Overseas investors remained net sellers of Indian equities for the fourth consecutive session on Thursday.

Foreign portfolio investors offloaded stocks worth Rs 1,636.19 crore, according to provisional data from the National Stock Exchange.

Domestic institutional investors remained net buyers and mopped up stocks worth Rs 1,464.70 crore, the NSE data showed.

The yield on the 10-year bond closed 2 bps higher at 7.19% on Thursday.

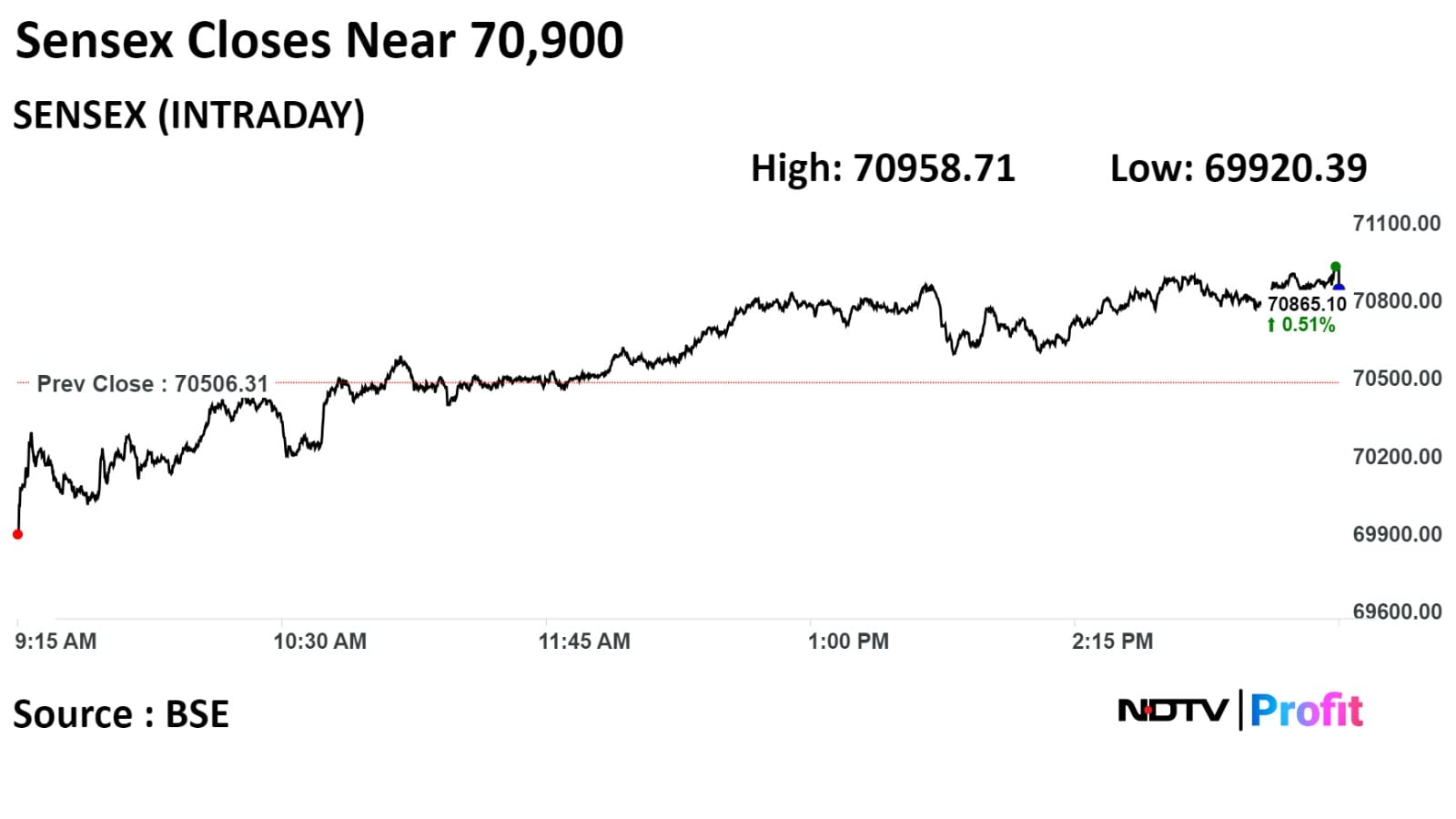

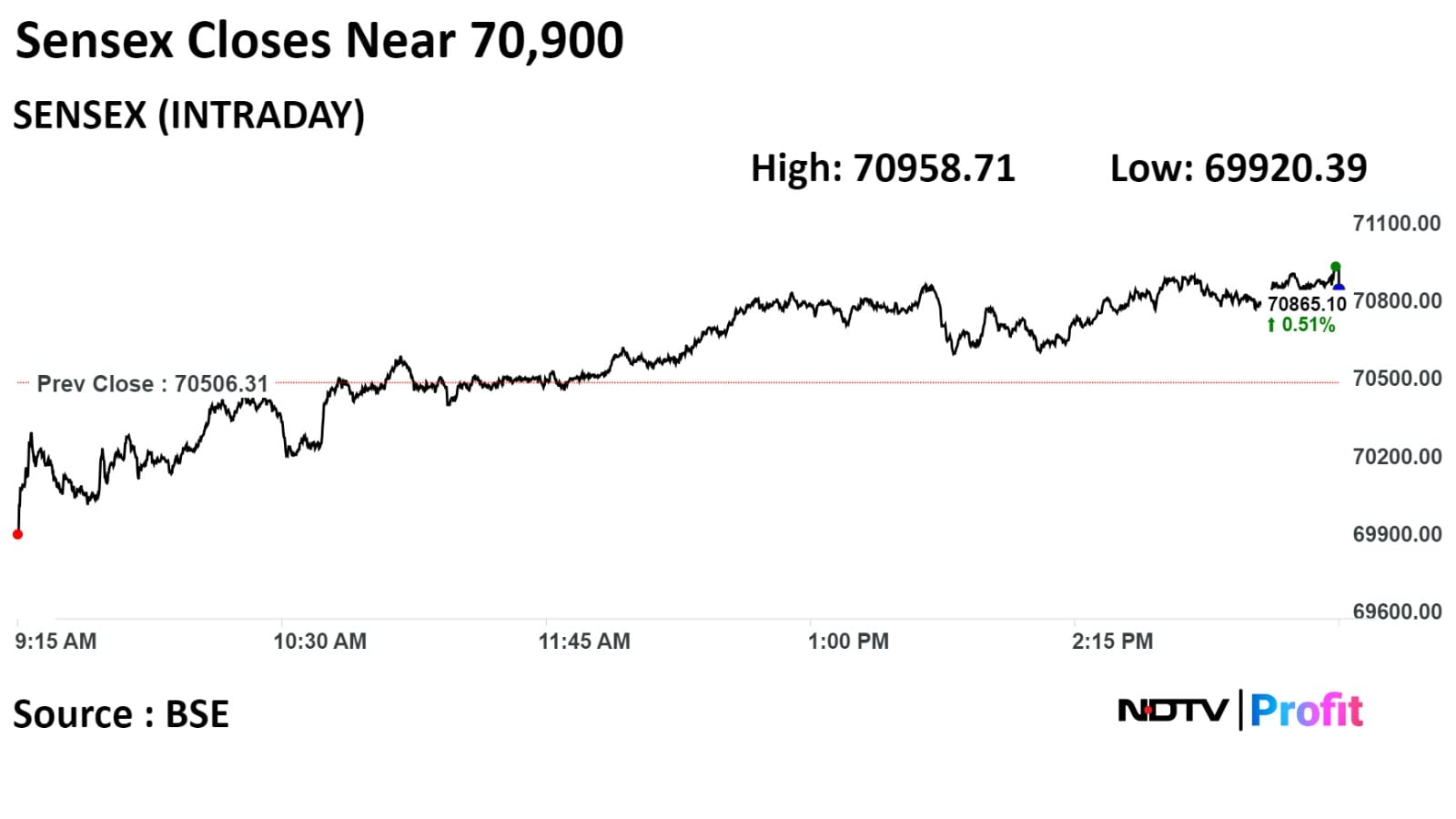

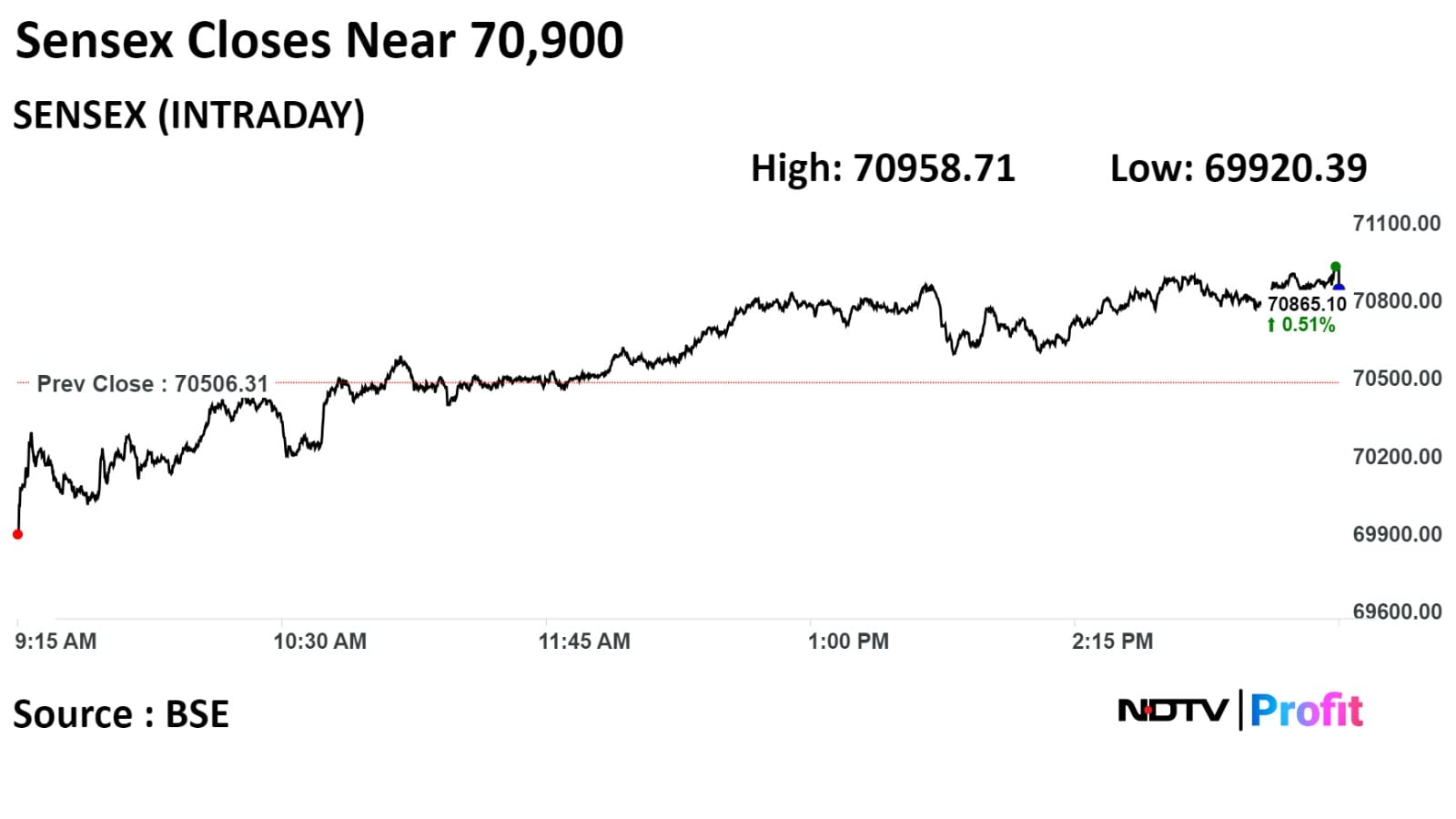

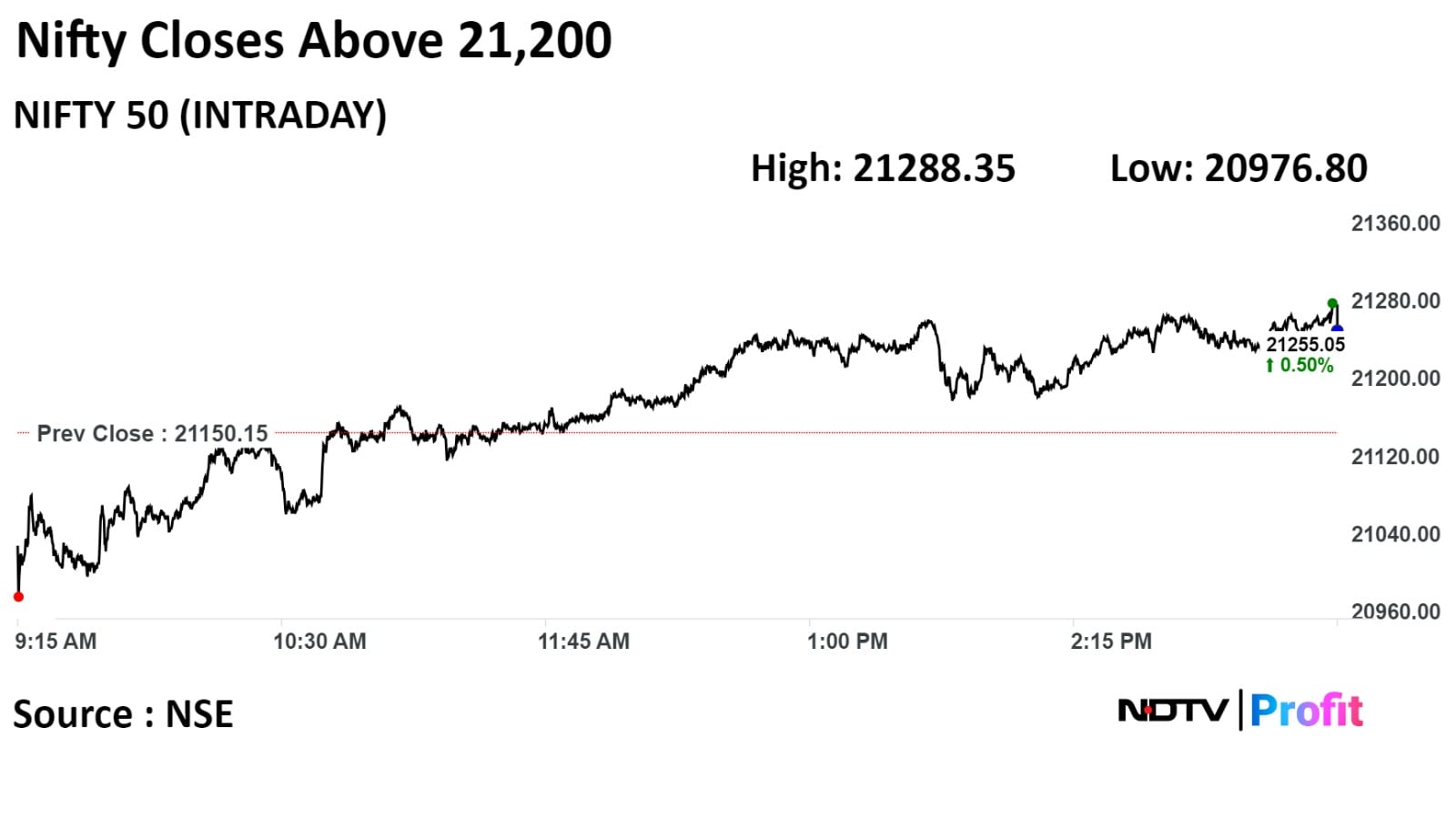

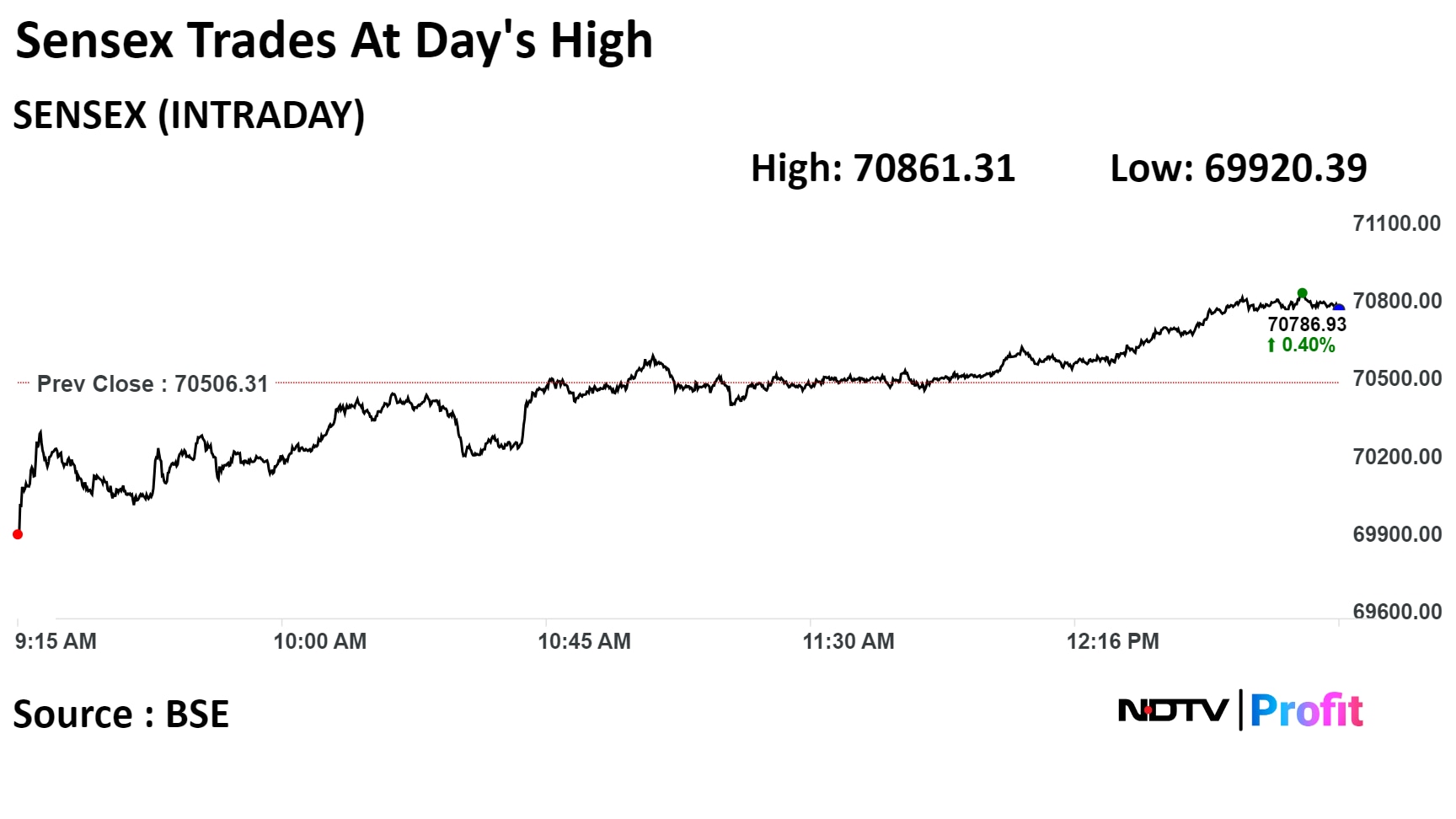

India's benchmark indices recovered from the worst sell-off, and ended higher on Thursday as HDFC Bank Ltd., Reliance Industries Ltd., Kotak Bank Ltd., and State Bank of India gained.

The NSE Nifty 50 settled 0.50% or 104.90 points higher at 21, 255.05, while the BSE Sensex ended 0.51% or 358.79 points higher at 70,865.10.

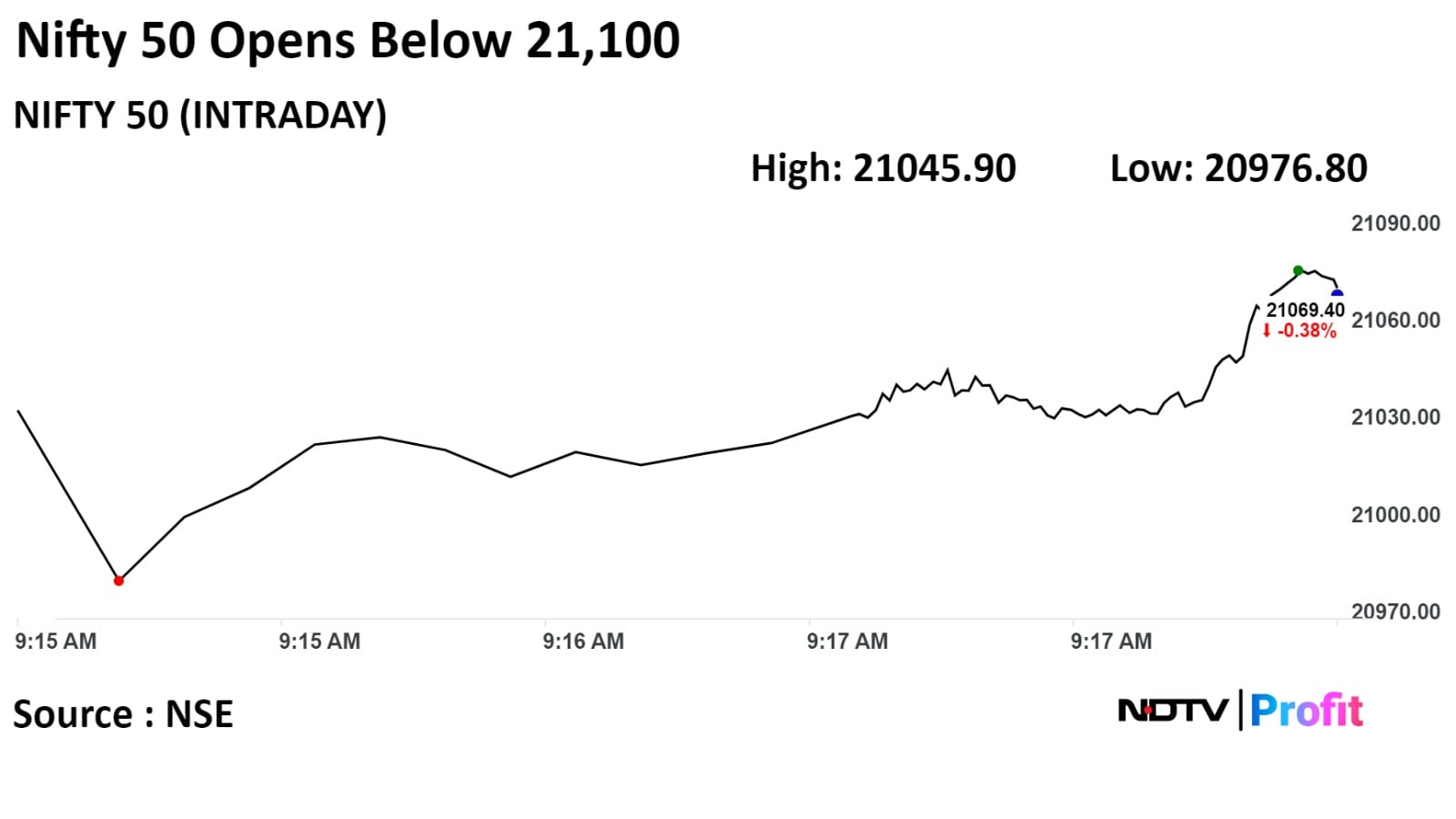

The benchmark indices also posted worst opening in two-months today.

The Nifty 50 fell the most in 10 months and gave up all recent gains on Wednesday as investors booked profits on Wednesday. The Sensex also declined the most since Oct 26.

"We are of the view that, as long as the market is trading above 21180/70600 the pullback formation is likely to continue. Above which, the market could rally till 21350-21400/71200-71350. On the flip side, below 21180/70600 the selling pressure is likely to accelerate. Below the same, the market could retest the level of 21000/70000. The current market texture is volatile hence level based trading would be the ideal strategy for the day traders," said Shrikant Chouhan, head, equity research, Kotak Securities.

“Markets witnessed a roller coaster ride, as key indices plunged in early trades only to recoup their lost ground and end sharply higher. Earlier, weak European and Asian indices weighed on sentiment but India’s strong growth story prospects gives investors the comfort to place long term bullish bets,” said Prashanth Tapse, senior vice president, research, Mehta Equities Ltd.

India's benchmark indices recovered from the worst sell-off, and ended higher on Thursday as HDFC Bank Ltd., Reliance Industries Ltd., Kotak Bank Ltd., and State Bank of India gained.

The NSE Nifty 50 settled 0.50% or 104.90 points higher at 21, 255.05, while the BSE Sensex ended 0.51% or 358.79 points higher at 70,865.10.

The benchmark indices also posted worst opening in two-months today.

The Nifty 50 fell the most in 10 months and gave up all recent gains on Wednesday as investors booked profits on Wednesday. The Sensex also declined the most since Oct 26.

"We are of the view that, as long as the market is trading above 21180/70600 the pullback formation is likely to continue. Above which, the market could rally till 21350-21400/71200-71350. On the flip side, below 21180/70600 the selling pressure is likely to accelerate. Below the same, the market could retest the level of 21000/70000. The current market texture is volatile hence level based trading would be the ideal strategy for the day traders," said Shrikant Chouhan, head, equity research, Kotak Securities.

“Markets witnessed a roller coaster ride, as key indices plunged in early trades only to recoup their lost ground and end sharply higher. Earlier, weak European and Asian indices weighed on sentiment but India’s strong growth story prospects gives investors the comfort to place long term bullish bets,” said Prashanth Tapse, senior vice president, research, Mehta Equities Ltd.

India's benchmark indices recovered from the worst sell-off, and ended higher on Thursday as HDFC Bank Ltd., Reliance Industries Ltd., Kotak Bank Ltd., and State Bank of India gained.

The NSE Nifty 50 settled 0.50% or 104.90 points higher at 21, 255.05, while the BSE Sensex ended 0.51% or 358.79 points higher at 70,865.10.

The benchmark indices also posted worst opening in two-months today.

The Nifty 50 fell the most in 10 months and gave up all recent gains on Wednesday as investors booked profits on Wednesday. The Sensex also declined the most since Oct 26.

"We are of the view that, as long as the market is trading above 21180/70600 the pullback formation is likely to continue. Above which, the market could rally till 21350-21400/71200-71350. On the flip side, below 21180/70600 the selling pressure is likely to accelerate. Below the same, the market could retest the level of 21000/70000. The current market texture is volatile hence level based trading would be the ideal strategy for the day traders," said Shrikant Chouhan, head, equity research, Kotak Securities.

