(Bloomberg) -- India's renewable energy stocks have enjoyed a scorching rally for the past two years as retail buyers pile in, but their extended valuations are flashing warning signs.

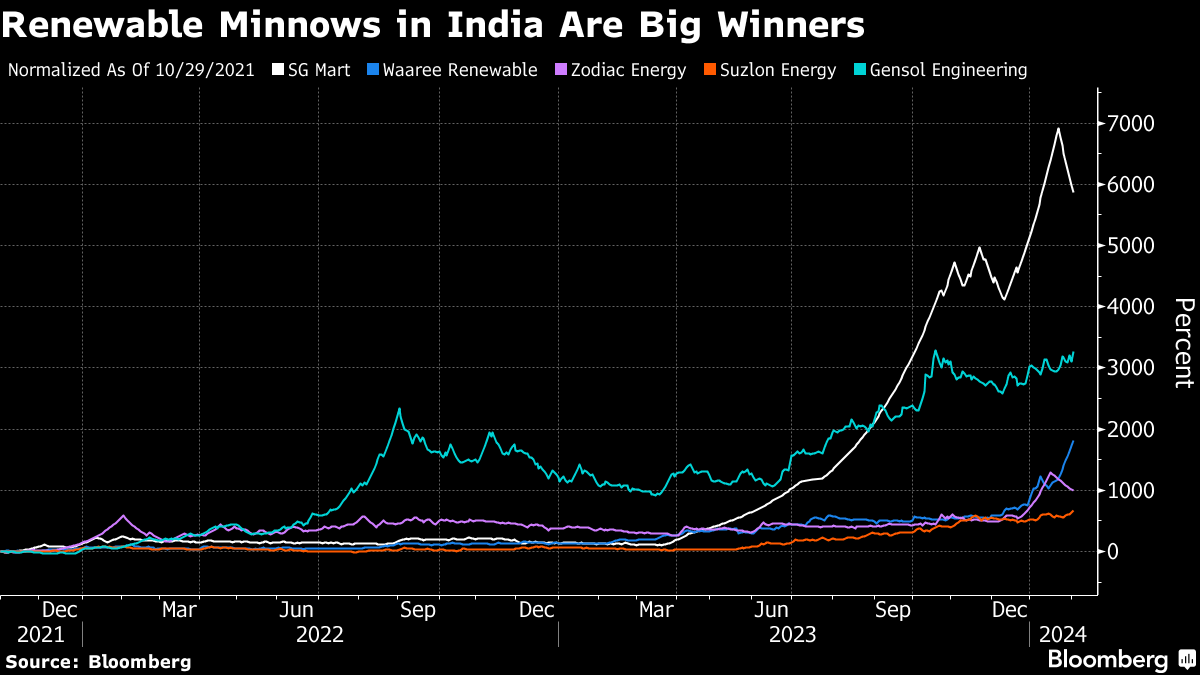

SG Mart Ltd., a Gujarat-based solar and wind energy producer, has soared over 5,800% since November 2021 — when Prime Minister Narendra Modi announced that India aimed to boost clean energy to more than two-thirds of overall capacity. Gensol Engineering Ltd. has rallied more than 3,200%, Zodiac Energy Ltd. 1,000% and Waaree Renewable Technologies Ltd. 1,800% in that same period.

“People are following the hype cycle rather than fundamentals,” said Rajeev Thakkar, chief investment officer at PPFAS Asset Management Pvt. Ltd., said via phone. “We are only watching the space and have not invested” in the stocks, he said, citing poor return ratios for some companies in the sector.

The skyrocketing share prices of these small stocks are now facing a reality check, as surging production capacity weighed on prices and earnings are struggling to keep up with the pace of gains. This is reminiscent of a US boom, which drove up valuations before a collapse sent the GS US Renewables basket of companies benefiting from renewable-energy transition down 43% from a high in February 2021.

Solar module prices fell to record lows this month, forcing leading Chinese equipment maker TCL Zhonghuan Renewable Energy Technology Co. last week to issue a profit warning.

“Plummeting prices across the solar supply chain in China and Southeast Asia will frustrate onshoring ambitions in Europe, India and the US,” Lara Hayim and Jenny Chase of BloombergNEF wrote in a note. Installations are rising, but some manufacturers will sell at a loss this year, they said.

