Buying shares when the market declines to capture future potential is a long-followed strategy of retail investors. As Indian equities corrected from their peaks, it was not just domestic retail investors who lapped up shares on cheap.

South Korea's small investors also adopted the playbook to scale up their India exposure through exchange traded funds.

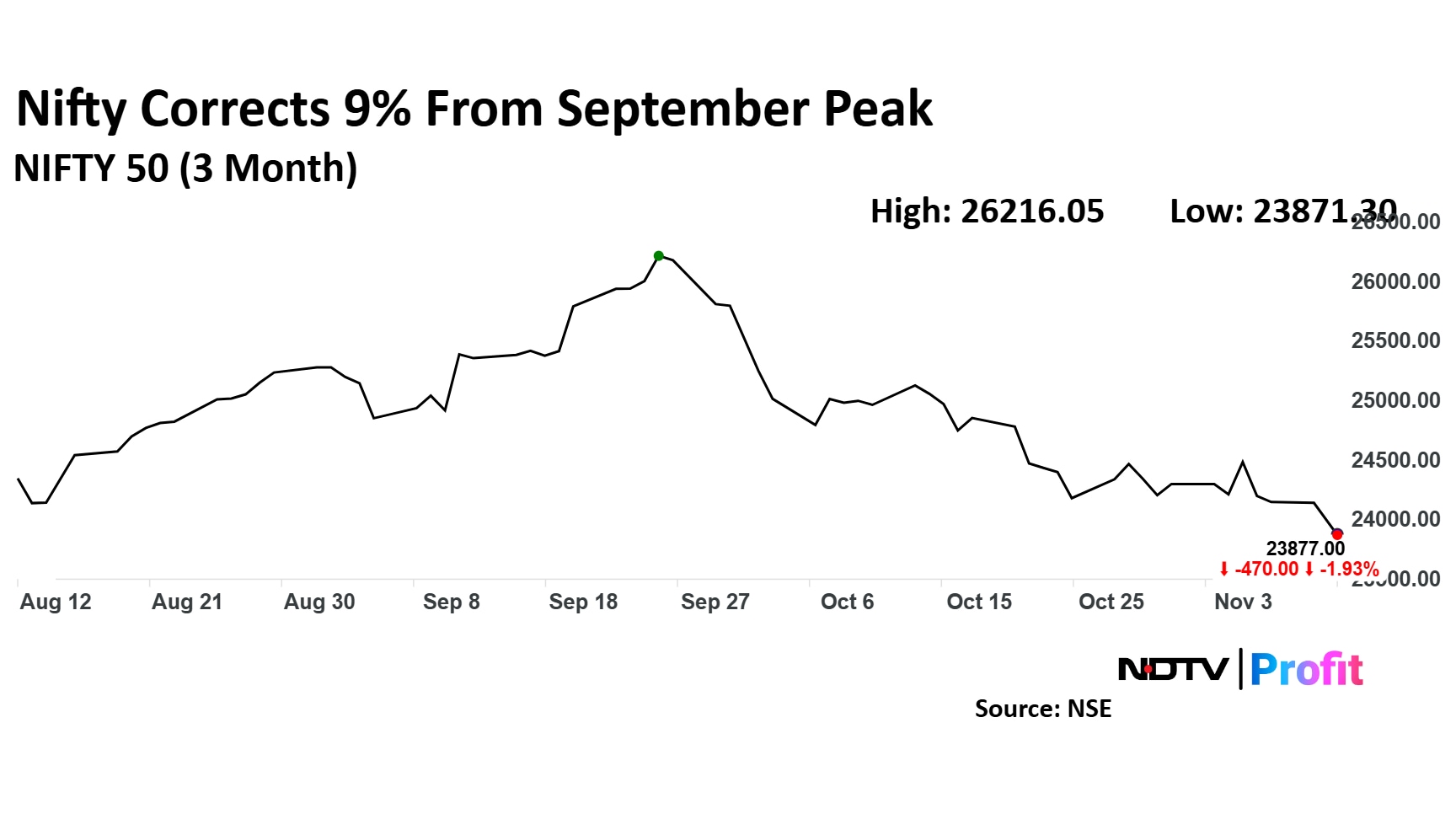

The benchmark NSE Nifty 50 corrected nearly 9% from its peak in late September, as concerns over valuation, a strong US dollar, weak corporate earnings and incessant foreign fund outflows took a toll.

Overseas investors pulled out Rs 1.5 lakh crore from Indian stocks in the last 32 sessions.

The correction has led to dips in Korean ETFs that track Indian equities. The Samsung Kodex India Nifty 50 and the Mirae Asset Tiger India Nifty 50 have lost 3.4% since Sept. 27.

Korean retail investors viewed the recent market declines as buying opportunities, with net purchases of 8.1 billion won or $5.8 million in the Samsung ETF and 11.5 billion won or $8.2 million in the Mirae ETF during the same period, according to a report by the Korea Economic Daily.

Such bold bets on Indian stocks have been driven by market expectations of a strong rebound in the stock market following Donald Trump's victory in the US presidential election.

Trump's pledge to impose punitive tariffs on Chinese imports can cause an exodus of multinational companies from the world's second-largest economy and their rush to find new manufacturing bases in India, according to market analysts.

India is set to gain significant geopolitical advantages from Trump's victory, Lee Jun-jae, portfolio manager at Samsung Asset Management Co. told the Korean publication. "India's importance in the global supply chain as an alternative to China will rise further."

Investor interest has led to South Korea fund managers offering new India-focused ETFs.

In May, Samsung Asset Management launched the Samsung Kodex India Tata Group ETF, featuring Tata Group companies as its underlying assets. That same month, Mirae Asset Global Investments introduced the Mirae Asset Tiger Indian Billion Consumer ETF, which tracks India's top 20 consumer brands, the Korea Economic Daily reported.

In September, Korea Investment Management Co. expanded its offerings with two active Indian ETFs — ACE India Consumer Power Active and ACE India Market Representative BIG5 Group Active — both targeting high-growth sectors in India.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.