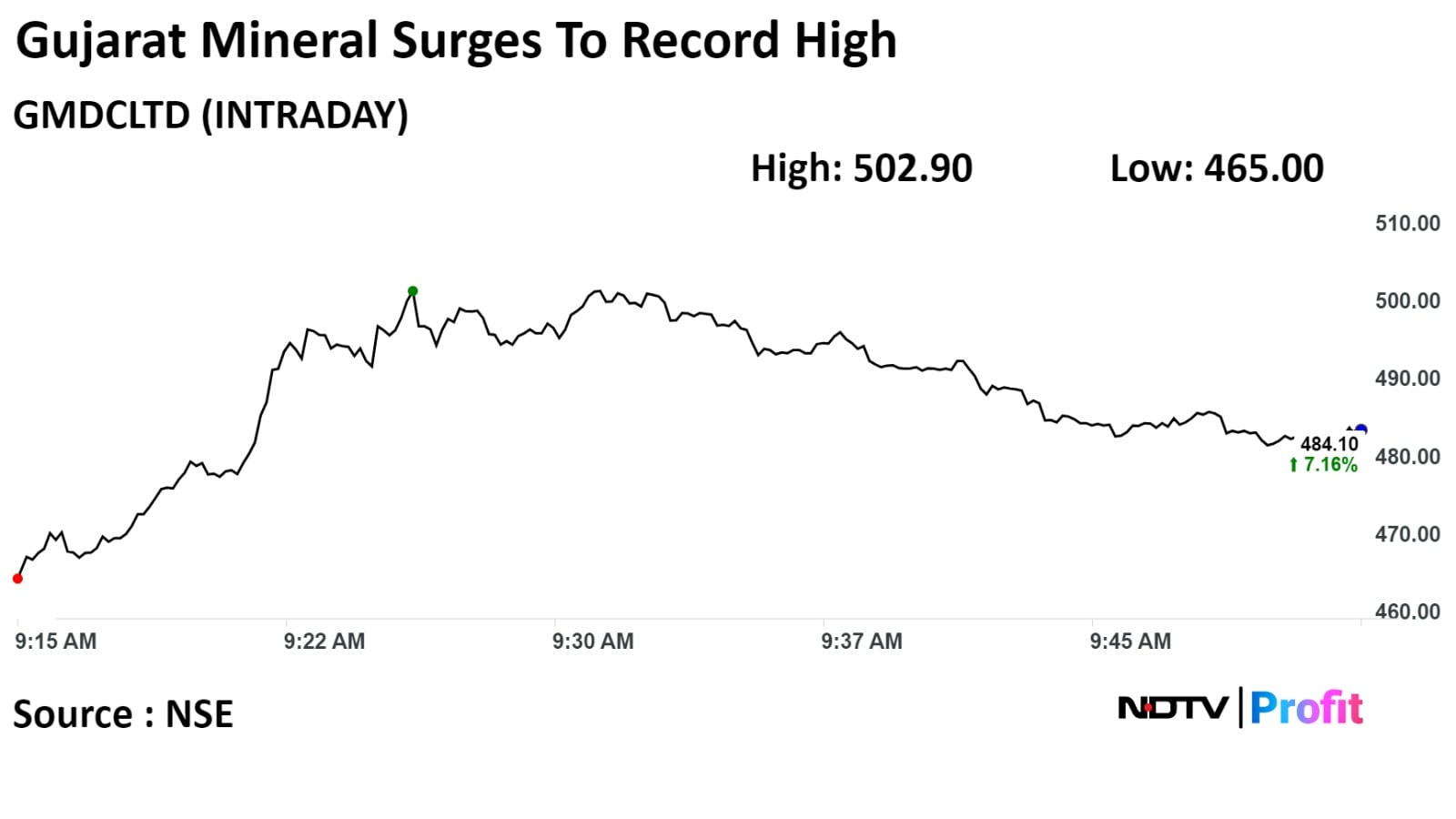

Scrips of Gujarat Mineral Development Corp jumped over 11% to hit fresh high on Tuesday as the company said to exchanges its Surkha Lignite mine received environment clearance for capacity expansion.

GMDC Surkha Lignite mine received environment clearance from Ministry Ministry of Environment, Forest, and Climate Change to expand its capacity from to 5 MTPA from 3 MTPA

Scrips of Gujarat Mineral Development Corp jumped over 11% to hit fresh high on Tuesday as the company said to exchanges its Surkha Lignite mine received environment clearance for capacity expansion.

GMDC Surkha Lignite mine received environment clearance from Ministry Ministry of Environment, Forest, and Climate Change to expand its capacity from to 5 MTPA from 3 MTPA

Gujarat Mineral Development Corp rose as much as 11.32% to Rs 502.90 apiece, the highest level since its listing on Jan 5, 1998. It pared gains to trade 6.54% higher at Rs 481.30 apiece, as of 10:09 a.m. This compares to a 0.61 advance in the NSE Nifty 50 Index.

It has risen 223.15% in 12 months. Total traded volume so far in the day stood at 7.7 times its 30-day average. The relative strength index was at 74.63, which implied the stock is overbought.

Out of two analysts tracking the company, one maintains a 'buy' rating and one suggests 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 21.6%.

Gains led by Bajaj Auto, Bharat Forge

8 out of 16 constituents hit fresh highs

Nifty Auto stocks that hit life high today: Bajaj Auto, Bharat Forge, Balkirshna Industries, Samvardhana Motherson International, Hero Motocorp, Tata Motors, , Escorts Kubota, Tube Investments of India

The conglomerate has signed a Memorandum of Understanding to invest over Rs 42,700 crore in Tamil Nadu.

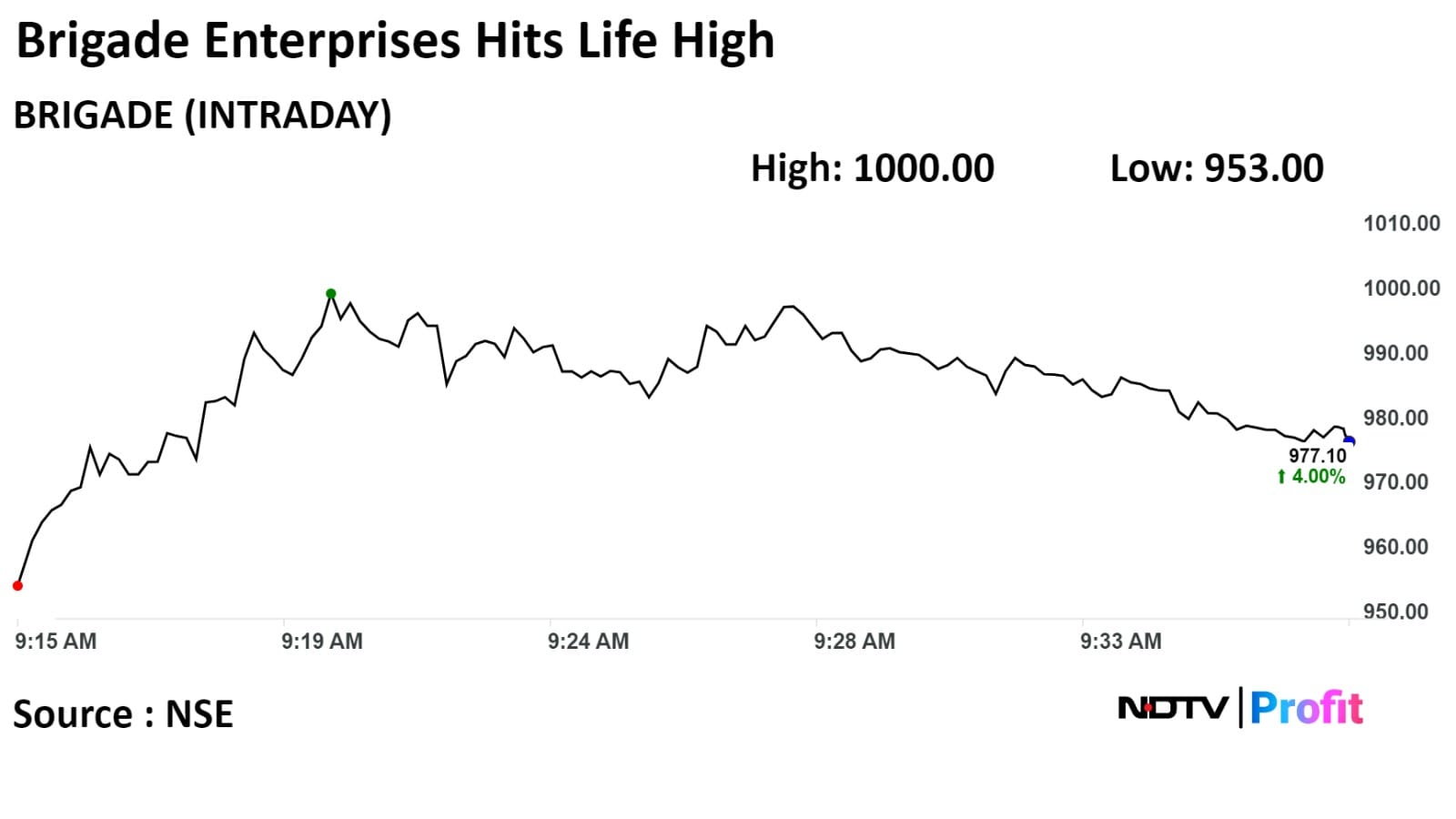

Shares of Brigade Enterprises Ltd. jumped to hit a lifetime high a day after the company announced that it has signed memorandum of understandings worth more than Rs 3,400 crore at the Tamil Nadu Global Investors Meet 2024.