‘Crazy' valuations

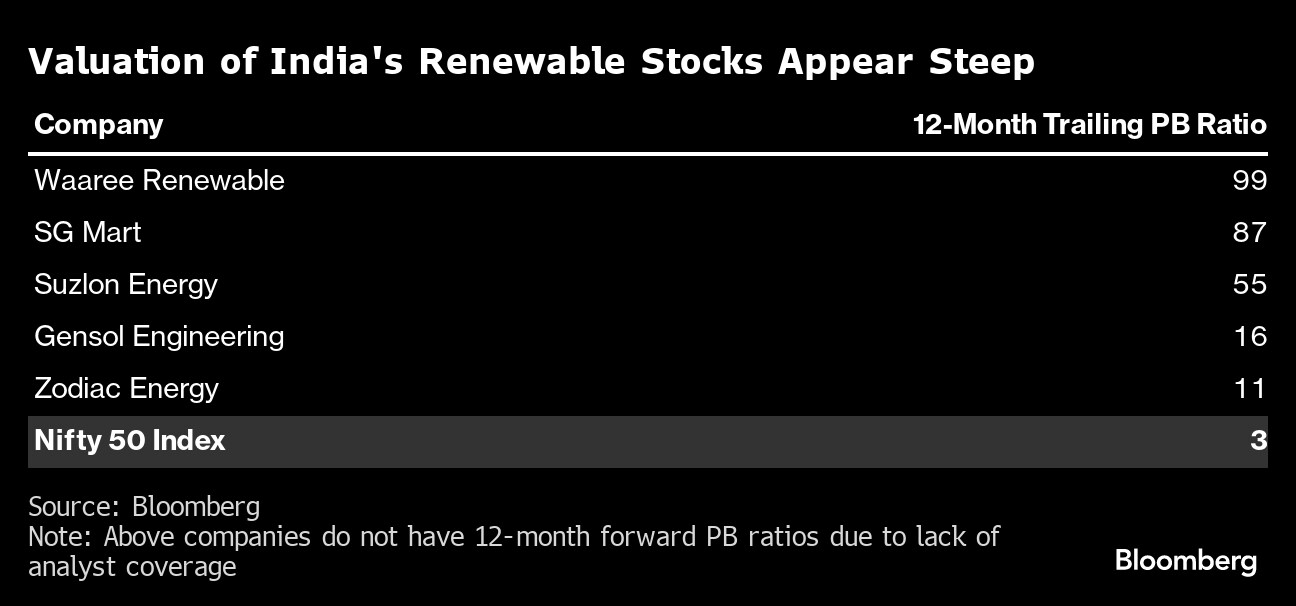

The biggest stock winners in India's renewable sector are now all facing the challenge from minuscule earnings, which has sent valuations through the roof.

SG Mart, for example, reported net sales of 15.6 million rupees ($190,000) and net income of 2 million rupees in the latest full fiscal year, but commands a market value of $720 million, data compiled by Bloomberg showed. The founders of SG Mart have sold some of their holdings in the company to retail and rich investors amid the rally. Similar patterns can be seen in Gensol and Waaree Renewable.

Waaree Renewable and SG Mart now command price-to-book values 99 times previous 12-month earnings and 87 times, respectively — much higher than the Nifty 50 index's three times.

Moms and pops are the ones diving in. Over the past 12 months, retail investors — defined as those with investments of up to 200,000 rupees — raised their holdings in most of the top gainers including Waaree Renewable, Gensol, Taylormade Renewable and Zodiac Energy, according to latest filings.

“I don't think investors are doing the right thing by chasing narratives,” Amit Doshi, portfolio manager at Care Portfolio Managers Pvt., said. “Making exceptional returns becomes difficult if you pay over the odds” to own companies, he said. Institutional investors like Doshi have largely stayed away from some of the big winners in the sector, citing untenable valuations and low free floats.

To be sure, as the government invests billions through state-owned enterprises, and provides incentives for various renewable equipment manufacturing and supports adoption of electric vehicles, the industry has plenty of growth potential. Finance Minister Nirmala Sitharaman also announced funding plans Thursday to support the use of renewable energy. But the risks for these small stocks may be too high to ignore.

Aniket Shah, New York-based head of global ESG for Jefferies Group LLC, said that slow growth in new capacity addition and lack of support from western economies on financing and technology transfer are things that are keeping him “up at night.” Investors are taking big technology and customer demand risks and they're “going to need to get compensated for that,” he said.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.