“Markets witnessed a roller coaster ride, as key indices plunged in early trades only to recoup their lost ground and end sharply higher. Earlier, weak European and Asian indices weighed on sentiment but India’s strong growth story prospects gives investors the comfort to place long term bullish bets,” said Prashanth Tapse, senior vice president, research, Mehta Equities Ltd.

India's benchmark indices recovered from the worst sell-off, and ended higher on Thursday as HDFC Bank Ltd., Reliance Industries Ltd., Kotak Bank Ltd., and State Bank of India gained.

The NSE Nifty 50 settled 0.50% or 104.90 points higher at 21, 255.05, while the BSE Sensex ended 0.51% or 358.79 points higher at 70,865.10.

The benchmark indices also posted worst opening in two-months today.

The Nifty 50 fell the most in 10 months and gave up all recent gains on Wednesday as investors booked profits on Wednesday. The Sensex also declined the most since Oct 26.

"We are of the view that, as long as the market is trading above 21180/70600 the pullback formation is likely to continue. Above which, the market could rally till 21350-21400/71200-71350. On the flip side, below 21180/70600 the selling pressure is likely to accelerate. Below the same, the market could retest the level of 21000/70000. The current market texture is volatile hence level based trading would be the ideal strategy for the day traders," said Shrikant Chouhan, head, equity research, Kotak Securities.

“Markets witnessed a roller coaster ride, as key indices plunged in early trades only to recoup their lost ground and end sharply higher. Earlier, weak European and Asian indices weighed on sentiment but India’s strong growth story prospects gives investors the comfort to place long term bullish bets,” said Prashanth Tapse, senior vice president, research, Mehta Equities Ltd.

India's benchmark indices recovered from the worst sell-off, and ended higher on Thursday as HDFC Bank Ltd., Reliance Industries Ltd., Kotak Bank Ltd., and State Bank of India gained.

The NSE Nifty 50 settled 0.50% or 104.90 points higher at 21, 255.05, while the BSE Sensex ended 0.51% or 358.79 points higher at 70,865.10.

The benchmark indices also posted worst opening in two-months today.

The Nifty 50 fell the most in 10 months and gave up all recent gains on Wednesday as investors booked profits on Wednesday. The Sensex also declined the most since Oct 26.

"We are of the view that, as long as the market is trading above 21180/70600 the pullback formation is likely to continue. Above which, the market could rally till 21350-21400/71200-71350. On the flip side, below 21180/70600 the selling pressure is likely to accelerate. Below the same, the market could retest the level of 21000/70000. The current market texture is volatile hence level based trading would be the ideal strategy for the day traders," said Shrikant Chouhan, head, equity research, Kotak Securities.

“Markets witnessed a roller coaster ride, as key indices plunged in early trades only to recoup their lost ground and end sharply higher. Earlier, weak European and Asian indices weighed on sentiment but India’s strong growth story prospects gives investors the comfort to place long term bullish bets,” said Prashanth Tapse, senior vice president, research, Mehta Equities Ltd.

India's benchmark indices recovered from the worst sell-off, and ended higher on Thursday as HDFC Bank Ltd., Reliance Industries Ltd., Kotak Bank Ltd., and State Bank of India gained.

The NSE Nifty 50 settled 0.50% or 104.90 points higher at 21, 255.05, while the BSE Sensex ended 0.51% or 358.79 points higher at 70,865.10.

The benchmark indices also posted worst opening in two-months today.

The Nifty 50 fell the most in 10 months and gave up all recent gains on Wednesday as investors booked profits on Wednesday. The Sensex also declined the most since Oct 26.

"We are of the view that, as long as the market is trading above 21180/70600 the pullback formation is likely to continue. Above which, the market could rally till 21350-21400/71200-71350. On the flip side, below 21180/70600 the selling pressure is likely to accelerate. Below the same, the market could retest the level of 21000/70000. The current market texture is volatile hence level based trading would be the ideal strategy for the day traders," said Shrikant Chouhan, head, equity research, Kotak Securities.

“Markets witnessed a roller coaster ride, as key indices plunged in early trades only to recoup their lost ground and end sharply higher. Earlier, weak European and Asian indices weighed on sentiment but India’s strong growth story prospects gives investors the comfort to place long term bullish bets,” said Prashanth Tapse, senior vice president, research, Mehta Equities Ltd.

India's benchmark indices recovered from the worst sell-off, and ended higher on Thursday as HDFC Bank Ltd., Reliance Industries Ltd., Kotak Bank Ltd., and State Bank of India gained.

