Stock Market Today: Nifty, Sensex End Volatile Session Mixed As Traders Await MPC Decision

Catch all live updates on Indian stock markets here on Feb 7.

KEY HIGHLIGHTS

- Oldest First

FPIs Snap Three-Day Buying Spree To Turn Net Sellers

Overseas investors turned net sellers of Indian equities on Wednesday after three consecutive sessions of buying.

Foreign portfolio investors offloaded stocks worth Rs 1,691 crore, according to provisional data from the National Stock Exchange.

Domestic institutional investors remained net buyers for the second straight day and mopped up equities worth Rs 327.7 crore, the NSE data showed.

Overseas institutional investors sold $3,096 million, or Rs 25,744 crore, worth of equities in January. This is the highest outflow in one year.

Foreign institutions have been net sellers of Rs 23,173 crore worth of Indian equities so far in 2023, according to data from the National Securities Depository Ltd., updated till the previous trading day.

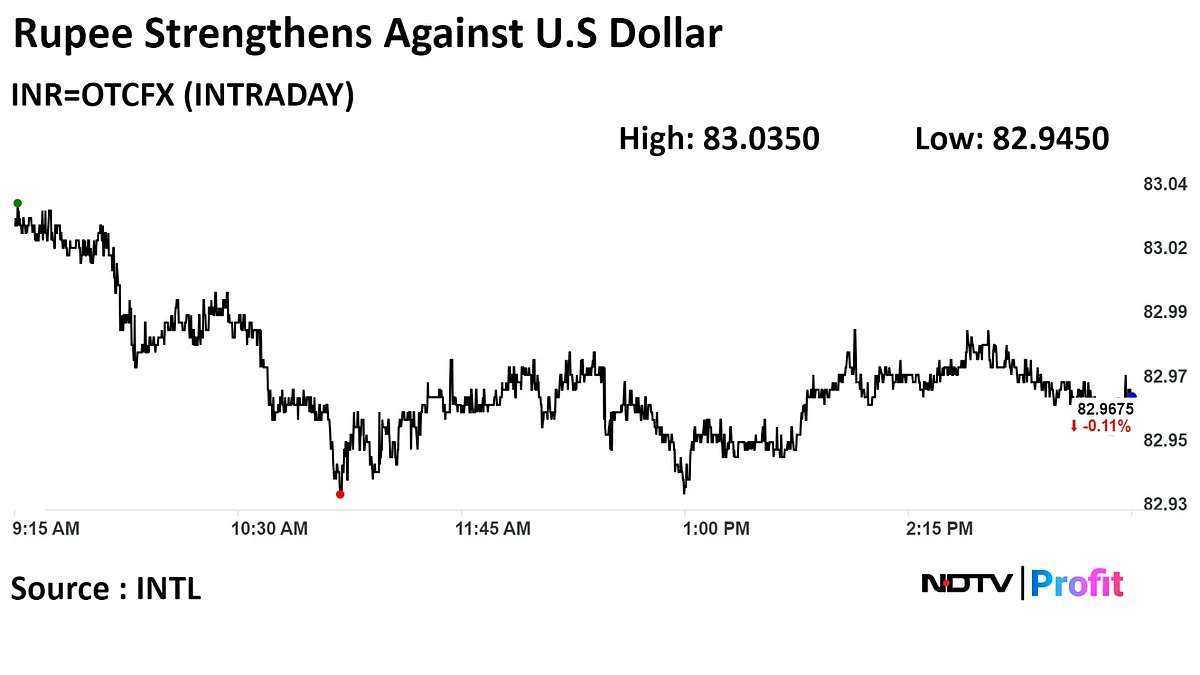

Rupee Strengthens Against U.S Dollar

The local currency strengthened 9 paise to close at 82.97 against the U.S dollar.

It closed at 83.06 on Tuesday.

Source: Bloomberg

Nifty, Sensex End Volatile Session Mixed As Traders Await MPC Decision: Market Wrap

India's benchmark stock indices ended on a mixed note on Wednesday as traders exercised caution ahead of the Monetary Policy Committee's policy decision, scheduled to be published on Thursday.

The NSE Nifty 50 settled 1.10 points or 0.01% higher at 21,930.50, and S&P BSE Sensex ended 34.09 points or 0.05% lower at 72,152.00.

Losses in shares of index-heavy Infosys Ltd, HDFC Bank Ltd weighed on the indices, while gains in State Bank of India, and Reliance Industries supported the indices.

Intraday, NSE Nifty 50 gained 0.56% to 22,053.30, and the S&P BSE Sensex rose 0.52% to 72,559.21.

"Benchmark indices slipped into the negative zone owing to profit-taking in IT and select financial shares in intra-day trades on Wednesday. Banks and financials topped the gainers list, with Bajaj Finance, Axis Bank, HDFC Life and SBI all rising around 3%," said Avdhut Bagkar, technical and derivatives analyst at StoxBox.

"Investors will keep an eye on the Reserve Bank of India's Monetary Policy Committee (MPC) decision on interest rates tomorrow. Several developments have unfolded in recent weeks that could shape the verdict," he added.

Despite the Nifty 50 opening on a strong note, with a gap-up of over 100 points, the price action failed to persist over the sentimental threshold of 22000, sparking weakness in the Wednesday’s trade, said Bagkar

"Today, the benchmark indices witnessed range bound activity, the nifty ends 1 points higher while the Sensex was down by 34 points. Among sectors, PSU Bank Index outperformed gained nearly 3.5 percent whereas IT index shed 1.25 percent. Technically, after a gap up opening, market witnessed intraday selling pressure at higher levels. However, the short-term texture of the market is still in to the positive side," said Shrikant Chouhan, head of Equity Research, Kotak Securities

We are of the view that, on intraday and daily charts the market is still holding higher bottom formation, which supports further uptrend from the current levels. For the day traders now, 21850/72000 would act as a key support level. Above the same, the market could rally till 22100-22150/72500-72700. On the flip side below 21850/72000 we could see one quick intraday correction till 21800-21750/71800-71650, he added.

Reliance Industries Ltd, State Bank of India, Axis Bank Ltd, Bajaj Finance Ltd., and Sun Pharmaceutical Industries Ltd added positively to the indices.

Infosys Ltd., HDFC Bank Ltd., Tata Consultancy Services Ltd., Larsen & Toubro Ltd., and ICICI Bank Ltd weighed on the indices.

On NSE, 10 sectors ended higher, one ended lower, and one remained flat. The Nifty PSU Bank index gained 2.86% to fresh record high, and was the top gainer among sectoral indices. Sharp gains in shares of State Bank of India contributed to the rise in the index.

The Nifty IT index declined the most among sectoral indices.

Broader markets ended higher. The S&P BSE Midcap rose1.48% and the S&P BSE Smallcap rose 0.35%.

On BSE, 16 sectors rose, and four fell. The S&P BSE Realty gained the most, while the S&P BSE IT fell the most.

The market breadth was skewed in favour of buyers. Around 2,261 stocks gained, 1,606 stocks fell, and 92 remained unchanged.

Indian Overseas Bank Has 66 Lakh Shares Change Hands In Large Trade

Indian Overseas Bank had 66 lakh shares changed hands in a large trade.

The lender's 0.03% equity changed hands at Rs 81.05 apiece.

Buyers and sellers are not known immediately.

Source: Bloomberg