"The company signed two MoUs, one with the Chennai Metropolitan Development Authority and the other with ELCOT, Information Technology and Digital Services Department, Government of Tamil Nadu," an exchange filing by the company said.

Shares of Brigade Enterprises Ltd. jumped to hit a lifetime high a day after the company announced that it has signed memorandum of understandings worth more than Rs 3,400 crore at the Tamil Nadu Global Investors Meet 2024.

"The company signed two MoUs, one with the Chennai Metropolitan Development Authority and the other with ELCOT, Information Technology and Digital Services Department, Government of Tamil Nadu," an exchange filing by the company said.

NCGTC to conduct a detailed audit for CGFMU

NCGTC audit not for bank, only audit of claim

Applied for second tranche CGFMU claim worth Rs 1,290 crore

Source: Exchange Filing

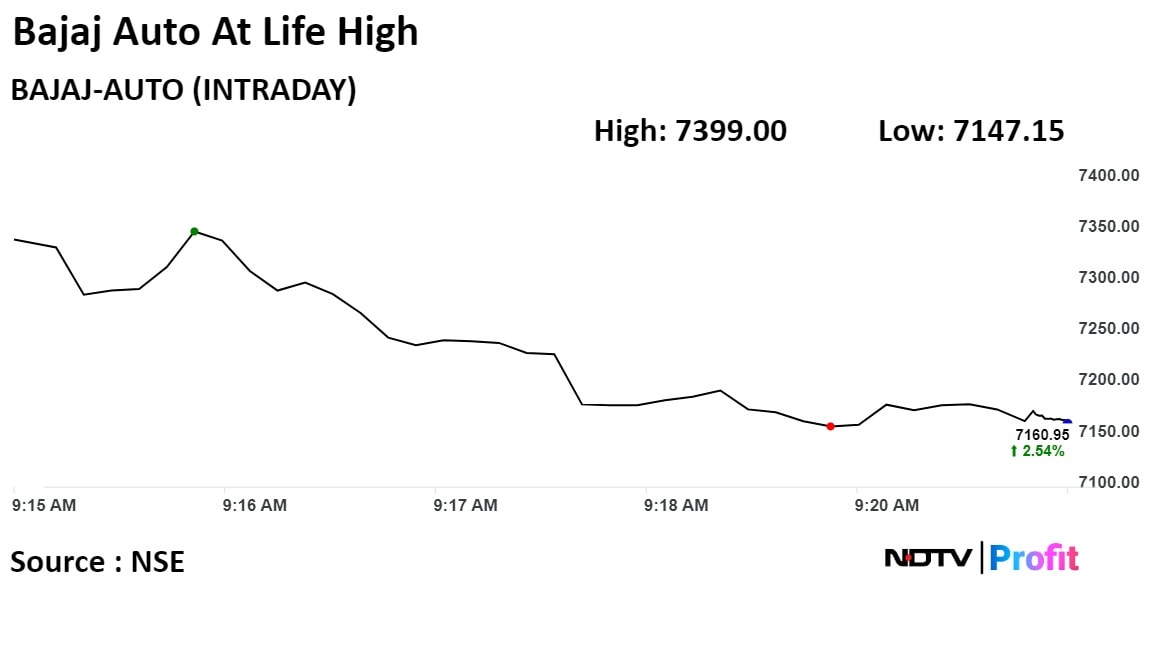

Shares of Bajaj Auto Ltd. rose on Tuesday after its board approved a Rs 4,000 crore buyback through a tender offer.

Shares of the company rose as much as 5.94% to 7,399 apiece, to touch a new all time high. It pared gains to trade 5% higher at Rs 7,333.35 apiece as of 9:17 a.m. This compares to a 0.61% advance in the NSE Nifty 50 Index.

It has risen 102.54% in the last 12 months. Total traded volume so far in the day stood at 49 times its 30-day average. The relative strength index was at 74.

Out of 46 analysts tracking the company, 26 maintain a 'buy' rating, 12 recommend a 'hold', and 8 suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 98.6%.

Shares of Bajaj Auto Ltd. rose on Tuesday after its board approved a Rs 4,000 crore buyback through a tender offer.

Shares of the company rose as much as 5.94% to 7,399 apiece, to touch a new all time high. It pared gains to trade 5% higher at Rs 7,333.35 apiece as of 9:17 a.m. This compares to a 0.61% advance in the NSE Nifty 50 Index.

It has risen 102.54% in the last 12 months. Total traded volume so far in the day stood at 49 times its 30-day average. The relative strength index was at 74.

Out of 46 analysts tracking the company, 26 maintain a 'buy' rating, 12 recommend a 'hold', and 8 suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 98.6%.

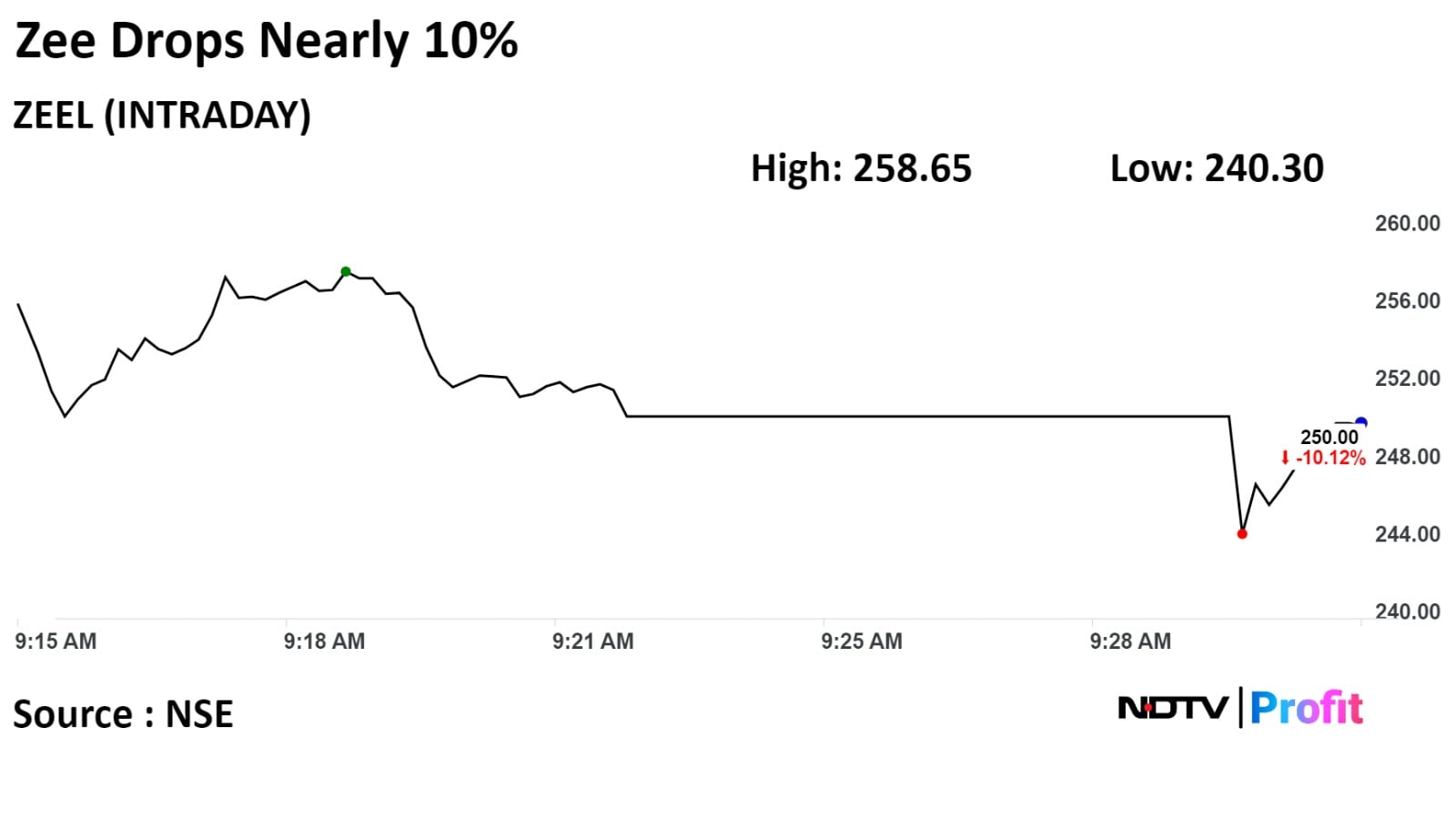

Shares of Zee Entertainment Enterprises Ltd. tumbled nearly 10% on a report that Sony Group Corp. intends to cancel the proposed merger agreement between its Indian subsidiary and Zee Entertainment Enterprises.

The Japanese conglomerate is looking to cancel the deal due to a standoff over whether Zee’s Chief Executive Officer Punit Goenka would lead the merged entity, Bloomberg reported on Monday, quoting unnamed people.

Shares of Zee Entertainment Enterprises Ltd. tumbled nearly 10% on a report that Sony Group Corp. intends to cancel the proposed merger agreement between its Indian subsidiary and Zee Entertainment Enterprises.