The NSE Nifty 50 settled 0.50% or 104.90 points higher at 21, 255.05, while the BSE Sensex ended 0.51% or 358.79 points higher at 70,865.10.

The benchmark indices also posted worst opening in two-months today.

The Nifty 50 fell the most in 10 months and gave up all recent gains on Wednesday as investors booked profits on Wednesday. The Sensex also declined the most since Oct 26.

"We are of the view that, as long as the market is trading above 21180/70600 the pullback formation is likely to continue. Above which, the market could rally till 21350-21400/71200-71350. On the flip side, below 21180/70600 the selling pressure is likely to accelerate. Below the same, the market could retest the level of 21000/70000. The current market texture is volatile hence level based trading would be the ideal strategy for the day traders," said Shrikant Chouhan, head, equity research, Kotak Securities.

“Markets witnessed a roller coaster ride, as key indices plunged in early trades only to recoup their lost ground and end sharply higher. Earlier, weak European and Asian indices weighed on sentiment but India’s strong growth story prospects gives investors the comfort to place long term bullish bets,” said Prashanth Tapse, senior vice president, research, Mehta Equities Ltd.

India's benchmark indices recovered from the worst sell-off, and ended higher on Thursday as HDFC Bank Ltd., Reliance Industries Ltd., Kotak Bank Ltd., and State Bank of India gained.

The NSE Nifty 50 settled 0.50% or 104.90 points higher at 21, 255.05, while the BSE Sensex ended 0.51% or 358.79 points higher at 70,865.10.

The benchmark indices also posted worst opening in two-months today.

The Nifty 50 fell the most in 10 months and gave up all recent gains on Wednesday as investors booked profits on Wednesday. The Sensex also declined the most since Oct 26.

"We are of the view that, as long as the market is trading above 21180/70600 the pullback formation is likely to continue. Above which, the market could rally till 21350-21400/71200-71350. On the flip side, below 21180/70600 the selling pressure is likely to accelerate. Below the same, the market could retest the level of 21000/70000. The current market texture is volatile hence level based trading would be the ideal strategy for the day traders," said Shrikant Chouhan, head, equity research, Kotak Securities.

“Markets witnessed a roller coaster ride, as key indices plunged in early trades only to recoup their lost ground and end sharply higher. Earlier, weak European and Asian indices weighed on sentiment but India’s strong growth story prospects gives investors the comfort to place long term bullish bets,” said Prashanth Tapse, senior vice president, research, Mehta Equities Ltd.

HDFC Bank Ltd, Reliance Industries Ltd, Kotak Mahindra Bank Ltd, State Bank of India, and Power Grid Corporation Ltd added positively to the indices.

Axis Bank Ltd, Bajaj Finance Ltd, HCL Technologies Ltd, ICICI Bank Ltd, and Bajaj Auto Ltd weighed on the indices.

All Sectors out of 14 advanced on the NSE. Nifty Media gained 2.49% and was the top gainer among sectoral indices.

The broader markets outperformed the benchmark indices with S&P BSE MidCap Index gaining 1.61%, whereas S&P BSE SmallCap Index was 1.69% higher. Around 19 out of 20 sectors compiled by BSE advanced, while only BSE Auto declined. S&P BSE Utilities and Power rose the most.

The market breadth was skewed in favour of the buyers. Around 2,659 stocks rose, 1114 declined, and 123 stocks remained unchanged.

Ami Organics signed MoU with electrolytes manufacturer for making battery cells & allied materials in Gujarat

The company will also sign MoU with Gujarat govt for investing up to Rs 300 crore for setting up electrolyte manufacturing plant

Source: Exchange filing

Network18 Media & Investments had 15.1 lakh shares changed hands in a large trade

Network18 Media & Investments' 0.1% equity changed hands at Rs 85.80 apiece

Buyers and sellers not known immediately

Source: Bloomberg

Heavy rainfall, flooding in Tamil Nadu lead to inundation of solar power plant of step-down unit

Co taking necessary measures in co-ordination with relevant teams to resume operations

Source: Exchange Filing

Poonawalla Fincorp 13.6 lakh shares changed hands in a large trade

0.2% equity changed hands at Rs 434.95 apiece

Buyers and sellers not known immediately

Source: Bloomberg

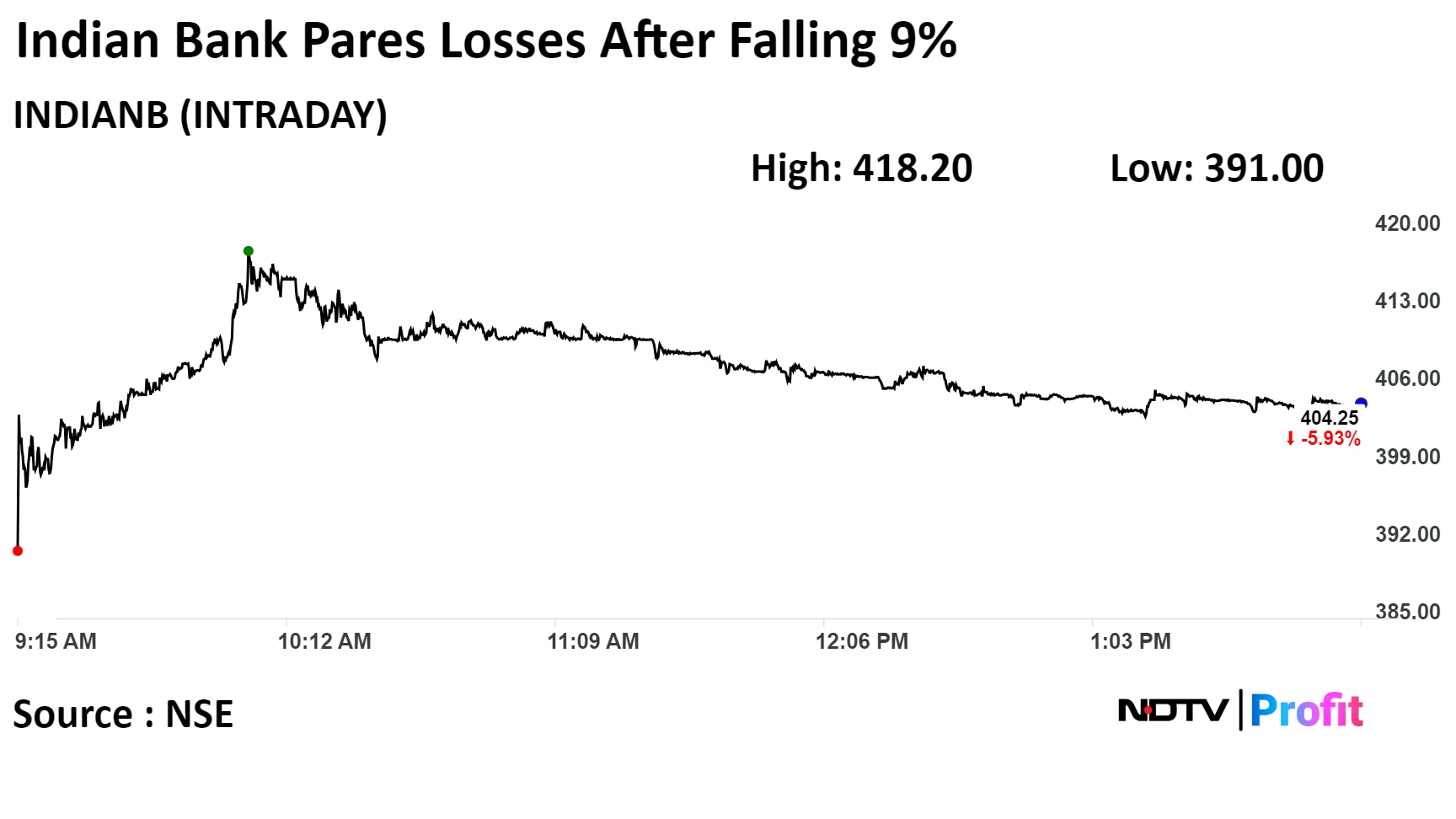

Indian Bank declined as much as 9.02% to Rs 391.00 apiece on Thursday. It pared losses to trade 5.92% lower at Rs 404.30 apiece, as of 1:55 p.m. This compares to a 0.35% advance in the NSE Nifty 50 Index.

It has risen 41.65% on a year-to-date basis. Total traded volume so far in the day stood at 15 times its 30-day average. The relative strength index was at 41.1.

Out of nine analysts tracking the company, seven maintain a 'buy' rating, two recommend a 'hold,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 18.4%.

IIFL Finance Ltd's Rs 910 crore AIF investments don't include any downstream

Rs 21.37 crore investment in AIF with Rs 3.28 crore debt exposure

Unit IIFL Home Finance holds investments of Rs 161.07 crore under Priority Distribution Model

Unit is adequately capitalised, having CRAR of 47.55% as of Sept 30

Source: Exchange Filing

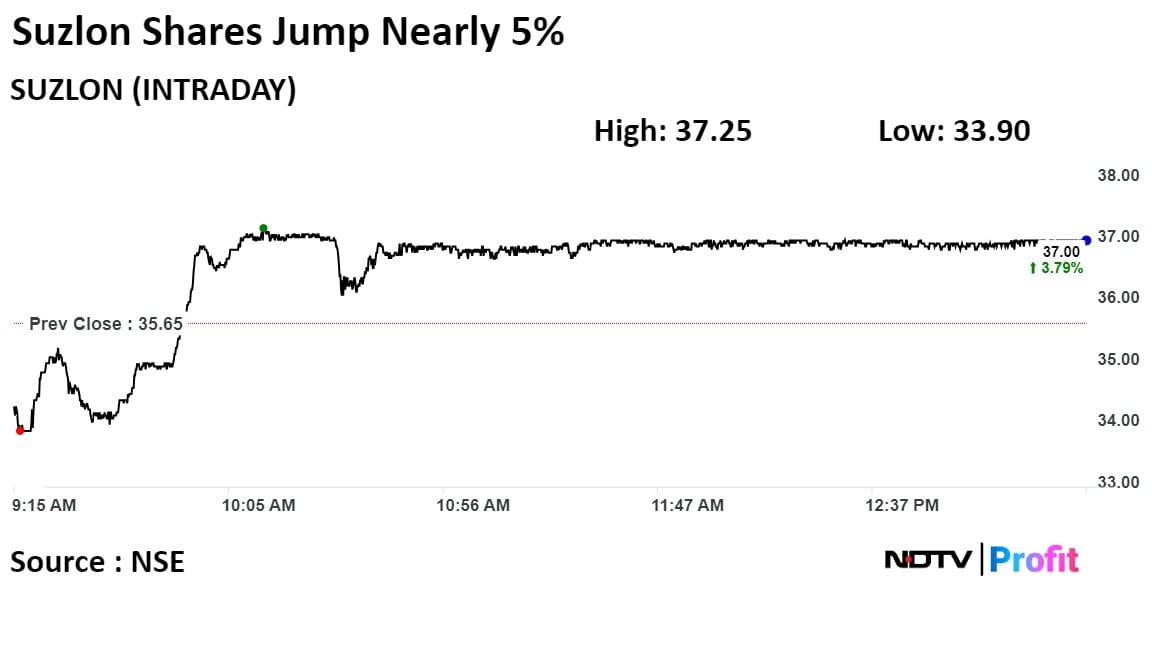

The shares of Suzlon Energy rises on Thursday after it received a new wind power project order from The KP Group.

Suzlon Energy shares rose as much as 4.49% to 37.25 apiece. The shares continued to trade at these levels through the week. It pared gains to trade 3.65% higher at Rs 36.95 apiece, as of 1:24 p.m. This compares to a 0.072% advance in the NSE Nifty 50 Index.

It has risen 248.58% on a year-to-date basis. Total traded volume so far in the day stood at 1.1 times its 30-day average. The relative strength index was at 47.

Out of 2 analysts tracking the company both maintain a 'buy' rating according to Bloomberg data. The average 12-month consensus price target implies an upside of 262.7%.

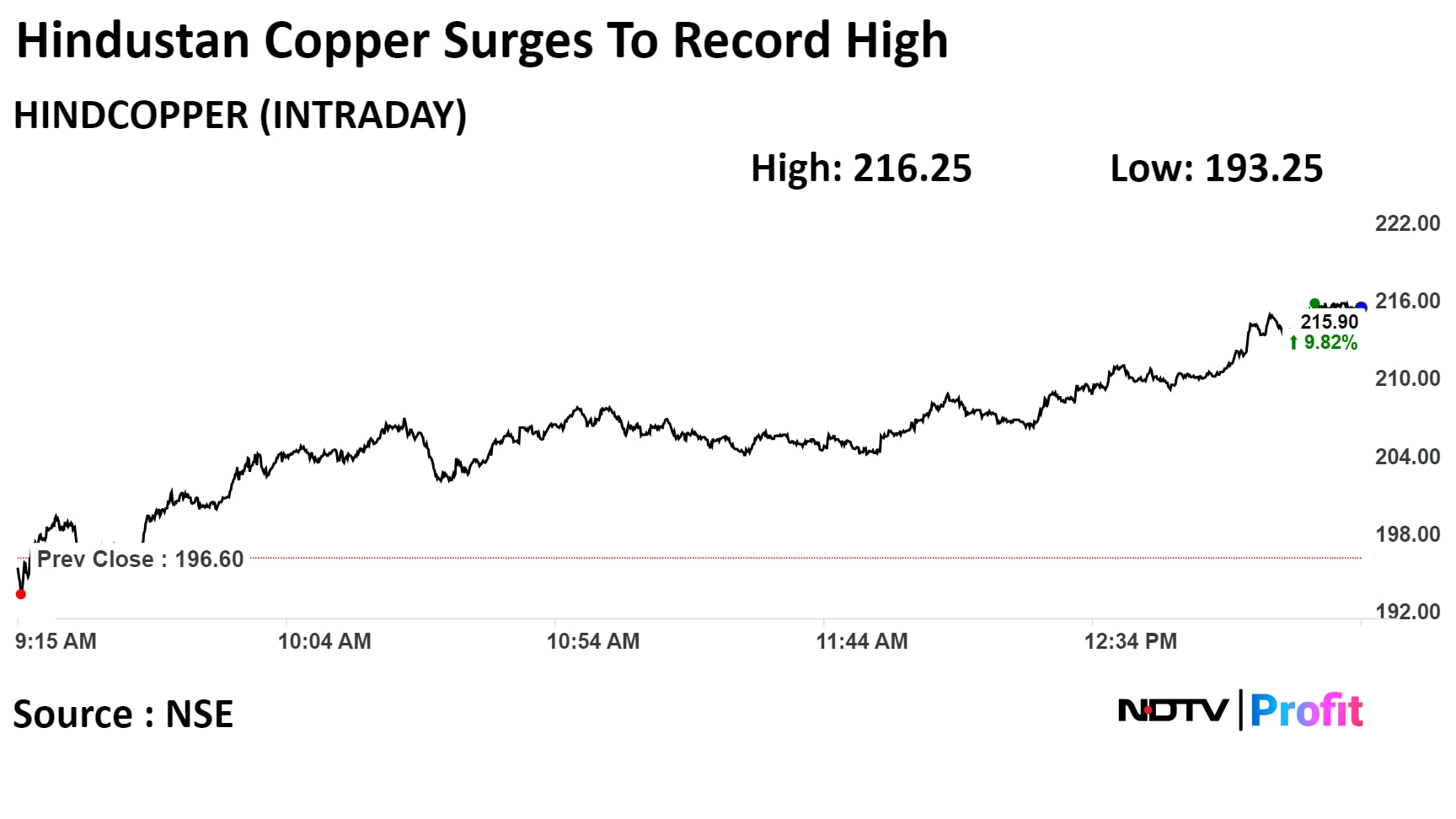

Shares of the Hindustan Copper Ltd surged 10% and touched a life high on Thursday.

