Analysts' commentary is divided on the shares of Star Health and Allied Insurance Co., with Citi Research assigning a 'sell' rating for the stock and CLSA maintaining a 'buy'.

Both the brokerages said the company warrants a premium valuation than its peers.

The current market price for Star Health implies lower growth priced-in versus ICICI Lombard General Insurance Co., even though the former operates in a faster-growing industry, according to CLSA, which has a target price of Rs 715 for the stock.

Citi Research said the current high valuation does not fully reflect business headwinds, including rising competitive intensity and likely market-share loss in the new individual health insurance business; lack of visibility into the steady-state net-incurred claims ratio; and regulatory issues, which can disrupt the arbitrage in product manufacturing and distribution.

Citi has assigned a 'sell' rating for the stock with a price target of Rs 560 apiece.

CLSA pointed out that books of the company along with ICICI Lombard's were best performing in terms of loss ratios among standalone health insurers and general insurers as their loss ratios have only seen a 1–10-percentage-point increase during the first nine months of the current fiscal. "The highest increase was for Aditya Birla Health (up 11 ppt YoY) and Bajaj Allianz Health (up 10 ppt YoY)," CLSA said.

"Among standalone health insurers, Star is the only company whose expense ratio (31%) is well within the stipulated cap of 35%. Per regulations, insurers have till FY26 to control costs," it said.

For Citi's call, it said the upside risks include a sharp rise in premium growth at a less than 25% annual growth; tight control over claims experience, led by favourable pricing arrangements with hospitals or one-off price hikes; and absence of any regulatory changes in product manufacturing and distribution of health insurance.

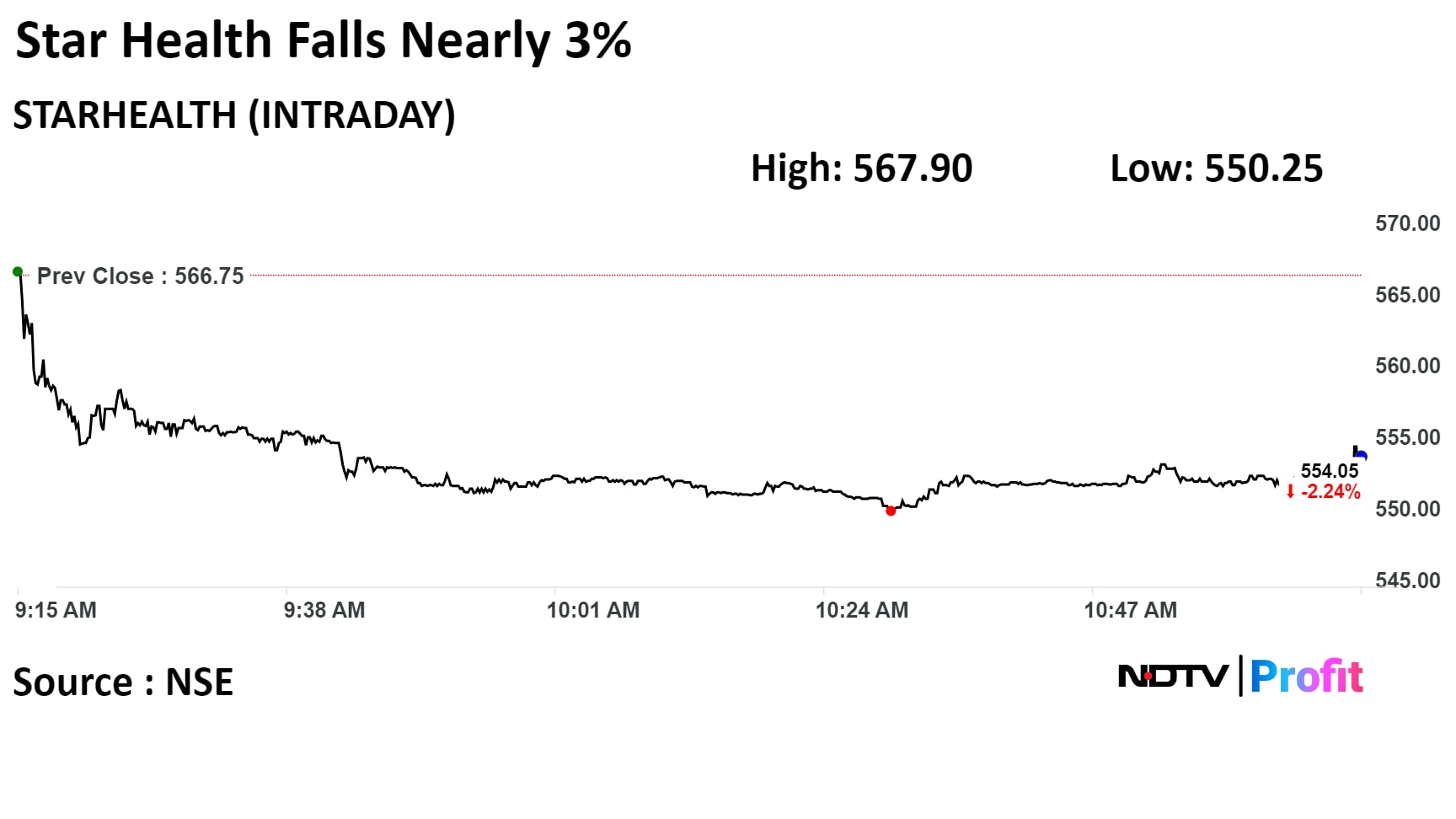

Star Health's stock fell as much as 2.91% during the day to Rs 550.25 apiece on the NSE. It was trading 2.23% lower at Rs 554.10 per share, compared to a flat Nifty 50 at 11:13 a.m.

The share price has risen 6.89% in the last 12 months. The total traded volume so far in the day stood at 0.34 times its 30-day average. The relative strength index was at 45.76.

Fourteen out of the 20 analysts tracking the company have a 'buy' rating on the stock and six suggest 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 17%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.