The Japanese conglomerate is looking to cancel the deal due to a standoff over whether Zee’s Chief Executive Officer Punit Goenka would lead the merged entity, Bloomberg reported on Monday, quoting unnamed people.

Shares of the company fell as much as 9.99% to Rs 250.35 apiece. It was trading 9.92% lower at Rs 250.55 apiece, compared to a 0.71% advance in the benchmark NSE Nifty 50 at 9.17 a.m.

It has risen 5.66% in the last 12 months. Total traded volume so far in the day stood at 19 times its 30-day average. The relative strength index was at 38

Of the 23 analysts tracking the company, 17 maintain a 'buy', four recommend a 'hold', and two suggest a 'sell', according to Bloomberg data. The average 12-month consensus price target implies a upside of 15%

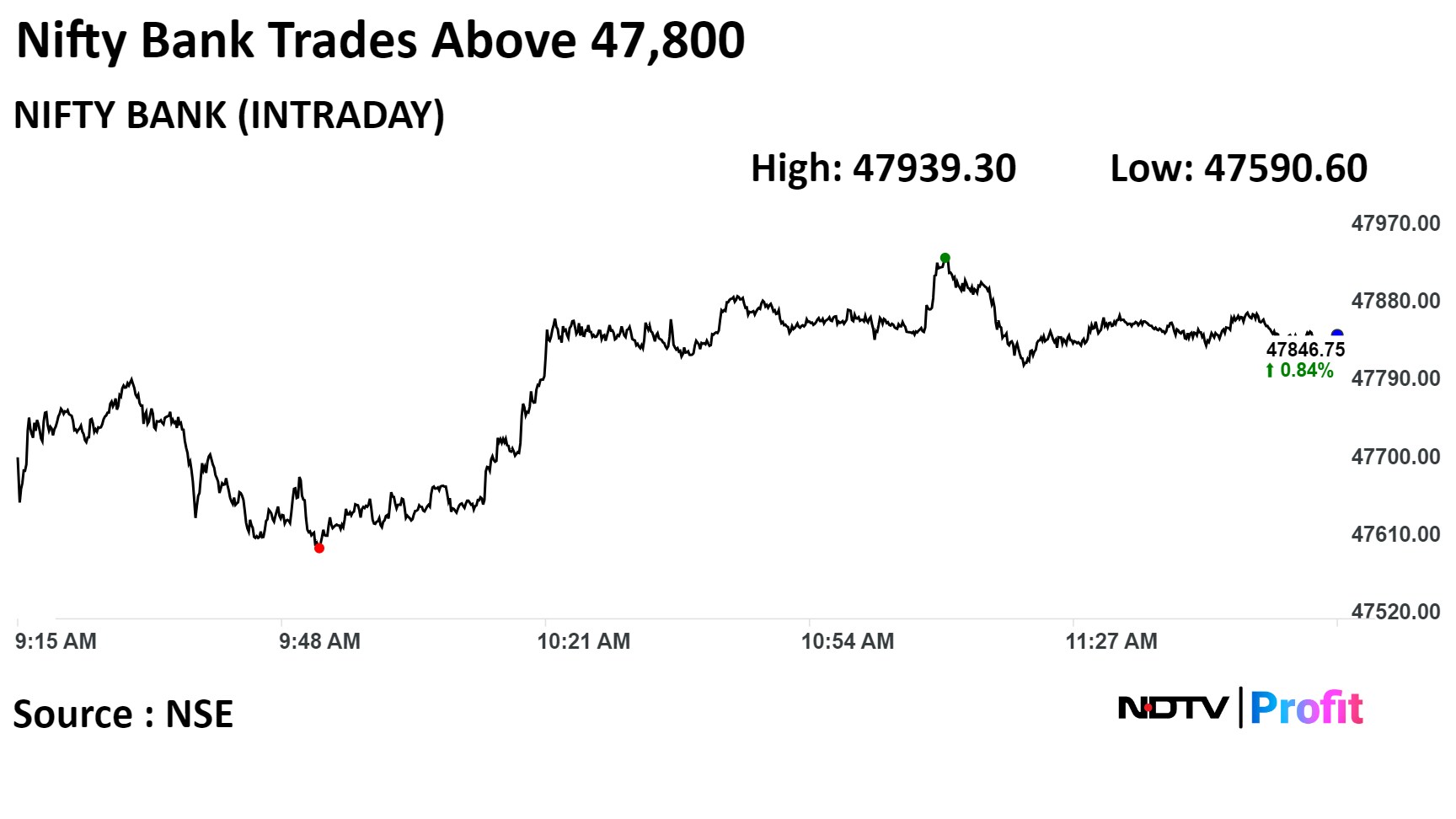

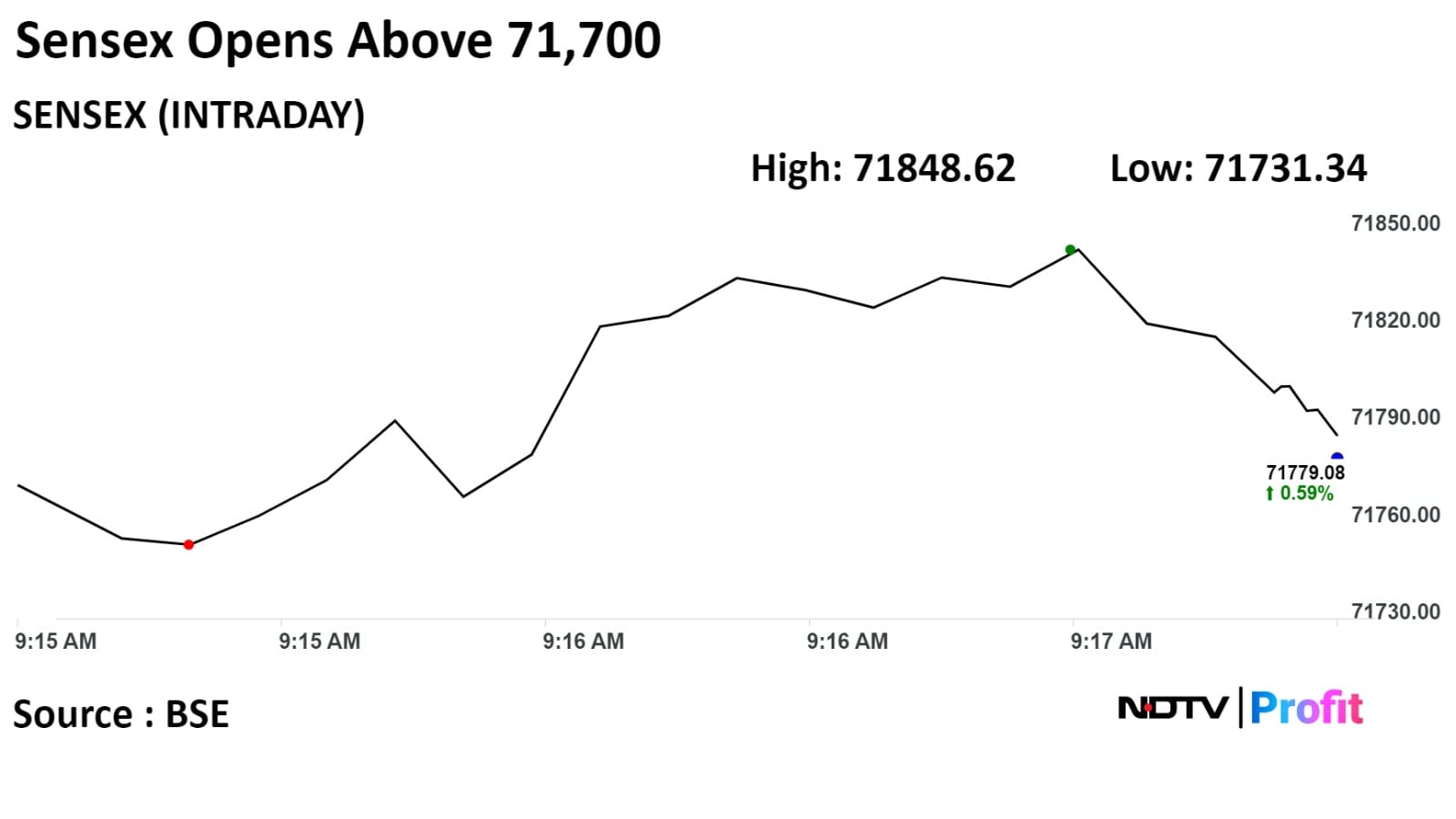

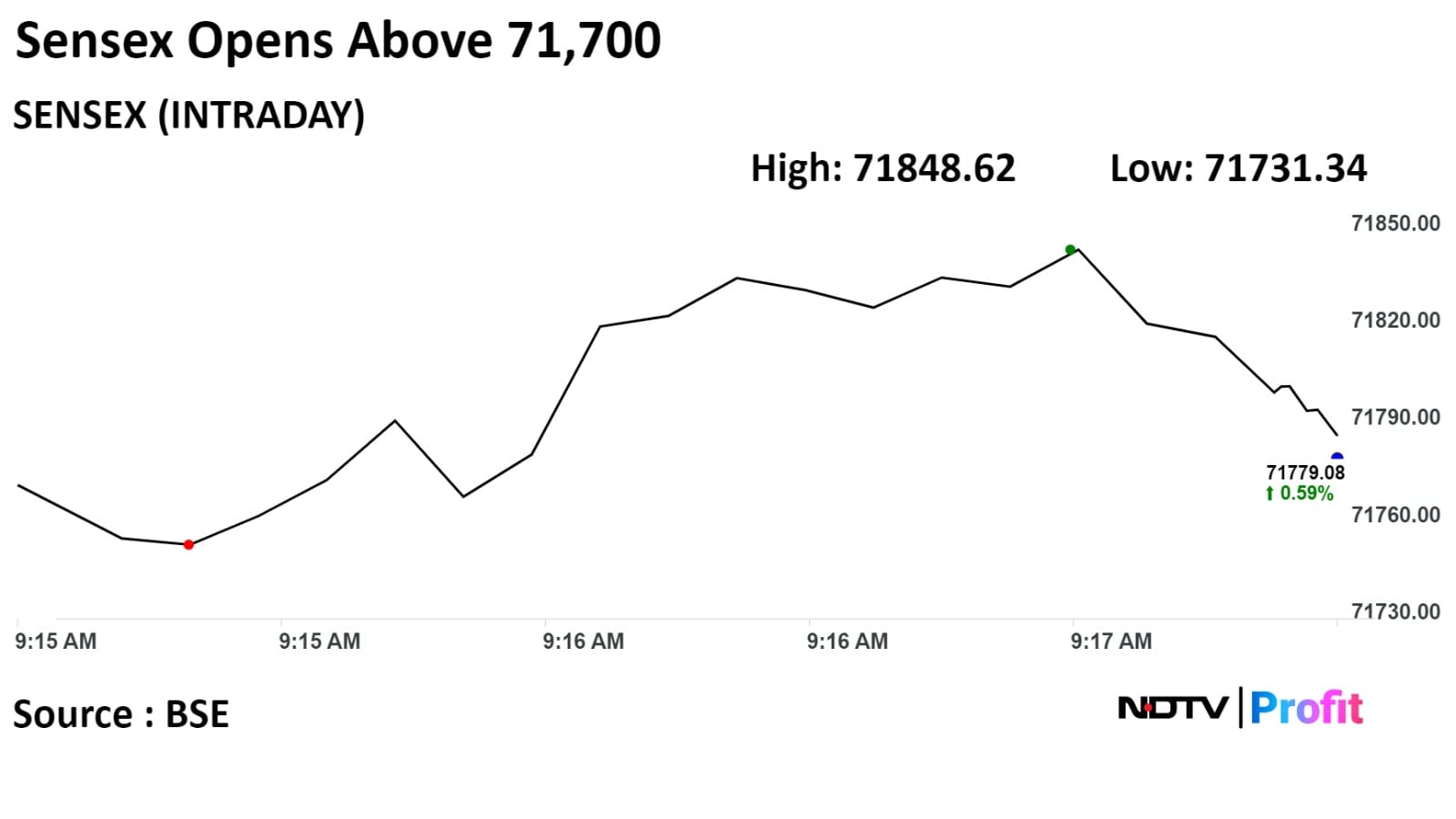

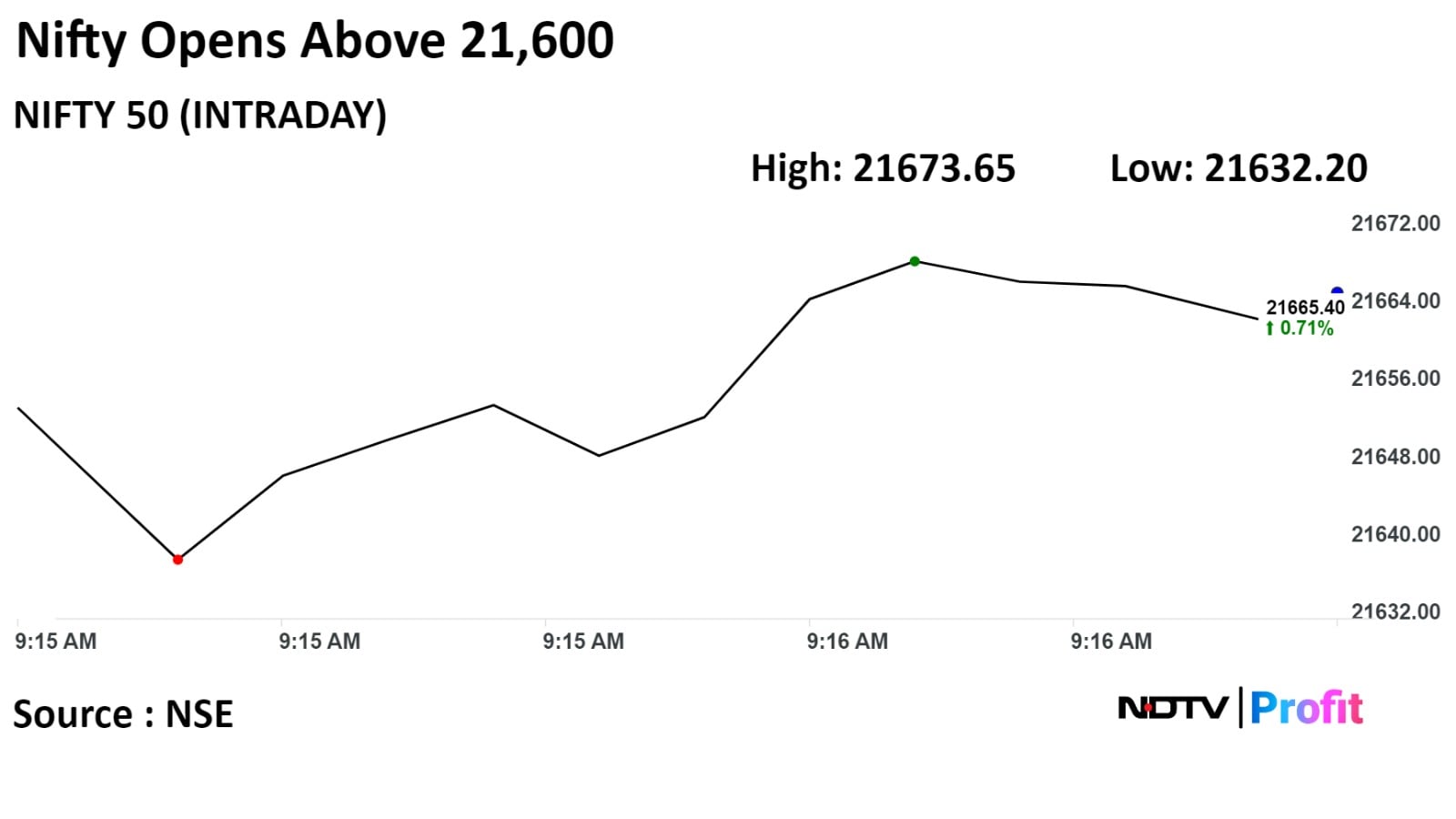

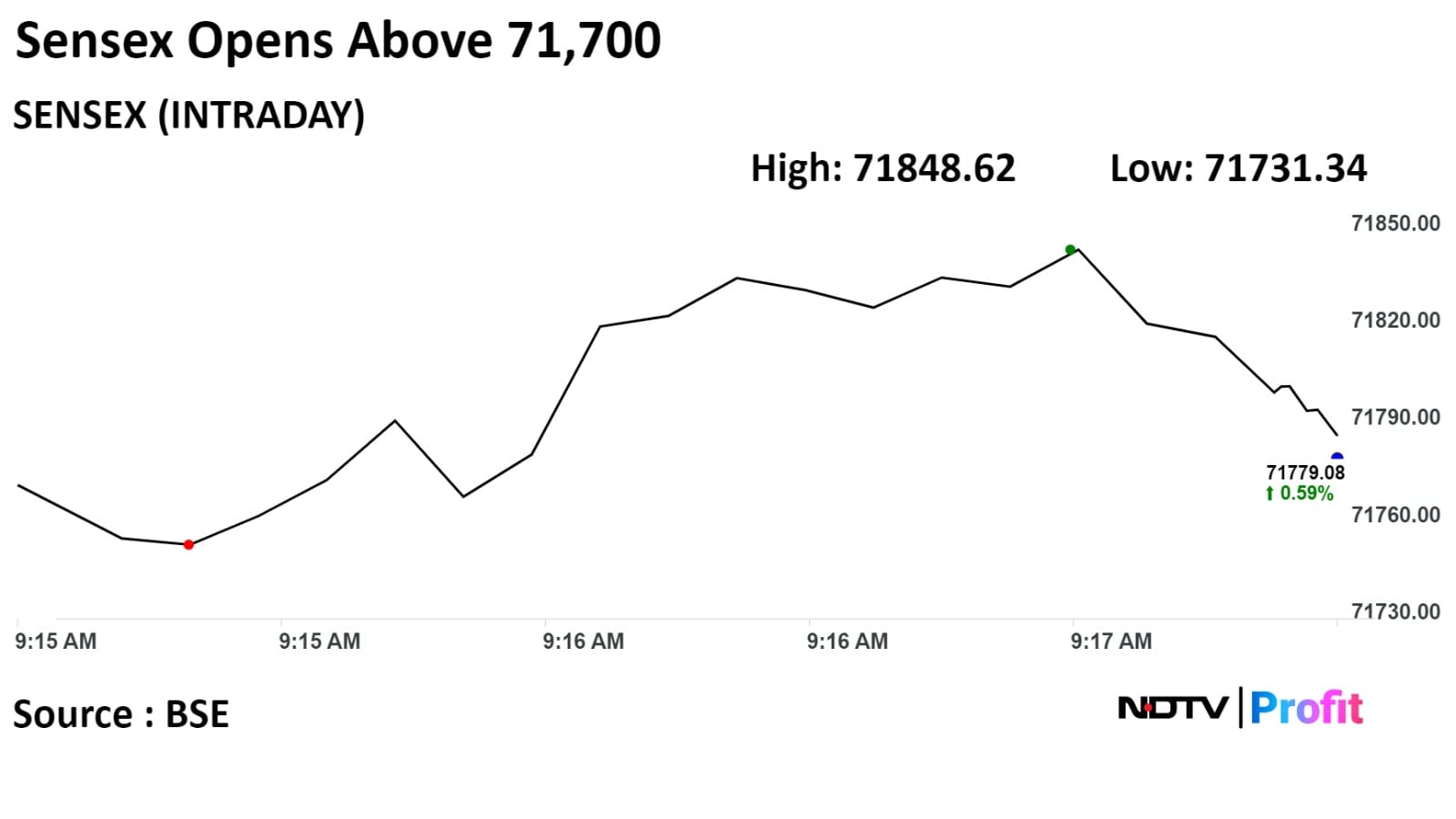

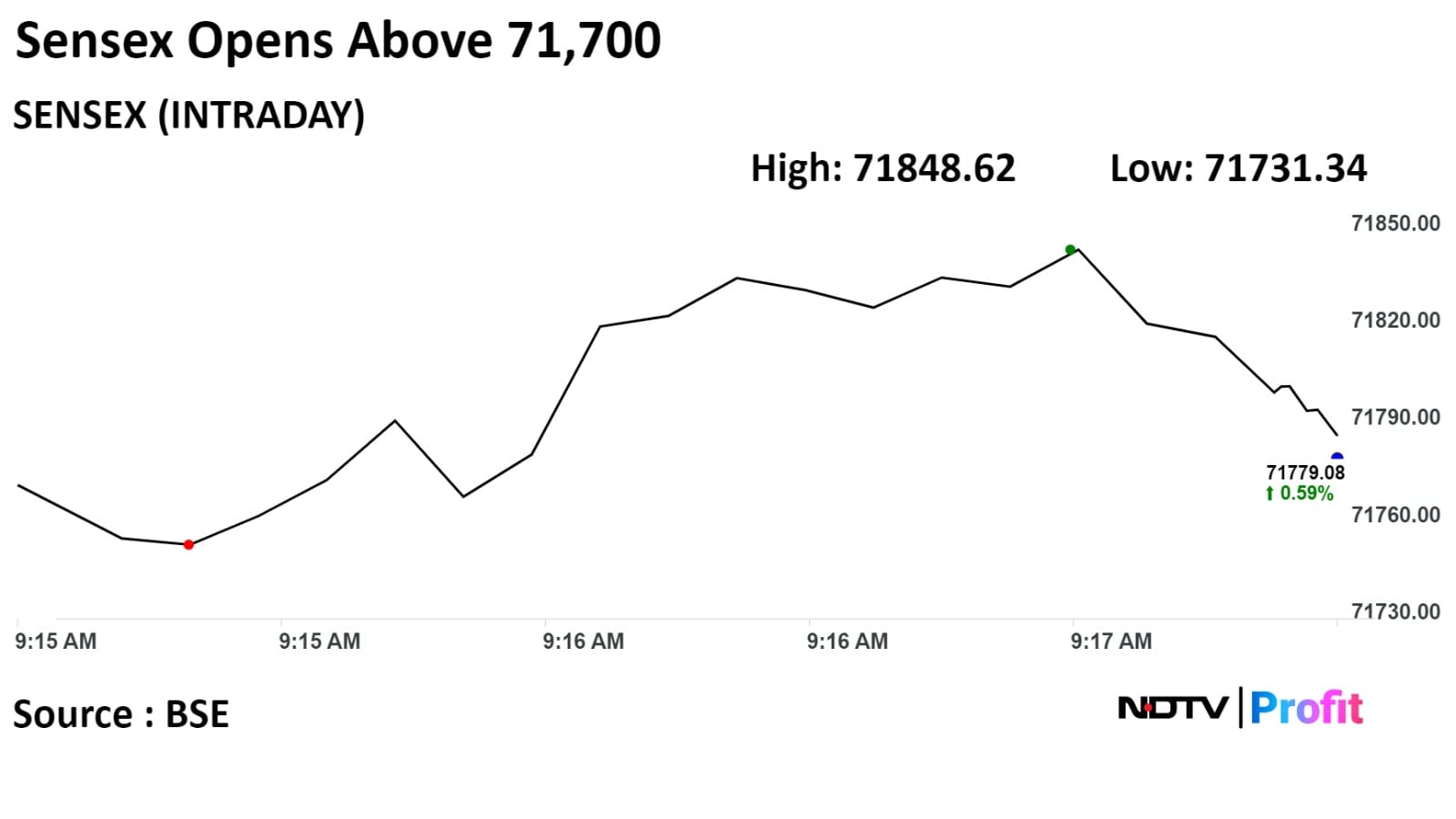

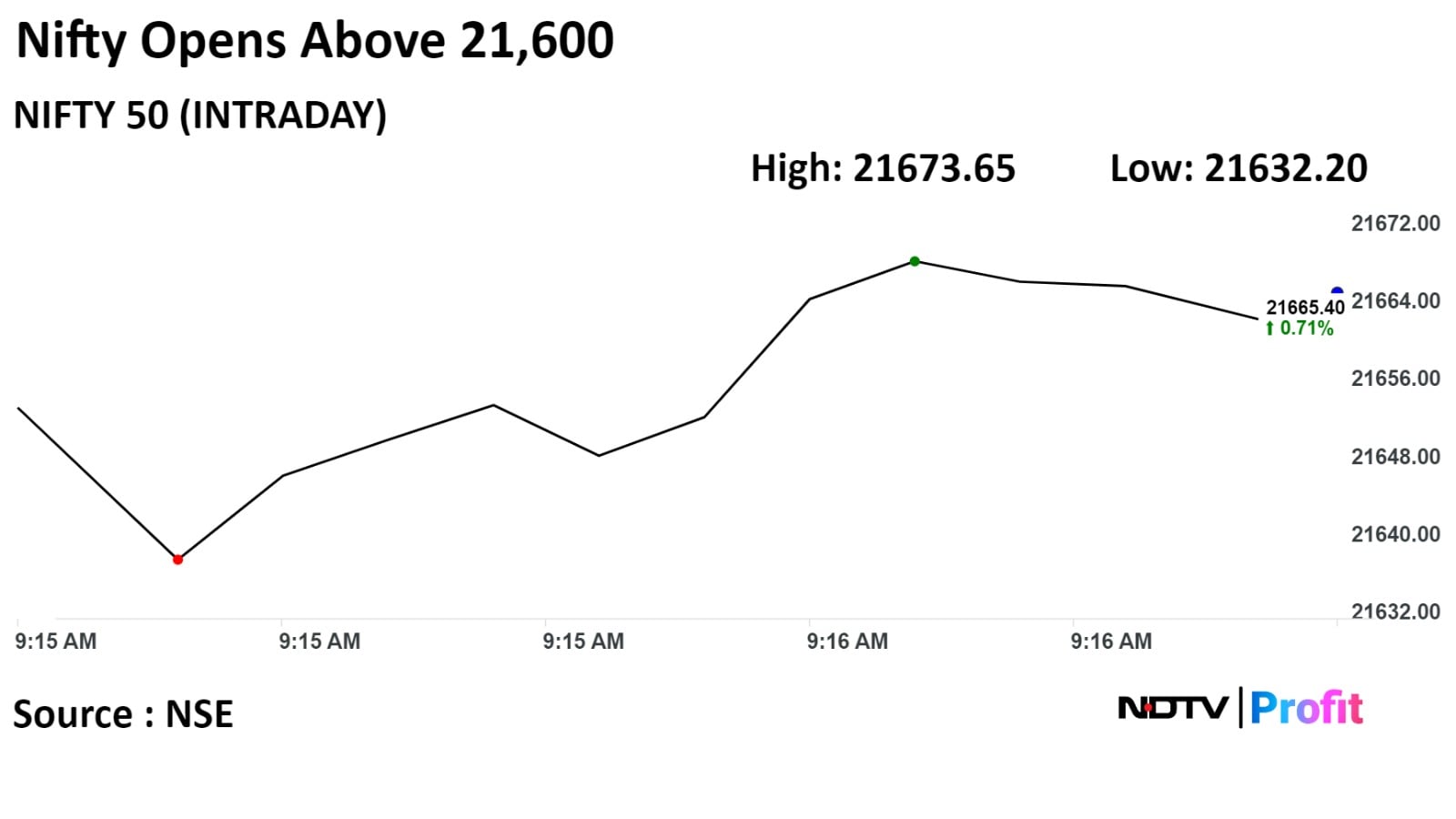

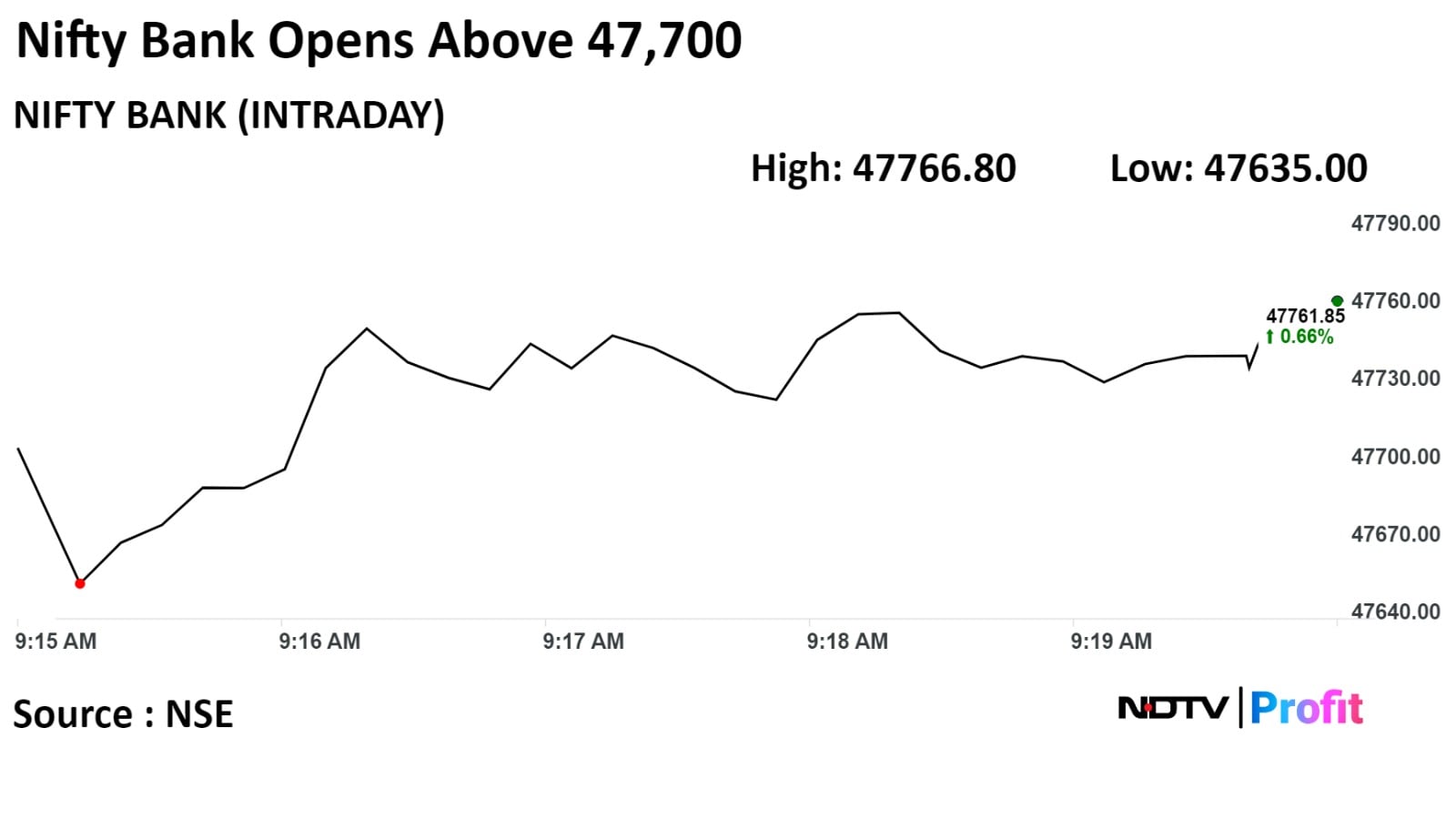

India's benchmark indices recouped Monday's sharp losses and opened higher as Infosys Ltd, Larsen & Toubro Ltd, and ICICI Bank Ltd gain.

As of 09:17 a.m., the benchmark S&P BSE Sensex was 0.65% or 467.22 points higher at 71,799.82, while the NSE Nifty 50 was 0.68% or 146.75 points higher at 21,659.75.

On Monday, the Nifty ended 197.80 points, or 0.91%, lower at 21,513.00 points, while the Sensex fell 670.93 points, or 0.93%, to close at 71,355.22.