Hindustan Copper Ltd informed the exchanged today, ICRA has reaffirmed its long-term 'AA+' rating, and short-term 'A1' rating on Tuesday. The rating agency cited stable outlook while reaffirming the ratings, according to the exchange filing.

Shares of the Hindustan Copper Ltd surged 10% and touched a life high on Thursday.

Hindustan Copper Ltd informed the exchanged today, ICRA has reaffirmed its long-term 'AA+' rating, and short-term 'A1' rating on Tuesday. The rating agency cited stable outlook while reaffirming the ratings, according to the exchange filing.

The scrip rose as much as 9.99% to Rs 216.25 apiece, the highest level since it got listed on the bourses. Hindustan Copper Ltd was listed on exchanged on Jan 8, 2010.

It was at 9.77% higher at Rs 215.80 apiece, as of 1:17 p.m. This compares to a 0.4% advance in the NSE Nifty 50 Index.

It has risen 97.0% on a year-to-date basis. Total traded volume so far in the day stood at 3.2 times its 30-day average. The relative strength index was at 76.35, which implied the stock is overbought.

Bandhan Bank approved transfer of NPAs worth Rs 775.6 crore to Asset Reconstruction Company

Housing finance NPA portfolio having dues over 180 days to be transferred to ARC

Bank has received a binding bid of Rs 280.4 crore for the NPA portfolio

Source: Exchange filing

Indian stock benchmark indices recovered from the worst open in two months and traded flat through midday on Thursday, as heavyweights HDFC Bank Ltd. and Reliance Industries Ltd. led gains.

As of 11:42 a.m., the Nifty 50 was 5.55 points, or 0.03% higher at 21,155.70, while the Sensex was trading up 13.91 points, or 0.02% at 70,520.23.

On Wednesday, both Nifty and Sensex witnessed a sharp fall from their lifetime highs, as investors booked profits a day before weekly expiry. Adding to this, fresh concerns about rising Covid-19 cases also weighed on sentiment.

"The upcoming days are anticipated to be volatile due to concerns about increasing Covid cases and geopolitical tensions, which have unsettled investors. This unease resulted in a significant market decline yesterday, and it appears to be carrying over into today," said Shrey Jain, founder and chief executive officer of SAS Online.

For Thursday's expiry, Jain anticipates challenges for the Nifty at higher levels because many investors are actively betting against it, as indicated by aggressive call writing in multiple call strikes.

Indian stock benchmark indices recovered from the worst open in two months and traded flat through midday on Thursday, as heavyweights HDFC Bank Ltd. and Reliance Industries Ltd. led gains.

As of 11:42 a.m., the Nifty 50 was 5.55 points, or 0.03% higher at 21,155.70, while the Sensex was trading up 13.91 points, or 0.02% at 70,520.23.

On Wednesday, both Nifty and Sensex witnessed a sharp fall from their lifetime highs, as investors booked profits a day before weekly expiry. Adding to this, fresh concerns about rising Covid-19 cases also weighed on sentiment.

"The upcoming days are anticipated to be volatile due to concerns about increasing Covid cases and geopolitical tensions, which have unsettled investors. This unease resulted in a significant market decline yesterday, and it appears to be carrying over into today," said Shrey Jain, founder and chief executive officer of SAS Online.

For Thursday's expiry, Jain anticipates challenges for the Nifty at higher levels because many investors are actively betting against it, as indicated by aggressive call writing in multiple call strikes.

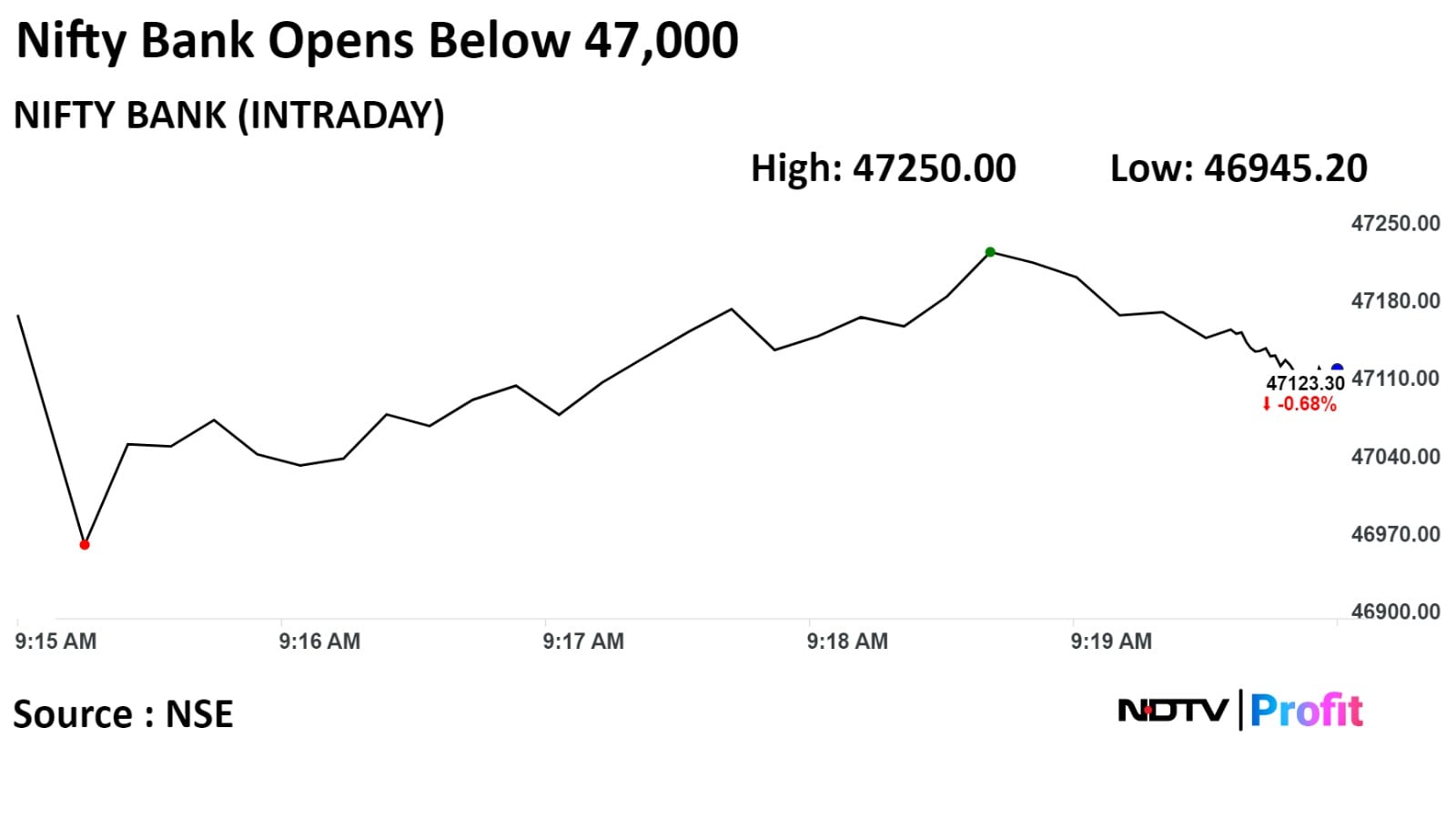

"With near-term support maintained near 20,800 zone, one needs to wait and watch for things to settle down and confirm a clarity for further development. The support for the day is seen at 21,000, while the resistance is seen at 21,300," Prabhudas Lilladher Pvt. said in a report.

Indian stock benchmark indices recovered from the worst open in two months and traded flat through midday on Thursday, as heavyweights HDFC Bank Ltd. and Reliance Industries Ltd. led gains.

As of 11:42 a.m., the Nifty 50 was 5.55 points, or 0.03% higher at 21,155.70, while the Sensex was trading up 13.91 points, or 0.02% at 70,520.23.

On Wednesday, both Nifty and Sensex witnessed a sharp fall from their lifetime highs, as investors booked profits a day before weekly expiry. Adding to this, fresh concerns about rising Covid-19 cases also weighed on sentiment.

"The upcoming days are anticipated to be volatile due to concerns about increasing Covid cases and geopolitical tensions, which have unsettled investors. This unease resulted in a significant market decline yesterday, and it appears to be carrying over into today," said Shrey Jain, founder and chief executive officer of SAS Online.

For Thursday's expiry, Jain anticipates challenges for the Nifty at higher levels because many investors are actively betting against it, as indicated by aggressive call writing in multiple call strikes.

Indian stock benchmark indices recovered from the worst open in two months and traded flat through midday on Thursday, as heavyweights HDFC Bank Ltd. and Reliance Industries Ltd. led gains.

As of 11:42 a.m., the Nifty 50 was 5.55 points, or 0.03% higher at 21,155.70, while the Sensex was trading up 13.91 points, or 0.02% at 70,520.23.

On Wednesday, both Nifty and Sensex witnessed a sharp fall from their lifetime highs, as investors booked profits a day before weekly expiry. Adding to this, fresh concerns about rising Covid-19 cases also weighed on sentiment.

"The upcoming days are anticipated to be volatile due to concerns about increasing Covid cases and geopolitical tensions, which have unsettled investors. This unease resulted in a significant market decline yesterday, and it appears to be carrying over into today," said Shrey Jain, founder and chief executive officer of SAS Online.

For Thursday's expiry, Jain anticipates challenges for the Nifty at higher levels because many investors are actively betting against it, as indicated by aggressive call writing in multiple call strikes.

"With near-term support maintained near 20,800 zone, one needs to wait and watch for things to settle down and confirm a clarity for further development. The support for the day is seen at 21,000, while the resistance is seen at 21,300," Prabhudas Lilladher Pvt. said in a report.

Support zone for Nifty Bank is near 46,300 levels, the report said. With bias turning little bit cautious, there is need for further clarity and conviction to forecast progress. Bank Nifty would have a daily range of 47,000–47900 levels, the brokerage said.

Indian stock benchmark indices recovered from the worst open in two months and traded flat through midday on Thursday, as heavyweights HDFC Bank Ltd. and Reliance Industries Ltd. led gains.

As of 11:42 a.m., the Nifty 50 was 5.55 points, or 0.03% higher at 21,155.70, while the Sensex was trading up 13.91 points, or 0.02% at 70,520.23.

On Wednesday, both Nifty and Sensex witnessed a sharp fall from their lifetime highs, as investors booked profits a day before weekly expiry. Adding to this, fresh concerns about rising Covid-19 cases also weighed on sentiment.

"The upcoming days are anticipated to be volatile due to concerns about increasing Covid cases and geopolitical tensions, which have unsettled investors. This unease resulted in a significant market decline yesterday, and it appears to be carrying over into today," said Shrey Jain, founder and chief executive officer of SAS Online.

For Thursday's expiry, Jain anticipates challenges for the Nifty at higher levels because many investors are actively betting against it, as indicated by aggressive call writing in multiple call strikes.

Indian stock benchmark indices recovered from the worst open in two months and traded flat through midday on Thursday, as heavyweights HDFC Bank Ltd. and Reliance Industries Ltd. led gains.

As of 11:42 a.m., the Nifty 50 was 5.55 points, or 0.03% higher at 21,155.70, while the Sensex was trading up 13.91 points, or 0.02% at 70,520.23.

On Wednesday, both Nifty and Sensex witnessed a sharp fall from their lifetime highs, as investors booked profits a day before weekly expiry. Adding to this, fresh concerns about rising Covid-19 cases also weighed on sentiment.

"The upcoming days are anticipated to be volatile due to concerns about increasing Covid cases and geopolitical tensions, which have unsettled investors. This unease resulted in a significant market decline yesterday, and it appears to be carrying over into today," said Shrey Jain, founder and chief executive officer of SAS Online.

For Thursday's expiry, Jain anticipates challenges for the Nifty at higher levels because many investors are actively betting against it, as indicated by aggressive call writing in multiple call strikes.

"With near-term support maintained near 20,800 zone, one needs to wait and watch for things to settle down and confirm a clarity for further development. The support for the day is seen at 21,000, while the resistance is seen at 21,300," Prabhudas Lilladher Pvt. said in a report.

Indian stock benchmark indices recovered from the worst open in two months and traded flat through midday on Thursday, as heavyweights HDFC Bank Ltd. and Reliance Industries Ltd. led gains.

As of 11:42 a.m., the Nifty 50 was 5.55 points, or 0.03% higher at 21,155.70, while the Sensex was trading up 13.91 points, or 0.02% at 70,520.23.

On Wednesday, both Nifty and Sensex witnessed a sharp fall from their lifetime highs, as investors booked profits a day before weekly expiry. Adding to this, fresh concerns about rising Covid-19 cases also weighed on sentiment.

"The upcoming days are anticipated to be volatile due to concerns about increasing Covid cases and geopolitical tensions, which have unsettled investors. This unease resulted in a significant market decline yesterday, and it appears to be carrying over into today," said Shrey Jain, founder and chief executive officer of SAS Online.

For Thursday's expiry, Jain anticipates challenges for the Nifty at higher levels because many investors are actively betting against it, as indicated by aggressive call writing in multiple call strikes.

Indian stock benchmark indices recovered from the worst open in two months and traded flat through midday on Thursday, as heavyweights HDFC Bank Ltd. and Reliance Industries Ltd. led gains.

As of 11:42 a.m., the Nifty 50 was 5.55 points, or 0.03% higher at 21,155.70, while the Sensex was trading up 13.91 points, or 0.02% at 70,520.23.

On Wednesday, both Nifty and Sensex witnessed a sharp fall from their lifetime highs, as investors booked profits a day before weekly expiry. Adding to this, fresh concerns about rising Covid-19 cases also weighed on sentiment.

"The upcoming days are anticipated to be volatile due to concerns about increasing Covid cases and geopolitical tensions, which have unsettled investors. This unease resulted in a significant market decline yesterday, and it appears to be carrying over into today," said Shrey Jain, founder and chief executive officer of SAS Online.

For Thursday's expiry, Jain anticipates challenges for the Nifty at higher levels because many investors are actively betting against it, as indicated by aggressive call writing in multiple call strikes.

"With near-term support maintained near 20,800 zone, one needs to wait and watch for things to settle down and confirm a clarity for further development. The support for the day is seen at 21,000, while the resistance is seen at 21,300," Prabhudas Lilladher Pvt. said in a report.

Support zone for Nifty Bank is near 46,300 levels, the report said. With bias turning little bit cautious, there is need for further clarity and conviction to forecast progress. Bank Nifty would have a daily range of 47,000–47900 levels, the brokerage said.

Britannia Industries Ltd., HDFC Bank Ltd., Power Grid Corp. Of India, Kotak Mahindra Bank Ltd. and Reliance Industries Ltd. were positively contributing to changes in the Nifty.

Whereas, Axis Bank Ltd., Bajaj Finance Ltd., ICICI Bank Ltd., IndusInd Bank Ltd. and Larsen & Toubro Ltd. were negatively contributing to the change.

Most NSE sectoral indices gained, with Nifty Media and Nifty Oil & Gas rising the most. Nifty Bank and Nifty Financial Services were the only indices that fell.

The broader markets outperformed the benchmark indices; the S&P BSE MidCap rose 0.79%, and the BSE SmallCap was up by 1.05%.

Nineteen of the 20 sectors compiled by the BSE rose. BSE Bankex was the only sector that fell.

