(Bloomberg) -- Some onshore funds that weathered the Chinese stock rout last year are losing their shine, as recent losses highlight the challenges of investing in the $8 trillion market where trends can swiftly reverse.

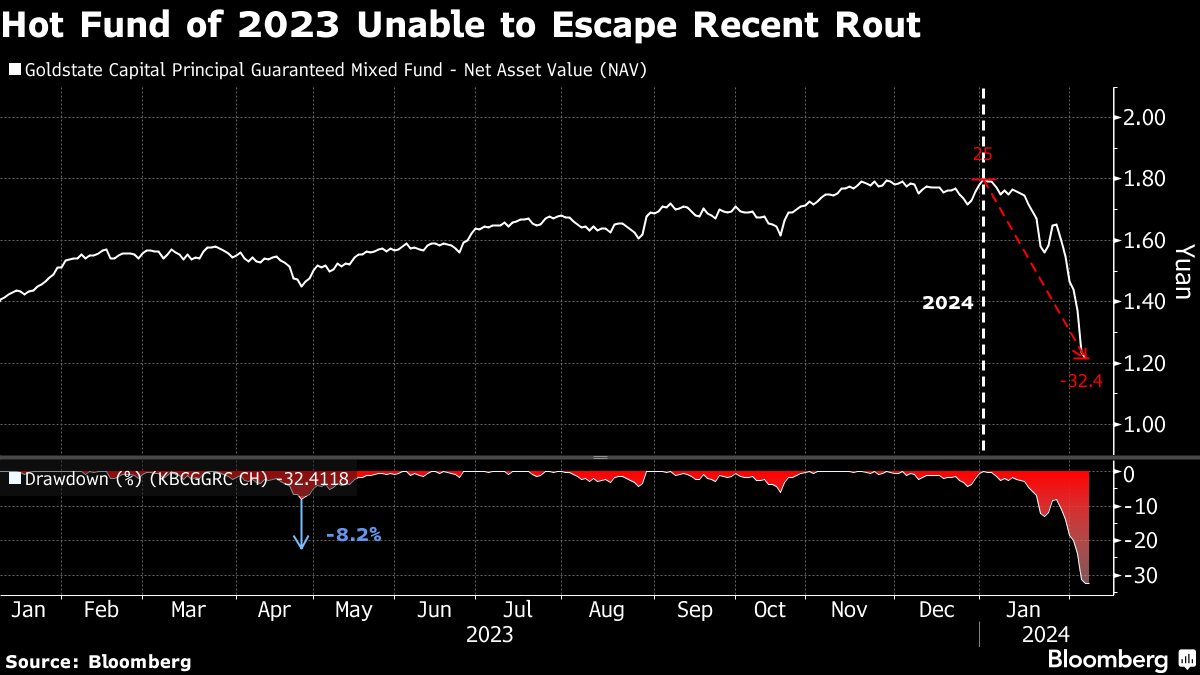

The Goldstate Capital Principal Guaranteed Mixed Fund, which defied the decline in the mainland benchmark CSI 300 Index with a near 29% return in 2023, has fallen 32% so far this year. Most of its holdings are small-cap stocks, which as a category have suffered steep losses lately.

Similarly, funds that had previously evaded market declines by focusing on niche plays have also been swept up by the latest strife. The ChinaAMC BJSE Innovative SME Selected 2Y Regular Open Mixed Launched Fund is down more than 15% after surging almost 60% last year. The Soochow Mobile Internet Flexible Allocation Mixed Fund, which bet on semiconductor names, has fallen about 12%.

The reversal highlights the difficulties money managers face in China, where even popular trades such as bets on AI names have a short lifespan. Fund closures in the country hit a five-year high last year, and this trend is expected to extend as investor confidence wanes. An index tracking active equity-focused funds is down 16% this year through Tuesday, outpacing the 2.6% drop in the CSI 300.

The relentless rout has erased more than $6 trillion from the value of equities in China and Hong Kong from their early 2021 peaks amid an anemic economic recovery and a prolonged property crisis. The CSI 300 Index sank to a five-year low last week before seeing a bounce this week amid hopes for authorities to take more forceful steps to sustain a nascent market recovery.

Bouts of stock gains spurred by stimulus hopes have only lasted a few days as weak economic data soon poured cold water on optimism. The swoon in Chinese equities is playing out against the backdrop of a rally in global stocks, with the US market trading near a record.

That's led to a record amount of Chinese money flowing into overseas equities as despondent investors seek a way out of the sagging local stock market.

Investor Q&A

In an effort to placate investors, Goldstate Capital published a Q&A with the fund manager last month.

“We understand how investor confidence has taken a hit amid the extreme loss this year, but it is a case of being oversold,” said portfolio manager Zhou Boyang, according to the company's official WeChat account. “We are still optimistic on the market for the rest of the year.”

Goldstate Capital and the two other asset management firms declined to comment on the losses when contacted by Bloomberg.

READ: Everything China Is Doing to Rescue Its Battered Stock Market

The meltdown has also wrecked havoc on some hedge funds. A top Chinese macro hedge fund said it slashed stock positions in January as the rout deepened, taking losses after acknowledging mistakes betting on a swift economic recovery. Last month, Singapore-based Asia Genesis Asset Management Pte. said it is closing its macro fund after wrong-way bets on Chinese and Japanese stocks inflicted “unprecedented” losses.

“It is indeed hard to invest onshore, and more often than not, it is difficult to make money so funds seek less common trades,” said Jiang Liangqing, managing director at Zhuhai Greenbamboo Private Fund Management. “But the thing with this is that the trend reverses quickly and gains evaporate.”

--With assistance from Mengchen Lu.

(Adds a tout)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.