“Yesterday's session at Dalal Street was unsettling for perma-bulls as the market dropped sharply. Market sentiments were rattled by Nifty's downturn, driven by inflationary concerns highlighted in Friday’s US jobs data. Futures traders now project a 62% chance of a Federal Reserve interest rate cut in March. Despite the gloom, there are positive notes - both FIIs & DIIs were net buyers, and WTI crude futures dropped 3.5% due to Saudi Arabia's price cuts and increased OPEC output. Technically, Nifty faces support at 21307, with upside hurdles at 21715, while Bank Nifty's major intraday support is at 46919. Nifty's options data suggests a range of 21300-21700. Looking ahead, the focus shifts to US CPI data and India’s inflation numbers this week," said Prashanth Tapse, senior vice president, research at Mehta Equities Ltd.

India's benchmark indices recouped Monday's sharp losses and opened higher as Infosys Ltd, Larsen & Toubro Ltd, and ICICI Bank Ltd gain.

As of 09:17 a.m., the benchmark S&P BSE Sensex was 0.65% or 467.22 points higher at 71,799.82, while the NSE Nifty 50 was 0.68% or 146.75 points higher at 21,659.75.

On Monday, the Nifty ended 197.80 points, or 0.91%, lower at 21,513.00 points, while the Sensex fell 670.93 points, or 0.93%, to close at 71,355.22.

“Yesterday's session at Dalal Street was unsettling for perma-bulls as the market dropped sharply. Market sentiments were rattled by Nifty's downturn, driven by inflationary concerns highlighted in Friday’s US jobs data. Futures traders now project a 62% chance of a Federal Reserve interest rate cut in March. Despite the gloom, there are positive notes - both FIIs & DIIs were net buyers, and WTI crude futures dropped 3.5% due to