The market breadth was skewed in the favour of buyers. Around 2,384 stocks advanced, 1,228 declined, and 137 remained unchanged on the BSE.

Kalyani Steel Ltd's CFO Bal Mukand Maheshwari resigned with effect from Apr 1, 2024

Source: Exchange Filing

Coforge Ltd collaborated with Microsoft to use Generative AI to empower next-gen solutions for enterprises

Source: Exchange Filing

Natco Pharma Ltd's name was dismissed by the plaintiff in an anti-trust lawsuit case regarding Pomalidomide

Natco Pharma was named by the Louisiana Health Service & Indemnity Company, Blue Cross and Blue Shield of Louisiana and HMO Louisiana, Inc back in September

Source: Exchange Filing

Coforge Ltd received a total Rs 97.98 crore tax demand, including interest from IT Department

Demand related alleged adjustment by assessment unit under transfer pricing

Source: Exchange Filing

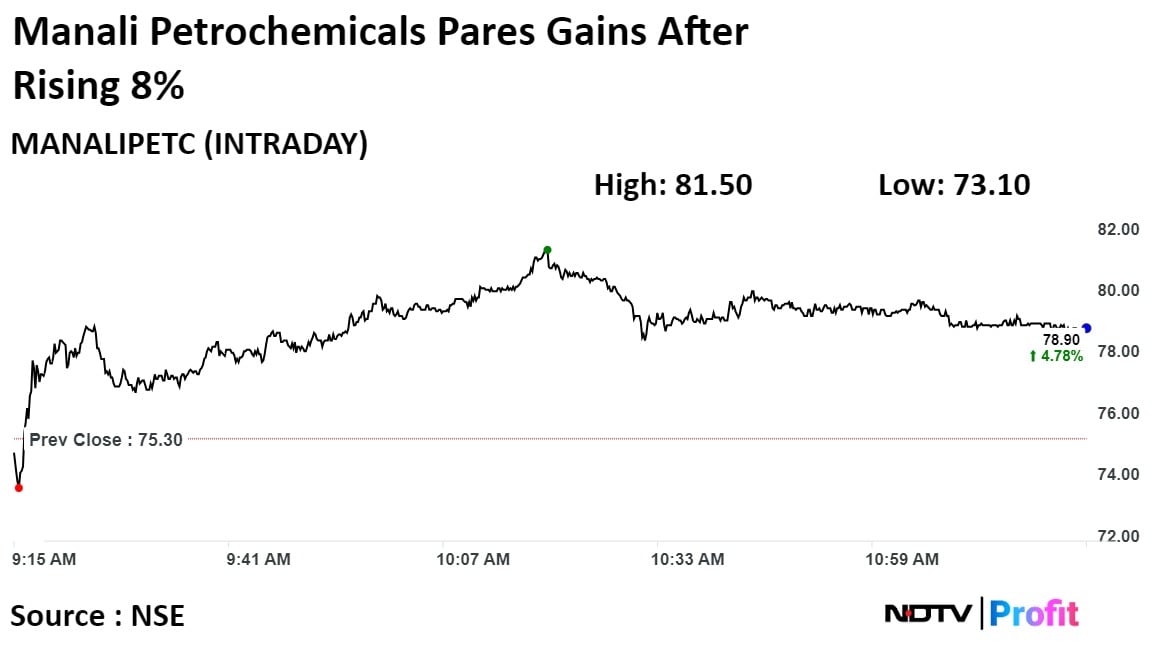

As the state of Tamil Nadu recovers from back-to-back floods, Manali Petrochemicals Ltd announced commencement of operations in Chennai. This pushed the shares to gain over 8% on Thursday.

Manali Petrochemicals has resumed the entire operation of plant 2 at Manali, while the operations of plant 1 have resumed partially, the company announced through an exchange filing. The company also added that it is in the process of restoring other manufacturing units in plant 1.

As the state of Tamil Nadu recovers from back-to-back floods, Manali Petrochemicals Ltd announced commencement of operations in Chennai. This pushed the shares to gain over 8% on Thursday.

Manali Petrochemicals has resumed the entire operation of plant 2 at Manali, while the operations of plant 1 have resumed partially, the company announced through an exchange filing. The company also added that it is in the process of restoring other manufacturing units in plant 1.

Manali Petrochemical shares rose as much as 8.23% to 81.50 apiece, it last traded at this level on Wednesday. It pared gains to trade 4.91% higher at Rs 79 apiece, as of 11:19 a.m. This compares to a 0.072% advance in the NSE Nifty 50 Index.

It has falled 3.18% on a year-to-date basis. Total traded volume so far in the day stood at 6.6 times its 30-day average. The relative strength index was at 74.

Ami Organics up 53.61x its 30 day average

Indian Bank up 5.29x its 30 day average

Astrazeneca Pharma India up 4.47x its 30 day average

IIFL Finance Ltd up 3.28x its 30 day average

Mahindra Holidays & Resorts India up 3.69x its 30 day average

State Bank of India has informed the exchanges that it's going to sign €200 million worth Line of Credit from European Investment Bank for supporting climate action projects in India

Source: Exchange Filing

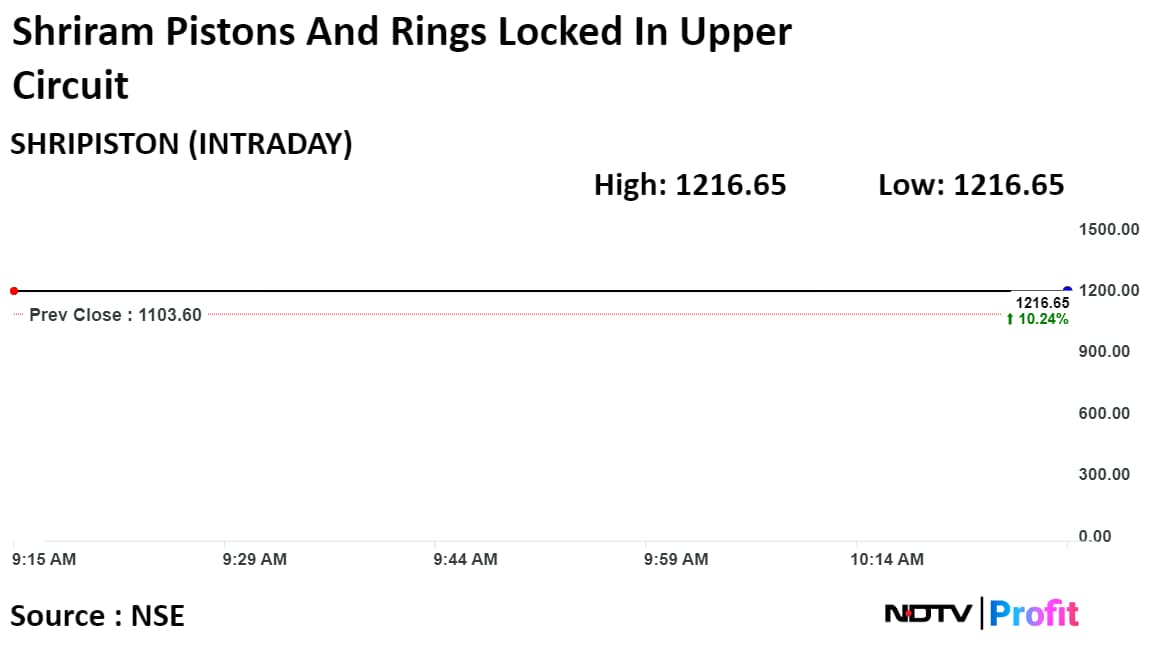

Shares of Shriram Pistons and Rings Ltd. were locked in upper circuit on Thursday, after the company acquired an additional 62% stake in Takahata Precision India Pvt.

The company's wholly-owned subsidiary, SPR Engenious Ltd., acquired the additional stake to increase its total holding to 75%.

Post acquisition, Takahata Precision has become a subsidiary of the company.

The decision to expand its existing product portfolio into new areas, like automotive and other industrial segments, was taken by Shriram Pistons to meet its vision for growth and diversification, an exchange filing said.

Shares of Shriram Pistons and Rings Ltd. were locked in upper circuit on Thursday, after the company acquired an additional 62% stake in Takahata Precision India Pvt.

The company's wholly-owned subsidiary, SPR Engenious Ltd., acquired the additional stake to increase its total holding to 75%.

Post acquisition, Takahata Precision has become a subsidiary of the company.

The decision to expand its existing product portfolio into new areas, like automotive and other industrial segments, was taken by Shriram Pistons to meet its vision for growth and diversification, an exchange filing said.

Shriram Pistons shares rose as much as 5% to 1,216.65 apiece, last trading at this level on Nov. 21. This compares to a 0.08% decline in the NSE Nifty 50.

The stock has risen 111.39% year-to-date. Total traded volume so far in the day stood at 0.6 times its 30-day average. The relative strength index was at 71.

Motherson Sumi Wiring Ltd has 18.7 lakh shares changed hands in a large trade

0.04% equity changed hands at Rs 60.40 apiece

Buyers and sellers not known immediately

Source: Bloomberg

Lists at Rs 949.65 on NSE vs issue price of Rs 660

Lists at a premium of 43.89% on NSE

Lists at Rs 933.15 on BSE vs issue price of Rs 660

Lists at a premium of 41.39% on BSE

Source: Exchanges

Suzlon Energy Ltd got a repeat order of 193.2 MW from KP group in Gujarat

Suzlon Energy to supply 92 wind turbines with rated capacity of 2.1 MW each

Source: Exchange Filing

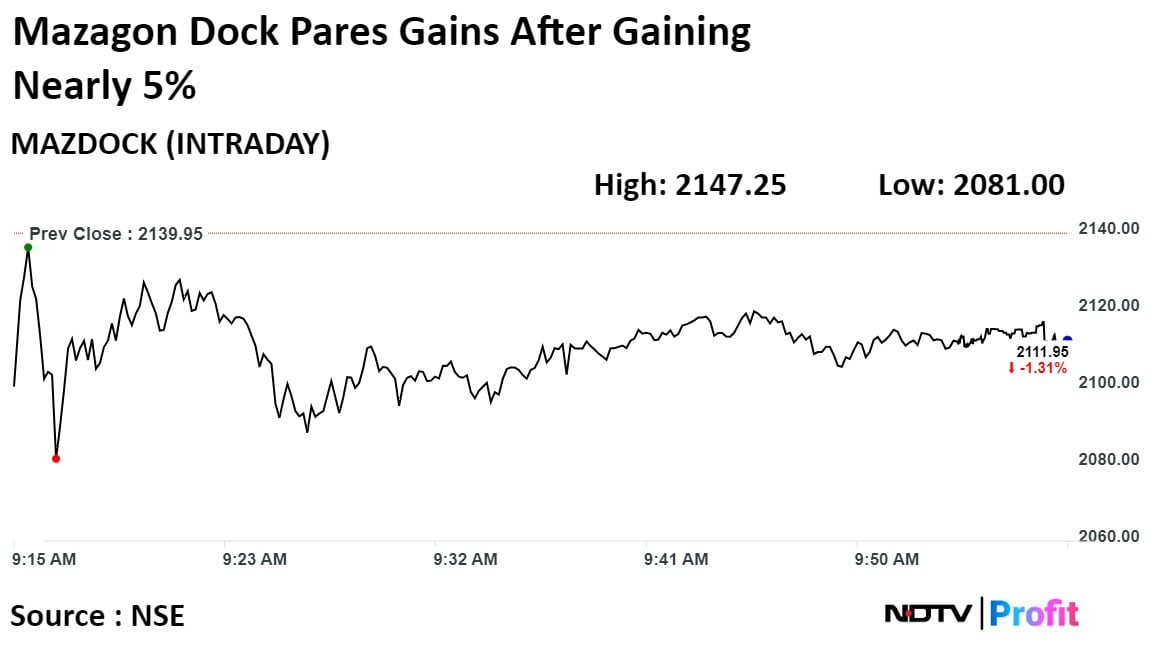

The stocks of Mazagon Dock Shipbuilders Ltd. rose on Thursday after it won an order worth Rs 1,614 crore from the defence ministry. This comes two days after the shares hit a two month high of Rs 2,175 on Tuesday.

Mazagon Dock shares rose as much as 4.94% to 2,147 apiece, it last traded on these levels on Dec. 18. It pared gains to trade 1.22% lower at Rs 2,114 apiece, as of 9:57 a.m. This compares to a 0.48% decline in the NSE Nifty 50 Index.

The stocks of Mazagon Dock Shipbuilders Ltd. rose on Thursday after it won an order worth Rs 1,614 crore from the defence ministry. This comes two days after the shares hit a two month high of Rs 2,175 on Tuesday.

Mazagon Dock shares rose as much as 4.94% to 2,147 apiece, it last traded on these levels on Dec. 18. It pared gains to trade 1.22% lower at Rs 2,114 apiece, as of 9:57 a.m. This compares to a 0.48% decline in the NSE Nifty 50 Index.

Shares of Zee Entertainment Enterprises Ltd. jumped nearly 6% on Thursday after the company and Sony Group agreed to discuss the extension of the merger date.

Shares of Zee Entertainment Enterprises Ltd. jumped nearly 6% on Thursday after the company and Sony Group agreed to discuss the extension of the merger date.

Zee's stock rose as much as 5.88% to Rs 266.80 apiece on the NSE. It pared gains to trade 3.75% higher at Rs 261.40 apiece compared to a 0.6% decline in the benchmark Nifty 50 at 9:30 a.m.

It has risen 9.77% on a year-to-date basis. The relative strength index was at 49.35.

Out of 23 analysts tracking the company, 17 have a 'buy' rating on the stock, four recommend a 'hold,' and two suggest 'sell,' according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 24.2%.