Saudi Arabia's price cuts and increased OPEC output. Technically, Nifty faces support at 21307, with upside hurdles at 21715, while Bank Nifty's major intraday support is at 46919. Nifty's options data suggests a range of 21300-21700. Looking ahead, the focus shifts to US CPI data and India’s inflation numbers this week," said Prashanth Tapse, senior vice president, research at Mehta Equities Ltd.

India's benchmark indices recouped Monday's sharp losses and opened higher as Infosys Ltd, Larsen & Toubro Ltd, and ICICI Bank Ltd gain.

As of 09:17 a.m., the benchmark S&P BSE Sensex was 0.65% or 467.22 points higher at 71,799.82, while the NSE Nifty 50 was 0.68% or 146.75 points higher at 21,659.75.

On Monday, the Nifty ended 197.80 points, or 0.91%, lower at 21,513.00 points, while the Sensex fell 670.93 points, or 0.93%, to close at 71,355.22.

“Yesterday's session at Dalal Street was unsettling for perma-bulls as the market dropped sharply. Market sentiments were rattled by Nifty's downturn, driven by inflationary concerns highlighted in Friday’s US jobs data. Futures traders now project a 62% chance of a Federal Reserve interest rate cut in March. Despite the gloom, there are positive notes - both FIIs & DIIs were net buyers, and WTI crude futures dropped 3.5% due to Saudi Arabia's price cuts and increased OPEC output. Technically, Nifty faces support at 21307, with upside hurdles at 21715, while Bank Nifty's major intraday support is at 46919. Nifty's options data suggests a range of 21300-21700. Looking ahead, the focus shifts to US CPI data and India’s inflation numbers this week," said Prashanth Tapse, senior vice president, research at Mehta Equities Ltd.