Ashok Leyland Ltd received an order worth Rs 500.97 crore for 522 buses from Tamil Nadu State Transport Corp

Order to supply BSVI diesel fuel type 12M low floor full built bus

Source: Exchange Timing

43.4 lakh shares or 12% equity changed hands in a large trade

Buyers and sellers not known immediately

Source: Bloomberg

IPCA Laboratories down 1.1%

Glenmark Pharmaceuticals down 0.6%

GlaxoSmithKline Pharmaceuticals up 0.5%

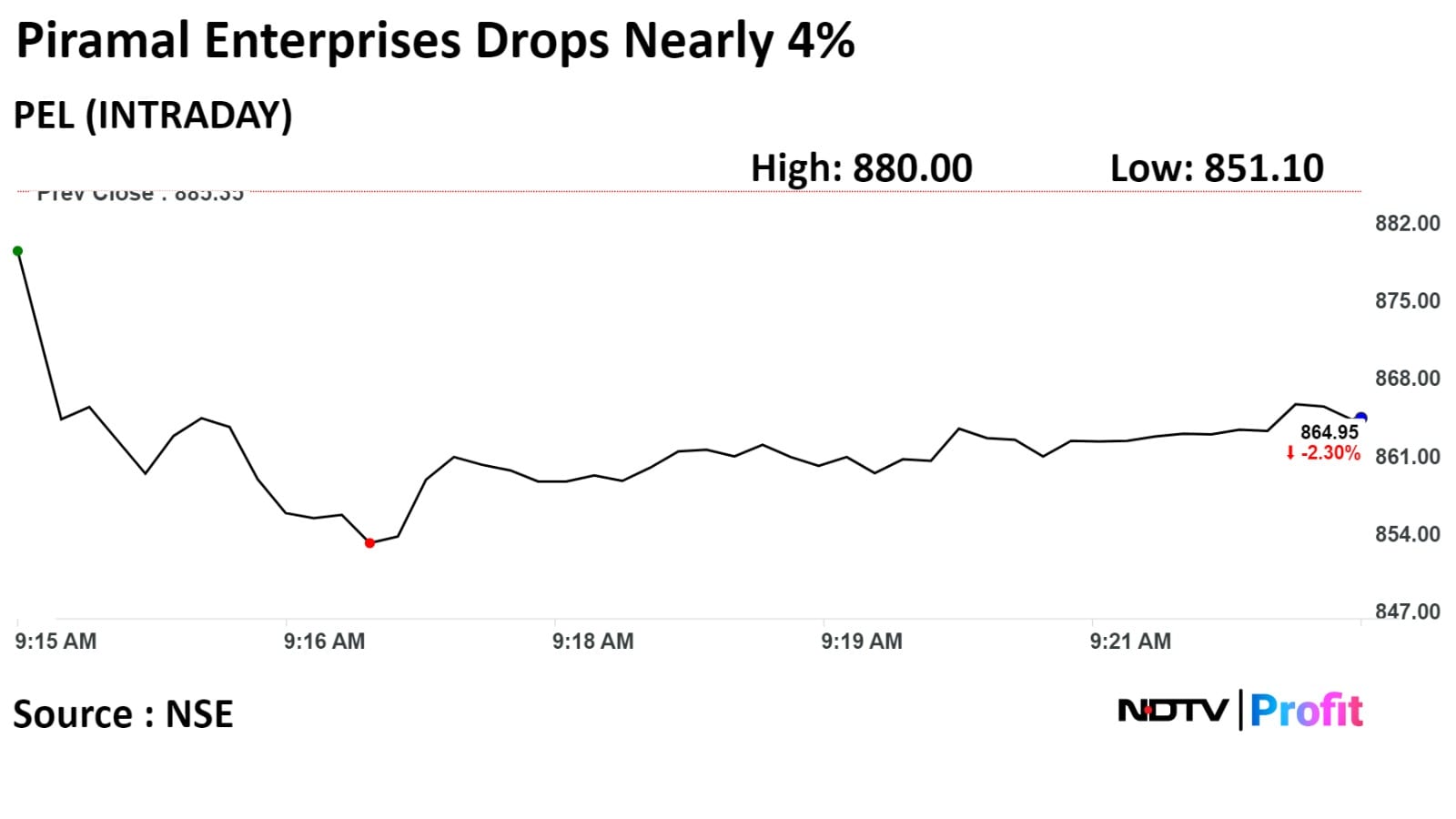

Shares of Piramal Enterprises fell today after the company announced that its investment In AIFs At Rs 3,817 crore post RBI's ban on banks and NBFCs from investing in alternative investment funds that have invested in debtor firms who have been their customers in the prior 12 months.

Shares of Piramal Enterprises fell today after the company announced that its investment In AIFs At Rs 3,817 crore post RBI's ban on banks and NBFCs from investing in alternative investment funds that have invested in debtor firms who have been their customers in the prior 12 months.

The scrip fell as much as 3.87% to Rs 851 piece, the lowest level since June 20. It was trading 2.52% lower at Rs 863 apiece, as of 09:47 a.m. This compares to a 0.32% decline in the NSE Nifty 50 Index.

It has risen 4.18% on a year-to-date basis. Total traded volume so far in the day stood at 5.3 times its 30-day average. The relative strength index was at 34.58.

Out of 10 analysts tracking the company, 7 maintain a 'buy' rating and three suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 13.5%.