India's benchmark indices recouped Monday's sharp losses and opened higher as Infosys Ltd, Larsen & Toubro Ltd, and ICICI Bank Ltd gain.

As of 09:17 a.m., the benchmark S&P BSE Sensex was 0.65% or 467.22 points higher at 71,799.82, while the NSE Nifty 50 was 0.68% or 146.75 points higher at 21,659.75.

On Monday, the Nifty ended 197.80 points, or 0.91%, lower at 21,513.00 points, while the Sensex fell 670.93 points, or 0.93%, to close at 71,355.22.

“Yesterday's session at Dalal Street was unsettling for perma-bulls as the market dropped sharply. Market sentiments were rattled by Nifty's downturn, driven by inflationary concerns highlighted in Friday’s US jobs data. Futures traders now project a 62% chance of a Federal Reserve interest rate cut in March. Despite the gloom, there are positive notes - both FIIs & DIIs were net buyers, and WTI crude futures dropped 3.5% due to Saudi Arabia's price cuts and increased OPEC output. Technically, Nifty faces support at 21307, with upside hurdles at 21715, while Bank Nifty's major intraday support is at 46919. Nifty's options data suggests a range of 21300-21700. Looking ahead, the focus shifts to US CPI data and India’s inflation numbers this week," said Prashanth Tapse, senior vice president, research at Mehta Equities Ltd.

India's benchmark indices recouped Monday's sharp losses and opened higher as Infosys Ltd, Larsen & Toubro Ltd, and ICICI Bank Ltd gain.

As of 09:17 a.m., the benchmark S&P BSE Sensex was 0.65% or 467.22 points higher at 71,799.82, while the NSE Nifty 50 was 0.68% or 146.75 points higher at 21,659.75.

On Monday, the Nifty ended 197.80 points, or 0.91%, lower at 21,513.00 points, while the Sensex fell 670.93 points, or 0.93%, to close at 71,355.22.

“Yesterday's session at Dalal Street was unsettling for perma-bulls as the market dropped sharply. Market sentiments were rattled by Nifty's downturn, driven by inflationary concerns highlighted in Friday’s US jobs data. Futures traders now project a 62% chance of a Federal Reserve interest rate cut in March. Despite the gloom, there are positive notes - both FIIs & DIIs were net buyers, and WTI crude futures dropped 3.5% due to Saudi Arabia's price cuts and increased OPEC output. Technically, Nifty faces support at 21307, with upside hurdles at 21715, while Bank Nifty's major intraday support is at 46919. Nifty's options data suggests a range of 21300-21700. Looking ahead, the focus shifts to US CPI data and India’s inflation numbers this week," said Prashanth Tapse, senior vice president, research at Mehta Equities Ltd.

India's benchmark indices recouped Monday's sharp losses and opened higher as Infosys Ltd, Larsen & Toubro Ltd, and ICICI Bank Ltd gain.

As of 09:17 a.m., the benchmark S&P BSE Sensex was 0.65% or 467.22 points higher at 71,799.82, while the NSE Nifty 50 was 0.68% or 146.75 points higher at 21,659.75.

On Monday, the Nifty ended 197.80 points, or 0.91%, lower at 21,513.00 points, while the Sensex fell 670.93 points, or 0.93%, to close at 71,355.22.

“Yesterday's session at Dalal Street was unsettling for perma-bulls as the market dropped sharply. Market sentiments were rattled by Nifty's downturn, driven by inflationary concerns highlighted in Friday’s US jobs data. Futures traders now project a 62% chance of a Federal Reserve interest rate cut in March. Despite the gloom, there are positive notes - both FIIs & DIIs were net buyers, and WTI crude futures dropped 3.5% due to Saudi Arabia's price cuts and increased OPEC output. Technically, Nifty faces support at 21307, with upside hurdles at 21715, while Bank Nifty's major intraday support is at 46919. Nifty's options data suggests a range of 21300-21700. Looking ahead, the focus shifts to US CPI data and India’s inflation numbers this week," said Prashanth Tapse, senior vice president, research at Mehta Equities Ltd.

India's benchmark indices recouped Monday's sharp losses and opened higher as Infosys Ltd, Larsen & Toubro Ltd, and ICICI Bank Ltd gain.

As of 09:17 a.m., the benchmark S&P BSE Sensex was 0.65% or 467.22 points higher at 71,799.82, while the NSE Nifty 50 was 0.68% or 146.75 points higher at 21,659.75.

On Monday, the Nifty ended 197.80 points, or 0.91%, lower at 21,513.00 points, while the Sensex fell 670.93 points, or 0.93%, to close at 71,355.22.

“Yesterday's session at Dalal Street was unsettling for perma-bulls as the market dropped sharply. Market sentiments were rattled by Nifty's downturn, driven by inflationary concerns highlighted in Friday’s US jobs data. Futures traders now project a 62% chance of a Federal Reserve interest rate cut in March. Despite the gloom, there are positive notes - both FIIs & DIIs were net buyers, and WTI crude futures dropped 3.5% due to Saudi Arabia's price cuts and increased OPEC output. Technically, Nifty faces support at 21307, with upside hurdles at 21715, while Bank Nifty's major intraday support is at 46919. Nifty's options data suggests a range of 21300-21700. Looking ahead, the focus shifts to US CPI data and India’s inflation numbers this week," said Prashanth Tapse, senior vice president, research at Mehta Equities Ltd.

India's benchmark indices recouped Monday's sharp losses and opened higher as Infosys Ltd, Larsen & Toubro Ltd, and ICICI Bank Ltd gain.

As of 09:17 a.m., the benchmark S&P BSE Sensex was 0.65% or 467.22 points higher at 71,799.82, while the NSE Nifty 50 was 0.68% or 146.75 points higher at 21,659.75.

On Monday, the Nifty ended 197.80 points, or 0.91%, lower at 21,513.00 points, while the Sensex fell 670.93 points, or 0.93%, to close at 71,355.22.

“Yesterday's session at Dalal Street was unsettling for perma-bulls as the market dropped sharply. Market sentiments were rattled by Nifty's downturn, driven by inflationary concerns highlighted in Friday’s US jobs data. Futures traders now project a 62% chance of a Federal Reserve interest rate cut in March. Despite the gloom, there are positive notes - both FIIs & DIIs were net buyers, and WTI crude futures dropped 3.5% due to Saudi Arabia's price cuts and increased OPEC output. Technically, Nifty faces support at 21307, with upside hurdles at 21715, while Bank Nifty's major intraday support is at 46919. Nifty's options data suggests a range of 21300-21700. Looking ahead, the focus shifts to US CPI data and India’s inflation numbers this week," said Prashanth Tapse, senior vice president, research at Mehta Equities Ltd.

Infosys Ltd, Larsen & Toubro Ltd, ICICI Bank Ltd, Reliance Industries Ltd, Tata Consultancy Services Ltd HDFC Life Insurance Co Ltd, and Eicher Motors Ltd added positively to the indices.

NTPC Ltd, Power Grid Corp of India Ltd, Britannia Industries Ltd weighed on the indices.

On NSE, 11 sectors out of 12 advanced, with the Nifty IT rising 1.43% to become the top gainer among sectoral indices. Nifty Media fell 2.76% and was the top loser.

The broader markets outperformed benchmark indices. The S&P BSE Smallcap Index increased 0.96%, whereas S&P BSE MidCap Index was 0.78% higher. All 20 sectors on BSE advanced with the S&P BSE Services and IT becoming the top gainers among sectoral indices

Market breadth skewed in the favour of buyers. On BSE, 2539 stocks rose, 505 declined, while 83 remained unchanged.

At pre-open, the benchmark S&P BSE Sensex was 0.58% or 415.69 points higher at 71,770.91, and the NSE Nifty 50 was 0.65% or 140.60 points higher at 21,653.60.

"The US market has moved mostly higher during trading on Monday, regaining ground after snapping a nine-week winning streak last week. The tech-heavy Nasdaq has shown a particularly strong upward move, although the Dow has bucked the uptrend. The Asian market was mostly higher on Tuesday after a tech-led surge on Wall Street as investors await the next set of US inflation numbers due this week, which could hint at when the Federal Reserve might start cutting interest rates. The Indian market is likely to open on an upbeat Tuesday, led by a sharp overnight fall in oil prices and easing bond yields on expectations of near-term interest rate cuts in the US," said Avdhut Bagkar Technical and Derivatives Analyst, StoxBox.

The yield on the 10-year bond opened 2 bps lower at 7.18% on Tuesday.

It closed at 7.20% on Monday

Source: Bloomberg

The local currency strengthened 7 paise to open at 83.06 against the U.S dollar on Tuesday.

It closed at 83.13 on Monday.

Source: Bloomberg

Capacit'e Infraprojects Ltd approved floor price for QIP at Rs 264.89 per share

Source: Exchange Filing

Production at 6.87 MT, up 12%

Capacity utilisation of Indian operations at 94%

Source: Exchange Filing

Signs MoU with Gujarat Govt to invest Rs 2,000 crore for EV manufacturing

Source: Exchange Filing

U.S. Dollar Index at 102.22

U.S. 10-year bond yield at 4.02%

Brent crude up 0.35% at $76.39 per barrel

Nymex crude up 0.20% at $70.91 per barrel

Bitcoin down 1.51% at 46,404.19

GIFT Nifty was trading 0.02% or 3.5 points higher at 21,705 as of 8:19 a.m.

HSBC maintained a 'buy' rating on FSN E-Commerce Ventures Ltd , and raised its target price by 44.2% to Rs.250

FSN E-Commerce Ventures Ltd is well positioned to capture long-term value in business, planning, and co-ordination segment with its scale and leadership, HSBC said.

Expects the BPC e-commerce market to grow at a 20-30% CAGR over the coming decade

Expects revenue to double every 2-3 years over the next five years

Valuation is appealing and implies c17% long-term earnings growth

Assigns 'sell' with price target of Rs 35,400

See risk to near-term topline, profitability

Demand headwinds in athleisure and active wear

MBO reach expansion slowing down, limited success in kids wear

Risk arising from likely change in strategy from recent management changes

Estimates 12% and 19% revenue and EPS CAGR over FY23-26

Maintain 'buy' on PI Industries with TP of Rs 4,290

Downgrade SRF to Underperform with TP of Rs 2,140

Maintains Hold on Navin Fluorine, awaits onboarding of new MD

Expect SRF business recovery to lag the recent stock rally

Expect growth normalization towards historical average by CY24 end

Mutual funds see equity inflows of Rs 17,000 crore in Dec 2023, retaining momentum

Estimates significant fall in lumpsum net flows (ex-SIP and NFOs) vs. past 4 months' trends

Robust pipeline of NFOs likely to dampen fresh inflows into existing schemes

The brokerage expects 36%/32% of net flows into large, mid, and small-cap schemes were towards NFOs

High redemption from low duration fixed income schemes

Rates 'sell' with target price of Rs 540

The company has unparalleled market leadership in underpenetrated health insurance segment

Large market share, dominant agency base, continued product innovation warrant premium valuation

Believes current high valuation doesn't fully reflect headwinds

Rising competition, unclear outlook on net incurred claims ratio, regulatory issues to create headwinds

Price band revised from 20% to 10%: Allcargo Terminals.