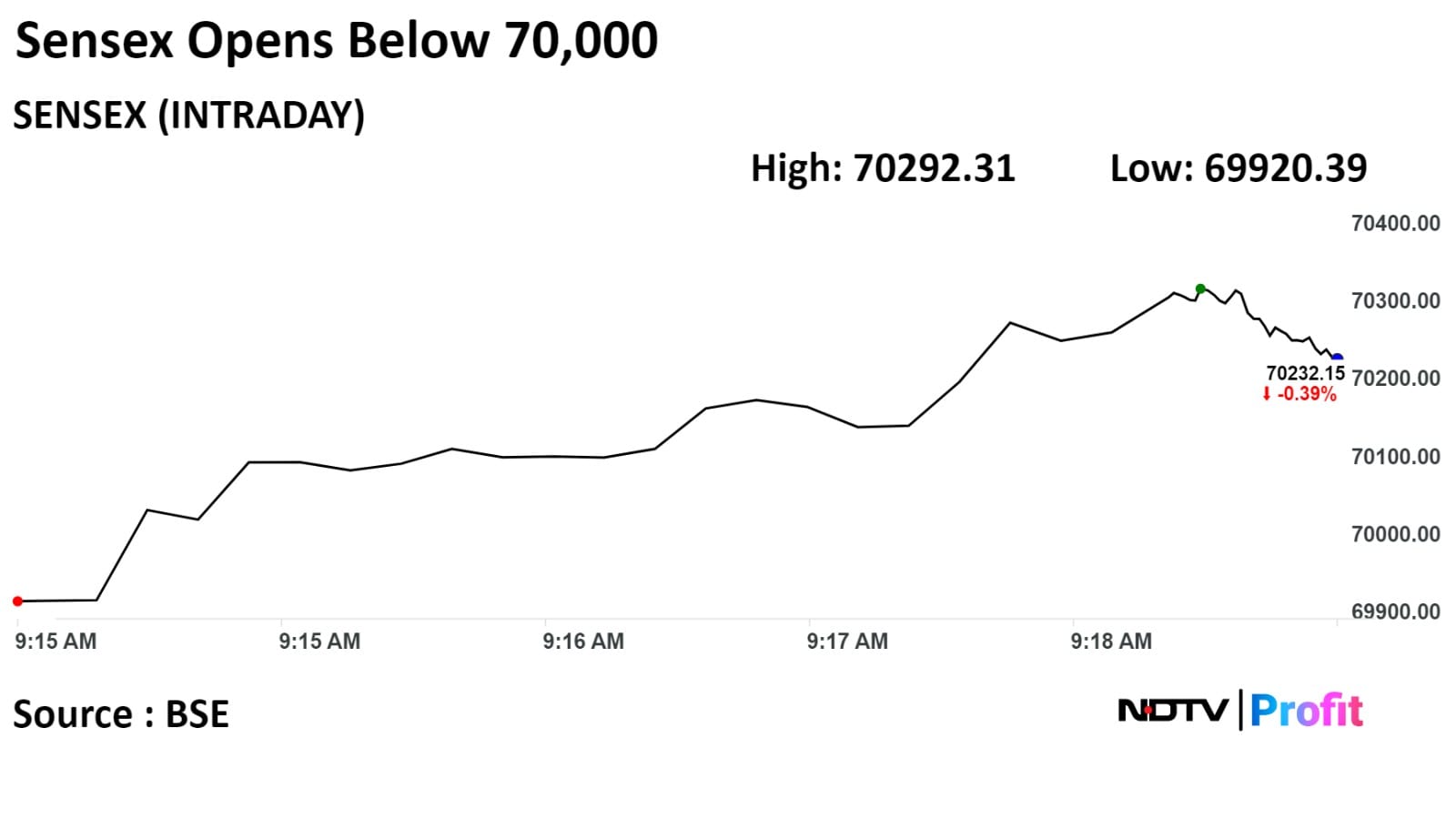

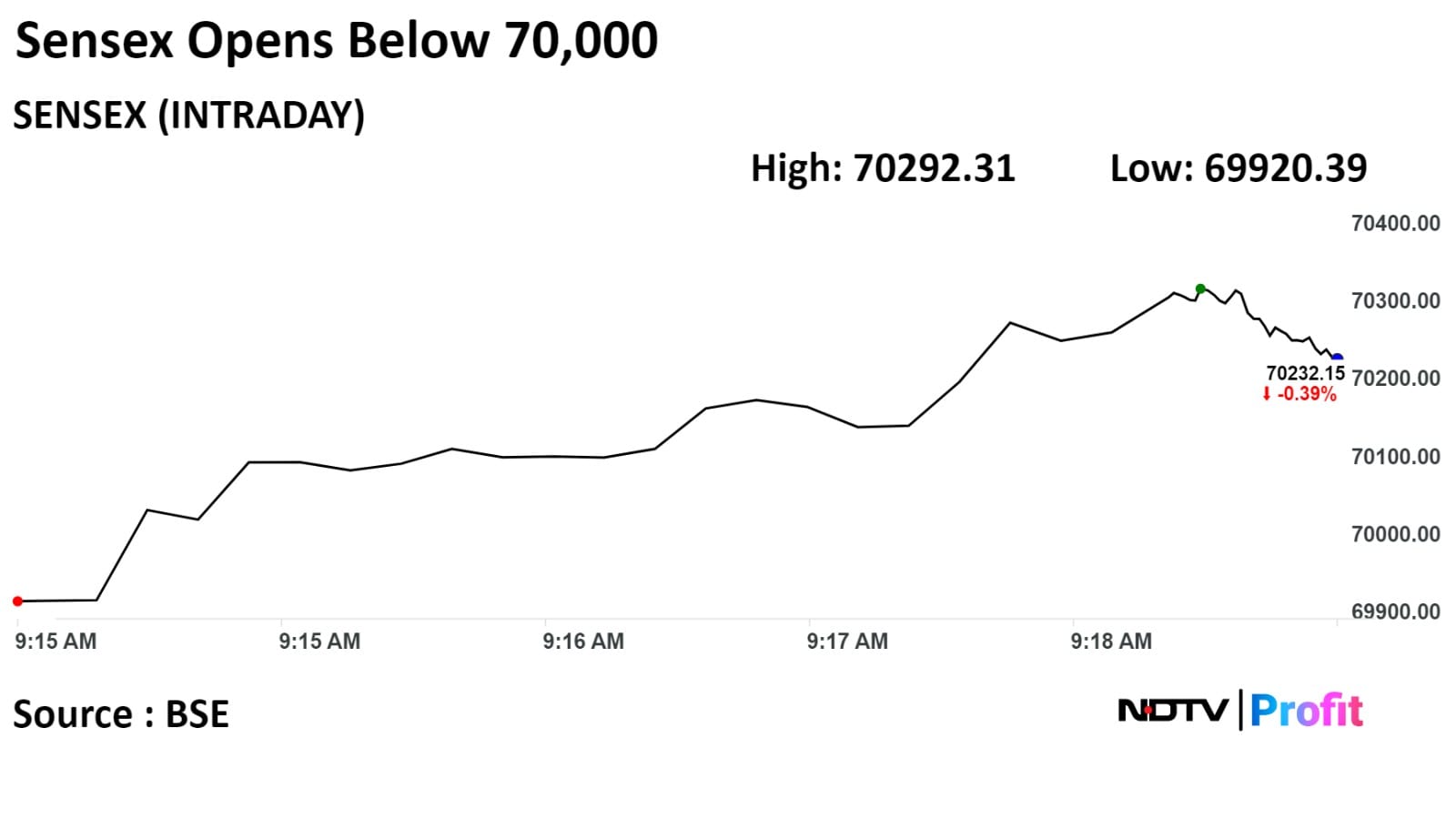

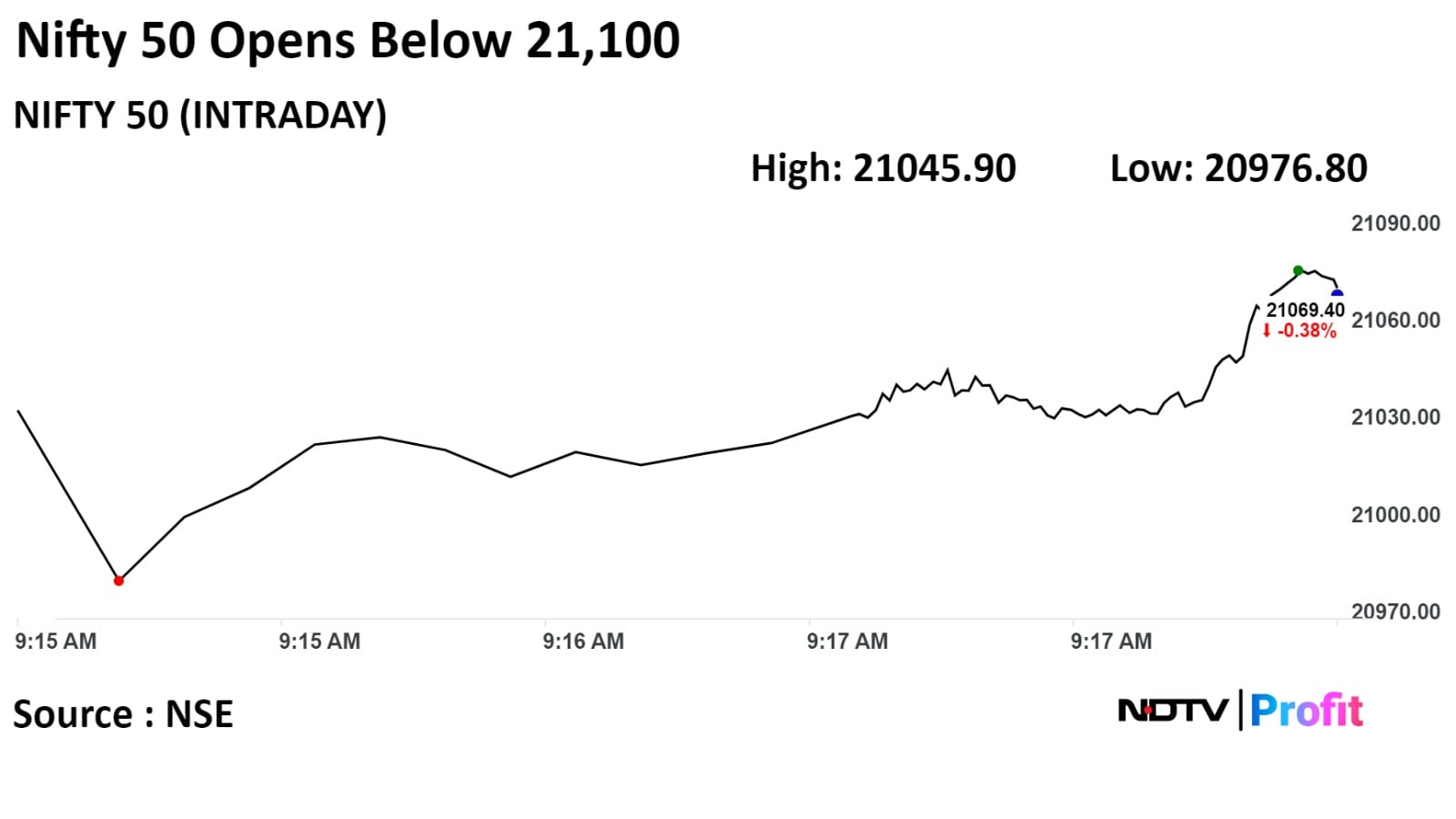

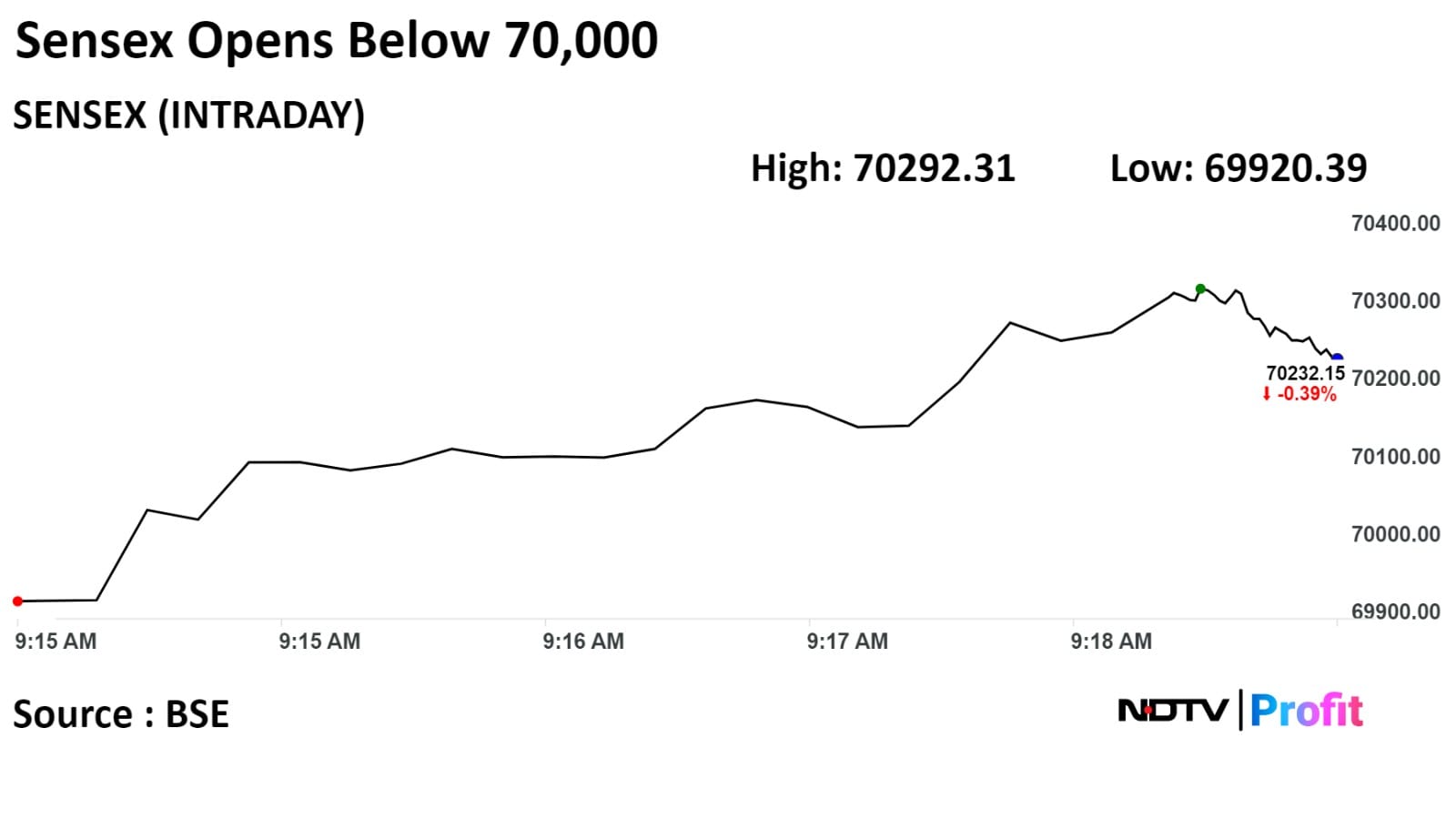

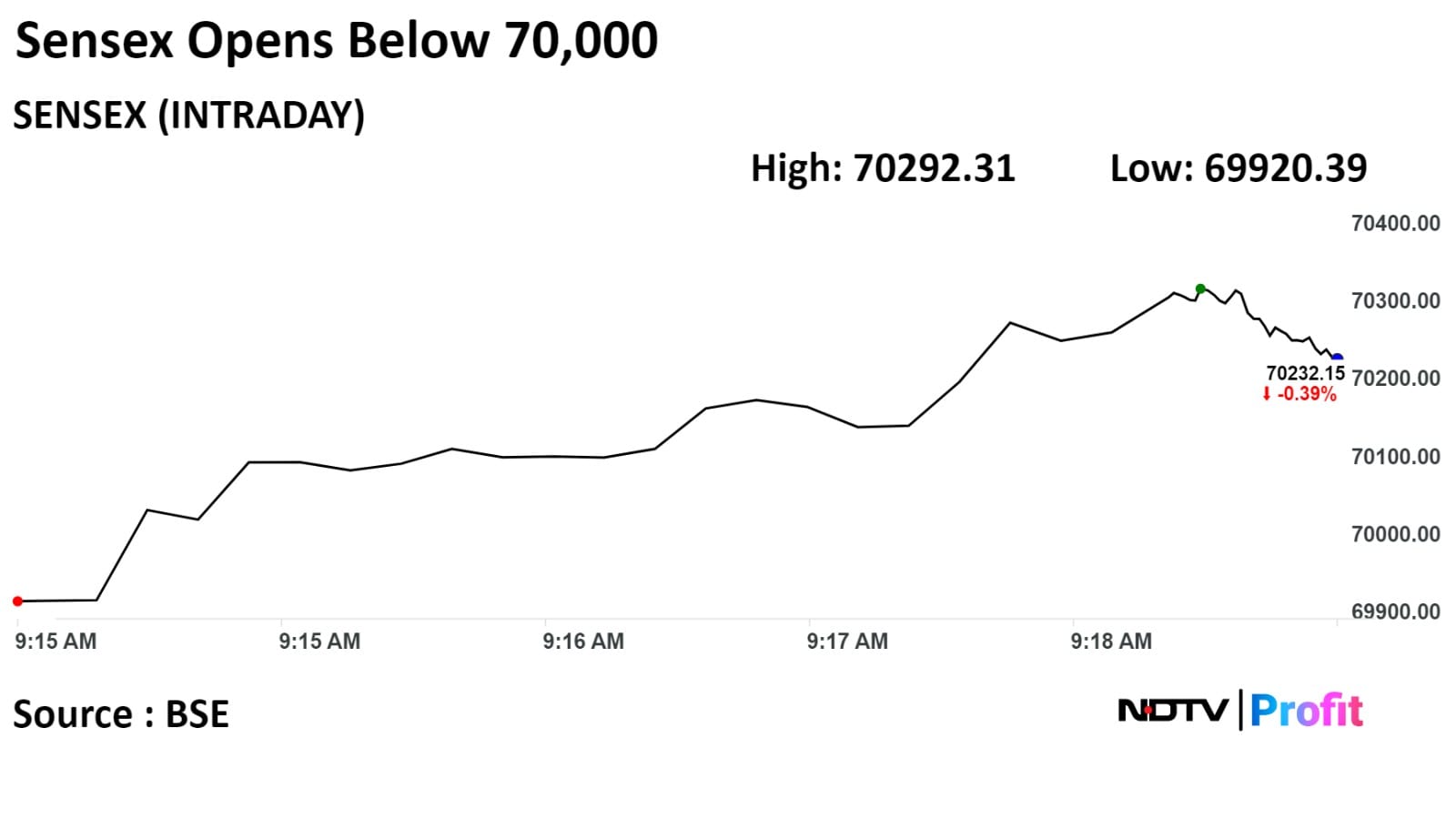

India's benchmark indices logged worst opening in two months on Thursday as ICICI Bank Ltd, HDFC Bank Ltd, Infosys Ltd dragged.

As of 09:17 a.m., the NSE Nifty 50 was 0.35% lower or 81.80 points at 21, 087.10. The BSE Sensex was 0.39% or 273.59 points down at 70,191.63.

The Nifty 50 fell the most in 10 months and gave up all recent gains on Wednesday as investors booked profits on Wednesday. The Sensex also declined the most since Oct 26.

"NIFTY-50 has witnessed a reversal from the all-time high at 21,593 with sharp correction in index pivotal and on the downside could expect some bounce from the support of 20,900 levels," said Vikas Jain, senior research analyst at Reliance Securities.

"Technical correction in the Indian equity markets could offer good buying opportunities. Undertone bullish sentiment in the market on account of strong domestic macroeconomic data, lower oil prices, sustained inflows from mutual fund investors, record foreign purchases, and an improving US rate outlook will support the stock market rally. Telecom stocks will be in focus today after the lower house (Lok Sabha) approved a new telecom bill."

India's benchmark indices logged worst opening in two months on Thursday as ICICI Bank Ltd, HDFC Bank Ltd, Infosys Ltd dragged.

As of 09:17 a.m., the NSE Nifty 50 was 0.35% lower or 81.80 points at 21, 087.10. The BSE Sensex was 0.39% or 273.59 points down at 70,191.63.

The Nifty 50 fell the most in 10 months and gave up all recent gains on Wednesday as investors booked profits on Wednesday. The Sensex also declined the most since Oct 26.

"NIFTY-50 has witnessed a reversal from the all-time high at 21,593 with sharp correction in index pivotal and on the downside could expect some bounce from the support of 20,900 levels," said Vikas Jain, senior research analyst at Reliance Securities.

"Technical correction in the Indian equity markets could offer good buying opportunities. Undertone bullish sentiment in the market on account of strong domestic macroeconomic data, lower oil prices, sustained inflows from mutual fund investors, record foreign purchases, and an improving US rate outlook will support the stock market rally. Telecom stocks will be in focus today after the lower house (Lok Sabha) approved a new telecom bill."

India's benchmark indices logged worst opening in two months on Thursday as ICICI Bank Ltd, HDFC Bank Ltd, Infosys Ltd dragged.

As of 09:17 a.m., the NSE Nifty 50 was 0.35% lower or 81.80 points at 21, 087.10. The BSE Sensex was 0.39% or 273.59 points down at 70,191.63.

The Nifty 50 fell the most in 10 months and gave up all recent gains on Wednesday as investors booked profits on Wednesday. The Sensex also declined the most since Oct 26.

"NIFTY-50 has witnessed a reversal from the all-time high at 21,593 with sharp correction in index pivotal and on the downside could expect some bounce from the support of 20,900 levels," said Vikas Jain, senior research analyst at Reliance Securities.

"Technical correction in the Indian equity markets could offer good buying opportunities. Undertone bullish sentiment in the market on account of strong domestic macroeconomic data, lower oil prices, sustained inflows from mutual fund investors, record foreign purchases, and an improving US rate outlook will support the stock market rally. Telecom stocks will be in focus today after the lower house (Lok Sabha) approved a new telecom bill."

India's benchmark indices logged worst opening in two months on Thursday as ICICI Bank Ltd, HDFC Bank Ltd, Infosys Ltd dragged.

As of 09:17 a.m., the NSE Nifty 50 was 0.35% lower or 81.80 points at 21, 087.10. The BSE Sensex was 0.39% or 273.59 points down at 70,191.63.

The Nifty 50 fell the most in 10 months and gave up all recent gains on Wednesday as investors booked profits on Wednesday. The Sensex also declined the most since Oct 26.

"NIFTY-50 has witnessed a reversal from the all-time high at 21,593 with sharp correction in index pivotal and on the downside could expect some bounce from the support of 20,900 levels," said Vikas Jain, senior research analyst at Reliance Securities.

"Technical correction in the Indian equity markets could offer good buying opportunities. Undertone bullish sentiment in the market on account of strong domestic macroeconomic data, lower oil prices, sustained inflows from mutual fund investors, record foreign purchases, and an improving US rate outlook will support the stock market rally. Telecom stocks will be in focus today after the lower house (Lok Sabha) approved a new telecom bill."

India's benchmark indices logged worst opening in two months on Thursday as ICICI Bank Ltd, HDFC Bank Ltd, Infosys Ltd dragged.

As of 09:17 a.m., the NSE Nifty 50 was 0.35% lower or 81.80 points at 21, 087.10. The BSE Sensex was 0.39% or 273.59 points down at 70,191.63.

The Nifty 50 fell the most in 10 months and gave up all recent gains on Wednesday as investors booked profits on Wednesday. The Sensex also declined the most since Oct 26.

"NIFTY-50 has witnessed a reversal from the all-time high at 21,593 with sharp correction in index pivotal and on the downside could expect some bounce from the support of 20,900 levels," said Vikas Jain, senior research analyst at Reliance Securities.

"Technical correction in the Indian equity markets could offer good buying opportunities. Undertone bullish sentiment in the market on account of strong domestic macroeconomic data, lower oil prices, sustained inflows from mutual fund investors, record foreign purchases, and an improving US rate outlook will support the stock market rally. Telecom stocks will be in focus today after the lower house (Lok Sabha) approved a new telecom bill."

India's benchmark indices logged worst opening in two months on Thursday as ICICI Bank Ltd, HDFC Bank Ltd, Infosys Ltd dragged.

As of 09:17 a.m., the NSE Nifty 50 was 0.35% lower or 81.80 points at 21, 087.10. The BSE Sensex was 0.39% or 273.59 points down at 70,191.63.

The Nifty 50 fell the most in 10 months and gave up all recent gains on Wednesday as investors booked profits on Wednesday. The Sensex also declined the most since Oct 26.

"NIFTY-50 has witnessed a reversal from the all-time high at 21,593 with sharp correction in index pivotal and on the downside could expect some bounce from the support of 20,900 levels," said Vikas Jain, senior research analyst at Reliance Securities.

"Technical correction in the Indian equity markets could offer good buying opportunities. Undertone bullish sentiment in the market on account of strong domestic macroeconomic data, lower oil prices, sustained inflows from mutual fund investors, record foreign purchases, and an improving US rate outlook will support the stock market rally. Telecom stocks will be in focus today after the lower house (Lok Sabha) approved a new telecom bill."

India's benchmark indices logged worst opening in two months on Thursday as ICICI Bank Ltd, HDFC Bank Ltd, Infosys Ltd dragged.

As of 09:17 a.m., the NSE Nifty 50 was 0.35% lower or 81.80 points at 21, 087.10. The BSE Sensex was 0.39% or 273.59 points down at 70,191.63.

The Nifty 50 fell the most in 10 months and gave up all recent gains on Wednesday as investors booked profits on Wednesday. The Sensex also declined the most since Oct 26.

"NIFTY-50 has witnessed a reversal from the all-time high at 21,593 with sharp correction in index pivotal and on the downside could expect some bounce from the support of 20,900 levels," said Vikas Jain, senior research analyst at Reliance Securities.

"Technical correction in the Indian equity markets could offer good buying opportunities. Undertone bullish sentiment in the market on account of strong domestic macroeconomic data, lower oil prices, sustained inflows from mutual fund investors, record foreign purchases, and an improving US rate outlook will support the stock market rally. Telecom stocks will be in focus today after the lower house (Lok Sabha) approved a new telecom bill."

India's benchmark indices logged worst opening in two months on Thursday as ICICI Bank Ltd, HDFC Bank Ltd, Infosys Ltd dragged.

As of 09:17 a.m., the NSE Nifty 50 was 0.35% lower or 81.80 points at 21, 087.10. The BSE Sensex was 0.39% or 273.59 points down at 70,191.63.

The Nifty 50 fell the most in 10 months and gave up all recent gains on Wednesday as investors booked profits on Wednesday. The Sensex also declined the most since Oct 26.

"NIFTY-50 has witnessed a reversal from the all-time high at 21,593 with sharp correction in index pivotal and on the downside could expect some bounce from the support of 20,900 levels," said Vikas Jain, senior research analyst at Reliance Securities.

"Technical correction in the Indian equity markets could offer good buying opportunities. Undertone bullish sentiment in the market on account of strong domestic macroeconomic data, lower oil prices, sustained inflows from mutual fund investors, record foreign purchases, and an improving US rate outlook will support the stock market rally. Telecom stocks will be in focus today after the lower house (Lok Sabha) approved a new telecom bill."

Reliance Industries Ltd., HDFC Bank Ltd., Adani Ports and Special Economic Zone Ltd., Oil and Natural Gas Corporation Ltd. added positively to the indices.

ICICI Bank Ltd., Axis Bank Ltd., Larsen & Toubro Ltd., ITC Ltd., Kotak Mahindra Bank Ltd. weighed on the indices.