Price band revised from 5% to 20%: Motisons Jewellers.

Moved into a short-term ASM framework: GTL Infrastructure.

Nifty January futures down by 1.03% to 21,569.95 at a premium of 56.95 points.

Nifty January futures open interest up by 0.6%.

Nifty Bank January futures down by 1.57% to 47,630 at a premium of 179.75points.

Nifty Bank January futures open interest up by 27%.

Nifty Options Jan 11 Expiry: Maximum Call open interest at 21,700 and Maximum Put open interest at 21,000.

Bank Nifty Options Jan 10 Expiry: Maximum Call Open Interest at 48,000 and Maximum Put open interest at 46,000.

Securities in the ban period: Balrampur Chini Mills, Bandhan Bank, Chambal Fertilizer, Delta Corp, Escorts Kubota, Gujarat Narmada Valley Fertilizer and Chemicals, Hindustan Copper, Indian Energy Exchange, India Cements, National Aluminium, Piramal Enterprise, SAIL, Zee Entertainment.

Pricol: To meet analysts and investors on Feb. 2.

Ajanta Pharma: To meet analysts and investors on Feb. 12 and 13.

Vishnu Chemicals: To meet analysts and investors on Jan. 11.

Wardwizard Foods and Beverages: To meet analysts and investors on Jan. 8. and 10.

Tilaknagar Industries: To meet analysts and investors on Jan. 11.

One 97 Communications: To meet analysts and investors on Jan. 20.

Hi-Tech Pipes: Manisha Gupta sold 9.99 lakh shares (0.76%), while Bandhan Mutual Fund bought 10 lakh shares (0.76%) at Rs 141 apiece.

Emami: Promoter group Suraj Finvest revoked a pledge for 6.7 lakh shares between Jan. 3 and 4. Promoter Diwakar Finvest revoked a pledge for 3 lakh shares on Jan. 4.

Delta Corp.

Jyoti CNC Automation: The IPO will open for bids on Tuesday. It will comprise a fresh issue of Rs 1,000 crore. The price band is fixed at Rs 315–331 apiece. The company has raised Rs 447.7 crore from anchor investors.

Bajaj Auto: The company has approved a Rs 4,000 crore buyback via a tender offer. It plans to buy back 40 lakh fully paid-up equity shares with a face value of Rs 10 each at Rs 10,000 apiece.

Zee Entertainment Enterprises: Sony Group is planning to call off the $10 billion merger pact with the company, according to Bloomberg.

Adani Group Companies: The conglomerate has signed a Memorandum of Understanding to invest over Rs 42,700 crore in Tamil Nadu.

Eicher Motors: The company’s unit, Royal Enfield, signed a non-binding Memorandum of Understanding with the Tamil Nadu government to invest around Rs 3,000 crore over eight years in the state to set up greenfield and brownfield projects in the region.

Brigade Enterprises: The company has signed a Memorandum of Understanding with the Tamil Nadu government to invest over Rs 3,400 crore for multiple construction projects.

Ashok Leyland: The company signed a Memorandum of Understanding with the Tamil Nadu government to invest Rs 1,200 crore in three to five years.

Bajaj Finserv: The company’s unit, Bajaj Alliance, reported a total new business premium of Rs 962 crore and a gross direct premium of Rs 1,425.1 crore for December.

IRB Energy: The company signed a Memorandum of Understanding with the Tamil Nadu government to invest up to Rs 858 crore over the years.

Caplin Point Laboratories: The company signed a Memorandum of Understanding with the Tamil Nadu government to invest Rs 700 crore over five years in diverse projects.

BEML: The company bagged an order worth Rs 329.87 crore from the Ministry of Defence for the supply of Mechanical Minefield Marking Equipment Mark-II.

Adani Enterprises: The company's unit, Mumbai International Airport, secured relief from an arbitration panel against the Airports Authority of India in the matter related to payment of the monthly annual fee during the COVID-19 period.

Cipla: The company’s UK-based arm announced a joint venture with Kemwell Biopharma and Manipal Education & Medical Group to develop novel cell therapy products for major unmet medical needs in the United States, Japan, and EU regions.

Life Insurance Corp.: The company will invest 10% in the new company promoted by the National Housing Bank for residential mortgage-backed securities.

Cupid: The company has received an additional purchase order worth Rs 16.23 crore from the Central Medical Services Society for the supply of male condoms.

Tata Motors: The company reported Jaguar Land Rover wholesales at 1.01 lakh units, up 27% YoY and retail sales at 1.09 lakh units, up 29% YoY. The order book continues to be strong, the company said.

Sanghi Industries: Ambuja Cements' open offer for acquiring a 26% stake in the company will open on Jan. 15 and close on Jan. 29.

Aurobindo Pharma: The U.S. FDA conducted its inspection at the company’s Telangana manufacturing facility. It ended with a 'Voluntary Action Indicated' classification.

Gujarat State Fertilisers and Chemicals: The company has commissioned a manufacturing plant at Fertilizernagar in Vadodara for the production of ammonium sulphate. The facility has an installed capacity of manufacturing 1,32,000 MT of ammonium sulphate.

Gujarat Mineral Development Corp. has received approval for environmental clearance from the Ministry of Environment, Forestry, and Climate Change to expand its capacity from 3 MTPA to 5 MTPA of lignite at Surkha (N) Lignite Mine.

Metropolis Healthcare: The company, in its Q3 business update, announced that its core business revenue grew by 12% YoY. It was largely driven by 9% volume growth and lower margins.

Fino Payments Bank: The company has applied for a small finance bank licence from the Reserve Bank of India.

Stock markets in the Asia-Pacific region rose Tuesday, taking cues from gains on Wall Street as investors await a slew of economic data from the region and the U.S.

Nikkei was trading 1.42% higher at 33,851.58, and S&P ASX 200 was 0.96% up at 7,522.80 as of 7:16 a.m.

In Tokyo, consumer prices, which leave aside fresh food, were 2.1% higher in December than in November. Japan's capital city's inflation figure is an early indicator for national figures, which will be announced next week, Bloomberg reported.

Market participants will keep an eye on China to see whether the country raises its monetary support to stimulate the faltering economy.

The U.S. CPI is scheduled for release on Thursday, which will provide further insight to investors about the Federal Reserve's monetary policy path going ahead.

A rally in big tech sent U.S. stocks higher at the start of a week that will bring key inflation data and bank earnings, Bloomberg reported.

The S&P 500 index and Nasdaq 100 advanced 1.41% and 2.11%, respectively, on Monday. The Dow Jones Industrial Average rose 0.58%.

Brent crude was trading 0.24% higher at $76.36 a barrel. Gold was up 0.28% at $2,033.65 an ounce.

GIFT Nifty was trading 0.02%, or 3.5 points, higher at 21,705 as of 8:19 a.m.

India's benchmark indices snapped their two-session rally to end lower on Monday, led by losses in financial services, FMCG and IT stocks. The Nifty ended 197.80 points, or 0.91%, lower at 21,513.00 points, while the Sensex fell 670.93 points, or 0.93%, to close at 71,355.22.

Overseas investors remained net buyers of Indian equities for the third consecutive session on Monday. Foreign portfolio investors mopped up stocks worth Rs 16 crore, while domestic institutional investors mopped up equities worth Rs 156 crore, according to provisional data from the National Stock Exchange.

The Indian rupee strengthened 2 paise to close at Rs 83.14 against the U.S. dollar on Monday.

Stock markets in the Asia-Pacific region rose Tuesday, taking cues from gains on Wall Street as investors await a slew of economic data from the region and the U.S.

Nikkei was trading 1.42% higher at 33,851.58, and S&P ASX 200 was 0.96% up at 7,522.80 as of 7:16 a.m.

In Tokyo, consumer prices, which leave aside fresh food, were 2.1% higher in December than in November. Japan's capital city's inflation figure is an early indicator for national figures, which will be announced next week, Bloomberg reported.

Market participants will keep an eye on China to see whether the country raises its monetary support to stimulate the faltering economy.

The U.S. CPI is scheduled for release on Thursday, which will provide further insight to investors about the Federal Reserve's monetary policy path going ahead.

A rally in big tech sent U.S. stocks higher at the start of a week that will bring key inflation data and bank earnings, Bloomberg reported.

The S&P 500 index and Nasdaq 100 advanced 1.41% and 2.11%, respectively, on Monday. The Dow Jones Industrial Average rose 0.58%.

Brent crude was trading 0.24% higher at $76.36 a barrel. Gold was up 0.28% at $2,033.65 an ounce.

GIFT Nifty was trading 0.02%, or 3.5 points, higher at 21,705 as of 8:19 a.m.

India's benchmark indices snapped their two-session rally to end lower on Monday, led by losses in financial services, FMCG and IT stocks. The Nifty ended 197.80 points, or 0.91%, lower at 21,513.00 points, while the Sensex fell 670.93 points, or 0.93%, to close at 71,355.22.

Overseas investors remained net buyers of Indian equities for the third consecutive session on Monday. Foreign portfolio investors mopped up stocks worth Rs 16 crore, while domestic institutional investors mopped up equities worth Rs 156 crore, according to provisional data from the National Stock Exchange.

The Indian rupee strengthened 2 paise to close at Rs 83.14 against the U.S. dollar on Monday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.