Most sectoral indices declined. Around 10 out of 14 sectors on NSE fell, while four advanced. Nifty Pharma fell 1.33% to be the top loser among sectoral indices.

Broader markets fell in tandem with the benchmark indices. The S&P BSE Sensex MidCap fell 0.73%, while the S&P BSE Sensex SmallCap declined 0.43%.

The market breadth was skewed in the favour of sellers. Around 1714 stocks declined, 1223 stocks advanced, and 93 remained unchanged.

At pre-opned, the NSE Nifty 50 was 0.55% or 116.20 points down at 21,033.75. The BSE Sensex was 0.83% or 585.42 points down at 69,920.89.

The yield on the 10-year bond opened flat at 7.16% on Thursday.

Source: Bloomberg

The local currency opened flat at 83.19 against the U.S dollar on Thursday.

Source: Bloomberg

Piramal Enterprises investments in AIF units at Rs 3,817 crore as of Nov 30

Receives Rs 905 crore as repayment of interest and principal on AIF units, so far

To adjust Rs 3,164 crore in financial statements via capital funds or provision

Remains confident of full recovery of underlying downstream investments in impacted AIF units

Source: Exchange Filing

Cautiously optimistic for 2024 and expect stability in China

Expect macro backdrop to turn positive with potentially weaker dollar, lower bond yields

Asian steel price improves but spread over raw material still at a decade low

India steel demand strong and price holding up

Constructive view on Indian metals and mining space, with preference for COAL over HNDL/TATA

Morgan Stanley rated DLF Ltd as 'Overweight' with a target price of Rs 770

DLF Ltd to launch first 500 units of Arbour 2/Privana South at Sector 77 on 21 Dec 2023

Successful launch of Arbour 2 likely to drive stock outperformance

Arbour 2 to increase 3QFY24 pre-sales amount

Assuming 50% pre-sales in Dec, it could contribute Rs. 4,500 crore to 3Q pre-sales

Morgan Stanley expects sales in nine months of FY24 to be at Rs 8,800 crore, or 33% up on year compared to guidance of Rs 13,000 crore for FY24

AstraZeneca announced to launch Enhertu in Jan 2024The drug, Enhertu is used in treating breast cancer in Adults

Source: Exchange Filing

Announces rejig and realignment of top management team

Anil Kumar Agarwal to serve as Deputy MD, CEO of the Freight Rail Systems with effect from Dec 20

Prithish Chowdhary to serve as Deputy CEO of Passenger Rail Systems

Source: Exchange Filing

Emkay Global Financial Services said in analyst meet multiple initiatives underway to accelerate growth of Landmark Cars.

Pre-owned car sales, car care business, digital transformation, after-sales business

Uniquely positioned to address the pre-owned car opportunity

Used car sales represent strong growth opportunity in the U.S.

Company expects no additional investment for the venture

Initiative launched on pilot basis with Mercedes

Refurbished cars to be bought on EMI, to be rolled out for other brands next year

DCGI issues letter to the drugs controllers of states and Union territories.

Orders anti cold producers to include warning on product for infants.

Drugs containing chlorpheniramine Maleate and Phenylephrine in specific units to not be prescribed to infants below four years.

Manufacturers to mention warning that FDC should not be used in children below four years of age on label and package.

Glenmark Pharmaceuticals, IPCA Laboratories, GlaxoSmithKline to get impacted

Source - Official letter by Drugs Controller General (India)

U.S. Dollar Index at 102.31

U.S. 10-year bond yield at 3.86%

Brent crude down 0.68% at $79.16 per barrel

Nymex crude down 0.62% at $73.76 per barrel

GIFT Nifty was 0.18% up at 21,129 as of 07:21 a.m.

Bitcoin was down 0.02% at $43,441.12.

Nifty December futures down 1.66% to 21,169.5 at a premium of 19.35 points.

Nifty December futures open interest up 2.49%.

Nifty Bank December futures down 1.37% to 47,349.85 at a discount of 95.45 points.

Nifty Bank December futures open interest up 0.9%.

Nifty Options Dec 21 Expiry: Maximum call open interest at 21,500 and maximum put open interest at 21,000.

Bank Nifty Options Dec 28 Expiry: Maximum call open Interest at 48,000 and maximum put open interest at 46,000.

Securities in the ban period: Ashok Leyland, Balrampur Chini Mills, Delta Corp, Indus Tower, Manappuram Finance, National Aluminum, Piramal Enterprises, RBL Bank, SAIL.

Nifty December futures down 1.66% to 21,169.5 at a premium of 19.35 points.

Nifty December futures open interest up 2.49%.

Nifty Bank December futures down 1.37% to 47,349.85 at a discount of 95.45 points.

Nifty Bank December futures open interest up 0.9%.

Nifty Options Dec 21 Expiry: Maximum call open interest at 21,500 and maximum put open interest at 21,000.

Bank Nifty Options Dec 28 Expiry: Maximum call open Interest at 48,000 and maximum put open interest at 46,000.

Securities in the ban period: Ashok Leyland, Balrampur Chini Mills, Delta Corp, Indus Tower, Manappuram Finance, National Aluminum, Piramal Enterprises, RBL Bank, SAIL.

Moved into short-term ASM framework: Nintec Systems, PC Jeweller, and Spencer’s Retail.

Moved out of short-term ASM framework: AGS Transact Technologies, and Patel Engineering.

Khadim: To meet investors and analysts on Dec. 26.

Krsnaa Diagnostics: To meet investors and analysts on Dec. 26.

Jyoti Resins and Adhesives: To meet investors and analysts on Dec. 21.

Waaree Renewable Technologies: To meet investors and analysts on Dec. 26.

UltraTech Cement: To meet investors and analysts on Dec. 21.

Usha Martin: Promoter group Peterhouse Investments India sold 30,000 shares on Dec. 19.

ION Exchange: Promoter group Mahabir Prasad Patni sold 1 lakh shares between Dec. 11 and 19.

Ultramine and Pigments: Promoter Deepa Ajay sold 13,967 shares between Dec. 18 and 19. Promoter S. Narayanan sold 16,839 shares on Dec.19.

Tips Industries: Kumar Sadhuram Taurani sold 34 lakh shares (2.64%) at Rs 346.44 apiece, Ramesh Sadhuram Taurani sold 34 lakh shares (2.64%) at Rs 342.91 apiece, while F3 Advisors bought 14.14 lakh shares (1.1%) at Rs 345.78 apiece, Mansi Share and Stock Advisors bought 7.33 lakh shares (0.57%) at Rs 346.21 apiece, and Sahastraa Advisors bought 6.6 lakh shares (0.51%) at Rs 344.79 apiece.

India Shelter Finance: Goldman Sachs Funds bought 5.91 lakh shares (0.55%) at Rs 593.08 apiece. Nippon India Mutual Fund bought 10.10 lakh shares (0.94%) at Rs 572.81 apiece.

Symphony: HDFC Mutual Fund Multi Cap Fund bought 6 lakh shares (0.87%), while Swayat Trading Co. sold 6 lakh shares (0.87%) at Rs 880 apiece.

Landmark Cars: Bajaj Finance sold 3.2 lakh shares (0.79%) at Rs 805.58 apiece.

Astral: Saumya Polymers LLP sold 36.2 lakh shares (1.34%), Kairav Chemicals sold 10.6 lakh shares (0.39%), while Morgan Stanley Institutional Fund Emerging Markets Portfolio bought 13.22 lakh shares (0.49%), Nippon India Mutual Fund bought 12 lakh shares (0.44%), Government of Singapore bought 8.83 lakh shares (0.32%), Abu Dhabi Investment Authority bought 5.25 lakh shares (0.19%), and Morgan Stanley Asia Singapore PTE bought 2.2 lakh shares (0.08%), among others, at Rs 1,889.8 apiece.

Nippon Life India Asset Management: IndusInd Bank sold 1.7 crore shares (2.86%) at Rs 445.35 apiece, while SBI Mutual Fund bought 77.82 lakh shares (1.23%), ICICI Prudential Mutual Fund bought 47.01 lakh shares (0.92%), Norges Bank bought 9.34 lakh shares (0.14%), Societe Generale bought 9 lakh shares (0.14%), and Morgan Stanley Asia Singapore Pte bought 2.25 lakh shares (0.03%), among others, at Rs 445.35 apiece.

Shriram Piston and Ring: K S Kolbenschmidt GMBH sold 39 lakh shares (8.85%), while Abakkus Asset Manager LLP, through five of its funds, bought 34.63 lakh shares (7.86%), and AL Mehwar Commercial Investments LLC bought 4.36 lakh shares (0.99%) at Rs 1,103.6 apiece.

Motisons Jewellers: The public issue was subscribed to 159.61 times on day 3. The bids were led by non-institutional investors (233.91 times), institutional investors (157.40 times), and retail investors (122.28 times).

Suraj Estates: The public issue was subscribed 15.65 times on day 3. The bids were led by institutional investors (24.31 times), non-institutional investors (18.9 times), and retail investors (9.3 times).

Muthoot Microfin: The public issue was subscribed 11.52 times on day 3. The bids were led by institutional investors (17.47 times), non-institutional investors (13.20 times), retail investors (7.61 times), and employee reserved (2.87 times).

Credo Brands: The public issue was subscribed 6.95 times on day 2. The bids were led by non-institutional investors (233.91 times), institutional investors (157.40 times), and retail investors (122.28 times).

RBZ Jewellers: The public issue was subscribed 7.15 times on day 2. The bids were led by non-institutional investors (3.49 times), retail investors (13.14 times), and institutional investors (0.05 times).

Happy Forgings: The public issue was subscribed to 159.61 times on day 2. The bids were led by non-institutional investors (11.48 times), retail investors (8.78 times), and institutional investors (0.35 times).

Azad Engineering: The public issue was subscribed 3.31 times on day 1. The bids were led by non-institutional investors (6.13 times), retail investors (3.93 times), and institutional investors (0.05 times).

Innova Captab: The IPO will open for bids on Thursday. It will comprise a fresh issue of Rs 320 crore and an offer for sale of Rs 250 crore. The price band is fixed at Rs 426–448 apiece. The company has raised Rs 76.74 crore from anchor investors.

Inox India: The company's shares will debut on the stock exchanges on Thursday at an issue price of Rs 660 apiece. The Rs 1,459.3-crore IPO was subscribed 61.28 times on its third and final day. Bids were led by institutional investors (147.80 times), retail investors (15.30 times) and non-institutional investors (53.20 times).

Mazagon Dock Shipbuilders: The company signed a contract worth Rs 1,615 crore with the Ministry of Defence for the construction and delivery of six next-generation offshore patrol vessels for the Indian Coast Guard.

Cochin Shipyard: The company received an order worth Rs 488.25 crore from the Defense Ministry to repair and maintain equipment and systems onboard the naval vessel.

Zee Entertainment: Culver Max and Bangla Entertainment have agreed to discuss the extension of the merger date. The deadline for the completion of the merger was set for Dec. 21.

BSE: The company received approval from the Securities Exchange Board of India for appointing Pramod Agrawal as chairman effective from Jan. 17, 2024.

UltraTech Cement: The company will buy a stake in renewable energy company Clean Max Terra for Rs 20.25 crore.

Adani Green Energy: The company will consider a proposal to raise funds via multiple instruments on Dec. 26.

ICICI Bank: The company received the Reserve Bank of India's nod for the re-appointment of Sandeep Batra as executive director.

Raymond: The company’s unit has incorporated the wholly owned subsidiary Ten X Realty East with the objective of undertaking real estate business.

Flair Writing: The company reported revenue of Rs 257 crore for Q2 FY24 and a net profit of Rs 33.15 crore for Q2 FY24.

REC: The company unit incorporated a wholly owned subsidiary, Kankani Power Transmission.

Sonata Software: The company signed a contract with AMMEGA Group, a global leader in conveyor belts and power transmission with manufacturing sites and customer solution centres around the world.

Tarsons Products: The company will acquire German medical distributor Nerbe for about €10–15 million.

Manali Petrochemical: The company has resumed its operations at the Chennai plant.

Asia markets fell on Thursday tracking overnight losses in the U.S. share indices as investors await for the gross-domestic-product and personal-consumption-expenditure data from the U.S.

The Bloomberg survey has projected the world's largest economy might have grown 5.2% on sequential basis in the third quarter. The U.S. GDP is due to be released later on Thursday.

Share indices in Japan, Australia, and South Korea declined, while share indices in Hong Kong rose. The Nikkei declined 1.31% down at 33,233.35, while the S&P/ASX 200 fell 0.36% to 7,511 as of 6:30 a.m.

The Hang Seng index was up 0.66% at 16,613.81 as of 6:30 a.m.

The S&P 500 index and Nasdaq 100 declined 1.47% and 1.53%, respectively on Wednesday. The Dow Jones Industrial Average fell by 0.64%.

Brent crude was trading 0.59% higher at $79.70 a barrel. Gold rose 0.12% to $2,033.77 an ounce.

The GIFT Nifty was trading 0.25% higher at 21,141 as of 7:04 a.m.

Indian stock benchmark Nifty 50 dropped the most in 10 months to retreat from all-time highs as investors booked profits, halting its record-setting burst.

The Nifty 50 ended 302.95 points, or 1.41%, lower at 21,150.15, while the Sensex closed 930.88 points, or 1.3%, down—the most since Oct. 26—at 70,506.31. Intraday, the Nifty hit a low of 21,087.35 and the Sensex fell to 70,302.60. The declines were broad-based, with all sectoral indices ending lower.

Overseas investors remained net sellers of Indian equities for the third consecutive session on Wednesday. Foreign portfolio investors offloaded stocks worth Rs 1,322.1 crore, while domestic institutional investors mopped up stocks worth Rs 4,754.3 crore, according to provisional data from the National Stock Exchange.

The Indian rupee closed at Rs 83.18 against the dollar.

Asia markets fell on Thursday tracking overnight losses in the U.S. share indices as investors await for the gross-domestic-product and personal-consumption-expenditure data from the U.S.

The Bloomberg survey has projected the world's largest economy might have grown 5.2% on sequential basis in the third quarter. The U.S. GDP is due to be released later on Thursday.

Share indices in Japan, Australia, and South Korea declined, while share indices in Hong Kong rose. The Nikkei declined 1.31% down at 33,233.35, while the S&P/ASX 200 fell 0.36% to 7,511 as of 6:30 a.m.

The Hang Seng index was up 0.66% at 16,613.81 as of 6:30 a.m.

The S&P 500 index and Nasdaq 100 declined 1.47% and 1.53%, respectively on Wednesday. The Dow Jones Industrial Average fell by 0.64%.

Brent crude was trading 0.59% higher at $79.70 a barrel. Gold rose 0.12% to $2,033.77 an ounce.

The GIFT Nifty was trading 0.25% higher at 21,141 as of 7:04 a.m.

Indian stock benchmark Nifty 50 dropped the most in 10 months to retreat from all-time highs as investors booked profits, halting its record-setting burst.

The Nifty 50 ended 302.95 points, or 1.41%, lower at 21,150.15, while the Sensex closed 930.88 points, or 1.3%, down—the most since Oct. 26—at 70,506.31. Intraday, the Nifty hit a low of 21,087.35 and the Sensex fell to 70,302.60. The declines were broad-based, with all sectoral indices ending lower.

Overseas investors remained net sellers of Indian equities for the third consecutive session on Wednesday. Foreign portfolio investors offloaded stocks worth Rs 1,322.1 crore, while domestic institutional investors mopped up stocks worth Rs 4,754.3 crore, according to provisional data from the National Stock Exchange.

The Indian rupee closed at Rs 83.18 against the dollar.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.